Join us for our latest webinar in collaboration with Cboe

Insights.

Our Data Debrief and Deep Dive insights are published twice a week and you can subscribe to them here.

Derivatives

09/02/2026 Data Debrief

Bitcoin's Latest Drop Signals Halfway Point of Bear MarketLast week’s correction triggered approximately $9 billion in liquidations and pushed stablecoin dominance above 10%, exceeding levels last seen during the FTX collapse.

![]()

Binance

02/02/2026 Data Debrief

Fed Reforms Spark Cross-Asset Volatility SpikeThe final week of January 2026 delivered a stress test across multiple markets simultaneously. As th...

Written by Laurens Fraussen![]()

Macro

26/01/2026 Data Debrief

Tariff Uncertainty Exposes Bitcoin's Identity CrisisTariff volatility exposed Bitcoin’s ongoing identity crisis. Trump’s Greenland tariff threats trigge...

Written by Laurens Fraussen

![]()

Bitcoin

19/12/2024 Deep Dive

Kaiko's Top 10 Charts of 2024As the year comes to a close we wanted to recap some of the top stories and datapoints of 2024. It was a seminal year for crypto markets. In spite of hostile regulatory conditions persisting it was also a monumental year for regulatory development with the launch of BTC and ETH ETFs alongside impending regime changes.

Written by Adam Morgan McCarthy![]()

Bitcoin

16/12/2024 Data Debrief

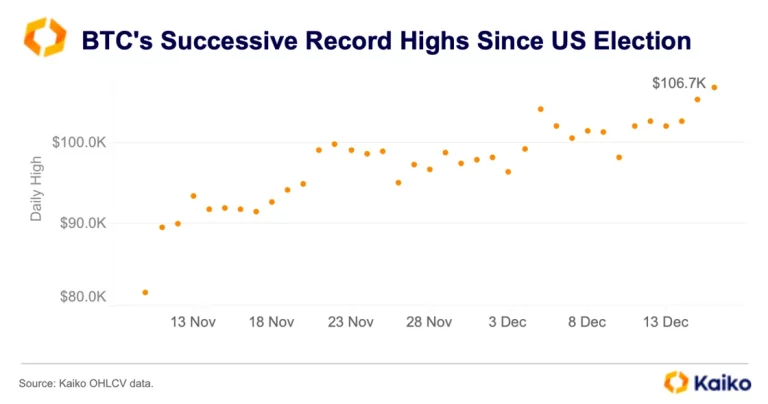

What are the odds of Santa Rally?Bitcoin hit a new all-time high early Monday, surpassing $106K on some exchanges amid US BTC strategic reserve buzz. In other news, Microstrategy secured Nasdaq-100 inclusion, the parent company of Japanese exchange Coincheck began trading on Nasdaq, and USDC issuer Circle announced a strategic partnership with Binance.

Written by The Kaiko Research Team![]()

Asia

12/12/2024 Deep Dive

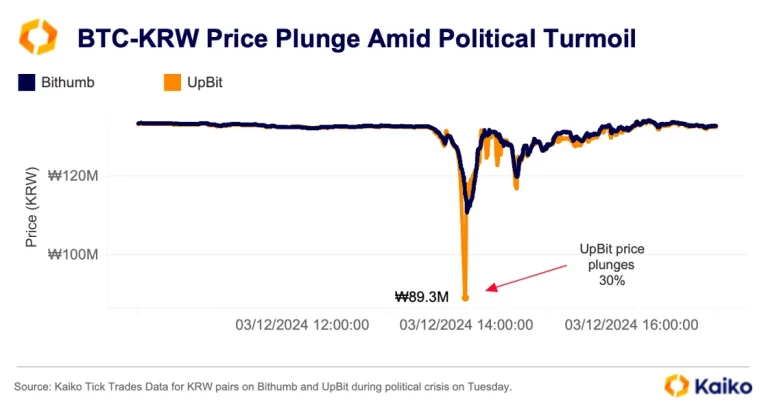

Around the world in crypto trendsAs the year winds down, we’ve analyzed global crypto market trends, spotlighting key figures driving adoption across various countries. This regional deep dive highlights successes, challenges, and how unique market drivers, regulations, and structures shape crypto usage in each country.

Written by Dessislava Aubert![]()

CEX

09/12/2024 Data Debrief

Isolationary regulation, a double-edged swordBitcoin finally crossed $100k in the early hours of Friday morning. It has since whipsawed either side of that number amid heightened volatility. Elsewhere, Donald Trump chose Paul Atkins to lead the SEC, following confirmation by the senate.

Written by The Kaiko Research Team![]()

CEX

02/12/2024 Data Debrief

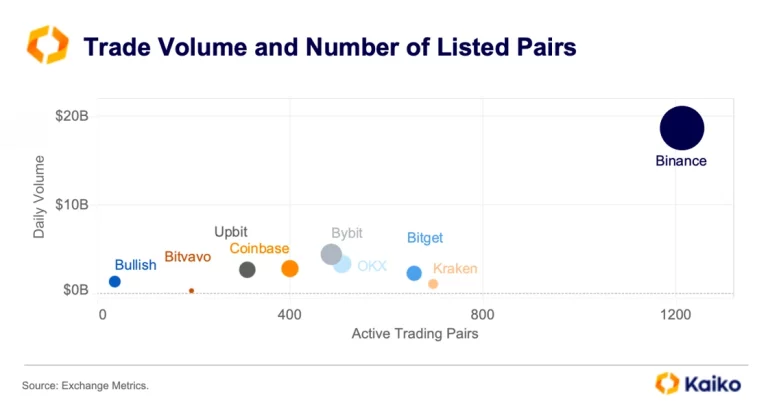

Shifting Exchange LandscapeBitcoin ended the week higher despite market jitters from President-elect Trump’s tariff threats on China, Canada, and Mexico. Meanwhile, Tether announced it will discontinue its EUR-backed stablecoin (EURT) due to regulatory challenges, while a U.S. court overturned sanctions on the cryptocurrency mixer Tornado Cash.

Written by The Kaiko Research Team![]()

Bitcoin

25/11/2024 Data Debrief

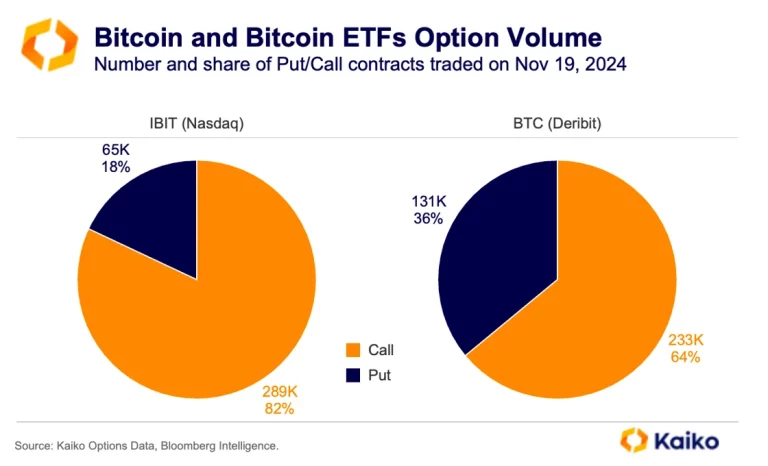

ETF options latest bullish signal for BTCBitcoin closed the week within touching distance of the highly symbolic level of $100k. Meanwhile, Cboe BZX Exchange filed four Solana spot ETF proposals, SEC Chair Gary Gensler announced plans to step down in January, and a Shanghai court ruled that individual cryptocurrency ownership is not illegal in China.

Written by The Kaiko Research Team![]()

Memecoins

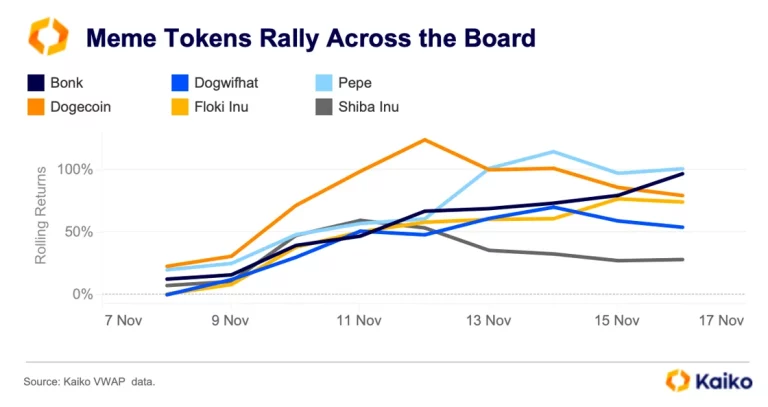

18/11/2024 Data Debrief

Attention Shifts to Meme TokensBitcoin maintains a strong momentum despite whipsawing either side of $90k over the weekend, after briefly surpassing $93K last week. Meanwhile, Bitwise filed for a multi-crypto ETF and SEC Chair Gary Gensler hinted at resigning.

Written by The Kaiko Research Team![]()

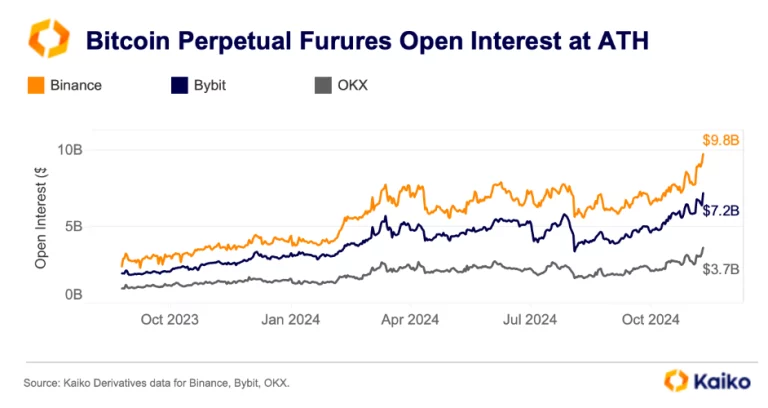

Bitcoin

14/11/2024 Deep Dive

The path to $100k for BitcoinThis week, we’re diving into the anatomy of BTC’s latest rally and its broader market implications. On Wednesday, BTC surged past $93K as post-election momentum gained traction. Meanwhile, memecoins are booming following the announcement of the creation of D.O.G.E., the U.S. Department of Government Efficiency.

Written by Dessislava Aubert![]()

Bitcoin

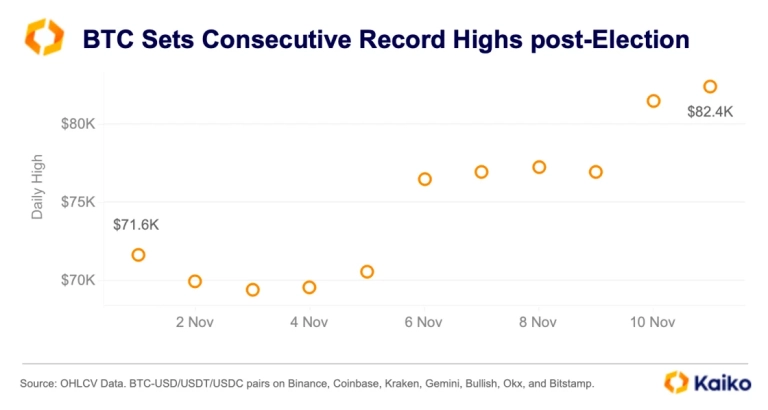

11/11/2024 Data Debrief

Bitcoin Breaks Above $80KBitcoin broke above $80K over the weekend after Donald Trump’s U.S. election win last week spurred a broad market rally. ETH is also up by over 30% since November 5, outpacing BTC for the first time in months. Meanwhile, a consortium of crypto companies launched a USD-backed stablecoin, and the U.S. SEC delayed its decision on spot ETH ETFs options.

Written by The Kaiko Research Team![]()

Bitcoin

04/11/2024 Data Debrief

2024 US General Election SpecialAhead of the US election, this week we’re revisiting the topic as a follow-up to our Deep Dive coverage from last week. We’ll examine key metrics to monitor as the election night approaches and explore the following:

Written by Adam Morgan McCarthy![]()

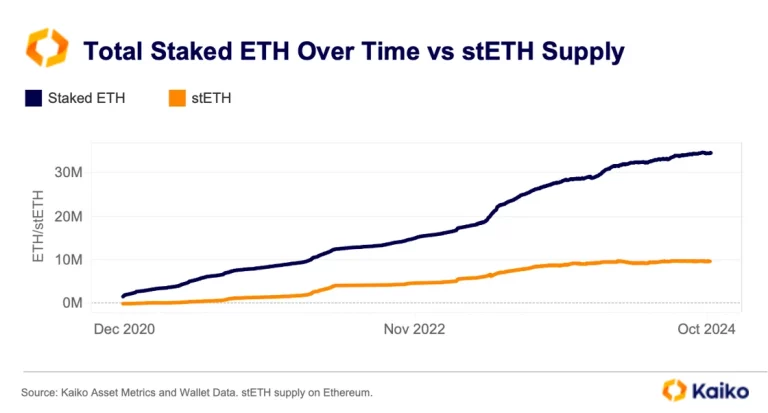

Ethereum

28/10/2024 Data Debrief

Staked ETH market tapers amid diversificationBitcoin’s price regained ground in the early hours of Monday after pulling back on Friday, following a WSJ report that U.S. regulators are investigating Tether, the issuer of the largest stablecoin. Meanwhile, Kraken announced plans to launch its own Layer 2 solution by 2025, and Robinhood debuted presidential election betting.

Written by The Kaiko Research Team![]()

Bitcoin

24/10/2024 Deep Dive

Crypto markets positioning ahead of the US electionThis week we’re peeling back the data on the upcoming US election. For the first time in 2024 digital assets have been a talking point during the Presidential campaign. Republican candidate Donald Trump promises to embrace Bitcoin and blockchain technology, while Democrat Kamala Harris has begun to address the crypto lobby.

Written by Adam Morgan McCarthy![]()

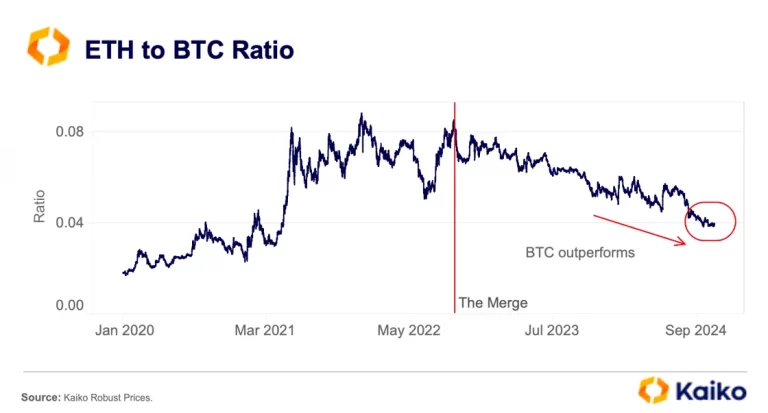

Ethereum

21/10/2024 Data Debrief

Why is ETH still lagging behind BTC?Bitcoin gained more than 5% last week despite Tesla moving $765 million of its BTC holdings to an unknown wallet. Meanwhile, DeFi protocol Radiant Capital halted lending after $50mn exploit, Singapore’s largest bank introduced tokenized banking services, and Robinhood announced it will launch BTC and ETH futures trading.

Written by The Kaiko Research Team![]()

DeFi

17/10/2024 Deep Dive

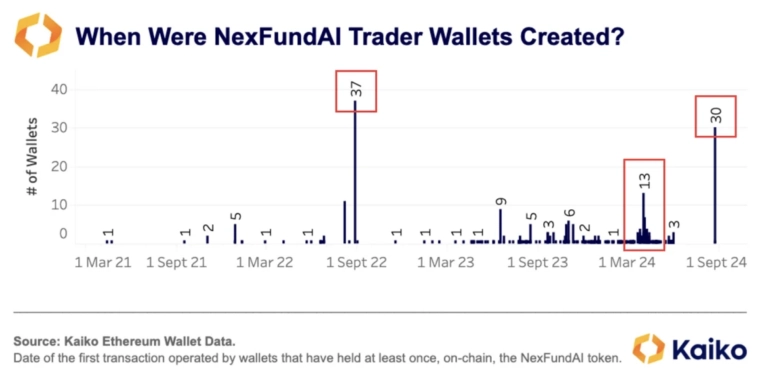

Data Reveals Wash Trading on Crypto MarketsThis week, we’re looking at wash trading on cryptocurrency exchanges, focusing on the FBI’s recent investigation, and exploring the metrics to use for raising concerns about market manipulation in crypto markets.

Written by Anastasia Melachrinos![]()

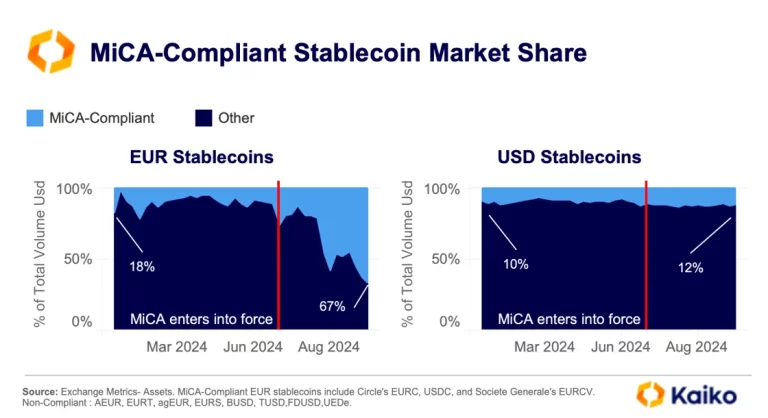

Stablecoin

14/10/2024 Data Debrief

MiCA is Reshaping EUR Stablecoin MarketsLast week saw significant regulatory developments in the cryptocurrency space. The U.S. Securities and Exchange Commission (SEC) charged Cumberland, one of the oldest liquidity providers in crypto, with operating as an unregistered broker-dealer. In a separate case, the SEC, in conjunction with the Department of Justice (DOJ), took action against several companies and individuals allegedly involved in wash trading.

Written by The Kaiko Research Team![]()

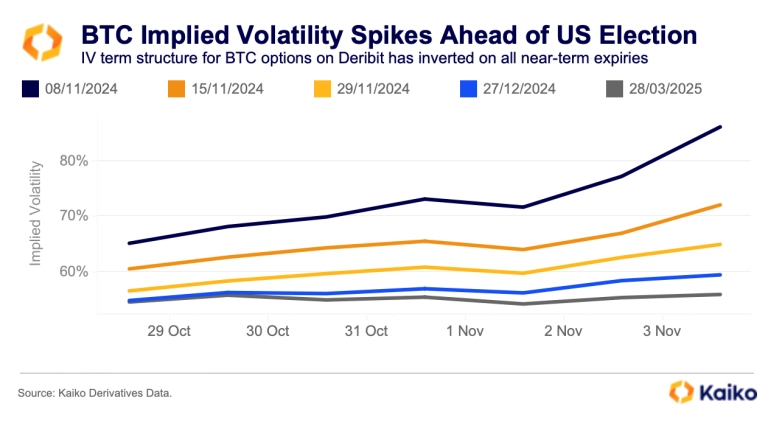

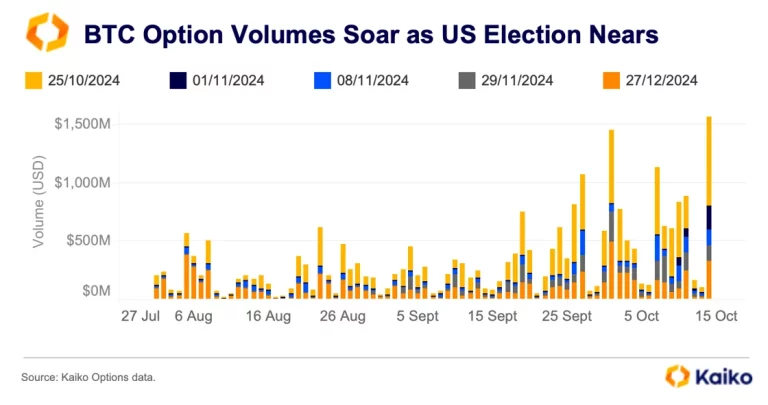

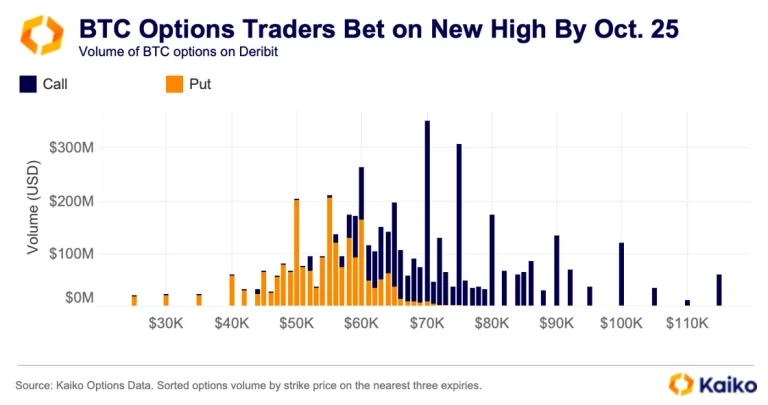

Derivatives

11/10/2024 Data Debrief

격동의 4분기를 앞두고 뜨거워지는 옵션 거래 활동Altcoins joined the rally last week after China announced its largest stimulus package since the pandemic, boosting risk-on demand. In other news, BNY Mellon has received approval from the US SEC to offer crypto custody.

Written by The Kaiko Research Team