BTC Unfazed by Billion Dollar Sale

Satoshi era Bitcoin wallets have been busy moving sats over the past few months, and some Bitcoiners’ worst fears were confirmed last week. Long-term BTC investors are selling in volume. However, the market is perfectly poised to handle it.

Galaxy Digital executed what might well be one of the largest ever BTC sales, in dollar terms. While 80k BTC wasn’t a lot in the early days of crypto, when the asset traded for below a dollar, it’s worth over $9bn now. That’s the scale of the sale that Galaxy executed for an early adopter last week, just a few weeks after the money moved for the first time in over a decade. The most impressive part of the transaction has less to do with Galaxy or the seller and more to do with how the market absorbed the sale.

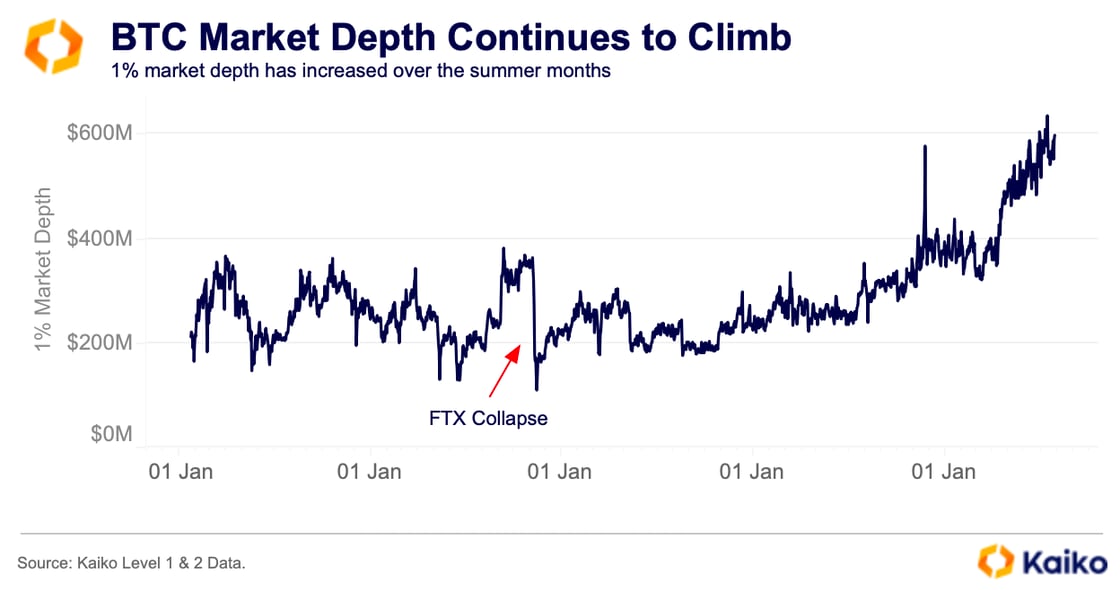

Despite the majority of the sale taking place over-the-counter, the fact that a sale of this size did little to impact the broader market is noteworthy. In the past, a significantly large transfer from a whale wallet has been enough to move prices, and that’s without confirmation of any sale. However, Bitcoin markets have matured considerably in recent years.

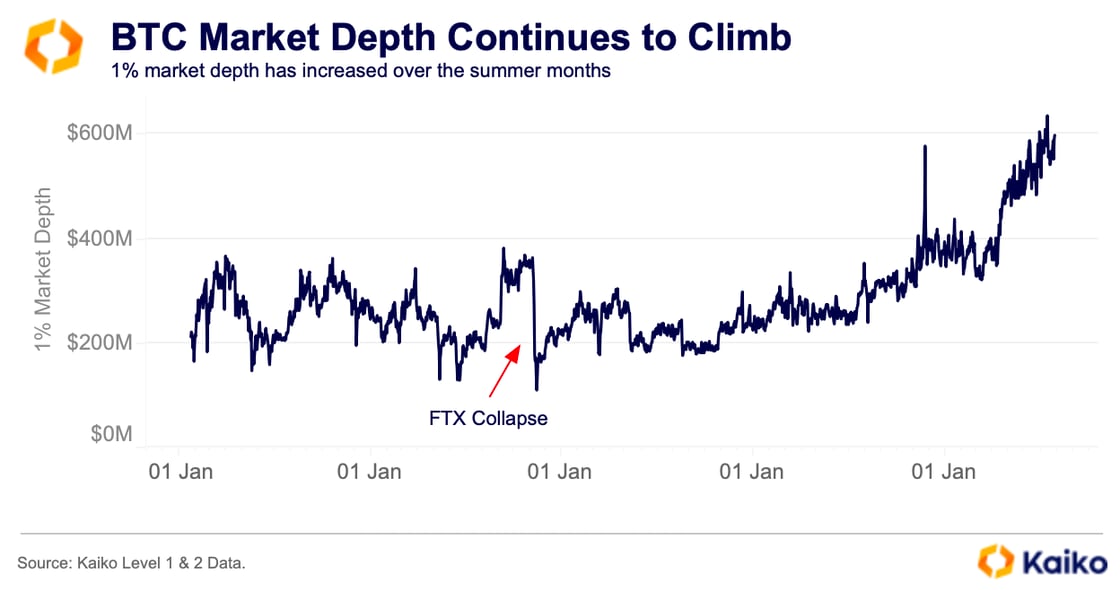

BTC liquidity, as measured by 1% market depth, has climbed to record highs in recent months. This increased liquidity is likely tied to several factors, such as institutional adoption and regulatory advancements.

The most important of these drivers is institutional adoption. This primarily comes from two main sources, corporate treasury purchases and spot BTC exchange-traded fund purchases. The surge in liquidity stems from multiple sources.

Since May, 98 different companies have raised, or revealed plans to raise, nearly $90bn to buy crypto (mostly BTC but also ETH and SOL), Meltem Demirors noted on X recently. At the same time BTC ETFs, such as BlackRock’s IBIT, have attracted billions of dollars in inflows. These market participants essentially act as a liquidity floor, insulating the broader market from sales such as last week’s. However, the demand might fall in the coming weeks. July is typically a strong month for U.S. equities and even last year we saw BTC ETF inflows spike in July before tapering off in August.

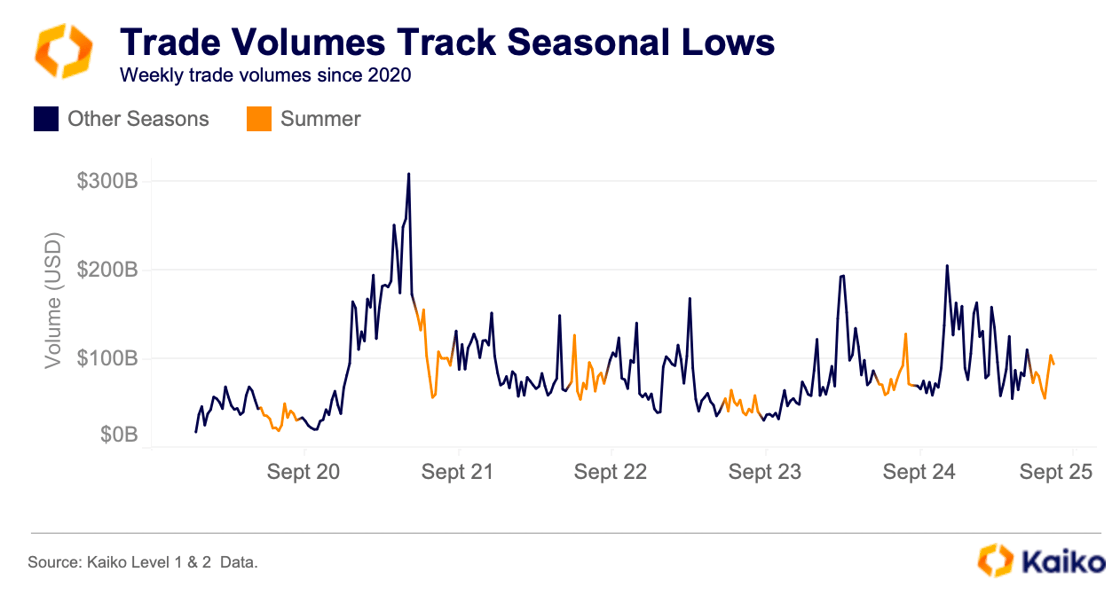

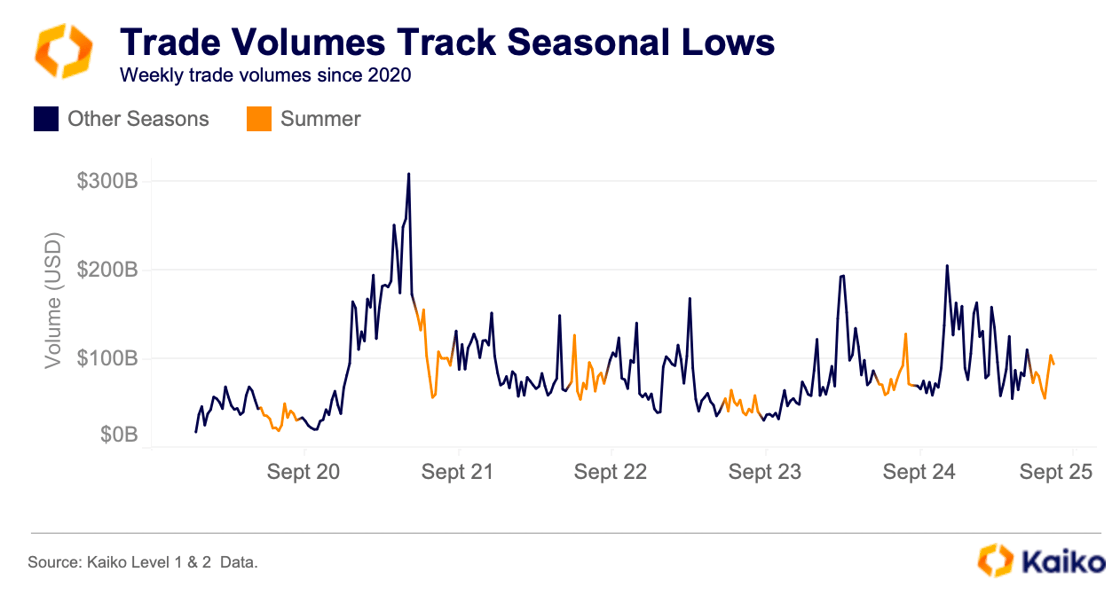

If that trend continues, then the support in the broader market is going to have to pick up. Trade volumes, aggregated across venues, have trended lower since the beginning of the year. In fact, trade volumes have failed to reach post-election highs despite prices trading well above Q4 2024 levels.

Essentially the current set up suggests there is little retail demand in the market right now. However, the strong liquidity profile, matched with the market’s ability to handle large orders and growing demand from treasury companies, indicates the presence of sophisticated traders. These traders are more price agnostic, which should bode well for BTC’s price action heading into what can be a choppy month.

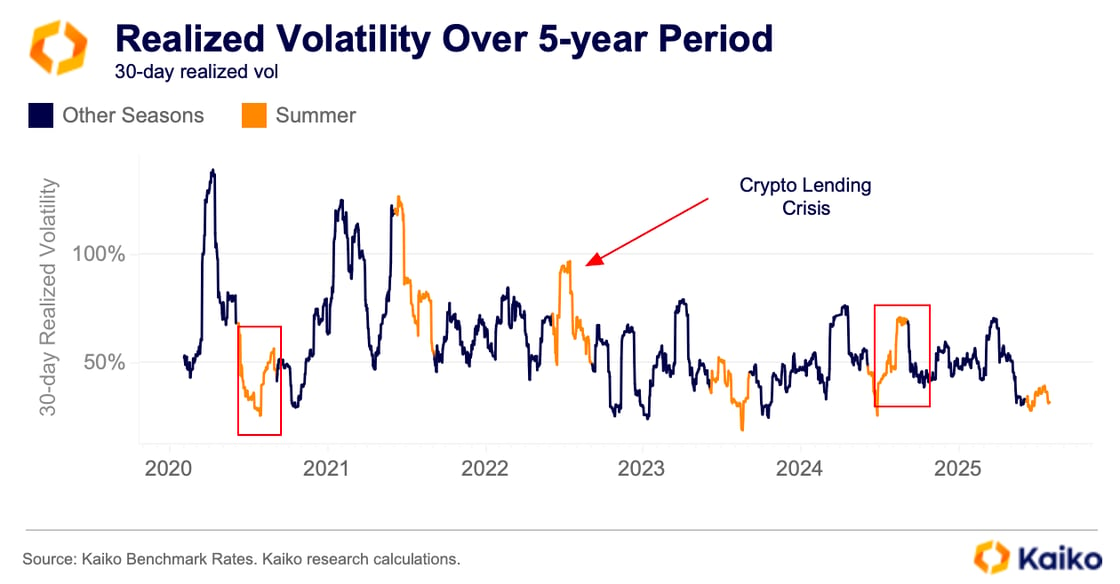

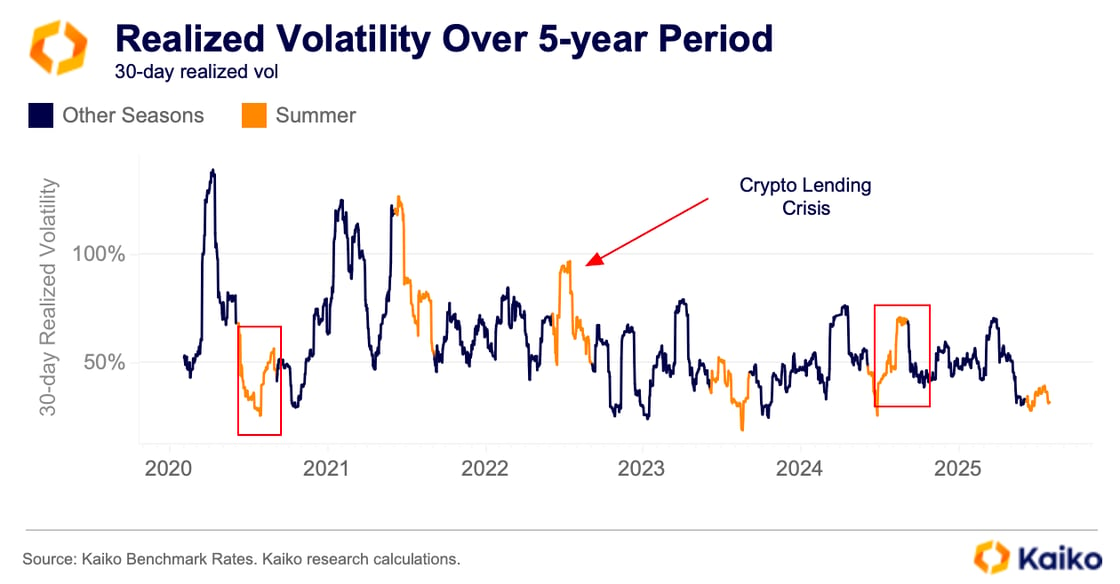

Last August, macro news caused an uptick in volatility (second red box below) as the Fed and Japanese interest rates changes spooked markets. BTC plunged into the first weekend of August on the news, before recovering well. This week’s stacked macro calendar is slightly less ominous following positive news around trade deals over the weekend, however, Fed Chair’s signalling on upcoming decisions will drive the narrative heading into Jackson Hole and could lead to some repricing of risk ahead of September’s rate decision.

The first red box above highlights an uptick in 30-day volatility at the end of August 2020, which was largely tied to profit-taking and inflation concerns at the time. The common thread? Macro news during quieter summer months can sometimes have an outsized impact on prices.

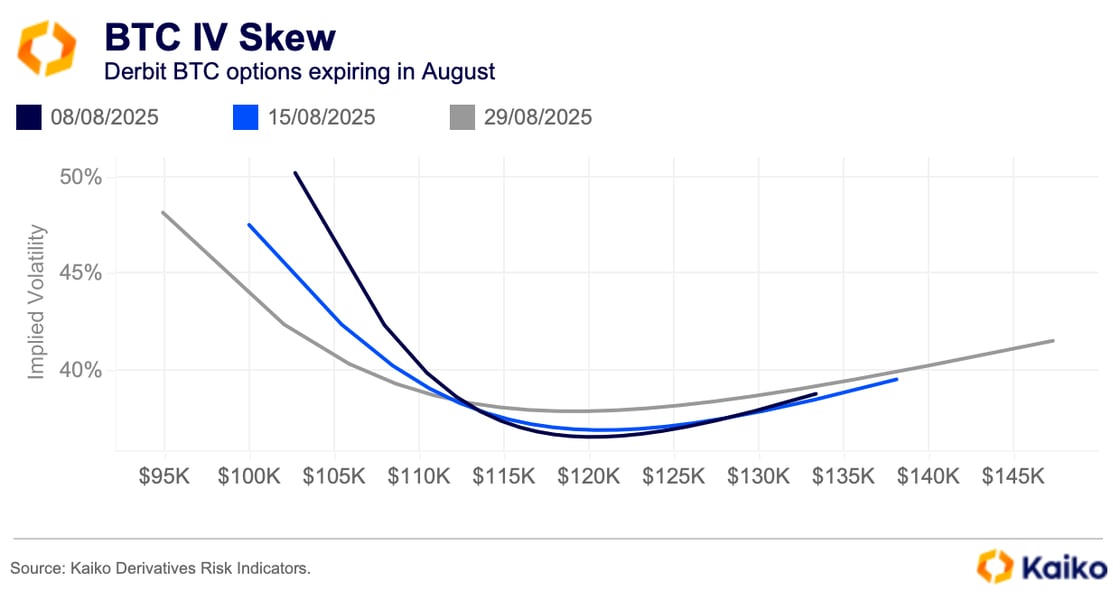

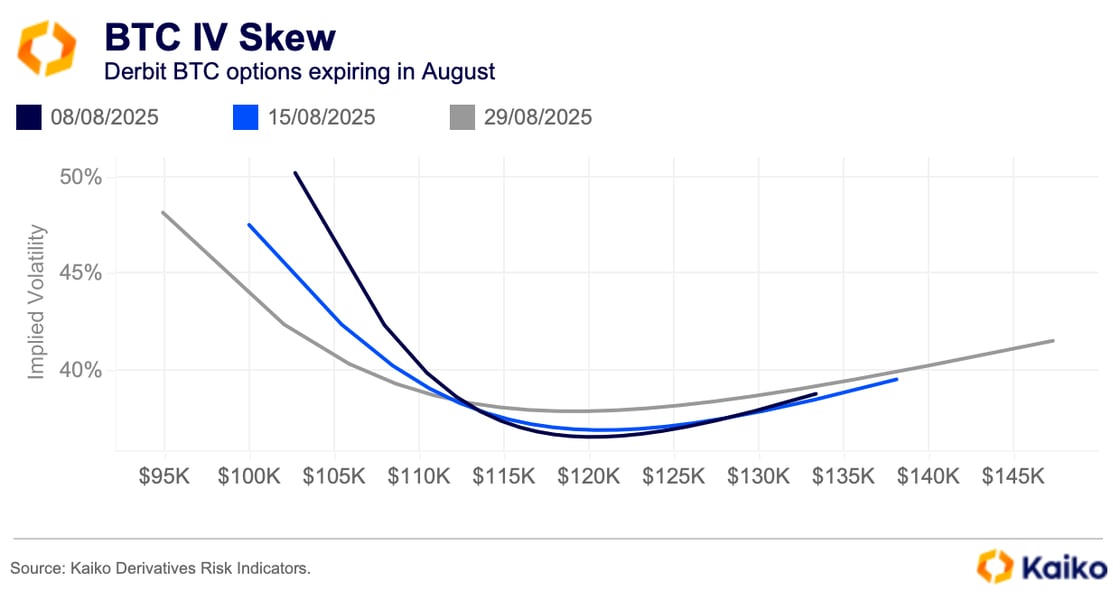

Activity in the BTC options market suggests some hedging against the risk of consolidation next month. There’s a slight bearish tilt in BTC options, reflected in the implied volatility skew for contracts expiring in August.

Data Points

TACO & Chips

As talks between the U.S. and China stalled, a new 90-day extension (with a twist) was announced, adding fuel to the “Trump Always Chickens Out” narrative. The delayed Chinese trade talks will also see both nations lift previously imposed trade restrictions, notably the export of AI chips and chip-related technology to China.

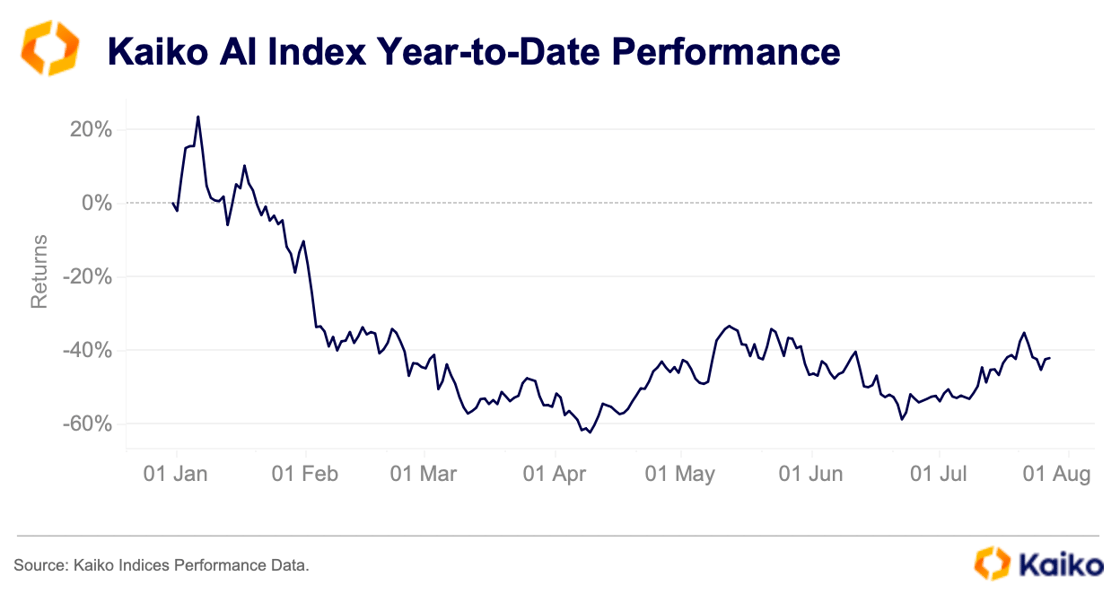

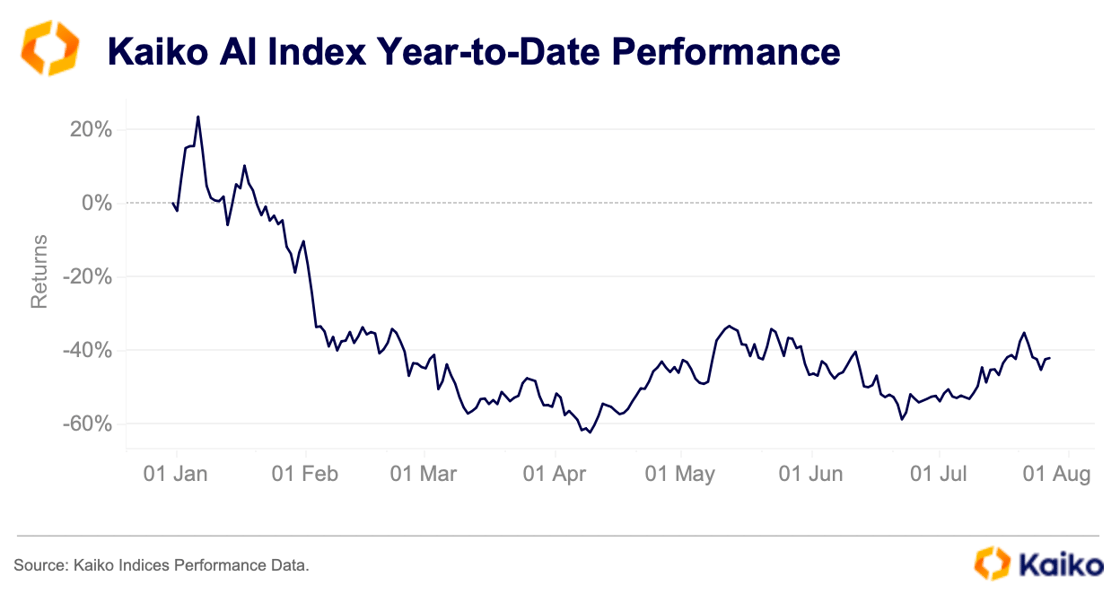

The positive developments around trade talks should prove a positive for risk assets too, with one less headwind to worry about. This could translate into more action in themes, in particular any AI-related crypto projects, which have languished this year, down over 40% since January.

AI stocks have suffered as tension between China and the U.S. rose. AI firms have been caught in the middle due to reliance on China for demand for finished chips, as well as rare earth minerals used as inputs to build products. The launch of China-based DeepSeek in Q1 also led to a massive repricing of expectations among AI investors, which has taken several months to shake out.

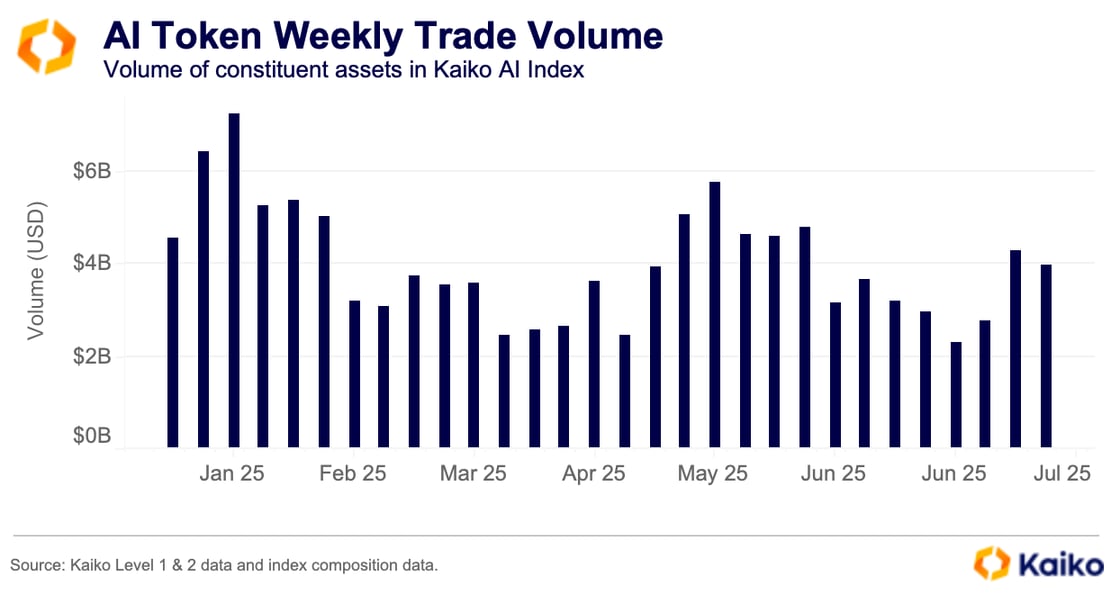

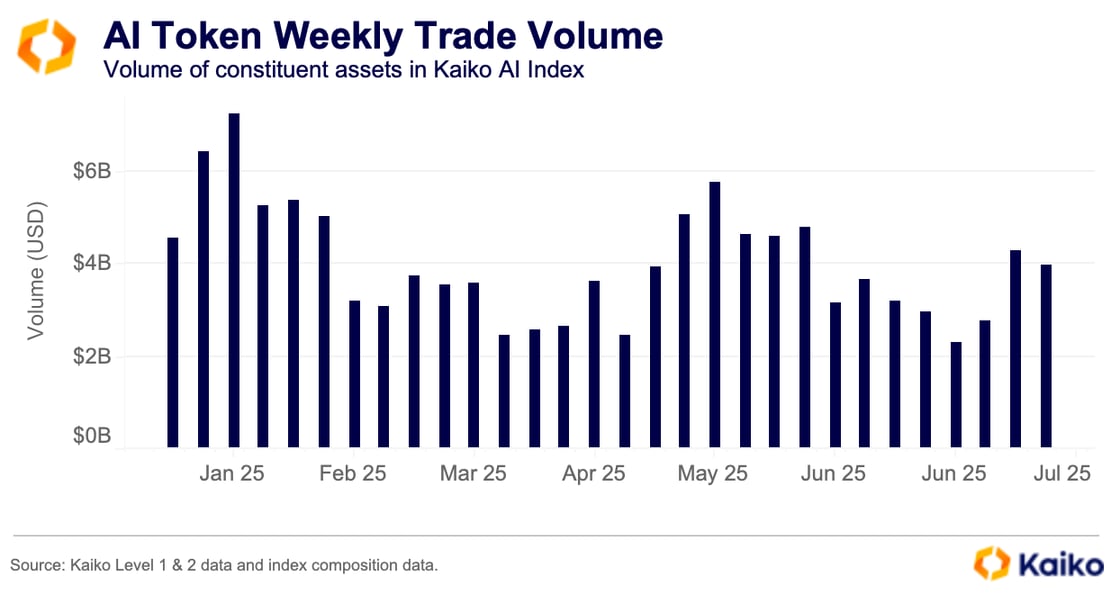

Trade volumes have failed to recovered to January levels, when the combined weekly trade volume of the Kaiko AI Index constituents exceeded $6bn on several occasions. Although volumes have picked up in the past few weeks, as sentiment improved.

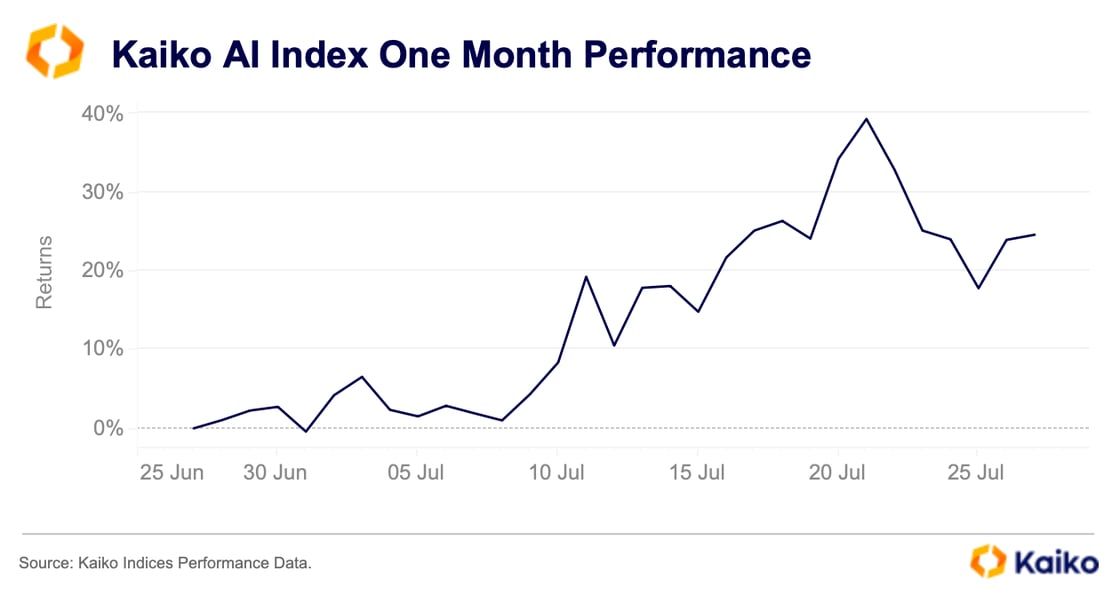

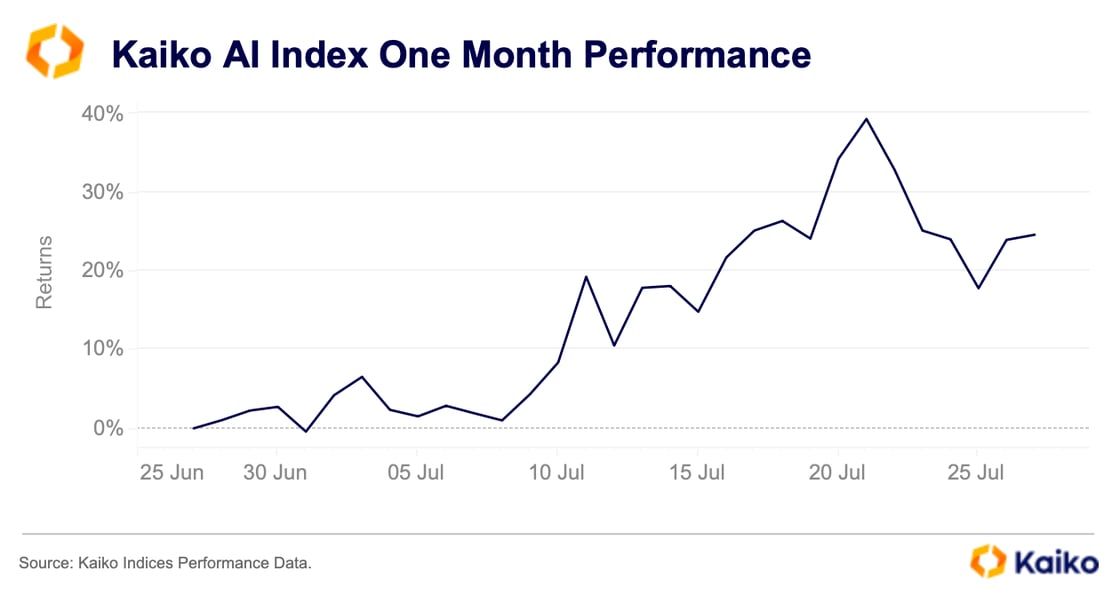

The increased activity in the underlying assets has been met by improved returns. Prices have recovered in the past month and the stay of execution on the U.S.-China trade deal should prove to be a positive tailwind for AI-related crypto assets.

![]()

![]()

![]()

![]()