Data Points

Coinbase beats market expectations on soaring volume.

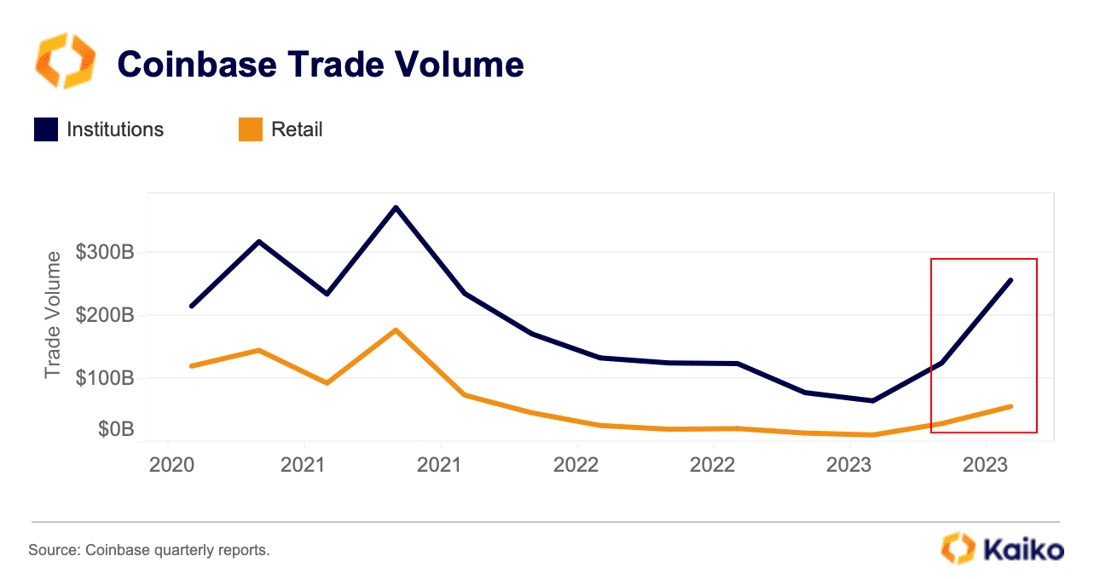

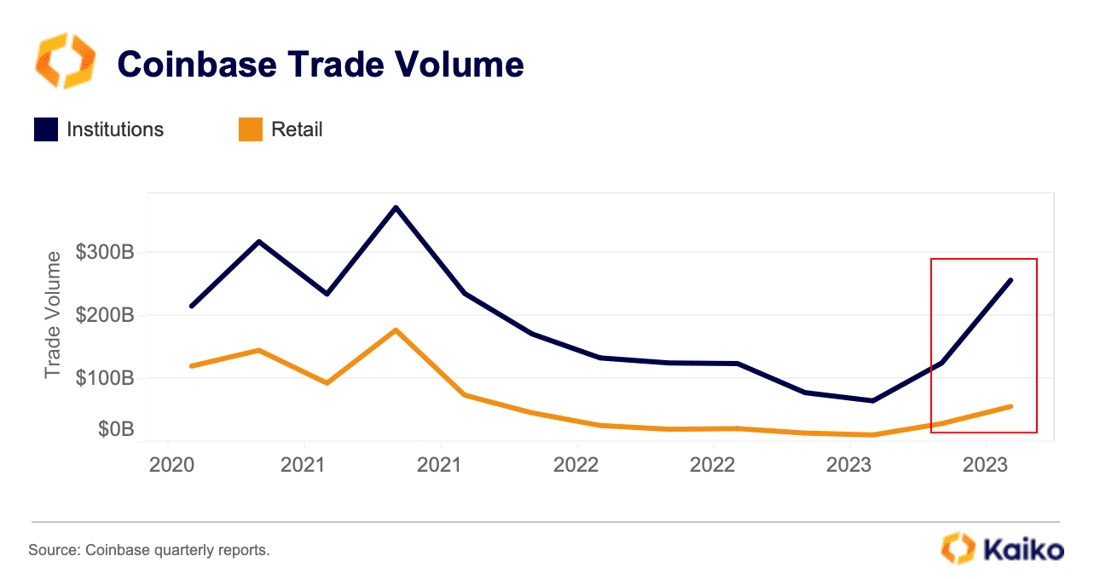

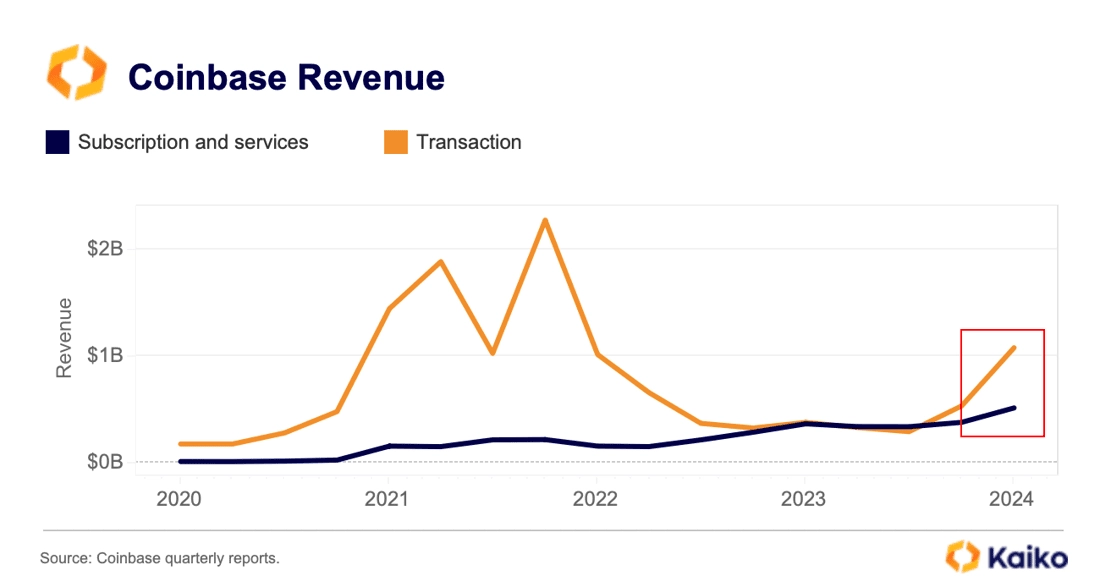

Last week, Coinbase reported a $1.2bn profit in Q1 due to rising trade volumes, strongly exceeding market expectations. Trade volume more than doubled to $312 billion, with institutional volume increasing faster than retail, accounting for 82% share of the total. However, COIN shares closed the week in the red amid worsening risk sentiment and falling BTC prices.

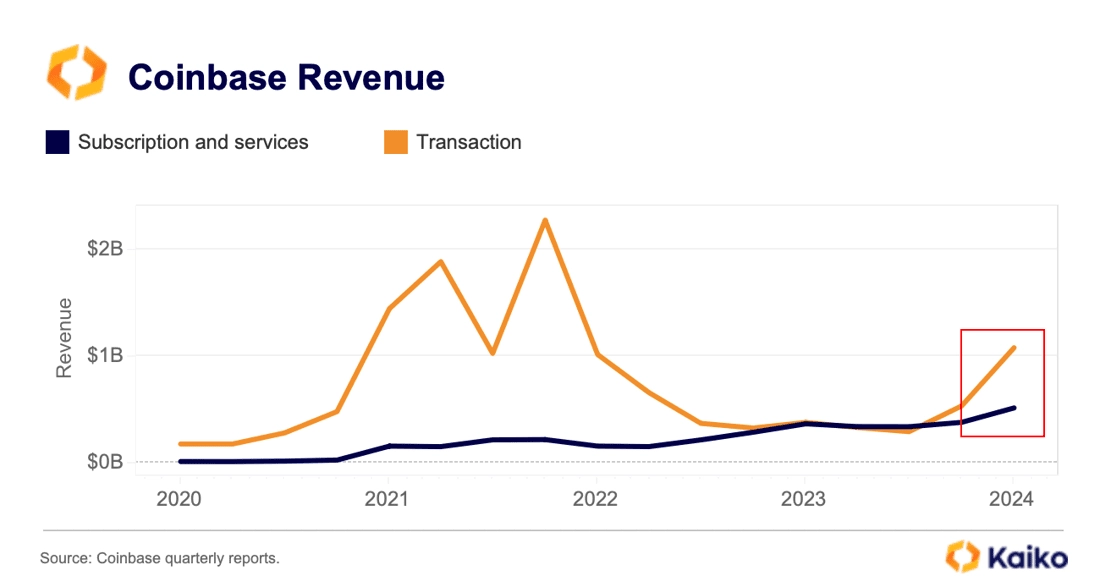

The exchange derives the majority of its revenue from retail transaction fees and from altcoins and staking services which are under regulatory scrutiny. Transaction revenue more than doubled relative to the previous quarter, reaching $1.08 billion and accounting for nearly 70% of Coinbase’s net income. The increase was mostly driven by rising retail fees and payments from Coinbase’s layer 2 BASE.

Although Coinbase’s institutional Prime platform hit an all-time high amid the launch of the spot ETF, the share of revenue related to this business, which includes income from custody, institutional trading fees, and interest and financing fees, remained relatively low at 11.6% of net income.

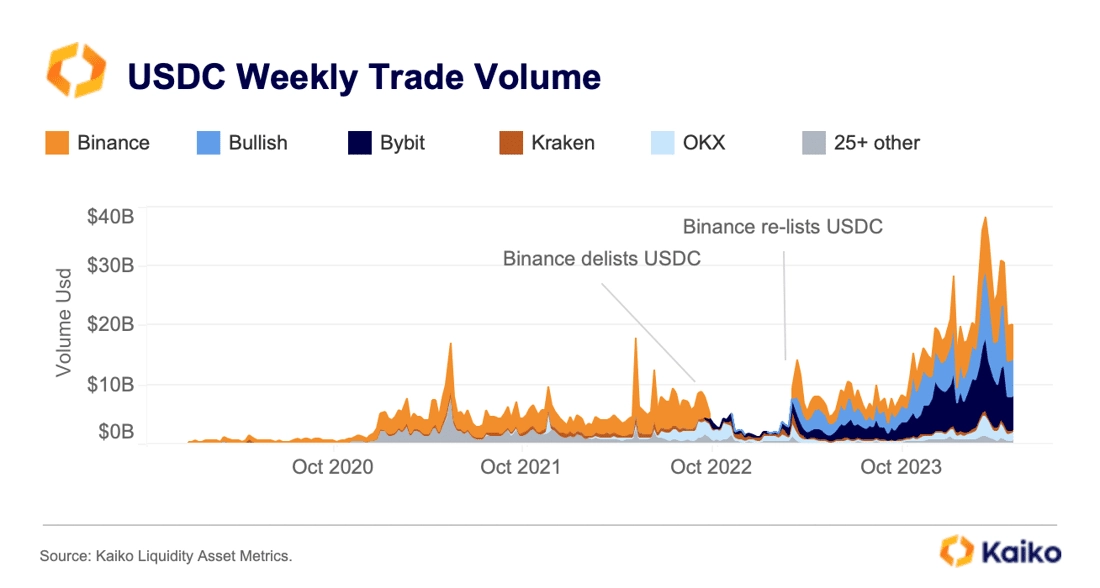

USDC gains momentum on CEXs.

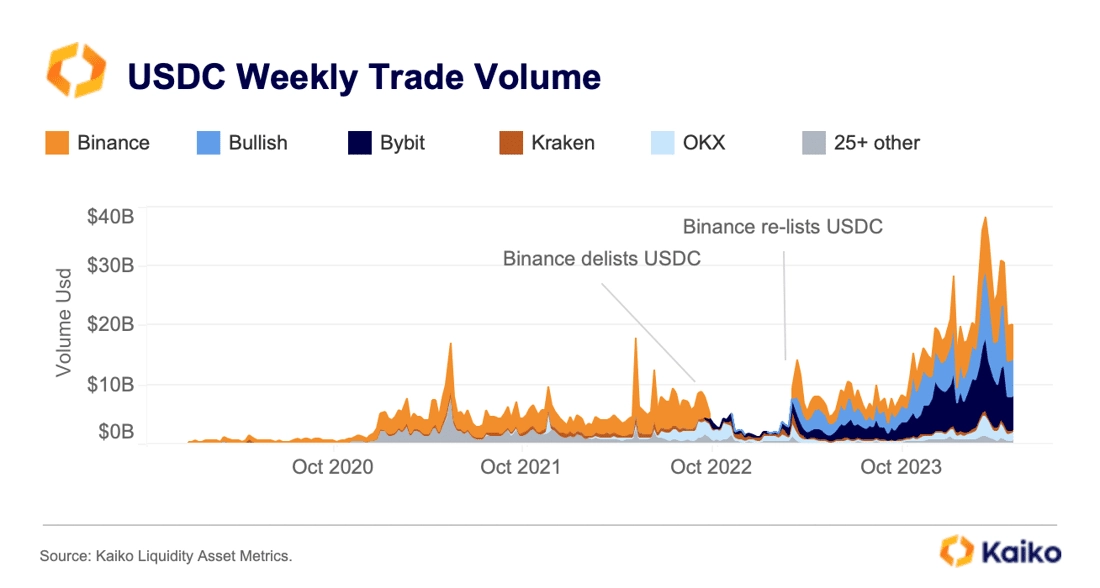

Circle’s USDC trade volume on centralized exchanges (CEXs) has surged in 2024, hitting an all-time high of $38 billion in March. USDC volume is significantly above the 2023 average of $8 billion. The increase was driven by Bybit and Bullish, which are the largest USDC markets, accounting for a combined 60% of trade volume.

Binance, which delisted USDC for several months in late 2022, has not recovered its dominant market share and currently holds around 30% of the market. One possible explanation for USDC’s rising popularity could be growing adoption and preference for regulated stablecoins. The trend has been mirrored by declining dominance of its main competitor Tether’s USDT.

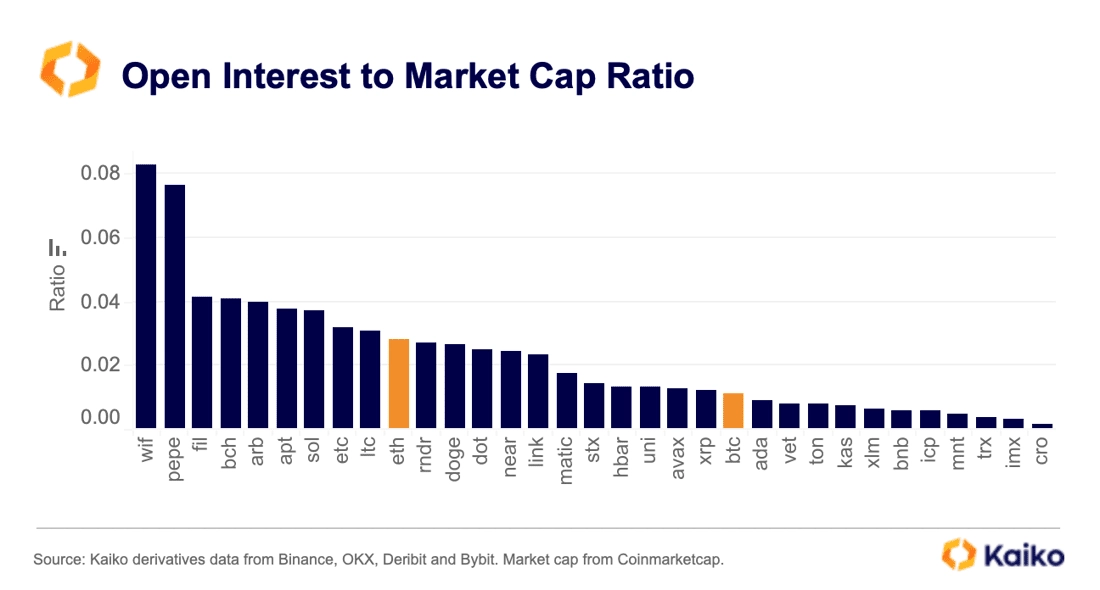

Meme tokens lead in leverage among top altcoins.

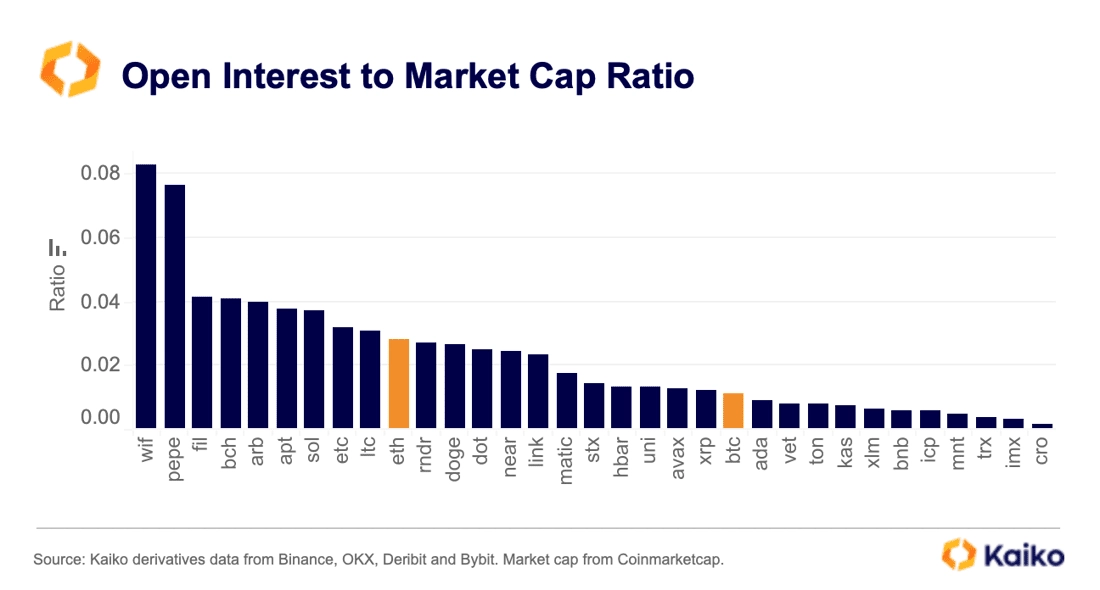

Derivative markets often have a significant influence on crypto price discovery, especially for altcoins, as crypto traders are known for their love of speculation. The open interest to market cap ratio can thus be seen as an indicator of leverage. A higher ratio indicates that the derivative market positioning for an asset is large compared to its market cap, making price discovery for these tokens more concentrated in perpetual futures markets.

Looking at the ratio for the top 30 altcoins by market cap, meme coins continue to lead the pack despite the recent market correction. Pepe (PEPE) and Dogwifhat (WIF) exhibit twice the ratio relative to other altcoins. The decentralized storage platform Filecoin’s FIL token, which saw a significant rally after it integrated with Solana in mid-February, comes next in line, followed by Bitcoin Cash (BCH). While the recent correction has sent many meme tokens back to zero, others remain among the best performers this year.

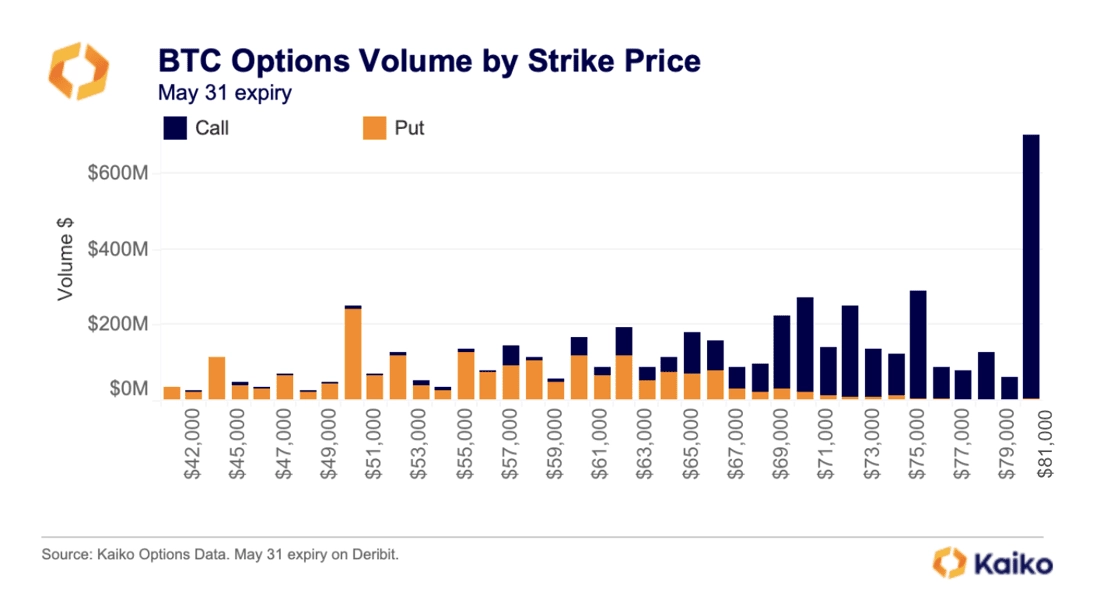

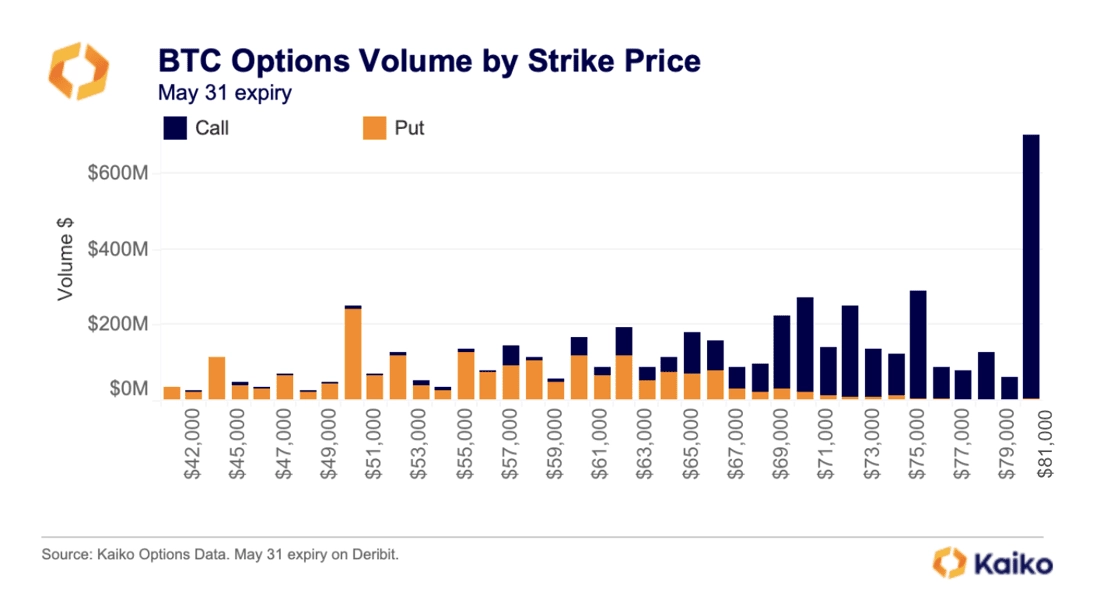

Bullish bias remains for BTC options.

BTC’s decline last week meant put options that expire at the end of May were briefly in-the-money, or profitable. Put options in the $57,000 to $60,000 range benefited from Bitcoin’s decline amid macroeconomic headwinds.

Puts are a type of option contract that give the holder the right to sell the underlying asset at a predetermined price. These account for around 28% of volume on Deribit for the May 31 expiry. Traders holding these positions are either hedging or expect prices to fall further. Alternatively call options give holders the right to buy the underlying asset at a predetermined price.

Since the price has recovered above $64,000 these puts are no longer profitable. Instead call options in the $60,000 to $65,000 range are back in-the-money, or profitable. Over $600 million worth of call options with a strike price of $80,000 are currently out-of-the-money, or unprofitable.

Calls still outnumber puts in terms of volume, as the market remains bullish over the coming months. Bitcoin options contracts that expire on September 27 are dominated by call options, with $65,000 being the most popular strike price. This means that just over $300 million worth of call options will be profitable if Bitcoin trades above $65,000 by the end of September, suggesting traders are bullish on prices trading around all-time highs by then.

![]()

![]()

![]()

![]()