Trend of the Week

Bitcoin’s latest record move in 10 charts.

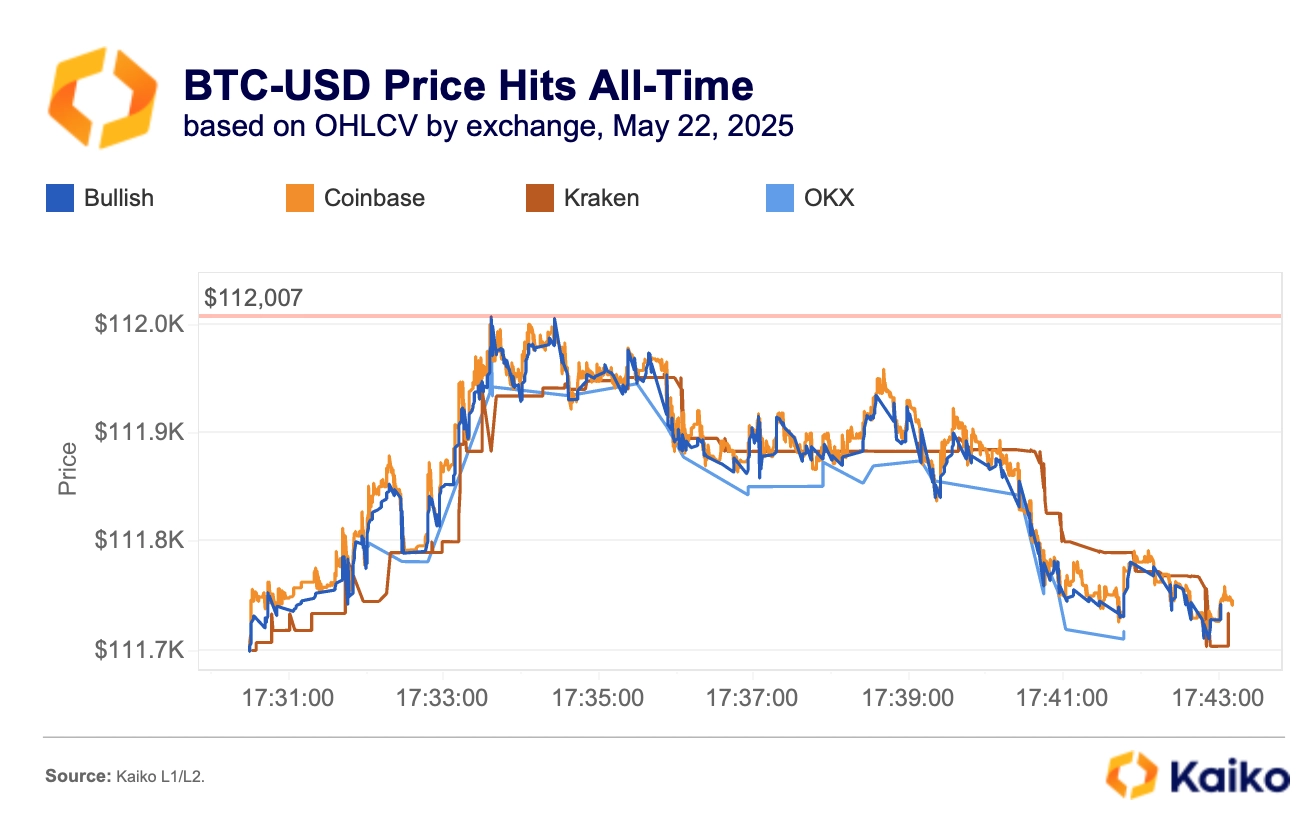

Bitcoin hit a new all-time high of $112K last week, the first since December 2024, before pulling back slightly as traders locked in profits. As of early Monday, prices had settled just below peak levels.

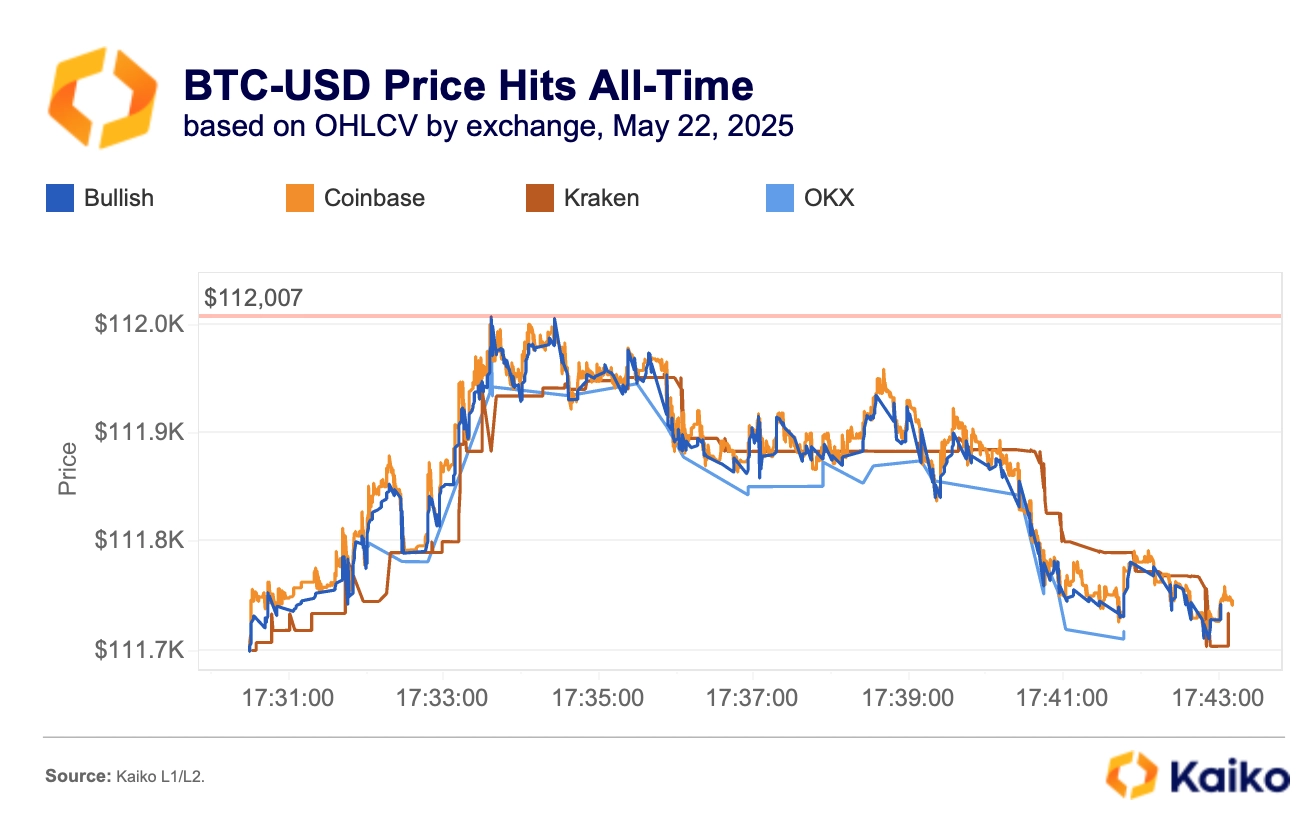

Bitcoin’s all-time high varies across markets. Using Kaiko’s tick level data by exchange for BTC-USD, we saw peak prices on platforms like Coinbase and Bullish, on which BTC reached $112k on May 22. On other platforms, such as Kraken and OKX, no trades were executed at that price.

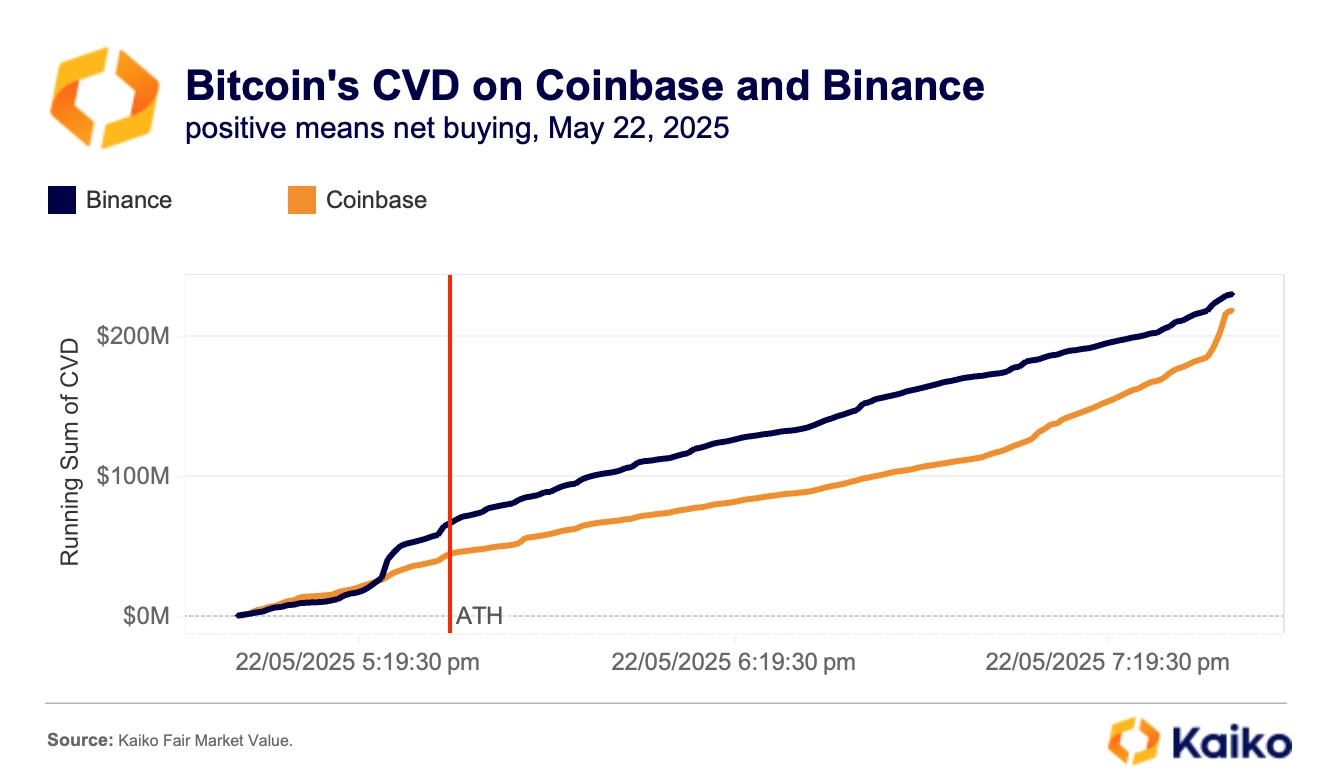

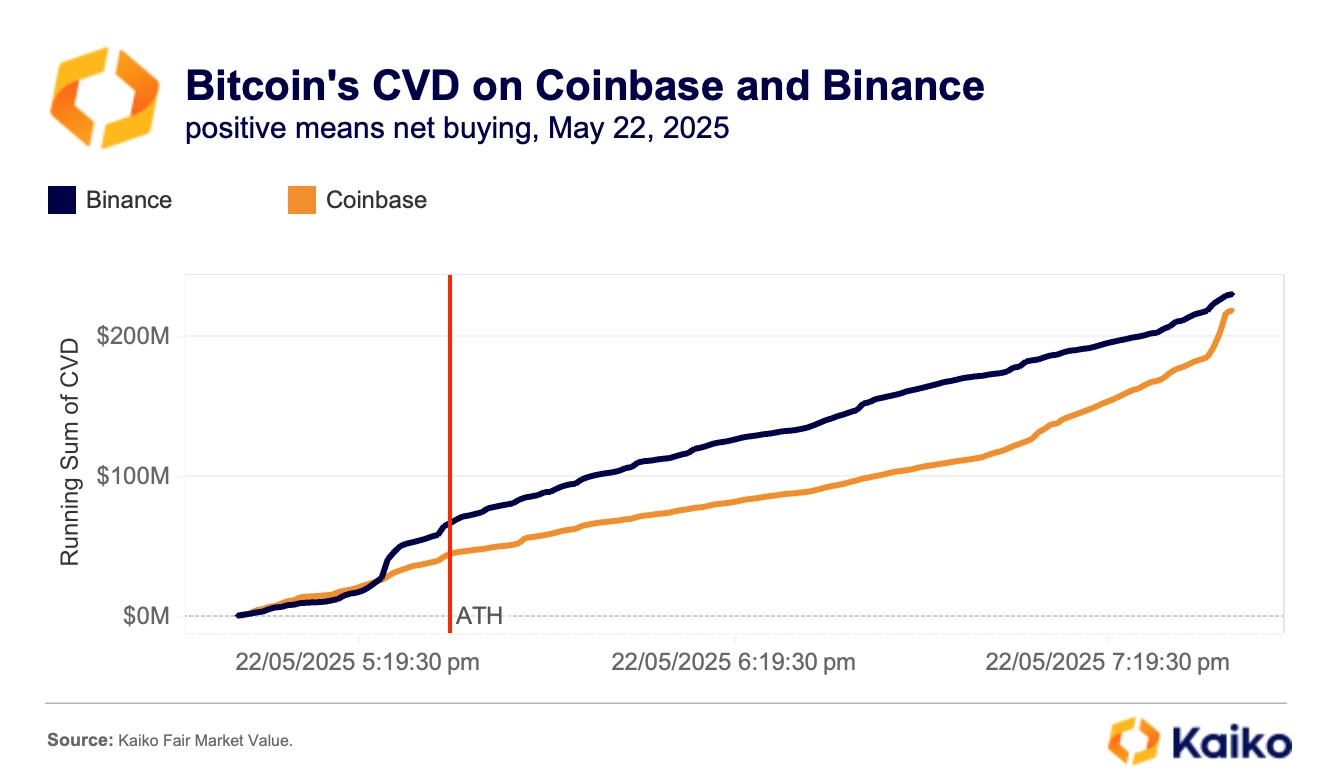

Bitcoin’s cumulative volume delta (CVD), which tracks net buying pressure, was positive across both U.S. and offshore exchanges, indicating the rally was broad-based. Notably, buying surged on Binance toward the end of U.S. trading hours on May 22 while Coinbase saw an increase at U.S. close.

The climb to $112K wasn’t without bumps. After jumping to $109K on May 21, Bitcoin briefly pulled back in tandem with risk assets as Moody’s U.S. credit downgrade, a weak20-year Treasury auction, and the passage of Trump’s tax bill rattled broader markets.

But the gloomy sentiment did not drag Bitcoin down for long. After a brief dip, it rebounded breaking above $111K during Asian trading hours around 3:40 AM UTC on May 22, a reminder of Asia’s influence in crypto price discovery.

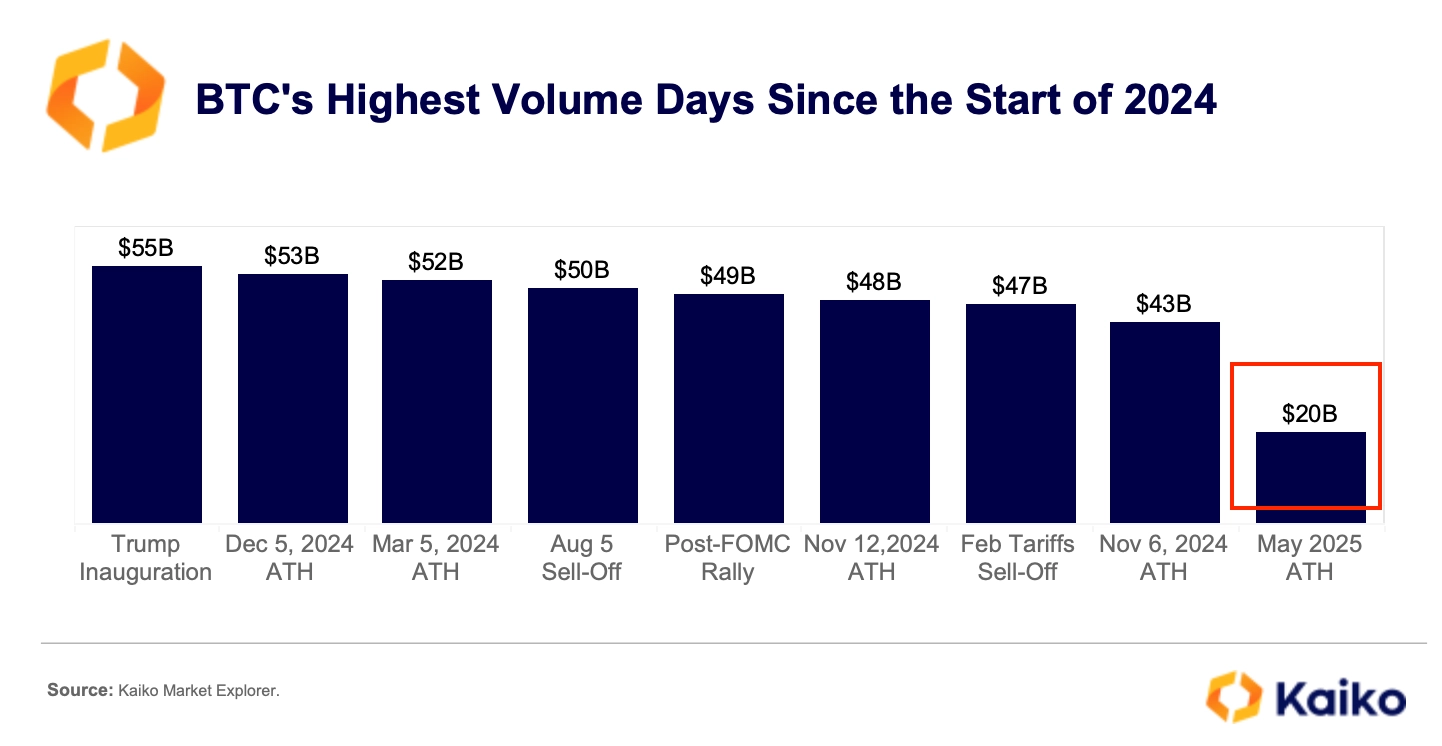

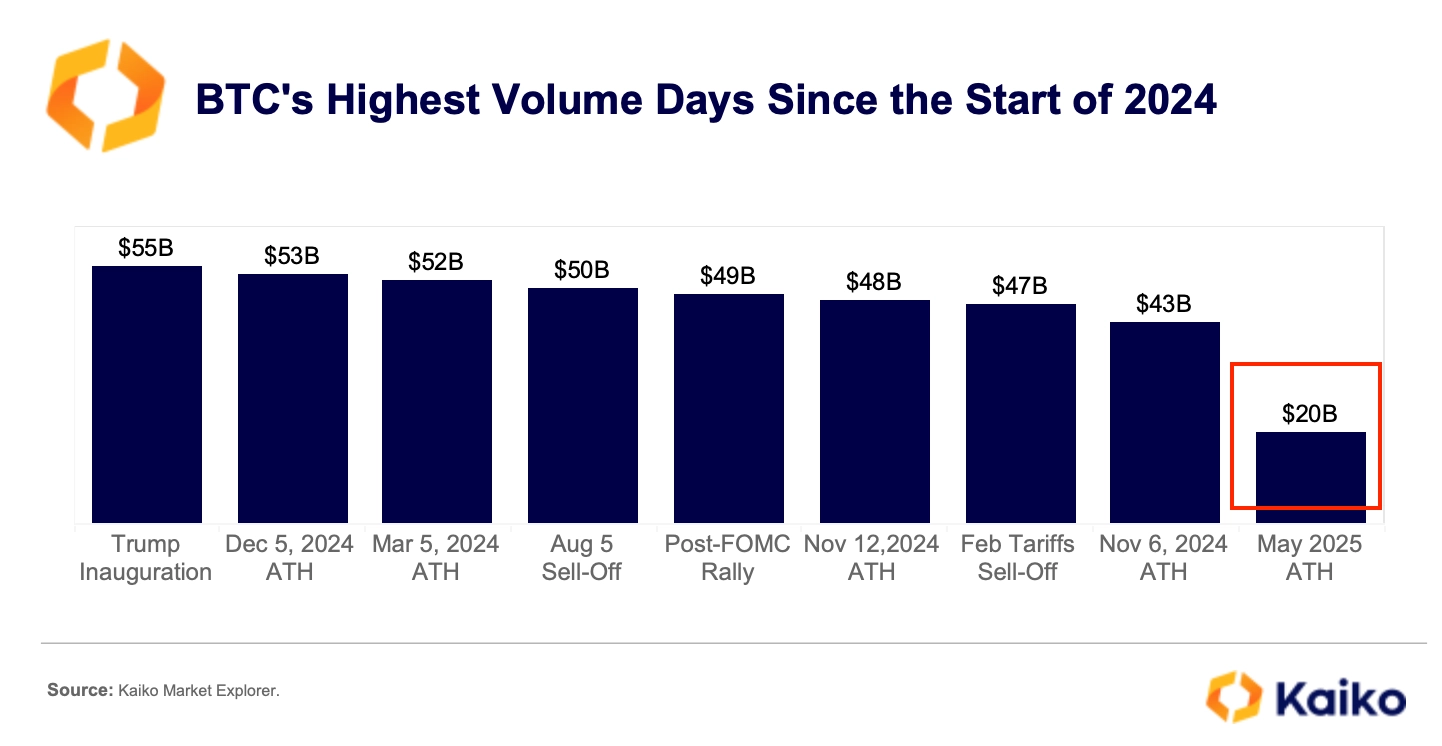

Despite the dramatic price move, however, spot trading volume remained remarkably subdued. On May 22, volume barely topped $20 billion, more than 50% below the activity seen during Trump’s inauguration or the December 5th 2024 rally, suggesting many participants are still waiting on the sidelines amid macro uncertainty.

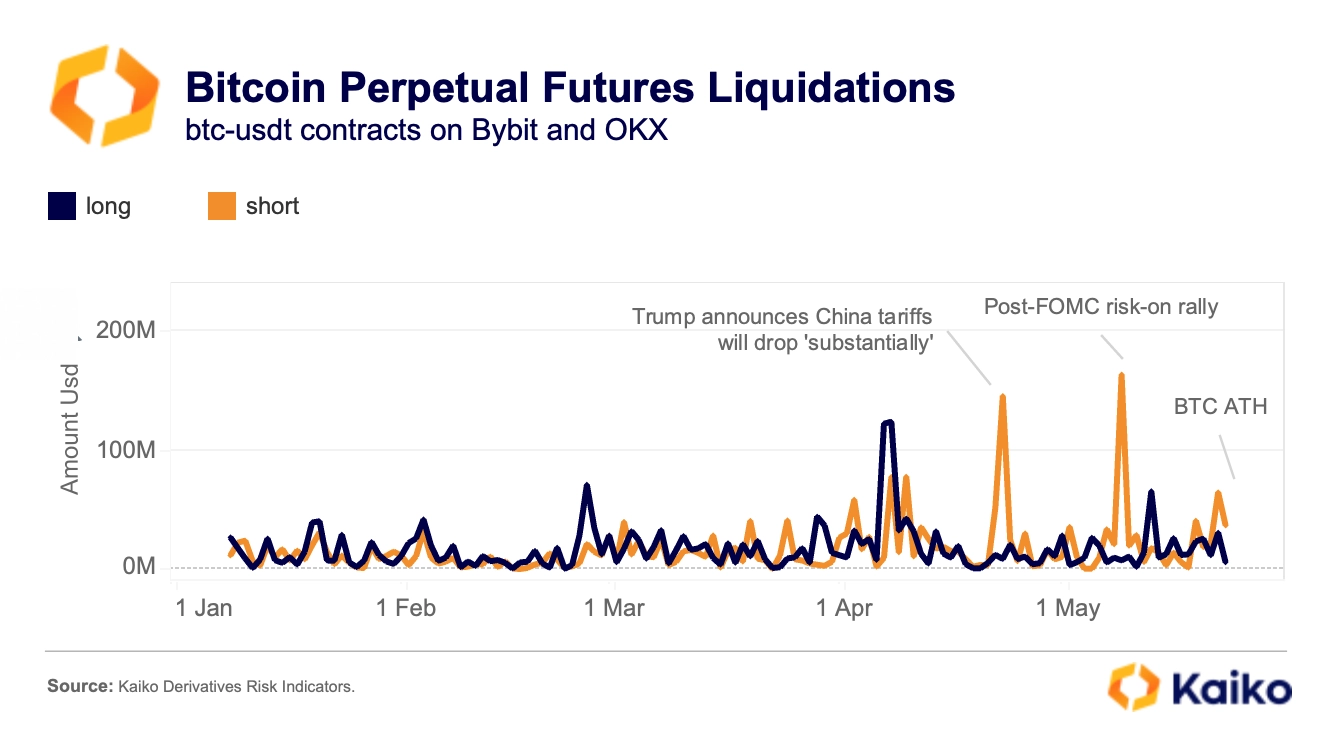

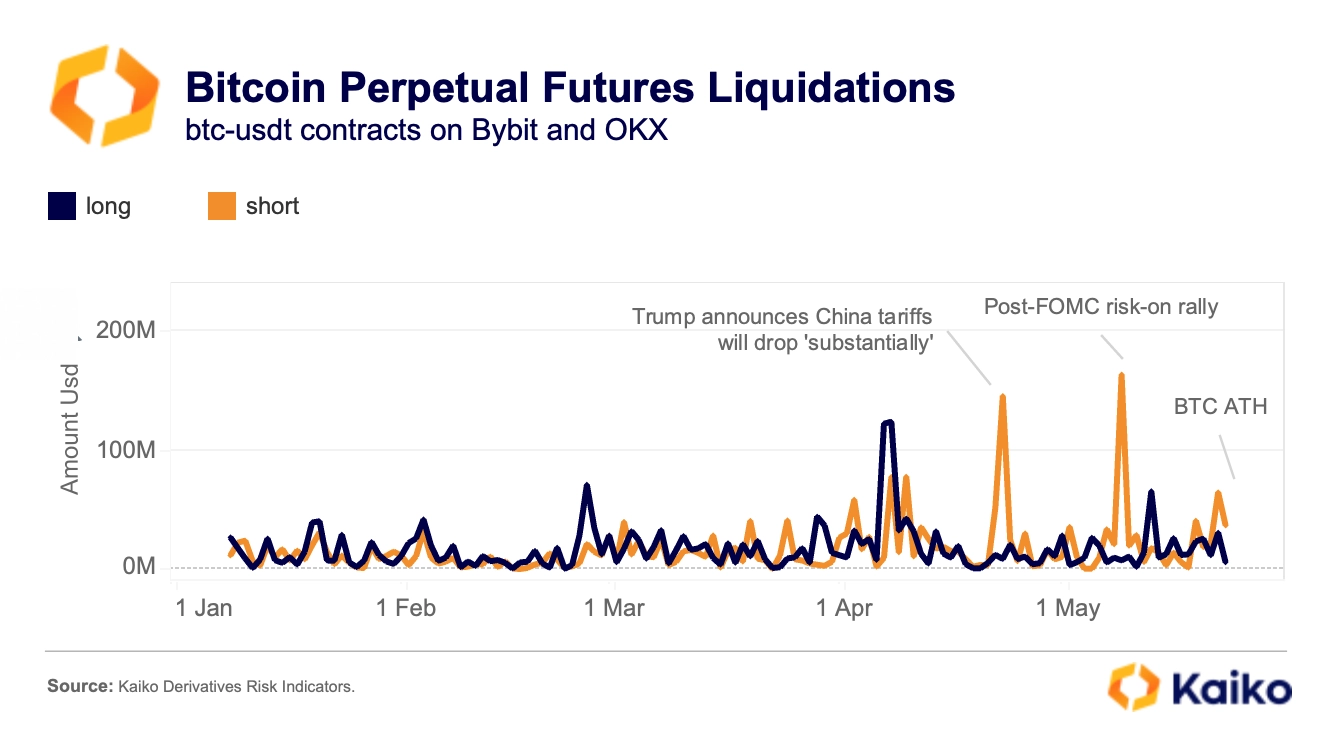

The recent rally sparked a wave of short liquidations in BTC-USDT pairs across Bybit and OKX. However, overall liquidation volumes were modest compared to the big spikes seen after the May 7 FOMC rally or the April 22 China tariff cut surge.

Notably, since late April, short-side liquidations have dominated, a clear sign that Bitcoin’s price action has continuously surprised to the upside.

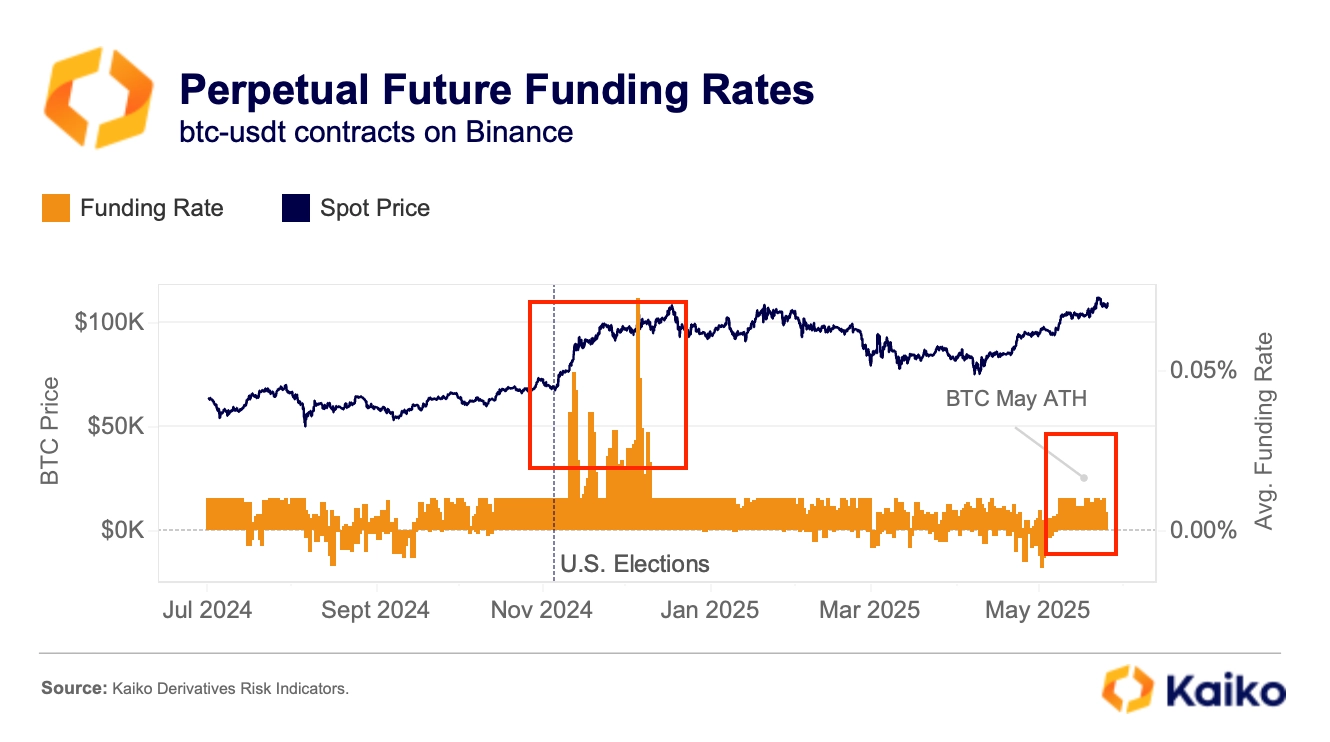

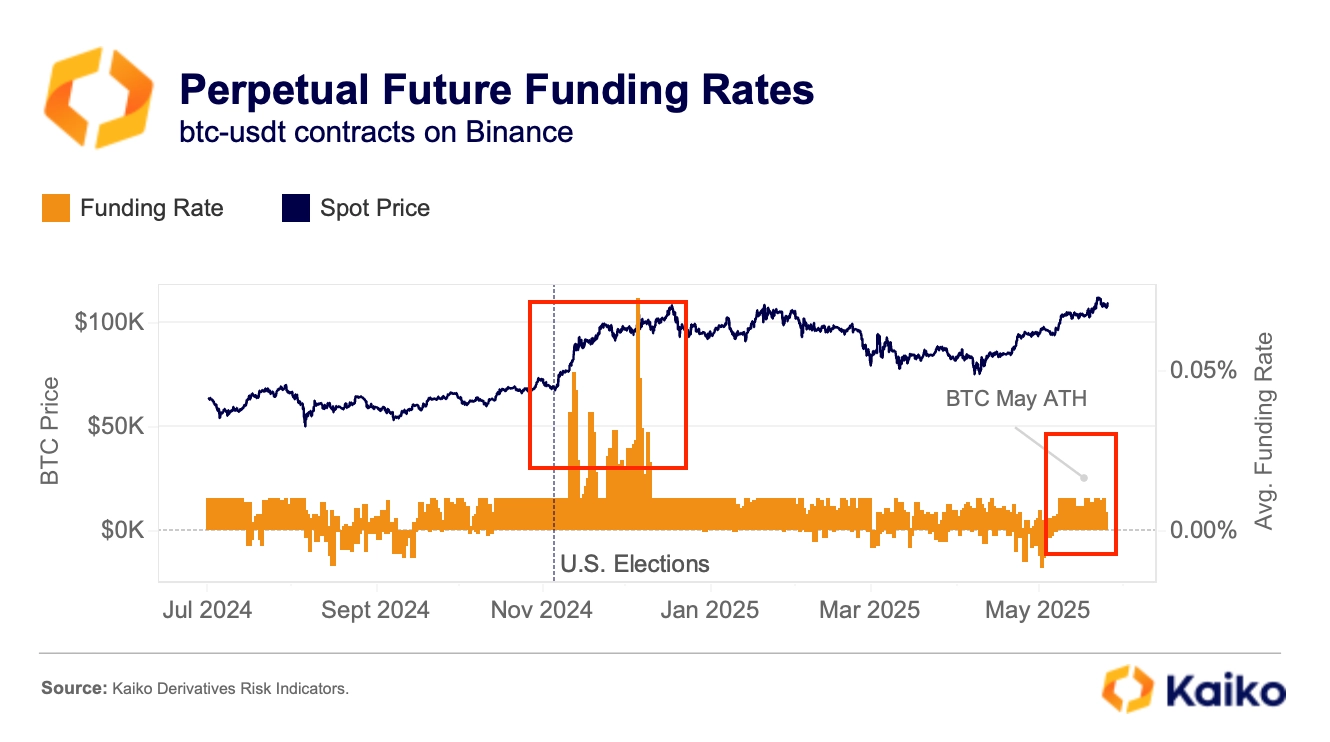

Despite the price surge, market leverage remains relatively low signalling a lack of retail euphoria. Funding rates turned positive in early May, showing renewed bullish sentiment, but they remain far below the overheated levels seen during the post-election rally. Perpetual futures open interest is also below end-2024 levels. This suggests that the market isn’t frothy just yet.

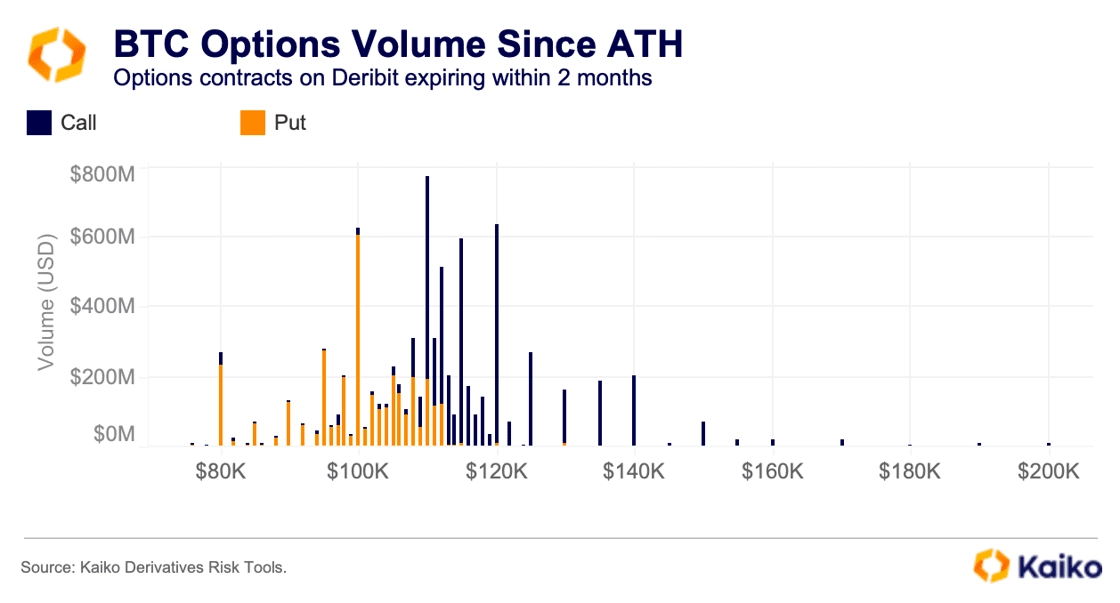

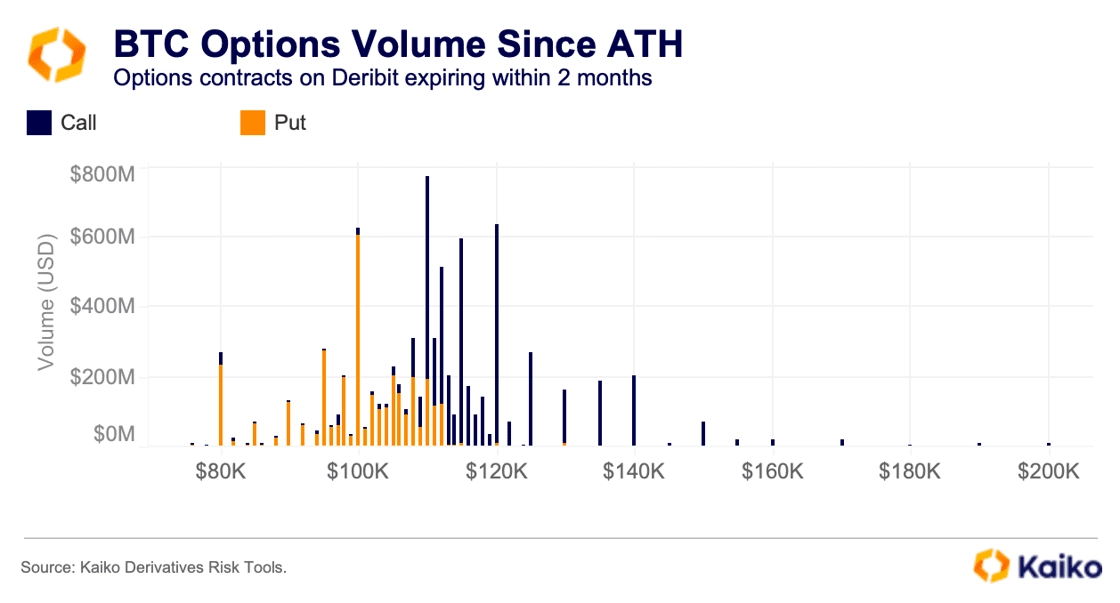

While leverage in perps remained low, activity in options markets since the new all-time high on May 22 has been somewhat subdued. Volume on options contracts expiring within two months was concentrated around the $110k mark, with calls dominating. The $115k and $120k strikes continue to see some action, as market participants position for more record highs.

There has been a lot of volume on puts at the $100k strike since the new highs. Since Thursday there’s been over $600mn worth of volume on puts at this level.

Perhaps more interestingly, there has been a lot of volume on puts at the $100k strike since the new highs. There has been over $600mn worth of volume on puts at this level since Thursday.

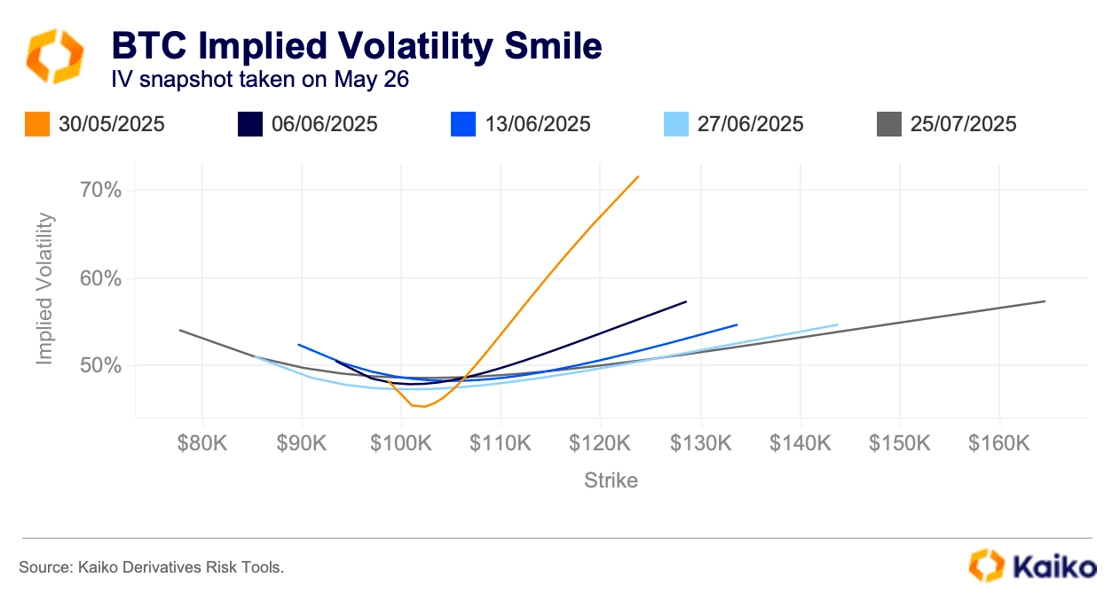

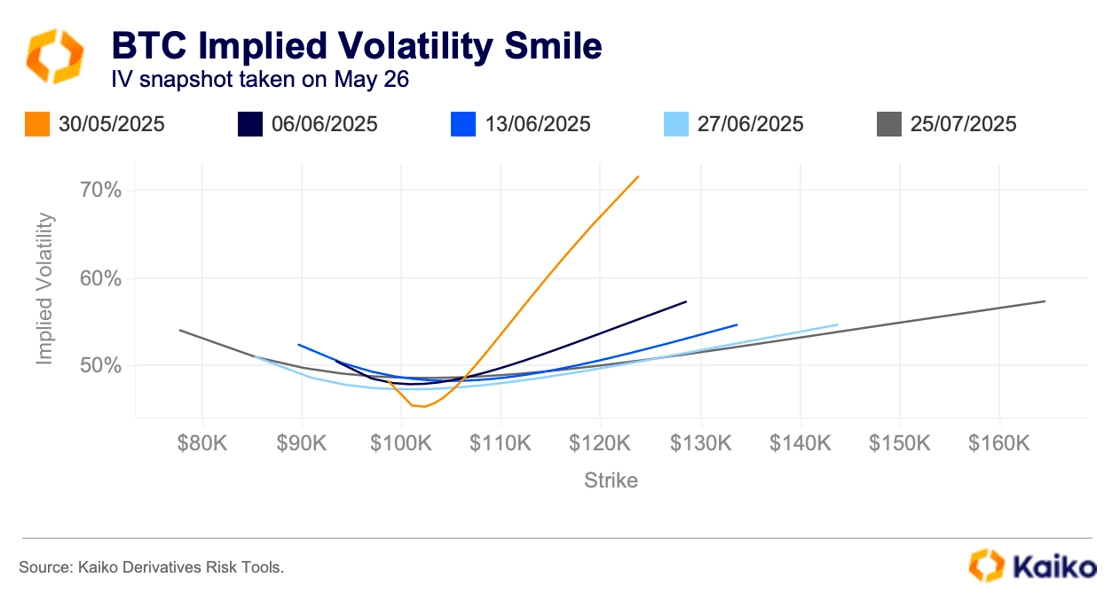

Bitcoin’s IV smile for upcoming expirations on Deribit shows a fairly balanced outlook in the medium-term. Friday’s jumbo expiration is skewed to the right, suggesting that there is strong demand for upside exposure in the short-run.

The IV smile for further-dated options follows a more typical pattern than Friday’s expiration, with IV peaking at the wings. This is to be expected in crypto markets as prices tend to whipsaw. No clear bias to the short or long side suggests relatively normal market conditions are to be expected as traders anticipate Bitcoin will hold its own in the coming weeks.

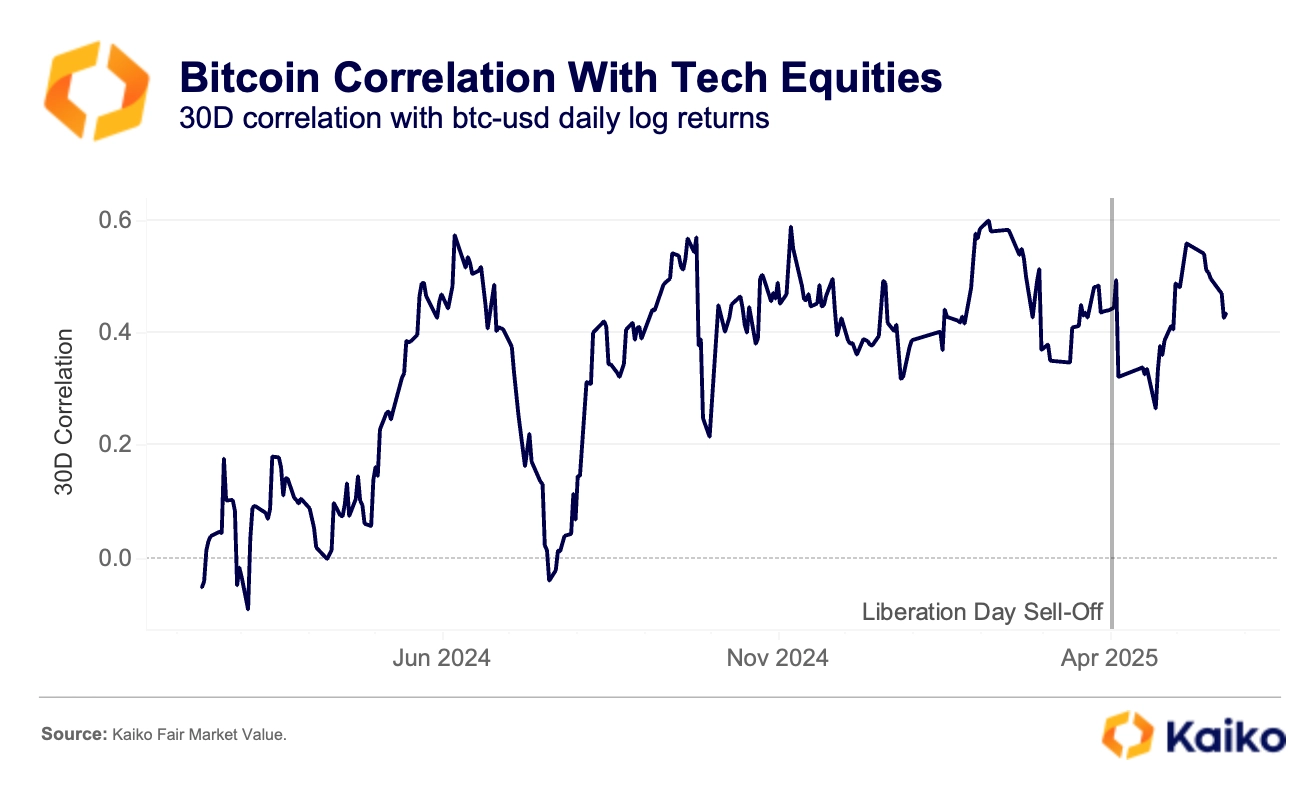

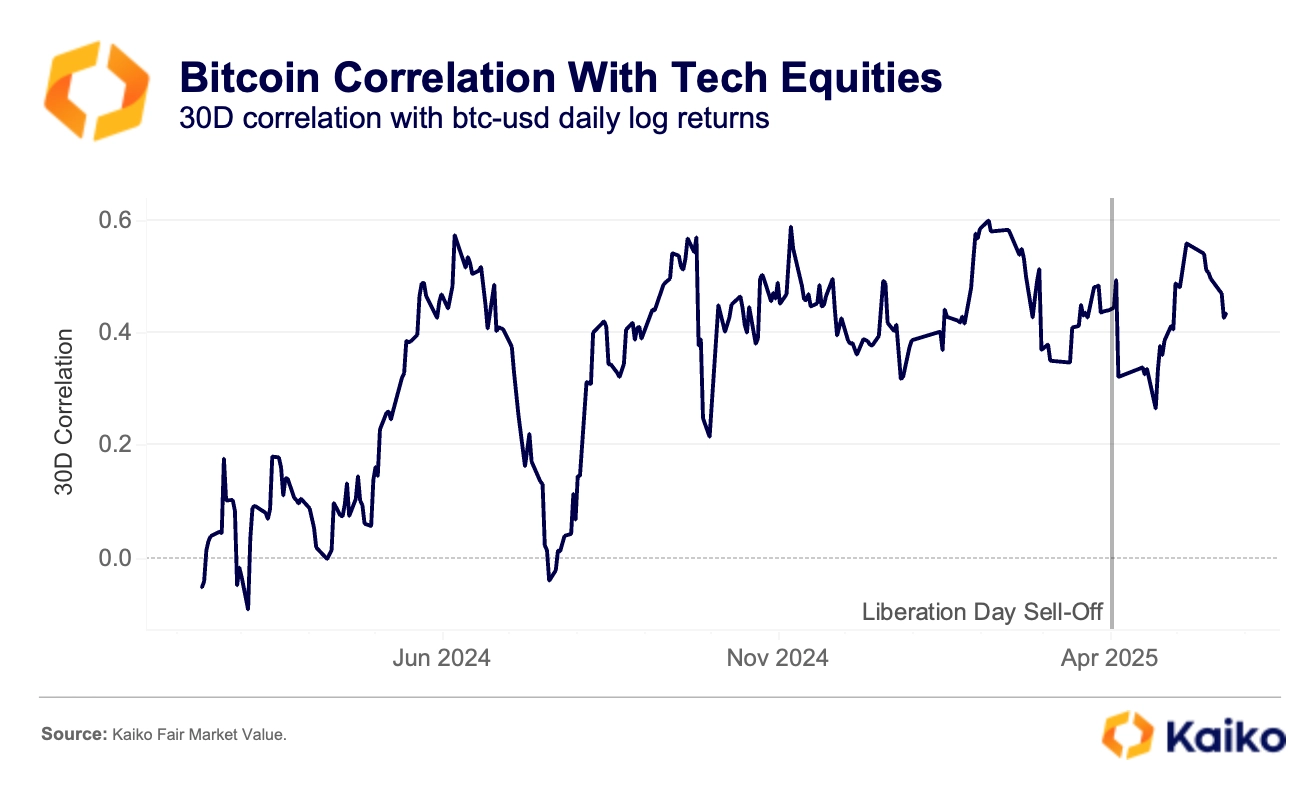

Bitcoin’s resilience has been especially notable against equity market weakness. Since the April 2 tariff selloff, BTC’s correlation with the Nasdaq 100 has declined to 0.27 , its lowest level since September 2024, despite bouncing back to 0.42 over the past weeks.

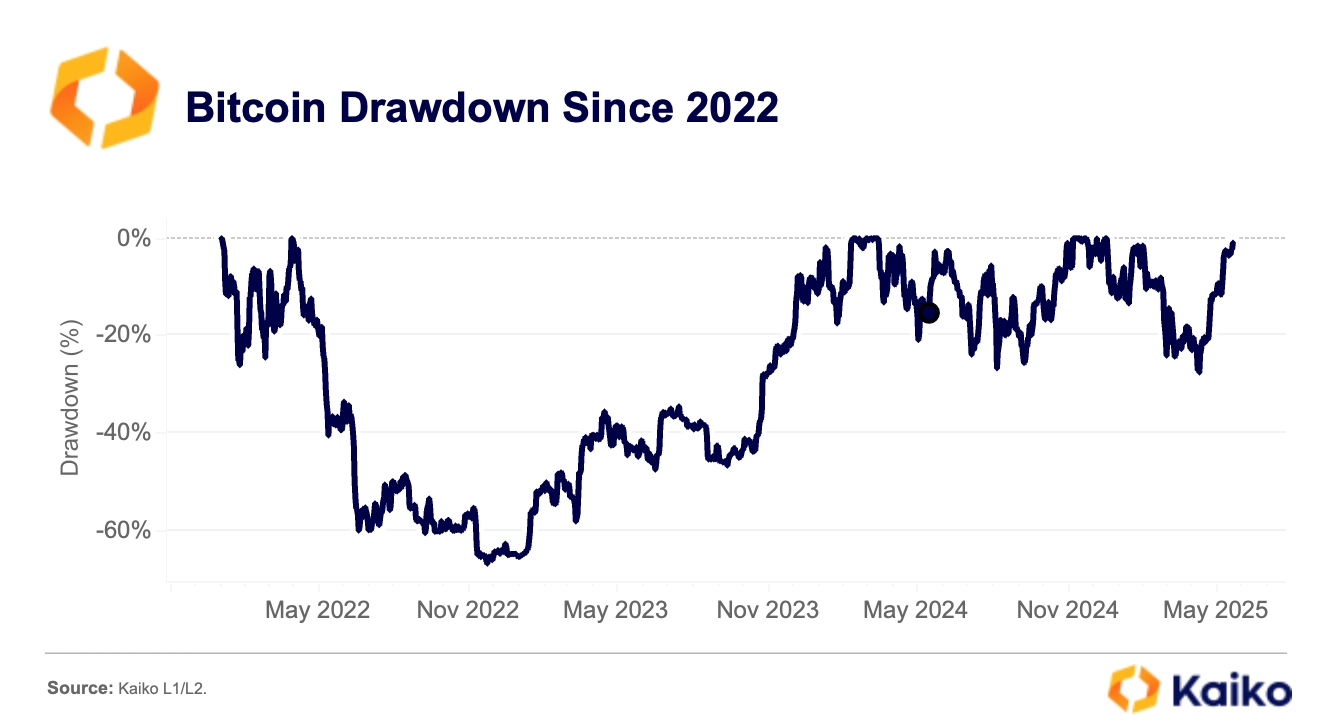

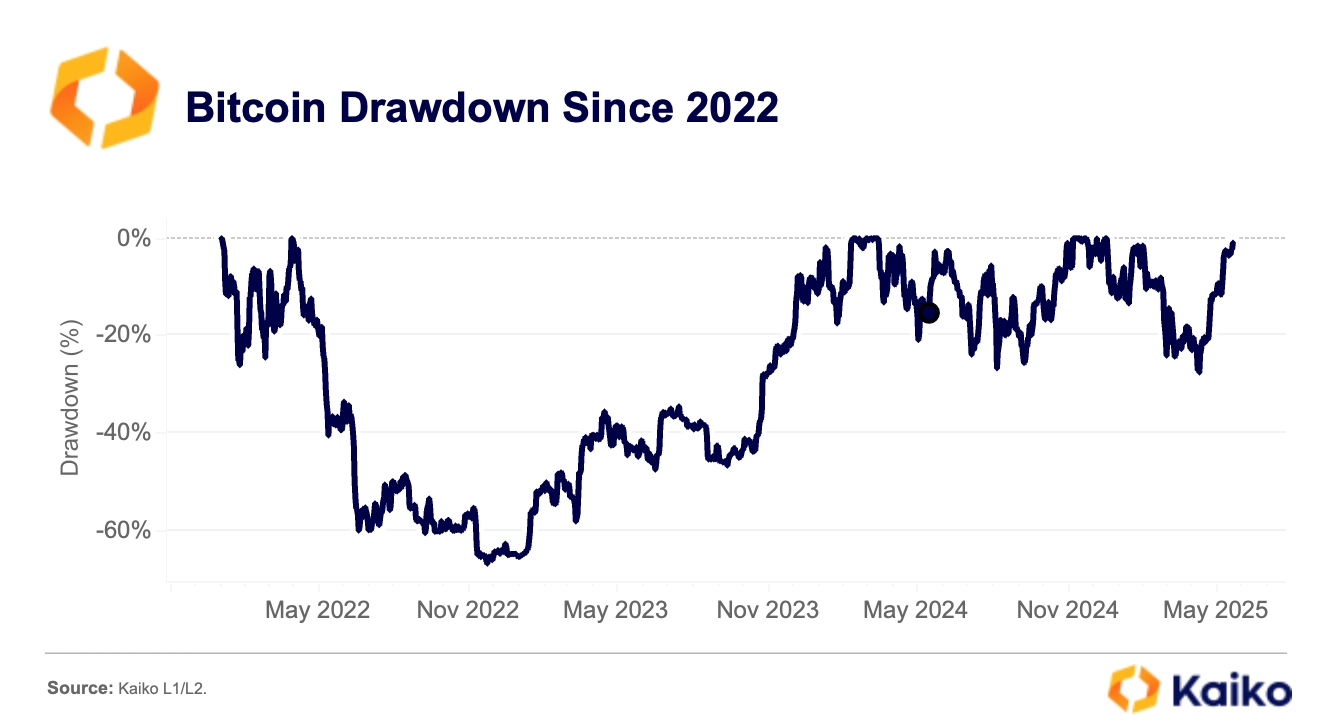

Overall, Bitcoin’s downside risk has also declined meaningfully. The trend has been ongoing since the start of the ETF-led rally in October 2023. Since then, BTC hasn’t suffered a drawdown greater than 30%, compared to the nearly 70% drop in late 2022.

Part of that stability is thanks to Bitcoin’s long-term holder base, with more than 60% of BTC wallets remained inactive through the 2022 bear market. But another key driver of this resilience is the growing trend of corporate accumulation.

Public firms across the U.S., Japan, Europe, and LATAM are building BTC positions. These strategies are also becoming more sophisticated. While some firms follow the debt-funded spot-buy model popularized by Strategy, others, like Japan’s Metaplanet, are layering in options (such as selling cash-secured puts) to either acquire BTC at lower prices or earn yield while they wait. This signals a maturing use case for Bitcoin as a corporate reserve asset.

These strategies offer downside buffers, but also bring new risks. Bitcoin’s volatility, while reduced since 2020, remains about three times higher than that of the Nasdaq 100. Should prices fall quickly, corporate treasuries using leverage or options may be forced to unwind, introducing new layers of volatility into the market.

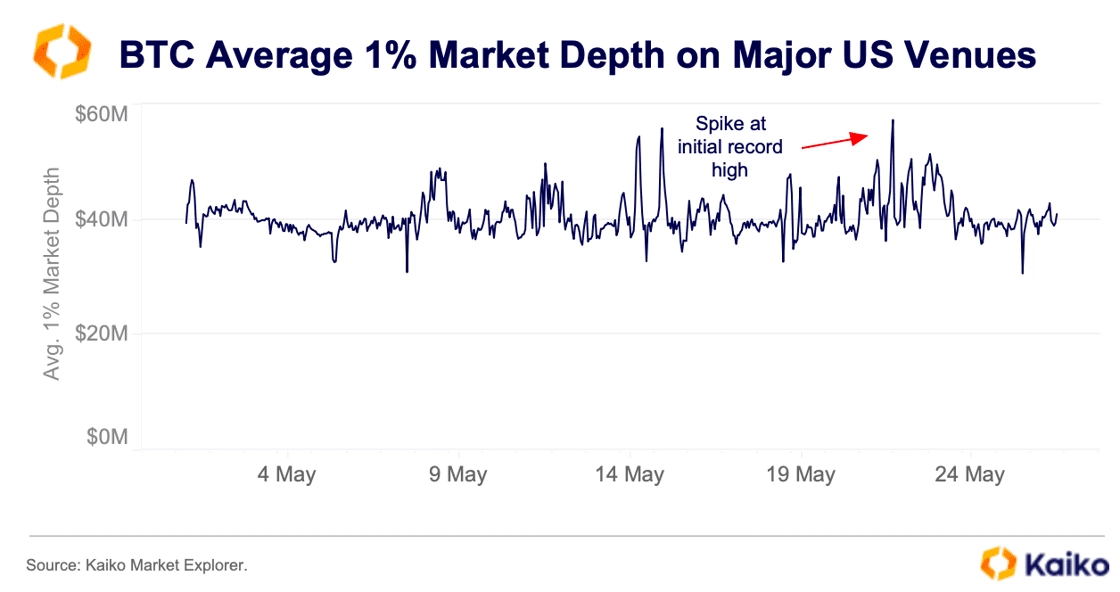

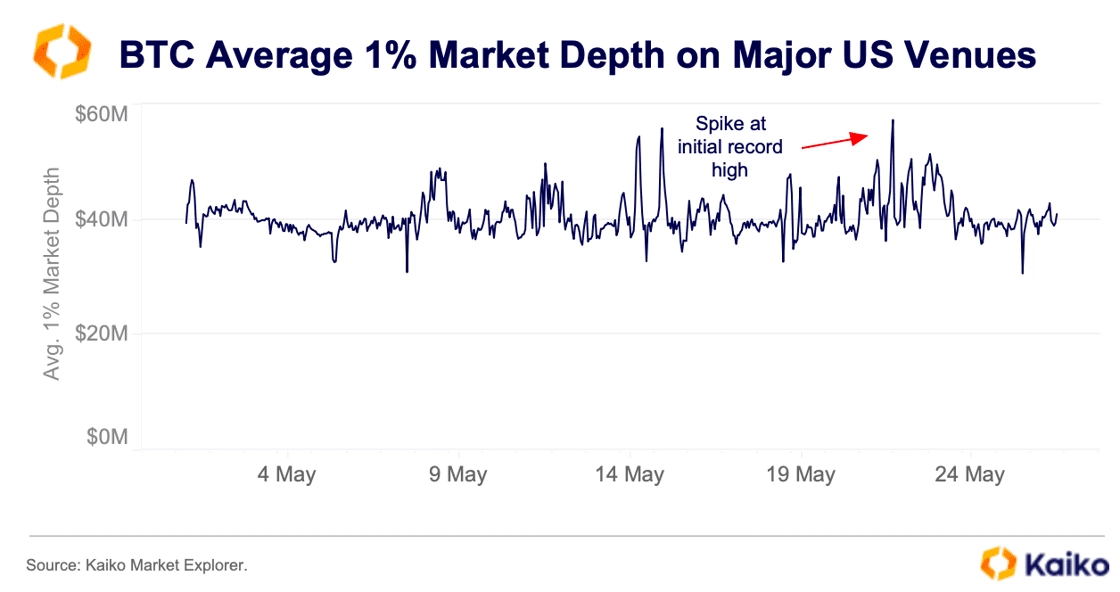

One metric that will be important to watch for potential volatility events such as that is market liquidity. Low liquidity enviroment lend themselves to price shocks as it becomes more difficult to move easily in and out of a position. Liquidity, measured by average 1% market depth, remains robust on U.S. venues for now. While it had trended lower into Memorial Day weekend it rose into Monday morning.

This week’s major Bitcoin conference in Las Vegas could impact liquidity, though. With a lot of attention on the world’s largest Bitcoin conference, falling directly after a major holiday, there could be less liquidity in markets and this would likely exacerbate any market moves.

![]()

![]()

![]()

![]()