Join us for our latest webinar in collaboration with Cboe

Kaiko research premium

The State of LATAM

Crypto Markets

2025 Trends in Trading Activity

Latin America (LATAM) is rapidly emerging as a significant player in global crypto markets. Although the region’s market size still lags behind major hubs like the US and South Korea, its momentum is accelerating due to improved infrastructure, clearer regulations, and growing institutional participation.

LATAM’s trade volumes reached multi-year highs in 2025.

Local exchanges are losing ground to global players.

USD-backed stablecoins remain the most traded asset across the region.

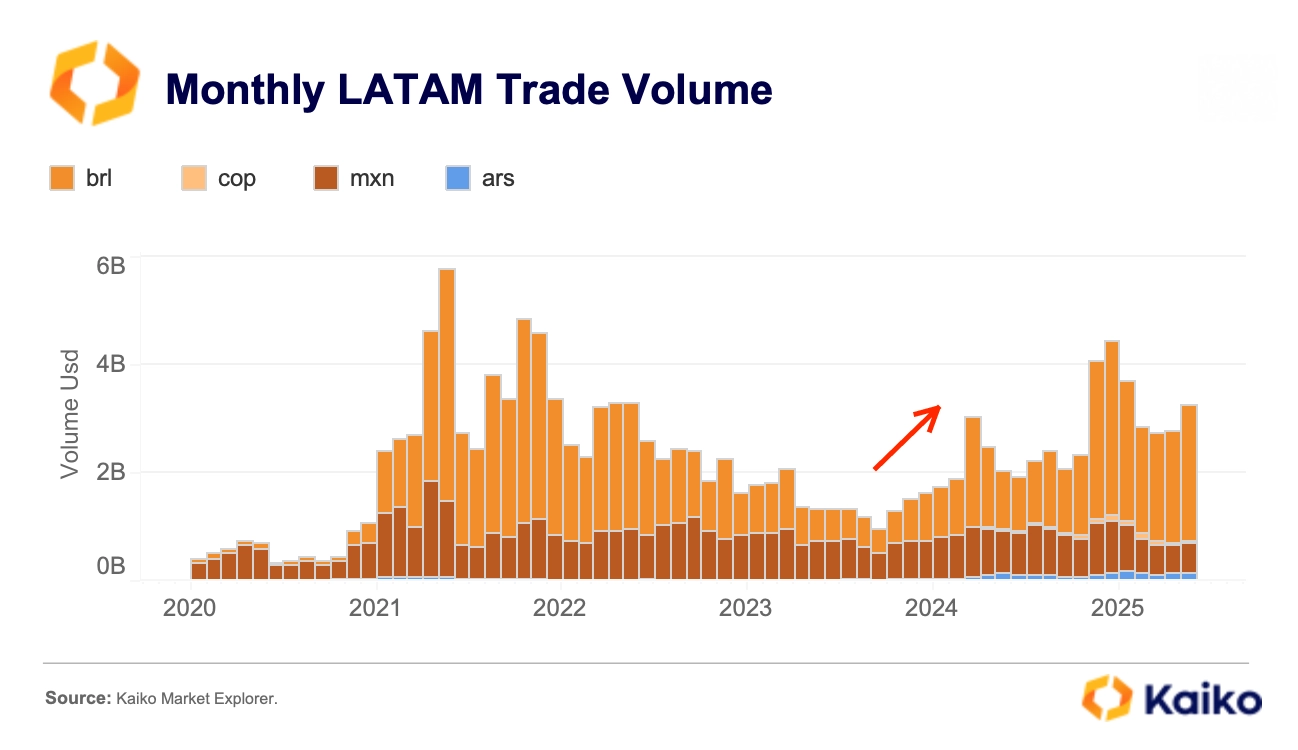

LATAM’s Trade Volume Hits Multi-Year Highs in 2025

Crypto trading in Latin America rebounded sharply in late 2023 and continued to gain momentum throughout 2024.

→Monthly volumes averaged $2.6 billion last year and exceeded $3 billion in 2025.

→Despite a global slowdown in early 2025, Latin America recorded $16.2 billion in trading volume between January and May, up 42% from the same period in 2024.

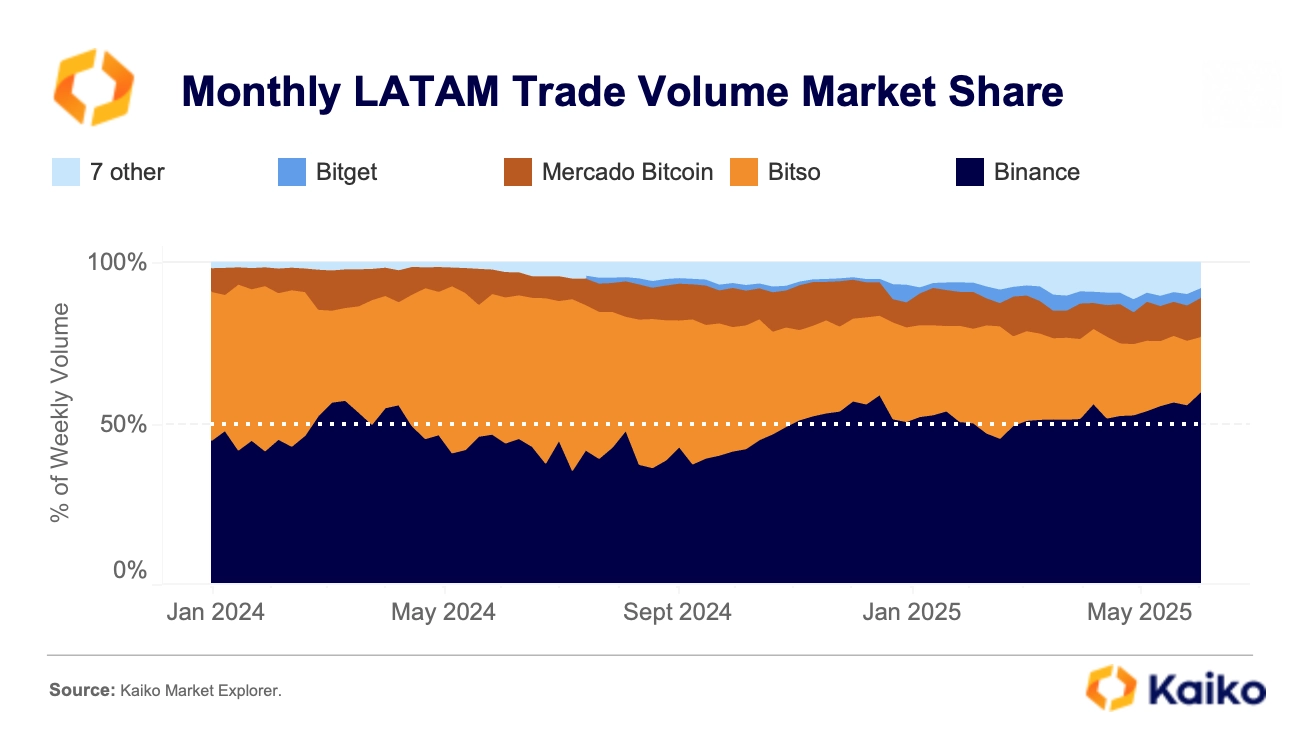

Competition Heats Up

Since 2022, local exchanges like Bitso and Mercado Bitcoin had been steadily eroding Binance’s dominance.

→ After the post-U.S. election rally, Binance’s market share in LATAM rebounded above 50% for the first time since June 2022.

→In contrast, Bitso’s share dropped to 17%, while Mercado Bitcoin held steady at 12%.

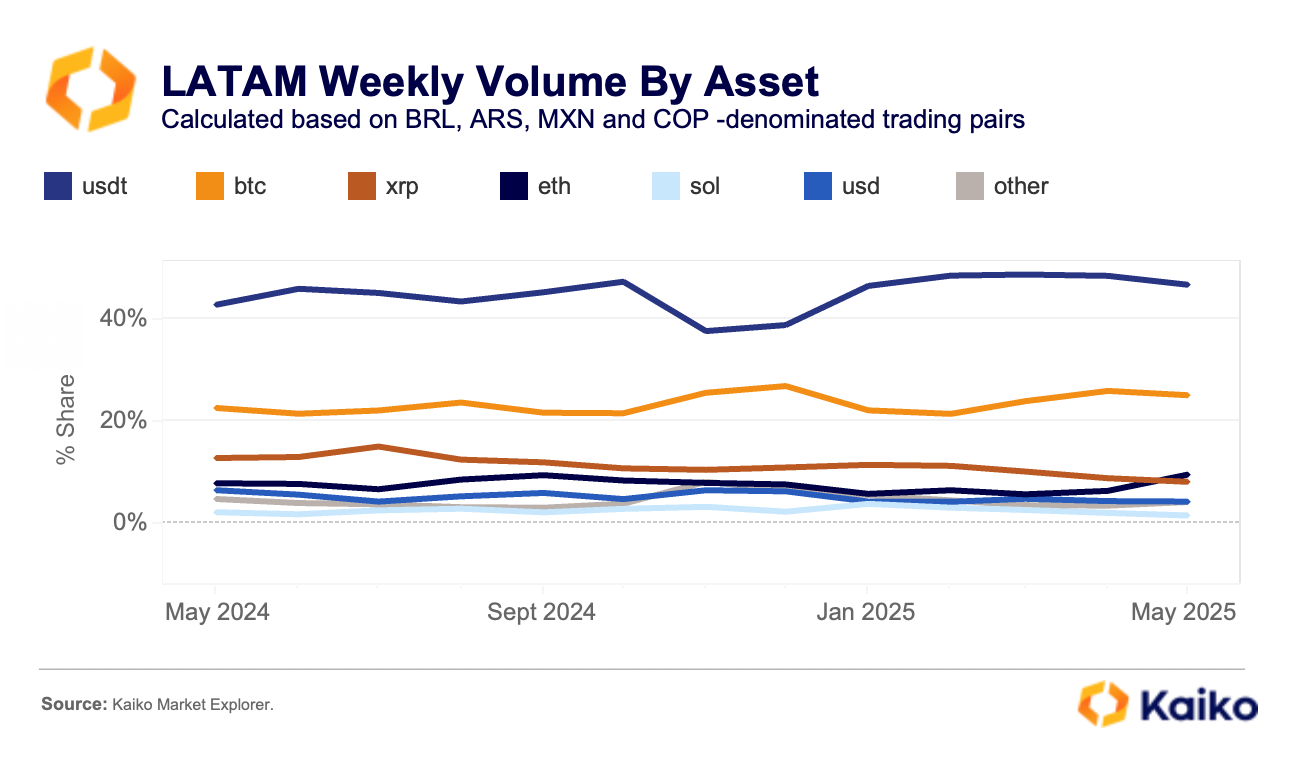

Stablecoins remain the most traded asset IN LATAM

Despite Bitcoin’s value proposition as a hedge against currency debasement, most crypto users in LATAM prefer stablecoins.

→USDT remains the most traded asset in LATAM, accounting for nearly half of volume.

→ Bitcoin ranks second, followed by Ethereum and XRP, which follow suit as the next most traded assets.