htx

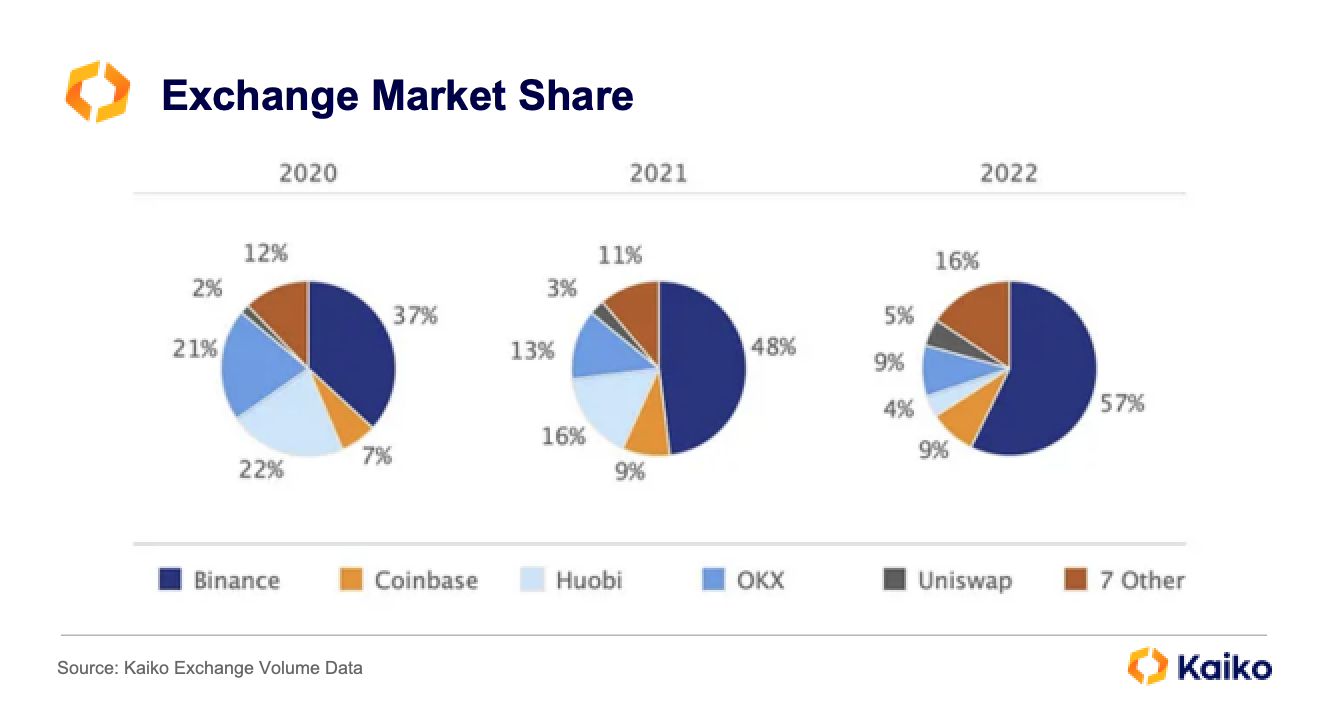

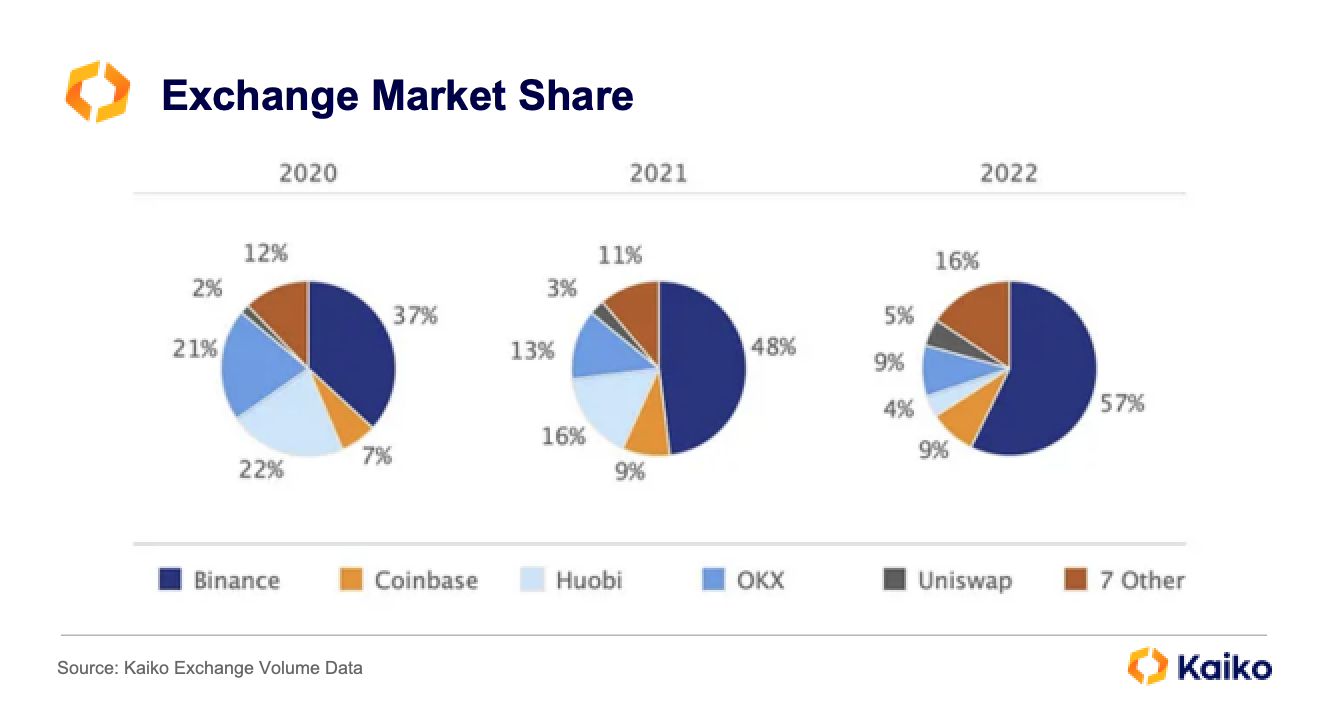

HTX was founded in 2013 and spent its first years of existence establishing a strong foothold in China, becoming one of the country’s dominant exchanges. As China’s regulatory stance towards crypto soured, HTX expanded to other countries. Still, China’s crypto ban in 2021 dealt a severe blow to the exchange, with its market share dipping from 22% in 2020 to just 4% in 2022.

In October 2022, HTX was sold to an investment firm reportedly headed by Sun, who was appointed to the exchange’s Global Advisory Board. It was unclear what authority this position afforded. This was clarified in January 2023 when an HTX press release stated that, “Under the leadership of Justin Sun, it can be said that Huobi has embarked on the path to rebirth.”

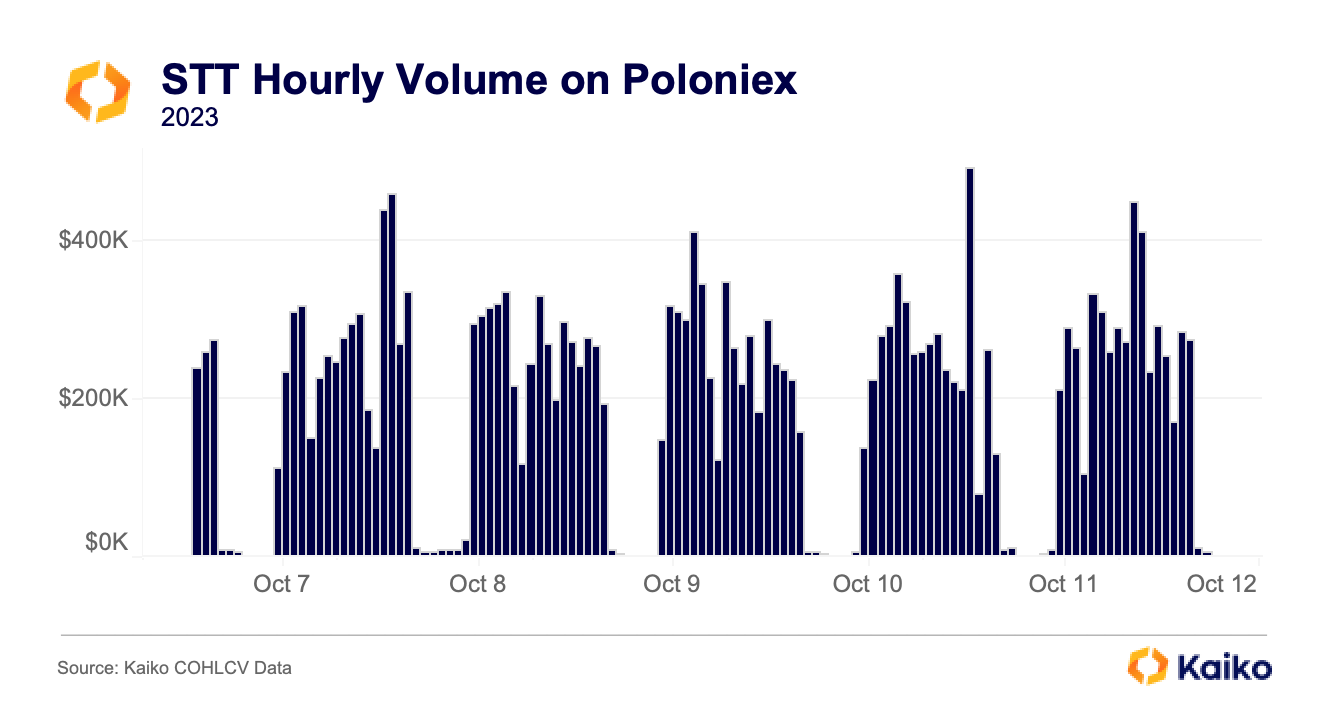

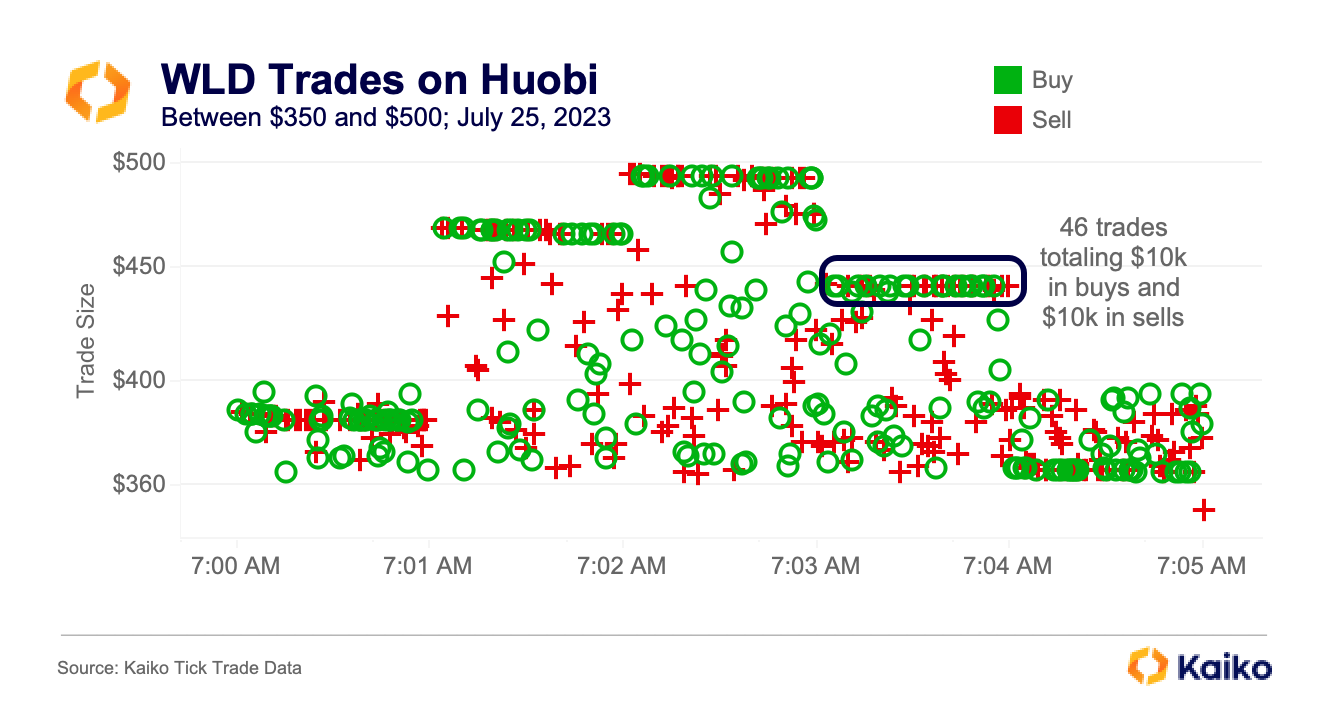

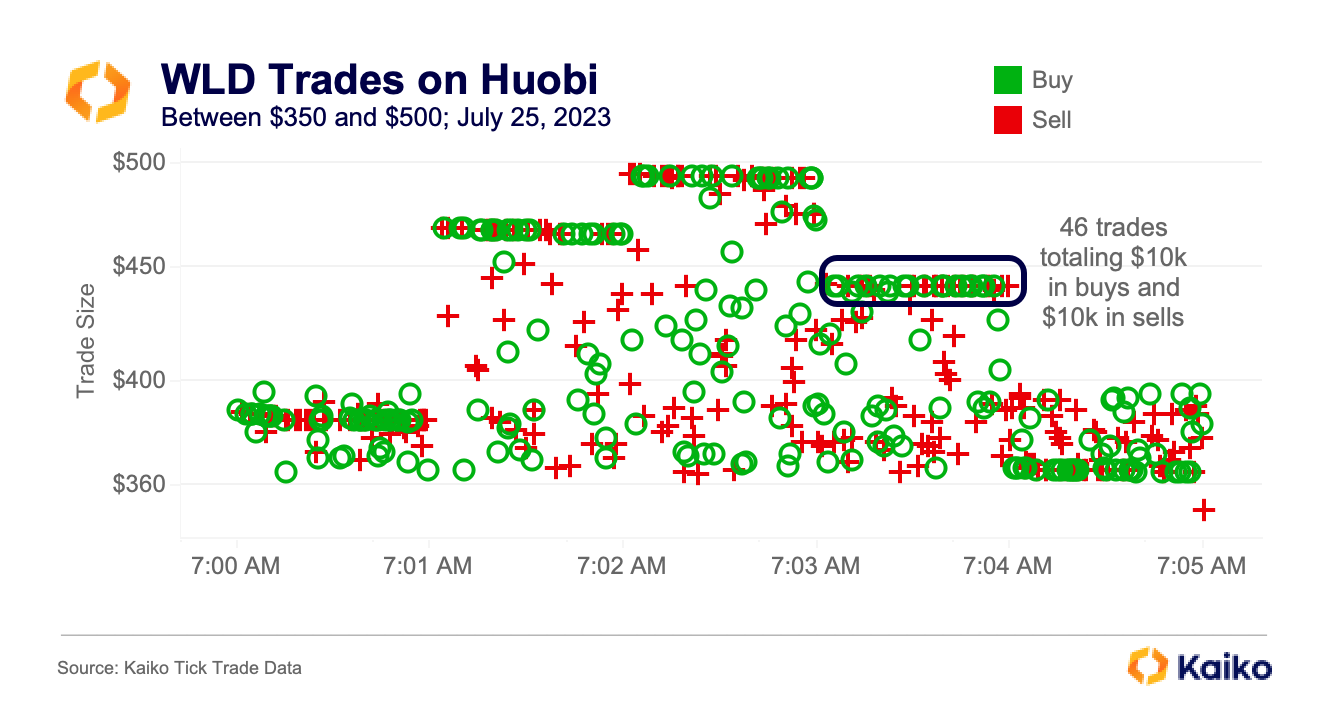

The unusual activity on HTX was first identified in our Deep Dive on Worldcoin’s launch, which found clusters of matching buys and sells shortly after WLD was listed.

These clusters are unlikely to be organic volume and were persistent enough that they constituted a majority of WLD’s volume on HTX in the days examined.

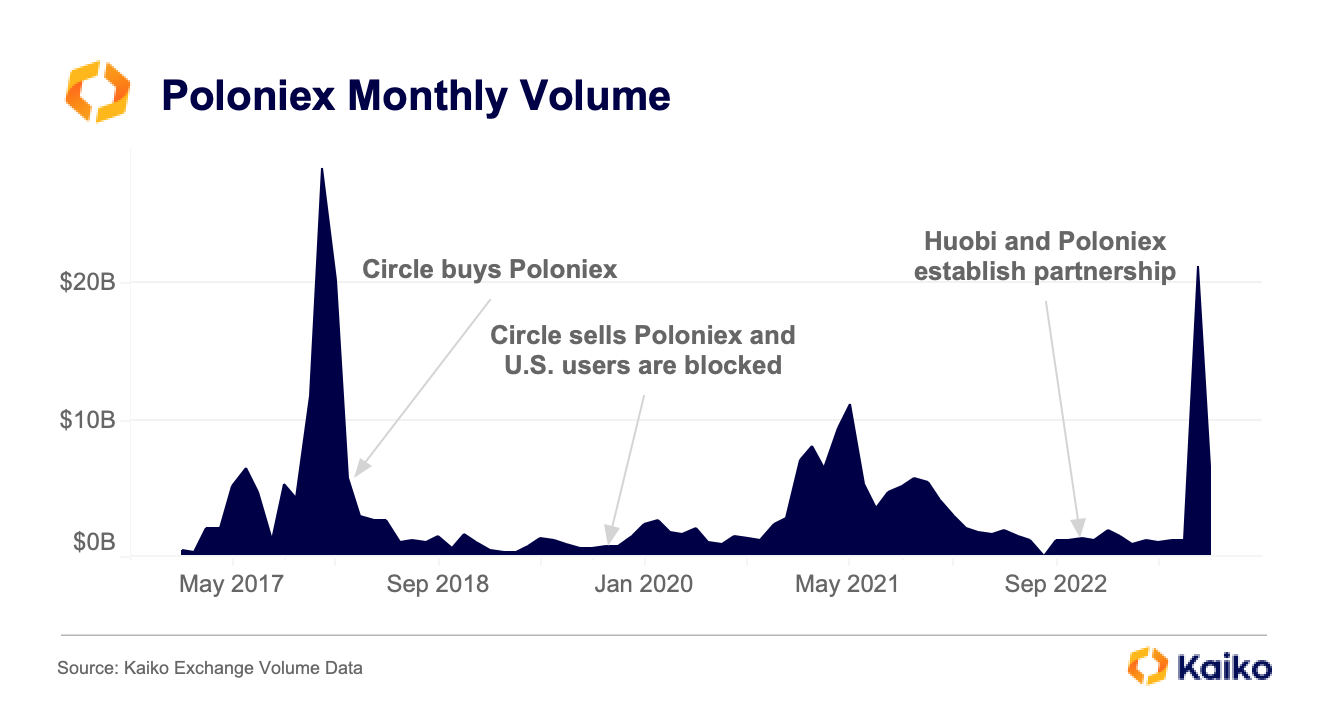

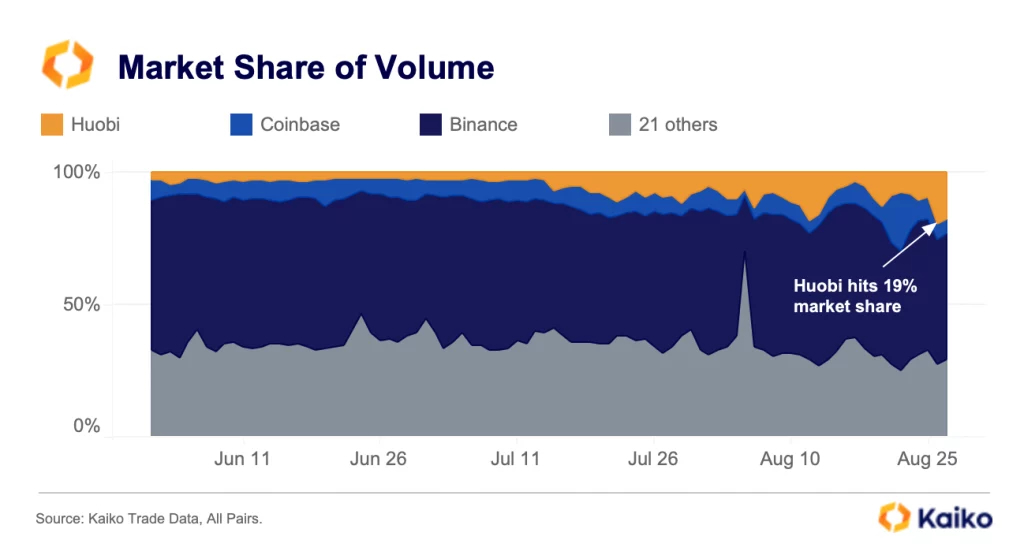

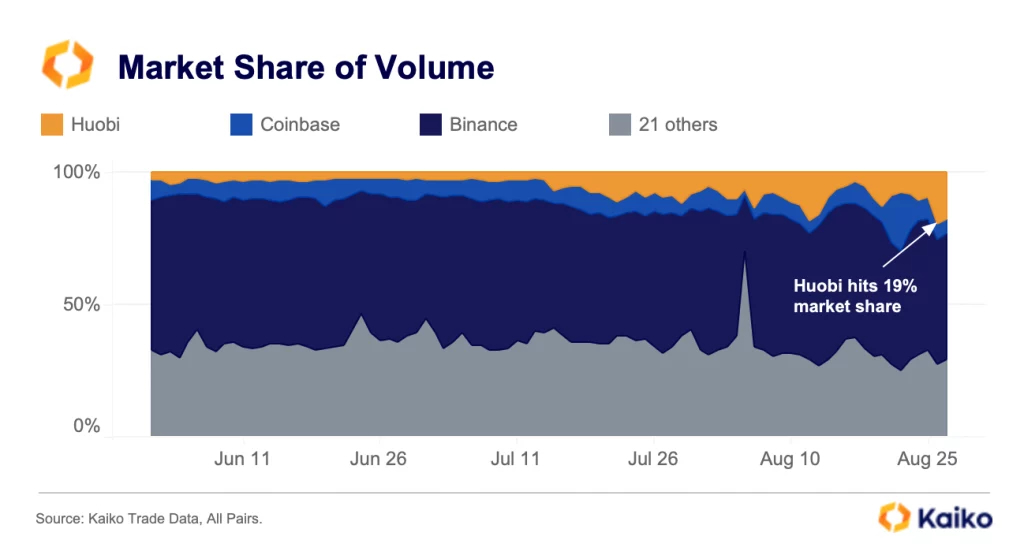

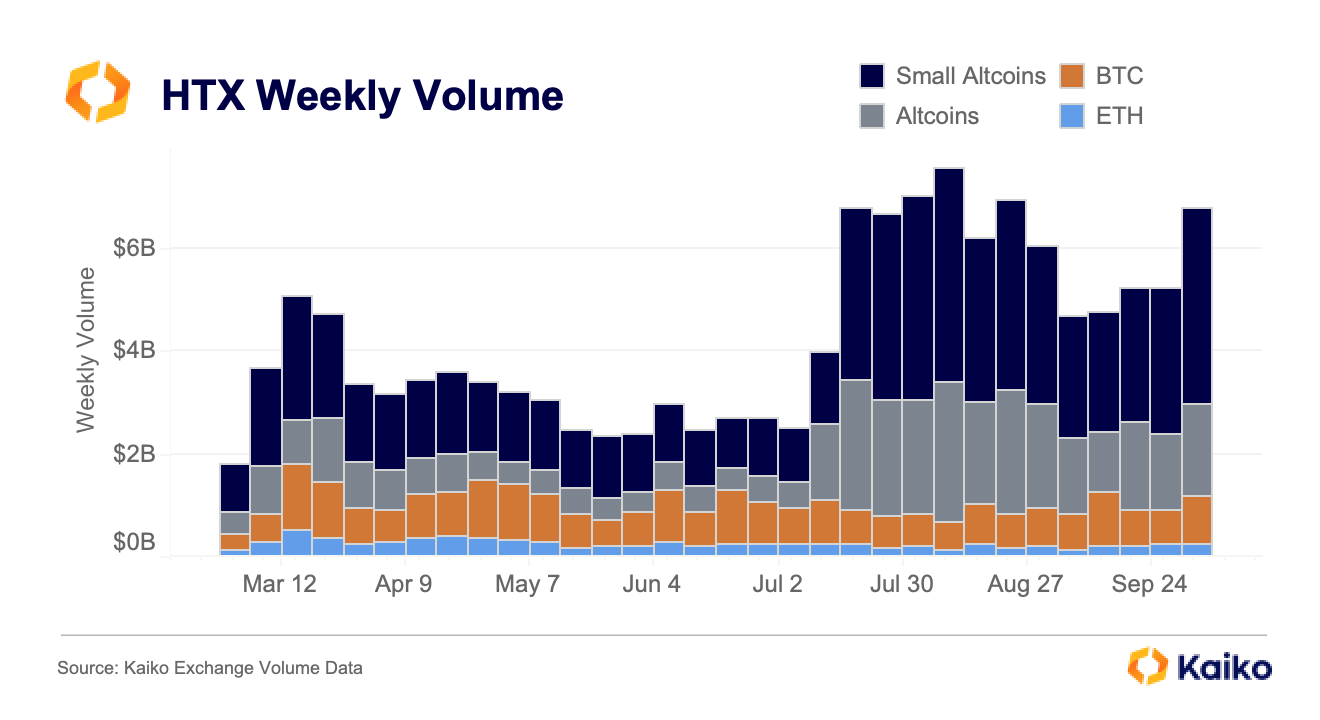

The scale of the activity was revealed when we examined exchange market share, finding that HTX had exploded from just 4% of centralized exchange volume to nearly 20%. Similar to the surge in volume on Poloniex, which came at roughly the same time, there was no obvious change that could explain such a drastic shift, especially when volumes were at multi-year lows on all other exchanges.

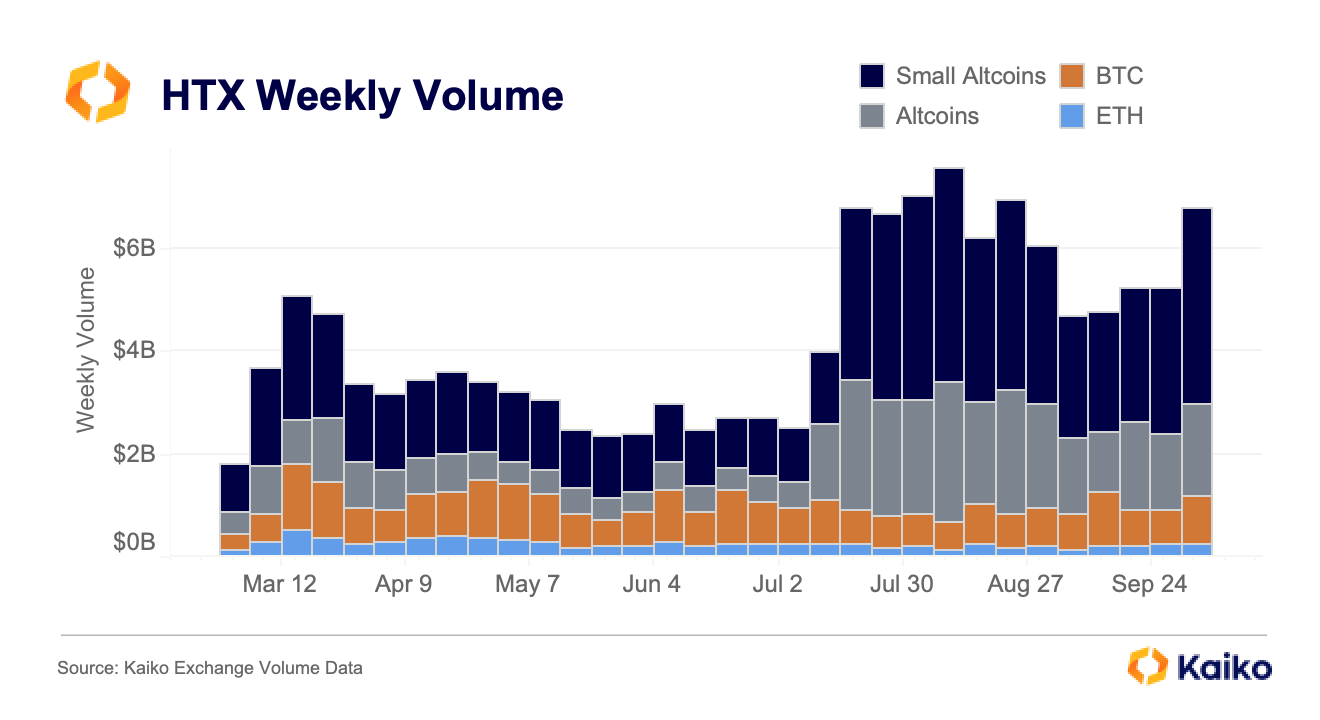

Small altcoins (with less than $1bn of volume from March to October) were responsible for a significant portion of HTX’s volume surge, jumping from $1.4bn the week of July 16 to $3.4bn the following week. Larger altcoins went from $500mn weekly volume to $2.5bn just two weeks later. Meanwhile, BTC and ETH volume stayed roughly the same.

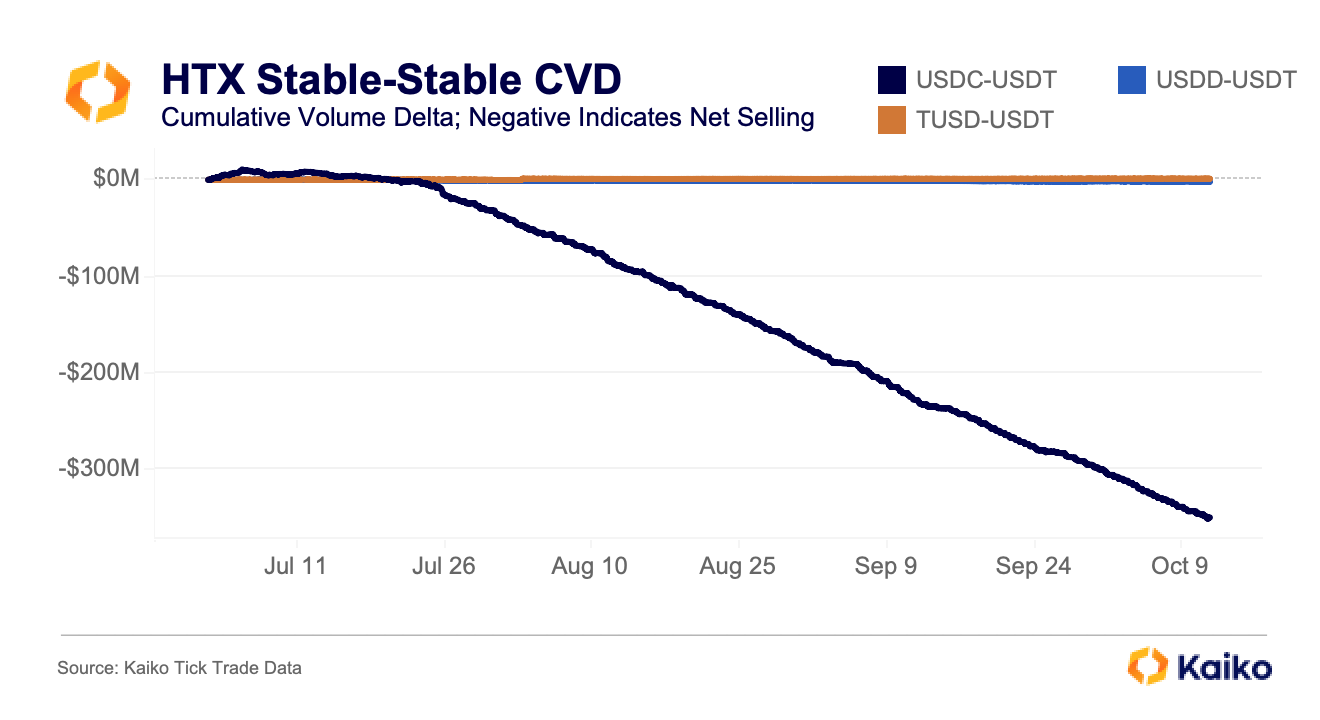

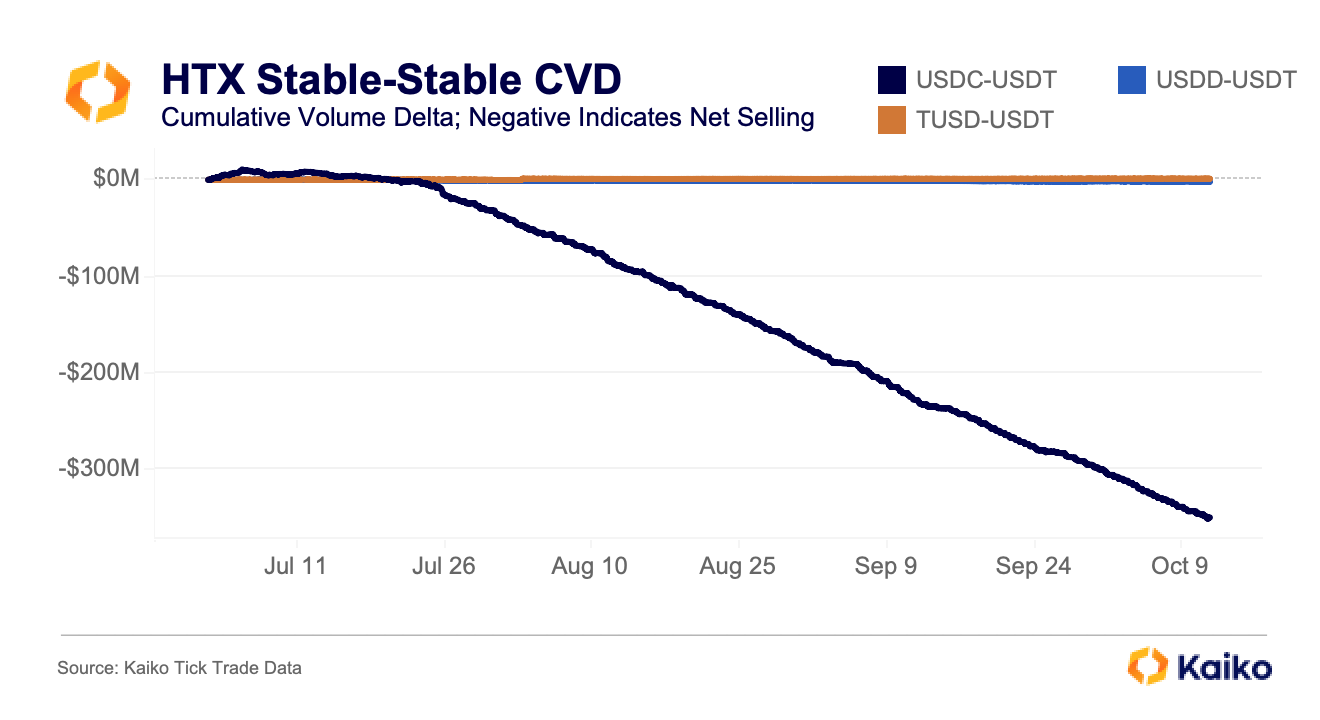

The next piece of the puzzle came when writing my Deep Dive proposing a methodology to measure stablecoin depegs. While researching, I noticed significant USDT depegs on HTX’s USDT-USDC pair. Upon further investigation, it was clear that this was being caused by unusual activity on the exchange. Since the start of July, a net of $350mn USDC has been market sold for USDT.

What’s most striking is how consistent this trend has been; there have only been a few short breaks in selling, each lasting less than 24 hours.

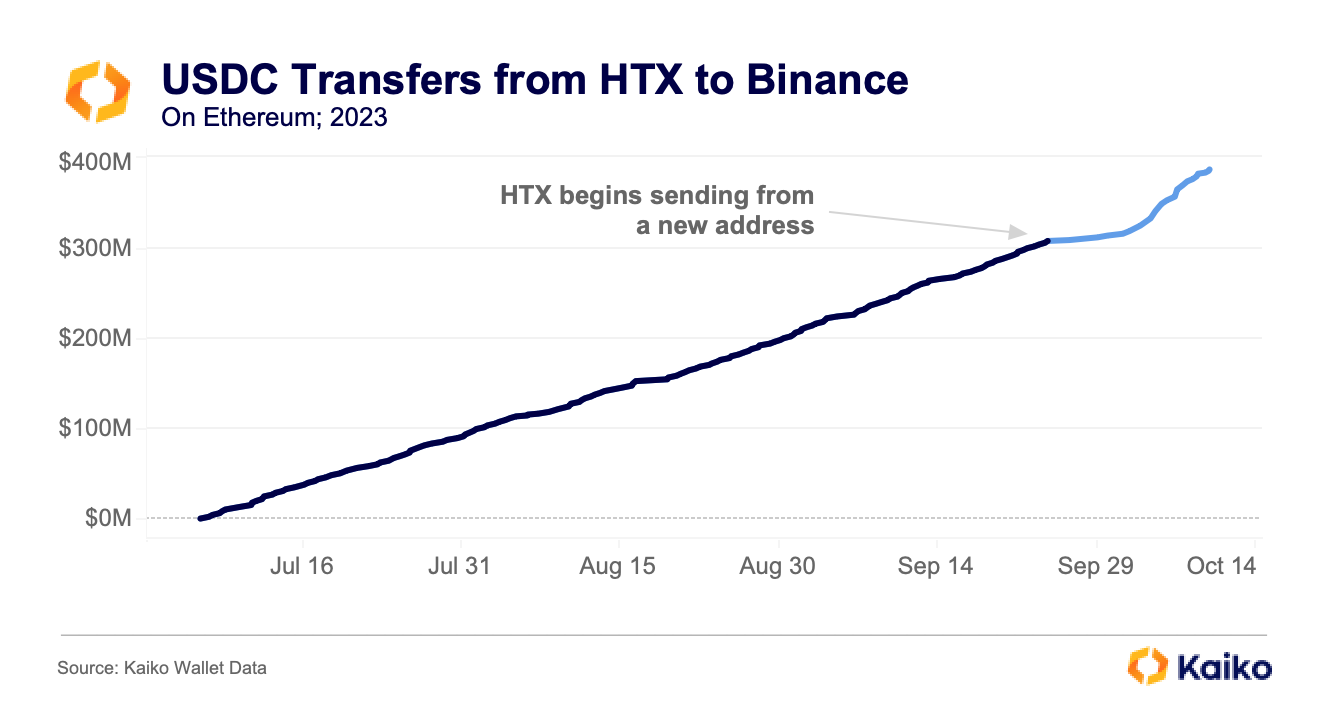

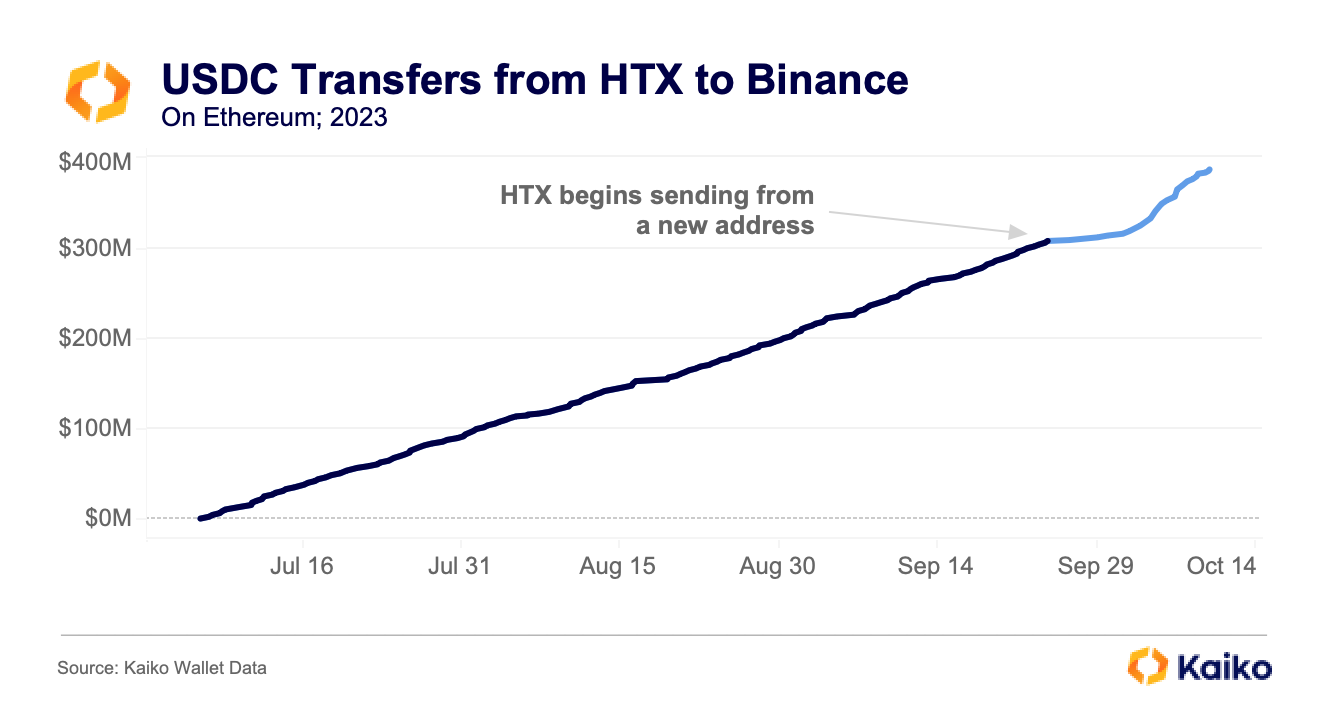

Using Kaiko’s new wallet data, we’ve been able to find that two wallets linked to HTX have transferred nearly $400mn USDC to Binance since the start of July; the first wallet stopped transferring on September 24 and was quickly replaced by the second wallet.

So, in the past three months, a net of $350mn USDC has been systematically sold for USDT on HTX while nearly $400mn USDC has been transferred from HTX to Binance at a similar rate.

The final potential piece of the puzzle comes from a ChainArgos (who previously uncovered that BUSD was not always fully backed) report on stUSDT, a “staked” version of USDT offered by JustLend that is supposed to generate yield by investing deposited USDT in real world assets (RWAs). However, it appears that this is not the case, as ChainArgos states that the “USDT on Huobi that belonged to customers has now been replaced with a fistful of IOUs in the form of stUSDT, with the USDT then re-hypothecated to JustLend.”

HTX currently holds $400mn stUSDT.

Conclusion

While not definitively linked, our data showing net $350mn USDC sold for USDT on HTX, alongside very similar USDC transfers to Binance, which also matches the amount of stUSDT held on HTX, is potentially concerning.

Even after regulatory crackdowns by jurisdictions all over the world, there are still broad swaths of the market that are loosely regulated. Whereas on-chain activity can be traced, centralized exchange activity remains something of a black box. Thus, it’s often necessary to combine many data types – in this case OHLCV, tick trade, and wallet data – to reveal a fuller picture of what’s happening on these exchanges.

![]()

![]()

![]()

![]()