PLETHORA OF ETF FILINGS

A lot has happened in the week since Gary Gensler left the US Securities and Exchange Commission. One of the more interesting developments has been the rapid uptick in exchange-traded fund filings tied to digital assets.

As of our last count there’s now 35 ETF live applications. These range from converting closed-end trusts into spot ETFs to more ambitious filings which would seek to turn newly minted memecoins into spot ETFs.

ProShares, which launched the first US-based BTC futures product in 2021, and Vol Shares have even applied for futures products on SOL and XRP—despite there being no regulated futures markets for these in the US.

ProShares, which launched the first US-based BTC futures product in 2021, and Vol Shares have even applied for futures products on SOL and XRP—despite there being no regulated futures markets for these in the US.

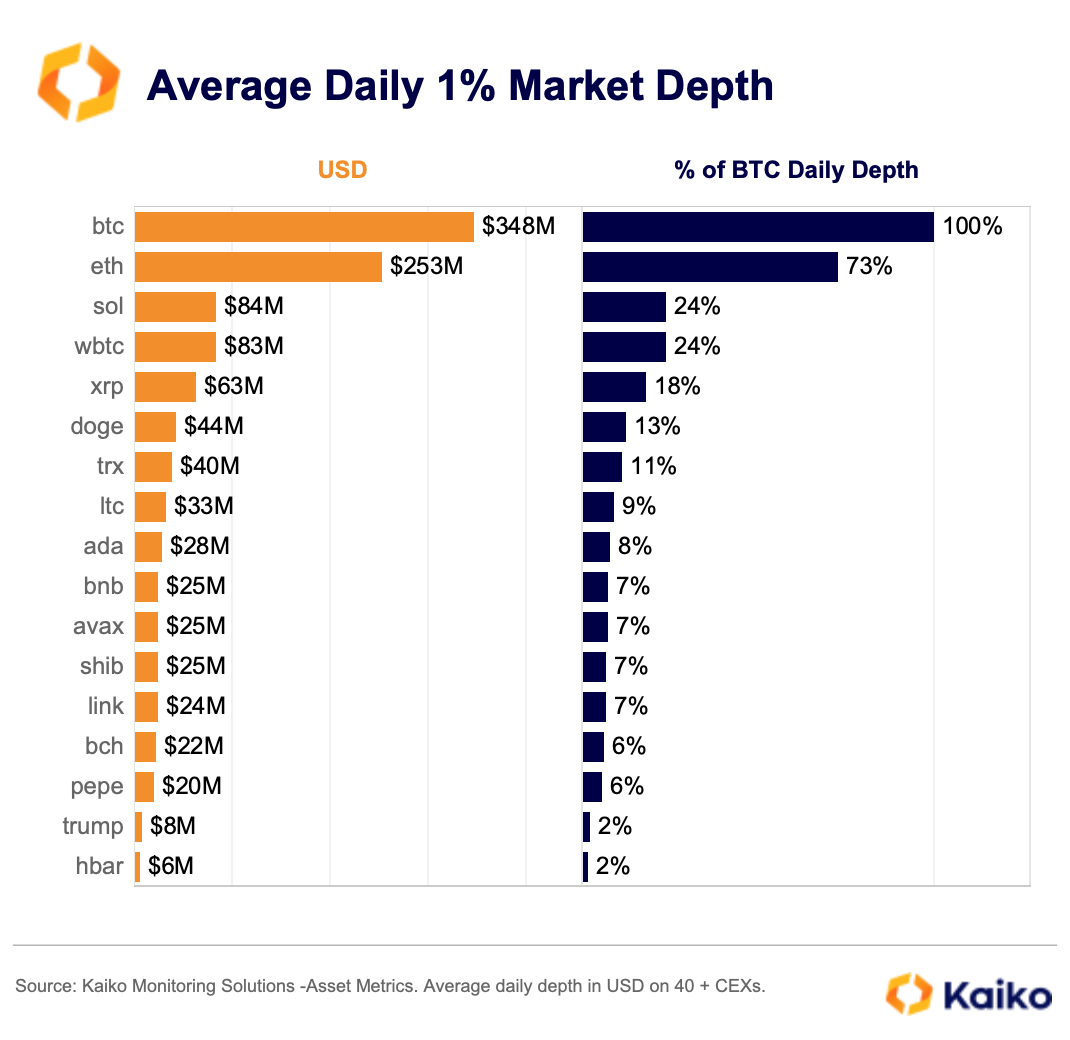

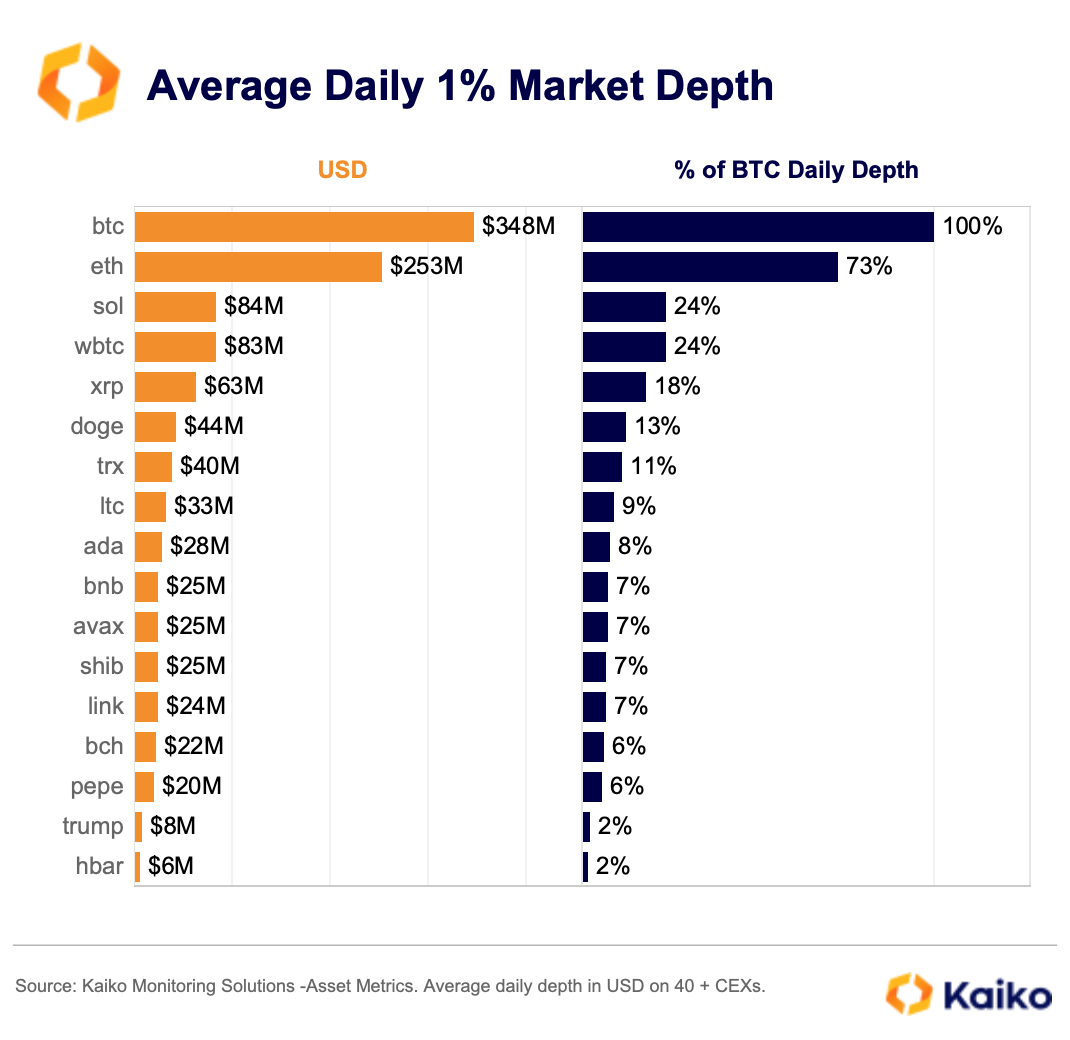

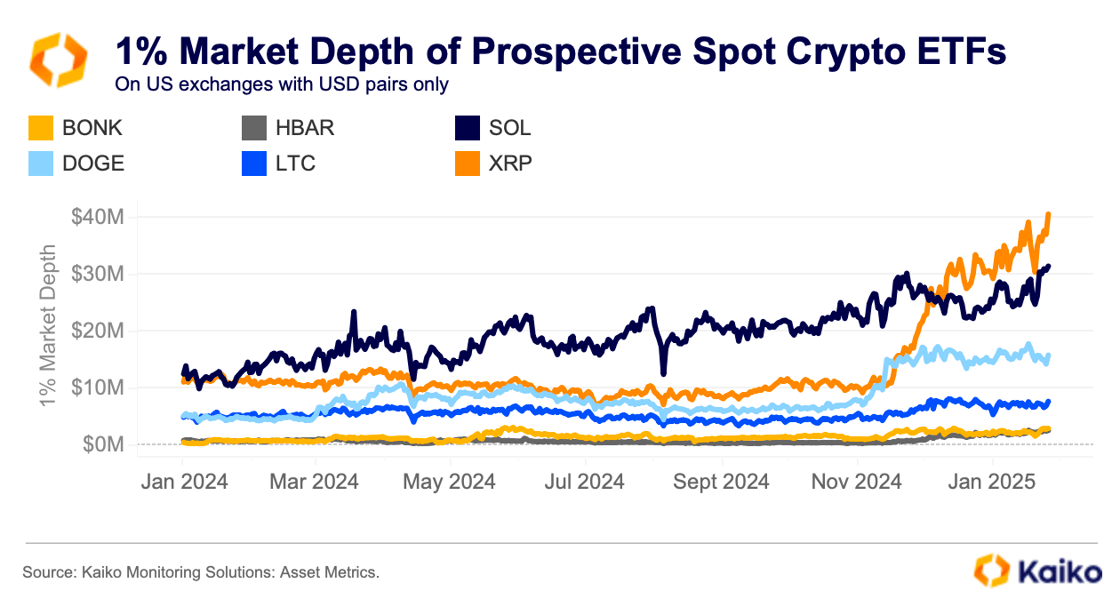

While the leadership at the SEC might have changed, it will still be important to look at the health of the underlying spot market when considering these applications. Below, we charted the average daily 1% market depth—the total of buy and sell orders within 1% of the mid-price—for some of the largest crypto assets. BTC and ETH, which already have regulated spot ETFs in the US, lead significantly, while SOL’s liquidity to date accounts for only 24% of BTC’s liquidity.

Market depth is a decent indicator of a markets ability to handle large orders. Lower depth can lead to higher volatility during periods of market pressure. More importantly, extremely low depth might imply a market is at risk of manipulation, as only a few large sellers could move the price.

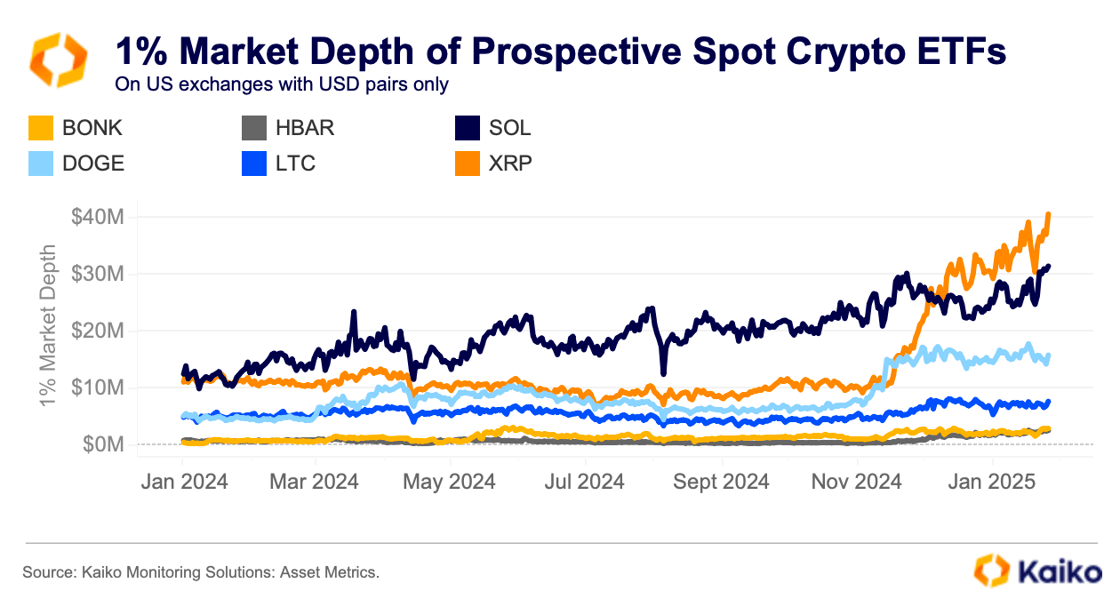

If we examine the evolution of market depth over time (chart below), some intriguing trends emerge. Notably, XRP’s depth has increased significantly, surpassing SOL’s depth since January 2025. However, SOL has demonstrated more consistent depth over time. This historical depth performance is an important factor to consider when evaluating a candidate asset for ETFs in the US.

Considering these applications are US-based we only took US exchanges into consideration in the above chart. Why does this matter? The SEC will likely be looking for the existence of efficient and stable markets before allowing these products to launch.

It’s important to caveat that this interpretation is based on the previous SEC’s approvals process and is very likely to change. We’ll get into all of this in more detail on Thursday in our upcoming deep dive on the subject.

Data Points

ai tokens sell-off amid market tumult

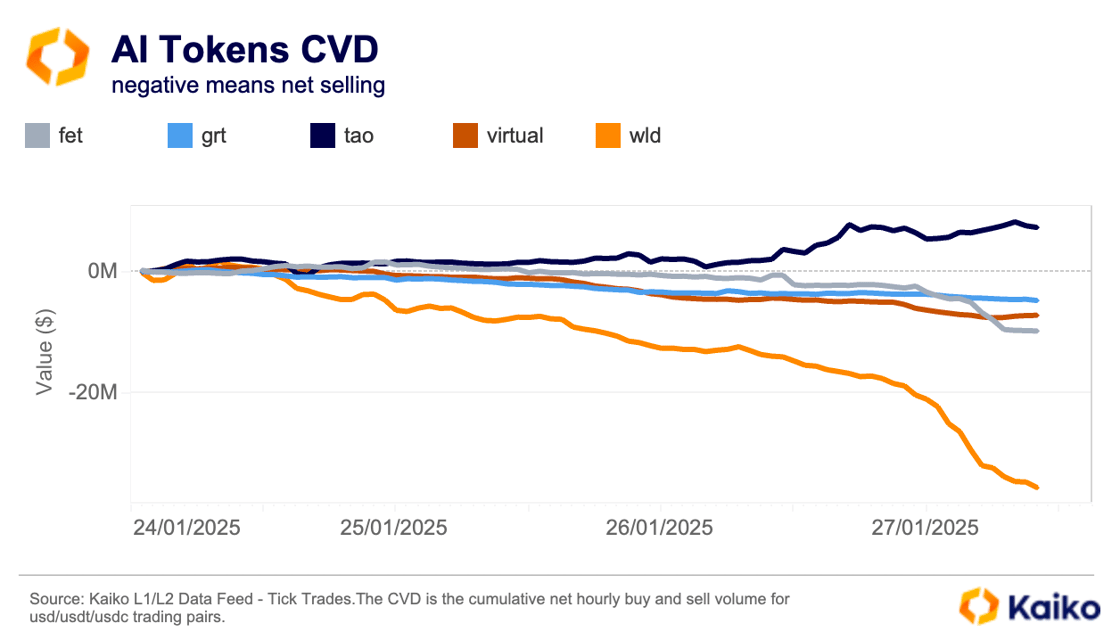

Crypto-AI tokens plunged in line with the broader market after the rising popularity of the China-based DeepSeek AI app triggered a rout in tech equities early Monday. AI tokens prices have dropped between 10% and 50% since the start of the year, with Virtual, Artificial Superintelligence Alliance’s FET, Internet Computer Protocol’s ICP, and Worldcoin’s WLD leading the declines.

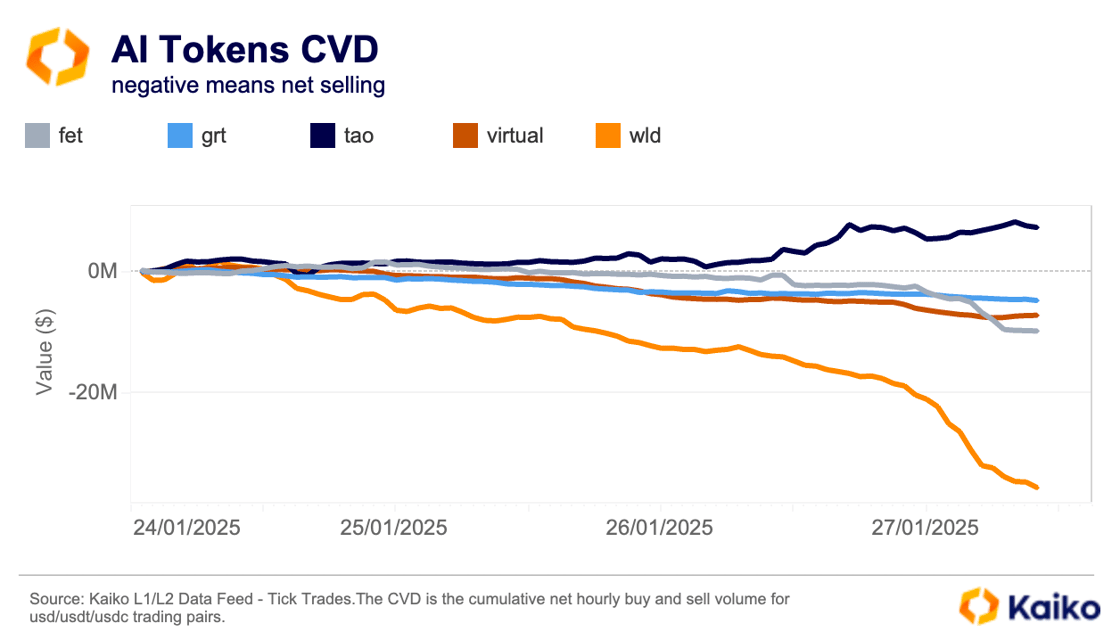

Looking at the cumulative volume delta for some of the top AI tokens since January 24, Sam Altman-linked WLD has experienced the most significant selling pressure.

Interestingly, Bittensor’s TAO seems to be attracting a different type of investor interest. Despite the overall downturn, the token has seen a positive CVD, suggesting some investors view the dip as an opportunity to buy in.

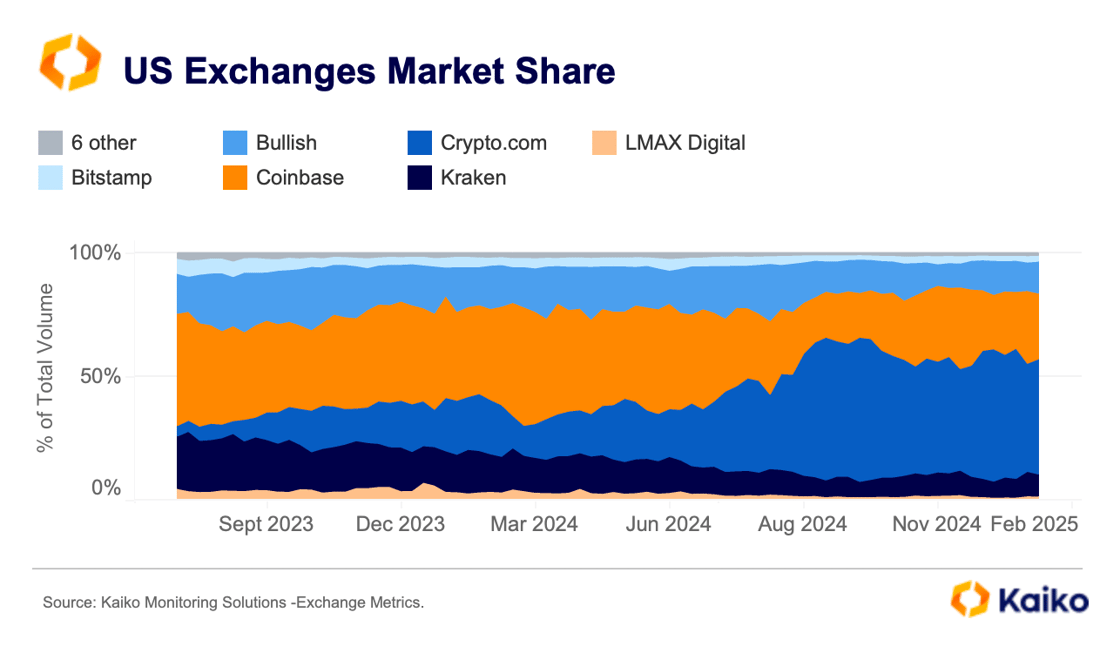

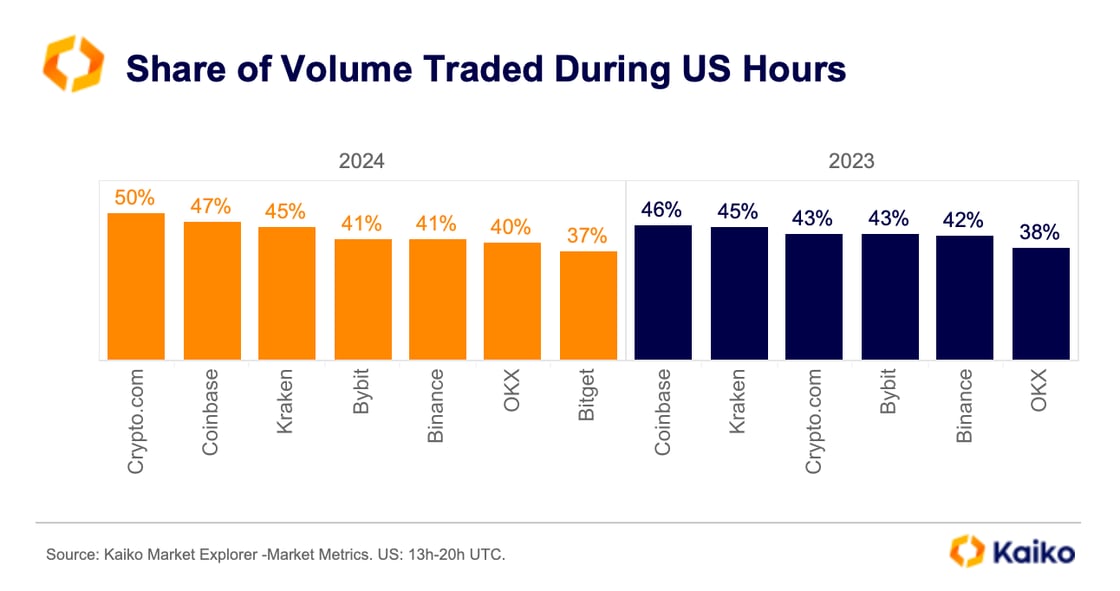

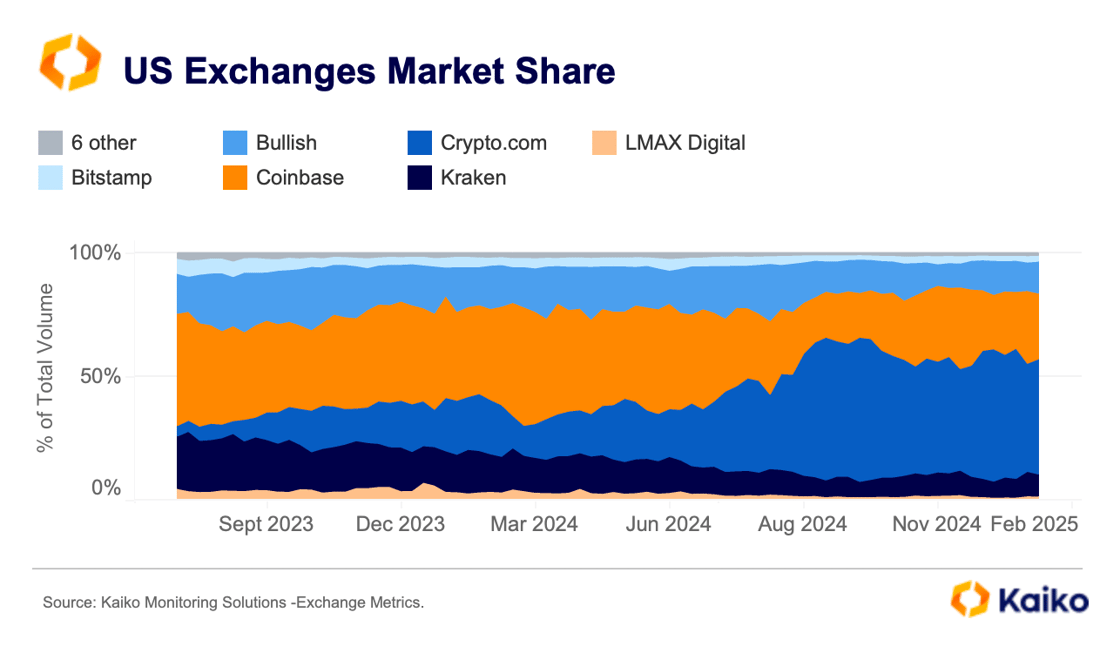

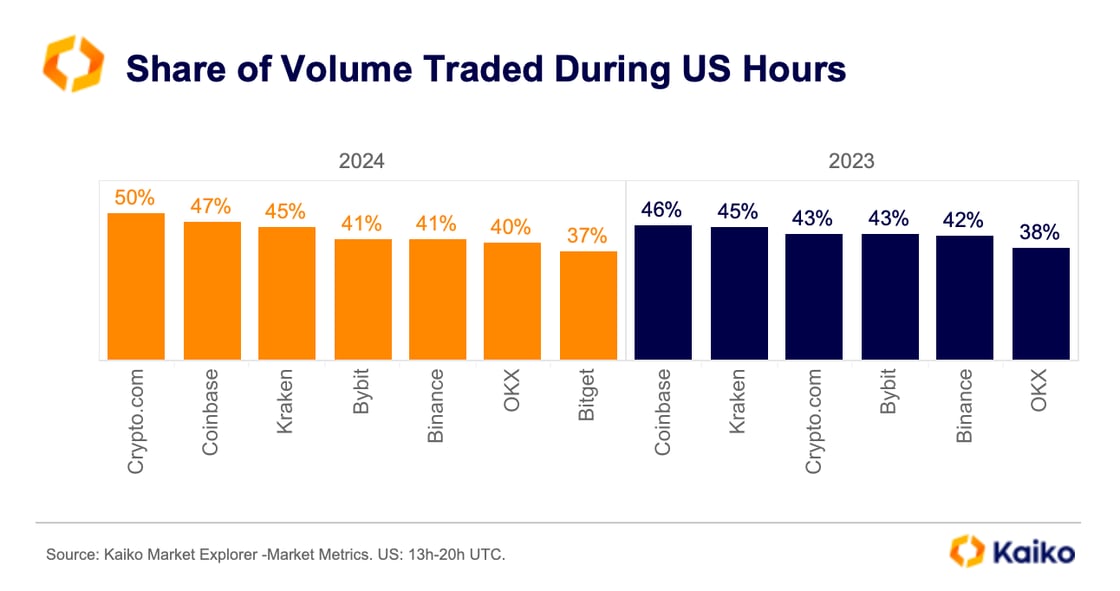

Crypto.com dominates us markets

Crypto.com has taken the U.S. market by storm, with its market share surging from 4% in 2023 to 47% as of last week. In contrast, Kraken and Coinbase have been the biggest losers, with Kraken’s share more than halving from 21% to 9%, and Coinbase’s declining from 45% to 27% over the same period.

One of the reasons for this increase is Crypto.com’s lower fees relative to its competitors, making it an appealing choice for U.S. traders. Half of Crypto.com’s trade volume now occurs during U.S. market hours (13:00 to 20:00 UTC), up from 43% a year ago

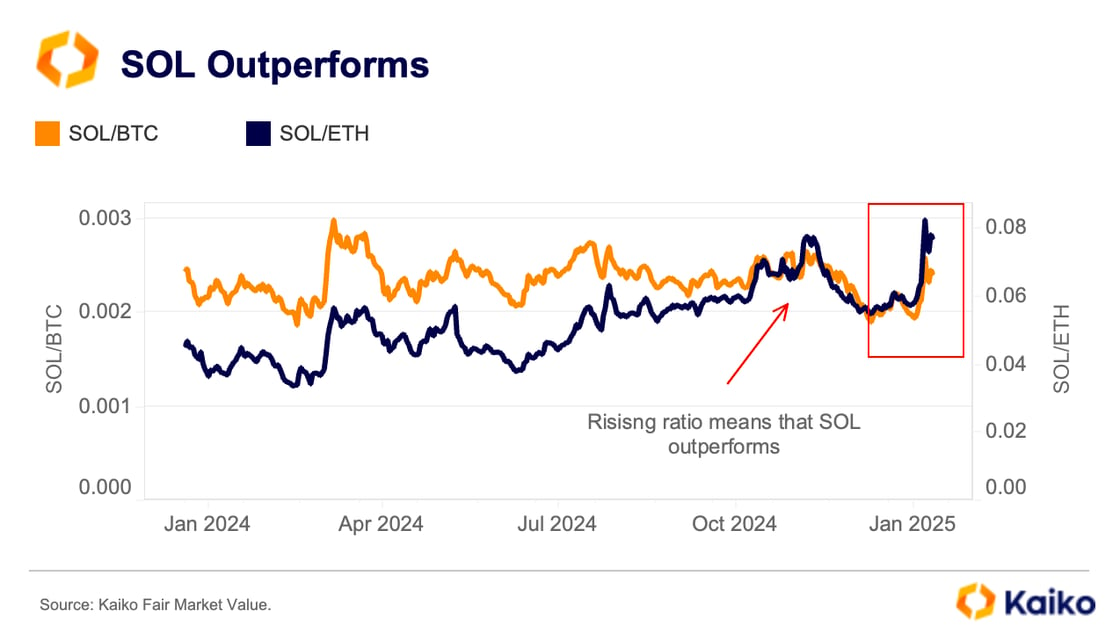

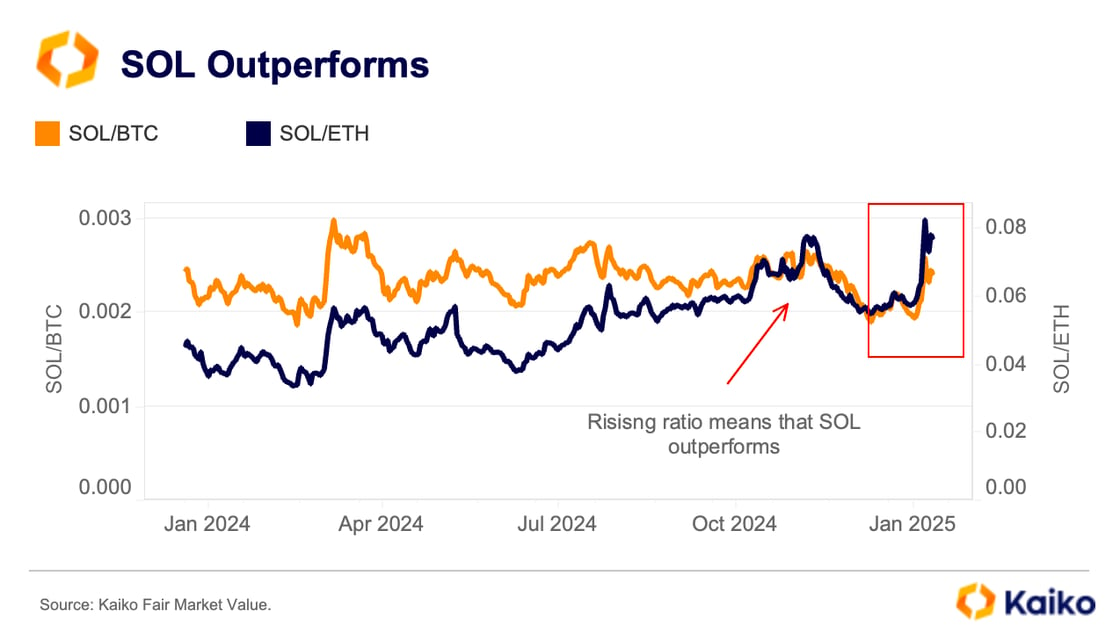

SOL outperforms ETH and BTC

After a period of underperformance since November, SOL has regained momentum, outperforming both Bitcoin and Ethereum. In January, the SOL/ETH and SOL/BTC ratios climbed sharply, with SOL/ETH reaching an all-time high and BTC/SOL hitting its highest level since March 2024.

A major catalyst behind this rally was the launch of the TRUMP and MELANIA meme tokens, which marked a significant milestone for Solana’s adoption. Over half of TRUMP and MELANIA buyers were first-time investors in Solana-based altcoins.

Despite steady inflows into Ethereum ETFs since November, ETH’s underperformance has raised concerns about the network’s competitiveness. The Ethereum Foundation is facing a leadership crisis, with increasing criticism over its lack of transparency and action, while key community figures have criticized the Ethereum roadmap.

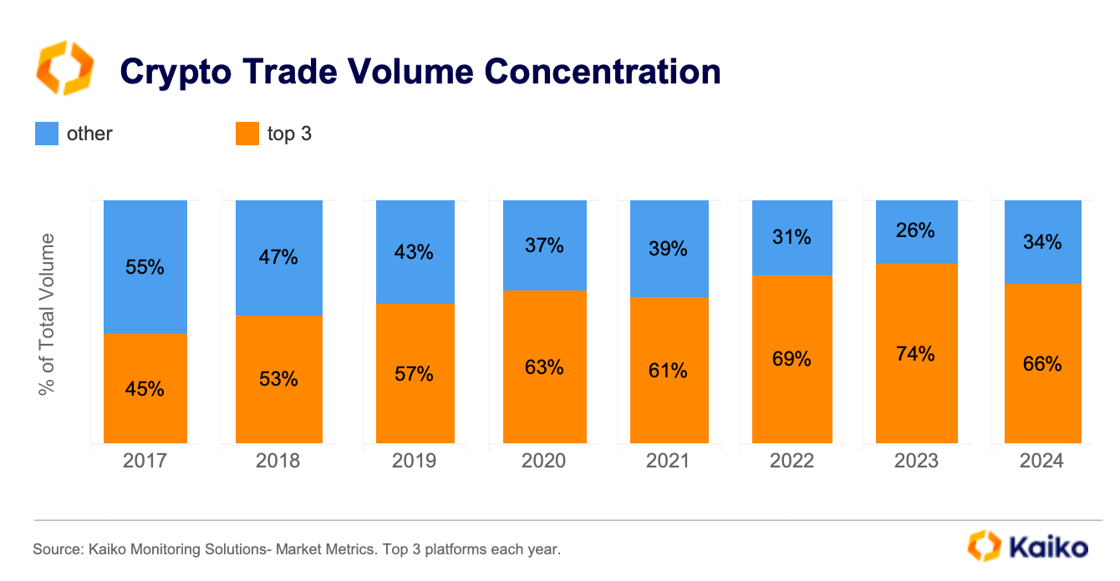

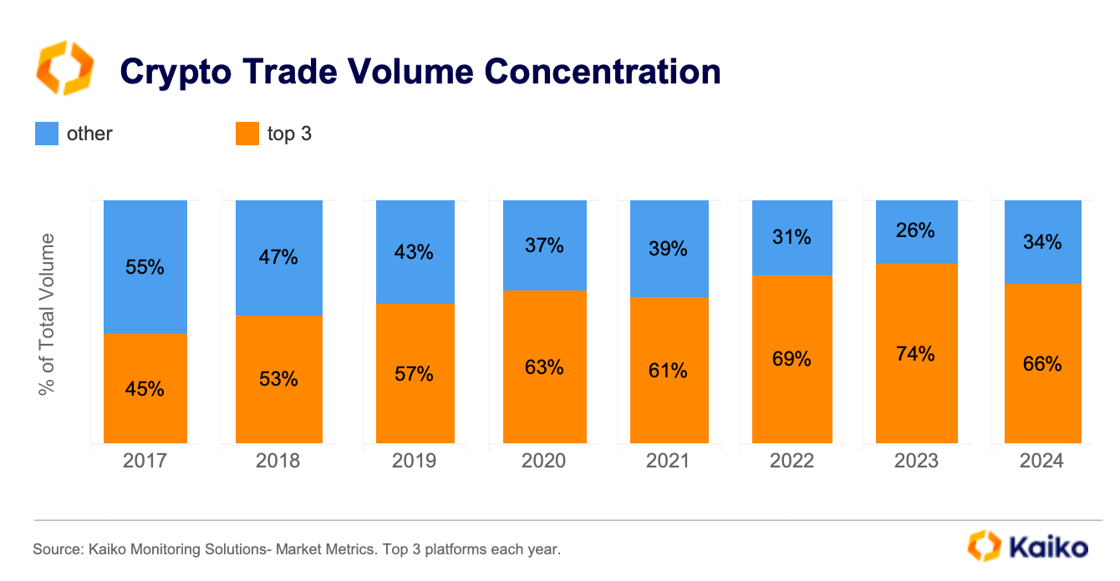

Crypto market concentration is retreating

Although there are hundreds of platforms in the crypto space, most trading activity remains concentrated on a handful of major exchanges. This trend accelerated during the 2020–2022 bull run, when large platforms like Binance grew rapidly by scaling up more effectively than smaller competitors.

However, 2024 seems to have reversed this trend. The top three exchanges now handle 66% of the total trading volume, down from 74% in 2023.

The decline in market concentration is mostly happening in offshore markets driven by growing competition between smaller exchanges.

In the U.S., however, stricter regulations have led to further consolidation. The top five U.S. exchanges expanded their combined market share from 92% in 2023 to 98% in 2024. Binance.US experienced a user exodus following an SEC lawsuit in 2023, while Bittrex ceased its U.S. operations and later filed for bankruptcy.

Another contributing factor to this trend is that compliance costs tend to burden smaller platforms more heavily. Interestingly, other regulated markets are exhibiting different dynamics. In South Korea, for example, Upbit has lost some of its dominance to rival Bithumb for the first time since 2020.

![]()

![]()

![]()

![]()

ProShares, which launched the first US-based BTC futures product in 2021, and Vol Shares have even applied for futures products on SOL and XRP—despite there being no regulated futures markets for these in the US.

ProShares, which launched the first US-based BTC futures product in 2021, and Vol Shares have even applied for futures products on SOL and XRP—despite there being no regulated futures markets for these in the US.