Chart of the Week

Crypto ETFs enter Korea’s political mainstream

Last week, South Korea elected a new president, bringing good news for crypto. Lee Jae-myung has pledged to support spot crypto ETFs and introduce a won-backed stablecoin.

Is Korea’s market ready? In 2025, KRW-denominated crypto trading reached $663 billion, which presents almost as much as the global USD denominated volume, making South Korea the second largest crypto market in the world. Nearly one in three South Korean adults owns crypto, twice the adoption rate in the U.S., highlighting the growing political and economic influence of digital assets.

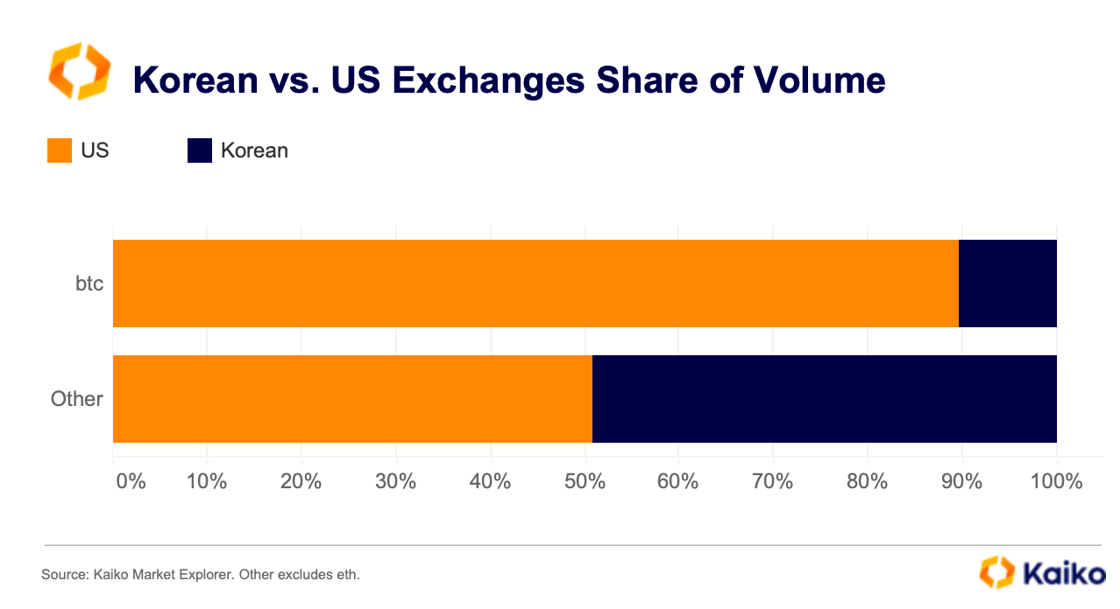

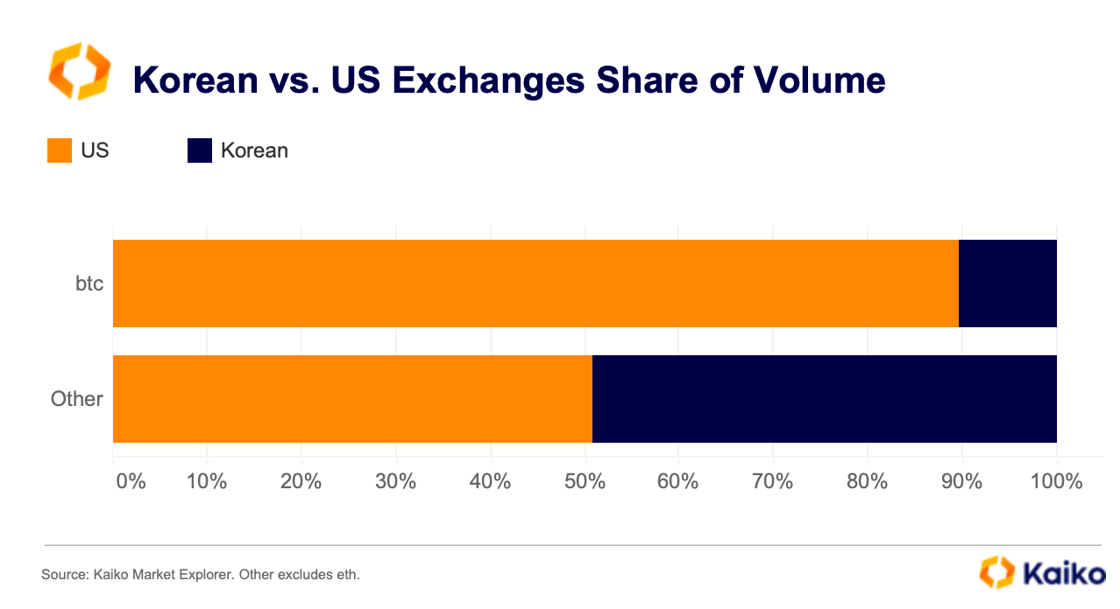

However, Korea’s crypto market remains heavily retail-driven, speculative, and fragmented. Domestic platforms account for nearly 50% of altcoin trading volume compared to U.S. exchanges, but only 10% of Bitcoin volume.

This imbalance reveals a deeper issue: South Korea lacks institutional-grade infrastructure. With no local crypto derivatives markets, market makers cannot access essential hedging tools. As a result, liquidity is limited and the development of products like spot Bitcoin ETFs is hindered.

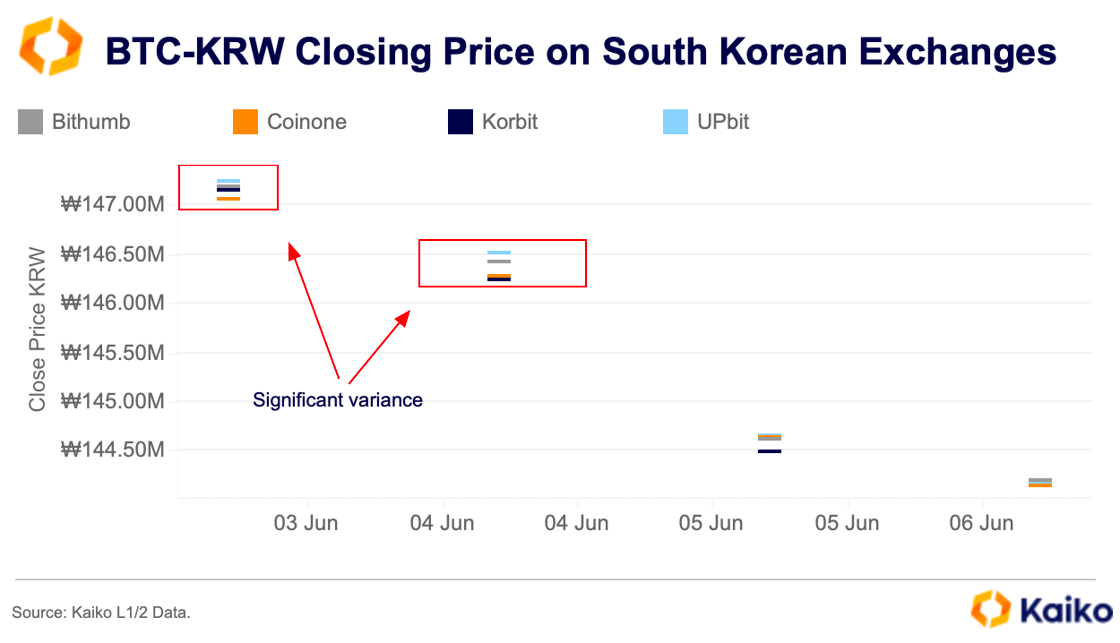

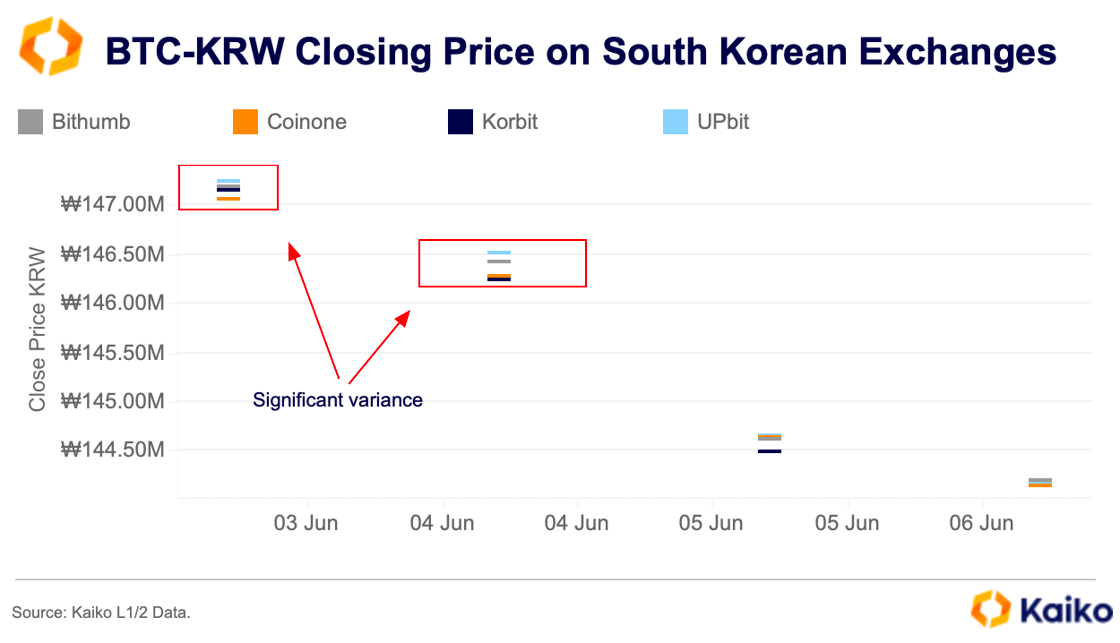

Limited product offerings and restricted activity make it difficult to accurately price BTC in South Korea, creating challenges for spot ETFs. During the recent rally to record highs near $112,000, BTC-KRW prices varied significantly across local exchanges. As a result, any future spot BTC ETF in South Korea will likely need to use a composite price based on data from all major exchanges.

However, this pricing method may not benefit South Korean investors. Strict capital controls create a “kimchi premium”—the gap between BTC-USD prices and BTC-KRW prices when converted to USD. Because capital controls limit arbitrage, BTC-KRW often trades higher than BTC-USD on international exchanges. Even with an accurate local price, the Korean market is likely to remain out of sync with global prices.

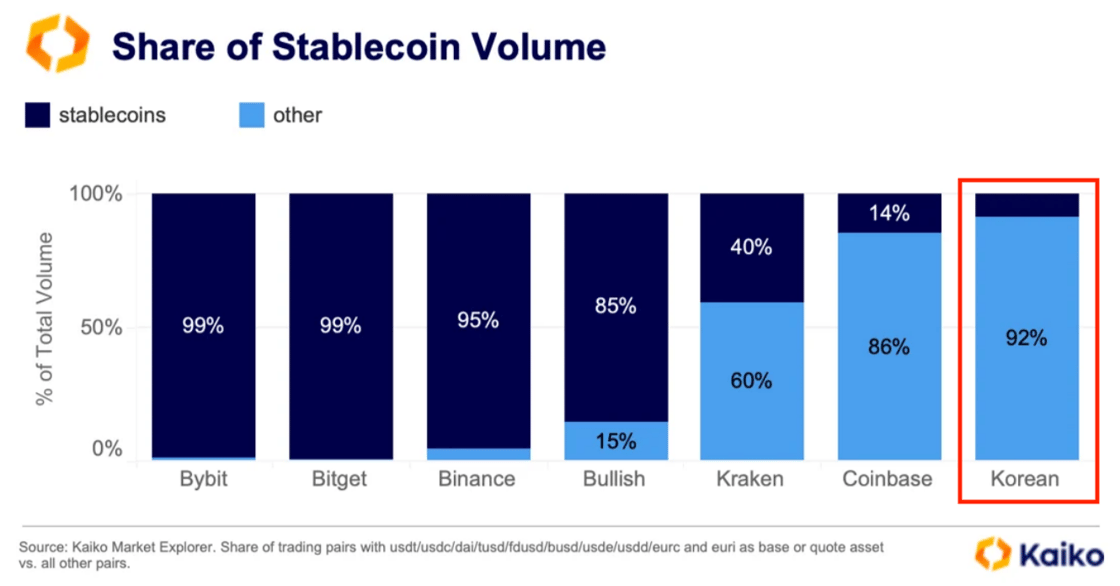

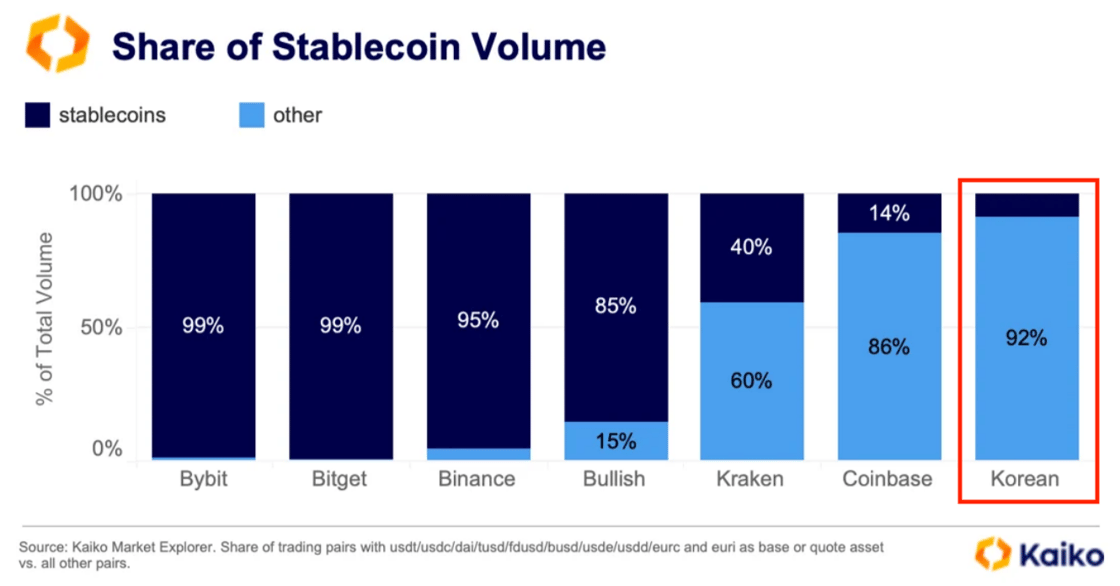

Low stablecoin adoption is another key barrier to developing Korea’s derivatives market. Historically, uptake of USD-backed stablecoins has been limited in Korea by strict FX controls and increased regulatory caution after the collapse of Terra and failures at platforms like Haru and Delio.

Major stablecoin-to-fiat pairs only began trading on platforms like Bithumb and Upbit in the past year, and while volumes are growing, they remain a very small part of the overall market.

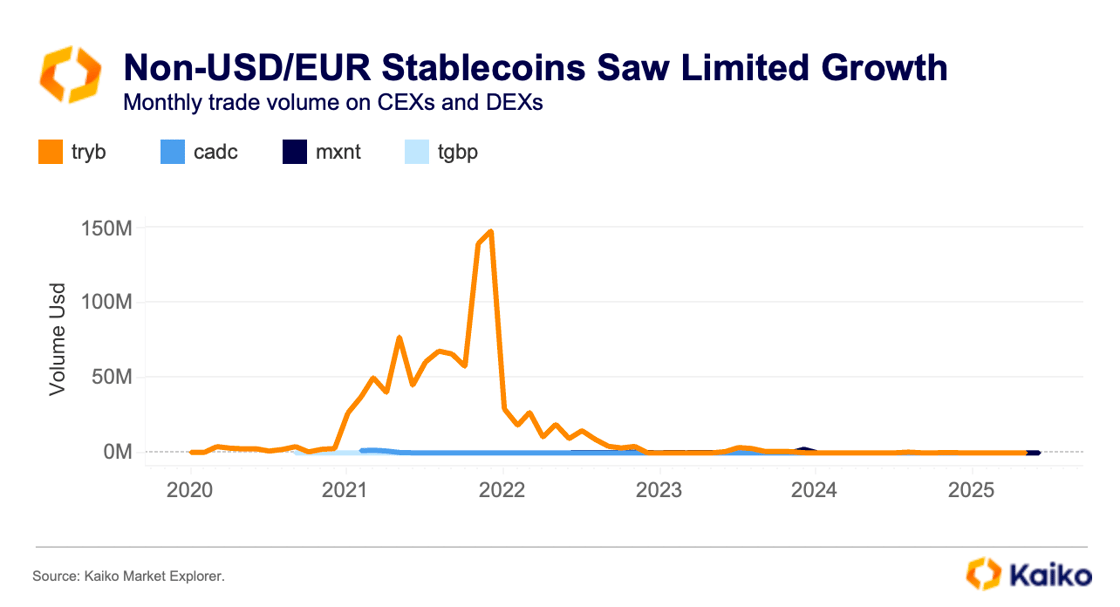

That may soon change. In April, top Korean banks announced plans for a KRW-backed stablecoin, potentially enabling real-time settlement and better liquidity for the local market. The main challenge will be scaling it in a space where USD-backed stablecoins dominate global flows and most non-USD stablecoins have struggled to gain traction.

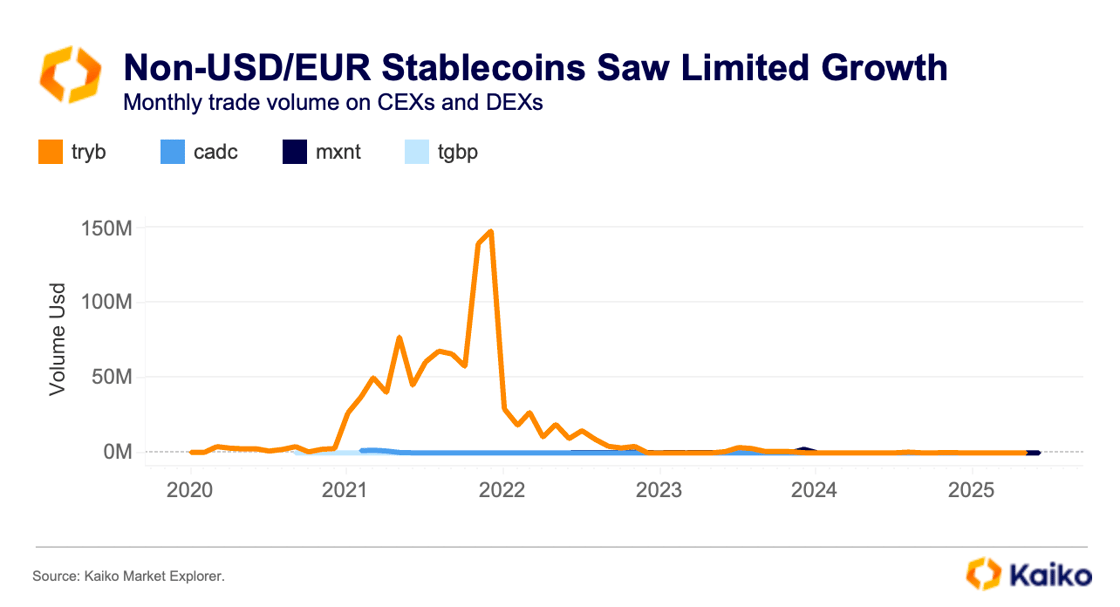

Since 2020, only TRYB, a Turkish lira stablecoin, has briefly reached $140 million in monthly volume, but its usage remained limited and declined after the collapse of FTX.

Institutional support could change that. Trump’s backing of USD stablecoins has prompted regulators globally to rethink the risks of dollar-based tokens, giving a boost to local alternatives in markets like Korea.

Data Points

Speculation and Rewards: USD1’s Rise in DeFi

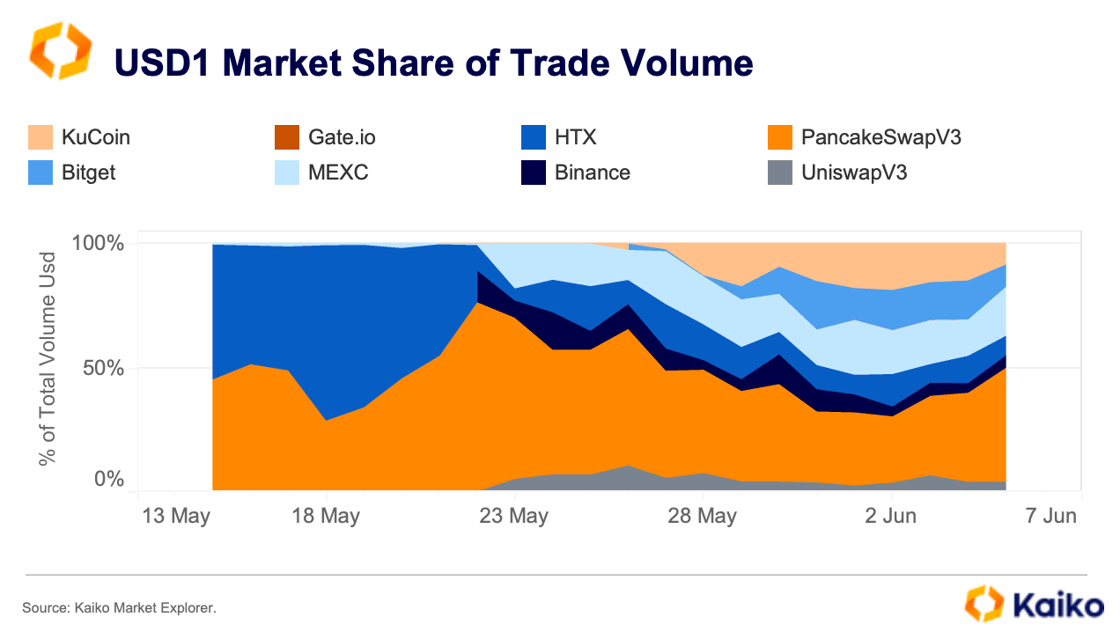

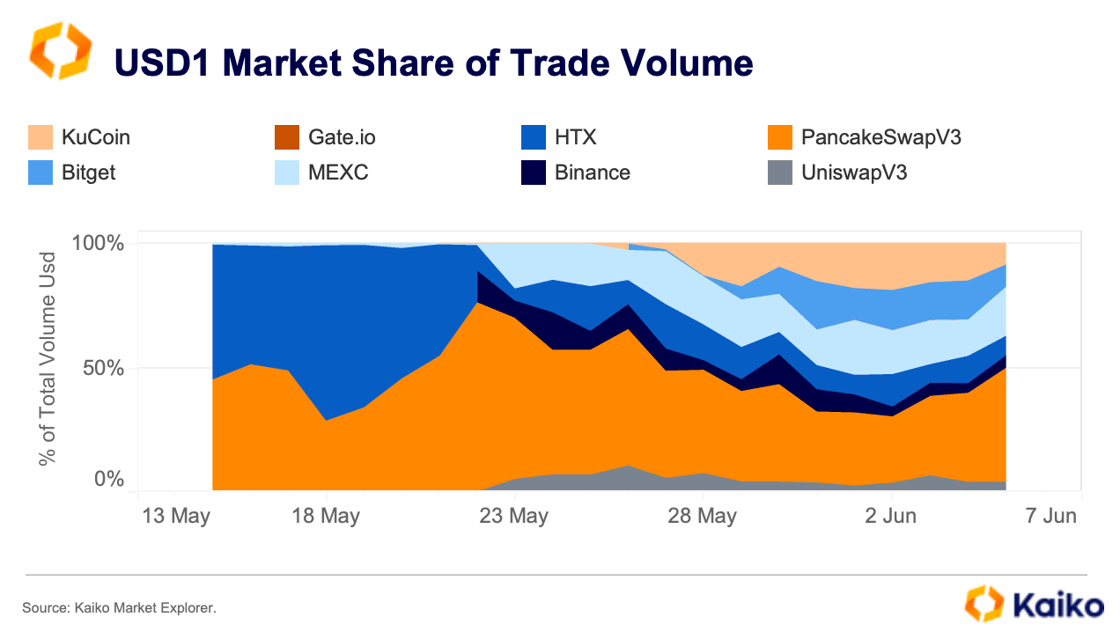

USD1 trading is heating up on Binance Smart Chain following a series of coordinated campaigns. On June 4, World Liberty Finance (WLFI) airdropped 47 USD1 tokens to participants of the WLFI token sale, just two days after launching a $1 million reward campaign on PancakeSwap, the leading DEX on BSC.

PancakeSwap now accounts for 46% of USD1’s total trading volume, far surpassing centralized competitors like MEXC (20%), KuCoin (9%), and Binance. However, most USD1 pools on PancakeSwap involve speculative meme tokens with low long-term utility, reflecting a broader trend on the BNB Chain, where volume is often driven by retail speculation, airdrop farming, and short-term incentives.

While this strategic push to build DeFi liquidity has generated short-term excitement, it remains to be seen whether the momentum can outlast incentive-driven activity. For now, despite a $2 billion deal with Abu Dhabi’s MGX, USD1 has struggled to gain traction on mainstream platforms, suggesting that retail speculation still outweighs institutional adoption.

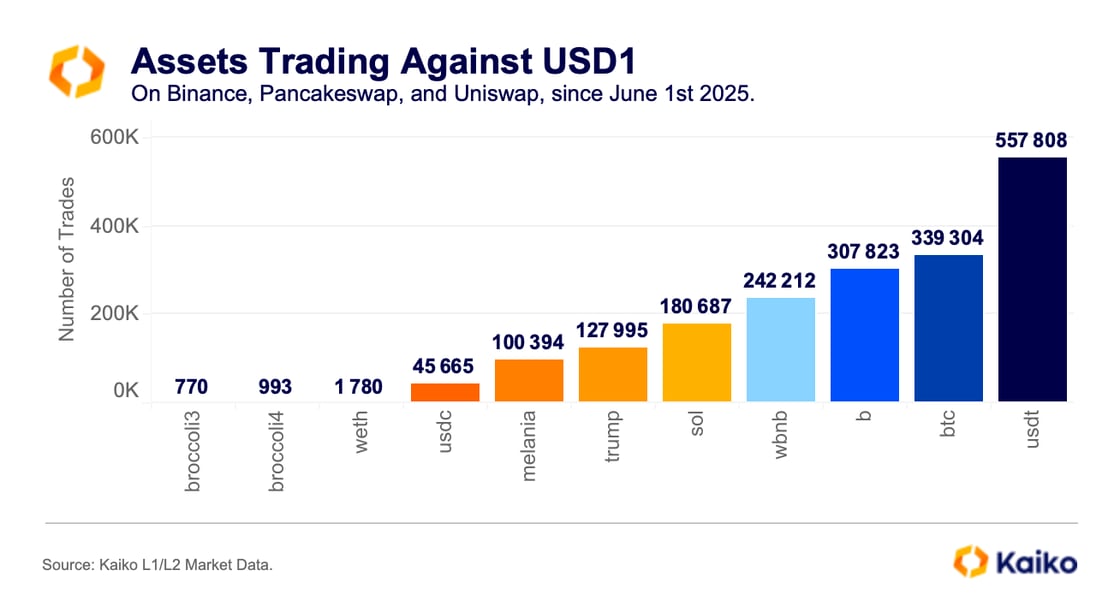

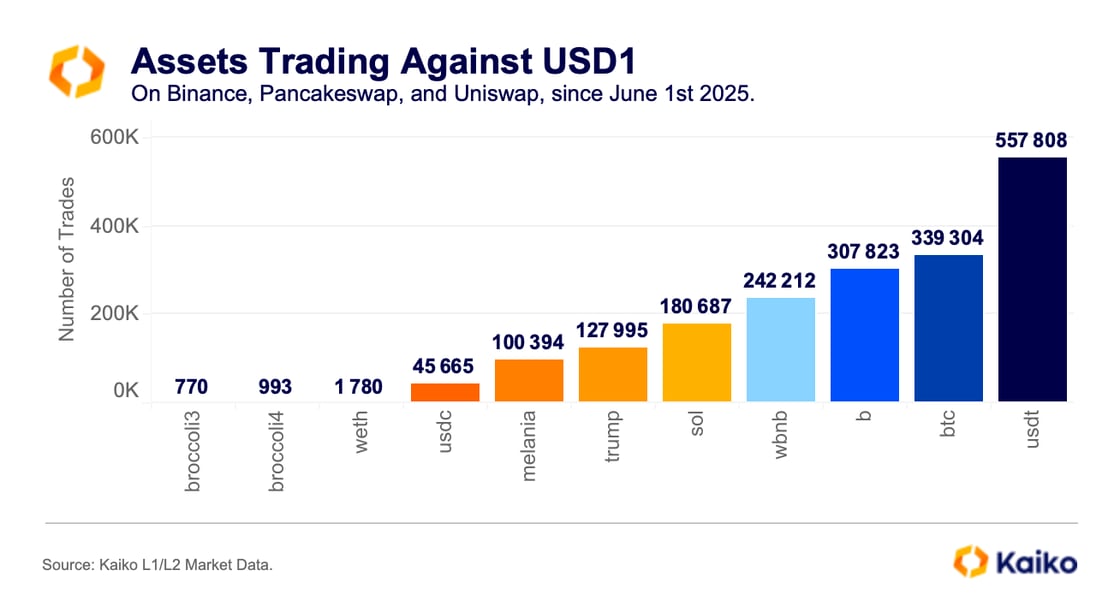

Trading activity reflects this speculative trend. Since June 1st, most USD1 trades have occurred against USDT, BTC, and BUILDon (B), with over 550,000 trades for USDT alone. Meme tokens like “trump” and “melania” also see significant volumes, outpacing established assets such as USDC and WETH. This pattern underscores USD1’s role in high-turnover, retail-driven markets, rather than as a bridge to more established cryptocurrencies or fiat.

Is Bitcoin’s decoupling different this time?

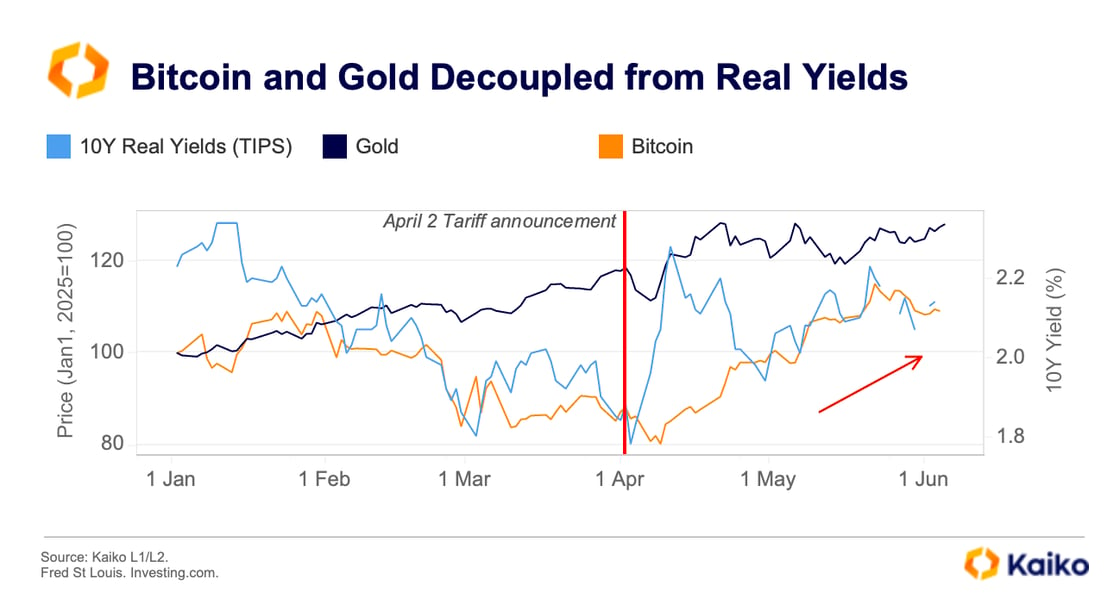

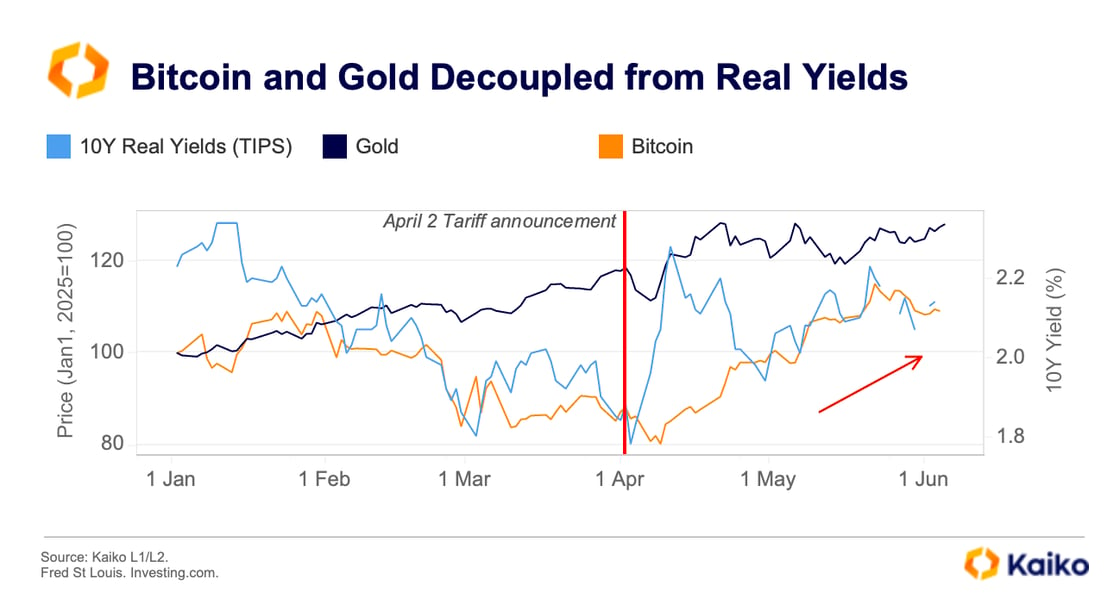

Since the U.S. tariff announcement on April 2, BTC has shown remarkable resilience. While equities wavered and the dollar strengthened, Bitcoin reached new all-time highs alongside gold, defying rising U.S. real yields. This divergence has reignited the safe haven debate, with many highlighting Bitcoin’s emerging role as a geopolitical and macro hedge.

Bitcoin has attracted haven flows during past crises, from the early days of the Russia-Ukraine war to the 2023 U.S. banking turmoil. However, these flows were usually short-lived, with BTC quickly reverting to its typical risk-on behavior.

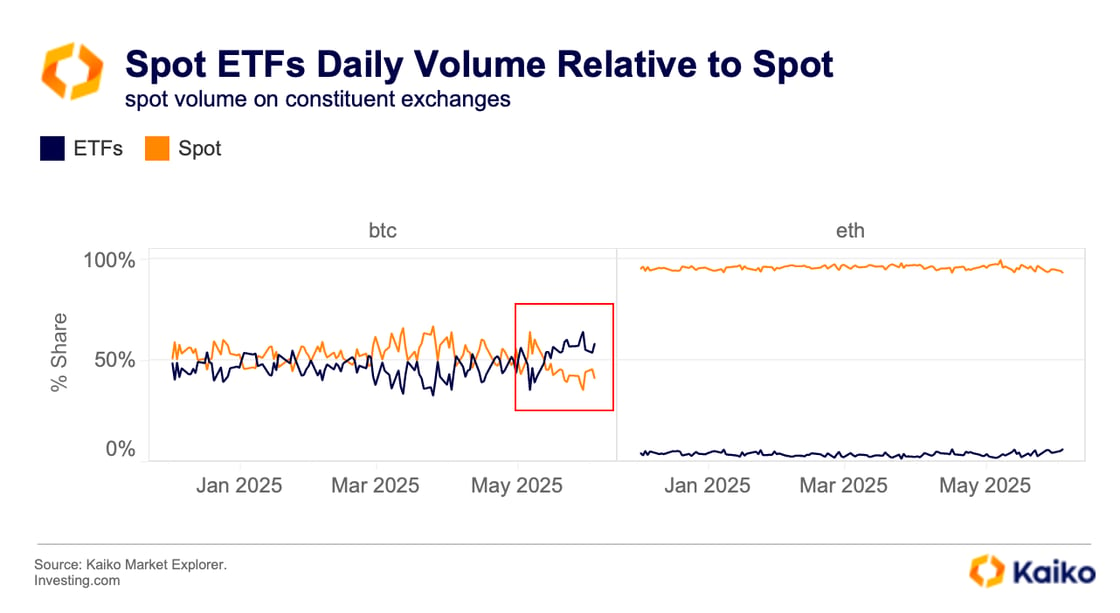

What’s different this time? For the first time, institutional investors can respond to macro shocks by allocating to Bitcoin through U.S.-listed spot ETFs. In May, Bitcoin ETFs saw significant inflows, led by BlackRock’s IBIT, which recorded its largest monthly intake ever.

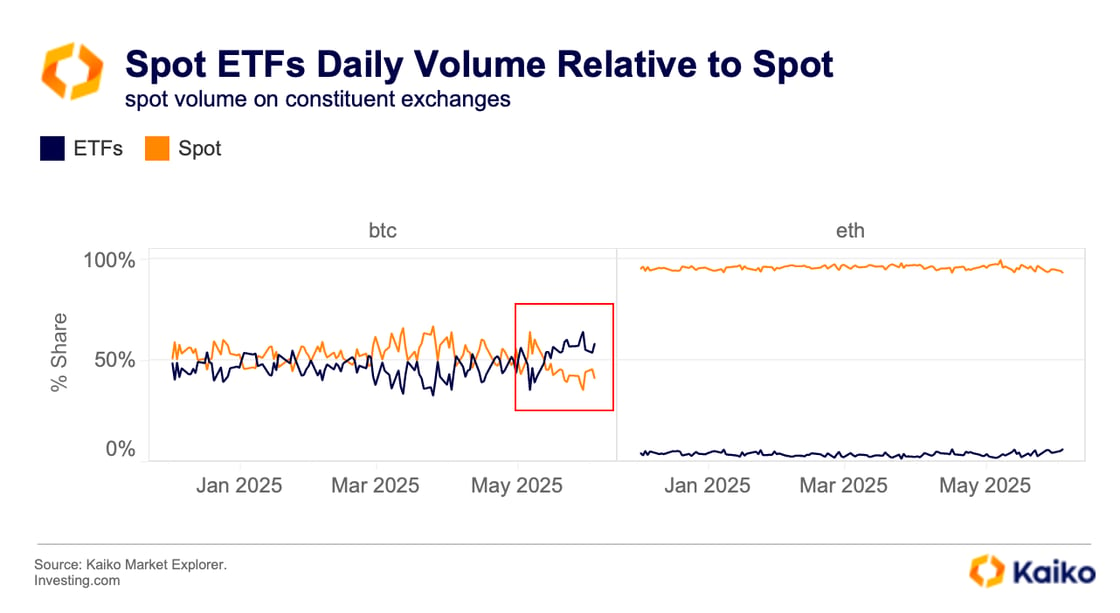

Historically, much of the flow into Bitcoin spot ETFs has come from the basis trade—an almost risk-free arbitrage between CME futures and spot prices—rather than broad net buying. While the premium has narrowed since the post-election rally in December, May saw ETF trading volumes surpass those of underlying spot exchanges, with ETF market share reaching a multi-month high of nearly 60%.

This trend remains unique to Bitcoin. Although Ethereum ETFs have also attracted inflows, their trading volumes relative to spot remain subdued, indicating that the current demand shift is centered on Bitcoin.

What’s behind tightening spreads?

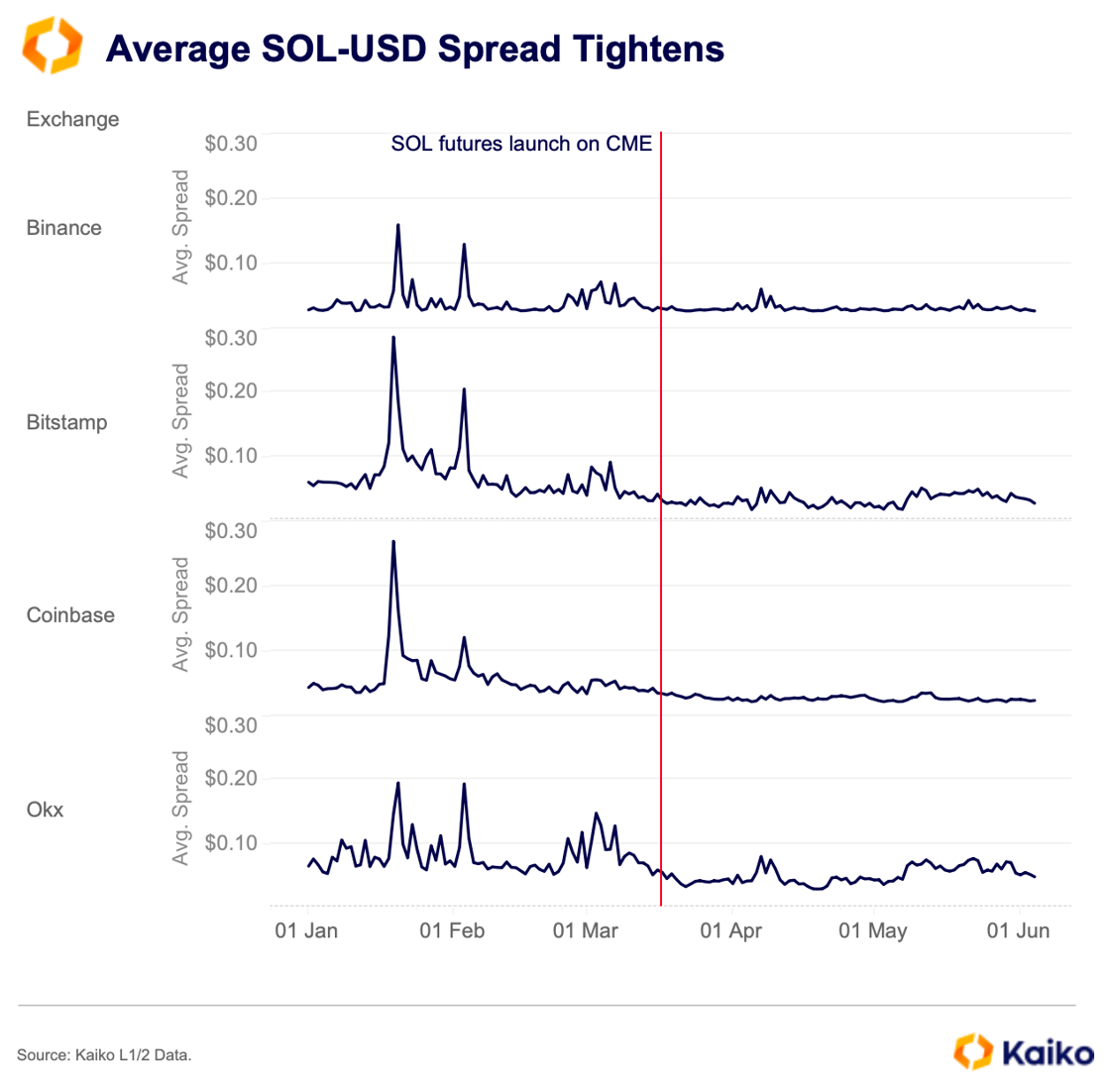

Bid and ask spreads are tightening across exchanges, driven by both common market factors and idiosyncratic trends that have improved order book efficiency.

The main driver is lower overall trade volume. With fewer price-agnostic retail traders, there’s been less of the consistent retail frenzy seen in previous years, especially as memecoins have taken a back seat to BTC.

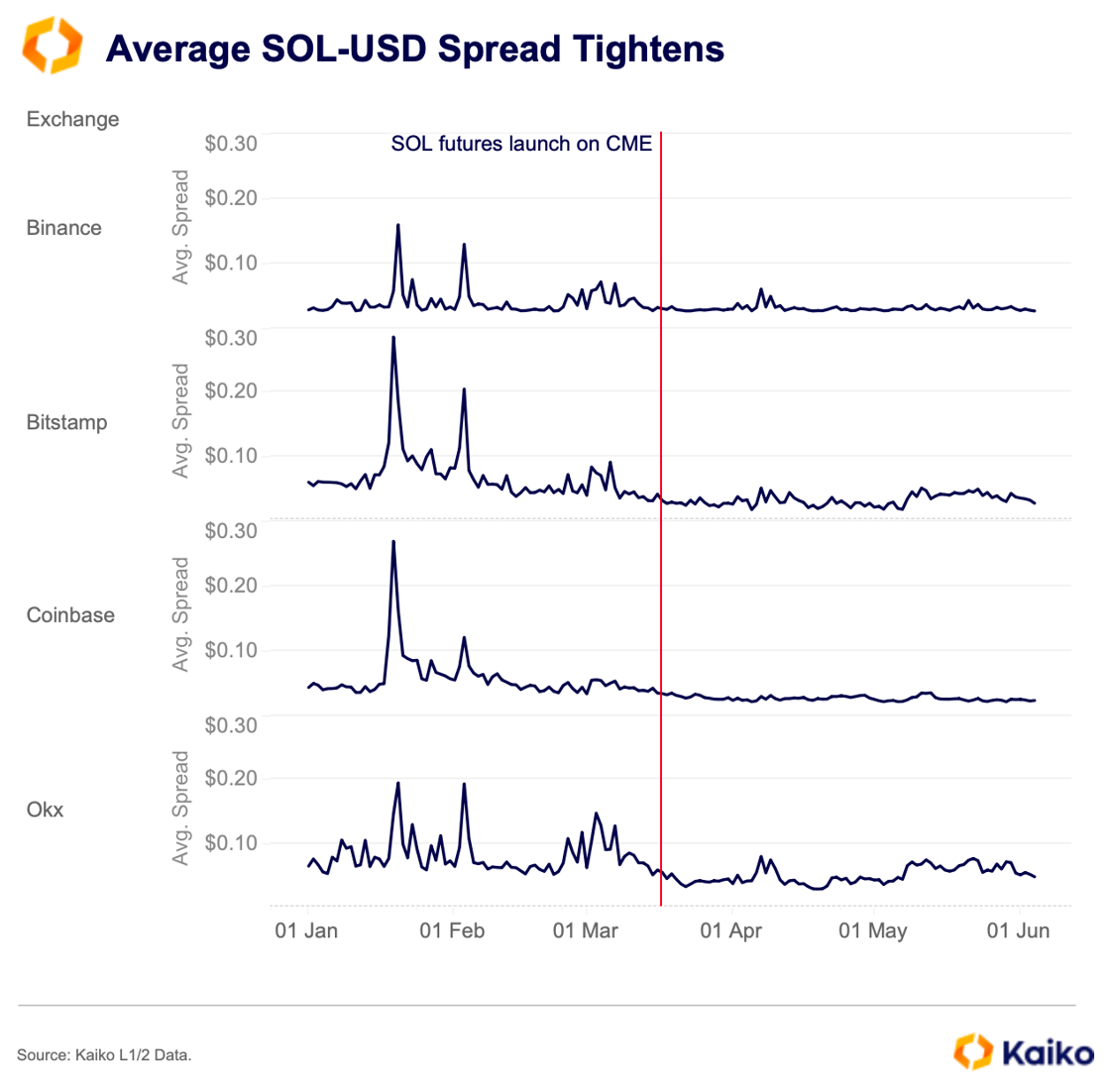

On Bitstamp, spreads have narrowed notably since January. The SOL-USD pair is a clear example, with average spreads more than halved since the start of the year—likely a result of the launch of SOL futures on CME and a drop in retail-driven memecoin speculation.

Robinhood’s acquisition of Bitstamp can’t be ignored. The U.S. retail trading giant’s purchase has likely brought more U.S. institutional flows to the highly regulated European exchange. Notably, one of Robinhood’s main counterparties is Citadel, which was reportedly preparing to enter crypto markets earlier this year.

![]()

![]()

![]()

![]()