Rising interest in ethena amid aave, usdtb launches

Stablecoins dominated headlines in 2024 as new regulations took effect and large players like Tether posted significant revenues. However, it wasn’t just the established players that saw success in 2024.

Ethena’s USDe stablecoin has been a resounding success by any measure. Since its public launch in February 2024, its total circulating supply has surged to over $6 billion, making it the third-largest stablecoin by market capitalization, surpassing DAI.

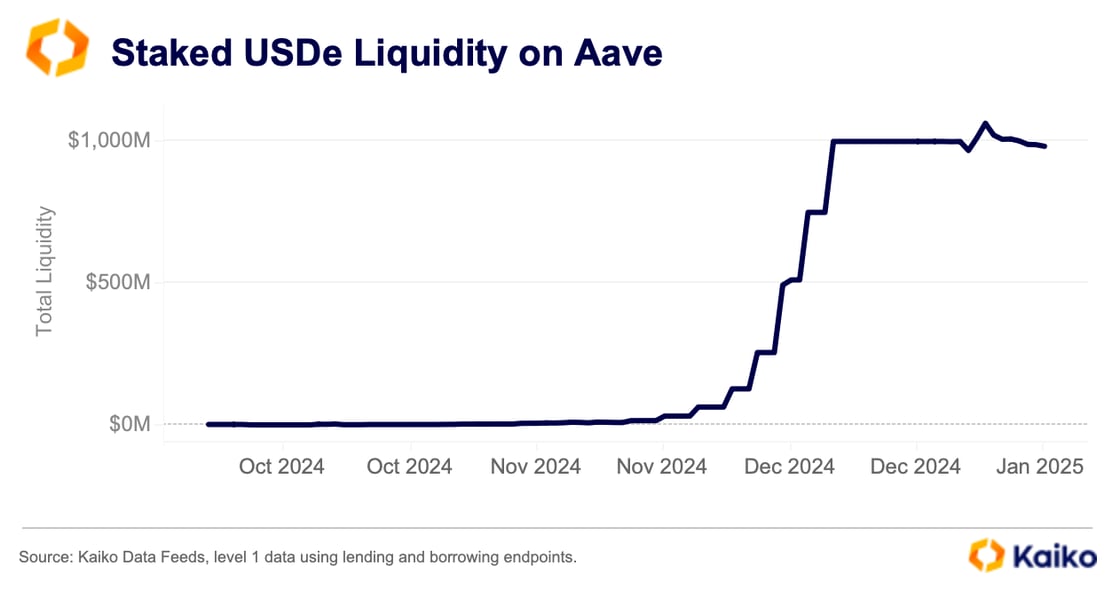

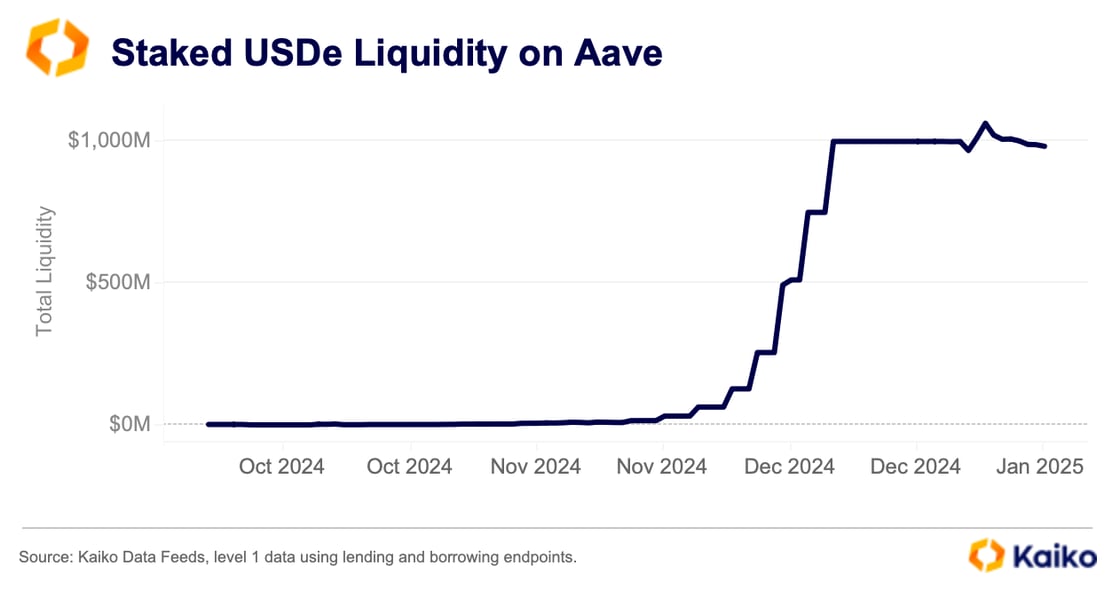

The protocol’s growth received a fresh boost with the launch of staked USDe (sUSDe) on Aave in the fourth quarter. Within the first few weeks of the integration, staked USDe saw over $1 billion in inflows. This integration allows users to leverage sUSDe as collateral on the lending platform, further driving adoption.

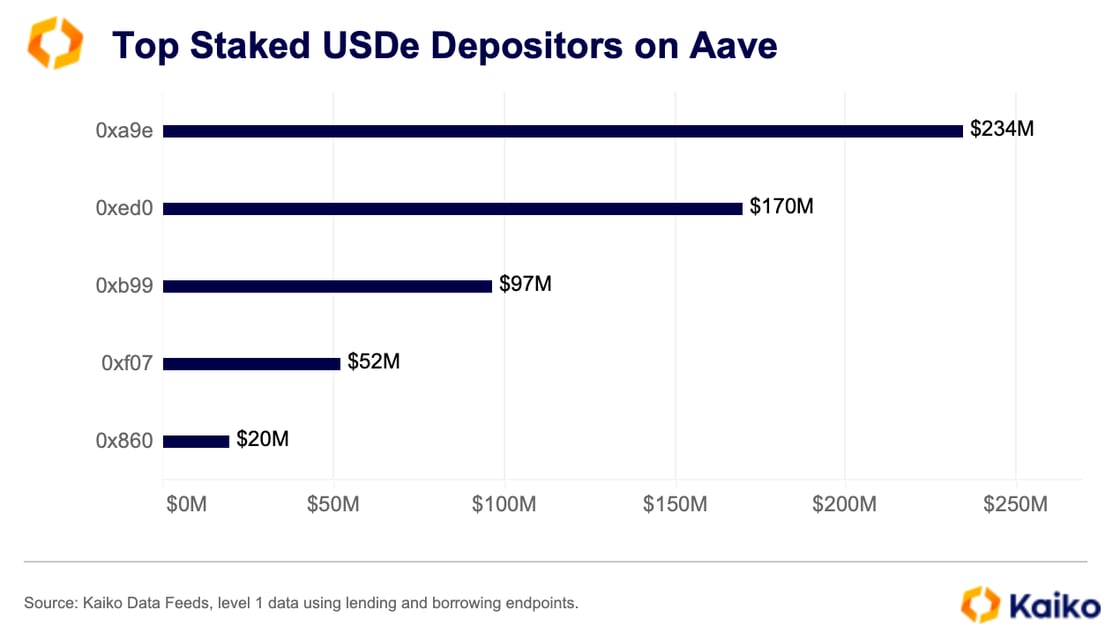

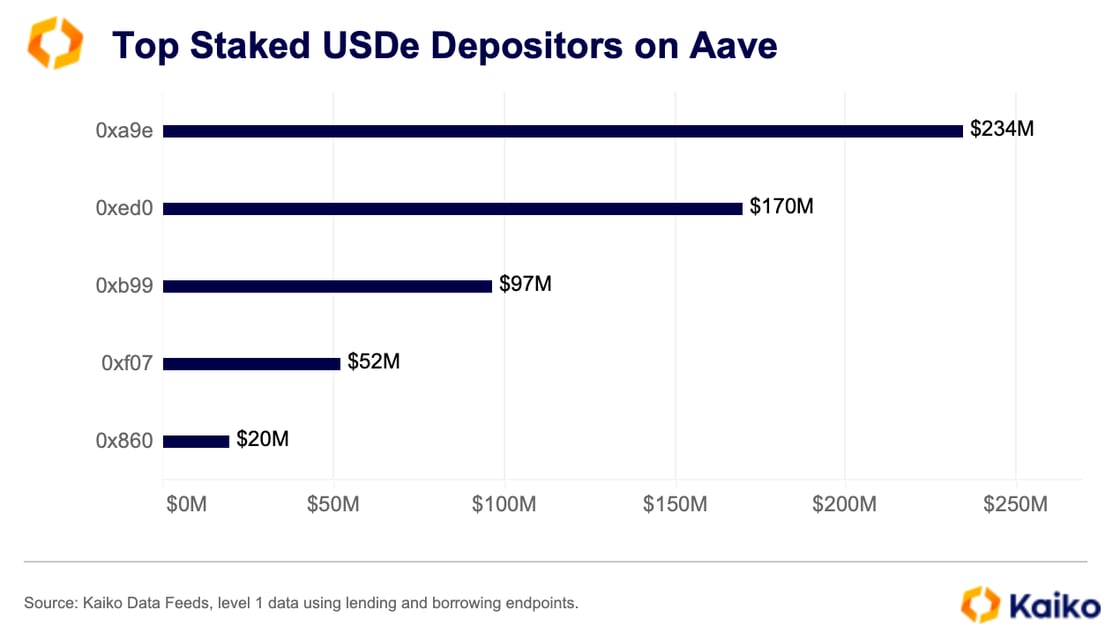

Using our lending and borrowing events data solution we where able to dive deeper into those numbers. As we can see below most of the inflows have come from just a few users, with over half a billion coming from the five addresses identified below.

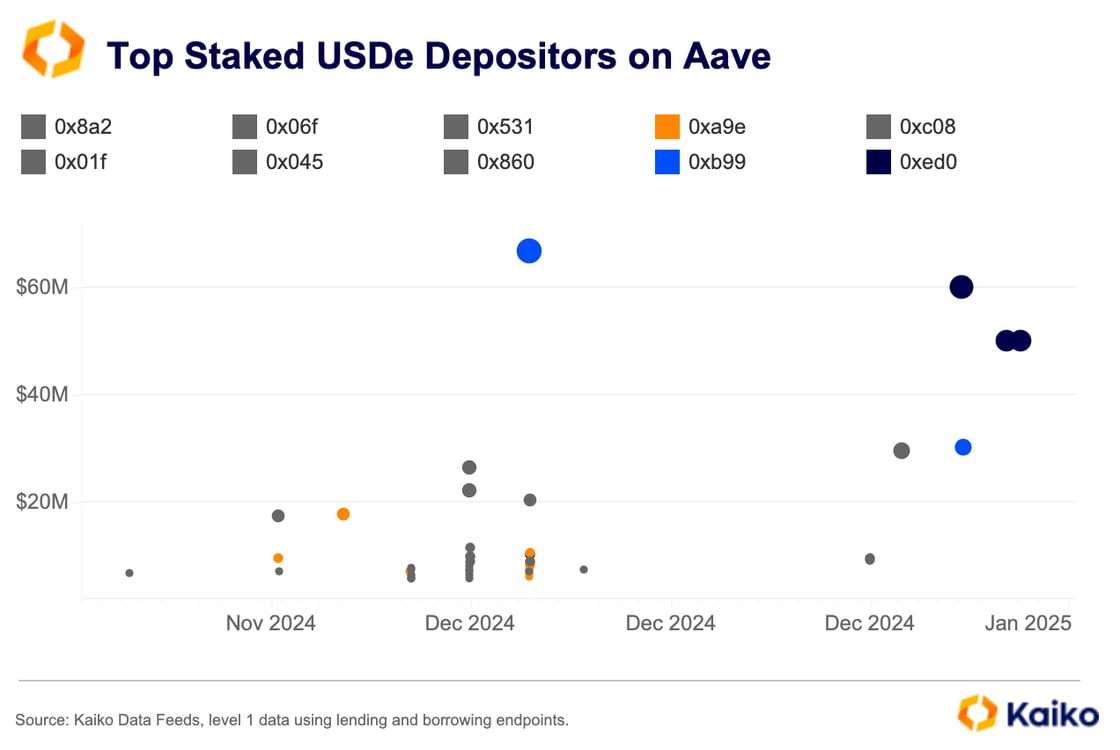

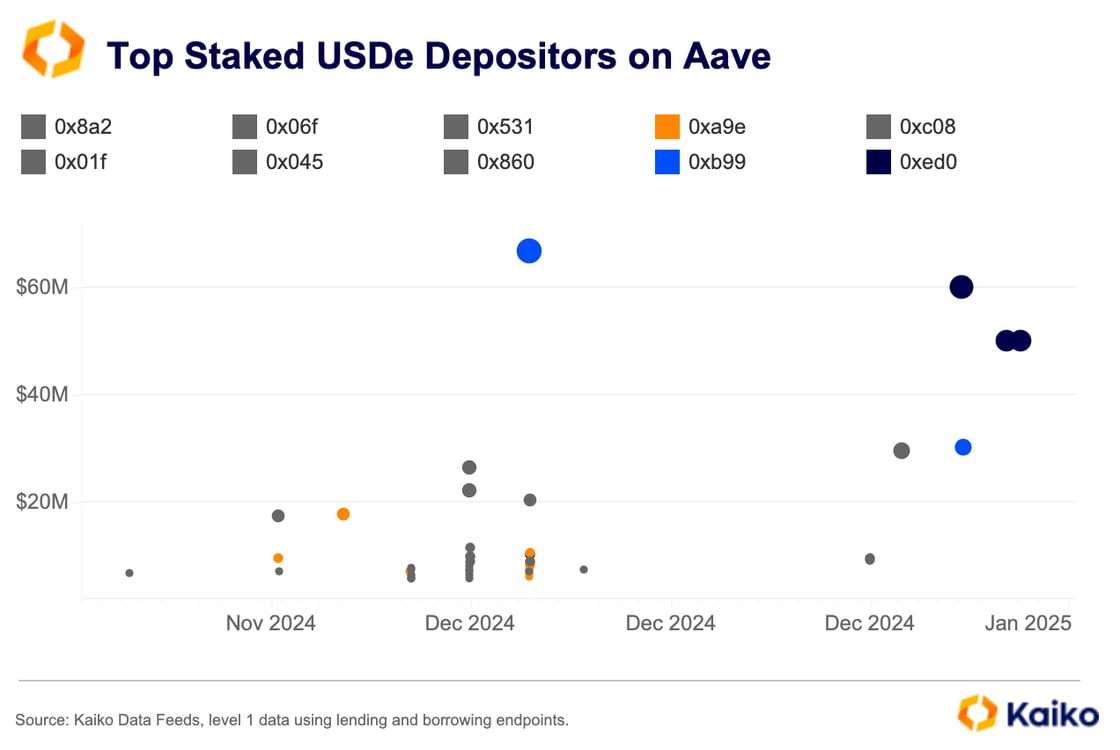

The addresses deposited funds in different manners. For instance, 0xb99 (light blue below) deposited funds in two instalments, first $67mn and then $30mn. Meanwhile 0x9e (orange below) made over 133 different deposits between November and December.

This behavior is not entirely unusual on Aave. For instance, one address deposited $13bn USDC across 200 transactions between November and December. Another split a $200mn deposit over five transactions.

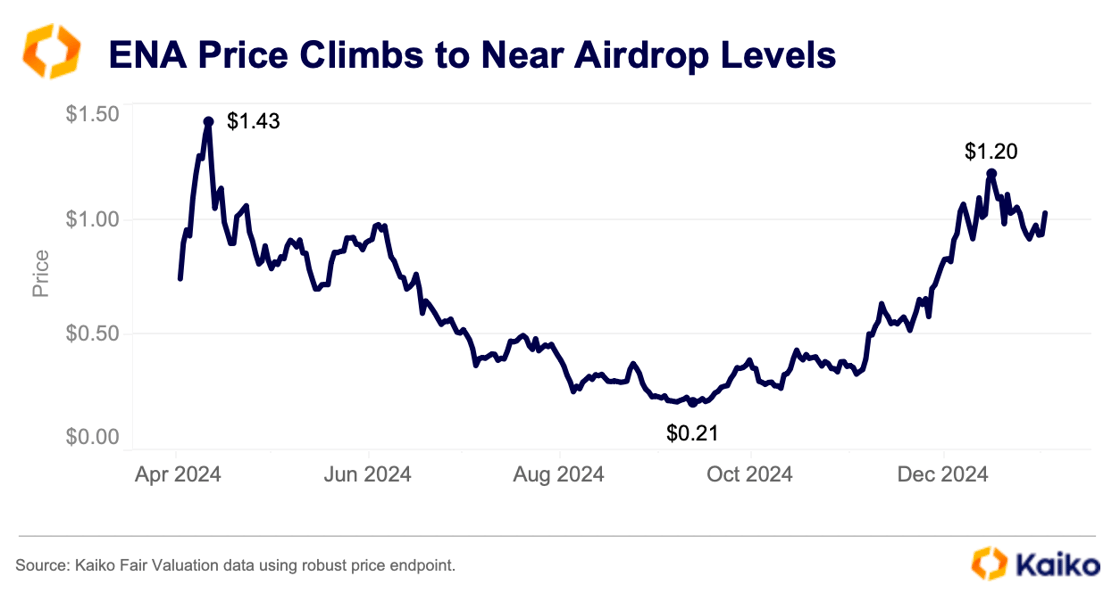

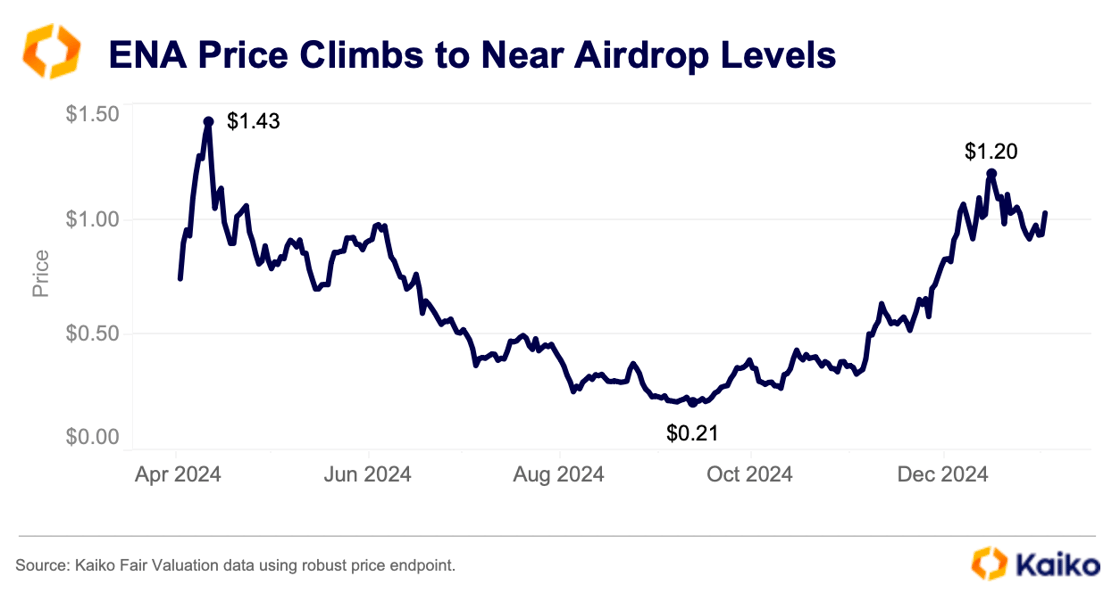

As sUSDe inflows soared and crypto prices rose across the board the price of Ethena’s governance token, ENA, climbed high. ENA returned to near-airdrop levels for the first time last month as BTC traded above $100k.

More recently the Ethena team launched the USDtb stablecoin, to compliment its USDe product. Before explaining the dynamics of USDtb we should first recap USDe, which has some unconventional mechanisms. The token keeps its peg by carrying out delta-neutral hedging strategies, this keeps the price somewhat stable and in line with its dollar peg.

USDtb offers more conventional options to investors. The essentially backed by US government bonds through its investment in BlackRock’s BUIDL as well as a small stablecoin backing to facilitate fast redemptions. BUIDL invests 100% of its assets in cash, US Treasury bills and other short term US government obligations.

The ability, and willingness, to innovate is one of the key drivers behind Ethena’s success in 2024. While the soaring inflows on Aave look great, they largely come from just a few holders and sUSDe is still some way off challenging USDC and USDT in reality.

However, the protocol can innovate more quickly than its older rivals and has chosen to do so. While Circle and Tether leadership grapple with MiCA compliance, Ethena’s on-chain first approach with integrations to some large centralized platforms, has contributed to its success so far. Furthermore, Maker’s decision to rebrand its platform which fragmented liquidity between DAI and the newly launched USDS benefited Ethena in claiming the third spot by market cap.

Going forward to regulatory outlook is set to change, which could further shake up the space and add renewed competition for the budding protocol in 2025.

Data points

Crypto trade volume and liquidity increase in 2024.

Despite worsening risk sentiment in December, Bitcoin closed out 2024 with a 118% gain, marking its third-best year since 2018 and its fifth-best in the past decade. It outperformed most major assets, trailing only MicroStrategy, Nvidia, and Palantir Technologies.

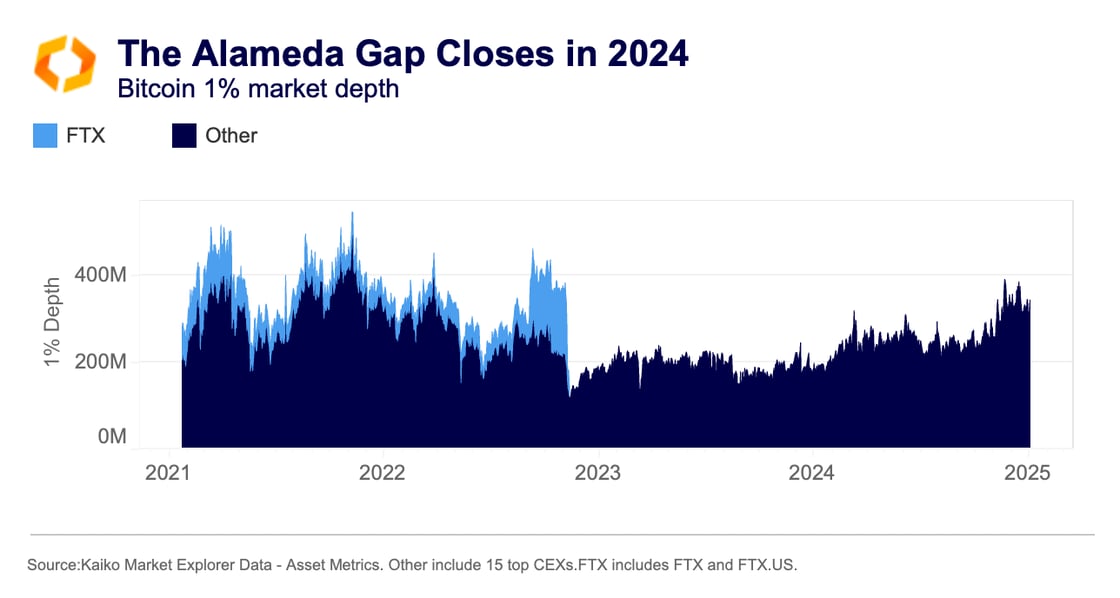

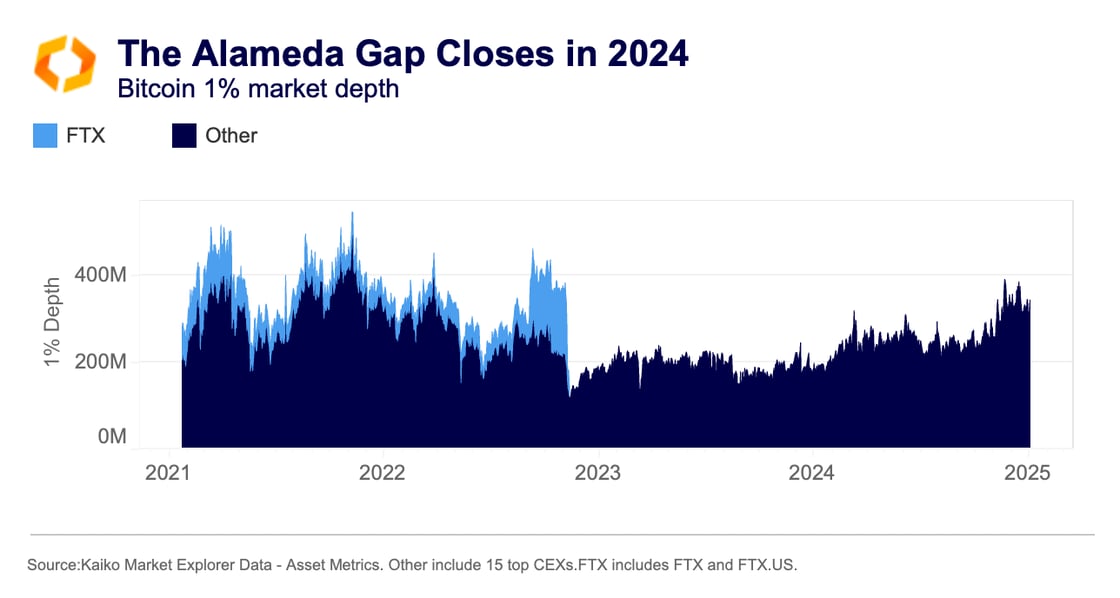

Trading activity also saw strong growth, signaling the rally has legs. Aggregate crypto trading volumes across 30+ centralized exchanges hit levels not seen since 2021. BTC 1% market depth rose by more than 85% last year to about $370M, matching pre-FTX levels. The increase was largely driven by the introduction of spot ETFs in the US, as market makers were more incentivized to provide liquidity due to higher trading volumes and lower hedging costs. As a result, the ‘Alameda Gap’ – the liquidity shortfall left in the wake of FTX’s collapse – closed up in 2024.

This marks a turning point, closing the chapter on the painful, high-profile failures that plagued the industry in recent years. Looking ahead, 2025 is poised to build on this momentum, with institutional interest expanding beyond Bitcoin into Ethereum and other crypto assets, driven by the anticipated regulatory clarity in the US.

Corporates buy record amount of BTC in Q4.

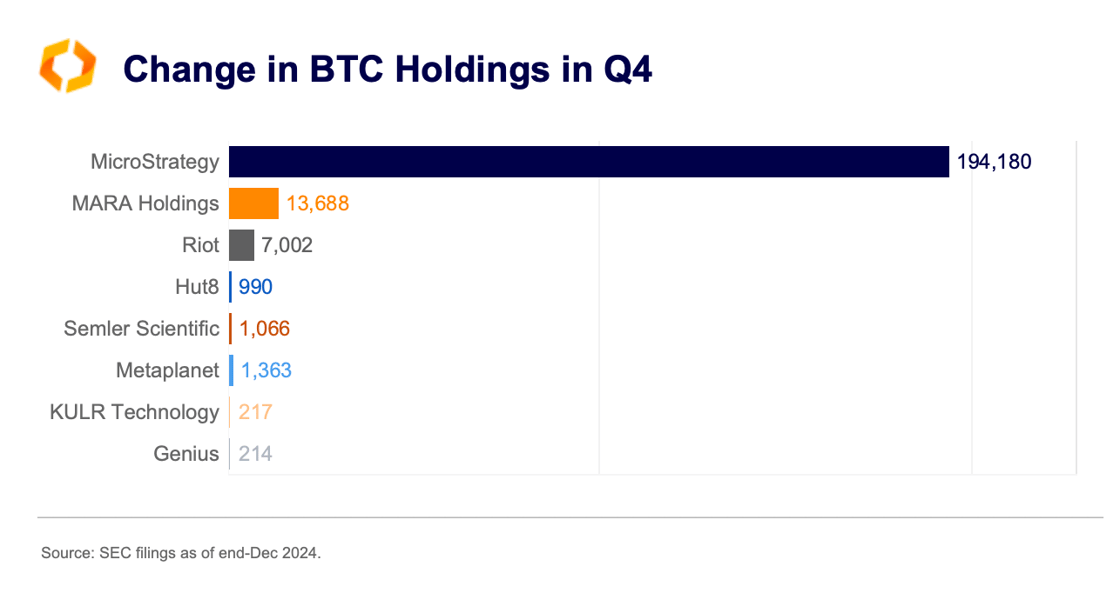

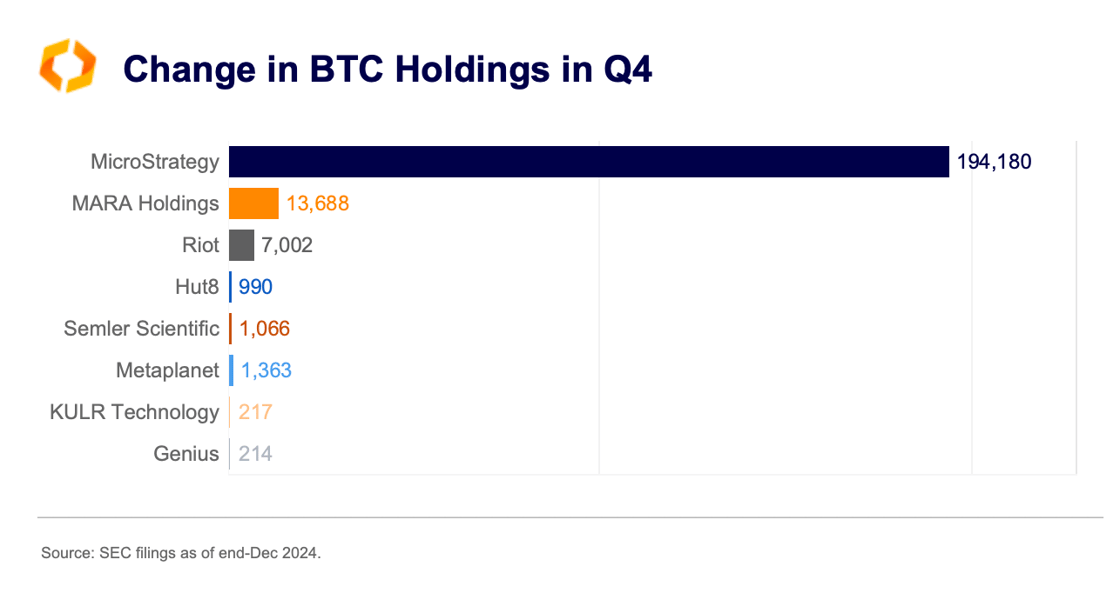

Bitcoin’s recent rally was also driven by strong corporate interest. Companies like KULR Technology, Rumble, and Genius Group began adding Bitcoin to their balance sheets in Q4. MicroStrategy, the largest Bitcoin holder, increased its holdings from 252,220 BTC in September to 446,400 BTC by December.

Despite December’s pullback, MicroStrategy outperformed Bitcoin and other BTC-exposed firms this year. The company plans to raise a total of $42 billion over three years for further Bitcoin purchases. However, December options data suggests investor sentiment toward MicroStrategy shifted from ultra-bullish to neutral, hinting at cooling interest.

Airdropped tokens exhibit mixed performance.

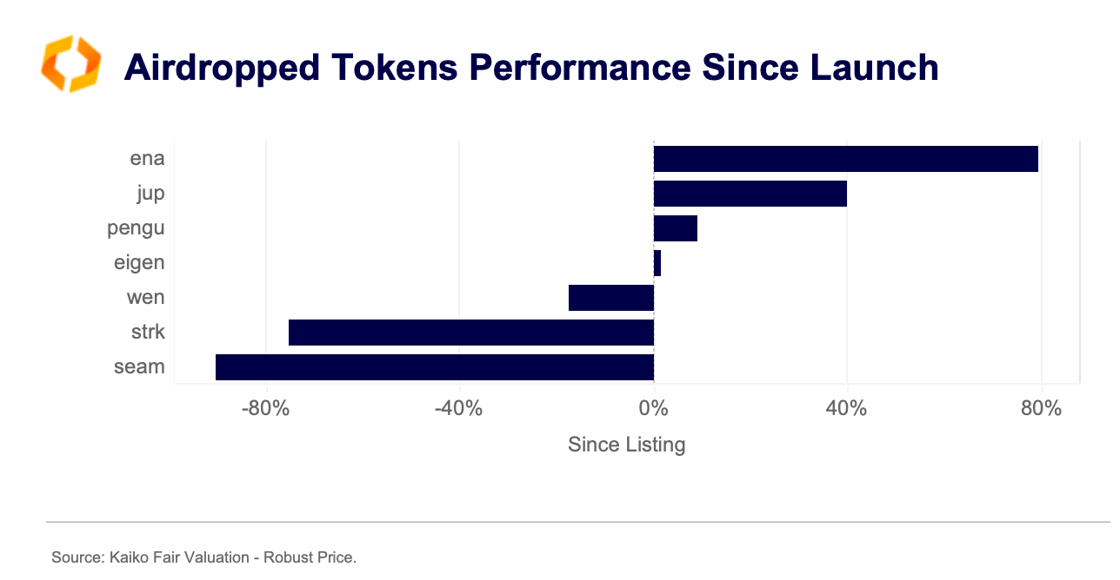

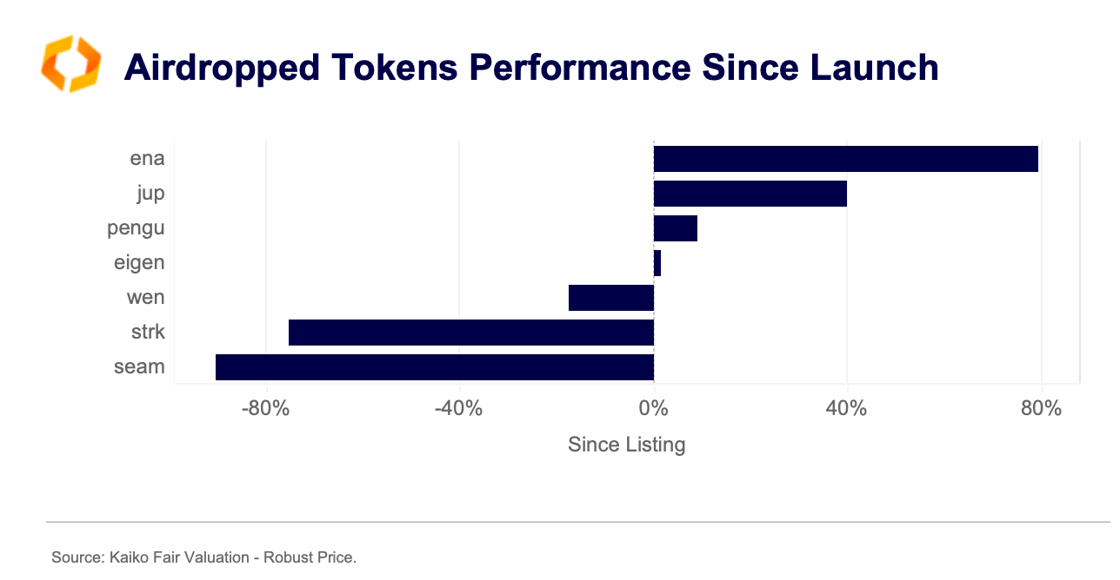

2024 witnessed several highly anticipated airdrops. While these events often generate initial hype, many tokens have struggled to maintain their value in the long term. For example, Eigen Layer’s EIGEN token has declined 11% since its October launch, Seamless Network’s SEAM plummeted 90%, and Starknet’s STRK is down over 70%. However, not all projects have underperformed. Ethena’s ENA and Jupiter’s JUP tokens recorded double-digit gains post-launch.

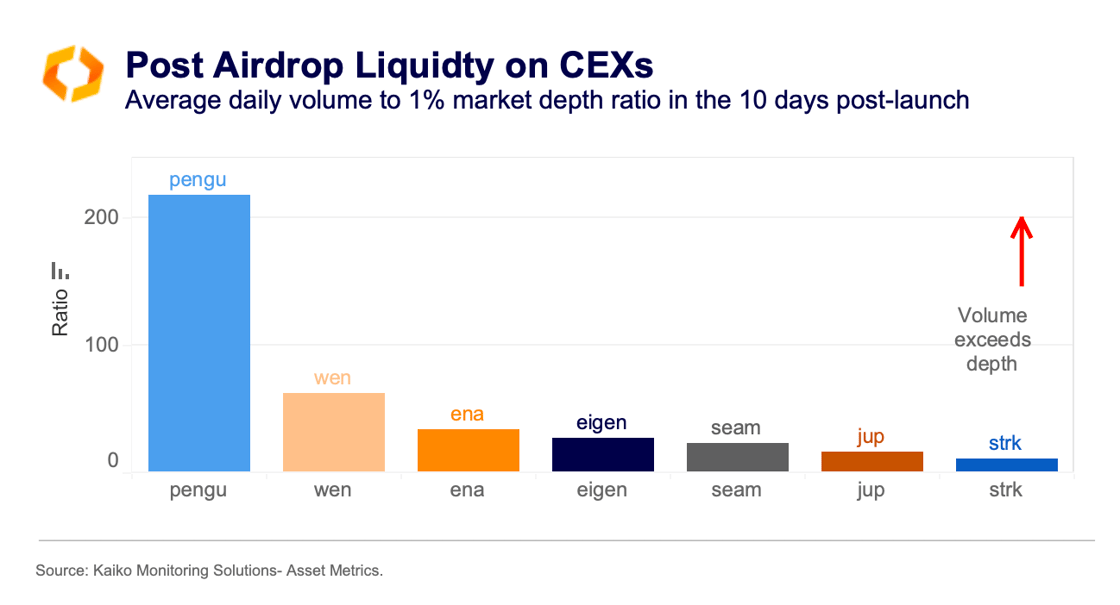

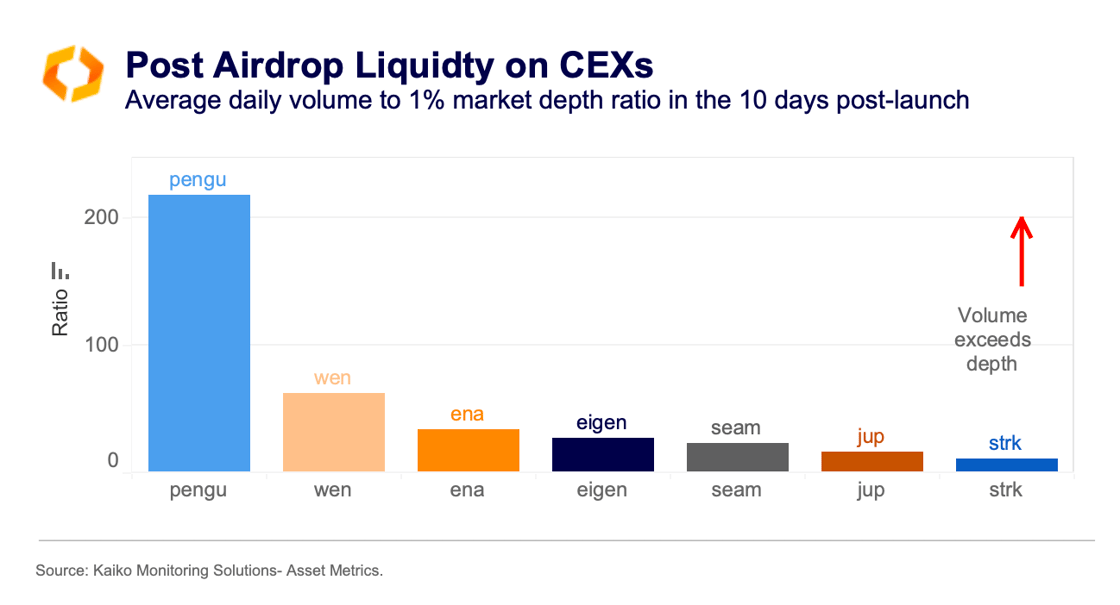

Liquidity has been critical in maintaining price stability, particularly during the volatile initial trading period when volumes tend to spike. The Pudgy Penguin PENGU token’s turbulent debut on centralized exchanges on December 17 offers a prime example. The token’s price surged briefly within the first minutes of trading, only to lose more than 50% of its value in the next few hours. This steep drop was exacerbated by unexpectedly high trading volumes. PENGU hourly trading volumes across eight exchanges exceeded $260 million in its first hour—driven largely by selling on Binance—while its 1% market depth was just $1 million.

An analysis of the average daily 1% market depth and trading volumes during the first ten days of trading for the top airdropped tokens this year reveals that PENGU’s daily trading volumes were disproportionately high relative to its available liquidity.

By comparison, tokens like JUP and EIGEN launched with relatively higher initial market depth, which helped stabilize their prices. It is noteworthy that CEXs are not always the primary market for these tokens which are mostly traded on DEXs. However, they are an important venue for exit liquidity post launch.

![]()

![]()

![]()

![]()