One year after the launch of BTC ETFs.

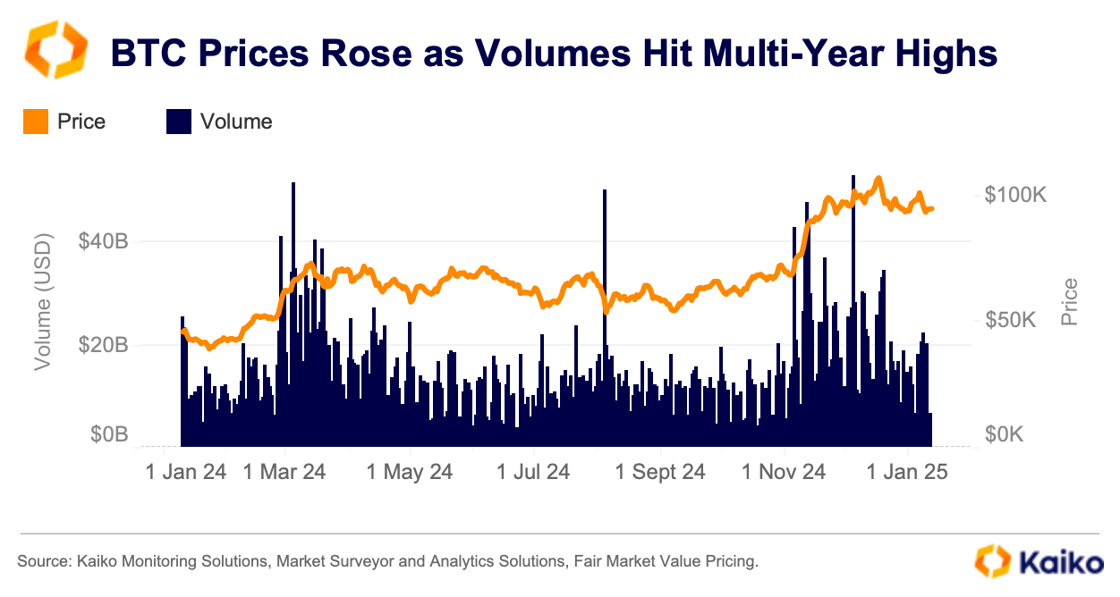

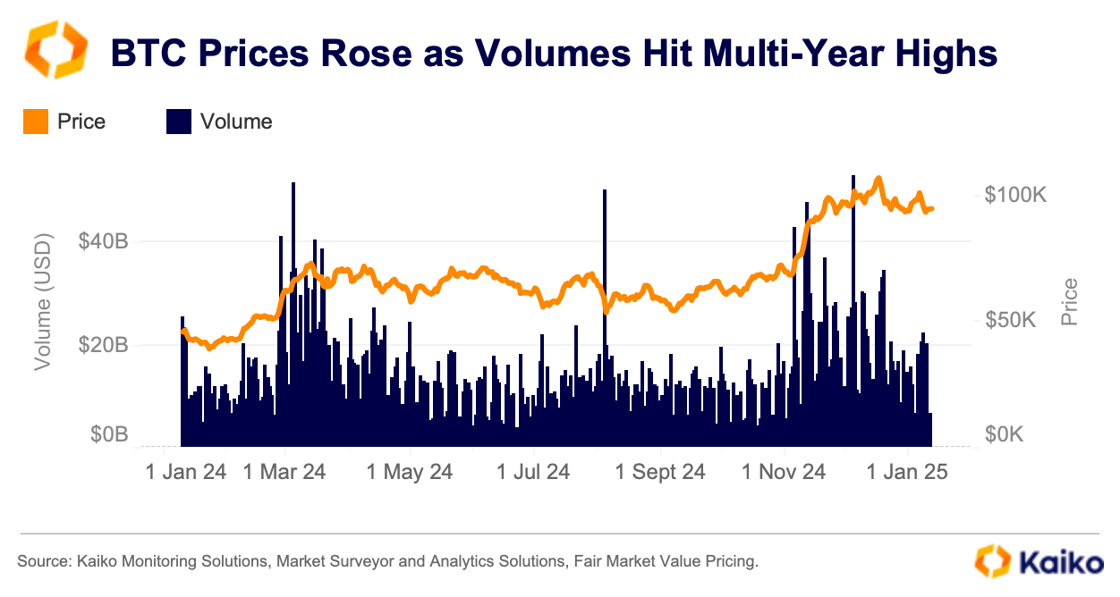

A lot has happened in the twelve months since the approval of spot BTC exchange-traded funds in the United States. The structure of the burgeoning digital asset market has shifted as major institutions finally got involved. BTC set consecutive record highs in 2024 as the underlying spot market volumes reached their highest levels since 2021.

The euphoria in the market culminated in BTC crossing $100k for the first time in early December, rising as high as $106k at one point last month. The increase in volumes alongside price tells us that this wasn’t a fluke, the broad base to the rally is another sign that the market has moved past the woes of 2022.

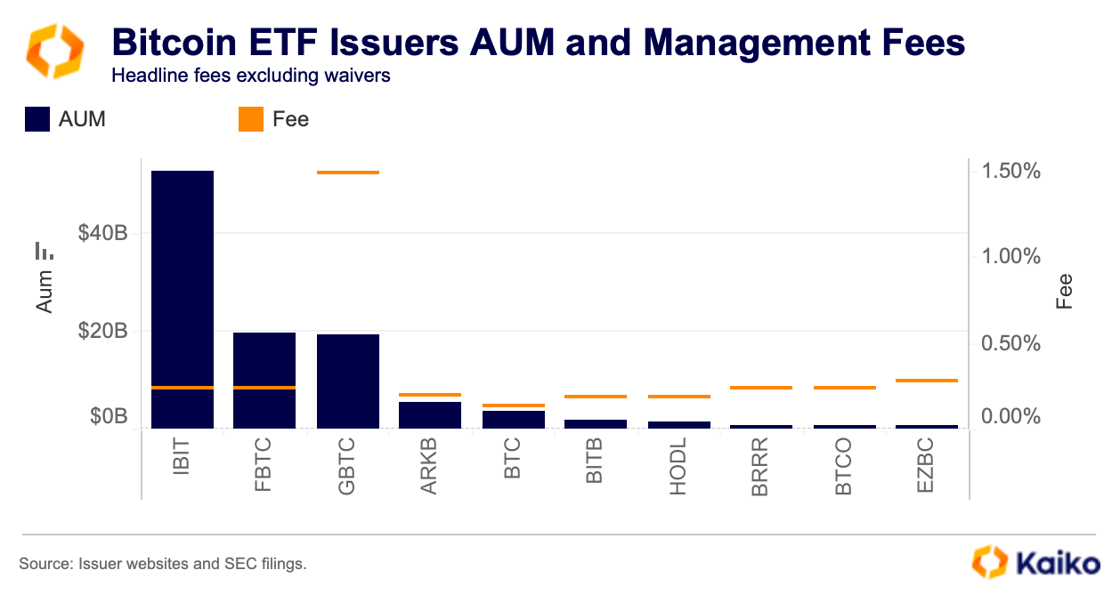

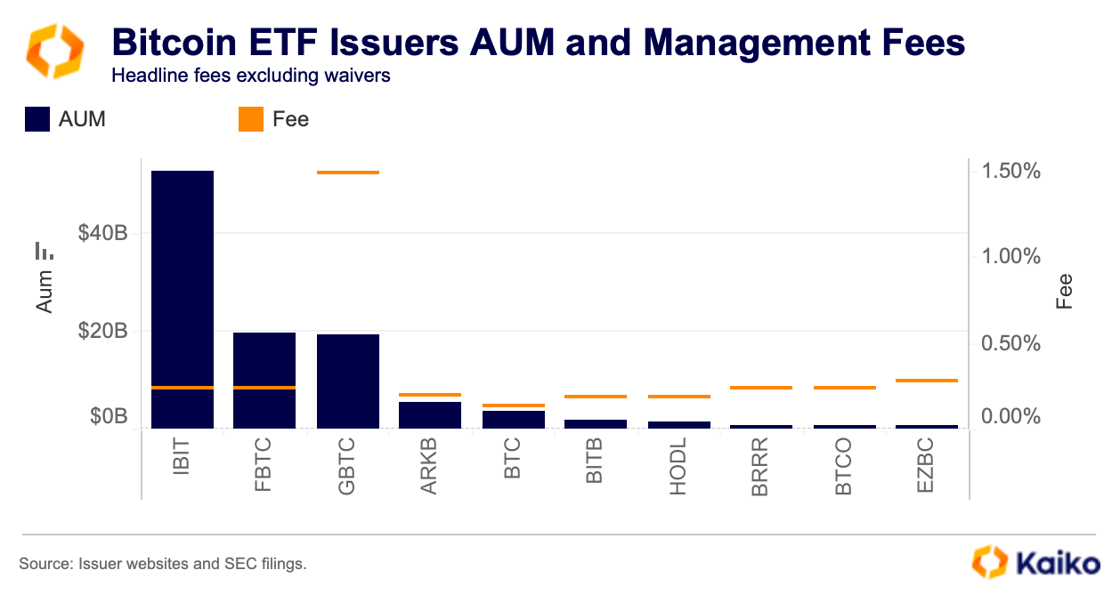

How much of this is down to BTC ETFs? The headline figures and data would suggest that the funds had a huge impact on prices and the market overall. The ETFs had $36bn in net flows in the first year and now manage around $110bn in assets. BlackRock’s IBIT was by all metrics one of, if not the most, successful launches of all time. IBIT ended the year with over $50bn in assets under management.

While Ark Invest and 21Shares ETF (ARKB) might look like its lagging the largest three, it’s actually one of the top 20 US ETF launches of all time, according to Bloomberg data.

Issuers continue to vie for market share despite BlackRock’s formidable lead, the weapon of choice? Fees. Most issuers that launched last January introduced fee waivers, offering either no fees on the first few billion dollars of assets under management or free management fees for the first 12 months. Some, like VanEck, have even extended these promotions as recently as November.

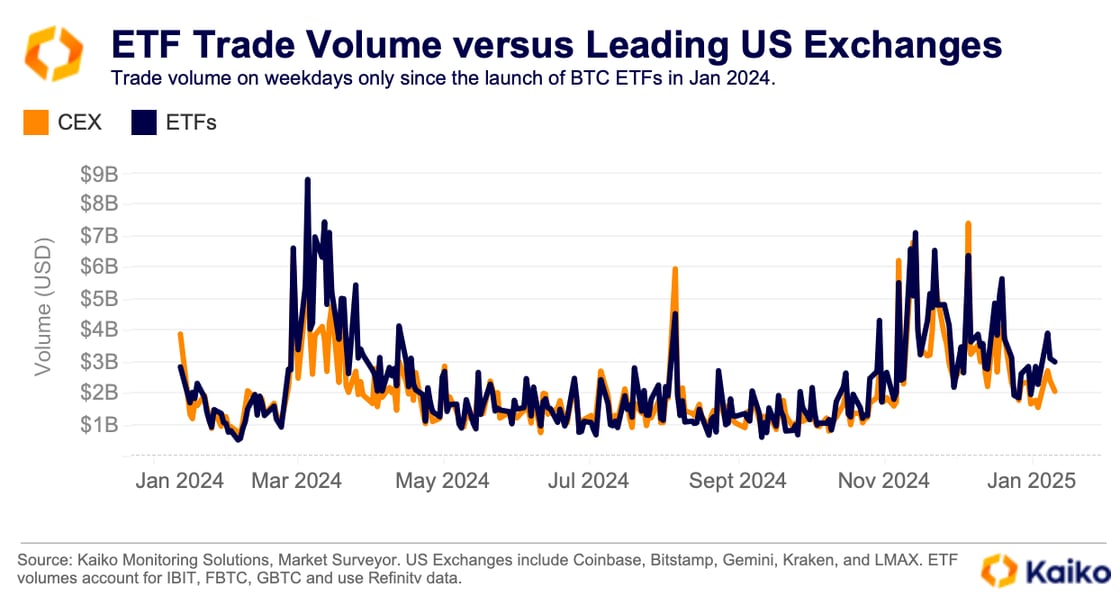

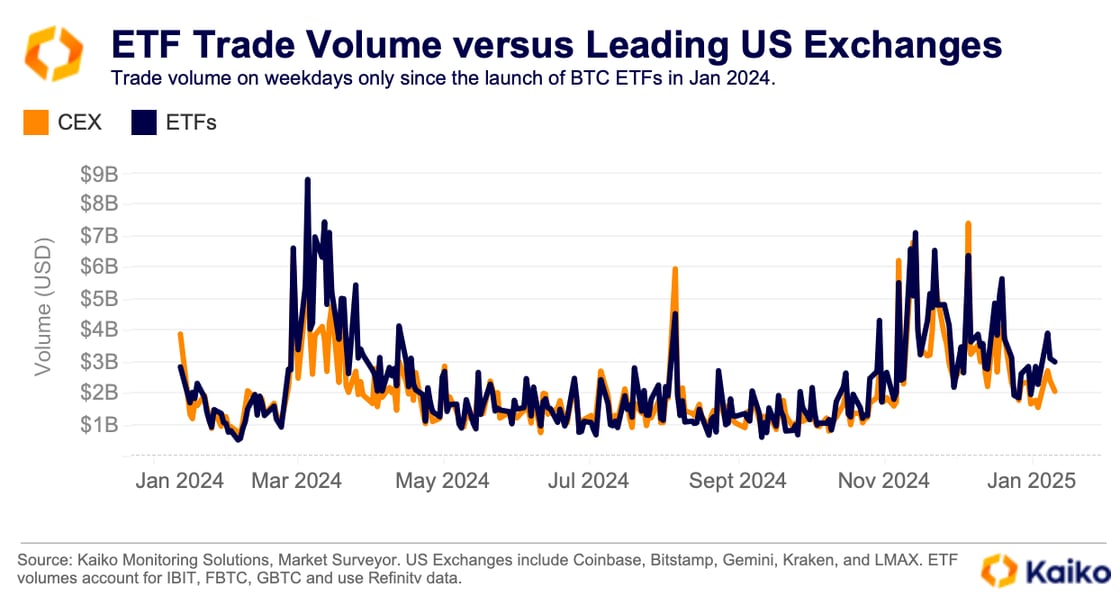

There’s not just competition among ETF issuers though, the major US exchanges now must contend with established Wall Street firms. For instance, if we look at the daily traded volume of three ETFs (IBIT, FBTC, GBTC) versus BTC volume on weekdays across the top US crypto exchanges.

While it’s not a perfect comparison, since ETF shares only represent a small amount of BTC, it does show the impressive growth of these funds. In just one year the top three ETFs by AUM regularly outperform major US exchanges in volume, but not the major global exchange. Binance, which has no US Dollar pairs, is not included above and regularly does 3x the volume of these three funds.

Sign up for our Deep Dive newsletters to receive the rest of our BTC ETFs report this Thursday, covering price impacts, fund profitability, and more.

Data points

Bitcoin gains as safe haven amid Korea turmoil.

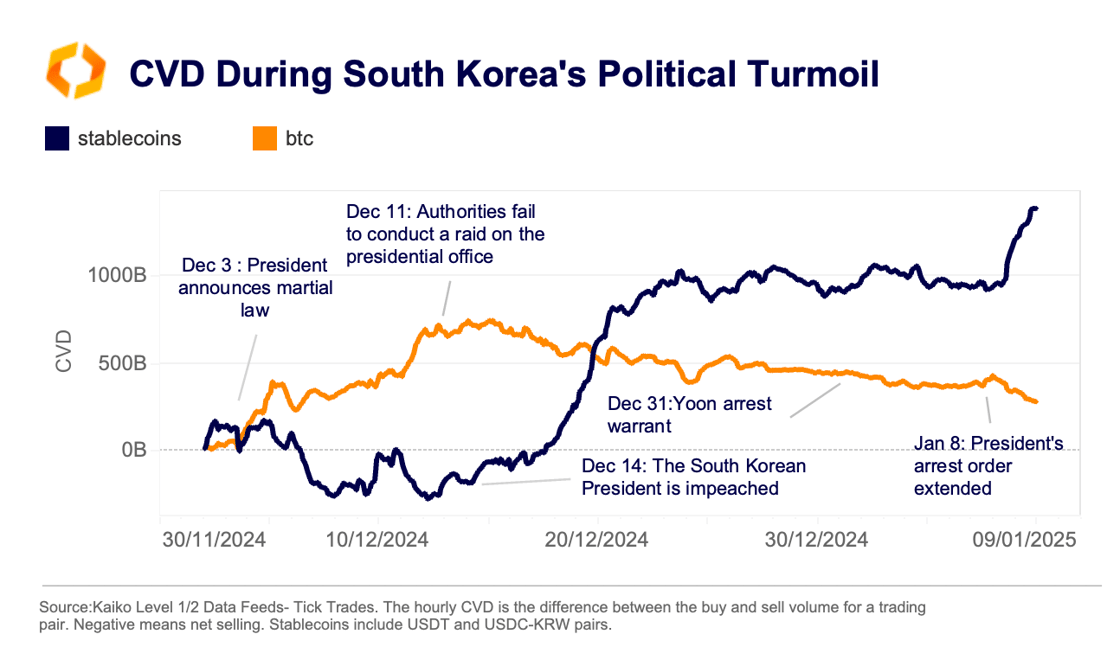

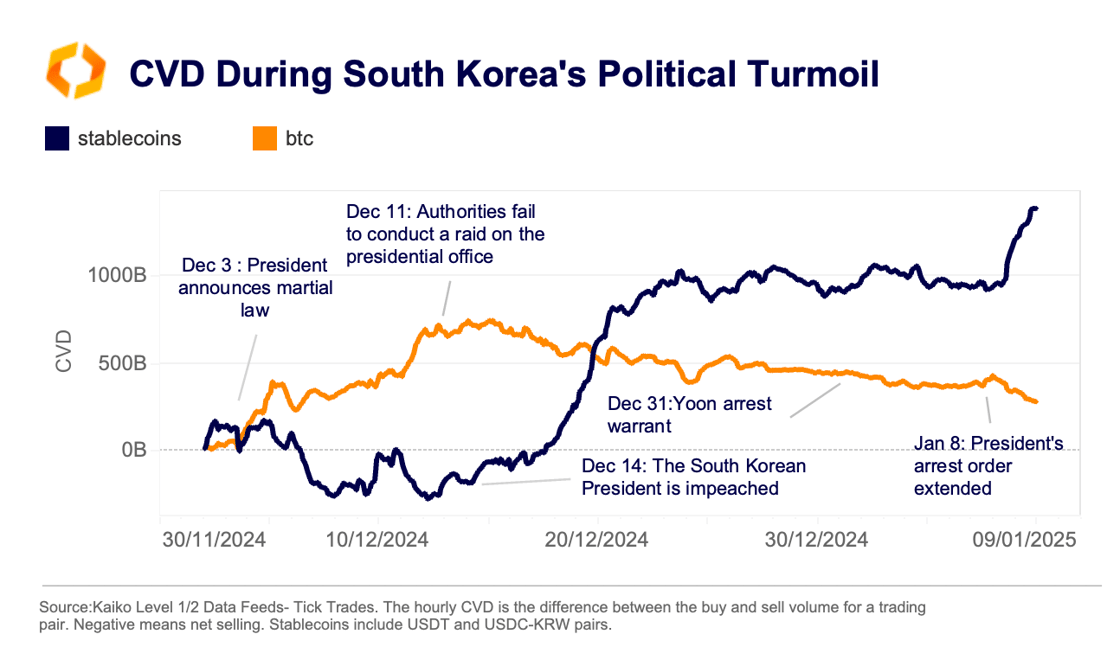

Bitcoin briefly plunged below $63K on Upbit on December 3 after President Yoon Suk Yeol declared martial law, marking the start of a turbulent month for Korea. Political instability escalated throughout December, culminating in President Yoon’s impeachment on December 14 and an arrest warrant issued against him by month’s end.

While Korean traders are traditionally more active in altcoins, which make up an average of 80% of market share on local platforms, Bitcoin saw significant safe haven flows during the crisis. BTC-KRW’s cumulative volume delta (CVD) on Upbit and Bithumb has remained positive since early December, signaling net buying activity. This stands in contrast to BTC-USD markets, where CVD remained neutral to negative over the same period.

The Kimchi Premium—Bitcoin’s price differential between Korean exchanges and U.S. markets—spiked above 5% in mid-December. Interestingly, however, stablecoins, which typically act as a safe haven during periods of uncertainty, saw net selling as traders rotated into fiat cash.

By early January sentiment began to shift. USDT’s CVD turned positive, signaling renewed demand, though USDC continued to face selling pressure. Korea’s ongoing political upheaval could have longer-term implications for its retail-driven crypto market, potentially eroding trust in centralized exchanges.

Fears of government BTC sales spark market volatility.

Crypto markets saw volatility last week after the US DOJ

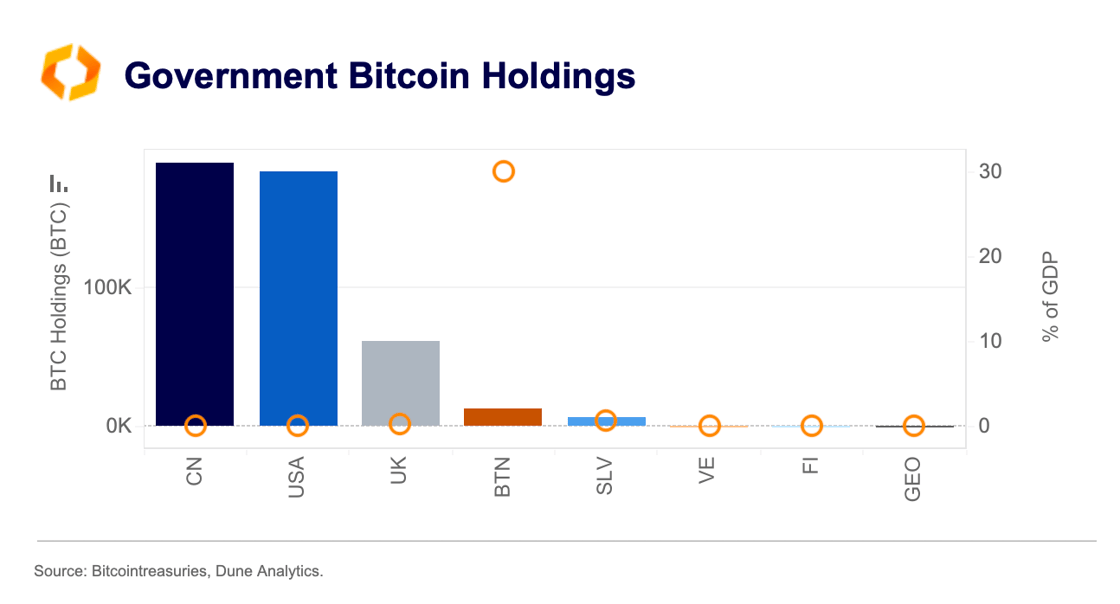

approved the sale of 69,370 BTC, triggering a sell-off. Governments remain among the largest holders of Bitcoin, creating a persistent source of selling pressure. For example, Germany’s liquidation of substantial Bitcoin reserves earlier this summer negatively impacted prices. Currently, China and the U.S. lead in nominal Bitcoin holdings, while Bhutan stands out with Bitcoin holdings equivalent to 30% of its GDP.

The introduction of official Bitcoin reserves could mitigate risks associated with government sell-offs, as it would encourage passive holding regardless of price movements. However, the likelihood of the U.S. establishing such a reserve under the Trump administration has dropped to 25%, according to Polymarket, as of December.

While discussions in the U.S. continue on whether establishing a Bitcoin reserve means actively acquiring more Bitcoin or simply holding a stockpile, most analysts agree that if the U.S. announces such a reserve, it will trigger global competition.

Overall, national Bitcoin reserves will likely differ significantly between countries, with smaller economies likely holding larger reserves relative to GDP due to restricted access to other assets, exposure to sanctions, or inflation concerns.

![]()

![]()

![]()

![]()