Join us for our latest webinar in collaboration with Cboe

Insights.

Our Data Debrief and Deep Dive insights are published twice a week and you can subscribe to them here.

Derivatives

09/02/2026 Data Debrief

Bitcoin's Latest Drop Signals Halfway Point of Bear MarketLast week’s correction triggered approximately $9 billion in liquidations and pushed stablecoin dominance above 10%, exceeding levels last seen during the FTX collapse.

![]()

Binance

02/02/2026 Data Debrief

Fed Reforms Spark Cross-Asset Volatility SpikeThe final week of January 2026 delivered a stress test across multiple markets simultaneously. As th...

Written by Laurens Fraussen![]()

Macro

26/01/2026 Data Debrief

Tariff Uncertainty Exposes Bitcoin's Identity CrisisTariff volatility exposed Bitcoin’s ongoing identity crisis. Trump’s Greenland tariff threats trigge...

Written by Laurens Fraussen

![]()

Derivatives

09/02/2026 Data Debrief

Bitcoin's Latest Drop Signals Halfway Point of Bear MarketLast week’s correction triggered approximately $9 billion in liquidations and pushed stablecoin dominance above 10%, exceeding levels last seen during the FTX collapse.

Written by Laurens Fraussen![]()

Binance

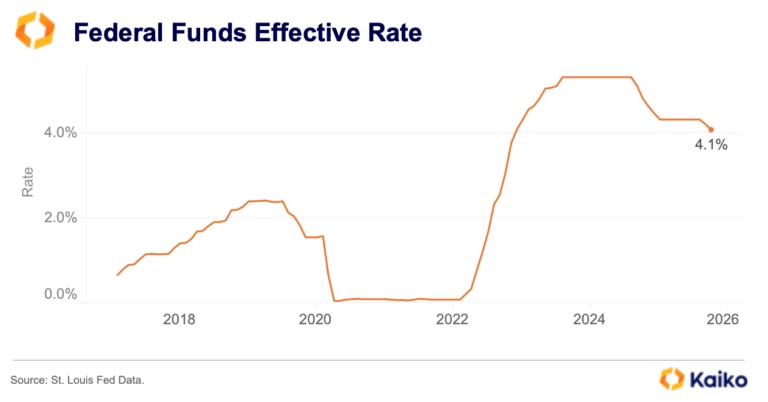

02/02/2026 Data Debrief

Fed Reforms Spark Cross-Asset Volatility SpikeThe final week of January 2026 delivered a stress test across multiple markets simultaneously. As the Federal Reserve held rates steady at 3.5-3.75% amid leadership transition uncertainty, Bitcoin declined 15% from $88,000 to $74,500, triggering ~$7 billion in liquidations.

Written by Laurens Fraussen![]()

Macro

26/01/2026 Data Debrief

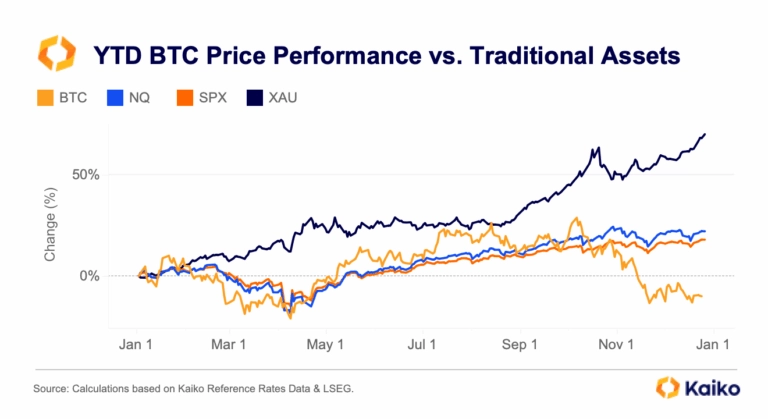

Tariff Uncertainty Exposes Bitcoin's Identity CrisisTariff volatility exposed Bitcoin’s ongoing identity crisis. Trump’s Greenland tariff threats triggered a violent round-trip in crypto markets, with Bitcoin plunging below $88,000 while gold surged over 5%, highlighting their inverse correlation. Behind the headlines, orderbook depth remained surprisingly stable even as the CME basis collapsed into negative territory for the first time in years, signaling the unwind of institutional carry trades that had anchored demand since ETF launches.

Written by Laurens Fraussen![]()

Macro

20/01/2026 Data Debrief

Infrastructure Is Holding Back TokenizationReal-world asset tokenization has evolved from a theoretical exercise into a measurable market, but the data reveals a split reality. Stablecoins have achieved massive scale, while tokenized securities, commodities, and infrastructure tokens remain concentrated, illiquid, and far from self-sustaining.

Written by Laurens Fraussen![]()

Macro

13/01/2026 Data Debrief

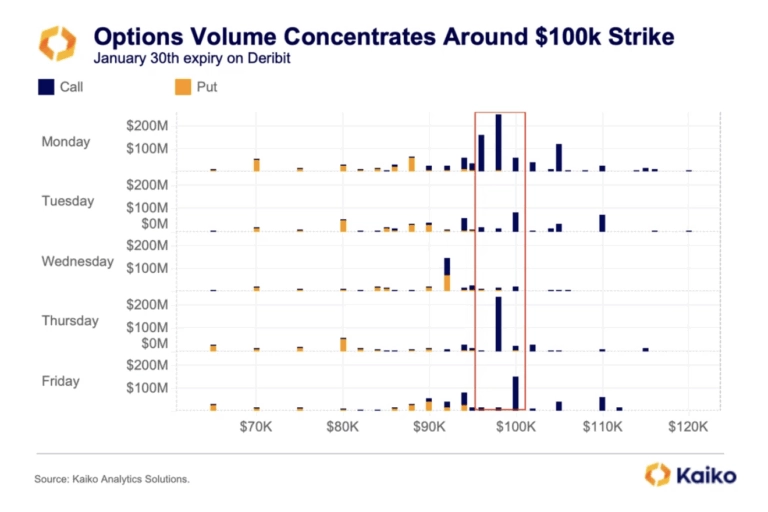

Positioning for $100K: Signals and Key CatalystsThis week’s Data Debrief examines the positioning dynamics beneath the surface of the early January rally. Extraordinary call volume concentration at and around the $100,000 strike, an inverted volatility term structure, and neutral funding rates suggesting balanced leverage.

Written by Adam Morgan McCarthy![]()

Indices

06/01/2026 Data Debrief

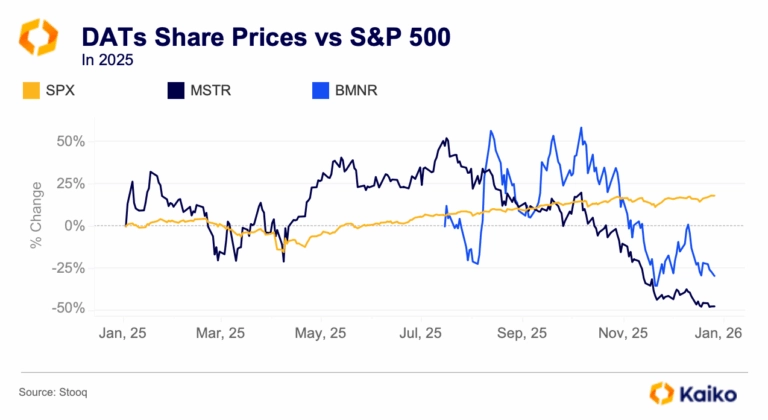

The Rise and Repricing of Digital Asset TreasuriesAs digital assets mature and market structure deepens, corporate and institutional crypto holdings are being reclassified from speculative bets to managed treasuries. Instead of sitting passively on balance sheets, these positions are increasingly treated as a distinct asset pool, with dedicated strategies for liquidity, risk, and yield.

Written by Laurens Fraussen![]()

Derivatives

29/12/2025 Data Debrief

Santa Rallies, Cycles, and Year-End Reflections for BitcoinAs markets approach the end of the year, Bitcoin finds itself at a familiar crossroads, caught between cyclical behavior and a steadily developing market. While year-end seasonality has historically played a role in shaping price action, recent data suggests that cyclical drivers are increasingly dominant.

Written by Laurens Fraussen![]()

Derivatives

22/12/2025 Data Debrief

Crypto in 2026, What Breaks, What Scales, What ConsolidatesCrypto markets enter 2026 in a markedly different position than in prior cycle transitions. Rather than resetting after a speculative peak, the market appears to be progressing through a phase of institutional consolidation.

Written by Thomas Probst![]()

Year in Review

01/12/2025 Data Debrief

Kaiko Research's Top 10 Charts of 2025In this report, we look back on 2025 and the key forces that shaped markets. From BTC record highs and fleeting altcoin rallies to major liquidation events and evolving regulation, we examine what shaped a seminal year for crypto.Written by Adam Morgan McCarthy![]()

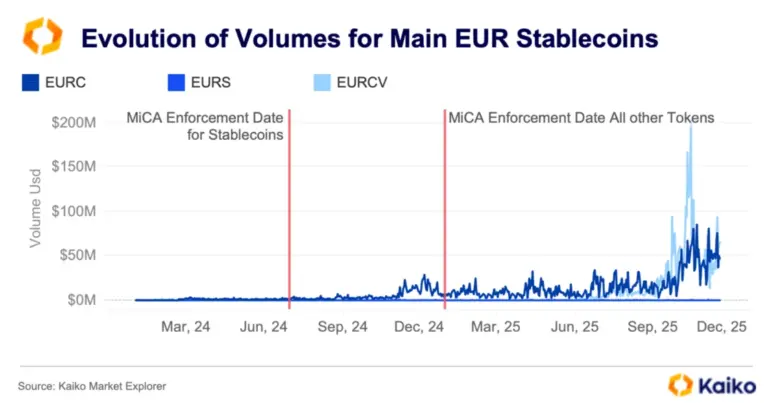

Stablecoin

24/11/2025 Data Debrief

MiCA's Impact on Crypto in EuropeEurope is progressing with a conservative structured crypto framework that leans towards regulating innovation.Written by Adam Morgan McCarthy![]()

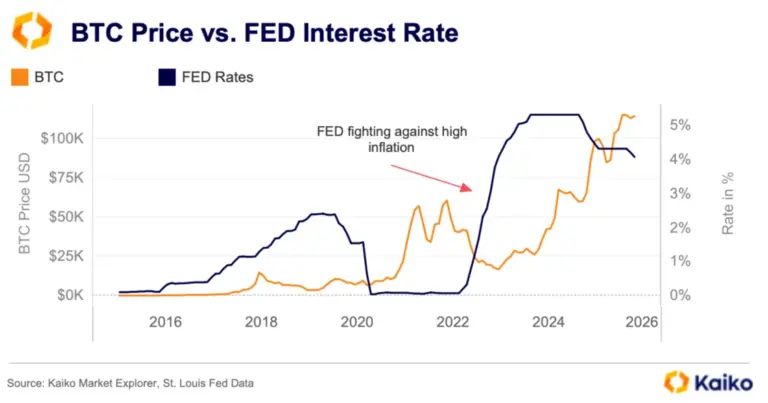

Macro

17/11/2025 Data Debrief

Navigating Fed Fears & AI Bubble BurstingGiven the current macroeconomic context, we are seeing the emergence of two major risks likely to have a decisive impact.

Written by Adam Morgan McCarthy![]()

Stablecoin

11/11/2025 Data Debrief

Stablecoins, the Beating Heart of Crypto MarketsThis week, we’re releasing our latest Asset Ranking. This time the scoring has developed beyond a simple liquidity ranking to encompass a broader range of metrics that truly measure the tradability of an asset. As well as looking at volume, liquidity and market capitalization the new ranking also considers market availability, maturity, and custody scores.

Written by Adam Morgan McCarthy![]()

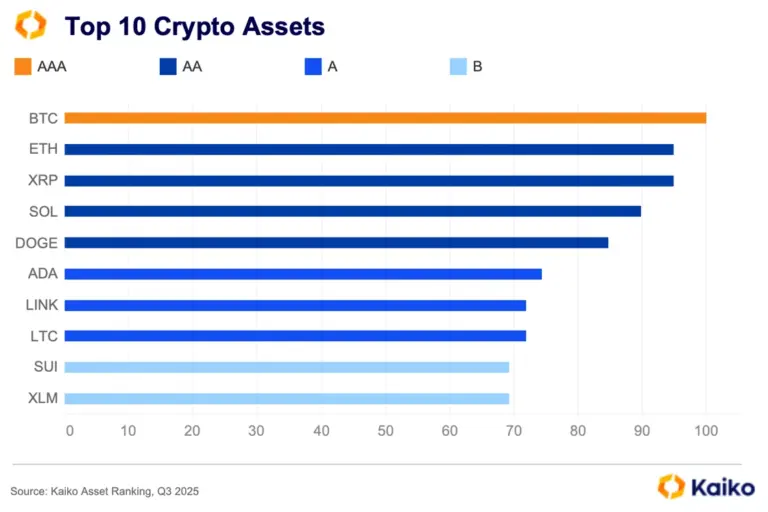

Layer 1

04/11/2025 Data Debrief

Introducing the Kaiko Crypto Asset RankingThis week, we’re releasing our latest Asset Ranking. This time the scoring has developed beyond a simple liquidity ranking to encompass a broader range of metrics that truly measure the tradability of an asset. As well as looking at volume, liquidity and market capitalization the new ranking also considers market availability, maturity, and custody scores.

Written by Adam Morgan McCarthy![]()

Derivatives

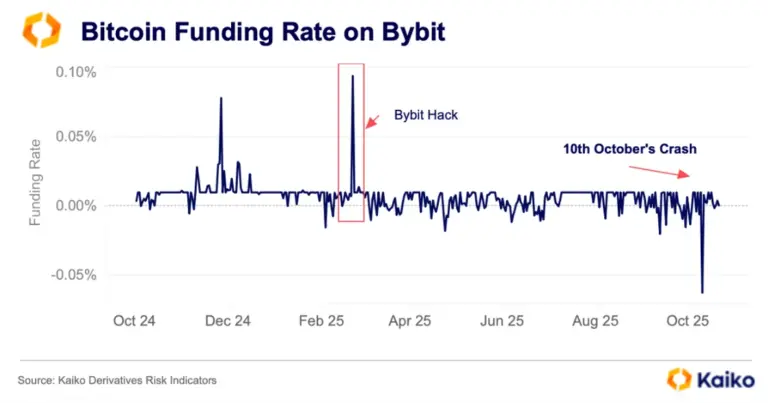

28/10/2025 Data Debrief

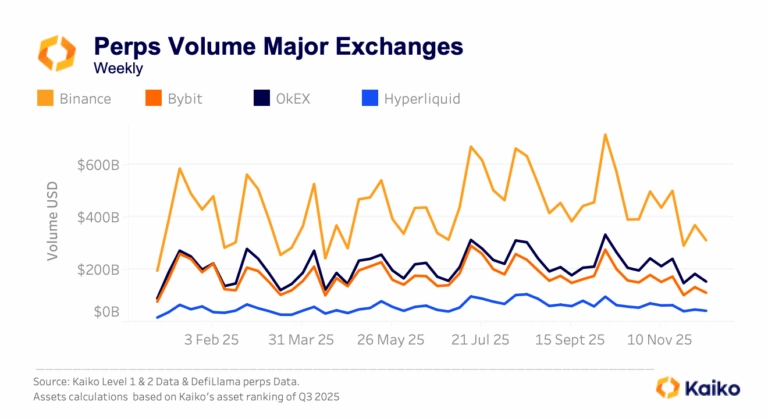

Time to Rethink Crypto HedgingFollowing recent market shocks, we’re examining hedging practices in crypto markets. Perps dominate trading volume, dwarfing options, but is it time for regime change and could options be the answer? The October 10 crash reminded us how extreme crypto’s volatility can be, and how current hedging tools are limited due to the relatively small size of the market.

Written by Adam Morgan McCarthy![]()

Liquidity

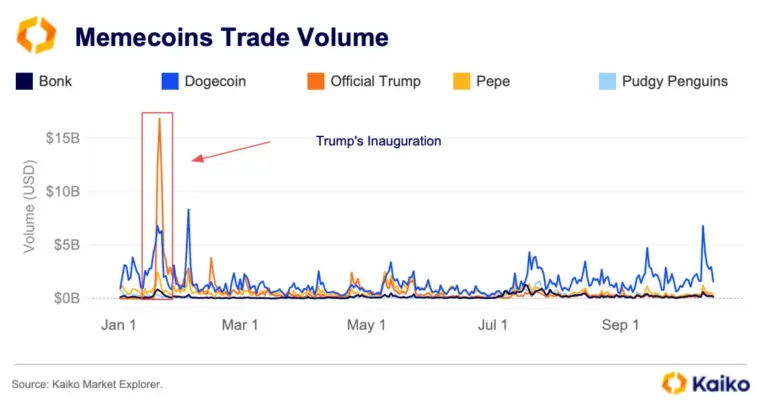

20/10/2025 Data Debrief

Inside Trump's Illiquid Crypto EmpireOne year after the Trump family’s first foray into crypto, we analyze the trends shaping their digital-asset empire. From humble beginnings to booming volumes, and even bigger busts, we explore what drives returns and losses in the first family’s much-touted crypto venture.

Written by Adam Morgan McCarthy![]()

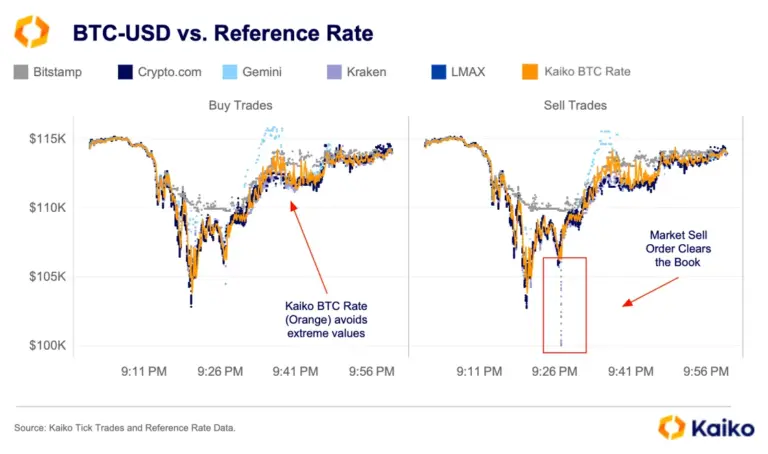

CEX

17/10/2025 Deep Dive

Crypto's Pricing Problem Laid BareLast week’s crash wasn’t just a market event — it was a live-fire test of the infrastructure underpinning crypto markets. In a period under 30 minutes, every asset whipsawed, long‑tail tokens sold off sharply, and oracle designs faltered. The lack of uniformity across markets determined who was liquidated, who accrued bad debt, and who ultimately paid the price.Written by Adam Morgan McCarthy