Trend of the Week

USDC outpaces Rivals.

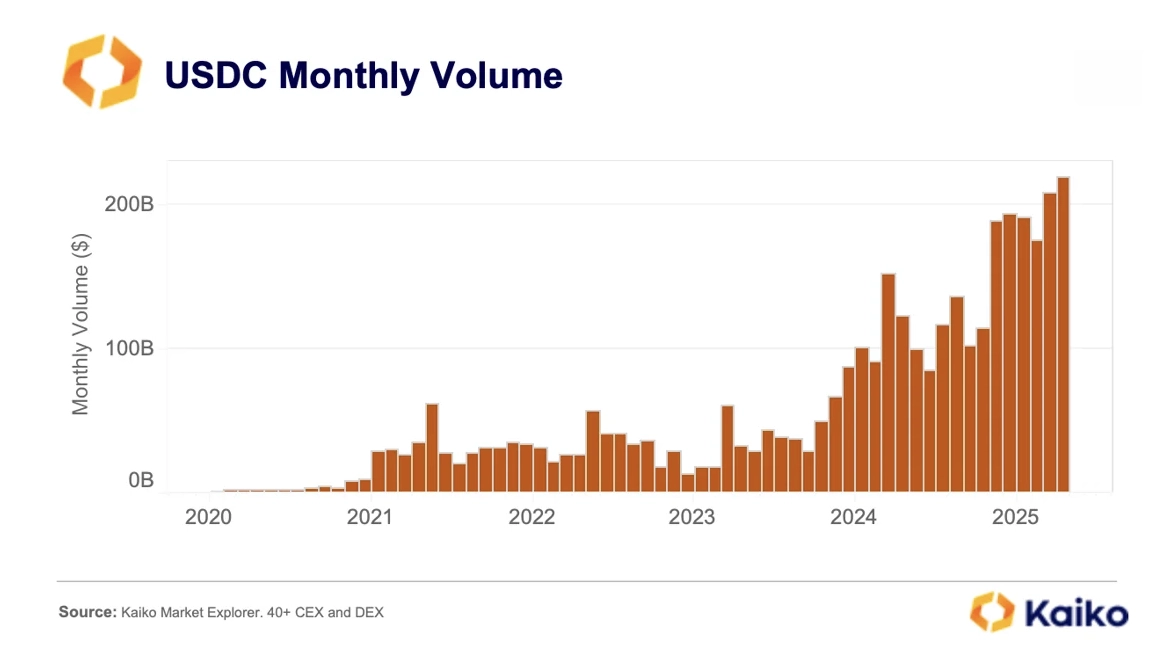

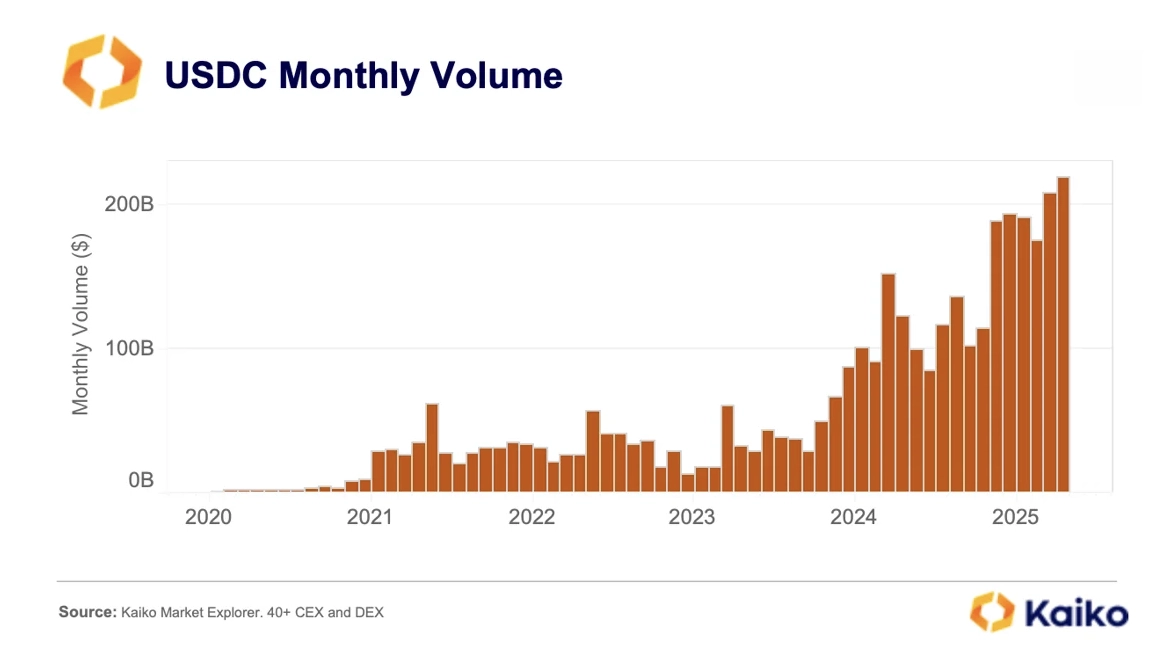

Despite broader macro headwinds—and reports that Circle may delay its IPO following the April 2025 Liberation Day tariff shock—USDC is bucking the trend. It set back-to-back volume records in March and April, surging to $219 billion last month—more than double its level in January 2024.

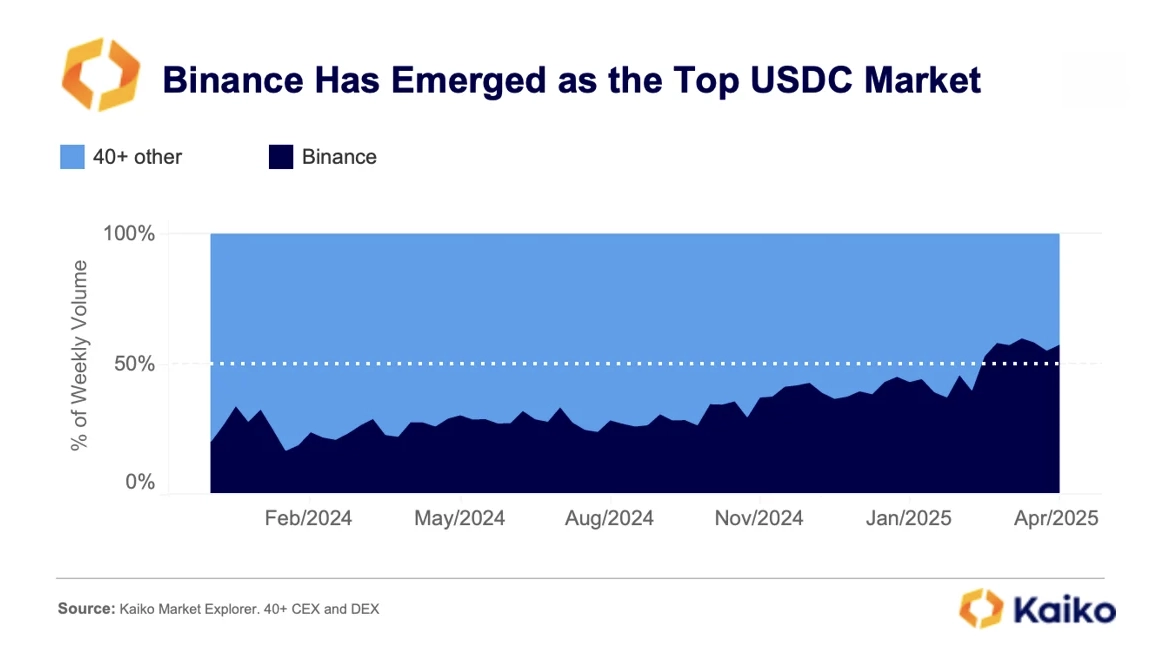

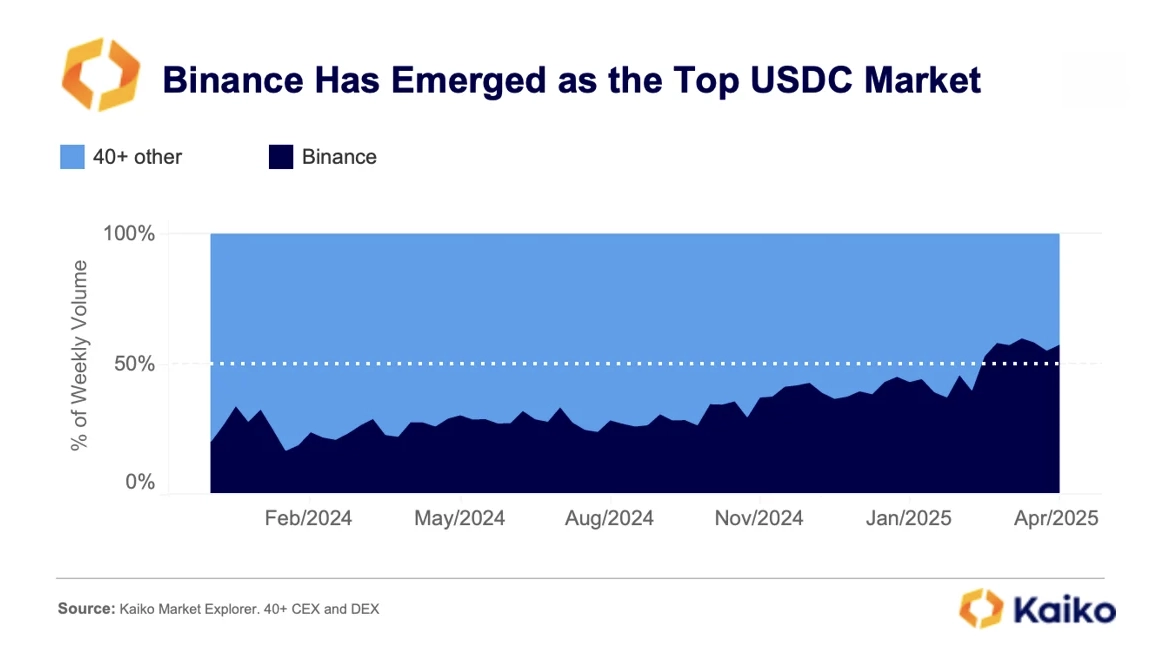

The key driver? Binance. The exchange now drives over 57% of global USDC volume, following a strategic partnership with Circle last December. The move comes as stablecoin competition heats up, with Paxos launching USDG in December 2024 and offering partners like Galaxy and Robinhood a share of stablecoin revenues.

The deal is also highly profitable for Binance, with Circle paying over $60 million upfront plus ongoing incentives, while aligning with Binance’s compliance push under Europe’s MiCA rules.

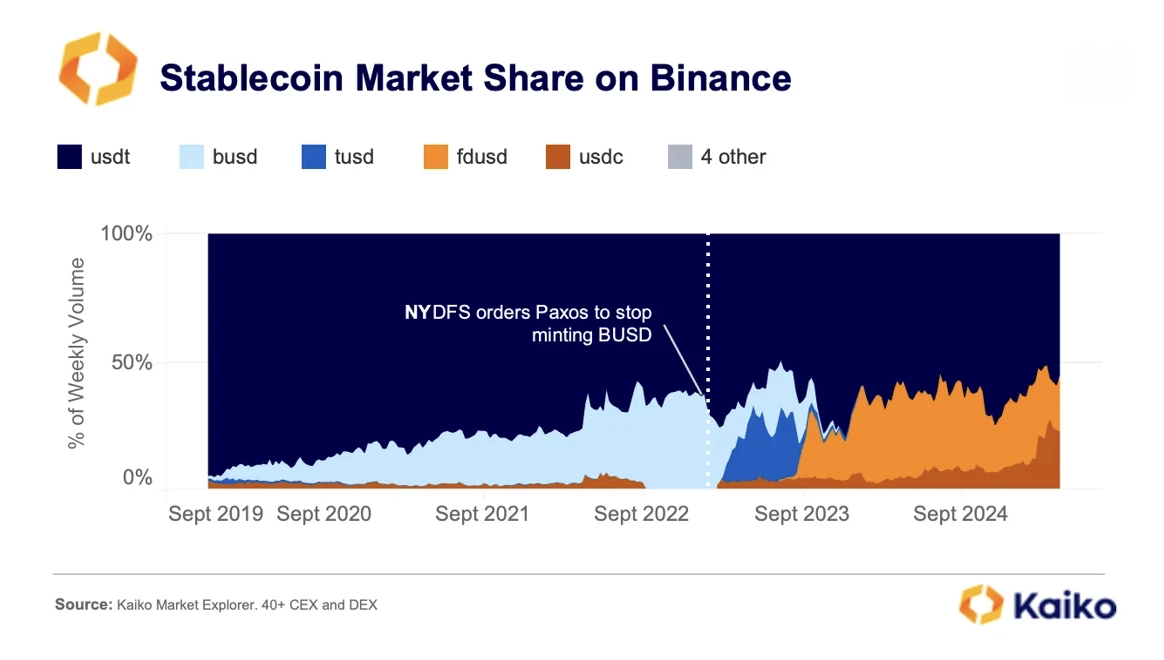

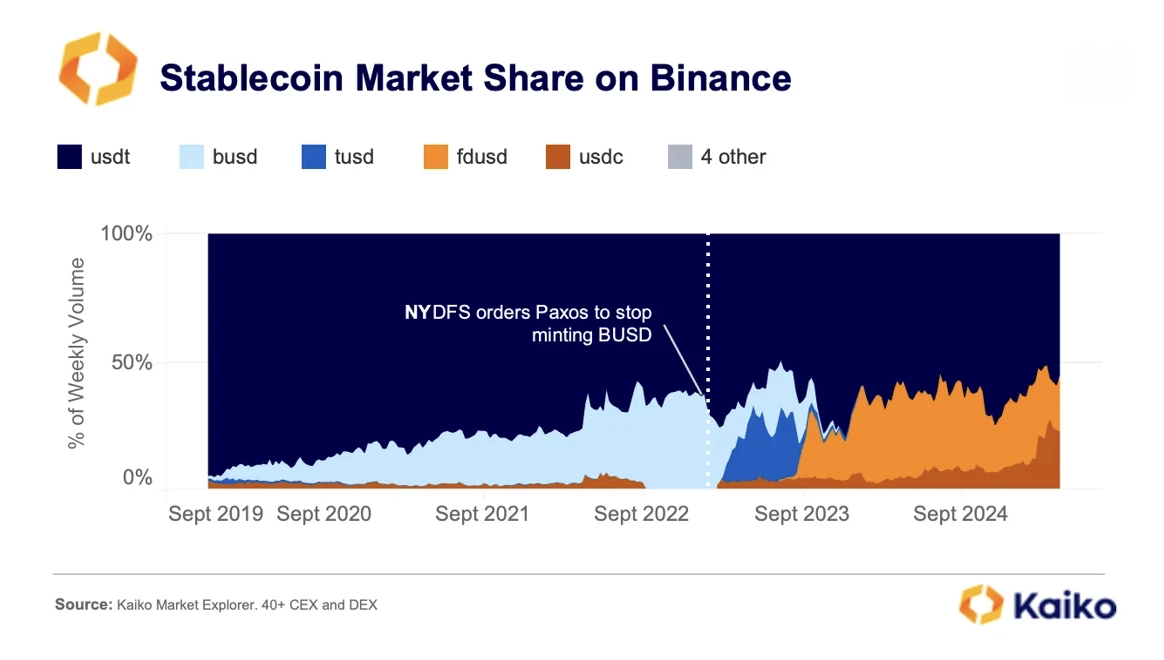

As the world’s largest crypto exchange, Binance, has long been a force in stablecoin flows. It had previously leaned heavily on its own stablecoin BUSD issued in partnership with Paxos, until New York regulators halted new issuance in early 2023.

Since then, it’s pivoted to alternatives like FDUSD and TUSD, propping them up with zero-fee trading and staking perks via tools like Binance Launchpool.

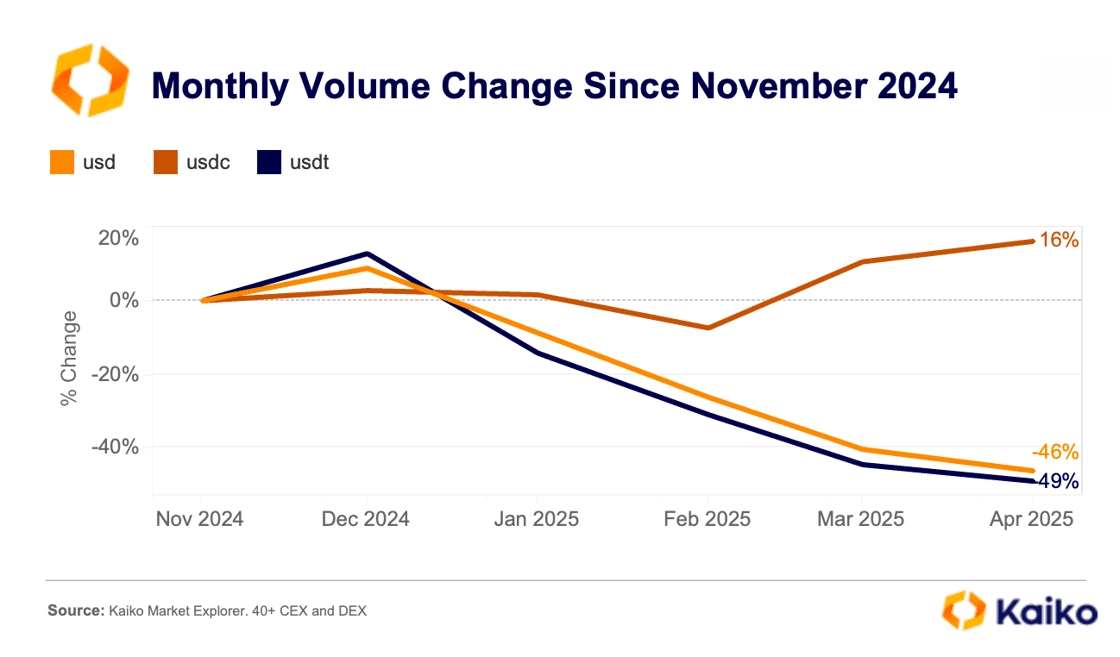

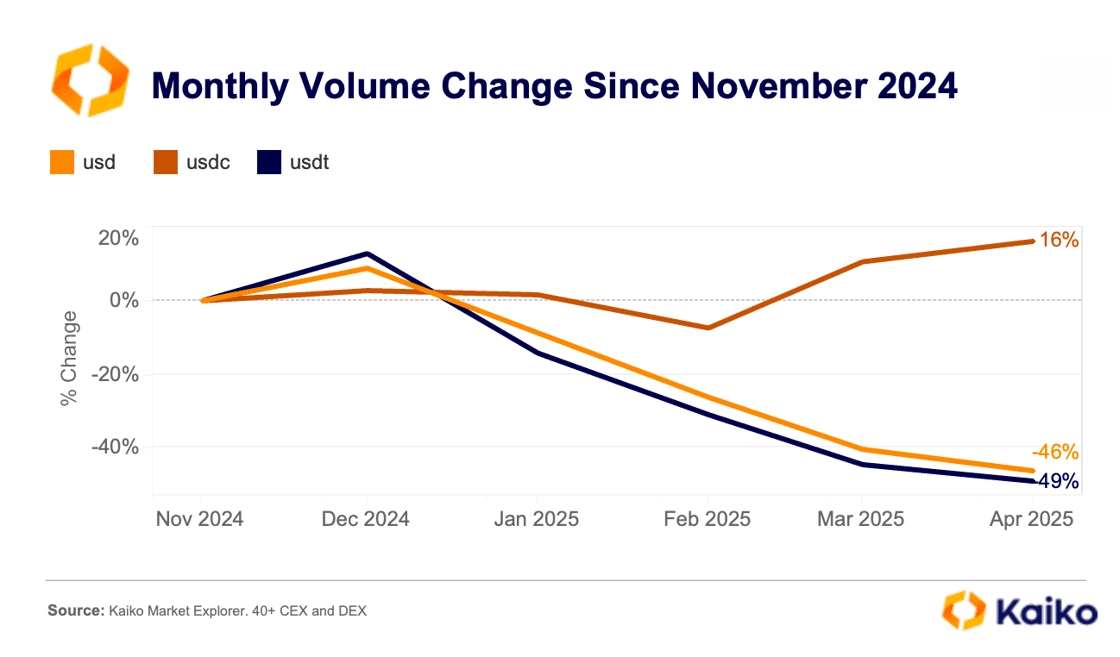

While USDC is gaining momentum on centralized exchanges, Tether’s USDT is facing headwinds. USDT trading volumes on CEXs have dropped sharply—nearly halving between November 2024 and April 2025—mirroring a broader contraction in USD-denominated trading activity. This decline reflects persistent risk-off sentiment, weaker retail engagement, and limited speculative appetite across crypto markets.

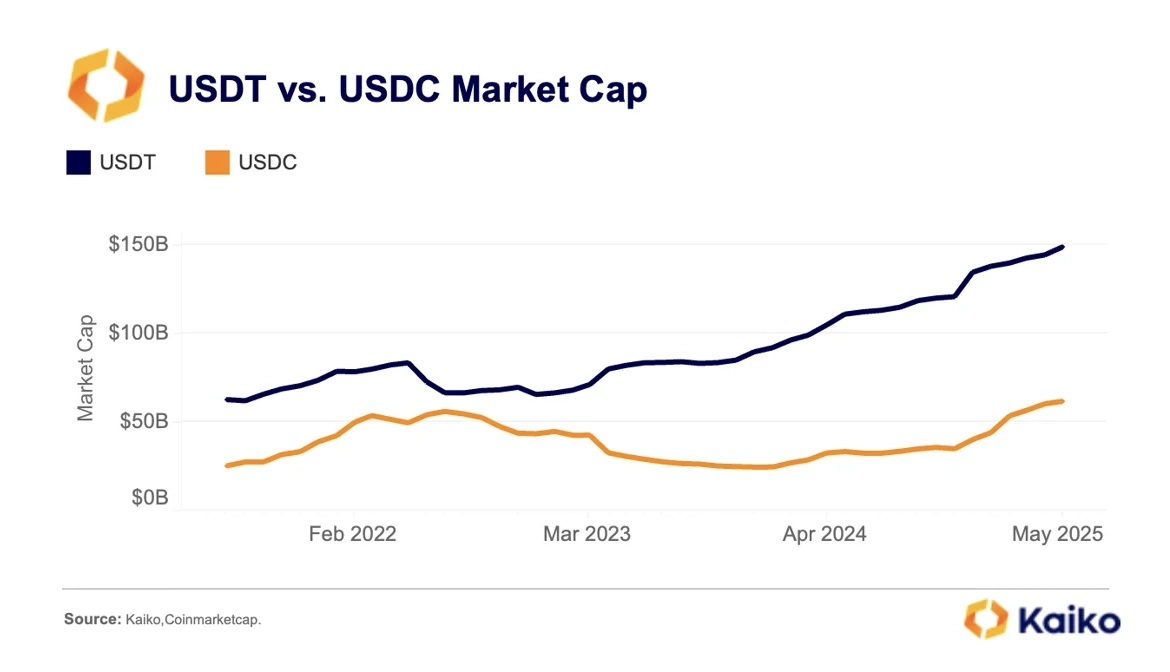

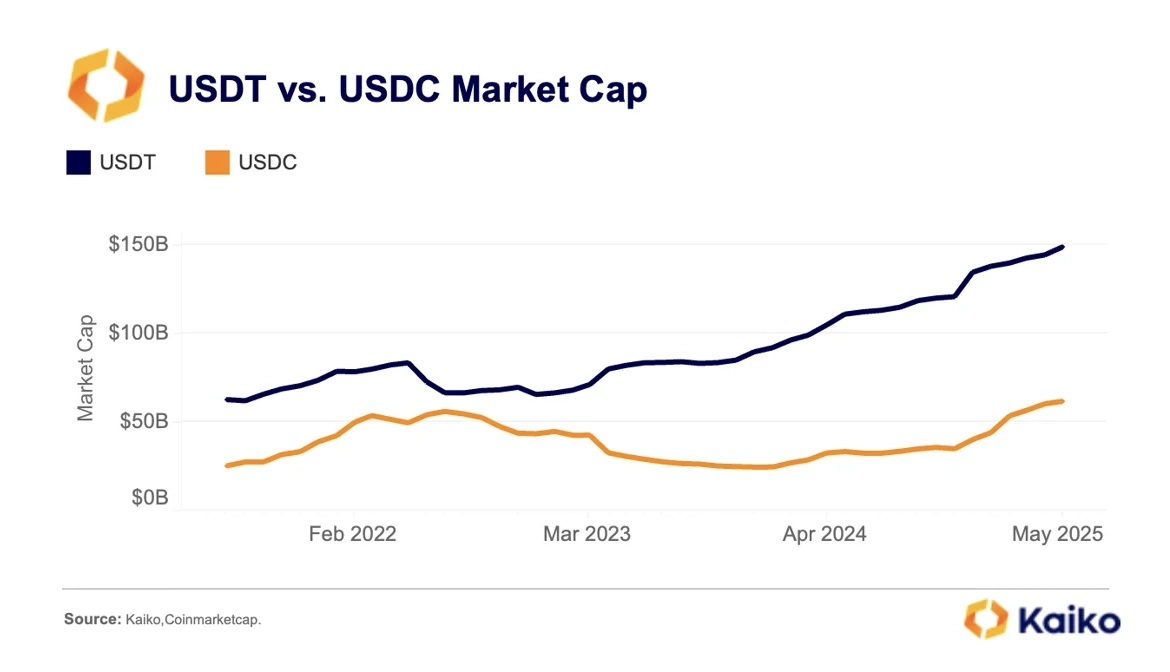

However, the stablecoin market cap tells a more nuanced story. USDT’s market cap has grown 19% since November, reaching $148 billion. The company behind it, Tether, also remains highly profitable, reporting $1 billion in operating profit for Q1 2025 and paying $2.3 billion in dividends—far surpassing Circle’s $150 million profit for all of 2024.

This suggests growing demand for USDT in off-exchange uses like cross-border payments. In March, Tron, which is favored in remittance-heavy regions for its low fees and speed, reclaimed the lead in USDT issuance. The blockchain currently hosts 71 billion tokens, compared to 65 billion on Ethereum.

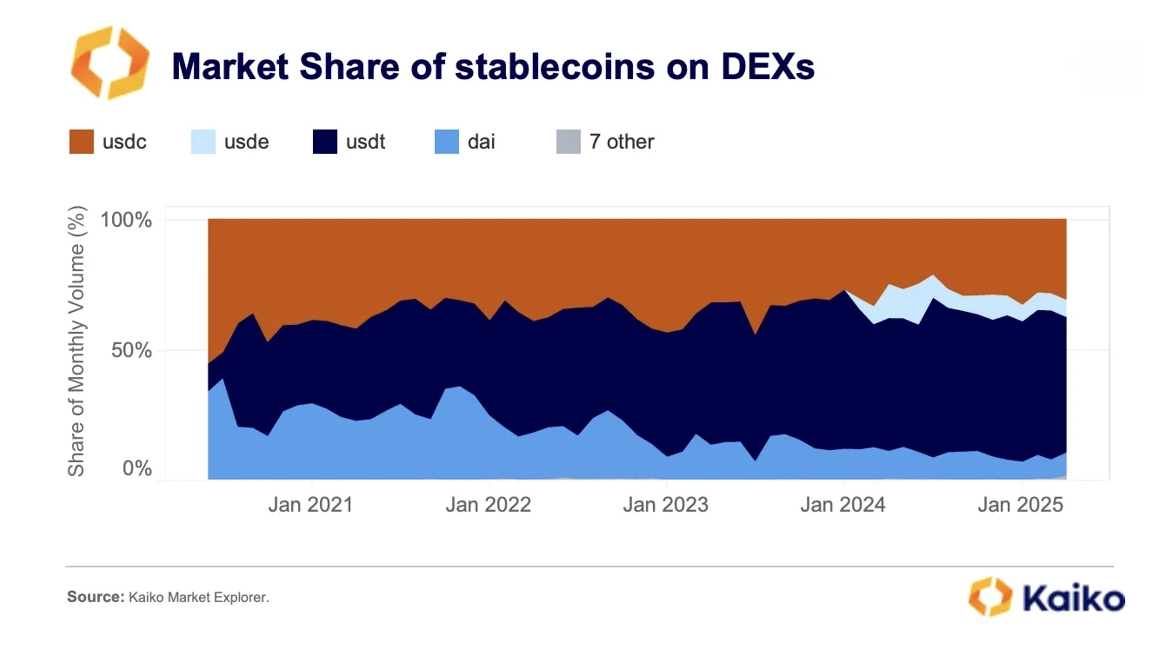

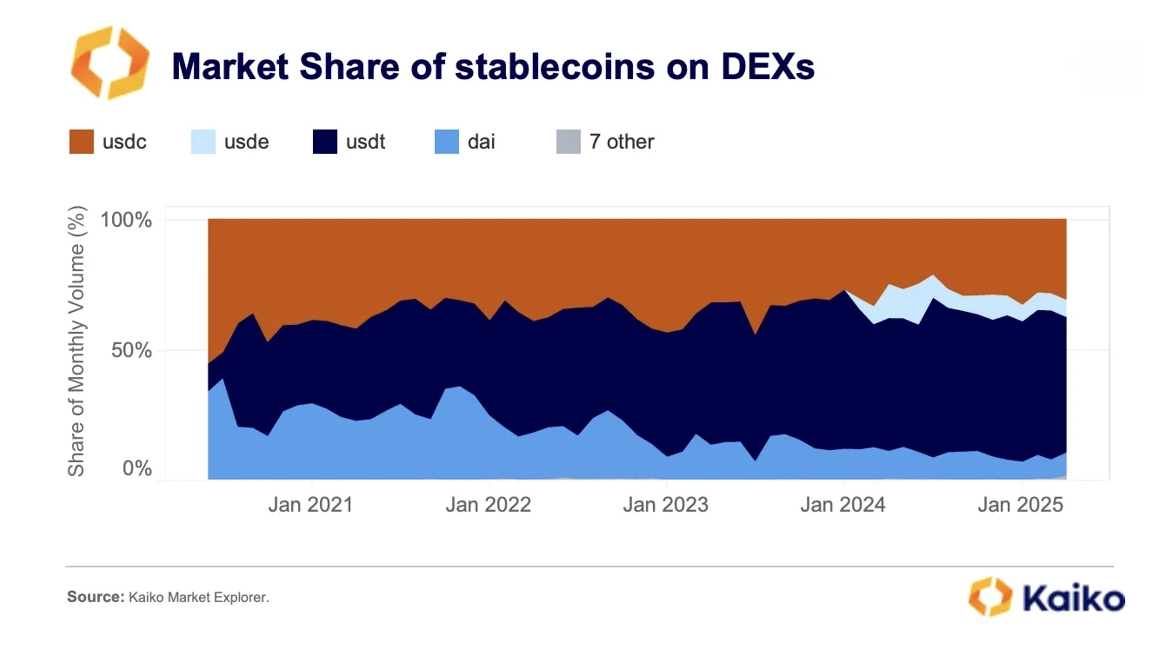

On-chain stablecoin competition is also heating up. USDC’s market share on DEXs has dropped from over 40% to around 30% in the past year, with new challengers such as Ethena’s synthetic USDe and USDtb, which are tokenized Treasury-backed assets, gaining ground.

These yield-bearing stablecoins are becoming increasingly popular in decentralized lending protocols, where their ability to serve as productive collateral offers an edge over traditional, non-yielding stablecoins.

Data Points

EUR Stablecoins are rising but lagging.

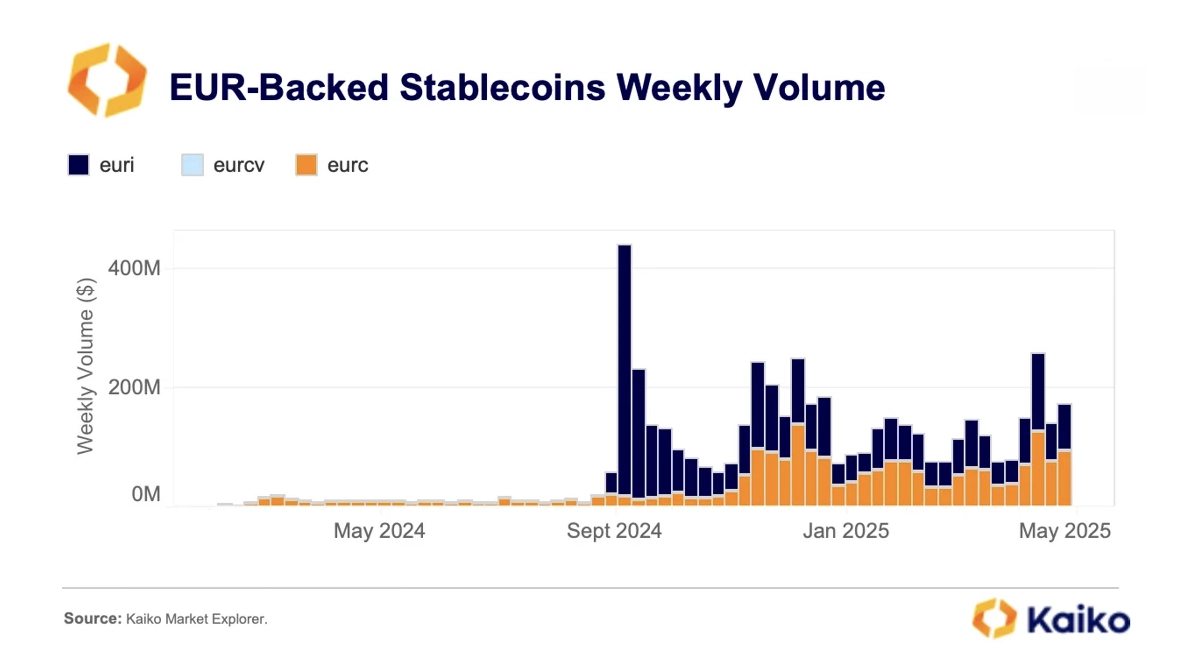

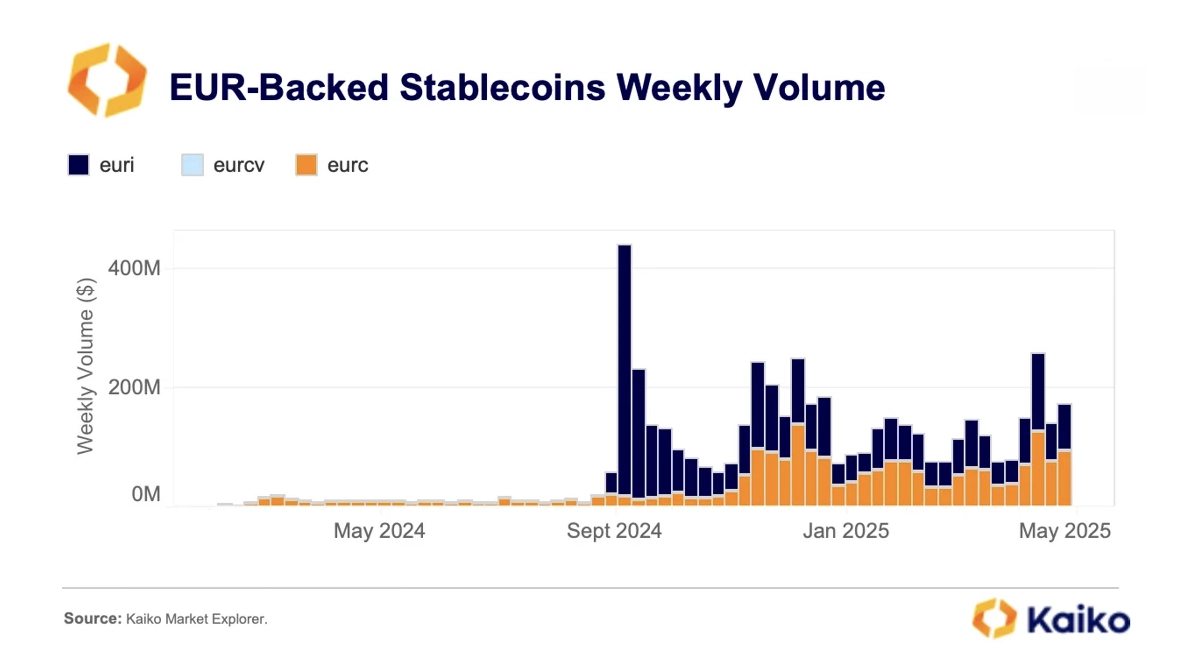

EUR-backed stablecoins have seen rapid growth, but remain a small fraction of the market. Average daily volumes reached $128 million in 2025—more than a 12x increase from $8 million in Q1 2024. Despite this, USD-backed stablecoins still dominate, averaging $48 billion in daily trade volume.

The market share of EUR-backed stablecoins peaked near 2% in September 2024 following Binance’s listing of Banking Circle’s EURI, but has since declined to just 0.3% in early May, staying below 0.4% for most of 2025.

In late April, reports emerged that the ECB is considering tighter MiCA oversight, citing financial stability concerns related to growing U.S. support for crypto. Regulators fear that widespread stablecoin adoption, as payments or as a store of value, could introduce risks through multiple channels: wealth effects from depegging events, reduced effectiveness of monetary policy, and accelerated capital outflows during periods of stress.

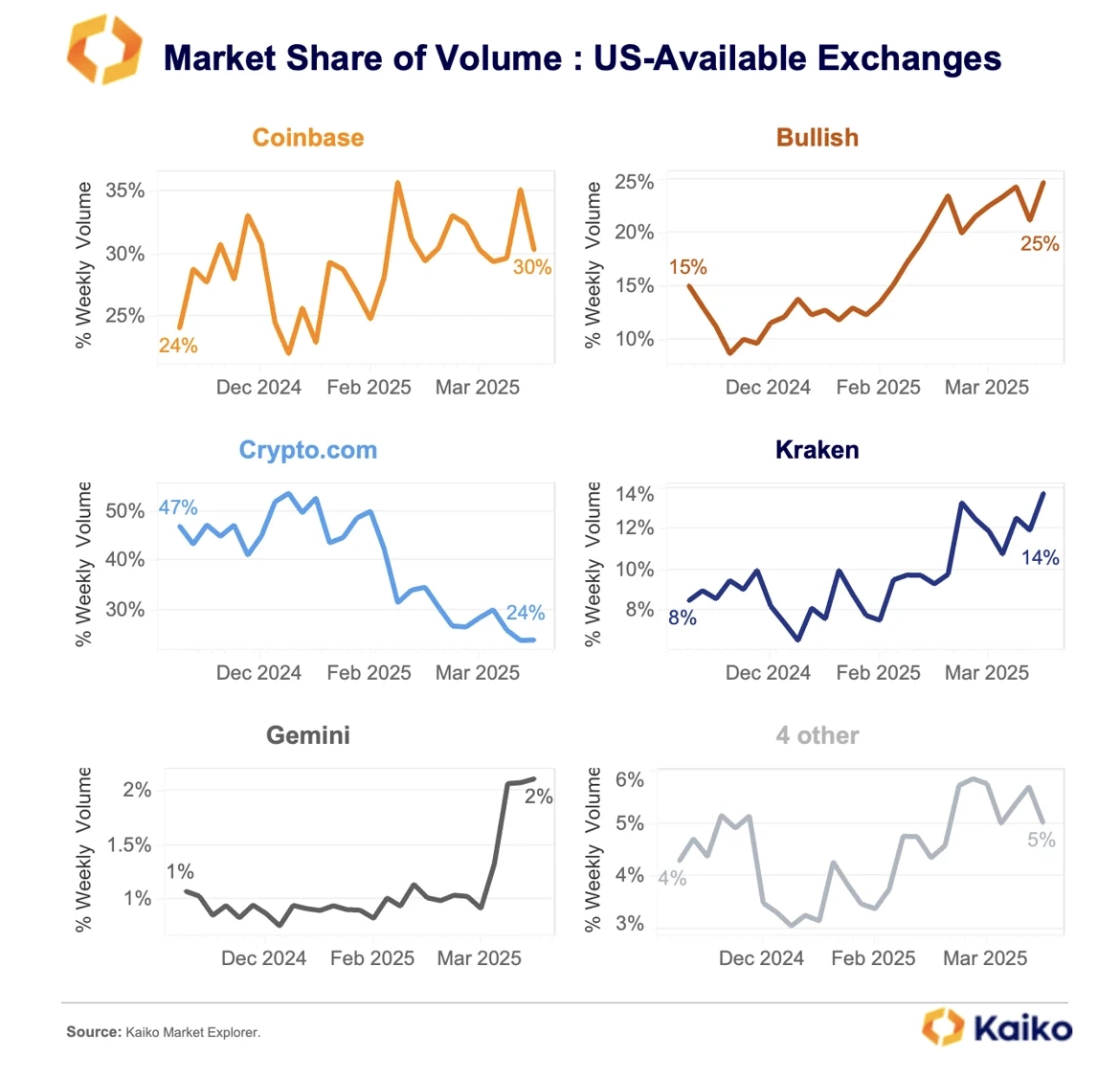

Coinbase and Bullish Are gaining as traders re-risk.

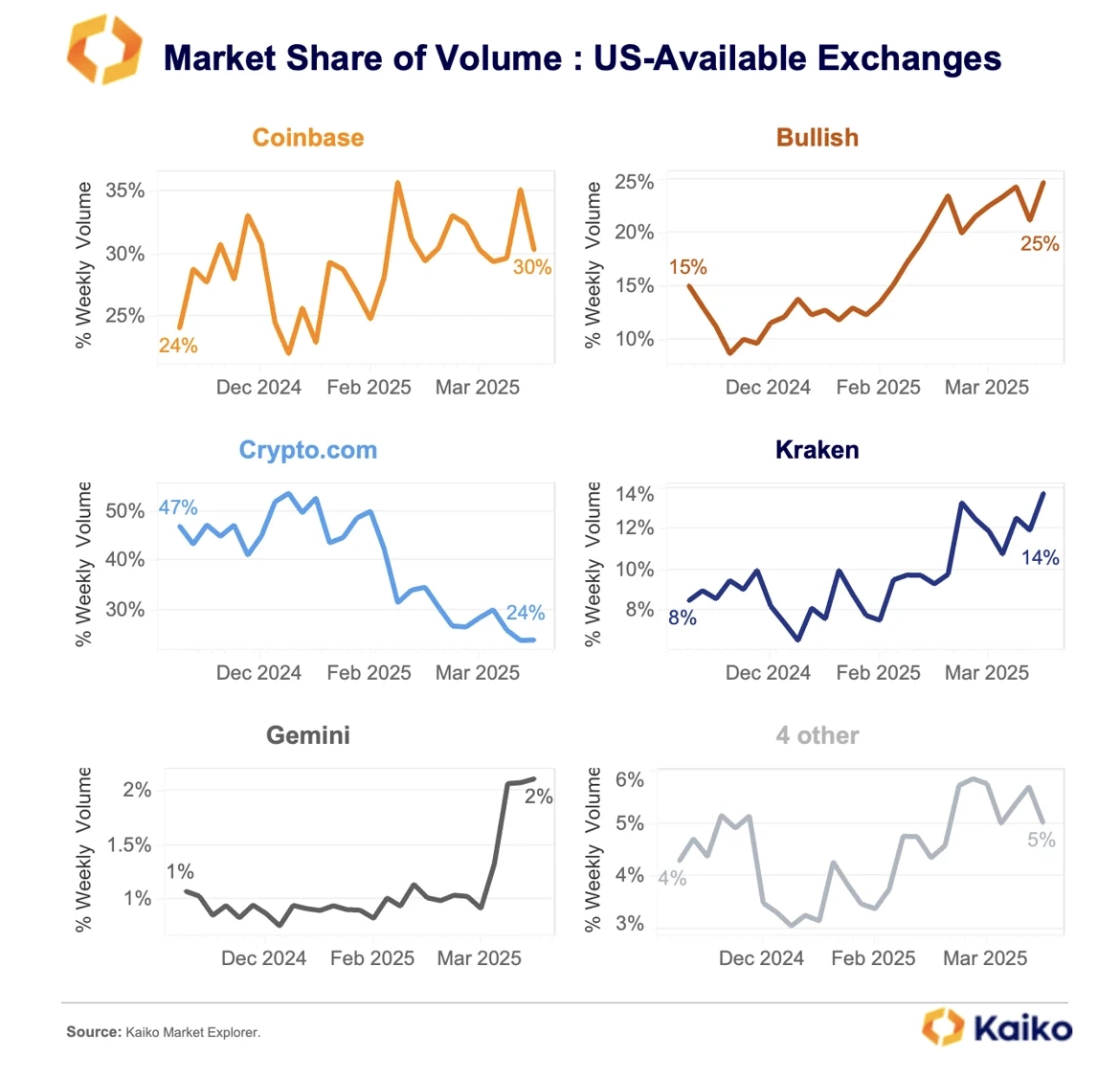

Coinbase and Bullish are emerging as the biggest beneficiaries of the recent wave of re-risking in crypto markets. Last week, Coinbase overtook Crypto.com to become the top U.S. exchange by market share, climbing to 30%, up from 24% in early November 2024.

Set to report Q1 earnings this week, Coinbase has remained profitable since Q4 2023. Still, it faces growing retail competition from Bullish and Crypto.com, which are attracting users with lower fees and faster token listings.

Bullish, in particular, has made strong gains. Its market share jumped from 15% in November to 25% by early May, driven largely by Bitcoin trading. BTC volumes now account for 60% of total trading on Bullish, up from 35% at the end of February.

In contrast, Crypto.com’s market share has fallen sharply since mid-February, mainly due to an 80% plunge in monthly ETH volumes relative to November. Even smaller players are seeing traction; Gemini, for instance, doubled its market share from 1% to 2% between March and April.

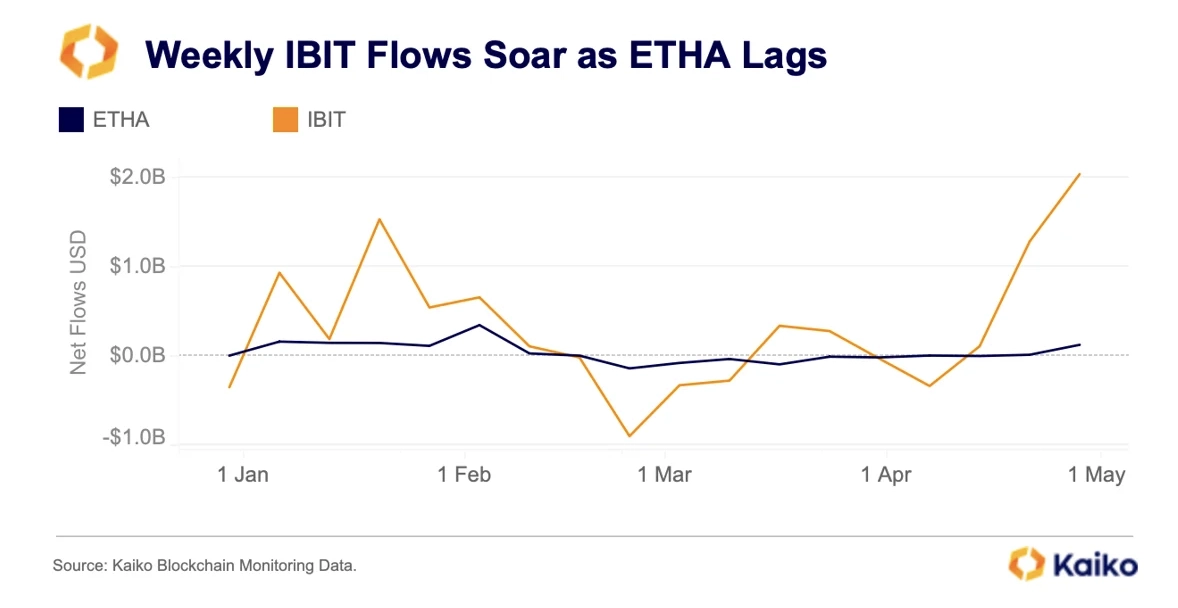

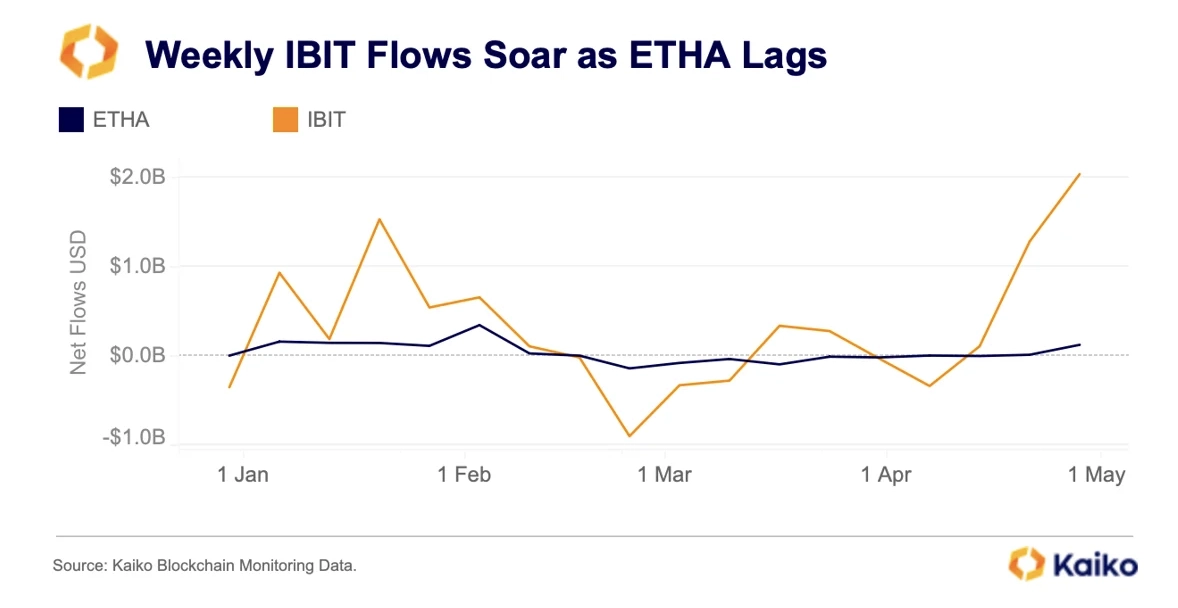

ETF Inflows.

IBIT flows spiked last week as BTC soared toward $100K again. BlackRock’s fund saw just over $2 billion in net inflows. This caps a strong rebound from the March lows, when net outflows dominated. The fund now holds over 3% of the entire BTC supply.

In contrast, BlackRock’s Ether fund, ETHA, has remained mostly flat throughout the year. This highlights the persistent divergence in investor demand between spot Bitcoin and Ether ETFs.

The stagnate flows into ETHA and other ETH ETFs mirror price action too. While other assets have set new record highs this year, like SOL, the rally has largely missed ETH.

![]()

![]()

![]()

![]()