Join us for our latest webinar in collaboration with Cboe

Insights.

Our Data Debrief and Deep Dive insights are published twice a week and you can subscribe to them here.

Derivatives

09/02/2026 Data Debrief

Bitcoin's Latest Drop Signals Halfway Point of Bear MarketLast week’s correction triggered approximately $9 billion in liquidations and pushed stablecoin dominance above 10%, exceeding levels last seen during the FTX collapse.

![]()

Binance

02/02/2026 Data Debrief

Fed Reforms Spark Cross-Asset Volatility SpikeThe final week of January 2026 delivered a stress test across multiple markets simultaneously. As th...

Written by Laurens Fraussen![]()

Macro

26/01/2026 Data Debrief

Tariff Uncertainty Exposes Bitcoin's Identity CrisisTariff volatility exposed Bitcoin’s ongoing identity crisis. Trump’s Greenland tariff threats trigge...

Written by Laurens Fraussen

![]()

CEX

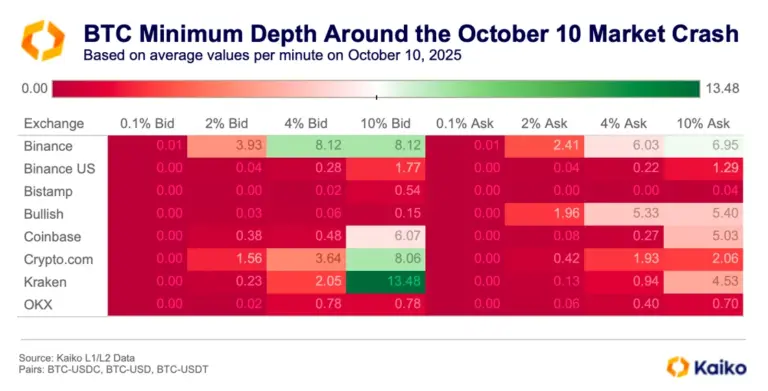

13/10/2025 Data Debrief

When October Surprise Meets Crypto Liquidity DroughtA sharp, geopolitics-triggered shock on Friday cascaded into one of crypto’s largest deleveraging events, with more than $500bn wiped from market cap as forced liquidations surged, order book depth vanished, and venue-specific pricing frictions amplified stress, especially around Binance and USDe, leaving open interest suppressed despite a partial weekend rebound.

Written by Adam Morgan McCarthy![]()

Bitcoin

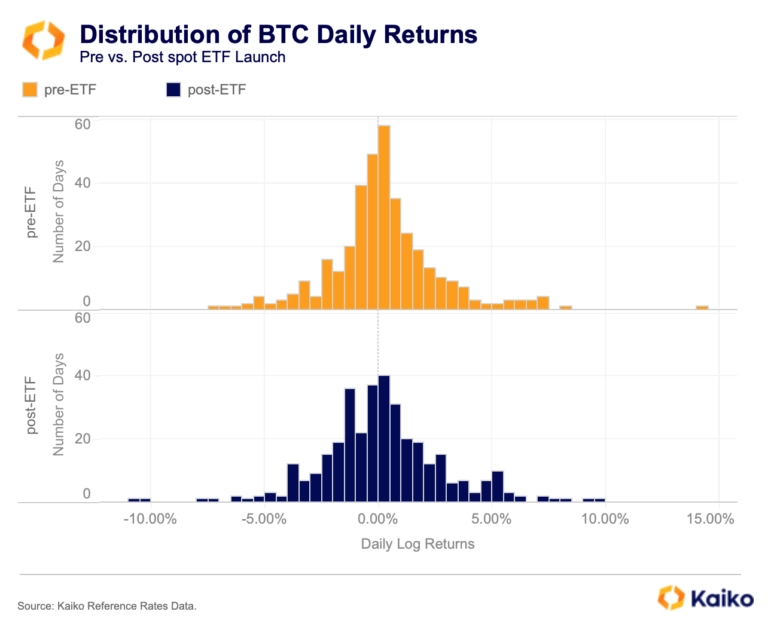

07/10/2025 Data Debrief

Is Wall Street Driving BTC Prices?BTC crossed $125k for the first time over the weekend as markets rose across the board last week. Following BTC’s latest record run, we’re exploring BTC’s price drivers and price discovery mechanisms. In particular, we look at the role of spot exchange-traded funds on prices, questioning a common assumption that they are the main driver of BTC’s price.

Written by Adam Morgan McCarthy![]()

Bitcoin

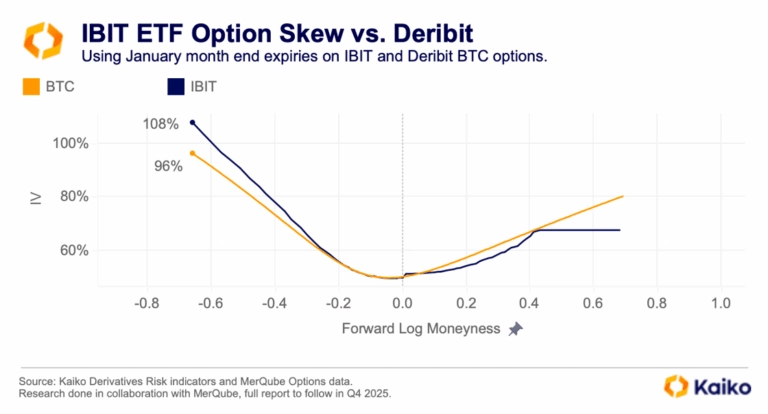

30/09/2025 Data Debrief

Why IBIT Options Traders Paid a Premium for ProtectionToday we’re looking at how risk is measured in crypto, by comparing both traditional and native markets. With the advent of multiple spot crypto exchange-traded funds there’s also a plethora of new derivative offerings. How traders price risk in these markets doesn’t always align. We’ll explore this today by looking at options on Deribit and Cboe.

Written by Adam Morgan McCarthy![]()

Indices

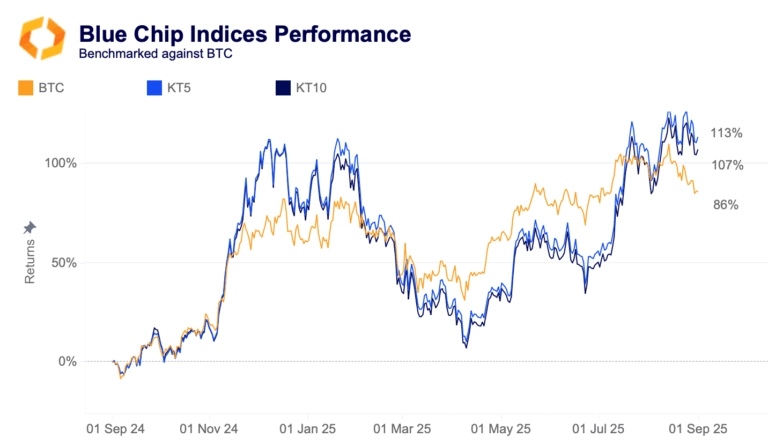

22/09/2025 Data Debrief

Not Just Bitcoin: Baskets Show The Wider Market StoryAs we approach the end of the third quarter, we’re casting an eye over the broader market and which individual assets are driving returns. Despite BTC languishing over the summer, as ETH and XRP outperformed it, BTC has still dominated the narrative. However, we found that it’s not just the original cryptocurrency that’s driving returns in the market right now.

Written by Adam Morgan McCarthy![]()

ETF

15/09/2025 Data Debrief

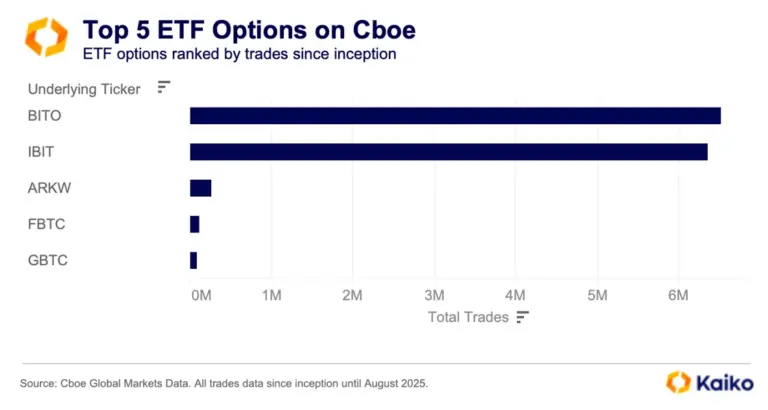

Competition for Crypto Options Heats UpThis week we’re diving into all things crypto derivatives, with a particular focus on options markets. Crypto derivatives markets have been dominated by native players over the past decade, but now competition is growing. We explore this growing competition and how options on traditional venues might offer broader growth opportunities for altcoins.

Written by Adam Morgan McCarthy![]()

Layer 1

08/09/2025 Data Debrief

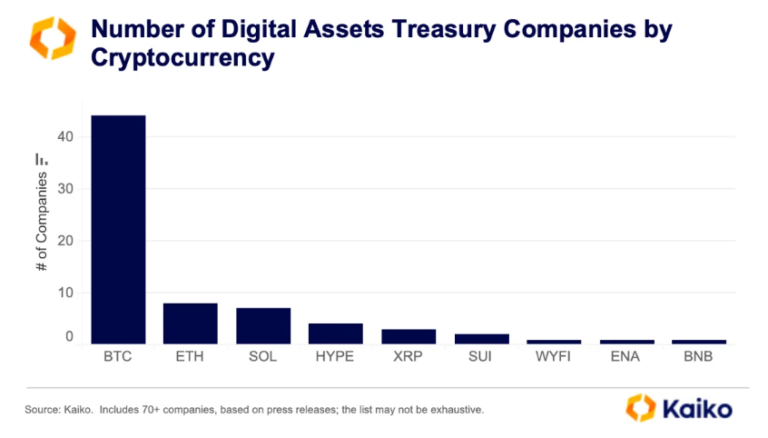

Corporate Treasuries Fuel Crypto SurgeDigital asset treasury companies are powering crypto’s rally this year as firms like Strategy, BitMine, and Metaplanet steadily accumulate Bitcoin, Ethereum, and altcoins. Their persistent buying is supporting spot prices, attracting new investors, and fueling the rapid growth of listed crypto-treasury firms, especially across APAC.

Written by The Kaiko Research Team![]()

CEX

01/09/2025 Data Debrief

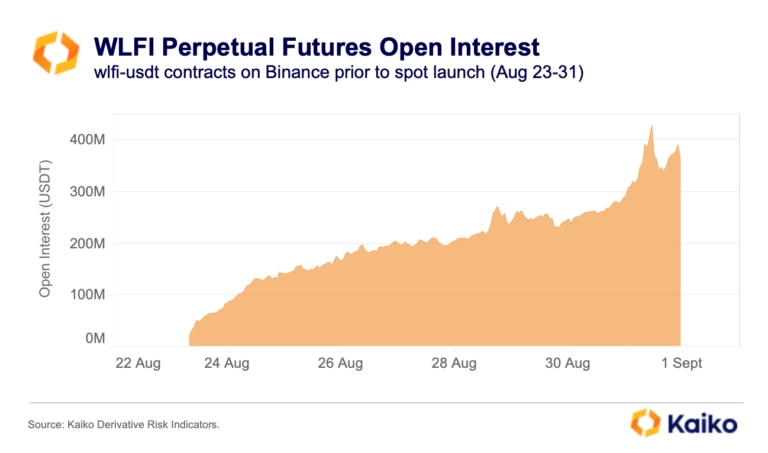

WLFI spot market launch off to a strong start.Today, 20% of Trump’s WLFI (World Liberty Financial) token supply was unlocked, coinciding with the debut of spot markets on several major exchanges, including Binance. Yet much of the market reaction had already been set in motion days earlier with derivative markets experienced significant activity in the days leading up to the spot debut.

Written by The Kaiko Research Team![]()

Bitcoin

25/08/2025 Data Debrief

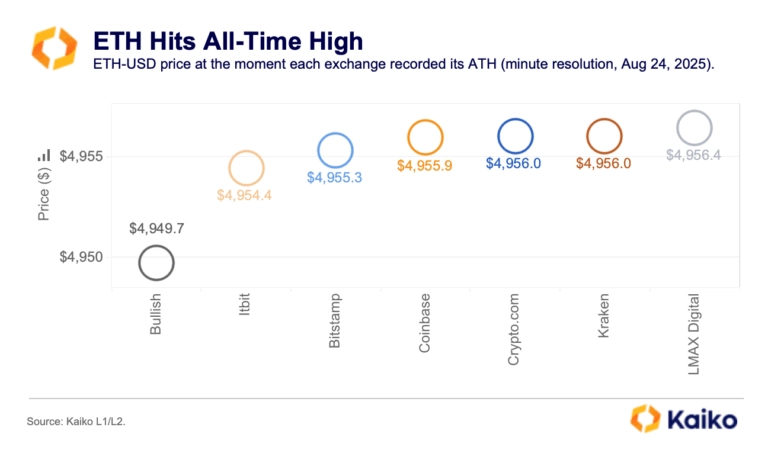

ETH breaks out on strong spot demand.ETH broke its 2021 all-time high over the weekend, reaching as high as $4,996 on some cryptocurrency exchanges and outperforming BTC in both price and volume. It later eased to around $4.6k on Monday, but volumes remain strong, indicating the rally still has momentum.

Written by The Kaiko Research Team![]()

Bitcoin

18/08/2025 Data Debrief

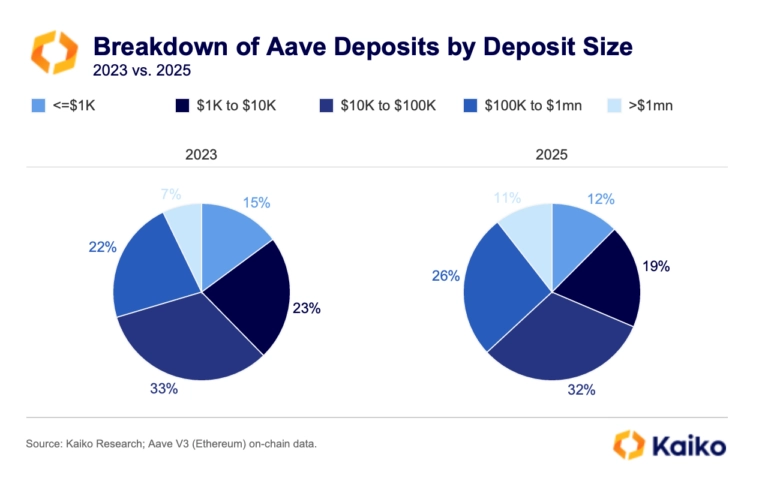

Mapping the AAVE User Base.Better on-ramps and embedded swaps are bringing more people on-chain. But DeFi lending and leverage still sit with a small group of large, sophisticated users. In this special edition we map Aave’s user base by deposit size, activity, collateral choices, and risk posture to understand who powers the protocol and what that implies for liquidity, stability, and growth.

Written by Louis Latournerie![]()

Bitcoin

11/08/2025 Data Debrief

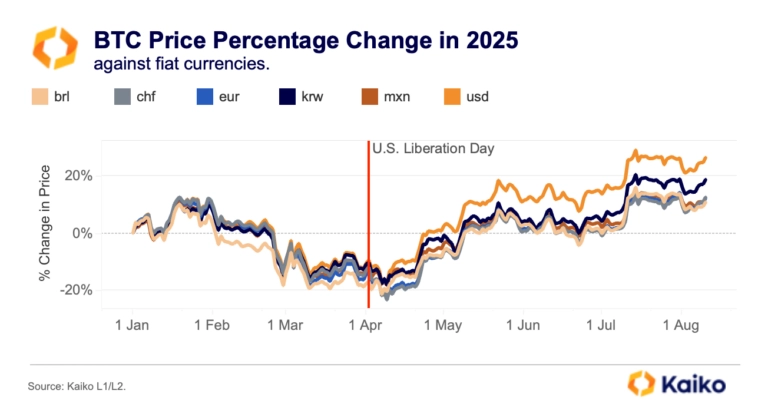

BTC Rally Tracks Softer USD.Bitcoin pushed back toward its all-time high near $123k early Monday after rebounding from early August lows around $112k. The move tracked a broader risk rally as markets priced a September Fed cut. Stephen Miran’s nomination to the Fed Board last week reinforced that view after weak July jobs data. A softer dollar added a tailwind, lifting USD‑quoted flows and amplifying BTC’s gains.

Written by The Kaiko Research Team![]()

CEX

04/08/2025 Data Debrief

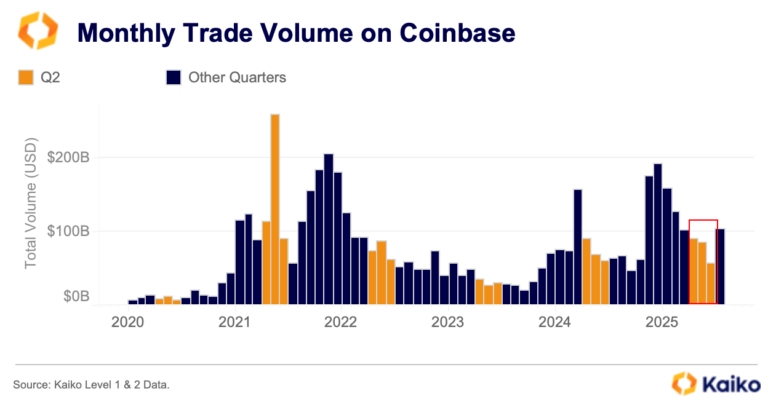

Why Coinbase Wants to be the Everything ExchangeThe bulk of public earnings took place last week, with plenty of crypto-related news to digest. In today’s Data Debrief, we’re focusing on Coinbase’s quarterly results and market positioning, looking at volume share versus competitors, COIN share performance, and the top asset performers on the exchange, along with their quarterly trends and the company’s strategy in becoming the “Everything Exchange.”

Written by Adam Morgan McCarthy![]()

Bitcoin

28/07/2025 Data Debrief

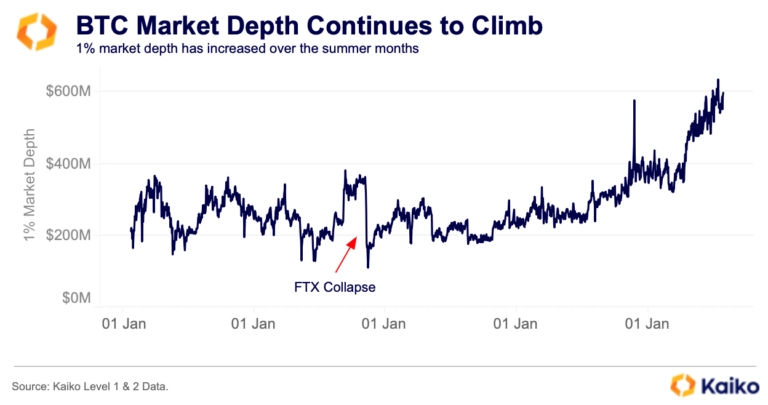

BTC Unfazed by Billion Dollar SaleIt’s a big week ahead for macro news, with multiple central bank meetings, including the Fed, and a plethora of economic data to sift through. Moreover, crypto markets just absorbed a enormous $9bn BTC sale without much fuss. We explore all these topics and more in this week’s debrief.

Written by The Kaiko Research Team![]()

Ethereum

21/07/2025 Data Debrief

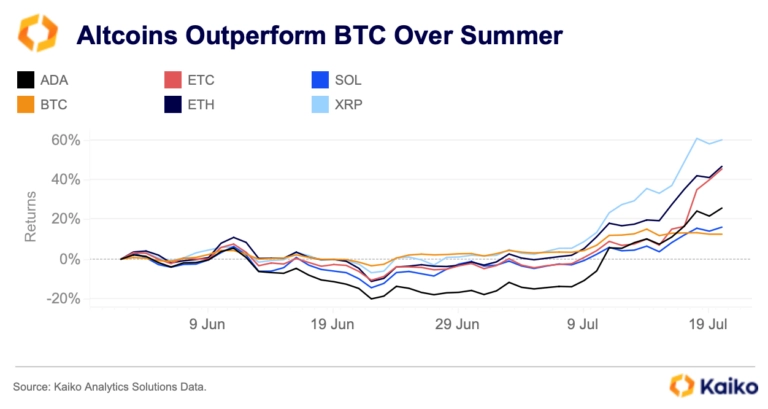

Altcoin Rally: This Time the Data's DifferentThis week we’re examining the shift in the crypto market towards altcoins. Last week’s rally was one of the largest moves over the past three years, hinting at a potential set up for an altcoin season. In contrast, Bitcoin’s stranglehold on the market has slipped somewhat, as investors favour smaller assets at present.

Written by The Kaiko Research Team![]()

Bitcoin

14/07/2025 Data Debrief

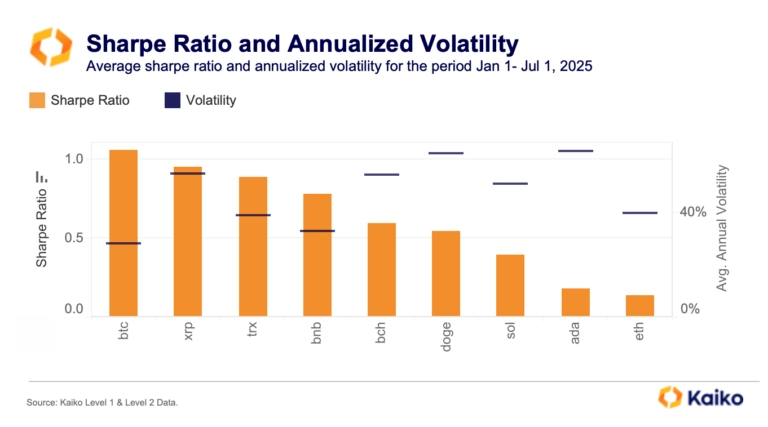

Bitcoin Booms in Low-Risk EnvironmentBitcoin topped $123k for the first time on Monday as last week’s rally extended into a second week. Today we’re going to explore the latest all-time highs in the context of portfolio risk, focusing on how BTC has consistently set highs during low volatility periods in recent months.

Written by The Kaiko Research Team![]()

USDC

07/07/2025 Data Debrief

Gap grows between Bitcoin and altcoins.Bitcoin came close to a new all-time high last week before strong U.S. jobs data dented rate-cut hopes and pulled markets lower. Yet momentum remains intact, driven by institutional demand and a clear shift toward Bitcoin over altcoins. This week, we explored the structural shifts that may be laying the groundwork for a breakout.

Written by The Kaiko Research Team![]()

USDC

30/06/2025 Data Debrief

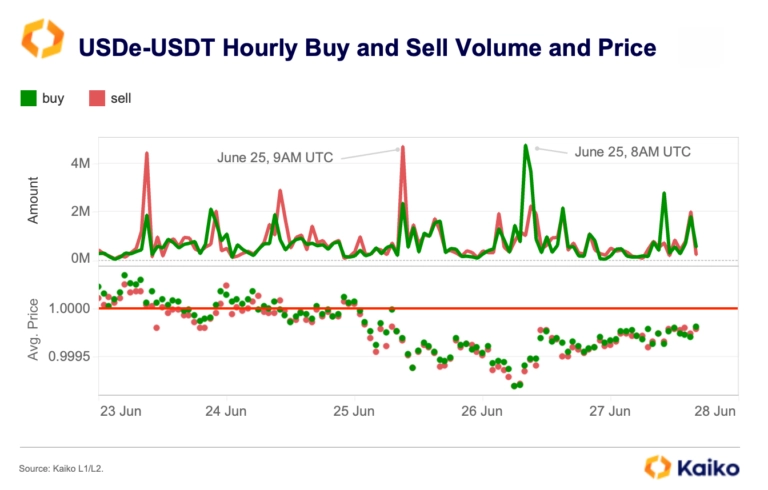

USDe faces regulatory setback in Europe.This week we’re diving into Ethena’s USDe, a stablecoin that’s quickly captured market share and regulatory attention. As global rules tighten and stablecoins become more integrated into mainstream finance, can USDe keep its momentum? We break down the data and the latest headlines.

Written by The Kaiko Research Team