It was a pretty quiet summer in crypto markets, with low trade volumes and even lower volatility. Yet, there were plenty of big events that kept the industry chattering:

Grayscale notched a major legal win, opening the door to a Bitcoin spot ETF

Ripple also notched a partial win, sending XRP soaring (then crashing)

Binance continued losing market share

FTX got approval to liquidate $3.4bn in holdings

Controversial “orb” project Worldcoin had an unusual token launch

Today, we break down the most interesting trends we spotted during Q3. For more, you can download our full quarterly report here.

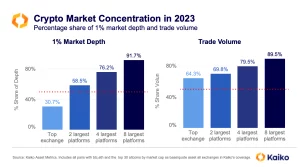

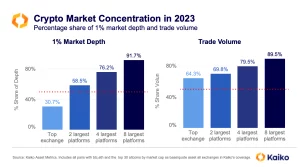

1. Liquidity is more concentrated than any time in recent history.

Liquidity is concentrated and has become more concentrated over time. In 2023, the top exchange, Binance, accounted for 30.7% of global market depth — which measures the quantity of orders on an order book — and 64.3% of global trade volume.

The top 8 largest platforms account for a whopping 91.7% of depth and 89.5% of volume. Liquidity concentration is a natural phenomenon that ultimately benefits individual traders, giving them better prices for their orders. However, because crypto markets by nature emphasize decentralization, liquidity concentration on centralized exchanges is worrying.

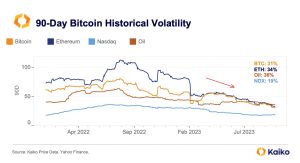

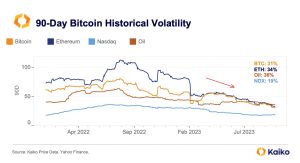

2. Crypto volatility is at multi-year lows.

Crypto volatility continued declining throughout Q3, hitting a multi-year low in September. Interestingly, even the Grayscale ruling at the end of August — which requires the SEC to review Grayscale’s application and is believed to increase the odds for a spot BTC ETF approval — did not cause any significant price movements.

Crypto volatility has been steadily decreasing since mid-2022, coinciding with a prolonged bear market. While crypto assets continue to exhibit more volatility than most traditional assets, the gap has been narrowing, with both BTC and ETH closing the quarter slightly less volatile than oil.

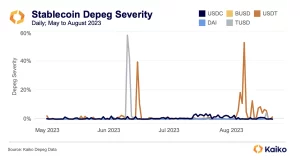

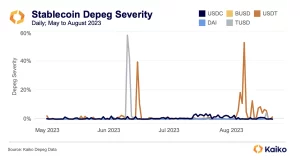

3. USDT’s peg was shaky.

Tether has long been the subject of significant controversy, but in March the stablecoin received a significant boost as its competitors USDC and DAI depegged during the banking crisis. However, in Q3, USDT was the stablecoin with peg stability issues. Our recent deep dive introduced a new methodology for measuring stablecoin peg stability, leveraging a stablecoin’s total volume to create a depeg threshold.

We found that USDT registered a 55% depeg in August, followed by minor depegs the rest of the month. USDT redemptions carry a 0.1% fee, meaning that it is often rational for holders to sell the token rather than redeem it. As liquidity has dwindled, this has put a strain on USDT’s peg. TUSD, too, had trouble in June as it paused minting because of problems with its partner Prime Trust.

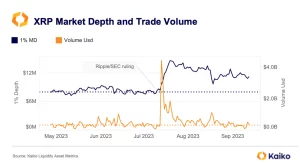

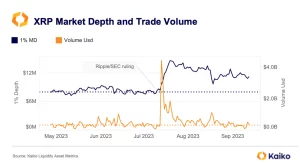

4. XRP liquidity surged after court ruling and exchange re-listings.

After years of waiting, Ripple finally got a ruling in their highly anticipated lawsuit with the SEC in July; the company did not violate federal securities law by selling its XRP token on public exchanges. Almost immediately after the ruling was announced XRP trade volume and price surged, with the token briefly surpassing BTC and ETH in market share. However, it lost most of its price gains and its trade volume declined significantly in August.

Still, XRP ended the quarter as one of the highest volume cryptocurrencies, a stark turnaround following one of the most protracted battles in crypto.

5. FTX liquidations could pressure altcoin markets.

In September, FTX was granted court approval to begin liquidating its crypto holdings, valued at $3.4bn. The sales are capped to $100mn per week. It is unclear whether FTX management, which has enlisted Galaxy to assist with the sales, will offload its holdings on centralized exchanges or OTC.

However, in both cases the market impact could be significant, as altcoin volumes and liquidity remain at multi-year lows. The chart above shows market depth for FTX’s crypto holdings on centralized exchanges (CEXs), categorized by ‘liquid’ vs. ‘illiquid’. We can see that illiquid tokens have very low market depth, meaning any liquidations could cause price volatility.

Over the past year, all of FTX’s crypto holdings have seen a big drop in liquidity over the past year.

Download Report

![]()

![]()

![]()

![]()