Introduction

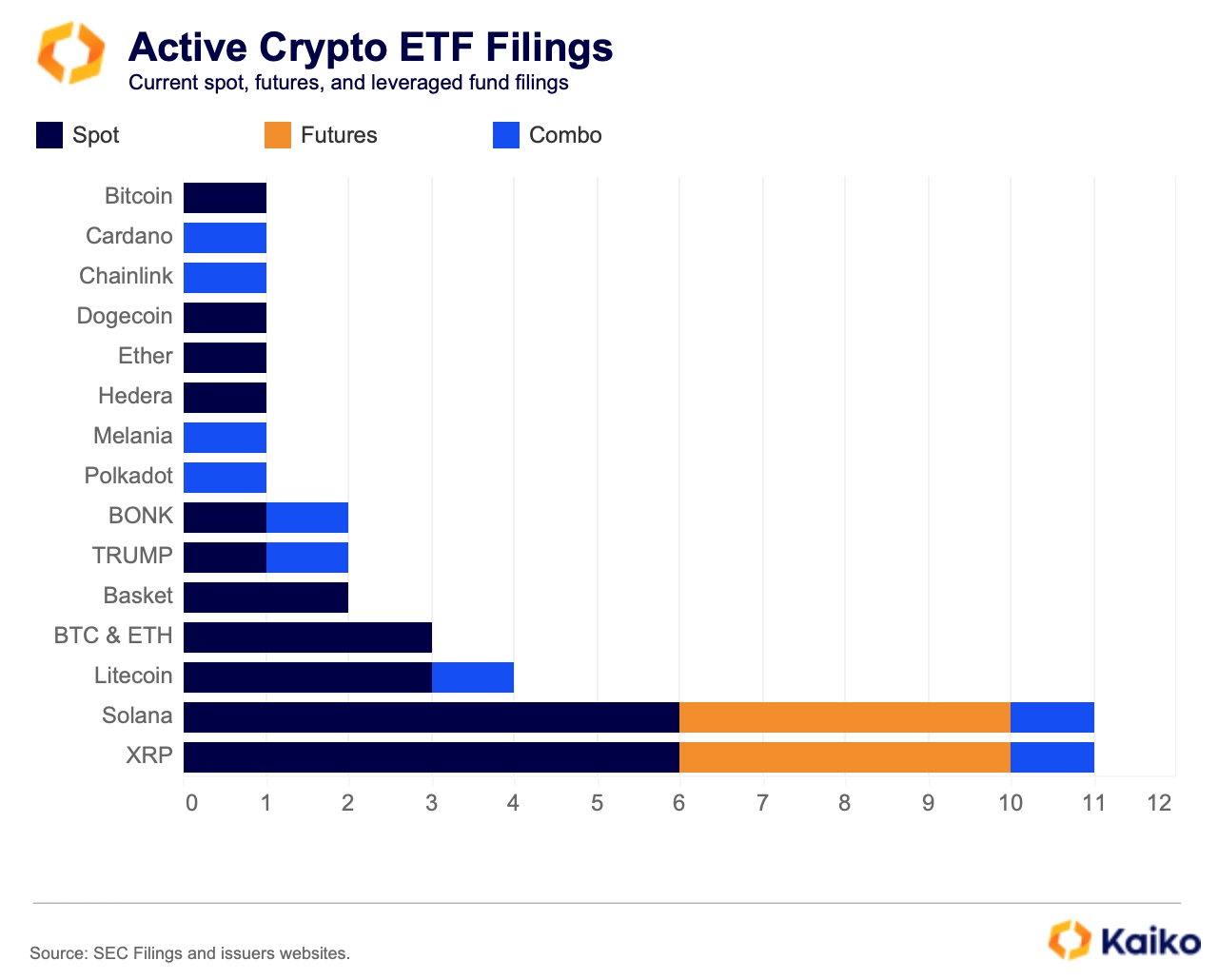

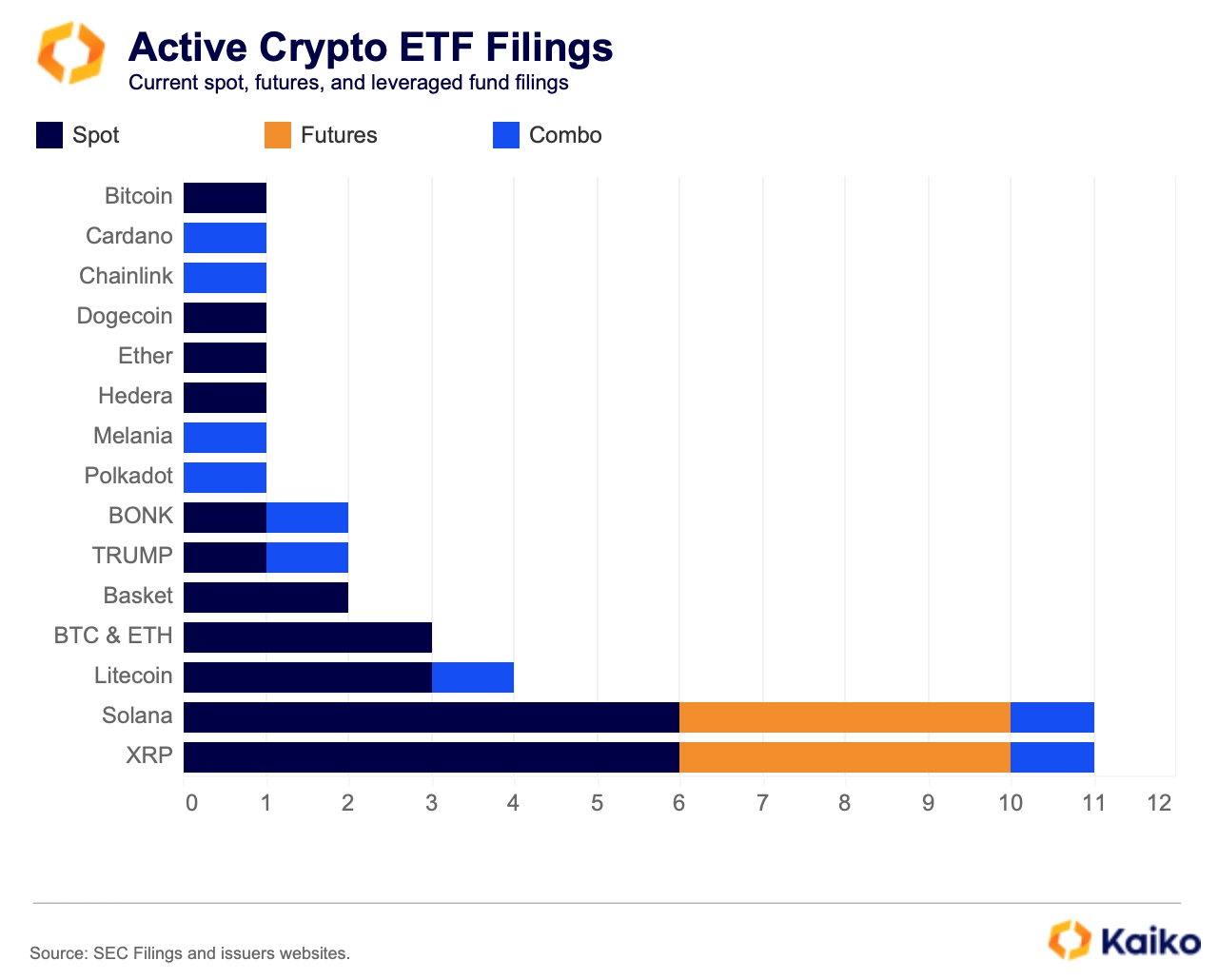

A lot has happened since Gary Gensler last stalked the halls of the US Securities and Exchange Commission. One of the more interesting developments has been the rapid uptick in filings for crypto-related exchange-traded funds.

There are now over 45 active applications. These range from converting closed-end trusts into spot ETFs to more ambitious filings which would seek to turn newly minted memecoins into spot ETFs.

Tuttle Asset Management’s ten leverage ETF filings on Monday evening were the latest applications, and potentially the most ambitious. ProShares—which launched the first US-based BTC futures product in 2021—and Vol Shares have also applied for futures products on SOL and XRP—despite there being no regulated futures markets for these in the US.

These filings might seem like a shot in the dark, but the fact that major firms are expending time and energy on this shouldn’t be ignored. Just over twelve months ago these 45 filings would have seemed laughable, now there’s serious discussion among market participants on the merits rather than regulatory roadblocks.

In the following section, we focus on key issues and develop a deeper understanding of the underlying markets, free from preconceived biases.

Markets of significant size

Regardless of who is leading the SEC there must be efficient and secure markets underpinning any ETF products.

When filing for new products issuers must address potential risks. Manipulation is a common risk in nascent markets like crypto. Bitwise addresses this in its XRP filing;

“Manipulative trading activity on digital asset trading platforms, which, in many cases, are largely unregulated or may not be complying with existing regulations.”

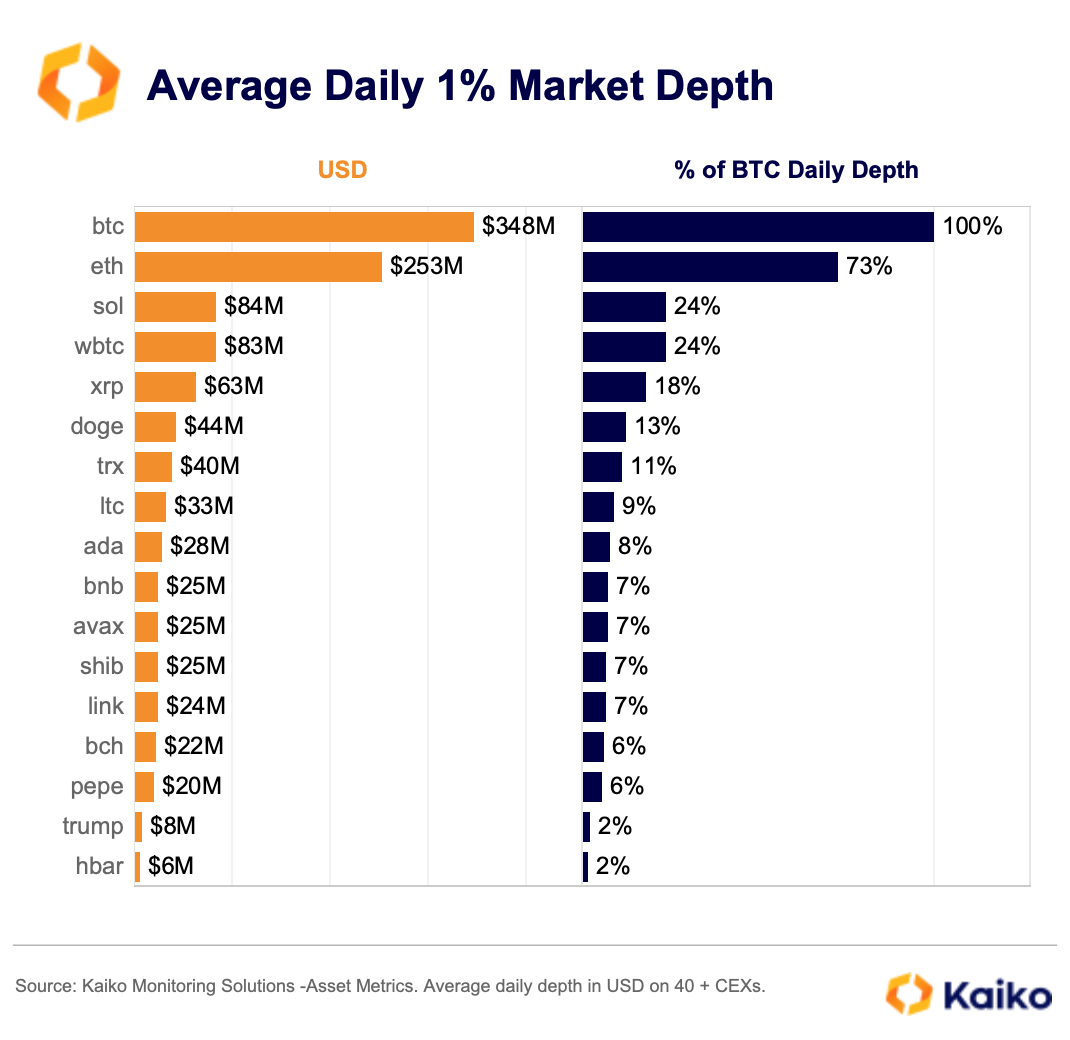

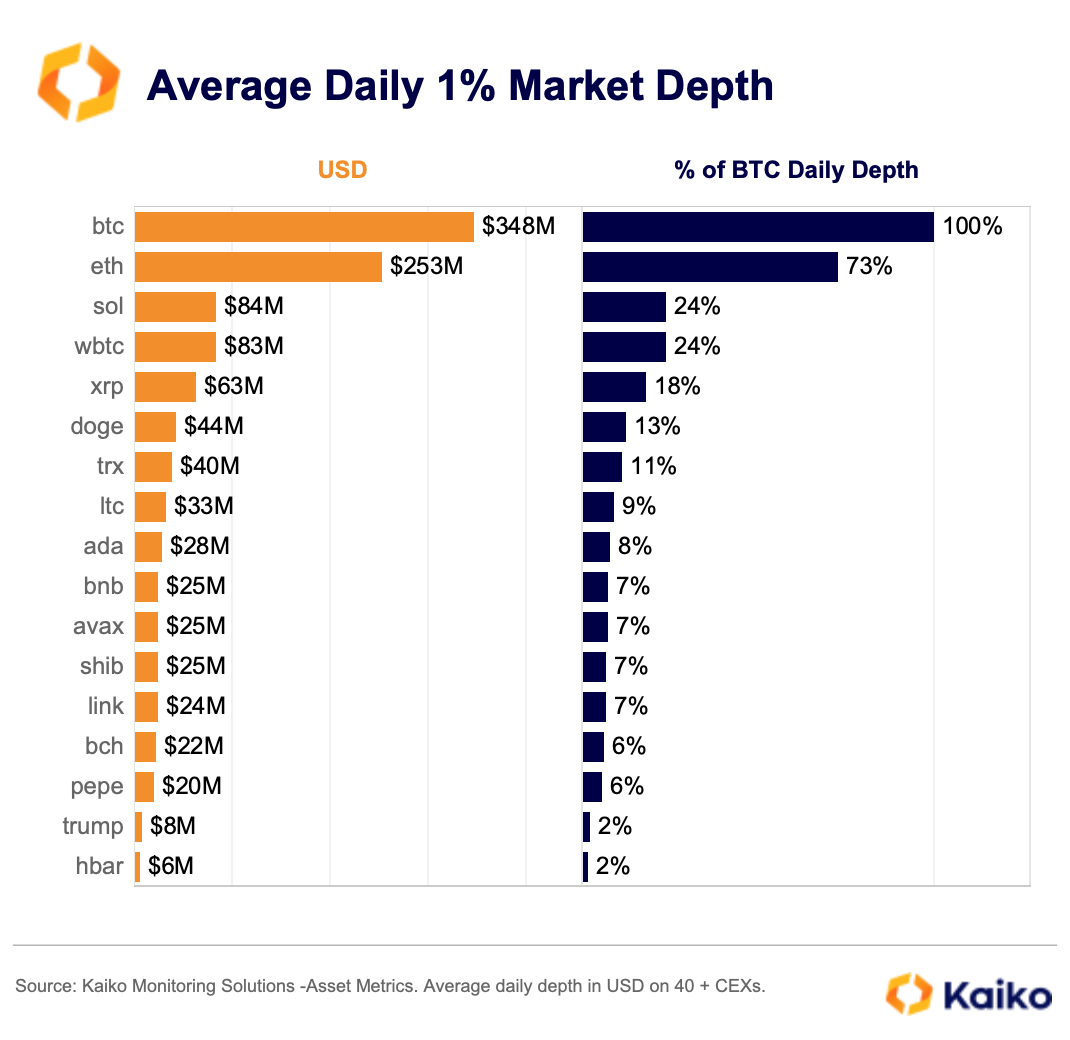

We’re not regulators so we can’t address the issue of trading platforms, but we can look at data on liquidity and market size to infer how malicious actors might be able to manipulate these markets. Below, we charted the average weekly 1% market depth—the total of buy and sell orders within 1% of the mid-price—for major crypto assets and those tied to ETF applications.

This gives us a macro view of the liquidity situation on all exchanges in our coverage. We can see that BTC and ETH (both with active spot ETFs) have significantly higher market depth than other assets. Most assets have less than 10% of BTC’s daily market depth.

Market depth is a decent indicator of a market’s ability to handle large orders. Extremely low depth might imply a market is at risk of manipulation, as only a few large sellers could move the price. Lower depth can also lead to higher volatility during periods of market pressure.

With that in mind, let’s focus on some of the more mature assets from the list of recent filings: XRP, SOL, and LTC. If we look at the average daily 2% market depth for these assets on US exchanges only—where authorised participants for ETFs would be trading.

Despite being widely traded for some time now and having relatively established markets on centralized platforms the depth is still quite low. XRP has recently eclipsed SOL on these exchanges, however, the latter’s liquidity profile has been far more consistent since late 2023.

Its not just to mitigate manipulation fears, higher liquidity also matters for authorised participants. These are the firms that create and redeem shares in the funds throughout the trading day, including the likes of JP Morgan, Jane Street, and DRW.

Its not just to mitigate manipulation fears, higher liquidity also matters for authorised participants. These are the firms that create and redeem shares in the funds throughout the trading day, including the likes of JP Morgan, Jane Street, and DRW.

The launch of spot BTC ETFs in the US has enhanced liquidity conditions, reflecting the market’s growing ability to handle large orders as trading matured. Authorised participants for US-based ETFs were key to this. These firms contributed to improved liquidity as price discrepancies between ETF shares and the underlying BTC have been efficiently arbitraged out of existence.

In the first quarter of the year, the average daily BTC 1% market depth has increased on US exchanges, with the institutional-focused LMAX exchange showing the most significant percentage increase.

BTC is orders of magnitude larger than every other cryptocurrency. That means managing price discrepancies and moving serious size is easier in BTC than other markets. This is another consideration for regulators, issuers, and really anyone involved in these potential ETFs.

At this juncture it’s important to caveat that our interpretation of the data here is not solely based on the previous SEC’s approvals process, but on how efficient markets work.

Concentration concerns

Beyond liquidity it’s also important to consider the location and reputation of venues where these assets trade. Most recent filings allude to the lack of transparency around digital asset trading platforms, as well as being unregulated.

Any new legislation in the US will partially mitigate this risk, however, it won’t impact most venues. Over 80% of activity for these prospective ETF filings occurs offshore. While the rules of the game in the US might be changing, the broader market structure has not changed.

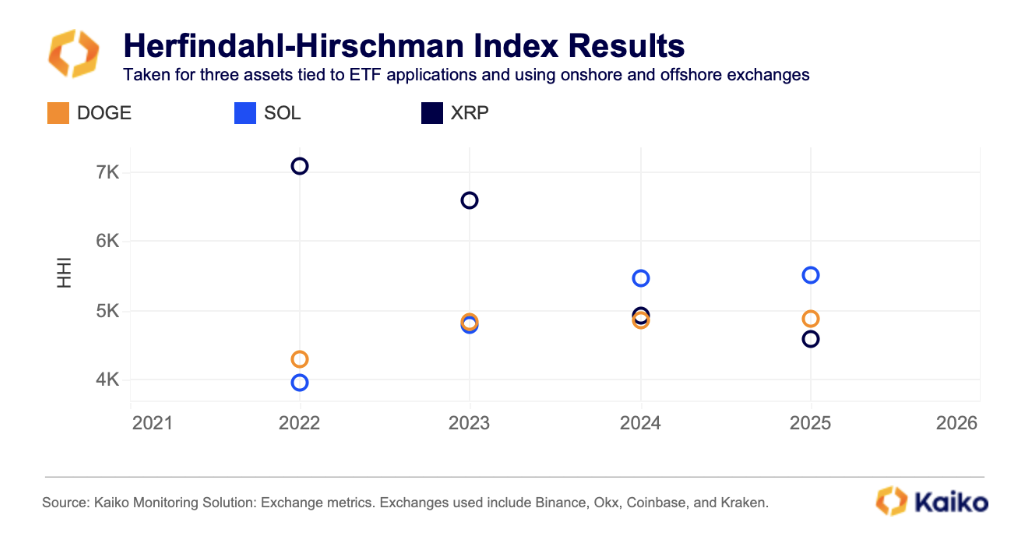

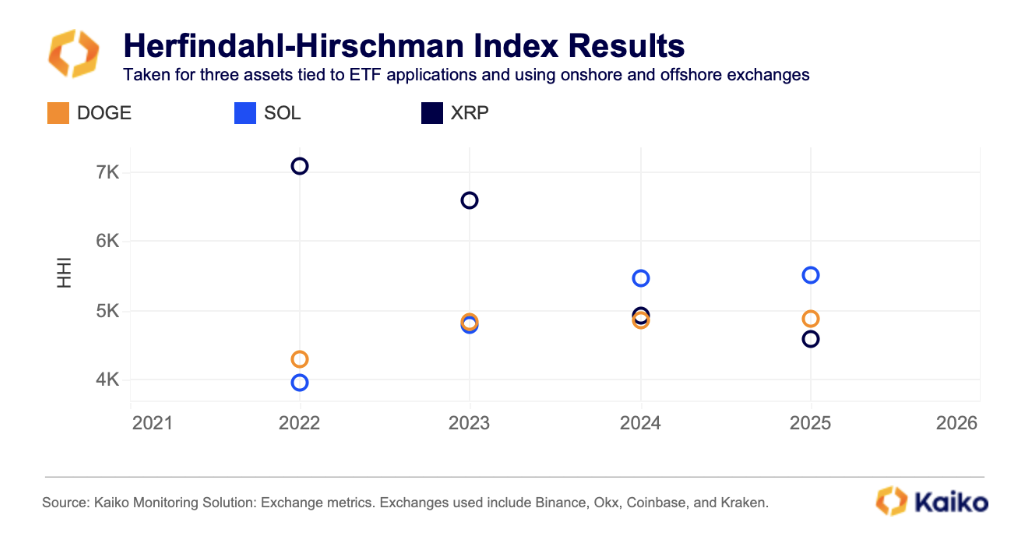

We decided to look a little deeper at this concentration risk. We used the Herfindahl-Hirschman Index to properly measure concentration for several assets. The calculation involves taking the market share of each exchange and then squaring it and adding these numbers together. The maximum the HHI can reach is 10,000, anything over 2,500 is considered highly concentrated while 1,500 to 2,500 is moderately concentrated.

We decided to look a little deeper at this concentration risk. We used the Herfindahl-Hirschman Index to properly measure concentration for several assets. The calculation involves taking the market share of each exchange and then squaring it and adding these numbers together. The maximum the HHI can reach is 10,000, anything over 2,500 is considered highly concentrated while 1,500 to 2,500 is moderately concentrated.

The exchanges included in our analysis were Binance, Coinbase, Okx, and Kraken. For the purposes of this report we’ve focused on the HHI results for a selection of assets which best represent the trend among all of the assets tied to active ETF applications.

Every asset had a score above 2,500, suggesting high concentration in trading. As we can see, concentration in SOL and DOGE markets has increased since 2022. In both cases this was driven by more concentrated volumes on Binance versus the other exchanges. XRP stands out as one of the only assets with concentration scores trending lower.

The re-listing of XRP on Coinbase in the summer of 2023 following a partial resolution in its court case with the SEC has been healthy for the market. As a result more volumes have come back onshore—and liquidity has improved as we discussed earlier.

Stablecoins vs. The doLLAR

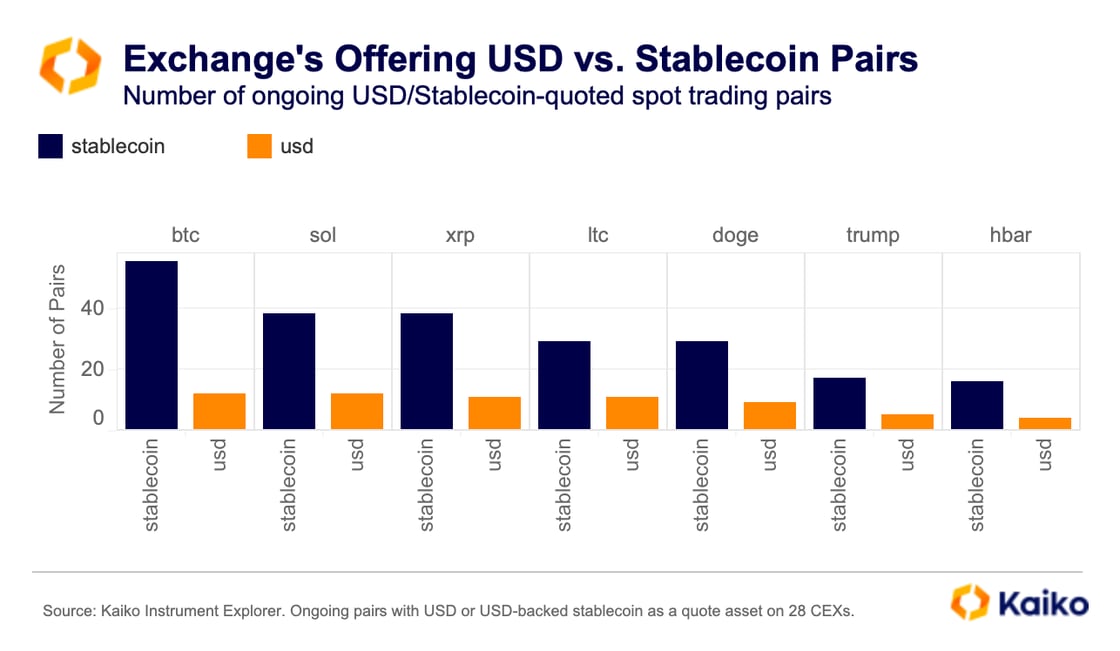

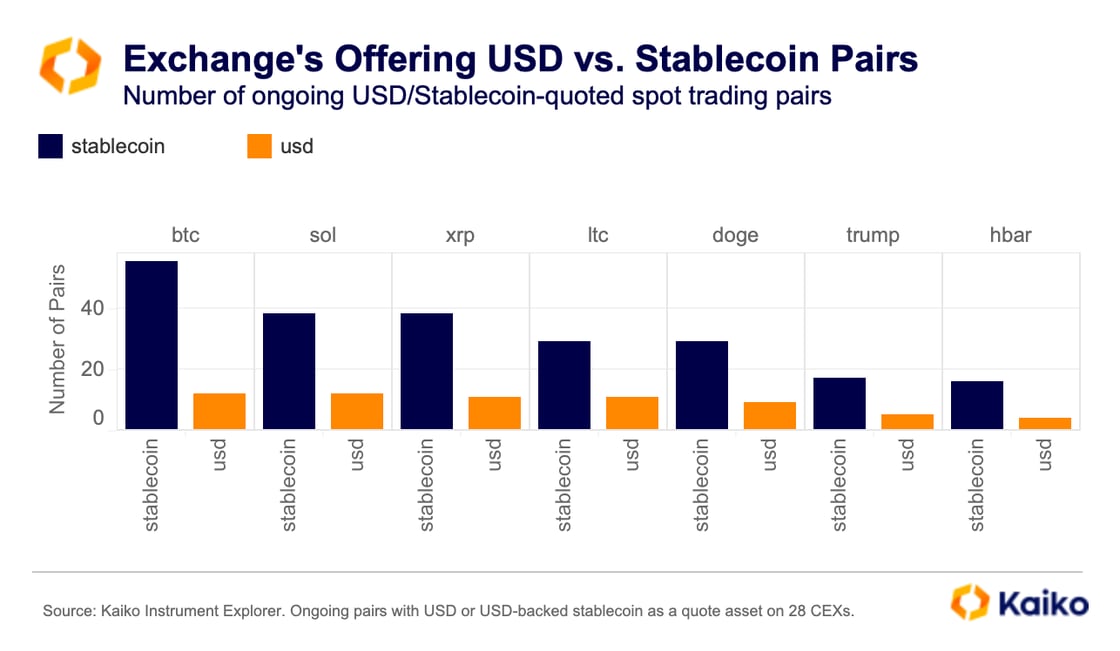

Another consideration before launching any ETFs on the above assets is the availability of USD pairs.

When it comes to crypto stablecoins are by far and away the most popular quoted pairs, in particular USD-denominated. Stablecoins have become more palatable and will continue to mature under a positive regulatory framework.

The new administration in the White House has pledged to work with the industry and in particular US-based firms. Actions taken so far suggest this isn’t an empty promise. For instance, as a result of clearer regulation the risk of depegs should decline for certain tokens. Take Circle’s USDC, clear regulation and the availability of more custody solutions in the US following the repeal of SAB 121 removes major risk factors for the stablecoin.

Despite the improving regulatory outlook there’s still demand for fiat options. More precisely, it’s a regulatory requirement. If an exchange doesn’t offer USD pairs on these assets then they can’t be included in regulated benchmarks—which are used to calculate net asset value of the ETF. This has knock on effects for the exchanges too, as we showed previously that inclusion in ETF benchmarks has a positive impact on volumes.

There’s currently a significant lack of USD pairs on SOL, LTC, XRP, and DOGE. Just 13 exchanges offer USD quoted SOL or XRP spot instruments per Kaiko data.

It’s no surprise that stablecoin pairs are more popular than fiat in crypto where they can easily facilitate the movement of funds across exchanges and protocols. The traditional finance world moves at a slightly different pace when it comes to adopting new payment rails though.

Derivatives markets and trading strategies

The SEC was eventually forced to approve spot BTC ETFs last year due to Grayscale’s seminal court case. Essentially this meant that the existence of the BTC futures market on the CME constituted a market of significant size for a surveillance sharing agreement to satisfy regulatory requirements. No such market currently exists beyond BTC and ETH. This reduces oversight capabilities—again based on the old administration’s contention.

It also reduces the amount of strategies available to investors. The BTC basis trade has been a huge hit with hedge funds since the launch of spot BTC ETFs. We’ve also seen increased activity in ETH futures markets on the CME suggesting funds are doing the same thing there—collecting the basis (difference between spot and futures price) by holding spot ETH ETFs and selling short the near month ETH futures contract.

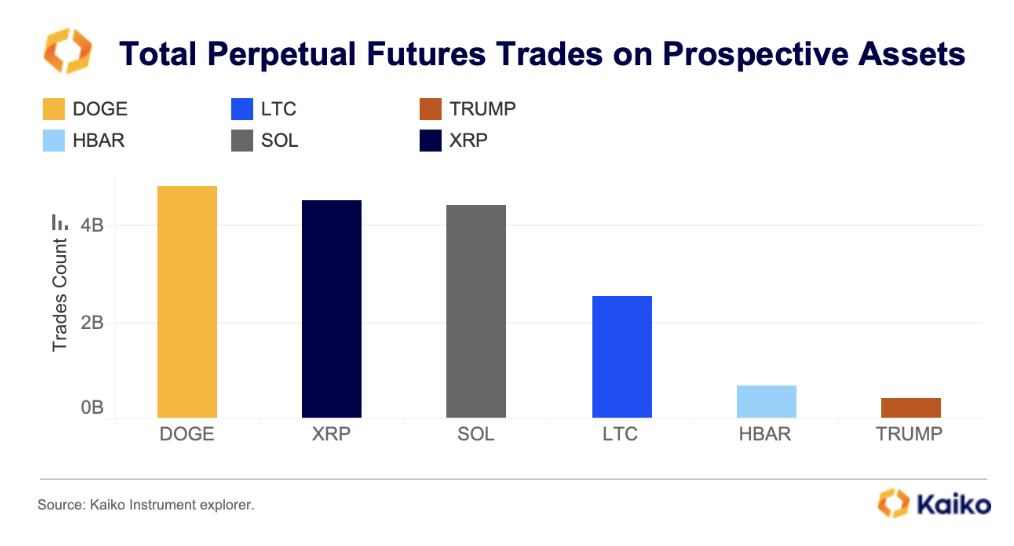

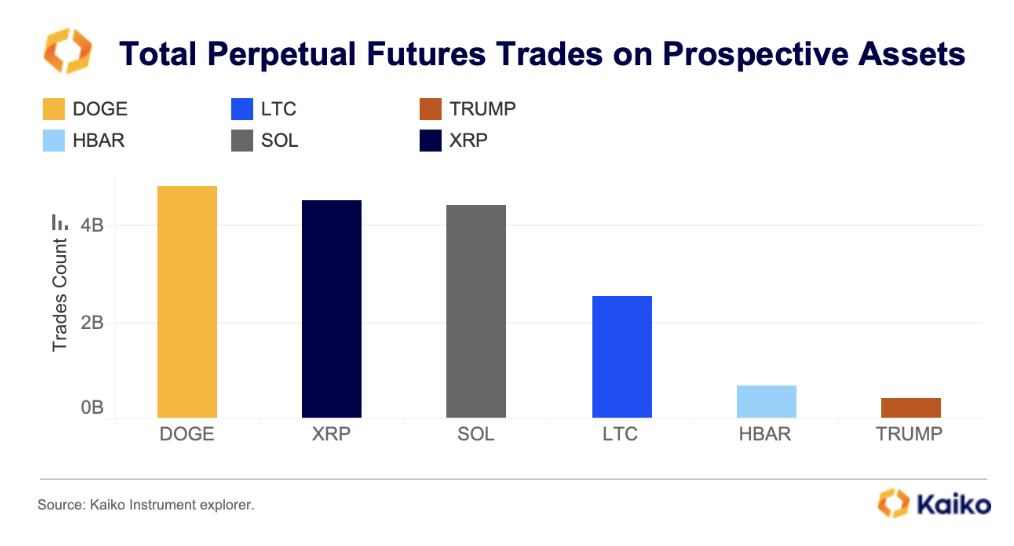

The absence of regulated futures markets for other cryptocurrencies doesn’t imply an absence of demand. Crypto exchanges in Kaiko’s coverage offer hundreds of pairs for these assets from vanilla futures to perpetual futures contracts—offering more leverage and trading in perpetuity without an expiration date.

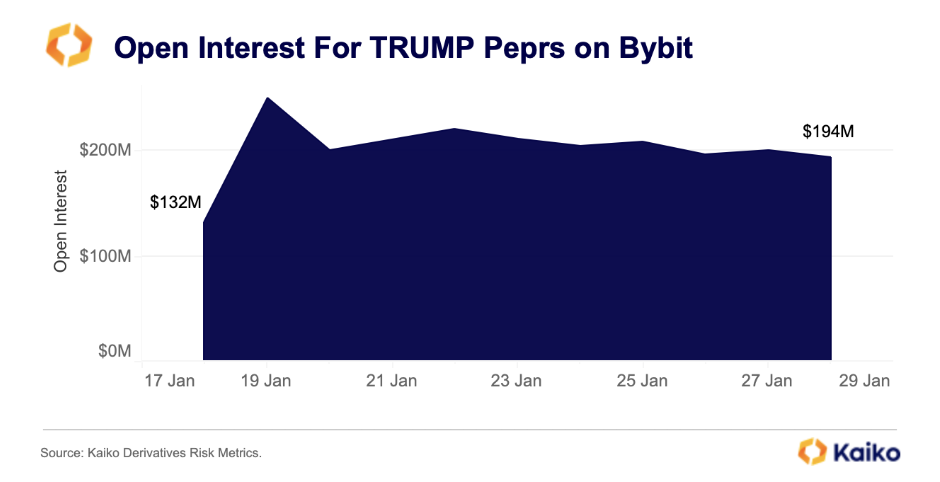

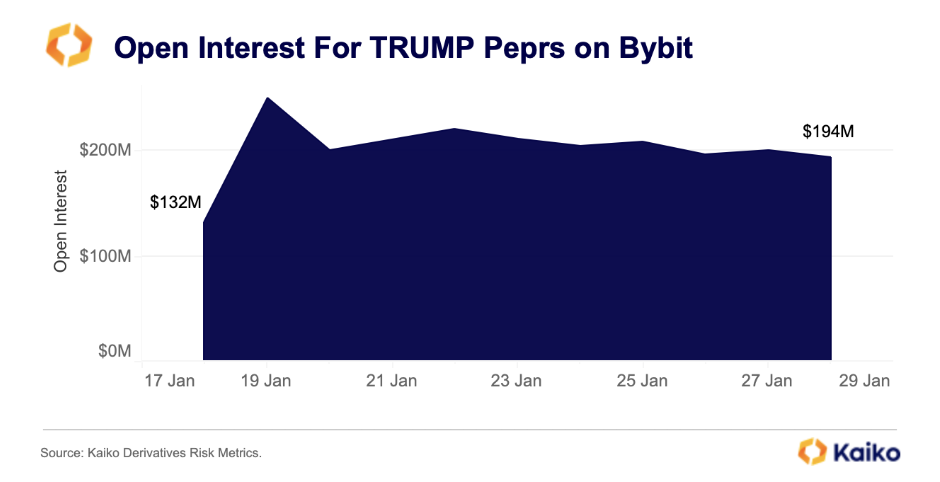

The perpetual futures markets for the smaller assets, and newly minted coins like TRUMP, have healthy liquidity levels and demand. Take the US President’s official memecoin for instance, it launched on January 18 and perps markets quickly followed suit. Its open interest on Bybit, the second largest crypto native perps venue by volume and OI, has been consistent so far.

Open interest for TRUMP perps on Bybit has been above $100mn since launch and is currently close to $200mn. This is despite a massive decline in the token’s value since inception.

Most of this volume could be attributed to pure retail speculation, but the major venues don’t seem to mind that. As we saw with the CME’s launch of Bitcoin Friday Futures—a product tailored to retail users with smaller contract sizes—traditional finance firms want to attract these users.

While Dogecoin ETFs or leveraged MELANIA and TRUMP filings might seem fanciful, there is demand in the underlying market. There’s also money to be made on fees and margin costs. Once the regulatory framework provides sufficient safeguards, Wall Street firms won’t hesitate to capitalize on fees and margin costs.

Network effects

Under the previous SEC administration decentralisation, or lack thereof, was a major sticking point. The regimes regulation by enforcement approach attempted to class most of the digital assets tied to ETF filings today as securities. The decentralization of the network behind the token was crucial here.

Decentralization is a key principle of blockchain technology. It ensures that no single entity controls a network. Typically, a higher degree of decentralization enhances network security and reduces vulnerability to attacks. However, it may also complicate decision-making and the network’s ability to address long-term challenges such as scaling.

When it comes to ETFs and crypto the more decentralized the better. As we discussed earlier, manipulation is a key risk for all of these products. A highly centralized network poses risks on this front. While the leadership at the SEC might have changed this hasn’t.

Conclusion

In December we hosted a webinar on the upcoming paradigm shift the new administration would bring. At the time Invesco’s global head of ETF capital markets Erik Pollackov said that people were “optimistic” again, ahead of the regime change at the SEC.

Its fair to say that optimism carried over into the new year. That boiled over into excess the weekend before Donald Trump was inaugurated as the 47th President. As Gary Gensler left the SEC issuers flocked to file for more crypto-related ETFs, and continue to.

Optimism is great, and the removal of regulatory hurdles which sucked the oxygen out of the room over the past few years is even better. However, the data doesn’t validate the desire just yet. The underlying markets for many of these ETF filings are shallow and concentrated on offshore venues. Furthermore the universe of investible products is smaller and the ability to capture basis between spot and futures doesn’t exist in the same way that it does for BTC and ETH.

All of these factors could limit the demand for more crypto-related ETFs going forward. While approval processes might change, market dynamics still have to catch up.

![]()

![]()

![]()

![]()

Its not just to mitigate manipulation fears, higher liquidity also matters for authorised participants. These are the firms that create and redeem shares in the funds throughout the trading day, including the likes of JP Morgan, Jane Street, and DRW.

Its not just to mitigate manipulation fears, higher liquidity also matters for authorised participants. These are the firms that create and redeem shares in the funds throughout the trading day, including the likes of JP Morgan, Jane Street, and DRW. We decided to look a little deeper at this concentration risk. We used the Herfindahl-Hirschman Index to properly measure concentration for several assets. The calculation involves taking the market share of each exchange and then squaring it and adding these numbers together. The maximum the HHI can reach is 10,000, anything over 2,500 is considered highly concentrated while 1,500 to 2,500 is moderately concentrated.

We decided to look a little deeper at this concentration risk. We used the Herfindahl-Hirschman Index to properly measure concentration for several assets. The calculation involves taking the market share of each exchange and then squaring it and adding these numbers together. The maximum the HHI can reach is 10,000, anything over 2,500 is considered highly concentrated while 1,500 to 2,500 is moderately concentrated.