Data Points

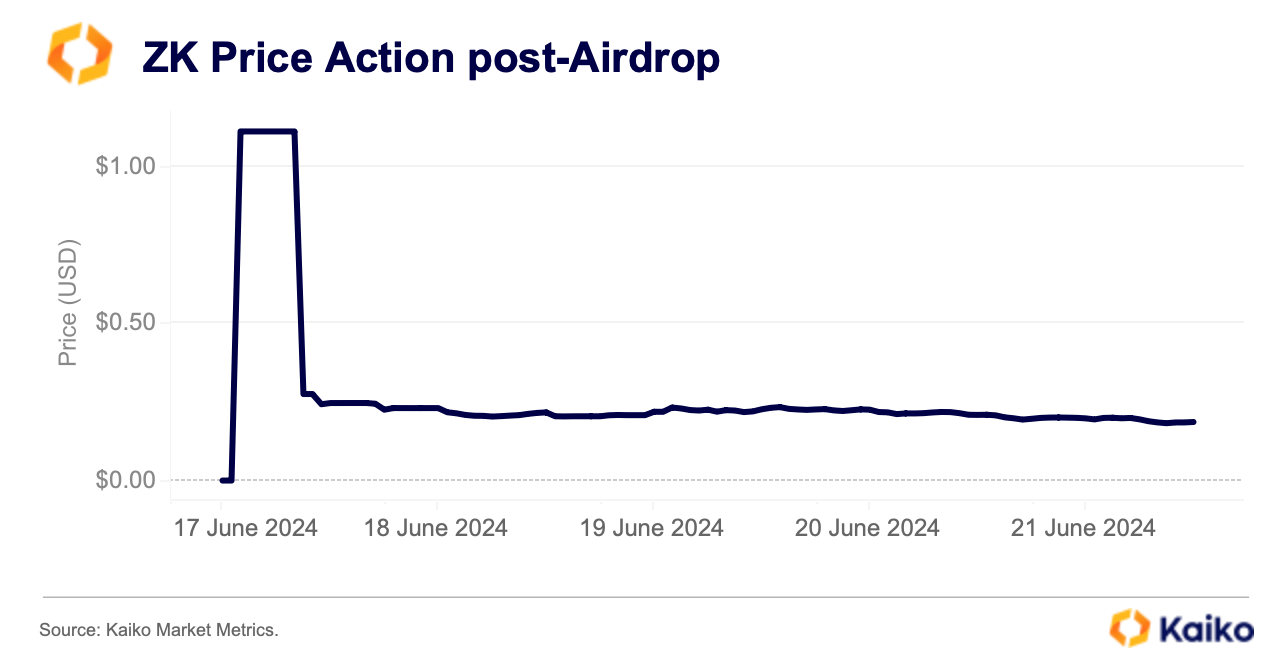

ZK sinks post-airdrop.

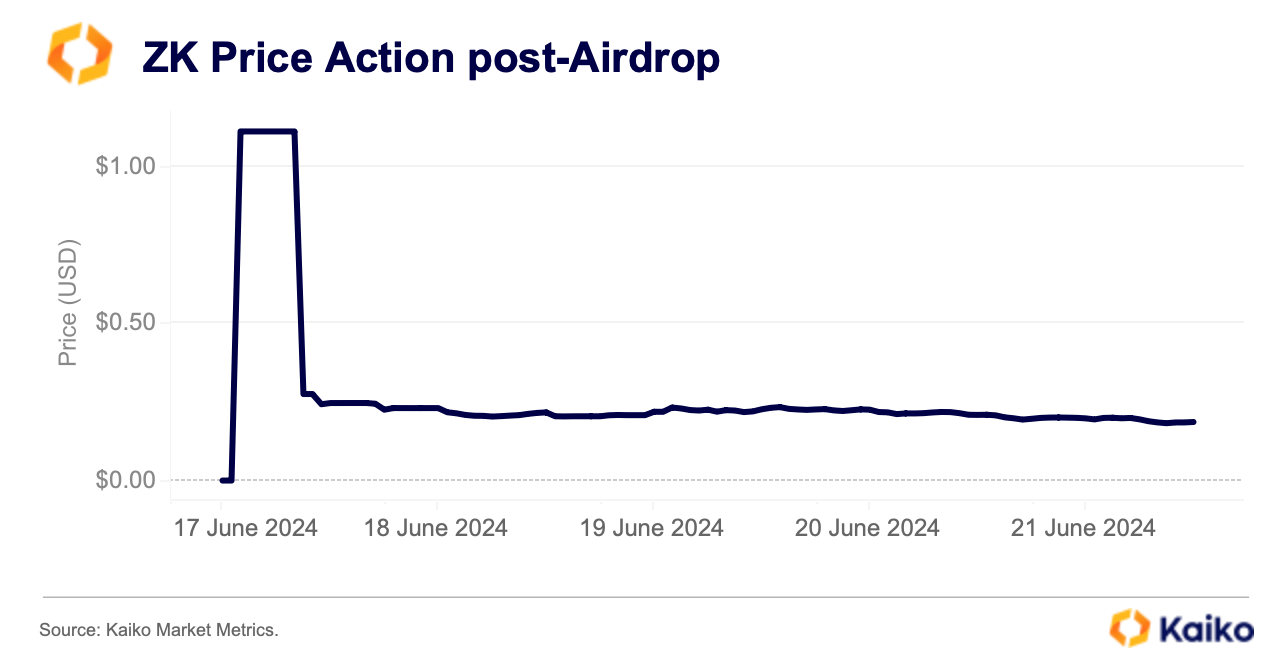

Last week, ZKsync distributed 3.6 million ZK tokens to early users of the protocol via an airdrop. Typically, when tokens are airdropped, they experience a surge in price followed by a sharp fall as recipients sell their newly acquired tokens. However, the price chart for ZK tokens has taken on a rather odd shape, suggesting that there may be more to the story than just a typical post-airdrop selloff.

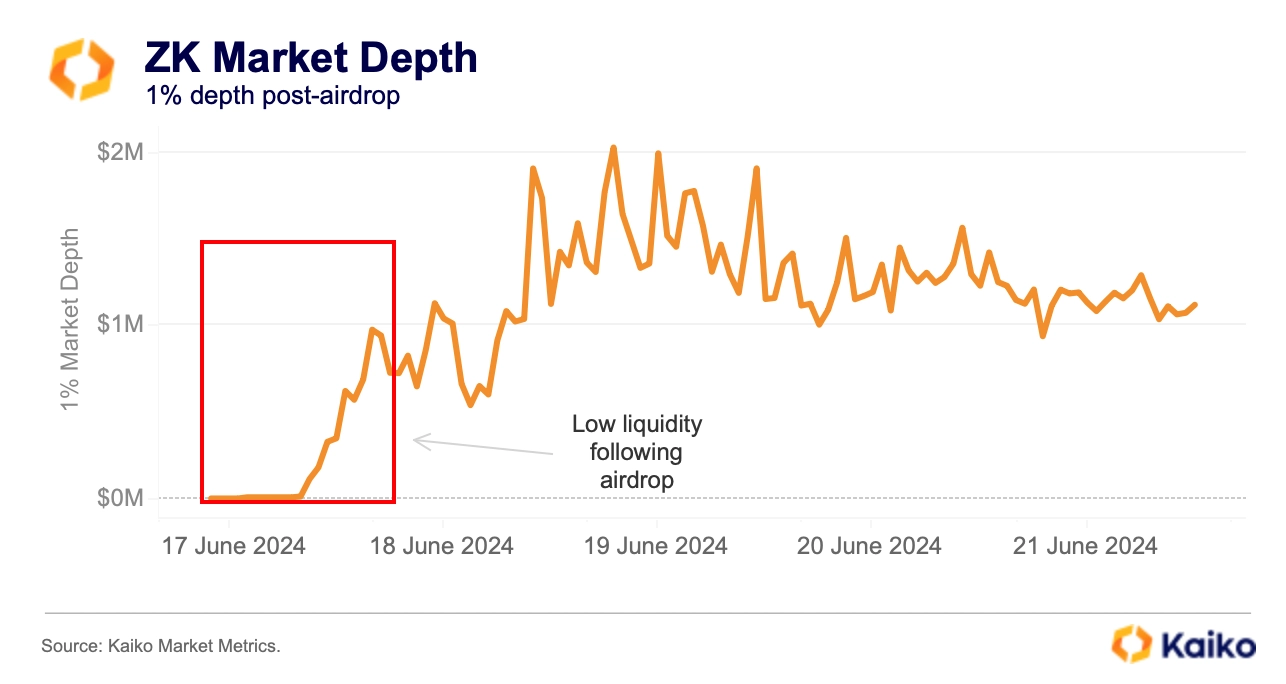

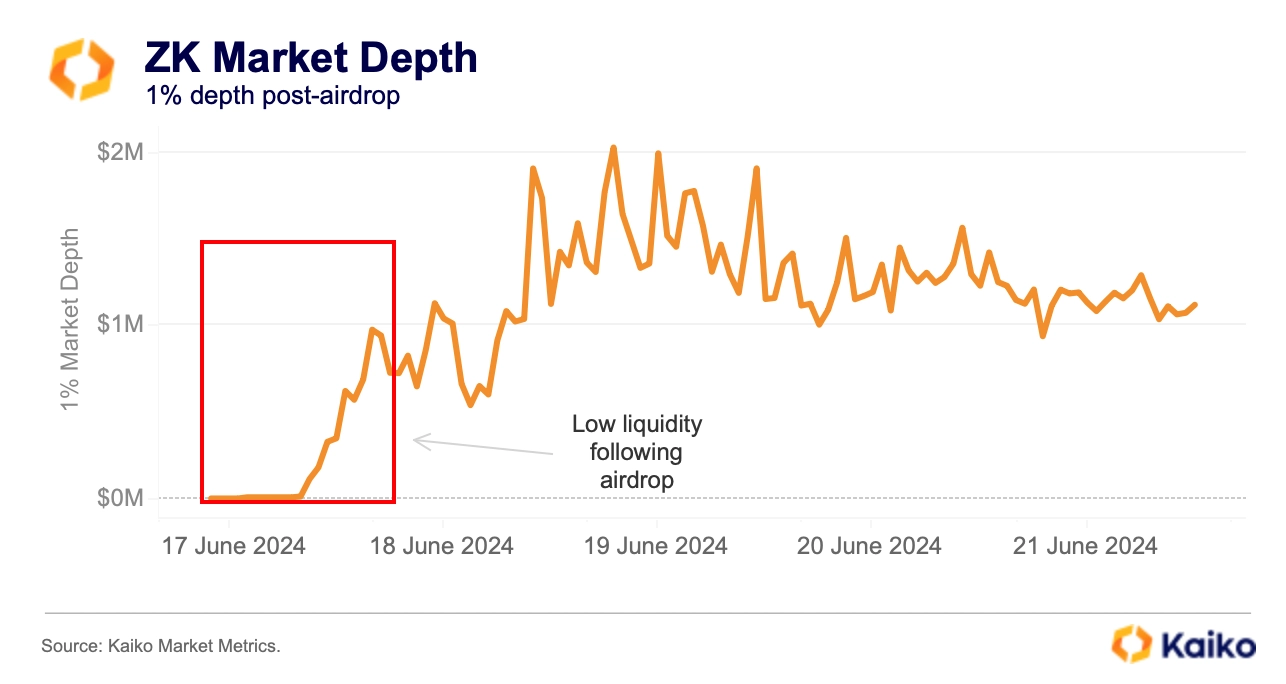

Limited liquidity can exacerbate volatility for newly minted tokens, as seen with ZK tokens. Launched on Binance, Bybit, and KuCoin after its airdrop, ZK’s liquidity was initially extremely limited, with 1% market depth consistently below $1 million. Market depth measures the market’s ability to sustain large orders without impacting the asset’s price.

The low liquidity during the first few hours of the token’s listing likely contributed to the initial surge and crash of the token’s price.

Long term ETH option traders keep bullish bias.

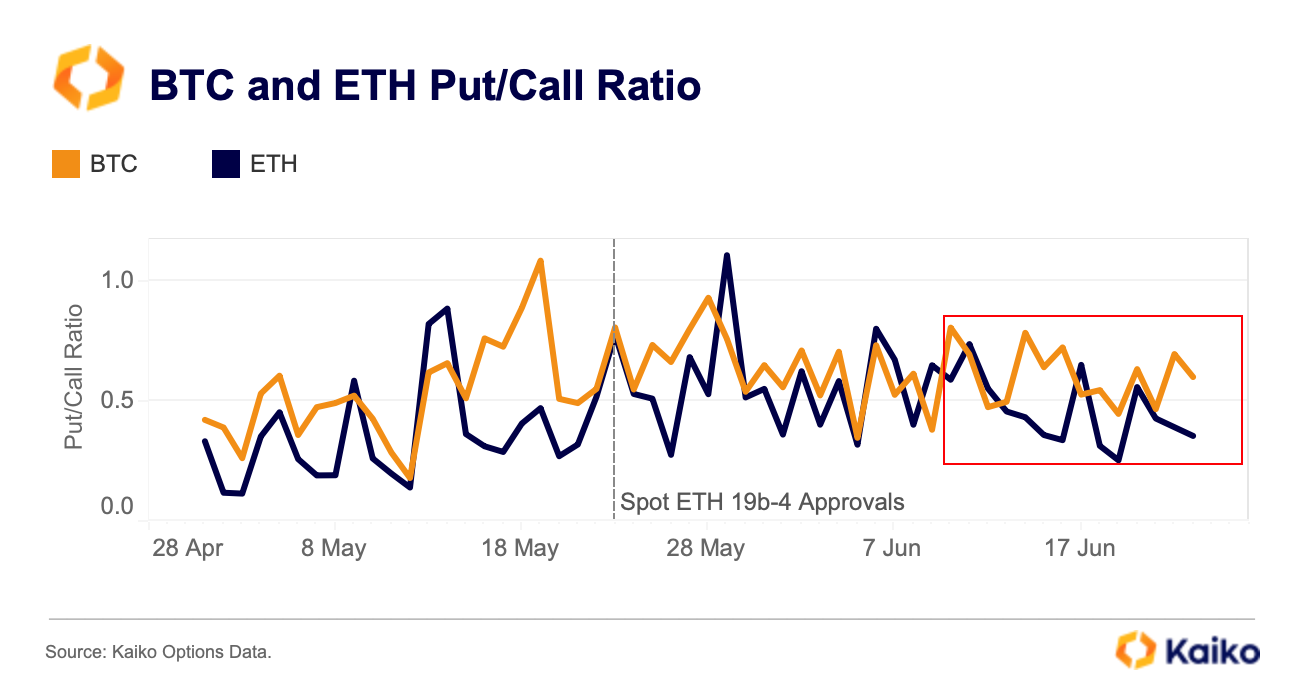

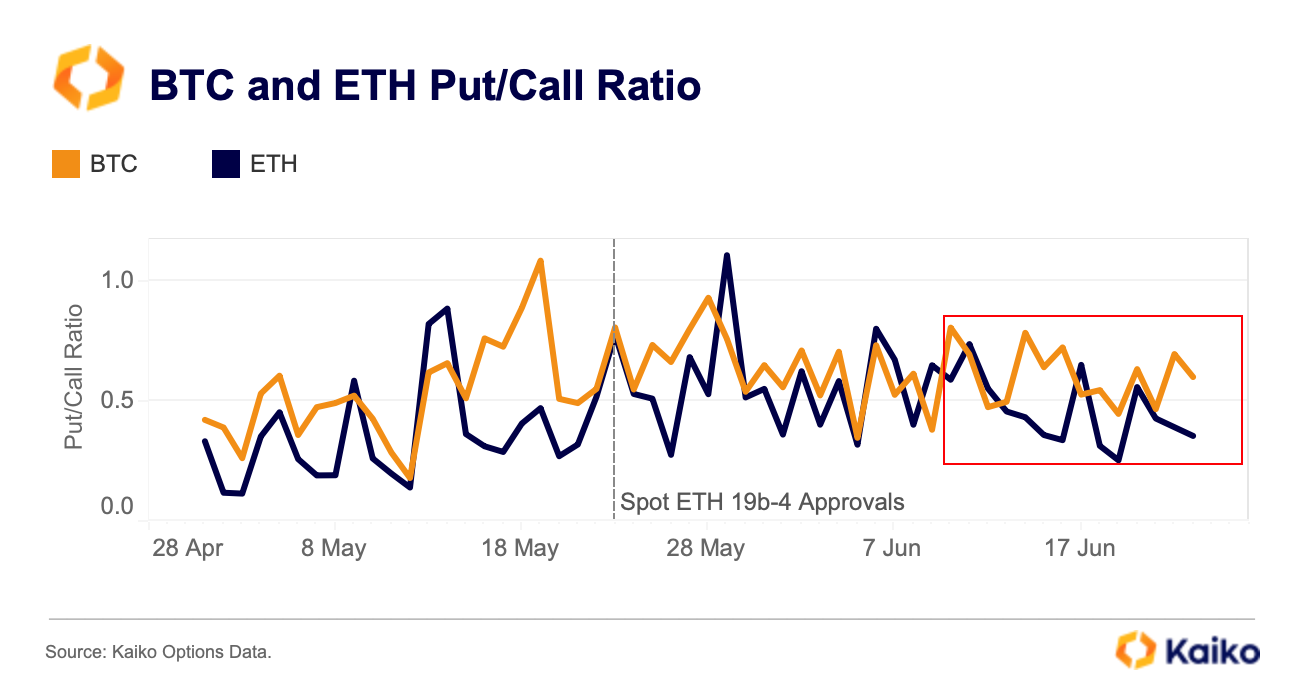

The put-call ratio for BTC and ETH, calculated by comparing put trading volumes to call volumes, retreated in June after mostly increasing in May. A rising ratio is generally seen as bearish, as it indicates more puts (bearish bets) than calls (bullish bets) being purchased. The BTC put-call ratio rose above 1 in May from just 0.2 in April before falling to around 0.5. The ETH ratio followed a similar pattern but has declined in recent weeks, boosted by ETF hopes.

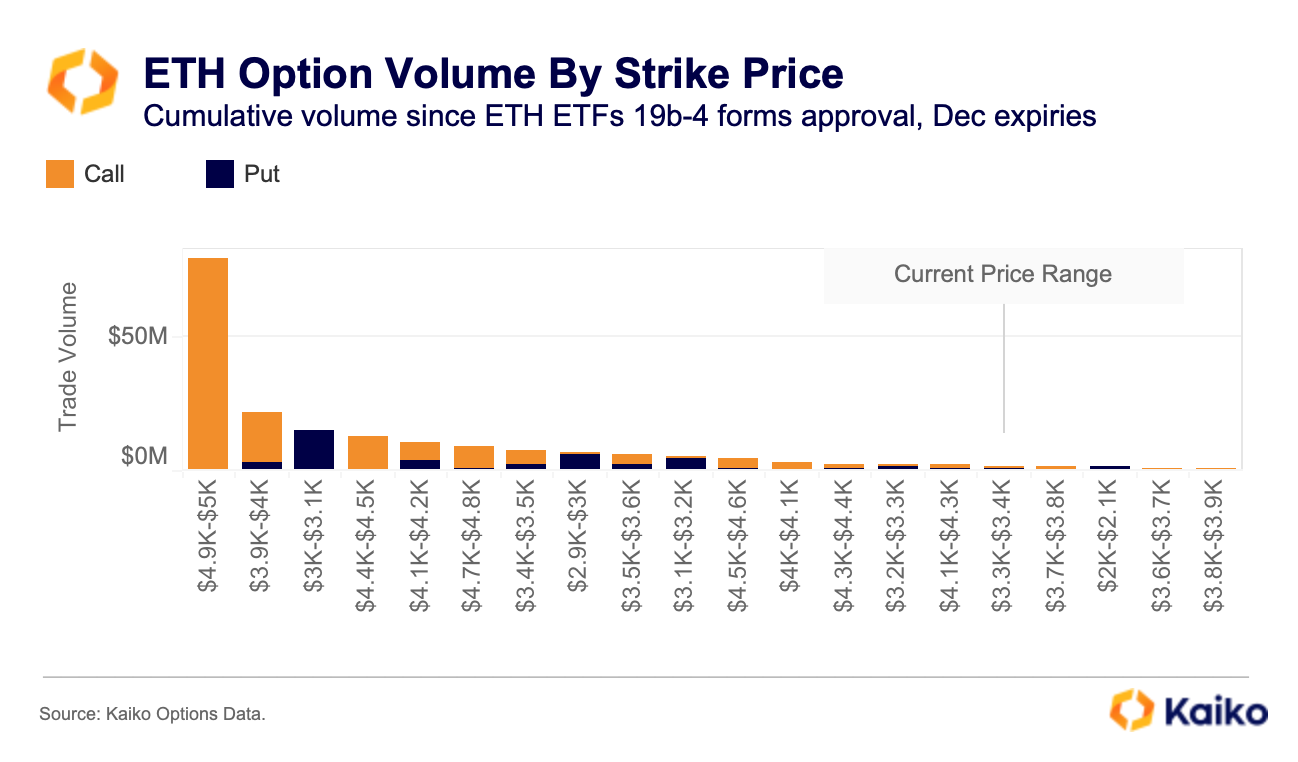

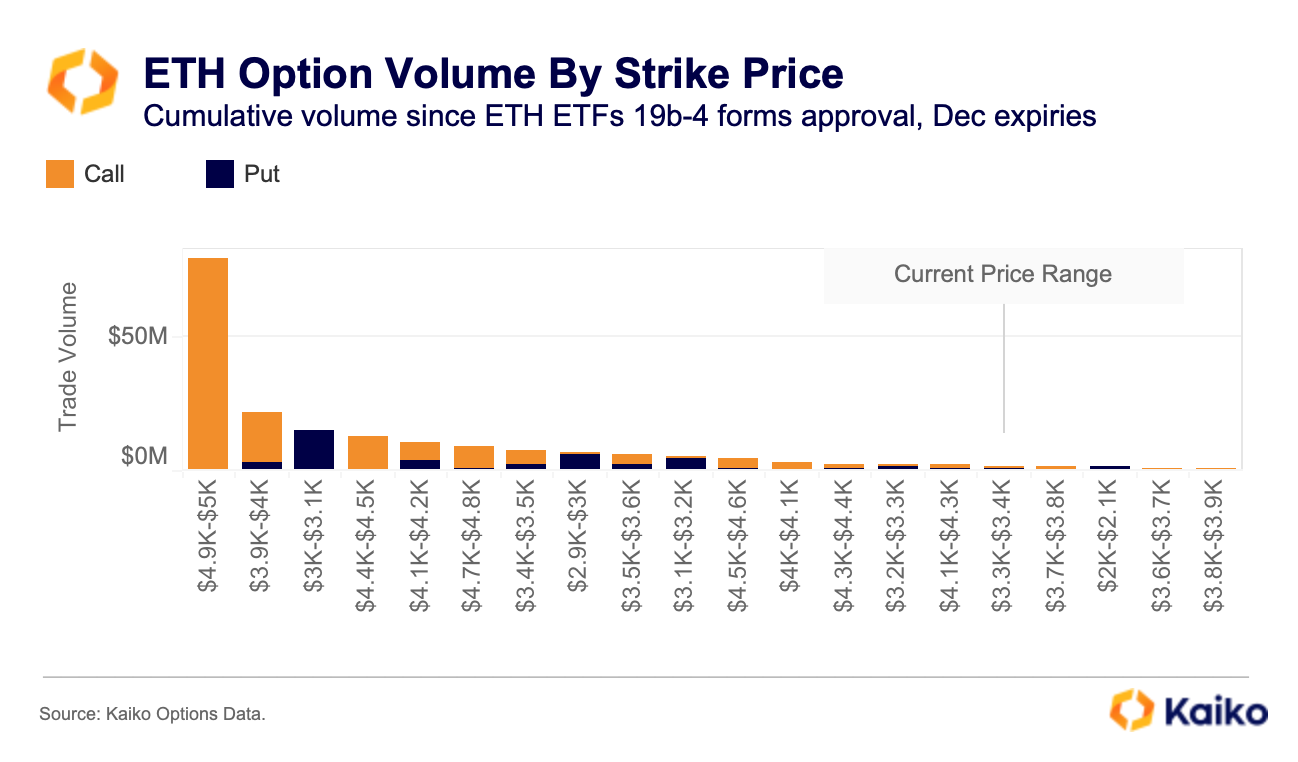

Despite the recent decline in the put-call ratio for ETH, traders seem to be bullish on its long-term outlook. Looking at volumes by strike price for the end-of-year December expiries, there is a noticeable trend of traders piling into calls at prices higher than the current level. This suggests that despite the increasing short-term bearishness, traders are optimistic about ETH’s long-term prospects.

This could be due to the improving regulatory outlook around ETH over the past month. Last week, the SEC dropped its case against Consensys regarding ETH’s potential status as a security.

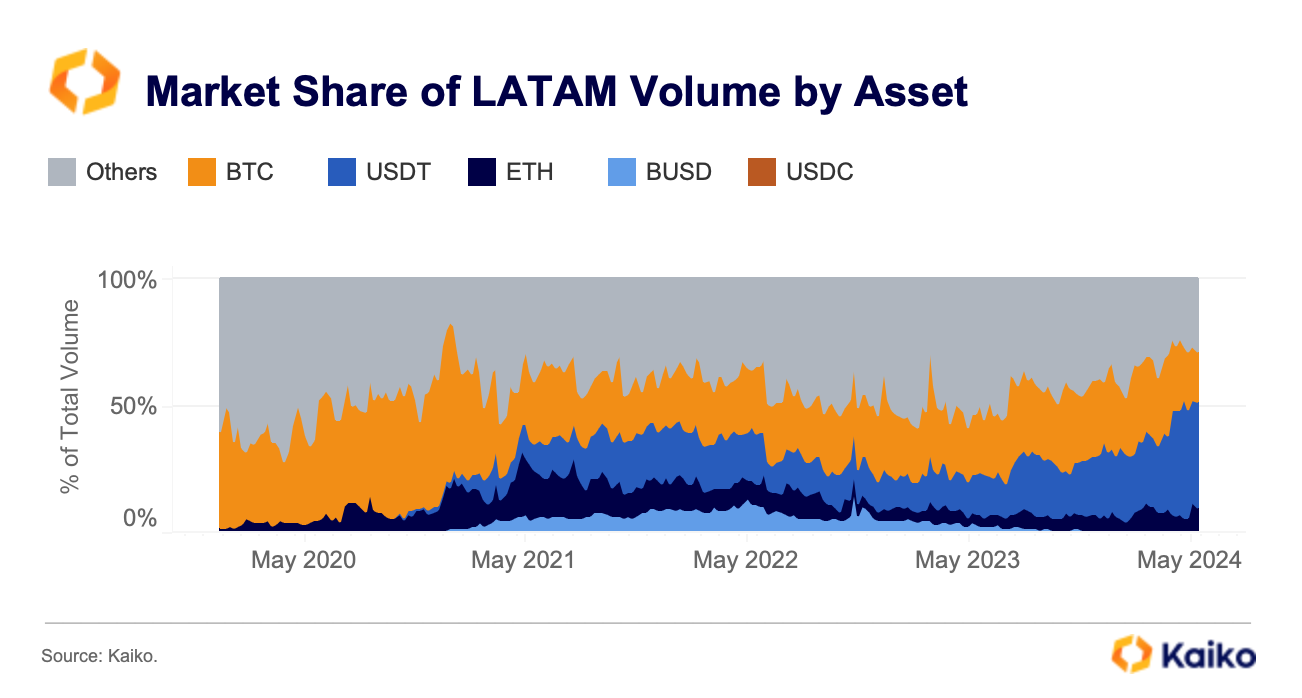

Latin American traders prefer stablecoins over Bitcoin.

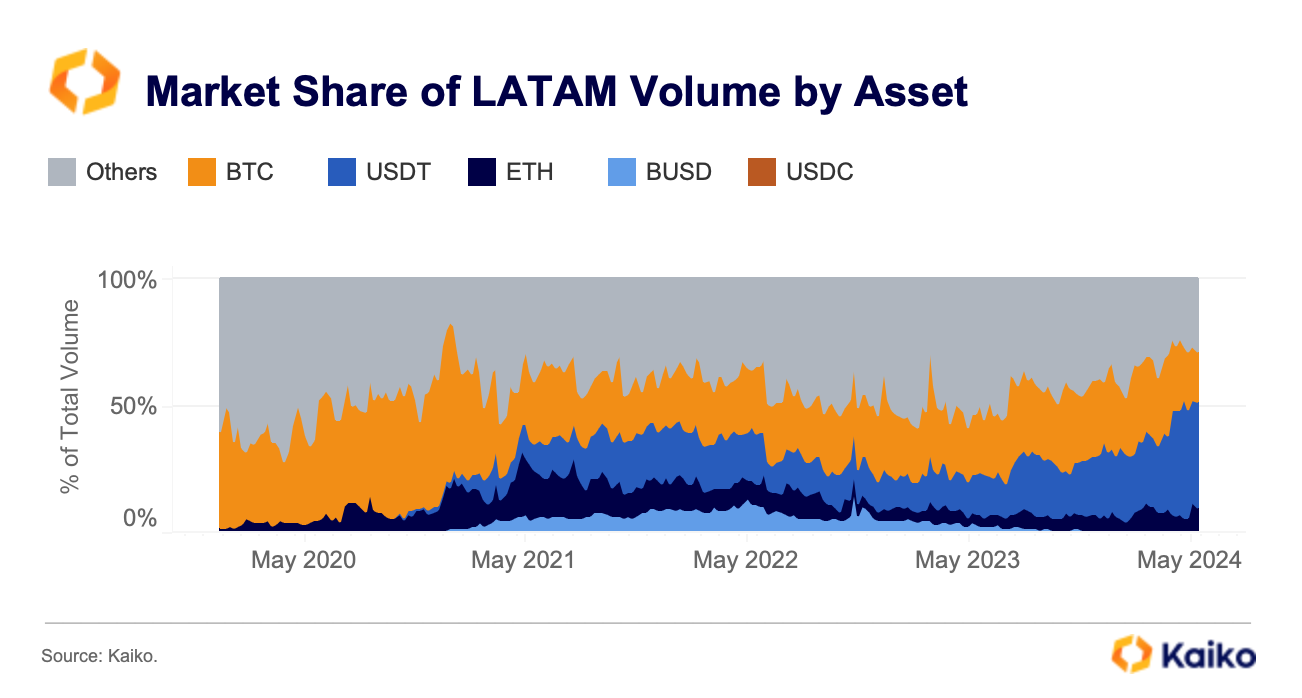

Despite Bitcoin’s value proposition as a hedge against currency debasement, most cryptocurrency users in Latin America prefer stablecoins. These pegged currencies are now the most popular digital asset to trade in the region, a trend that emerged in early 2021. According to trading volume data on top exchanges, more than 40% of all trades involve USDT, and nearly half of Brazilian Real (BRL)-denominated trades involve stablecoins.

The preference for stablecoins in Latin America could be explained by the region’s currency instability and high inflation. To gain a better understanding of the reasons behind the growing interest in stablecoins among Latin Americans, check out the full report on the state of the LATAM crypto markets.

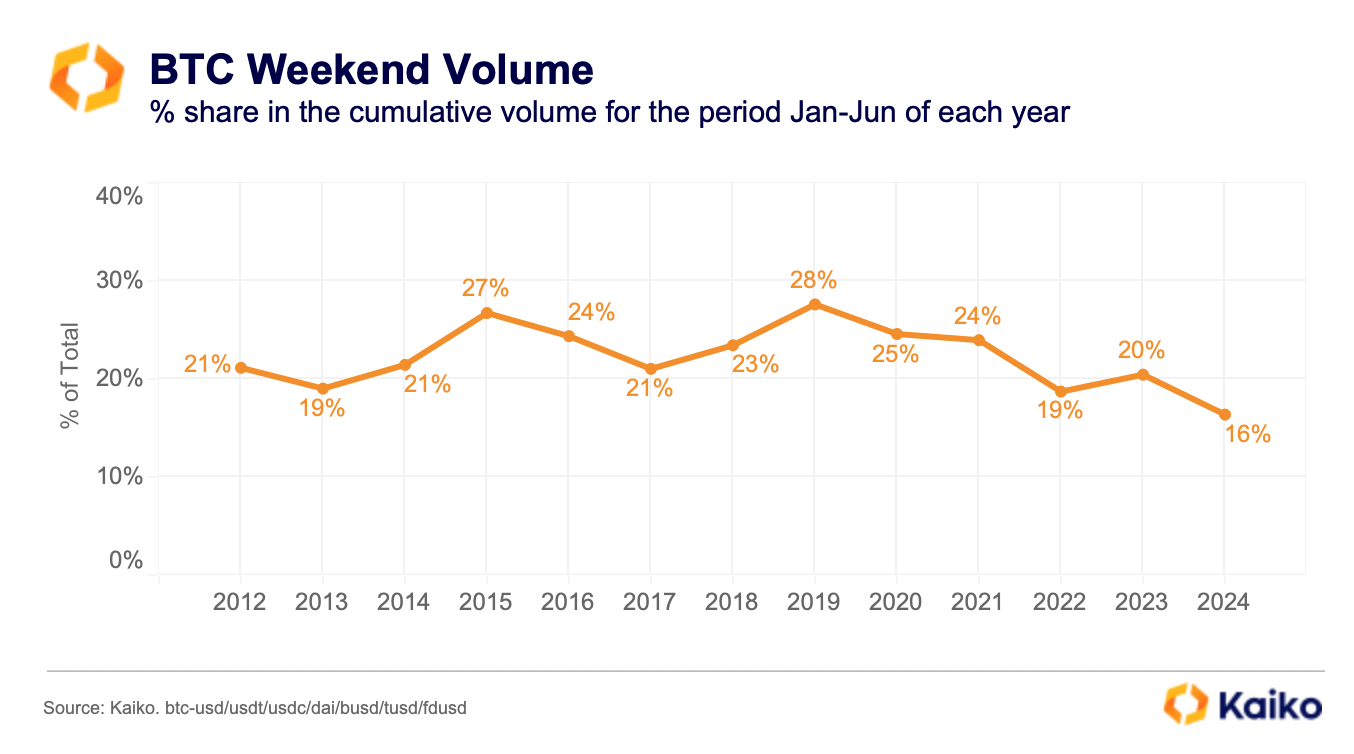

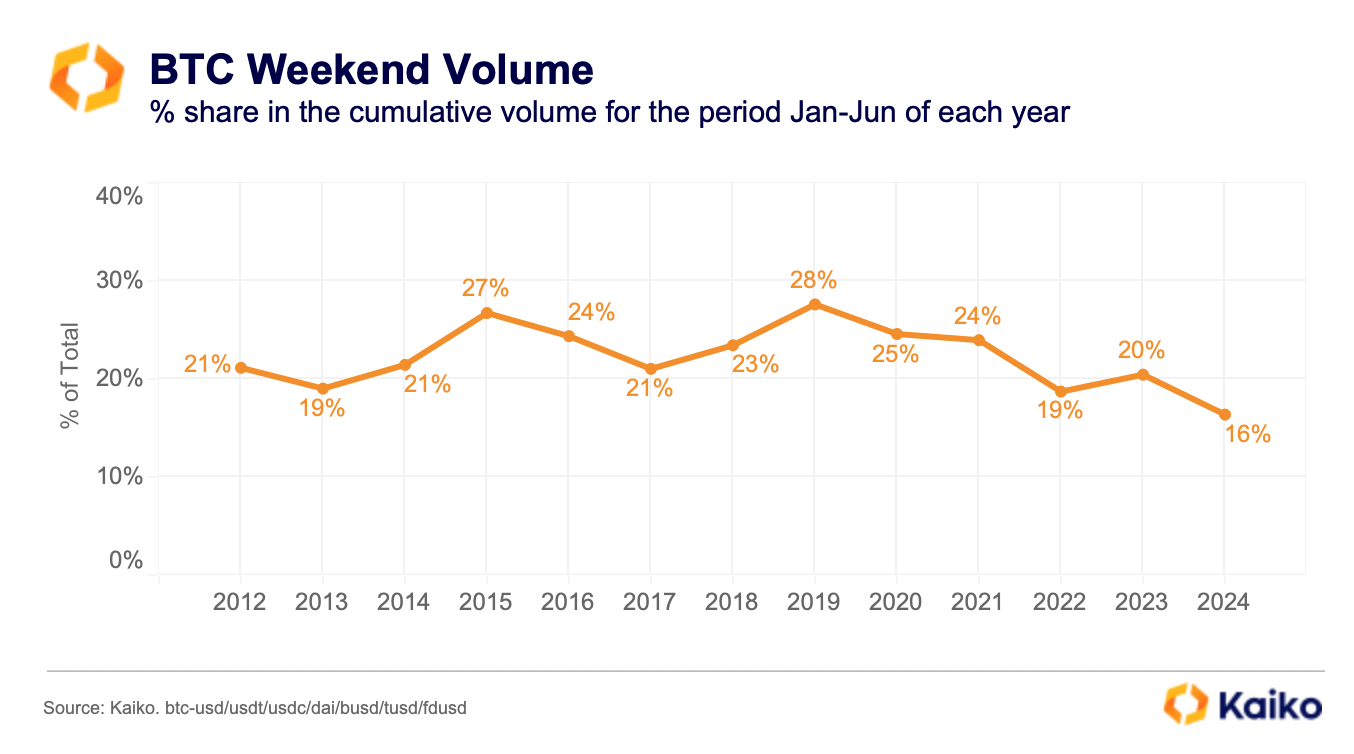

Bitcoin’s weekend liquidity continues to dwindle.

The launch of spot Bitcoin ETFs has improved BTC liquidity, with bid-ask spreads and market depth showing signs of improvement. However, the gap between weekend and weekday trade volumes has continued to widen, with the share of weekend Bitcoin trade volume reaching an all-time low of 16% in 2024. This trend has been ongoing for six years, with the share of BTC traded on weekends dropping from 28% in 2019 to 20% in 2023. The ETF launch has exacerbated the mismatch, suggesting that the positive liquidity shock has been primarily concentrated during weekdays.

The weekend / weekday gap is likely to persist as market makers, who derive their revenues from large amounts of trades earning the bid-ask spread, are less incentivized to provide liquidity in a low volume environment. Compounding this issue is the worsening market infrastructure following the 2023 March banking crisis and the collapse of two crypto-friendly banks and their 24/7 real-time payment networks primarily used by market makers.

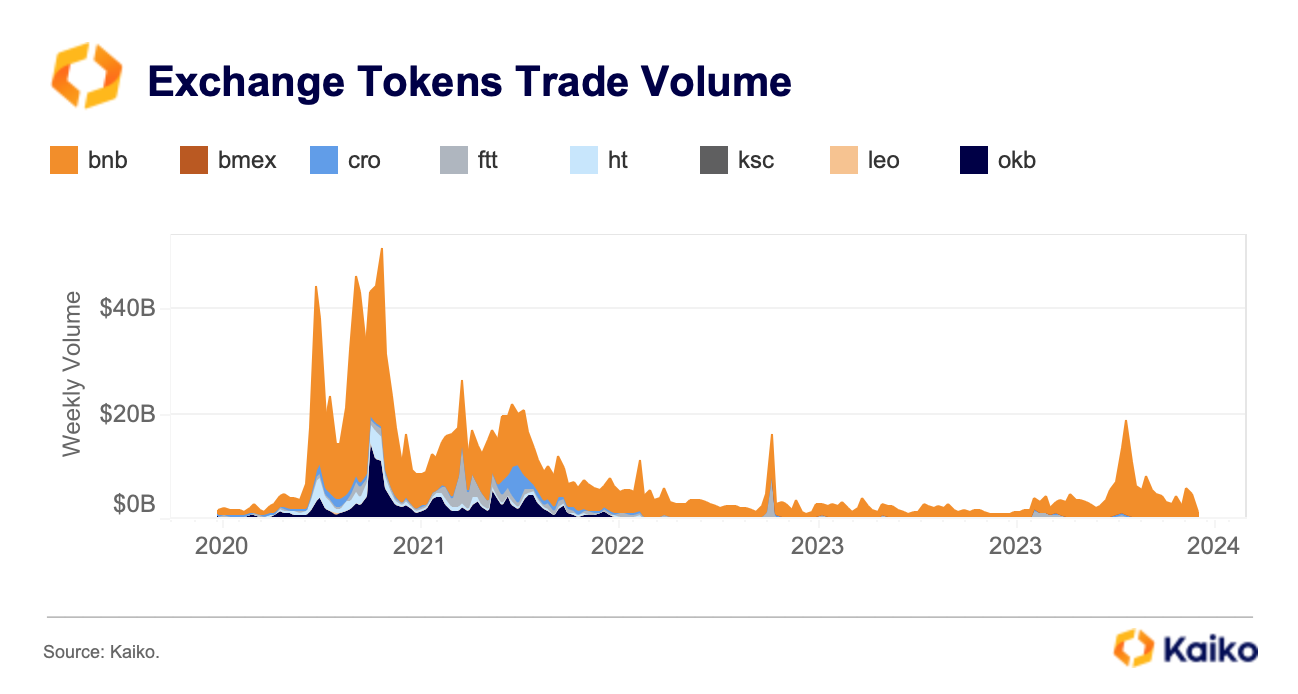

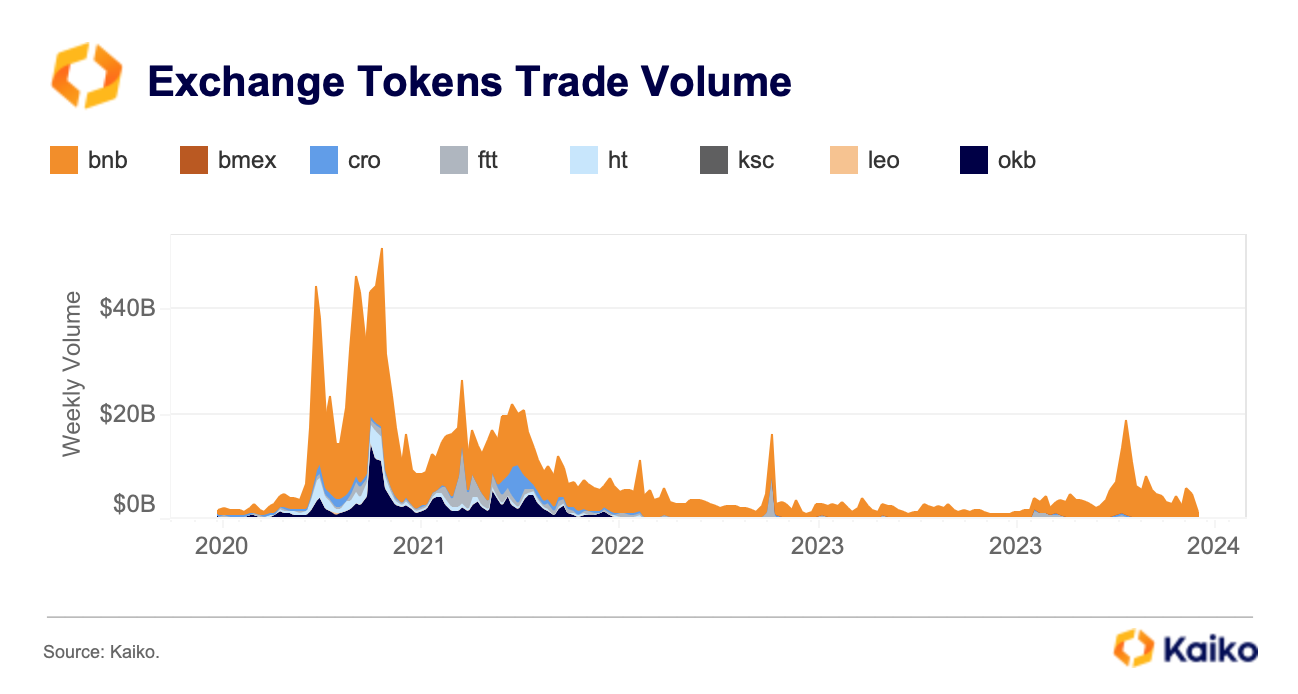

Is this the end of exchange tokens?

Exchange token volumes have dropped four-fold since the 2021 bull run, decreasing from an average of $20bn weekly to just $5bn in 2024. These tokens are issued and primarily traded on their respective exchanges. Holding and staking them unlock rewards and fee discounts, enhancing user engagement and retention.

Their value and utility are closely tied to the issuing exchange, often reflecting exchange volumes and regulatory outlooks. An interesting exception is FTX’s FTT token, which continues to trade on several exchanges despite having virtually no utility.

Despite the decline in trading volume, the number of exchanges offering their tokens has been growing. Interestingly, while overall exchange token volume has declined, Binance’s BNB token, which recently hit an all-time high, has shown remarkable resilience. Its market share has increased from around 50% in 2021 to a whopping 94%.

![]()

![]()

![]()

![]()