Data Points

Crypto traders bet on the US election.

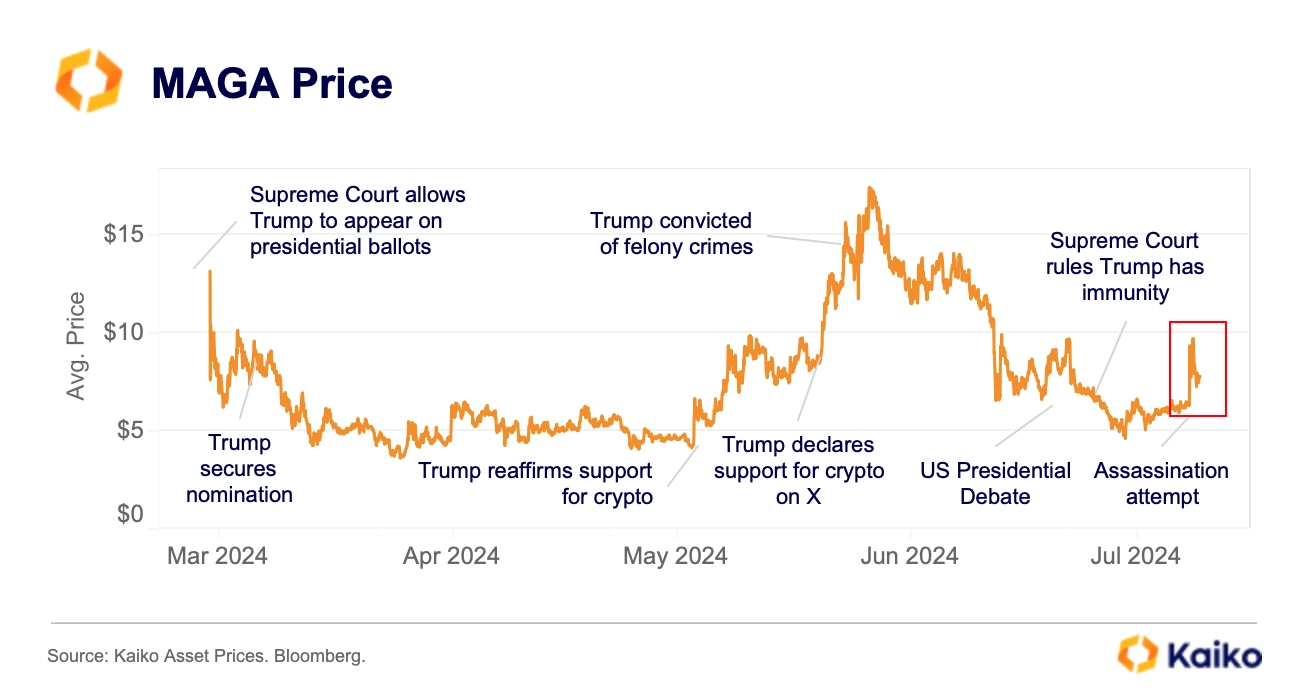

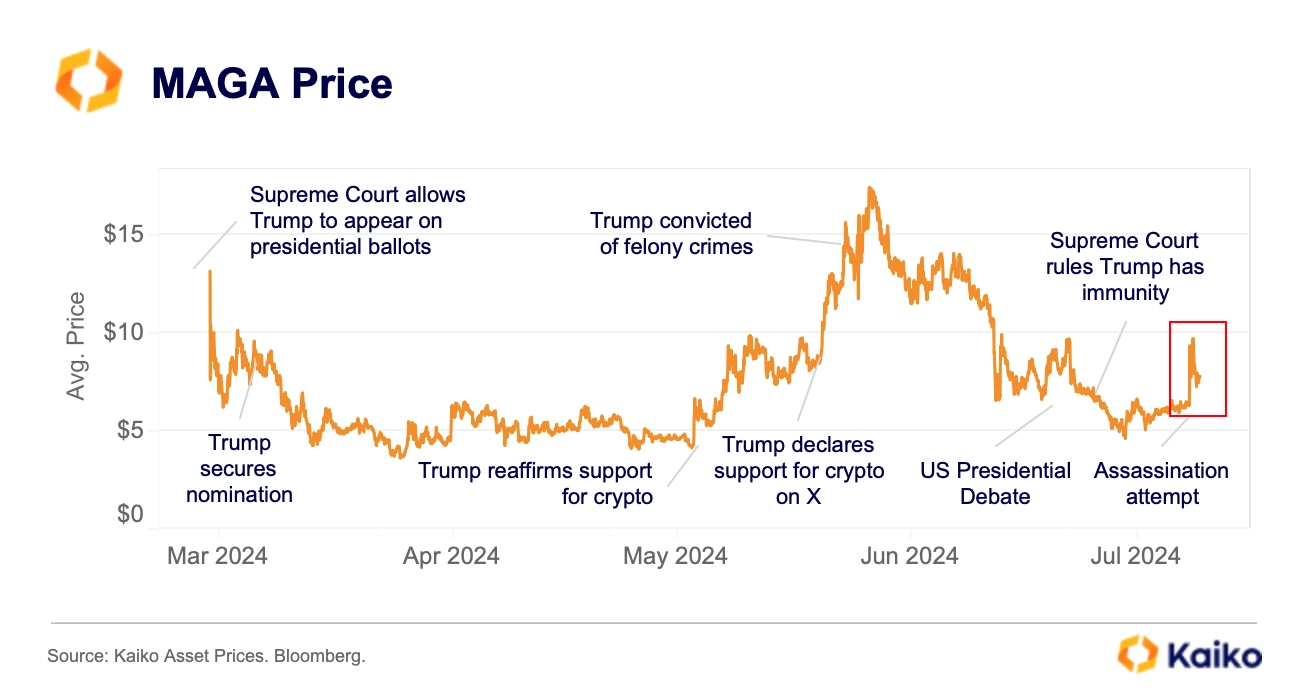

PolitiFi tokens, some of which are designed to speculate on election-driven hype, have surged in popularity this year due to the increasing significance of crypto in the US presidential campaign.

Most large-cap PolitiFi tokens are linked to former President Donald Trump and have seen significant price fluctuations based on his crypto stance and campaign news. The MAGA token surged 51% in two hours after Trump’s shooting on Saturday, though it lost some gains the following day. This rise was mirrored by an increase in shares of Trump’s Media & Technology Group (DJT), indicating that some investors are betting on a potential sympathy vote.

While MAGA remains highly speculative, its weekly trading volume has also increased, suggesting growing interest from market participants. Volume surged from $10-15 million in February to a peak of $120 million in June before retreating in early July alongside prices.

So far, these tokens have shown little signs of predictive value. However, the trend suggests that a win for Trump could be pivotal for the industry, which is in need of regulatory clarity.

It’s not just PolitiFi tokens that are being used to take positions on the upcoming election. Solana’s SOL could be considered a bet on the presidency as well. Matthew Sigel, head of digital asset research at VanEck said his firm’s SOL ETF filing was a bet on the election.

The SEC has until March 2025 to respond to VanEck’s SOL ETF filing, which doesn’t leave much time for a new administration to be appointed — if President Biden lost the election.

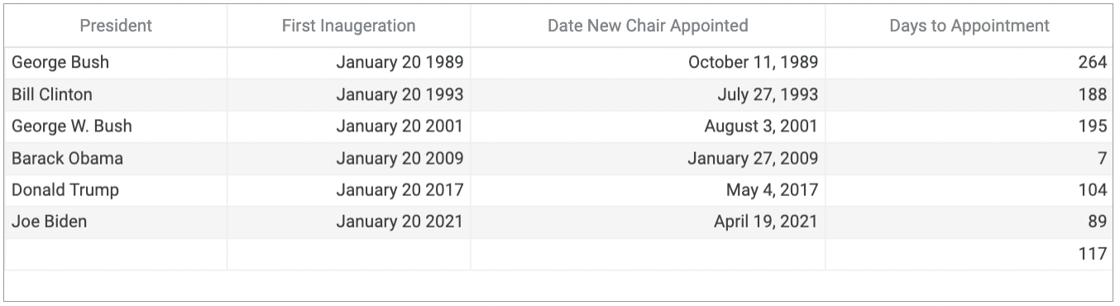

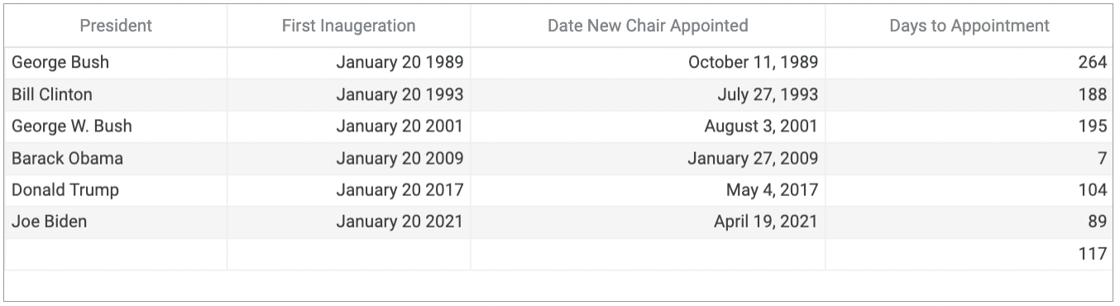

On average it has taken 117 days for new presidents to appointment a Chairperson to the SEC. While, Barack Obama broke the mould when he appointed Mary Schapiro just seven days into his first term, it was under exceptional circumstances during the global financial crisis.

BTC appeal as a treasury asset is rising.

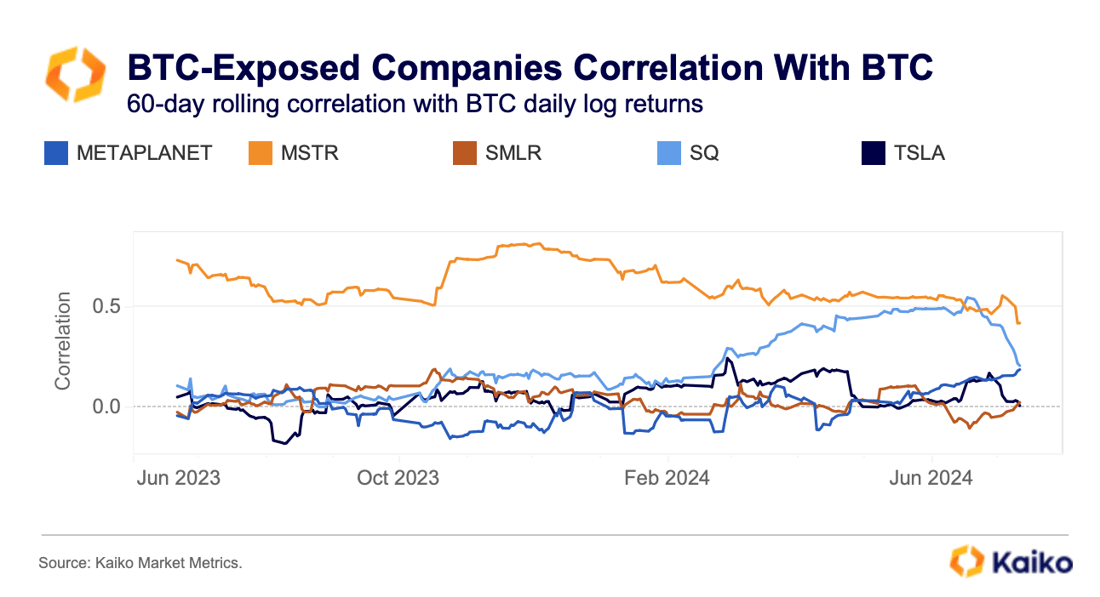

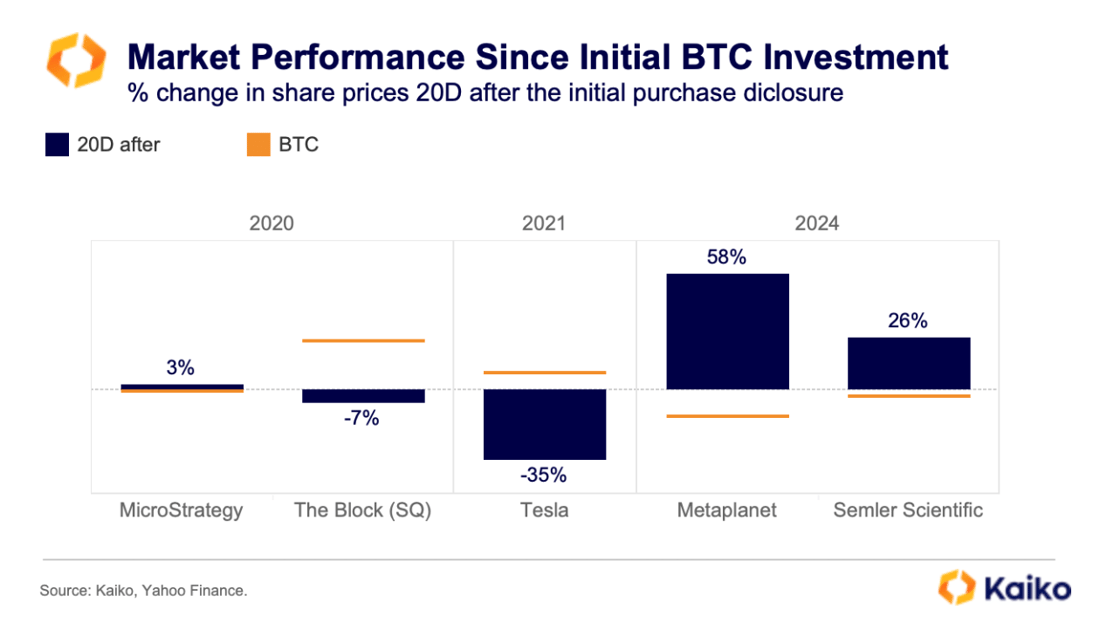

In 2024, several companies began to follow the lead of MicroStrategy (MSTR), Tesla (TSLA), and The Block (SQ) by allocating portions of their balance sheets into Bitcoin. This shift was driven by Bitcoin’s increasing appeal as a treasury asset, largely due to regulatory factors.

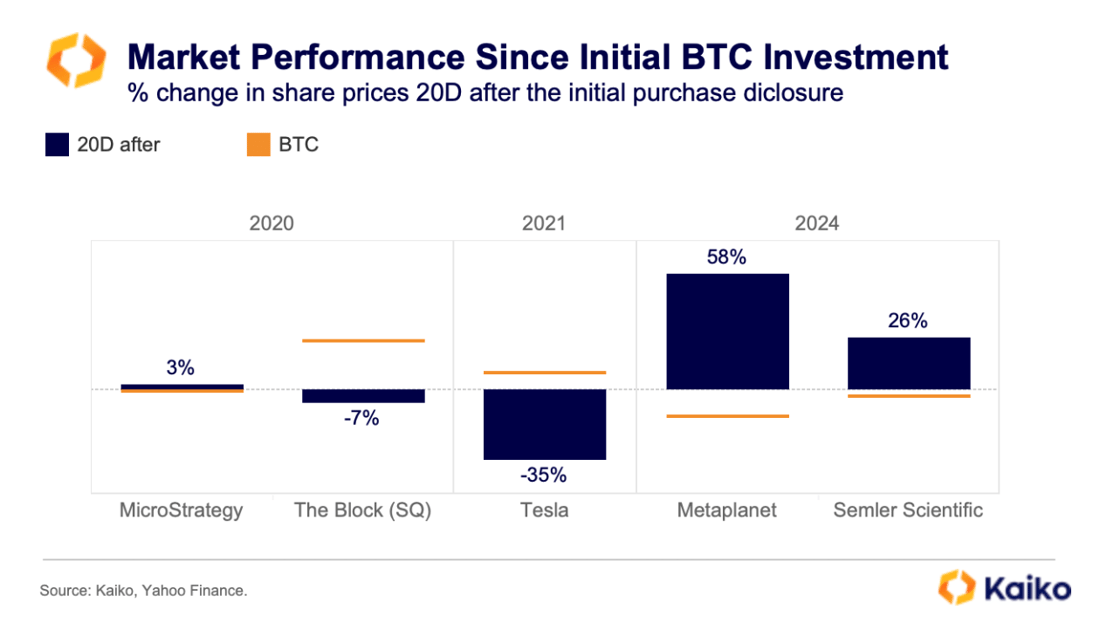

The move has yielded varied results. Some companies such as MicroStrategy, saw substantial gains, while others faced minimal impact.

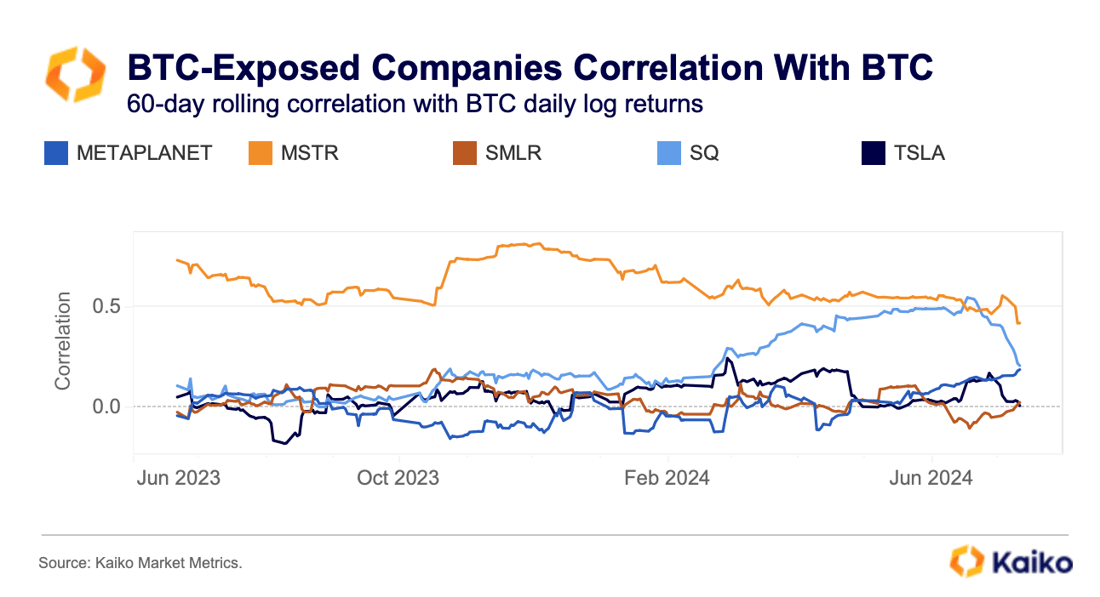

The 60-day rolling correlation of these companies’ share prices with Bitcoin’s daily returns varies significantly from zero to 0.4. Historically, MSTR and SQ have shown the strongest correlation with Bitcoin. Interestingly, Metaplanet’s correlation has increased to a multi-year high of 0.2 since April, coinciding with the company’s decision to add BTC to its balance sheet.

Overall, however, the initial impact in 2024 was more significant compared to previous years.

Metaplanet and Semler Scientific, which integrated BTC into their balance sheets in April and May 2024, saw their share prices surge by 58% and 25% respectively, even though Bitcoin’s price was falling during the same period. In contrast, despite a significant rise in its value over the past four years, MSTR’s share prices showed a minimal increase after its first BTC purchase, while both Square’s and Tesla’s share prices dipped.

This trend could be due to Bitcoin’s growth since 2020, improved regulation, increased acceptance, and recognition as a legitimate investment. Additionally, the approval of spot ETFs in the US and promotional campaigns led by major asset managers like BlackRock and Fidelity have greatly increased global public education about BTC, likely amplifying the announcement effect.

BTC and ETH dominate perpetual futures markets.

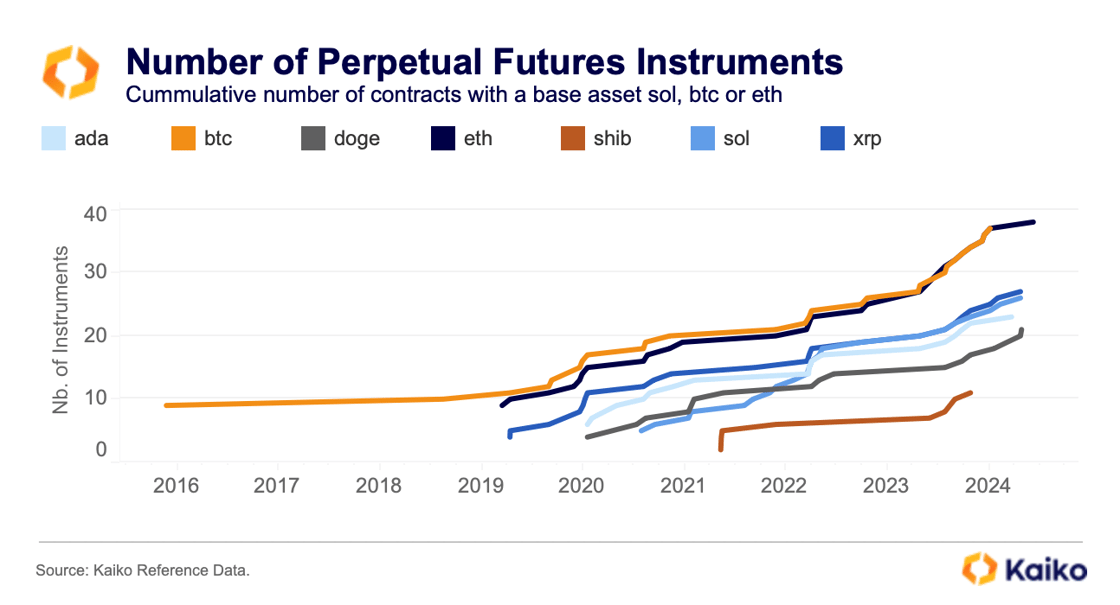

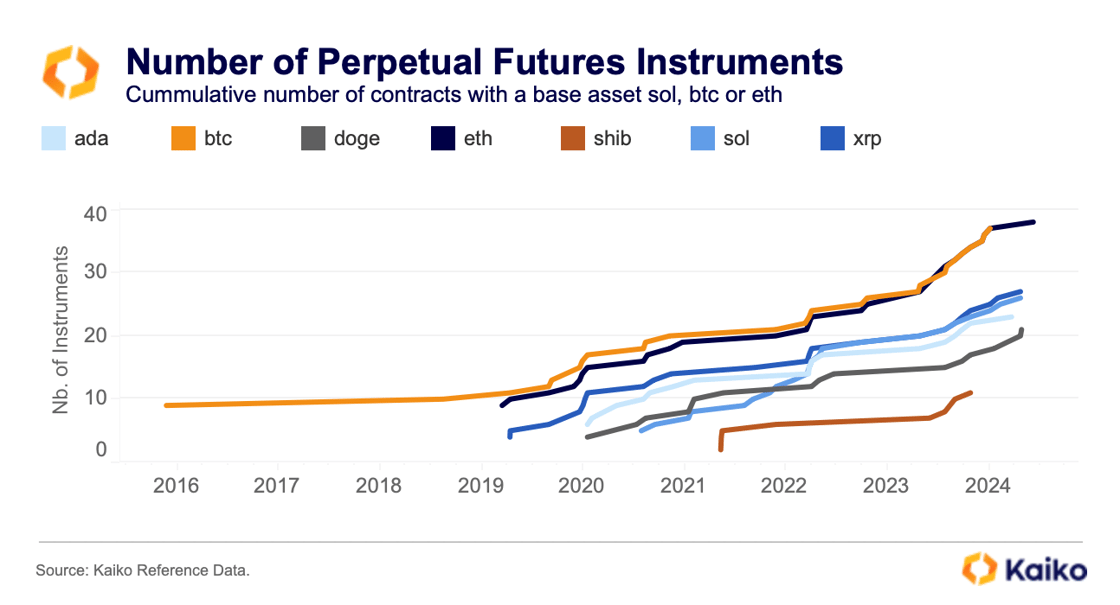

BTC and ETH continue to dominate the perpetual futures market in both volume and the number of available derivatives instruments. Perpetual futures are essential tools for traders to hedge and speculate on assets, facilitating price discovery. Over the past years, BTC and ETH have consistently maintained a higher number of available contracts compared to other cryptocurrencies.

Although large-cap altcoins such as SOL, ADA, XRP, and DOGE have experienced growth in the number of available perpetual futures contracts, the gap between these altcoins and the two major cryptocurrencies (BTC and ETH) has widened.

Exchanges have slowed the listing of altcoin perpetual futures instruments since the Terra collapse in May 2022 as speculative demand waned and market participation plummeted. However, this trend has reversed over the past year, with the number of newly listed perpetual futures instruments rising by double digits.

Uniswap keeps pace with Coinbase.

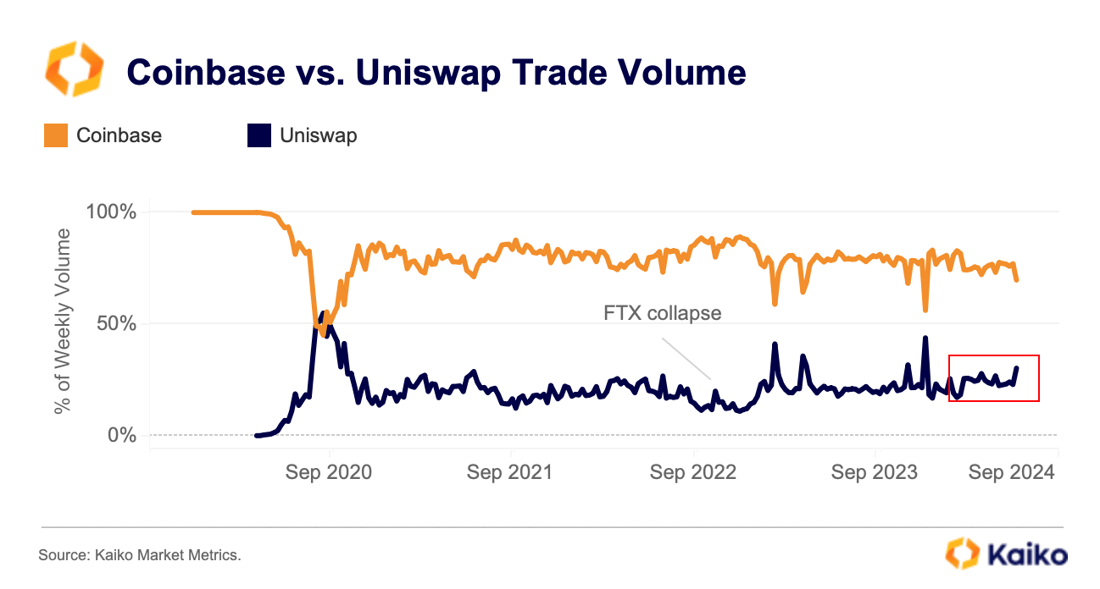

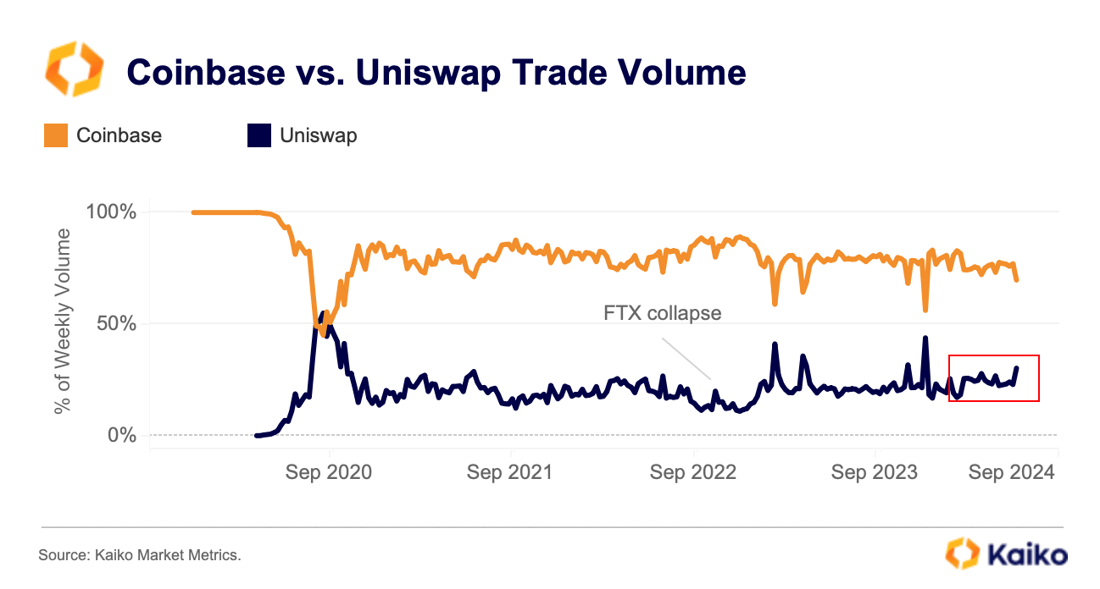

This year, Uniswap’s trading volume on Ethereum has managed to keep up with Coinbase, the largest US-based exchange, maintaining an average market share of 24%. This represents a slight increase from the previous year’s share of 21% . However, Uniswap’s current market share is significantly lower than its peak of 55% during the DeFi summer of 2020. One explanation for this is that Ethereum-based DEXs have lagged significantly other blockchains namely Arbitrum, Base and Solana during the recent market rally.

Overall, DEXs volumes are still low compared to CEXs as they offer less-user friendly-experience. However, demand for non-custodial trading has increased following the collapse of FTX, with Uniswap’s market share remaining consistently above 20% for the longest period since 2020/21, indicating a robust interest in DEXs among traders.

![]()

![]()

![]()

![]()