Altcoin volatility surges on strategic reserve news.

The U.S. strategic petroleum reserve dominated headlines during the previous administrations term, this time round it seems a strategic crypto reserve will steal the focus. On Sunday, President Trump announced its formation, initially naming XRP, SOL, and ADA before adding BTC and ETH.

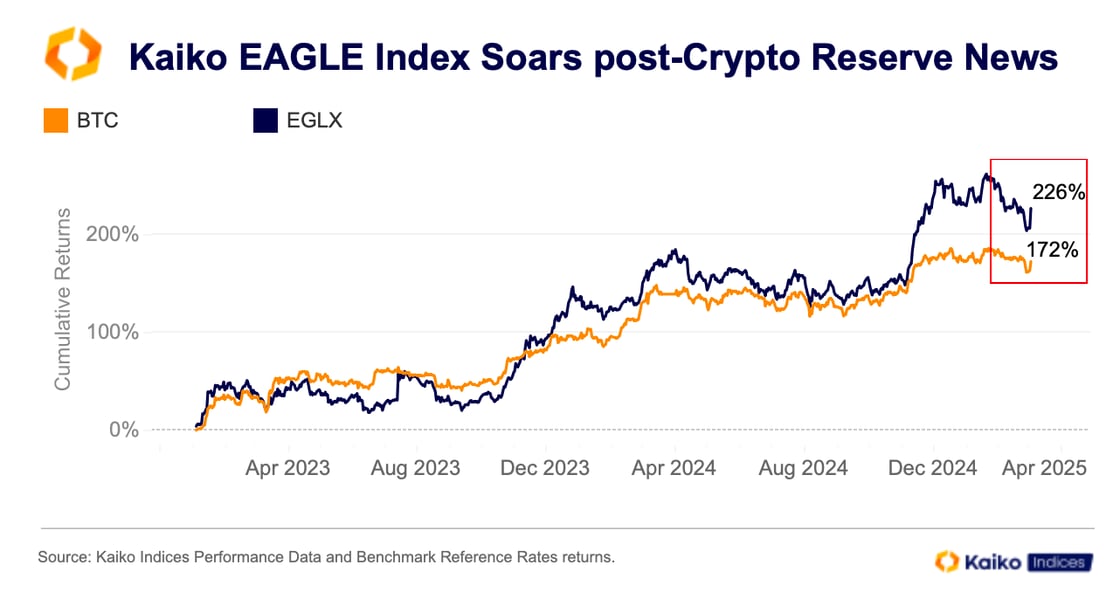

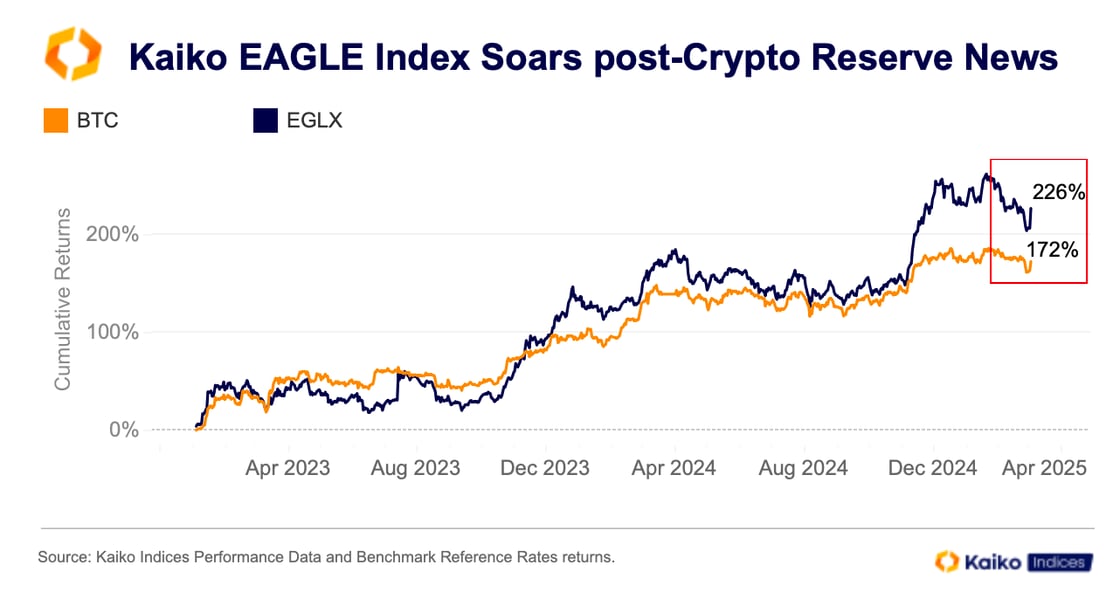

Following President Trump’s inauguration in January, Kaiko Indices launched the Kaiko EAGLE index to capture upside from these types of announcements. The EGLX index has jumped nearly 30% since Sunday, bringing its cumulative log returns since 2023 to over 226%, now outpacing BTC by more than 50 percentage points.

Both XRP and SOL are included in the regional index and have driven returns over the past 24 hours, alongside smaller tokens like AVAX.

Both XRP and SOL are included in the regional index and have driven returns over the past 24 hours, alongside smaller tokens like AVAX.

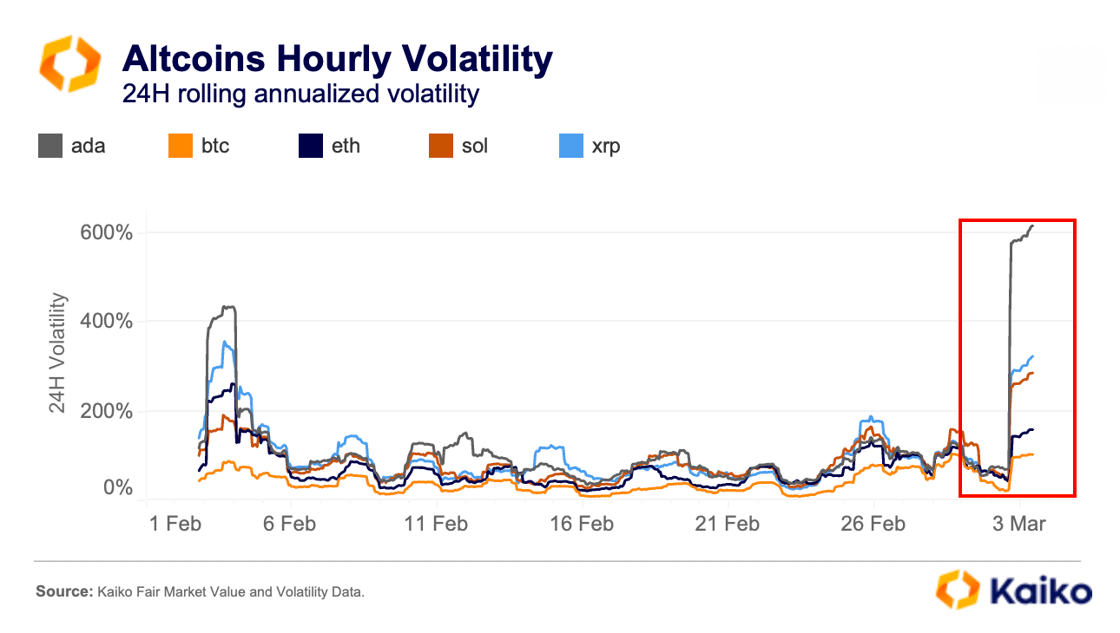

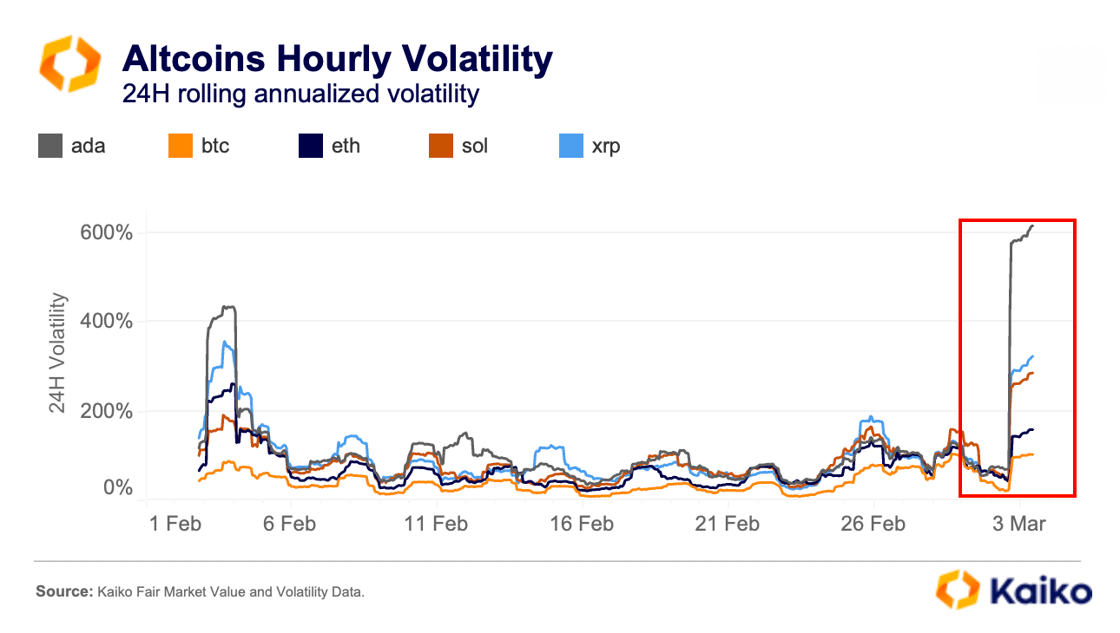

While BTC’s reaction has been relatively muted, market-wide volatility surged, particularly among altcoins. Hourly intraday volatility, which had remained below 200% since the February tariff selloff, spiked following the announcement—soaring past 600% for ADA, marking the largest increase among major altcoins.

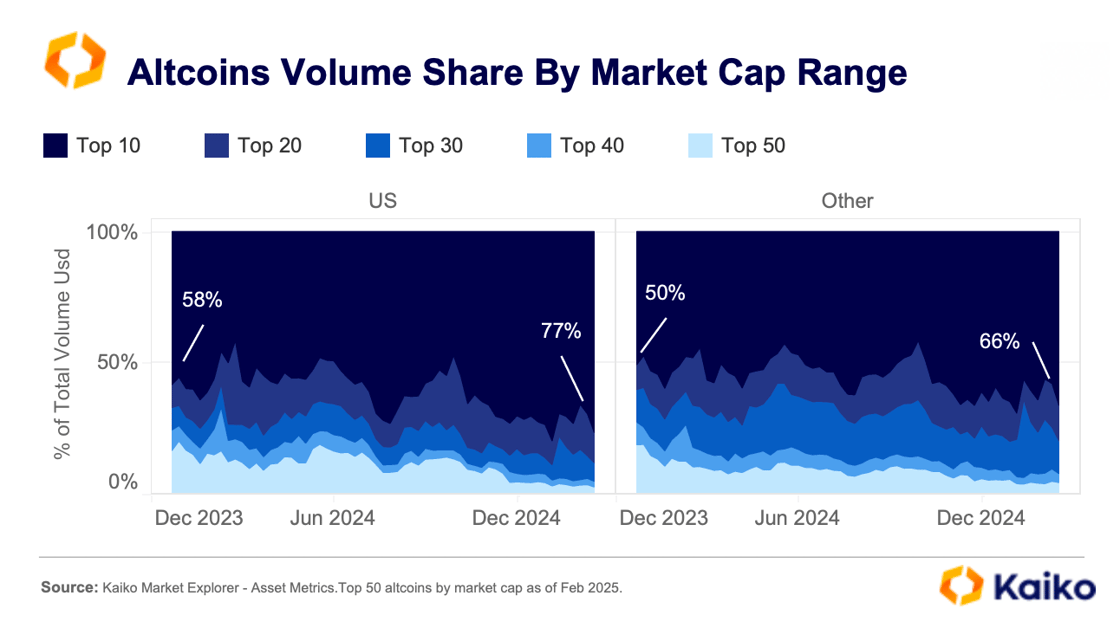

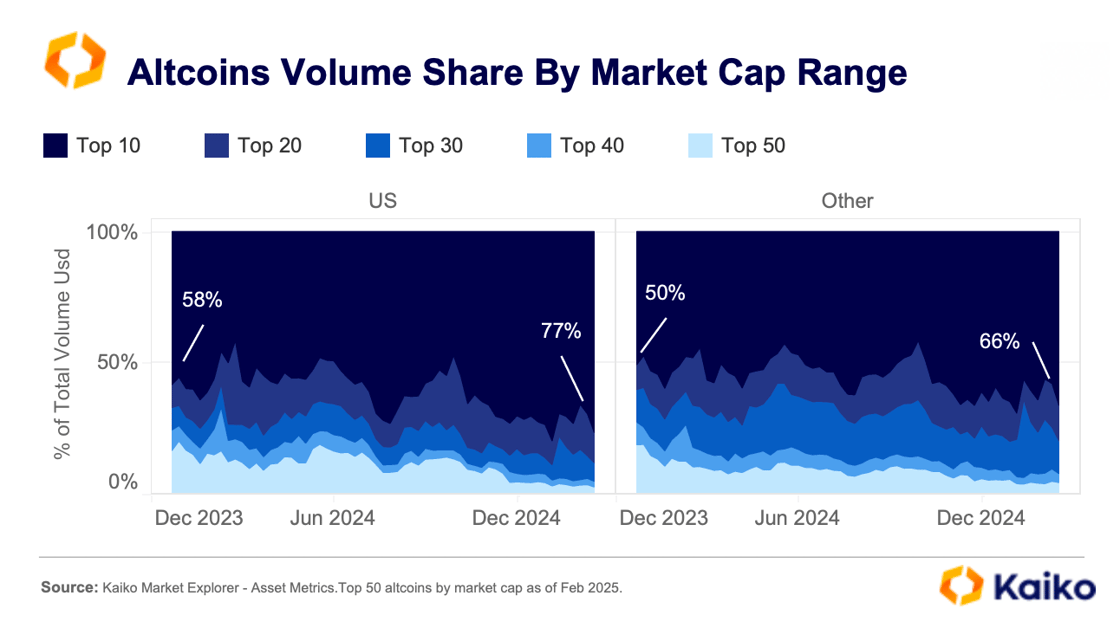

The inclusion of select altcoins in a U.S. strategic reserve is likely to accelerate capital rotation within altcoins, reinforcing the growing concentration of the altcoin rally. Since November, trading activity, particularly on U.S. exchanges, has become increasingly dominated by large-cap assets.

The inclusion of select altcoins in a U.S. strategic reserve is likely to accelerate capital rotation within altcoins, reinforcing the growing concentration of the altcoin rally. Since November, trading activity, particularly on U.S. exchanges, has become increasingly dominated by large-cap assets.

A year ago, the top 10 altcoins by market cap accounted for 58% of altcoin volume on U.S. platforms and 50% on offshore exchanges. As of last week, those shares had risen to 77% and 66%, respectively.

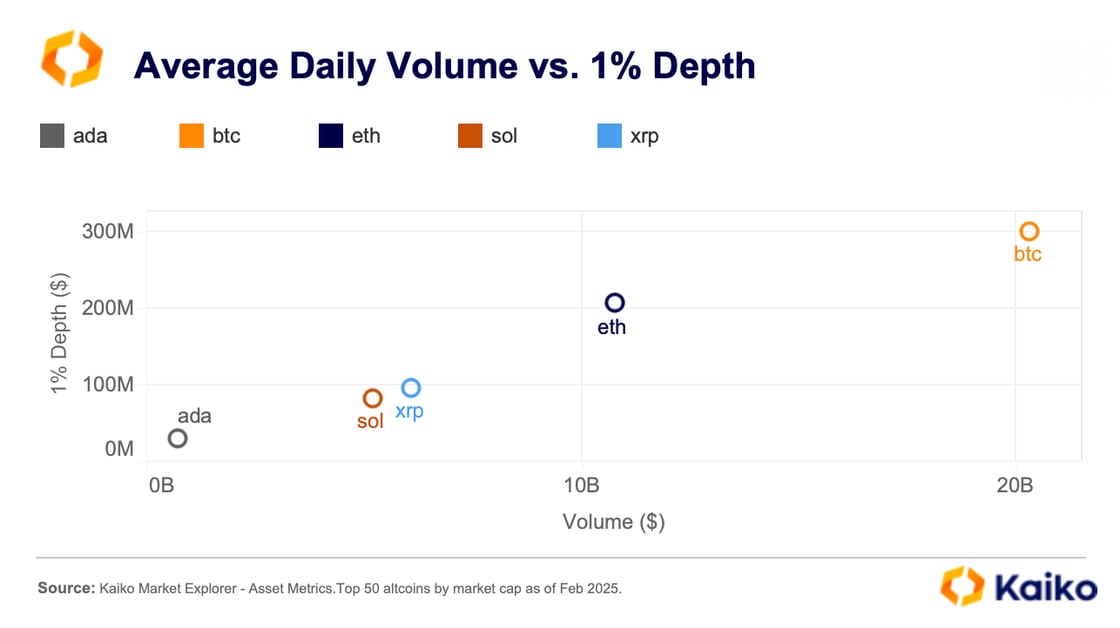

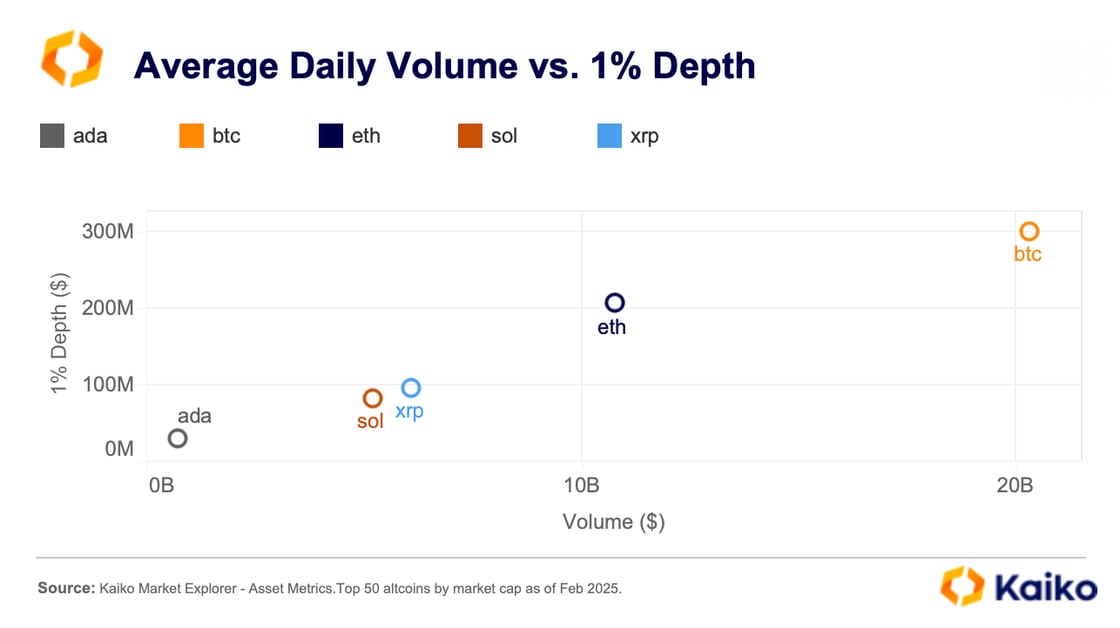

The rising volatility of altcoins and their concentration on certain exchanges may be tied to market liquidity. Altcoins, being less liquid than Bitcoin, could experience stronger price impacts. The chart below highlights Bitcoin’s dominance in trading volume and market depth, far surpassing the next most liquid altcoin, SOL.

Notably, ADA lags all other assets in the strategic reserve and could see the strongest price impact.

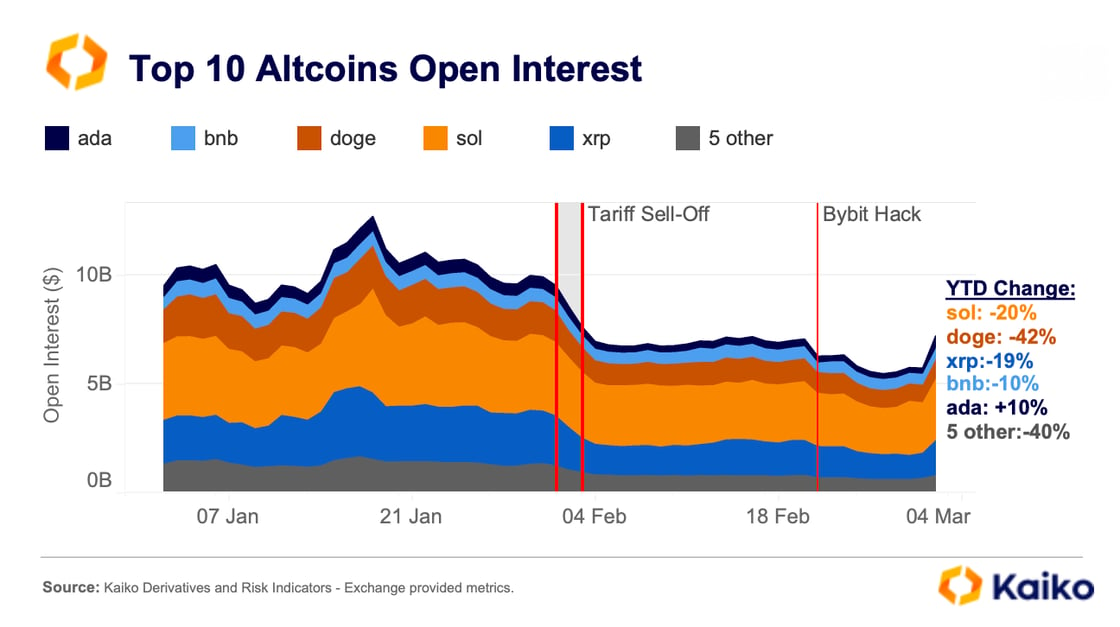

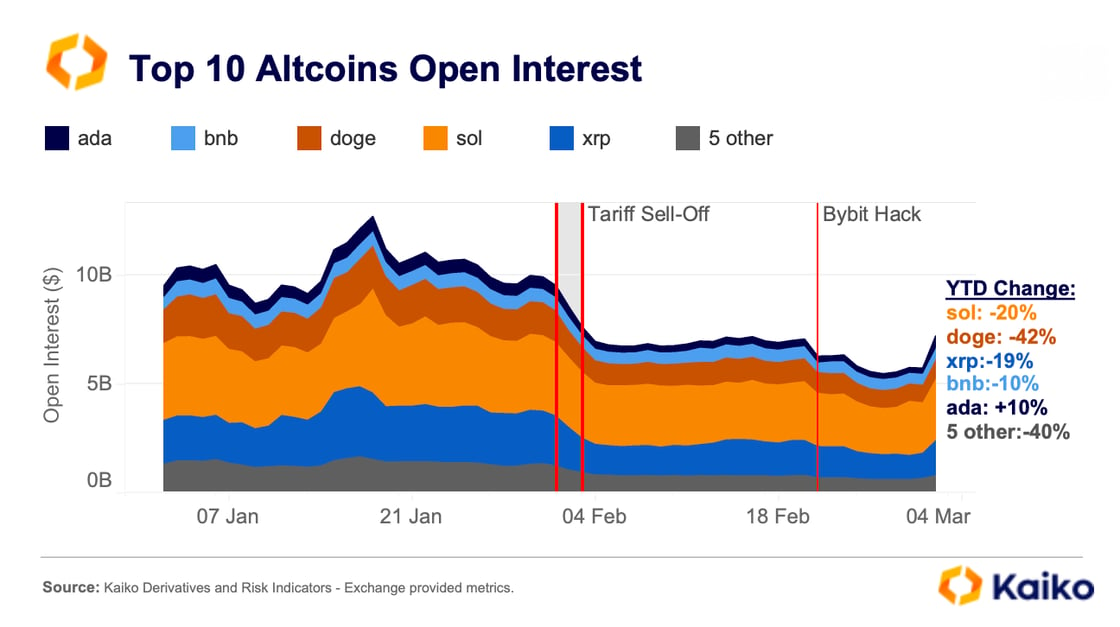

Looking at the number of open contracts on Bybit, OKX, and Binance, ADA has recorded the strongest capital inflows since the announcement. This suggests its inclusion in the reserve may not yet be fully priced in. ADA’s open interest is up 10% YTD to $554 million.

Overall, February’s market downturn triggered several waves of liquidations, reducing leverage for the top ten altcoins. This positioning reset is arguably leaving the market primed for a healthier, more sustained rally in the coming weeks.

Overall, February’s market downturn triggered several waves of liquidations, reducing leverage for the top ten altcoins. This positioning reset is arguably leaving the market primed for a healthier, more sustained rally in the coming weeks.

Data points

Bybit hackers move funds.

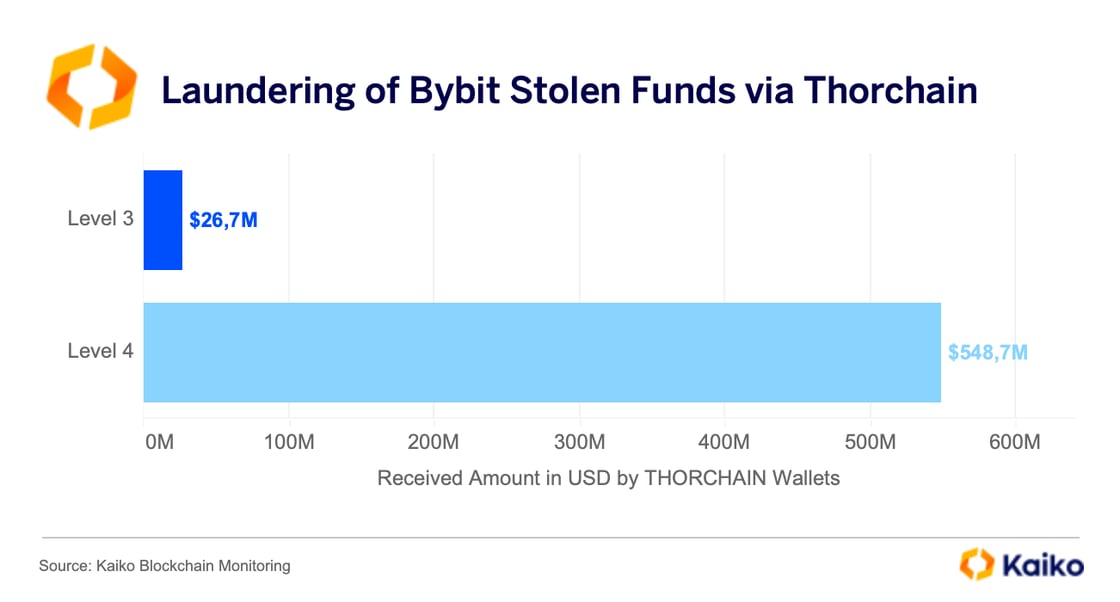

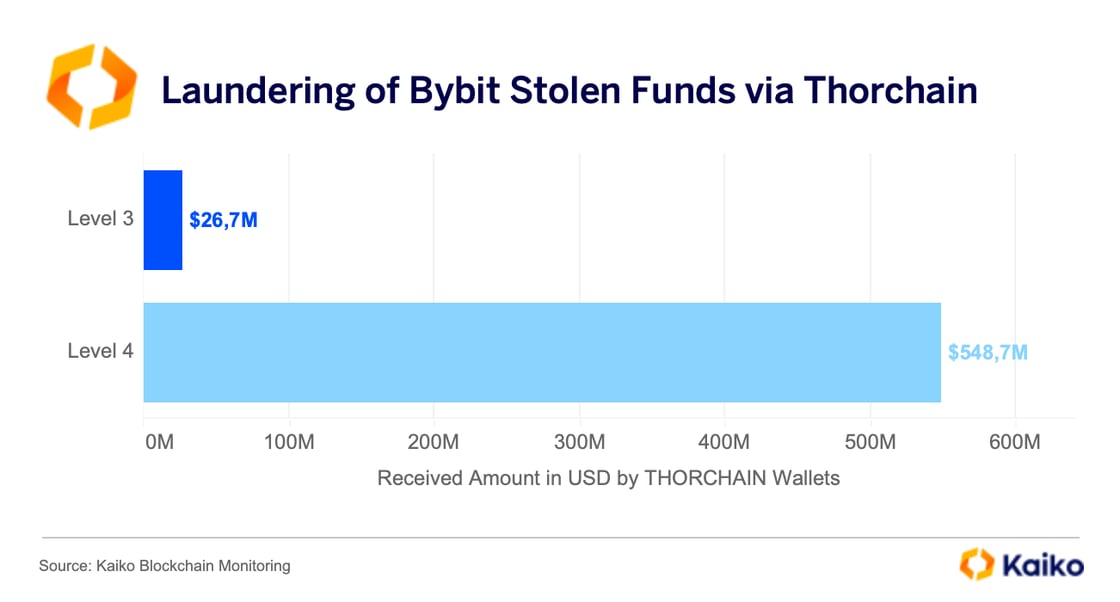

Just over a week after the $1.5 billion exploit of Bybit’s Ethereum wallet, most of the stolen funds remain in circulation. Analysis of wallets that received funds at various stages from the hacker’s original wallet suggests that the culprit, identified as the Lazarus Group by on-chain investigators, is using Thorchain to launder some of the stolen assets.

At least $25 million, transferred from Level 3 wallets to Thorchain wallets, appears to be linked to the Bybit exploit according to Kaiko data. However, the hacker has conducted additional transactions further along the laundering chain. While the full extent remains unclear, a portion of the $548 million sent from Level 4 wallets to Thorchain wallets is also likely connected to the stolen funds.

Funds sent by Level 3 wallets to Thorchain wallets are significantly more likely to be linked to the Bybit exploiter than those sent by Level 4 wallets. Level 3 wallets are those we identified as direct counterparties to Level 2 wallets—those transacting with identified exploiter wallets.

When will Saylor’s Strategy lose steam?

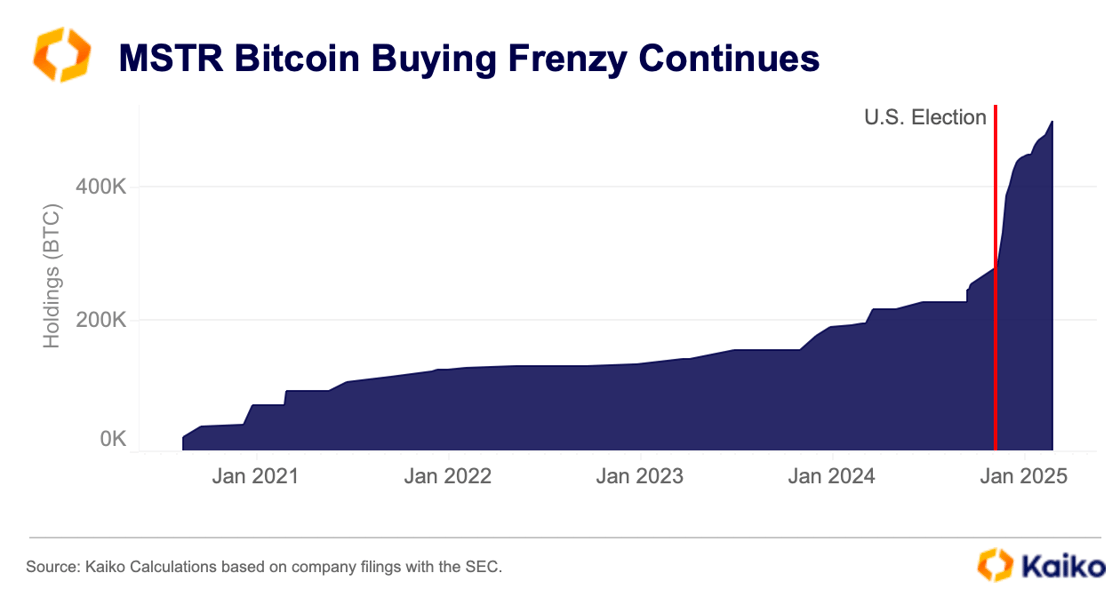

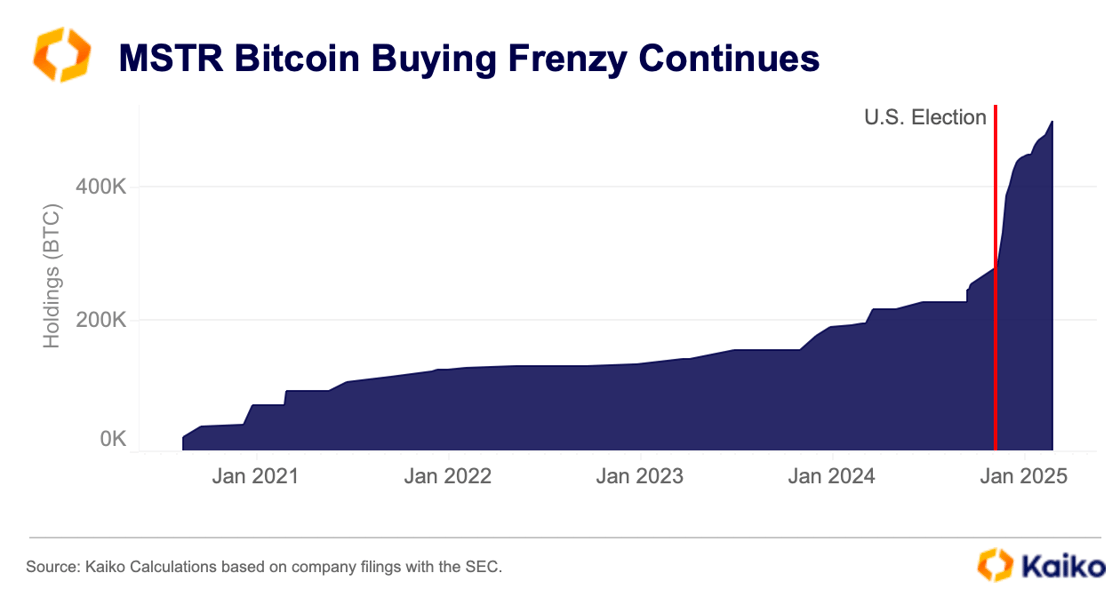

Michael Saylor’s recently rebranded Strategy took a breather from buying BTC this week. The business intelligence firm has added over 220K BTC since the U.S. election, nearly doubling its holdings as its total investment climbed to $33 billion.

However, the hype around Strategy might be losing steam. While BTC is flat year-to-date, MSTR has shed nearly 15%—although this could change by the end of today following the strategic reserve news.

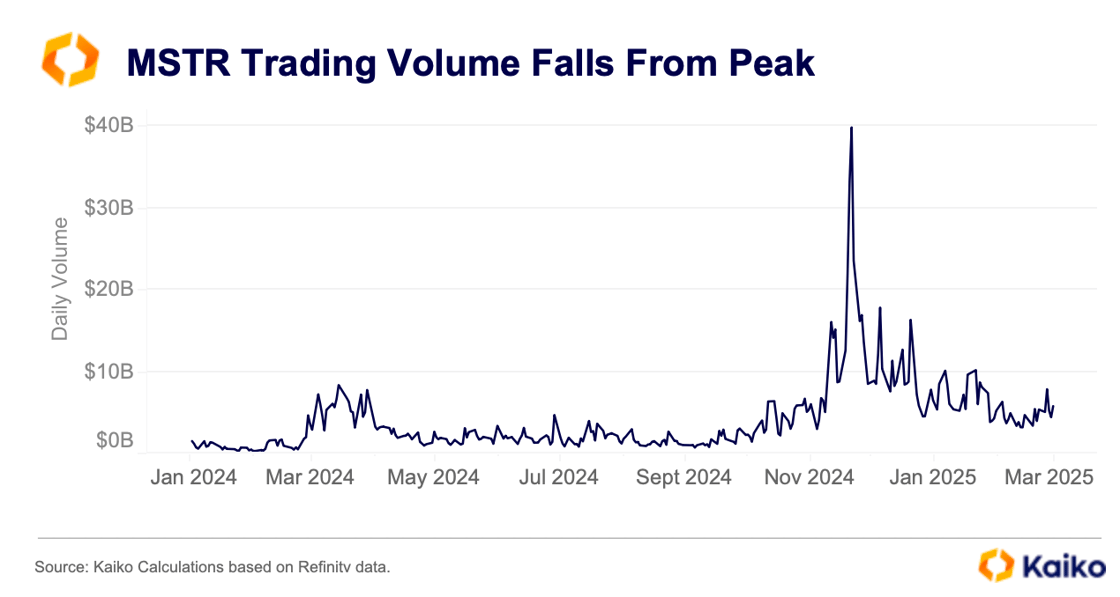

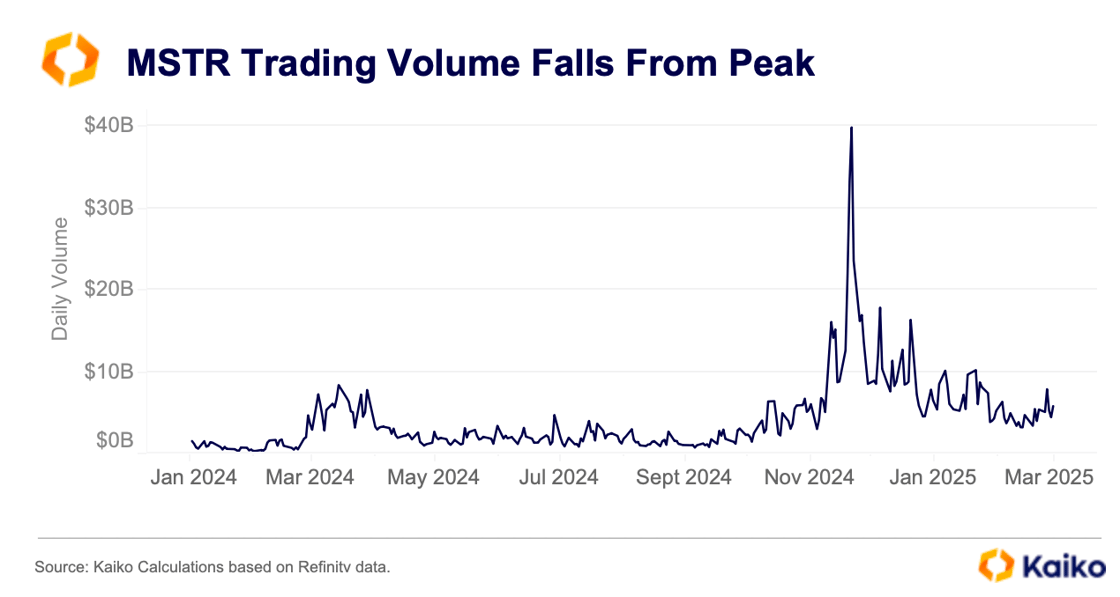

However, even a brief bump in the market today could mask a declining appetite for the high-risk BTC proxy. One sign of MSTR’s dwindling appeal is the daily trading volume of its shares.

Activity peaked in November after the U.S. election as BTC rose to $100K. At that time, the firm capitalized on market euphoria by issuing convertible bonds to further fund its BTC purchases. Saylor’s staunch support of BTC and his willingness to issue endless amounts of debt to fuel his passion have so far been met with strong demand in the bond market, with every issuance selling out. However, lower trading volumes and increased volatility in crypto markets might dampen that demand.

Even gamblers in prediction markets have adjusted their outlook on MSTR. This subset of the market is typically more risk-positive, but they appeared to lose faith in Saylor’s purchasing prowess in mid-February. A market on whether MSTR would hold 500K BTC before the end of March was tilted toward “no” for most of the month, despite the firm coming incredibly close to reaching 500K with a week to go.

TRUMP market share dips.

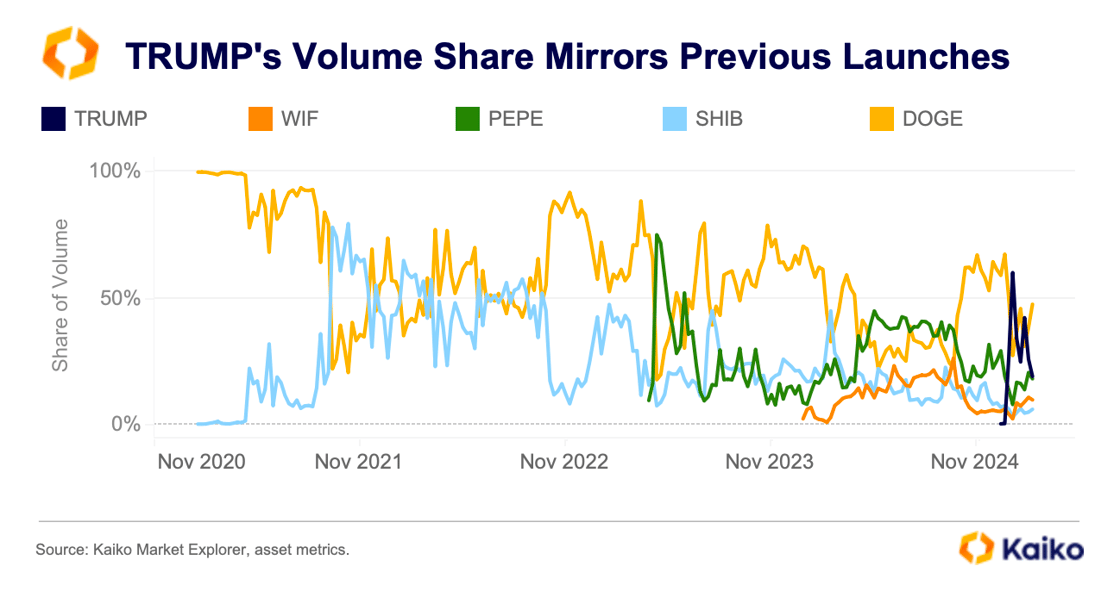

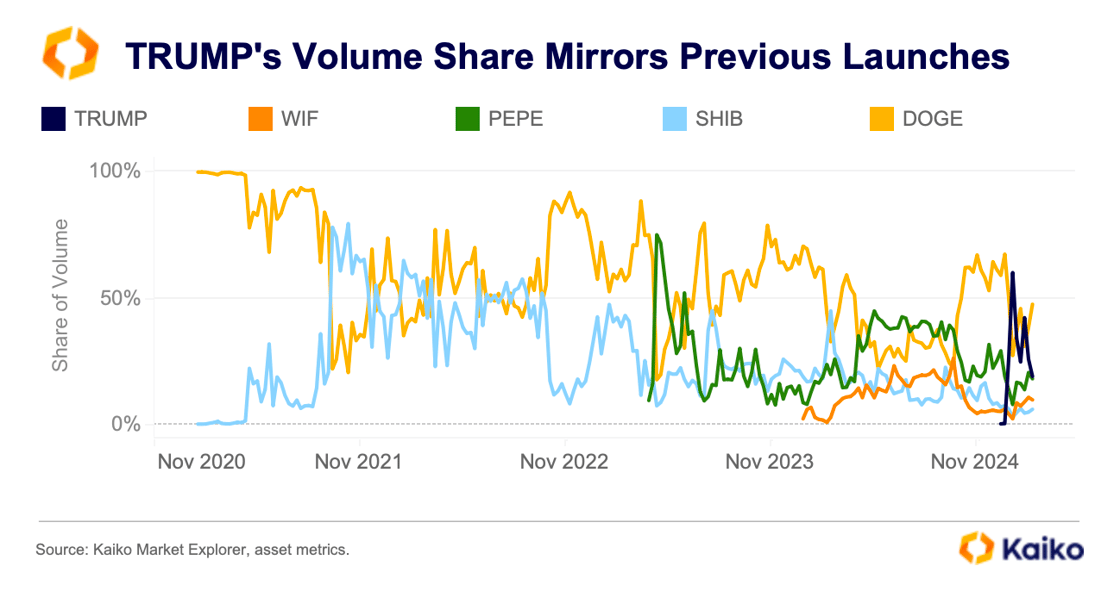

When it comes to the market share of memecoin trading on centralized exchanges, DOGE rarely comes in second place, and when it does, it’s not usually there for long. So, it shouldn’t have been too surprising to see TRUMP, the U.S. President’s newly minted memecoin, eclipse it earlier this year.

TRUMP launched several days before the 45th and 47th President’s inauguration, causing a massive spike in activity. It remains one of the largest memecoins by trading volume, but its share has slipped to 18% from as much as 60% in January. However, this is unlikely to spell the end of the TRUMP token mania.

During the 2021 bull market, DOGE’s supremacy was tested by SHIB for several months. While DOGE eventually regained the upper hand, SHIB has intermittently challenged its share. Similarly, PEPE shot to fame in mid-2023 and briefly eclipsed DOGE before spending even longer at the top over the summer of 2024—amid a flurry of activity and new listings on centralized platforms.

So, while TRUMP’s volume has fallen, it’s highly likely that an uptick in broader market activity will lead to spikes in its share of volume again. The current market environment appears to be weighing on smaller memecoins as traders prefer DOGE.

![]()

![]()

![]()

![]()

Both XRP and SOL are included in the regional index and have driven returns over the past 24 hours, alongside smaller tokens like AVAX.

Both XRP and SOL are included in the regional index and have driven returns over the past 24 hours, alongside smaller tokens like AVAX. The inclusion of select altcoins in a U.S. strategic reserve is likely to accelerate capital rotation within altcoins, reinforcing the growing concentration of the altcoin rally. Since November, trading activity, particularly on U.S. exchanges, has become increasingly dominated by large-cap assets.

The inclusion of select altcoins in a U.S. strategic reserve is likely to accelerate capital rotation within altcoins, reinforcing the growing concentration of the altcoin rally. Since November, trading activity, particularly on U.S. exchanges, has become increasingly dominated by large-cap assets.

Overall, February’s market downturn triggered several waves of liquidations, reducing leverage for the top ten altcoins. This positioning reset is arguably leaving the market primed for a healthier, more sustained rally in the coming weeks.

Overall, February’s market downturn triggered several waves of liquidations, reducing leverage for the top ten altcoins. This positioning reset is arguably leaving the market primed for a healthier, more sustained rally in the coming weeks.