Data Points

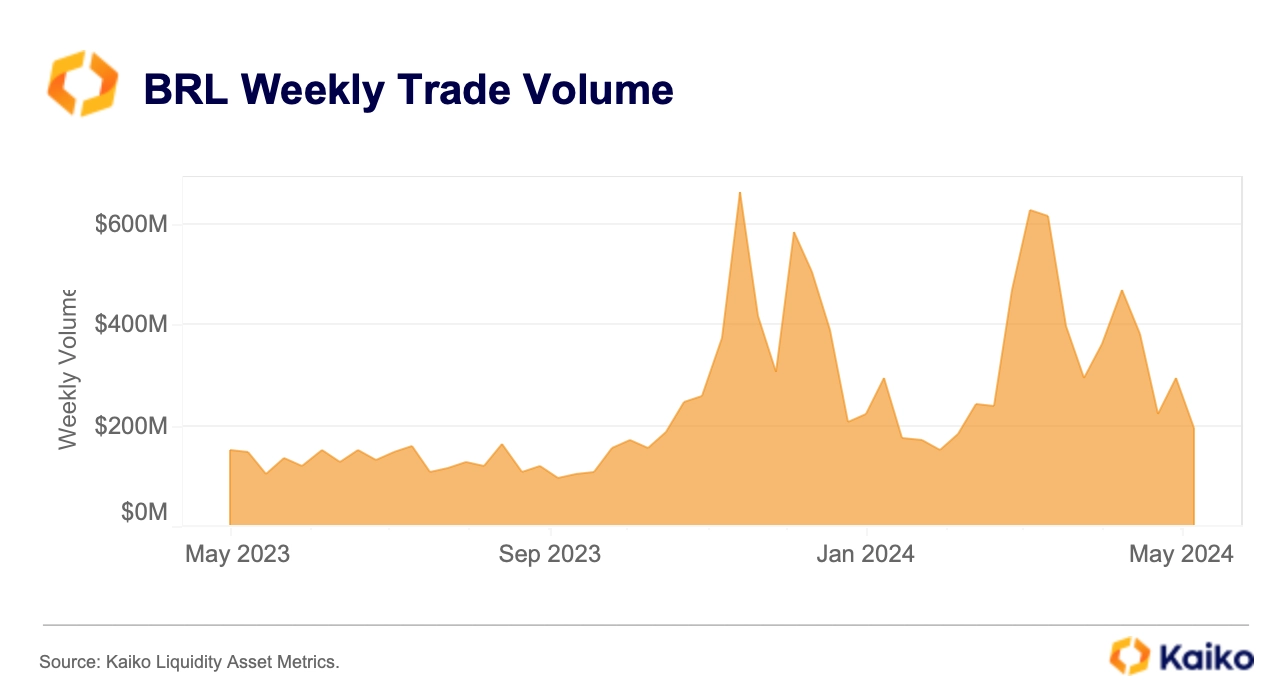

Crypto trading surges in Brazil.

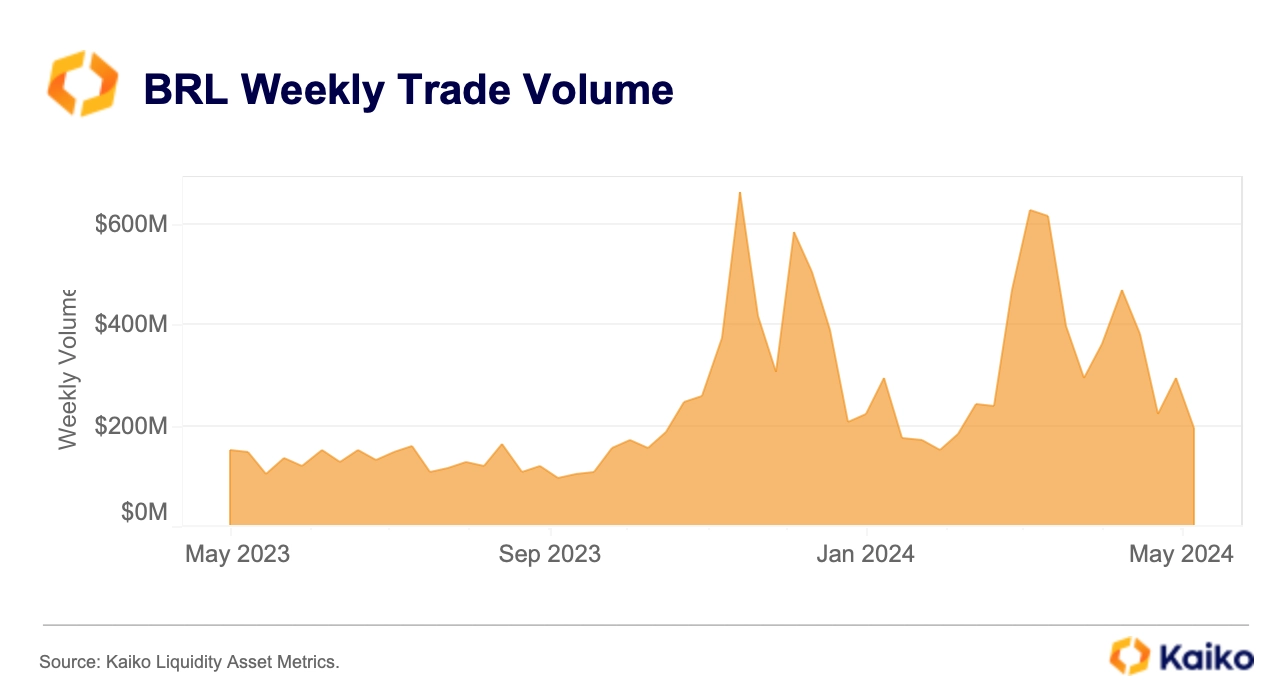

The Brazilian crypto market has experienced significant growth this year, with weekly BRL trade volume increasing faster than USD trade volumes since late January. Despite the recent market correction, BRL trade volumes are still up 30% compared to last year.

In total, BRL-denominated crypto trading volume reached $6 billion from January to early May 2024, making it the largest LATAM market and placing it 7th among global fiat currencies. For context, the Mexican Peso (MXN) volume totalled $3.7 billion this year, while the Argentine Peso (ARS) was around $300 million.

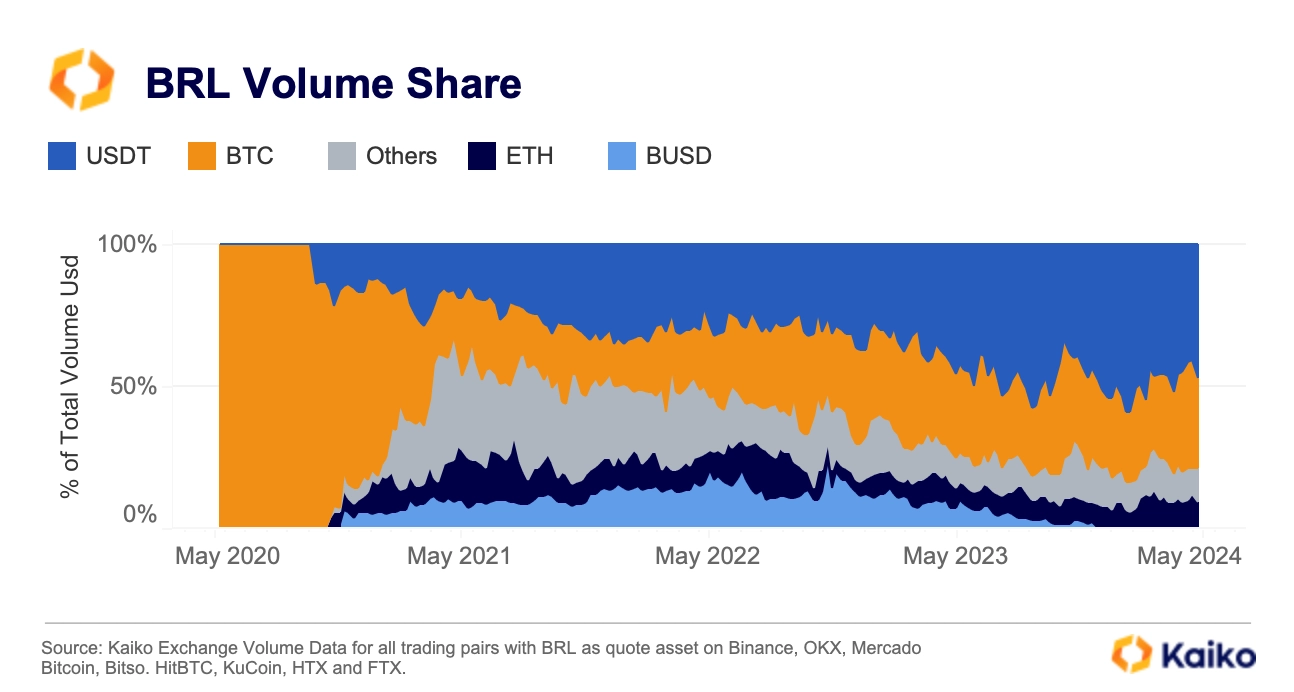

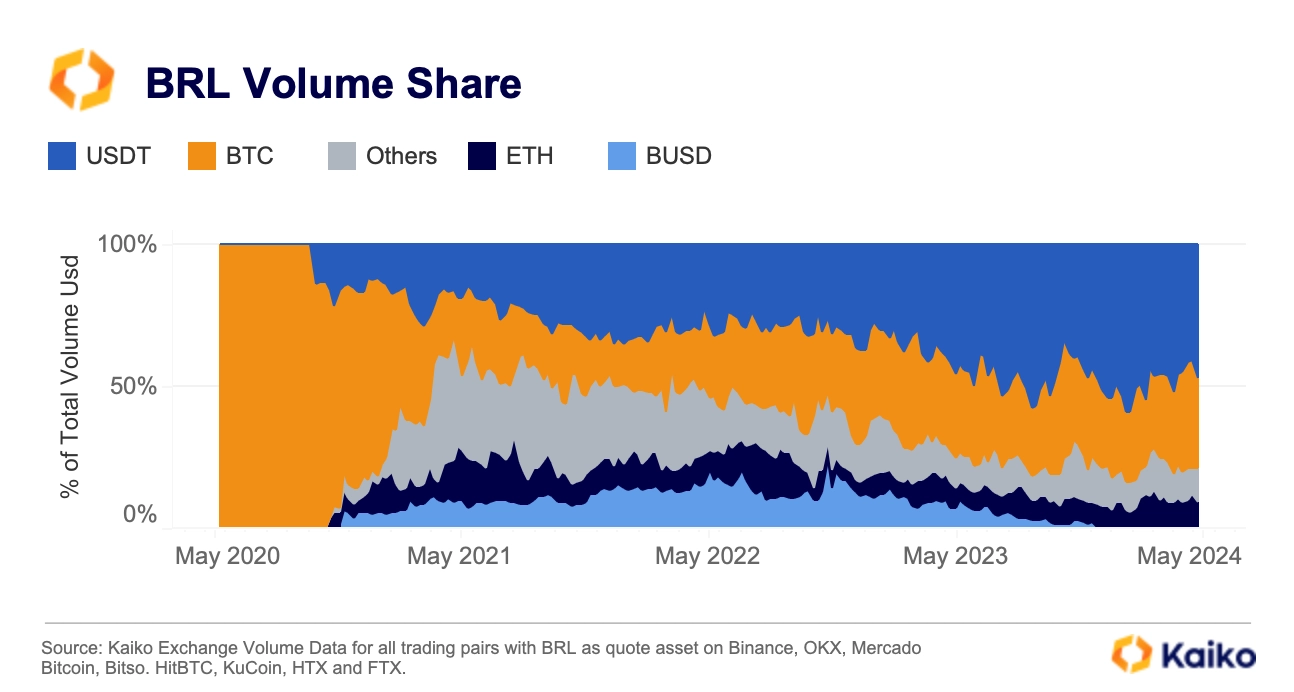

When looking at the breakdown by asset, Brazilians’ preference for stablecoins surpasses that for altcoins and Bitcoin. Nearly half of BRL-denominated trades involved stablecoins. USDT’s share of BRL volume has surged by nearly 20% since the 2021 bull market, taking market share from altcoins.

BTC and ETH accounted for a combined 43% of BRL trade volumes. For context, they make up more than 70% of USD-denominated volumes.

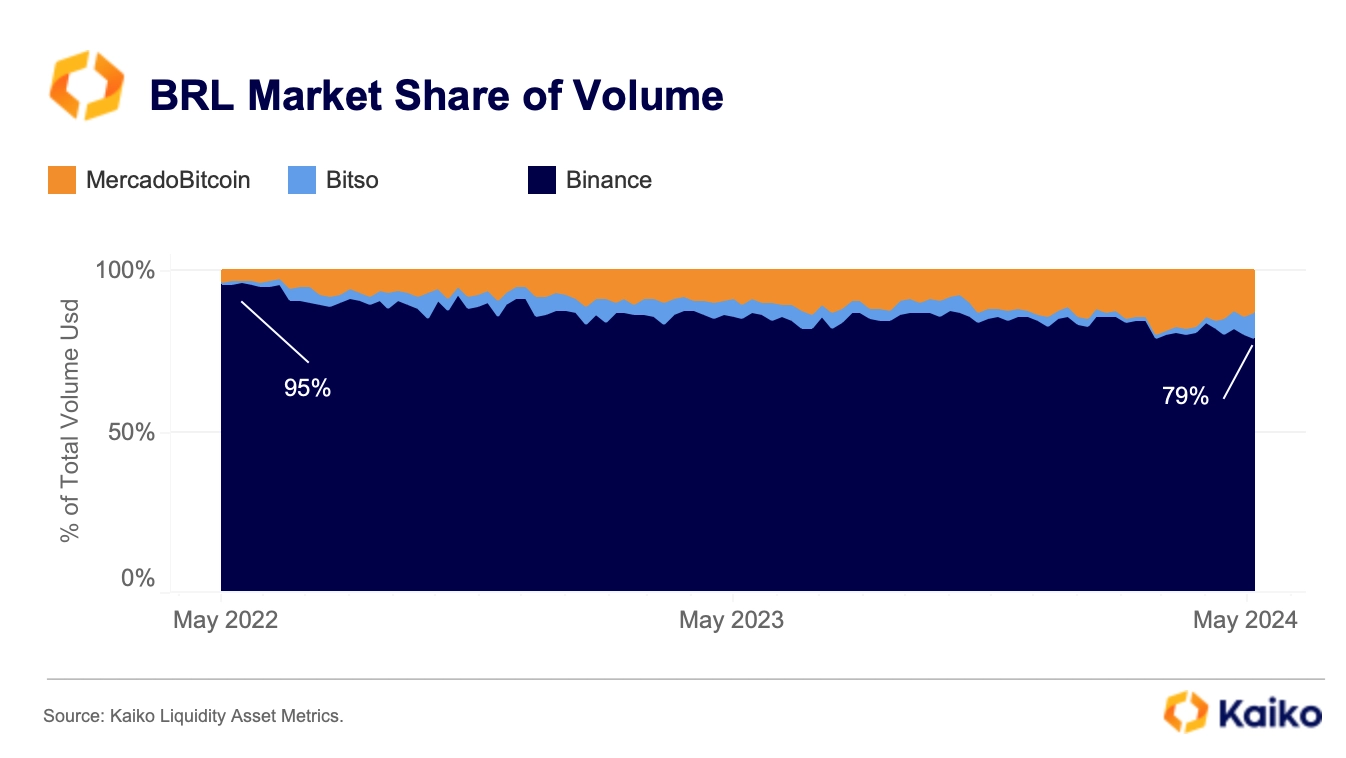

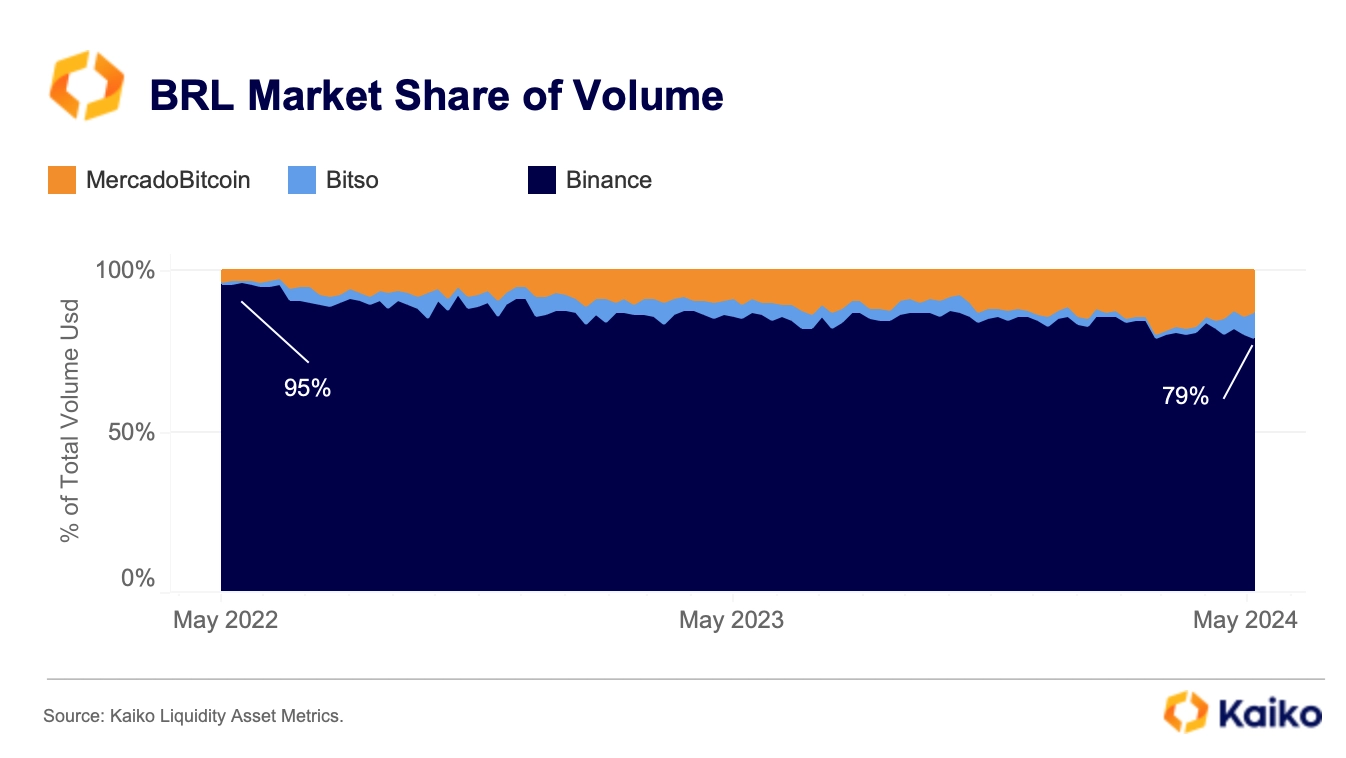

While Binance is currently the largest BRL market with a market share of 79%, its dominance has been declining.

The largest Brazilian exchange Mercado Bitcoin and Mexican-based Bitso have seen their combined market share rise to 21% in early May – the highest level in more than three years.

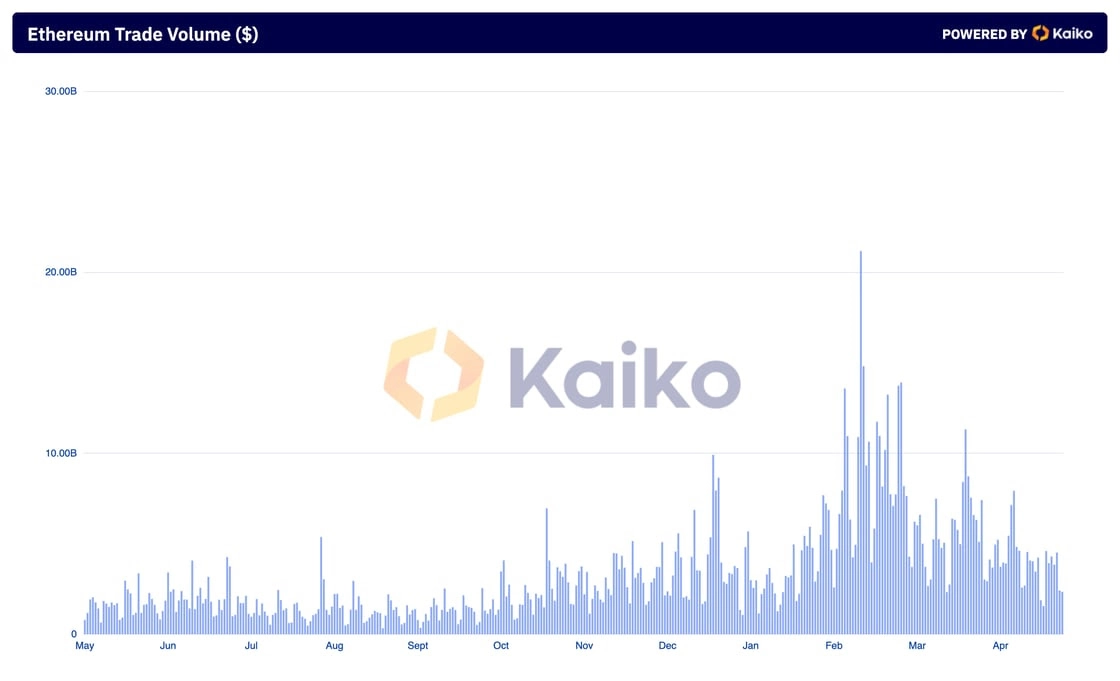

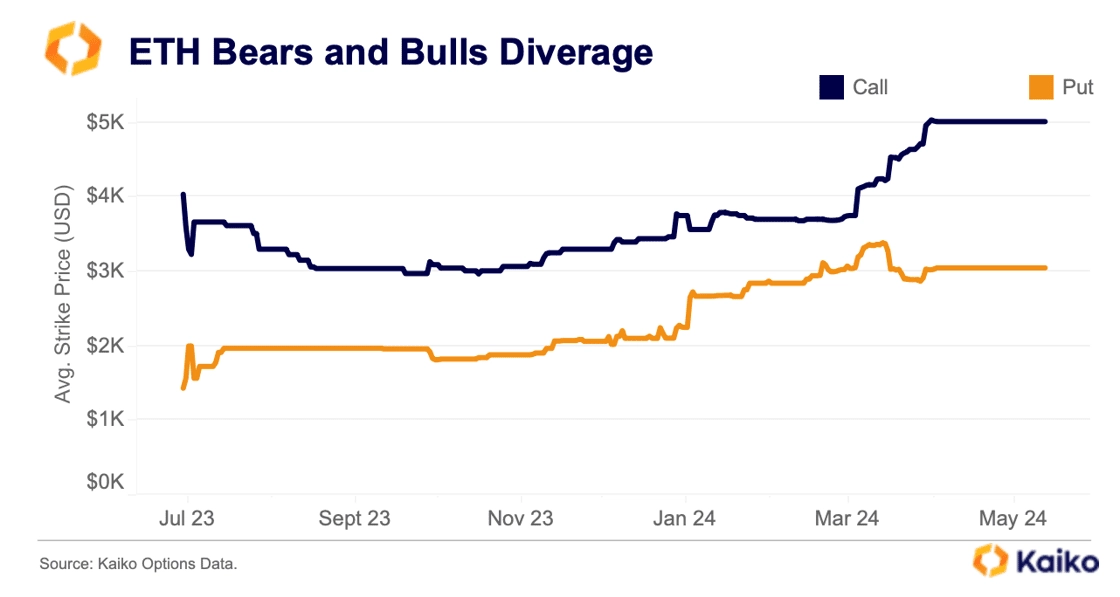

ETH options signal volatility ahead of ETF deadline.

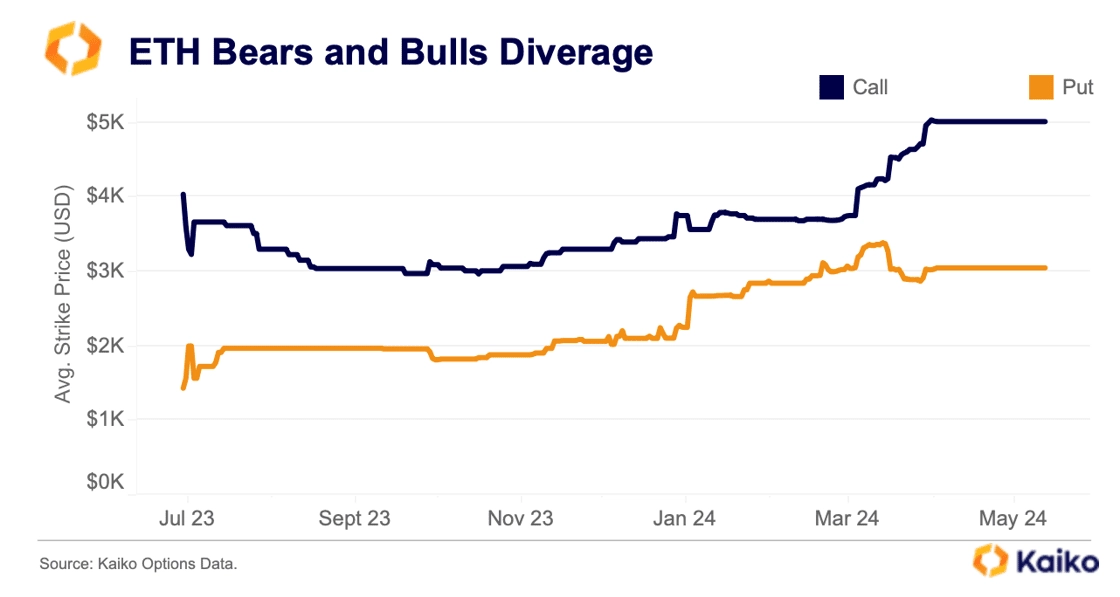

The average strike price for puts and calls on ETH options has been diverging since March. Puts give the option holder the right to sell the underlying asset at a predetermined price, these option holders benefit from downward price moves in the asset. Alternatively call holders benefit from upward price moves as these contracts give them the right, but not the obligation, to buy the underlying asset as a set price.

As the average strike price for calls rises this suggests options traders have tilted bullish. In other words, they are anticipating on ETH’s price to increase in the coming months and are willing to buy options at higher strike prices to benefit from this increase.

With the US Securities and Exchange Commission expected to approve or deny spot Ether ETFs by May 23, the divergence between bulls and bears in ETH options markets could be a sign of impending volatility.

The regulator is widely expected to deny applications from issuers such as BlackRock and ARK Invest, however, were they to approve these applications it could cause a significant surprise to the upside — at least thats what options traders seem to be betting on.

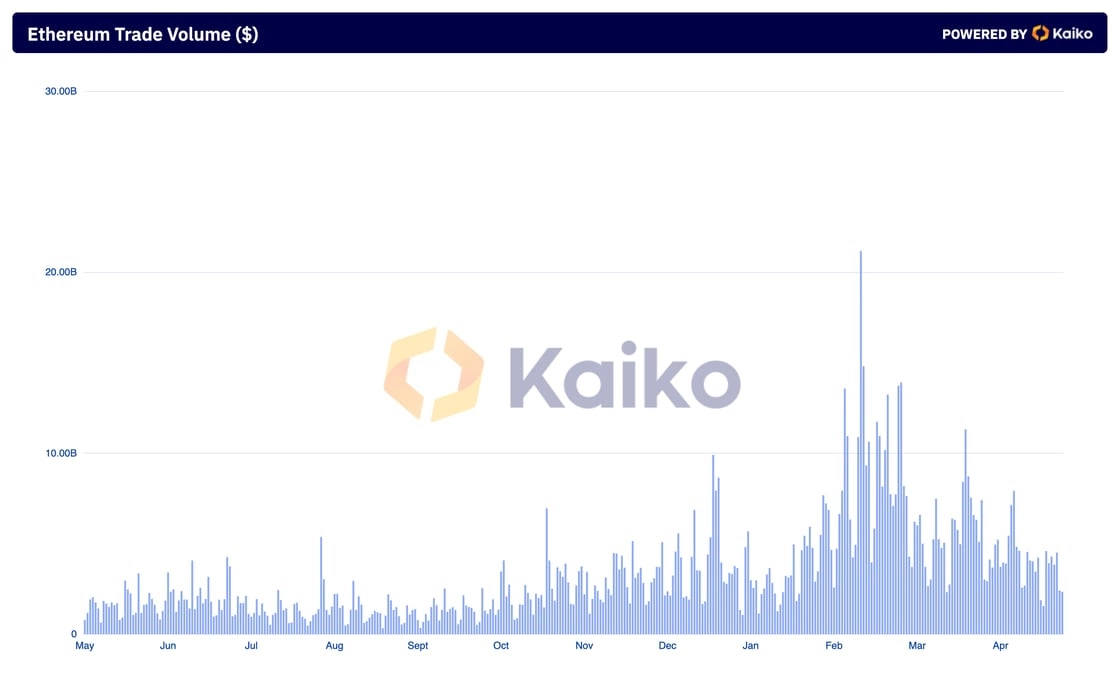

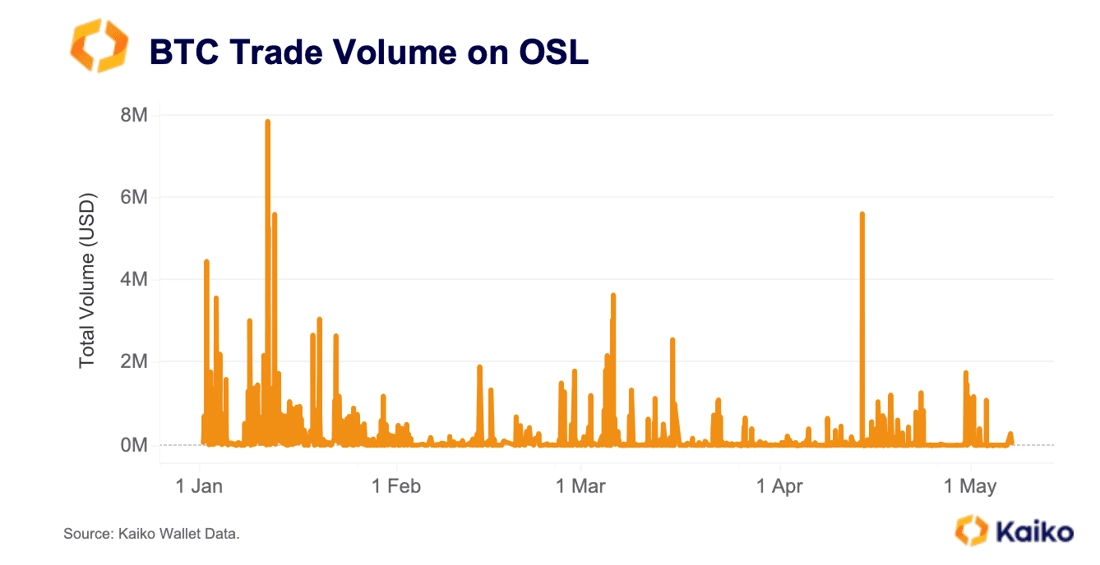

OSL volume remains muted post ETF launch.

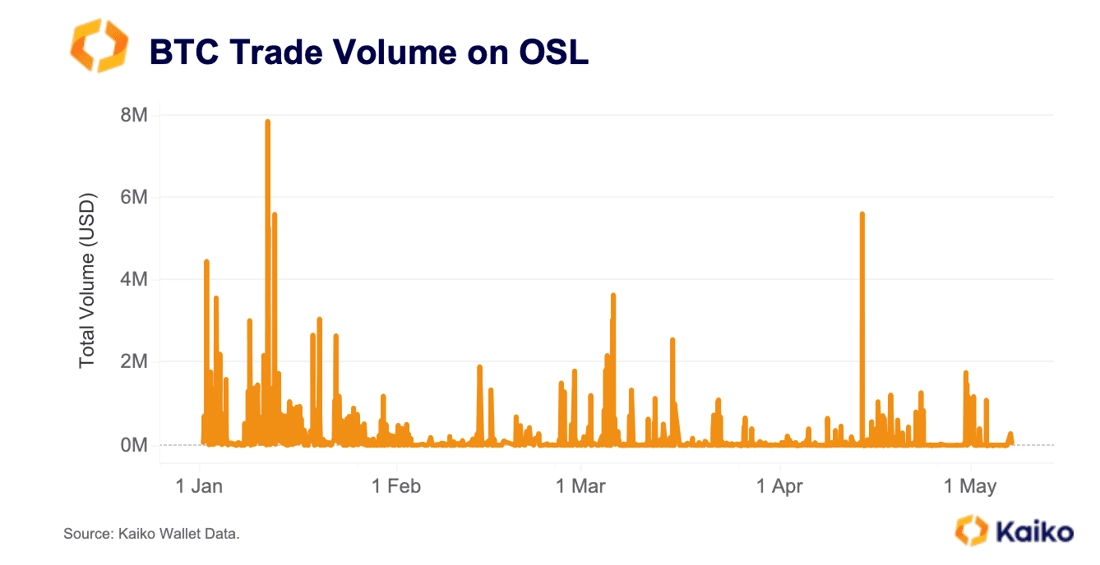

Crypto ETF launches aren’t what they used to be. The arrival of Bitcoin and Ether ETFs in Hong Kong at the end of April has, so far, failed to stimulate markets.

For instance, OSL — one of just two virtual asset trading partners for the Hong Kong ETFs — has seen a fraction of the trade volume it experienced post US Bitcoin ETF launch.

Bitcoin trade volume on OSL spiked to over $1.7 million on April 30, but has since fallen, according to Kaiko data. The launch of spot Bitcoin ETFs in the US in January had a far greater impact on OSL’s volumes, which spiked to around $8 million.

The lacklustre impact of the Hong Kong crypto ETFs is likely another sign that the ETF rally has run out of steam — for now.

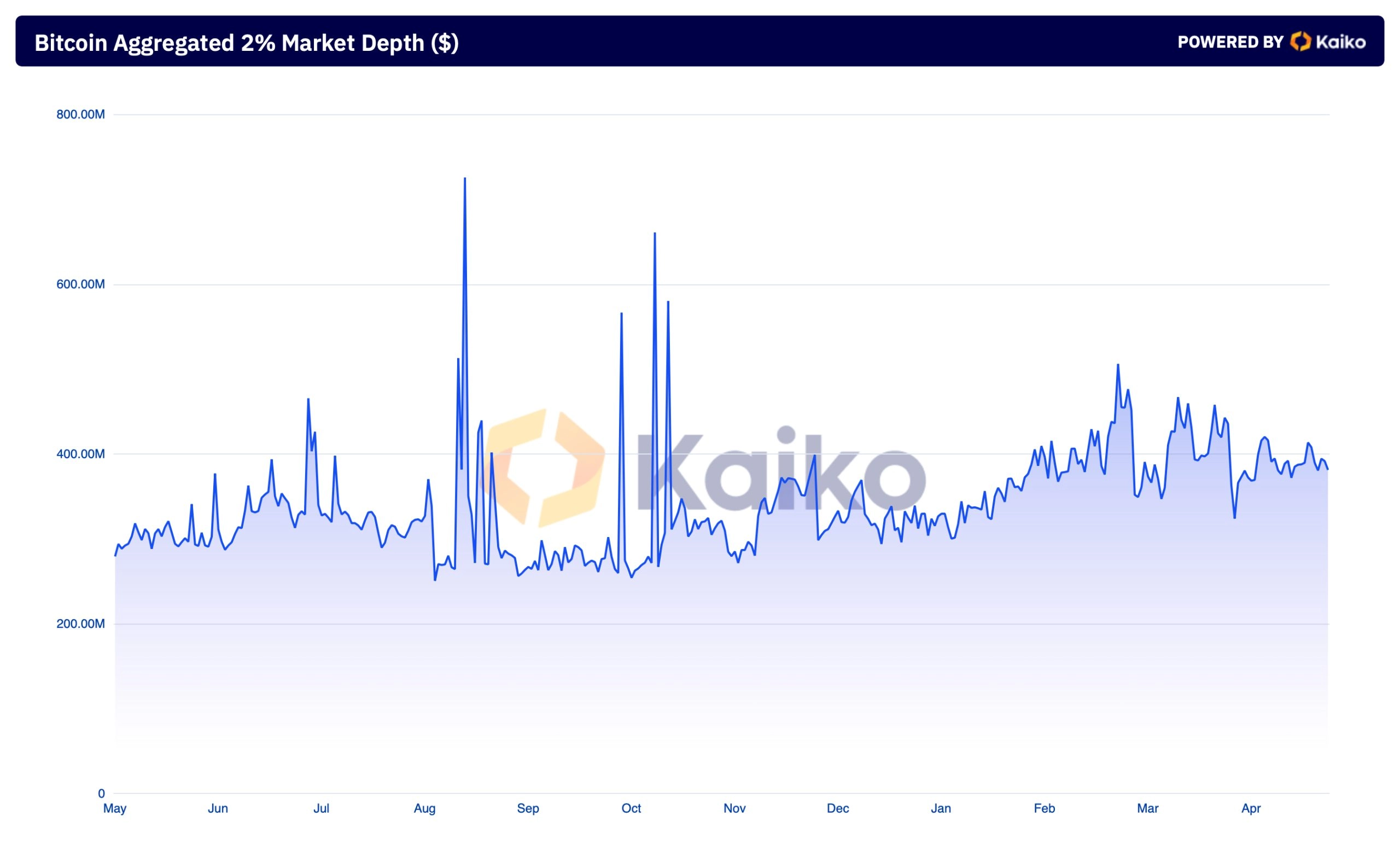

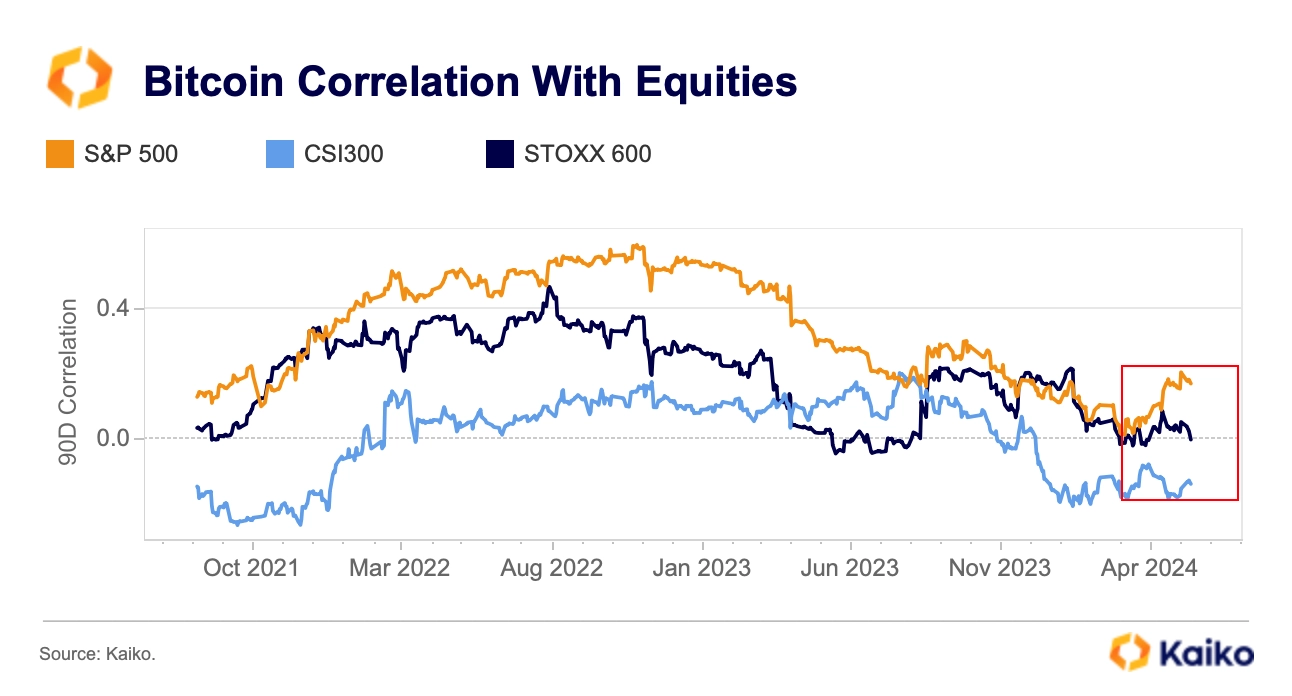

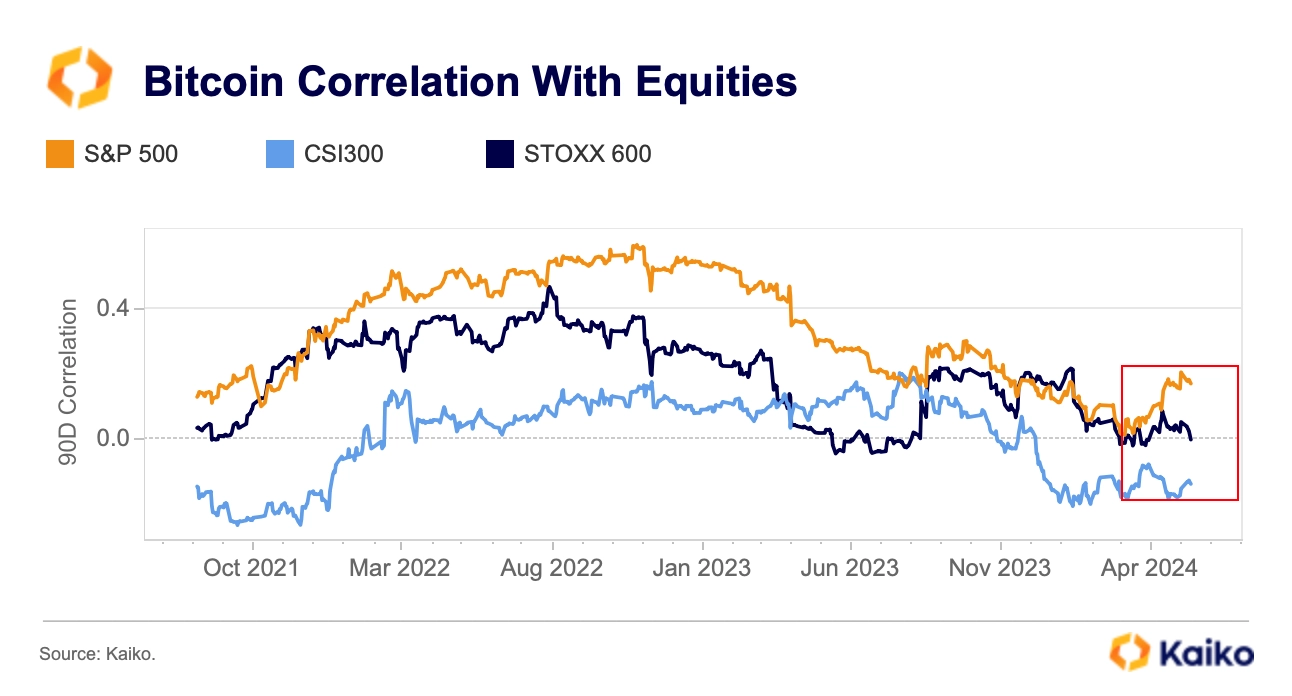

BTC correlation with US equities is rising.

Bitcoin’s 90-day correlation with US equities rose to 0.17 last week, after reaching a multi-year low of just 0.01 in March. Over the past few weeks, risk sentiment has deteriorated amid increasing macroeconomic headwinds and geopolitical tensions, resulting in a broad selloff of risk assets in early April. However, Bitcoin’s price action continues to be heavily influenced by idiosyncratic factors such as spot ETF flows. Overall, Bitcoin’s correlation with risk assets remains well below its bull market highs of over 0.6.

Interestingly, the correlation between Bitcoin and the European equities index, STOXX 600, which tracks the 600 largest companies across European regions, has remained mostly flat this year at around zero. Meanwhile, the correlation between Bitcoin and Chinese equity markets, represented by the CSI 300 index, has been negative in 2024, standing at -0.14.

![]()

![]()

![]()

![]()