Trend of the Week

Has Pectra reset ETH’s bull case?

On May 7, Ethereum made history by rolling out its largest upgrade to date in terms of Ethereum Improvement Proposals (EIPs). With 11 EIPs under the hood, Pectra takes direct aim at fast-rising competitors like Solana, which have gained traction with simpler staking, higher yields, and a smoother user experience.

Key changes include raising the validator cap from 32 to 2,048 ETH and enabling partial withdrawals (EIP-7251, EIP-7002)—a big win for institutional stakers seeking better capital efficiency and liquidity. On the UX front, EIP-7702 allows standard wallets to tap into smart contract capabilities like transaction batching and gas sponsorship. This enables third parties (smart contracts or dApps) to cover gas fees, with users repaying them using ERC-20 tokens, removing the need to own ETH to pay transaction fees.

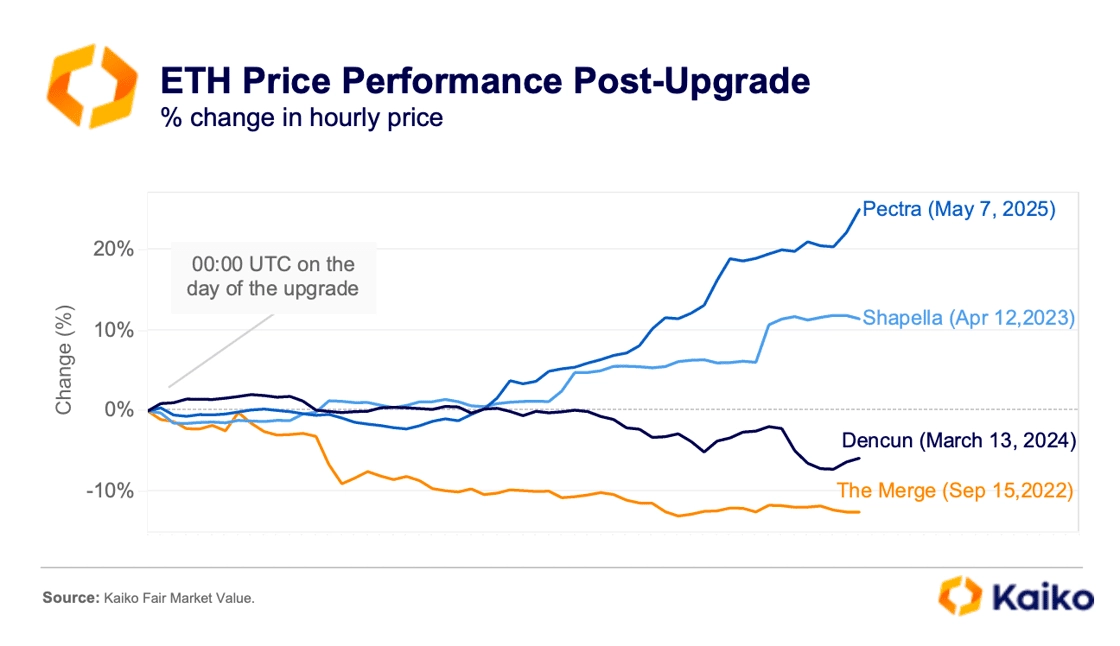

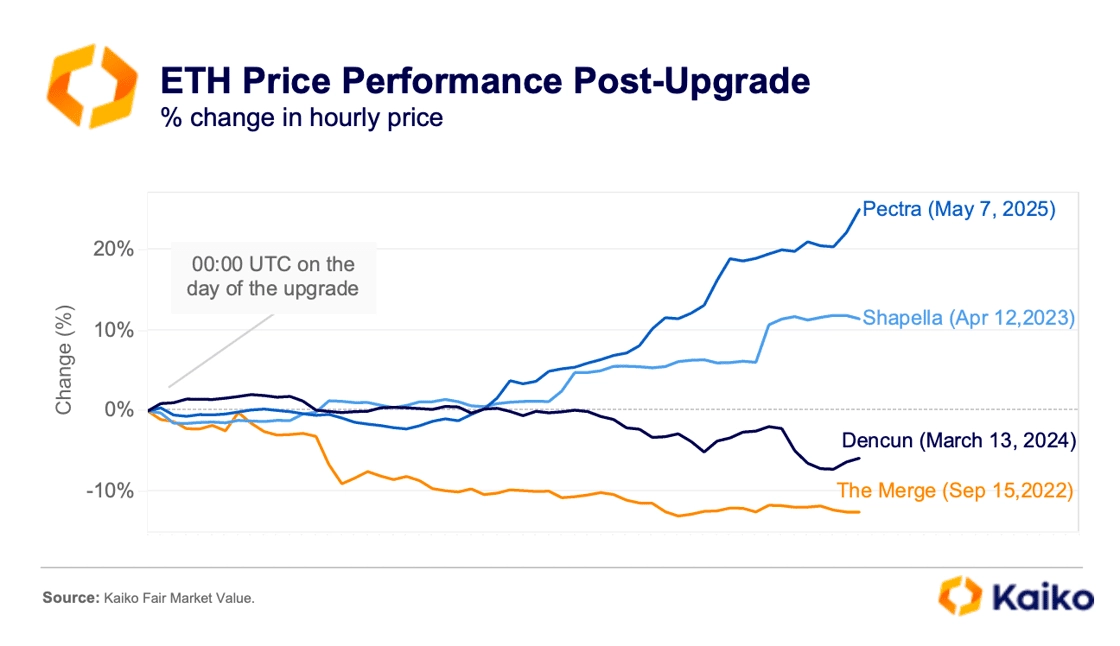

The market responded with a rally, catching many traders off guard. While historically, Ethereum upgrades have been classic “sell-the-news” events, Pectra defied that trend. ETH surged by 25% between May 7 and 9, marking the strongest post-upgrade performance to date.

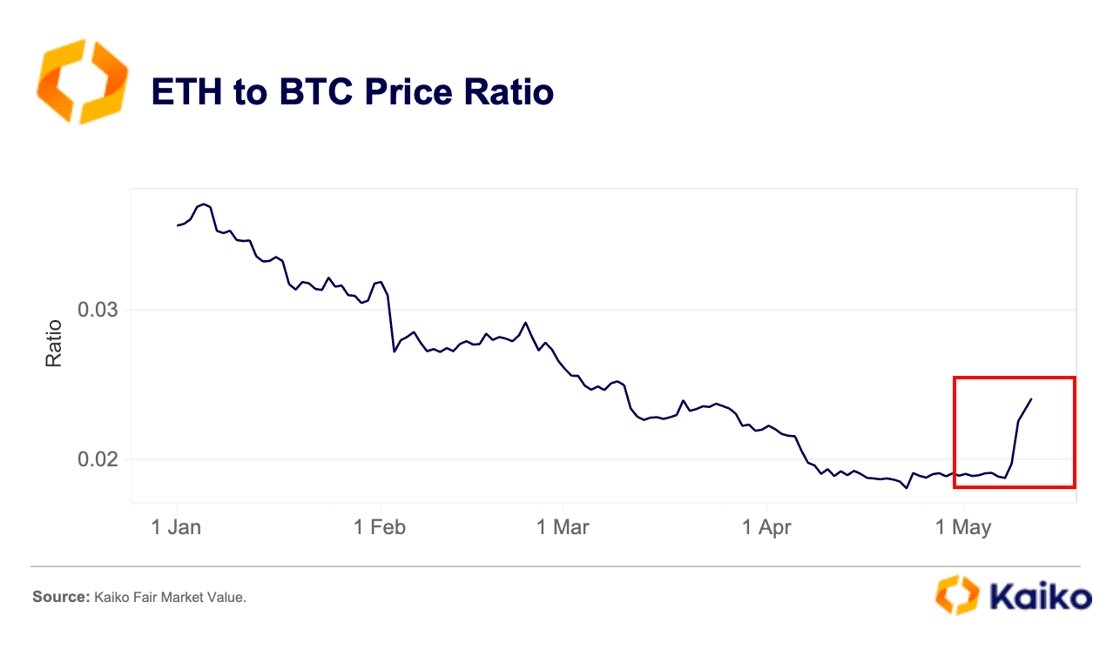

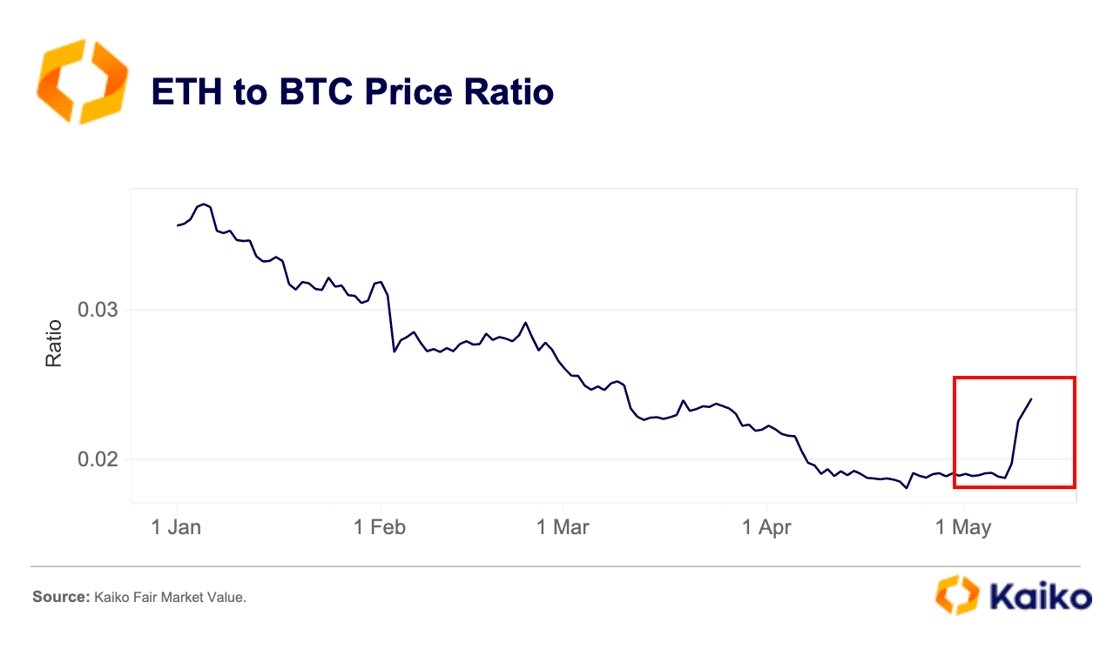

The rally was also supported by improving investor sentiment, boosted by the UK-US trade deal and a 90-day China-US ceasefire announced over the weekend. However, for the first time in months, ETH outperformed BTC on a relative basis, indicating that macro factors were not the main catalyst. The ETH/BTC ratio, which had been in steady decline since the Merge in 2022, rebounded from 0.019 to 0.024 last week.

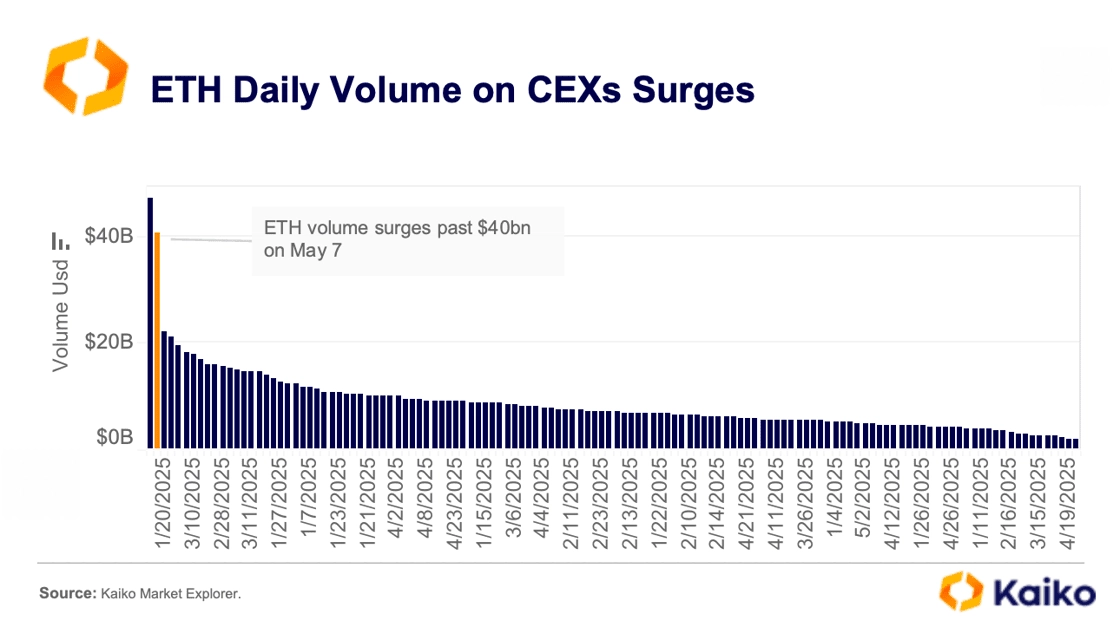

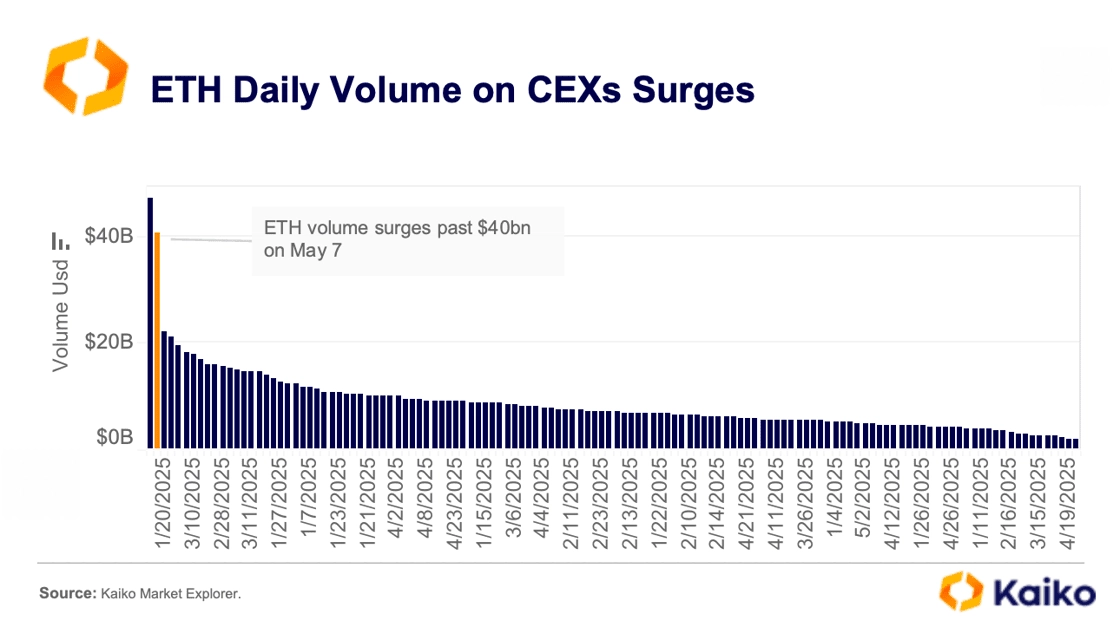

It’s not just prices: ETH daily trading volume on CEXs exceeded $40 billion on May 7, the second-highest level this year, surpassed only during the tariff-driven panic in February. Notably, both U.S. and offshore exchanges contributed to the spike, indicating demand from a diverse range of traders.

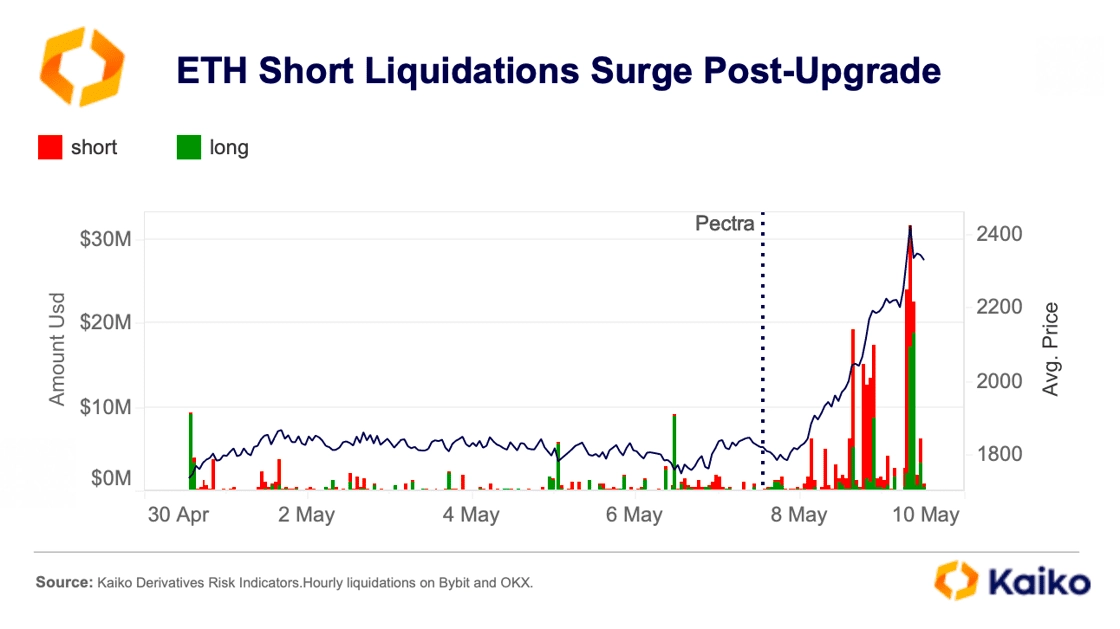

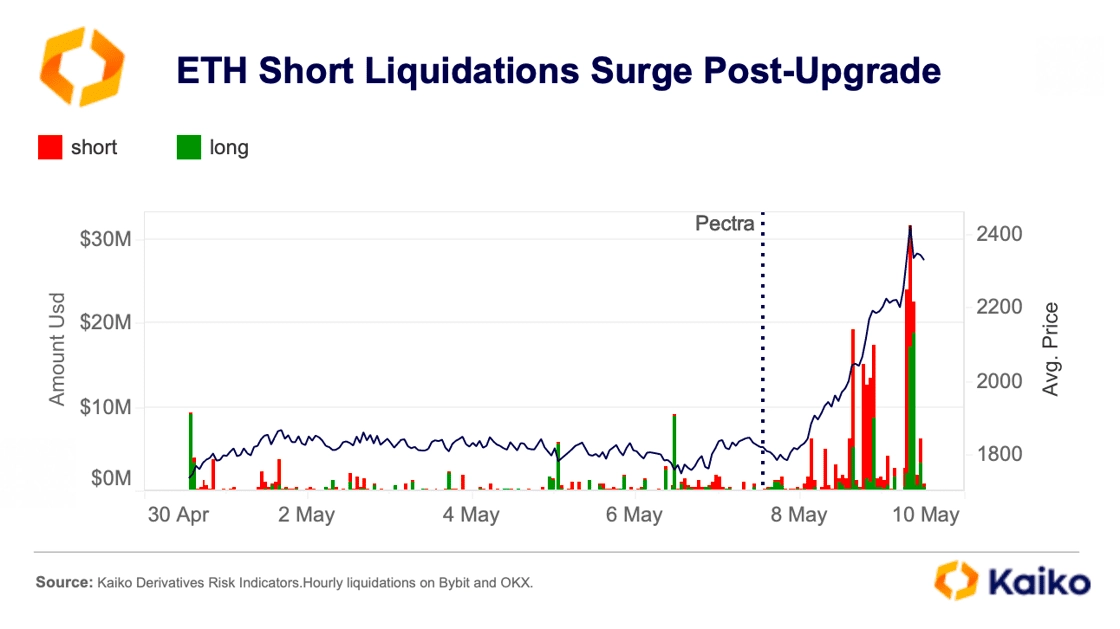

The shift in sentiment caught traders off guard. Following the upgrade, ETH funding rates flipped from negative to positive, leading to a wave of liquidations on OKX and Bybit as bearish traders were forced to unwind their losing positions.

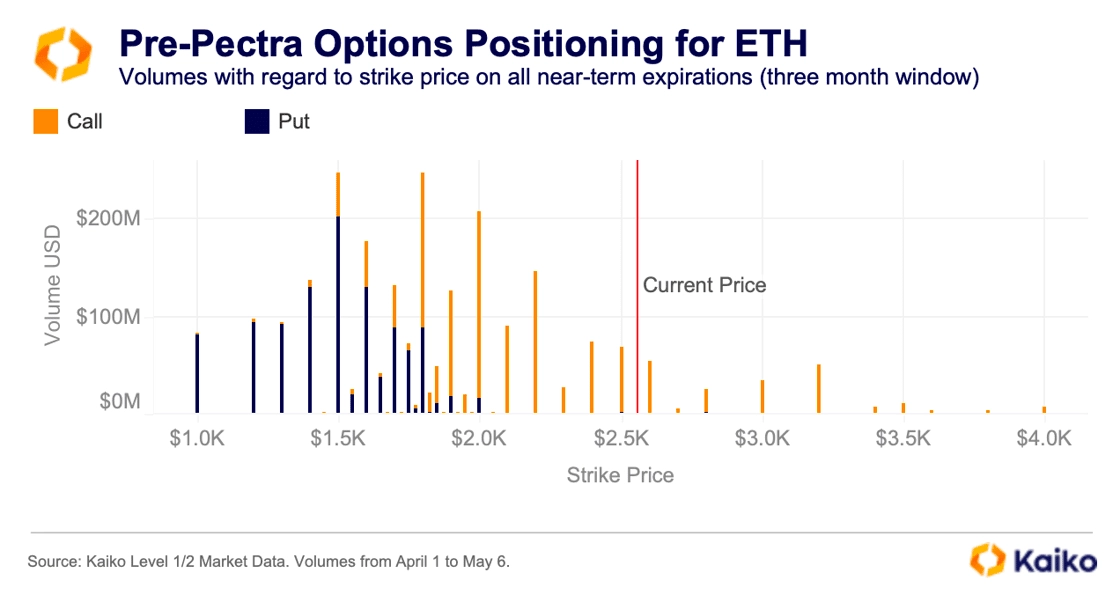

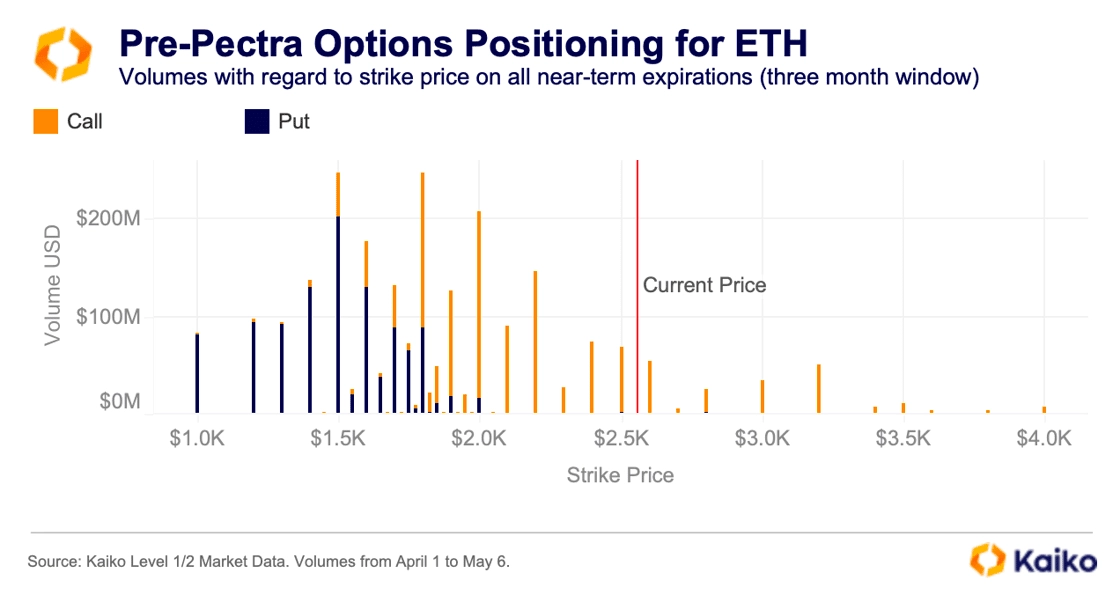

Trade volumes in ETH options markets before Pectra showed a lack of directional plays. Most volumes were centered around at-the-money puts or calls, with puts dominating as options traders apparently hedged against a potential drawdown after Pectra.

Only a small amount of attention was given to out-of-the-money calls above the $2k mark. However, the limited volume on these calls has now benefited massively as prices have soared above $2.5k since Pectra.

Beyond staking and user experience improvements, Pectra has revived Ethereum’s deflationary narrative. As network usage rebounded, total ETH burned from transaction fees has increased, outpacing issuance. Since early May, Ethereum’s circulating supply has declined by 0.1%, potentially signaling a period of deflation ahead if demand remains strong.

Data Points

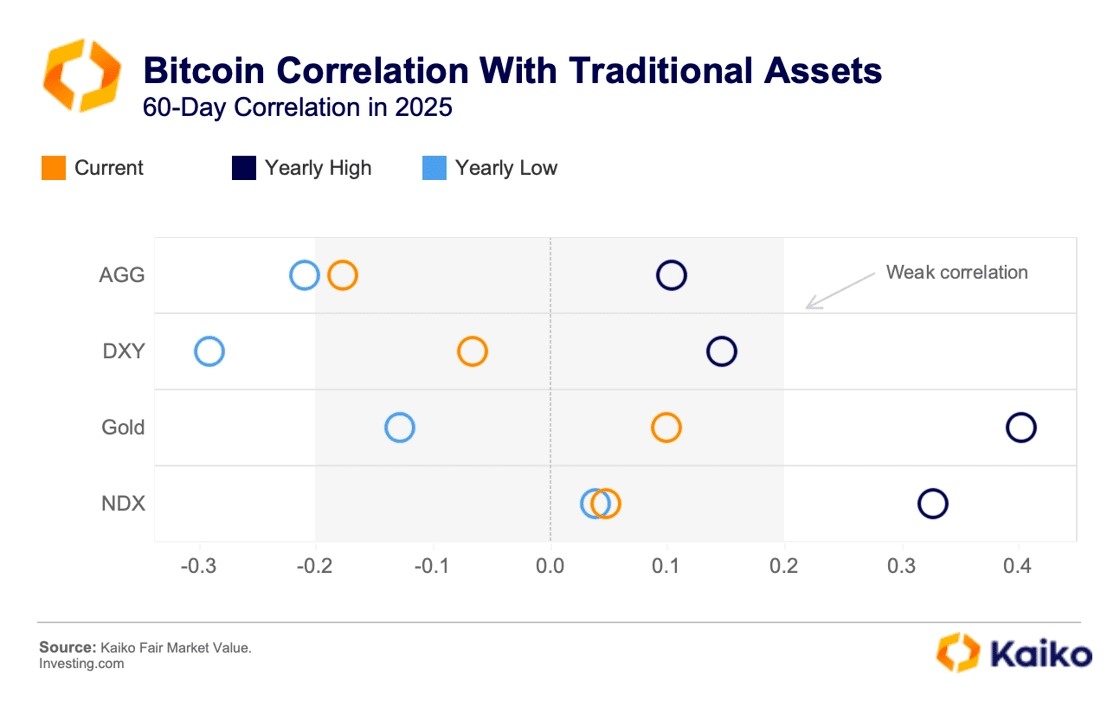

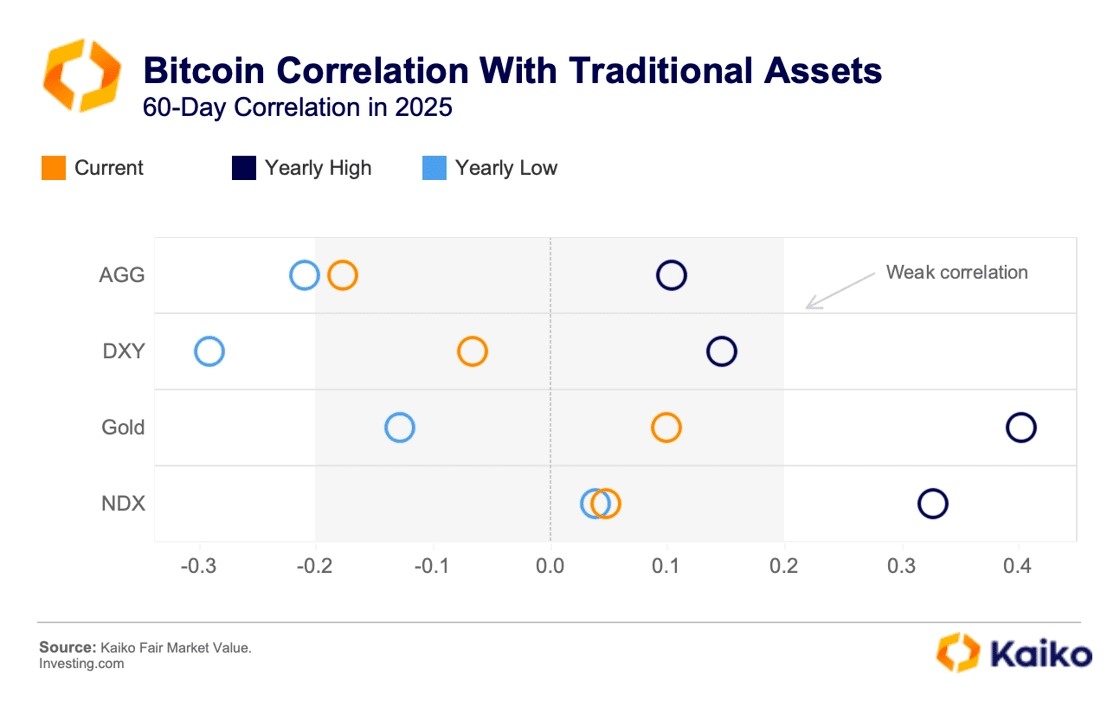

Bitcoin holds as a diversifier amid volatility.

Over the past few weeks, Bitcoin has stood out as a rare diversifier in markets gripped by volatility. As of last week, its 60-day correlation with U.S. tech stocks, bonds, and the dollar remained low, ranging between -0.2 and +0.2, offering diversification at a time when traditional assets moved in sync.

In early April, bonds, equities, and even the U.S. dollar sold off together, a breakdown in traditional correlations that typically signals extreme market stress.

Despite widespread expectations at the start of the year that the dollar would strengthen due to tariffs, the U.S. Dollar Index (DXY) has fallen by 8.9% year-to-date, with a 4% drop since April 2.

The initial decline was driven by concerns over U.S. growth, while the post–Liberation Day selloff reflects rising policy uncertainty and shifts in investor positioning away from U.S. assets. For the first time in years, the growth differential that once favored the U.S. is being questioned, with some analysts predicting Eurozone growth will surpass the U.S. by 2026. Meanwhile, growing concerns over the Federal Reserve’s independence and unpredictable tariff policies are prompting investors to reassess their exposure to U.S. assets.

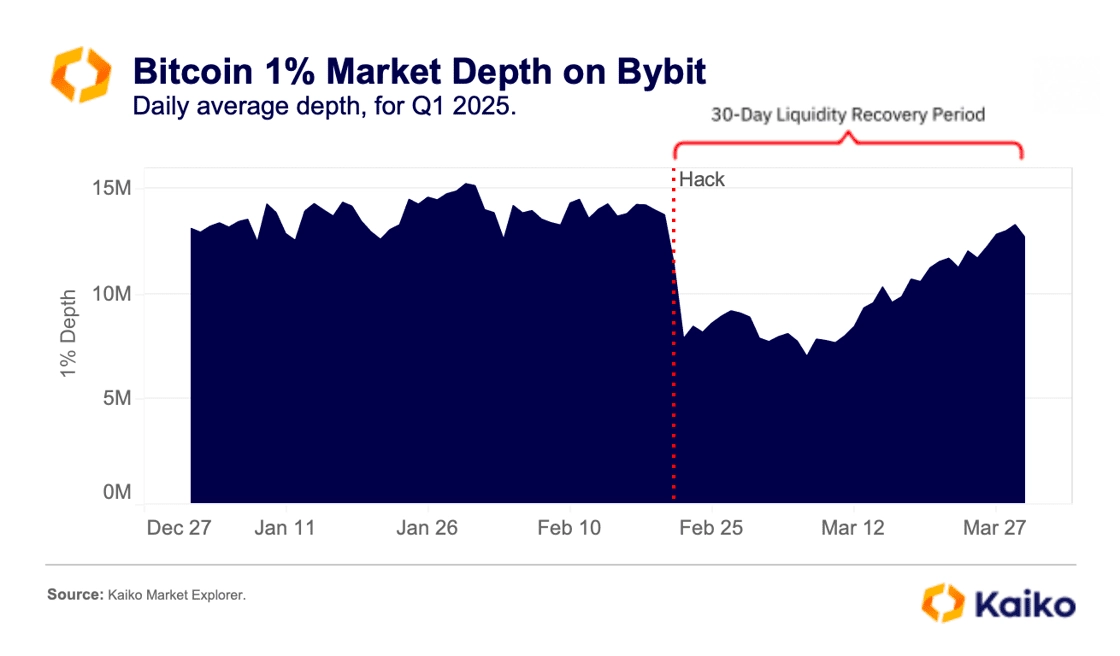

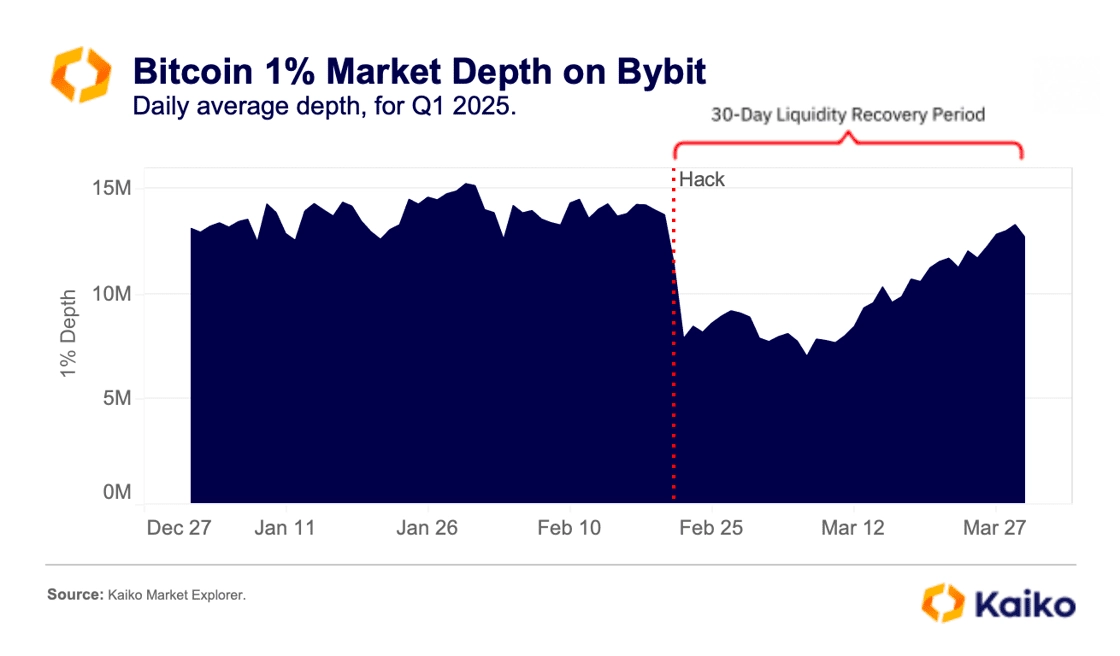

BTC liquidity on Bybit totally recovers 1 month post-hack.

In February, Bybit was hit by a record-breaking $1.5 billion hack. Yet within just 30 days, Bitcoin liquidity on the platform had fully recovered to pre-hack levels, outpacing most other venues and signaling a strong return of market maker confidence.

Despite broader uncertainty and muted trading volumes in Q1, key indicators such as 1% BTC market depth on the exchange (which averaged $13 million daily by the end of the quarter) showed resilience. Liquidity has since strengthened across all levels, leading to tighter spreads, lower slippage, and smoother execution for large orders.

Our latest report explores how Bybit’s liquidity conditions stabilized so quickly, highlighting the resilience of its trading infrastructure and the confidence of its participants.

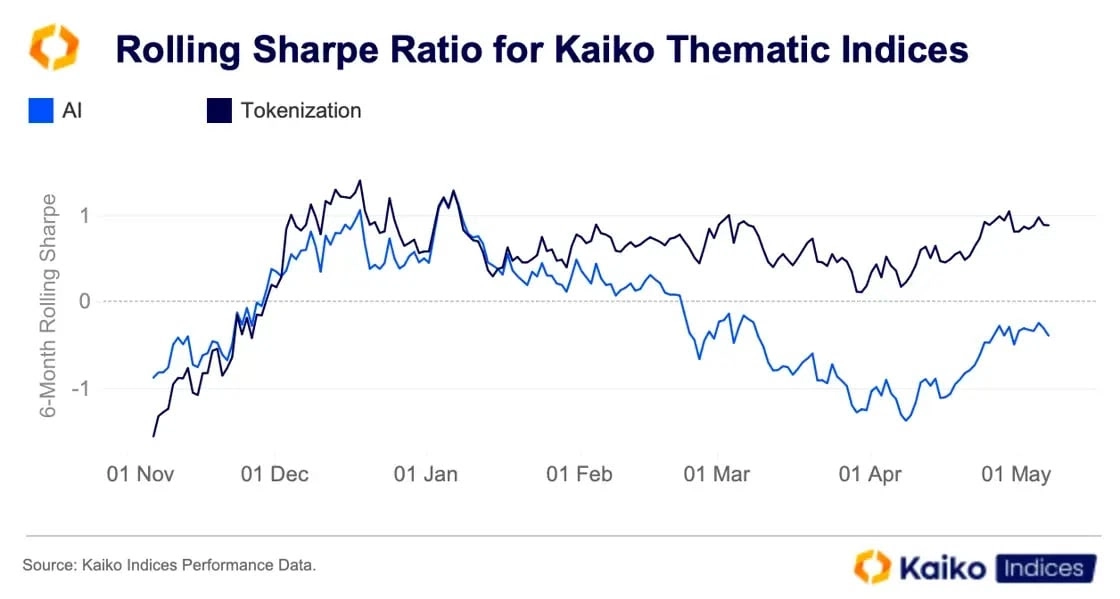

A tale of two themes.

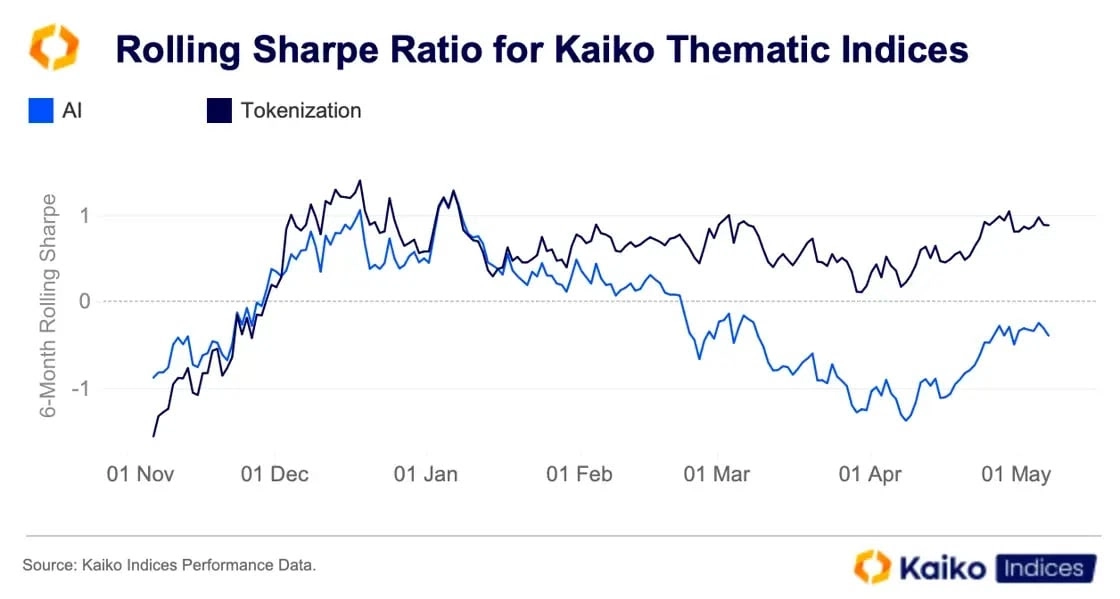

Kaiko Indices’ latest Index in Focus report, released last Thursday, focused on thematic indices in digital asset markets. It examined the performance of our two leading thematic baskets: tokenization and artificial intelligence.

Despite the broad decline in markets, the risk profiles of the two thematic indices are quite different. The Kaiko Tokenization Index currently offers better risk-adjusted returns, with a Sharpe ratio of around 0.9, while the AI Index has a negative Sharpe ratio of -0.37. These ratios are calculated on a rolling six-month basis; thus, the tokenization index maintains a positive Sharpe despite recent declines.

![]()

![]()

![]()

![]()