What Is Different Now?

There are several differences in market conditions today compared with the previous halvings.

Transaction Fees

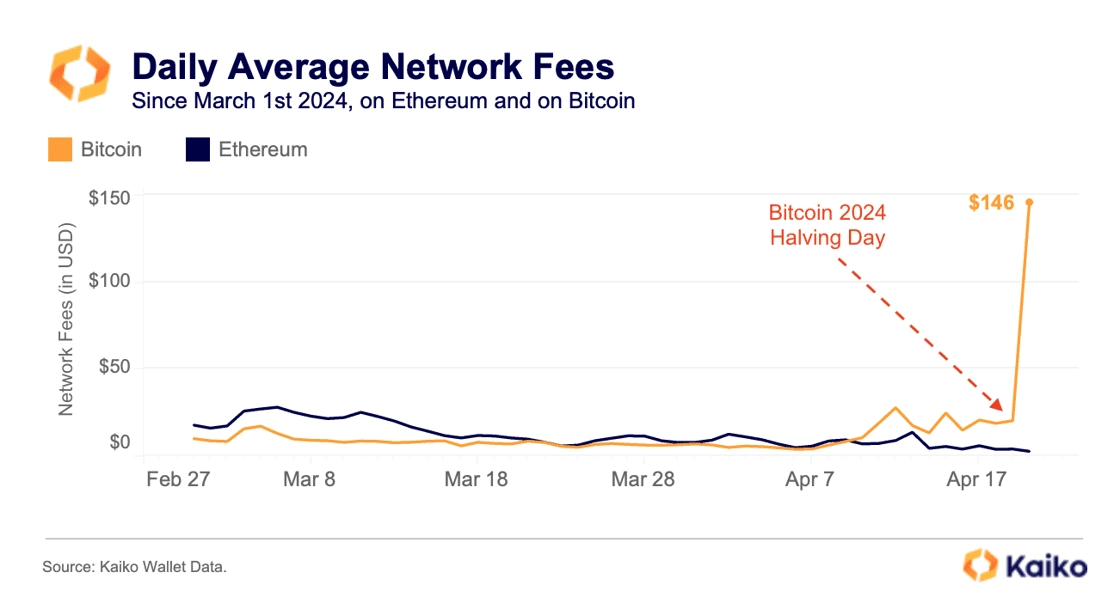

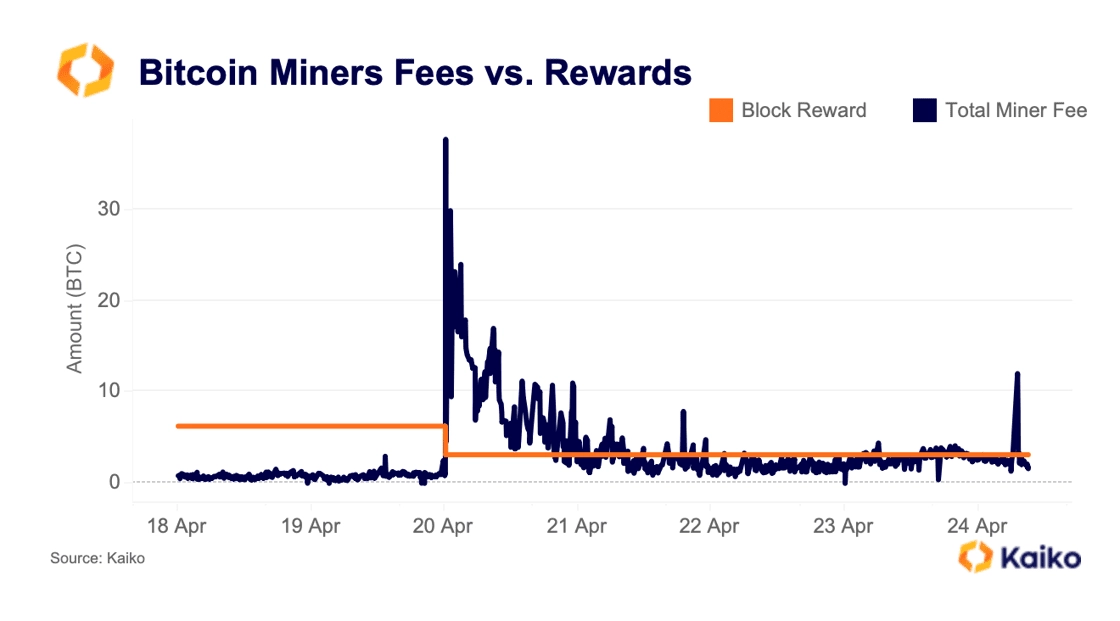

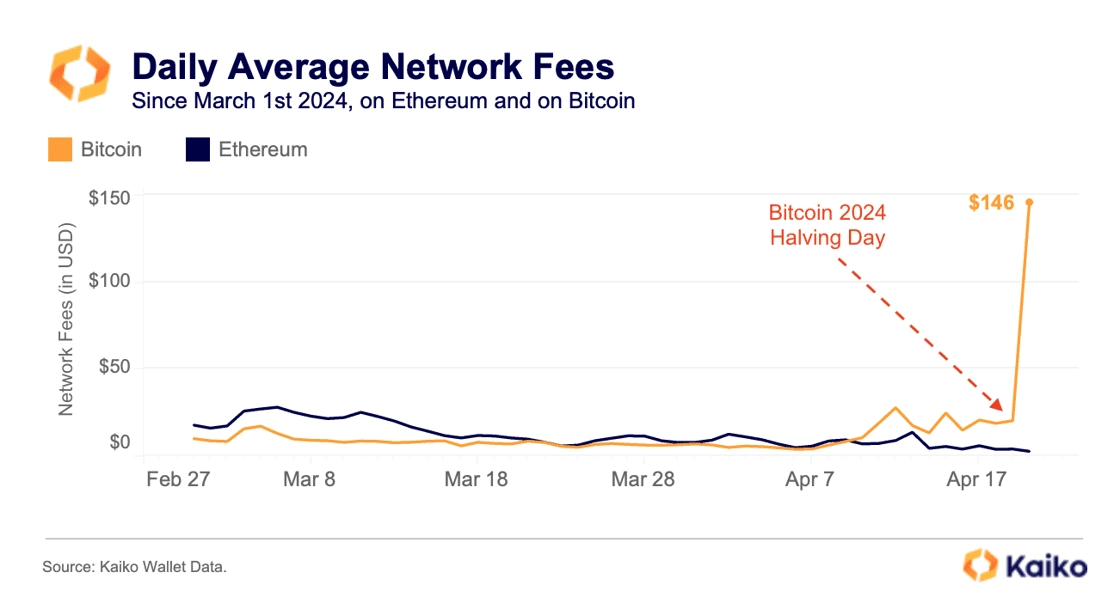

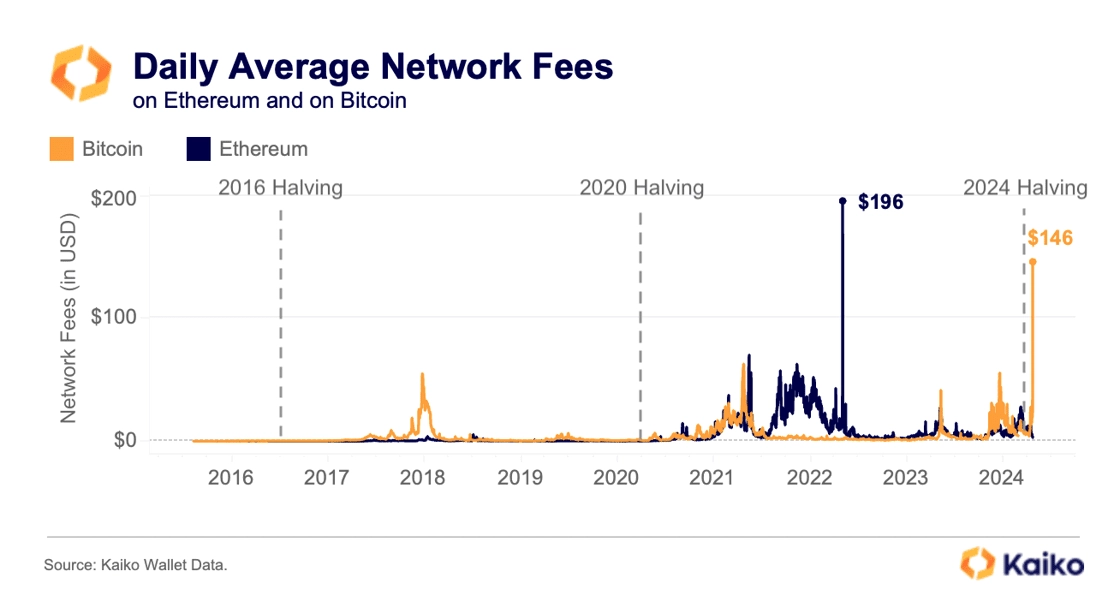

Miners fees have increased following previous halvings, however, fees have remained elevated for longer following the fourth halving, according to our data.

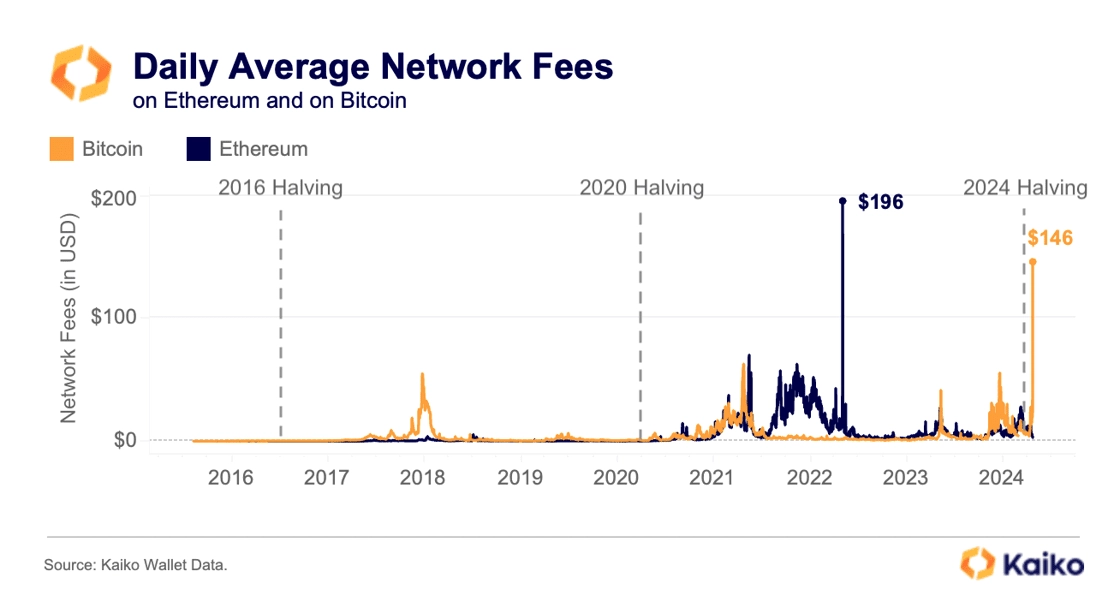

Last weekend, fees spiked as a new protocol on Bitcoin drove demand for block space. The average network fee surged on Saturday, reaching an all-time high of $146, almost breaking Ethereum’s all time high of $196. This was significantly higher than Ethereum’s average fee of $3 on the same day, according to Kaiko’s Wallet Data.

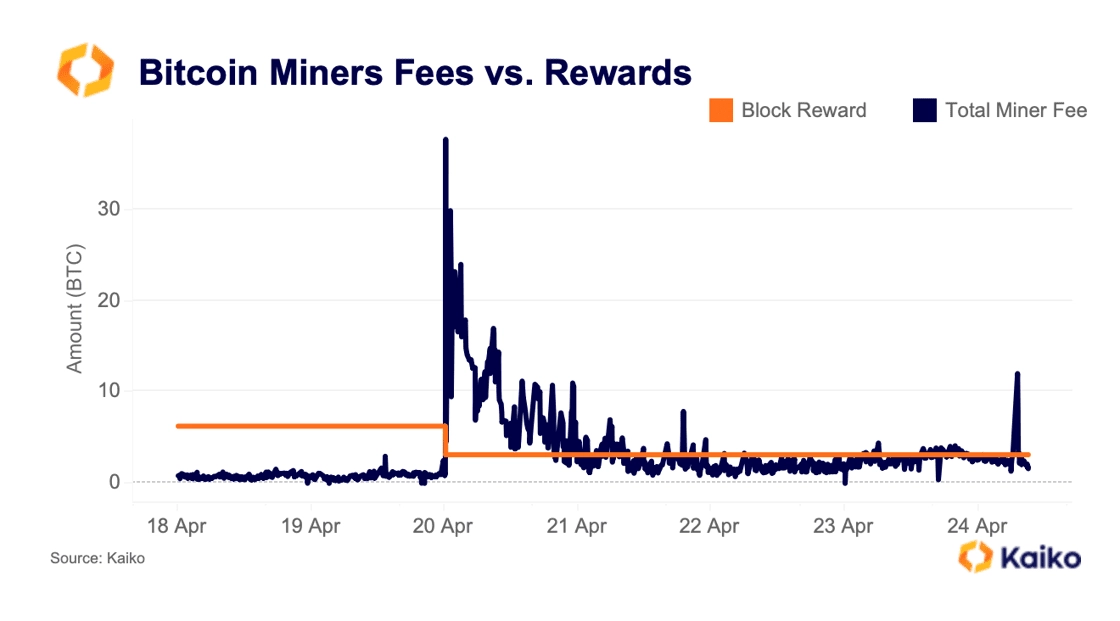

The spike in fees was perhaps the most significant development over the halving weekend, catching many market participants by surprise, despite warning signs.

This increase in fees was anticipated after Ordinals creator Casey Rodamor announced plans to launch Runes, a protocol for issuing fungible tokens on Bitcoin. Similar to the launch of Ordinals, a protocol for inscribing data and images on newly created blocks, Rodarmor’s latest project increased the demand for block space on Bitcoin and boosted the fees earned by miners.

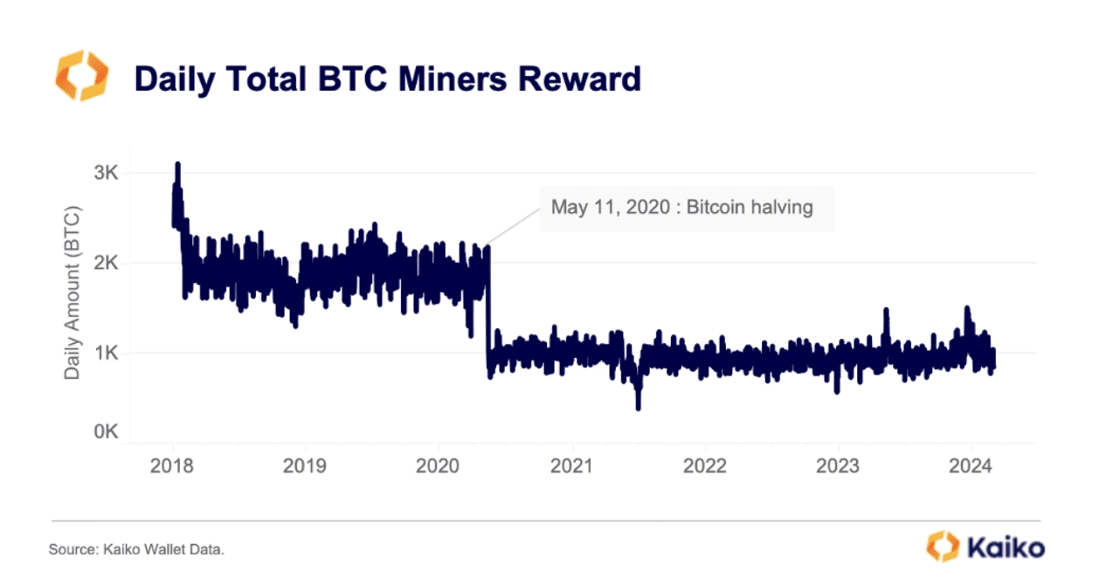

The halving has typically been a selling event for Bitcoin miners as the process of creating new blocks incurs significant costs, forcing miners to sell to cover costs.This dynamic means miners are likely to accept lower prices as they rush to convert Bitcoin into cash to cover overheads.

Liquidity and Prices

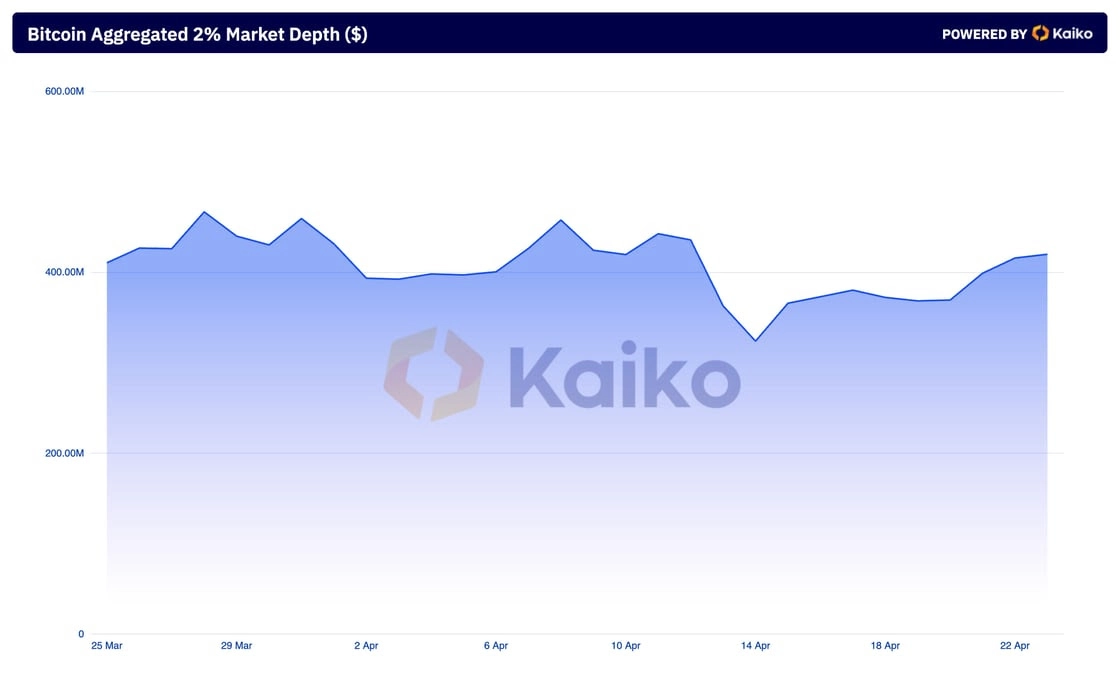

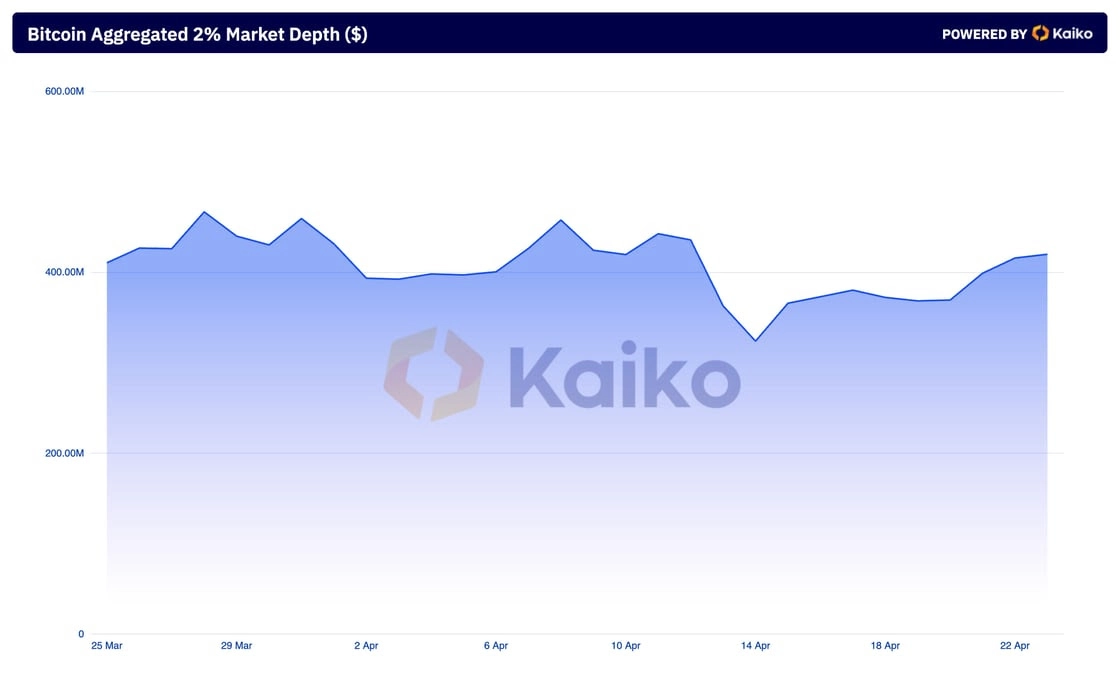

As the market impact of the fourth halving plays out over the next few months, liquidity will likely play a significant role. Liquidity in financial markets refers to the ease with which an asset can be bought or sold without significantly affecting its price. Ever since the approval of the Bitcoin spot ETFs, liquidity has almost fully recovered since lows reached in the aftermath of the FTX collapse.

This is good news for Bitcoin because stronger liquidity can reduce price volatility and lessen the impact of selling. Strong liquidity is crucial to supporting a sustained rise in Bitcoin’s price over the coming months. This also contributes to improved demand as better liquidity increases confidence in markets.

Since the halving, Bitcoin’s aggregated market depth increased from $323.91mn on April 14 to $419.97 on April 22.

Explore this data on Data+

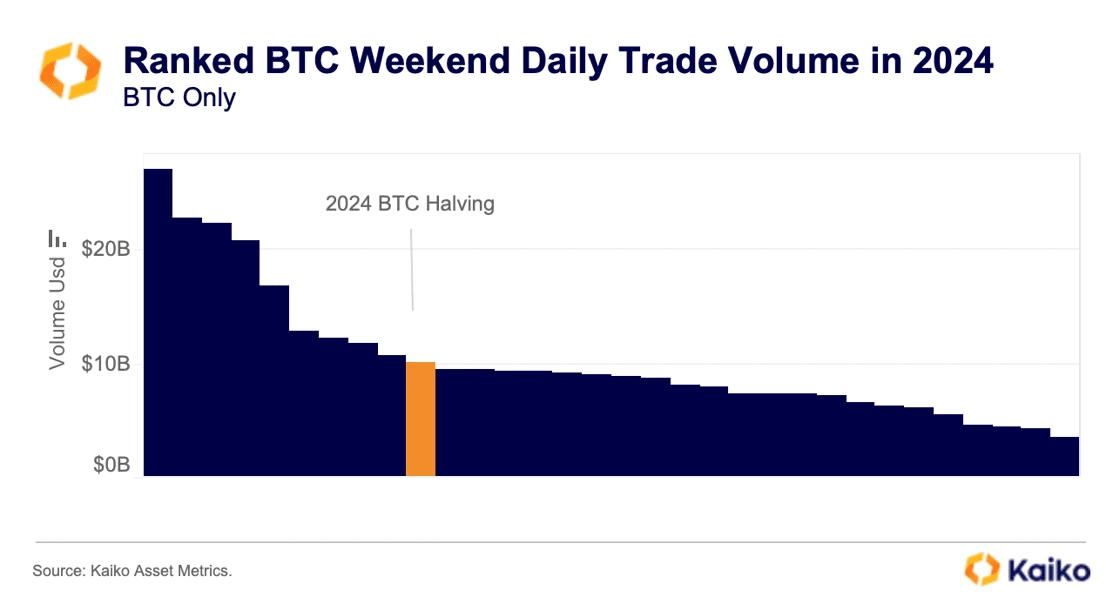

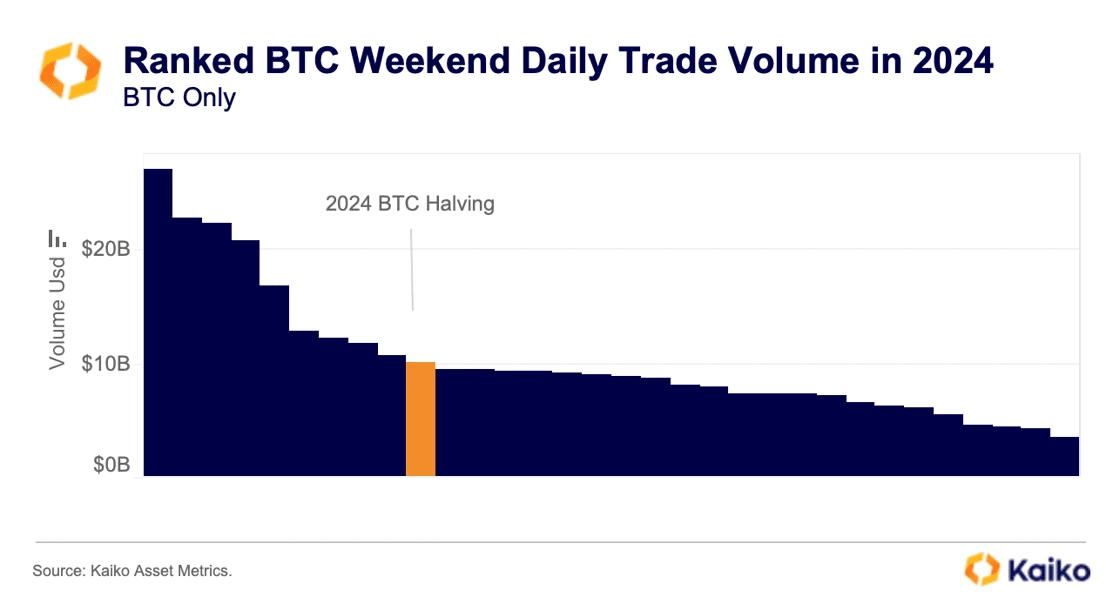

While global liquidity is approaching all time highs, a big drop in weekend trading activity could have negative consequences. Weekend and overnight liquidity management is a challenge for crypto markets that trade around the clock, causing Bitcoin’s weekend trading activity to fall consistently over the past three years.

The halving didn’t have an immediate impact on weekend trade volumes, according to Kaiko data. During the weekend of the halving, daily trade volume was sluggish at around $10 billion.

Macroeconomic Conditions

Bitcoin’s previous halvings and subsequent bull runs came during a sustained period of lower interest rates and consistent inflation. Between 2009 and 2016 the US Federal Reserve held interest rates at around 0.25%. The central bank briefly increased rates to 2.5% in 2019 before cutting to 0.25% again by the time of Bitcoin’s third halving in 2020.

Low interest rate environments incentives investors to put their money to work and typically benefit risk assets. While Bitcoin has sometimes behaved like a safe haven asset during market tumults it is more often correlated with risk assets and as such benefitted from lower interest rates.

This is the first time a halving has taken place in a high interest rate environment, so there is no precedent to how Bitcoin will trade in the long-run.

What’s next for Bitcoin?

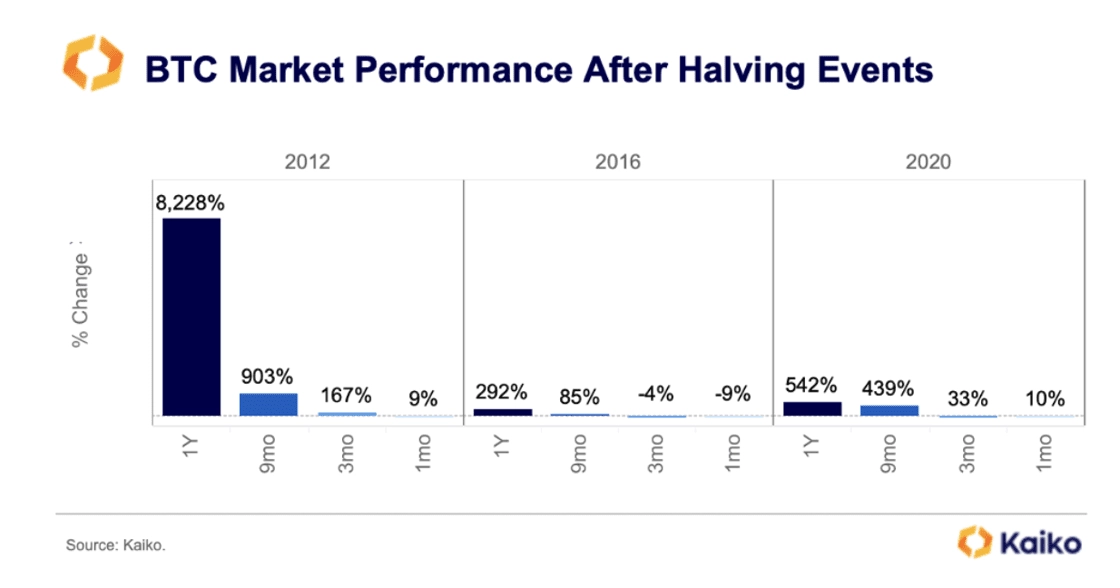

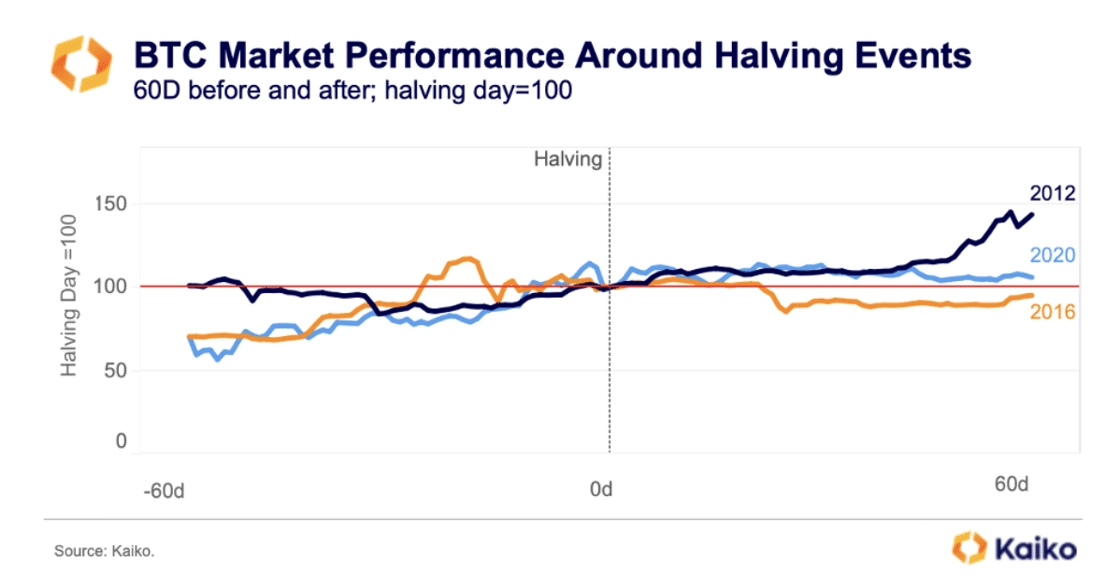

The reality is Bitcoin’s halving alone won’t be a catalyst for a sustained bull run over the next 12 to 18 months. It may have enjoyed massive returns following its previous halvings, but the latest event comes as the asset class matures and macroeconomic conditions remain uncertain.

A sustained bull run will depend on Bitcoin being an attractive investment option for new investors, who will likely come to crypto via spot ETFs in the US — and soon Hong Kong.

Therefore, robust liquidity and increasing demand will play a crucial role in improving Bitcoin’s value proposition in the coming months.

![]()

![]()

![]()

![]()