Trump takes over memecoins

The 45th, and soon-to-be 47th, President of the United States of America just launched a memecoin. Just three days before his second inauguration Donald Trump, and just a few hours after Gary Gensler’s last day as Chair of the SEC, told his followers on X that it was “time to celebrate everything we stand for: WINNING,” before urging supporters to join his community by buying the TRUMP memecoin.

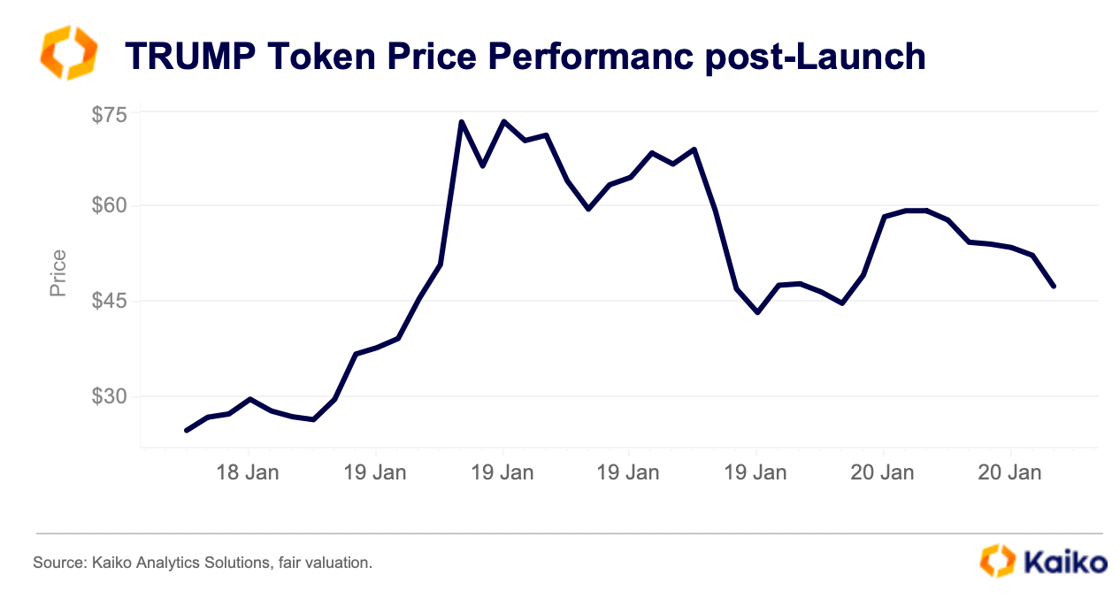

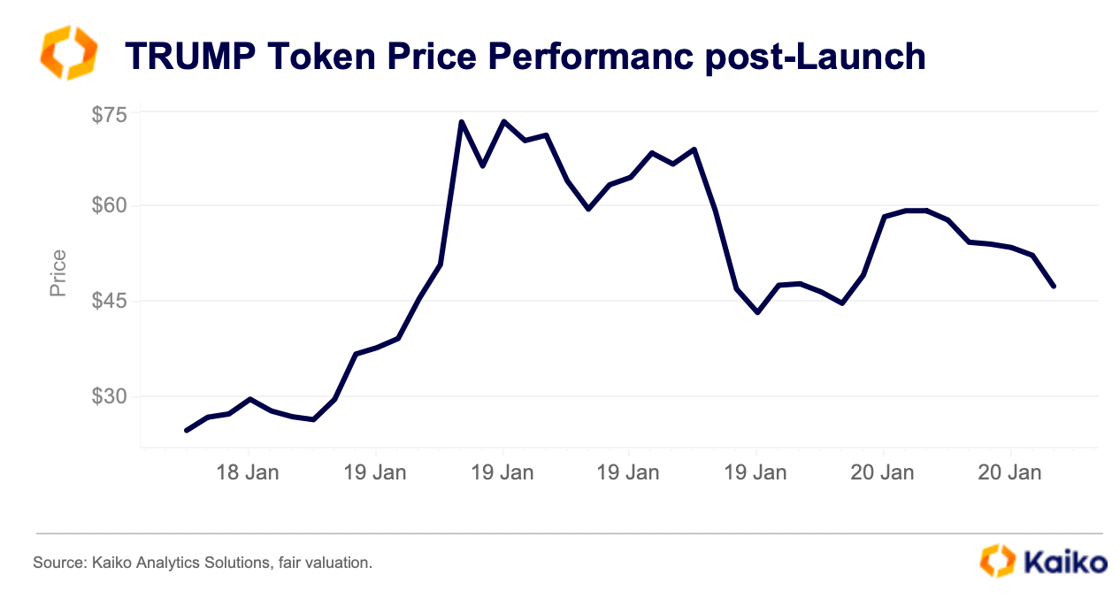

Market participants obliged and the price of the newly minted Solana-based memecoin soared over the weekend. TRUMP traded over $72 on Sunday as major centralized exchanges including Coinbase announced plans to list it.

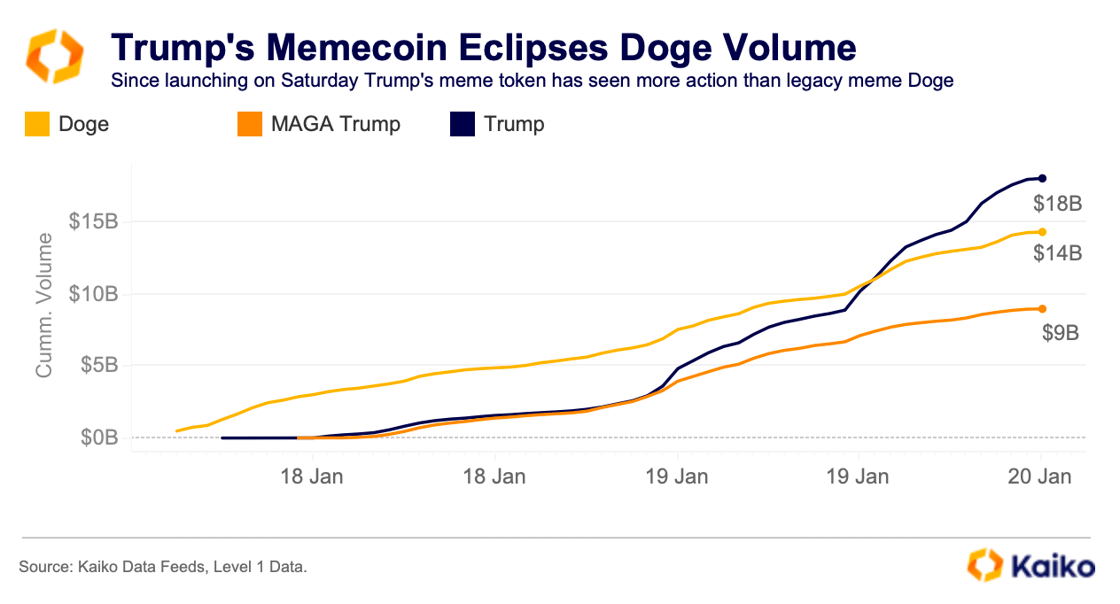

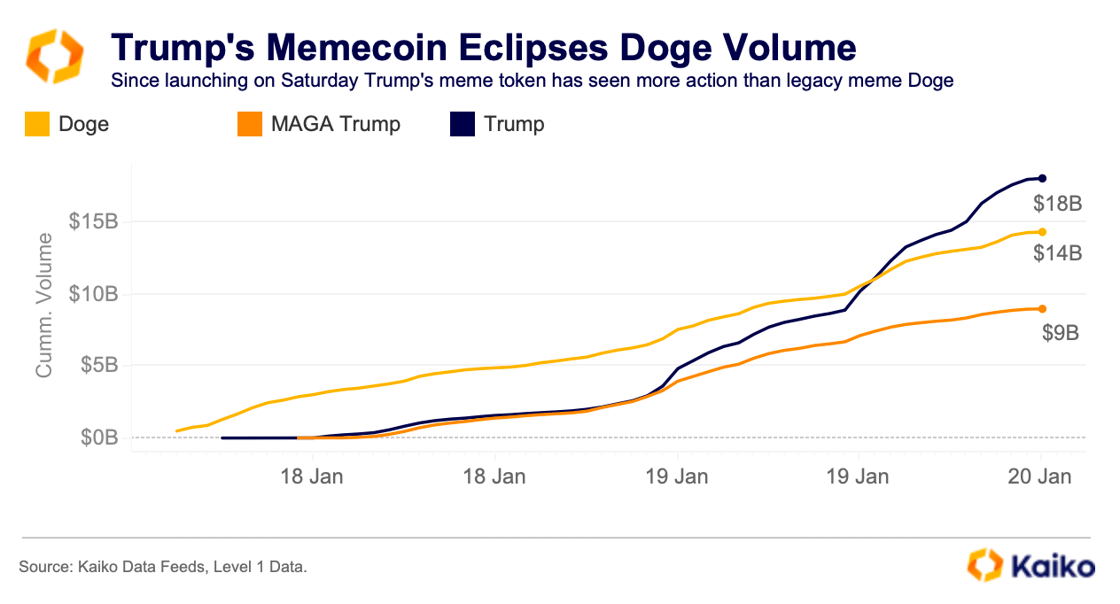

The fervor around Trump’s memecoin led to it outperforming Dogecoin in terms of trade volume. Since launch, TRUMP has had over $18bn in cumulative trade volume, $4bn more than DOGE. The launch also appears to have benefited some unofficial memecoins such as MAGA Trump which had a record $9bn in volume since Saturday.

However, along with soaring volumes and prices there was also plenty of volatility. While this is natural in memecoin markets, which are inherently speculative, there were two more mitigating factors.

Firstly, the launch of an official Melania Trump memecoin: The First Lady’s memecoin launched shortly after TRUMP and coincided with a sell-off in her husbands token, likely linked to traders rotating between the two to capture upside in the newer coin.

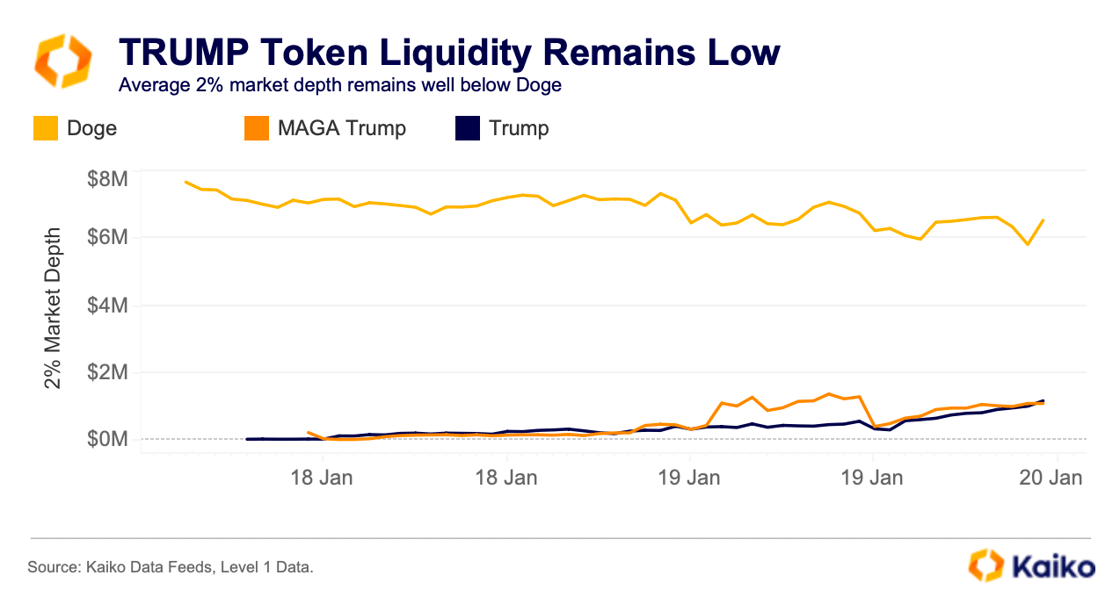

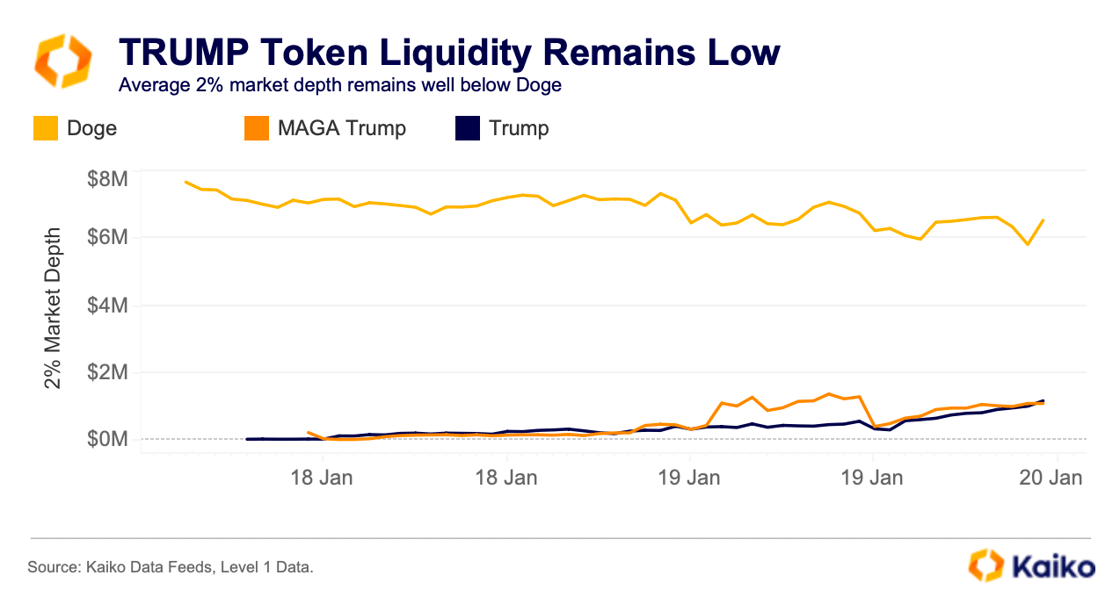

Furthermore, and perhaps more importantly, the liquidity profile of TRUMP markets is still very shallow. Its market depth—the sum of buy and sell orders 2% from the mid-price—is far below Dogecoin and even below MAGA Trump. Basically this means it’s harder to convert TRUMP into stablecoins. As a result any large sell or buy orders could lead to sharp price moves. In other words you can’t get out of these positions in size.

The current liquidity situation will continue to be uncertain over the coming days as the market begins to take shape.

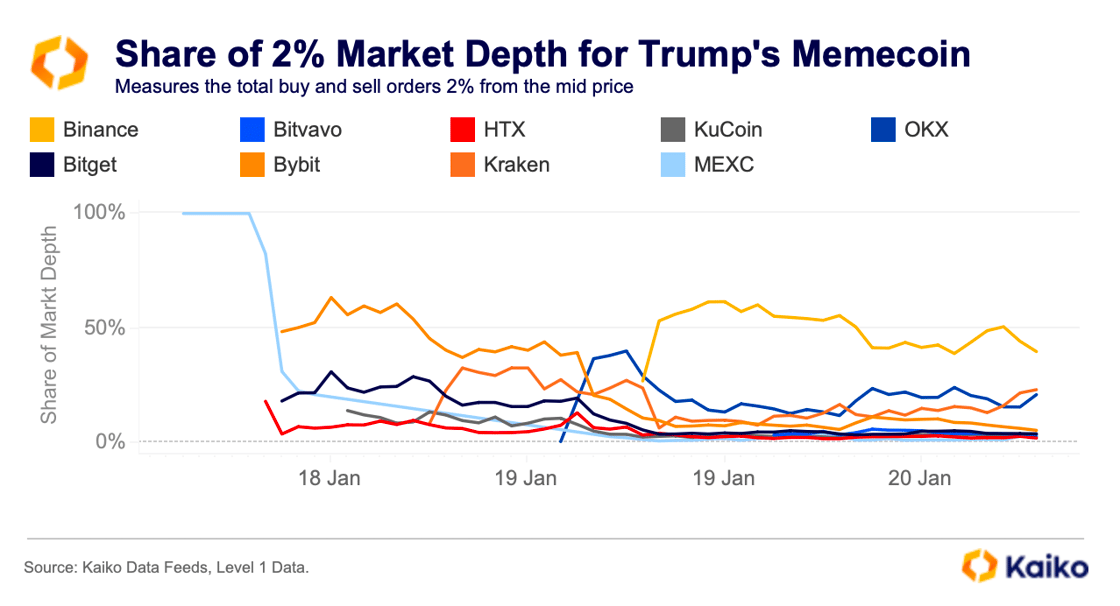

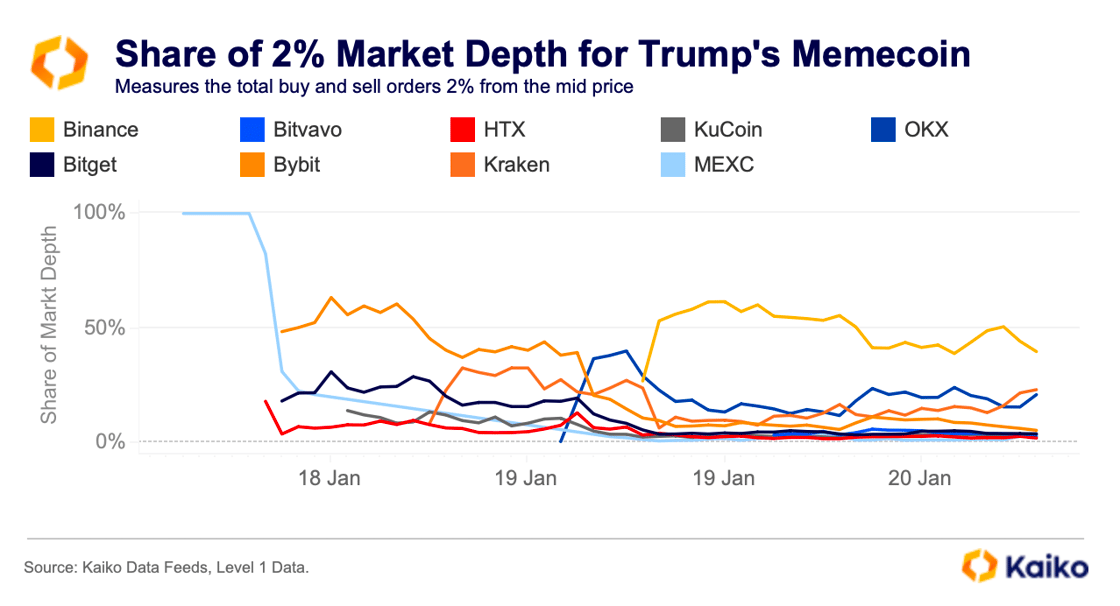

Below we can see how the liquidity distribution across exchanges for TRUMP has changed since Saturday. As new exchanges list the token the market should become more liquid. For example, Binance now has an active spot market so it should begin to steady soon. Coinbase is also expected to list it later this week, which will open up access to more US-based investors. With more major exchange listings more market makers will be comfortable to engage with the market.

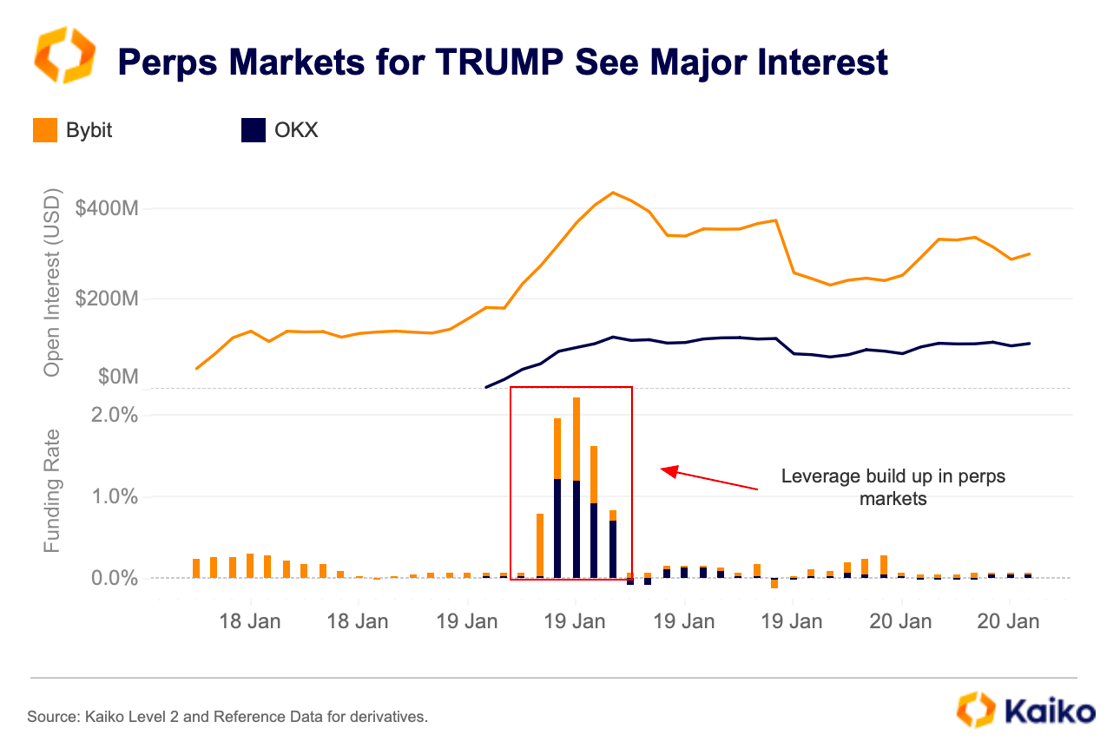

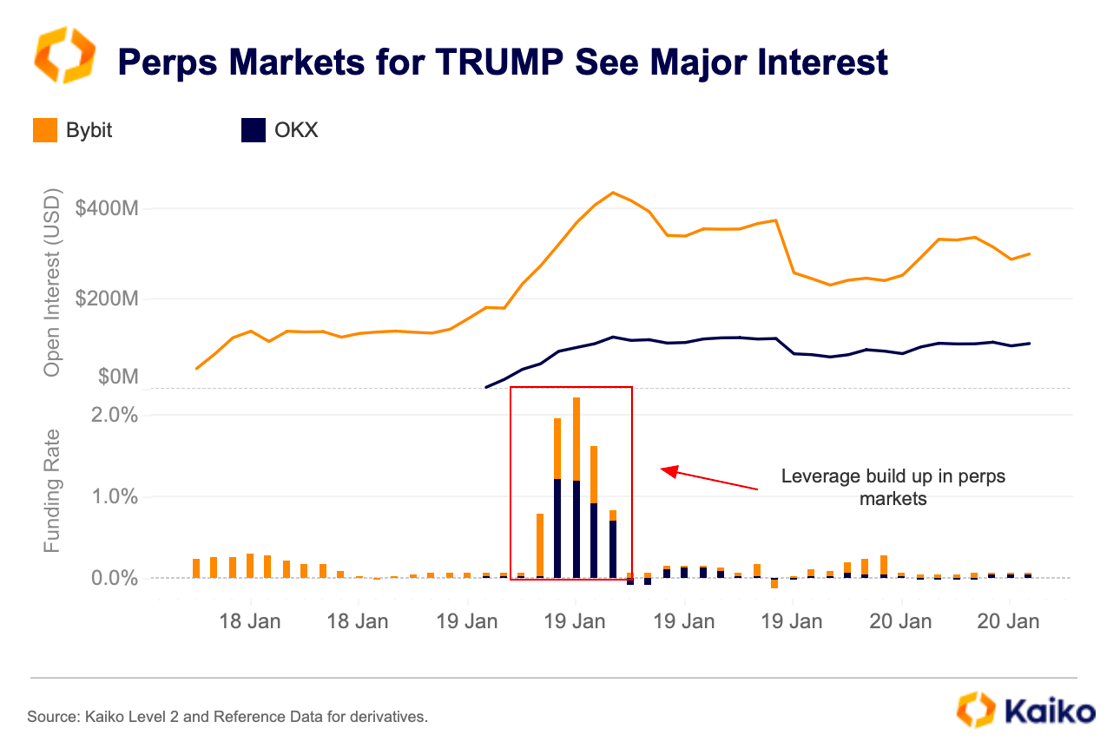

Another factor to watch when examining the liquidity profile of the TRUMP token is the availability of derivatives on the memecoin. Despite only being in its infancy there already exists a substantial market for TRUMP perps. On Bybit alone there is over $300mn in open interest for these perps.

However, the perps market is still taking shape, and as we can see below there was a large spike in funding rates on Sunday evening. This means there was likely a large build-up of leverage in the perps markets on Bybit and OKX as traders made increasingly bullish bets.

High positive funding rates imply that traders with long positions are willing to pay more to keep positions open. This can be risky as sharp changes in prices can lead to liquidations. Open interest above is expressed in dollar amounts, and while it does decline following the spike in prices the number of contracts didn’t fall as sharply, suggesting that a small number of traders were over their skies on this trade here.

The euphoria in crypto markets is likely to continue throughout today as Trump’s inauguration takes place.

Data Points

Altcoin dominance increases

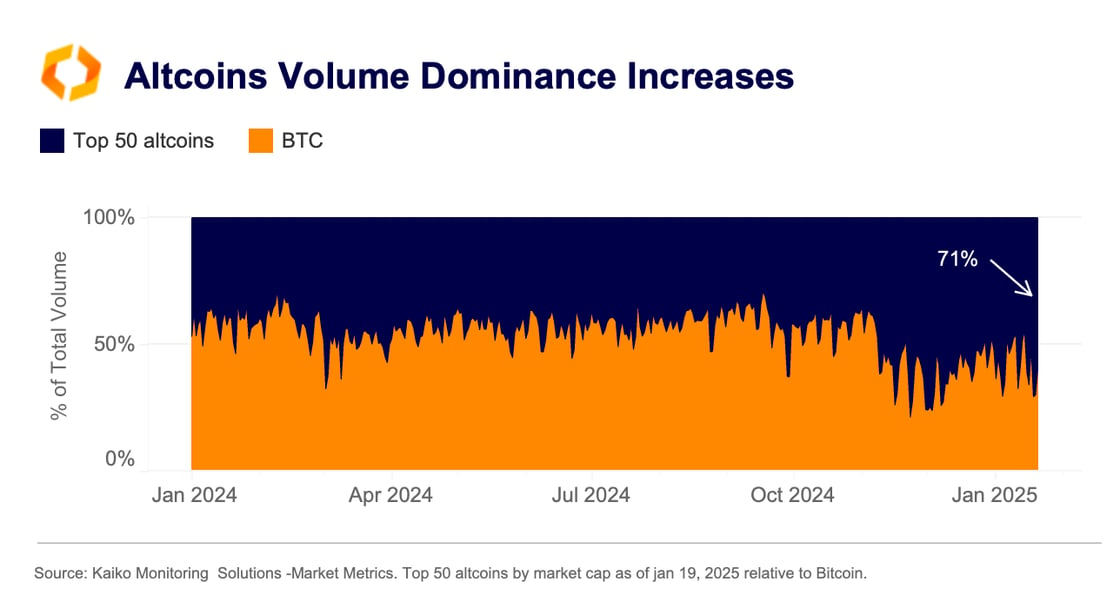

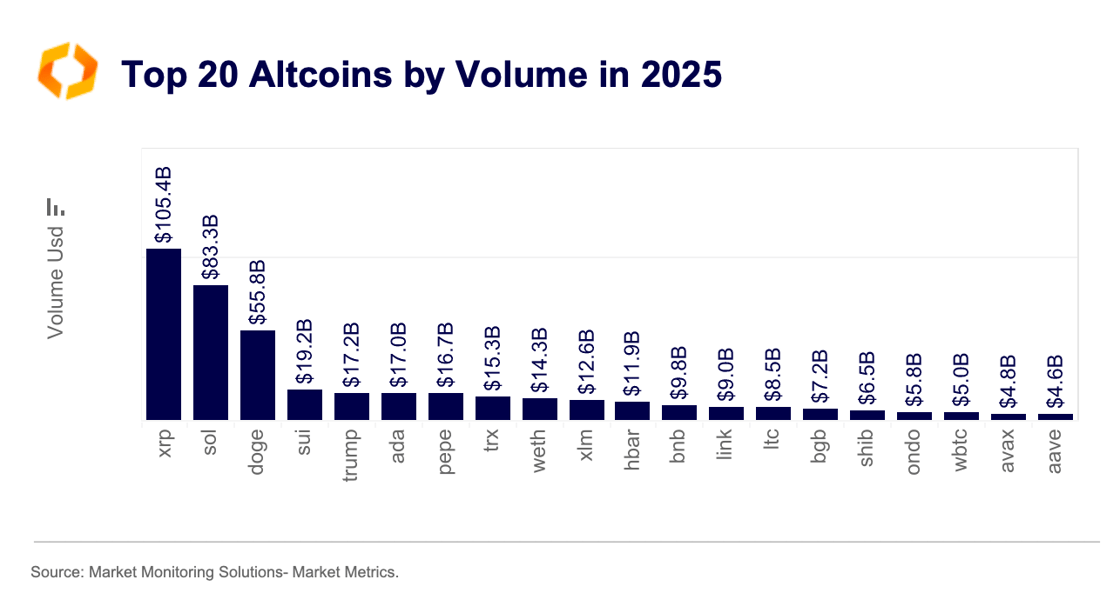

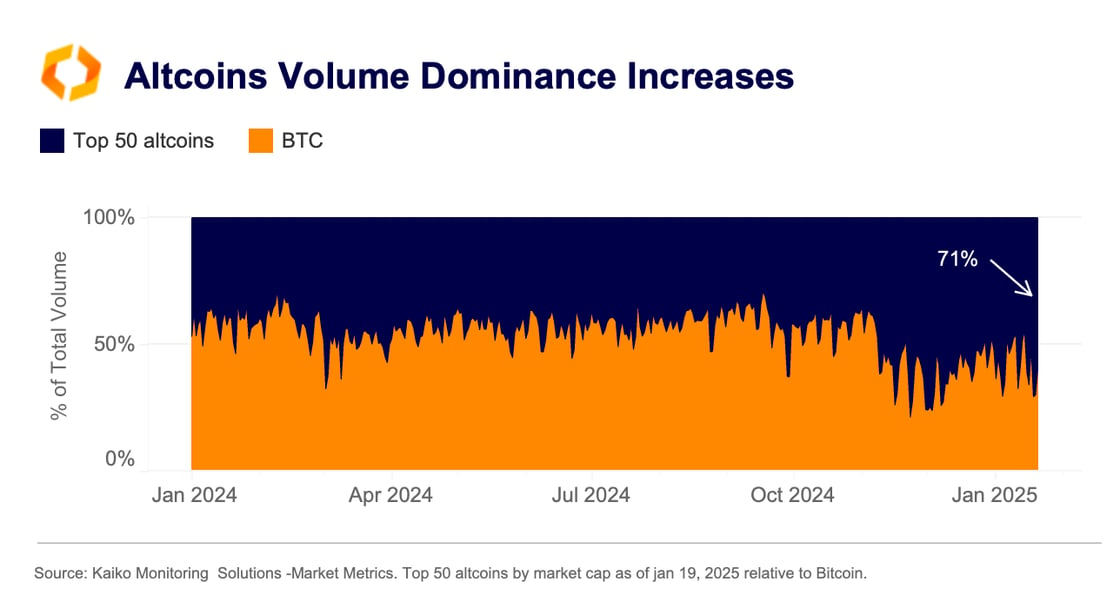

Despite Bitcoin hit a new all-time high in price in early hours of Monday, altcoin showed relative strength. The top 50 altcoin trading volume dominance climbed to 71%, matching levels last seen in early November. Notably, XRP surpassed Bitcoin in trade volume on U.S. exchanges on January 16, while SOL reached an all-time high, likely fueled by the Trump-linked meme token craze.

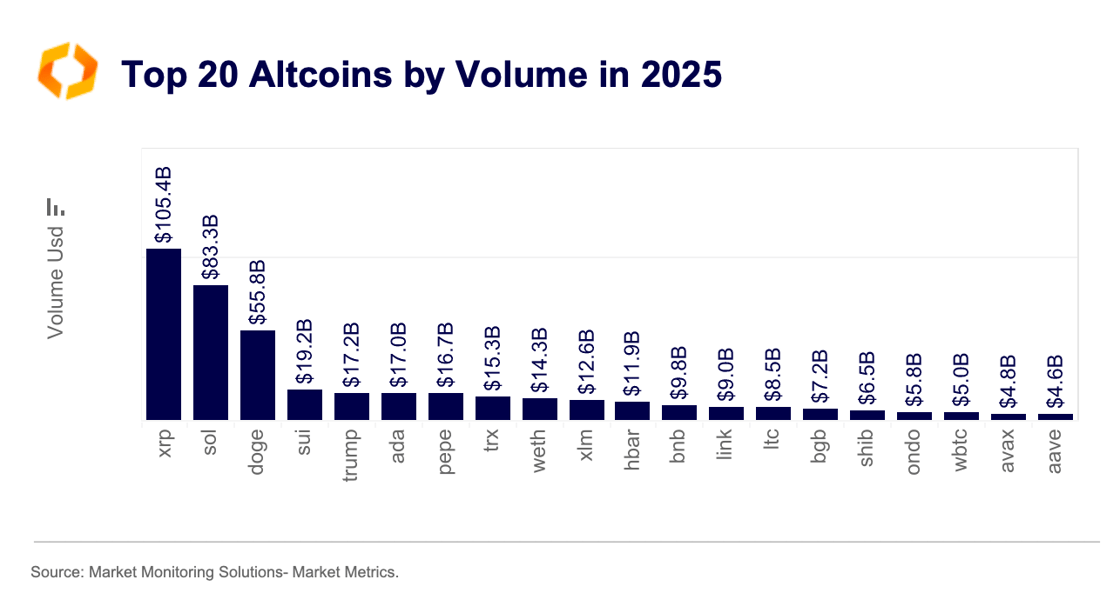

XRP led the altcoin market in 2025, with a cumulative trading volume of $105 billion, surpassing SOL at $83 billion and DOGE at $56 billion. Since Trump’s election victory, XRP has surged by more than 500%, significantly outpacing SOL by a factor of ten.

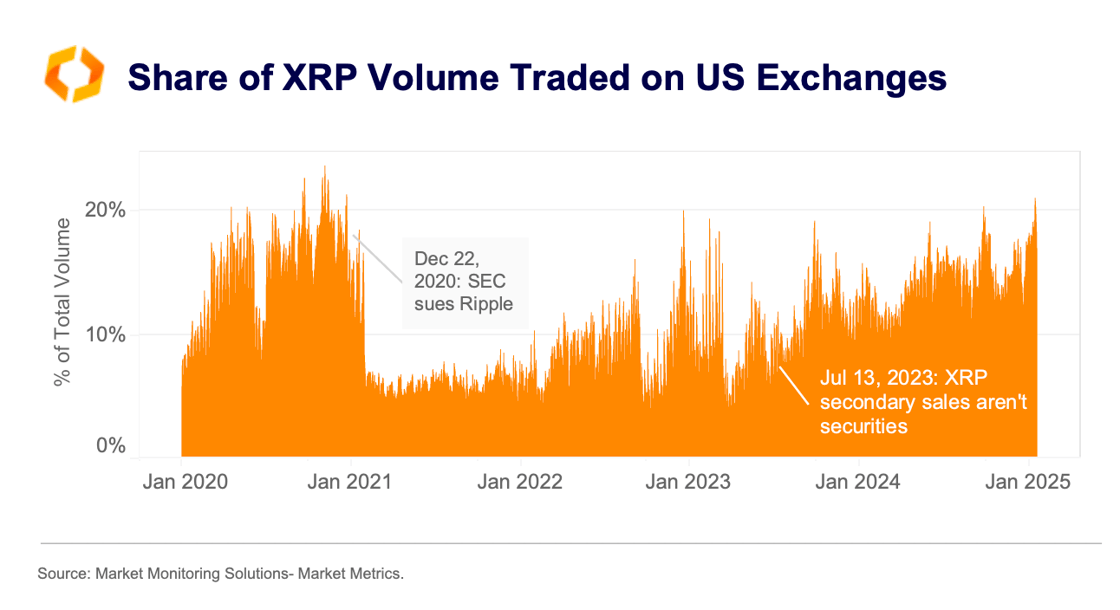

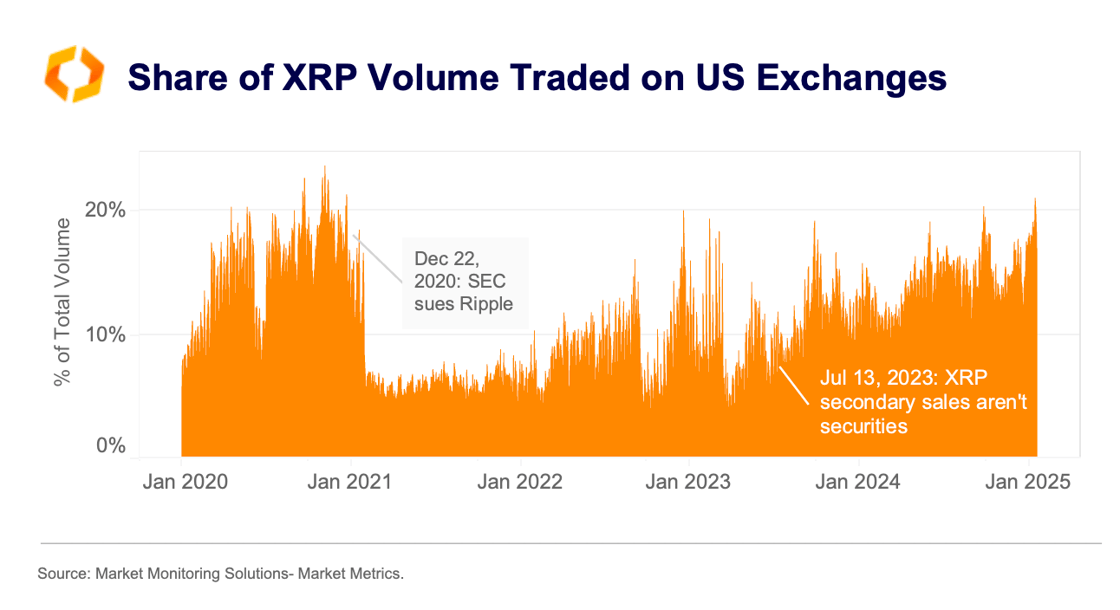

This trend has been driven largely by U.S. exchanges, with the share of XRP traded on these platforms rising to 21%—its highest level since the SEC lawsuit in 2020. In contrast, only about 10% of SOL’s global volume is traded on U.S.-available platforms, making XRP one of the most U.S.-centric altcoins.

This surge in XRP effectively fills the gap left after the SEC’s lawsuit against Ripple, which led to delistings from major US exchanges like Coinbase due to regulatory concerns. However, market sentiment could weaken if the second Trump administration’s crypto-friendly policies fall short of expectations.

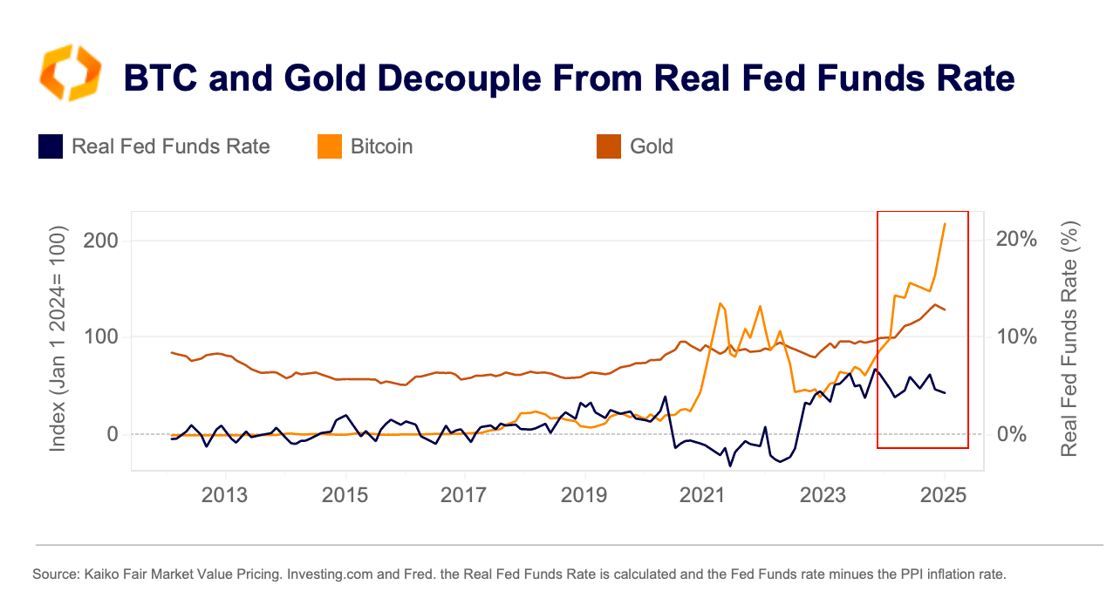

Bitcoin resilience to real yields is rising

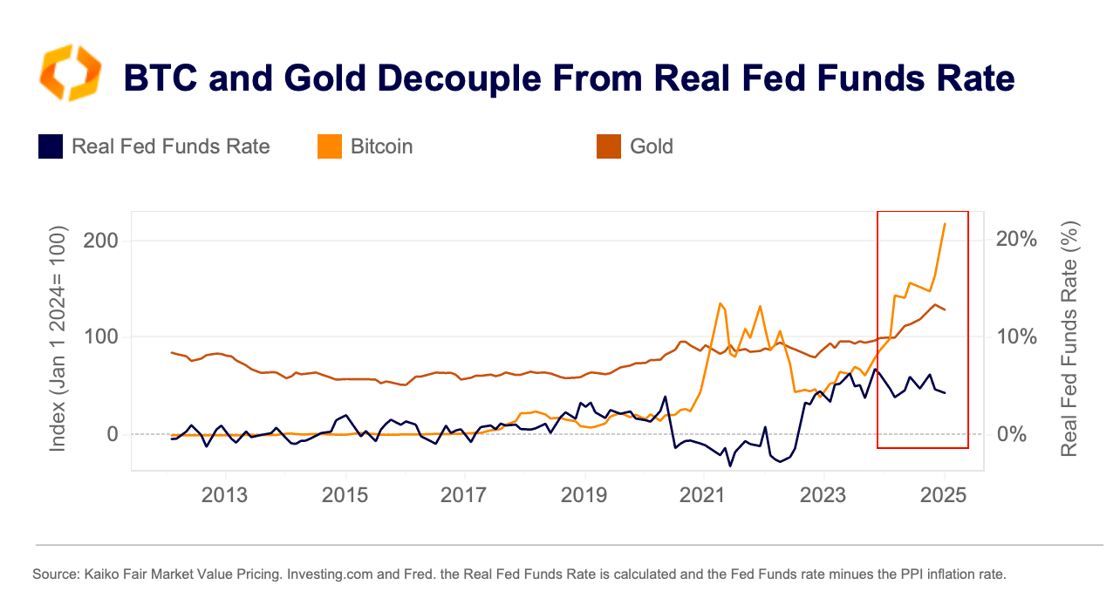

With interest rates expected to stay higher for longer, the broader macroeconomic environment remains challenging for crypto assets. However, Bitcoin’s ability to withstand macroeconomic headwinds appears to be strengthening.

Over the past year, both Bitcoin and gold have shown signs of decoupling from real yields, likely driven by growing demand for fiscal debasement hedges and steady, price-inelastic interest from corporate players like MicroStrategy.

This resilience could grow further if institutional – and potentially sovereign stockpiling – continues. According to Polymarket, the odds of Bitcoin being added to a national reserve within the first 100 days of the new administration have risen above 50% in the early hours of Monday, up from a multi-month low of 22% in early January.

![]()

![]()

![]()

![]()