Join us for our latest webinar in collaboration with Cboe

Insights.

Our Data Debrief and Deep Dive insights are published twice a week and you can subscribe to them here.

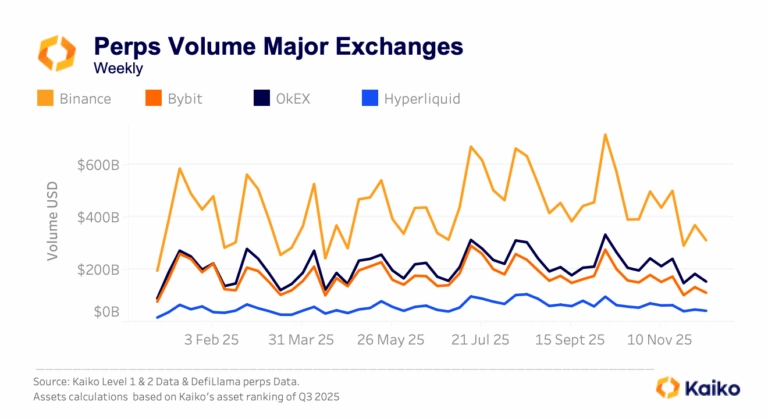

Derivatives

29/12/2025 Data Debrief

Santa Rallies, Cycles, and Year-End Reflections for BitcoinAs markets approach the end of the year, Bitcoin finds itself at a familiar crossroads, caught between cyclical behavior and a steadily developing market. While year-end seasonality has historically played a role in shaping price ...

![]()

Derivatives

22/12/2025 Data Debrief

Crypto in 2026, What Breaks, What Scales, What ConsolidatesCrypto markets enter 2026 in a markedly different position than in prior cycle transitions. Rather t...

Written by Thomas Probst![]()

Year in Review

01/12/2025 Data Debrief

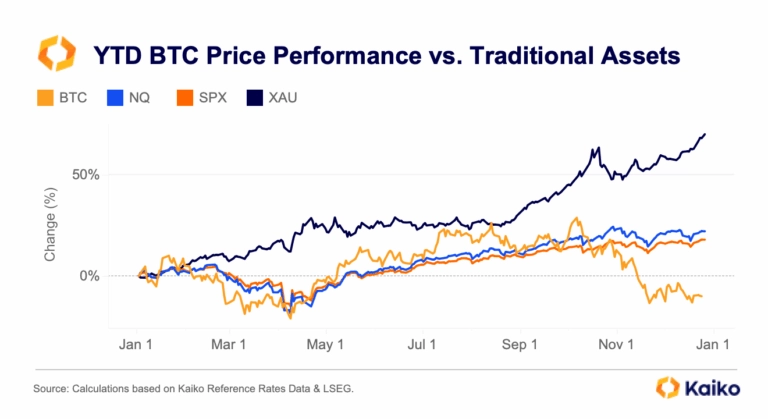

Kaiko Research's Top 10 Charts of 2025In this report, we look back on 2025 and the key forces that shaped markets. From BTC record highs a...Written by Adam Morgan McCarthy

![]()

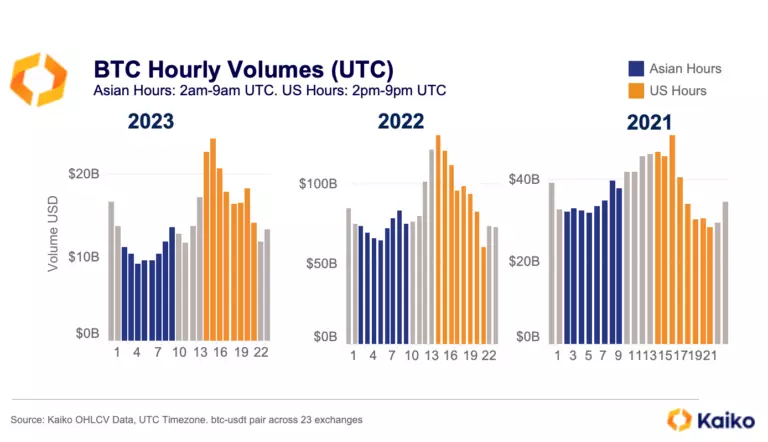

Liquidity

23/02/2023 Deep Dive

A Crypto Friendly Asia: What It Will Mean For MarketsThis week, reports emerged that Hong Kong could soon enable retail investors to trade certain cryptocurrencies. Will Asia lead the next bull run as US regulators continue to clamp down? What will this mean for Asia-based crypto projects and exchanges? How do indices play a role? We dive into the narrative and explore its ramifications.

Written by Conor Ryder, CFA![]()

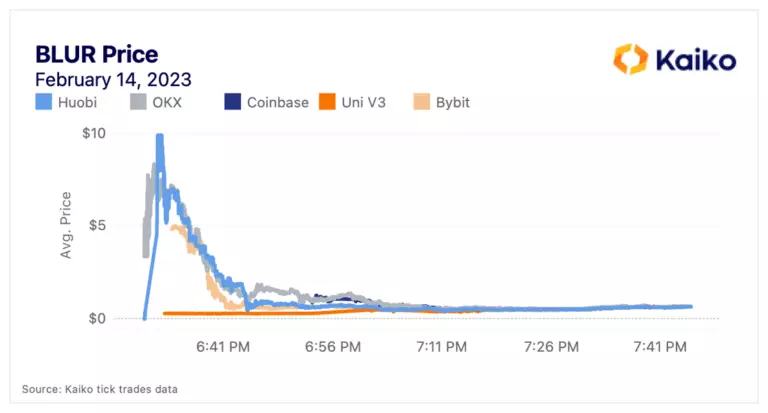

DeFi

20/02/2023 Data Debrief

BLUR’s Big DebutCrypto markets continued to soar despite another week packed with regulatory punches. Last week, the SEC formally charged Terra founder Do Kwon, alleging a “multi-billion dollar fraud” against investors in the UST stablecoin and LUNA.

Written by The Kaiko Research Team![]()

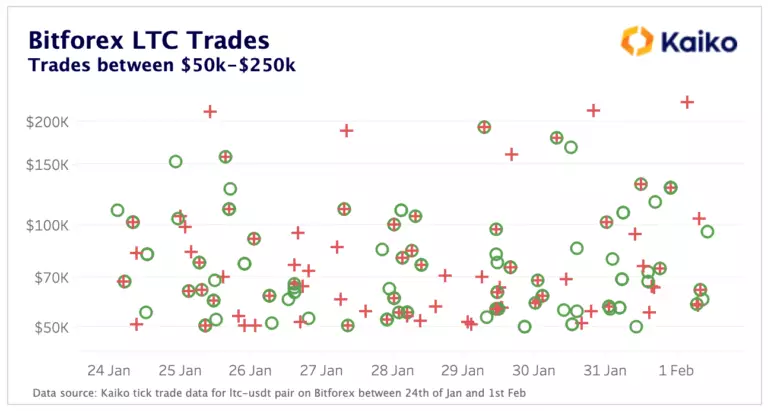

Liquidity

09/02/2023 Deep Dive

How to Spot Artificial VolumeOften times investors are left scratching their heads when they see a small exchange high up the volume ranking on certain websites. The assumption is that some, or a significant amount of these volumes figures are artificially inflated by wash-trading on that exchange. This week, we present a framework that can be used to spot cases of wash-trading, pointing out potential examples of our own on the way.

Written by Conor Ryder, CFA