Introduction

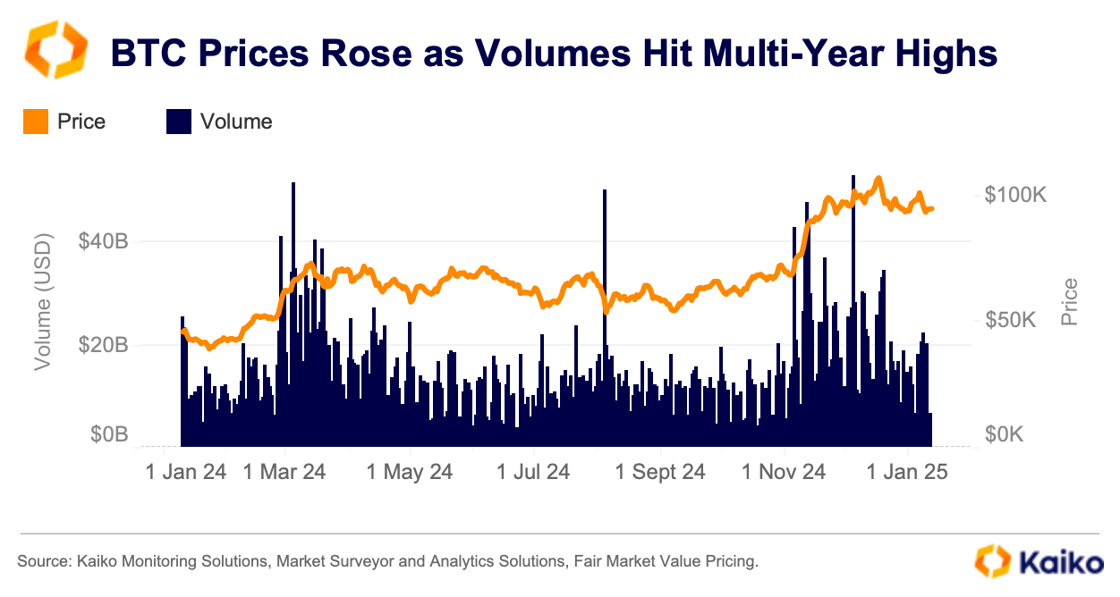

The market has come a long way since the SEC begrudgingly approved spot BTC ETFs last January. Over the past year, we’ve seen structural market changes, surging BTC demand, and record-breaking prices. The newly launched ETFs brought in over $36bn in net inflows in their first year, proving to be a reliable source of demand at key moments.

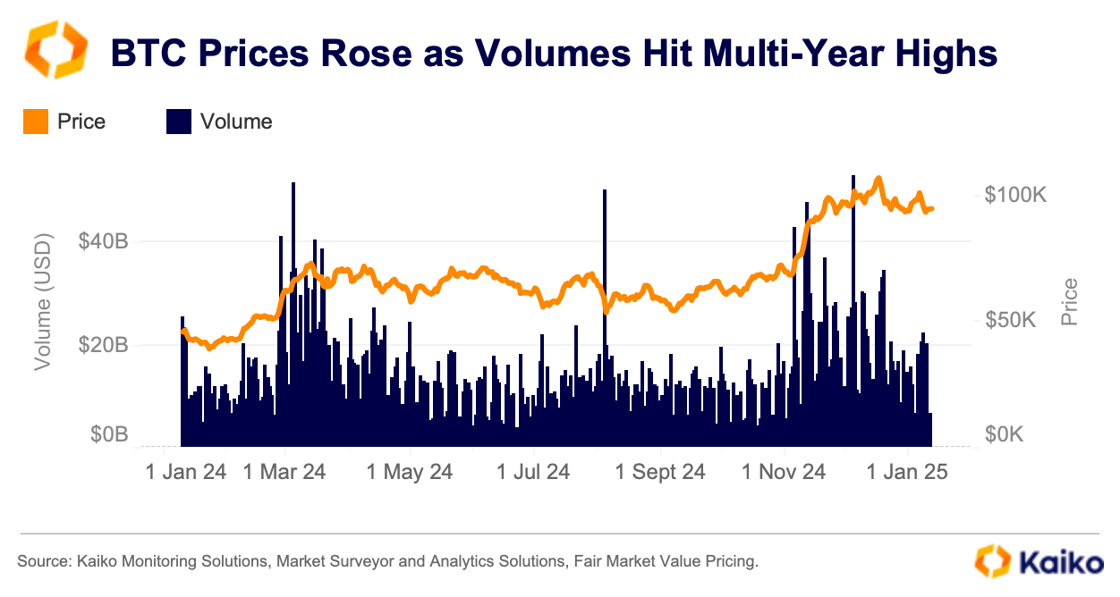

This all culminated in BTC crossing $100k for the first time in early December, peaking at $107k.

The rise in volumes alongside price, as shown above, confirms this rally was no fluke. Its broad base is yet another sign that the market has moved beyond the troubles of 2022.

But just how much of a role did the ten spot ETFs play in the market rebound?

BTC ETFs by the numbers

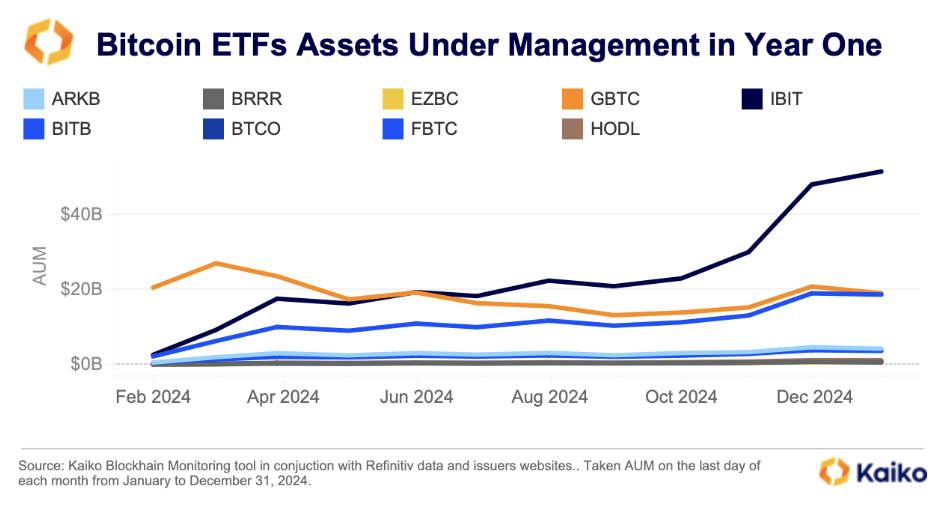

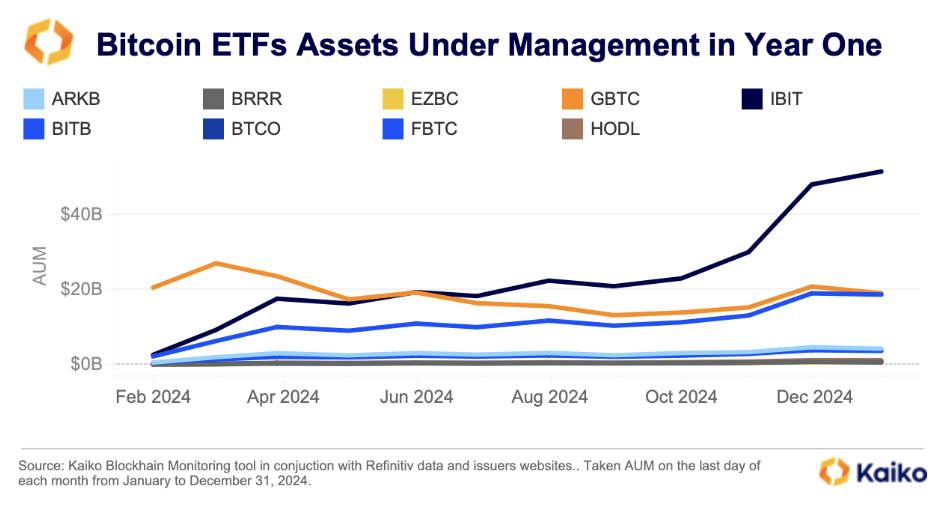

The headline figures and data suggest these funds had a significant impact on prices and the market overall. With $36bn in net flows during their first year, ETFs now manage around $110bn in assets. BlackRock’s IBIT stands out as one of the most successful launches ever, closing the year with over $50bn in assets under management.

While Ark Invest and 21Shares ETF (ARKB) might seem to trail the top three, Bloomberg data ranks it among the top 20 US ETF launches of all time by total assets after one year. When adjusted for inflation IBIT still comes first by $18bn.

Bitwise, with nearly $4bn in AUM, has outperformed traditional finance giants like Franklin Templeton and Invesco. As a crypto-first asset manager, Bitwise set itself apart by publicly sharing all custody addresses for its fund, leading the way in transparency.

Tracking these ETFs effectively requires both on-chain and market data, as settlement processes vary between funds. For instance, BlackRock’s IBIT is the only BTC ETF requiring create/redeem orders a day in advance, a detail we’ll explore further later when we look at the price impact of BTC ETFs.

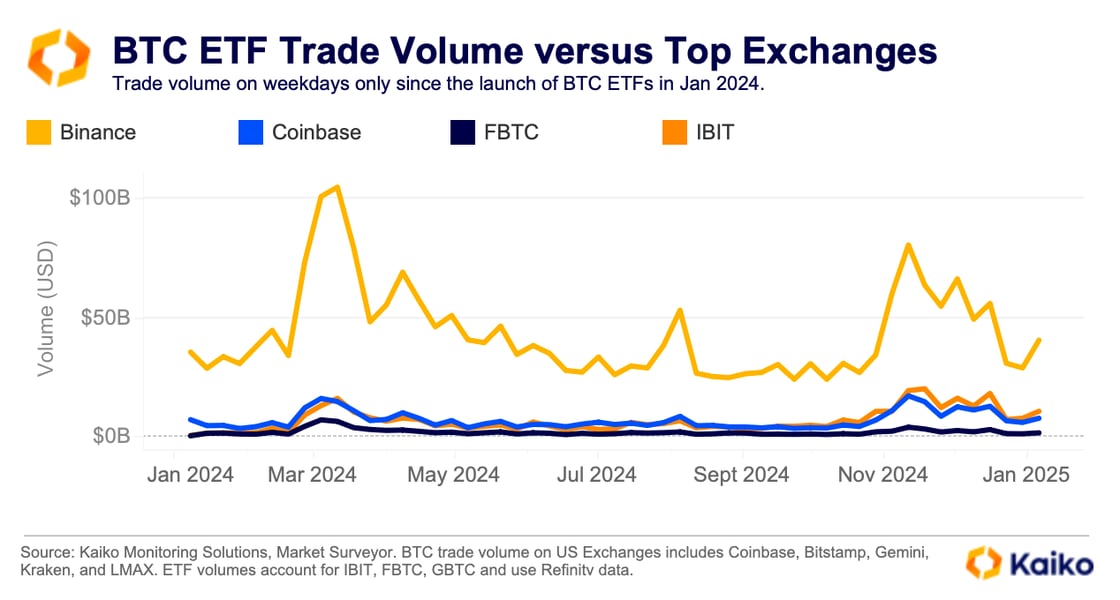

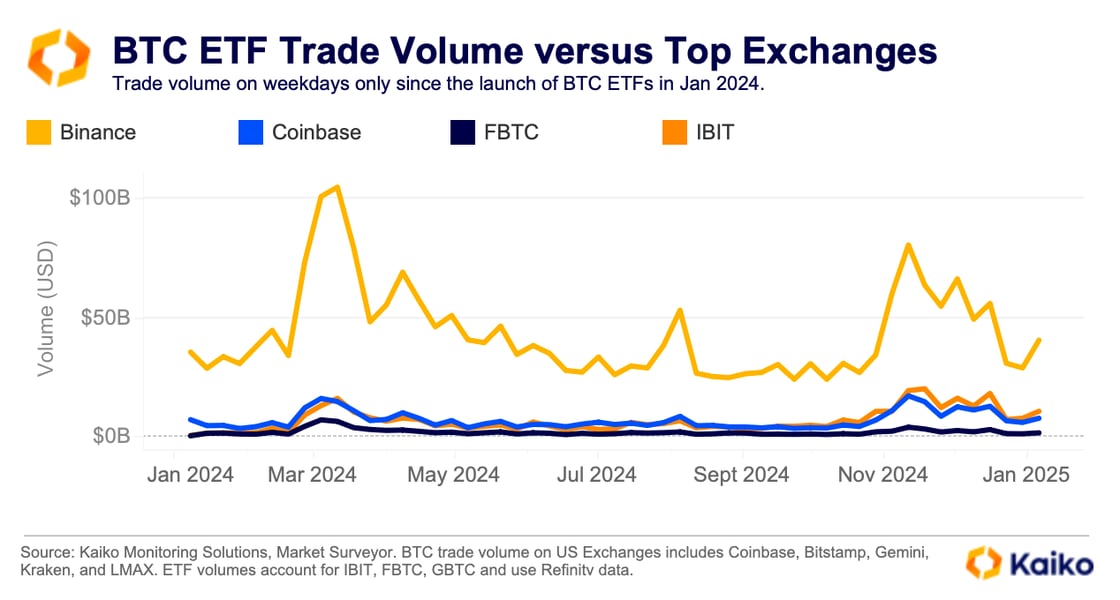

Competition for crypto venues

With new financial instruments available for investing in Bitcoin, major US crypto exchanges, once the sole platforms for trading crypto assets, now face competition from more traditional, and established, firms. Comparing the daily traded volume of the top three ETFs on the Nasdaq (IBIT, FBTC, GBTC) with BTC volumes on weekdays across leading US crypto exchanges underscores this shift.

In just one year, the top three ETFs by AUM consistently outperformed major US crypto exchanges in volume, though not global leaders like Binance, which does three times the volume of these three funds.

Shifting market structure

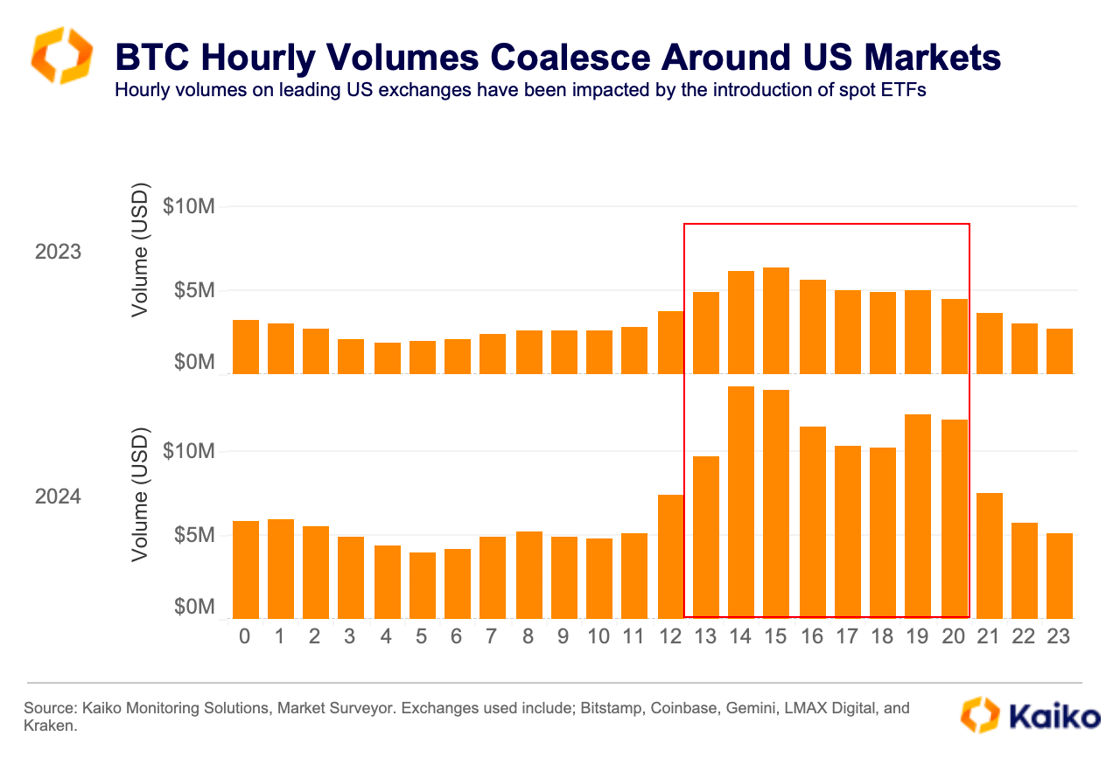

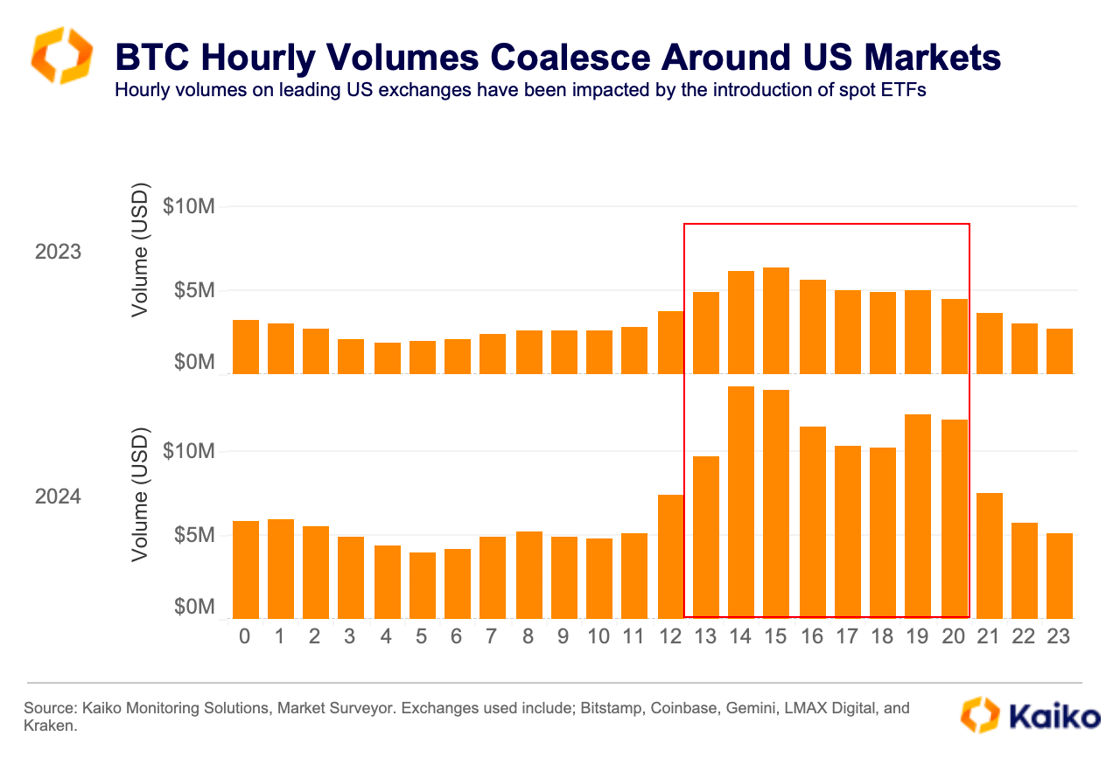

As mentioned in previous research, BTC ETFs have impacted the underlying crypto market. To explore this, we’ll focus on select US exchanges: Bitstamp, Coinbase, Gemini, LMAX Digital, and Kraken.

ETF issuers use prices from these exchanges to calculate the net asset value of their funds near the end of the day, which has led to increased activity between 3pm and 4pm New York time. This is evident in the average hourly volume on weekdays, which spikes during this time window across these exchanges.

The ecosystem surrounding BTC ETFs has also improved liquidity across crypto platforms. ETF issuers’ “authorized participants” are responsible for creating and redeeming shares, requiring these firms to manage risk throughout the day.

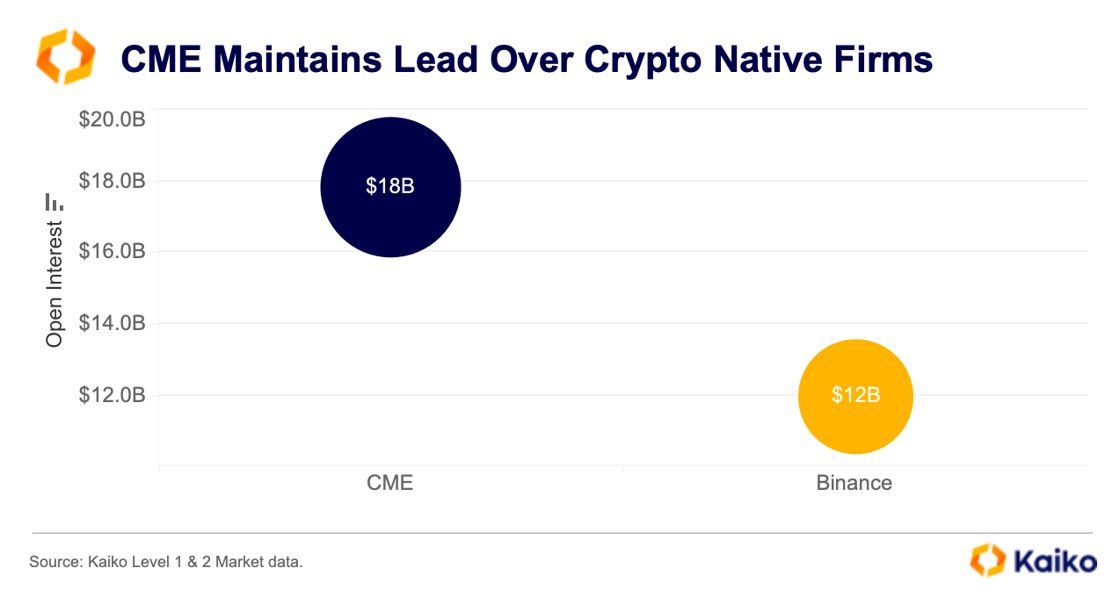

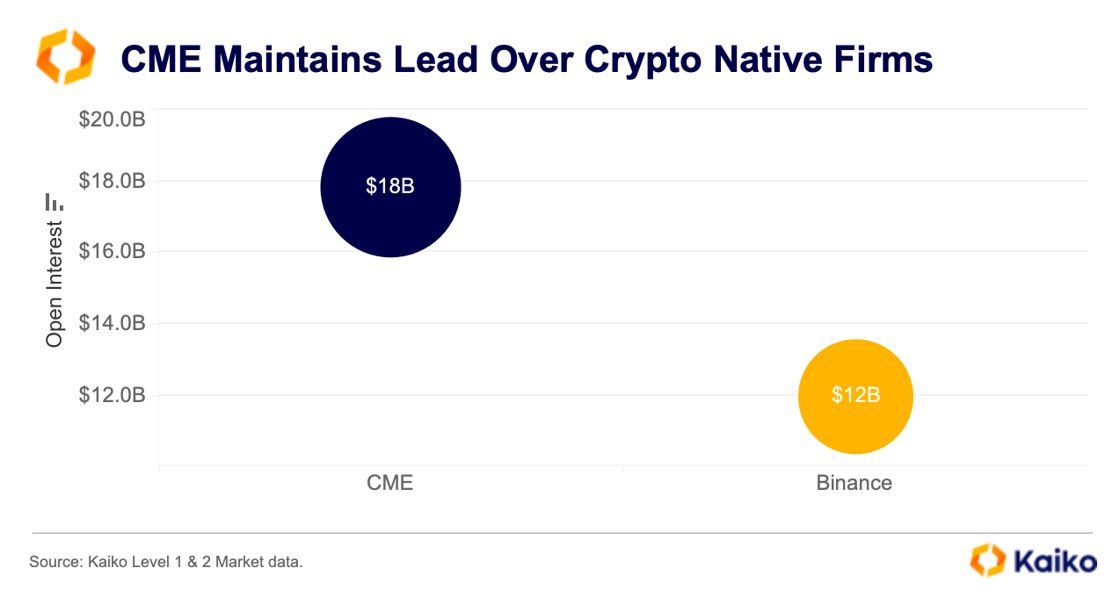

Beyond the spot market, the introduction of spot BTC ETFs has affected crypto derivatives. This shift began even before the launch, but has intensified since. In October 2023, the CME surpassed Binance as the world’s largest BTC futures venue.

Bitcoin futures lead Ether futures significantly on the CME, and this rising popularity has even prompted new product offerings. The Bitcoin Friday Futures (BFF), launched in fall 2024, is designed with smaller contract sizes, clearly targeting a retail audience, indicating more competition ahead for crypto-native venues.

A key consideration for crypto natives is the basis trade amid the CME’s rising volume. Hedge funds were net short on BTC futures, as discussed in our May report, trading the basis, or more specifically, the “long basis.”

This strategy involves selling futures short while holding spot BTC (with 13-F filings confirming massive institutional demand). It exploits the price difference between the two, providing a hedge against price fluctuations and guaranteeing a specific sale price during volatility.

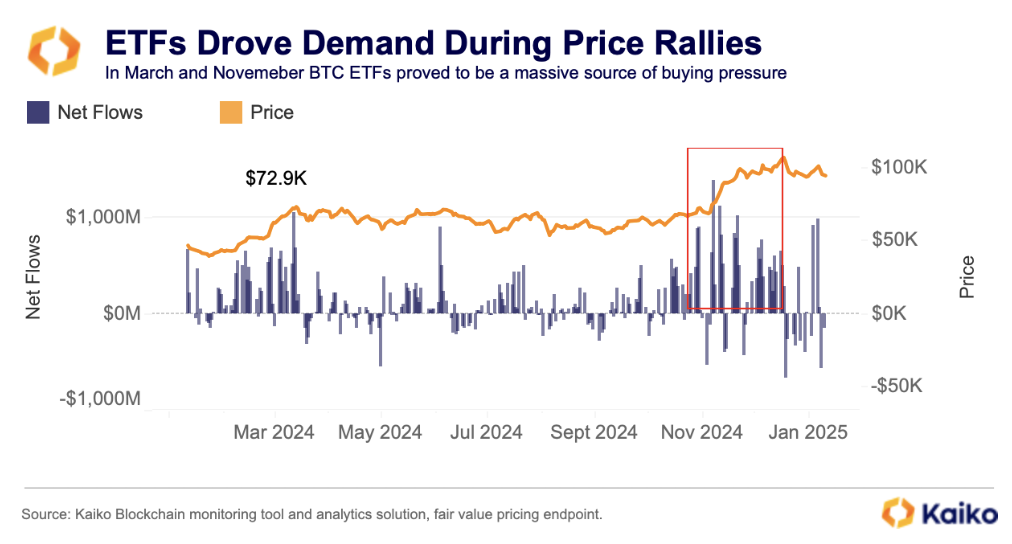

Price impact of BTC ETFs

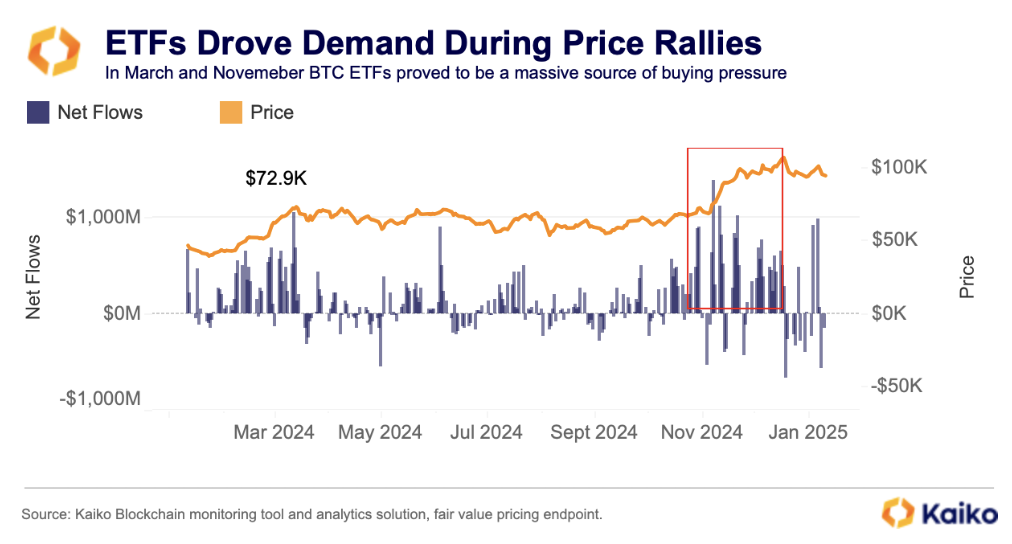

During BTC’s initial surge above $70k in March, the impact of the ETFs was evident. After weeks of selling pressure from bankrupt firms liquidating BTC holdings, the ETFs became a key source of demand, as prices soared to new record highs.

However, BTC’s rally stalled after reaching new highs in March, with on-chain inflows to wallets responsible for holding the underlying bitcoin to the created shares, slowing. This pattern repeated in November, when rising net inflows preceded fresh record highs following the US election.

Without this demand, 2024 could have played out very differently, as governments liquidated holdings and the market moved past the legacies of 2022—such as FTX, Genesis, and other estates. ETF flows certainly contributed to the asset’s performance this year.

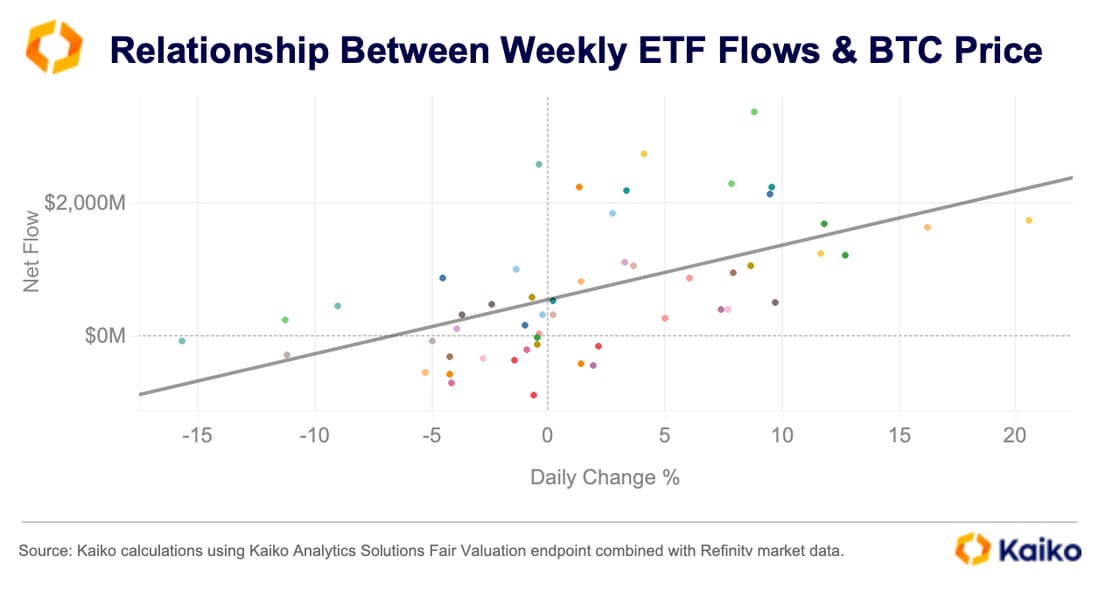

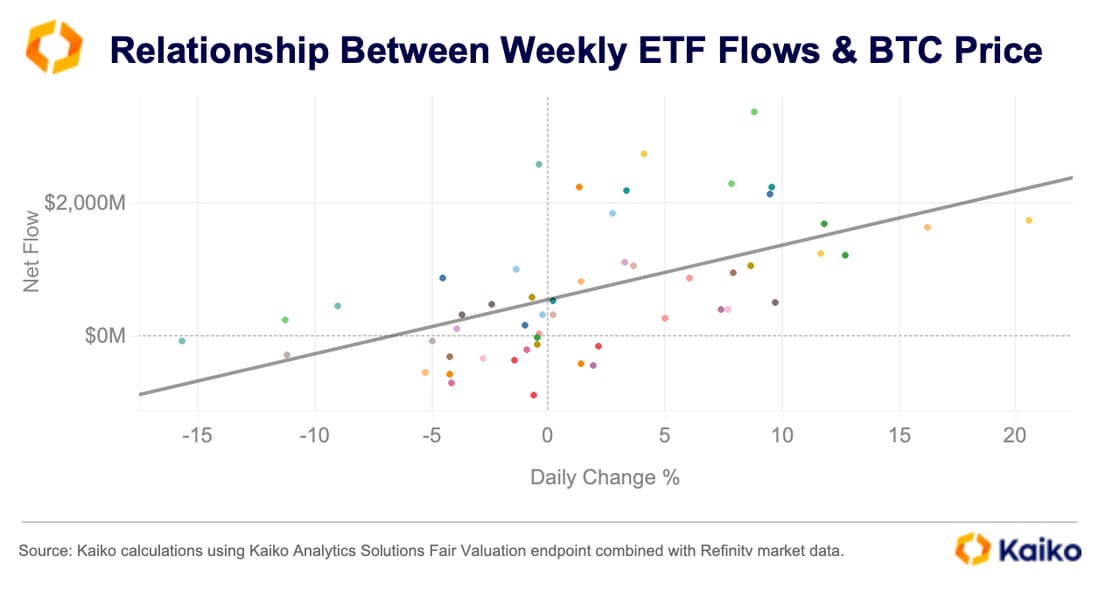

However, two examples don’t establish a clear trend. A closer look reveals that the relationship between on-chain net flows for US BTC Spot ETFs and daily BTC-USD price changes remains weak. Kaiko’s analysis shows an R-squared value of 0.32, while still quite low this does suggest some relationship between the two exists.

Why is the relationship between flows and price changes relatively weak in this example? Shifting market dynamics throughout 2024 and fund specific factors likely explain most of this.

Let’s look at the fund structures themselves first. As noted earlier BlackRock’s fund requires creation/redemption requests a day early. In essence its flows are a lagging indicator. Since IBIT dominates the market it distorts the relationship between weekly inflows and price changes, i.e. some Monday flows represent a Friday purchase order and so there are points with mismatched data.

There are other ways to look at how flows impact prices though. It’s not always about driving prices but also support during market turbulence.

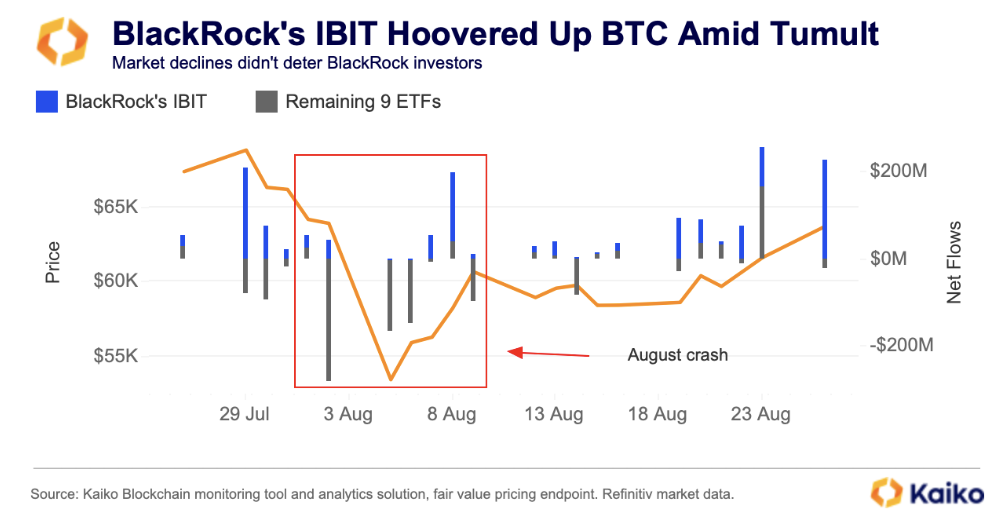

Take the summer months for instance. There was significant selling pressure from the German government and during macro-induced market shocks.

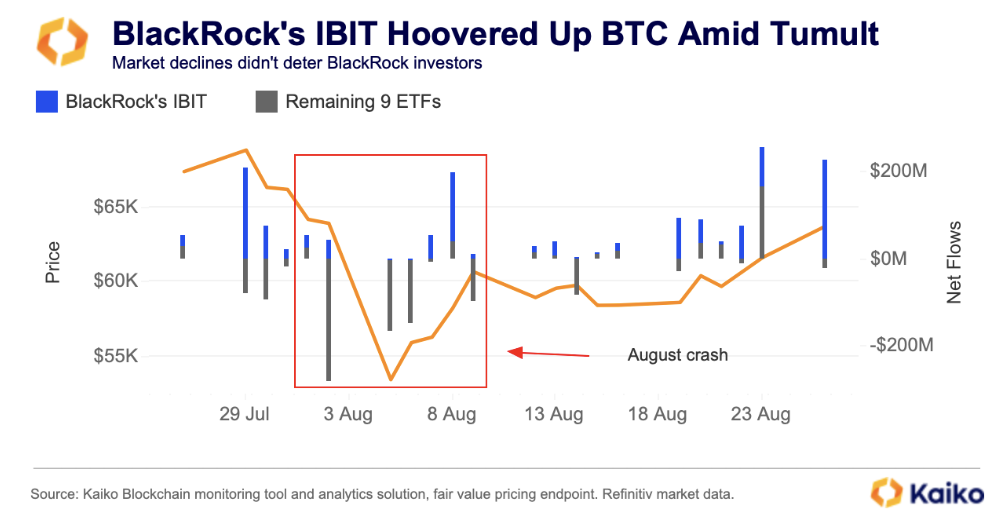

The Japanese carry trade unwind in August showcased another key benefit of the ETF structure. Implied volatility surged on Deribit during the first weekend of August as traders panicked. A risk-off mood hit markets, fueled by the BoJ tightening monetary policy and the Fed signaling a rate shift. This spooked investors, causing BTC to plummet nearly 20%.

And ETF investors? Nothing over the weekend as the market was closed, but there was some selling on Monday—nothing catastrophic though.

Some investors traded out of BTC ETFs on Monday, but nothing catastrophic occurred. In fact, the market bounced back by Wednesday, with IBIT in particular driving demand with over $200 million in net flows that week.

BlackRock’s fund recorded over $1.1 billion in net inflows by the end of August, which suggests ETF investors will happily buy the dip. Investors in ETFs naturally have a longer term outlook. The regulated structure and shorter market hours also help to mitigate selling pressures over weekends and during shocks after hours.

Fee wars and maintaining momentum

While these funds have brought many positives, one notable challenge is the downward pressure on fees, a trend seen across the ETF space.

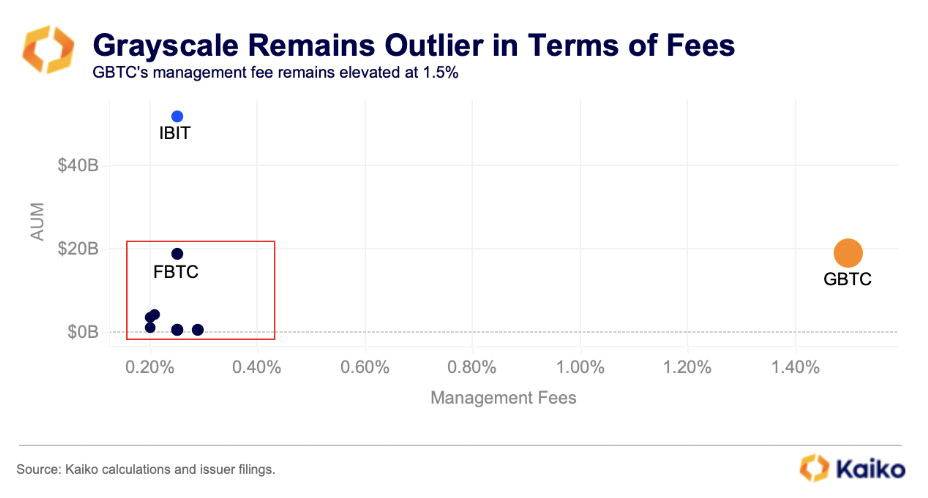

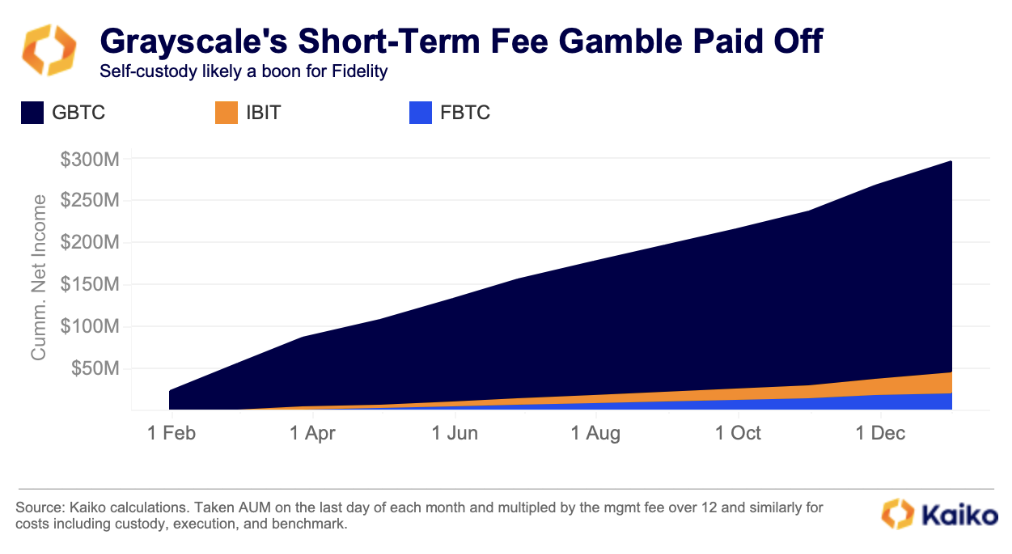

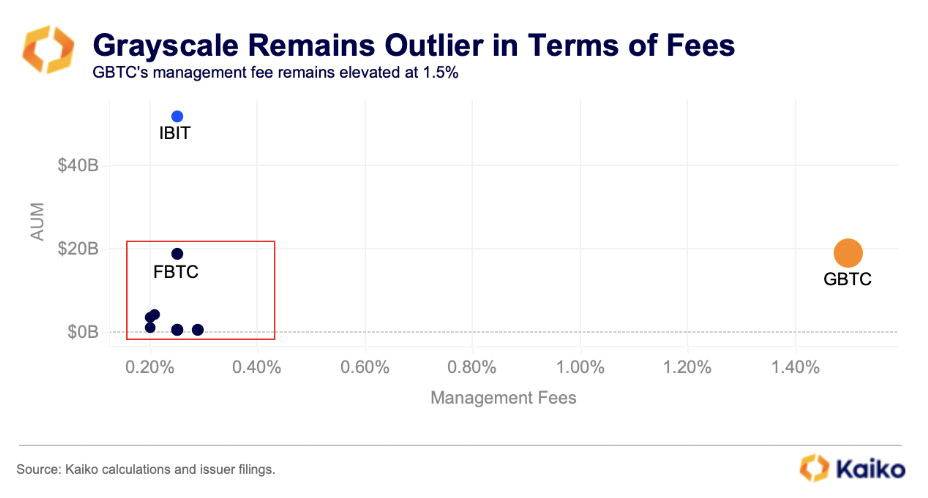

From the outset, and even before launching, issuers competed for market share by offering reduced management fees. Many introduced fee waivers at launch in January 2024, such as no fees on the first few billion dollars of assets under management or free management fees for the first 12 months. Some, like VanEck, have even extended these promotions as recently as November. Grayscale, however, has maintained its fees at 1.5%.

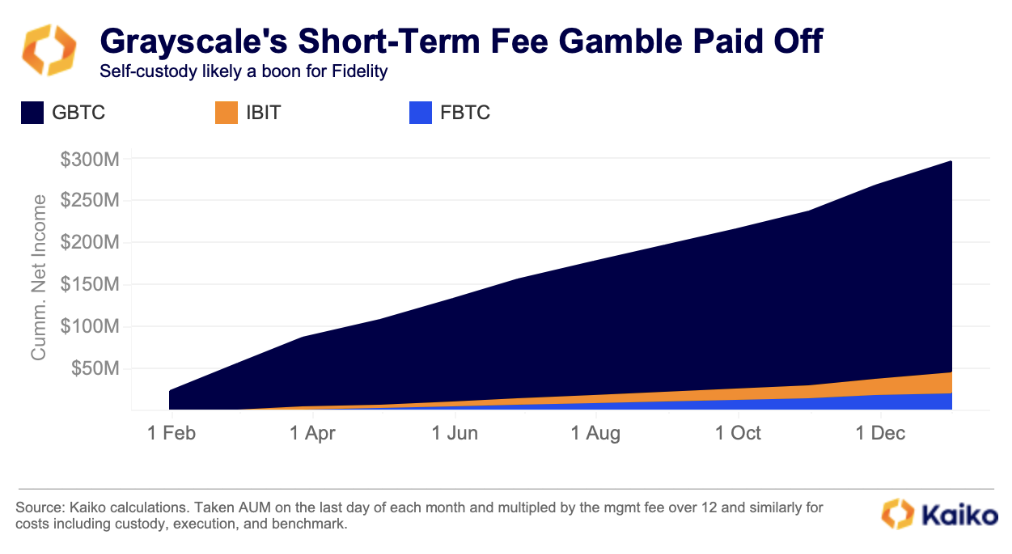

What’s the result? Grayscale lost billions of dollars in assets but remains the most profitable fund and one of the largest ETFs in the world. BlackRock’s IBIT surpassed Grayscale’s GBTC in AUM terms in May, while Fidelity overtook it more recently. However, both lag behind the crypto-native firm in terms of net income.

Net income is calculated using assumed prices based on standard industry trends and fund issuer filings. The end result is calculated by taking management fees less custody, execution, and benchmark costs.

Custody is excluded from Fidelity’s net figure as FBTC is self-custodied. As a result, FBTC competes on net income terms with IBIT.

The remaining funds also kept fees low, which proved effective. Despite similarities in AUM and fee structures, no BTC ETF launched in January 2024 manages less than $750 million, with two managing approximately $4 billion.

It’s not inconceivable that all 10 of these ETFs end up with over $1bn AUM at some point this year. Issuers will likely need to innovate beyond just offering low fees to maintain a competitive edge. The introduction of BTC ETF options on some funds in late 2024 has created opportunities for new strategies and is expected to contribute to the growth of these funds.

Conclusion

Just over twelve months ago many commentators said BTC ETFs would struggle to attract investors. Now they’re the most successful products of all time. Spot BTC ETFs are an unmitigated success, and the impact on the crypto market is evident.

What’s next for these funds and how can they build on this growth?

The next stage of growth should focus more on innovation than on fees and other cheap parlour tricks. Traditional firms may need to adapt in order to compete with crypto-native players. They’re not afraid to do this, as we saw with the CME’s introduction of Bitcoin Friday Futures.

One big innovation in 2025 will be getting BTC into long-term portfolios, i.e. pension funds. The traditional 60/40 portfolio stands in the way. The equity/bond mix is the standard, but things are changing. Bitcoin has a place in a balanced, diversified portfolio.

VanEck has produced reports stating that a modest (up to 6%) allocation to BTC can improve risk-adjusted returns in portfolio. A BlackRock Investment Institute paper said BTC can be added to balanced portfolios too, at least between 1% to 2%. If financial advisors begin adopting these approaches in 2025 and investors are comfortable, ETFs will continue to be a significant boon for crypto markets.

However, potential headwinds for growth remain. In the first quarter of the year these are likely to be macro-related, and could persist into the summer. Policy shifts from the new administration could cause short-term spikes in vol for instance. However, the strong regulatory tailwinds expected due to the regime change in Washington will outweigh these in the long-run.

![]()

![]()

![]()

![]()