Data Points

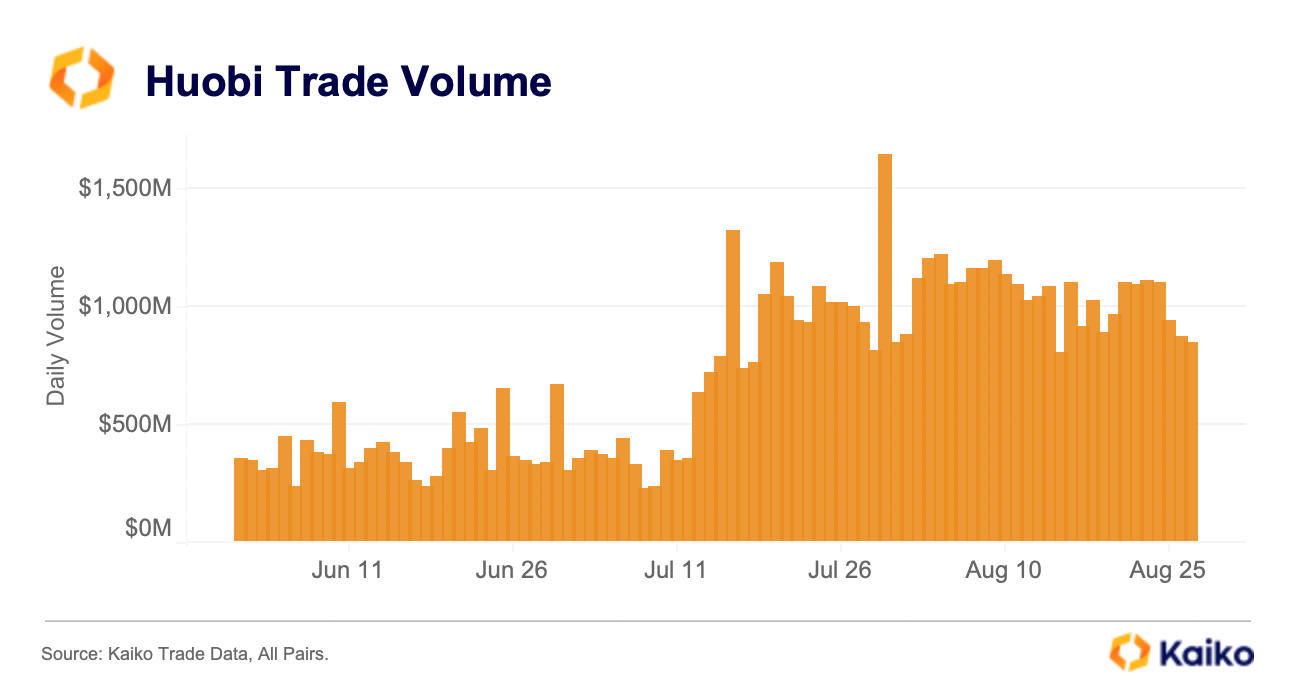

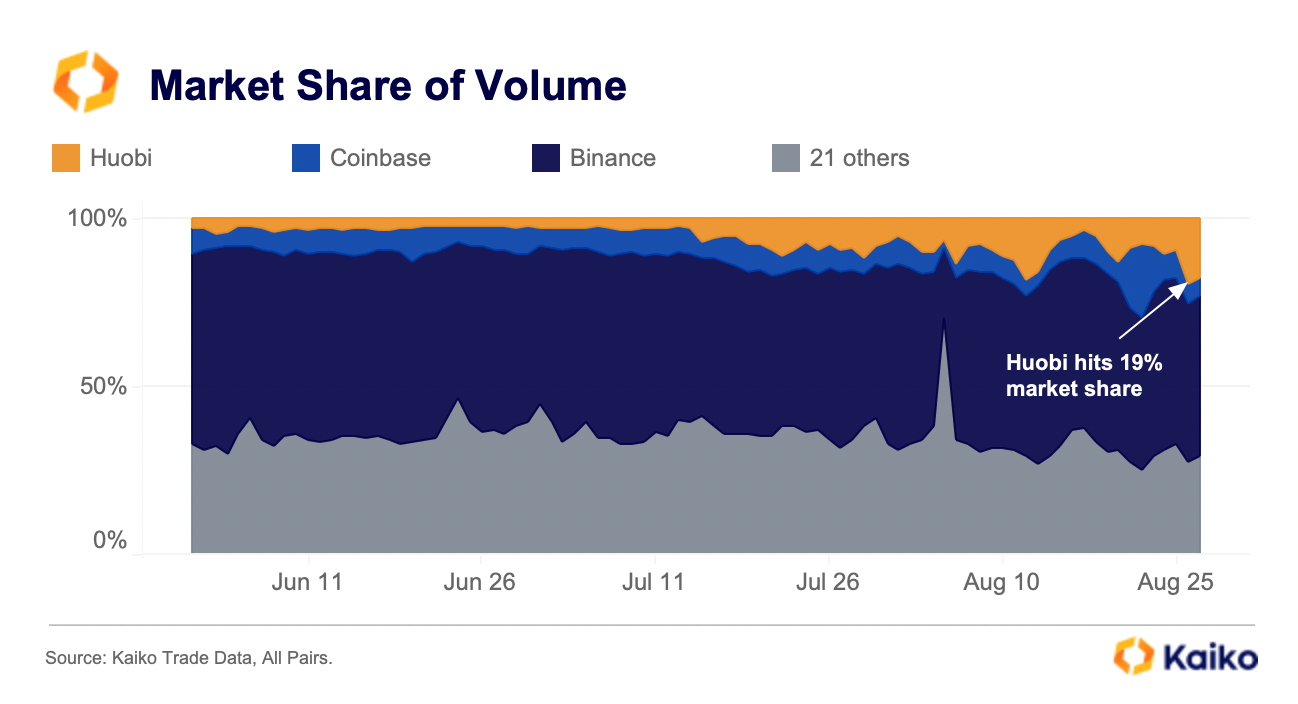

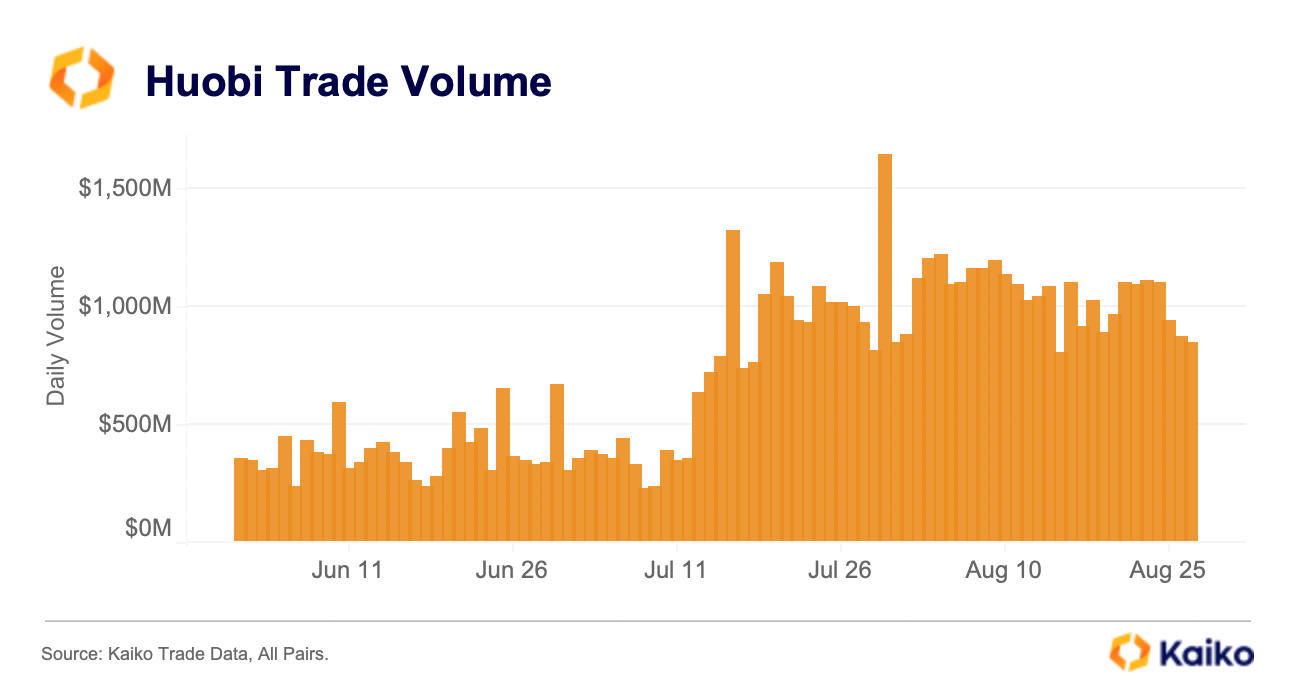

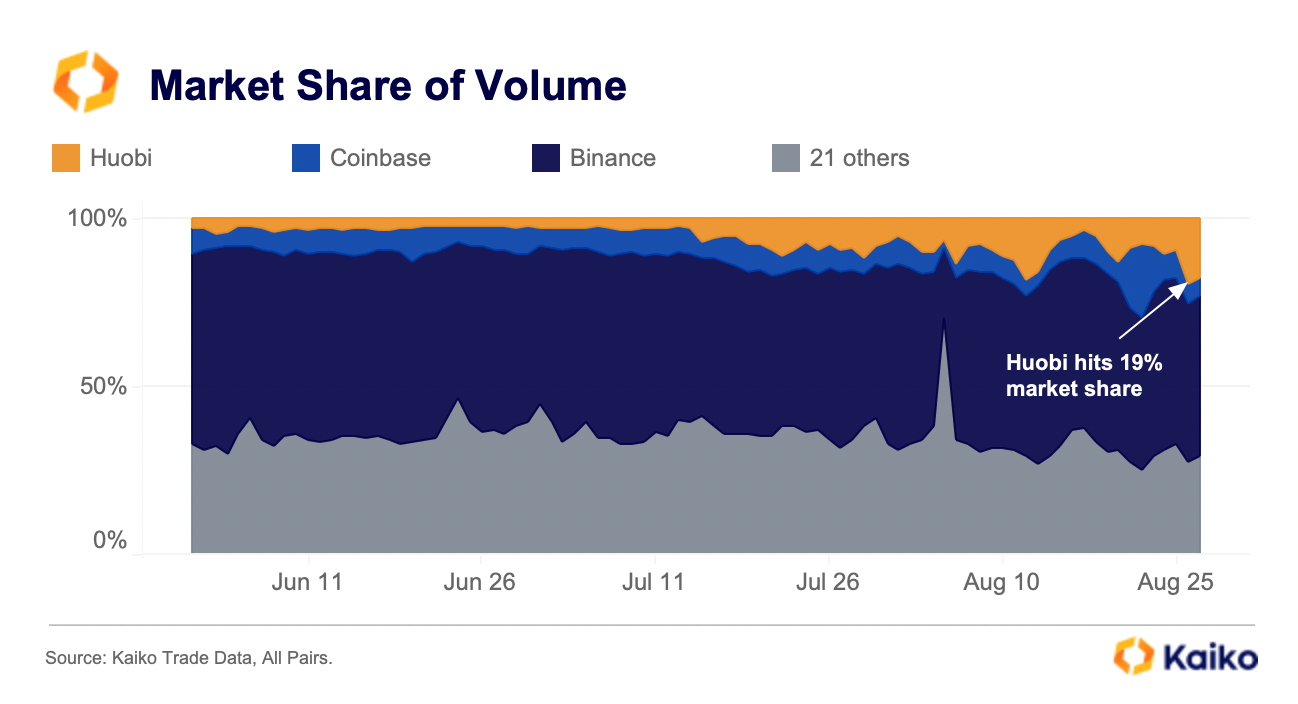

Huobi’s high volume persists.

Its been a low-volatility, low-volume summer, which has strongly impacted the fortunes of many crypto exchanges. Yet, one major exchange has bucked this trend: Huobi. This comes as the exchange grapples with rumors of insolvency and executives getting detained, which triggered heavy outflows at the start of August. Interestingly, the negative press has had virtually no impact on trade volume, which has stayed all but flat since mid-July. In our analysis of Worldcoin’s launch we observed probable wash trading on the exchange back in July.

Huobi is one of the only exchanges that we regularly analyze that has not experienced a decline in volumes since the start of the summer.

This has helped its market share relative to its closest competitors rise from just 2-3% to as high as 19% in a span of just a couple of months. Altcoins account for the vast majority of volume on the exchange, with no one coin claiming dominant market share.

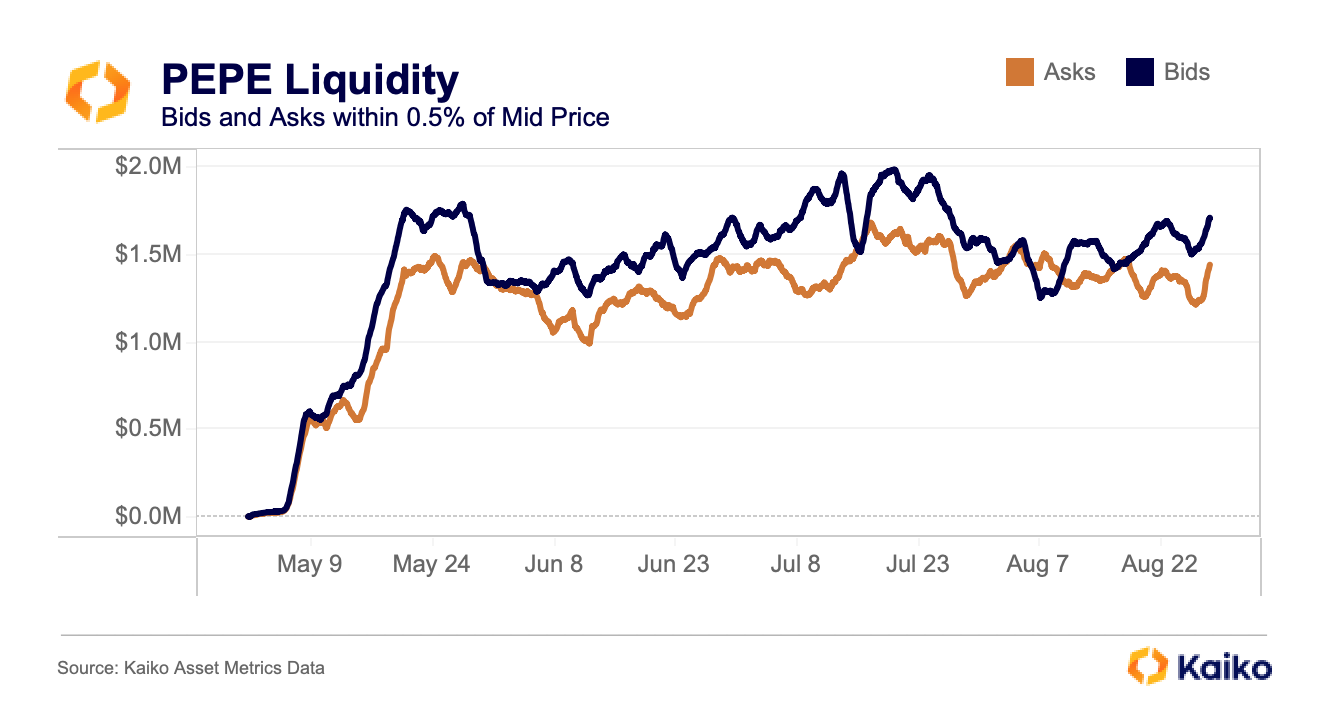

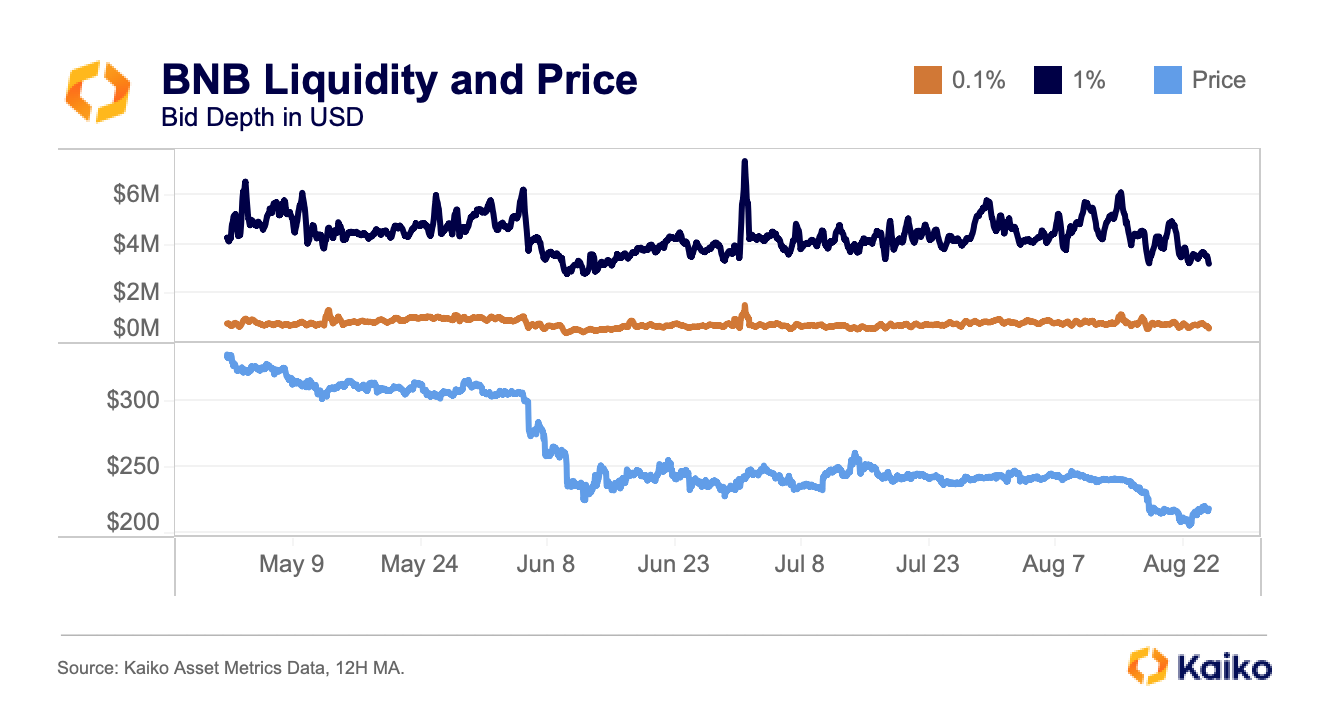

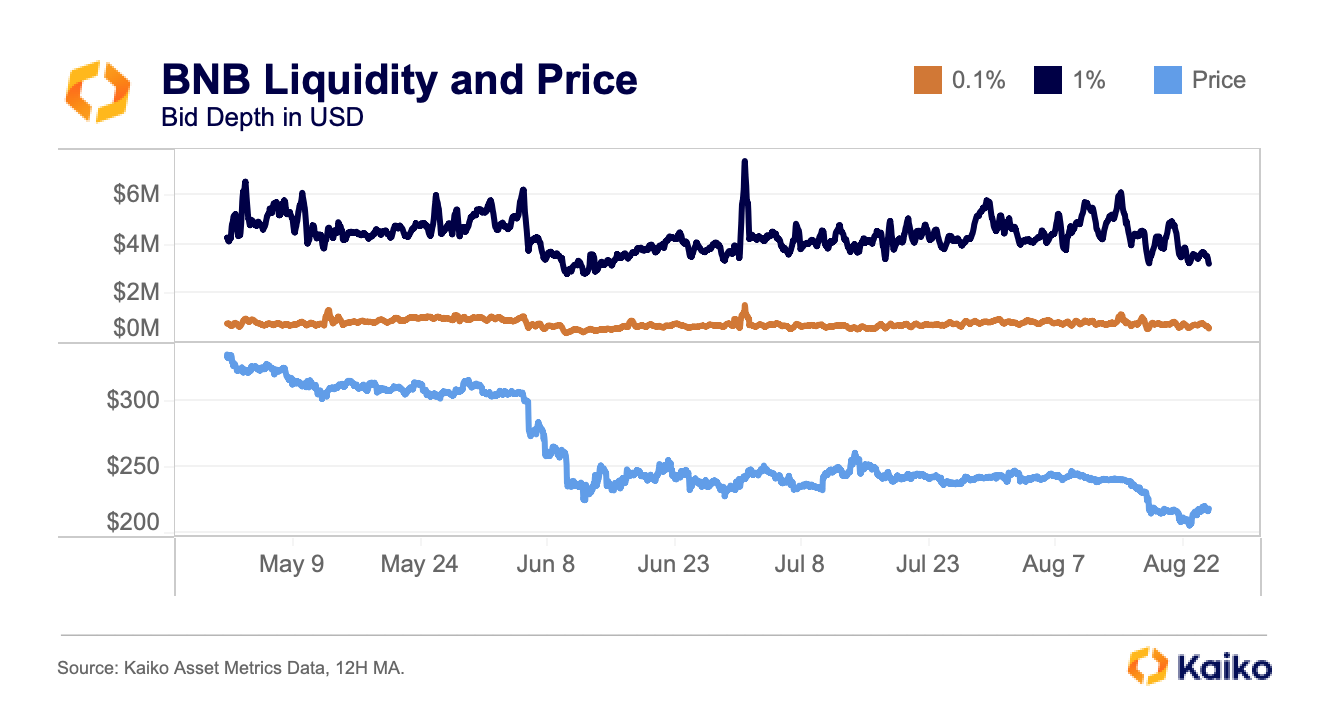

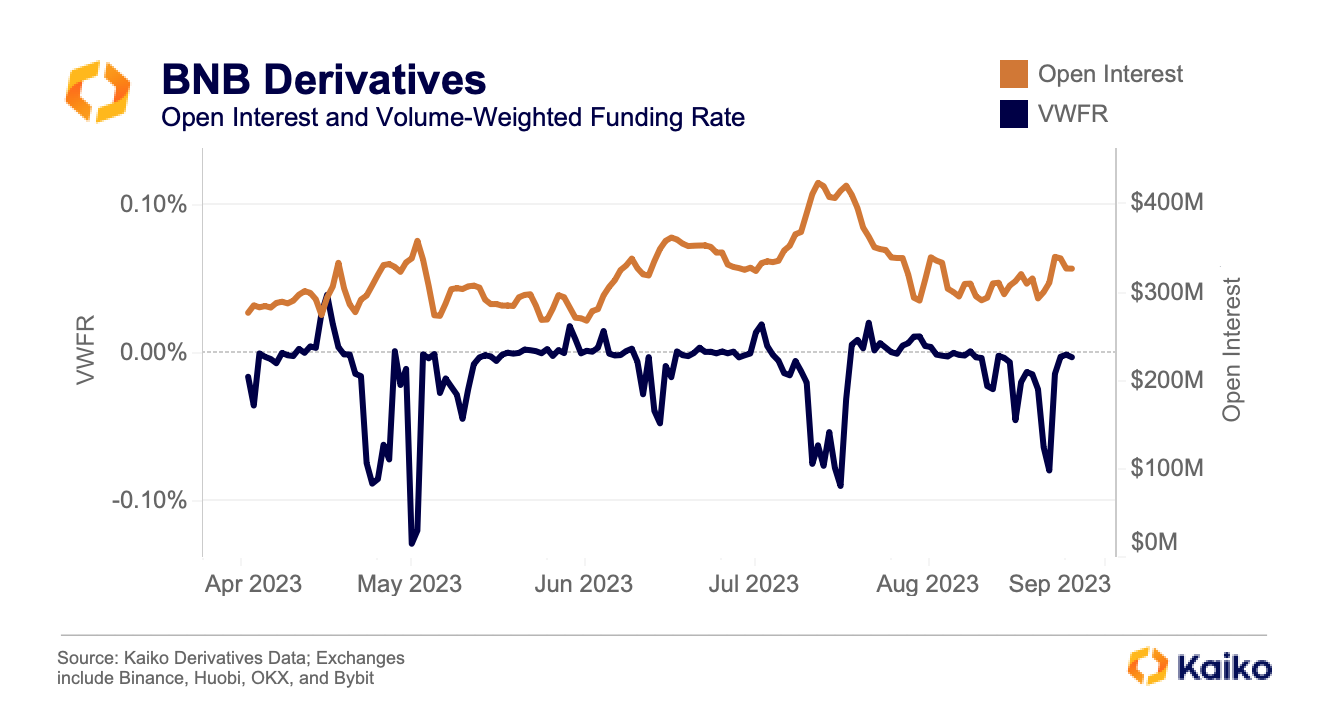

BNB liquidity is resilient despite price drop.

Rumors continued to swirl this week as BNB bounced off of $200, a level of support that has held for over two years, only broken briefly after Terra’s collapse. Similar to PEPE, despite the recent price drop – the token was at $350 back in April – liquidity has remained strong. However, it’s important to note that about 90% of BNB liquidity is on Binance. This has fueled speculation that Binance is propping up BNB’s price by selling other tokens. While we have seen no evidence of this, the resilience of bid depth at both the 0.1% and 1% levels shows that BNB does have strong bid support even as its price has dropped.

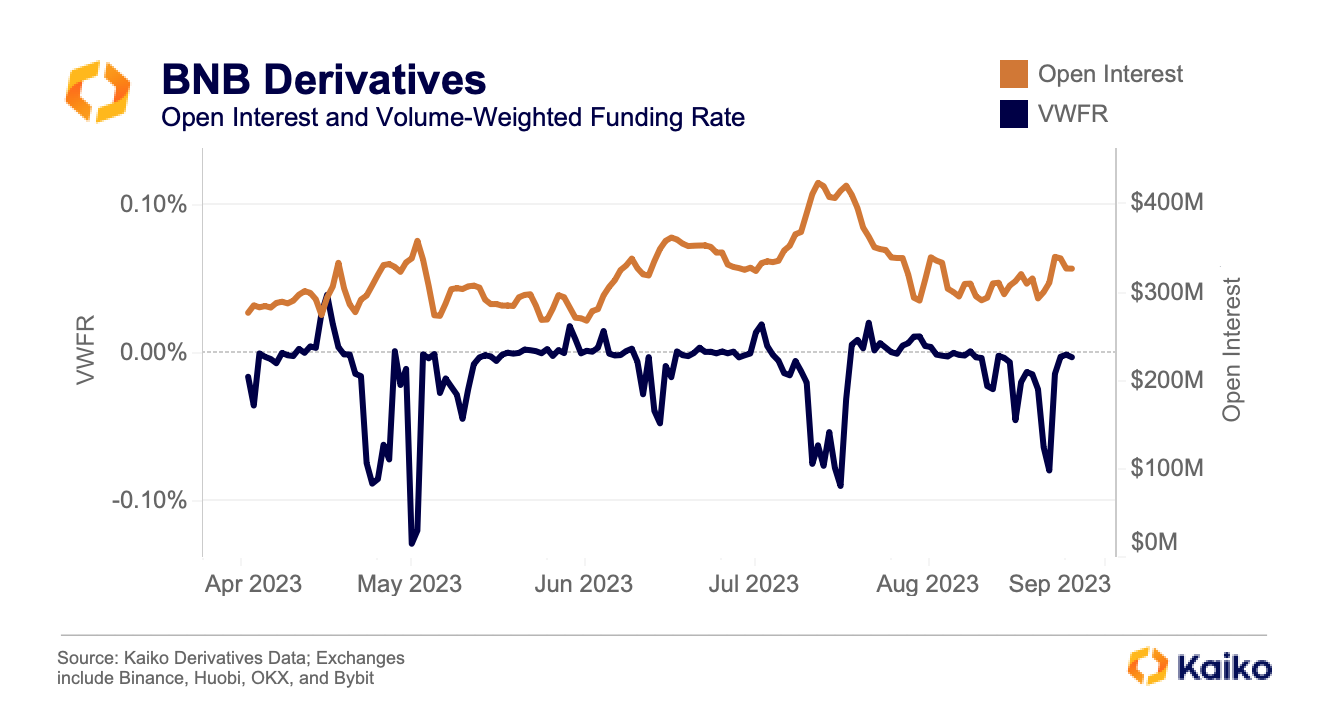

Additionally, derivatives data shows that aggressive shorting of BNB has subsided, at least temporarily.

On July 11, open interest peaked at $440mn as the volume-weighted funding rate (VWFR) quickly fell from roughly neutral to -0.07%, indicating most of the new positions opened were shorts. Open interest began to fall and VWFR returned to neutral on July 17 as BNB found footing in the $240 range. It began another leg down on August 16; this time, open interest remained flat and VWFR didn’t dip deeply negative until August 22, when BNB bounced off $200. Since then, price has stabilized around $215 and both open interest and VWFR have remained flat, showing that speculation around the token has cooled for now.

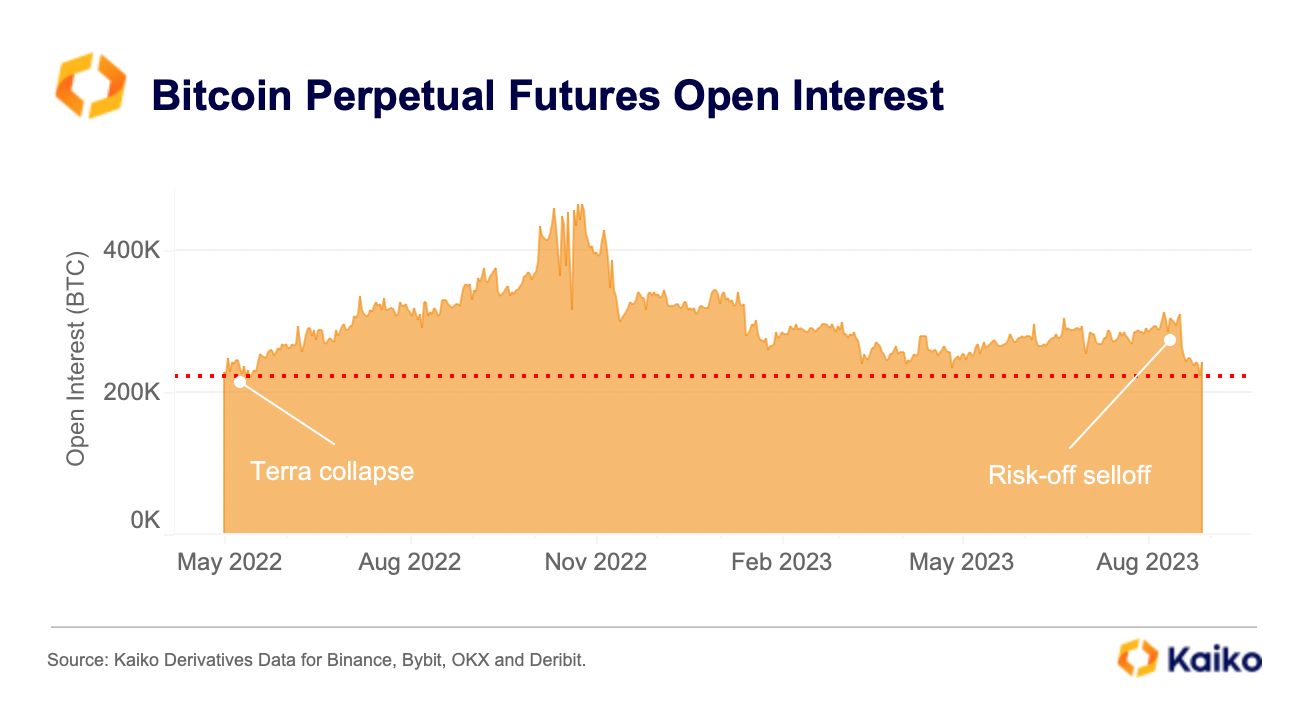

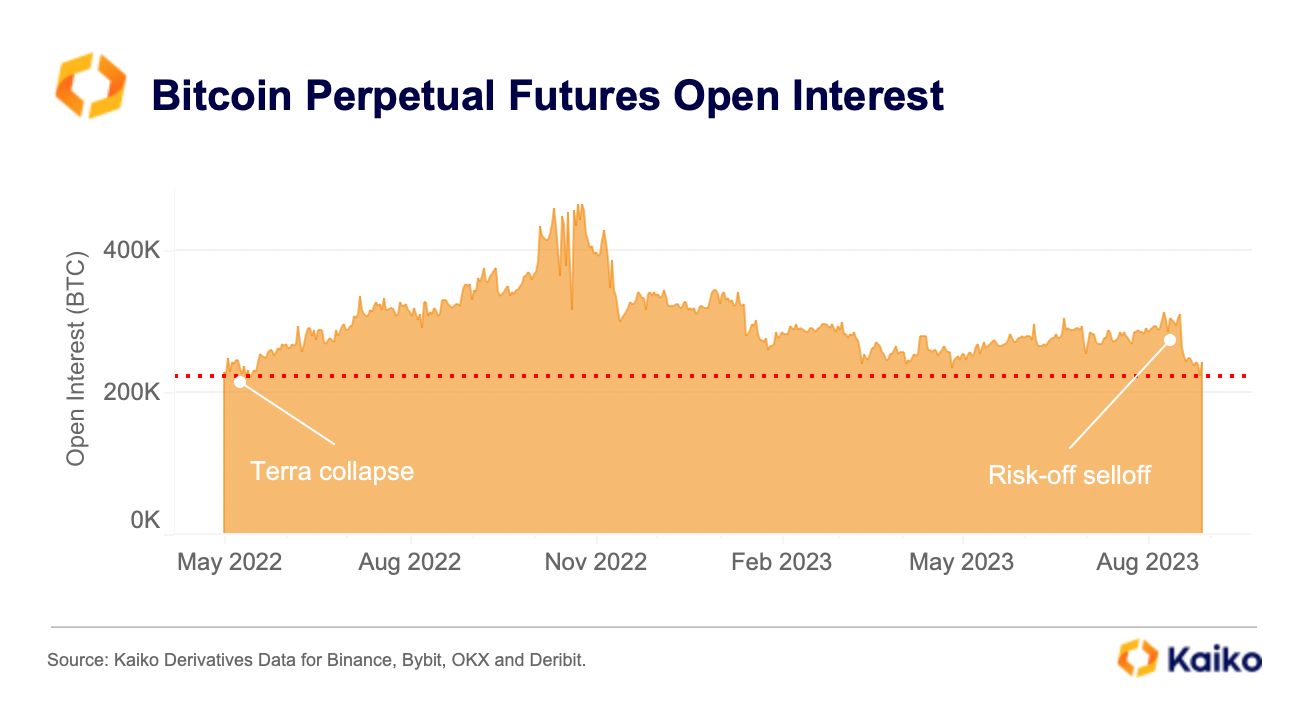

Bitcoin open interest hits lowest since Terra collapse.

Bitcoin open interest — measured in units of BTC — continued declining last week after the August 17 sell-off, hitting its lowest level since the collapse of Terra in May 2022. The amount of open contracts aggregated on four exchanges dropped by more than 20% between August 16 and 19 following the largest liquidation event since FTX. Capital flows have remained lackluster since even though funding rates have flipped slightly positive and spot prices have stabilized around $26k.

Analysis: Binance liquidity for long-tail tokens.

Last week, news broke that Binance staff had contacted crypto projects with low liquidity tokens trading on the exchange asking for details on market making relationships. A spokesperson said it was part of an “ongoing risk management initiative.” They also asked projects to contribute 1-5% of tokens to their savings program to earn interest.

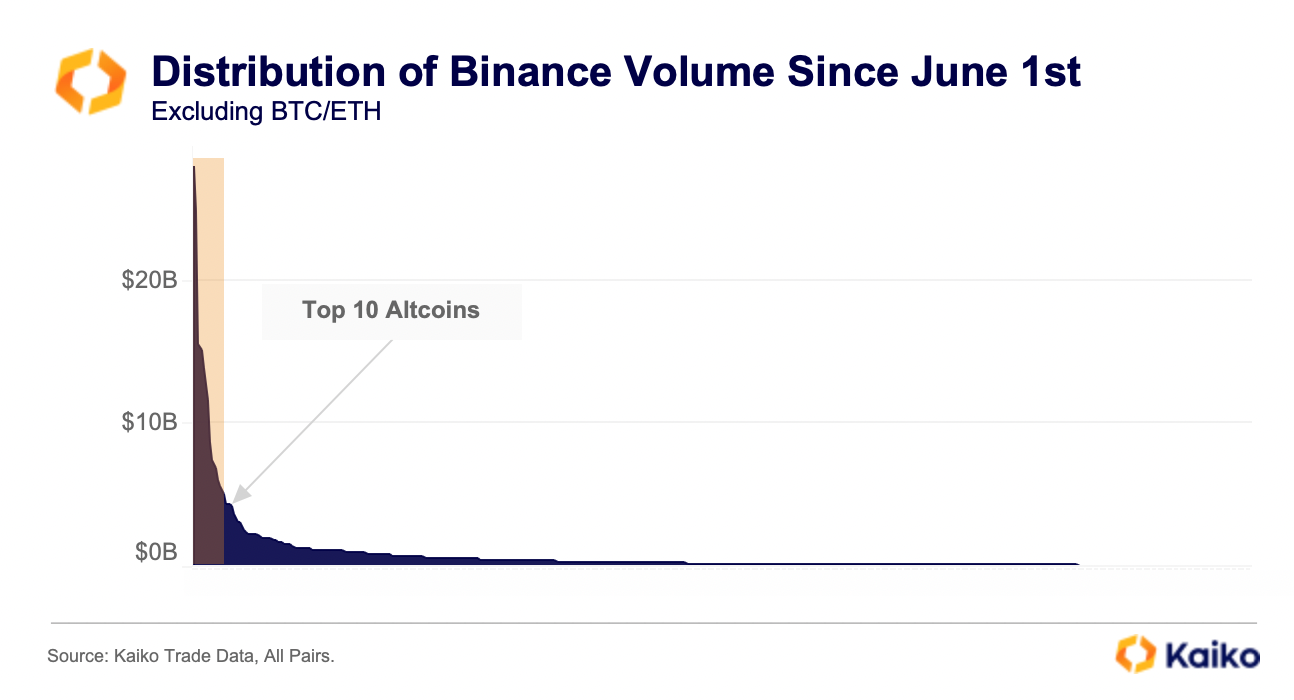

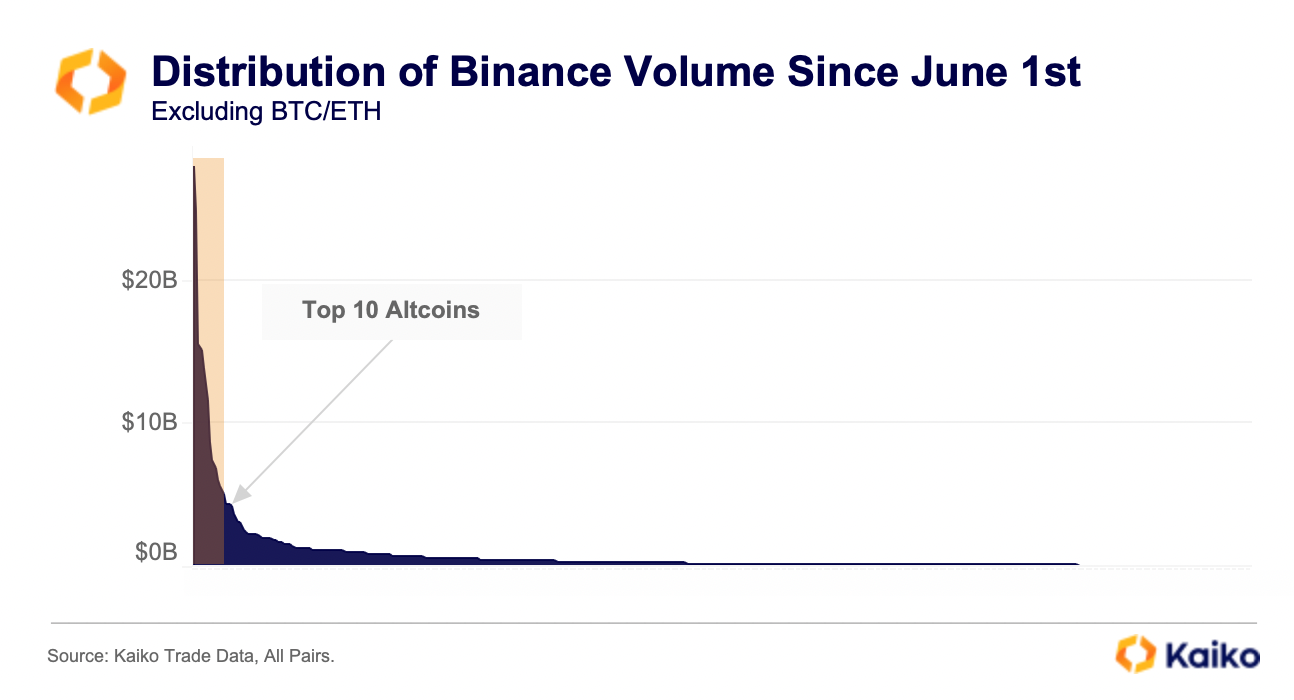

Market making is common, if not expected, of crypto projects in order to guarantee liquidity for a token, which improves the overall trading experience. Binance currently has more than 380 assets trading on the exchange, many of them very illiquid. When looking at the distribution of trade volume, we can see that the vast majority is skewed within the top 10 altcoins (excluding BTC/ETH, which overall account for the majority of volume).

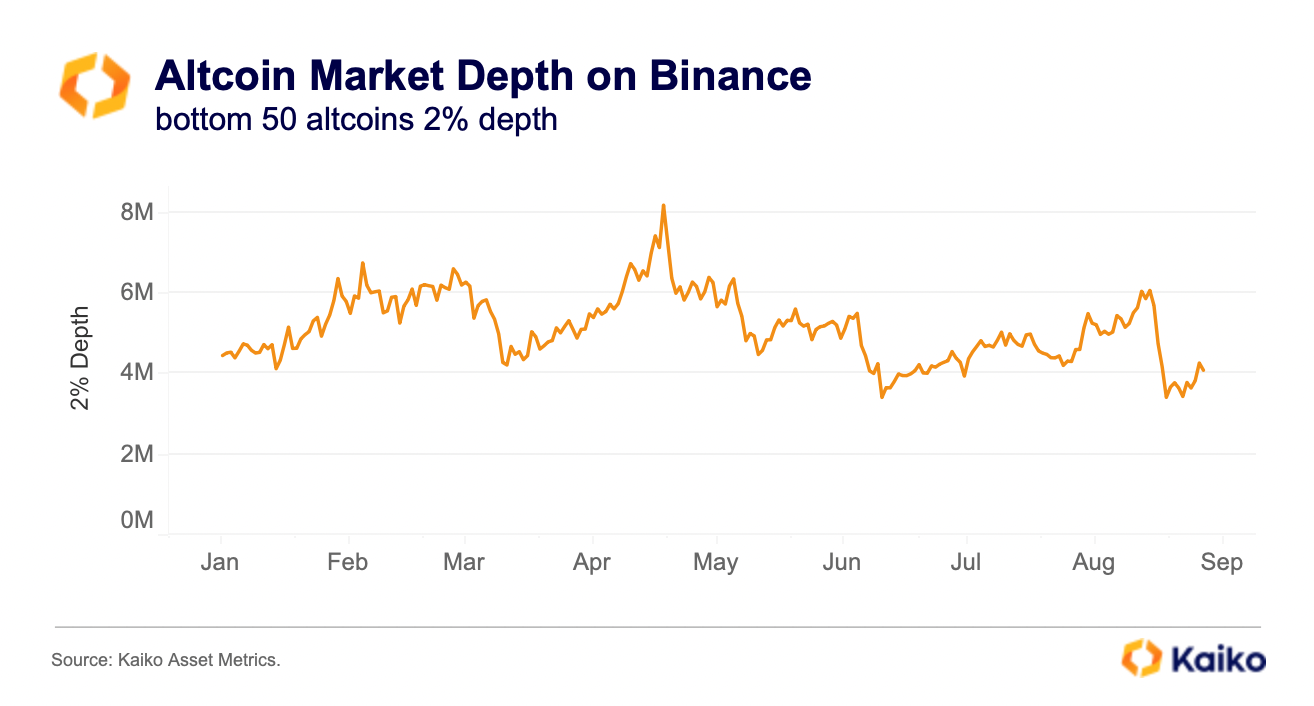

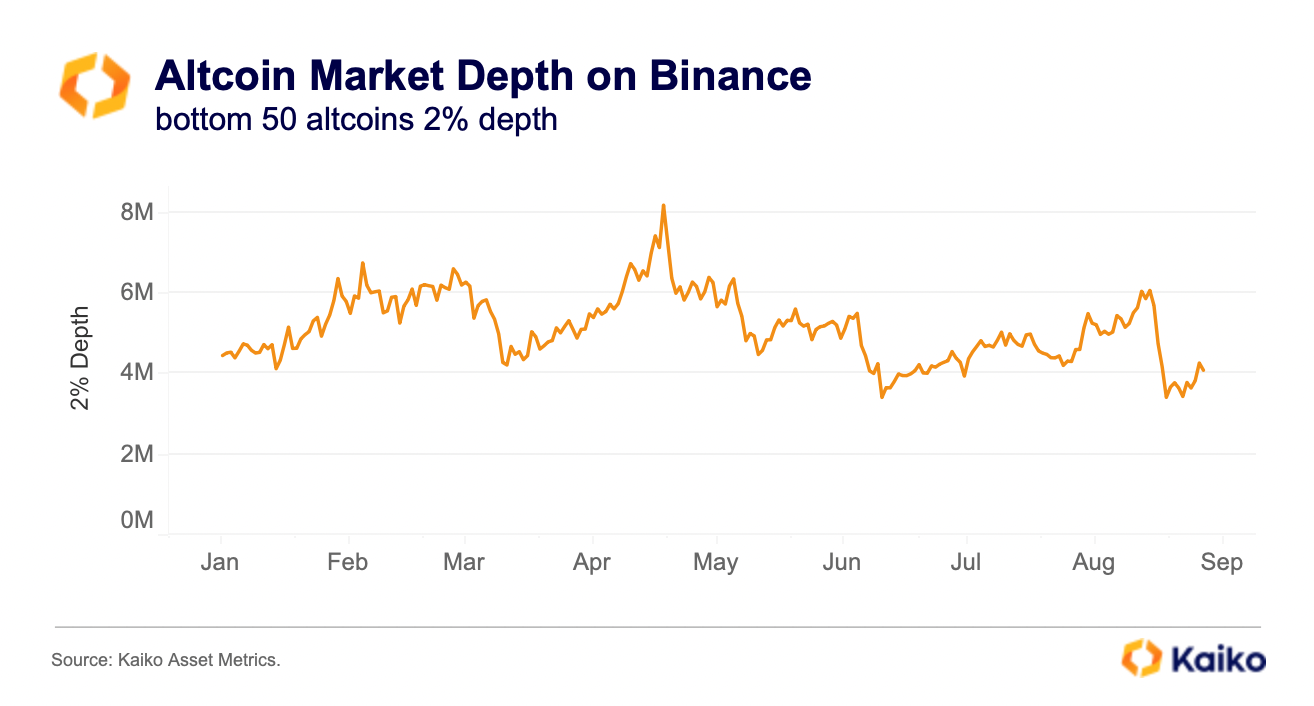

The distribution shows that most tokens have low volume, which could disincentivize projects or market makers to shore up market depth. To understand if this is the case, we looked at 2% market depth for the bottom 50 tokens trading on Binance, as measured by volume.

The trend is not overly striking, showing that depth for these 50 tokens is about the same as it was at the start of the year, at about $4mn. We will monitor to see if liquidity improves after Binance’s outreach efforts.

![]()

![]()

![]()

![]()