Data Points

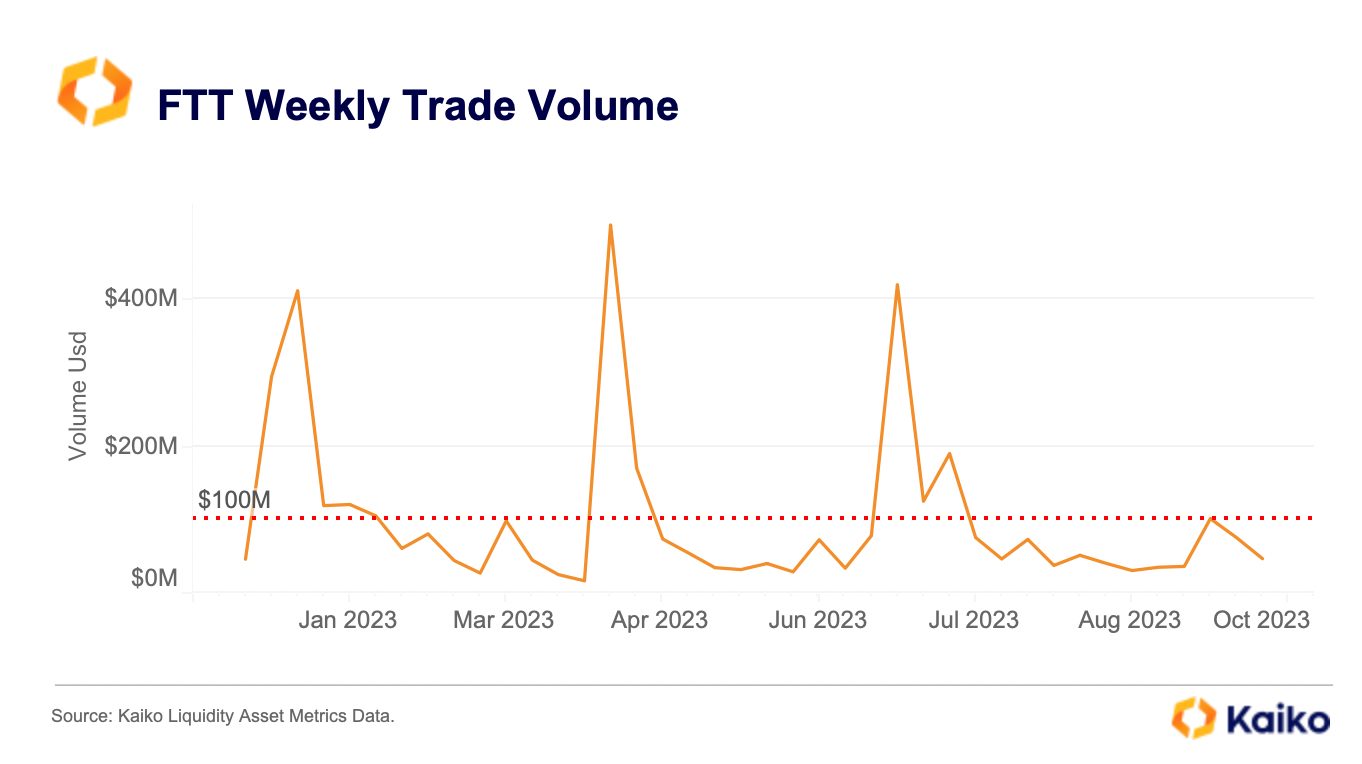

Who is still trading FTT?

FTT, issued by the now-defunct FTX exchange, ought to be a completely worthless cryptocurrency. Before the exchange’s collapse, the token already had virtually no utility beyond the exchange, letting holders use it as collateral and earn “socialized gains.” Today, there is no active exchange thus no use case for FTT. So why is it still trading?

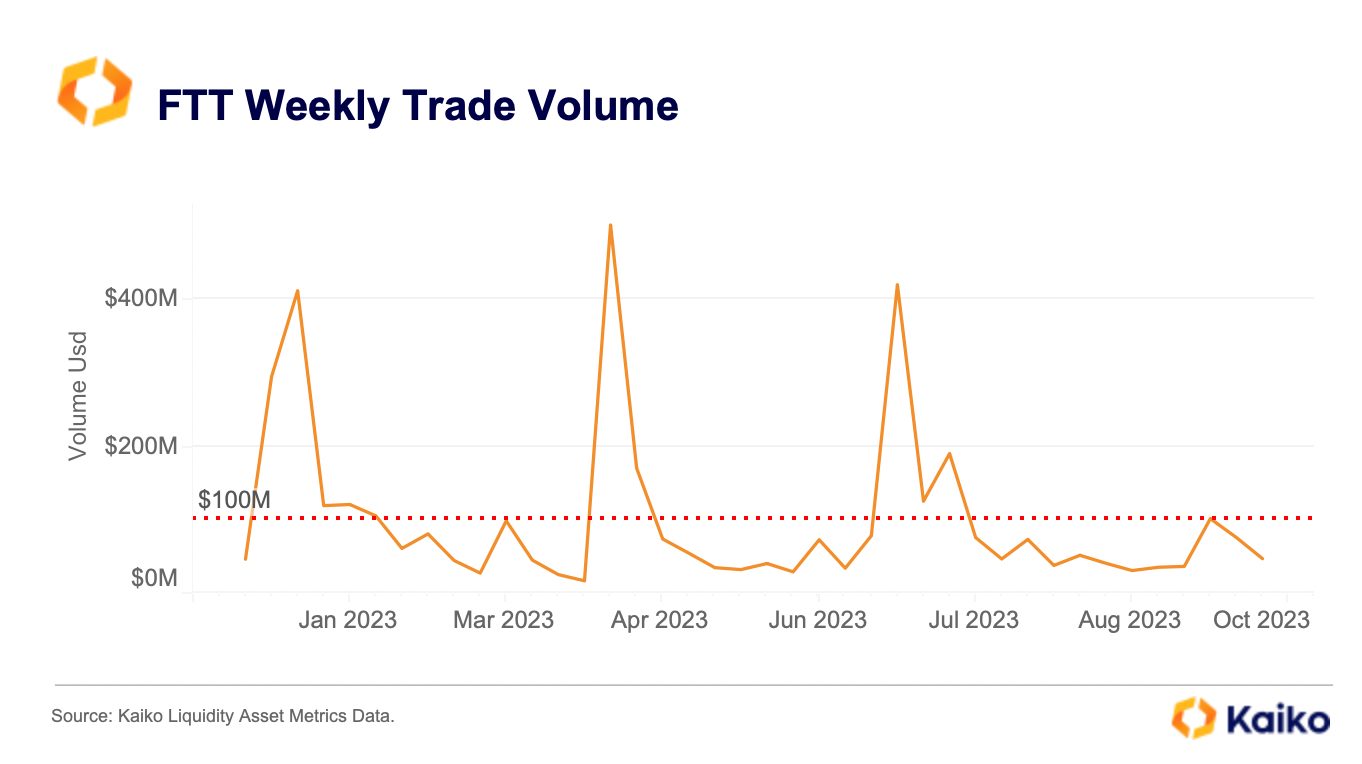

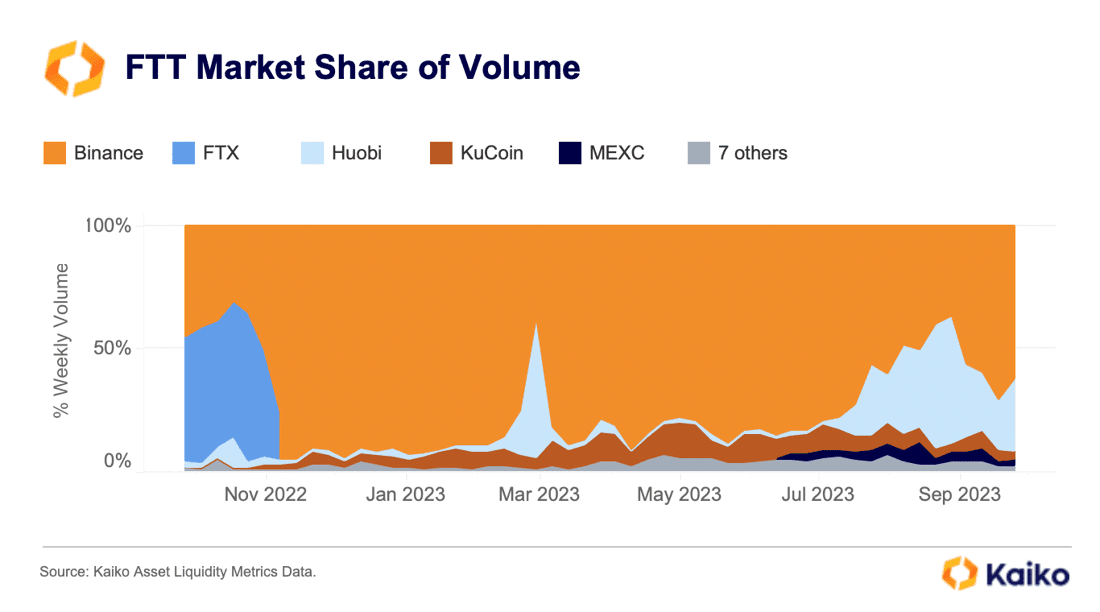

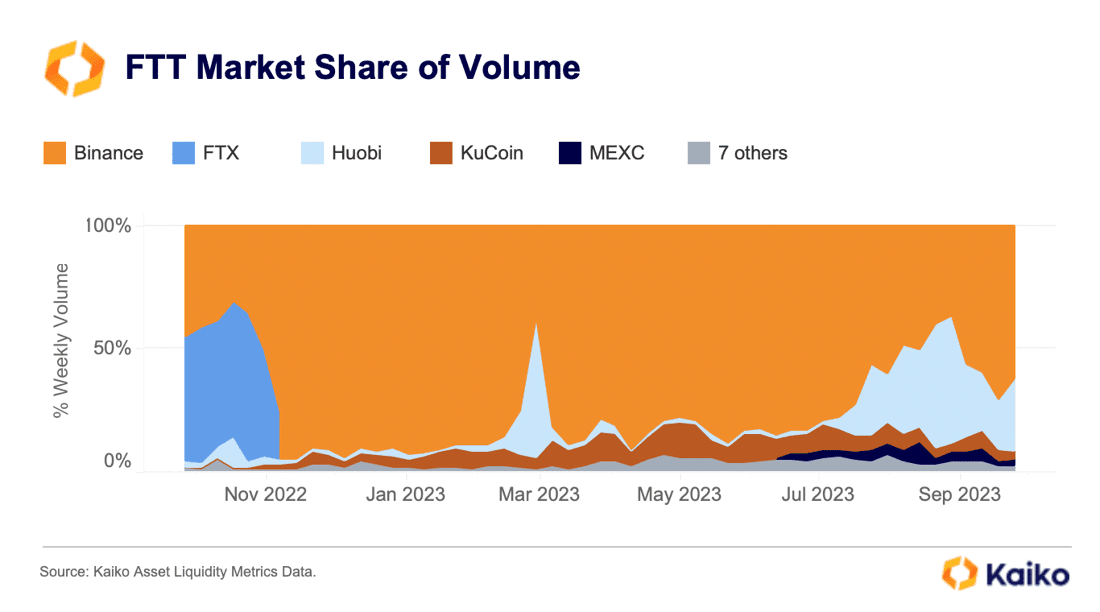

Since the collapse, average weekly volume has been $100mn. The trade volume is concentrated on just a handful of exchanges, with Binance accounting for more than 60%.

Recently, Huobi (now HTX) has gained a huge amount of market share, climbing to more than 30%. The rise in market share correlates closely to suspicious trading activity we previously reported on the exchange, suggesting artificial volumes. The persistence of FTT volume is suspicious across the board, but this wouldn’t be the first time markets behaved irrationally. The best evidence of irrationality is that the token’s price does not appear correlated to any updates in the FTX lawsuit.

Ruble volume remains low but consistent.

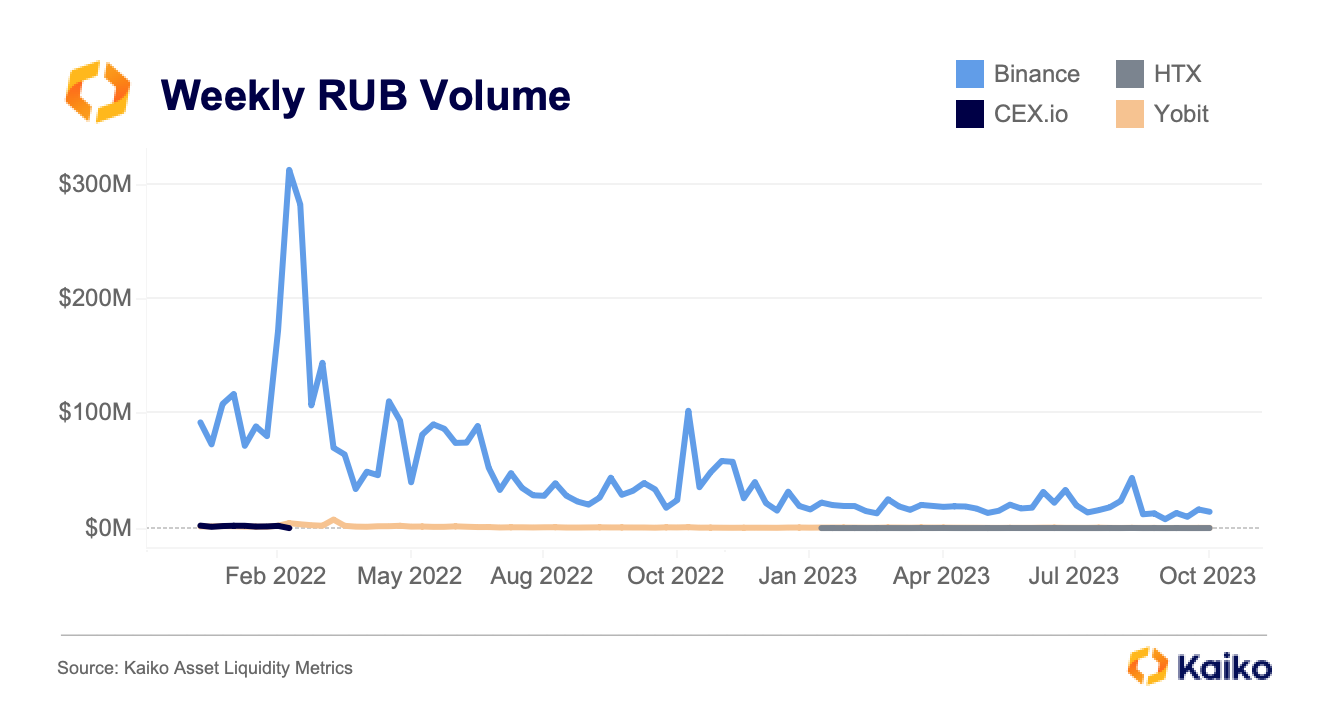

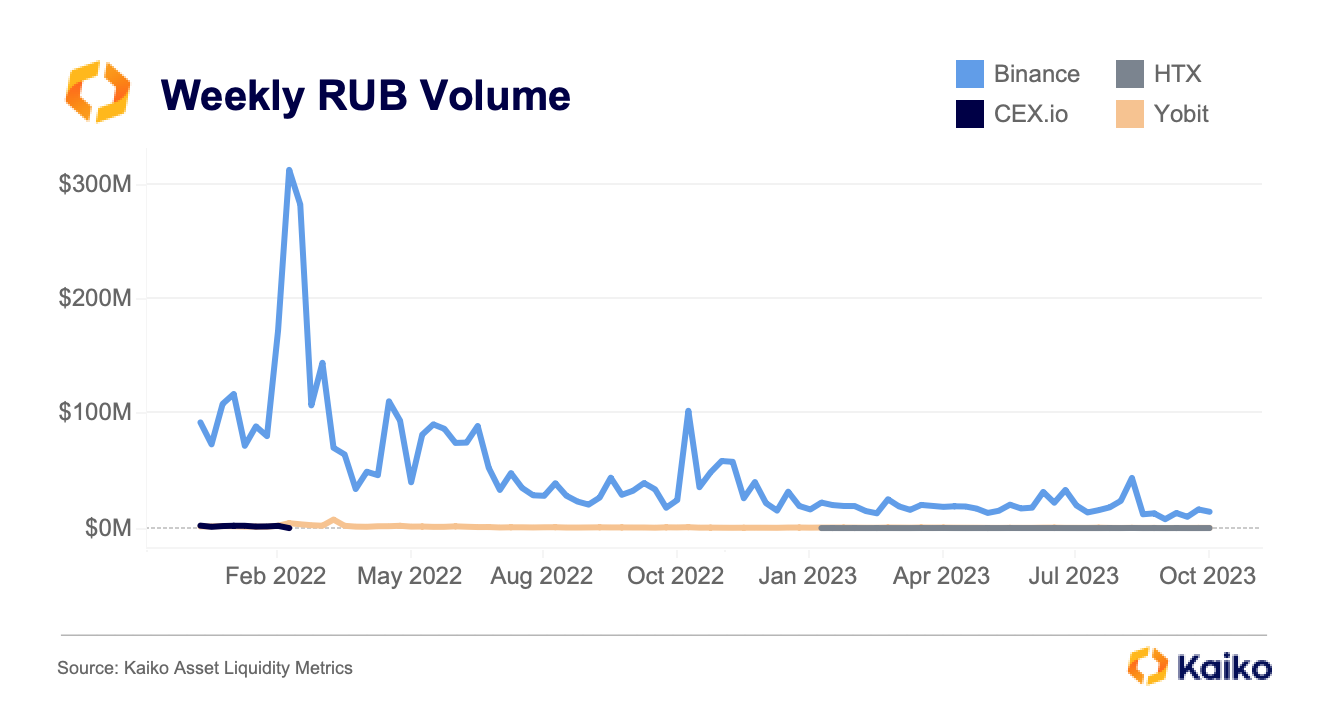

Crypto trading involving the Russian ruble is much lower than it was last year; the top volume week this year was just $45mn, compared to $300mn in 2022. Additionally, virtually all volume is on Binance, with HTX (formerly Huobi) and Yobit the only other two exchanges in Kaiko’s coverage that continue to offer RUB trading, albeit with extremely low volumes. CEX.io offered RUB trading until February 2022.

The drop in volumes has largely been driven by increasing regulatory pressures, which led many exchanges to delist RUB pairs and ban Russian users. Most recently, Binance sold its Russian unit to the exchange CommEX, though there was speculation that Binance CEO CZ also owned CommEX, which he has denied. It was reported in May that the U.S. Department of Justice was investigating whether Binance allowed Russian users on its platform in violation of sanctions.

AVAX liquidity surges thanks to friend.tech clone.

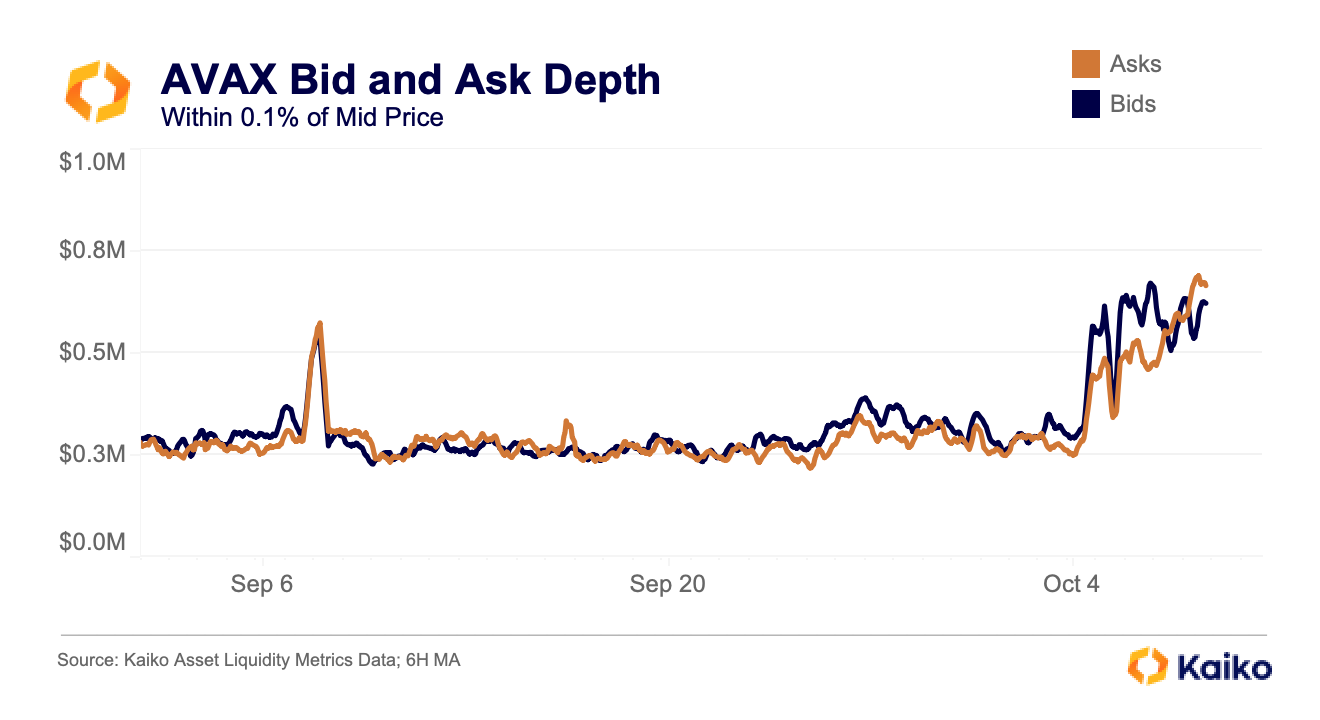

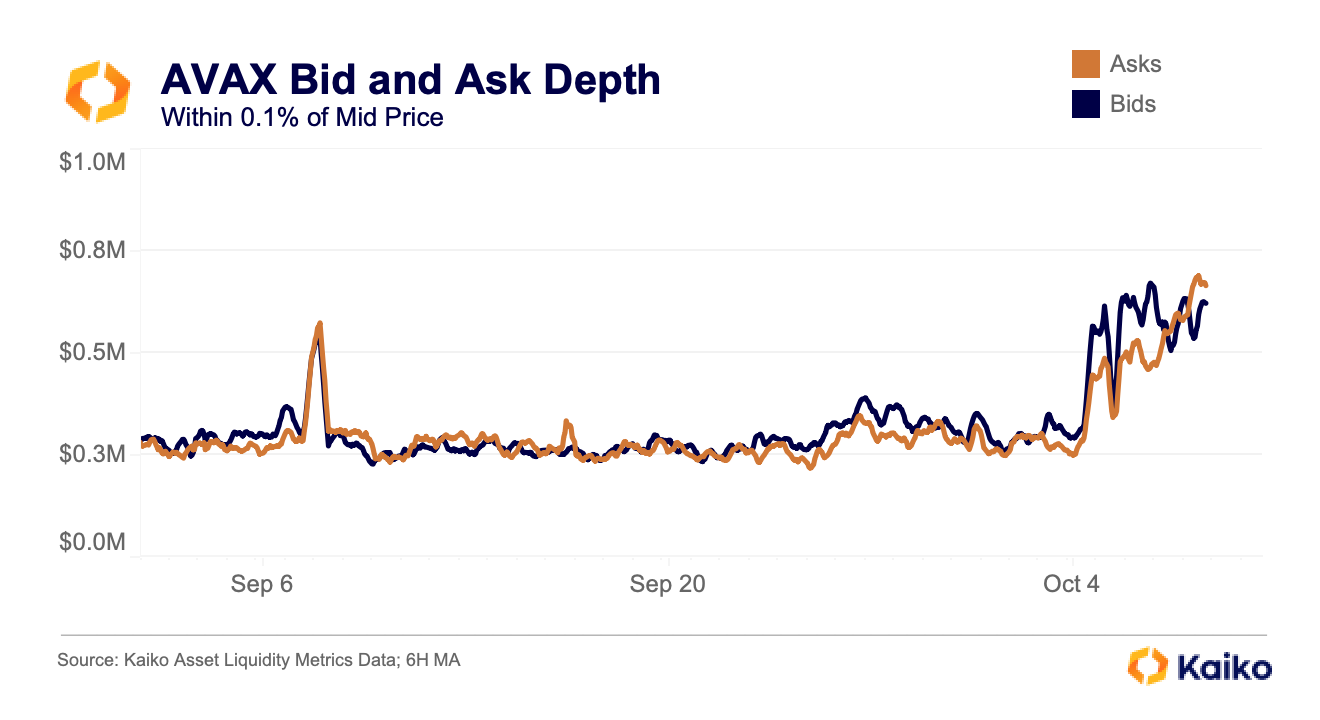

Avalanche (AVAX) briefly found itself in the limelight last week as the decentralized social network Stars Arena – similar to Base’s hit friend.tech – rapidly gained users and generated protocol fees. However, its fortune changed quickly as Stars Arena was hit with a $3mn exploit. Surging activity on Avalanche helped boost the blockchain’s native token, AVAX, which ran from $9 two weeks ago to a high of $11.50 this weekend.

This has been matched with surging liquidity, with both bids and asks within 0.1% of the mid price jumping from $300k to $750k. This is a positive development for AVAX, which had dropped 11 places in our liquidity ranking from Q2 to Q3, the largest drop of any token we covered.

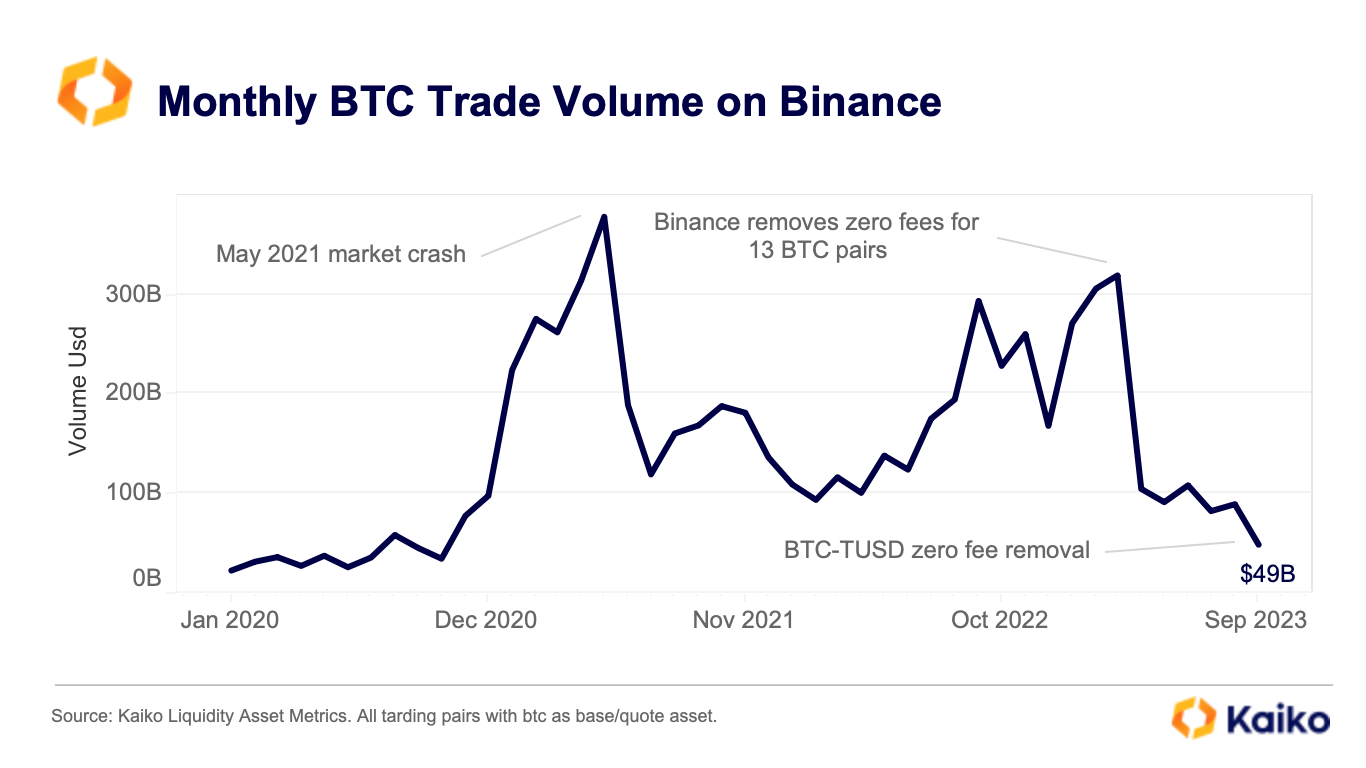

Bitcoin trade volume plummets on Binance.

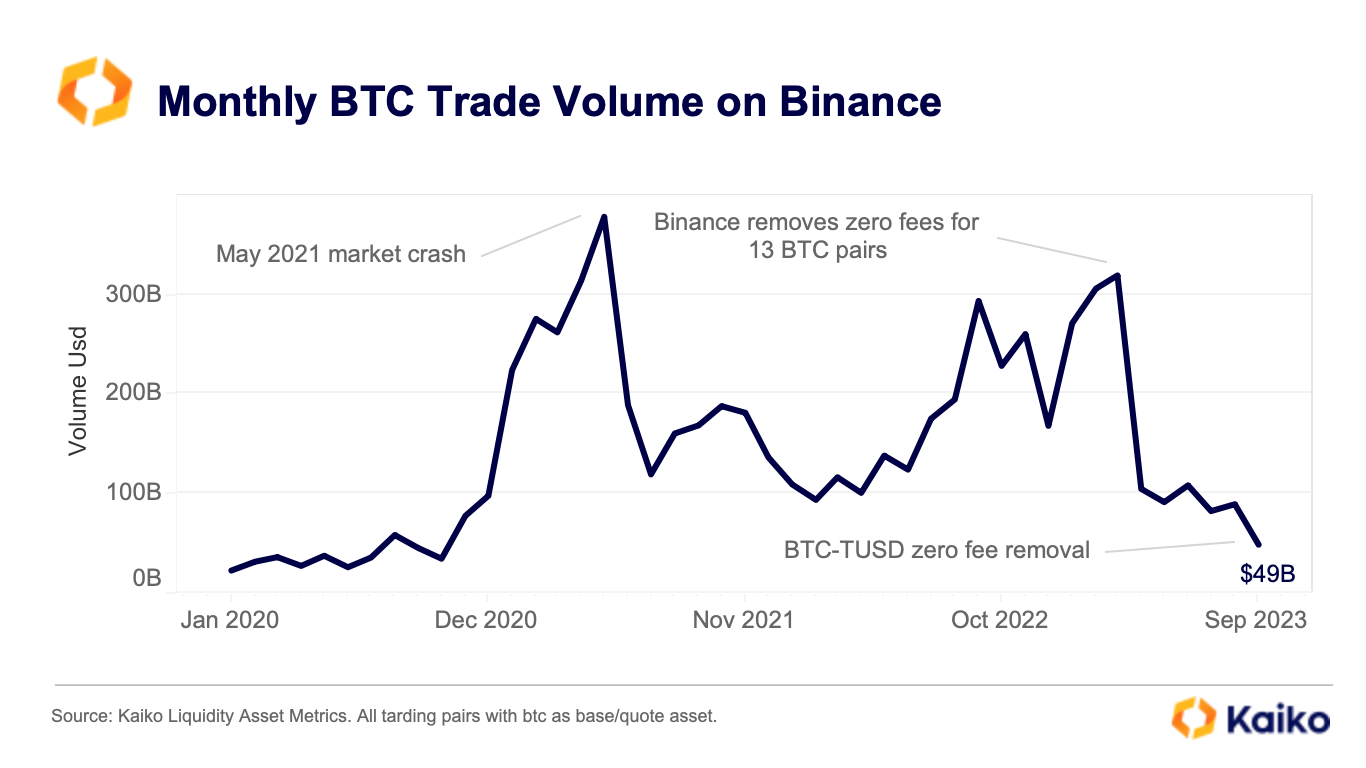

Bitcoin trade volume on Binance nearly halved to $49bn in September, its lowest level since Oct 2020, after the exchange removed its zero-fee promotion for its largest Bitcoin trading pair BTC-TUSD. This is the second largest monthly drop since 2020. In April, BTC trade volume already fell by a whopping 67% — a decline comparable with the 2021 market crash — after Binance removed its large-scale zero fee promotion for 13 BTC trading pairs.

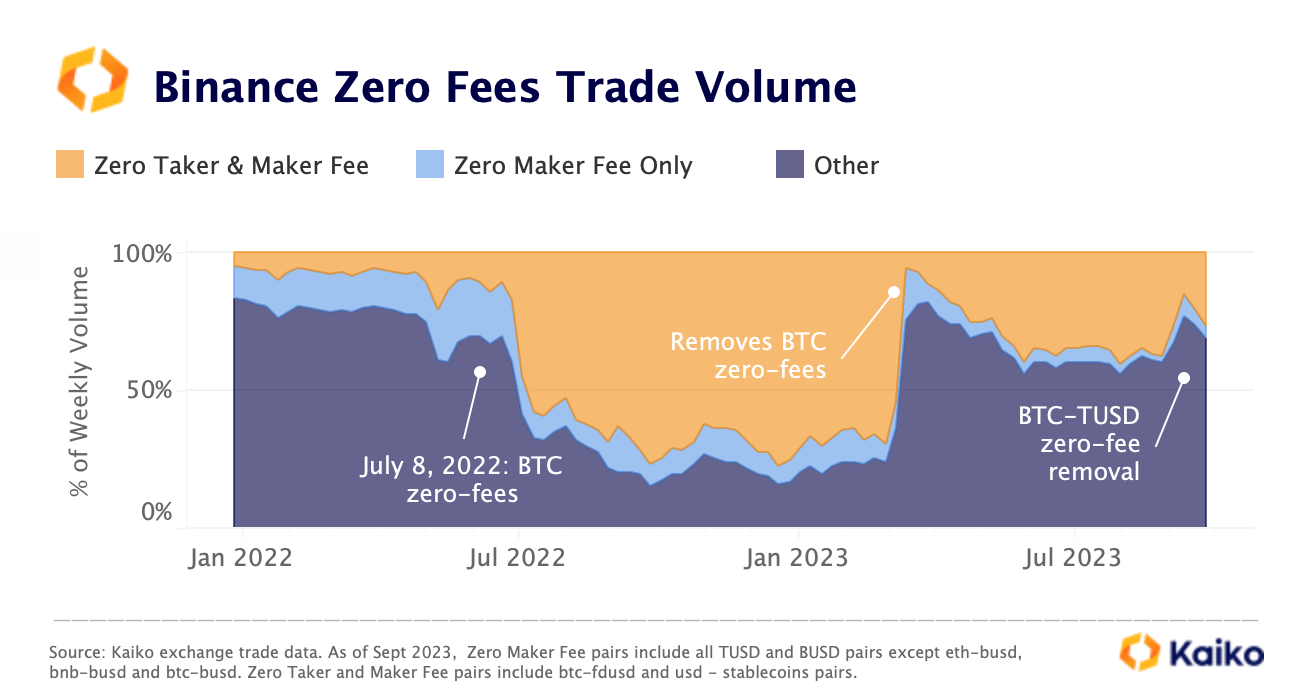

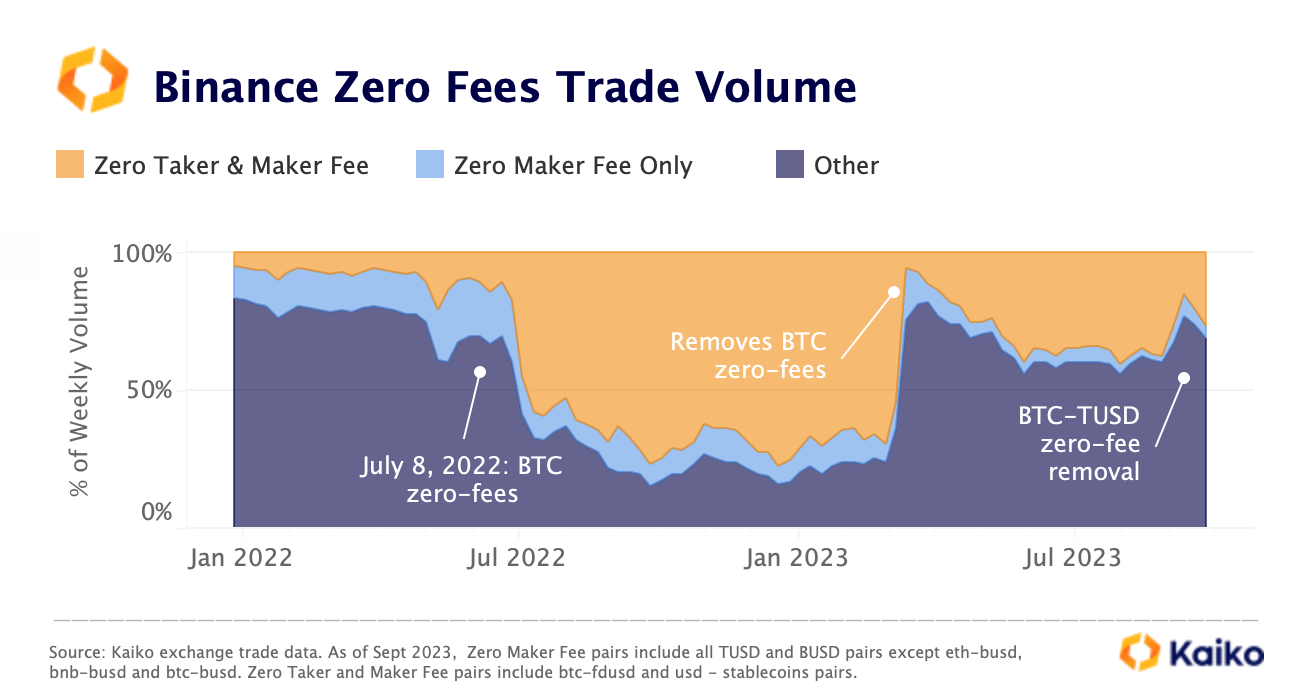

The trend is clear evidence that trade volume on Binance is heavily linked to their trading fee promotions. Our deep dive on the topic found that at one point, 85% of trade volume on Binance was on trading pairs that had zero fees.

Overall, the share of zero fee trading on Binance has declined significantly this year as Binance re-adjusts its strategy.

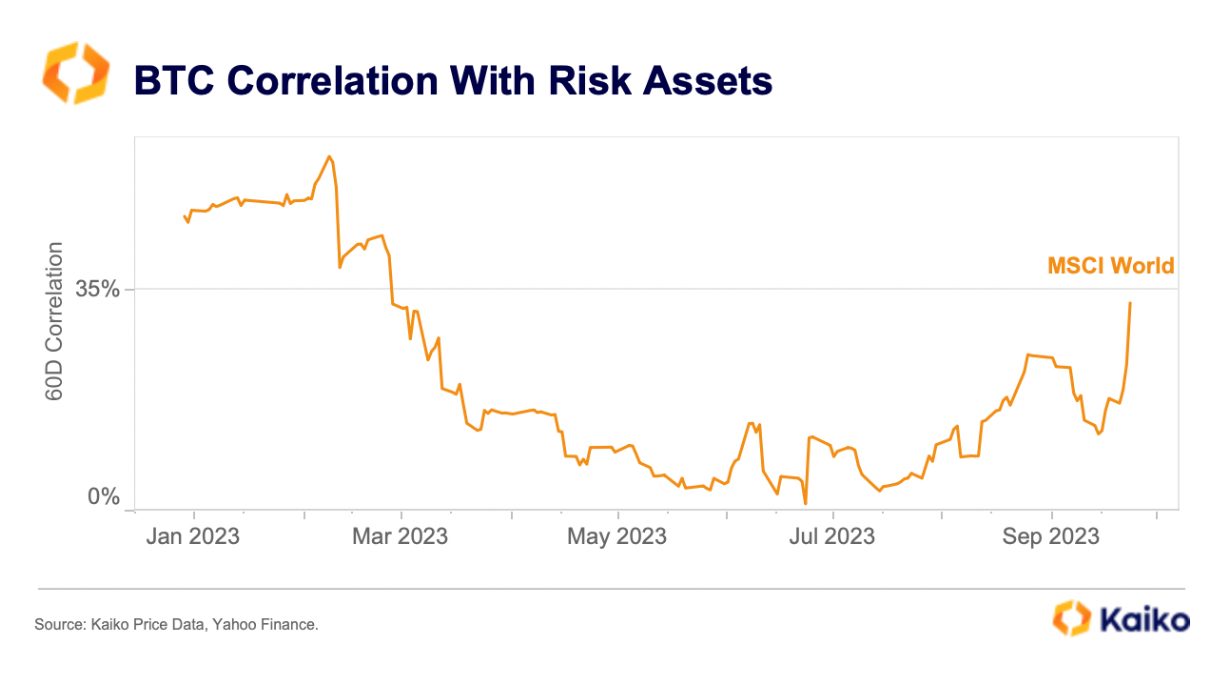

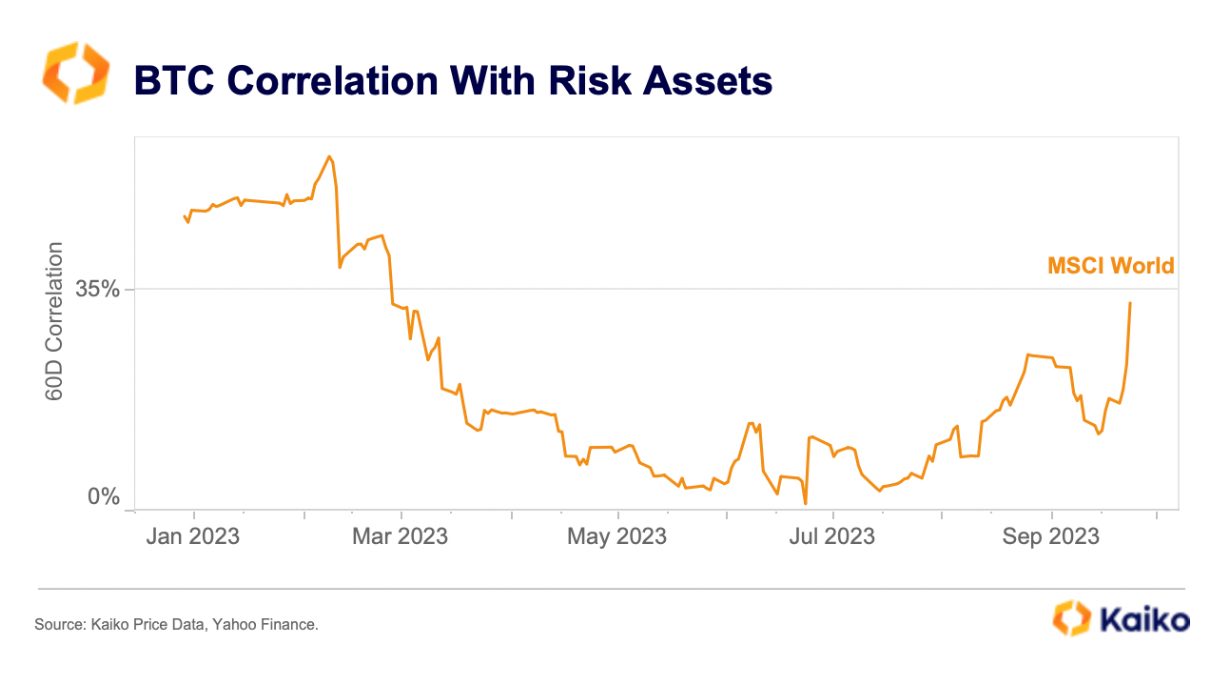

Bitcoin’s correlation with risk assets is rising.

While BTC 60-day correlation with risk assets has been moving upwards, it is way below its 2022 average of over 50%. In fact, BTC showed remarkable resilience to surging borrowing costs and growing macro uncertainty in September, outperforming the S&P 500 and the Nasdaq 100. This suggests it has strong support and traders prefer BTC liquidity in times of uncertainty. Overall, the rout in Treasuries is unlikely to halt without a meaningful decline in risk assets which would increase the attractiveness of fixed-income. This could still spill into crypto markets as correlations tend to converge in times of stress.

![]()

![]()

![]()

![]()