Trump topples markets with tariff gambit

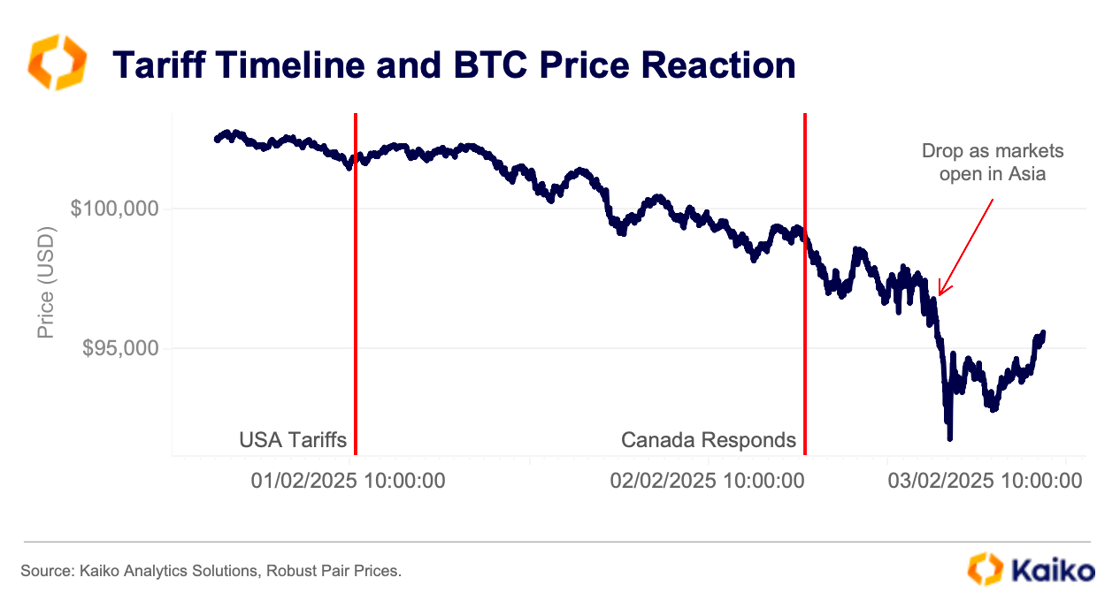

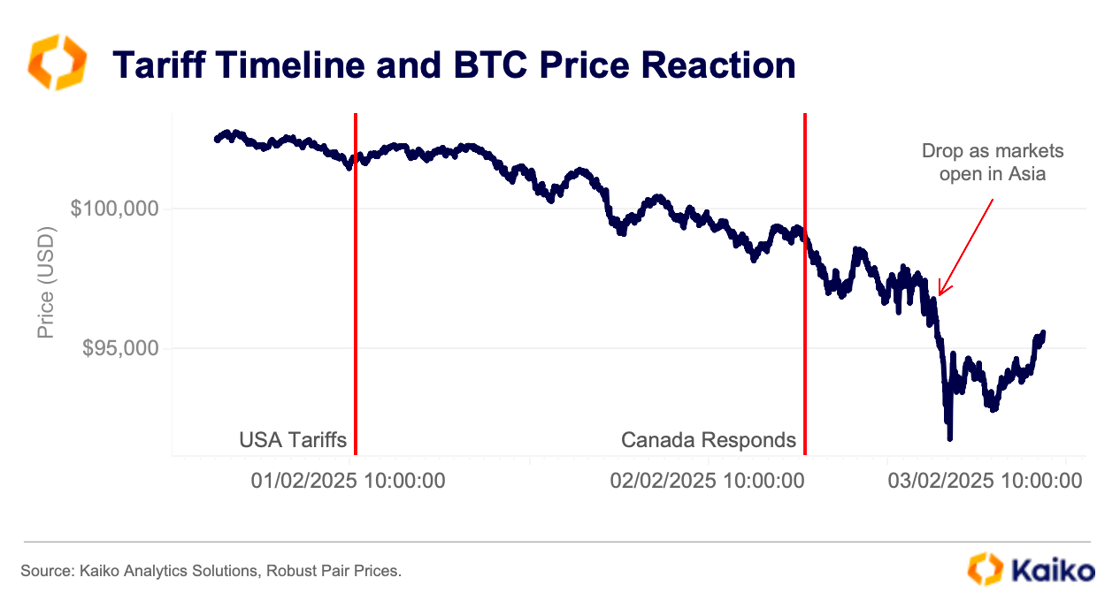

Crypto markets whipsawed over the weekend as a trade war looked set to break out after U.S. President Donald Trump placed tariffs on imports from Canada, Mexico, and China. The situation intensified following Canadian PM Trudeau’s decision to impost retaliatory tariff’s on US goods. As Asian markets opened on Monday BTC traded below $91K, but has since climbed back towards $96k.

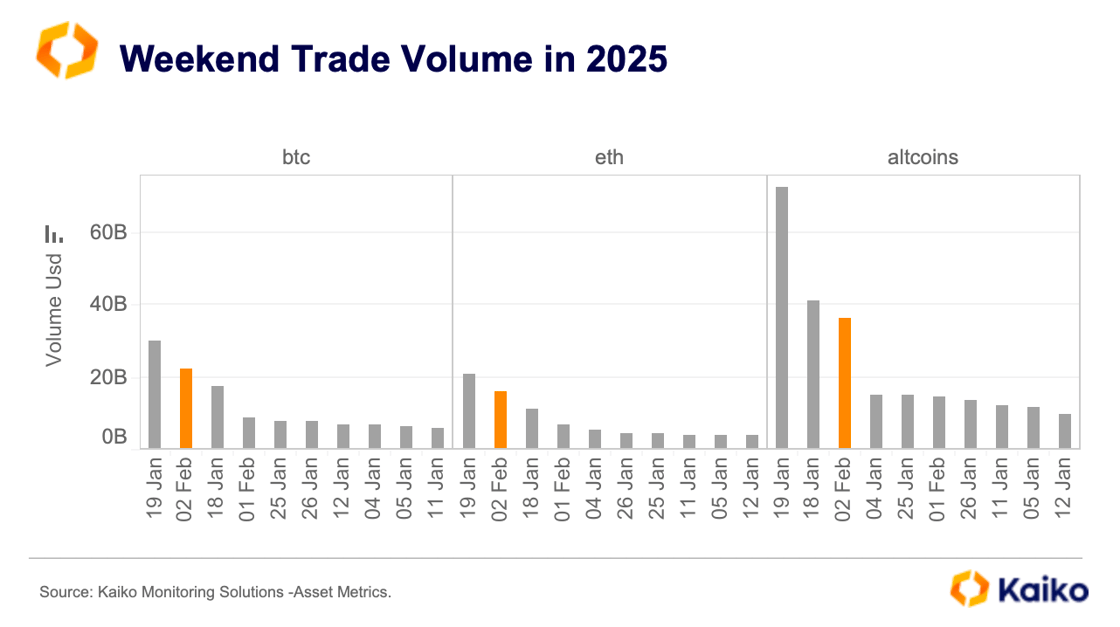

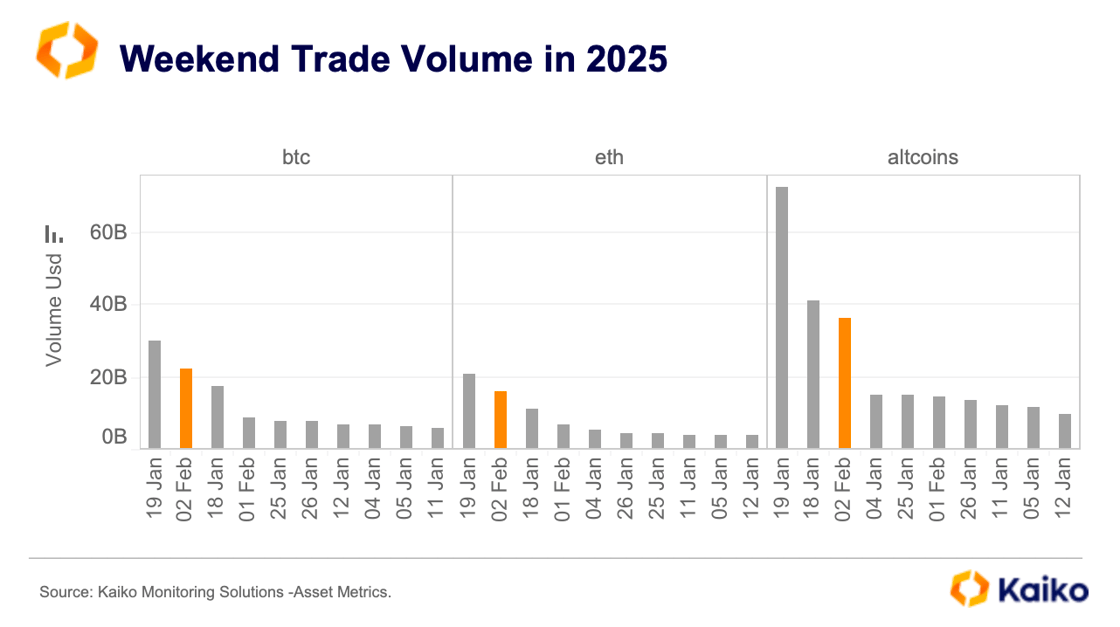

While trade volumes for BTC, ETH, and top altcoins were lower than January highs—they were relatively elevated for a weekend, with Sunday marking the most active trading session since January 19.

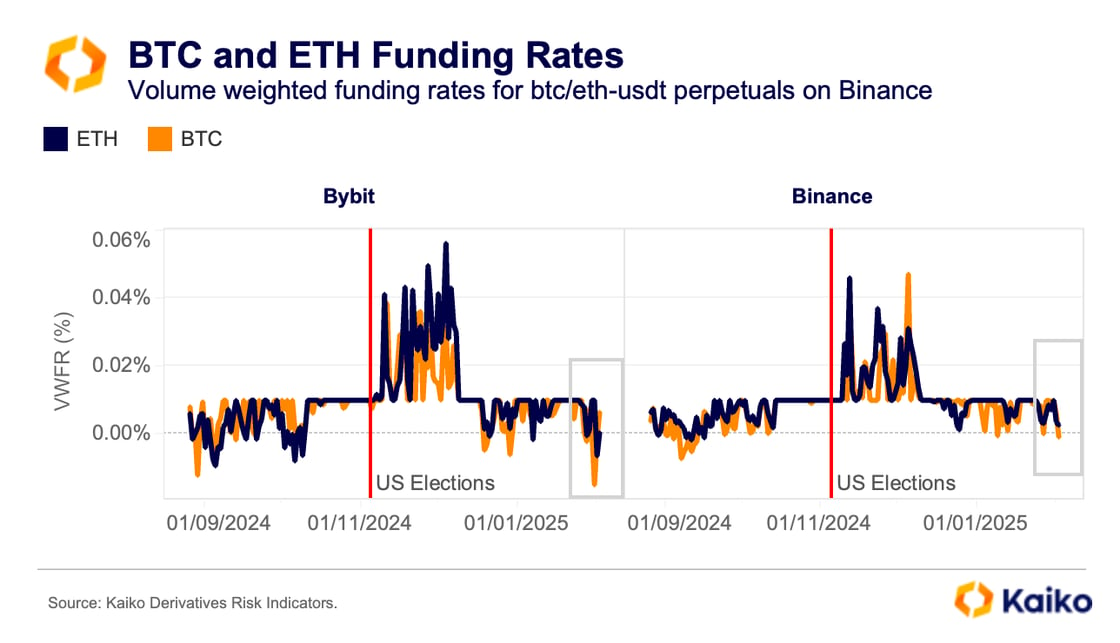

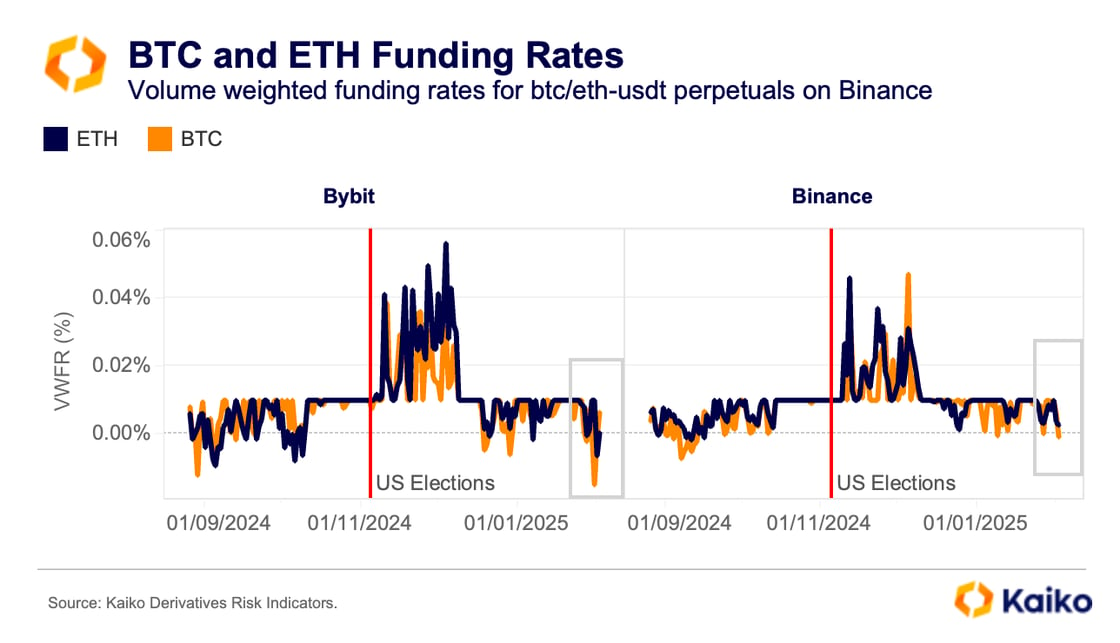

A wave of liquidations in the derivatives market has also fueled volatility. BTC and ETH open interest (not charted) on Binance, Bybit, and OKX dropped over the weekend by 4% and 12%, respectively. As for funding rates, they turned negative for the first time since early January, signaling increased short positioning.

Overall, funding rates—often a gauge of market sentiment—have remained subdued this year, reflecting a market struggling for clear direction amid growing uncertainty.

Pricing in options markets quickly reacted to the tariff news as well. The IV smile below shows a skew to left on near-term expiries, up until February 14.

This means there’s more demand for protection in the short-run, but that trend doesn’t extend to the end of the month. The February 21 and 28 expirations are far more evenly balanced, implying the recent the current price action could be short-lived.

This means there’s more demand for protection in the short-run, but that trend doesn’t extend to the end of the month. The February 21 and 28 expirations are far more evenly balanced, implying the recent the current price action could be short-lived.

The balance here is typical in BTC markets, where prices are just as likely to rip higher as they are to plunge lower. The lack of a clear direction, skew left or right, at the end of the month suggests markets see BTC prices holding up well amid the tariff driven turmoil. Although, this might be a sign of mispricing risk in crypto markets, which were clearly caught off guard by Trump’s policy decision this weekend.

Data Points

Is the meme frenzy over?

Most meme tokens have lagged the broader market this year, with declines of 10% and 70% YTD, but the frenzy is far from over.

Despite volatility, meme tokens outperformed last year, and the surge in new launches—especially on Solana—signals ongoing interest. More than just speculation, meme tokens thrive on hype, entertainment, and the promise of quick gains, mirroring a broader post-COVID shift toward digital entertainment and gamified investing.

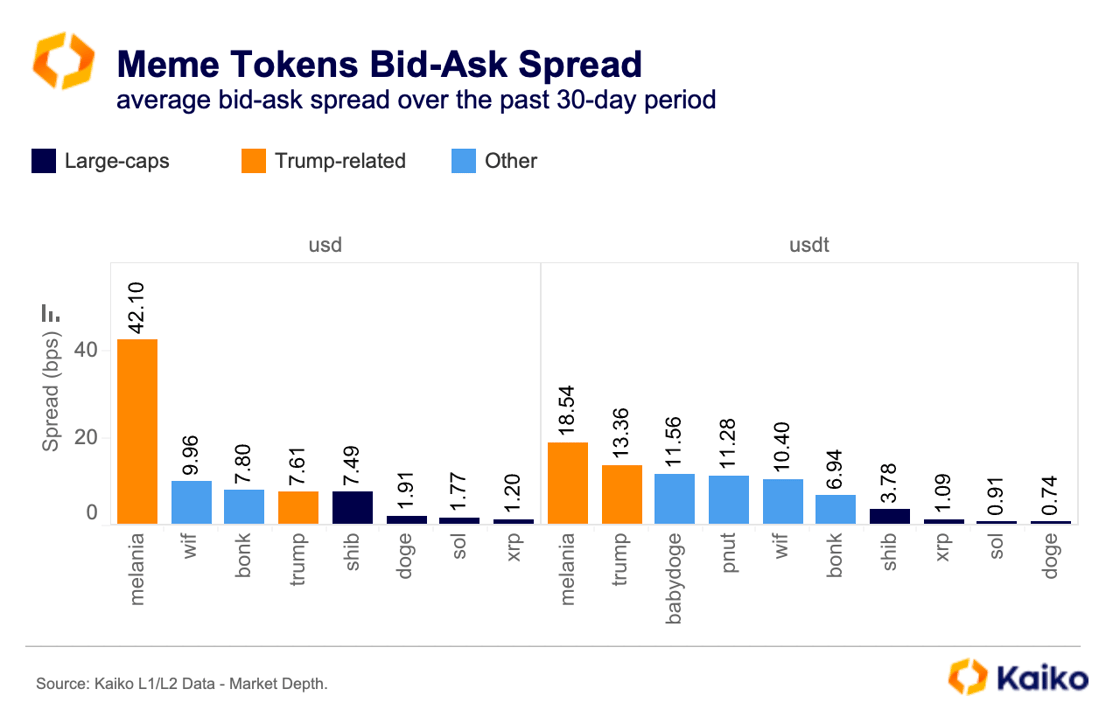

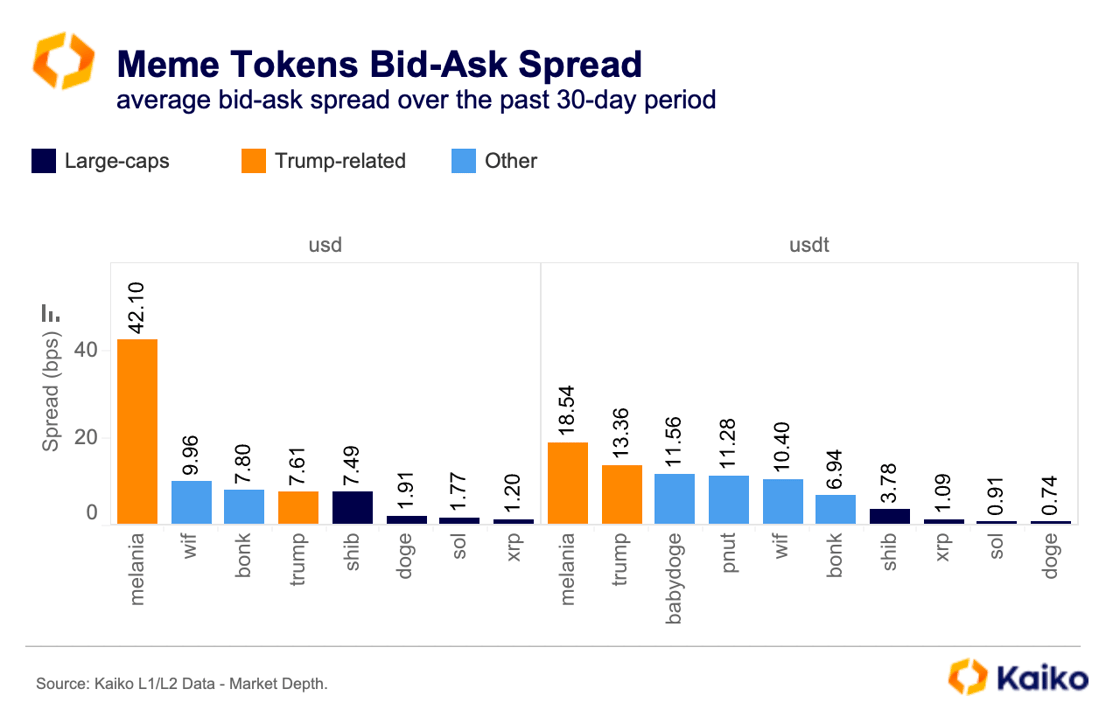

They’re also highly profitable for both exchanges and market makers. The average bid-ask spread for these tokens – which represents the amount earned by market makers for providing liquidty – far exceeds those of large-cap altcoins like SOL and XRP.

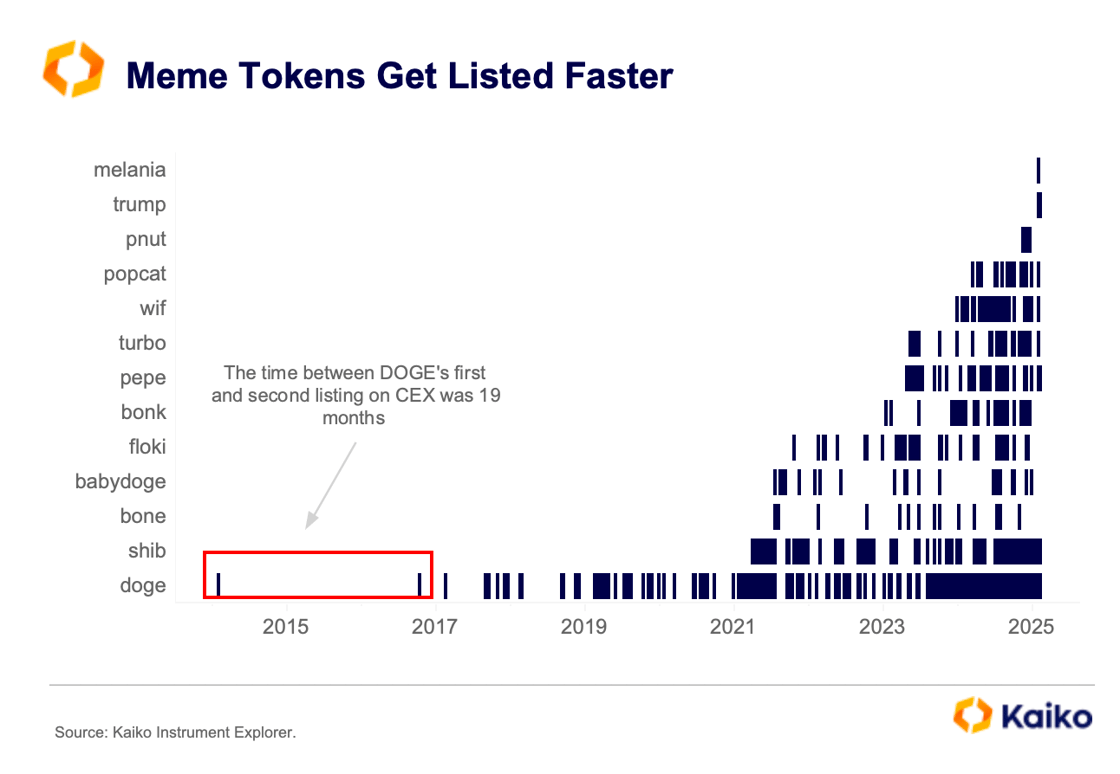

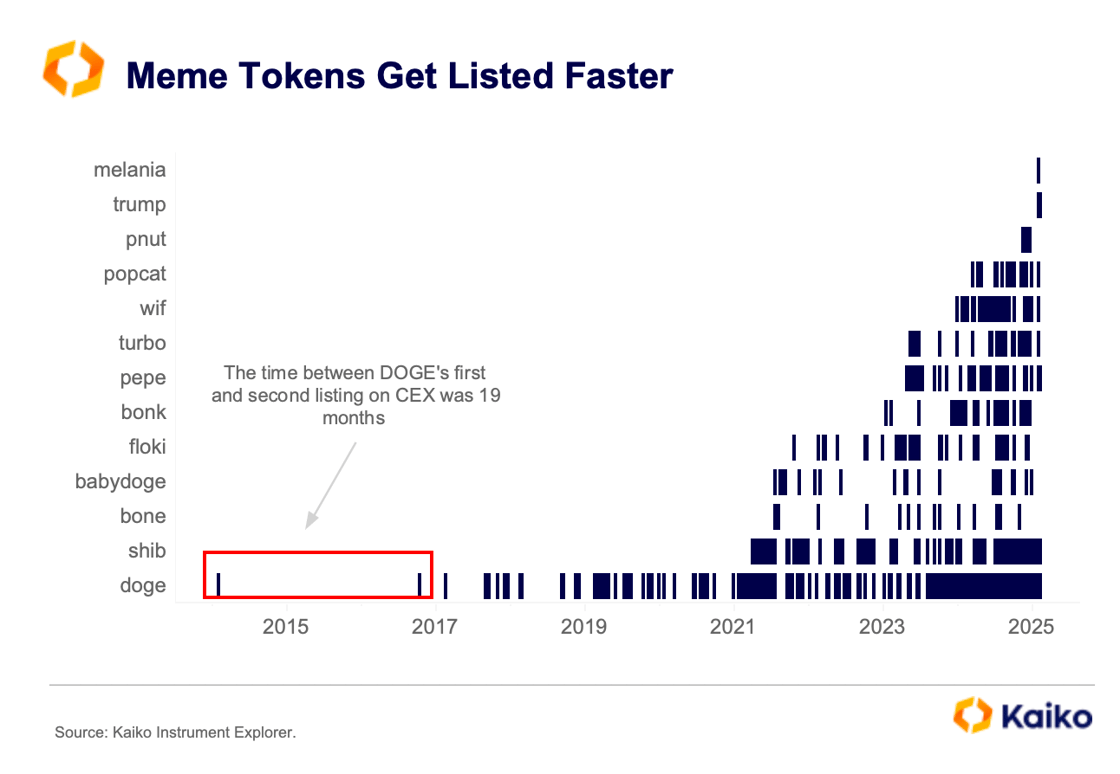

Exchanges are also profiting significantly from meme trading, which generates millions in trading fees, with listings on CEXs accelerating since 2020. While U.S.-regulated exchanges still list them more slowly than offshore platforms, the gap between offshore launches and U.S. listings has narrowed from years to months.

Some tokens, like PNUT, TRUMP, and MELANIA, landed on Binance and Coinbase within days, likely boosted by their ties to the U.S. President and the hype they generated.

Major US exchanges, like Coinbase, are now considering a move from an “allowlist” to a “blocklist” strategy to manage the influx of tokens more efficiently.

However, the rapid pace of listings, especially for highly volatile meme tokens, brings challenges. Meme tokens often generate massive volumes that far exceed available liquidity, particularly at launch. TRUMP, for example, saw $16bn in volume on Jan 20—nearly 30% of Bitcoin’s daily volume—while its initial volume-to-depth ratio surpassed 1000 (not charted).

If listings happen too quickly, liquidity may fail to keep up with the rising volumes, intensifying volatility. This mismatch will force market makers to widen bid-ask spreads to compensate for the increased risk, ultimately driving up costs for traders.

Altcoins sell-off deepens on Upbit.

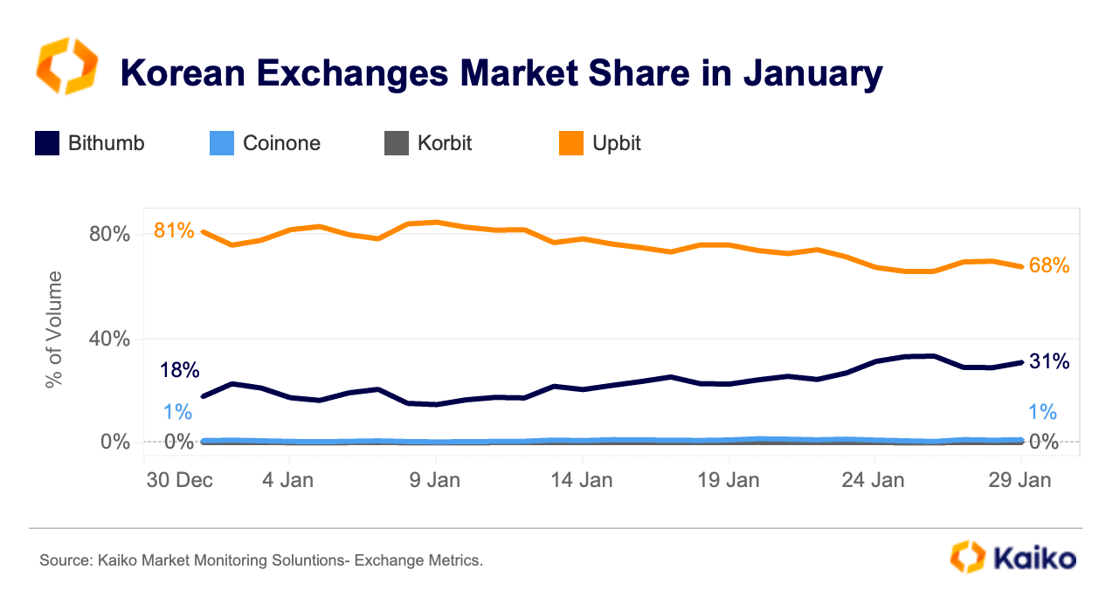

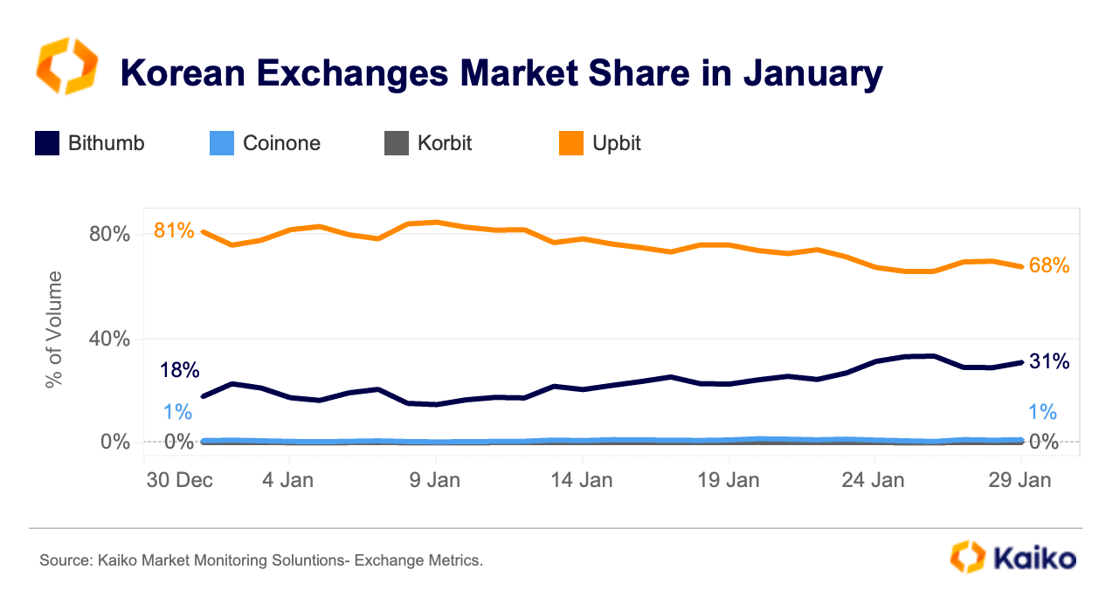

Korean crypto trading volumes have dropped significantly since December’s political unrest, with daily volumes on major platforms falling from $9bn in November to around $1bn. This decline was particularly sharp on Upbit, which faces regulatory scrutiny over KYC violations, alongside broader derisking by local traders.

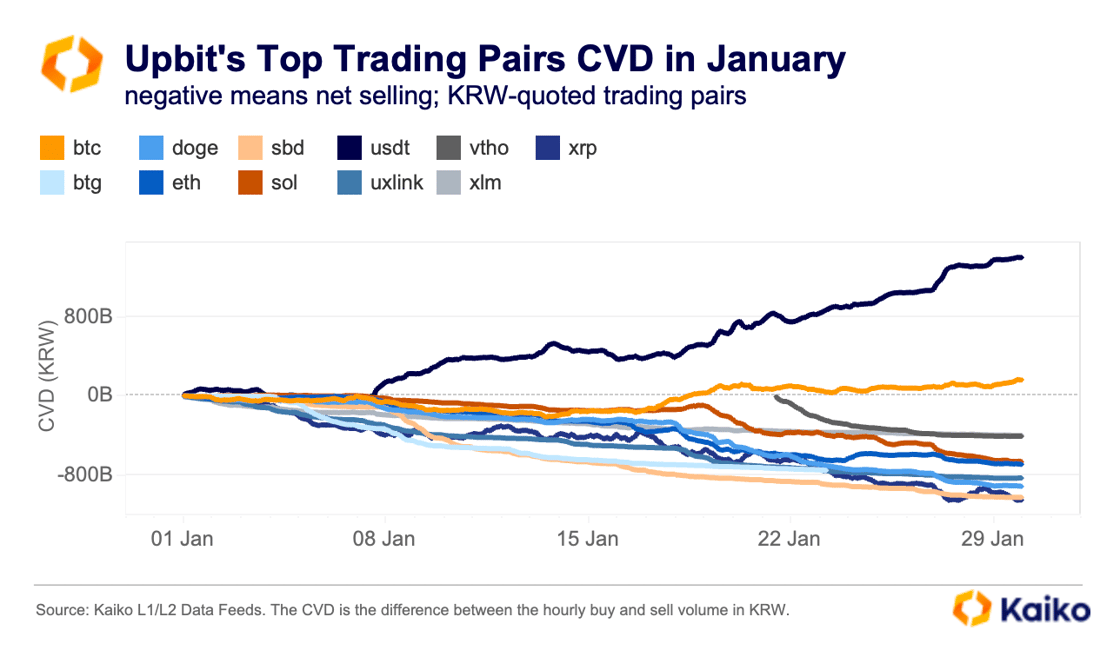

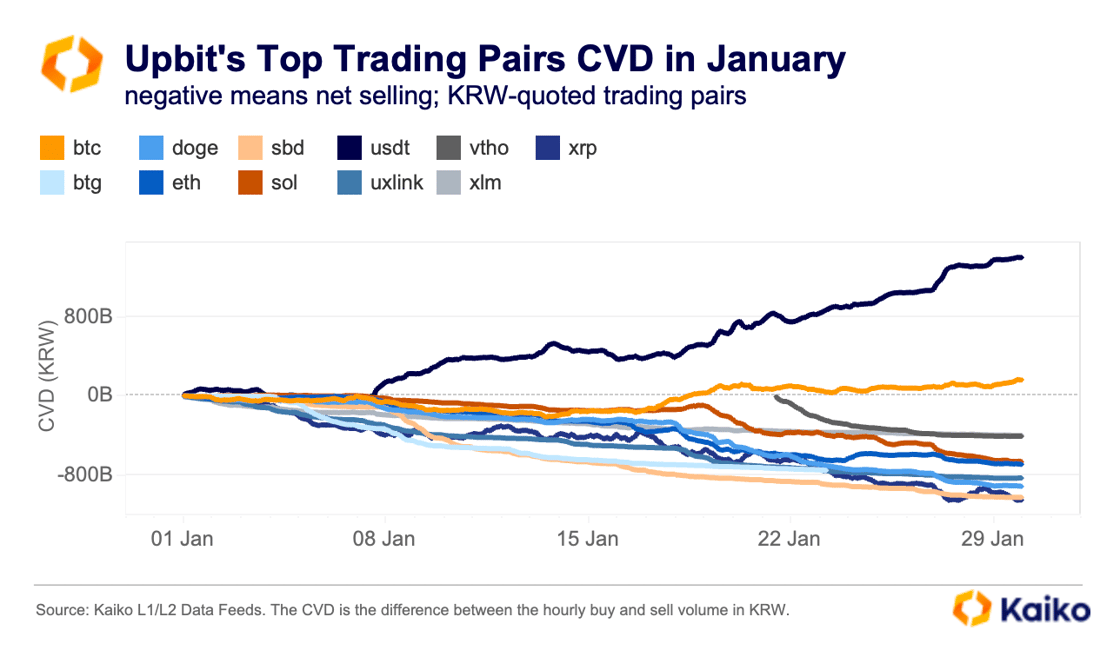

Breaking the trend down by asset, altcoins—led by XRP and DOGE—continued to see strong selling pressure throughout January, whereas BTC and USDT’s cumulative volume delta (CVD) remained net positive in January.

Interestingly, however, while both XRP and DOGE experienced net selling, the structure of the sell-off differed. The chart below shows the distribution of the number of trades for XRP-KRW and DOGE-KRW on Upbit, categorized by trade size and price range. The x-axis represents the price range of trades in Won, the y-axis represents the number of trades within each price range.

For DOGE, large orders dominated at the highest price ranges (around 575–600 KRW), potentially indicating that large traders or whales were leading the sell-off, likely taking profits.

For XRP, smaller orders were more prevalent at peak prices (4,750 KRW). XRP’s average trade size (not charted) steadily declined in January, adding evidence for a potential shift from institutional-sized orders to smaller, retail-driven trades.

For XRP, smaller orders were more prevalent at peak prices (4,750 KRW). XRP’s average trade size (not charted) steadily declined in January, adding evidence for a potential shift from institutional-sized orders to smaller, retail-driven trades.

XRP was by far the most actively traded asset in January with cumulative volume on Upbit of about $790mn, more than twice DOGE’s $284mn.

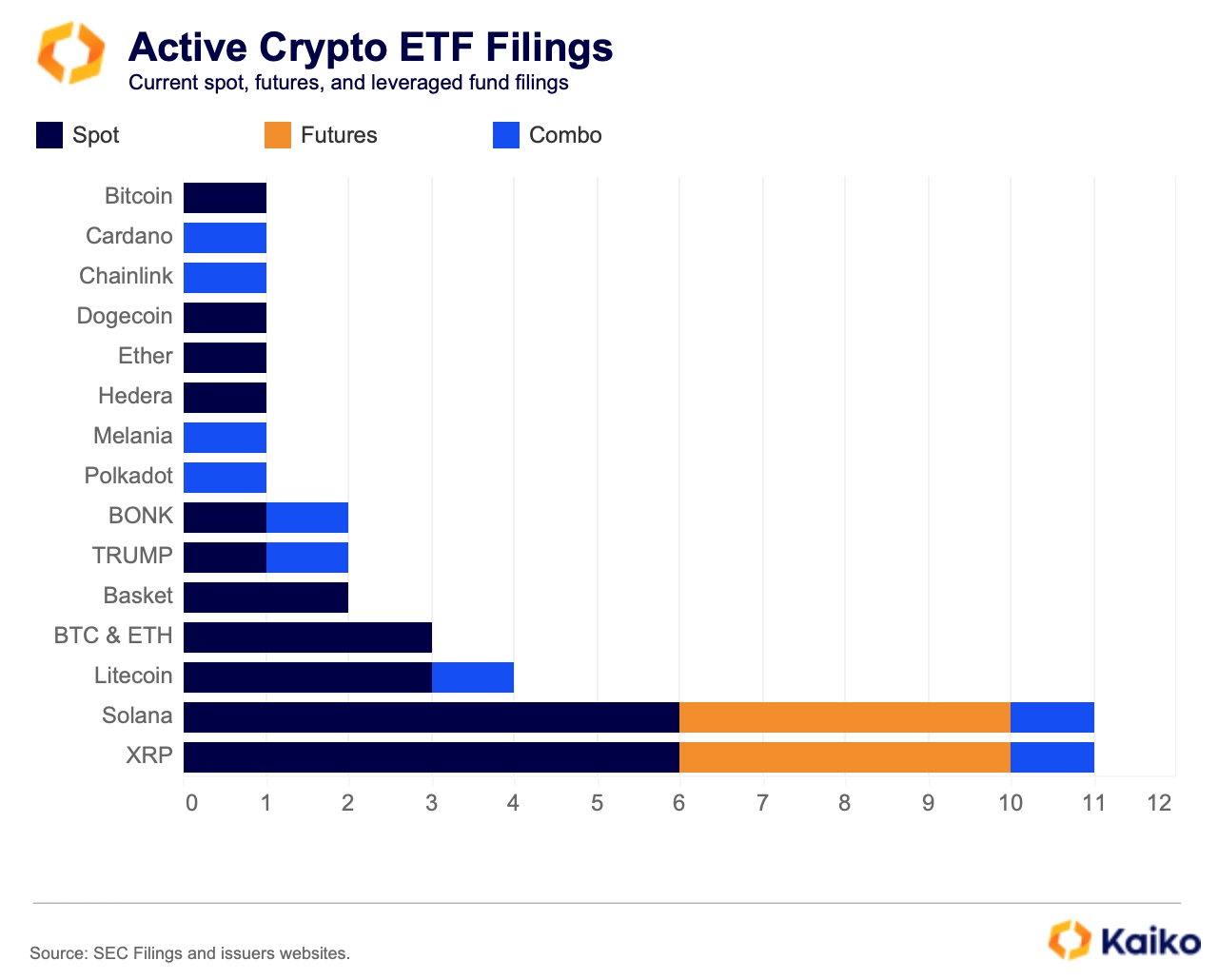

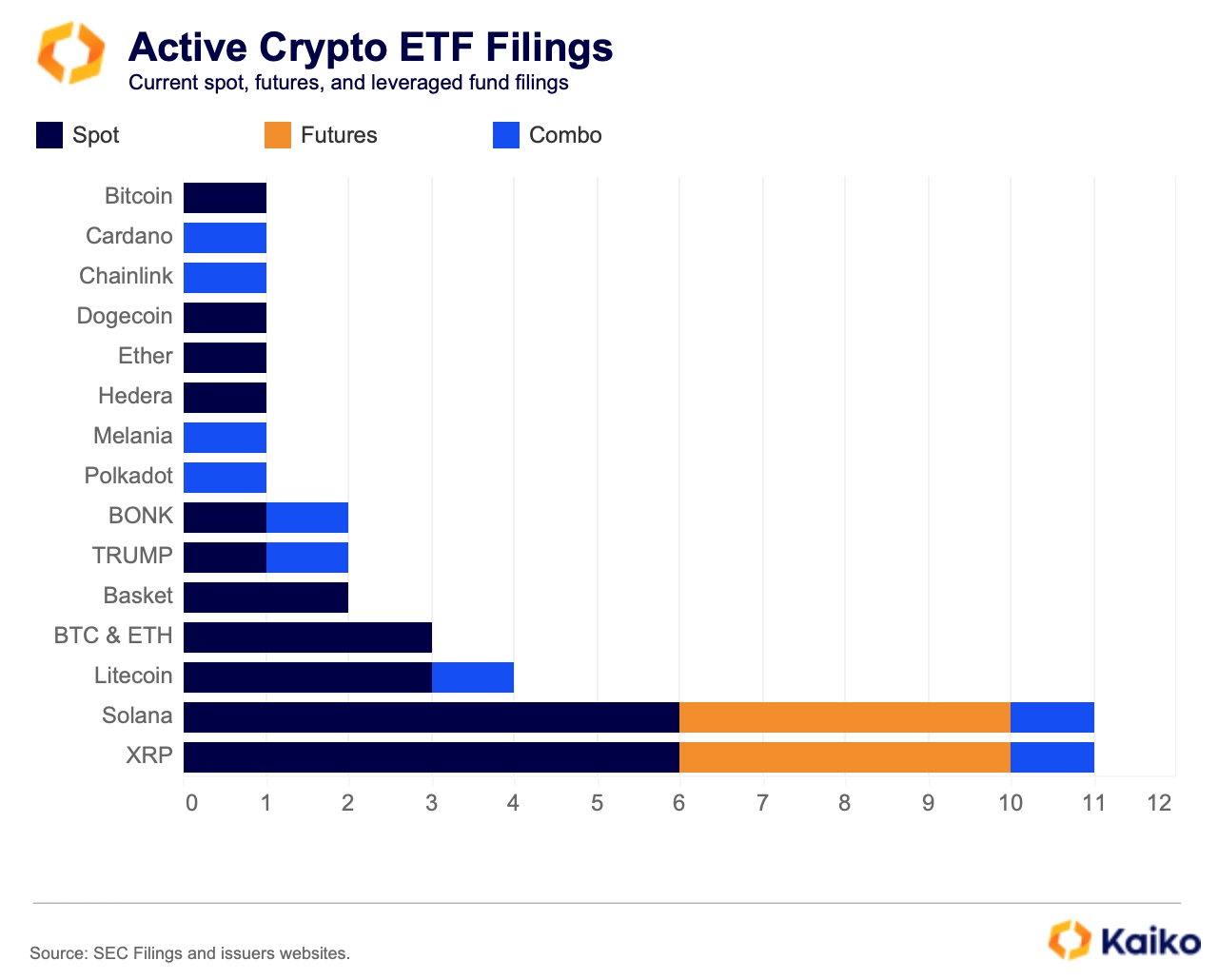

ETF FILING BONANZA

With over 40 active exchange-traded fund filings related to digital assets it’s set to be a busy year for US regulators. President Trump’s pick for Chair—former Commissioner Paul Atkins—still need to be confirmed, but issuers have wasted no time filing a host of speculative applications in recent weeks.

Issuers, such as Bitwise and Tuttle Asset Management, have even begun filing for memecoin-related ETFs. At the same time Grayscale is launching a Dogecoin trust, which will allow them to temperature check demand for such a product before potentially converting it to a spot ETF in the future.

How the new regime at the securities regulator handles these applications will drive sentiment in the medium to long term and shed light on how much the rules truly have changed.

In our latest Deep Dive we got into how the underlying market remains a key factor for regulators and the non-negotiable’s for launching a spot ETF product. Read more on that here.

![]()

![]()

![]()

![]()

This means there’s more demand for protection in the short-run, but that trend doesn’t extend to the end of the month. The February 21 and 28 expirations are far more evenly balanced, implying the recent the current price action could be short-lived.

This means there’s more demand for protection in the short-run, but that trend doesn’t extend to the end of the month. The February 21 and 28 expirations are far more evenly balanced, implying the recent the current price action could be short-lived.

For XRP, smaller orders were more prevalent at peak prices (4,750 KRW). XRP’s average trade size (not charted) steadily declined in January, adding evidence for a potential shift from institutional-sized orders to smaller, retail-driven trades.

For XRP, smaller orders were more prevalent at peak prices (4,750 KRW). XRP’s average trade size (not charted) steadily declined in January, adding evidence for a potential shift from institutional-sized orders to smaller, retail-driven trades.