Join us for our latest webinar in collaboration with Cboe

Insights.

Our Data Debrief and Deep Dive insights are published twice a week and you can subscribe to them here.

Macro

13/01/2026 Data Debrief

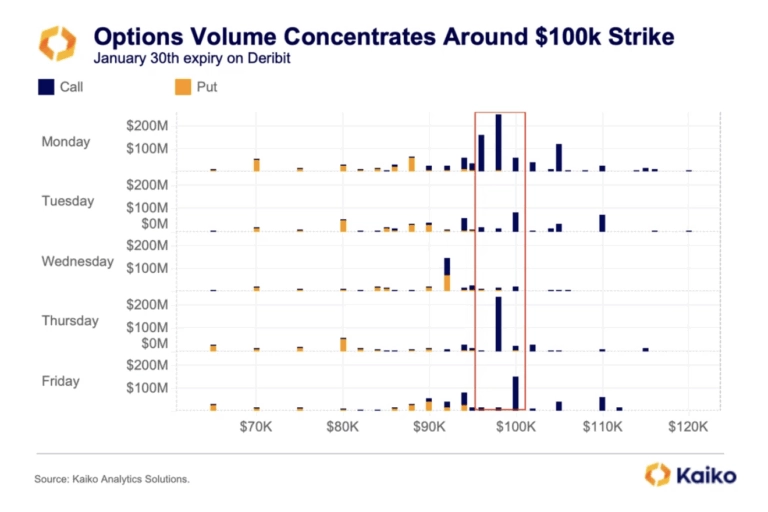

Positioning for $100K: Signals and Key CatalystsThis week’s Data Debrief examines the positioning dynamics beneath the surface of the early January rally. Extraordinary call volume concentration at and around the $100,000 strike, an inverted volatility term structure, and neutr...

![]()

Indices

06/01/2026 Data Debrief

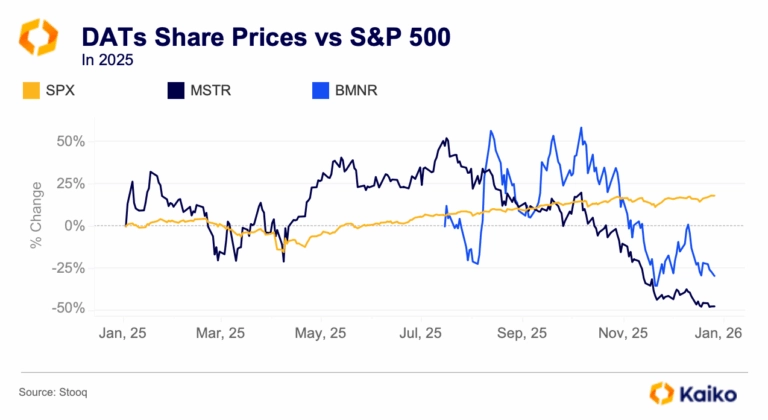

The Rise and Repricing of Digital Asset TreasuriesAs digital assets mature and market structure deepens, corporate and institutional crypto holdings a...

Written by Laurens Fraussen![]()

Derivatives

29/12/2025 Data Debrief

Santa Rallies, Cycles, and Year-End Reflections for BitcoinAs markets approach the end of the year, Bitcoin finds itself at a familiar crossroads, caught betwe...

Written by Laurens Fraussen

![]()

Liquidity

19/10/2023 Deep Dive

Understanding Centralized Exchange Liquidity DataThis week we take a step back to explain some fundamental concepts around Kaiko’s liquidity data.

Written by Riyad Carey![]()

Liquidity

16/10/2023 Data Debrief

Ethereum Reaches Staking EquilibriumWelcome to the Data Debrief! BTC recovered from two-week lows early Monday, closing the week flat ahead of the third week of SBF’s trial. Last week, star witness Caroline Ellison took the stand, providing new details into how Alameda Research used FTX customer funds. This week, we explore:

Written by The Kaiko Research Team![]()

CEX

12/10/2023 Deep Dive

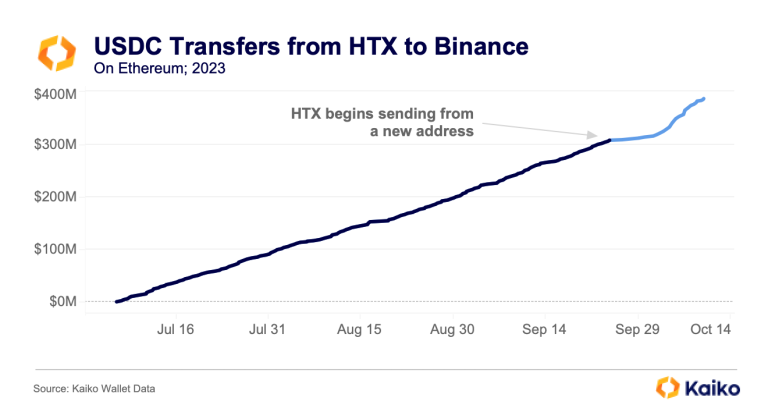

What's Happening at Huobi?Detailing unusual activity on HTX, beginning by exploring the exchange’s relationship with Poloniex, then moving to trading volumes, its USDT-USDC pair, and transactions with Binance.

Written by Riyad Carey![]()

Ethereum

09/10/2023 Data Debrief

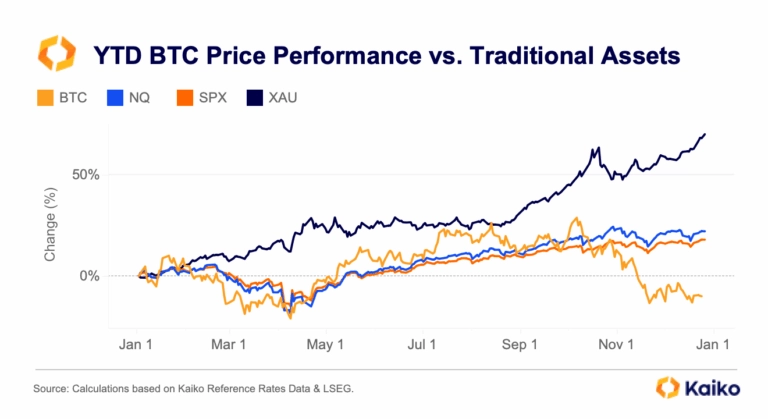

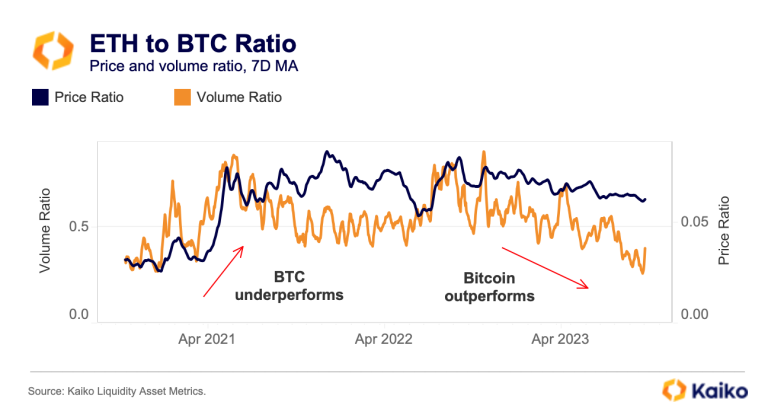

Why is ETH underperforming BTC?Bitcoin briefly hit a 2-month high over the weekend, crossing $28k amid a volatile macro news cycle and turmoil in the middle east. Meanwhile, week two of the SBF trial begins today, Visa tapped Solana for USDC settlement, a Swiss startup issued a tokenised security on Coinbase’s Base network, and six new ETH ETFs received a lukewarm reception. This week, we explore:

Written by The Kaiko Research Team![]()

Liquidity

05/10/2023 Deep Dive

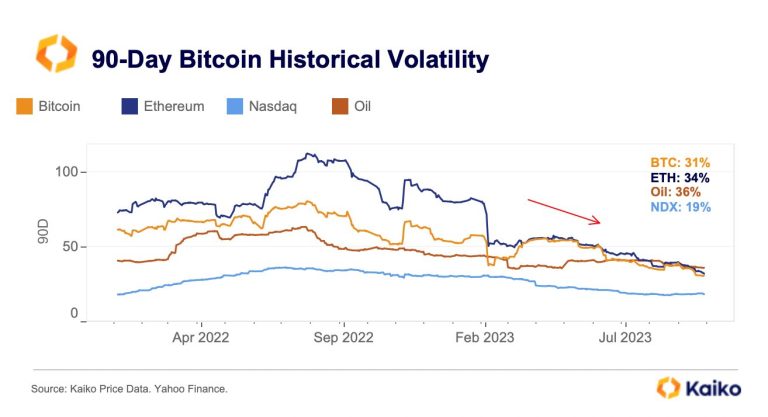

Breaking Down Q3's Top 5 TrendsIt was a pretty quiet summer in crypto markets, with low trade volumes and even lower volatility. Yet, there were plenty of big events that kept the industry chattering. This week, we present our top five trends of Q3.

Written by The Kaiko Research Team![]()

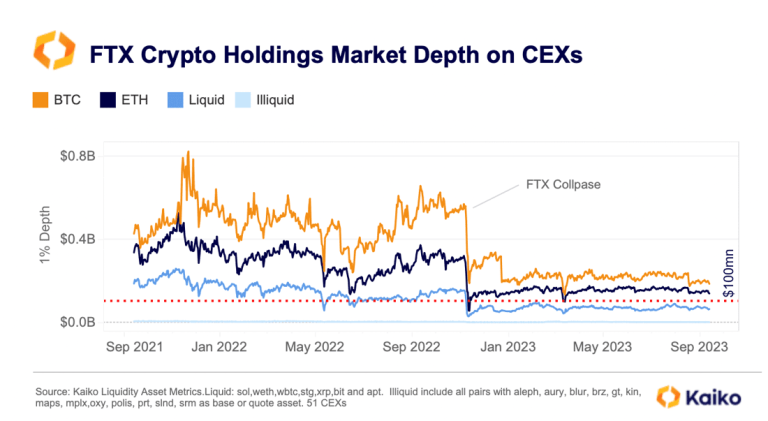

FTX

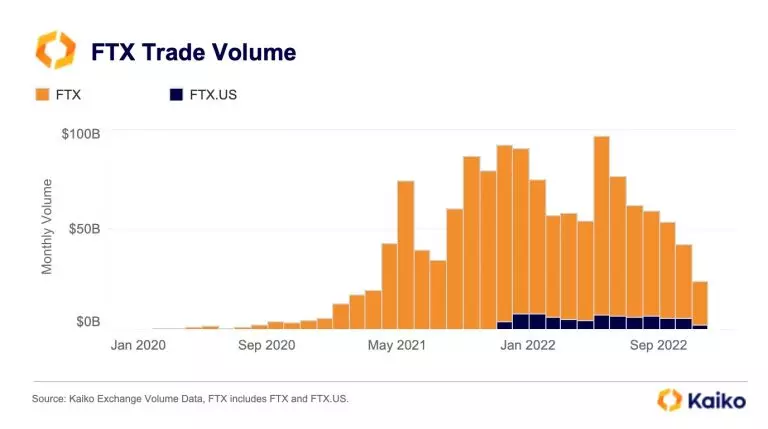

02/10/2023 Data Debrief

Looking Back on FTX's ImpactBitcoin started Q4 on a positive note, hitting multi-month highs this morning after closing September in the green for the first time since 2016.

Written by The Kaiko Research Team![]()

Liquidity

28/09/2023 Deep Dive

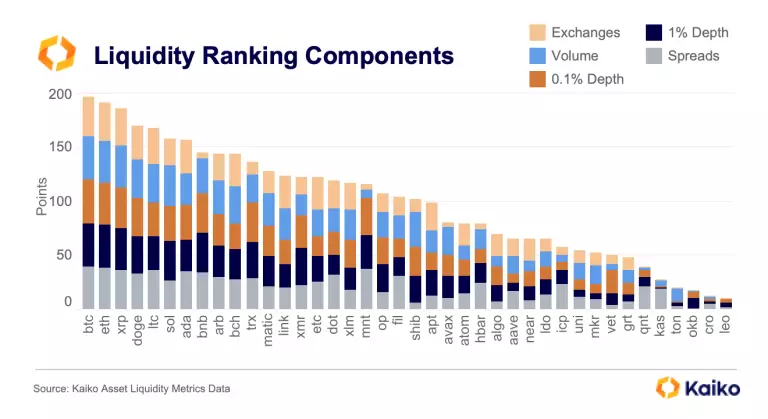

Q3 Token Liquidity RankingsWe’re back with another edition of Kaiko Research’s quarterly liquidity ranking, this time enhanced with more metrics and expanded to the top 40 tokens. As mentioned in previous rankings, it’s our contention that market capitalization is a flawed metric, and a ranking of liquidity is more representative of a token’s true value. Let’s see how the tokens fared this quarter before breaking down the components that went into the ranking.

Written by Riyad Carey![]()

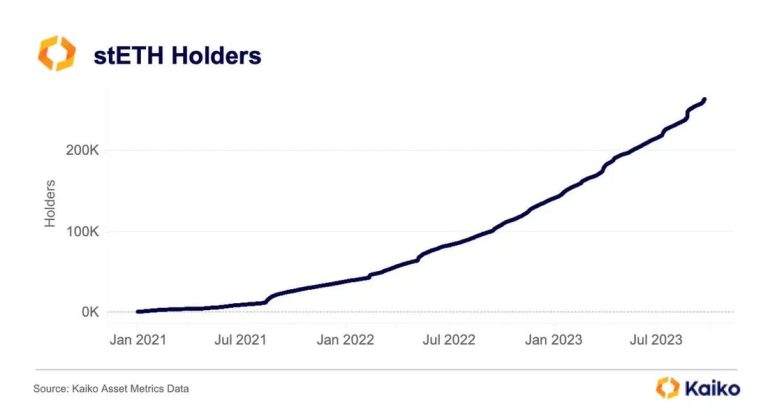

Ethereum

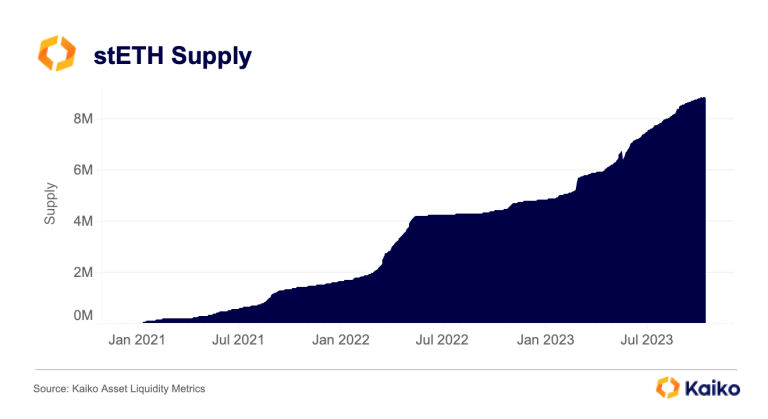

25/09/2023 Data Debrief

ETH, One Year Post-Merge.Bitcoin remained range-bound over the past week despite a hawkish Fed meeting that caused equity markets to shudder. Meanwhile, Mt Gox postponed its creditor repayment deadline, Balancer suffered yet another attack and Bybit announced it will suspend its UK services. This week we explore:

Written by The Kaiko Research Team![]()

FTX

18/09/2023 Data Debrief

Will FTX Liquidations Trigger an Altcoin Crash?BTC made some early morning gains, crossing $27k for the first time since August 31. This capped a volatile week triggered by concerns around FTX’s altcoin liquidations. In other news, Deutsche Bank will offer crypto custody for institutional clients and the ECB hiked rates to an all-time high.This week we explore:

Written by The Kaiko Research Team![]()

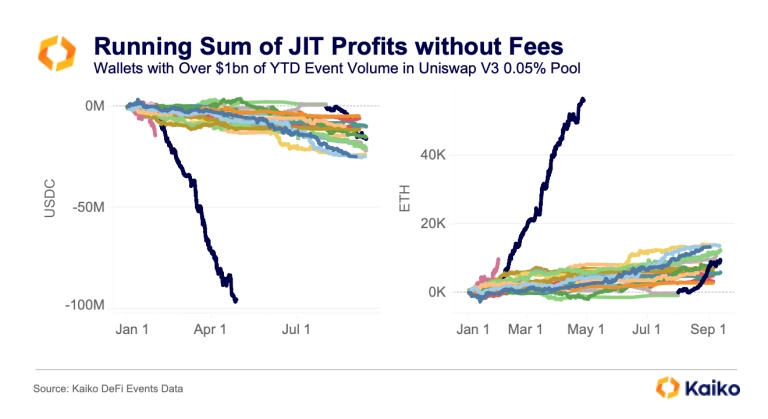

DEX

14/09/2023 Deep Dive

Beneath the Surface of Uniswap Pools: Just-in-Time Liquidity RevisitedThis week we take another look at just–in–time liquidity, a little-studied phenomenon that has generated $750bn in liquidity event volume on Uniswap V3 this year.

Written by Riyad Carey![]()

Liquidity

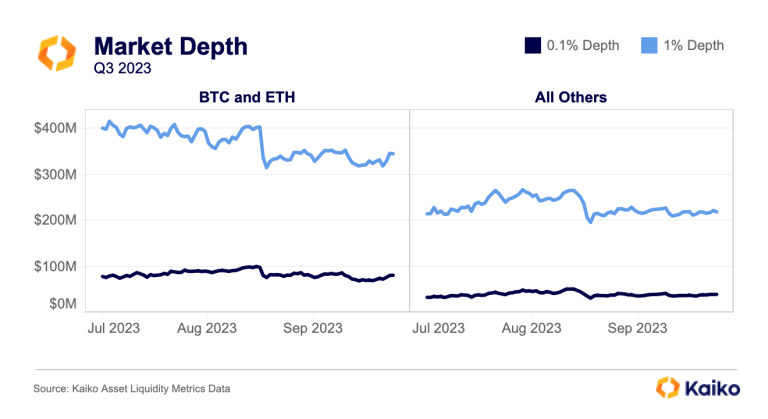

11/09/2023 Data Debrief

Liquidity Remains Flat Amid Low VolatilityIt was another low-volatility week for crypto markets, though plenty still happened. Visa expanded stablecoin settlement to Solana, the London Stock Exchange Group is exploring plans for a digital asset business, and three DeFi protocols were hit with CFTC enforcement actions.This week we explore:

Written by The Kaiko Research Team![]()

Liquidity

07/09/2023 Deep Dive

The Crypto Liquidity Concentration Report.We are back this week with a brand new crypto liquidity analysis. Using trade volume and market depth, we find that the majority of liquidity is concentrated on just a handful of exchanges.

Written by Clara Medalie![]()

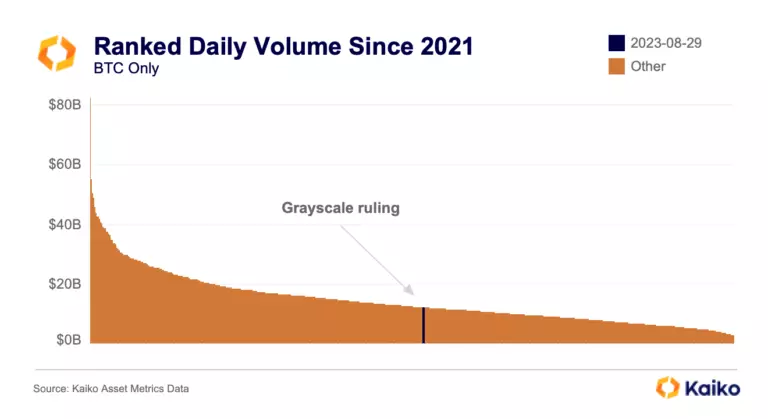

XRP

04/09/2023 Data Debrief

Bitcoin ETF Decision Ignites VolatilityMarkets pulled back after the SEC delayed a decision on several ETFs until October. In other news, Coinbase’s Base blockchain continues to see strong activity, the SEC settled with an NFT issuer, and a judge called ETH a commodity.

Written by The Kaiko Research Team![]()

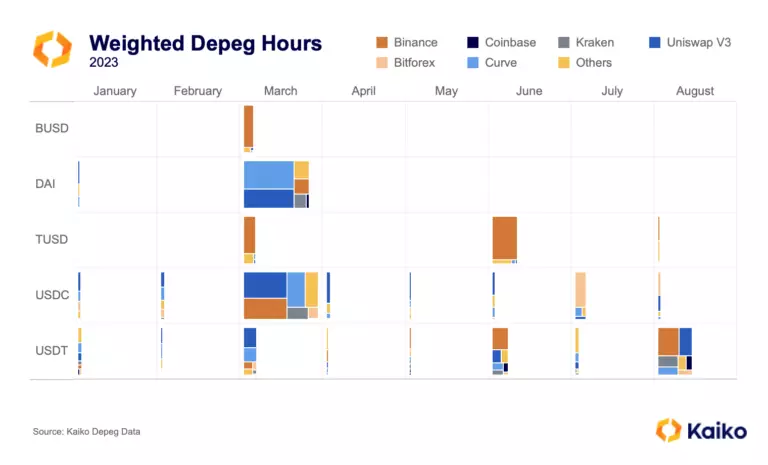

Stablecoin

31/08/2023 Deep Dive

Defining Depegs: A New Metric for Stablecoin StabilityThis week we present a novel method for measuring the severity of stablecoin depegs.

Written by Riyad Carey![]()

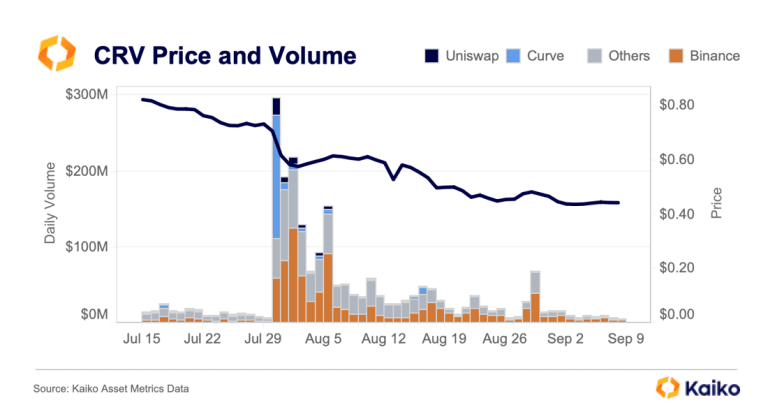

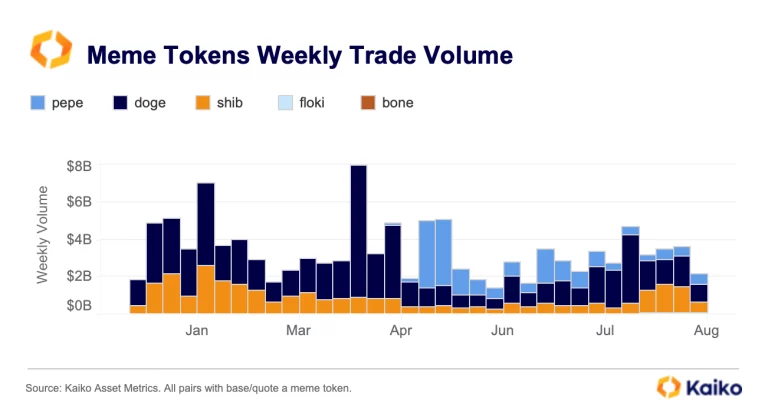

Memecoins

28/08/2023 Data Debrief

PEPE Plunges as Founders SellMarkets are flat with BTC and ETH still trading at 2-month lows. Last week, MasterCard and Visa announced they are stepping back from Binance card partnership, the IRS proposed new crypto tax rules, and the U.S. central bank Jackson Hole symposium failed to move markets.

Written by The Kaiko Research Team![]()

Liquidity

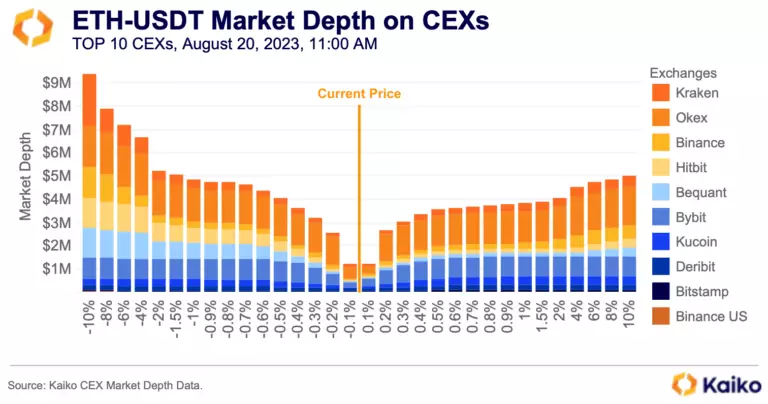

24/08/2023 Deep Dive

Comparing Liquidity on Uniswap and BinanceThis week we’ll take our first in-depth look at Market Depth on CEXs and on Uniswap V3 with a comparative approach. We’ll mainly focus on liquidity distribution across prices and markets, aiming to enhance our understanding of liquidity dynamics and provide you with tools to harness the potential of CEX/DEX data. In today’s trading landscape with DEXes gaining market share, knowing which exchanges or pairs offer optimal trade execution is crucial. Kaiko’s depth data makes that possible.

Written by Anastasia Melachrinos