How crypto data informs earnings.

With Coinbase reporting Q4 earnings on Thursday (Feb 13), we examine market data offering early insights into its performance. While earnings guidance and analyst outlooks influence share prices, crypto market data serves as a leading indicator of exchange health.

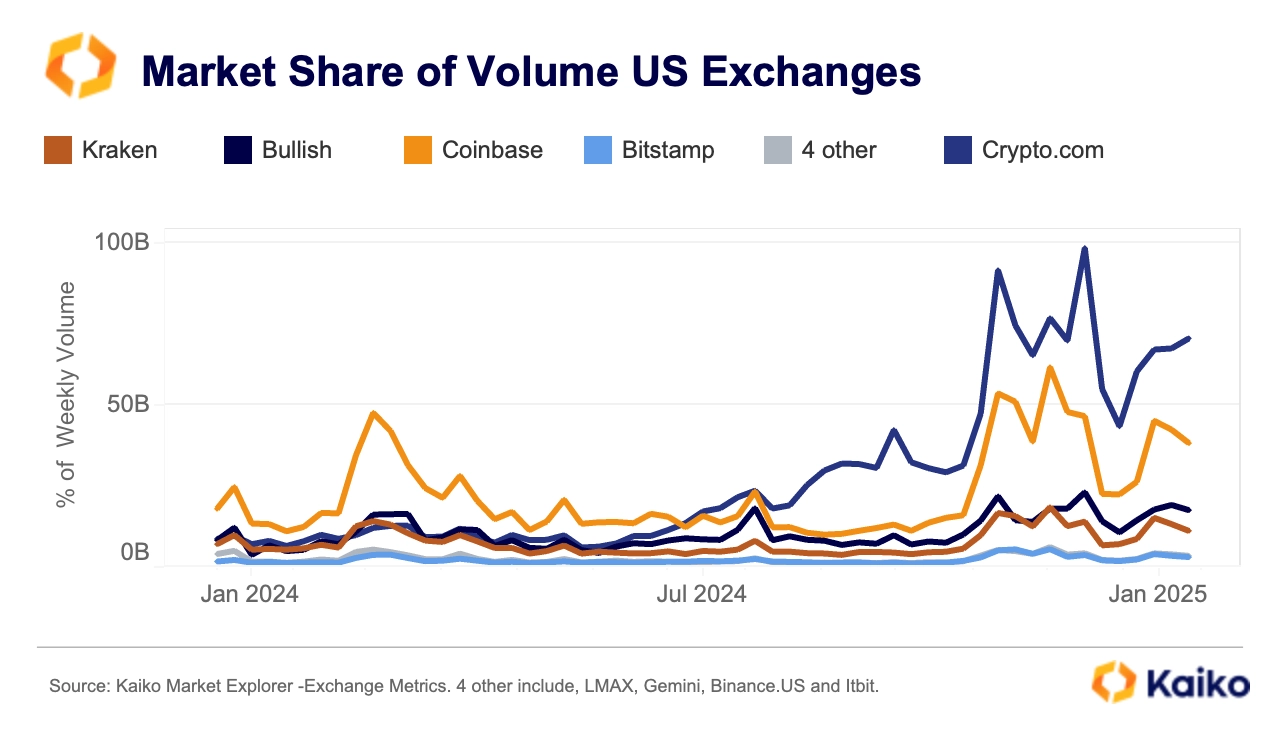

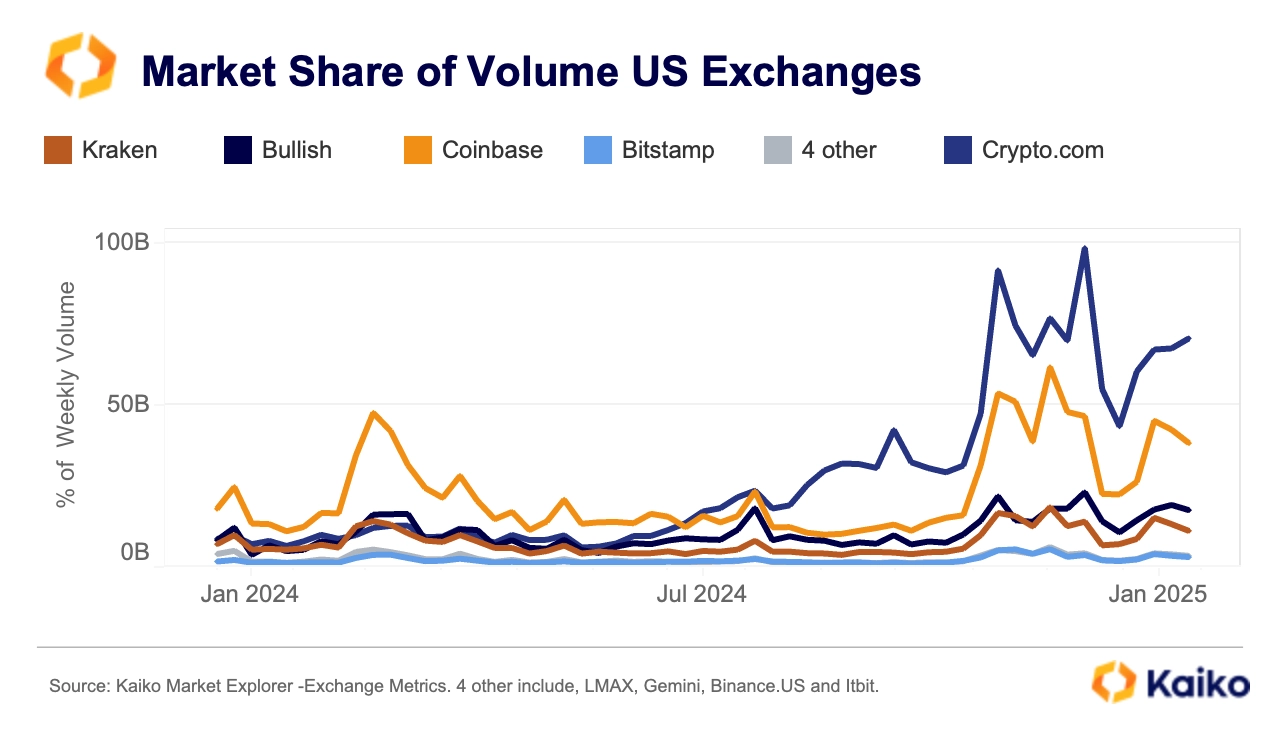

In Q4 Coinbase weekly trade volume surged to its highest level in two years, suggesting it benefited strongly from the post-election rally.

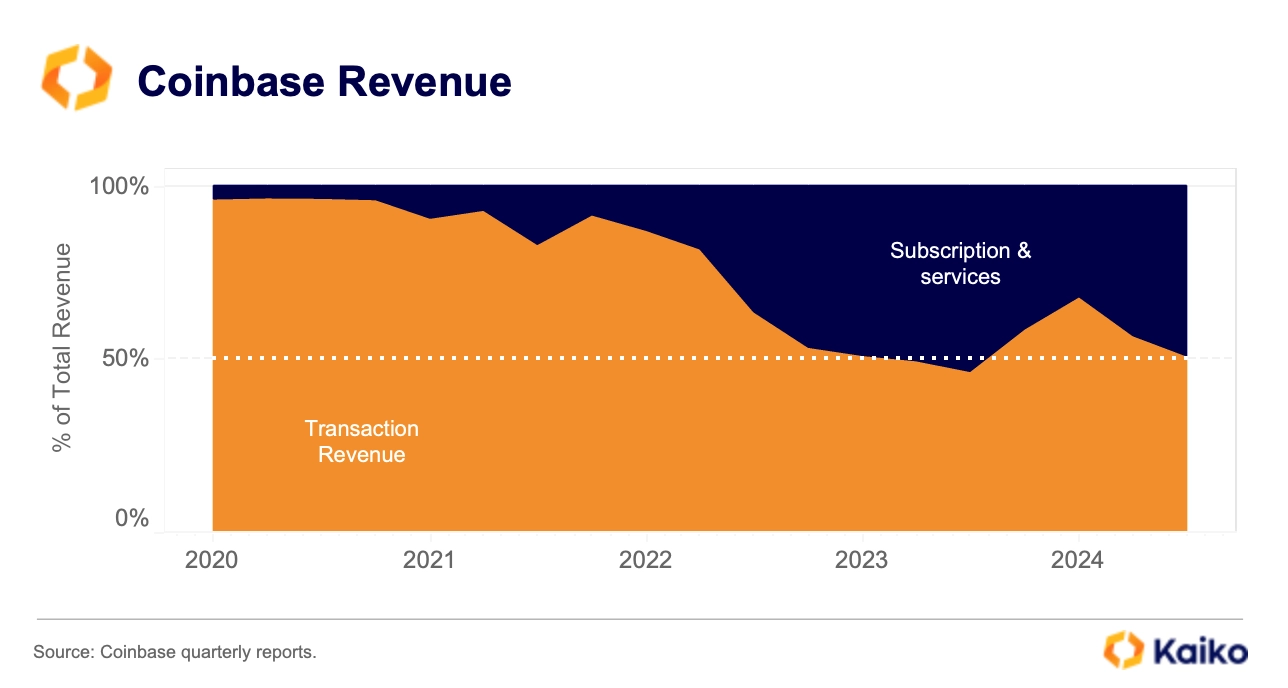

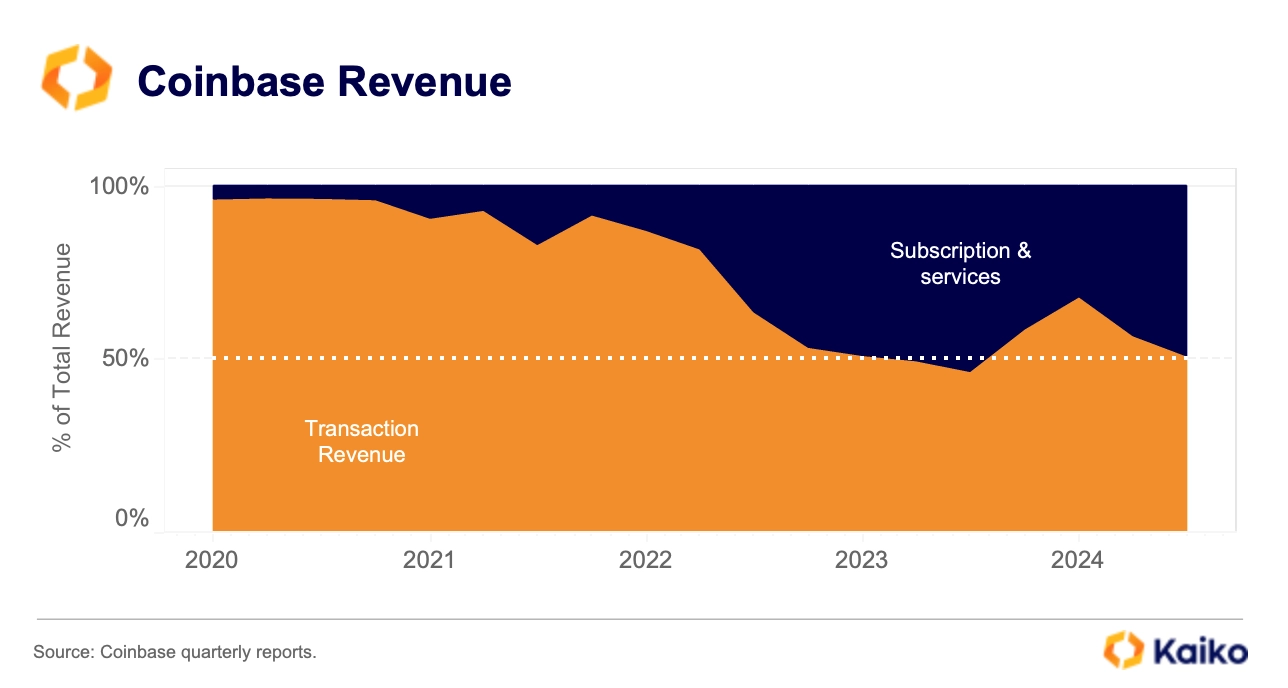

Over the past few years, Coinbase has diversified into areas beyond trading, with revenue from “subscriptions and services”—including blockchain rewards, custodial fees, and USDC interest—sharply increasing as a percentage of its total income.

However, it remains a trading platform at its core, with trading still accounting for—excluding one quarter in 2023—more than 50% of revenue.

Furthermore, subscriptions and services are inherently tied to activity in the underlying crypto market and do not act as diversifiers to protect against market drawdowns and trading lulls. A poor quarter for trading and price action will exacerbate losses in subscriptions and services revenue.

For example, in the third quarter of 2024 the firm’s blockchain rewards revenue fell 16% due to lower ETH and SOL prices. An understanding of staking and price trends here would have informed an investor as to the health of Coinbase’s business lines, without having to wait for the quarterly report.

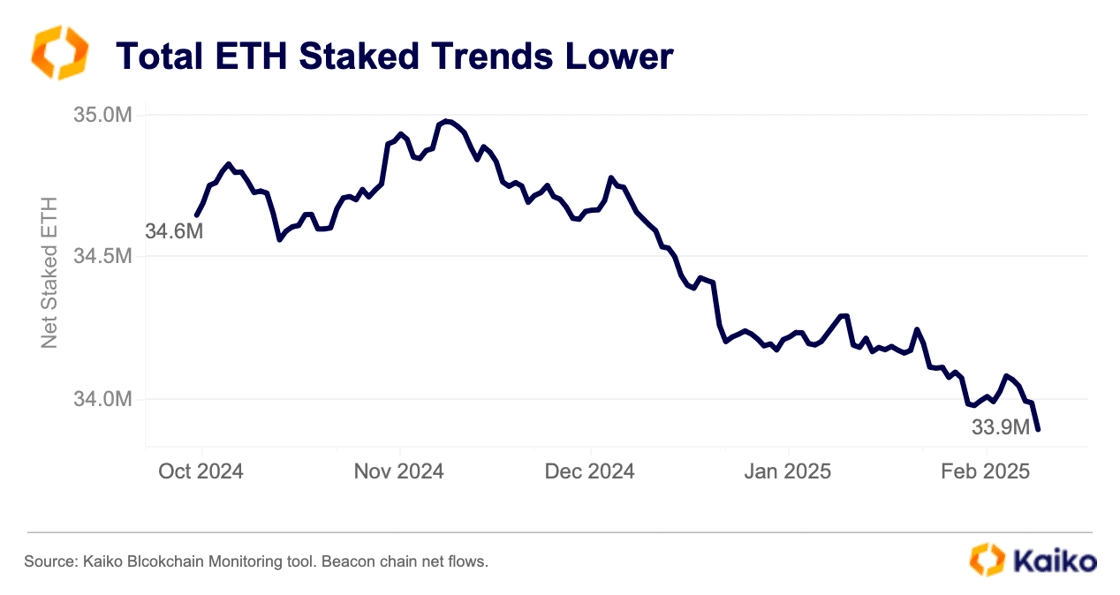

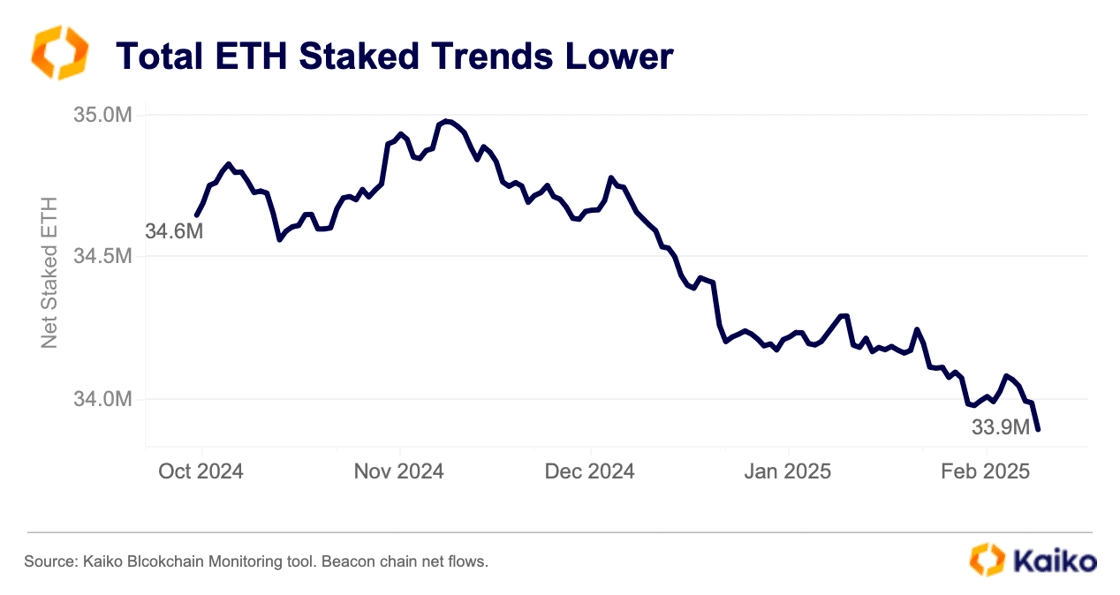

Using Kaiko’s blockchain monitoring tool we can see that net flows on Ethereum’s beacon chain fell during the fourth quarter. Coinbase which is currently the second largest ETH staking entity after Lido – is one of the largest contributors to this decline. Over the past six months the exchange’s share of the staking market has declined by 3.8%, with a net outflow of 1.29mn ETH in that period.

While part of the staking decrease will be offset by the higher ETH and SOL prices during the quarter, the data still suggests blockchain rewards revenue likely suffered in the fourth quarter.

Meanwhile, Coinbase’s USDC-related revenue, tied to its commercial agreement with Circle, could further provide a cushion. Circle’s new partnership with Binance and record-high USDC volumes may further help offset lower income from staking (more on this in our Data Points below).

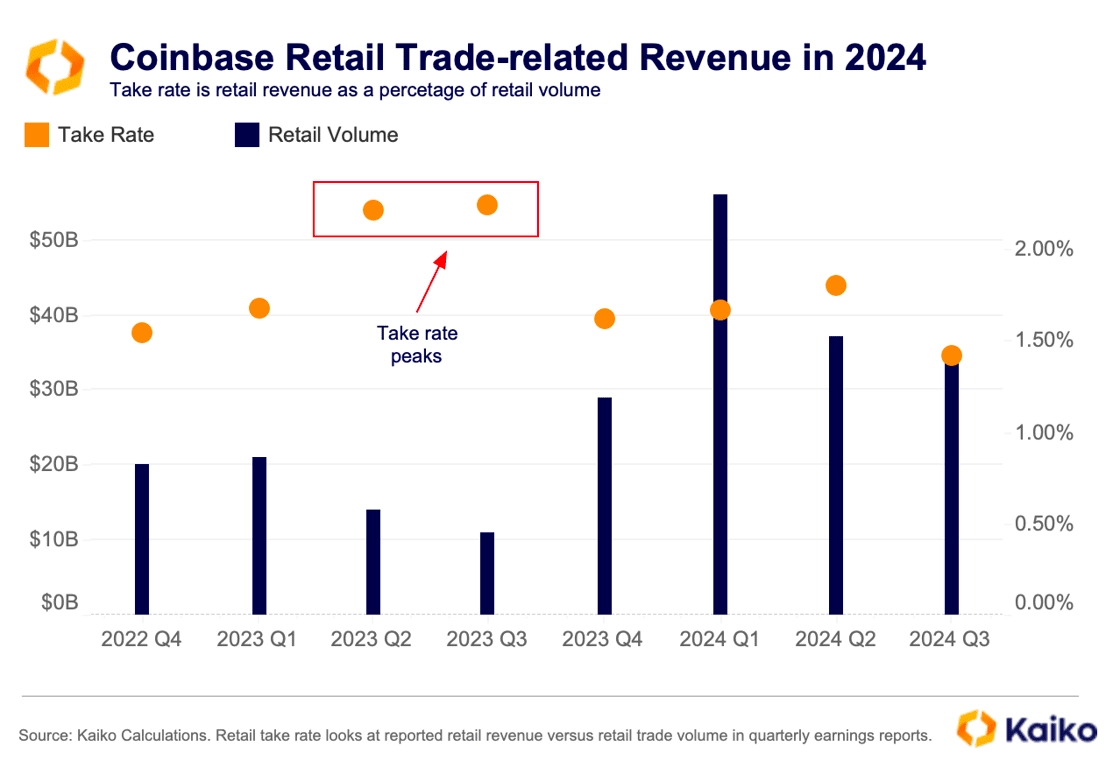

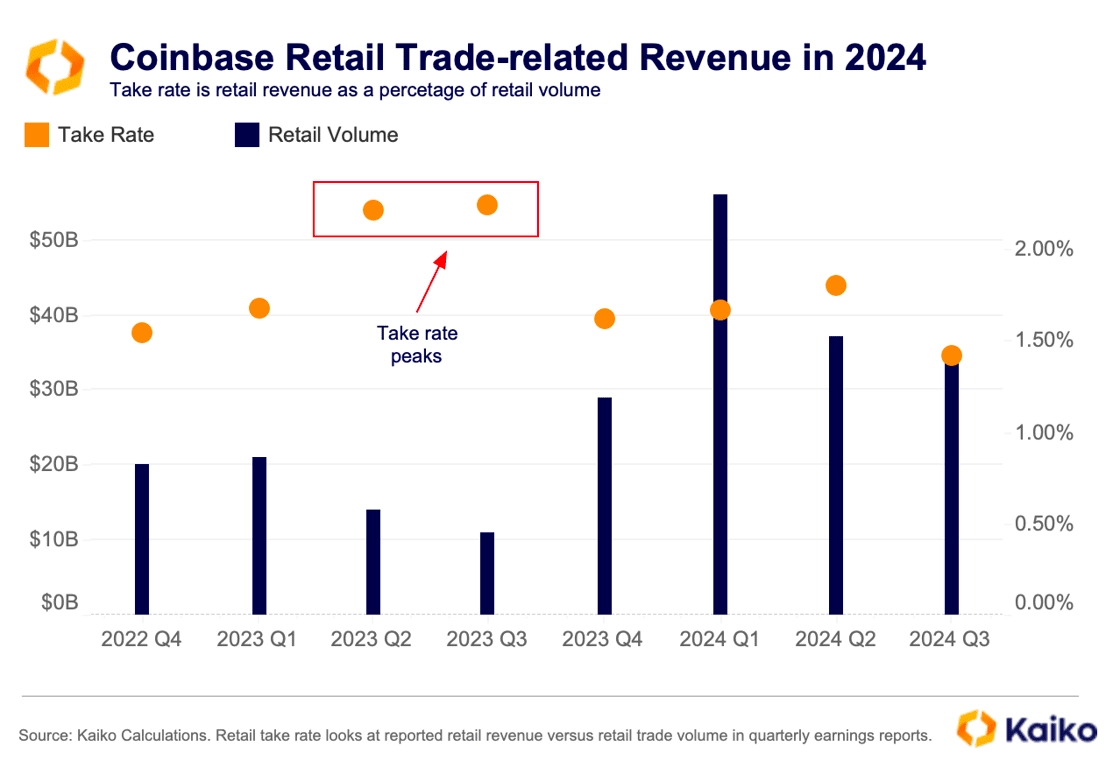

Still, retail traders—the highest fee payers—have not returned in force, with their share of volume shrinking to just 18%, down from 40% in 2021. Despite growth in subscriptions, this continues to weigh on transaction revenue.

Since peaking in mid-2023, the so-called “take rate”—a measure of the revenue generated from retail traders—has fallen to its lowest point since the first half of 2022, when the crypto market was hit hard by the collapse of Terra Luna and the crashing credit market.

This decline in retail-based revenue comes against the backdrop of an increasingly competitive landscape in the US with some platforms offering significant fees discounts.

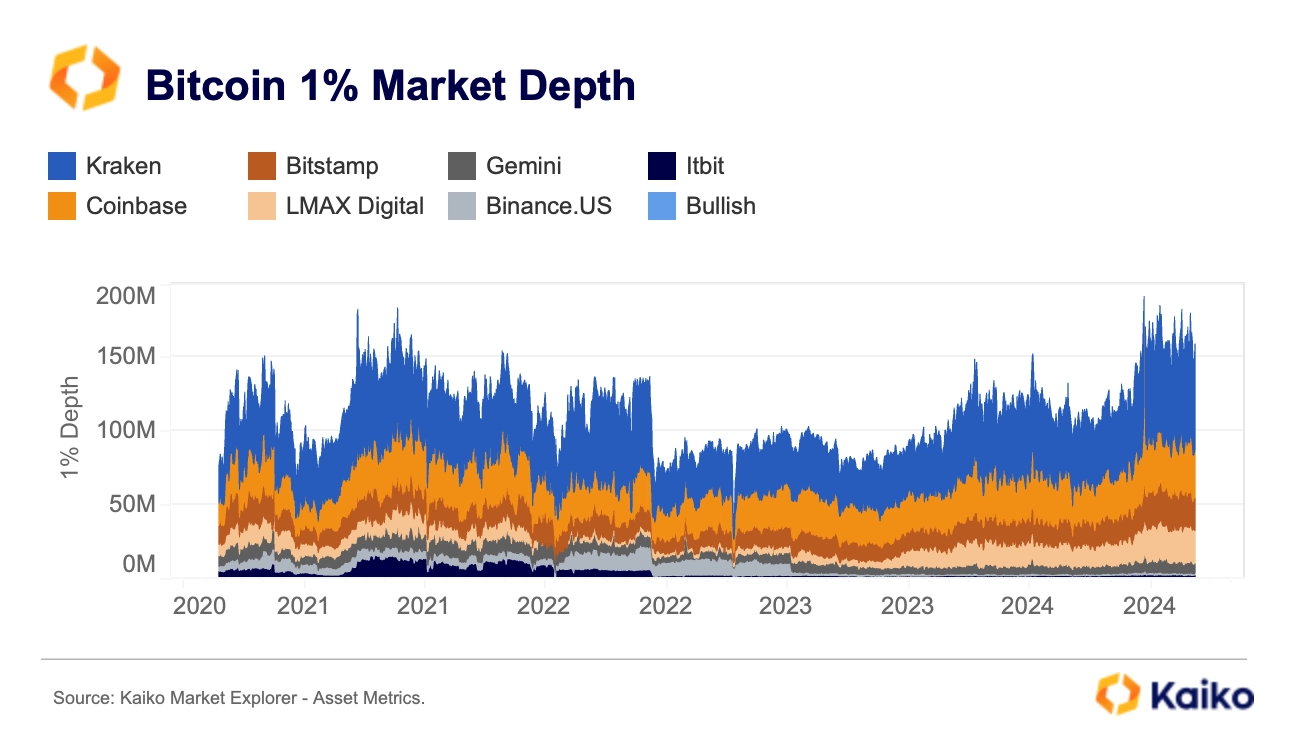

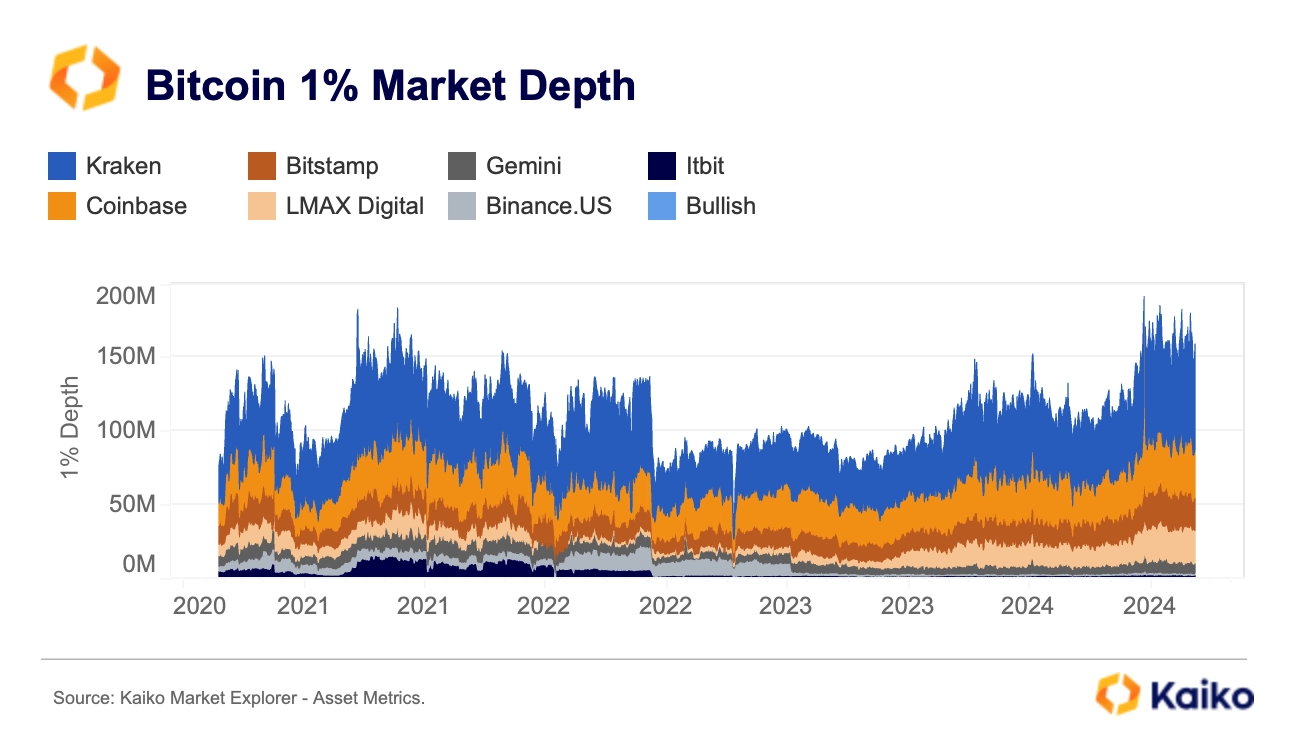

Although Coinbase remains one of the most liquid exchanges in the US, its fee structure – like most other platforms – favors market makers over takers and has remained relatively stable.

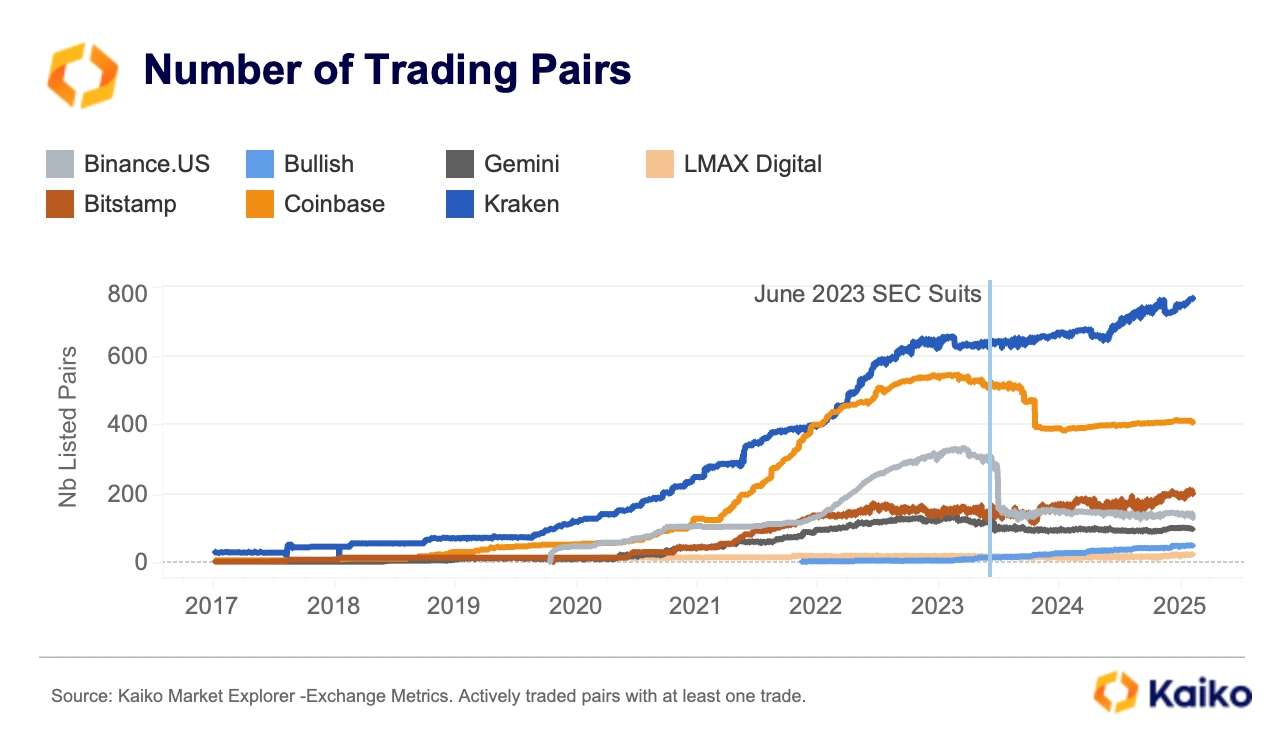

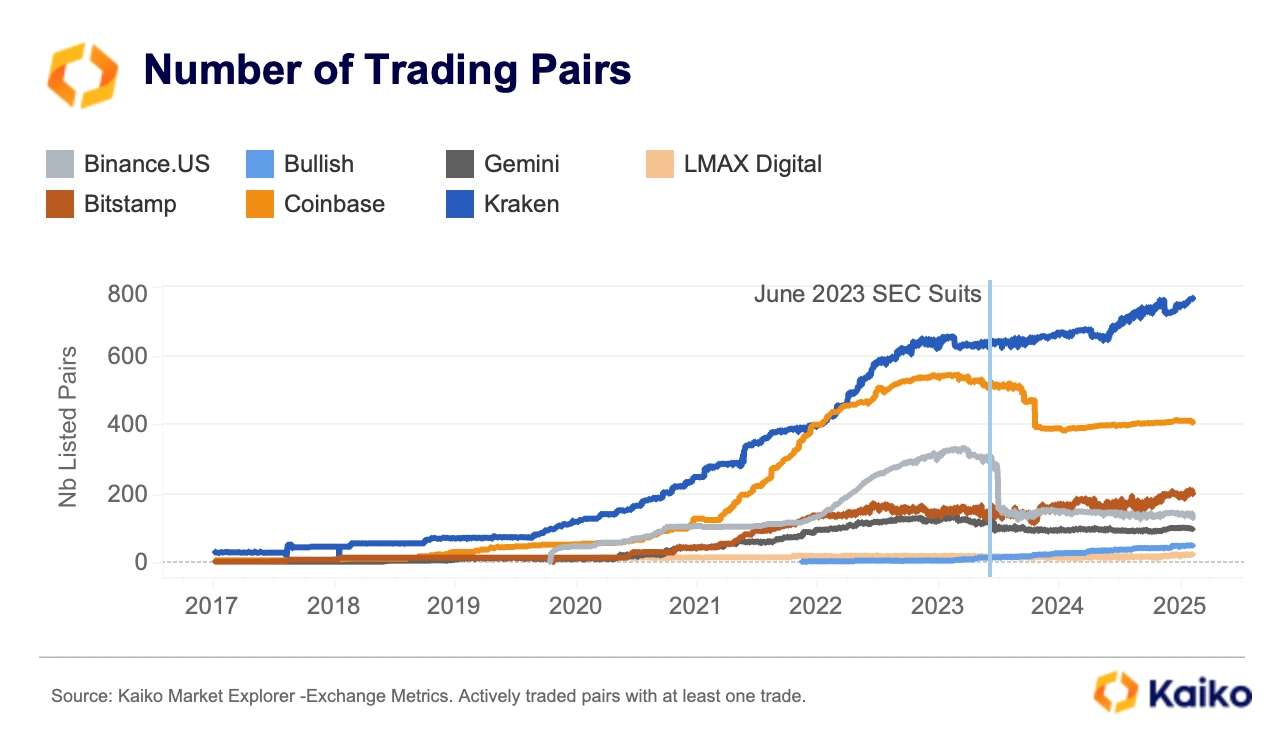

Additionally, despite diversifying its product offerings and benefiting more from cross-product synergies, Coinbase has slowed down its listing activity due to the challenging regulatory environment in the US.

The chart below shows a sharp decline in the number of actively traded pairs on both Binance.US and Coinbase following the SEC lawsuits against the two platforms in June 2023. However, this could change if the regulatory landscape improves, potentially increasing Coinbase’s appeal to retail traders.

Data Points

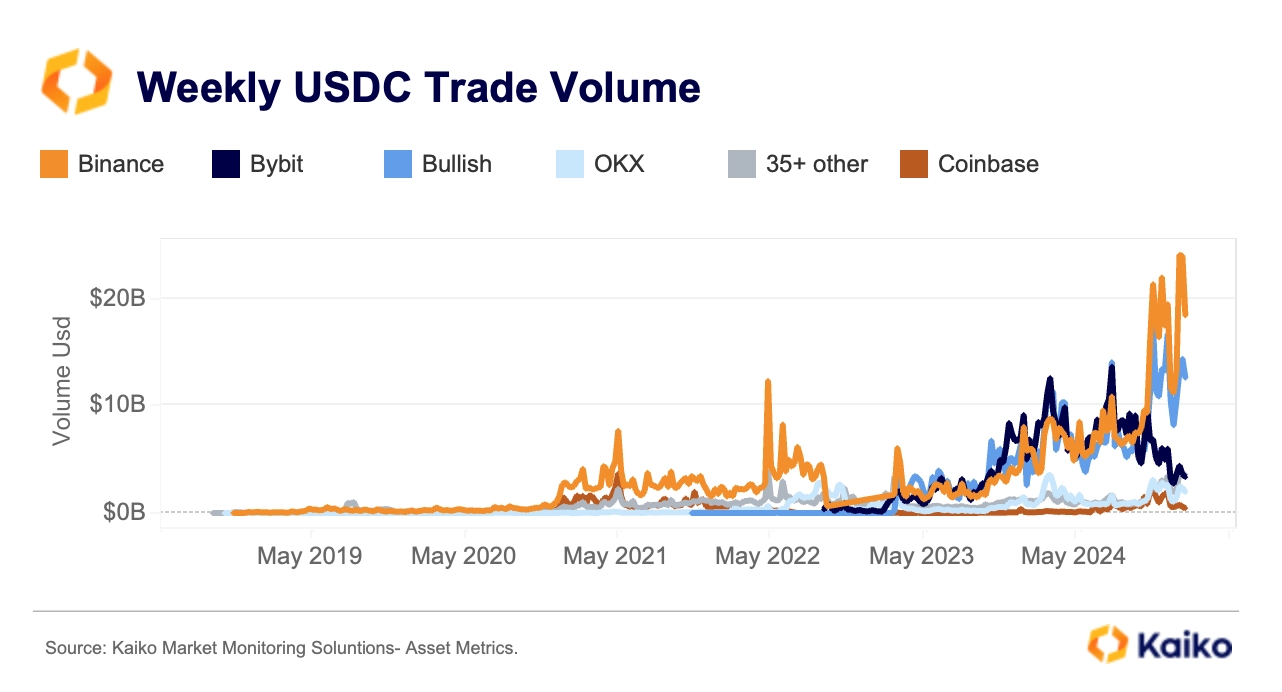

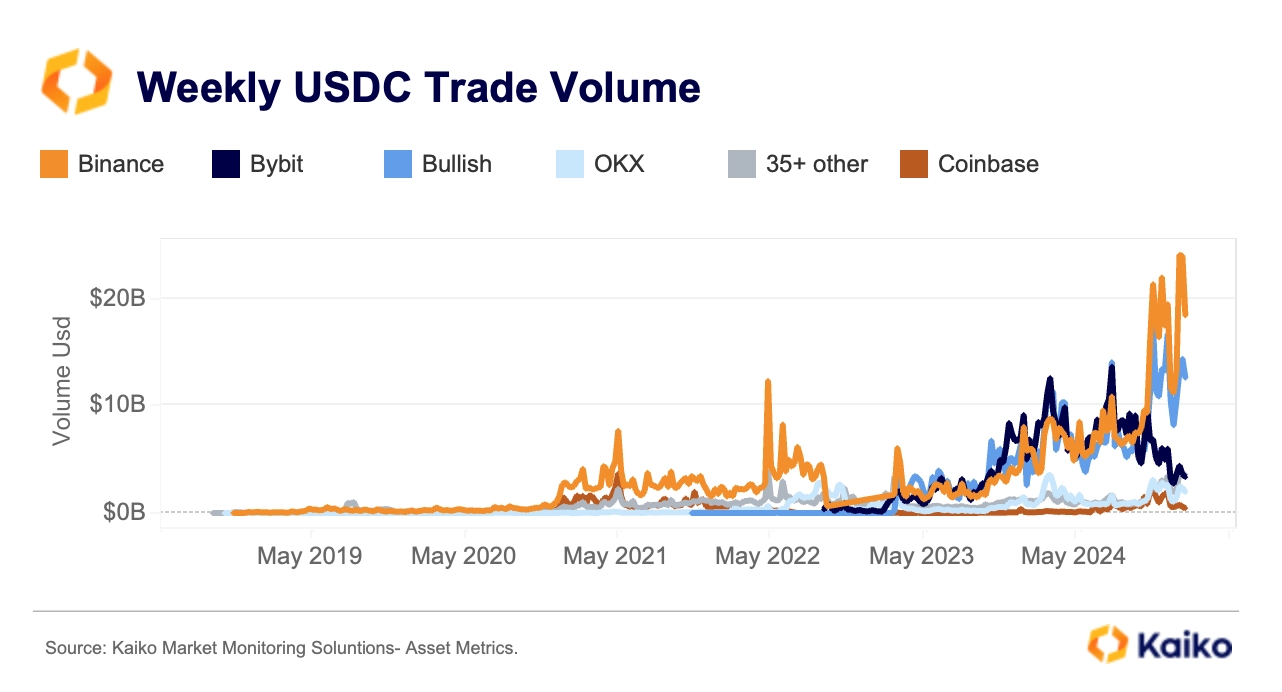

USDC trade volume hits record high on Binance.

Binance has become the largest USDC market, with weekly trading volumes hitting $24bn in January—49% of global USDC volume, its highest share since September 2022. This surge follows its strategic partnership with Circle in late 2024, aimed at expanding USDC adoption.

In contrast, Bybit’s dominance has dropped from 38% in October to just 8% today, following its decision to reintroduce trading fees on USDC pairs and phase out USDC-settled options and futures by the end of the month.

Bullish has emerged as a strong competitor, now rivaling Binance with a 32% share of the USDC market.

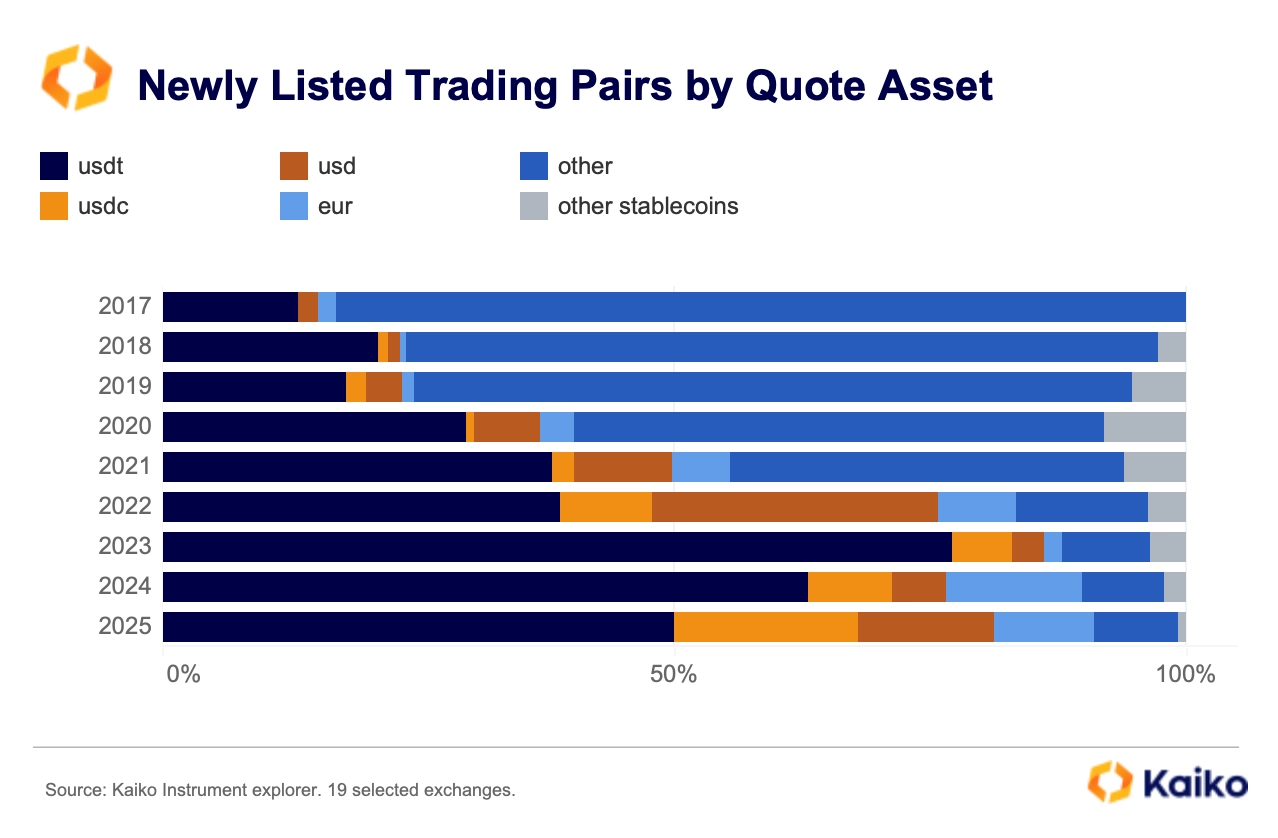

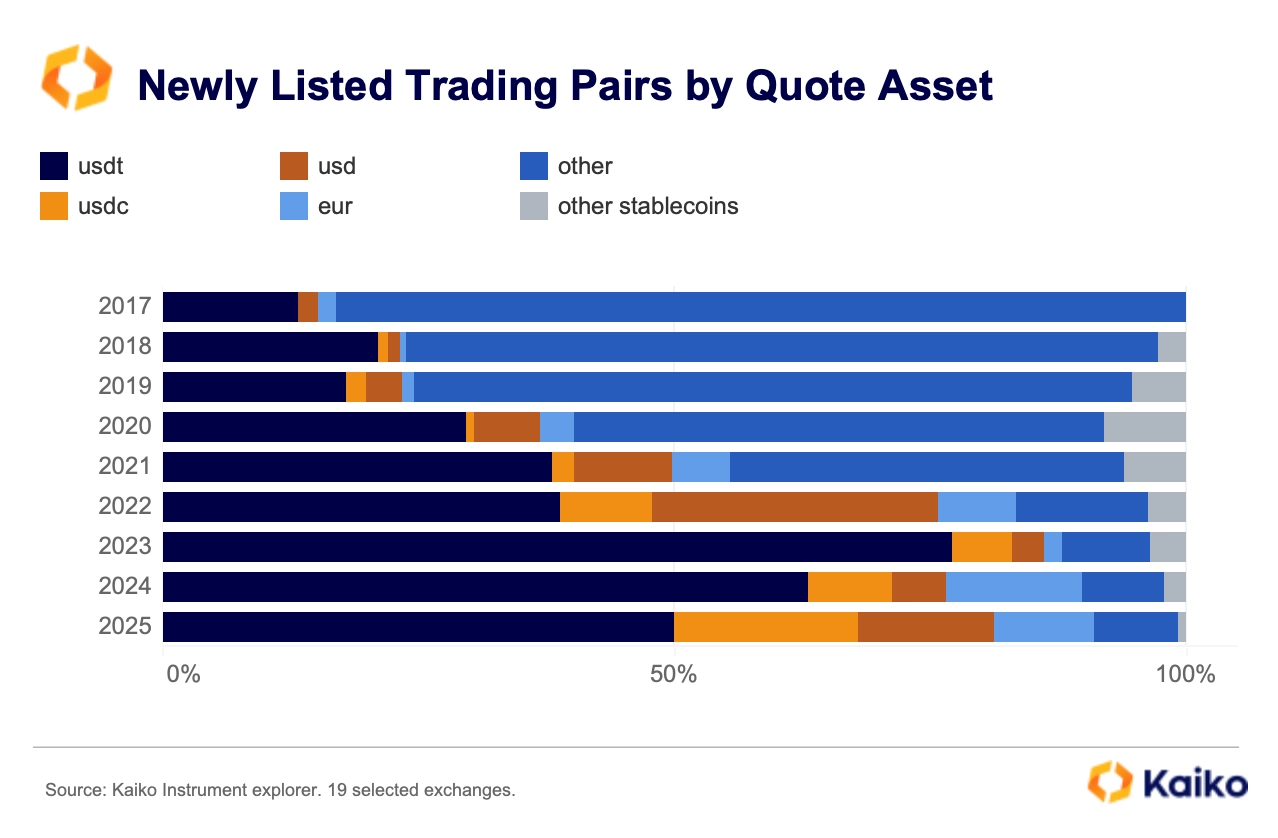

This shift is happening alongside a broader decline in the share of newly listed USDT-quoted pairs, dropping from 77% of total listings in 2023 to below 63% in 2024 and just 50% so far in 2025—pointing to intensifying competition among stablecoins.

Interestingly, EUR-backed trading pairs are gaining traction, potentially signaling a revival in EU markets following last year’s implementation of MiCA. For a deeper dive into EUR market trends, check out our latest report.

Altcoins liquidity increases unevenly accross tokens.

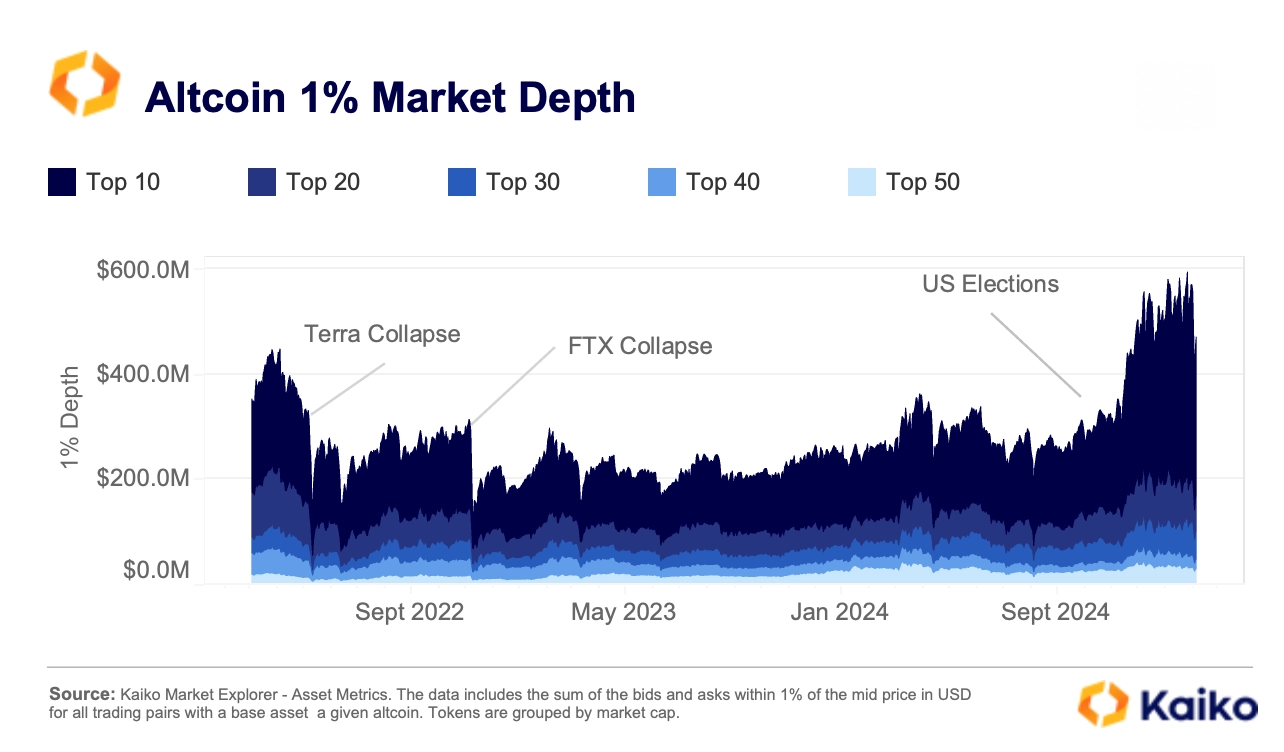

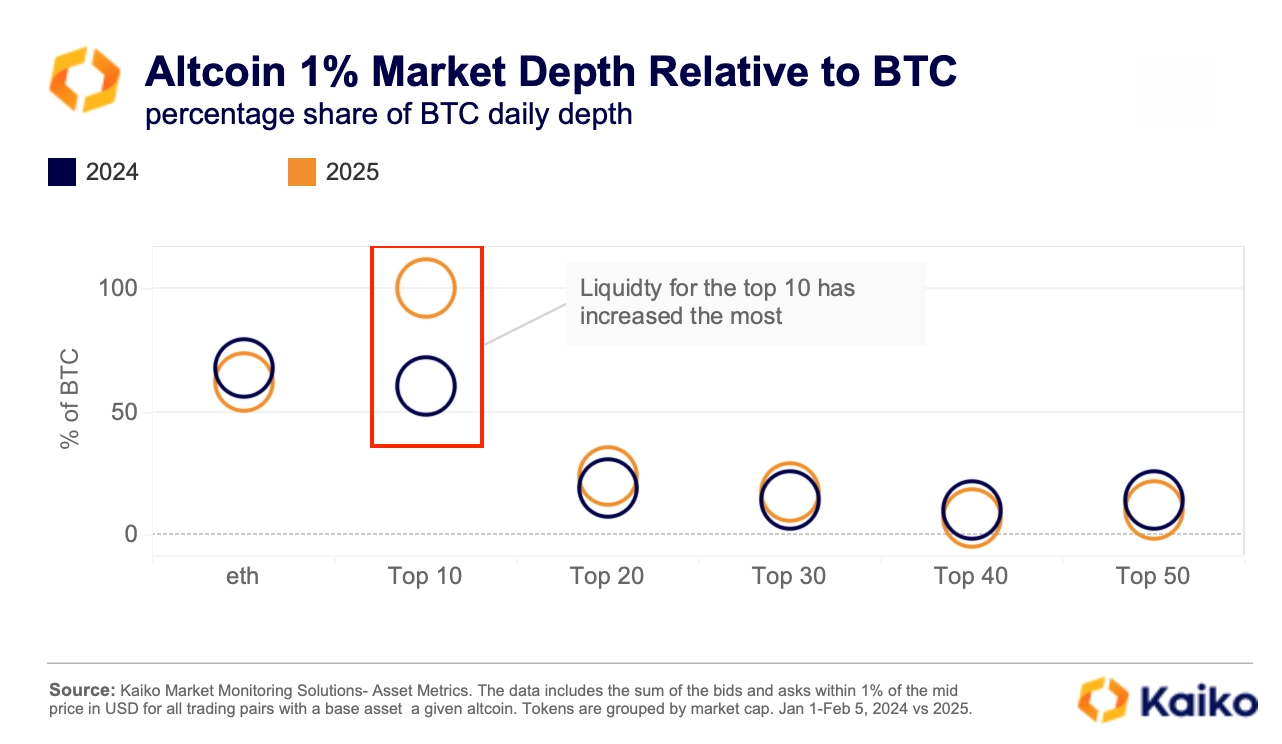

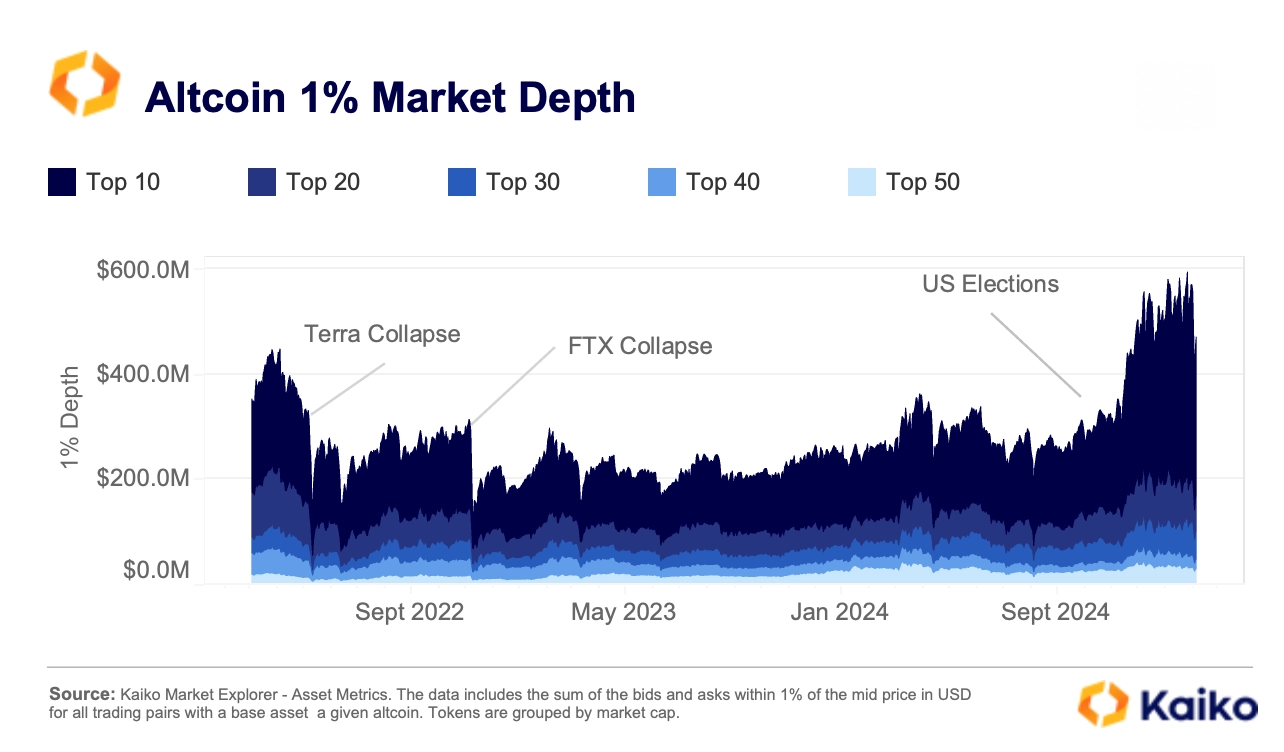

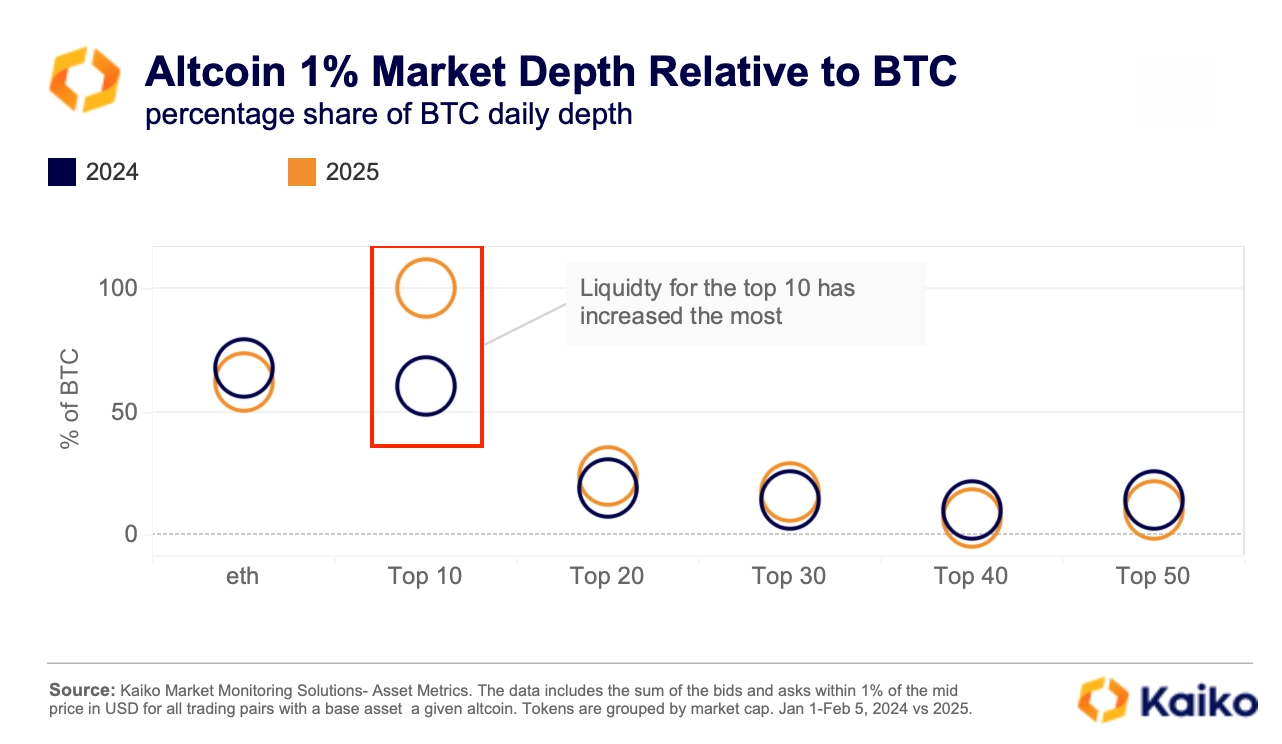

The outlook and sentiment around altcoins have improved since the U.S. elections, fueling a wave of new altcoin ETF filings and a surge in trading activity. Daily altcoin liquidity—measured by the 1% market depth of the top 50 tokens—has nearly doubled since September, reaching $960mn.

However, liquidity remains highly concentrated, with the top 10 altcoins now accounting for 64% of total market depth. Mid-cap tokens (top 20–30) have seen their share decline, while smaller caps (top 50) have surprisingly gained ground, surpassing higher market-cap groups (top 40) in liquidity share.

However, liquidity remains highly concentrated, with the top 10 altcoins now accounting for 64% of total market depth. Mid-cap tokens (top 20–30) have seen their share decline, while smaller caps (top 50) have surprisingly gained ground, surpassing higher market-cap groups (top 40) in liquidity share.

![]()

![]()

![]()

![]()