Data Points

Alameda Research-linked wallet consolidates holdings

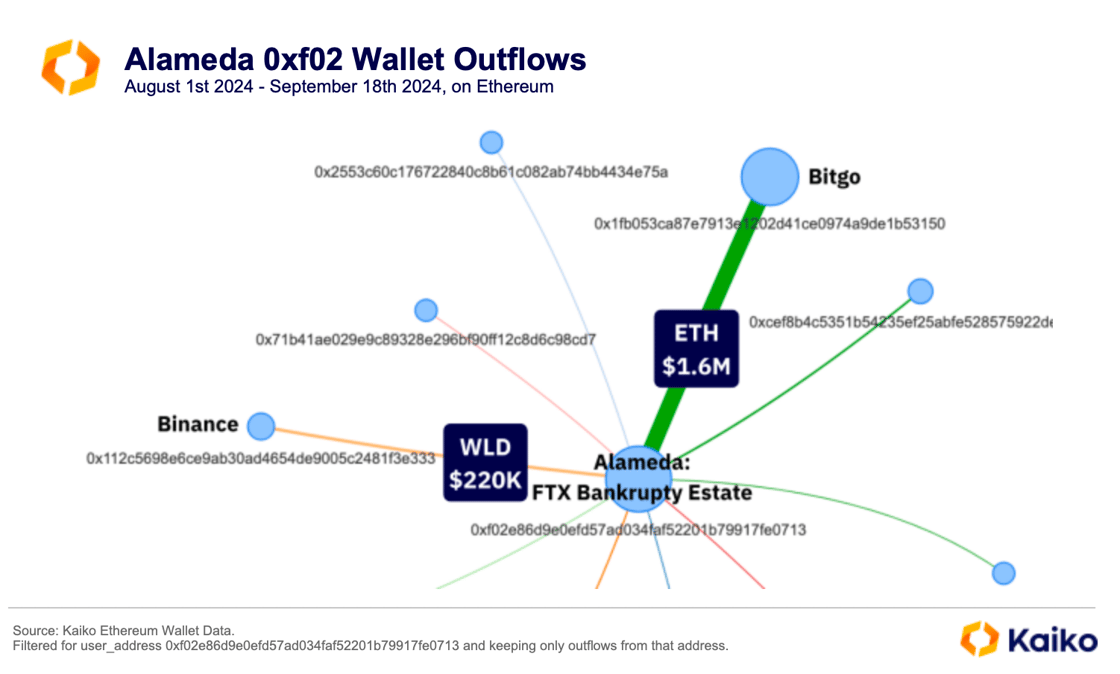

A crypto wallet, allegedly linked to FTX’s sister company Alameda Research, has been actively moving funds over the past month, sparking speculation that the FTX bankruptcy estate is consolidating assets ahead of potential creditor repayments. Earlier this year, FTX announced that it had recovered enough tokens to pay most of its creditors back in full, based on the value of their holdings at the time it filed for bankruptcy. The exchange is expected to start repayments after the final approval of its wind-down plan, expected in early October.

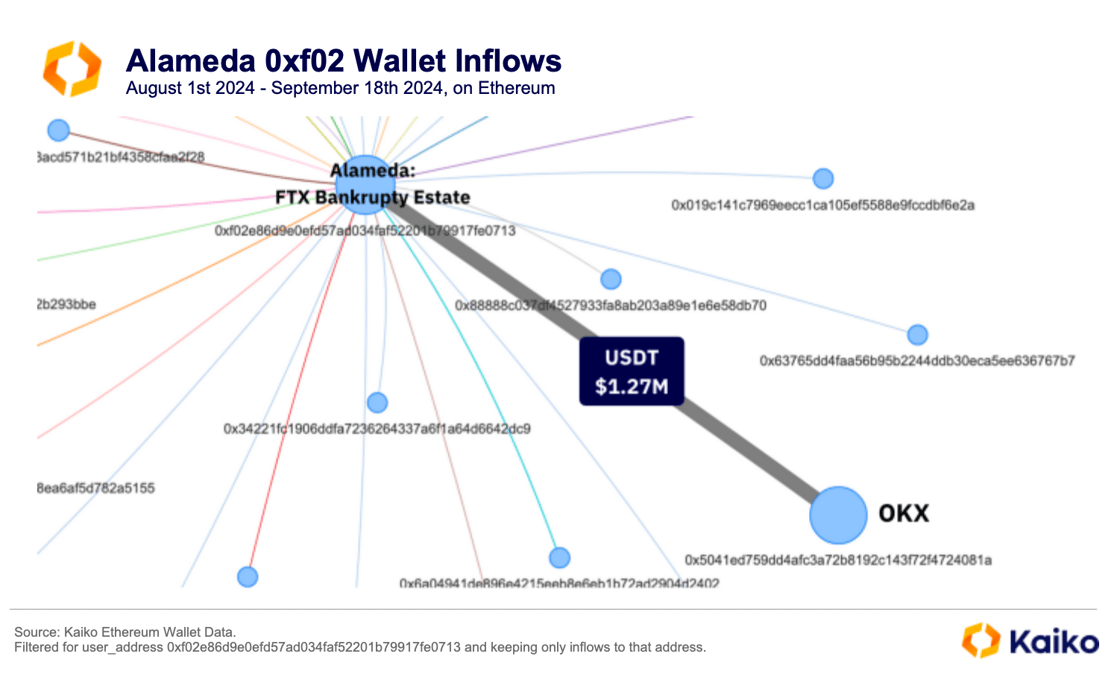

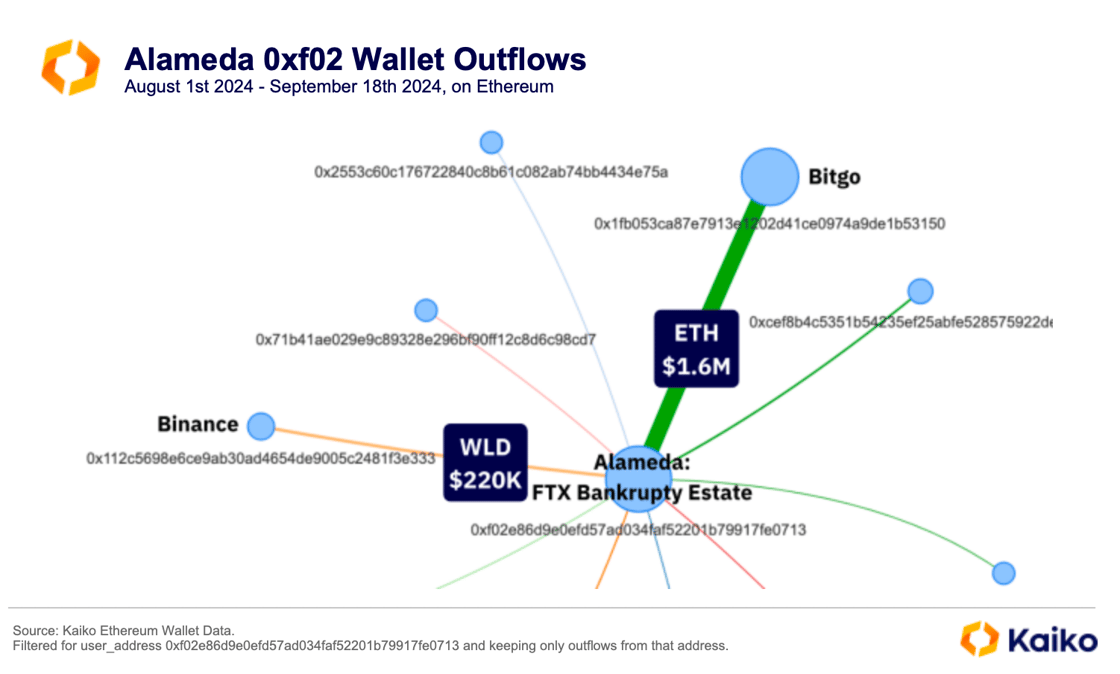

Using Kaiko’s wallet data solution, we investigated the transfers in and out of the wallet (0xf02e86d9e0efd57ad034faf52201b79917fe0713). Over the past month, it has transferred $1.6 million in ETH to crypto custodian BitGo and $220K in World Coin (WLD) to Binance.

Transfers to exchanges are generally viewed as bearish because traders usually move assets there to sell them. Alameda Research was an early investor in Worldcoin, holding 75 million ($118M) WLD tokens. Since July, these tokens have been gradually unlocked by Worldcoin’s developer, Tools for Humanity (TFH).

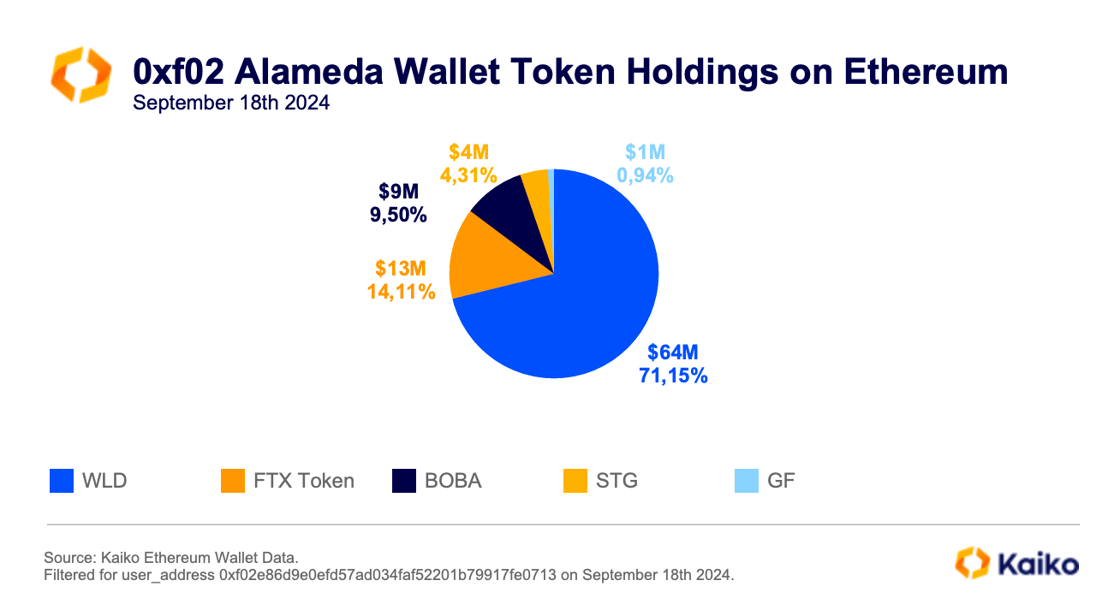

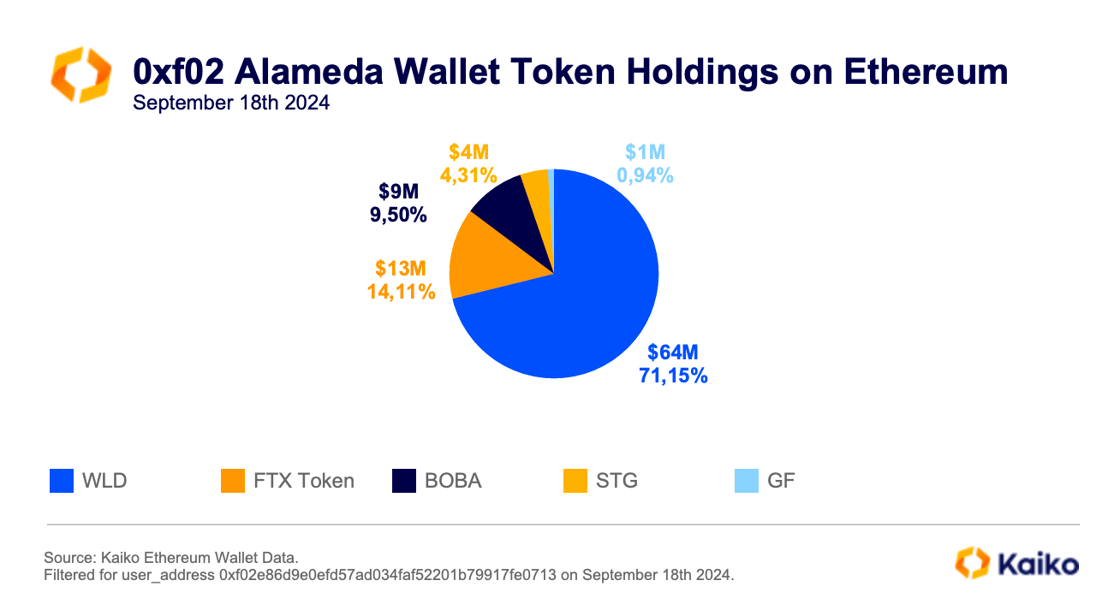

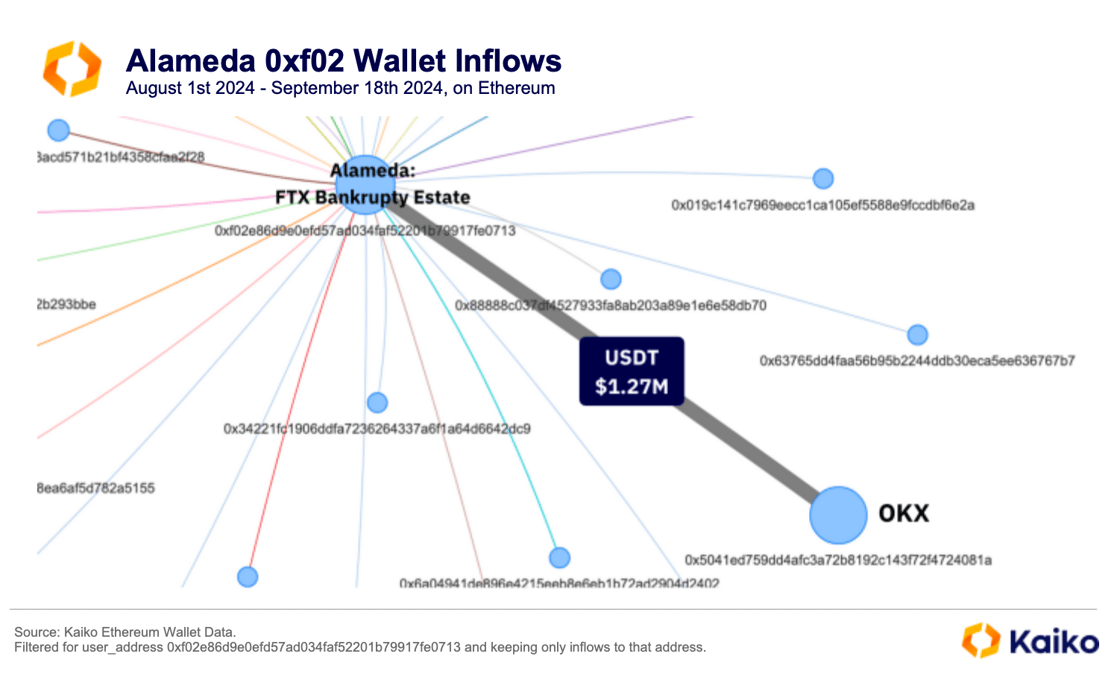

A closer look at the wallet’s inflows reveals asset consolidation through multiple transfers from various smaller wallets, most likely owned by Alameda Research, with the largest inflow totalling $1.27 million USDT coming from OKX. As of September 18, Alameda’s wallet still holds $64M in WLD. Selling these could heavily impact prices, which are already down 30% since the July 24 token unlock. Other major holdings include several small, illiquid tokens like FTX’s FTT ($13M) and Bona Network’s BOBA ($9M) tokens, which together have a 1% market depth of only $0.7M daily.

As of September 18, Alameda’s wallet still holds $64M in WLD. Selling these could heavily impact prices, which are already down 30% since the July 24 token unlock. Other major holdings include several small, illiquid tokens like FTX’s FTT ($13M) and Bona Network’s BOBA ($9M) tokens, which together have a 1% market depth of only $0.7M daily.

Traders turn to Crypto.com amid US market shake up

The US crypto exchange landscape has been reshaped this year amid regulatory changes and market structure developments. Cboe Digital shuttered its digital asset spot trading operations in June after originally announcing plans to do so in April, focusing now exclusively on derivatives.

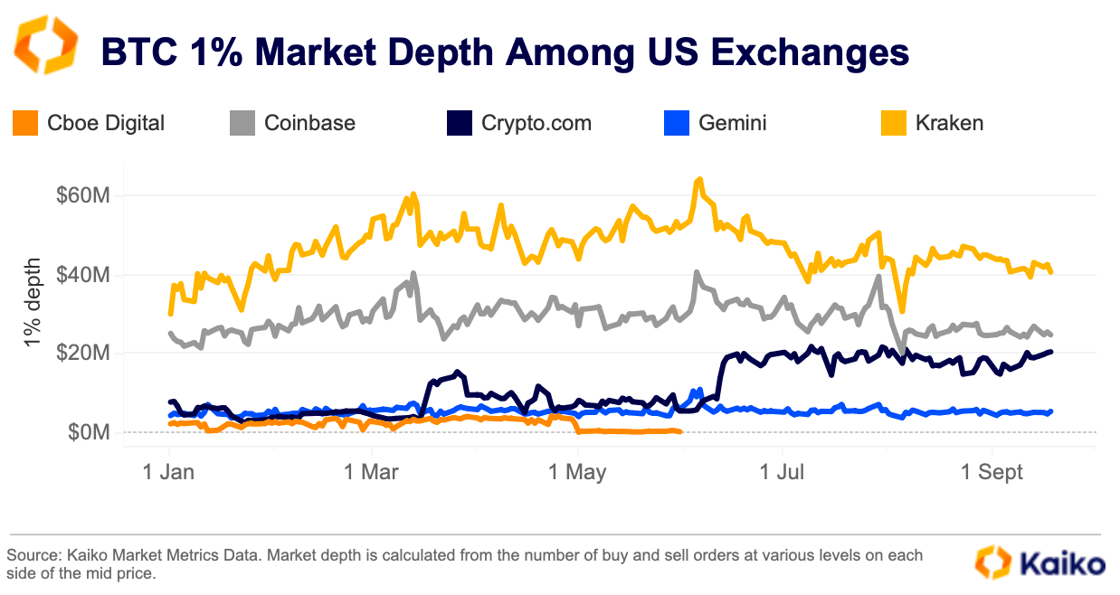

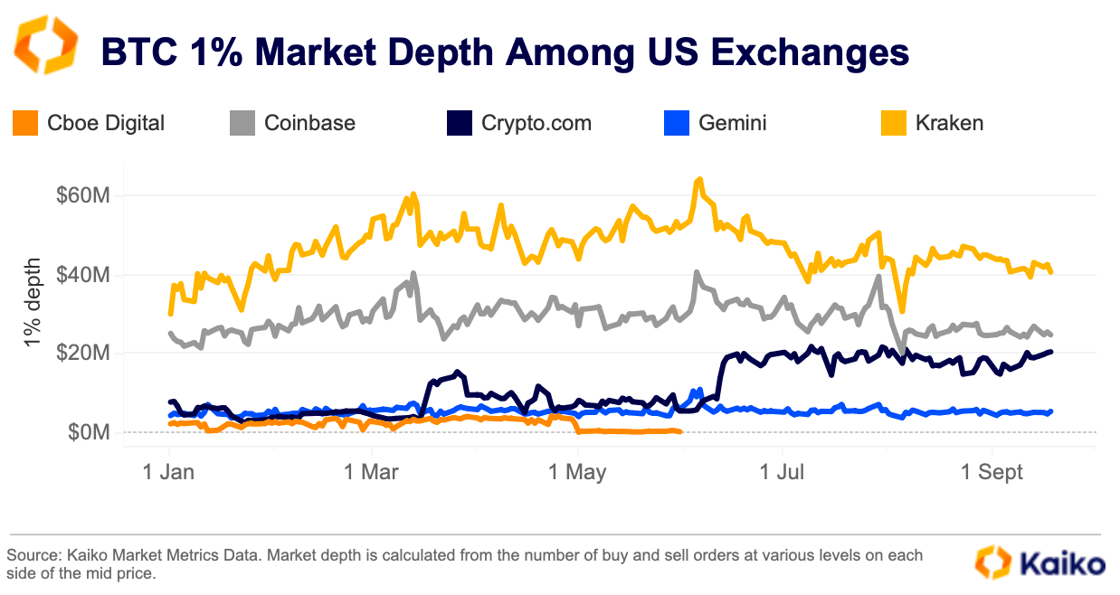

Crypto.com appears to have picked up significant volume and market share since June, suggesting it likely benefited from the exchange’s closure. Trade volumes soared, and so did liquidity. BTC 1% market depth on the exchange spiked over the summer, as it eclipsed Gemini and challenged Coinbase’s liquidity. Coinbase has even lost market share in the third quarter.

Crypto.com’s competitive fee structure has also likely contributed to increased trading activity on the platform. The exchange currently charges zero maker fees for VIP tier customers, among other promotions. Additionally, fees on Crypto.com are generally quite competitive compared to other US-based exchanges.

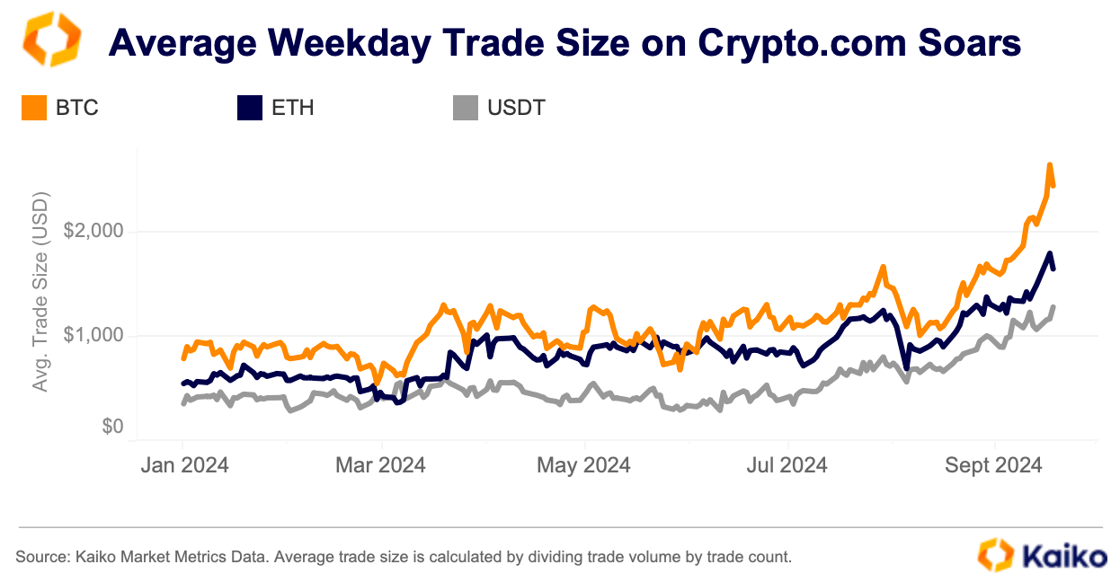

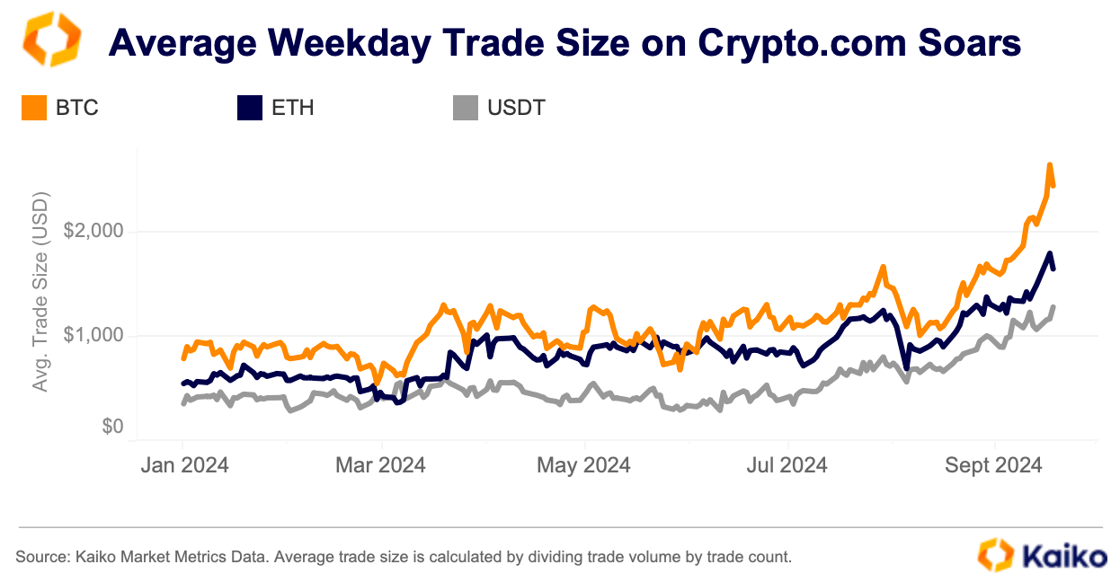

The increase in liquidity alongside volumes suggests that market makers are also more active on Crypto.com now. The growth in average trade size on the exchange is another sign that it might have picked up volume from Cboe’s closure.

If we look at weekday trading for BTC, ETH, and USDT, we see that volumes have steadily increased since March, with a sharp move higher over the summer months. Since Cboe was an institutional venue, its average trade size was much higher than most retail venues. The uptick in trade size on Crypto.com suggests increased institutional activity.

Why is altcoins liquidity increasingly concentrated?

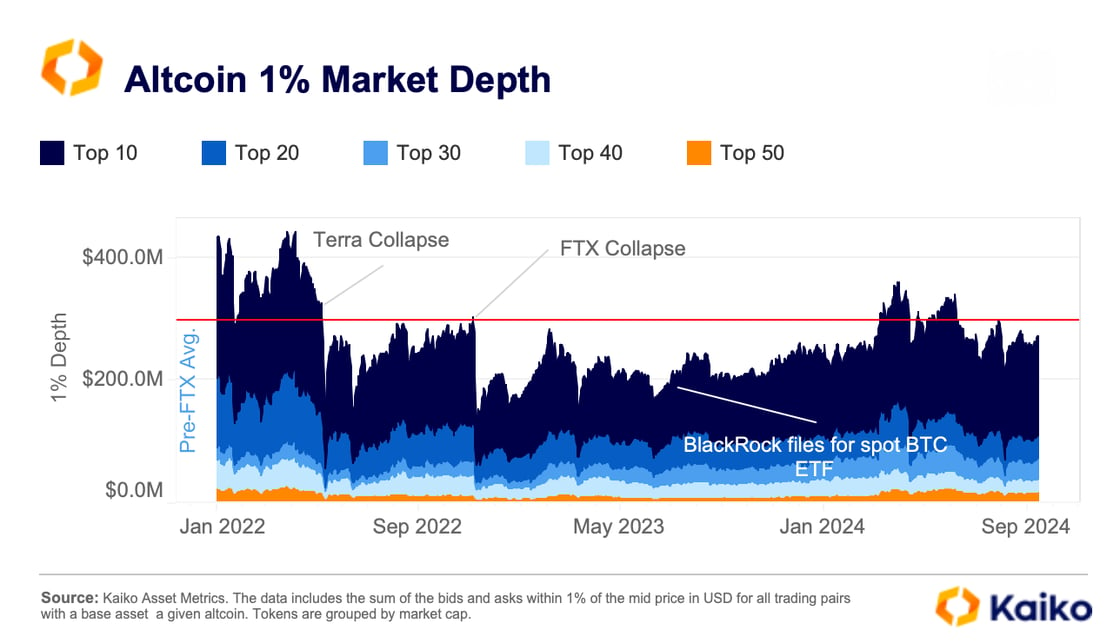

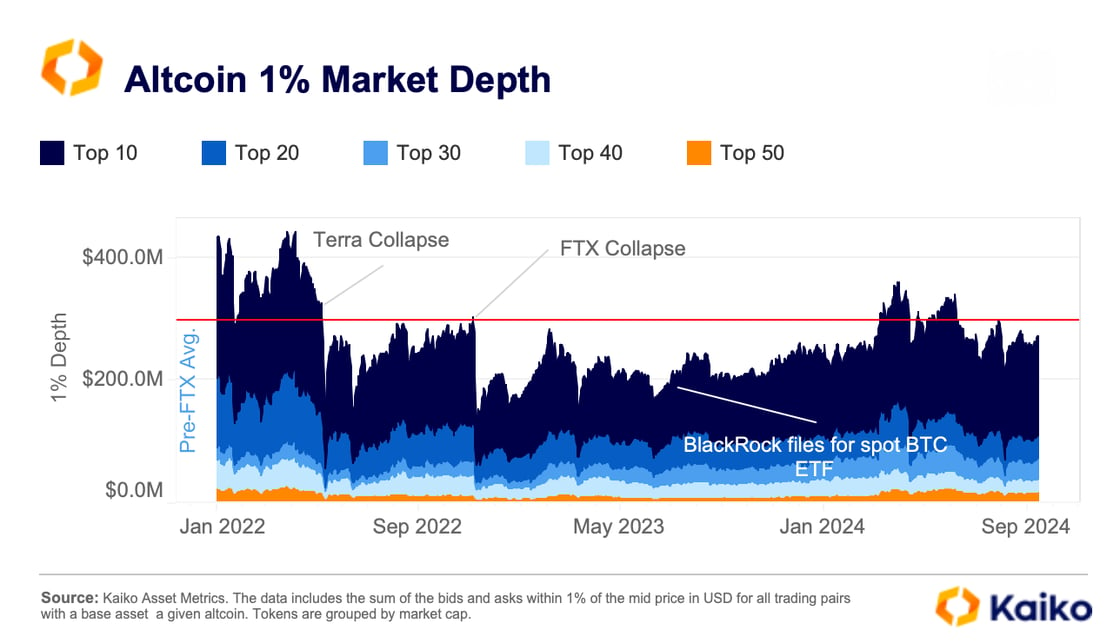

Despite significant volatility over the past months, the 1% altcoins market depth has remained relatively flat at $270 million in Q3, suggesting that market makers continue to provide liquidity despite the ongoing volatility.

Altcoins liquidity has been heavily impacted by the collapse of FTX and Terra, dropping by more than 60% between April and December 2022. Over the past year, liquidity has gradually improved, surpassing its pre-FTX average in Q1 2024 before retreating in Q3.

However, breaking this trend down by asset suggests that this recovery has been uneven. Altcoins liquidity is increasingly concentrated, with large caps gaining relative to smaller assets.

The top ten altcoins by market cap accounted for 60% of the total depth in early September, up from around 50% in early 2022. In contrast, the share of the top 20 has declined sharply from 27% to 14% over the same period.

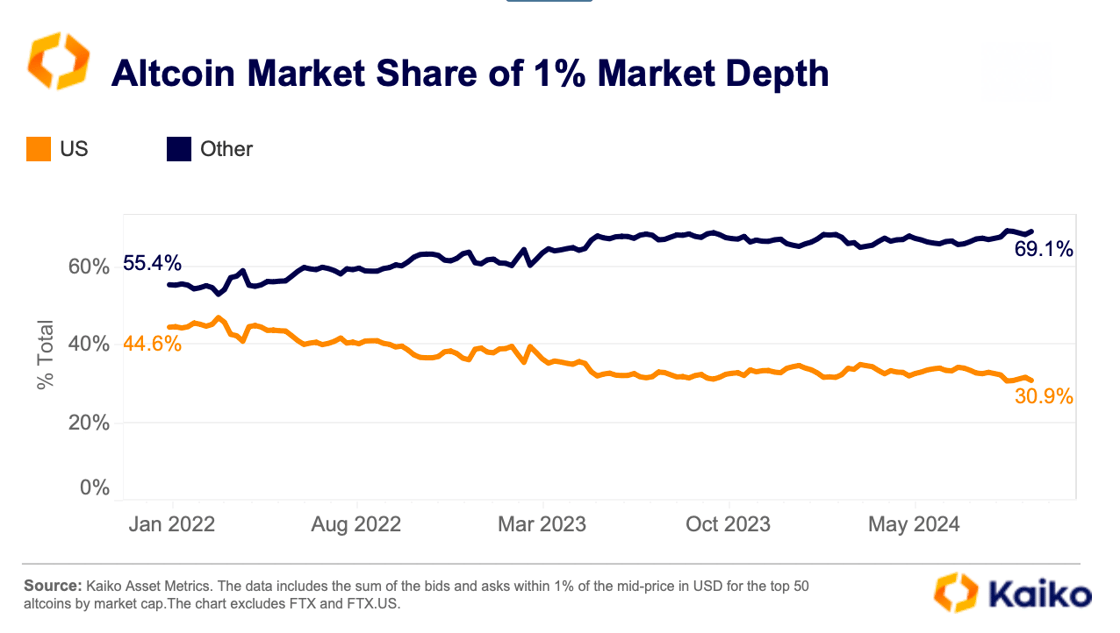

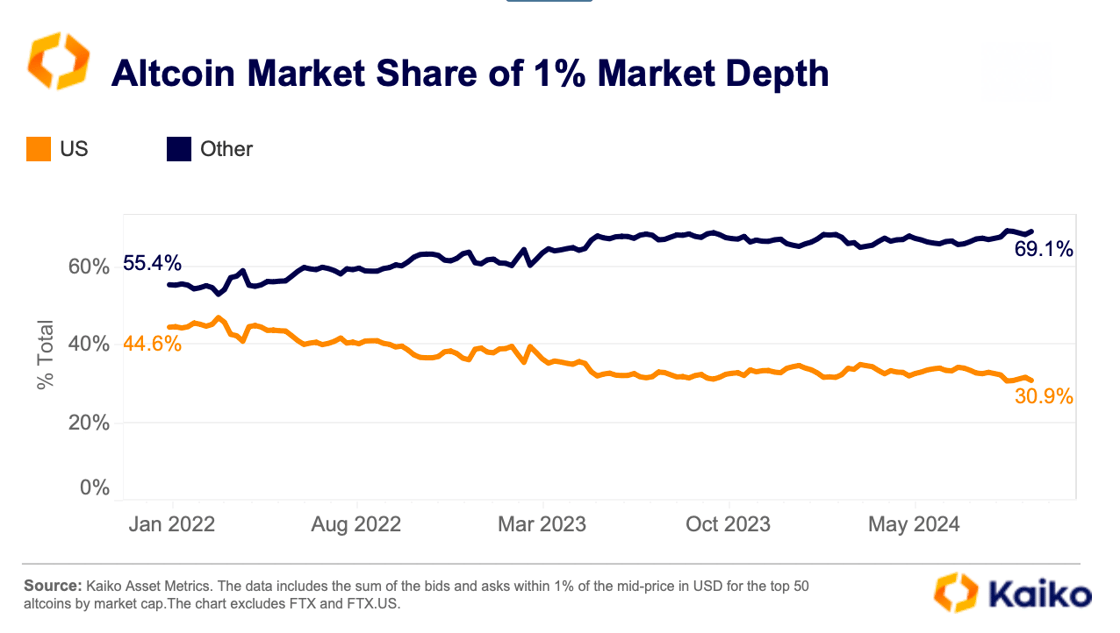

Altcoin liquidity is also more concentrated on offshore exchanges. Their share of the total altcoin depth has increased to 69% from 55% in early 2022. The trend has been driven by large and mid-cap altcoins.

We observe the opposite trend in Bitcoin liquidity, with US exchanges gaining share relative to offshore markets. This suggests that some market makers may have derisked their portfolios or rotated into Bitcoin.

Exchanges listings cool off in 2024

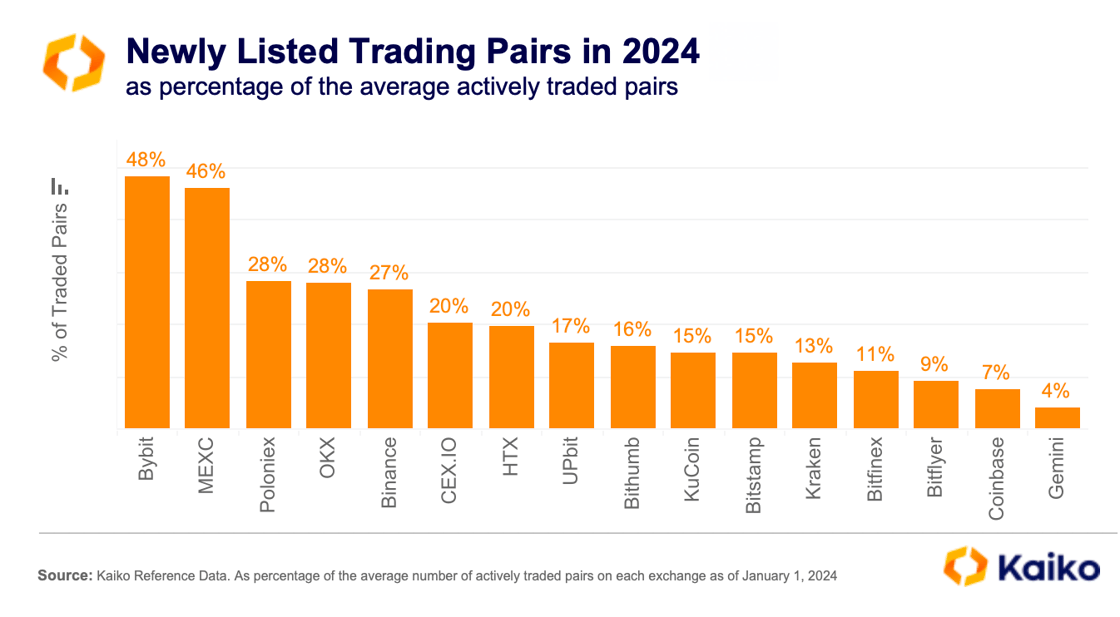

Heightened global regulatory scrutiny has significantly altered crypto exchange listing strategies, leading to a marked slowdown in new listings compared to the 2021 bull run.

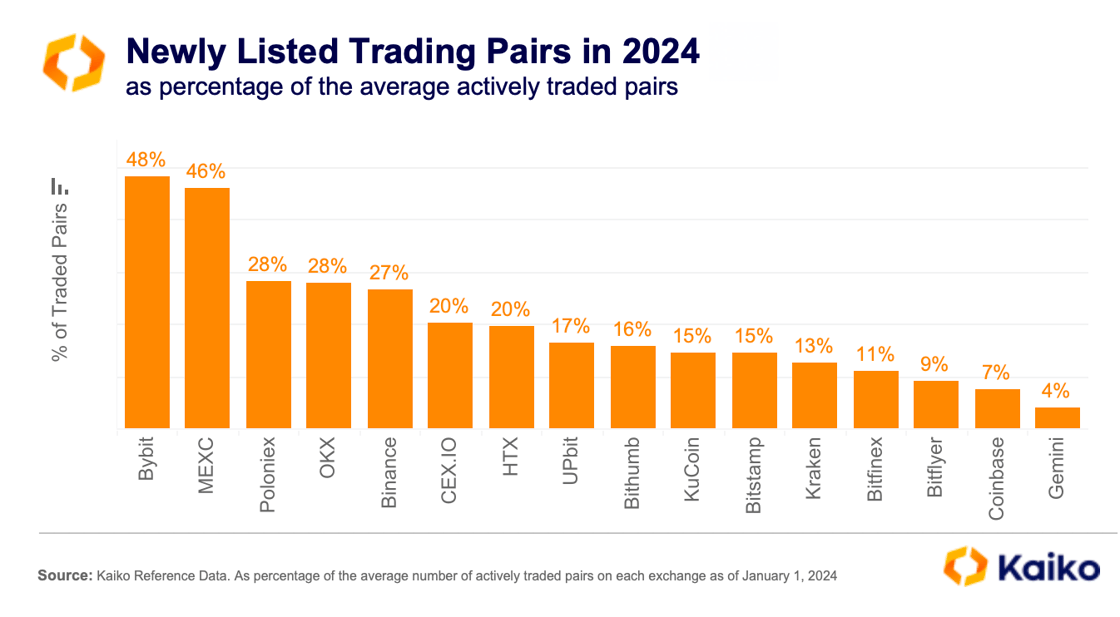

However, focusing solely on the nominal number of new listings offers a limited view of how exchanges are expanding their offerings. To provide a clearer picture, we compared the number of new listings relative to the total number of actively traded pairs across exchanges.

In 2024, Binance added over 300 new pairs and ranked second in total listings, behind MEXC. However, these additions accounted for only 27% of its total offerings, putting Binance behind Bybit, Poloniex, and OKX in terms of listing expansion.

U.S.-based exchanges have been even more conservative, with new listings making up just 4% to 15% of their current offerings. For instance, Coinbase introduced only 29 new trading pairs in 2024—a tenfold drop compared to 2021.

Overall, new listings across major exchanges represent about 20% of existing traded pairs this year, a significant decline from the 50% average seen during the peak of 2021.

US presidential race sparks volatility in crypto markets

Digital assets are a growing narrative among the two main US presidential candidates. Former President Trump pledged his support for Bitcoin and the broader space months ago and is even set to launch his own cryptocurrency project in the coming weeks. The Republican candidate’s support for Bitcoin has been seen as positive by many market participants.

However, this can be a double-edged sword, as seen during the recent debate. BTC fell during the debate, as the market reacted poorly to Trump’s performance against Harris.

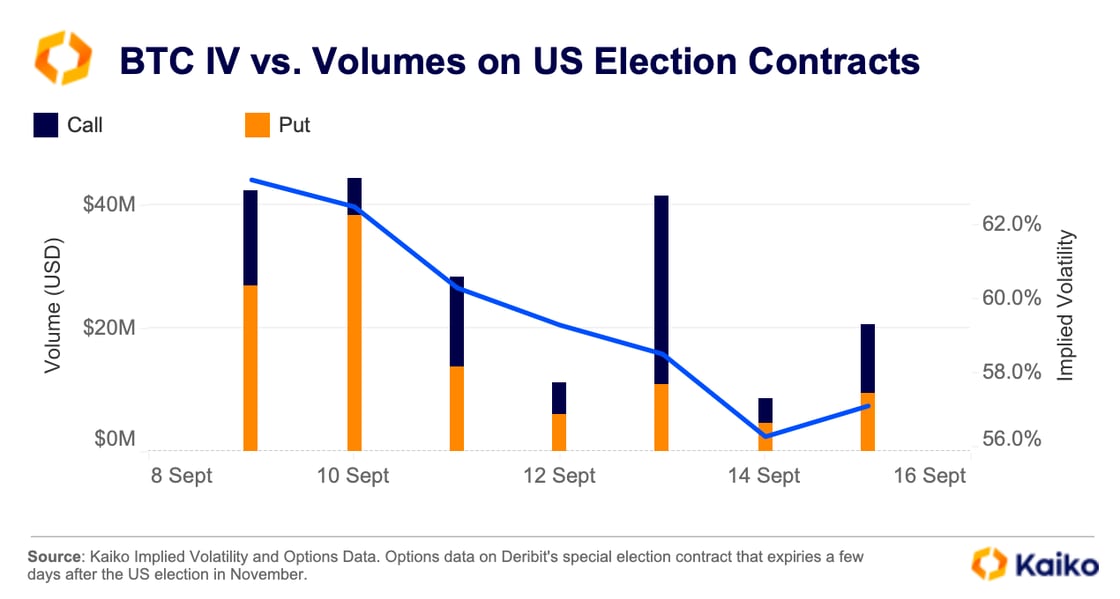

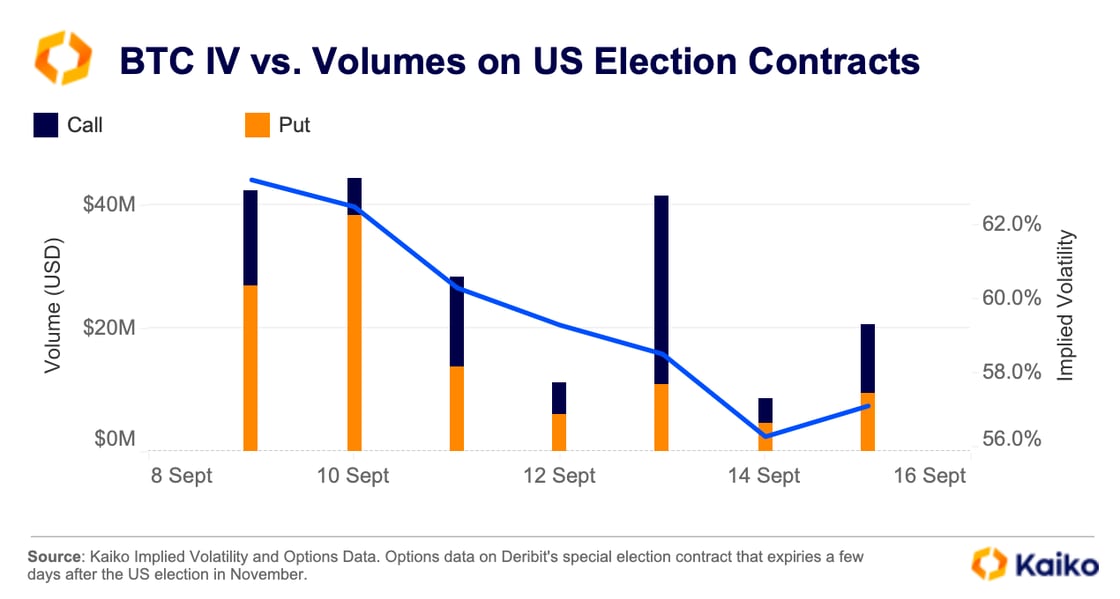

Implied volatility on Deribit’s November 8 BTC options contracts—which expire just 3 days after Americans cast their votes—spiked in the run-up to the debate. During the debate, volumes on the special election contracts soared above $40 million, with traders primarily buying put options, which benefit when the price of BTC falls.

The US election could continue to be a source of heightened volatility over the coming weeks as we enter the final stretch of the election cycle. While BTC and digital assets weren’t a feature of the 2020 campaign, they are increasingly important this time around. Former President Donald Trump set out his stall early on, pledging to support digital assets in the US and even speaking at the Bitcoin conference in August. While Kamala Harris had been less vocal in her support for digital assets, the current Vice President said she would support digital asset innovation at a fundraising event on Sunday.

![]()

![]()

![]()

![]()

As of September 18, Alameda’s wallet still holds $64M in WLD. Selling these could heavily impact prices, which are already down 30% since the July 24 token unlock. Other major holdings include several small, illiquid tokens like FTX’s FTT ($13M) and Bona Network’s BOBA ($9M) tokens, which together have a 1% market depth of only $0.7M daily.

As of September 18, Alameda’s wallet still holds $64M in WLD. Selling these could heavily impact prices, which are already down 30% since the July 24 token unlock. Other major holdings include several small, illiquid tokens like FTX’s FTT ($13M) and Bona Network’s BOBA ($9M) tokens, which together have a 1% market depth of only $0.7M daily.