Join us for our latest webinar in collaboration with Cboe

Insights.

Our Data Debrief and Deep Dive insights are published twice a week and you can subscribe to them here.

Hyperliquid

09/03/2026 Data Debrief

Bitcoin Ranges While Traditional Assets Find New Home on Crypto RailsAs Bitcoin ranges between $60k and $72k following the early February sell-off, the crypto market navigates competing forces, with geopolitical shocks testing 24/7 infrastructure and options markets pricing elevated volatility into...

![]()

Ethereum

02/03/2026 Data Debrief

The Pressure of Dilution on Layer 1 ValuationsAs Layer 1 tokens are increasingly traded through ETFs and evaluated like equity investments, the ma...

Written by Laurens Fraussen![]()

Ethereum

23/02/2026 Data Debrief

Staking Products Launch Despite Treasury FailuresAs crypto volatility continues, the markets are testing whether institutional ETH adoption follows p...

Written by Laurens Fraussen

![]()

Hyperliquid

09/03/2026 Data Debrief

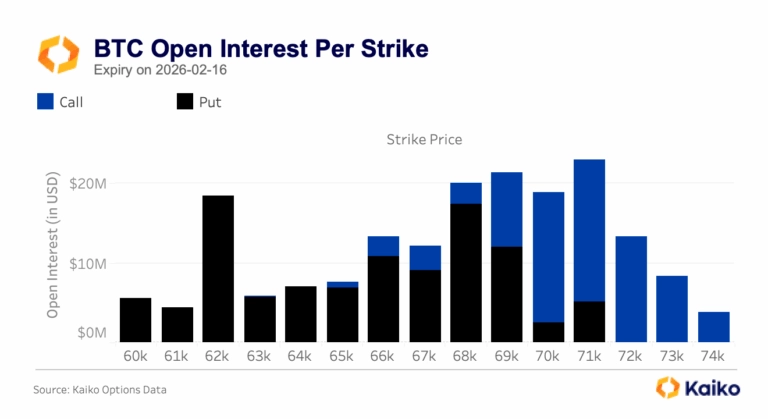

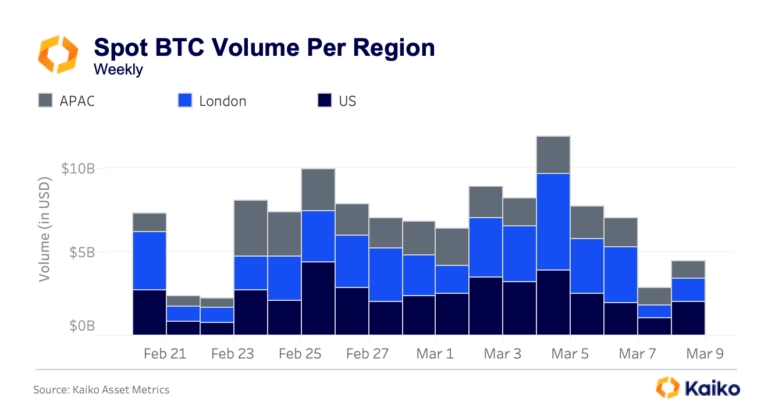

Bitcoin Ranges While Traditional Assets Find New Home on Crypto RailsAs Bitcoin ranges between $60k and $72k following the early February sell-off, the crypto market navigates competing forces, with geopolitical shocks testing 24/7 infrastructure and options markets pricing elevated volatility into the Federal Reserve’s March 18th decision.

Written by Laurens Fraussen![]()

Ethereum

02/03/2026 Data Debrief

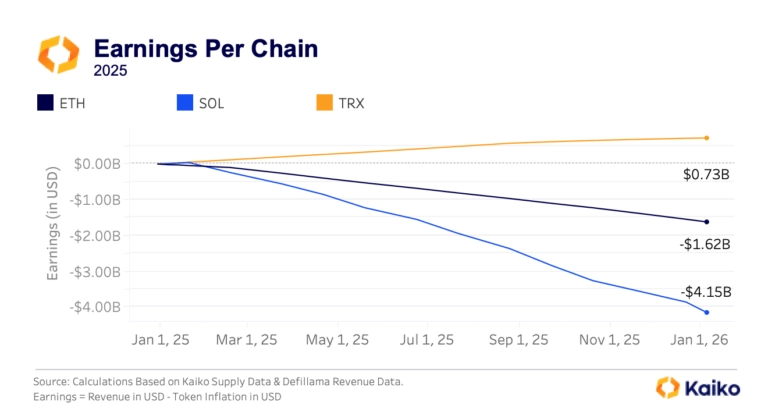

The Pressure of Dilution on Layer 1 ValuationsAs Layer 1 tokens are increasingly traded through ETFs and evaluated like equity investments, the market is discovering an uncomfortable truth, most major blockchains operate as loss-making businesses. With Ethereum posting $1.62B in annual losses and Solana bleeding $4.15B despite generating hundreds of millions in fee revenue, validator dilution costs consistently outpace income by 7-25x.

Written by Laurens Fraussen![]()

Ethereum

23/02/2026 Data Debrief

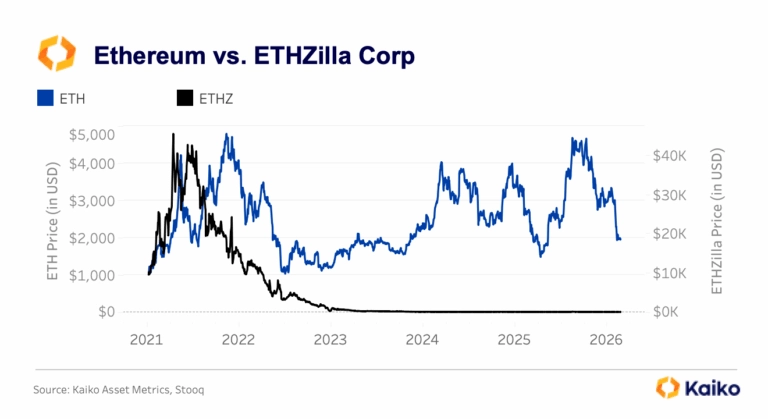

Staking Products Launch Despite Treasury FailuresAs crypto volatility continues, the markets are testing whether institutional ETH adoption follows price or infrastructure development. With ETH plunging 50% from its mid-2025 peaks to $2,000, this triggered a 95%+ collapse in equity treasury vehicles like ETHZilla and $4B in spot ETF outflows.

Written by Laurens Fraussen![]()

Prediction Markets

16/02/2026 Data Debrief

Prediction Markets Liquidity In FocusPrediction markets captured mainstream attention throughout 2025 as Polymarket processed over $2 billion in election-related volume. The post-election collapse from $1 billion to $200 million in open interest exposed fundamental questions about sustainability.

Written by Laurens Fraussen![]()

Derivatives

09/02/2026 Data Debrief

Bitcoin's Latest Drop Signals Halfway Point of Bear MarketLast week’s correction triggered approximately $9 billion in liquidations and pushed stablecoin dominance above 10%, exceeding levels last seen during the FTX collapse.

Written by Laurens Fraussen![]()

Binance

02/02/2026 Data Debrief

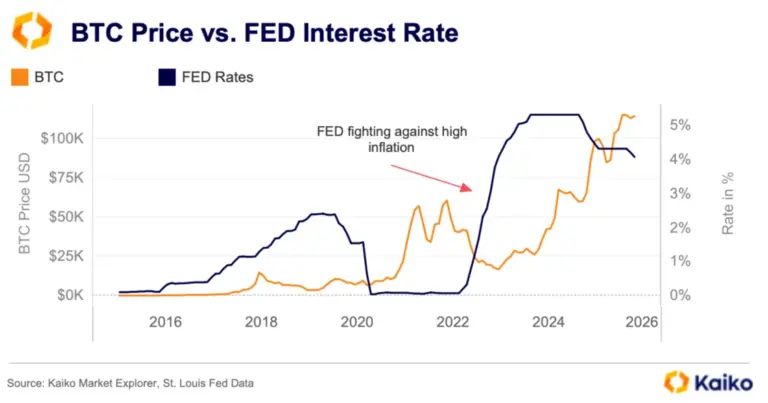

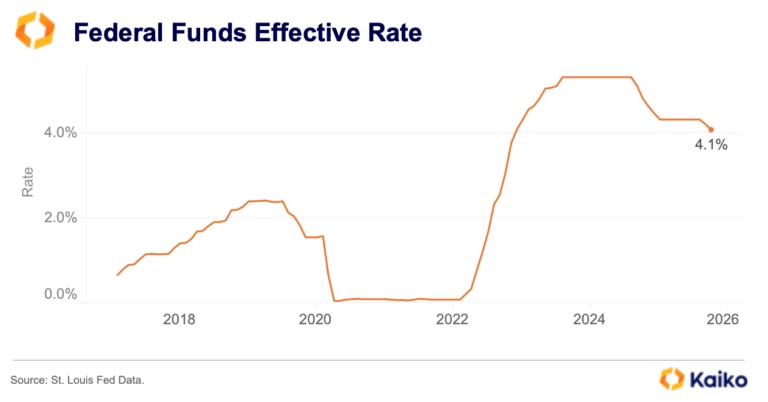

Fed Reforms Spark Cross-Asset Volatility SpikeThe final week of January 2026 delivered a stress test across multiple markets simultaneously. As the Federal Reserve held rates steady at 3.5-3.75% amid leadership transition uncertainty, Bitcoin declined 15% from $88,000 to $74,500, triggering ~$7 billion in liquidations.

Written by Laurens Fraussen![]()

Macro

26/01/2026 Data Debrief

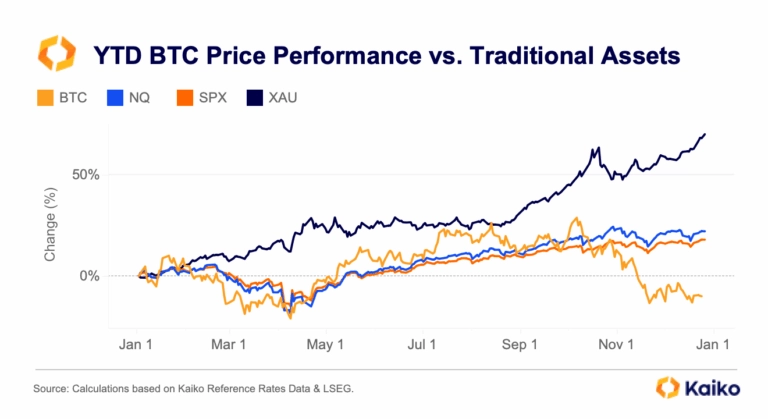

Tariff Uncertainty Exposes Bitcoin's Identity CrisisTariff volatility exposed Bitcoin’s ongoing identity crisis. Trump’s Greenland tariff threats triggered a violent round-trip in crypto markets, with Bitcoin plunging below $88,000 while gold surged over 5%, highlighting their inverse correlation. Behind the headlines, orderbook depth remained surprisingly stable even as the CME basis collapsed into negative territory for the first time in years, signaling the unwind of institutional carry trades that had anchored demand since ETF launches.

Written by Laurens Fraussen![]()

Macro

20/01/2026 Data Debrief

Infrastructure Is Holding Back TokenizationReal-world asset tokenization has evolved from a theoretical exercise into a measurable market, but the data reveals a split reality. Stablecoins have achieved massive scale, while tokenized securities, commodities, and infrastructure tokens remain concentrated, illiquid, and far from self-sustaining.

Written by Laurens Fraussen![]()

Macro

13/01/2026 Data Debrief

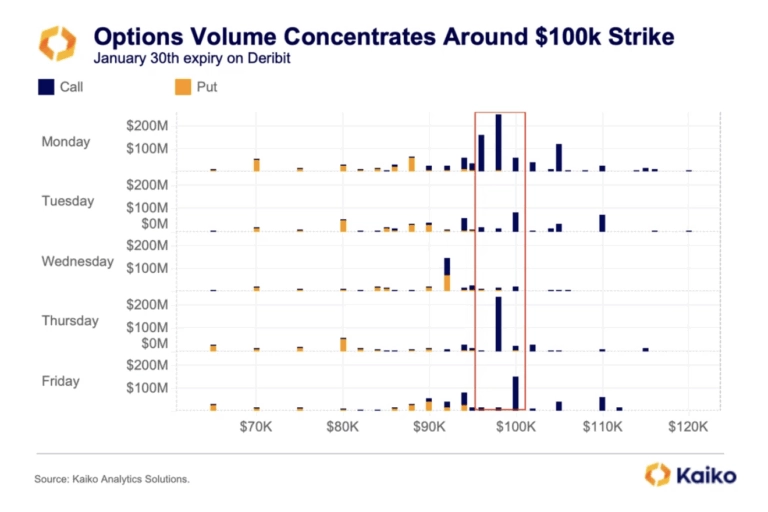

Positioning for $100K: Signals and Key CatalystsThis week’s Data Debrief examines the positioning dynamics beneath the surface of the early January rally. Extraordinary call volume concentration at and around the $100,000 strike, an inverted volatility term structure, and neutral funding rates suggesting balanced leverage.

Written by Adam Morgan McCarthy![]()

Indices

06/01/2026 Data Debrief

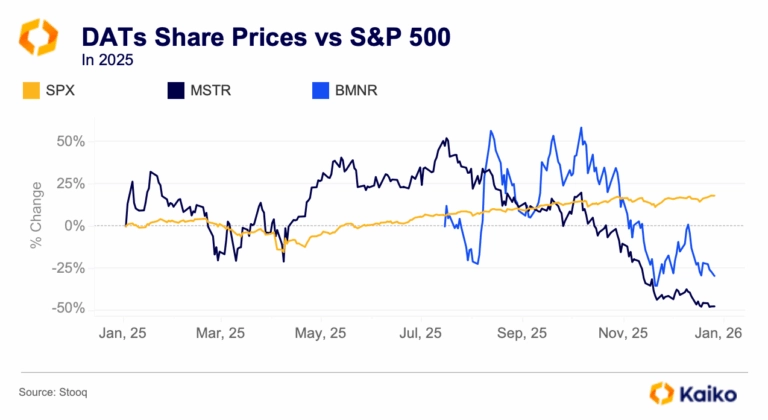

The Rise and Repricing of Digital Asset TreasuriesAs digital assets mature and market structure deepens, corporate and institutional crypto holdings are being reclassified from speculative bets to managed treasuries. Instead of sitting passively on balance sheets, these positions are increasingly treated as a distinct asset pool, with dedicated strategies for liquidity, risk, and yield.

Written by Laurens Fraussen![]()

Derivatives

29/12/2025 Data Debrief

Santa Rallies, Cycles, and Year-End Reflections for BitcoinAs markets approach the end of the year, Bitcoin finds itself at a familiar crossroads, caught between cyclical behavior and a steadily developing market. While year-end seasonality has historically played a role in shaping price action, recent data suggests that cyclical drivers are increasingly dominant.

Written by Laurens Fraussen![]()

Derivatives

22/12/2025 Data Debrief

Crypto in 2026, What Breaks, What Scales, What ConsolidatesCrypto markets enter 2026 in a markedly different position than in prior cycle transitions. Rather than resetting after a speculative peak, the market appears to be progressing through a phase of institutional consolidation.

Written by Thomas Probst![]()

Year in Review

01/12/2025 Data Debrief

Kaiko Research's Top 10 Charts of 2025In this report, we look back on 2025 and the key forces that shaped markets. From BTC record highs and fleeting altcoin rallies to major liquidation events and evolving regulation, we examine what shaped a seminal year for crypto.Written by Adam Morgan McCarthy![]()

Stablecoin

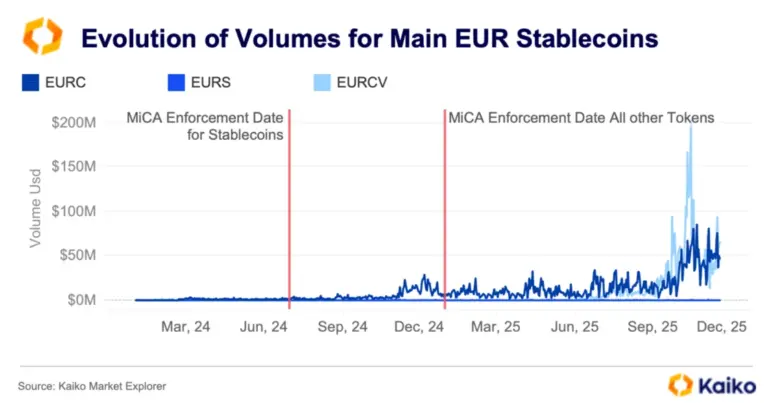

24/11/2025 Data Debrief

MiCA's Impact on Crypto in EuropeEurope is progressing with a conservative structured crypto framework that leans towards regulating innovation.Written by Adam Morgan McCarthy![]()

Macro

17/11/2025 Data Debrief

Navigating Fed Fears & AI Bubble BurstingGiven the current macroeconomic context, we are seeing the emergence of two major risks likely to have a decisive impact.

Written by Adam Morgan McCarthy![]()

Stablecoin

11/11/2025 Data Debrief

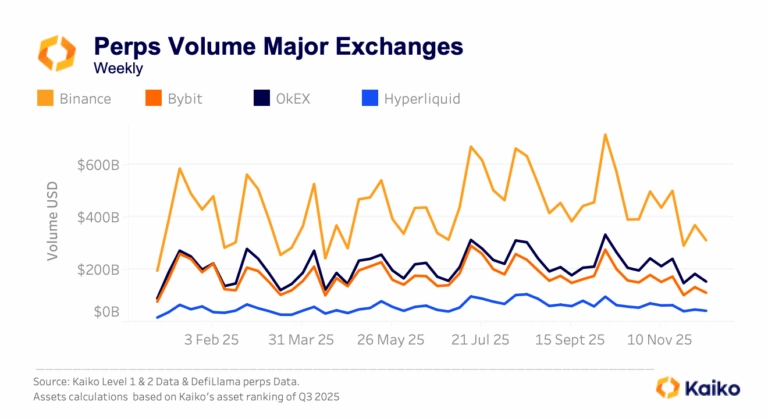

Stablecoins, the Beating Heart of Crypto MarketsThis week, we’re releasing our latest Asset Ranking. This time the scoring has developed beyond a simple liquidity ranking to encompass a broader range of metrics that truly measure the tradability of an asset. As well as looking at volume, liquidity and market capitalization the new ranking also considers market availability, maturity, and custody scores.

Written by Adam Morgan McCarthy