Why Coinbase Wants to be the Everything Exchange

by Adam Morgan McCarthy

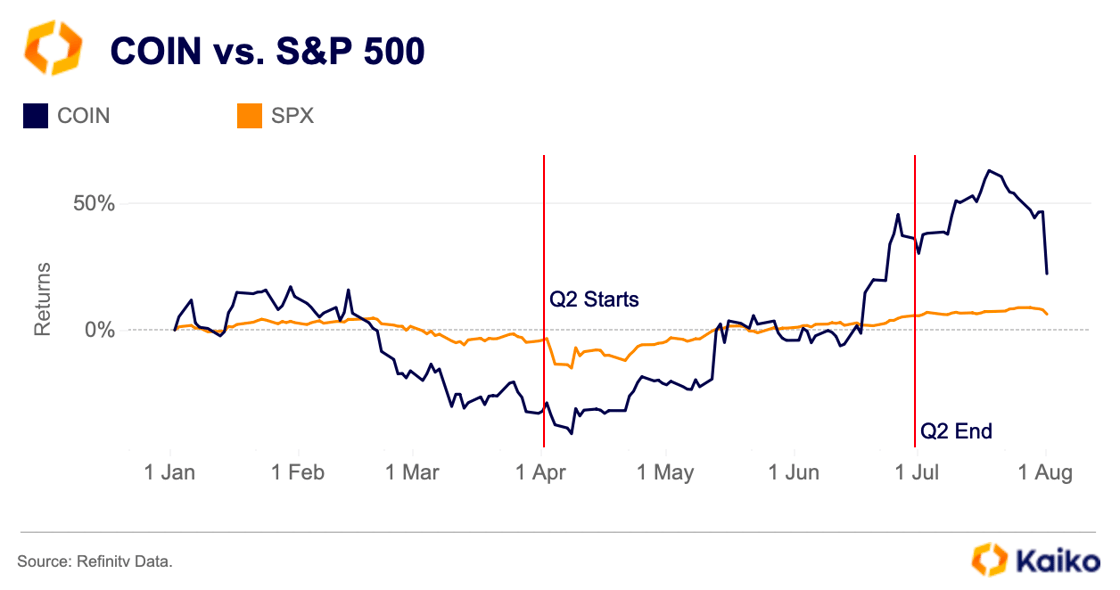

Coinbase missed estimates last week as its second-quarter earnings revealed the impact of this cycle’s lopsided crypto market. Revenues rose 3.3% year-over-year to $1.5 billion, but still came in slightly below analyst expectations of $1.59 billion. COIN shares fell to end the week, although broader market concerns and more tariff announcements likely hurt it as much as the earnings miss.

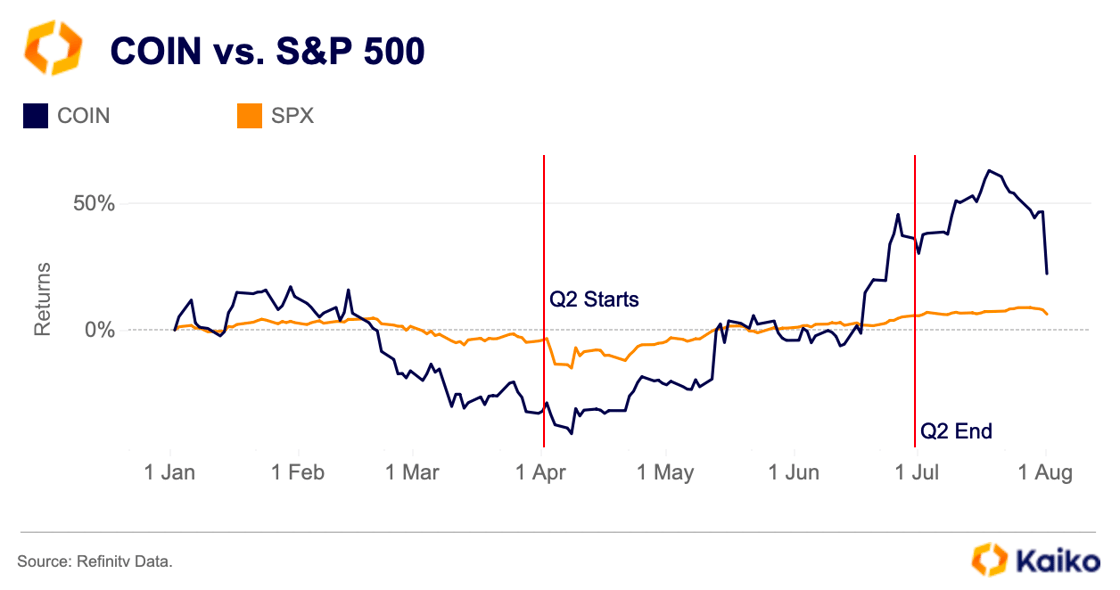

However, it’s not all that bad for the crypto exchange as its shares remain up on the year. COIN is higher than the S&P 500 this year, gaining over 22% while the equity index is up just 6.3% since January. The crypto exchange entered the world’s most traded index in May, further establishing itself on Wall Street.

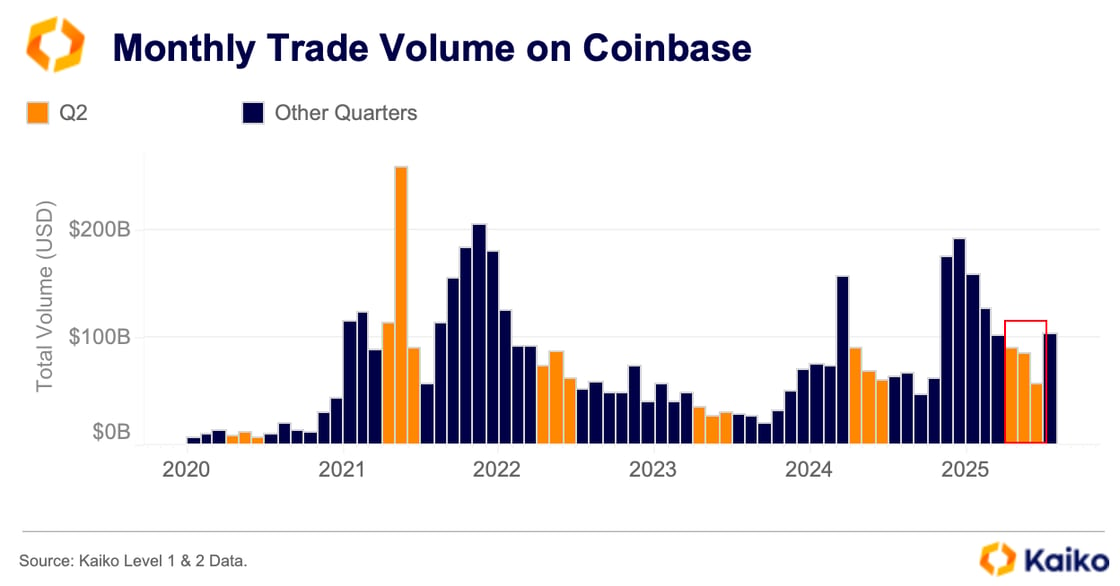

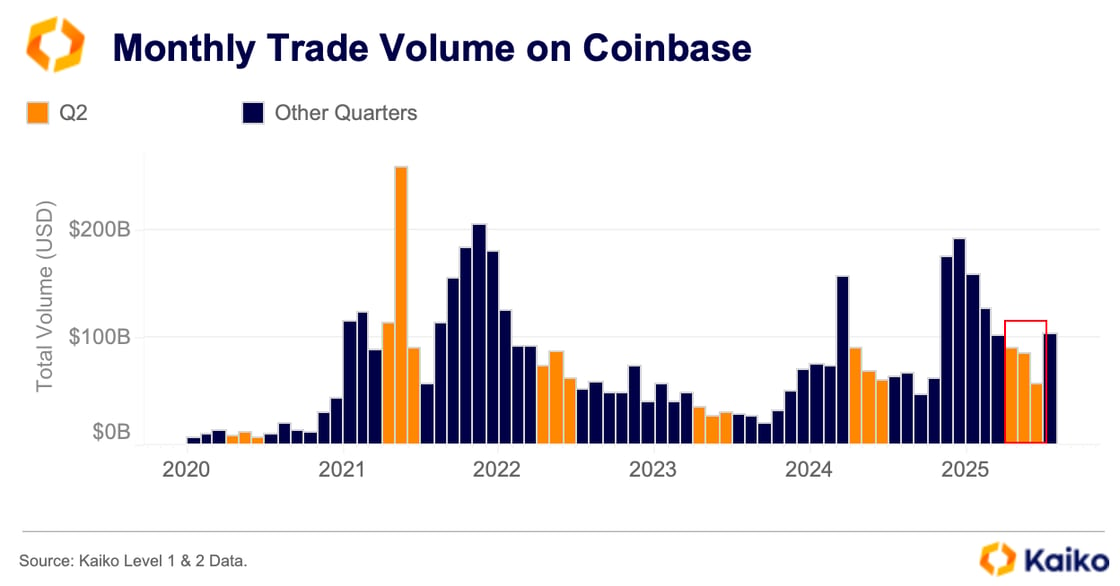

Furthermore, executives have a plan to combat revenue volatility. The shortfall in Q2 revenue is not uncommon for Coinbase, which relies heavily on trading volumes (a reliance it wants to combat) to drive returns. Monthly trading volume on Coinbase Exchange declined steadily during the quarter, from $89 billion in April to below $57 billion in June. In contrast, monthly volumes in the first quarter never fell below $100 billion.

Furthermore, executives have a plan to combat revenue volatility. The shortfall in Q2 revenue is not uncommon for Coinbase, which relies heavily on trading volumes (a reliance it wants to combat) to drive returns. Monthly trading volume on Coinbase Exchange declined steadily during the quarter, from $89 billion in April to below $57 billion in June. In contrast, monthly volumes in the first quarter never fell below $100 billion.

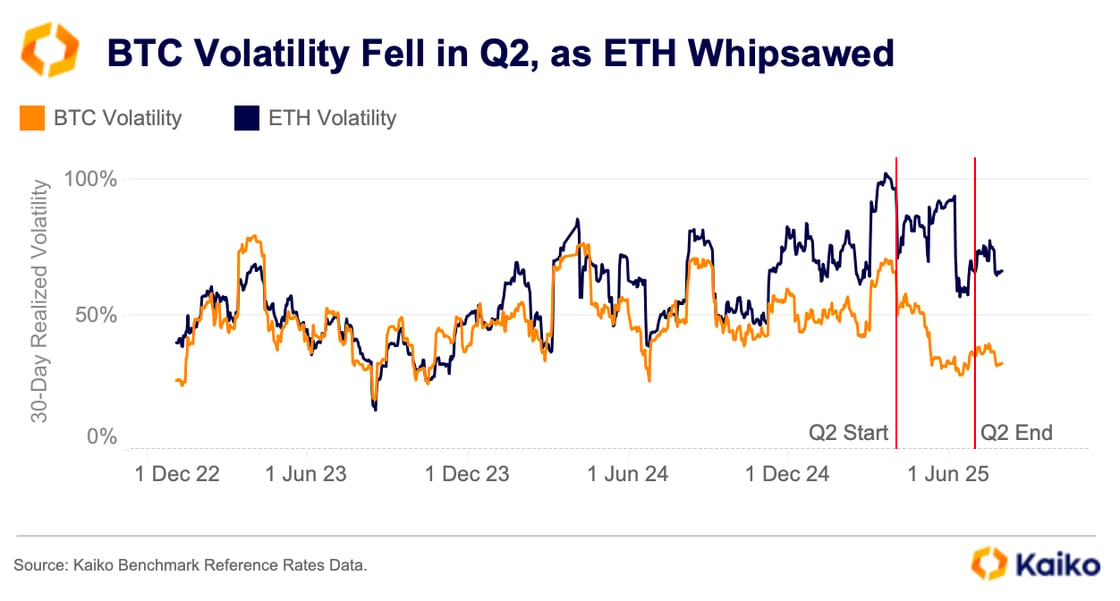

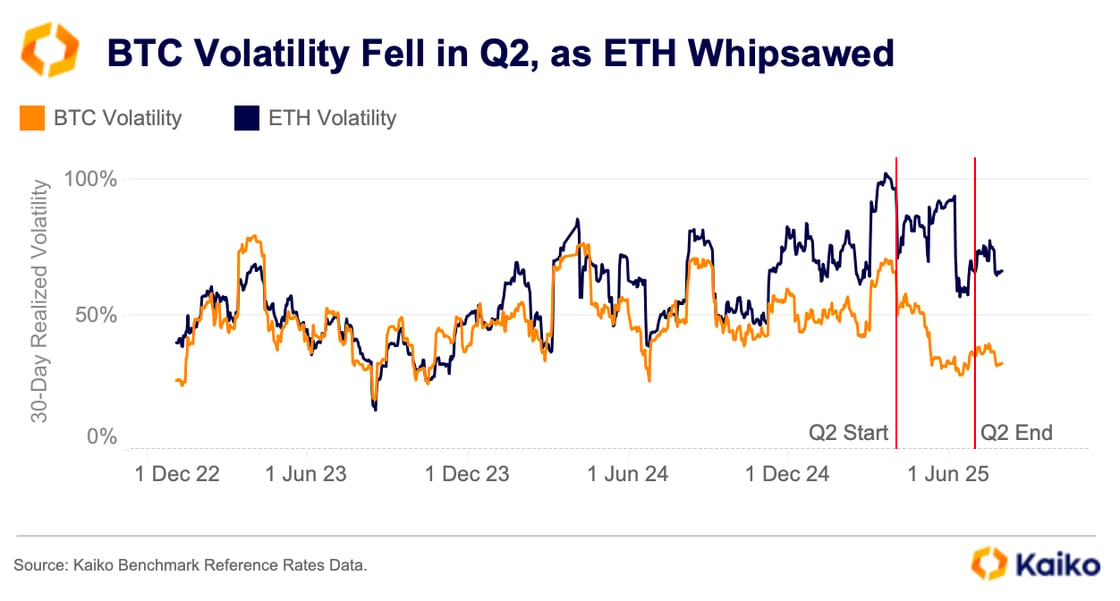

The drop in the second quarter coincided with reduced market volatility, even though BTC prices reached record highs in May. BTC’s 30-day realized volatility trended lower throughout the quarter, as did trading volumes. However, this trend was not universal. ETH’s 30-day realized volatility rose to nearly 100 percent in early June.

Crypto traders are typically drawn to volatility, which often gives them the confidence to enter the market. For the most part, volatility is seen as a feature, not a bug. As a result, lower volatility often corresponds with lower trading volumes, and vice versa. That is what makes ETH’s trading activity on Coinbase particularly interesting. Despite an uptick in volatility last quarter and a notable rally following the Pectra upgrade in May, traders appear to have shifted their attention to other assets.

Crypto traders are typically drawn to volatility, which often gives them the confidence to enter the market. For the most part, volatility is seen as a feature, not a bug. As a result, lower volatility often corresponds with lower trading volumes, and vice versa. That is what makes ETH’s trading activity on Coinbase particularly interesting. Despite an uptick in volatility last quarter and a notable rally following the Pectra upgrade in May, traders appear to have shifted their attention to other assets.

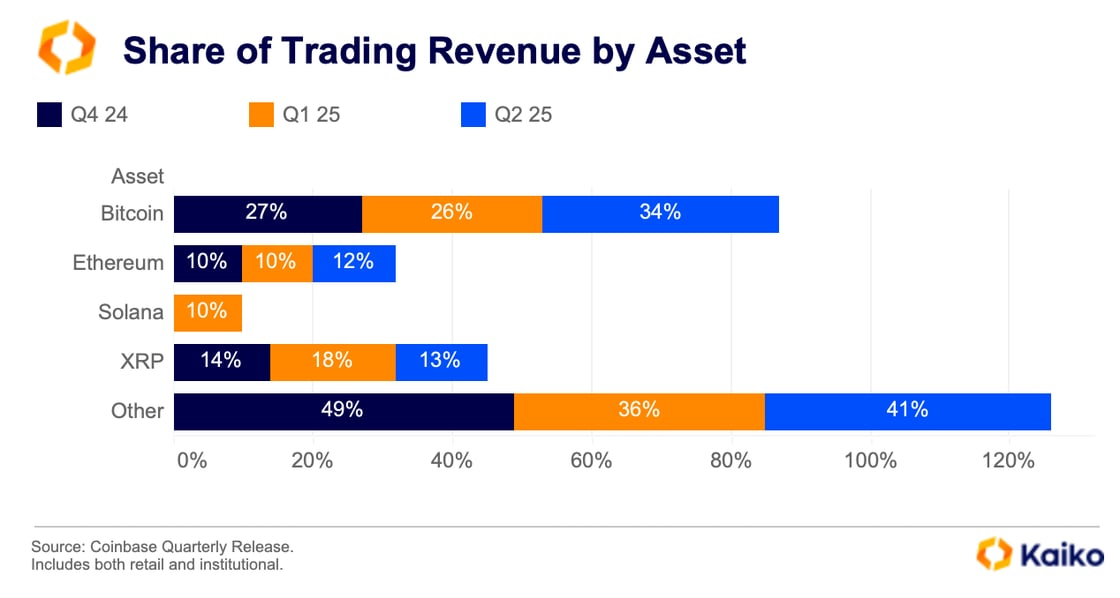

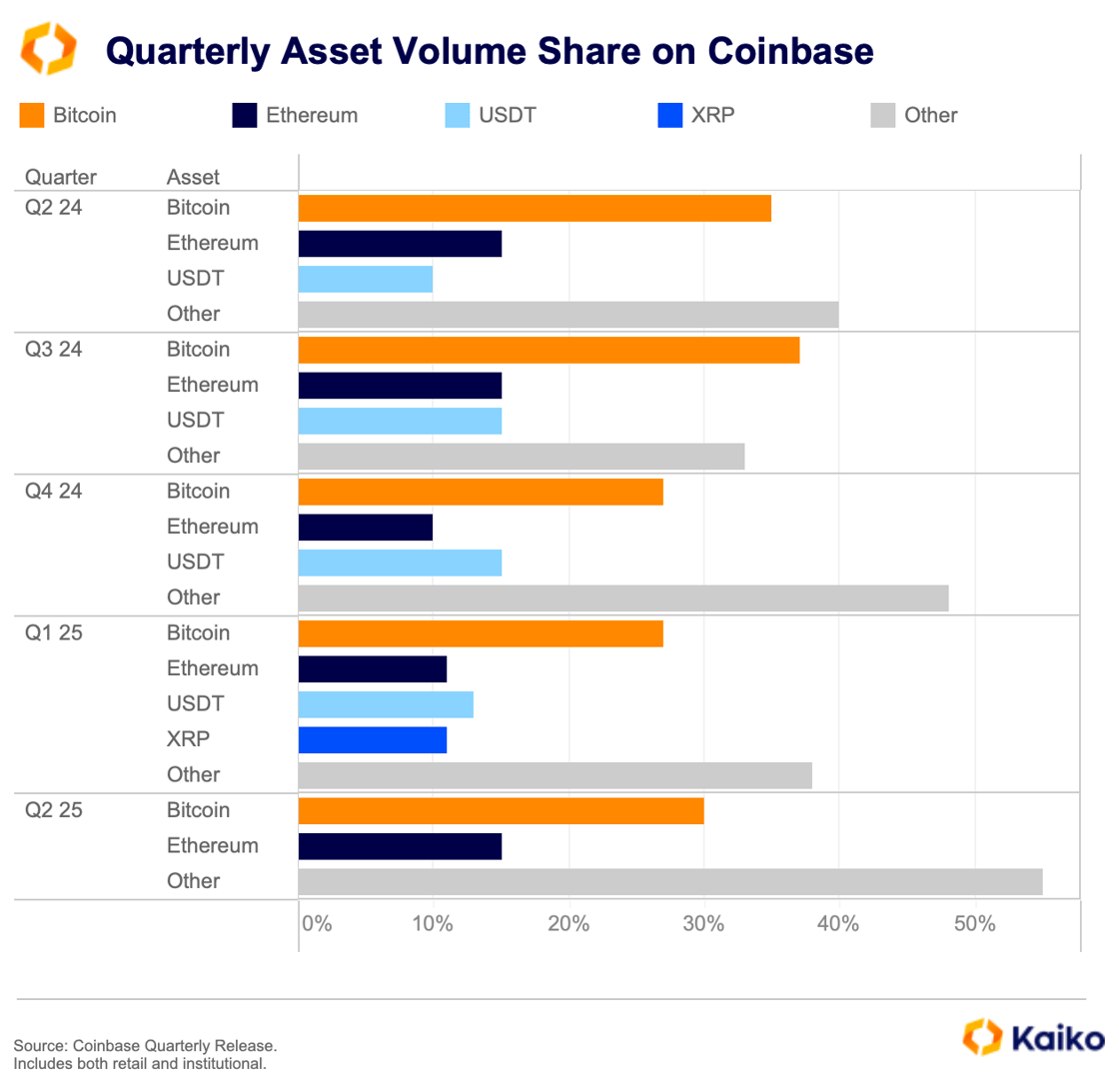

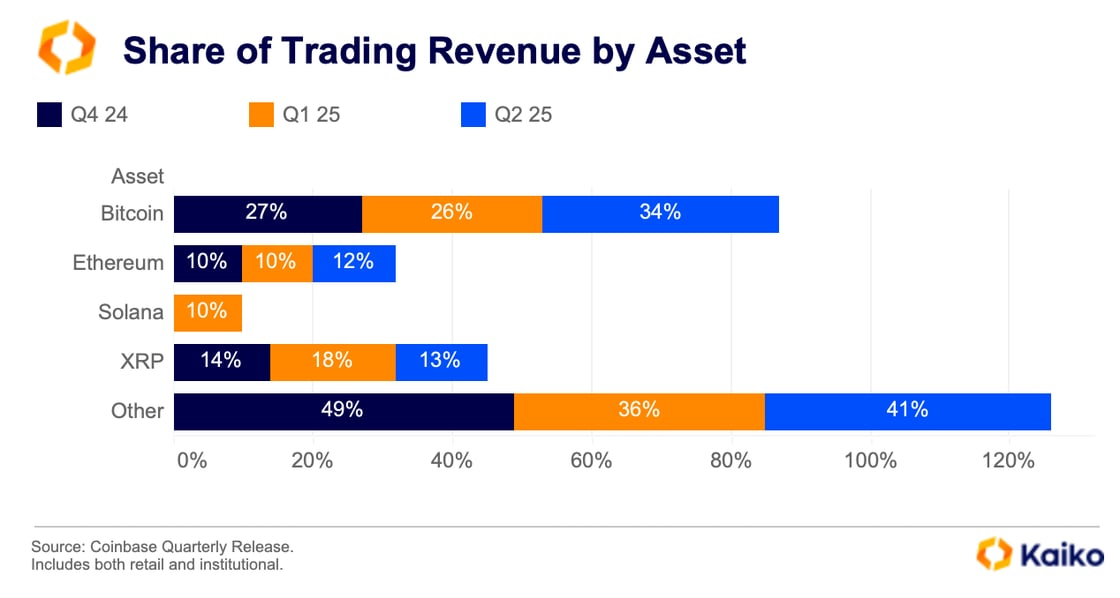

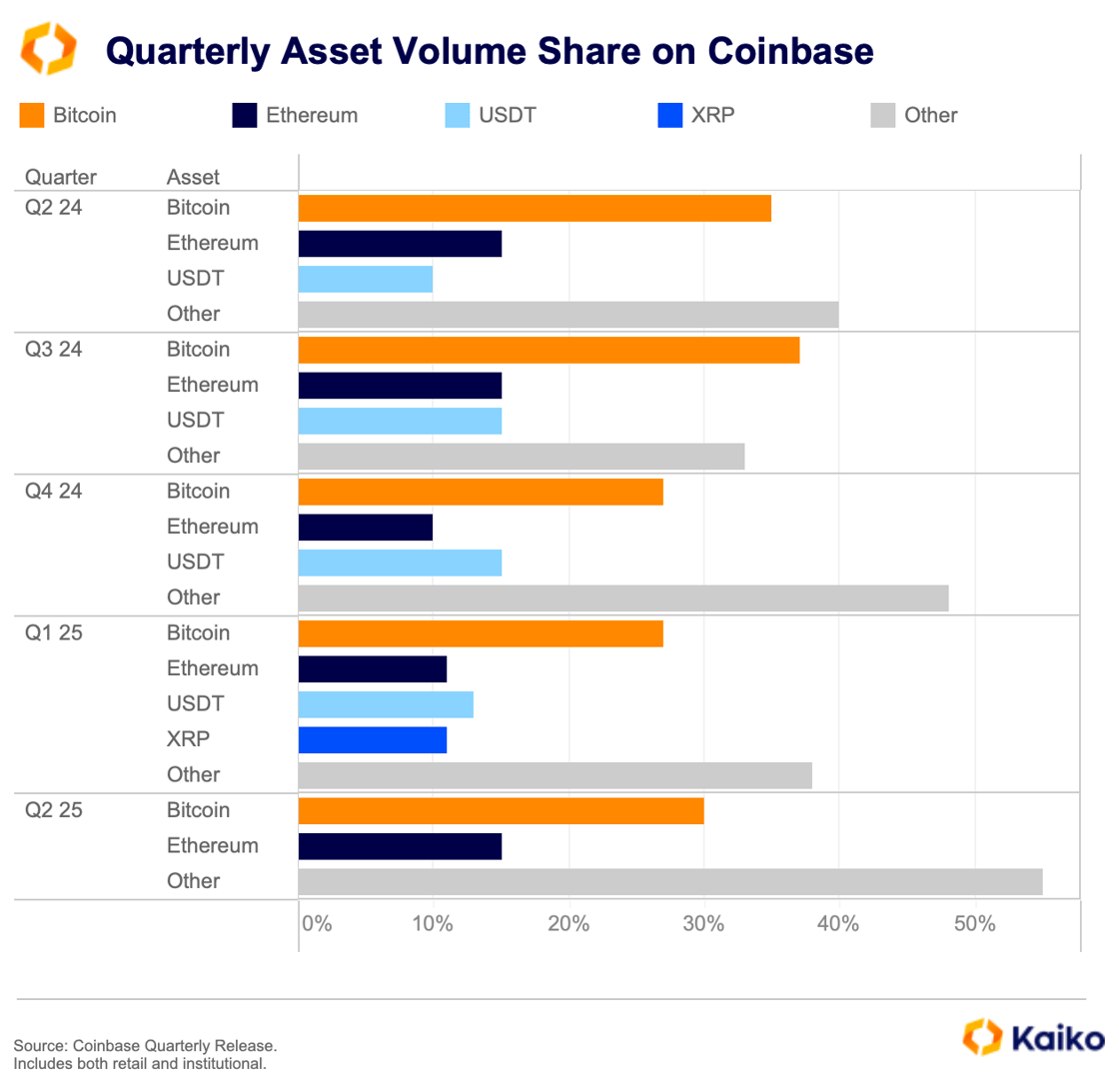

ETH trading only accounted for 15% of all activity last quarter, across both retail and institutional customers, according to Coinbase’s latest earnings release. This is during a quarter where ETH outperformed BTC, up 38% to 27%, and rallied 40% in one week following Pectra.

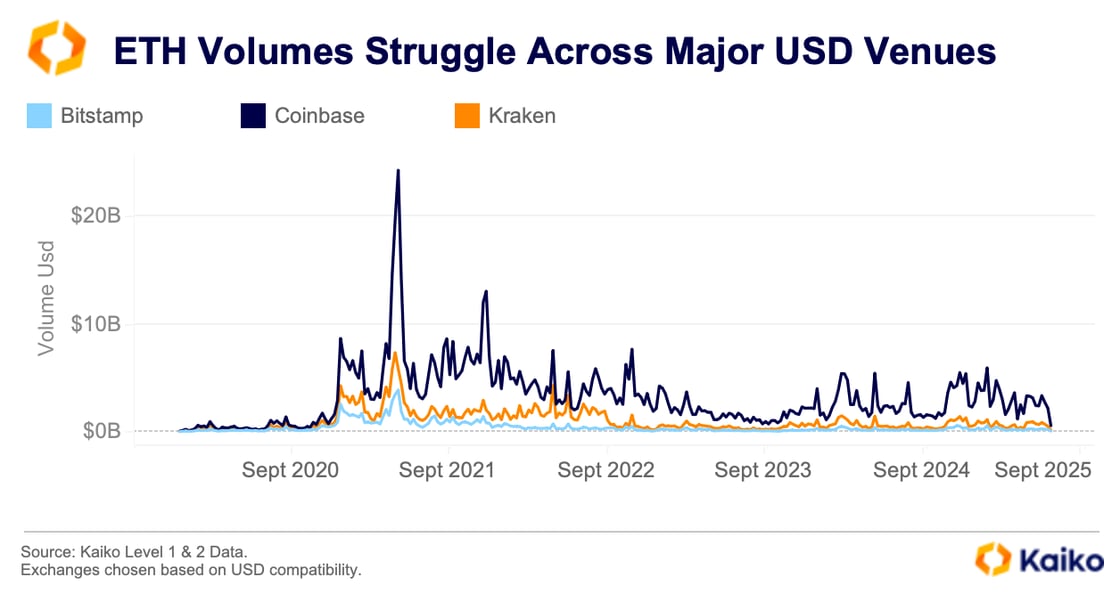

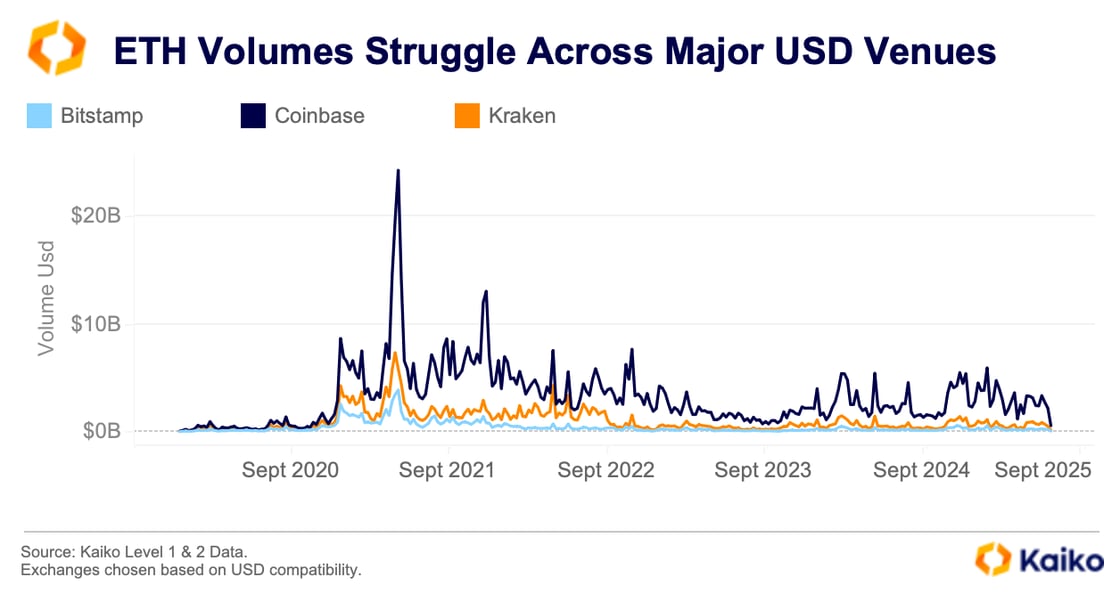

It’s not just on Coinbase that ETH is struggling though, other major U.S. Dollar compatible exchanges have seen muted volumes, with none eclipsing 2021 levels so far this cycle. Weekly ETH volumes on Kraken haven’t been above $2bn since August 2024 for instance.

It’s not just on Coinbase that ETH is struggling though, other major U.S. Dollar compatible exchanges have seen muted volumes, with none eclipsing 2021 levels so far this cycle. Weekly ETH volumes on Kraken haven’t been above $2bn since August 2024 for instance.

That is perhaps unsurprising considering ETH hasn’t yet challenged its previous all-time high of $4.8k, set in November 21. As a result of muted ETH volumes XRP has contributed more to Coinbase’s revenue for the past three quarters now. But XRP hasn’t established itself as a consistent revenue source for Coinbase just yet, and its contribution is inconsistent. There was a similar story with SOL, it briefly offered as much as ETH in the first three months of the year, before dropping below 10% share of trading venue last quarter.

BTC has increased its share of trading revenue, this mirrors BTC’s dominance during this market cycle. Other assets increased their share to back above 40%, after dipping to 36% of trading revenue in Q1. A result of this lopsided demand on the venue, and indeed across most crypto venues, is the rush to add new assets.

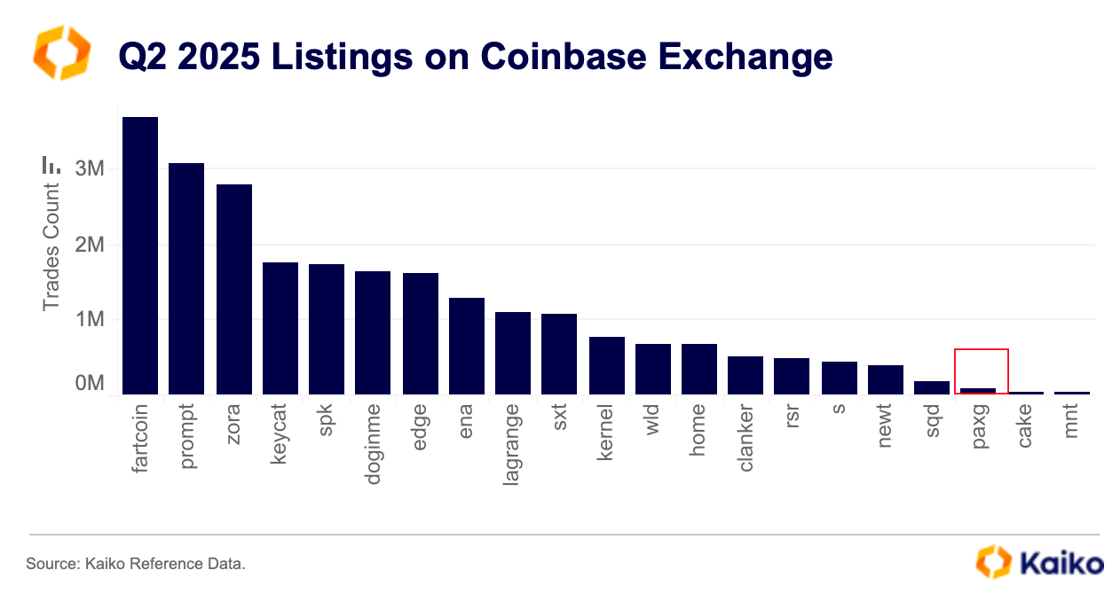

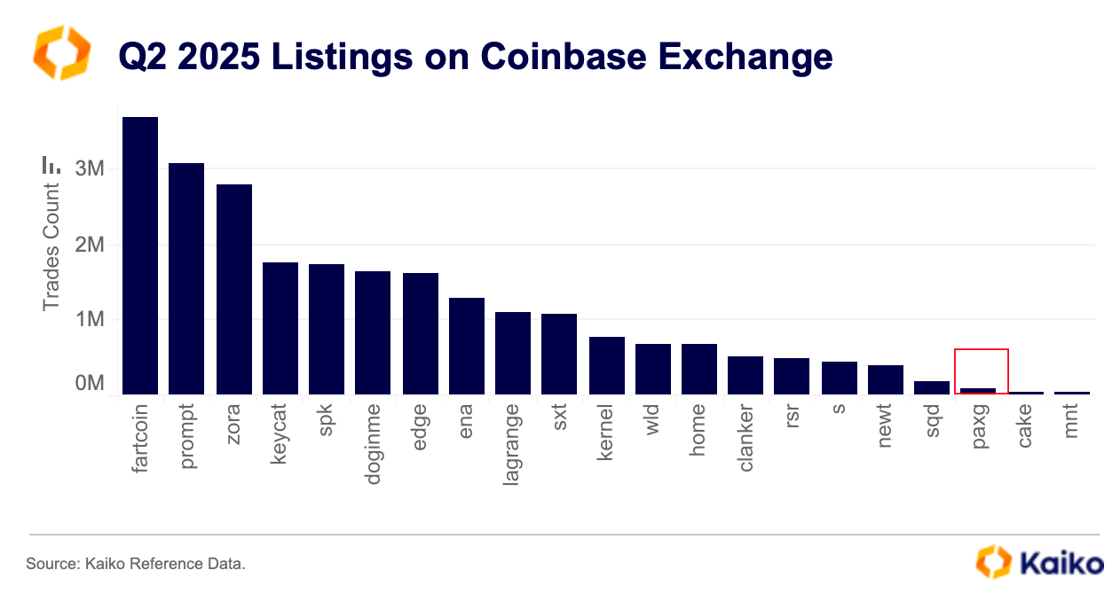

Coinbase continued to add new assets during the second quarter, with a total of 21 new listings based on Kaiko reference data. These types of listings are aimed at retail users, rather than being driven by institutional demand. This is evident as assets like Fartcoin have drawn the most demand since listing last quarter, with over 3 million trades executed since launch.

Meanwhile, Paxos Gold has hardly seen any activity despite the dominate Gold narrative in the market at present amid rising prices and political uncertainty. The preference for memecoins over established assets also potentially hinders one of Coinbase’s solutions to its trading reliance. That is the tokenization of stocks, which we discuss later.

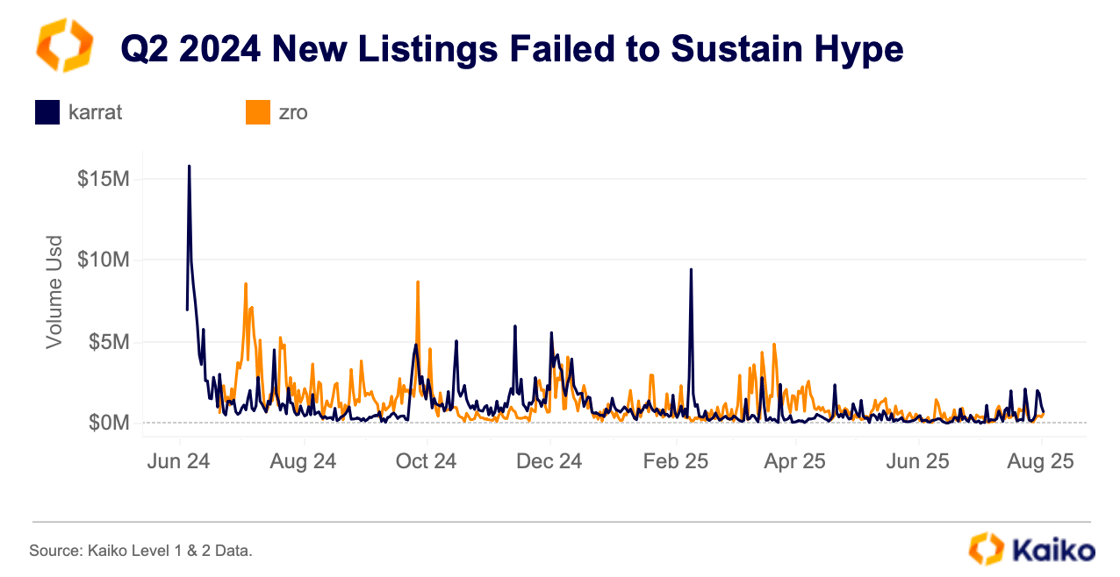

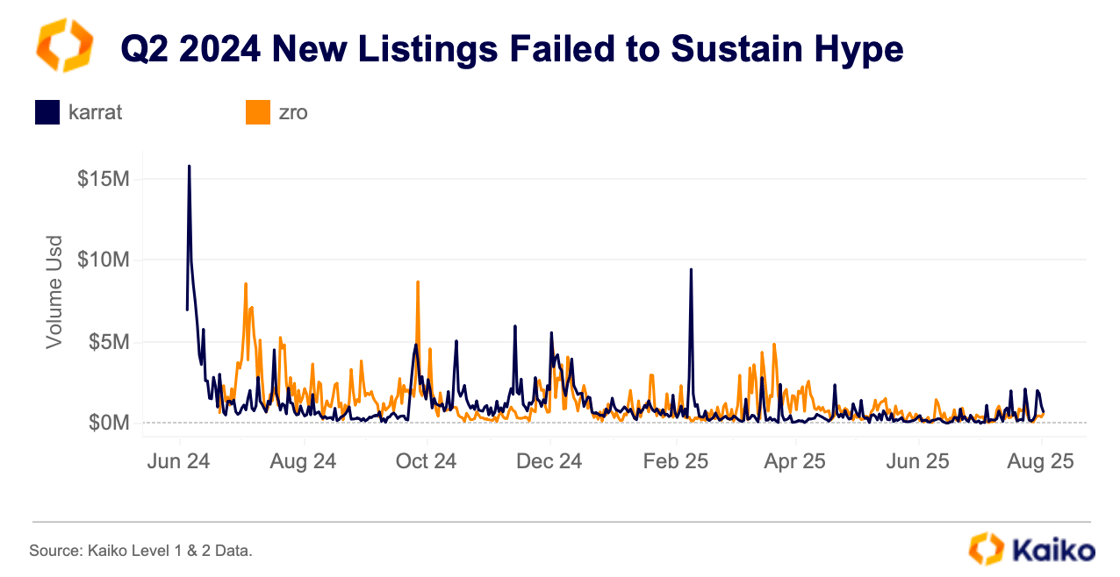

This isn’t a new trend on the exchange, last year during the same quarter Coinbase added 12 new assets, with two seeing a significant amount of trades following launch. Those were ZRO and KARRAT, neither maintained those levels and have failed to significantly impact revenues or trading activity long-term.

So, what is Coinbase doing to combat this reliance on spot trading? The main idea is to diversify income streams across various verticals, to become the “everything exchange.”

The launch of Base and the push into DeFi is one area of growth CEO Brian Armstrong earmarked during an investor relations roundtable with crypto and fintech analysts on Friday, which Kaiko attended. Armstrong also pointed out the potential for tokenization, and in particular tokenized stock trading. The total addressable market for this is sizeable, the CEO said, telling attendees that if they could capture just 3% of equities trading then this would double the current crypto market cap.

Another area of growth earmarked during this call was the launch of perpetual futures, which will be priced off of Coinbase’s own spot market. The circular nature of this pricing mechanism is likely another way to drive spot volumes higher, potentially a more successful method than rushing to launch new tokens each quarter.

These aren’t silver bullets though, as the market for perpetual futures is already crowded with billions of dollars traded on Binance, Okx, and Bybit each day and some tokenized assets on Coinbase, like PAXG, see limited activity. Furthermore, competitors in the U.S. like Robinhood are also launching their own perps markets, as well as making pushes into the tokenization space. Time will tell if the everything exchange can break Coinbase’s revenue reliance on trading volumes.

![]()

![]()

![]()

![]()

Furthermore, executives have a plan to combat revenue volatility. The shortfall in Q2 revenue is not uncommon for Coinbase, which relies heavily on trading volumes (a reliance it wants to combat) to drive returns. Monthly trading volume on Coinbase Exchange declined steadily during the quarter, from $89 billion in April to below $57 billion in June. In contrast, monthly volumes in the first quarter never fell below $100 billion.

Furthermore, executives have a plan to combat revenue volatility. The shortfall in Q2 revenue is not uncommon for Coinbase, which relies heavily on trading volumes (a reliance it wants to combat) to drive returns. Monthly trading volume on Coinbase Exchange declined steadily during the quarter, from $89 billion in April to below $57 billion in June. In contrast, monthly volumes in the first quarter never fell below $100 billion.

Crypto traders are typically drawn to volatility, which often gives them the confidence to enter the market. For the most part, volatility is seen as a feature, not a bug. As a result, lower volatility often corresponds with lower trading volumes, and vice versa. That is what makes ETH’s trading activity on Coinbase particularly interesting. Despite an uptick in volatility last quarter and a notable rally following the Pectra upgrade in May, traders appear to have shifted their attention to other assets.

Crypto traders are typically drawn to volatility, which often gives them the confidence to enter the market. For the most part, volatility is seen as a feature, not a bug. As a result, lower volatility often corresponds with lower trading volumes, and vice versa. That is what makes ETH’s trading activity on Coinbase particularly interesting. Despite an uptick in volatility last quarter and a notable rally following the Pectra upgrade in May, traders appear to have shifted their attention to other assets. It’s not just on Coinbase that ETH is struggling though, other major U.S. Dollar compatible exchanges have seen muted volumes, with none eclipsing 2021 levels so far this cycle. Weekly ETH volumes on Kraken haven’t been above $2bn since August 2024 for instance.

It’s not just on Coinbase that ETH is struggling though, other major U.S. Dollar compatible exchanges have seen muted volumes, with none eclipsing 2021 levels so far this cycle. Weekly ETH volumes on Kraken haven’t been above $2bn since August 2024 for instance.