volume weighting

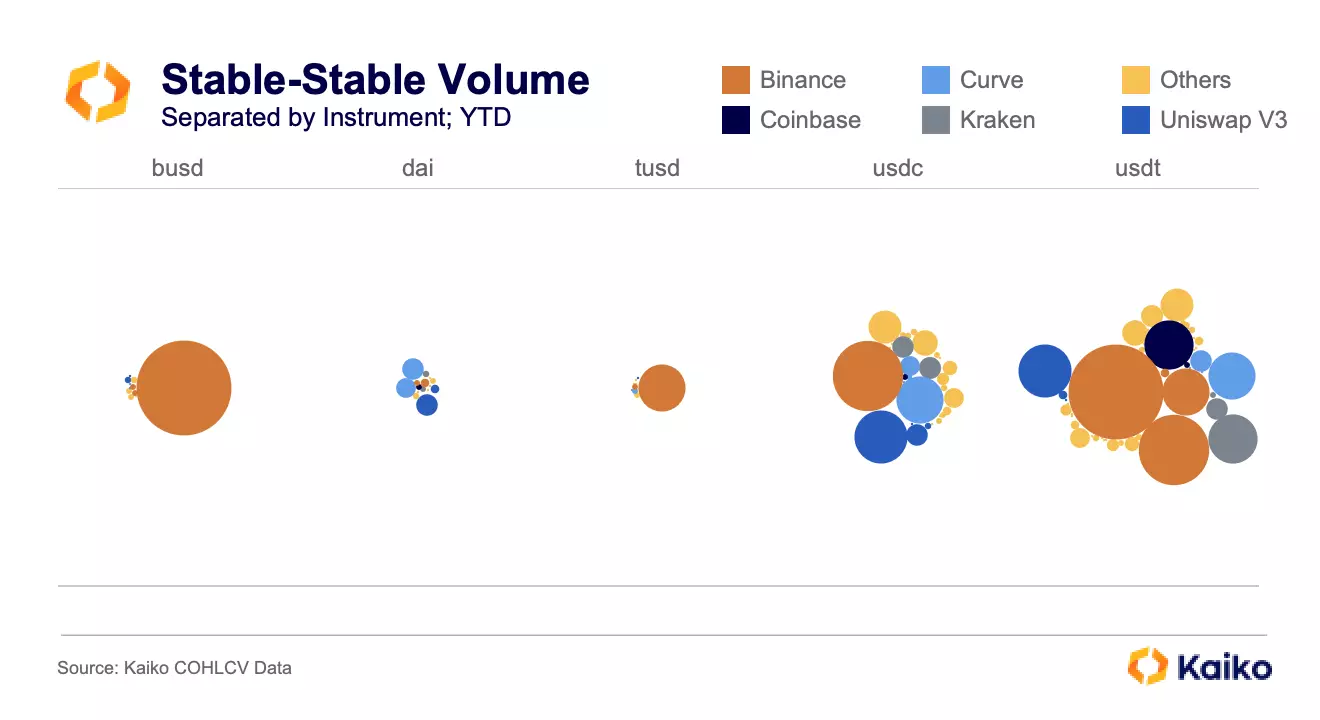

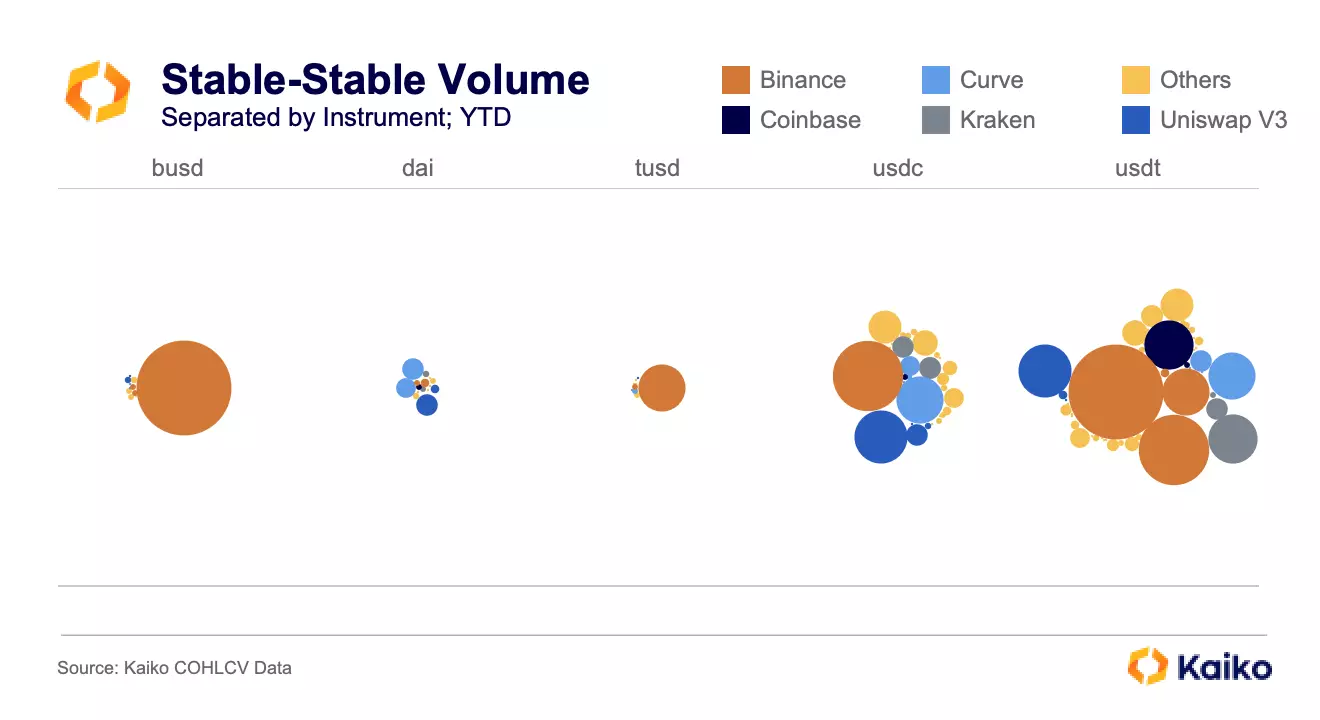

The chart below shows YTD stablecoin-stablecoin instrument volumes, with colors representing different exchanges [2]. DAI has the lowest volumes of the bunch at just $17bn, nearly $13bn of which was on Uniswap V3 and Curve. TUSD is next up, with just $24.5bn in volumes, $23.5bn of which came on a single instrument: TUSD-USDT on Binance.

BUSD measures in at $97.5bn and is similarly concentrated, with $93bn of that coming from BUSD-USDT on Binance. USDC and USDT look quite different from the others; USDC has $150bn in volume distributed across 48 instruments while USDT has $320bn distributed across 75.

I’ve used this to create a weighting system for the instruments. For example, in TUSD’s case, TUSD-USDT on Binance is 95% of TUSD’s stablecoin-stablecoin volumes, thus it is assigned 95 points in TUSD’s data set. USDC-USDT on Uniswap V3 is 9 points in USDT’s data set and 19 points in USDC’s data set; it accounts for more of USDC’s volume and is thus relatively more important to its peg stability than it is to USDT’s. I’ve also excluded any instrument that accounted for less than 0.01% of a stablecoin’s volume. In USDC’s case, this eliminated 15 out of 48 instruments.

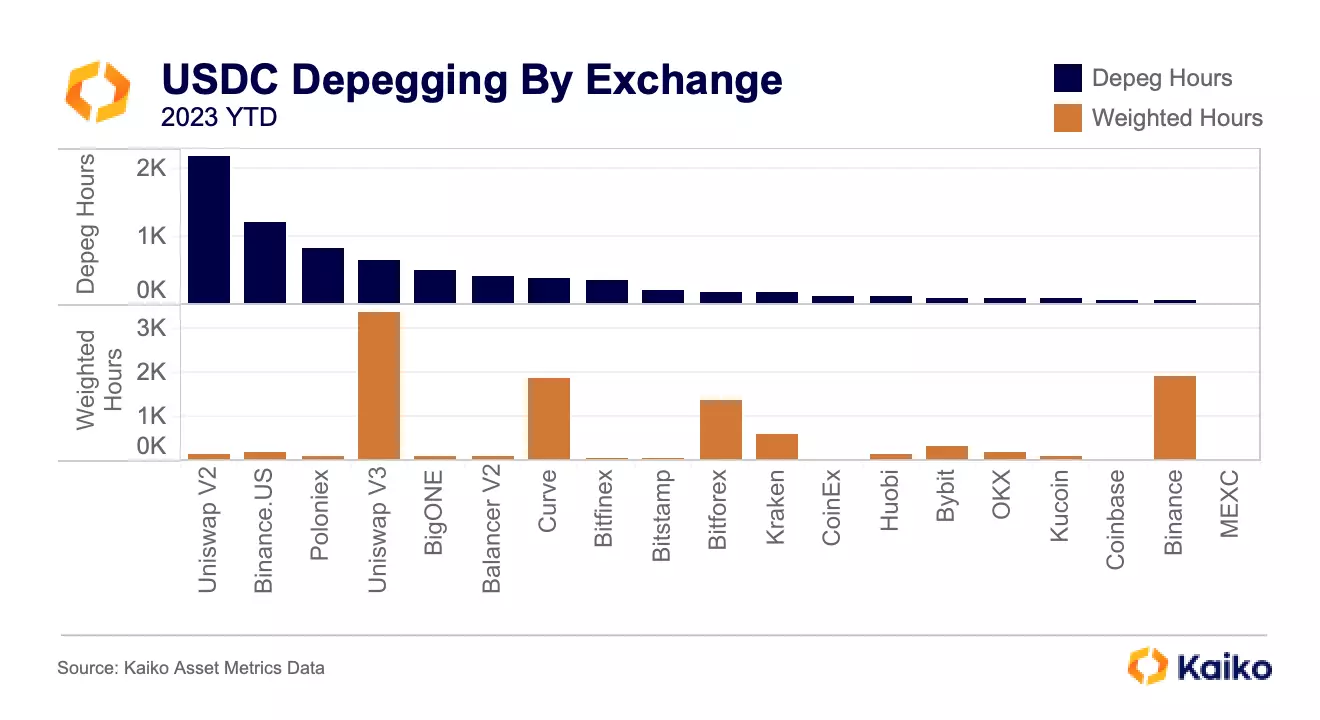

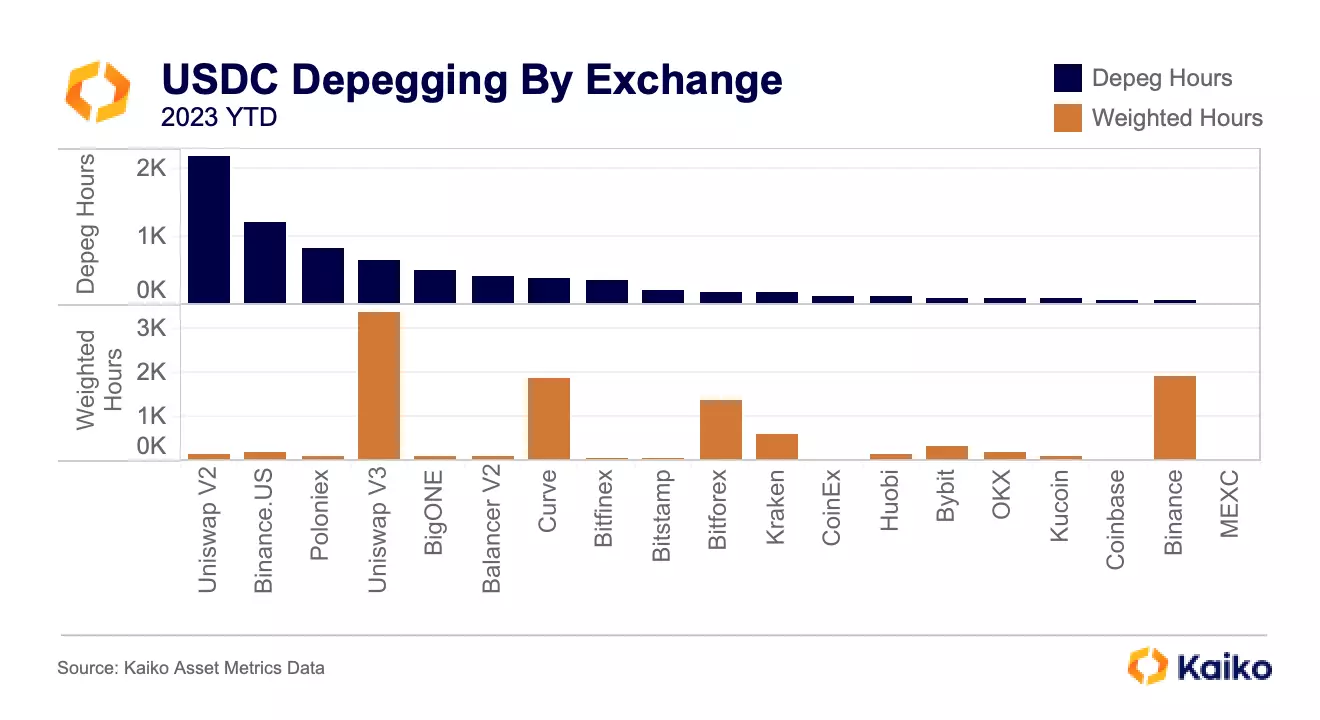

The example below uses USDC to show why the weighting is so important.

Unweighted, Uniswap V2 has by far the most “depeg hours”, which is just the number of hours that USDC has dipped below its threshold on the exchange. But Uniswap V2 is not a significant driver of USDC’s stablecoin-stablecoin volume. The same is true for Binance.US, where there have been many depegs since the exchange was included in an SEC lawsuit. There were very few USDC depeg hours on Binance, yet it is the second highest in “weighted hours” because of its high volumes. Note that I’ve excluded some exchanges with suspicious volumes; a future version of this metric may exclude more exchanges.

the result

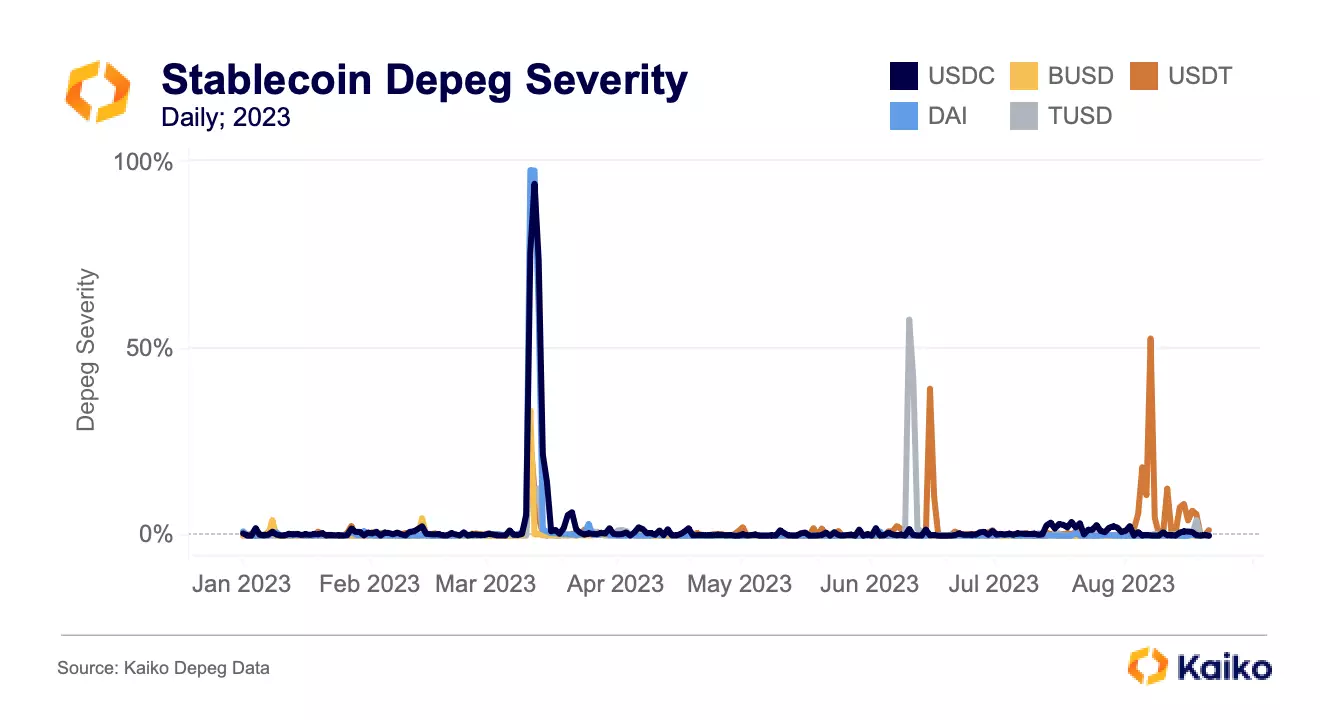

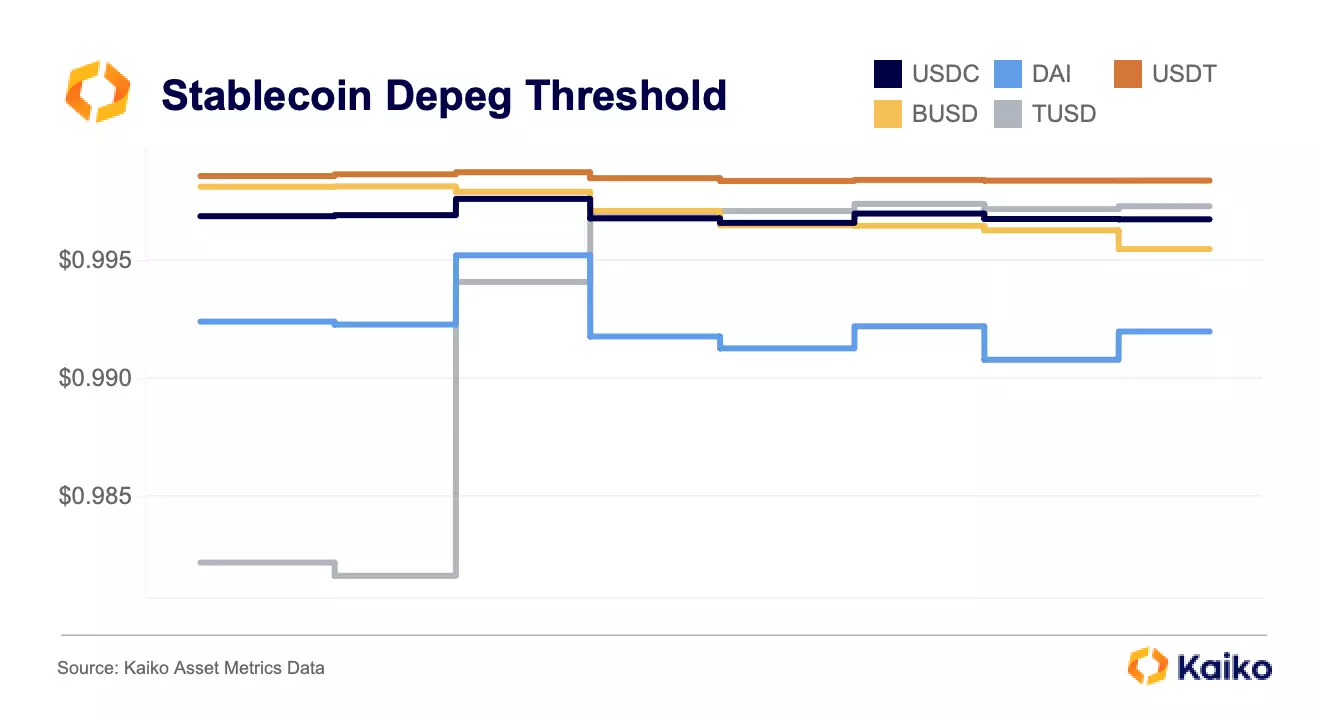

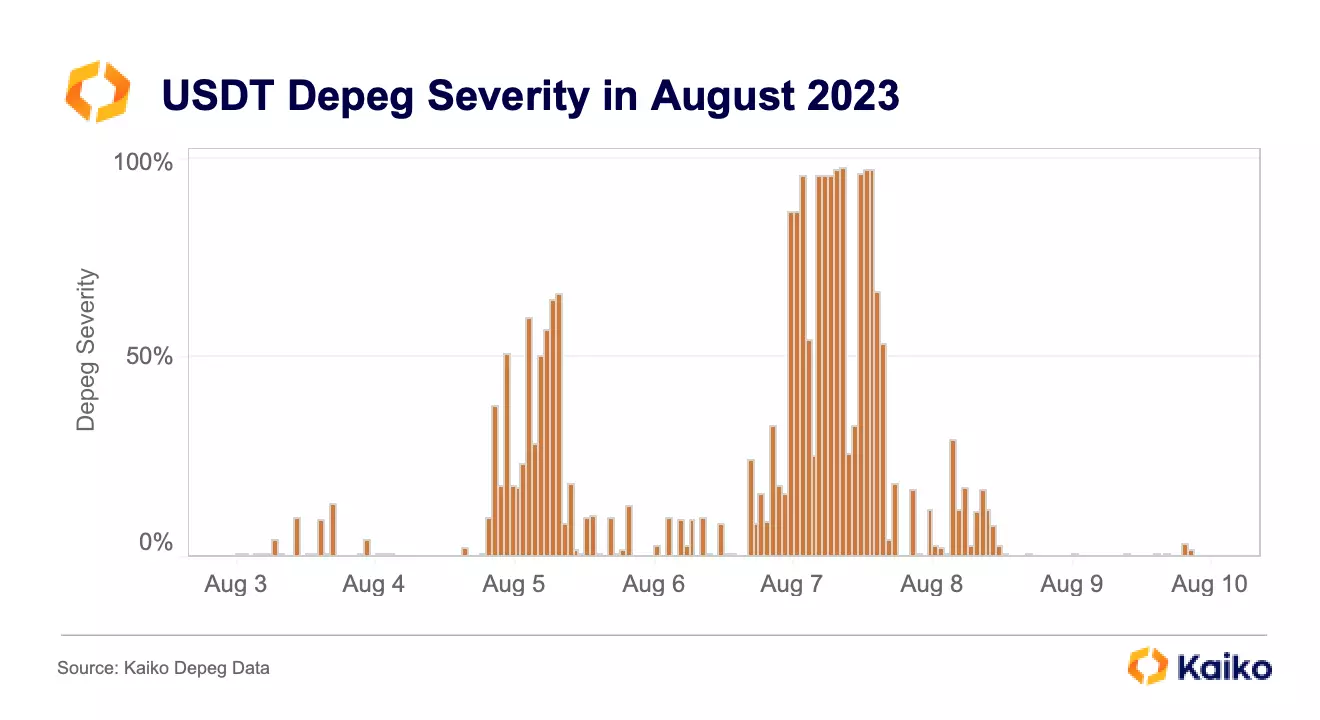

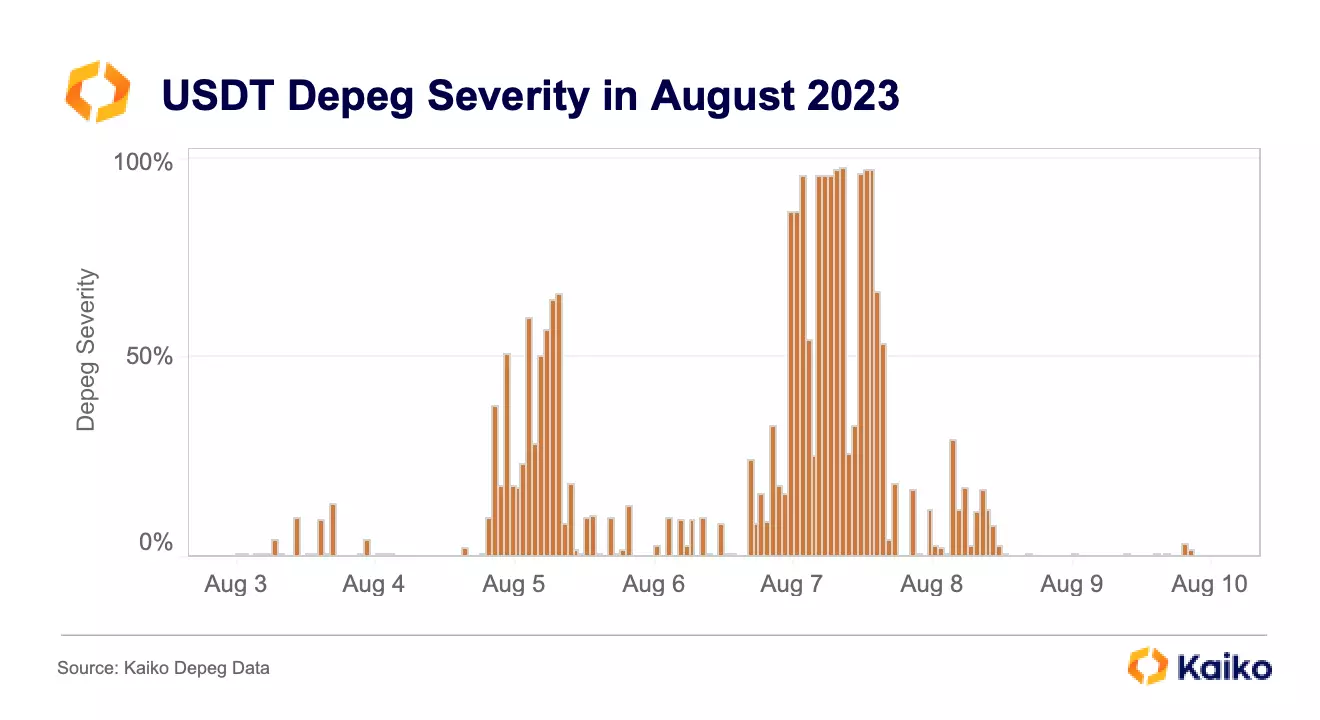

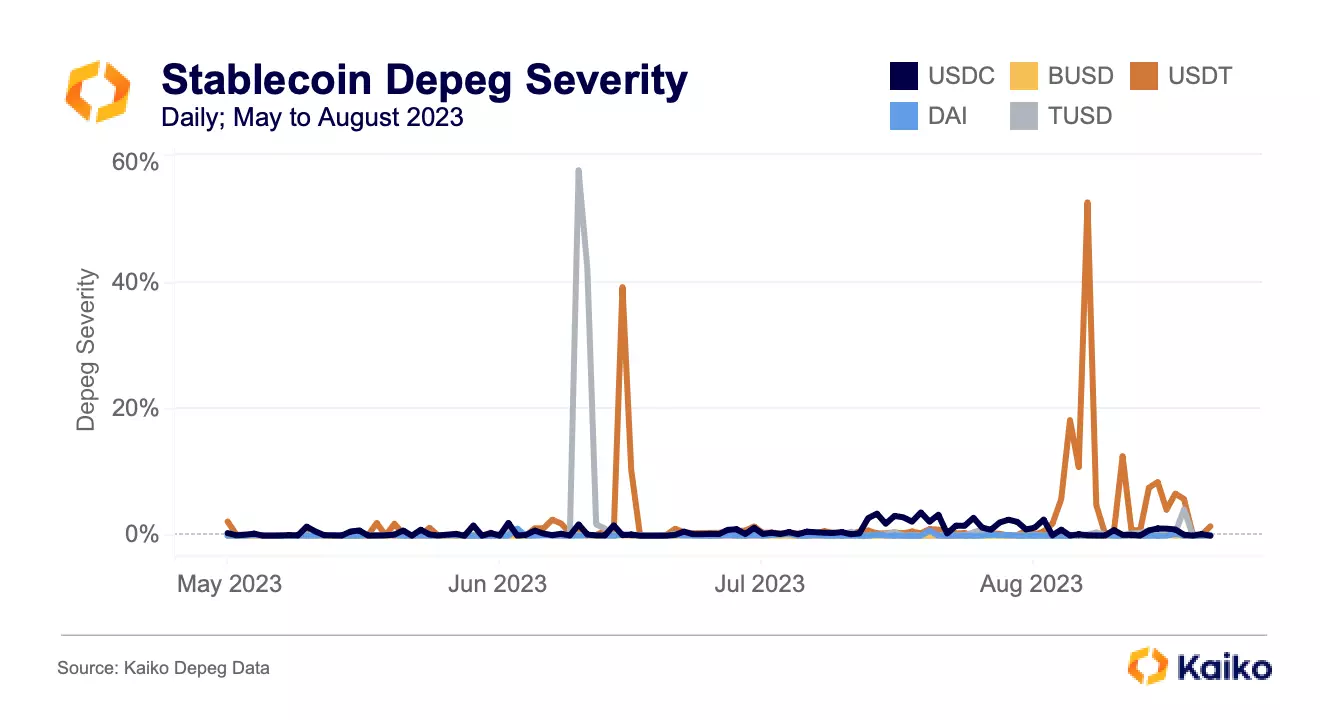

This method allows for different sensitivities to depegging. For example, looking at the beginning of August using an hourly granularity shows hours of very severe USDT depegs.

Why wasn’t this bigger news? Because the depeg wasn’t as dramatic as some past depegs in pure price terms. However, on August 7 at 8am UTC, it hit a 98% depeg severity, meaning that USDT traded at a discount on virtually every instrument. These depegs came after $500mn total net selling of USDT in just a few days on Binance, Huobi, and Uniswap. As I’ve written about previously, Tether’s redemption fee and minimum make USDT’s supply less elastic than it should be; combined with decreasing liquidity it’s not surprising to see more frequent USDT depegs.

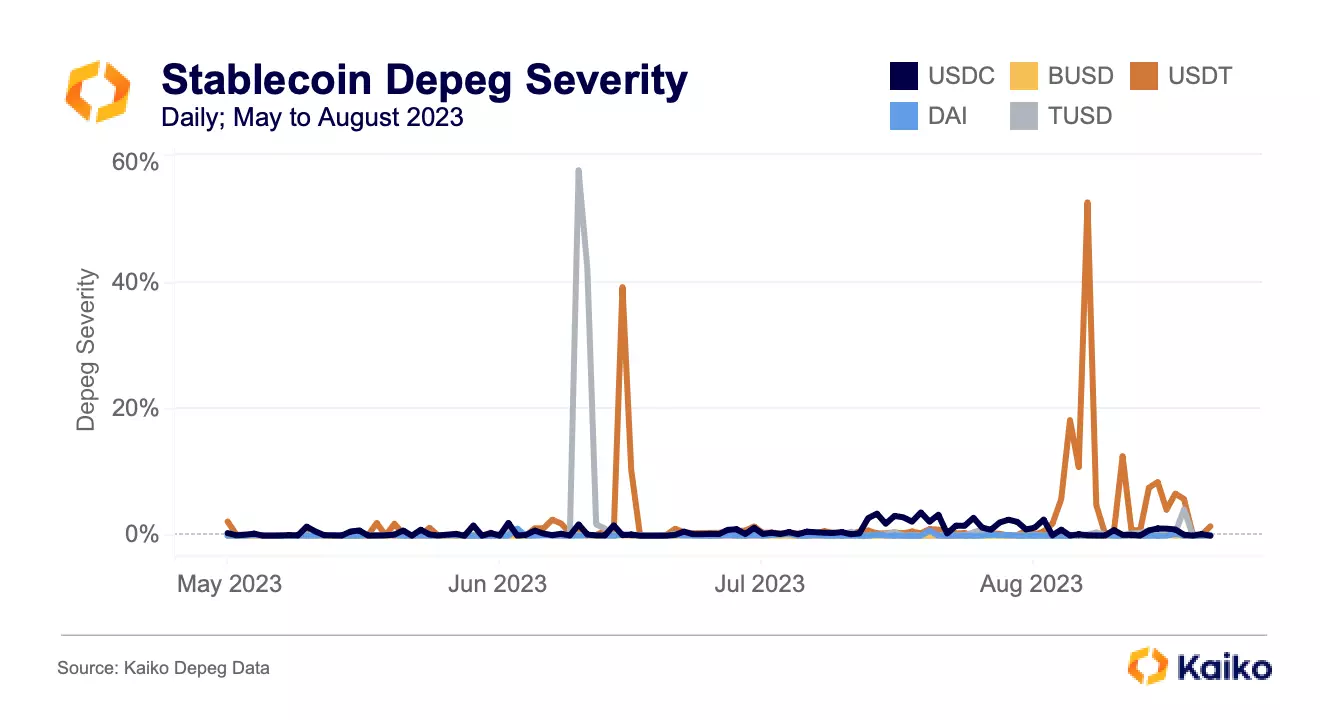

Alternatively, it’s possible to use daily granularity for a less sensitive measure. This shows that the most severe depeg since May was TUSD on June 7, hitting nearly 60% as TUSD traded at a discount on its main Binance pair for most of the day.

I like to refer to the daily metric using depeg magnitudes, where the magnitude is just the percentage divided by 10 [3]. So, the TUSD depeg on June 7 was a magnitude 6, while the USDT depeg that came after was a magnitude 4. To stretch the metaphor further, the magnitude 5 depeg on August 7 was preceded by a magnitude 2 foreshock on August 5 and followed by magnitude 1 aftershocks the rest of the month. Like earthquakes, anything under magnitude 2.5 isn’t usually felt. USDC, BUSD, and DAI haven’t had a magnitude 1 in the last 4 months.

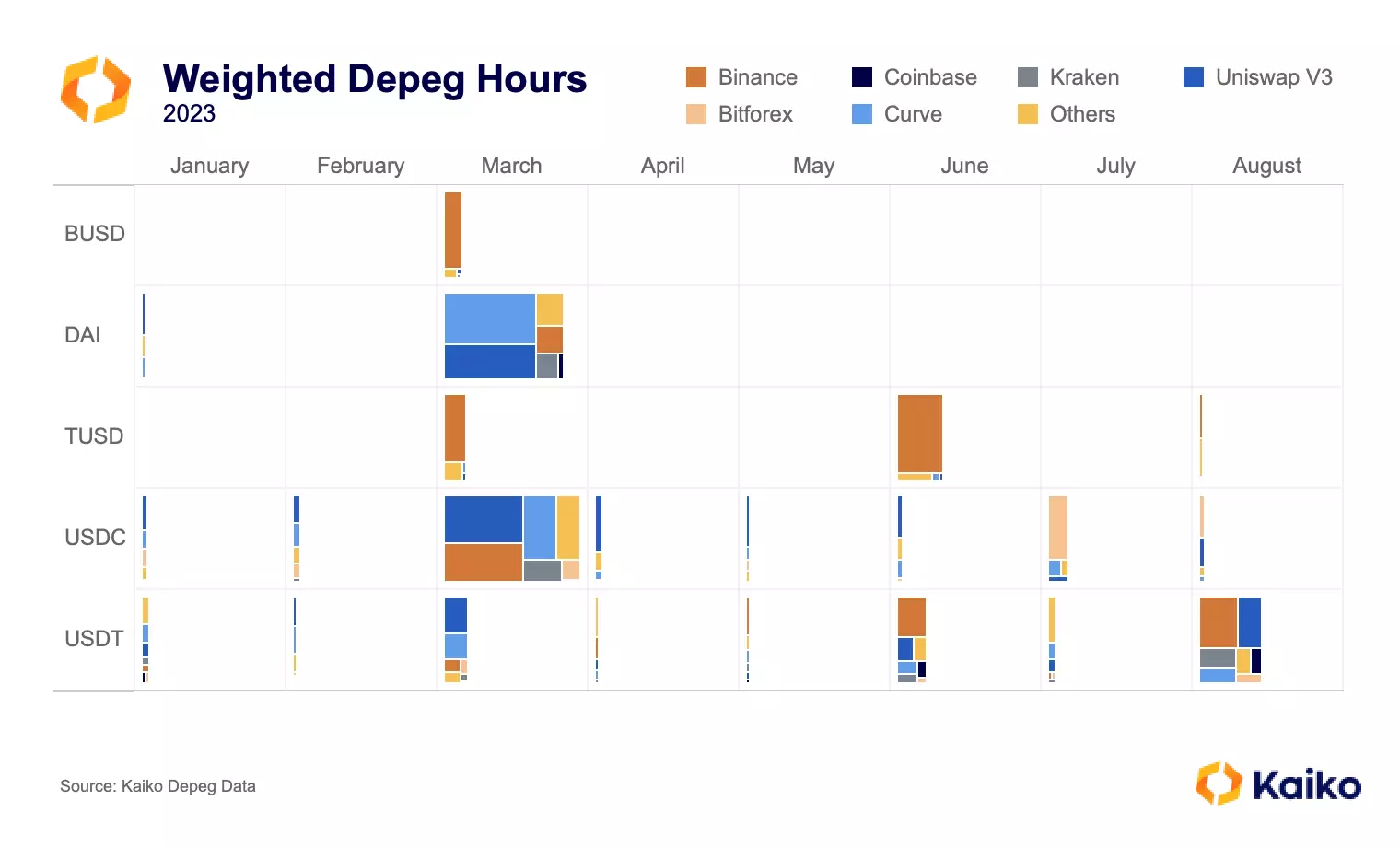

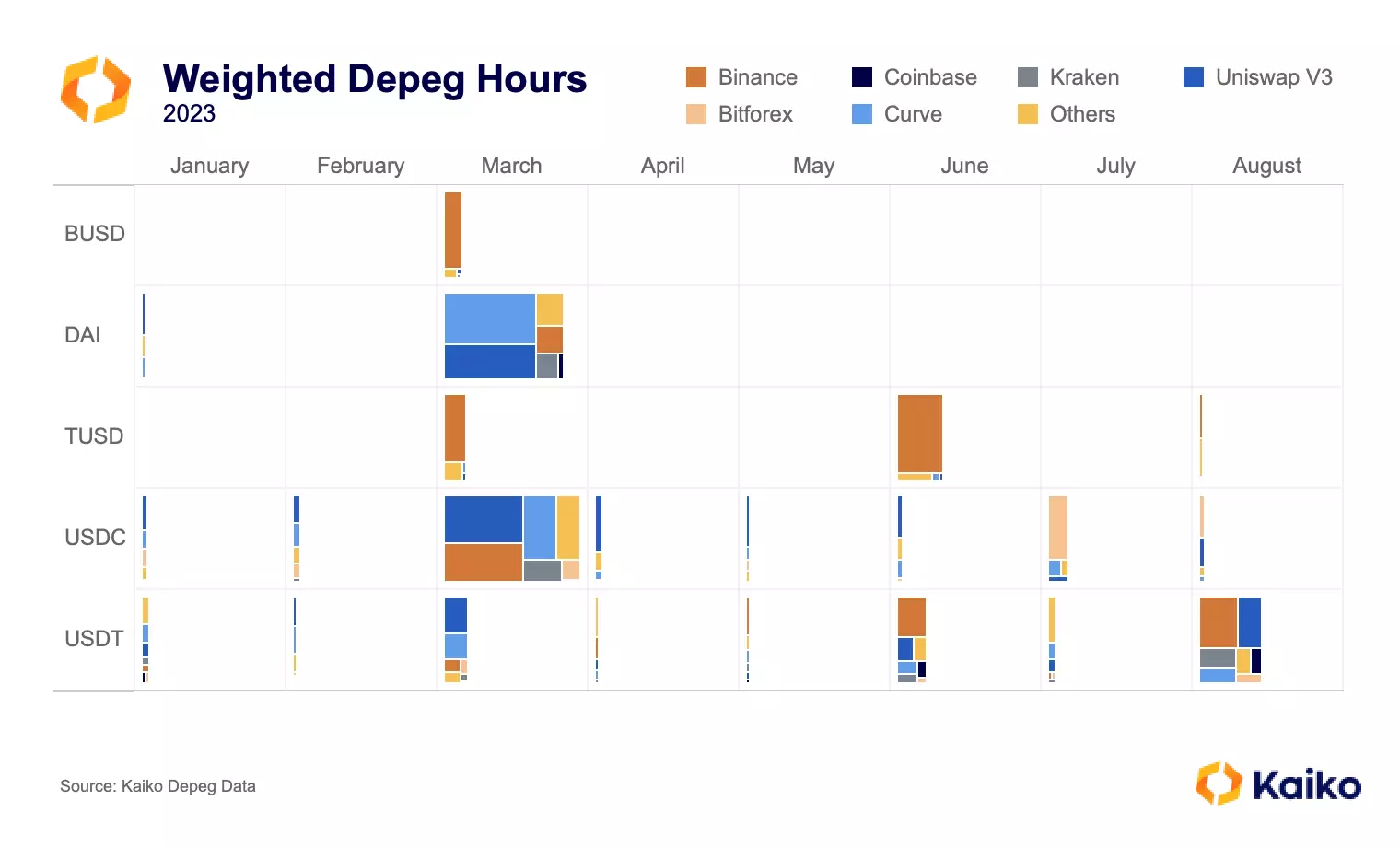

Finally, we can see which exchanges have been contributing the most to each stablecoin’s depegs.

Moving chronologically, it’s interesting to note that USDT barely depegged on Binance amidst the March craziness. Instead, it depegged on Uniswap V3 and Curve. June was a bad month for both USDT and TUSD. In both July and August, Bitforex has accounted for nearly all of USDC’s weighted depeg hours. Throughout the year, BUSD has been a model of stability, which may be unexpected given its NYDFS-ordered expiration date coming early next year, but isn’t surprising to anyone who has been watching its liquidity.

improvements

There are some areas of improvement for this metric that immediately stand out. The first is to remove more exchanges based on suspicious volumes. There are a few exchanges included that I’m fairly sure have significant artifiical volumes. The next would be to make the instrument weighting slightly more dynamic rather than fixed across a whole year. These are relatively minor changes that would have only small effects on the output.

Conclusion

When I first began this project I expected that TUSD would be the worst offender. Instead, TUSD has benefited from the fact that its liquidity is almost entirely concentrated on a single instrument rather than fragmented across exchanges. Meanwhile, DAI and BUSD – two very different stablecoins – have been extremely stable since April.

USDC is maybe the most interesting. It of course had a magnitude 10 depeg in March and since then has not breached magnitude 1, though it does have consistent tremors on Curve, Uniswap, and lately Bitforex. However, as USDT’s stability has suffered in August, USDC has actually become more stable, again adding to the unpredictable nature of stablecoin relationships.

USDT has a peg stability problem. Its redemption fee and minimum means it’s often rational for USDT holders to sell the token on the market rather than redeem it for USD with Tether. As liquidity has dwindled, the market is no longer able to absorb significant USDT selling. While the depegs in price terms are not huge, its consistent discount is cause for concern and could seriously erode trust if it continues. The obvious solution is for Tether to remove its redemption fee and minimum. Tether reported an $850mn profit in Q2; removing the fee would not have a significant effect on profits unless the company believes that making redemptions cheaper would significantly decrease USDT’s supply.

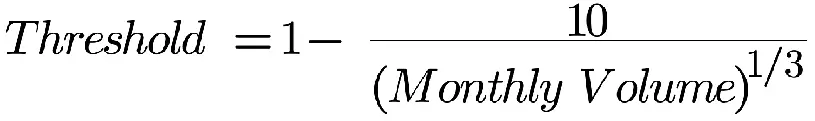

[1] One could argue the volume could be more dynamic, for example a monthly moving average. This raises an issue in which the threshold would shrink arbitrarily long after a significant market event.

[2] Note that I’ve opted to only focus on stablecoin-stablecoin instruments, as incorporating crypto-stablecoin pairs would have introduced too much noise into the data set.

[3] I know earthquake magnitudes use a logarithmic scale, please don’t be upset.

![]()

![]()

![]()

![]()