Trend of the Week

Trump’s Table Turn.

U.S. President Donald Trump is testing the narrative (and his political rivals patience) that memecoins have no value. The latest TRUMP token developments have riled his political rivals, as the dinner announcement led to a 60% price jump (from $9 to $14.50) and increased onchain activity.

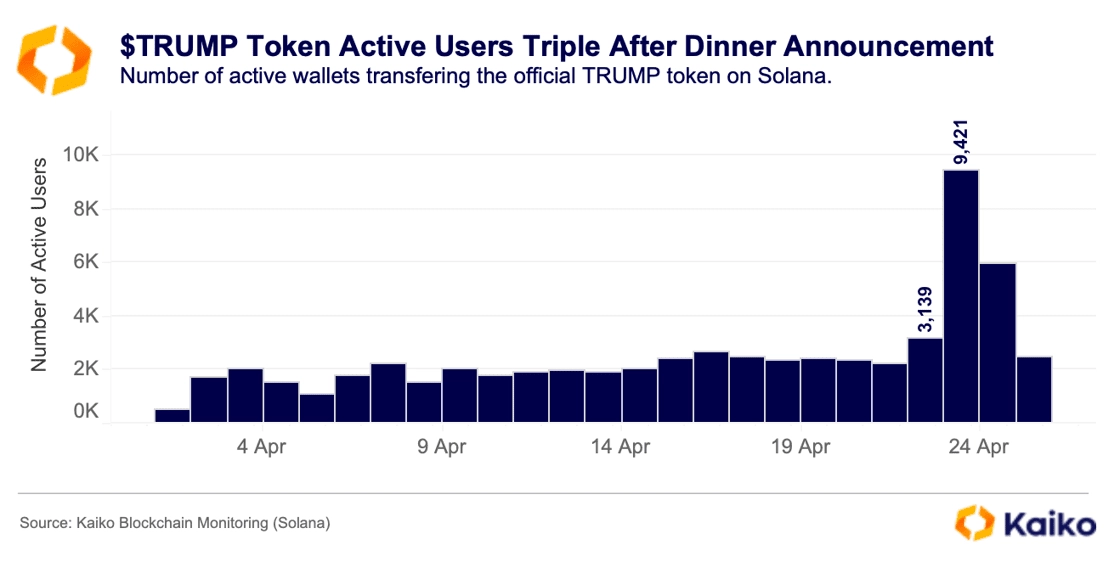

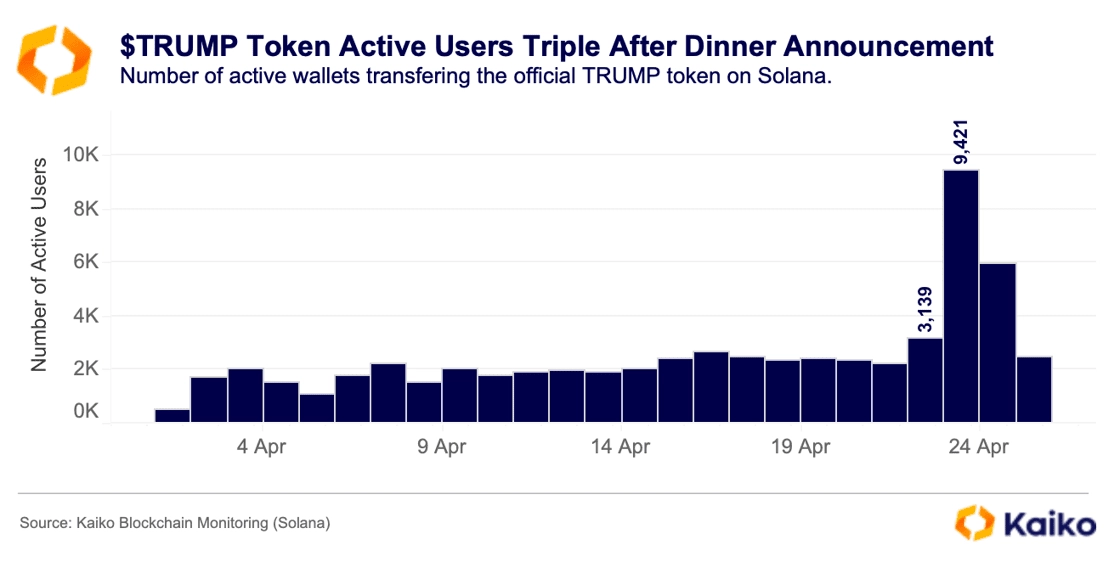

On Wednesday, April 23, the team behind the official TRUMP memecoin announced plans for an exclusive dinner for the top 220 holders, with the top 25 receiving a meet-and-greet with the sitting President. Onchain activity spiked following the announcement, with nearly 10,000 wallets transferring TRUMP tokens that day, which was a 200% increase from Tuesday.

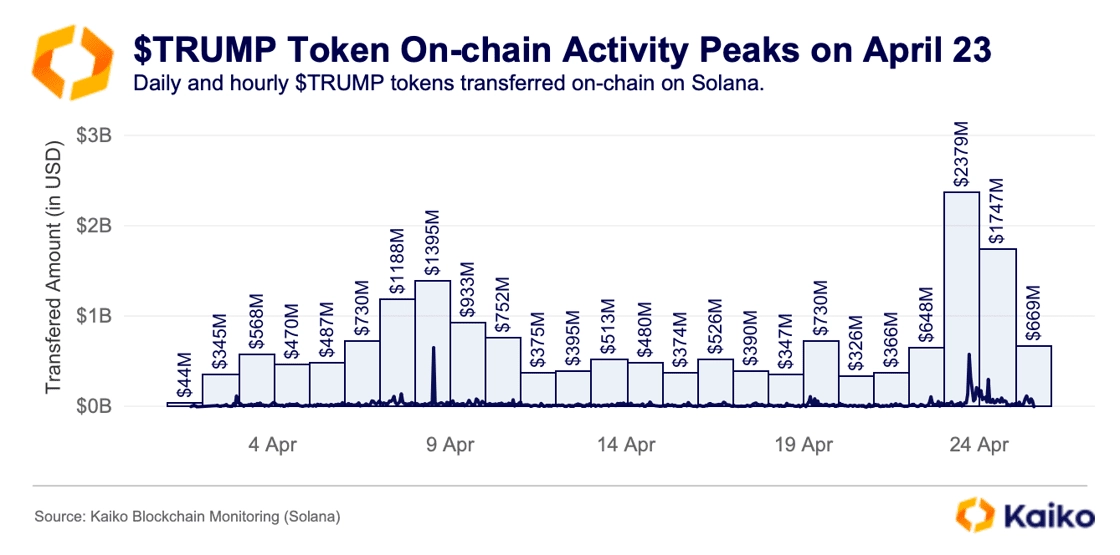

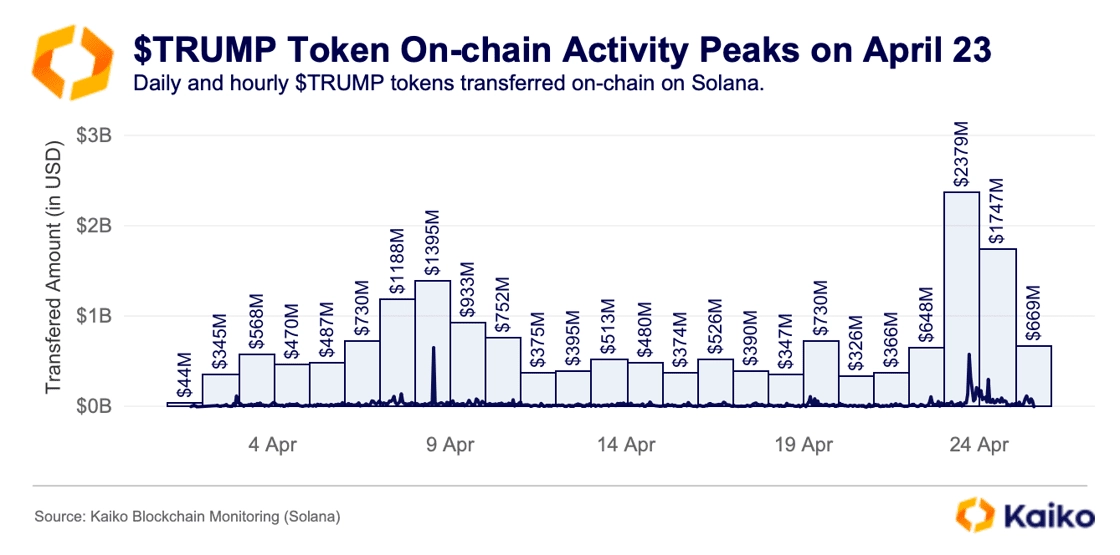

That activity followed the dinner announcement, with around $2.3 billion worth of TRUMP transferred onchain on Wednesday, making it the busiest day of the month.

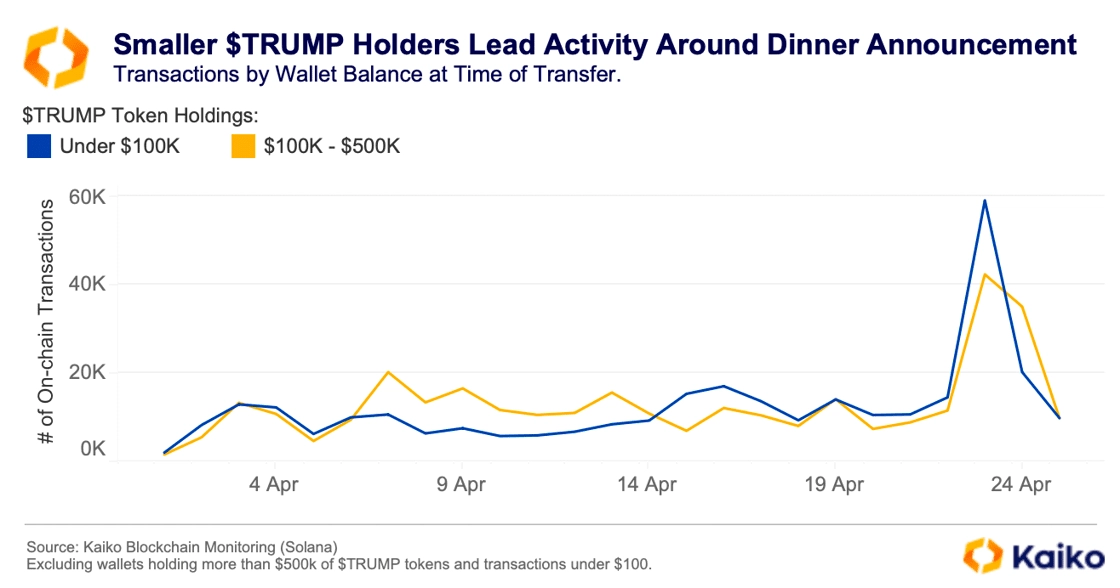

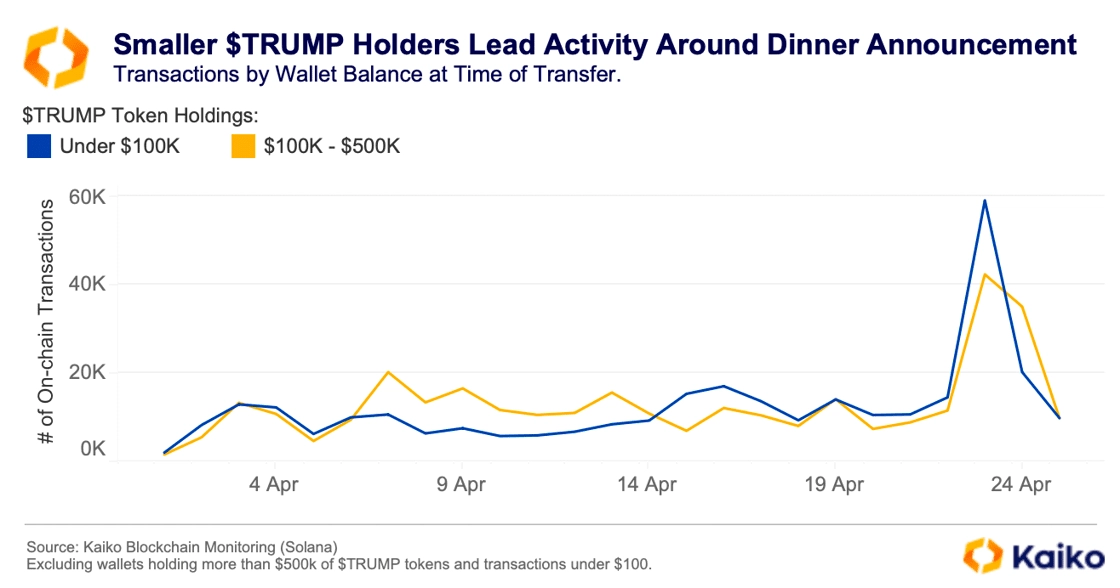

The majority of the volume was driven by smaller token holders. Wallets holding less than $100,000 worth of TRUMP tokens dominated activity on Wednesday. Larger wallets maintain more consistent activity, with high volumes continuing through Thursday, probably because among them are OTC desks, exchanges, and market maker wallets that need to settle structural operations related to the momentum-driven activity.

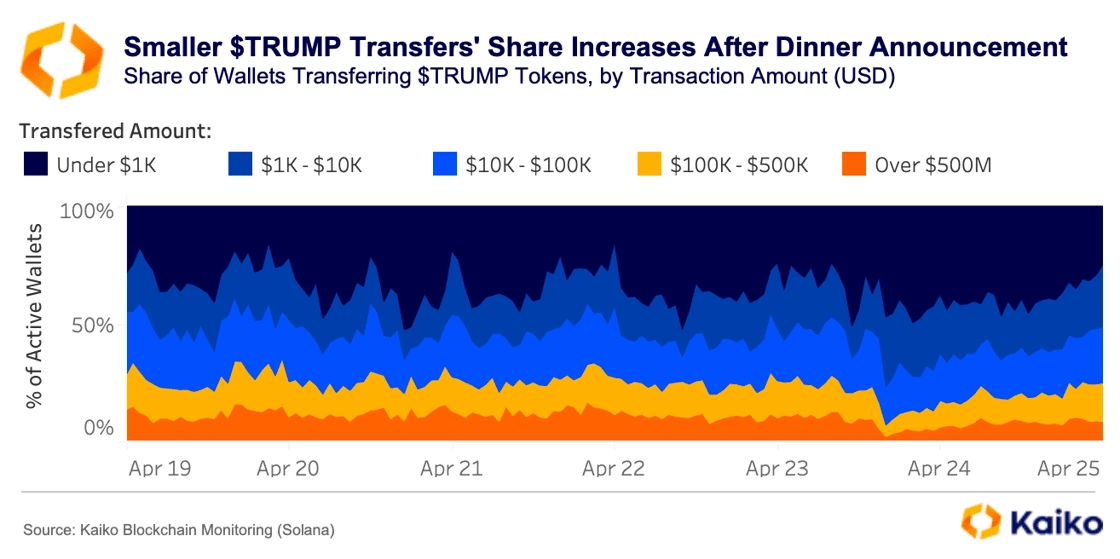

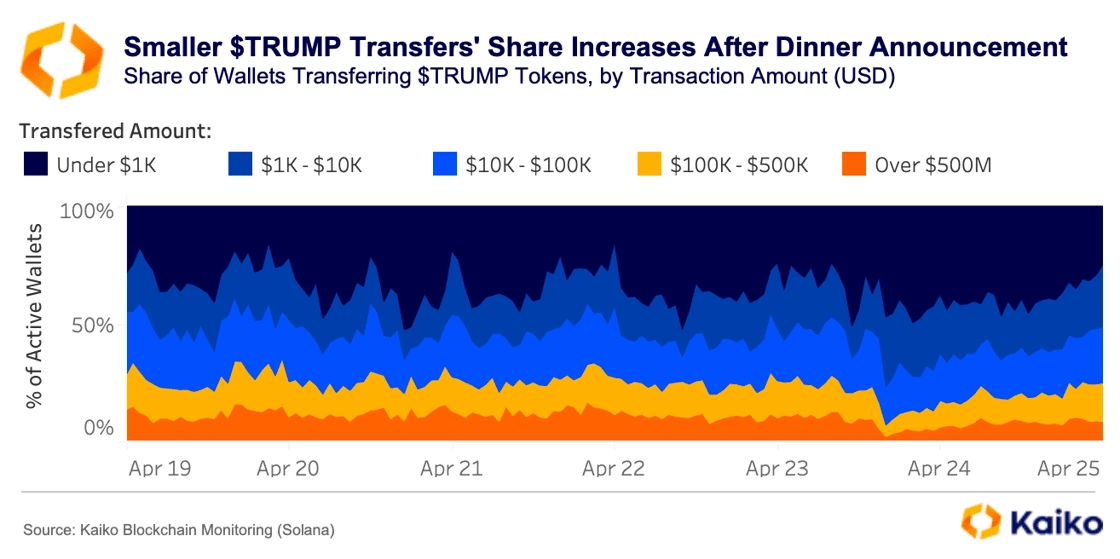

Drilling down into the data more, reveals that on the day the TRUMP incentive dinner was announced, there was a sharp increase in the share of wallets transferring smaller amounts of TRUMP tokens on the Solana blockchain. Typically, around 46% of active wallets transfer less than $10k worth of TRUMP, but this jumped to 75% following the announcement. Most of this surge came from very small transfers (under $1k), which alone made up 47.2% of active wallets.

This marked a significant but short-lived shift from the usual trend, where activity is more evenly split between large transactions (over $100k) and smaller ones.

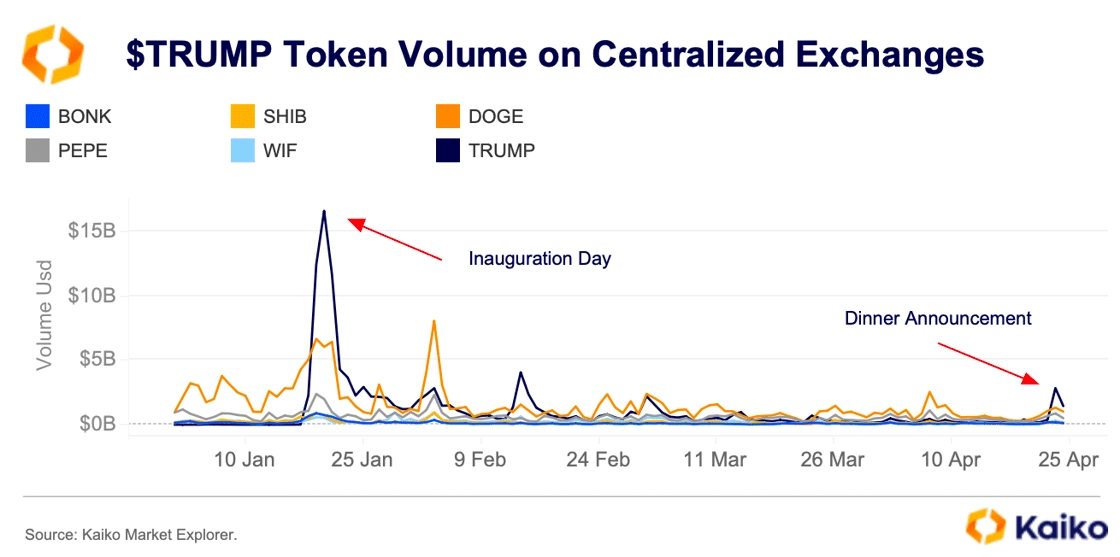

It wasn’t just on-chain activity that soared following the dinner announcement. TRUMP recorded its highest daily trading volume on centralized exchanges since mid-February, marking its third-largest volume since launch.

Following the dinner announcement, TRUMP token’s volume eclipsed all other major memecoins, including DOGE. The U.S. President’s memecoin accounted for nearly 50% of all memecoin trading volume on centralized exchanges last Wednesday.

Volumes have since tapered off as the euphoria waned, similar to onchain activity. However, based on the website’s rules for the competition, we can expect to see more activity in the coming weeks. The rules stipulate that the top 220 average TRUMP holders between April 23 and May 12 will be eligible for the dinner. Increased activity is likely as the deadline approaches and holders move funds back onchain to qualify for the event.

Data points

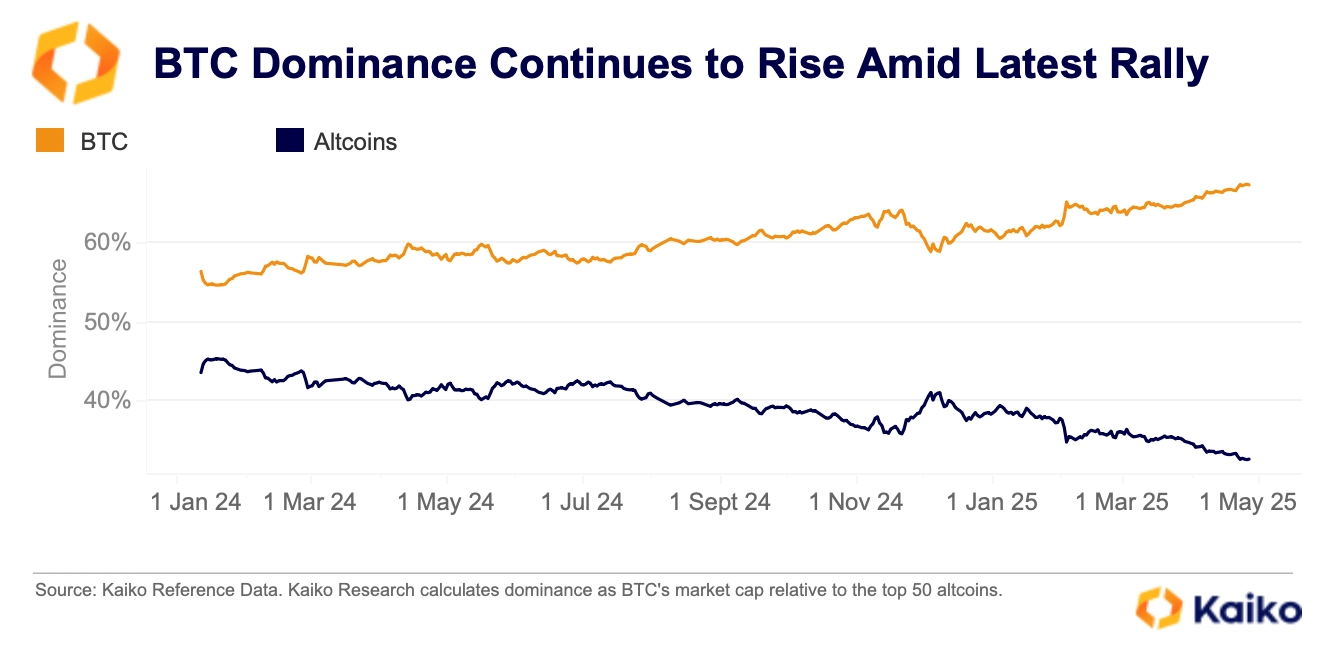

BTC Extends Lead Over Altcoins

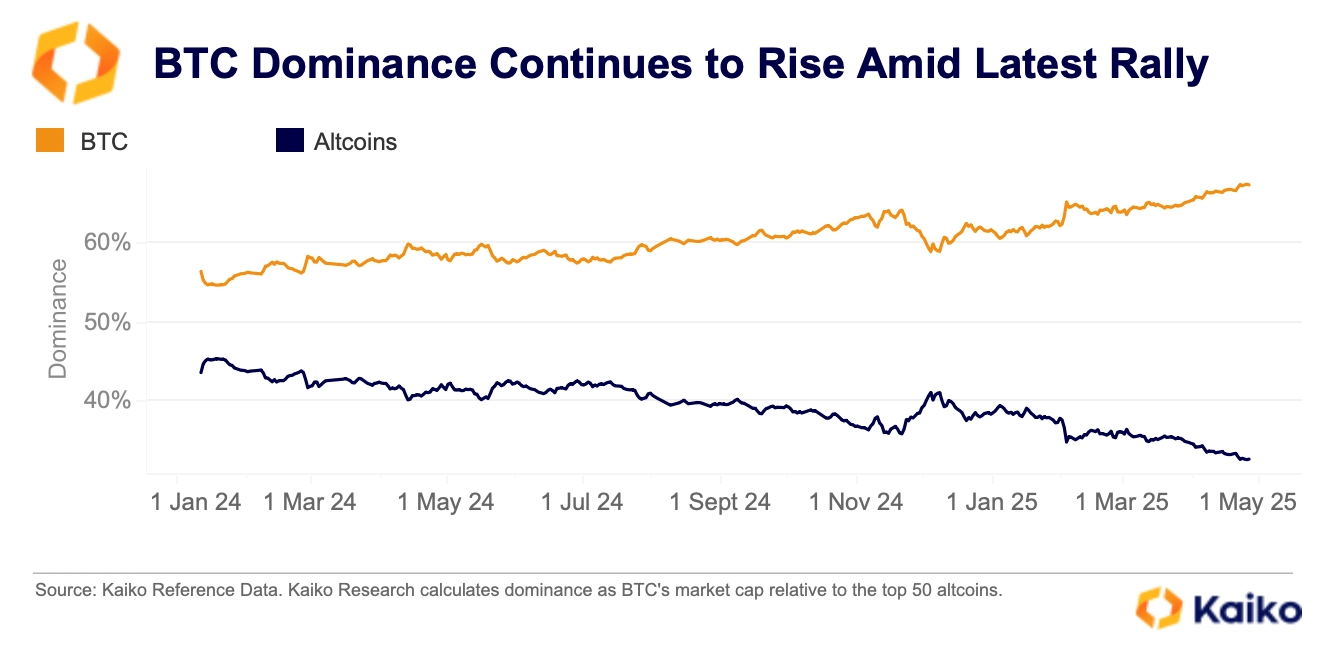

Memecoins like TRUMP have dominated the news cycle alongside BTC during the current bull run (2022–present). Previous crypto market cycles have all seen an eventual rotation into small-cap assets, dubbed an “altcoin season.” This cycle has been a little different.

Memecoins like TRUMP have dominated the news cycle alongside BTC during the current bull run (2022–present). Previous crypto market cycles have all seen an eventual rotation into small-cap assets, dubbed an “altcoin season.” This cycle has been a little different.

The last time BTC dominance was this high was in the first half of 2021, shortly before the market rotated into smaller-cap cryptocurrencies.

However, that’s not to say this is a sign of an imminent altcoin season. In fact, there are several arguments to support sustained BTC dominance due to structural changes in the market.

Options Outlook Suggests Sustained BTC Rally.

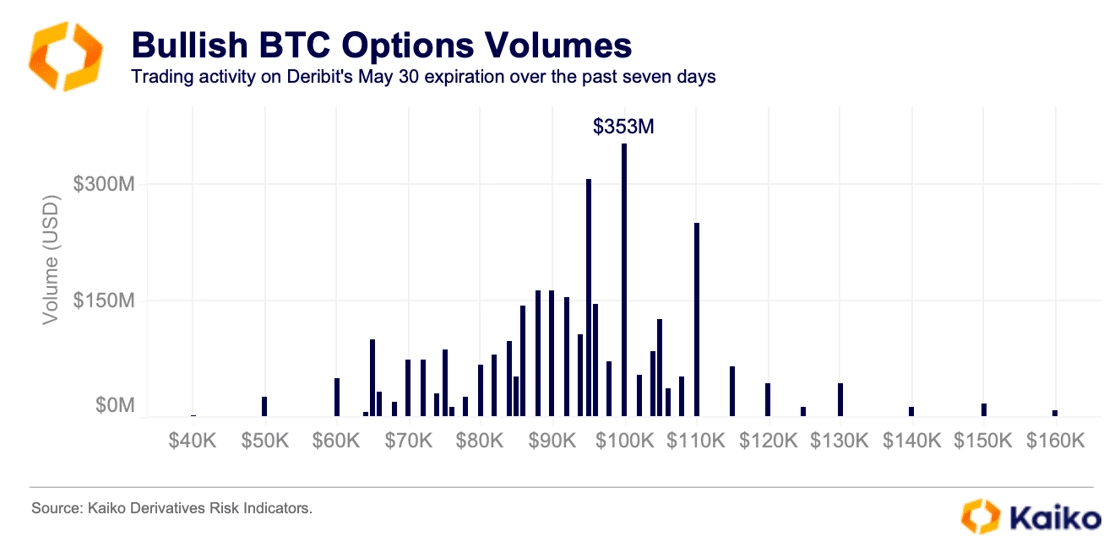

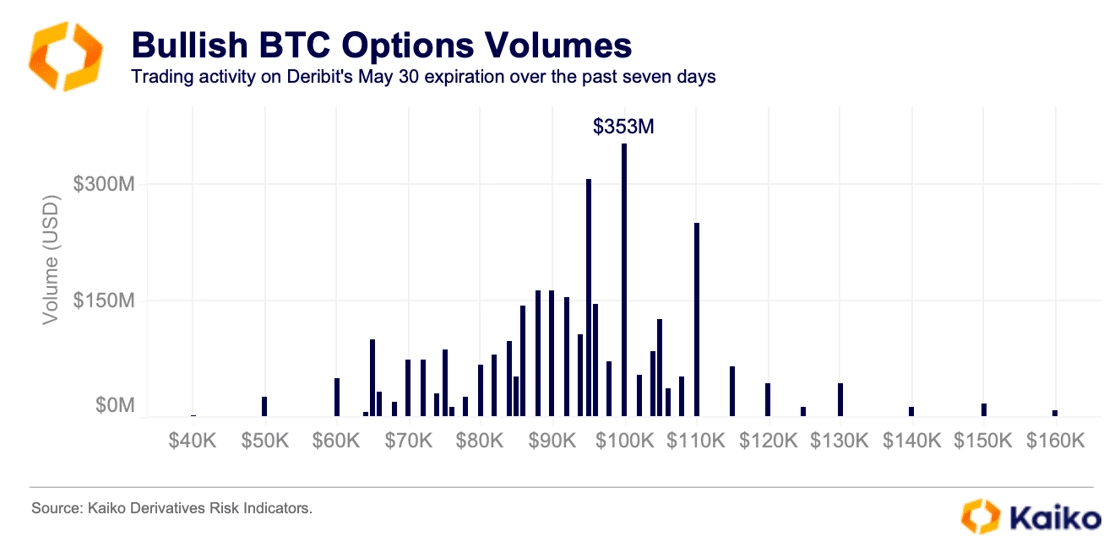

Options markets appear confident that the current status quo will remain unchallenged heading into the summer. The May 30 expiration on Deribit has seen significant volume over the past month, especially following Friday’s large expiration.

The majority of the increased activity since Friday has been focused on the $100,000 strike for this expiration. There has been nearly $350 million worth of volume on this strike over the past seven days.

Is this volume simply a sign of the bullish tilt in markets following improved sentiment over the past week, or is there reason to expect a prolonged rally through May?

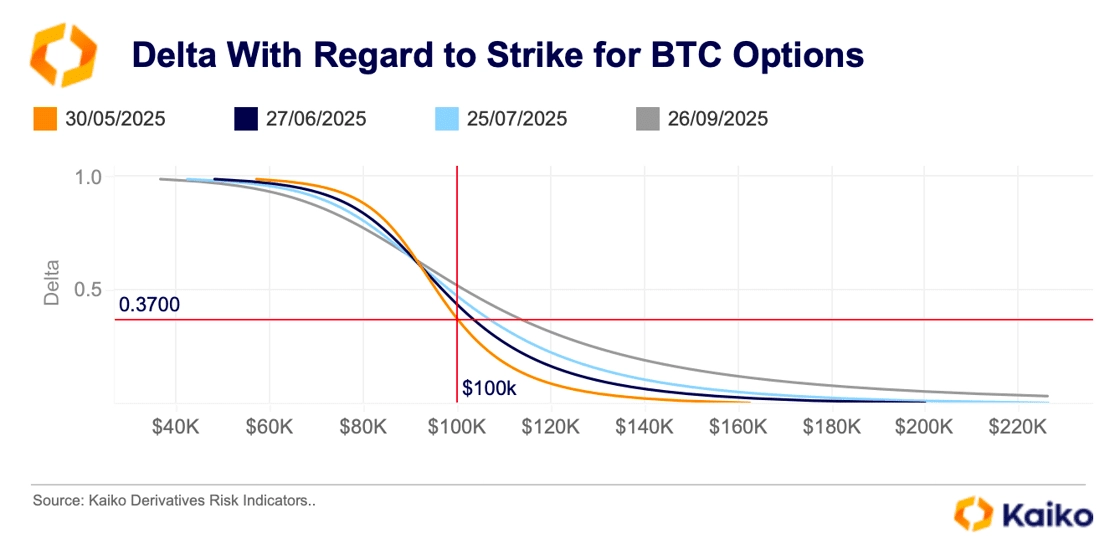

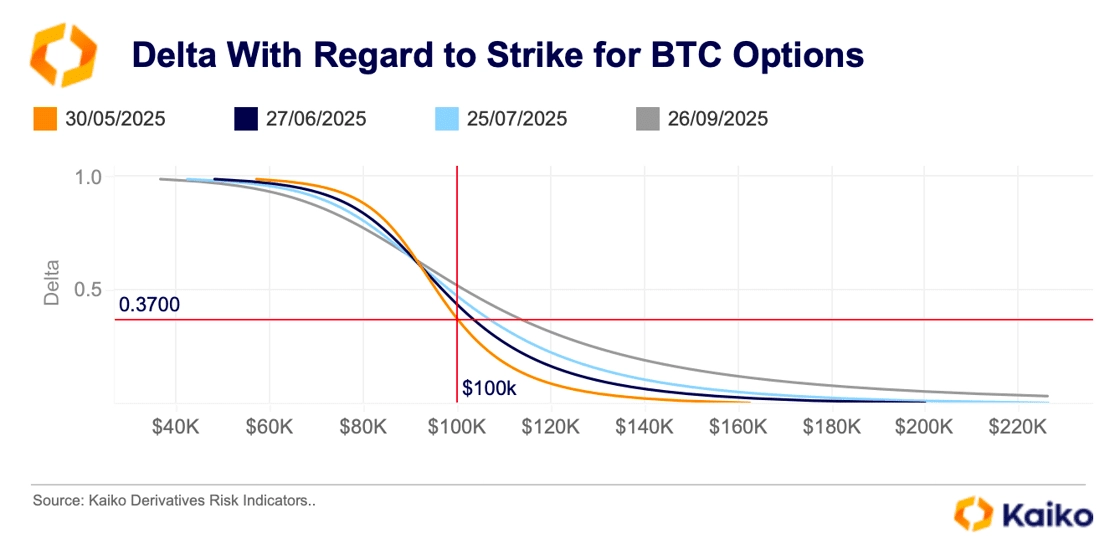

Looking at the options delta, we can approximate the probability of it finishing in the money. Our implied volatility tool shows the delta for this popular $100,000 strike at the end of May to be 0.37. In other words, there’s roughly a 37% chance that spot BTC will be trading above $100,000 after May 30. Not bad odds, considering BTC traded near $74,000 just three weeks ago.

A Structural Shift in Crypto Markets?

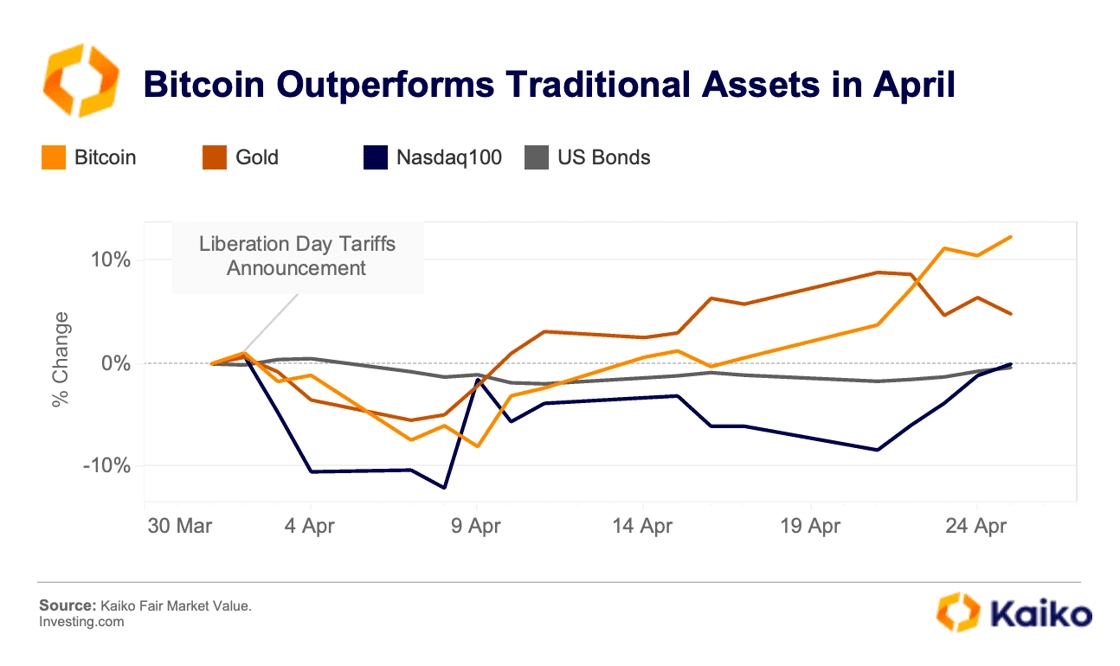

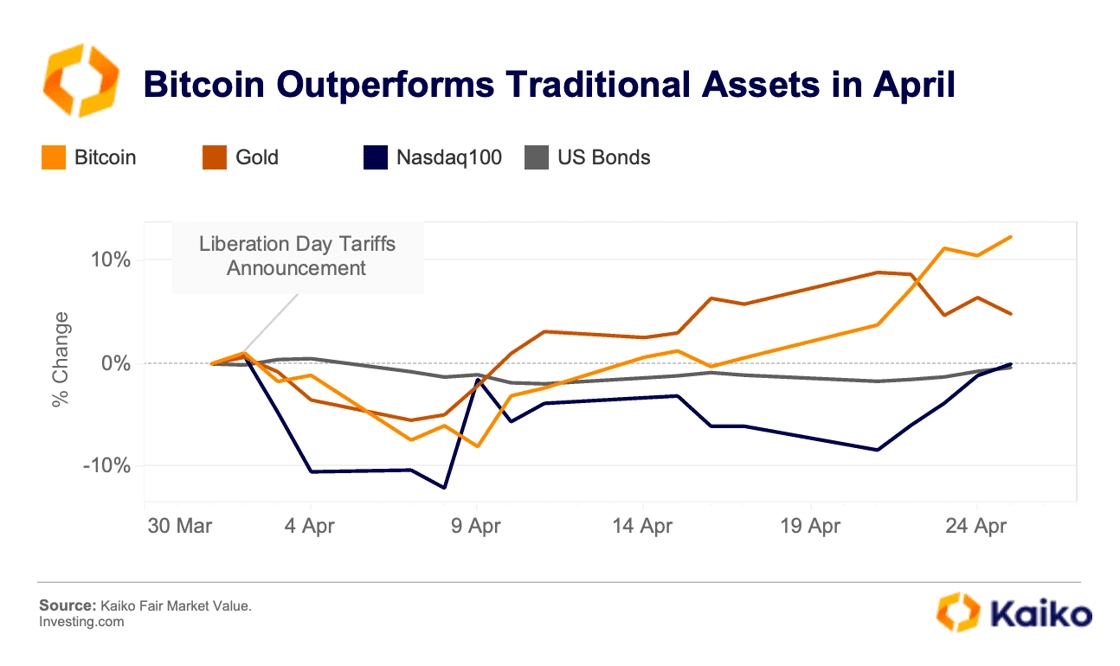

Despite a February–March sell-off alongside broader risk assets, Bitcoin has outperformed most traditional investments since the April 2 Liberation Day tariff announcement. This includes traditional safe havens like gold and US Treasuries, as well as risk assets like tech equities.

The robust performance over the past few weeks has led some to reconsider BTC’s safe haven potential. Historically, Bitcoin has attracted safe haven flows on several occasions, such as during the Russia-Ukraine war in February 2022 and the US banking crisis in March 2023. However, it has typically tracked risk assets during major sell-offs and rallies.

So, are we seeing the early signs of a structural shift towards safe haven status?

A major factor behind Bitcoin’s strength is the rise in corporate adoption as a treasury asset. This type of demand is typically less sensitive to short-term price fluctuations and adds stability, as companies tend to accumulate Bitcoin during price declines.

A major factor behind Bitcoin’s strength is the rise in corporate adoption as a treasury asset. This type of demand is typically less sensitive to short-term price fluctuations and adds stability, as companies tend to accumulate Bitcoin during price declines.

Cantor Fitzgerald’s project is not an outlier either, as Michael Saylor’s strategy once was. Over the past year, the investment case has matured, with over 130 companies, ETFs, and countries globally now holding Bitcoin. There has even been an emergence of new investment vehicles, such as Bitwise’s OWNB, which offers exposure to companies holding over 1,000 BTC.

The strategy has begun to extend to other assets, as several firms have recently raised money to add SOL to their corporate holdings. Market maker GSR injected $100 million into Upex, in a private investment in a public company (PIPE) deal, to buy SOL. Meanwhile, Canadian firm SOL Strategies secured $500 million last week to expand its SOL holdings.

![]()

![]()

![]()

![]()

It wasn’t just on-chain activity that soared following the dinner announcement. TRUMP recorded its highest daily trading volume on centralized exchanges since mid-February, marking its third-largest volume since launch.

It wasn’t just on-chain activity that soared following the dinner announcement. TRUMP recorded its highest daily trading volume on centralized exchanges since mid-February, marking its third-largest volume since launch.

A major factor behind Bitcoin’s strength is the rise in corporate adoption as a treasury asset. This type of demand is typically less sensitive to short-term price fluctuations and adds stability, as companies tend to accumulate Bitcoin during price declines.

A major factor behind Bitcoin’s strength is the rise in corporate adoption as a treasury asset. This type of demand is typically less sensitive to short-term price fluctuations and adds stability, as companies tend to accumulate Bitcoin during price declines.