Trend of the Week

Trump’s stablecoin sees massive on-chain flows.

Stablecoins have been in the spotlight lately, as mainstream adoption accelerates and regulators worldwide ramp up efforts to monitor cross-border transactions.

U.S. President Trump’s favorable stance on crypto is another key catalyst, just as his family’s DeFi project enters the market. World Liberty Financial, the DeFi project associated with Trump and his sons, launched USD1 at the end of April, with major centralized exchanges listing the asset in May.

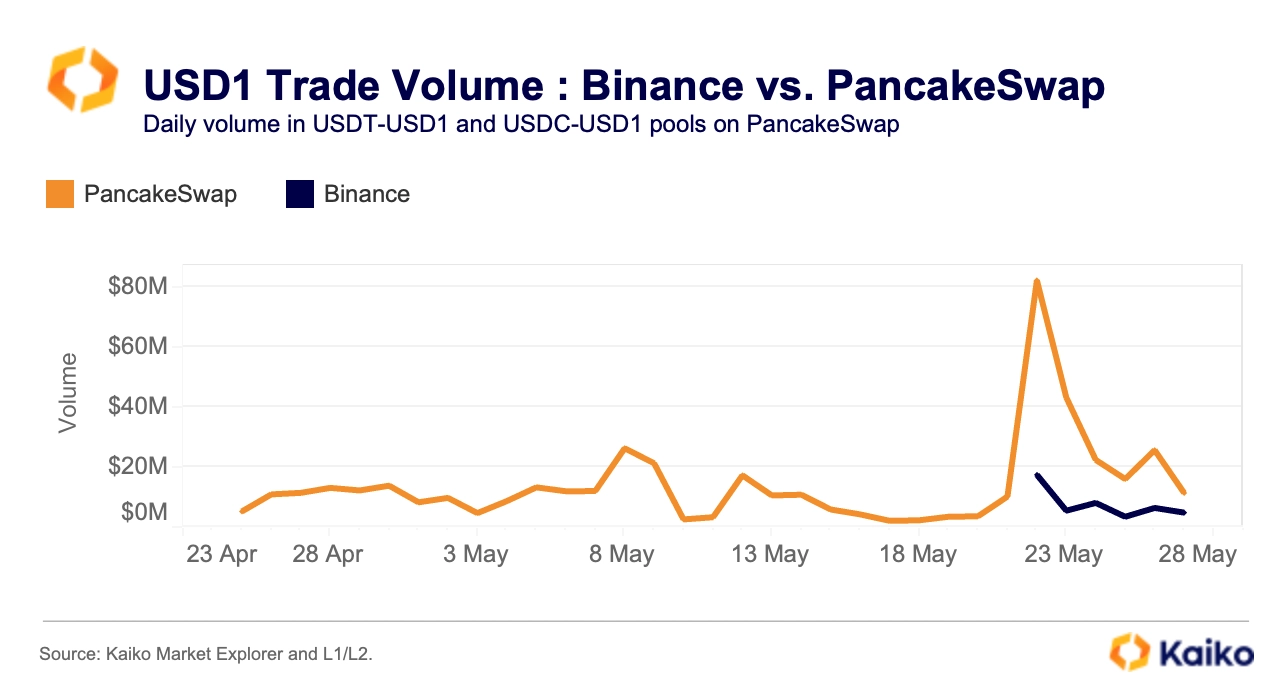

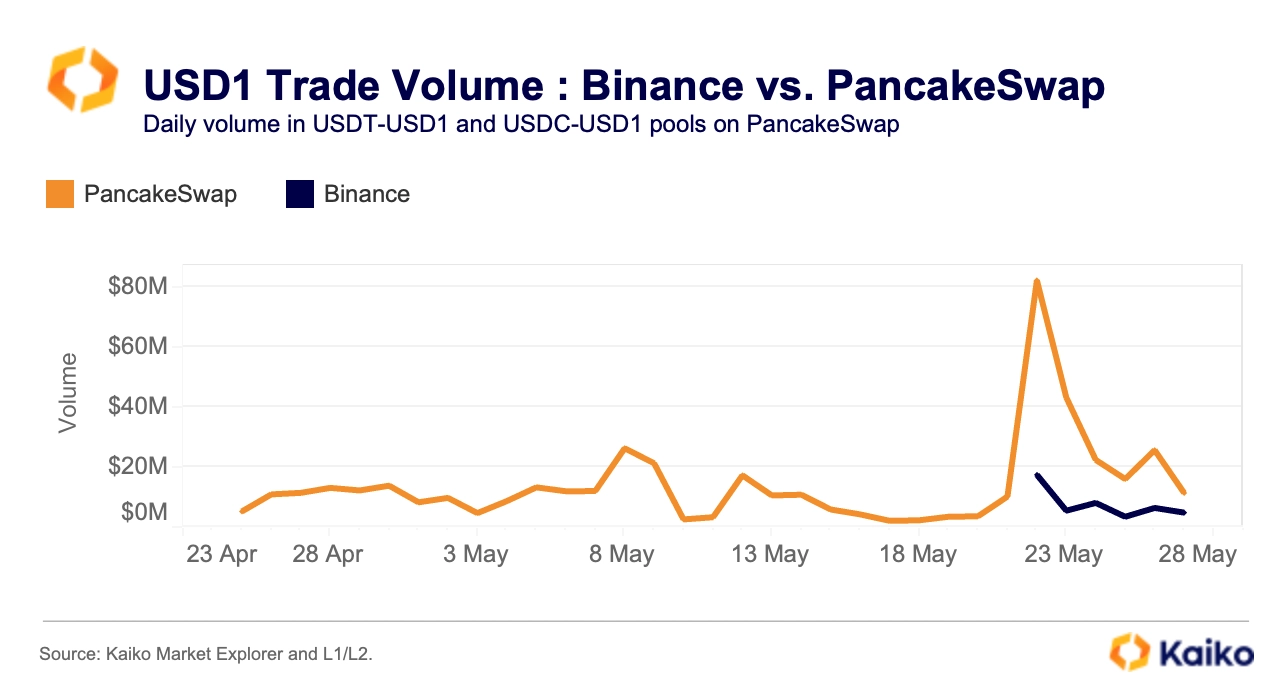

Despite the buzz, most USD1 trading has stayed on-chain. Over the past month, average daily volume on PancakeSwap’s main pools (USDT-USD1 and USDC-USD1) reached $14 million, outpacing Binance’s $8 million.

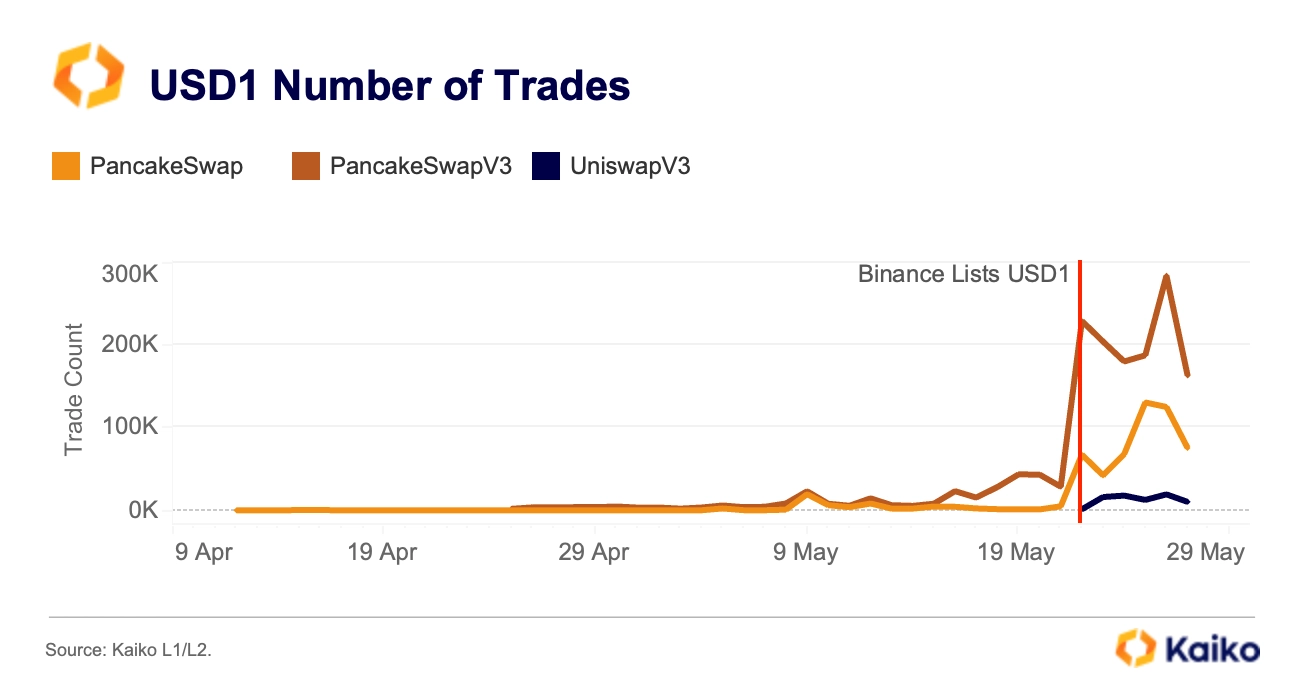

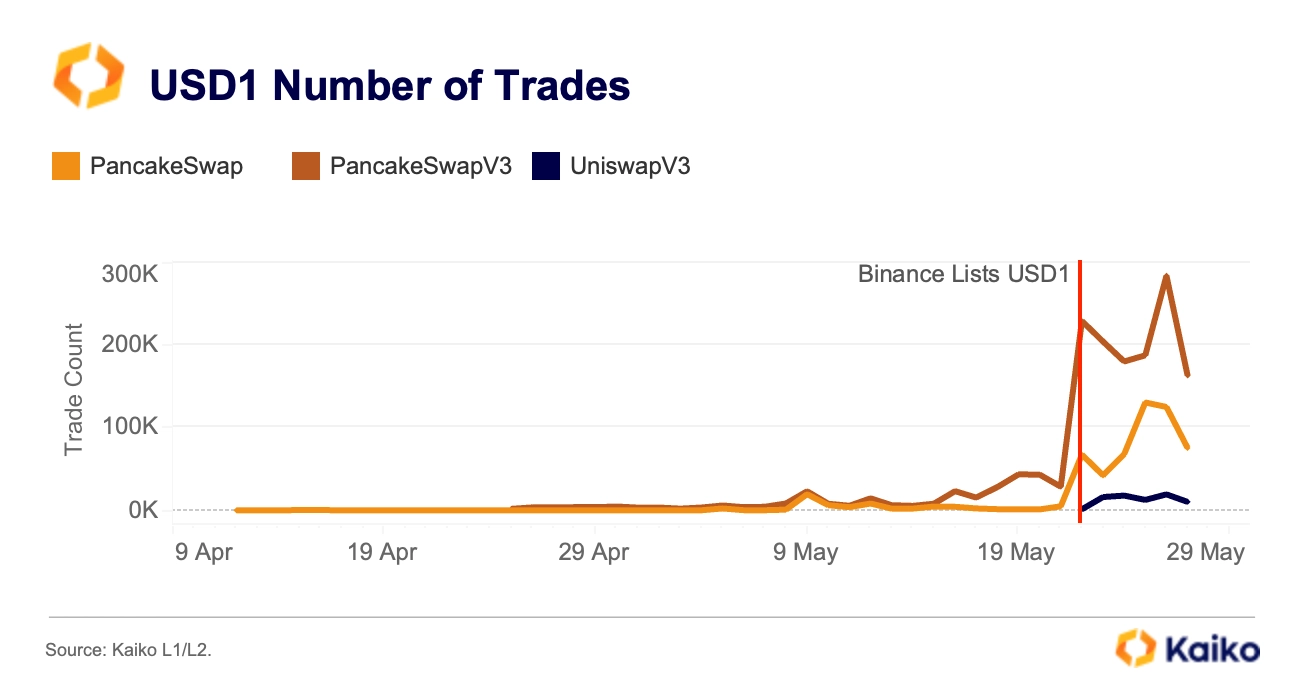

USD1 broke the mould with its Binance listing: after debuting on Binance on May 22, on-chain activity surged, with the number of trades on the DEX PancakeSwap V3 jumping from 28,000 on May 21 to over 283,000 by May 26.

Most PancakeSwap pools involving USD1 are dominated by highly speculative altcoins that typically see little activity. This trading pattern between the World Liberty Financial stablecoin and long-tail assets mirrors trends seen with the TRUMP memecoin, where investors also support other newly minted, low-liquidity tokens.

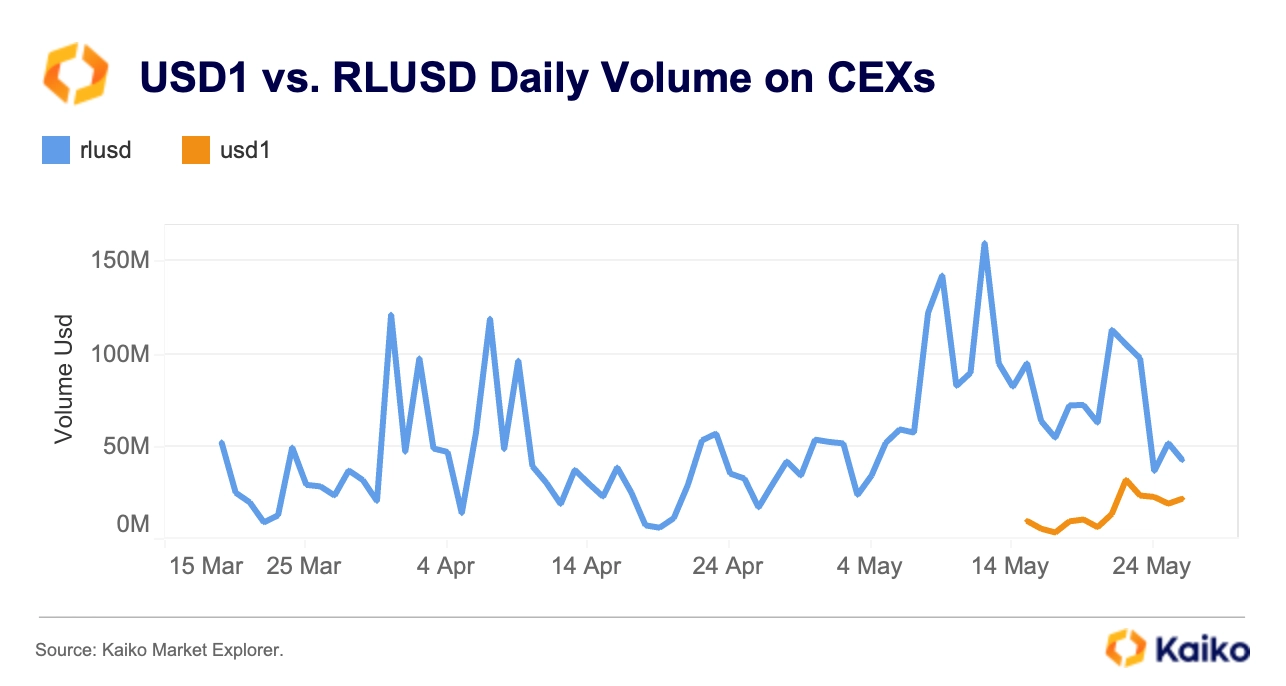

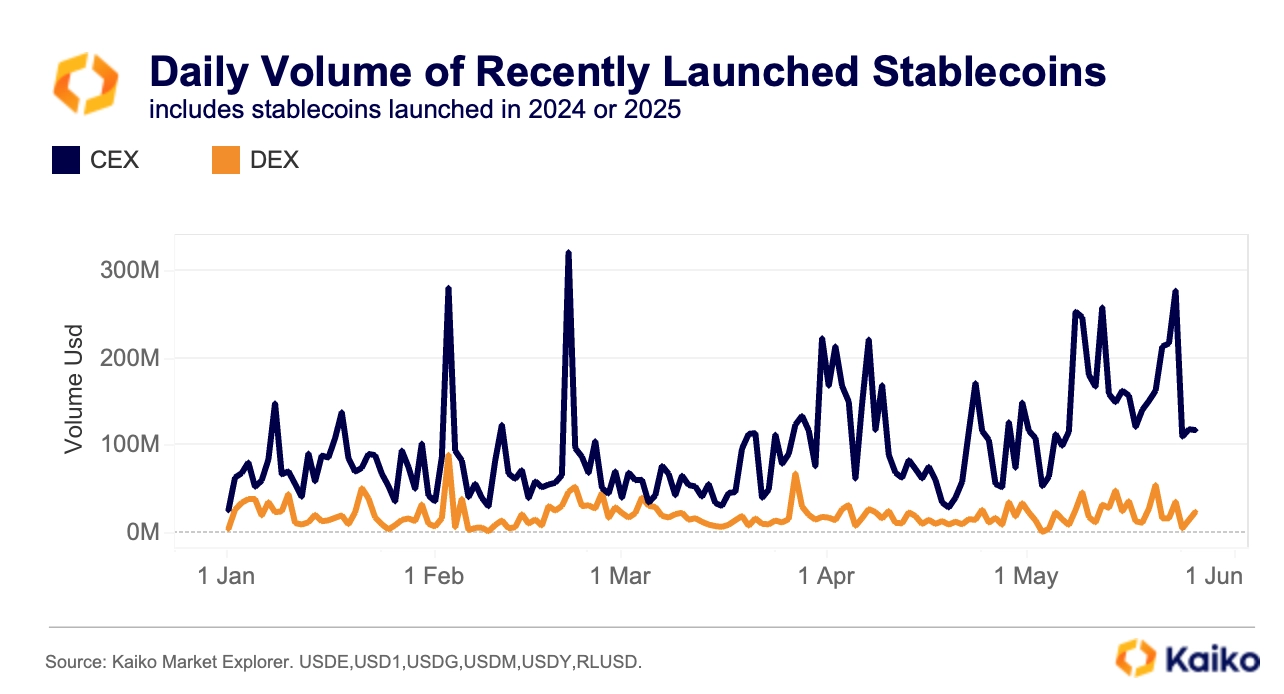

Despite the hype, USD1’s CEX volume still lags behind other recently launched stablecoins like Ripple’s RLUSD, which has averaged $50 million in daily CEX volume since launch.

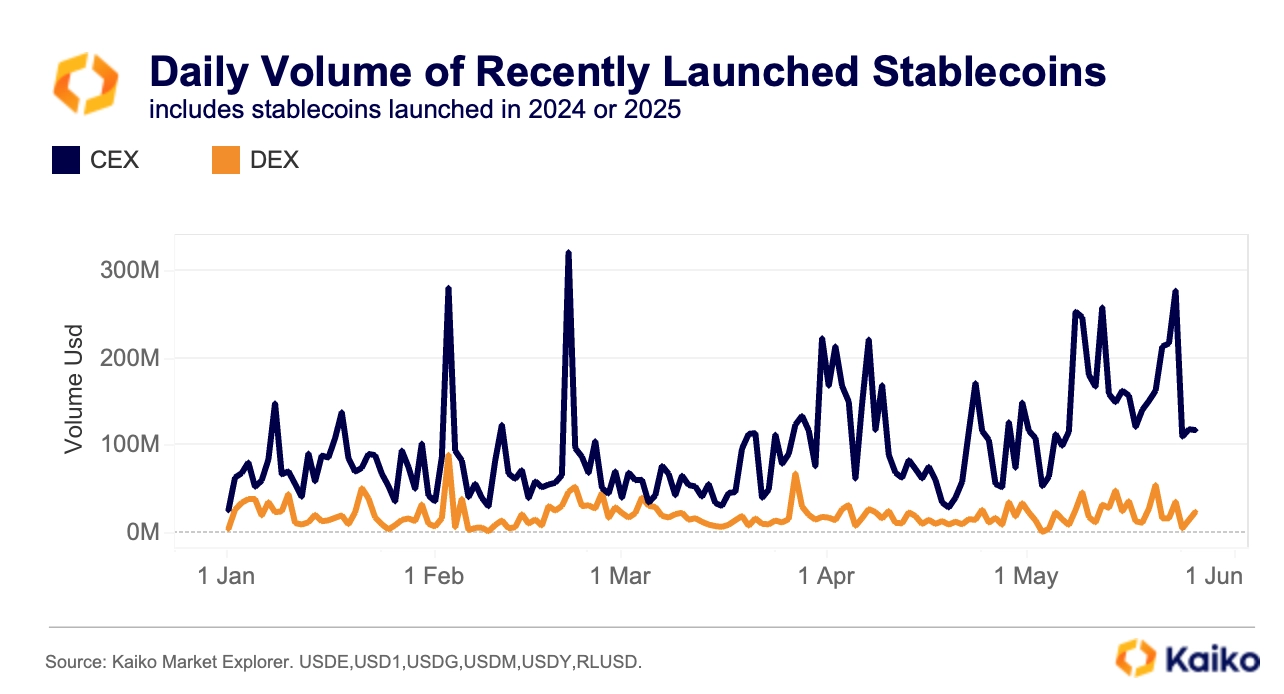

This mismatch between on-chain and off-chain activity is at odds with broader market trends. Most stablecoins launched in 2024 and 2025, including Ripple’s RLUSD and Ethena’s USDE, have seen their share of DEX trading decline sharply this year, making USD1’s on-chain momentum even more notable.

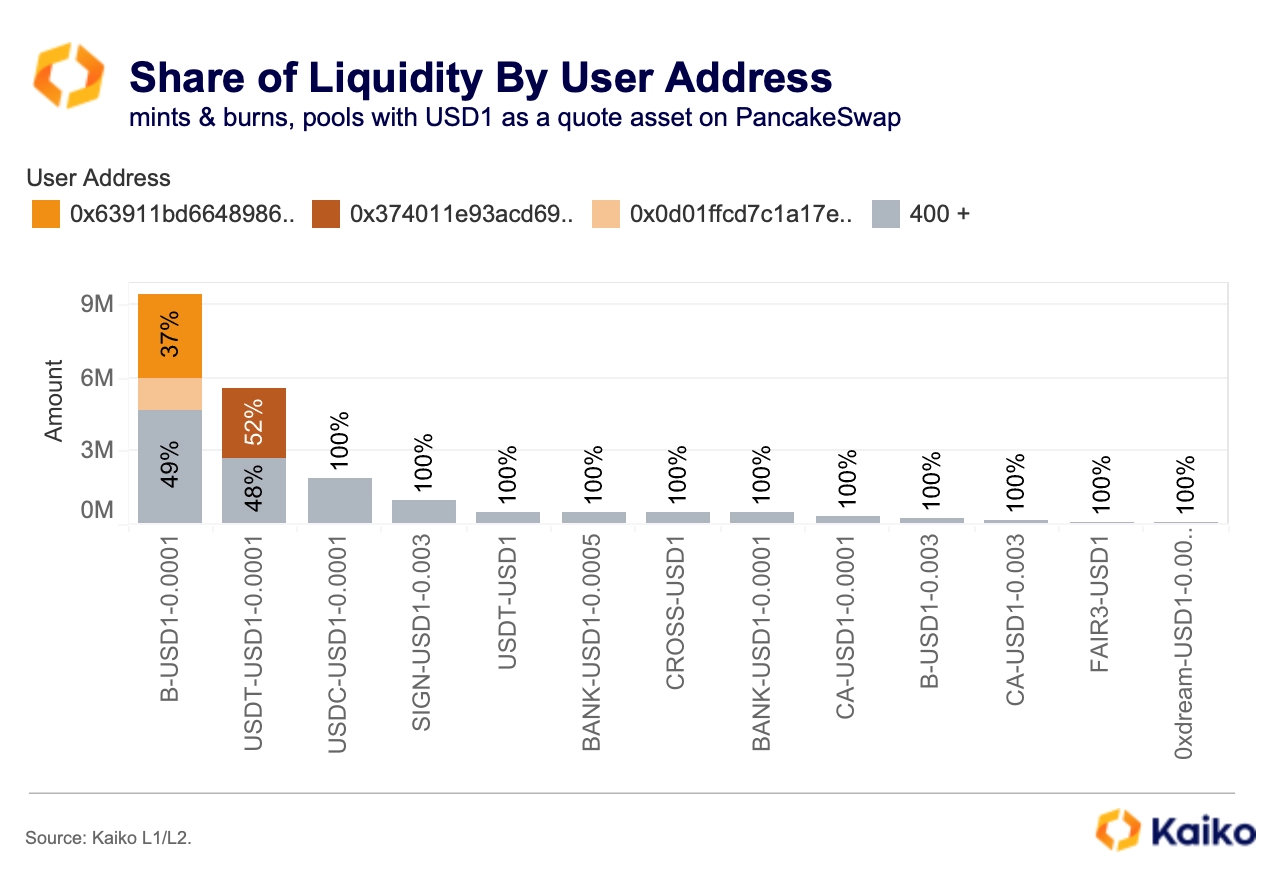

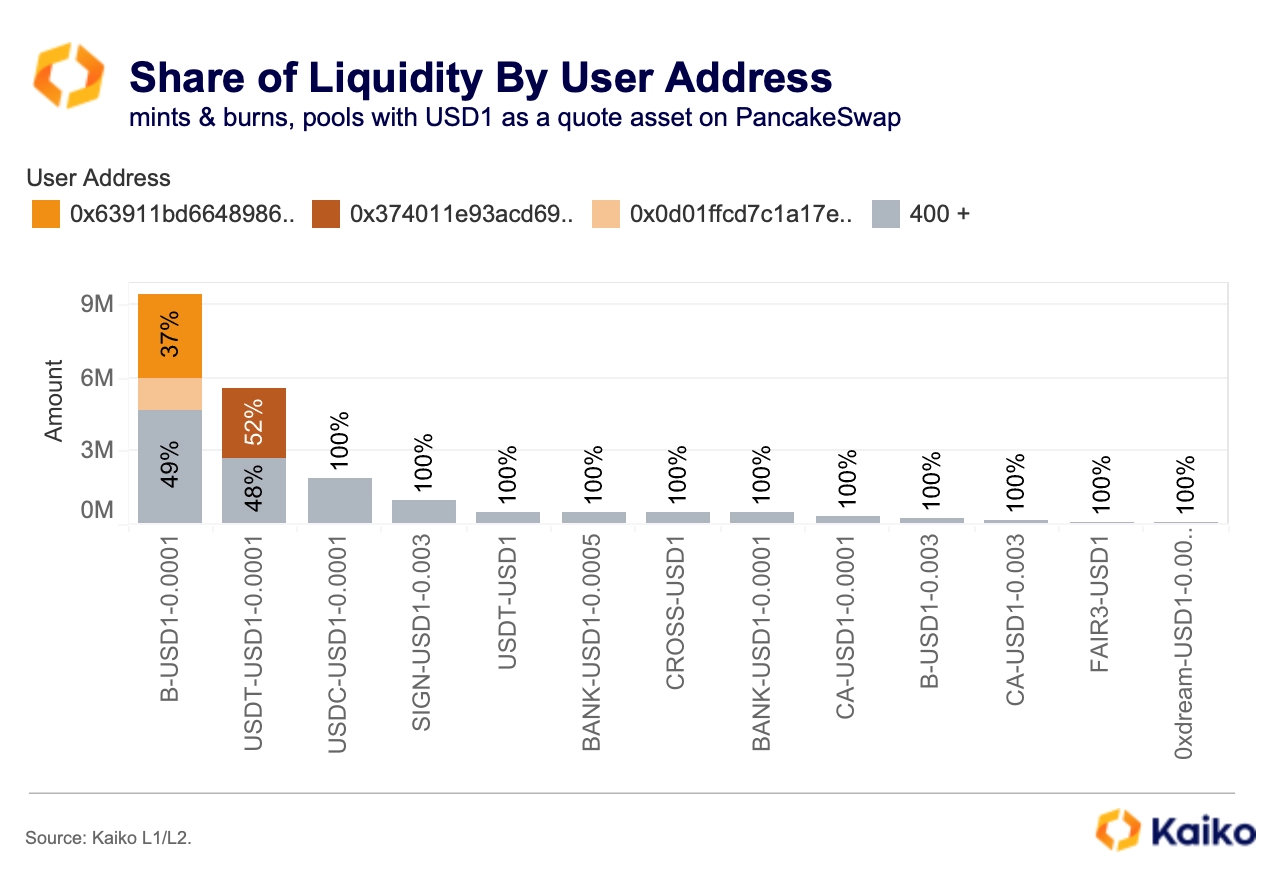

A closer look at liquidity provision on PancakeSwap shows that over half of market-making activity in the top USD1 pools comes from just three wallets, representing more than $7.5 million in USD1 flows.

While high liquidity concentration among a few wallets is common on DEXs, this degree of concentration also indicates limited broader adoption.

If USD1 has institutional ambitions or aims to break into the stablecoin market, it will need to find use cases on major platforms. These venues typically see much higher volumes than decentralized alternatives and facilitate more institutional trading.

One potential use case is its partnership with Wintermute, one of the largest crypto market makers. Similar partnerships have benefited other stablecoins, such as USDC with Coinbase and FDUSD with Binance. While USD1 was used for MGX’s massive $2 billion investment in Binance earlier this year, that endorsement from the Abu Dhabi-based fund has yet to boost volumes.

Data points.

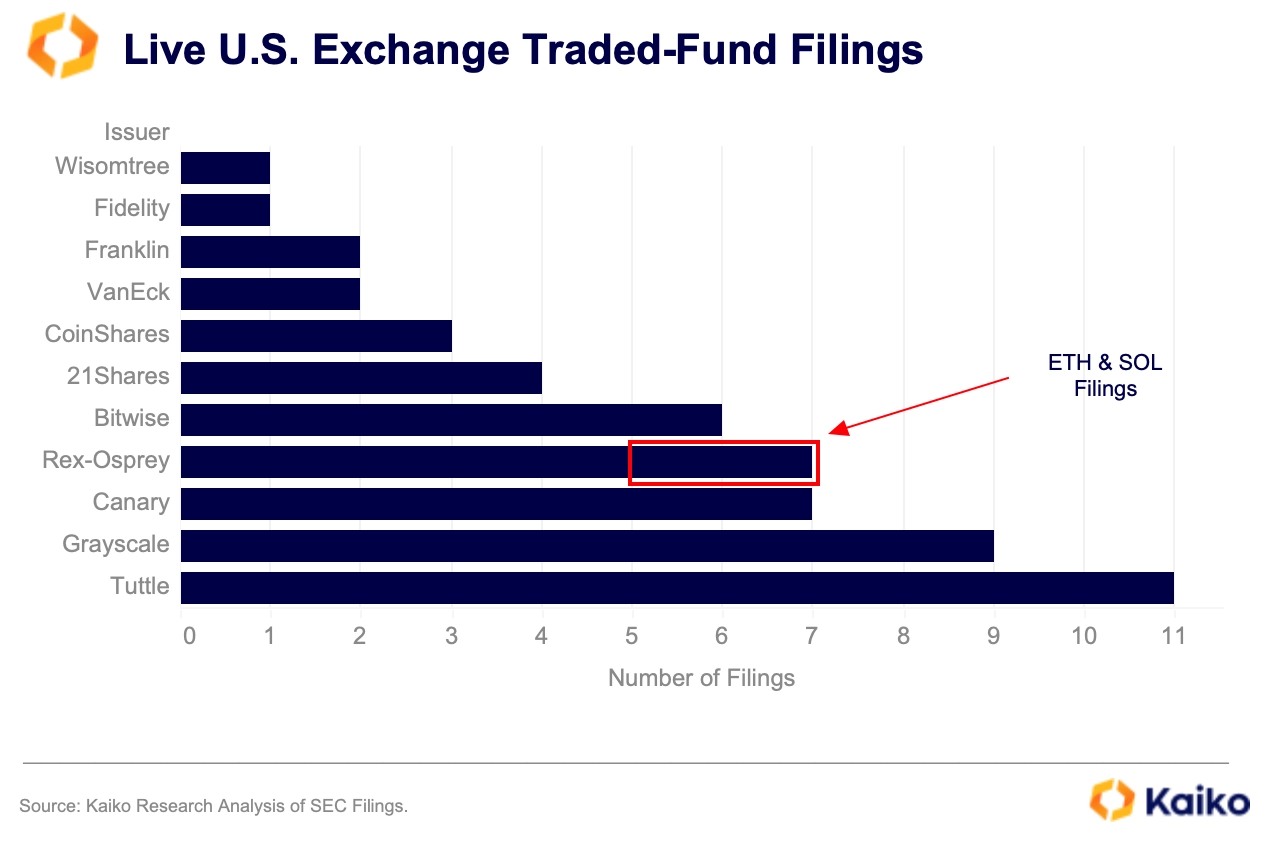

Regulatory hurdles fall as ETF fervor rises.

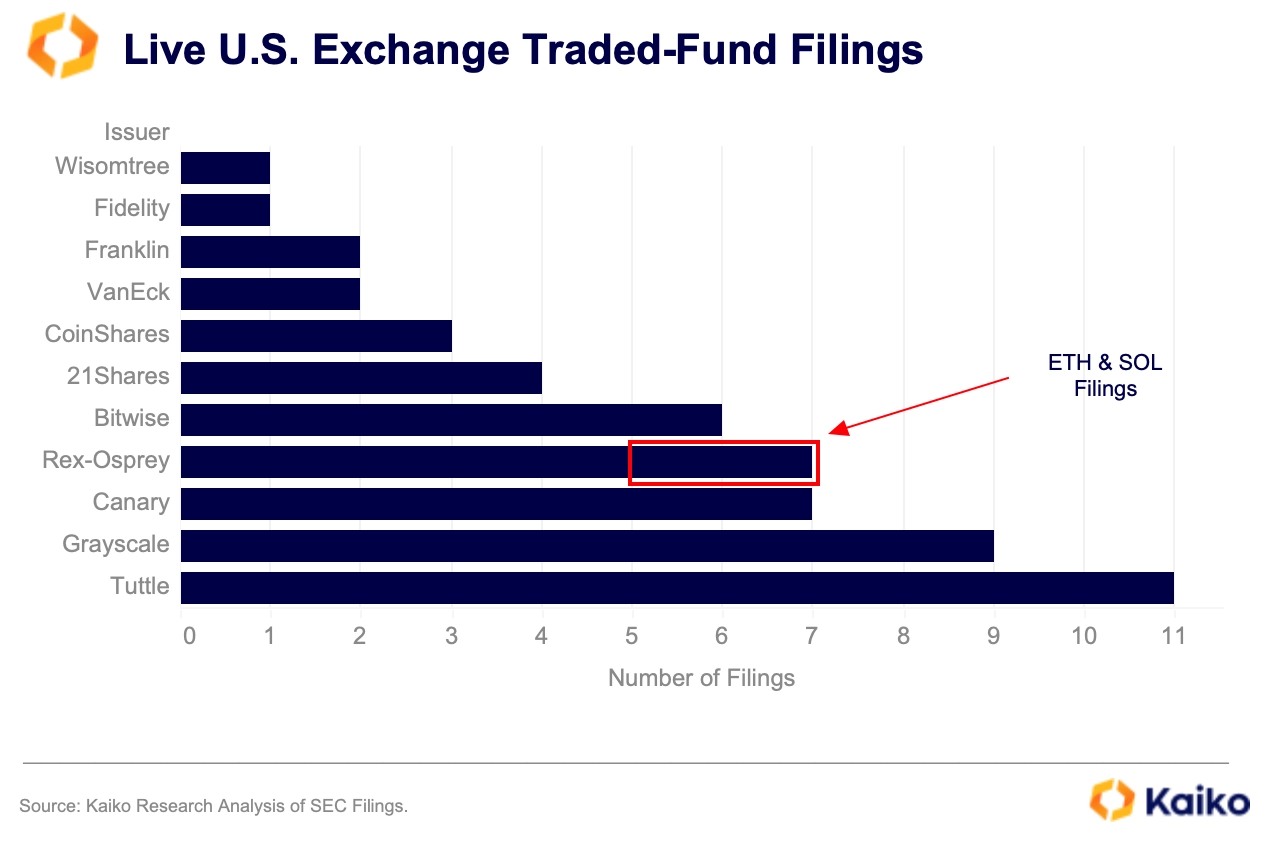

The stage is set for movement on crypto-related ETF applications as the new SEC outlines its approach. In just over a month, new Chair Paul Atkins has closed lingering cases and clarified the Commission’s stance on key crypto topics, such as staking (which we’ll discuss later), fueling anticipation of more crypto-related ETFs and new product variants.

Last week, the Commission stated that staking does not constitute the sale or offer of securities, setting itself apart from the previous administration—a shift that could be significant for ETF issuers, as seen with REX Shares filing to launch ETH and SOL staking ETFs.

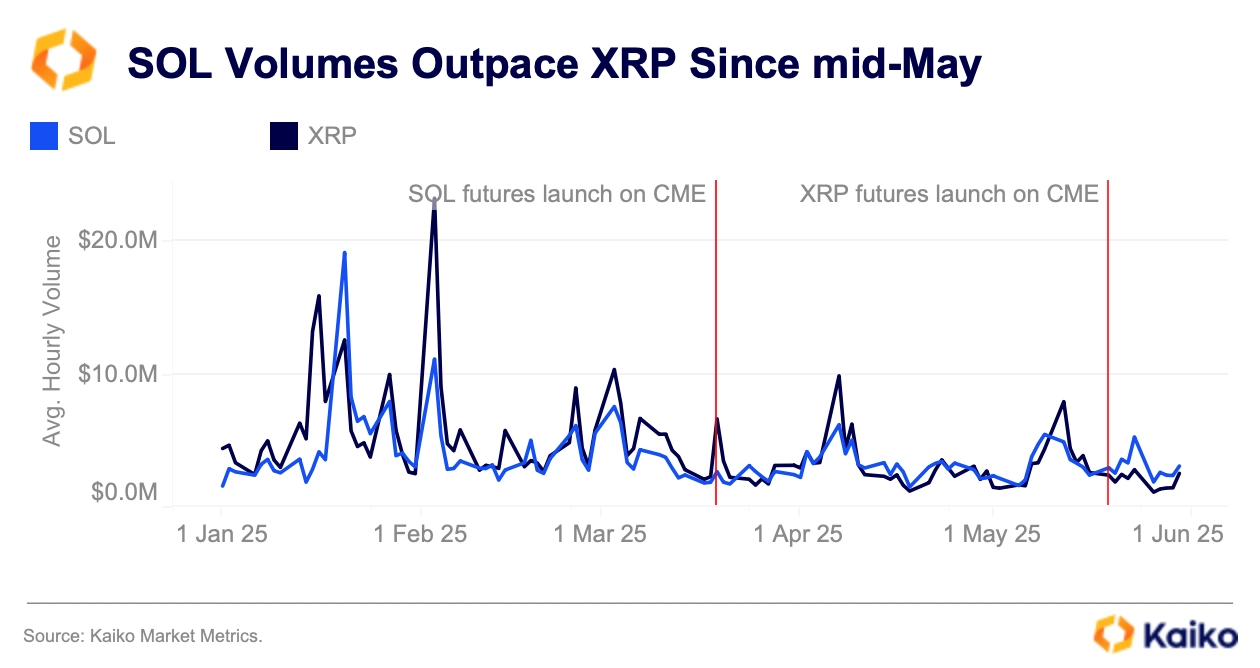

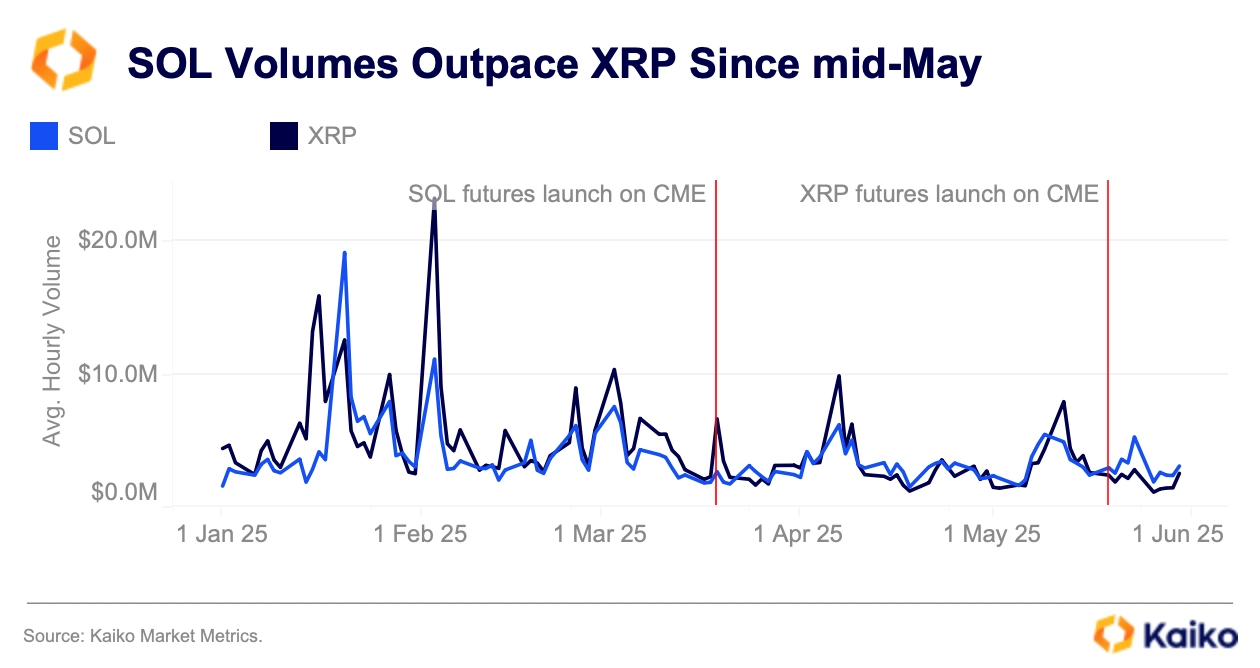

As well as a SOL ETF, market participants and analysts suggest an XRP fund could be next to gain approval. Both assets now have futures markets on the CME, which was a requirement for crypto ETFs under the last Commission.

XRP futures launched on the CME on May 18, reaching around $19 million in trading volume on the first day—about 60% more than SOL futures saw on their debut. However, competition in the spot markets flipped the other way after the futures nod for XRP.

All these futures volumes tell us for now is that there is some, albeit limited, demand for these products from investors on the CME. The CME launch did little to improve spot market volumes for either asset, as they remain well below Q1 levels, but spot ETF approval would likely lead to a resurgence in volumes.

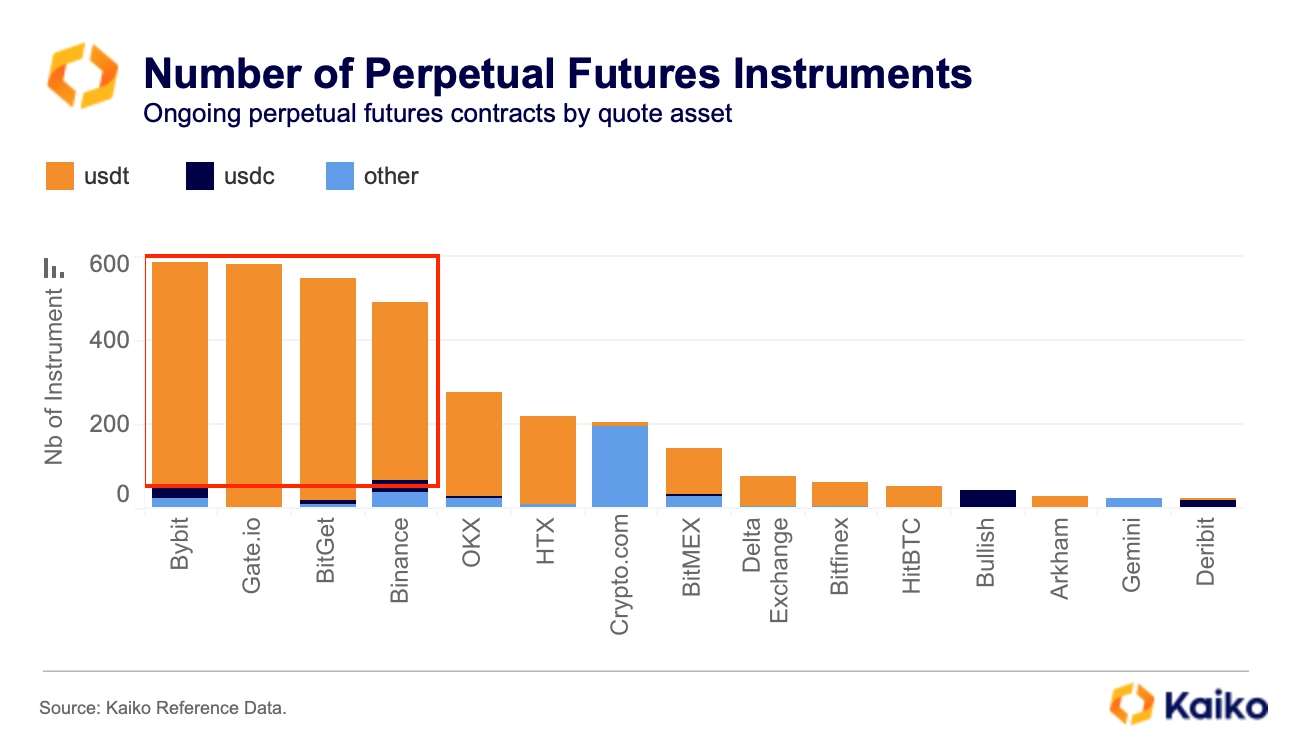

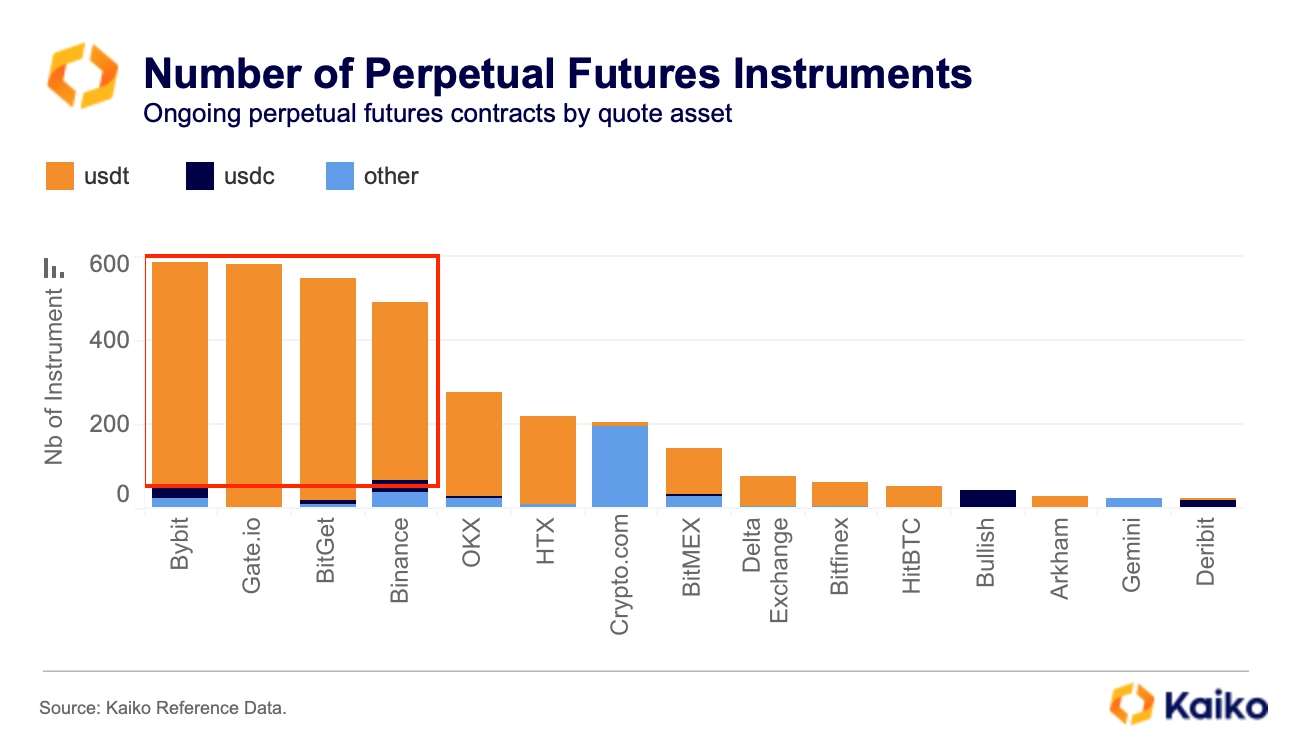

U.S. platforms take aim at offshore perpetuals dominance.

For years, the center of the crypto perpetuals market, where traders use leverage to bet on price movements without expiry, has been dominated by offshore exchanges. Platforms such as Bybit, Gate.io, Bitget, and Binance each offer hundreds of perpetual futures contracts, allowing traders to bet on a wide range of altcoins with relatively small collateral.

Stablecoins like Tether’s USDT are favored over fiat for derivatives settlement and margin, due to instant, final transfers and around-the-clock collateral management.

Notably, perps are an important driver of offshore activity and have historically acted as a buffer during spot trading slowdowns.

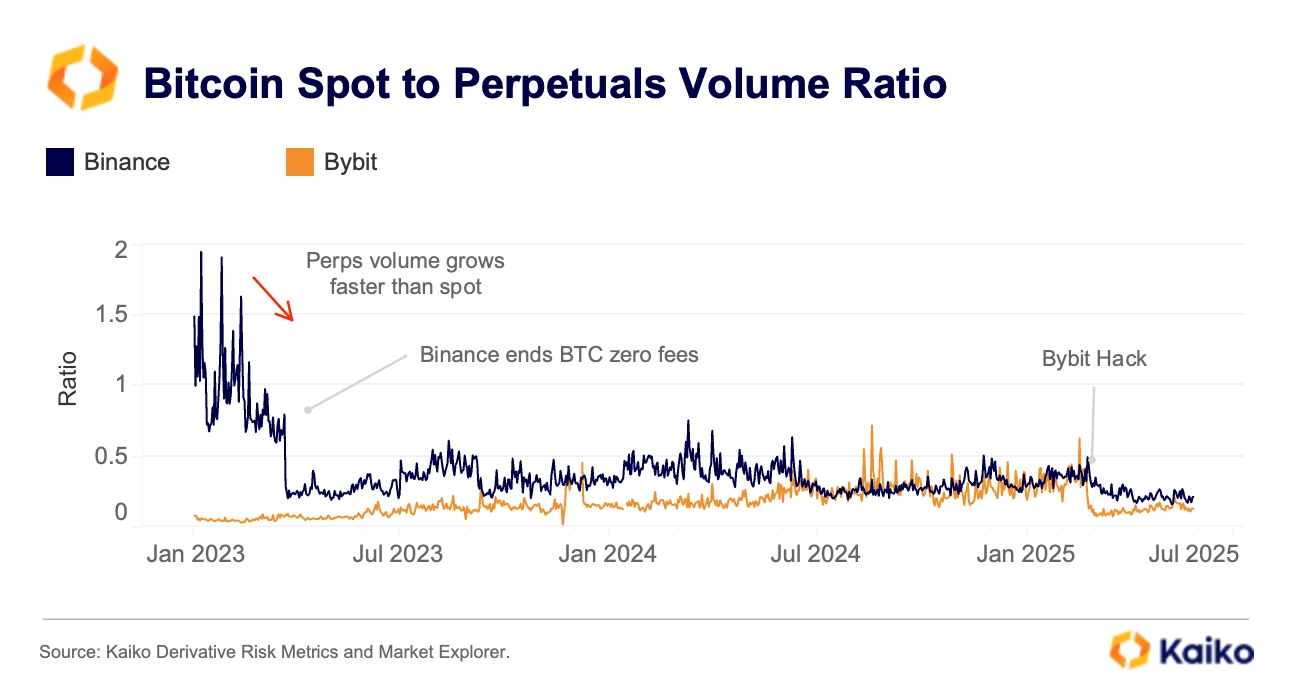

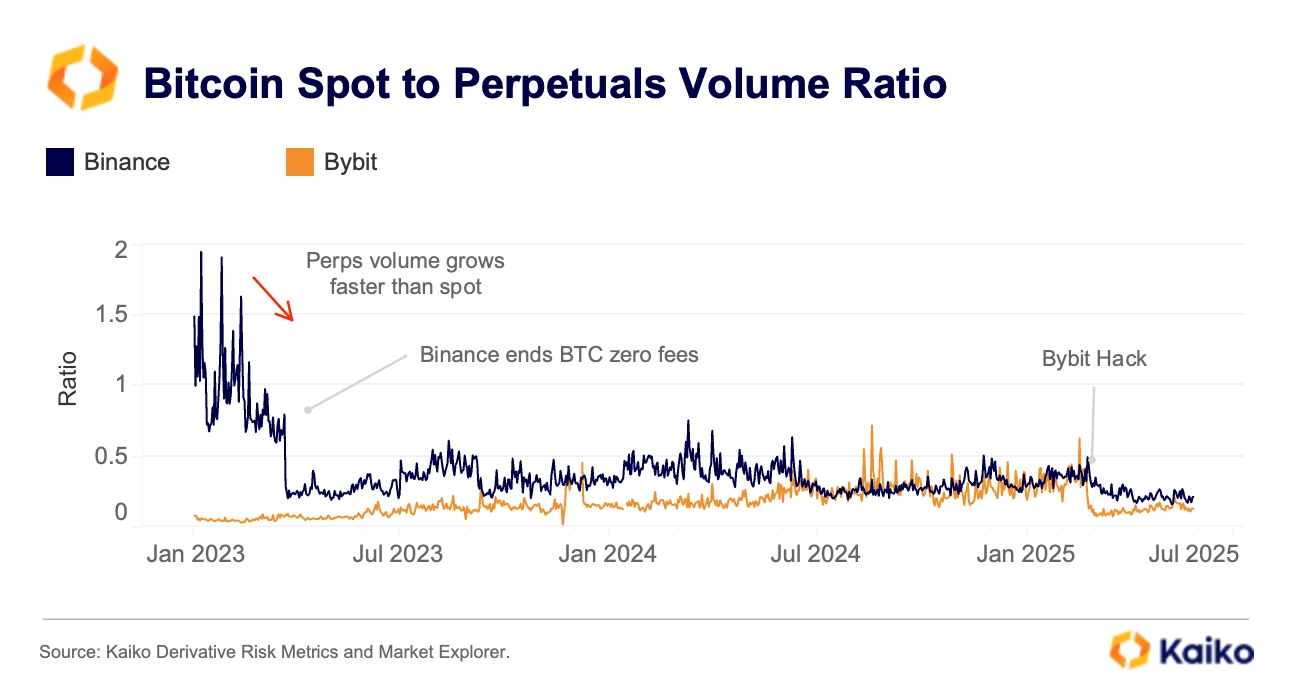

Perpetual futures volumes routinely eclipse spot volumes by a wide margin on offshore exchanges, and that gap has only widened in recent weeks. The Bitcoin spot-to-perps volume ratio hit a multi-year low on both Binance and Bybit at the end of May. The ratio declines when perpetual futures volumes grow faster than spot, indicating that derivatives have taken the lead in market activity during the recent period of macro volatility.

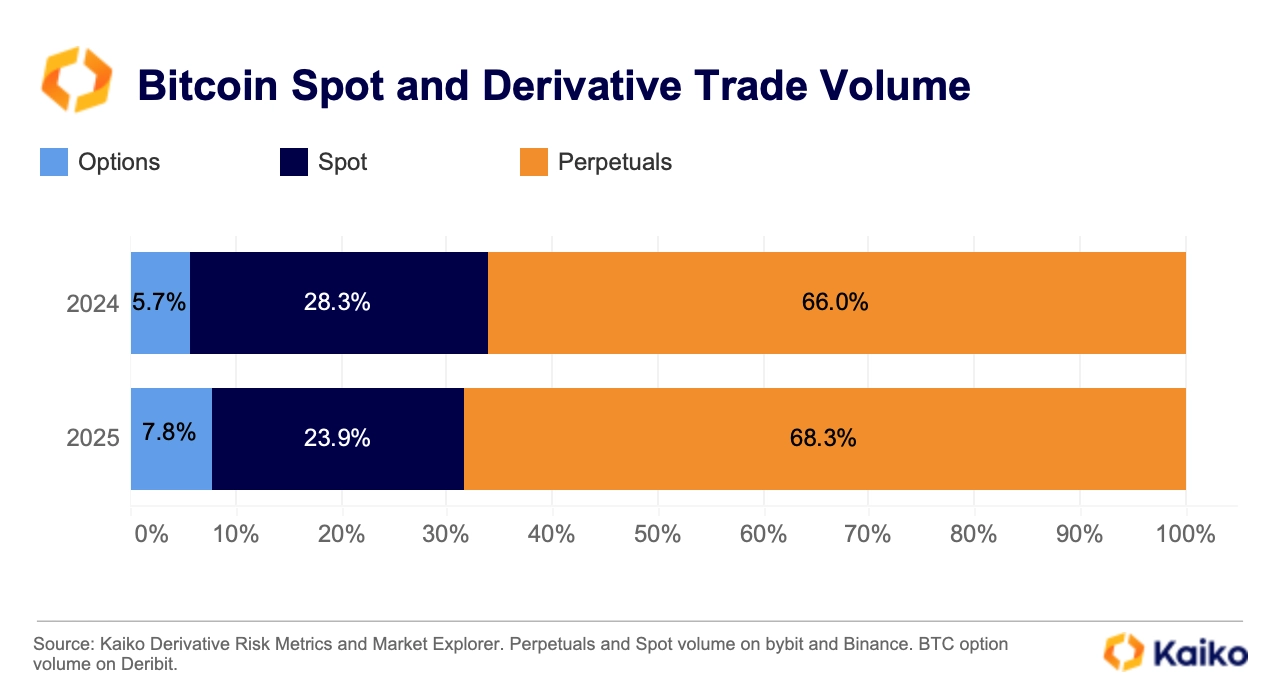

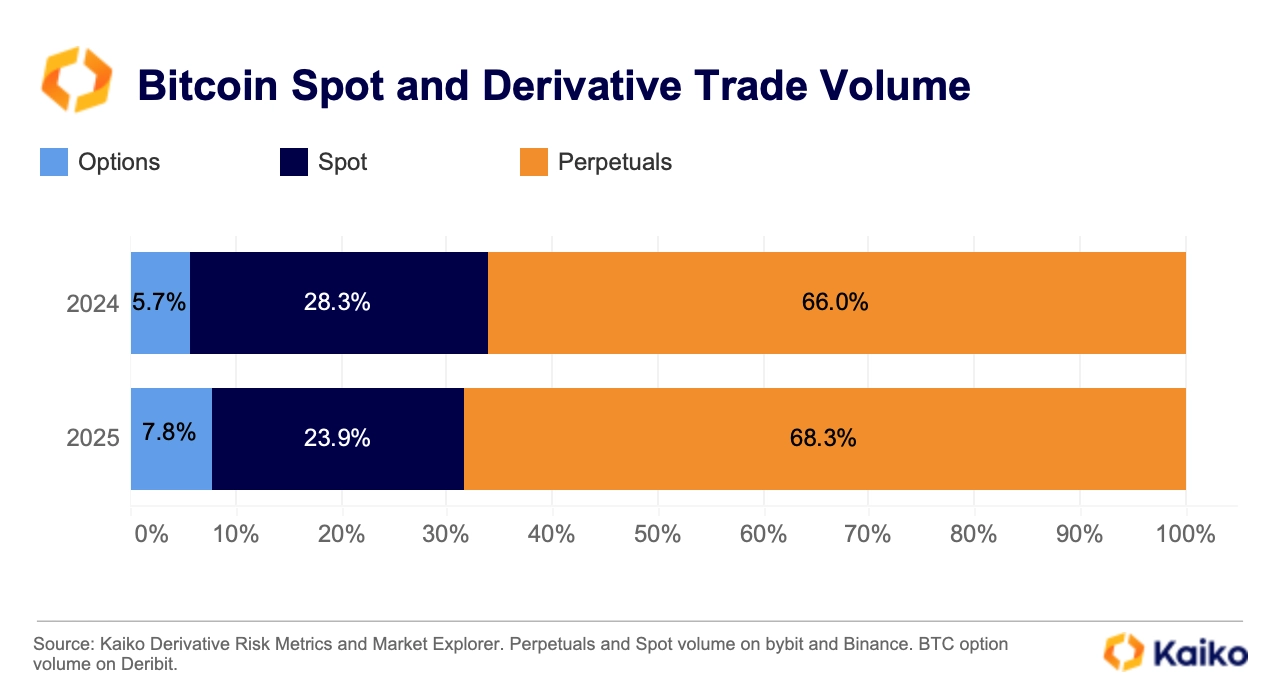

Overall, perpetual futures on Bybit, Binance, and Deribit accounted for 66% of total crypto trading volume in 2024, dwarfing spot (28%) and options (6%). This dominance has only increased in 2025, as traders increasingly favor derivatives.

As the U.S. regulatory stance toward crypto evolves, competition in the crypto derivatives market is heating up. U.S.-based exchanges are working to bring more of this trading onshore, under regulated frameworks. At the same time, strengthening derivatives offerings is key to capturing a larger share of global trading activity, where derivatives dominate volumes.

Coinbase began expanding into derivatives in 2022, but the effort has accelerated recently. Major acquisitions, such as Coinbase’s $2.9 billion purchase of Deribit and Kraken’s $1.5 billion deal for NinjaTrader, highlight the push to challenge offshore dominance and grow both domestically and abroad.

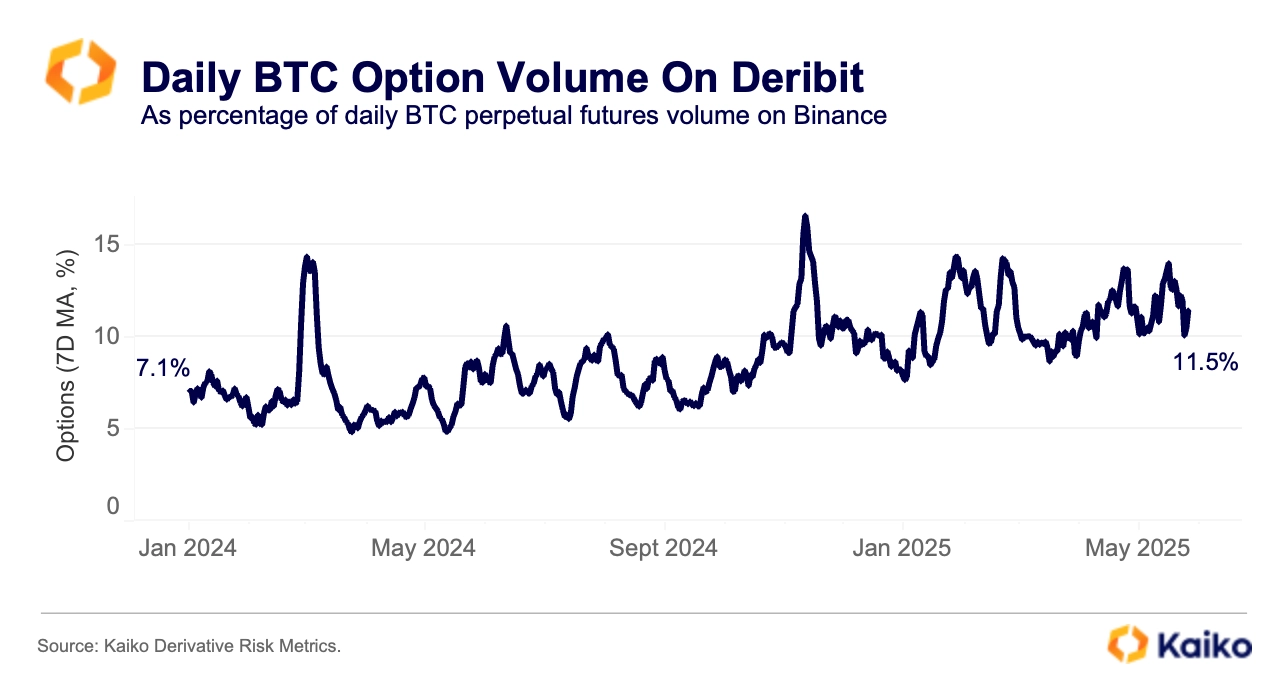

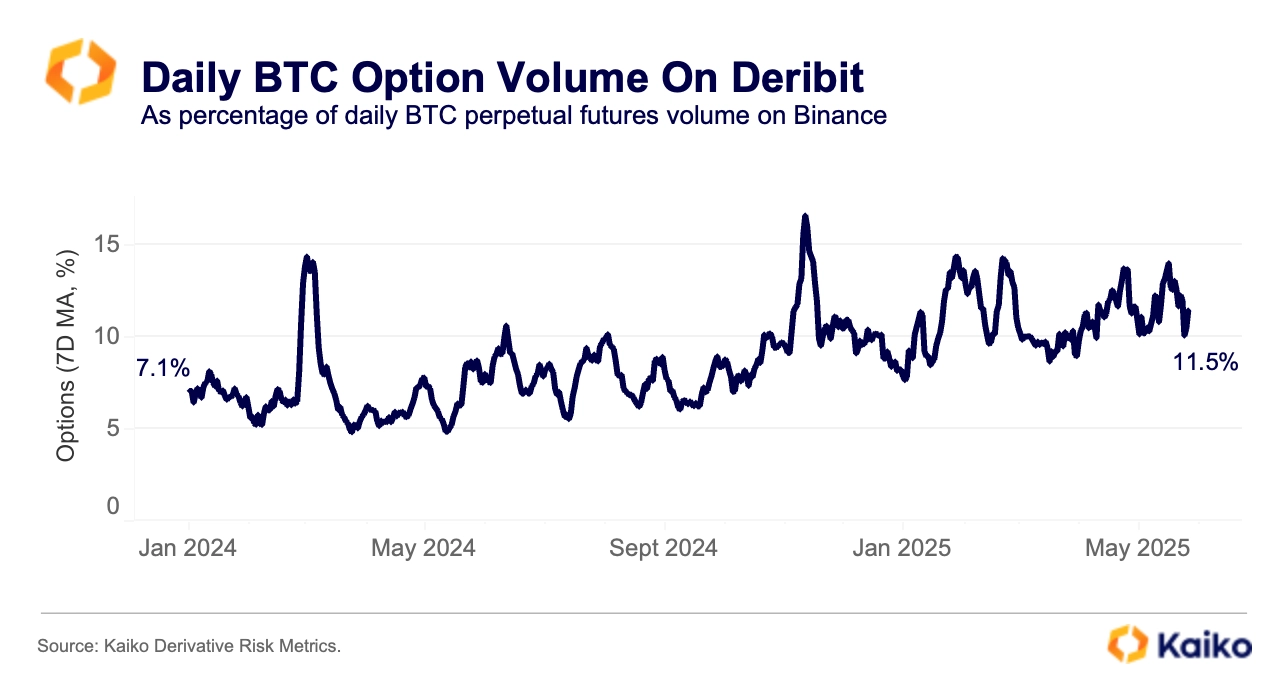

Bitcoin option market matures.

The share of Bitcoin options in overall crypto derivatives trading has been steadily rising, signaling growing market sophistication. While perps remain the dominant crypto derivative, Bitcoin options on the largest options market, Deribit, have increased their share relative to perps on Binance from just 7% in early 2024 to a peak of 17% in November, before settling around 12% as of last week.

This steady growth suggests that BTC options are no longer a niche tool used solely for speculative punts. They are increasingly being used for hedging, yield enhancement, and structured strategies, particularly among more sophisticated participants.

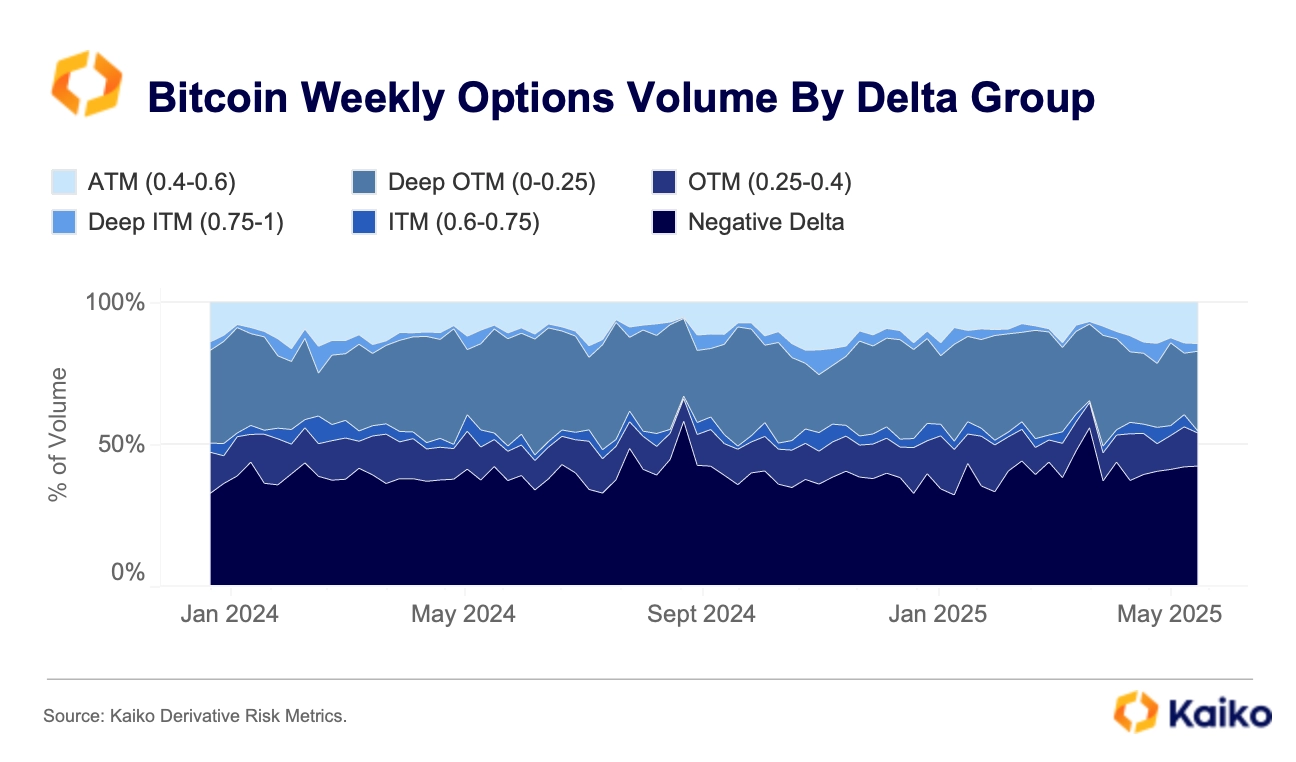

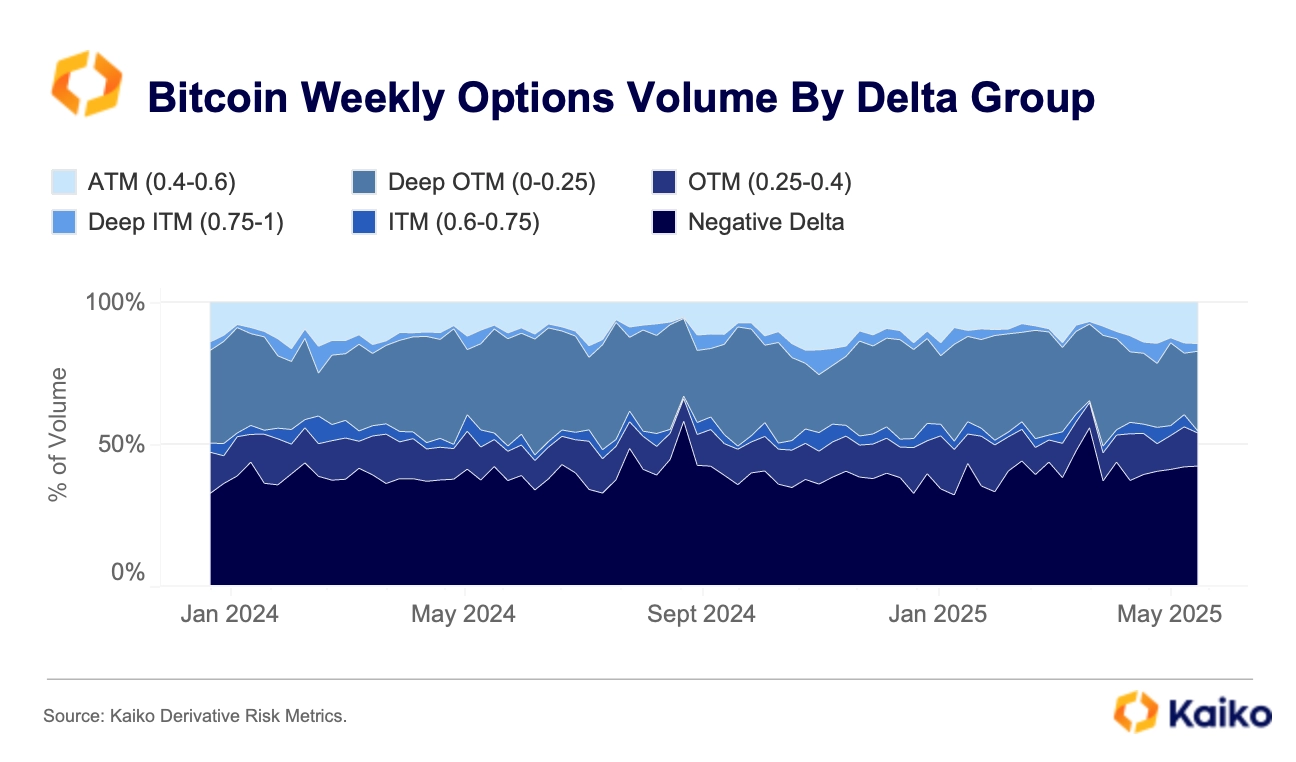

Digging deeper, the distribution of trading volumes across delta buckets reveals further insights into trader behavior. Delta measures how much an option’s price moves relative to the underlying asset, with a 0.5 delta typically indicating an at-the-money (ATM) option.

Unlike traditional markets, which lean heavily on ATM options for hedging, Bitcoin options markets are characterized by significant demand for out-of-the-money (OTM) calls. This indicates that many traders are speculating on large price gains and seeking cheaper ways to bet on Bitcoin going up.

At the same time, the high share of negative delta options, which gain when Bitcoin falls, points to persistent defensive positioning and strong hedging demand.

This context is important when analyzing other risk metrics, such as the shape of the IV smile or dealer positioning. Dealer hedging activity can significantly influence spot price movements during periods of volatility. For a deeper dive into analytics and crypto-specific risk management metrics, explore our IV report.

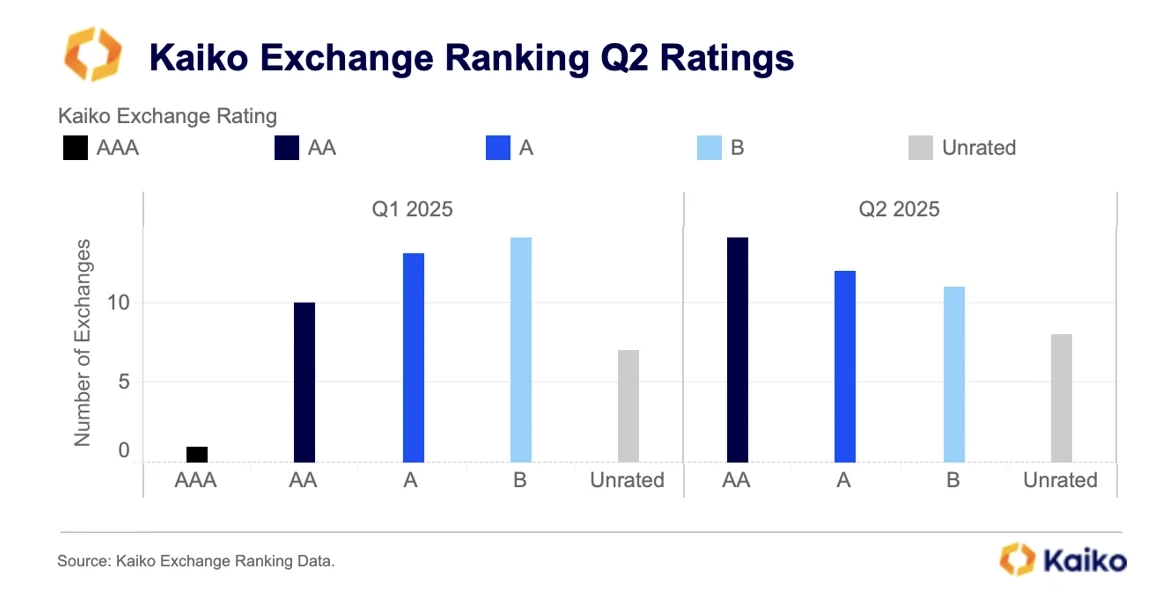

Kaiko Exchange Ranking Results.

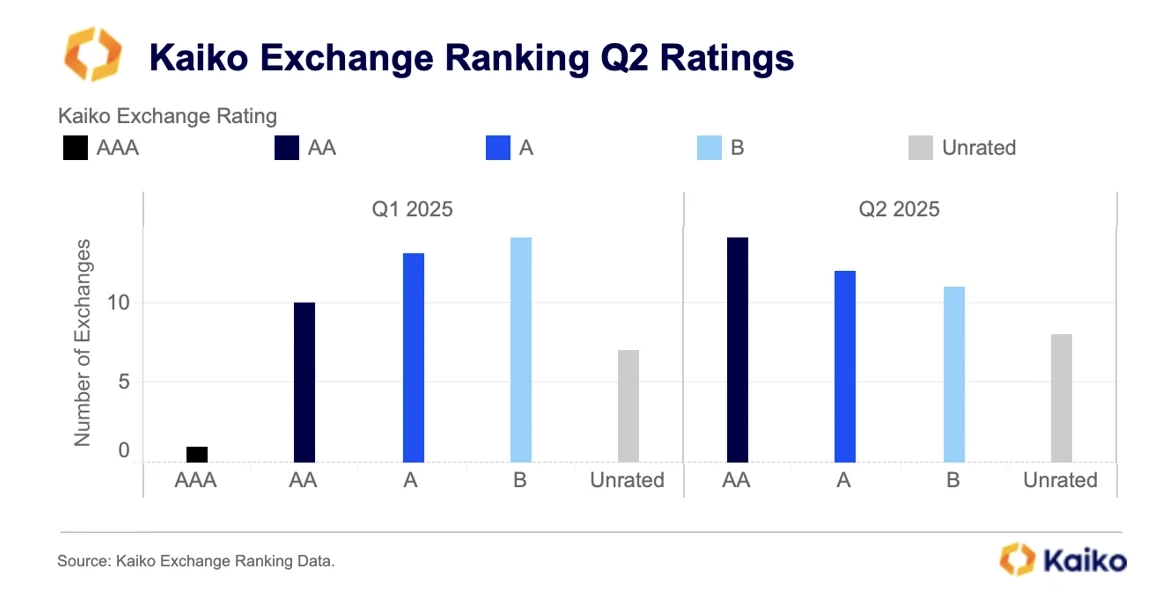

This quarter, 45 spot exchanges were evaluated as part of the Kaiko Exchange Ranking. Coinbase topped the list with a score of 90, while all exchanges in the top ten scored above 79. In fact, nine out of ten earned an AA rating.

Each exchange’s rating is determined by its overall and individual scores, ensuring an objective and transparent assessment across the industry. No exchange achieved the highest AAA rating this quarter. Check out the full ranking here.

What the Kaiko Research Team is Reading This Week:

![]()

![]()

![]()

![]()