Gap grows between Bitcoin and altcoins.

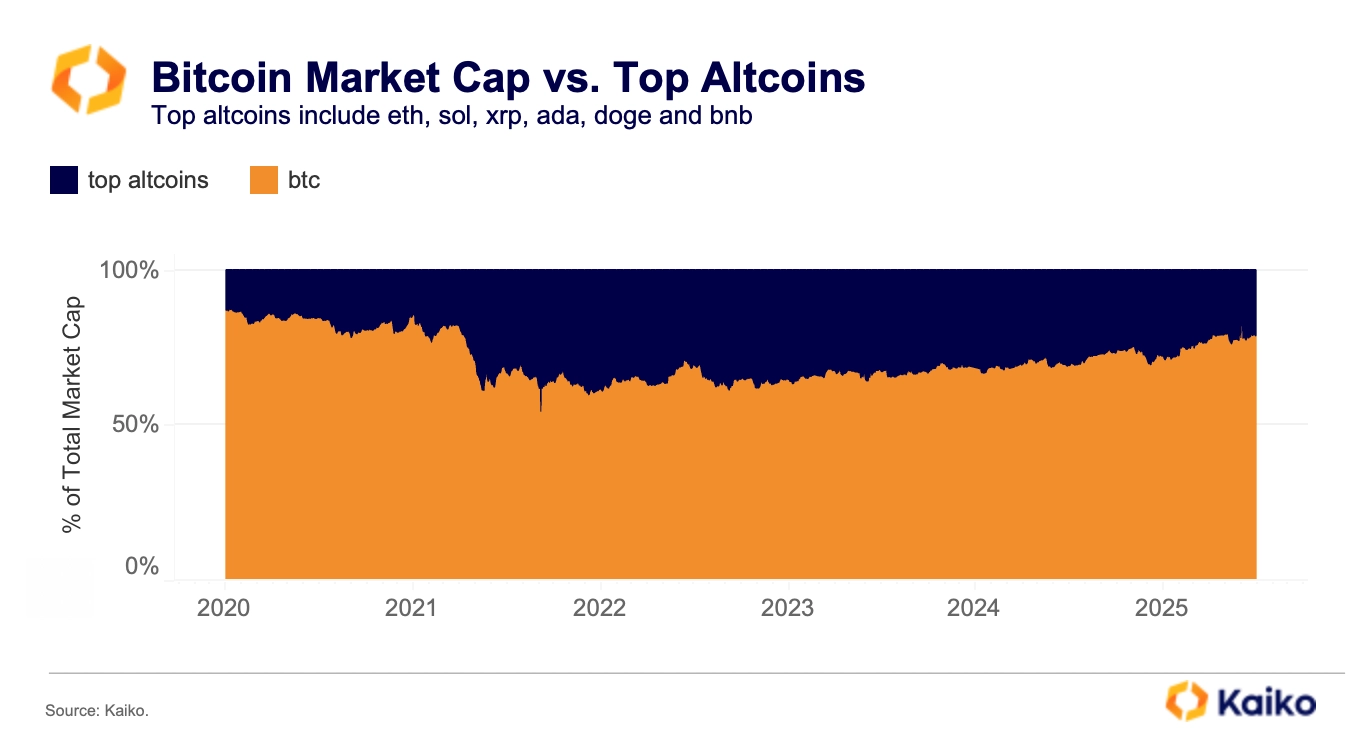

In 2025, Bitcoin is carving out its own path, powered by rising institutional demand and clearer U.S. regulation. Meanwhile, altcoins have slipped into a phase of consolidation and narrative churn. This growing divergence may mark a structural shift, with Bitcoin maturing into a distinct asset class while altcoins remain tied to speculative cycles.

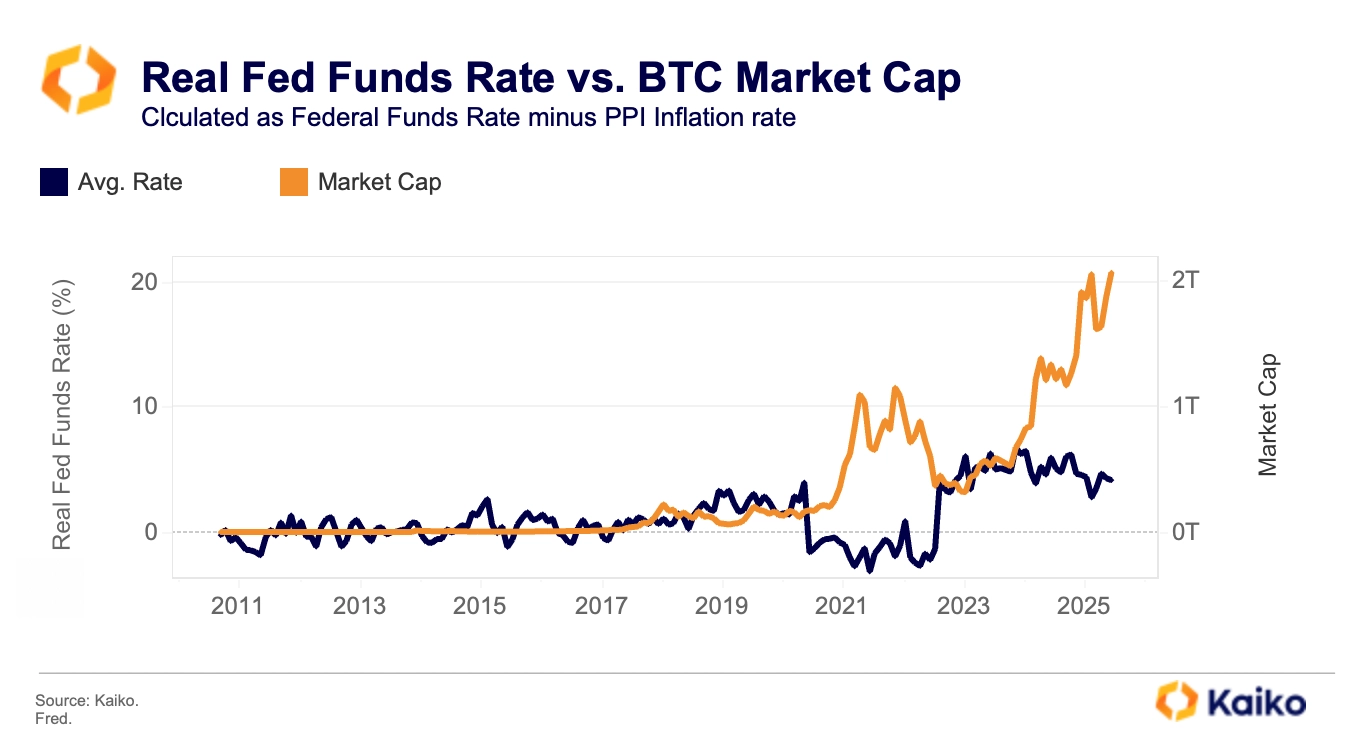

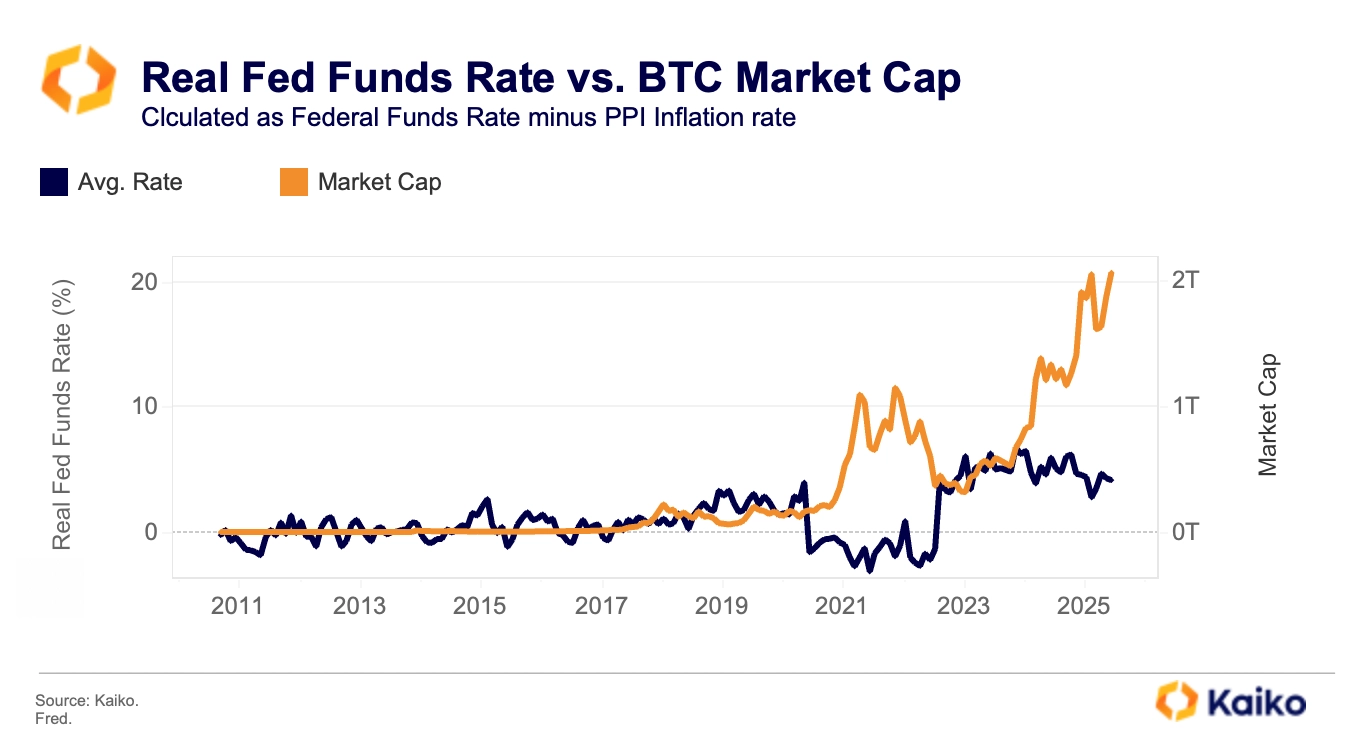

Unlike altcoins, Bitcoin has decoupled from traditional macro correlations, particularly real interest rates, signaling a more mature asset class with distinct drivers.

This means that shifting rate expectations, like last week’s delay of a July rate cut after stronger-than-expected U.S. jobs data, are less likely to derail Bitcoin’s momentum.

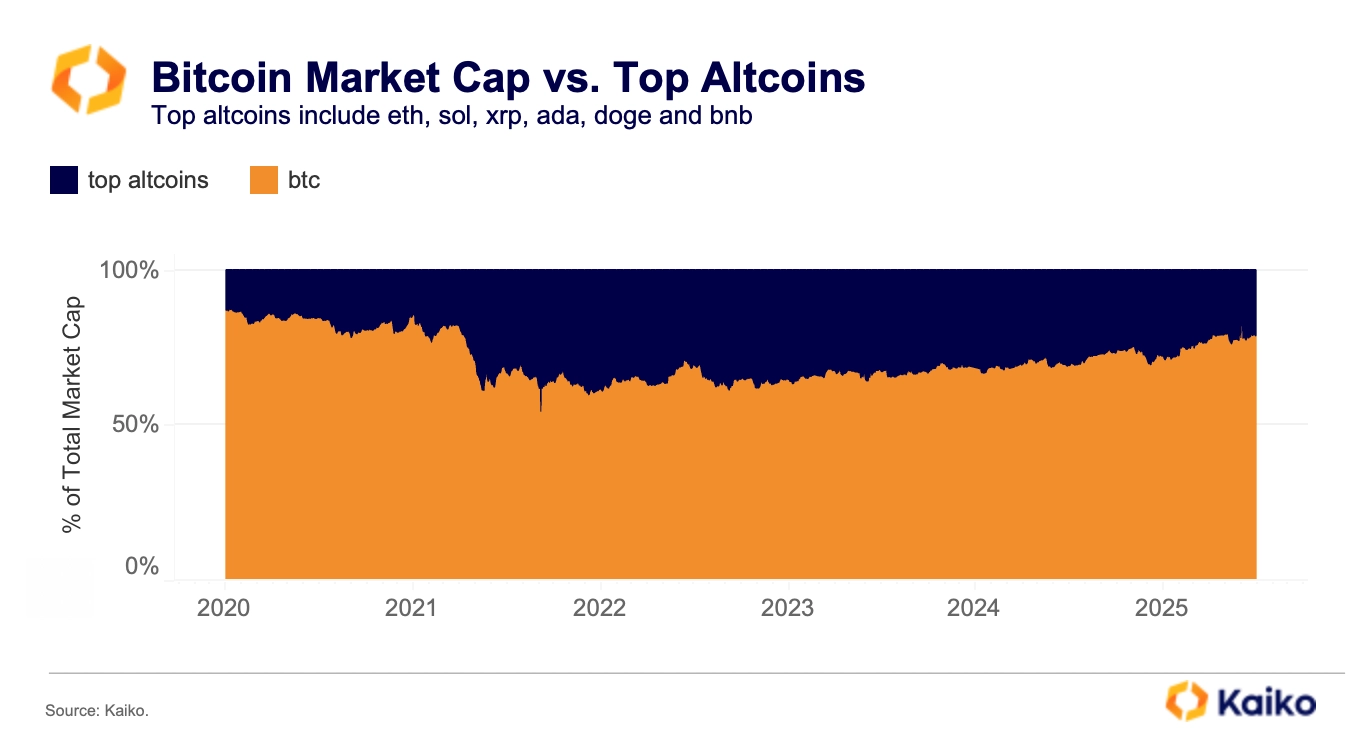

Bitcoin’s growing dominance is evident in its market cap, which has reached $2 trillion, with its share compared to ETH and top altcoins now nearing levels last seen during the 2020–2021 bull run. This trend is reinforced by a growing array of financial products, which is keeping capital anchored in Bitcoin instead of rotating into higher-risk, leveraged altcoin exposure.

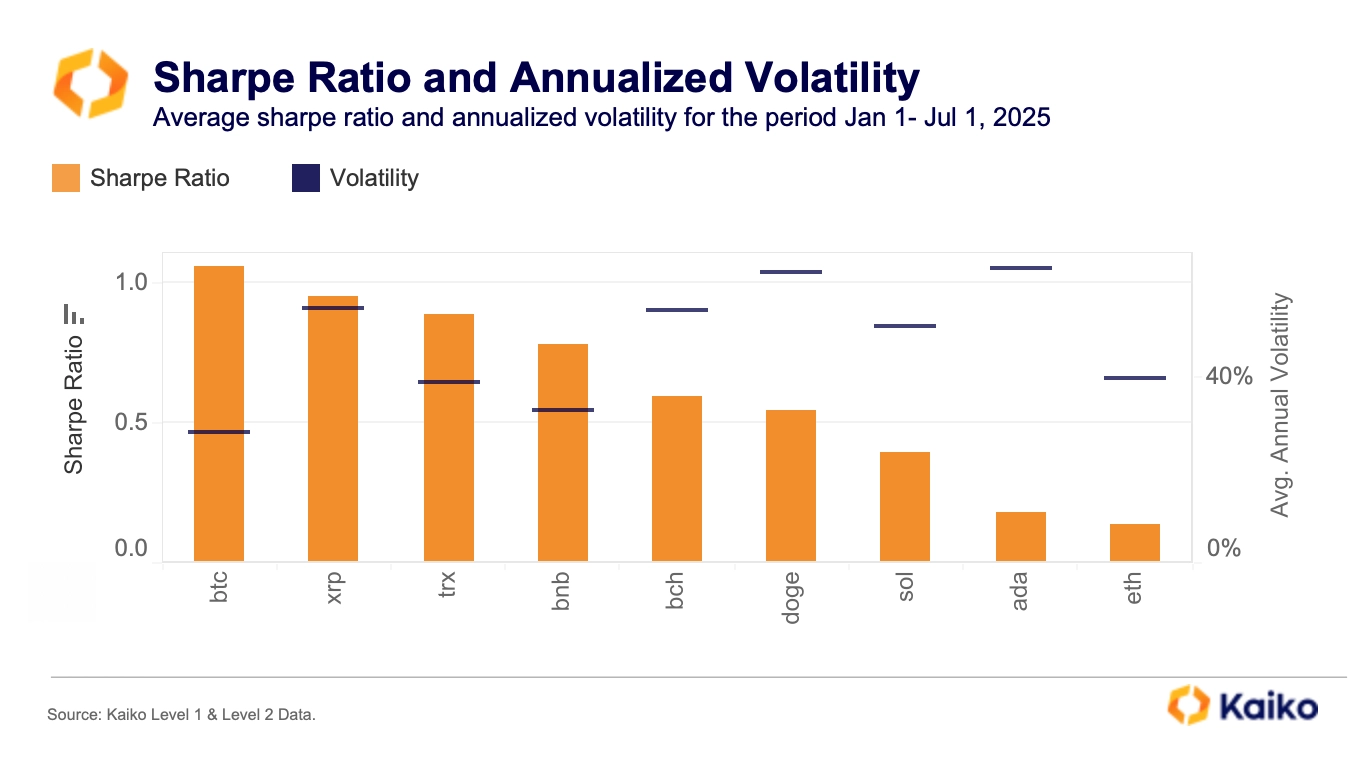

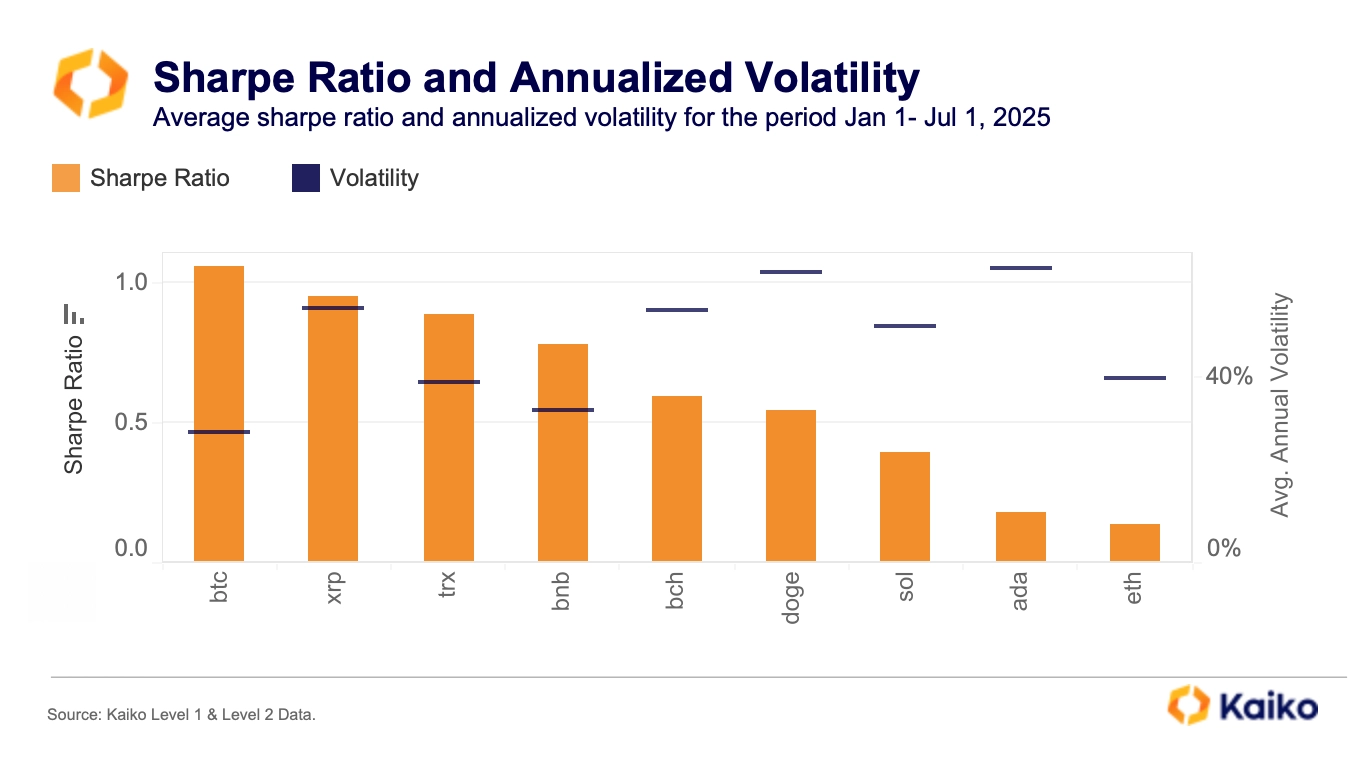

Bitcoin also offers better risk-adjusted returns than most altcoins. Its Sharpe ratio is higher than that of traditionally high-performing altcoins like SOL and XRP, a shift supported by falling volatility.

Solana, once the poster child of high-beta outperformance, has notably fallen behind. Its returns have been underwhelming in 2025, with elevated volatility contributing to a weakening risk-reward profile.

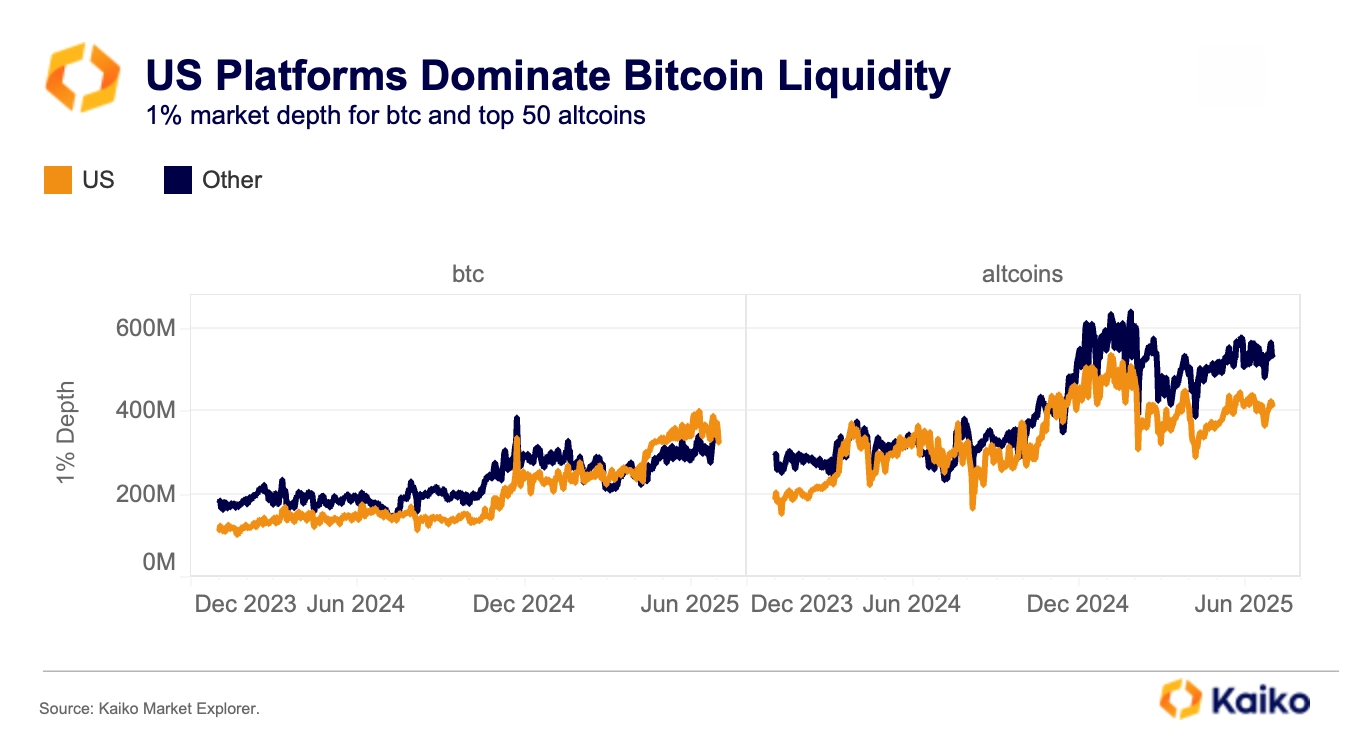

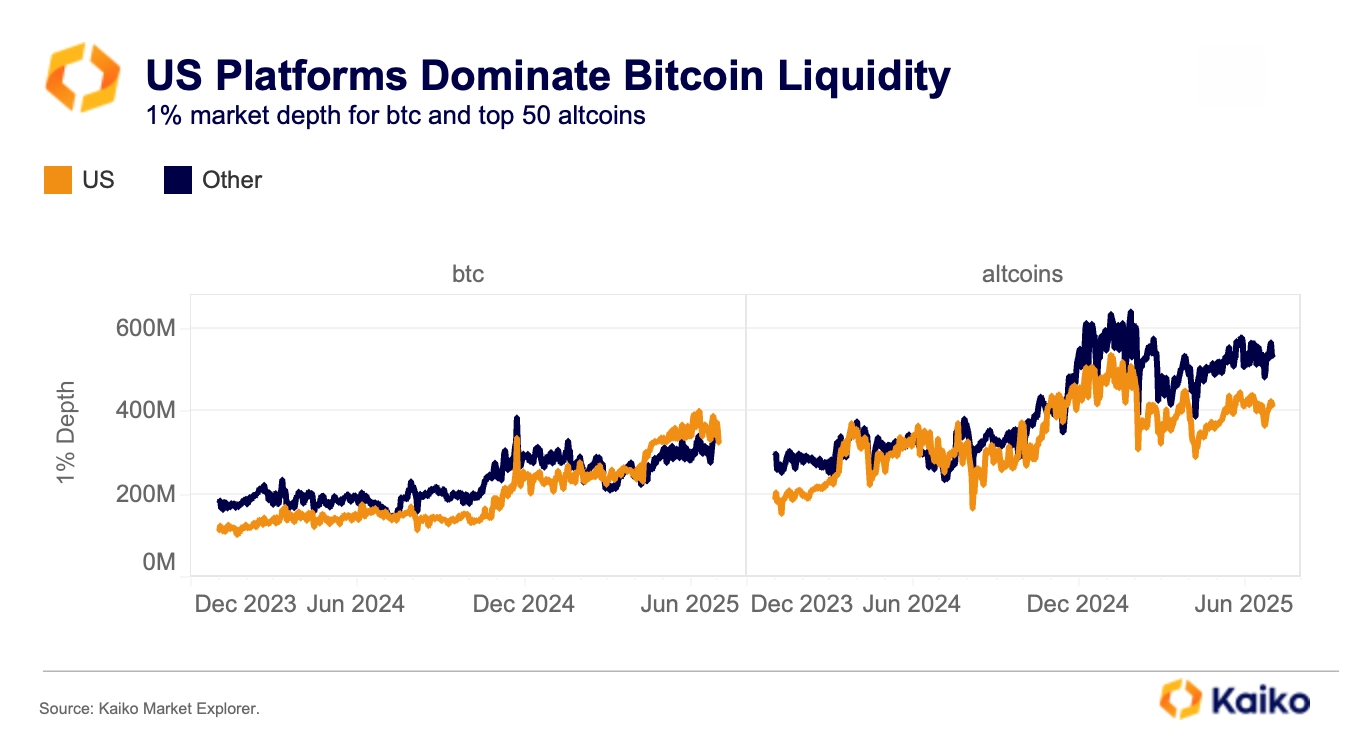

Bitcoin’s advantage is reinforced by growing liquidty on U.S.-based exchanges, which now dominate its global 1% market depth.

Regulatory clarity and institutional-grade execution have created a positive feedback loop with better liquidity attracting more capital, further deepening the market.

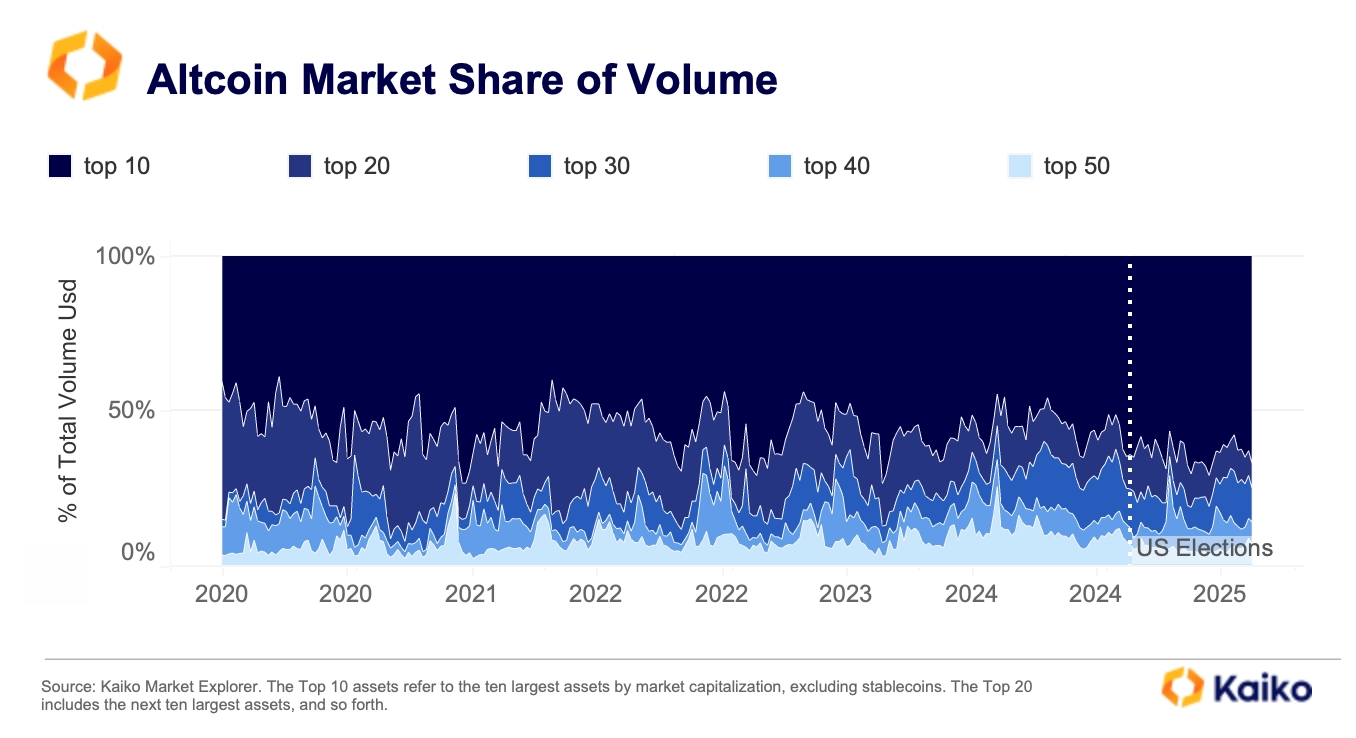

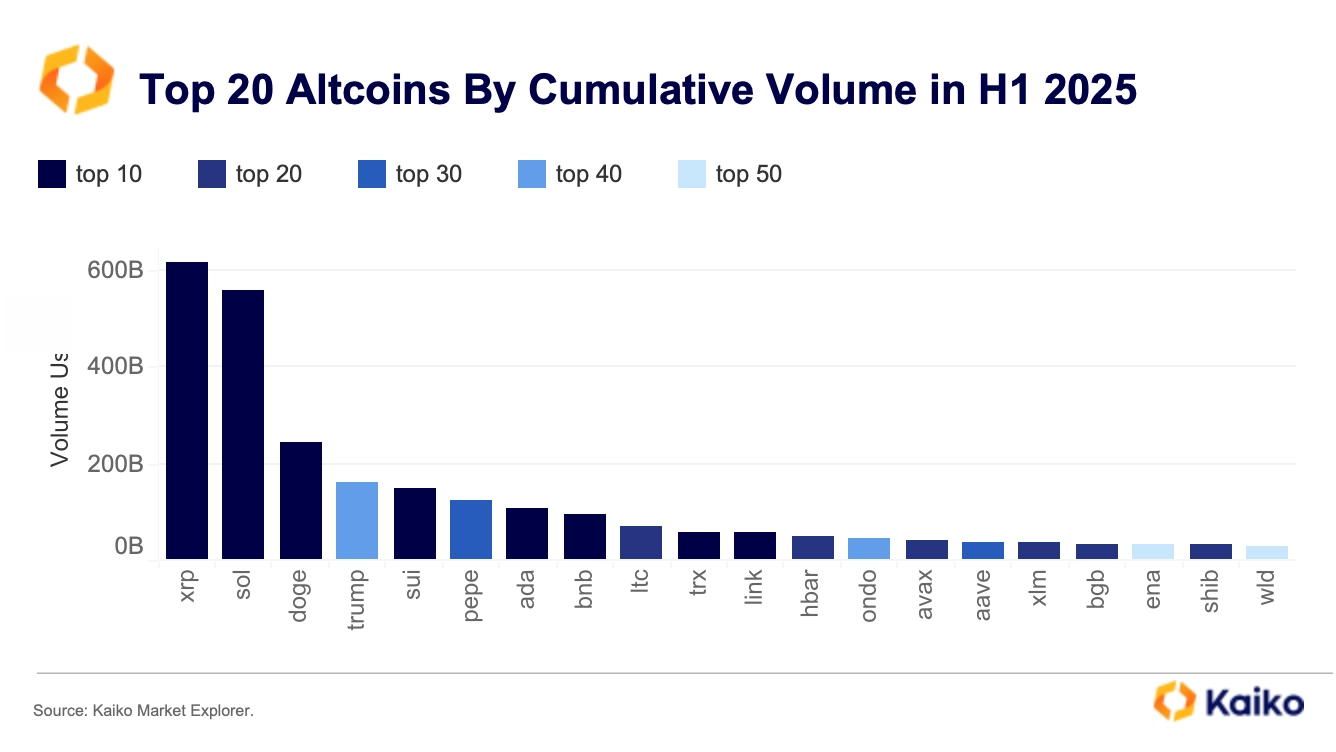

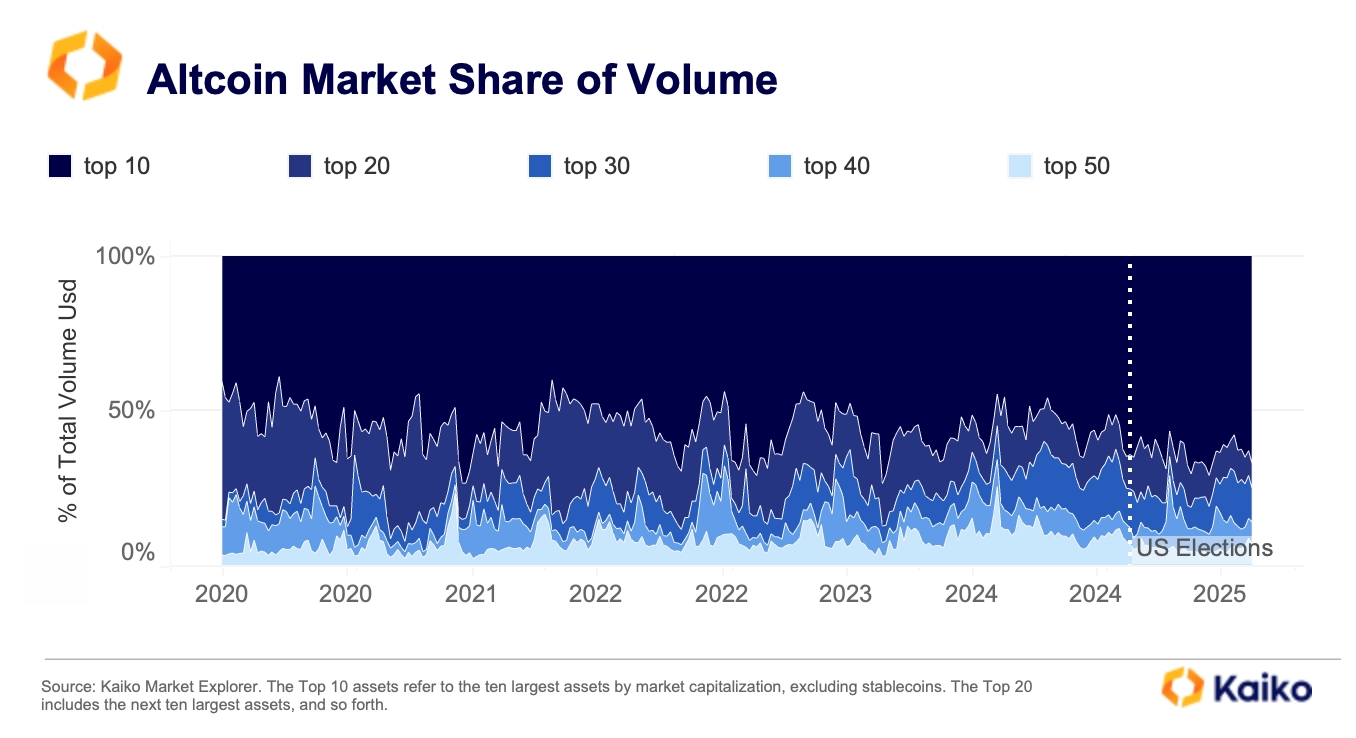

Altcoins, in contrast, are consolidating. Since November, trading activity has increasingly concentrated in the top ten assets by market cap, which now account for 63% of altcoin volume, up from about 50% just months ago.

A handful of narratives are driving what little momentum remains in altcoins, with tokens tied to real-world assets (like ONDO), yield-bearing stablecoins (such as Ethena’s ENA), and political memes (Trump’s token) attracting attention.

Yet beneath the surface, demand is softening.

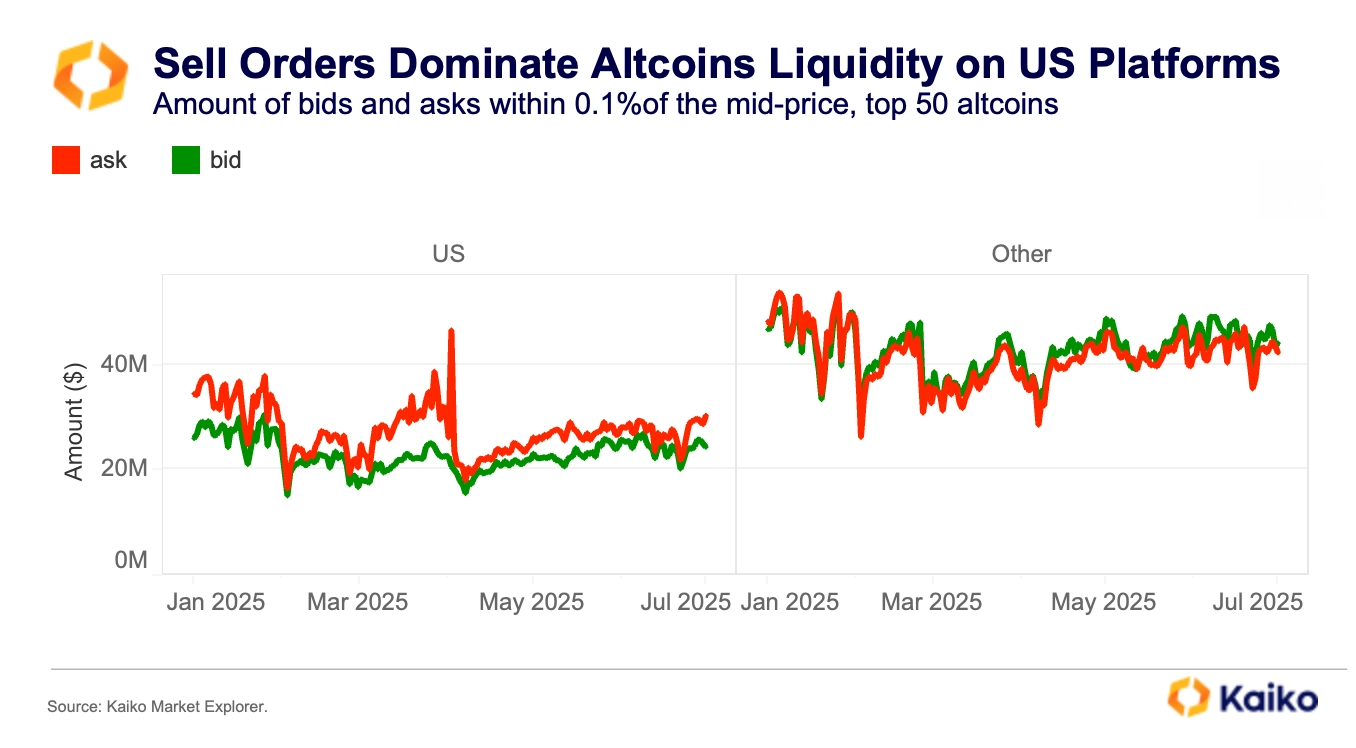

Order book data paints a cautious picture for altcoins. On U.S. exchanges, sell-side liquidity dominates near the mid-price across the top 50 altcoins, signaling weak demand and a likely seasonal liquidity lull.

Offshore venues, which still handle about 90% of altcoin volume, show more buying interest. However, even there, activity in small-cap tokens is fading, pointing to a broader retreat from risk.

Data Points

Altcoins face greater liquidity stress.

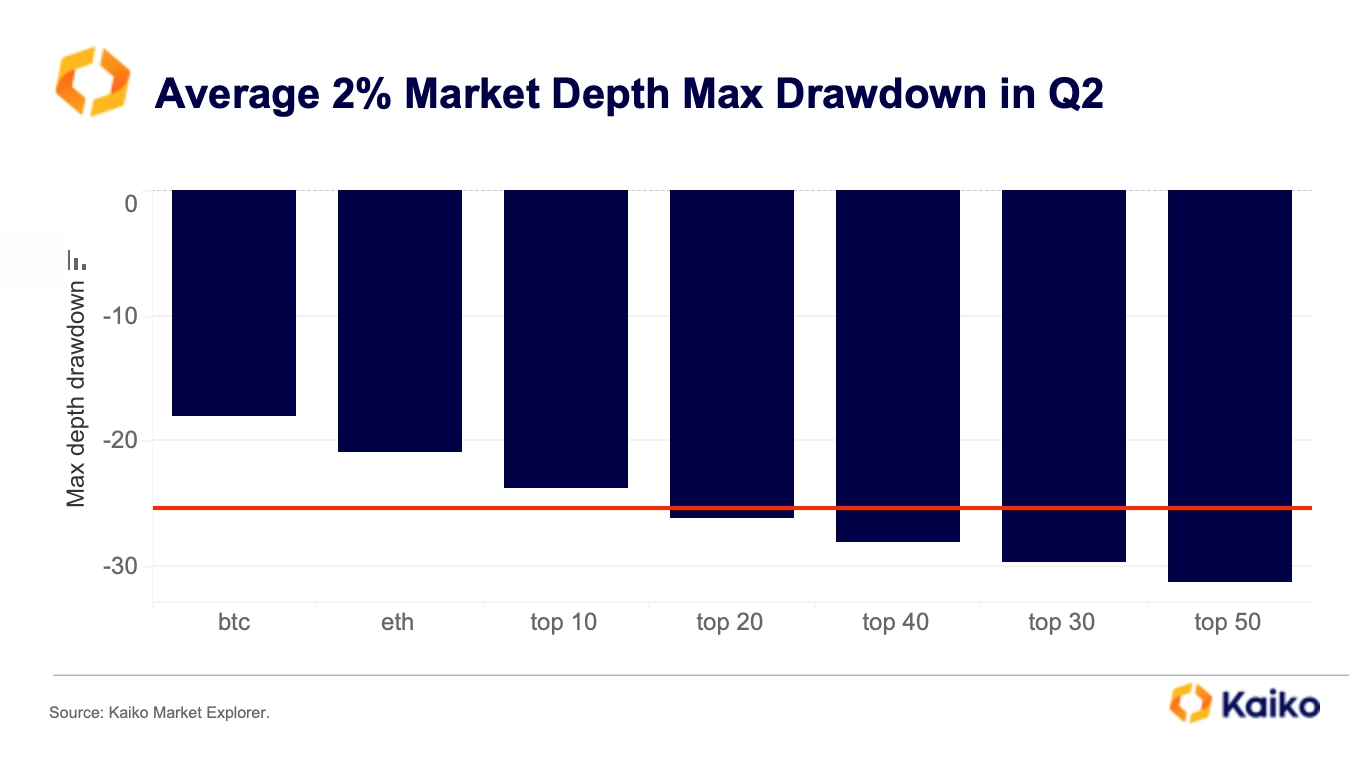

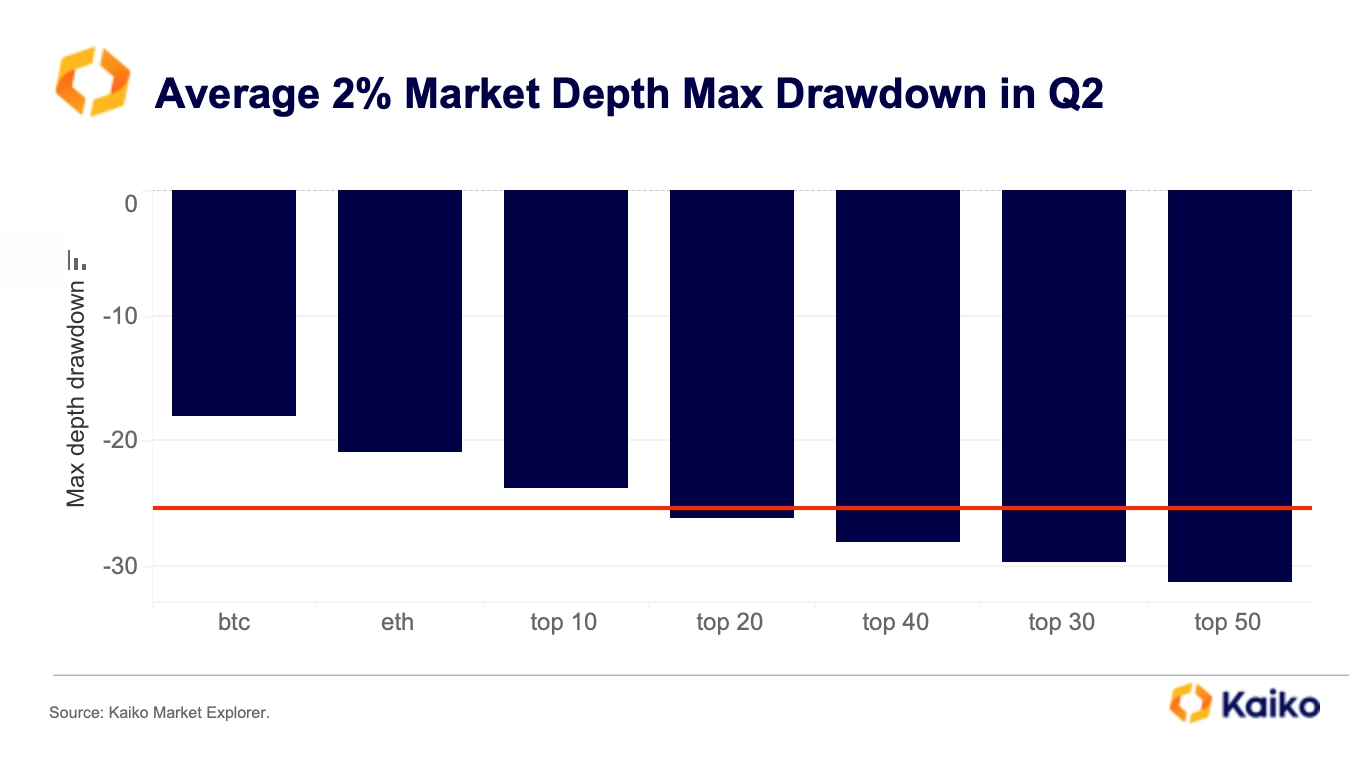

Allocating to altcoins carries significantly higher risk than BTC, primarily due to their weaker liquidity infrastructure.

Analysis of Q2’s 2% depth maximum drawdown reveals that altcoins suffered declines of up to -31.3%, nearly twice as severe as BTC’s -18.05%. Maximum drawdown serves as a key stress indicator, highlighting the sharpest contraction in liquidity, often occurring when market stress prompts liquidity providers to withdraw.

Altcoins are more exposed to liquidity shocks and selloffs because they have thinner order books, fewer market makers, and less institutional participation. When volatility increases, altcoin liquidity can vanish rapidly, leading to a chain reaction of higher slippage, wider spreads, and greater price impact for sizable trades.

Overall, while Bitcoin functions as a liquidity anchor during turbulent periods, altcoins transform into liquidity deserts, amplifying both downside risk and execution costs for investors.

SOL staking ETF goes live.

Last week, the REX-Osprey Solana Staking ETF (SSK) debuted on Cboe, becoming the first ETF to allow traditional investors in the U.S. access both Solana’s price performance and staking rewards through a regular brokerage account. Previously, earning crypto-native staking yields meant running a validator node or trusting tokens to third-party platforms, barriers that kept mainstream investors on the sidelines.

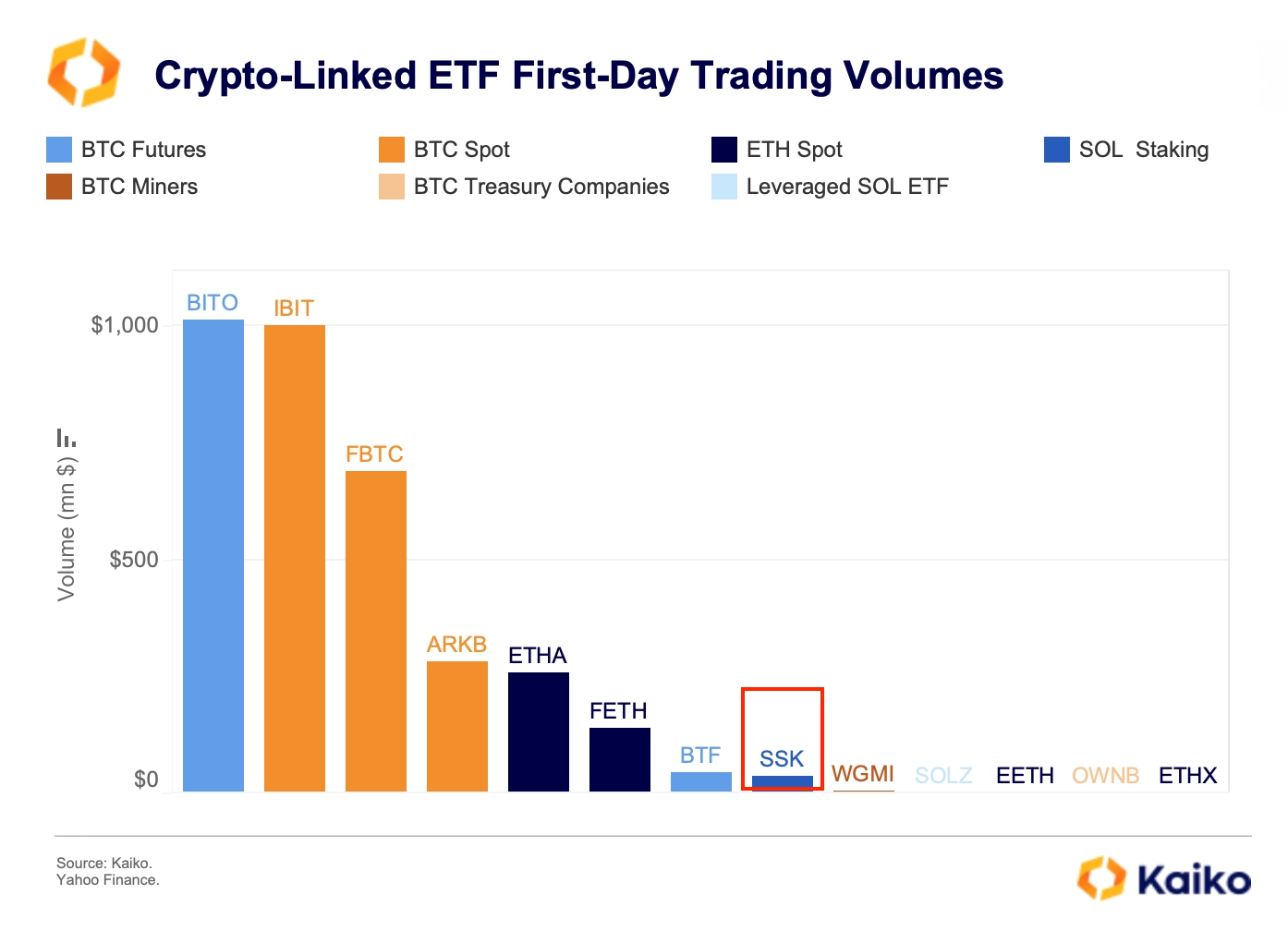

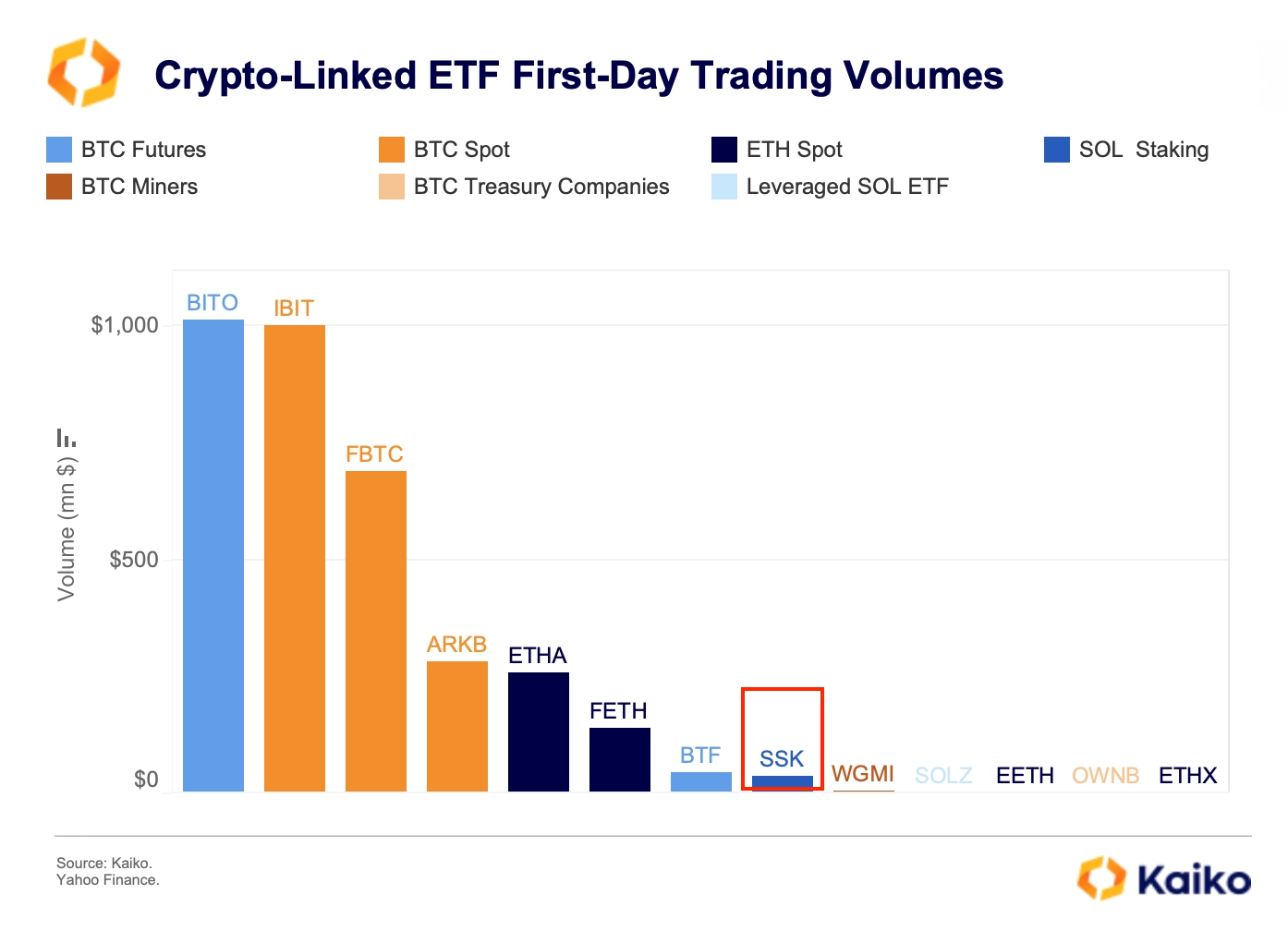

Despite launching during a holiday week, SSK posted $34 million in first-day trading volume, ranking in the top 1% of ETF launches and signaling strong interest in passive, yield-generating crypto products.

While SSK’s launch marks progress for crypto yield products, there are still challenges for funds structured as grantor trusts under the 1933 Act. For example, the spot ETH ETFs that launched in July 2024 have not enabled staking rewards for investors. The grantor trust structure these funds use is limited to simply holding spot ETH, making it difficult for issuers to retroactively offer staking solutions.

By launching SSK as a C-corp under the 1940 Act, Rex made it possible to offer staking rewards to investors. However, this structure also requires the fund to hold a diversified mix of Solana-related assets, rather than holding only spot SOL.

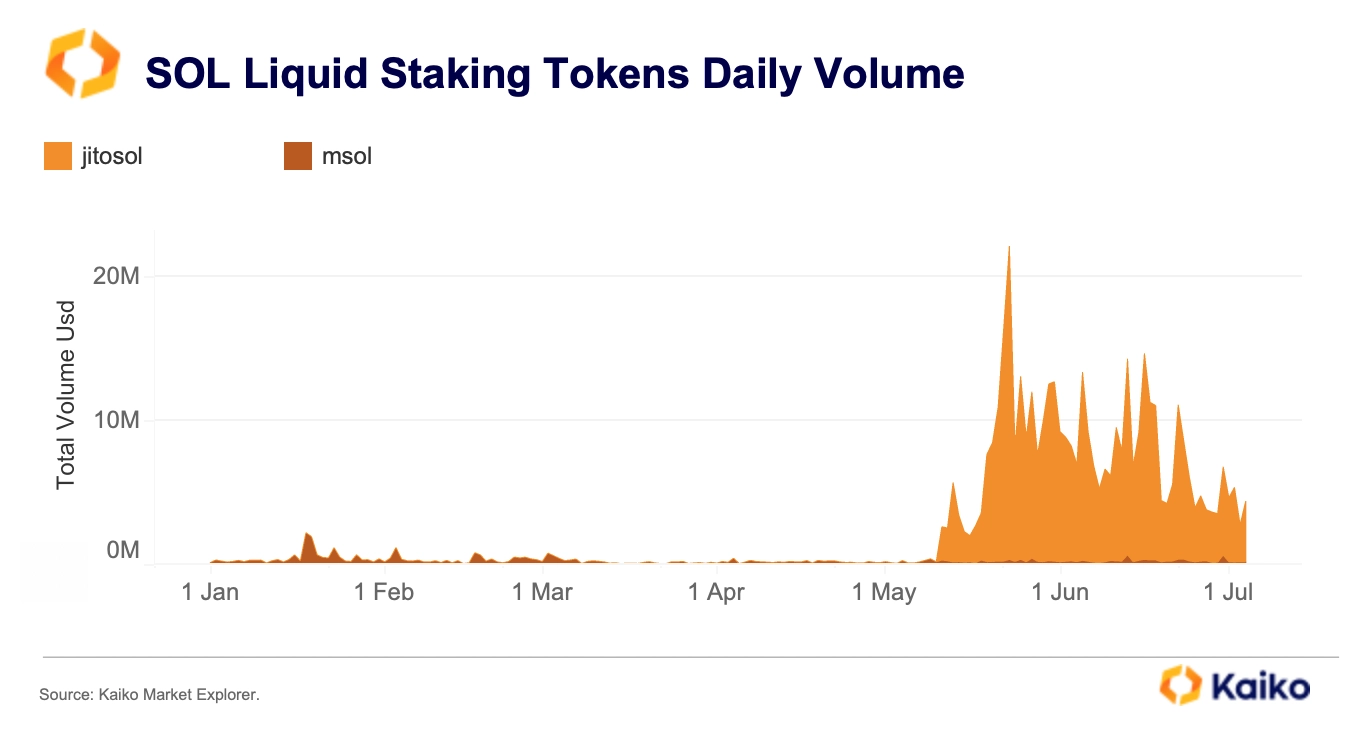

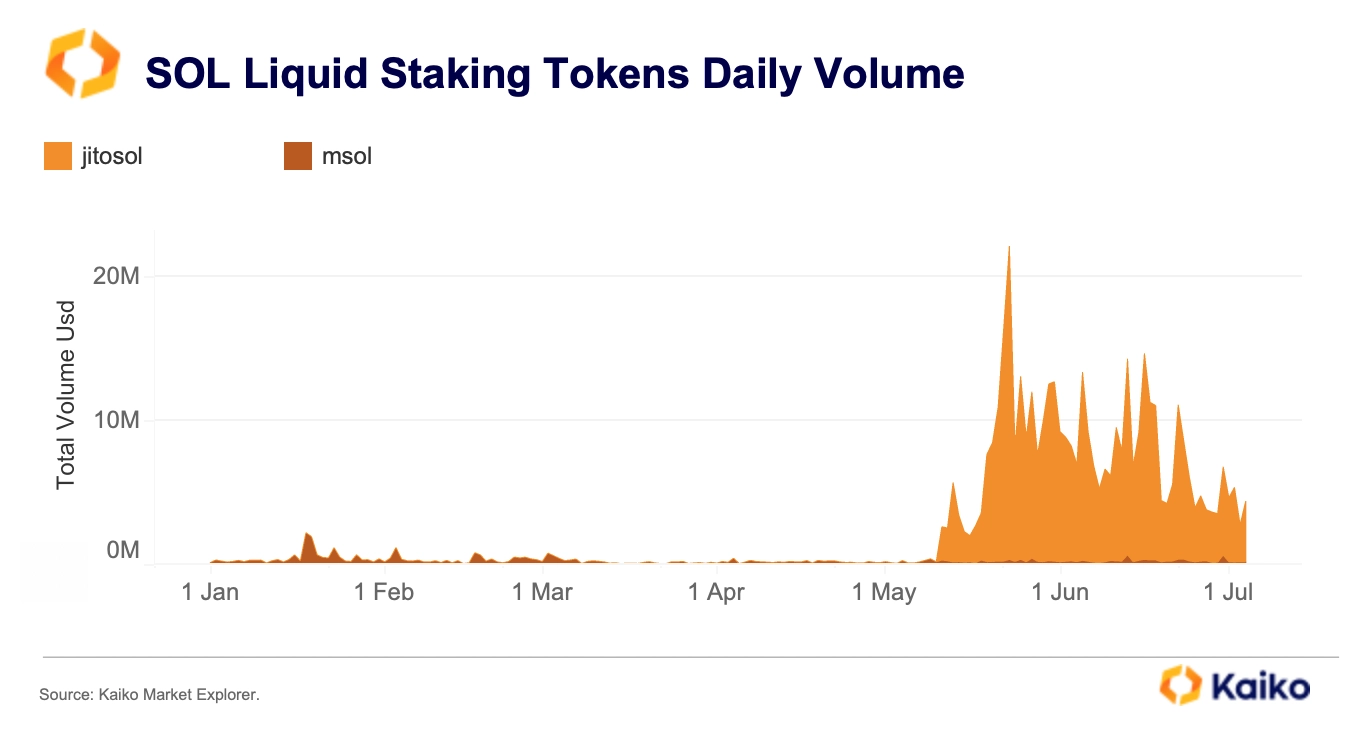

SSK must invest at least 80% of its assets in Solana and SOL-related products, this includes directly staking SOL through Anchorage Digital and up to 40% in non-U.S. Solana ETPs. The remaining 20% can be invested in other assets, such as liquid staking tokens like JitoSOL or mSOL.

This setup could drive more demand for Solana liquid staking tokens (LST) like JitoSOL. JitoSOL already dominates the narrow Solana LST market, with major exchange listings on OKX, Gemini, and Bullish driving its daily volumes to around $5 million, far ahead of mSOL’s $200K–$300K.

![]()

![]()

![]()

![]()