The price of leveraged bets

Perps are a type of derivative contract that trade in perpetuity, or in other words they have no specific expiration date.

The fee charged for keeping the position open indefinitely is known as the funding rate. This is also the mechanism by which the contract tracks the underlying spot price. If the rate is positive then traders going long pay a fee to short sellers to maintain their position. The opposite is true if the rate is negative.

Perps typically offer traders the option to take on significant leverage. As a result traders can maintain a large position with a small amount of collateral. BitMEX offers up to 100x leverage on some of its Bitcoin perps, meaning that $1,000 of collateral can control a position worth $100,000.

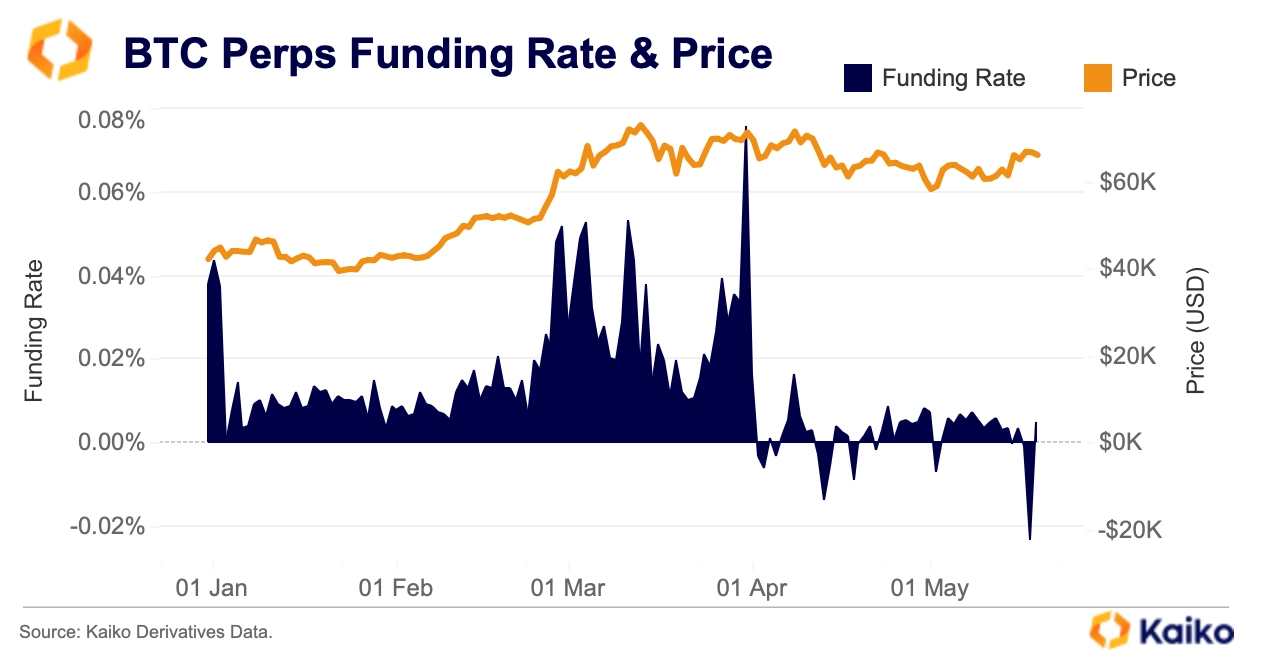

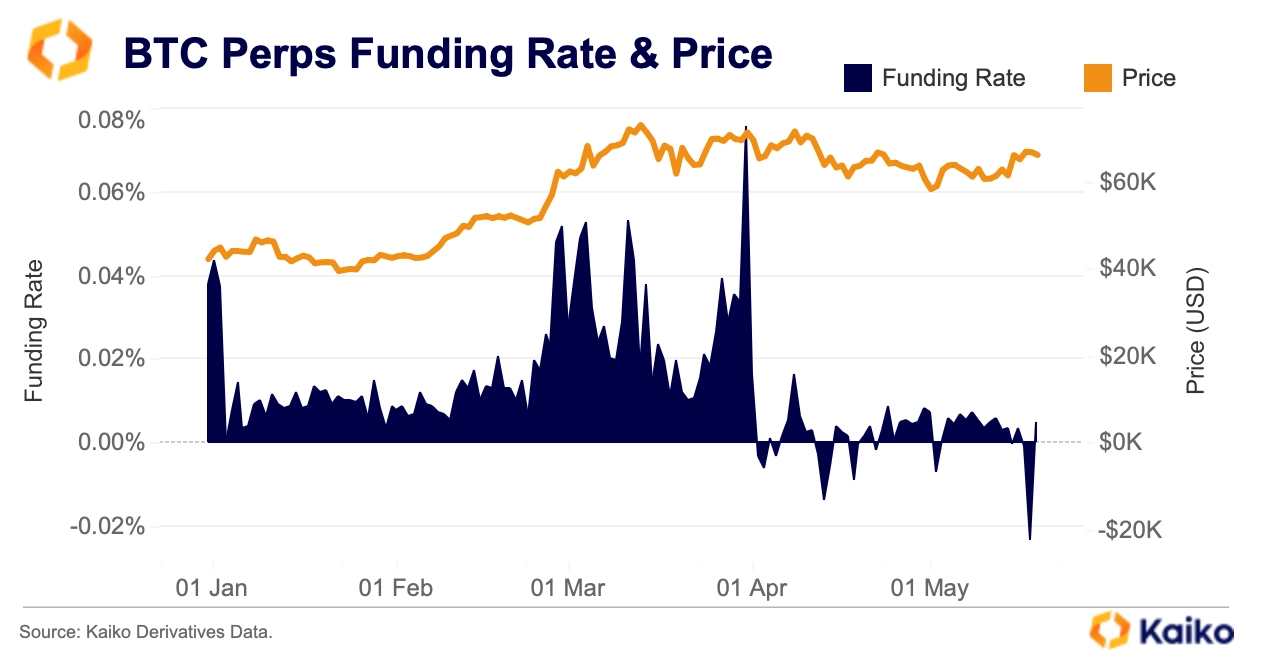

High funding rates, above 0.07%, are typically a sign that the market is overheating. Traders are willing to pay significantly more to maintain long positions as prices rise rapidly. Typically traders take on more leverage when placing these bets to increase any potential returns. Considering the volatility of crypto markets this is usually an unsustainable strategy.

A prime example of funding rates reversing as the market was overweight in favour of longs occurred in March, shortly after BTC set a new record high above $72,000.

As seen above, funding rates spiked to nearly 0.08% in March, before quickly turning negative. The market was lopsided and long traders paid the price (on top of fees) as prices fell and their positions were liquidated.

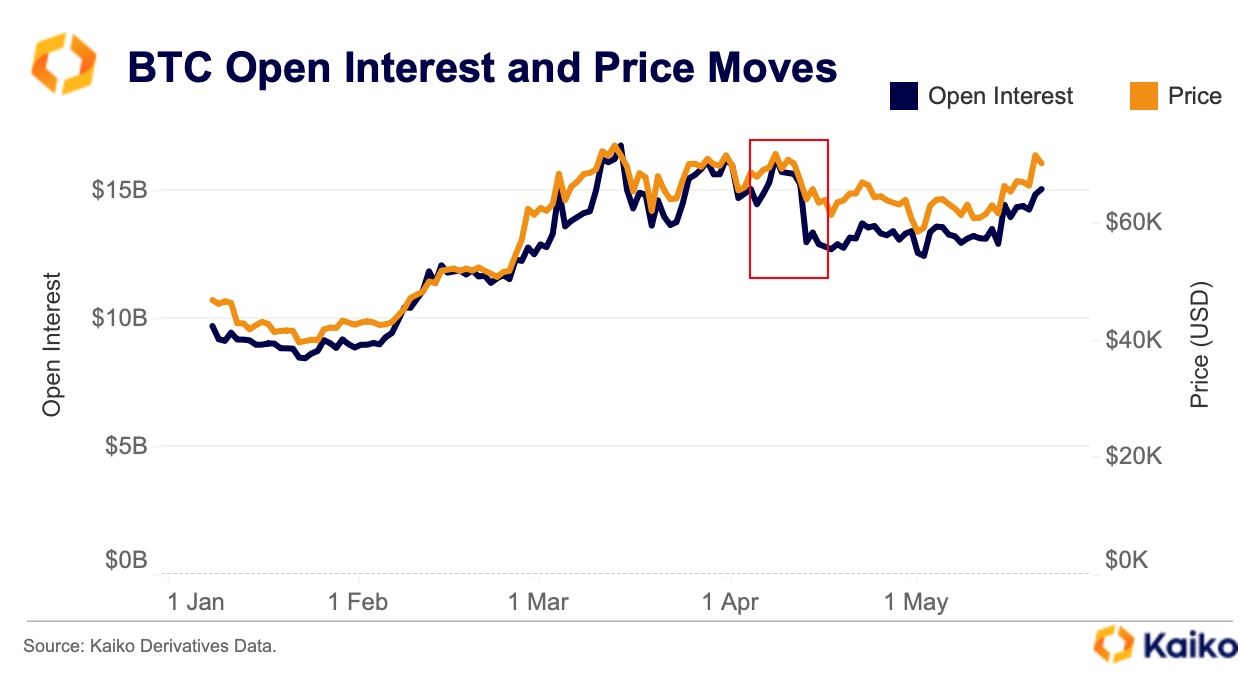

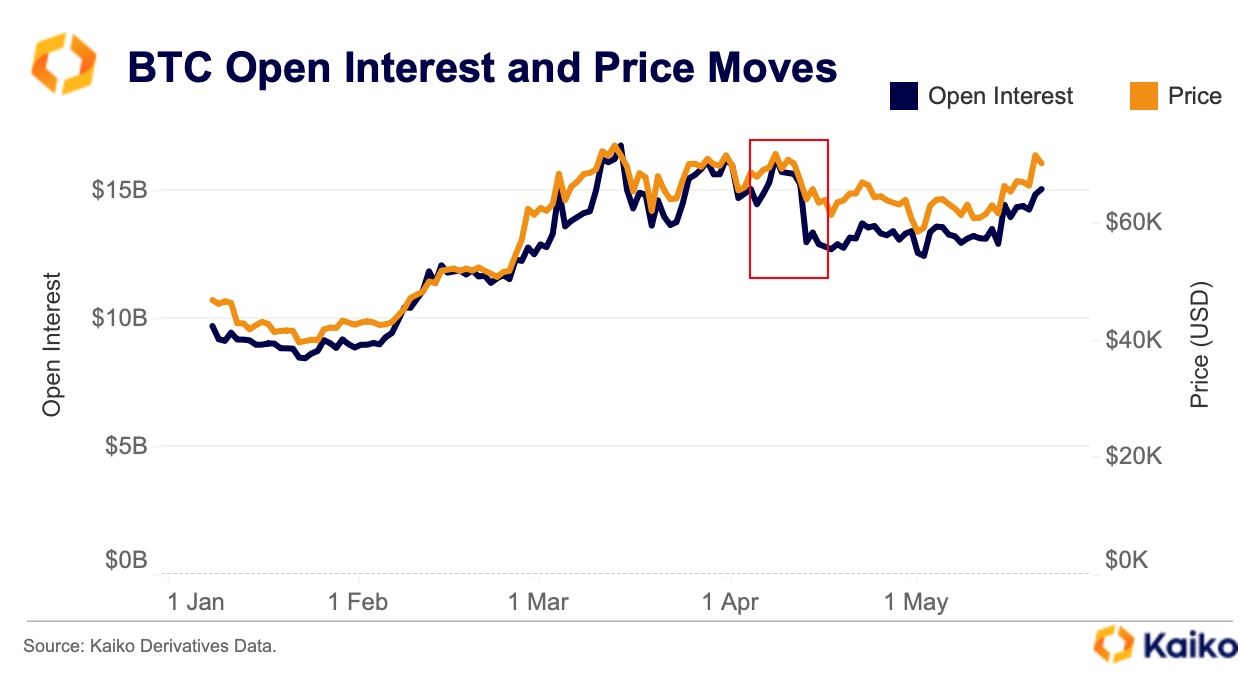

Around $4 billion in open interest, which refers to the total number of outstanding contracts that have yet to be settled, was wiped out as BTC moved from $72,000 to $61,000.

This was a prime example of a deleveraging after funding rates remained stubbornly high. Since then, open interest has recovered above $15bn.

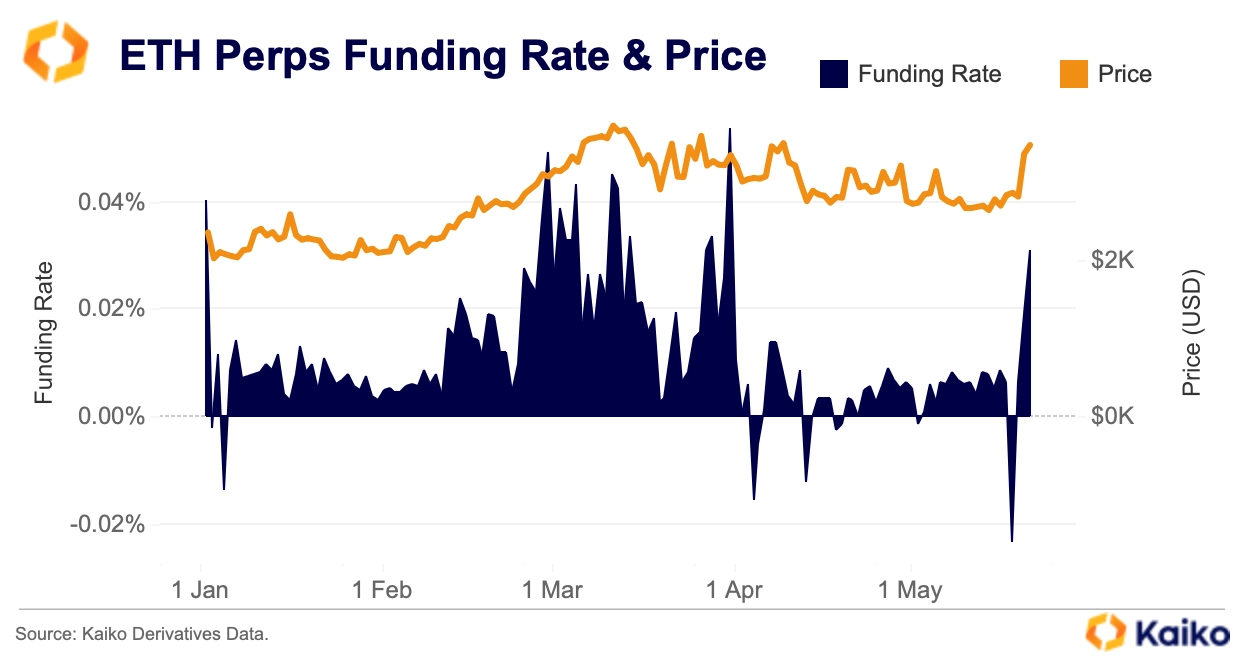

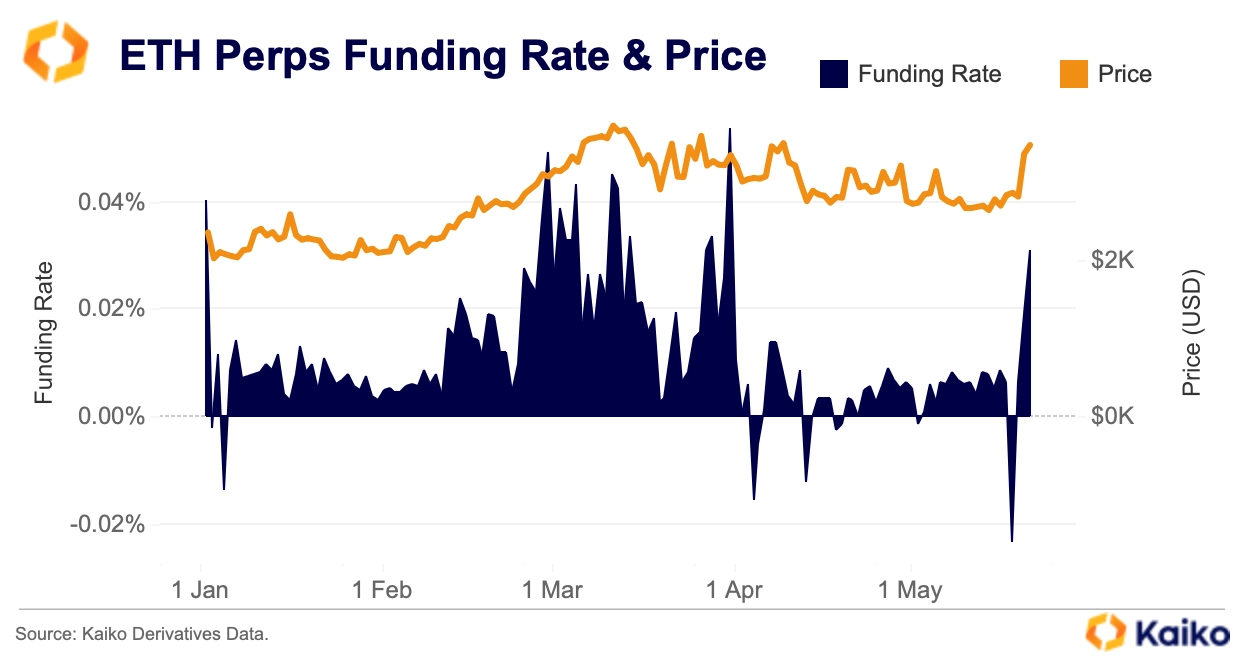

ETH perps follow similar patterns to BTC as the assets remain highly correlated with one another. However, some asset specific features can lead to divergence among the two assets, which happened this week.

The funding rate for ETH perps jumped from -0.02% on Saturday to 0.03% by Tuesday. The increase followed reports that the US Securities and Exchange Commission will now approve spot ETH ETFs for listing on US exchanges. Previously hopes of approval had faded.

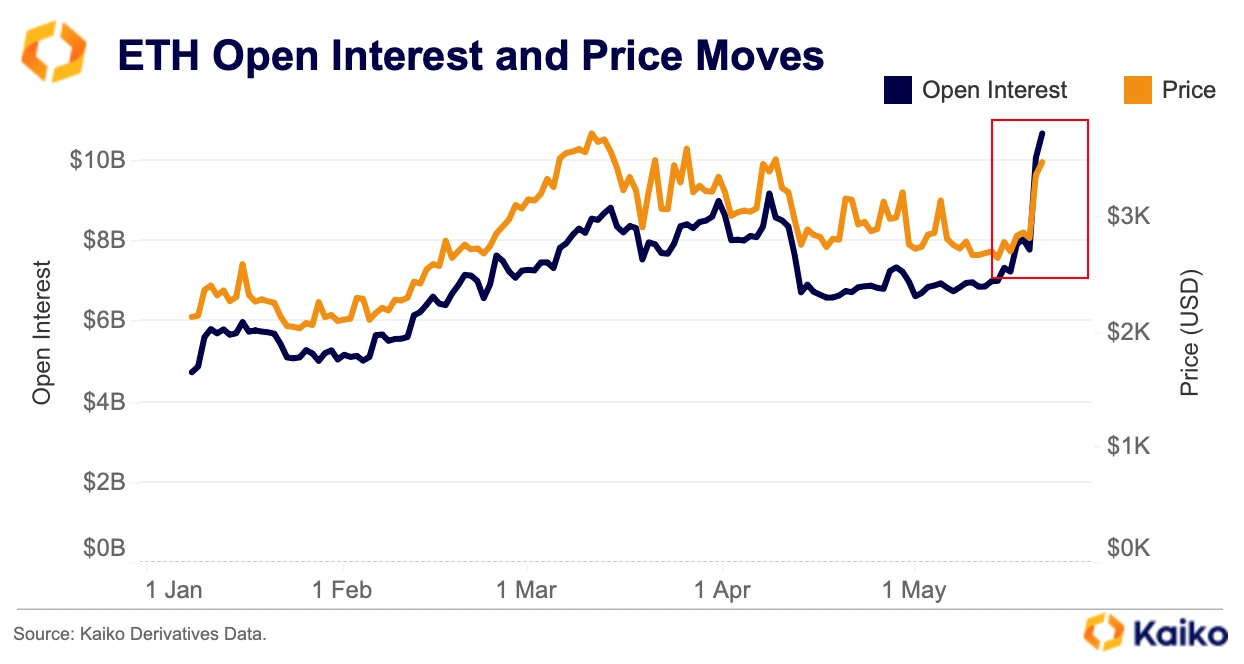

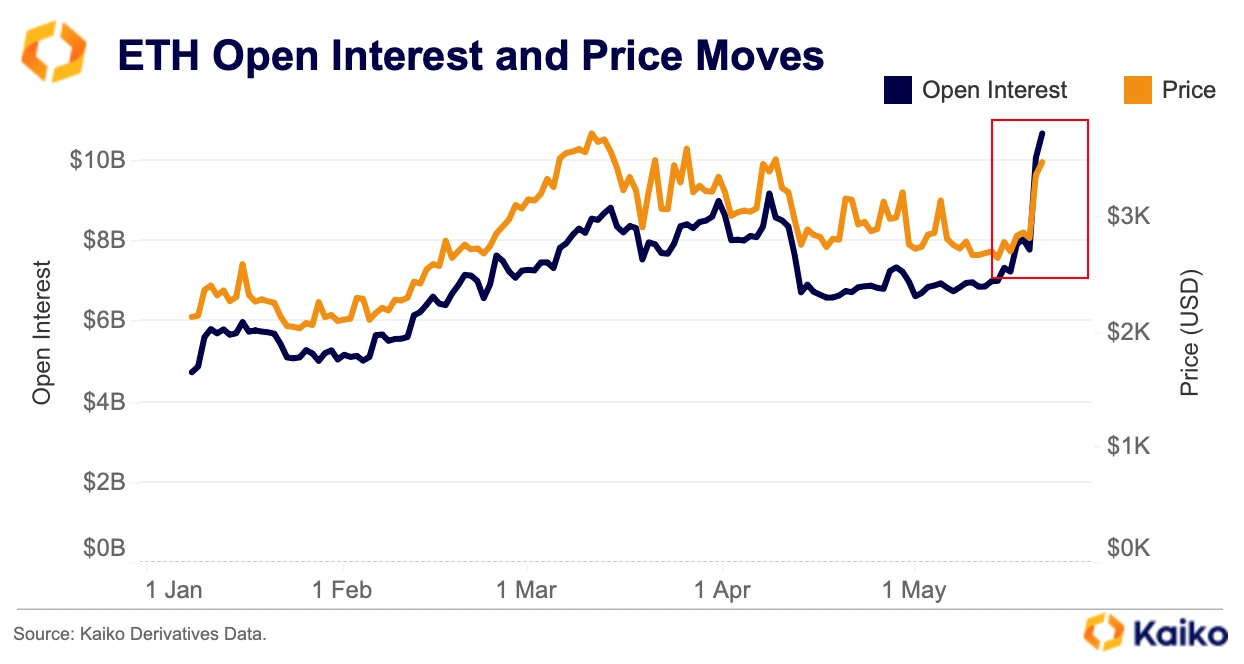

Open interest in ETH perps soared to all-time highs over $10.7 billion as its price increased 23% to over $3,500. BTC open interest remains below record highs as it trades based on idiosyncratic factors at present.

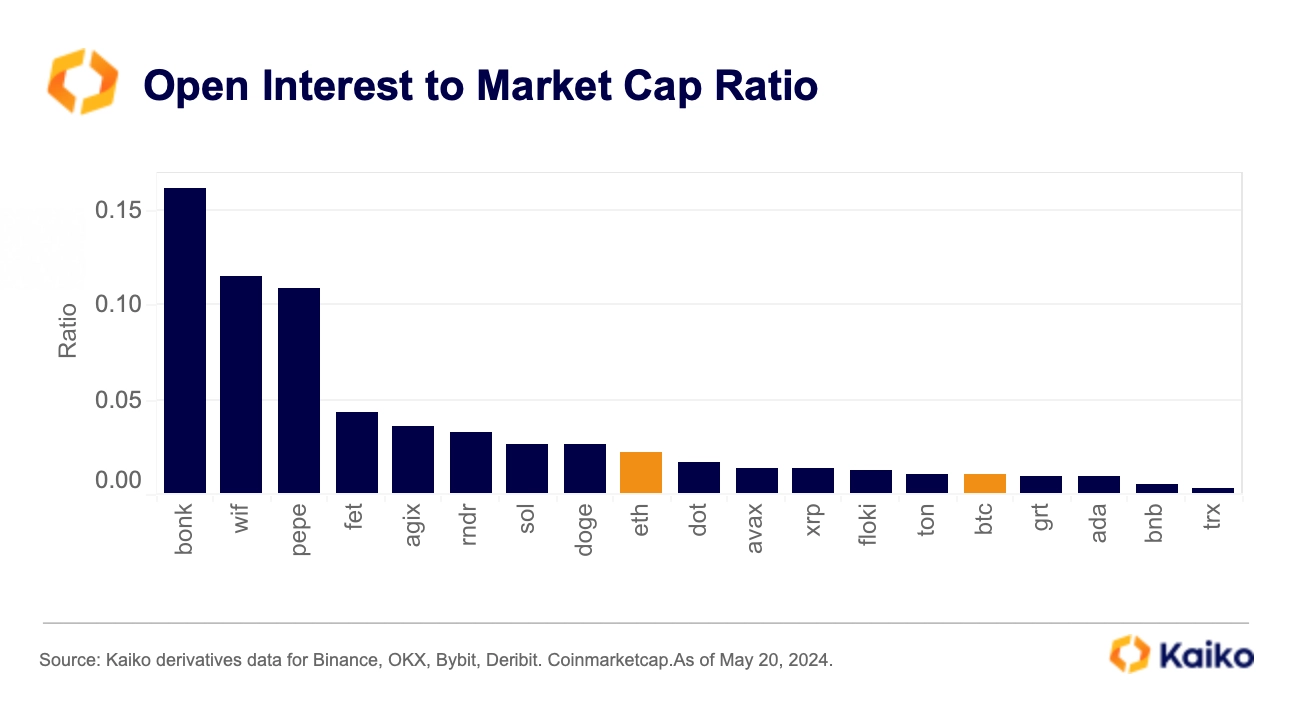

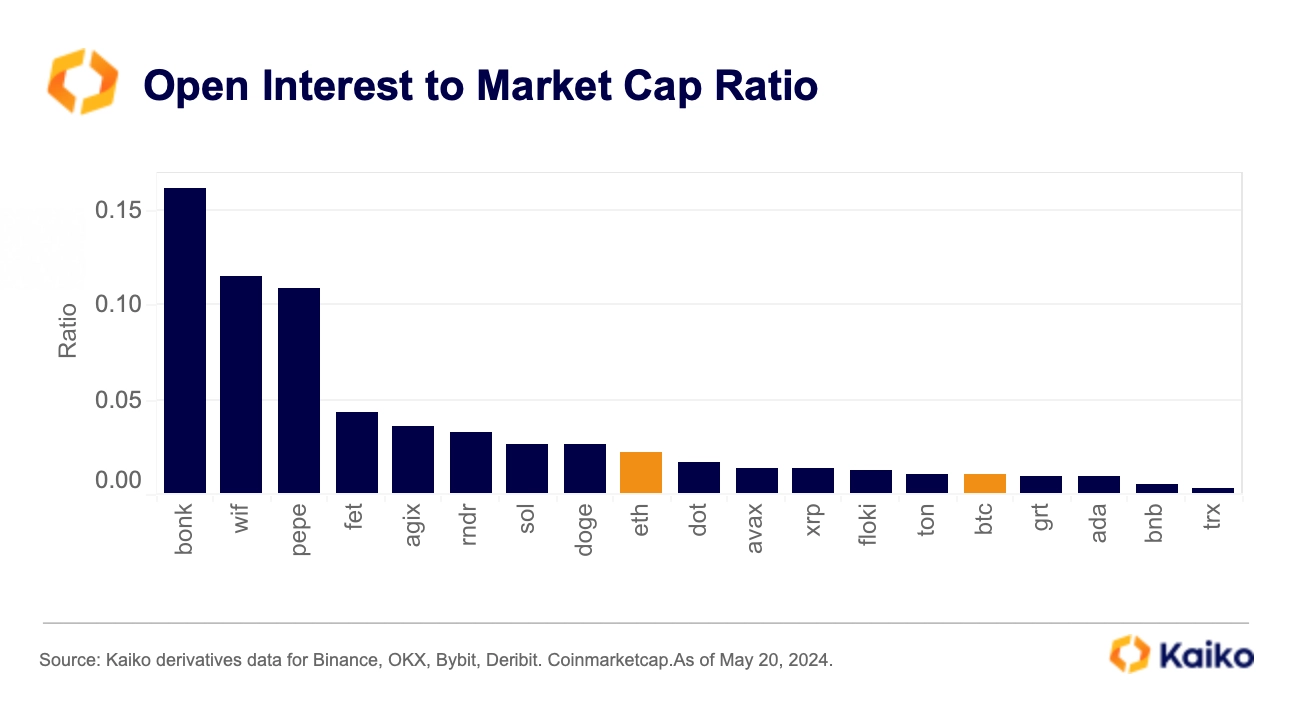

It’s not just Bitcoin and Ethereum that see significant leveraged bets and price discovery in perps. Positions in altcoins, which are less widely traded cryptocurrencies can be quite large compared to their respective market capitalisations. This suggests that most price discovery for these assets takes place in perpetual futures markets.

The below graphic shows the open interest to market cap ratio of some of the most widely traded altcoins in futures markets versus Bitcoin and Ethereum. This ratio highlights the outsized perpetual futures positions open relative to market cap.

Options TRADERS TILT BULLISH

Another type of derivative, options, offer important insight into market sentiment and positioning.

Options are a type of derivative contract that give the holder the right — but not the obligation — to buy or sell the underlying asset at a predetermined price. The holder of a put option can sell the underlying at a set price at expiration.

The right to sell is determined by the underlying trading below a specific price, known as the strike price. When the option is favourable compared to the strike price it is known as an “in-the-money option,” meaning it has value.

Most options trading in crypto takes place on Deribit, OKX, and Binance. While the CME offers Bitcoin and Ether options, the market is still dominated by crypto first platforms like Deribit. Most crypto options are “European style,” meaning the holder can only exercise the option at expiration. Options that offer early expiration are referred to as “American style.”

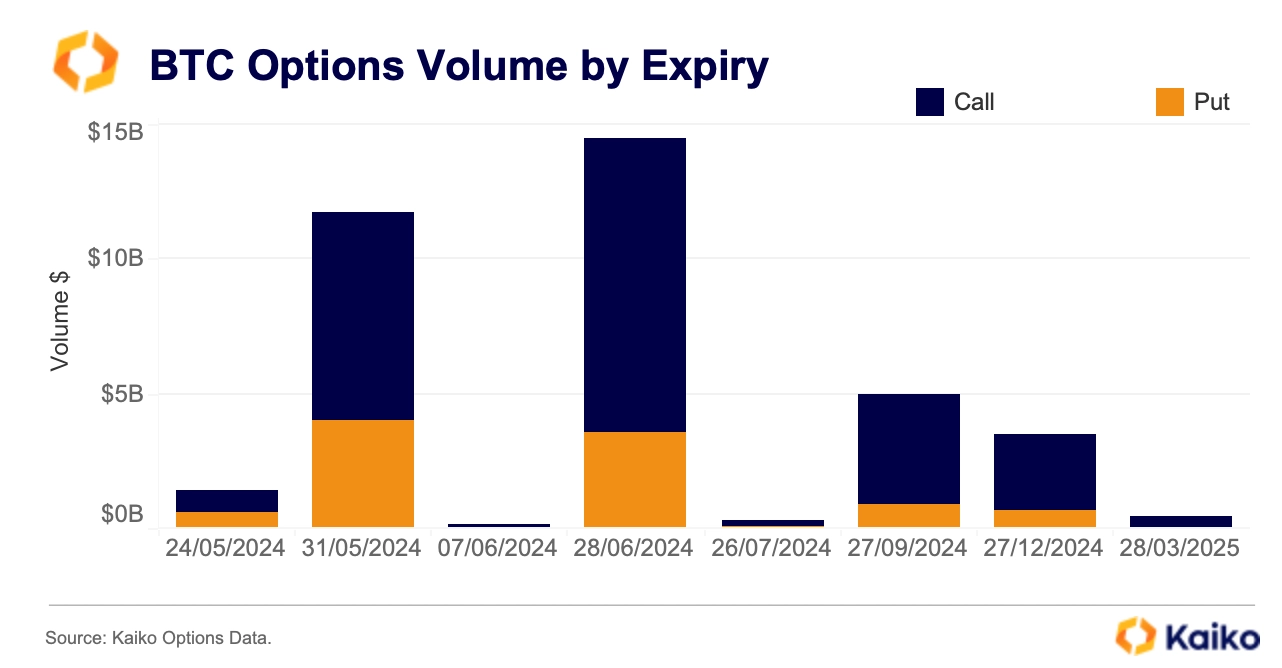

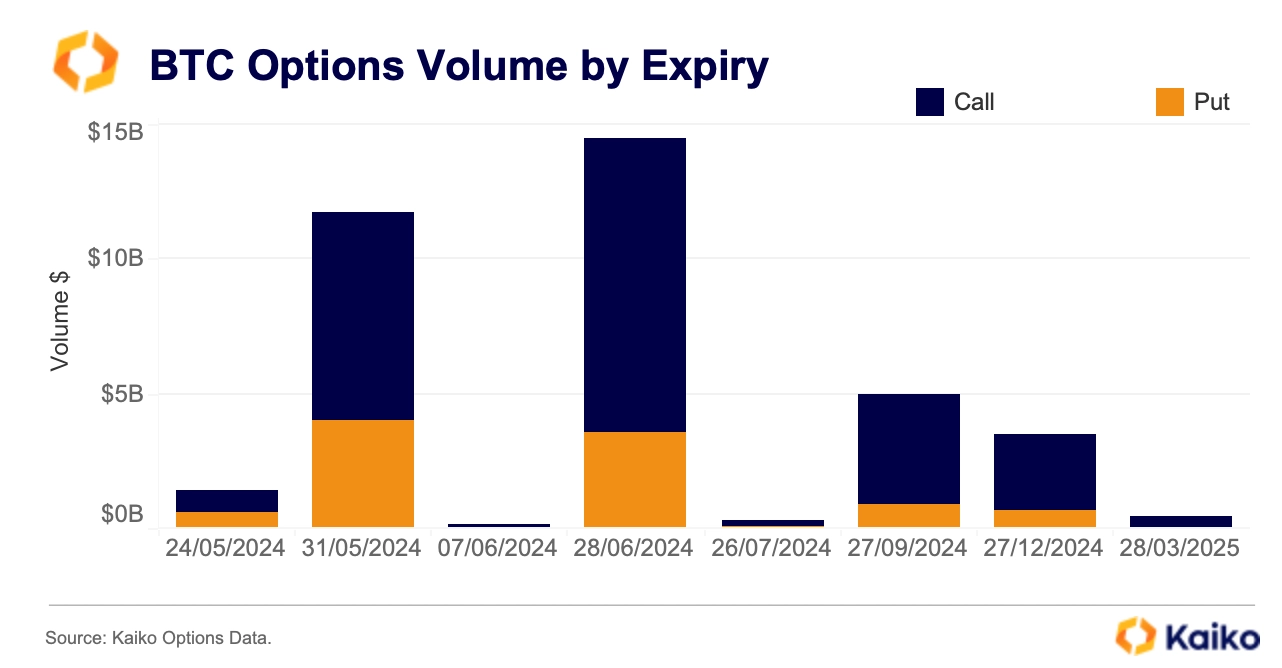

Using Kaiko options data we can see that volumes for BTC options are heaviest for expirations on May 31 and June 28. Calls dominate both of these expires, suggesting that traders are bullish on BTC and have placed bets that will be profitable if BTC rises.

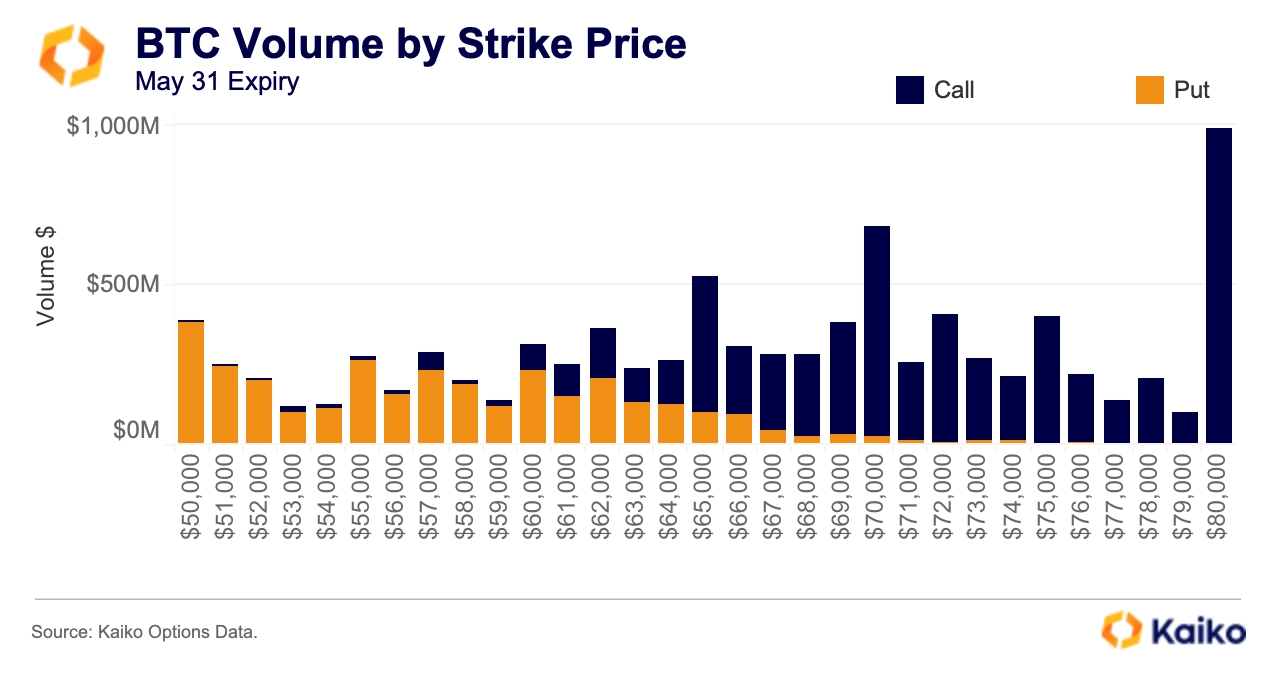

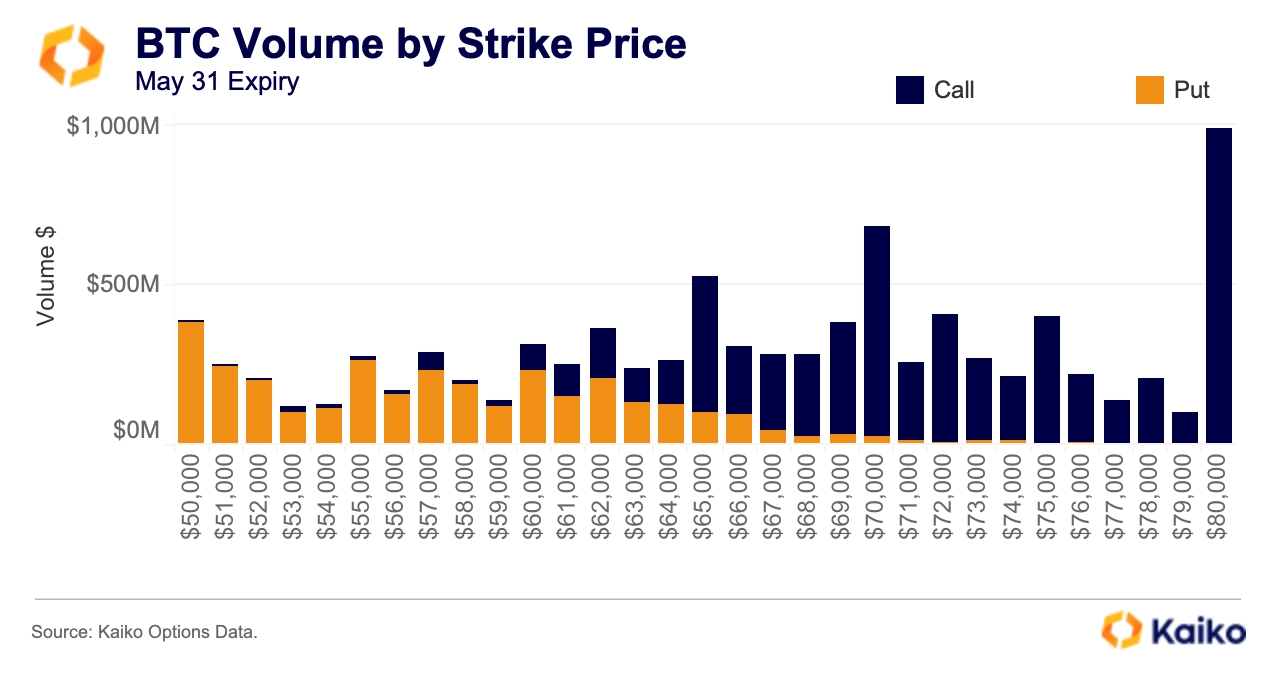

We can dig into that further by breaking down the volume by strike price. The highest volume strike for BTC contracts expiring next Thursday is $80,000, made up of contracts with a notional value of just under $910 million, according to Kaiko data.

The next two most popular strikes are $65,000 and $70,000 — both of which are in-the-money at present based on BTC’s latest price moves. Since these contracts are European style traders will have to wait to exercise these options and the market could yet move against them.

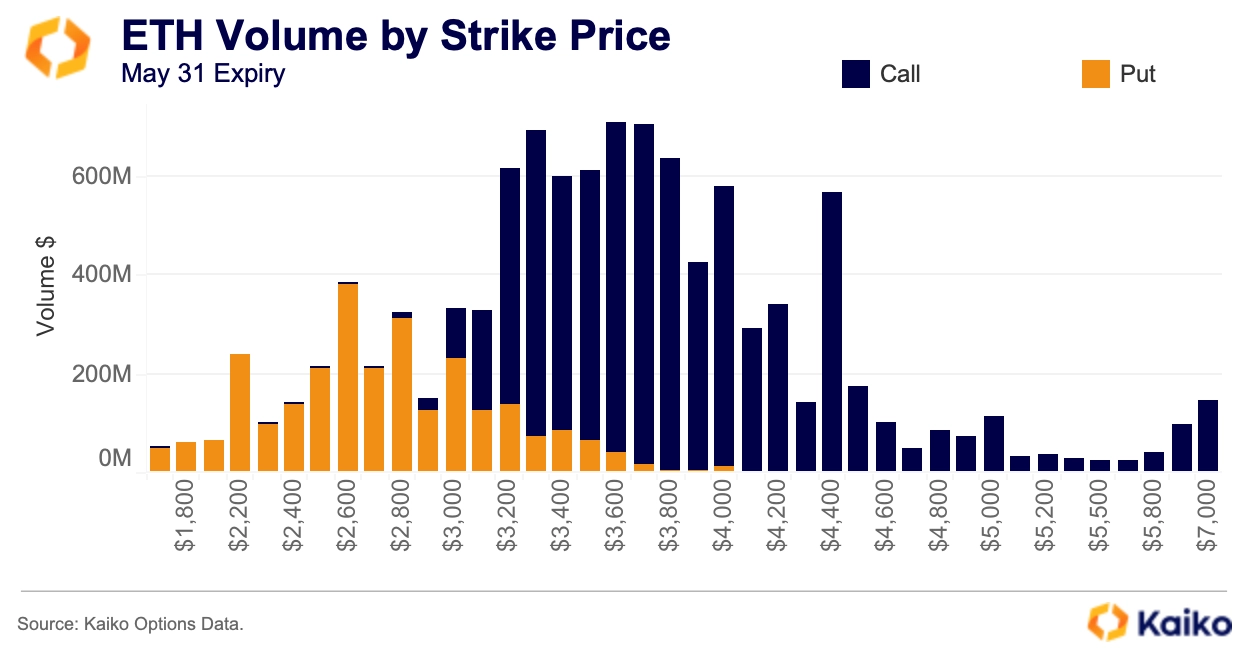

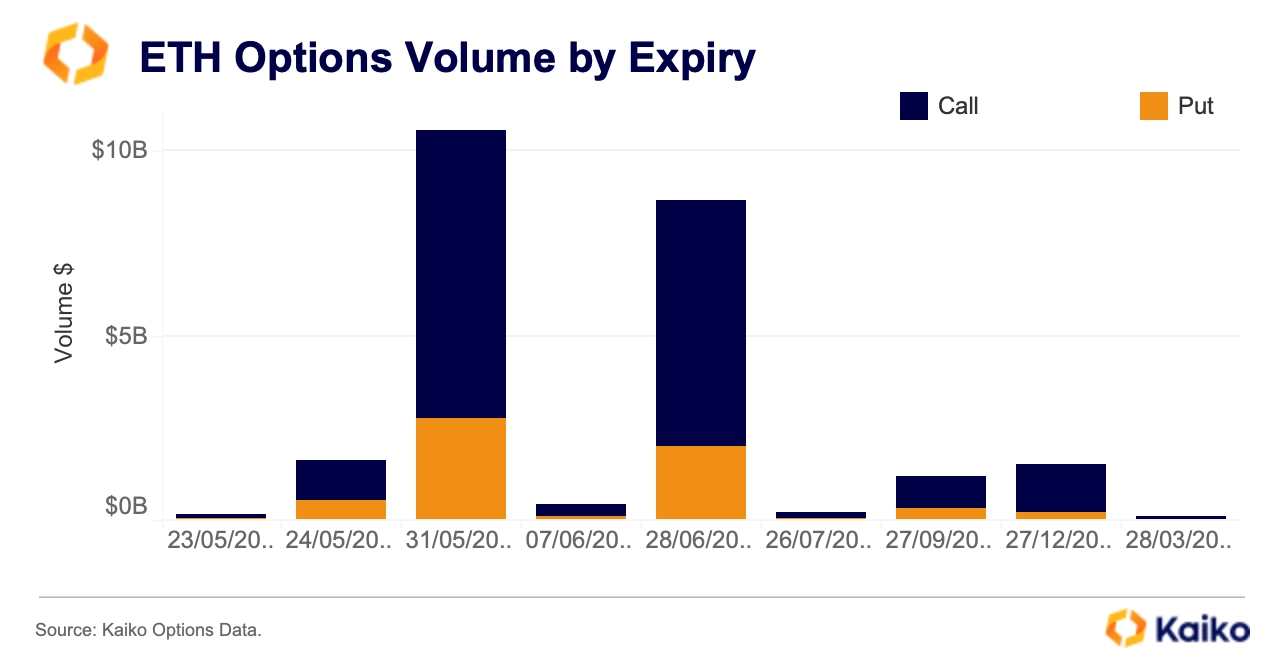

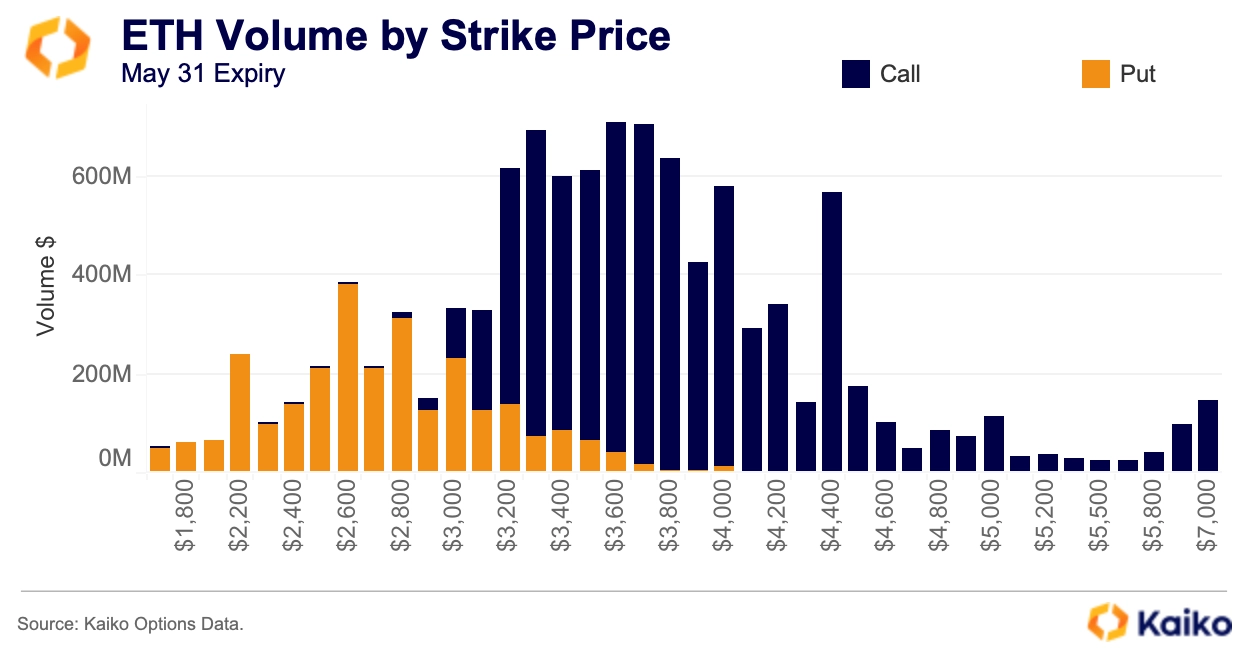

ETH OPTIONS SURGE

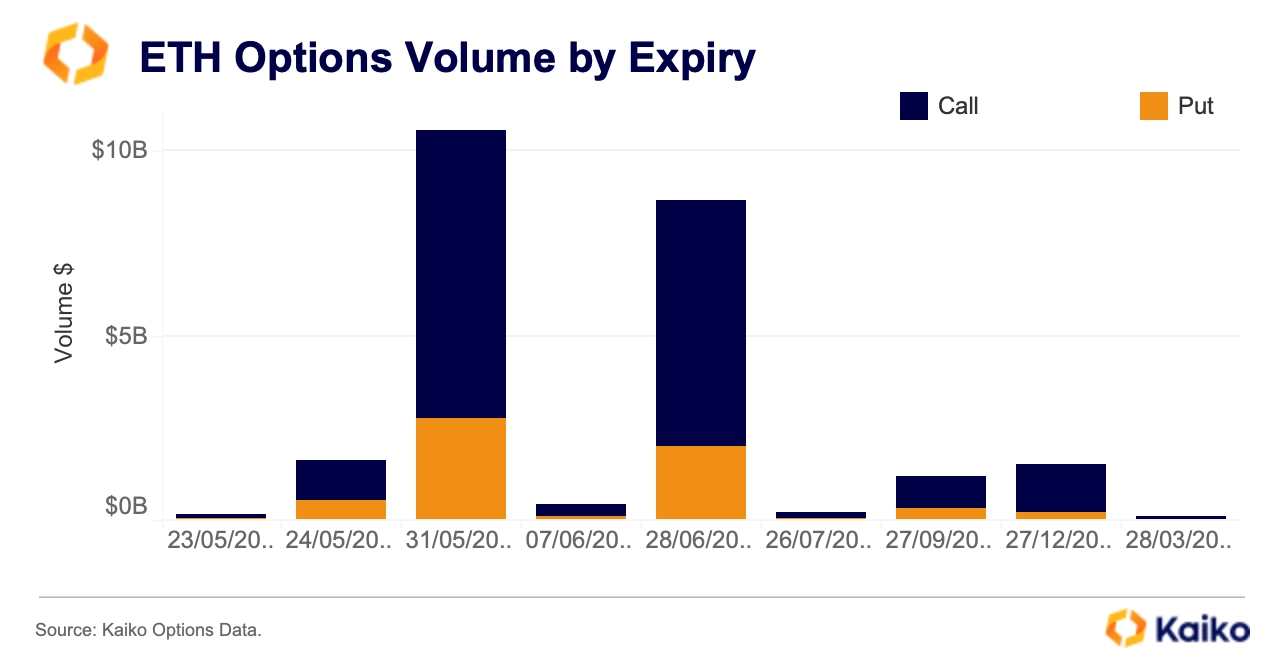

Similar to perps activity, ETH options are being driven by separate factors at present. Volume for ETH options expiring on May 31 increased to nearly $11 billion by Wednesday, from just over $8 billion on Monday, according to Kaiko data.

Calls continue to dominate here, with the top two volume strikes being $3,600 and $3,800 — the latter is entirely dominated by calls suggesting traders have tilted bullish on ETH ahead of potential ETF approval in the US.

However, some traders have bought protection against a potential “buy the rumour sell the news” event with significant volumes on strike prices around $2,800 and $2,600. While these are currently out-of-the-money, or unprofitable, things could change in the next seven days depending on what the SEC does next.

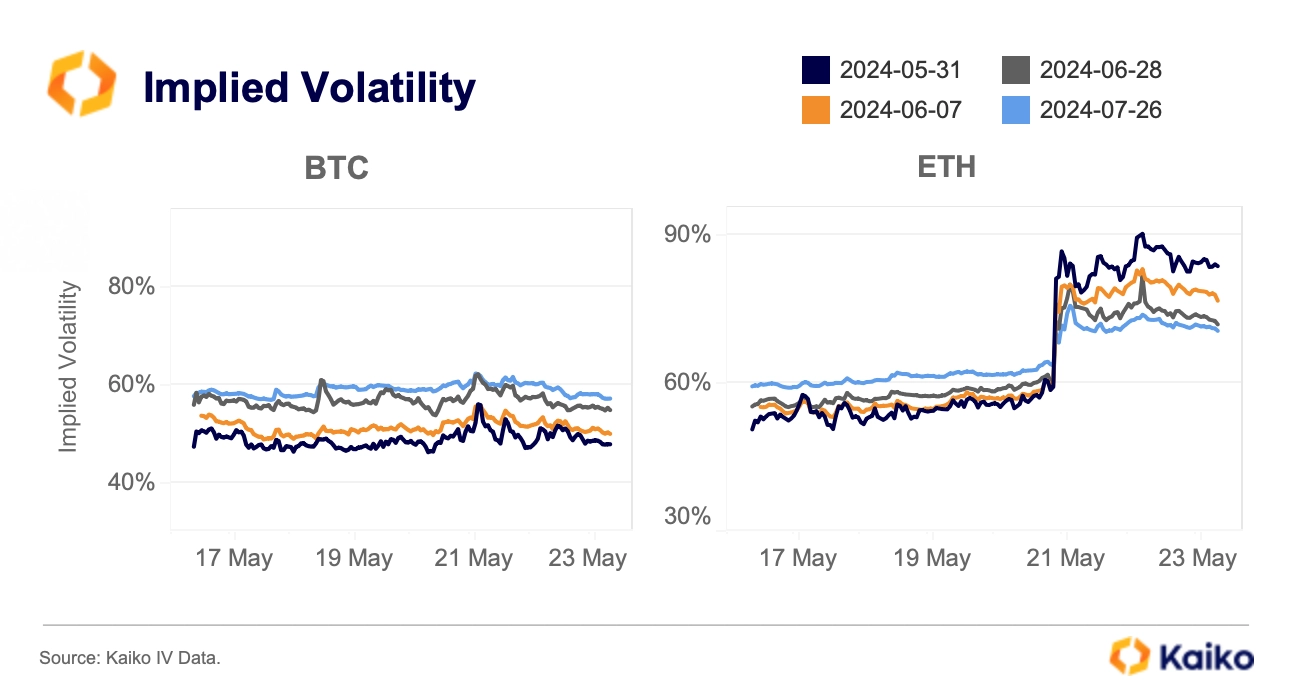

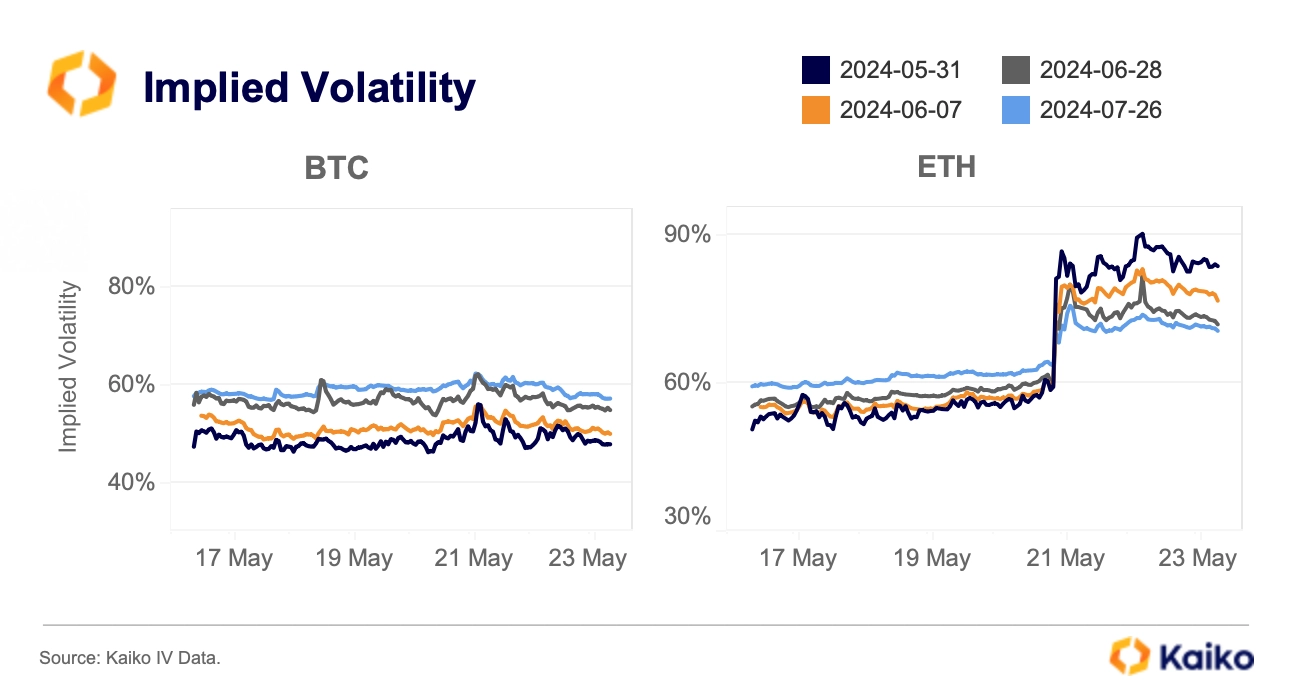

Implied volatility on ETH contracts expiring over the next few months spiked amid the apparent ETF u-turn. Implied volatility on May 31 contracts jumped from 60% to over 90% between Monday and Wednesday this week. BTC contracts for the same expiries were unchanged.

Increases in implied volatility usually mean traders are less confident on the direction of prices and will pay higher premiums to protect positions or to speculate on potential price moves — up or down.

iNSTITUTIONAL PULSE

While crypto first platforms currently dominate the derivatives landscape for this burgeoning asset class, institutional exchanges are playing an increasingly important role. CME has offered BTC futures since 2017 and ETH futures since early 2021. The Chicago-based exchange overtook Binance in terms of open interest in October 2023 and remains the largest futures venue for Bitcoin.

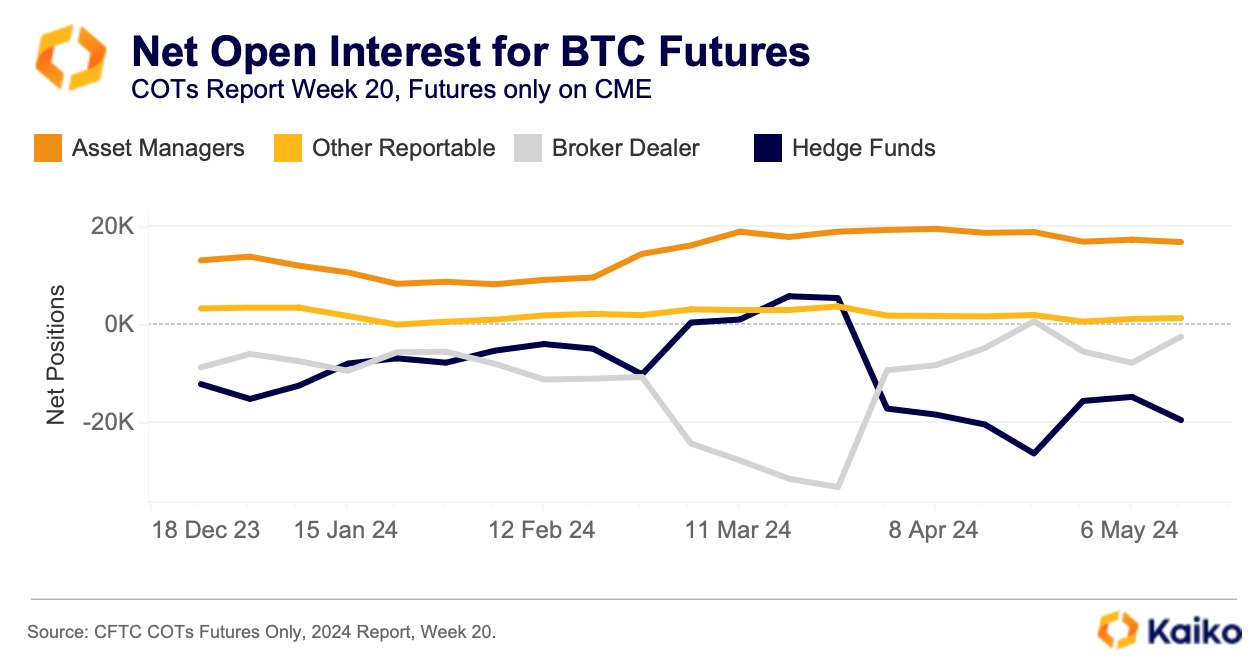

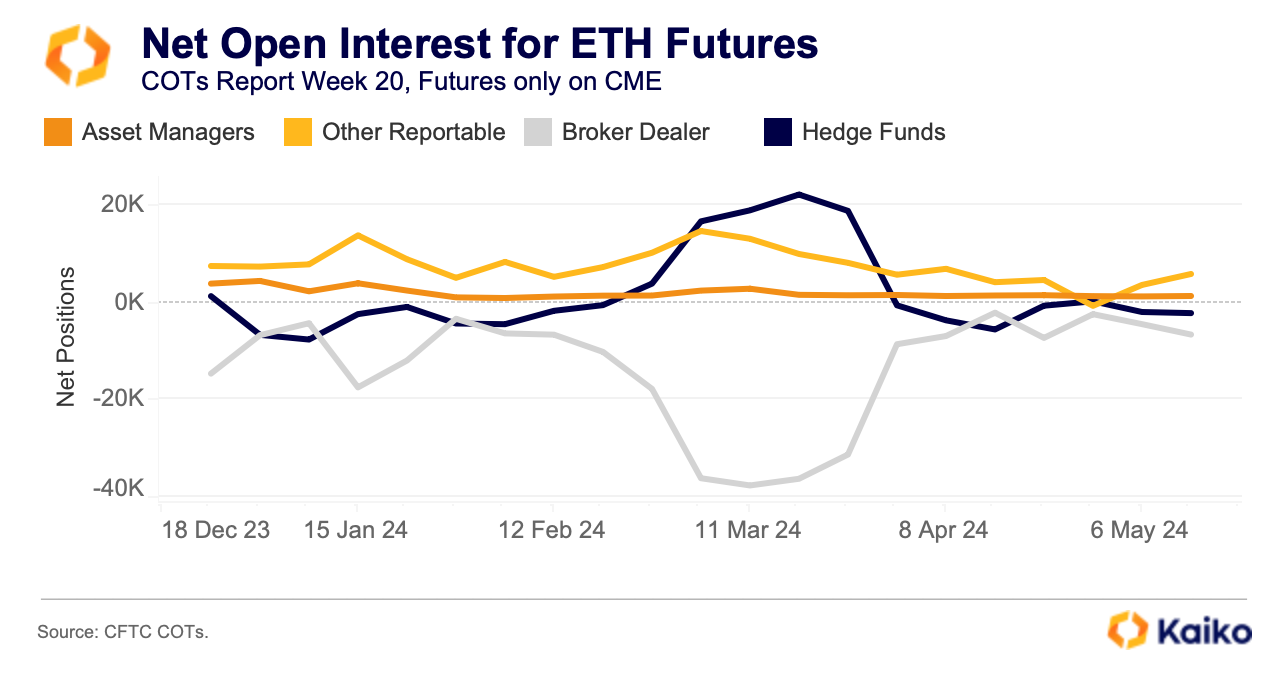

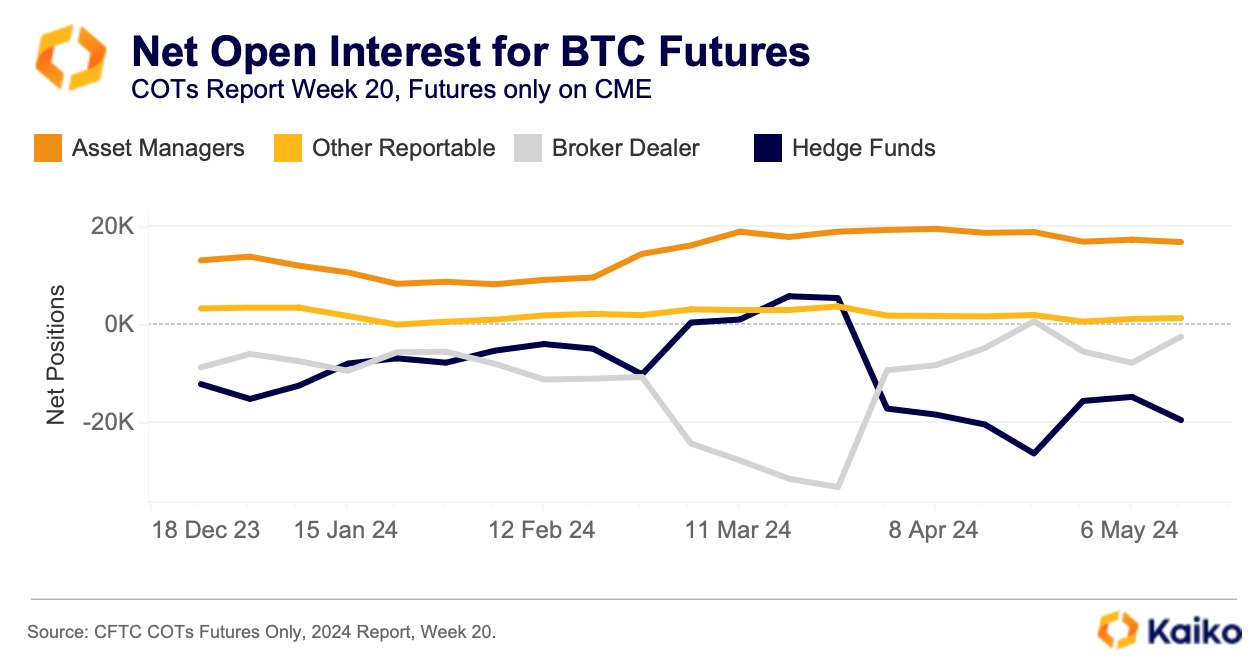

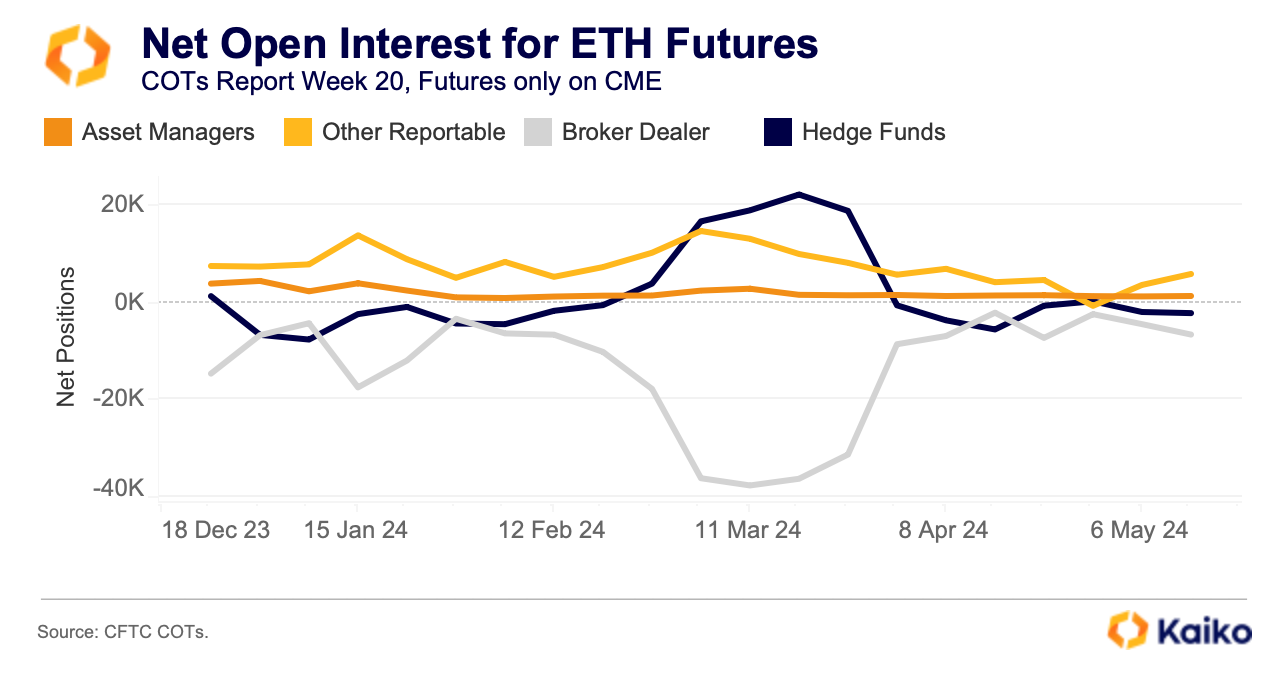

The Commodity Futures Trading Commission’s weekly Commitment of Traders report provides a breakdown of institutional traders positioning.

Hedge funds are net short across BTC and ETH futures on the CME, according to Tuesday’s COTs report. However, this doesn’t necessarily mean these funds are bearish on crypto, it’s more likely they’re engaging in one of crypto’s most popular trades, the basis trade.

The basis trade is a type of arbitrage strategy that exploits the price difference between two similar assets. In this case between an BTC or ETH spot and futures.

Hedge funds are likely “long basis” at present. This means they are selling futures short while holding spot BTC or ETH. This protects against price moves and guarantees a specific sale price in the event of volatility in the underlying asset.

The long basis trade works best when prices are in a state of contango — which means futures prices are above spot prices. The two prices will trend towards one another as expiration nears.

While we don’t have the data to say with certainty that this is why hedge funds are net short, it’s the most likely explanation for the massive short positions held by these sophisticated traders, who would rarely short without hedging.

Conclusion

Perps continue to dominate crypto derivatives markets and as such traders should pay close attention to changing dynamics, especially as open interest approaches all time highs.

While options markets in crypto are still developing they can offer insights into sentiment and outlook. Volumes and behaviour in options markets in response to new information can explain what traders think will drive increase in the futures. Soaring volumes on calls for May 31 this week emphasise the importance placed on the SEC’s ETH ETF decision, for instance.

![]()

![]()

![]()

![]()