Join us for our latest webinar in collaboration with Cboe

Insights.

Our Data Debrief and Deep Dive insights are published twice a week and you can subscribe to them here.

Derivatives

09/02/2026 Data Debrief

Bitcoin's Latest Drop Signals Halfway Point of Bear MarketLast week’s correction triggered approximately $9 billion in liquidations and pushed stablecoin dominance above 10%, exceeding levels last seen during the FTX collapse.

![]()

Binance

02/02/2026 Data Debrief

Fed Reforms Spark Cross-Asset Volatility SpikeThe final week of January 2026 delivered a stress test across multiple markets simultaneously. As th...

Written by Laurens Fraussen![]()

Macro

26/01/2026 Data Debrief

Tariff Uncertainty Exposes Bitcoin's Identity CrisisTariff volatility exposed Bitcoin’s ongoing identity crisis. Trump’s Greenland tariff threats trigge...

Written by Laurens Fraussen

![]()

Indices

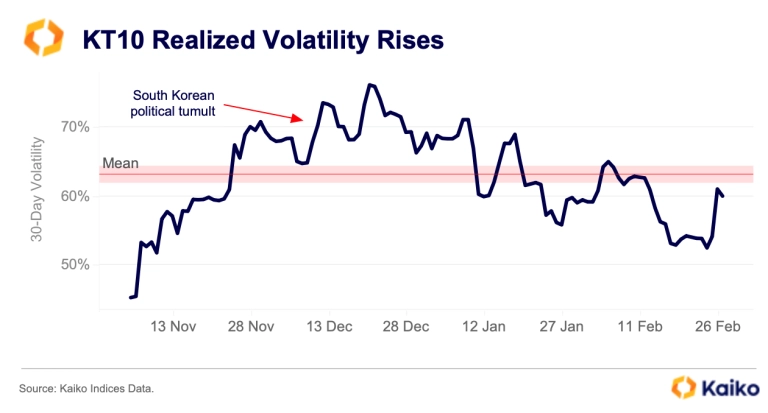

06/03/2025 Index in Focus

A Standard for Benchmarking SuccessThis week, we’re analyzing the Kaiko 10 Index (KT10), part of our multi-asset Blue Chip indices. With a compound annual growth rate of nearly 60% since inception, the index offers a competitive returns that capture the broader markets performance without sacrificing.

Written by Adam Morgan McCarthy![]()

Macro

03/03/2025 Data Debrief

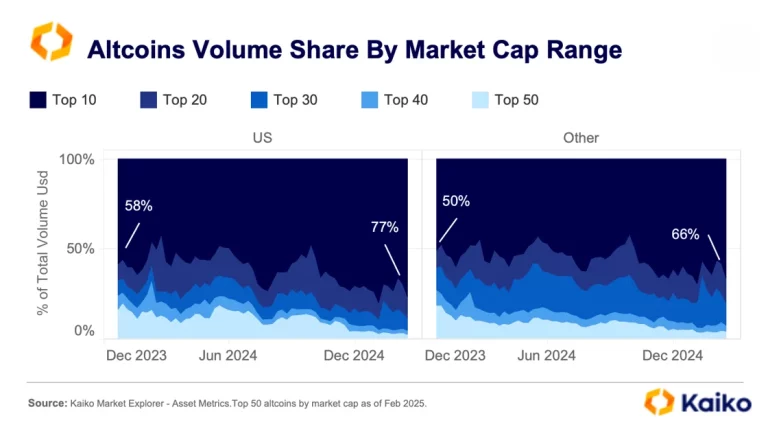

Altcoin volatility surges on strategic reserve newsAfter one of the most volatile weeks in crypto, Bitcoin has stabilized above $90K, boosted by US President Donald Trump’s announcement of the creation of a strategic crypto reserve. Meanwhile, OKX’s operator pleaded guilty to U.S. anti-money laundering violations and agreed to a $505 million penalty, and the SEC closed its investigation into Uniswap Labs.

Written by The Kaiko Research Team![]()

Indices

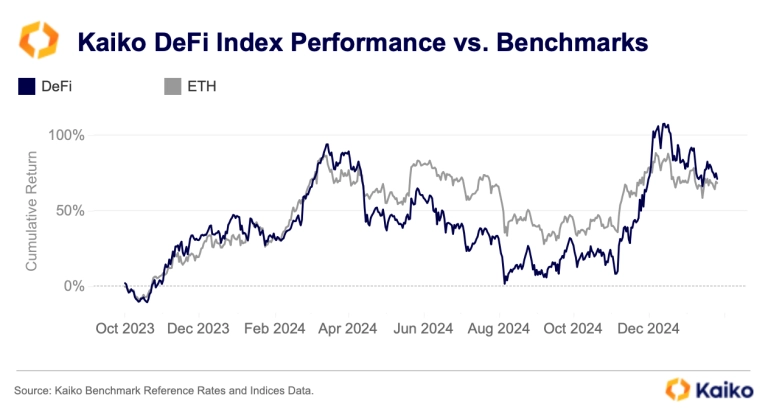

27/02/2025 Index in Focus

Diversified Access to DeFiThis week, we’re looking at the Kaiko DeFi Index, part of our family of sector-based indices. The Kaiko Indices DeFi index offers strong sector exposure while diversifying across key growth verticals.

Written by Adam Morgan McCarthy![]()

CEX

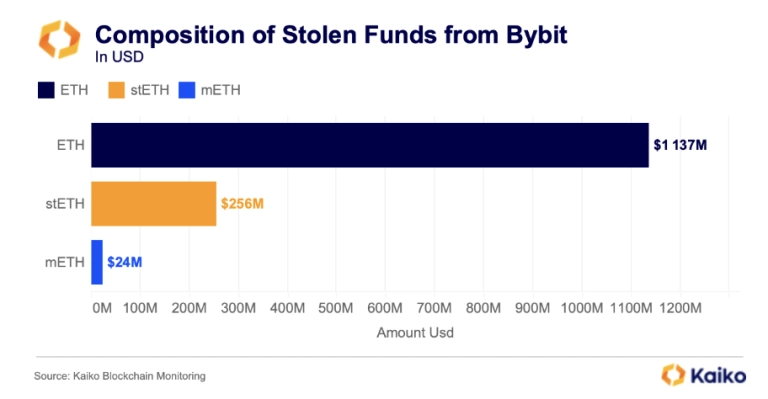

24/02/2025 Data Debrief

Bybit Hack by the NumbersDespite the SEC dropping its case against Coinbase and Robinhood, and Brazil approving the first spot XRP ETF this week, positive sentiment was short-lived. Bybit suffered what could be the largest hack of any institution—crypto exchange, bank, or otherwise—on Friday, with $1.4 billion worth of ETH and ETH derivatives stolen. Due to the magnitude of this hack, we’ve made this a special edition of the Debrief to address all the critical details.

Written by The Kaiko Research Team![]()

Indices

20/02/2025 Index in Focus

Moving Beyond Bitcoin with the KT5 IndexThis week we’re looking at one of Kaiko Indices Blue Chip product, the Kaiko 5 Index. The benchmark tracks the top five assets in our list of vetted tokens, while still offering diversified returns.

Written by Adam Morgan McCarthy![]()

Binance

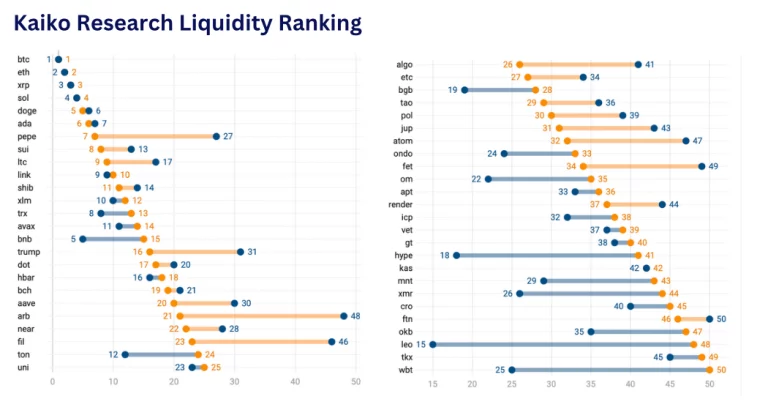

17/02/2025 Data Debrief

Liquidity lowdown: asset rankingMarkets shrugged off a hotter-than-expected U.S. CPI last week. Meanwhile, Abu Dhabi’s sovereign wealth fund revealed it had invested in Bitcoin, the SEC and Binance sought a 60-day pause in their lawsuit, and Argentine President Javier Milei’s brief support for the LIBRA token sparked controversy.

Written by The Kaiko Research Team![]()

Indices

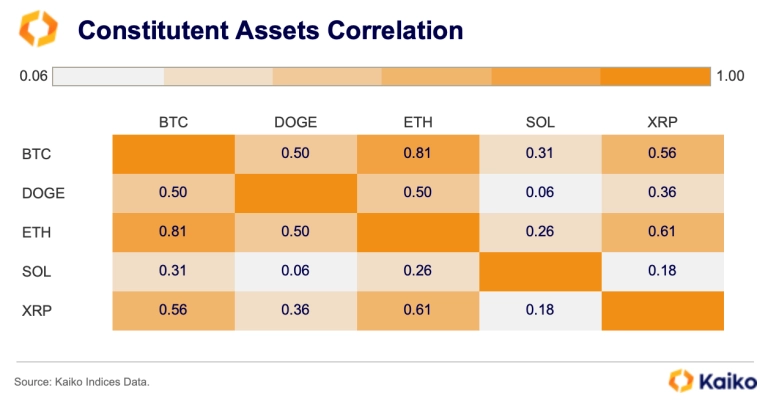

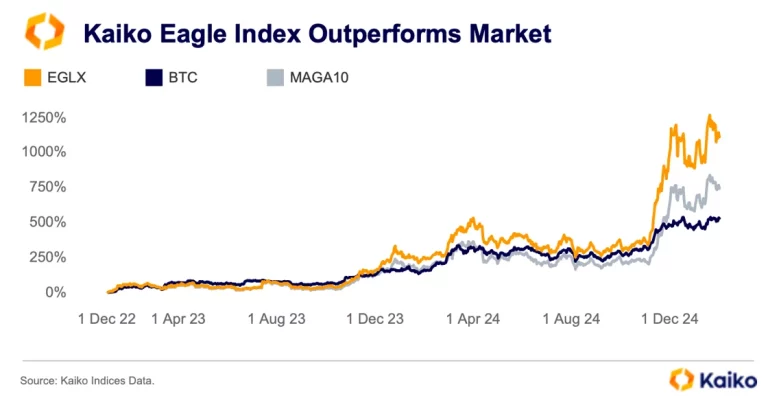

13/02/2025 Index in Focus

Fly, EAGLE FlyThis week we’re looking at one of Kaiko Indices newest products, the Kaiko EAGLE Index. This is our first regional index and asset selection wasn’t sector specific. As such it includes Layer-1 assets, a meme coin and a utility token.

Written by Adam Morgan McCarthy![]()

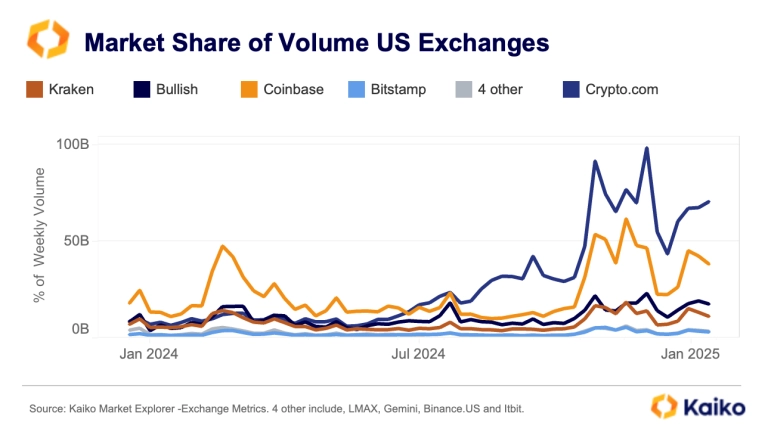

CEX

10/02/2025 Data Debrief

Coin earningsMarkets stabilized after a speedy resolution to tariff disagreements in North America. The US is exploring the creation of its own sovereign wealth fund, while regulator and crypto czar David Sacks envisages a “golden age” for digital assets.

Written by The Kaiko Research Team![]()

Indices

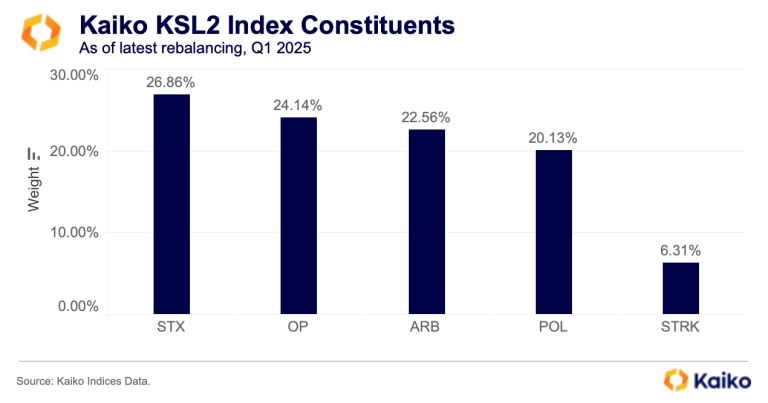

06/02/2025 Index in Focus

Capturing the Layer-2 NarrativeThis week we’re launching something new, the Kaiko Index in Focus. In our first edition we’re looking at the Kaiko Layer-2 Index, a sector index tracking L2s across Bitcoin and Ethereum.

Written by Adam Morgan McCarthy![]()

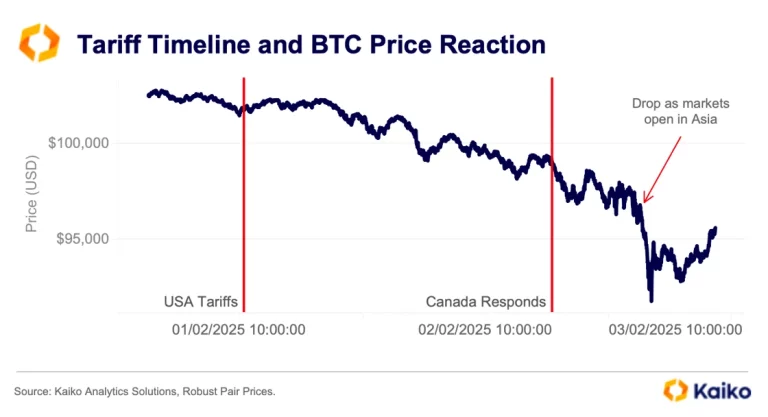

Macro

03/02/2025 Data Debrief

Tariff Driven TumultFears of an escalating trade war are weighing on Bitcoin and other risk assets after the U.S. imposed tariffs on China, Canada, and Mexico, prompting retaliation from Canada. Meanwhile, the SEC has approved another joint BTC and ETH ETF, and Trump-affiliated product websites have begun accepting TRUMP and MELANIA tokens as payment.

Written by The Kaiko Research Team![]()

ETF

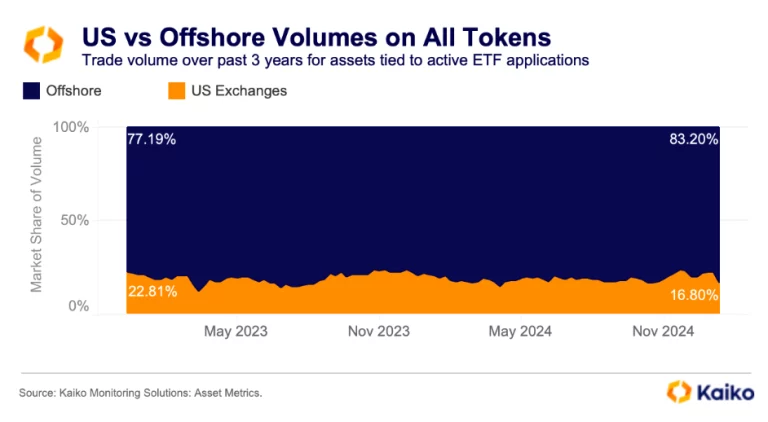

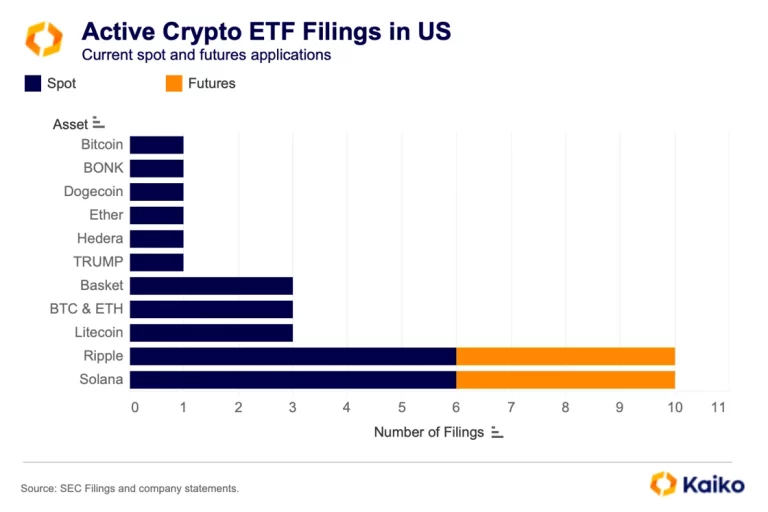

30/01/2025 Deep Dive

ETF applications are eating the worldIts a who’s who of hedge fund managers in Miami this week as conference season kicks into gear. For the second year running the south Florida skyline lit up with the BTC symbol as well as a homage to US President Donald Trump. With this symbolic celebration of crypto’s ascends into the mainstream we’re looking at the latest ETF applications and just how likely it is we’ll see a Dogecoin or Bonk product hit the market.

Written by Adam Morgan McCarthy![]()

ETF

27/01/2025 Data Debrief

ETF Filing FrenzyBitcoin fell below $100K early Monday as Chinese AI app DeepSeek gained popularity, triggering a risk-off market rout. Meanwhile, the U.S. SEC revoked SAB 121, allowing banks to offer crypto custody without accounting for clients’ assets as liabilities, and the U.S. President signed an order to form a crypto regulation group and explore a national Bitcoin reserve

Written by The Kaiko Research Team![]()

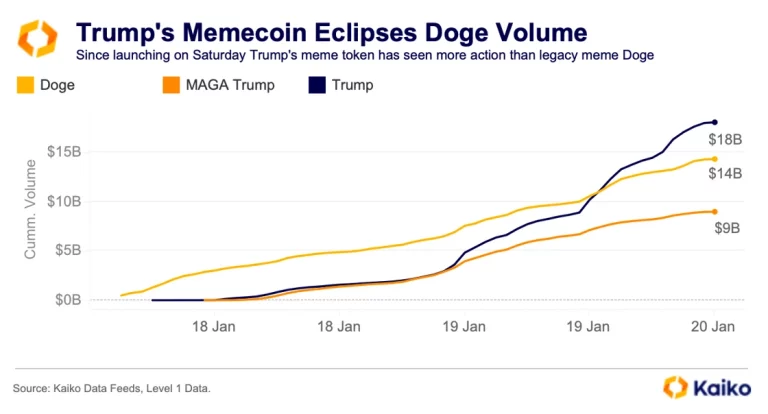

Memecoins

20/01/2025 Data Debrief

Trump takes over memecoinsBitcoin and several altcoins hit an all-time high as markets anticipate a flurry of executive orders following President-elect Donald Trump’s inauguration today.

Written by The Kaiko Research Team![]()

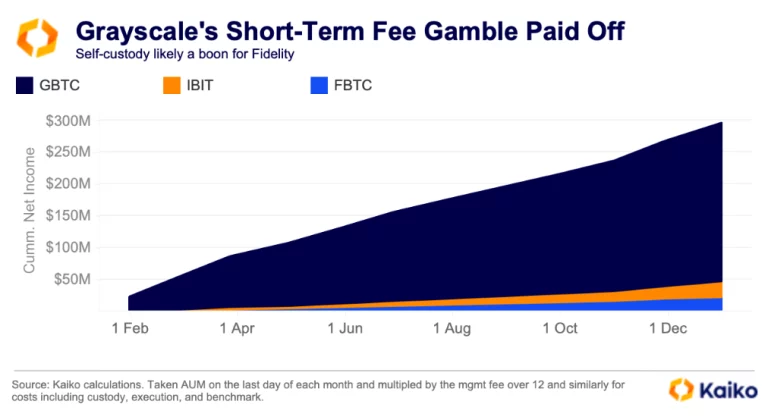

Bitcoin

16/01/2025 Deep Dive

How BTC ETFs reshaped cryptoJust over one year on from spot BTC ETF launch we took a look back at life after approval; how ETFs have reshaped crypto markets, supported prices, and what’s next for these burgeoning funds.

Written by Adam Morgan McCarthy![]()

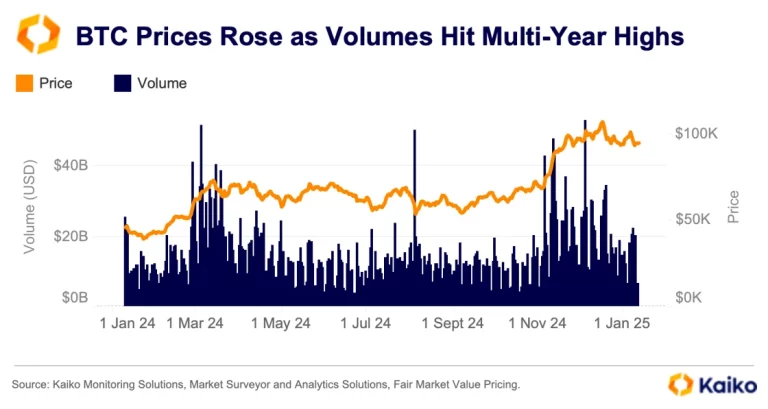

Bitcoin

13/01/2025 Data Debrief

Life after BTC ETFsBitcoin closed the week lower as risk assets tumbled on hotter than expected US jobs report, with prices now nearing a two-month low. In other news, the US Department of Justice approved to sell $6.5bn BTC adding to the risk-off mood.

Written by The Kaiko Research Team![]()

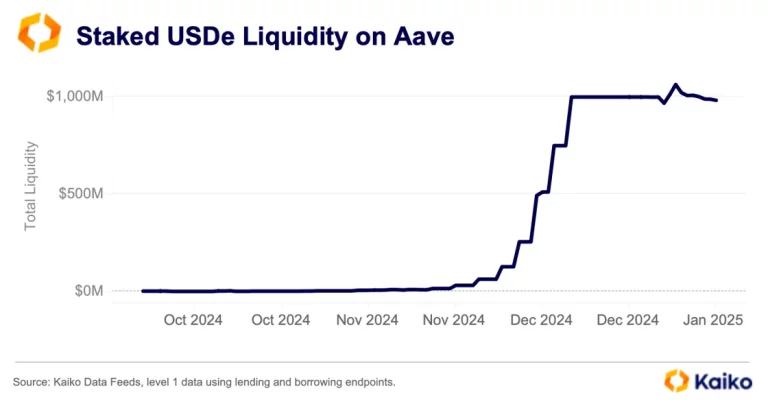

Stablecoin

06/01/2025 Data Debrief

Rising interest in Ethena amid Aave, USDtb launchesHappy New Year, Bonne Année, Gutes Neues Jahr, and all the rest! We’re back from our holiday hiatus just as BTC once again approaches $100k. While the past few days have been relatively quiet, expect increased activity this week with Congress set to ratify the US election results and the first full week of trading since mid-December.

Written by The Kaiko Research Team