Turkish Lira’s growing role in crypto

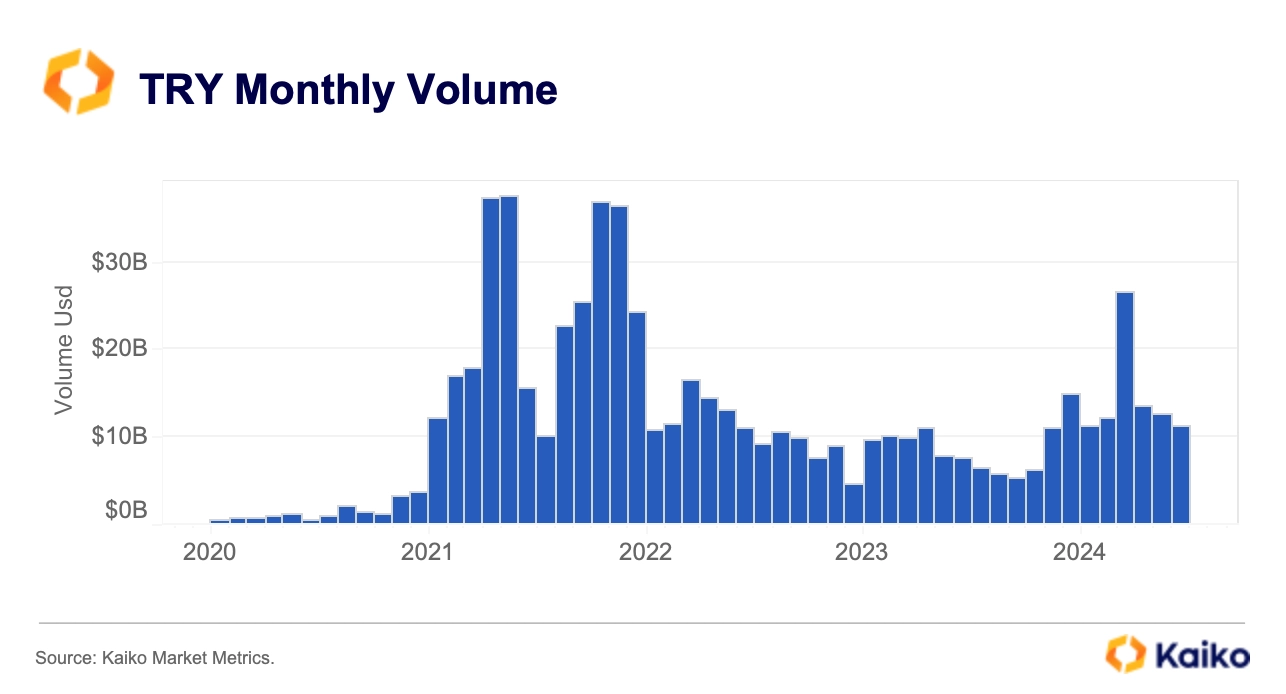

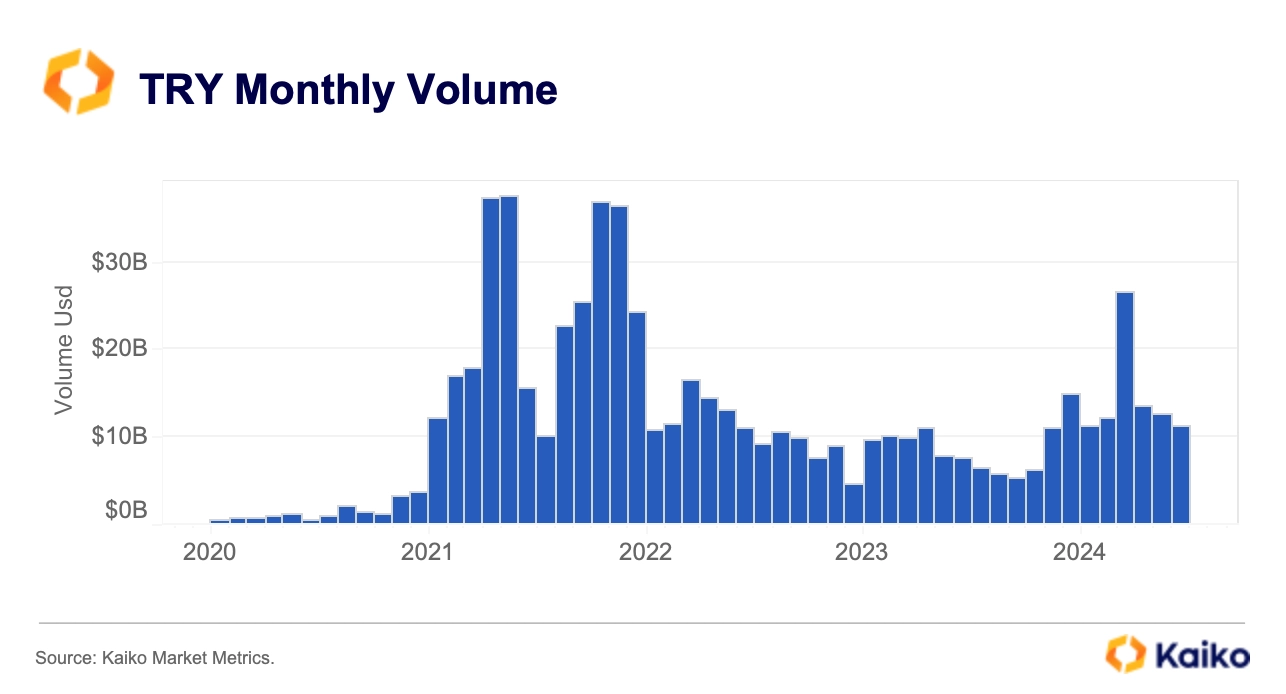

Turkish Lira (TRY) trade volume has increased steadily, from just a few million four years ago to over $10 billion. In 2024, the monthly volume, which includes all trading pairs with TRY as a base or quote asset in USD on seven exchanges, demonstrated remarkable resilience to crypto market volatility. It exceeded $10 billion monthly for eight consecutive months—the longest period on record.

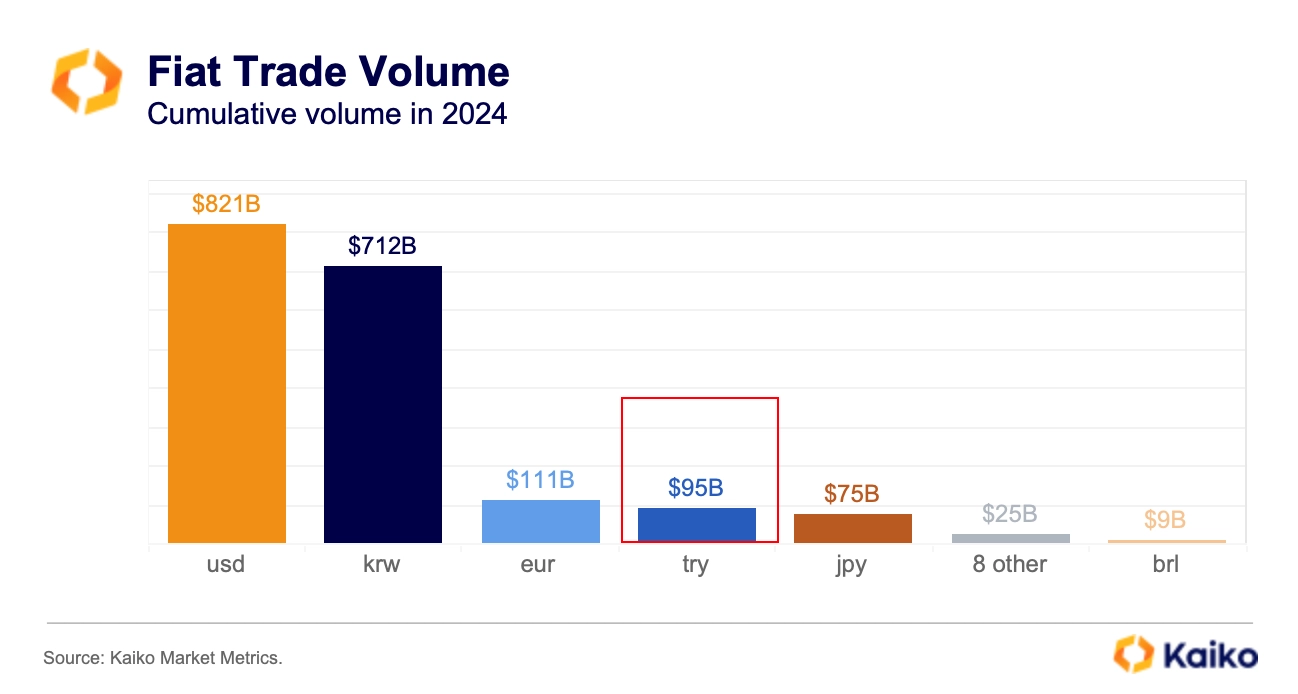

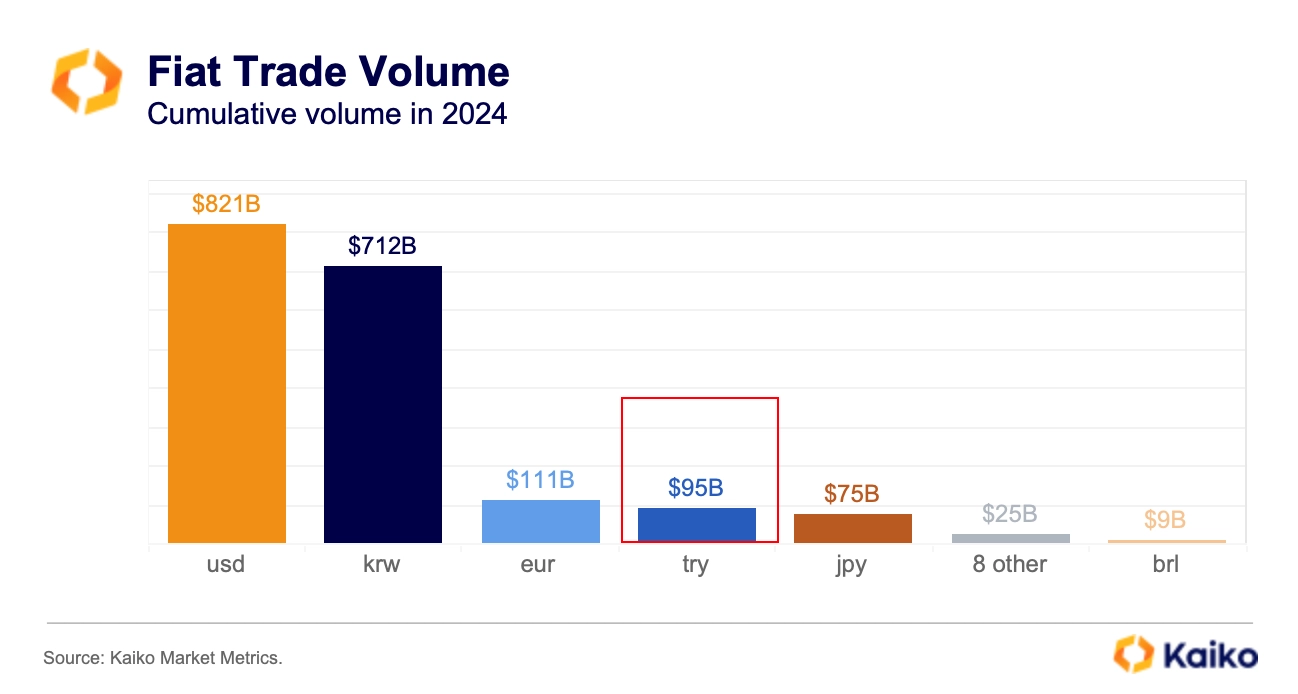

In 2024, the cumulative Lira volume was about $95 billion, nearly matching the total annual amount for the whole of 2023.

Since 2022, the TRY has consistently ranked fourth in trade volume behind the US Dollar, the Korean Won, and the Euro.

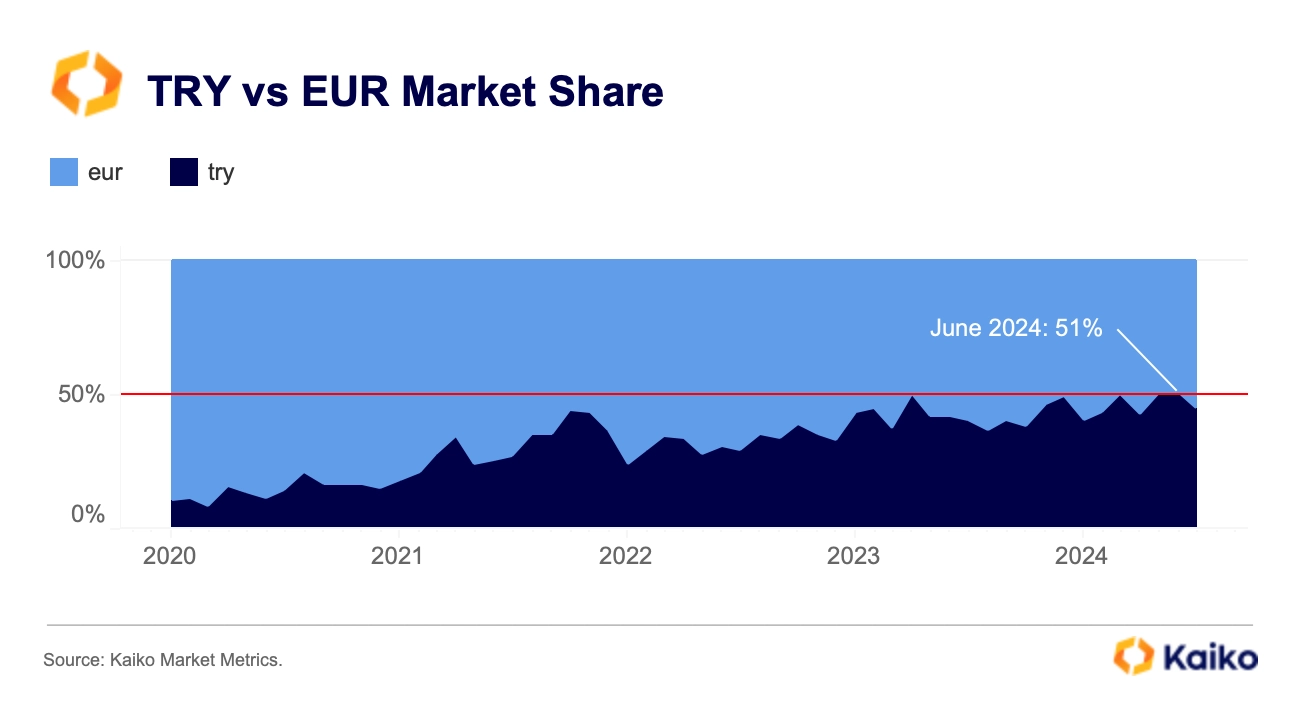

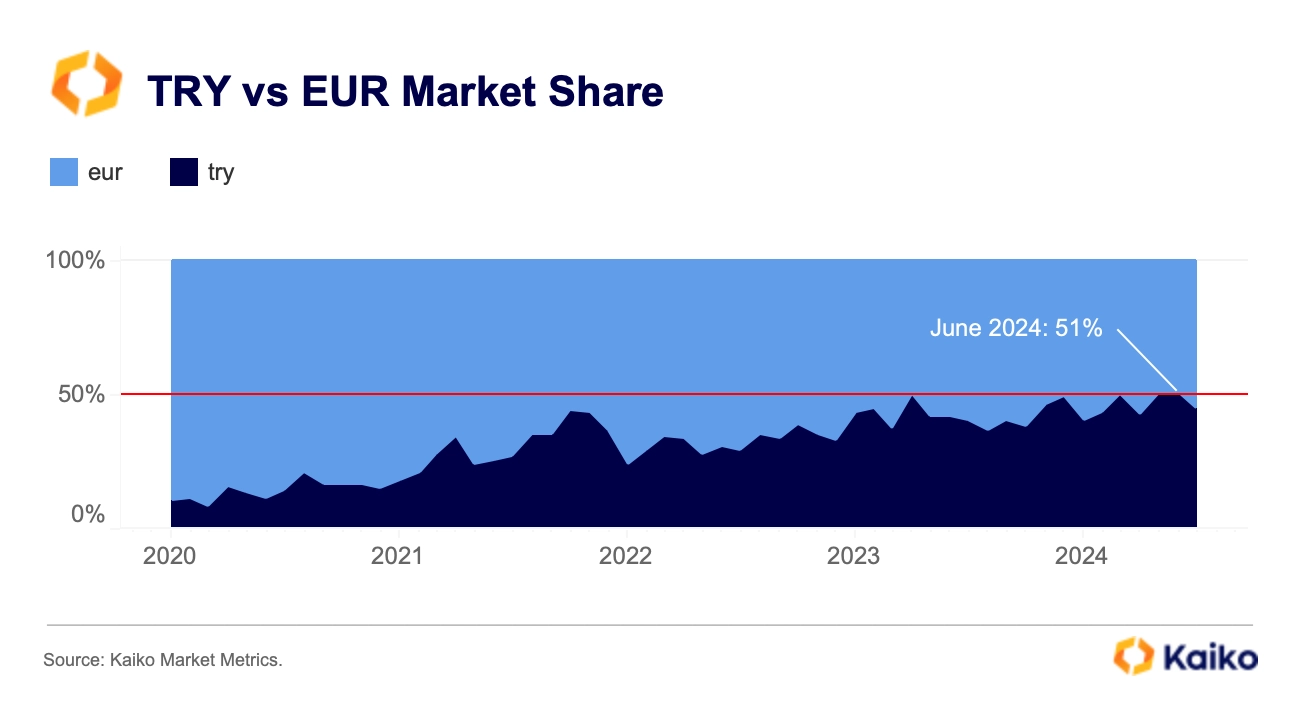

The Lira has been rapidly closing the gap with its closest competitor, the Euro. Its market share against the EUR rose from just 10% in early 2022 to approximately 40-50% today. Notably, the TRY briefly surpassed the Euro in total volume for the first time ever in early June.

This upward trend has been further intensified by the tightening global regulatory environment. This posed challenges for Binance, as its EUR payment processor dropped support for the exchange last year.

The factors driving crypto adoption in Turkey

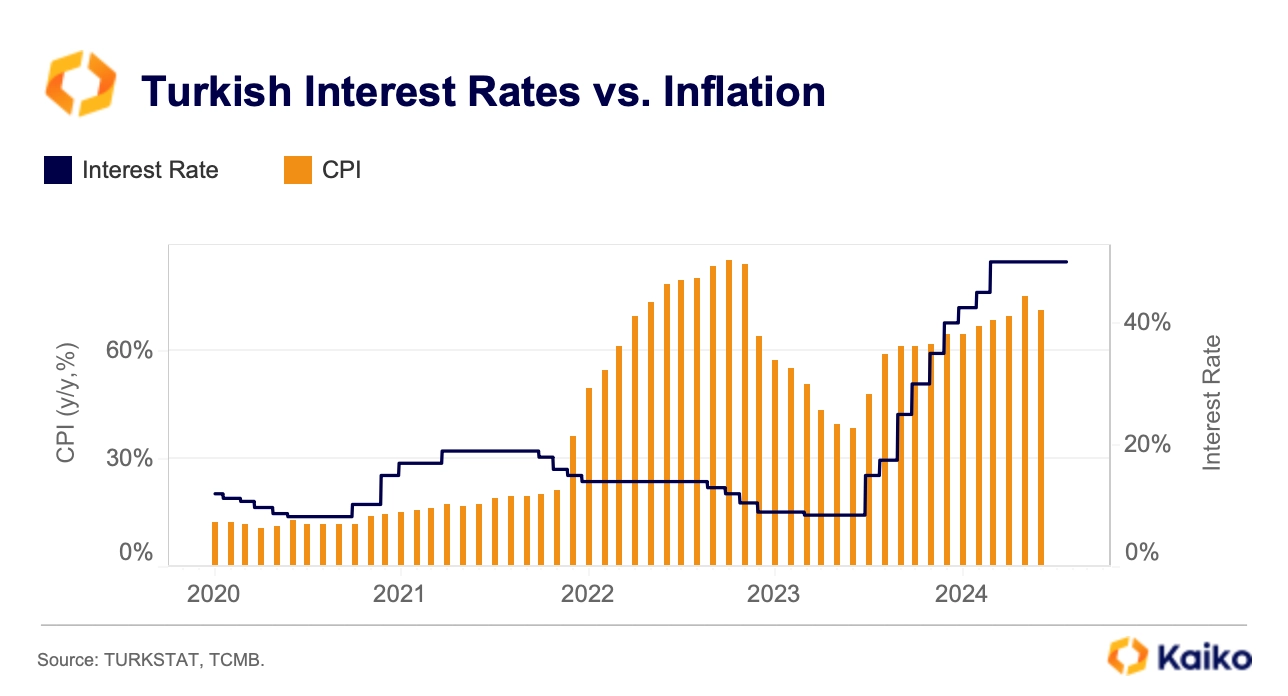

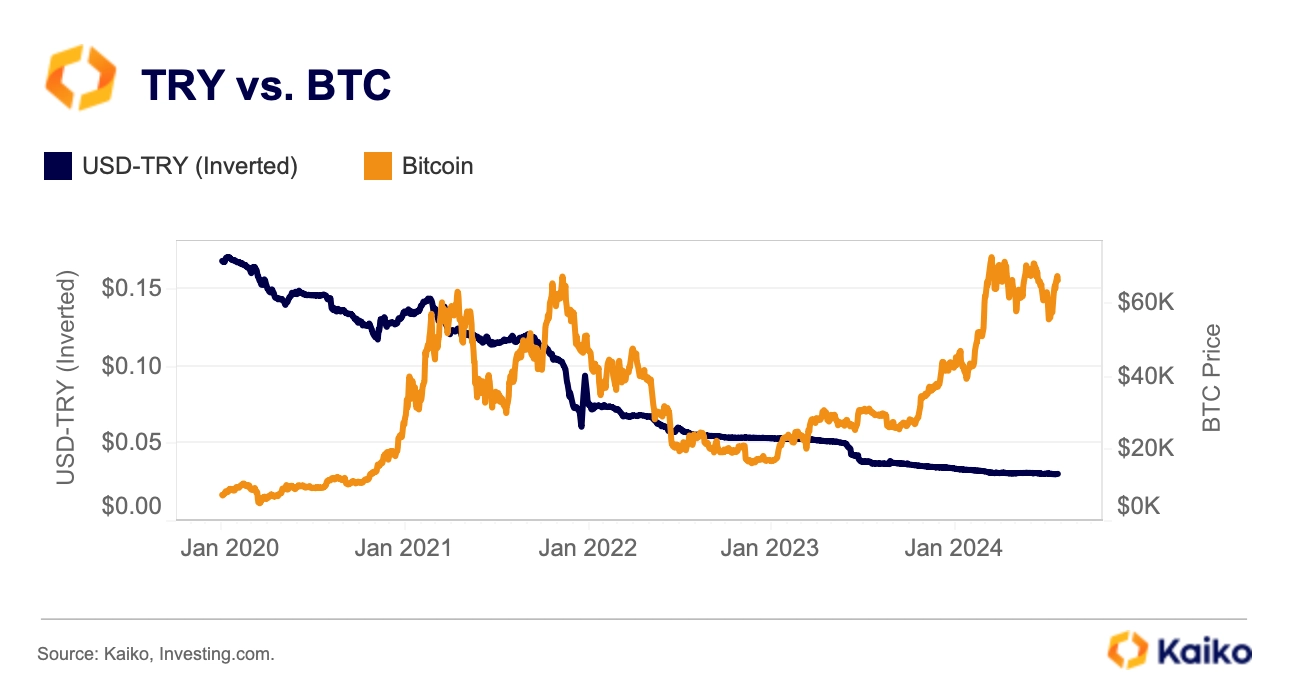

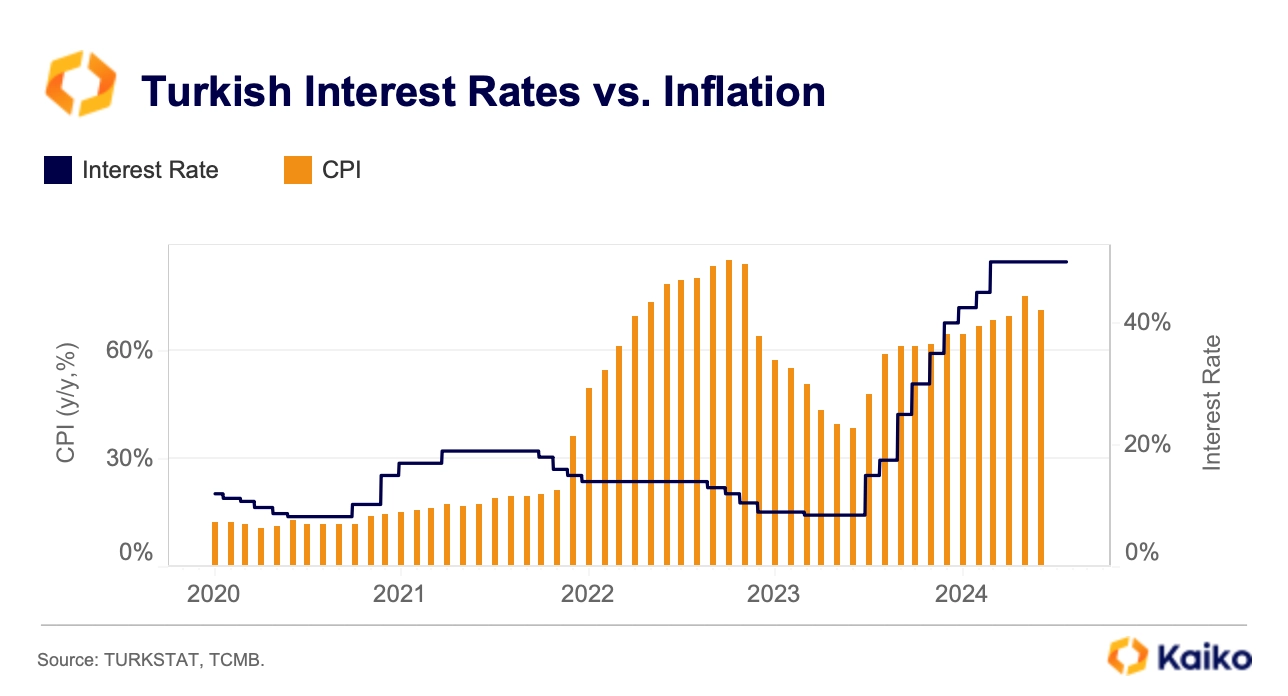

Turkey has been grappling with double-digit inflation and currency devaluation for years. The average inflation rate in the country over the past five years has been more than 40%.

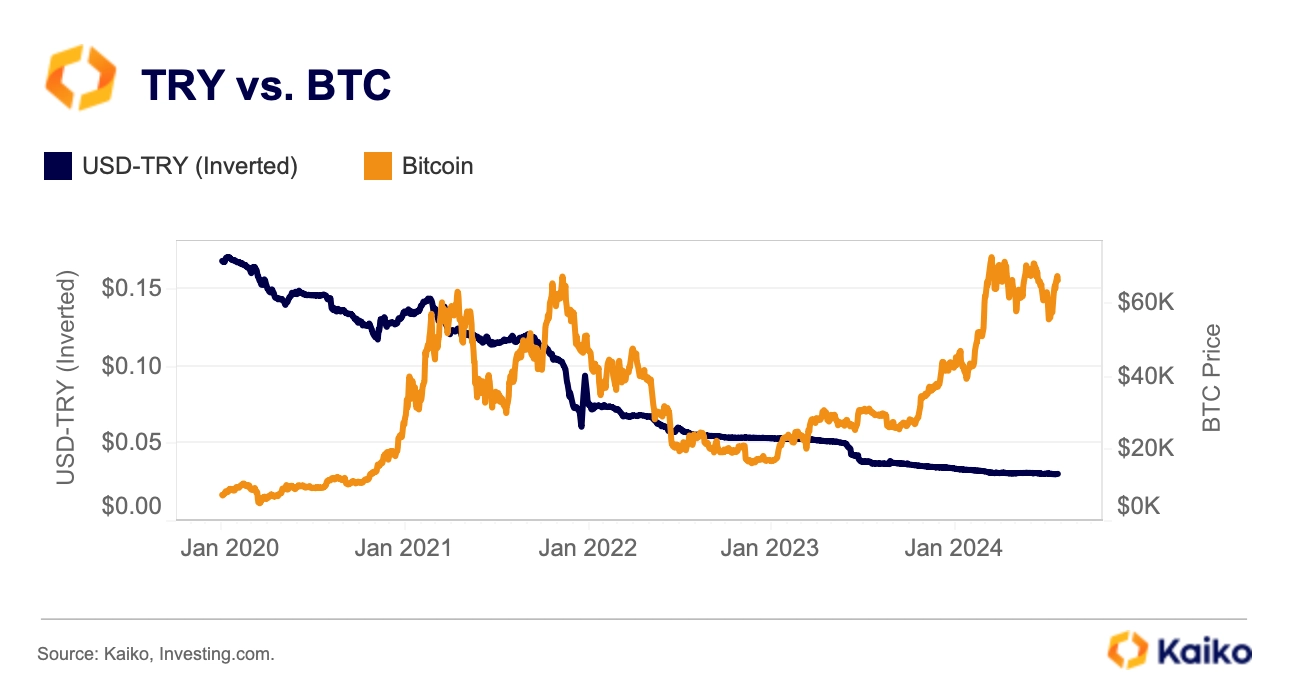

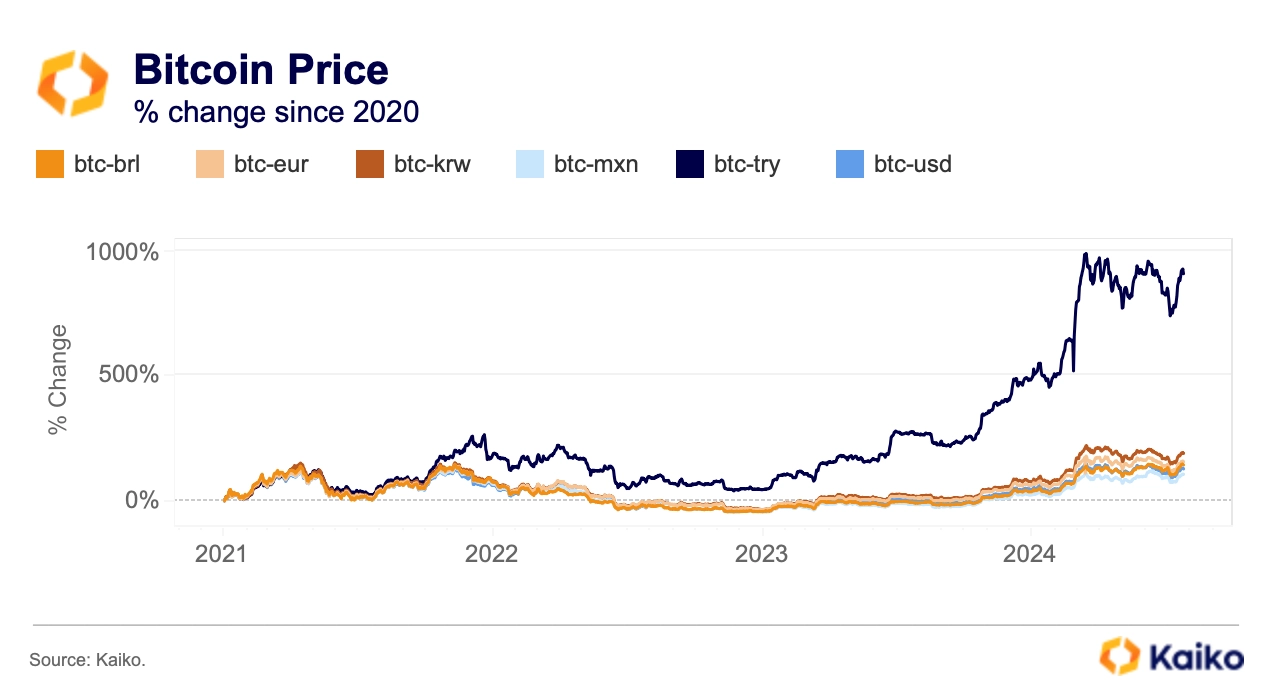

As inflation rose, the Turkish central bank pursued an unorthodox monetary policy, continuing to cut rates until June 2023. This exacerbated the devaluation of the Turkish Lira, which lost more than 300% of its value between the end of 2020 and the end of 2023.

Despite a U-turn to normalize its monetary policy after the 2023 general elections, Turkey failed to boost confidence in the TRY, which continued to lose value in 2024, albeit at a slower pace.

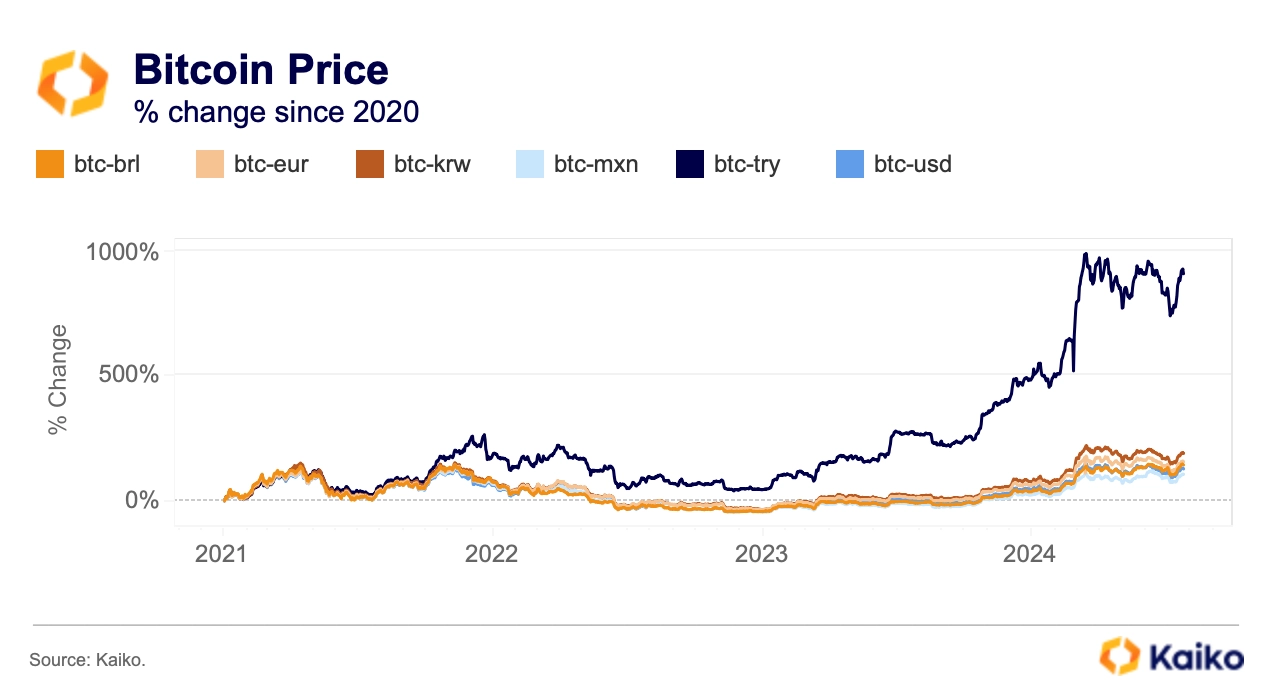

On the other hand, despite its high volatility, BTC has appreciated significantly since 2021, offering obvious benefits as a store of value. The combined effect of BTC’s rising value and the depreciation of the Turkish Lira led to a surge in the TRY-denominated BTC pair. BTC-TRY jumped by more than 800% since 2021, outperforming other fiat-denominated BTC pairs by a large margin.

Interestingly, Borsa Istanbul’s main stock index, the BIST 100, which tracks the performance of the 100 largest companies listed on the Istanbul Stock Exchange also saw triple-digit gains over the same period. This suggests that Turkish investors have also turned to equities to safeguard their wealth.

Binance rising dominance

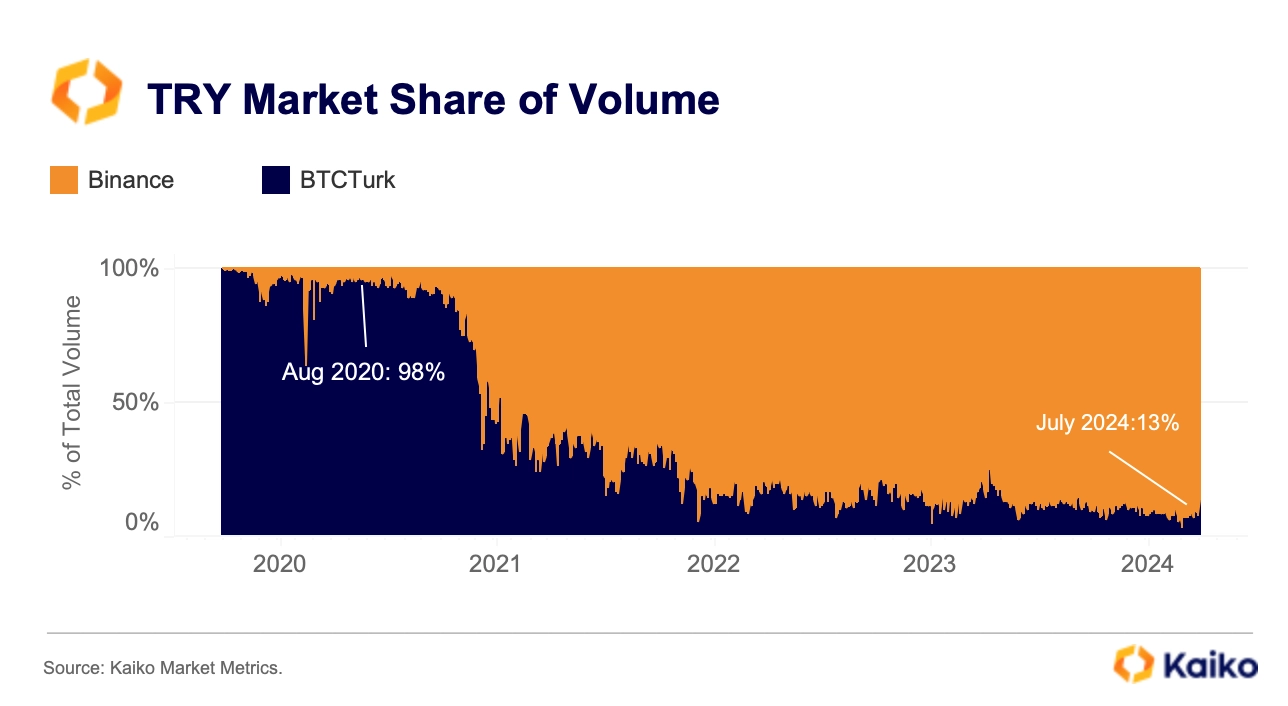

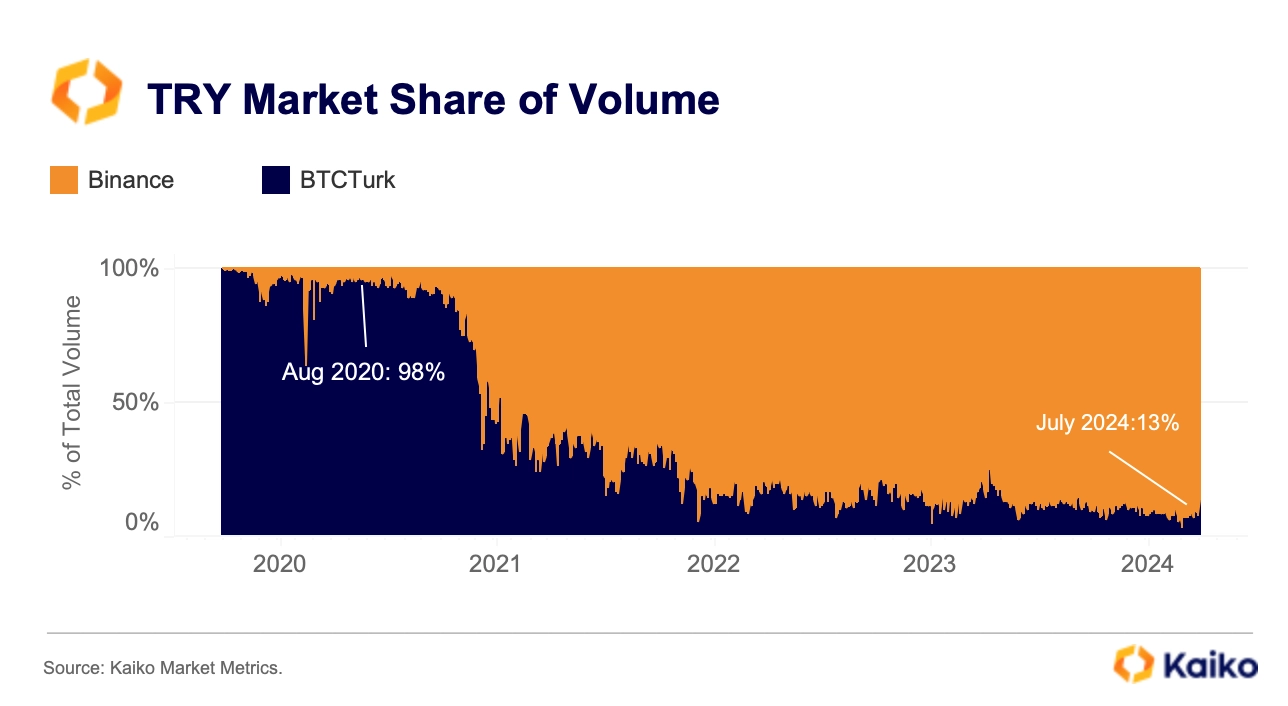

Binance and BTCTurk are the two biggest trading platforms for Turkish traders. While BTCTurk remains the largest local platform with more than 5 million users, its share of TRY volume fell from more than 95% in 2020 to just 13% in early July 2024.

Several other exchanges, such as Gate.io, KuCoin, and OKX, have also entered the market recently, but have struggled to gain traction. These exchanges combined market share remains below 1%.

Binance’s rising dominance can be partly explained by is its deep liquidity and low fees. Between July 2022 and March 2023, the exchange offered zero fees for BTC-TRY trading as part of a large-scale zero-fee campaign. Even though fees have been reintroduced, the average cost of trading, as measured by the BTC-TRY bid-ask spread, remains about twice as high on BTCTurk (5.4 bps) compared to Binance (2.2 bps).

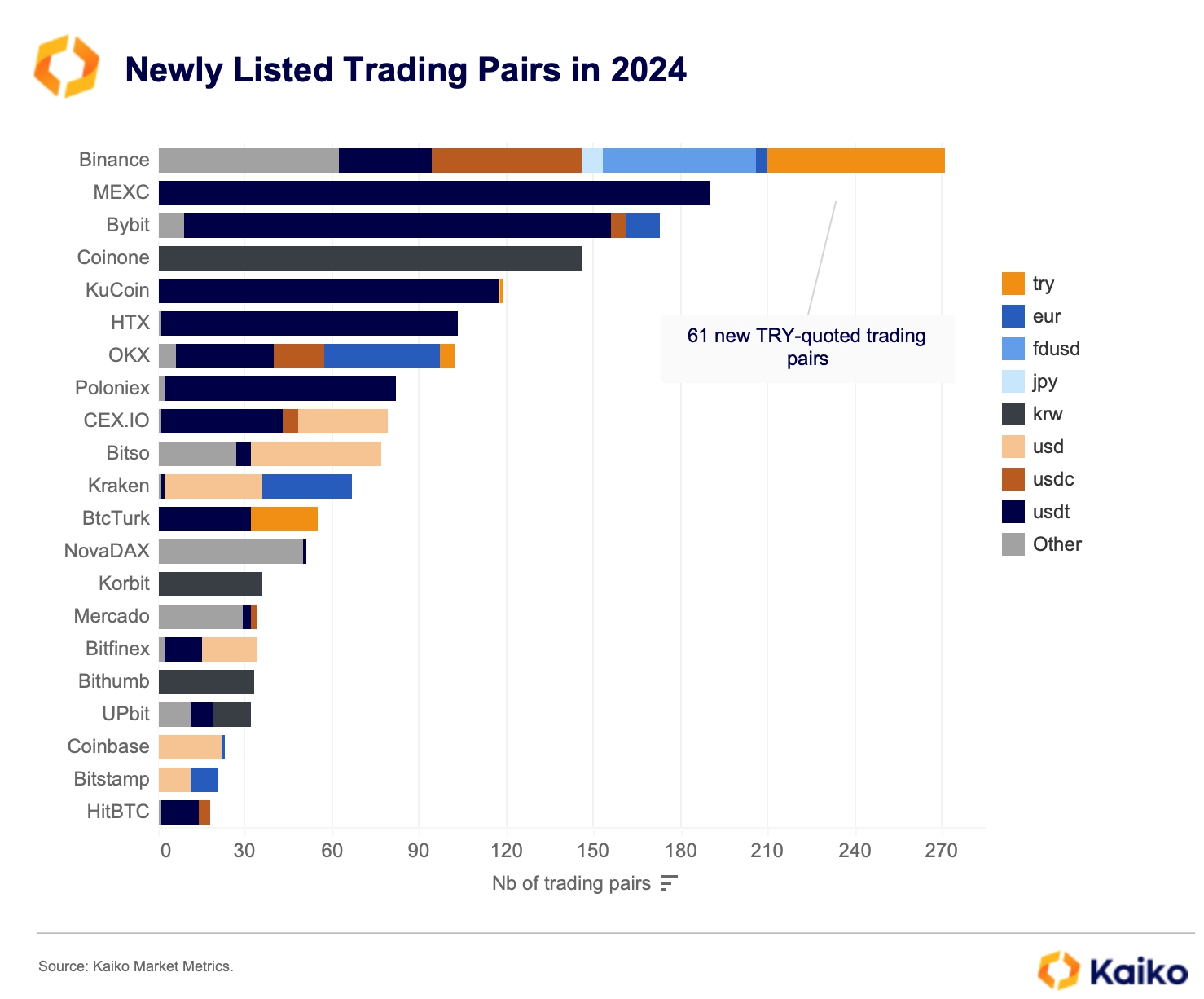

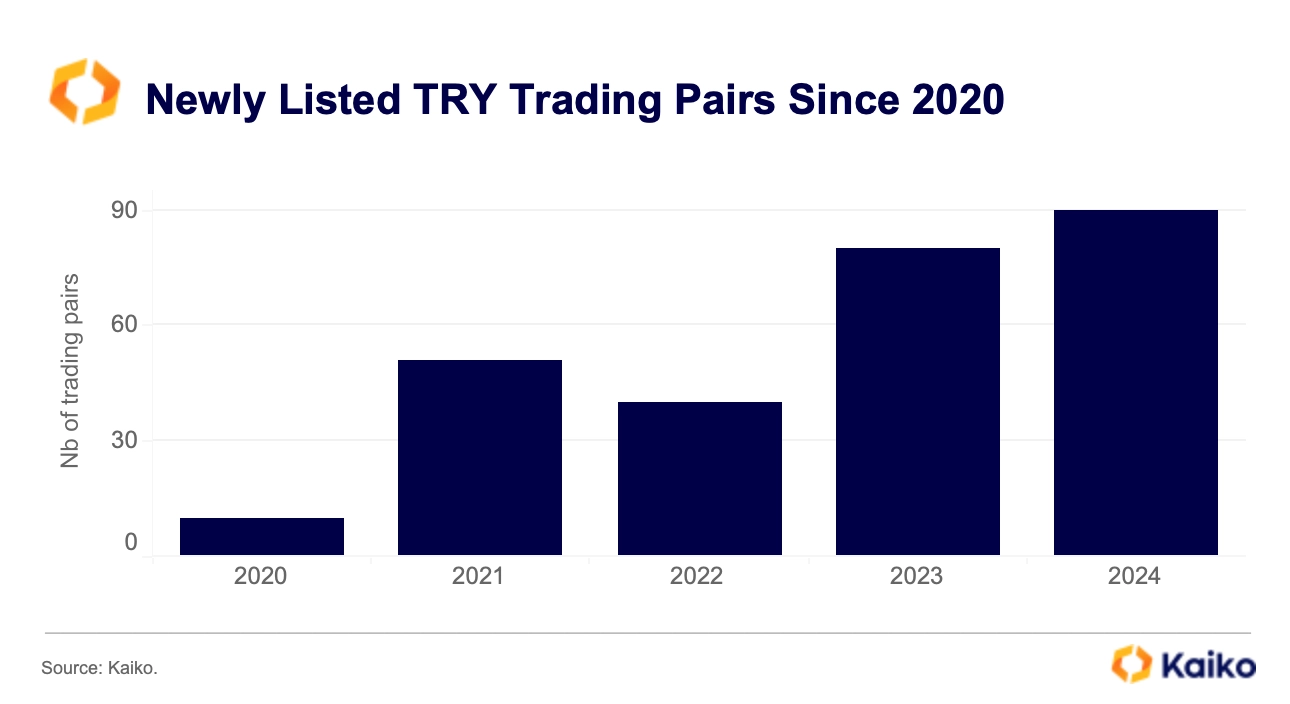

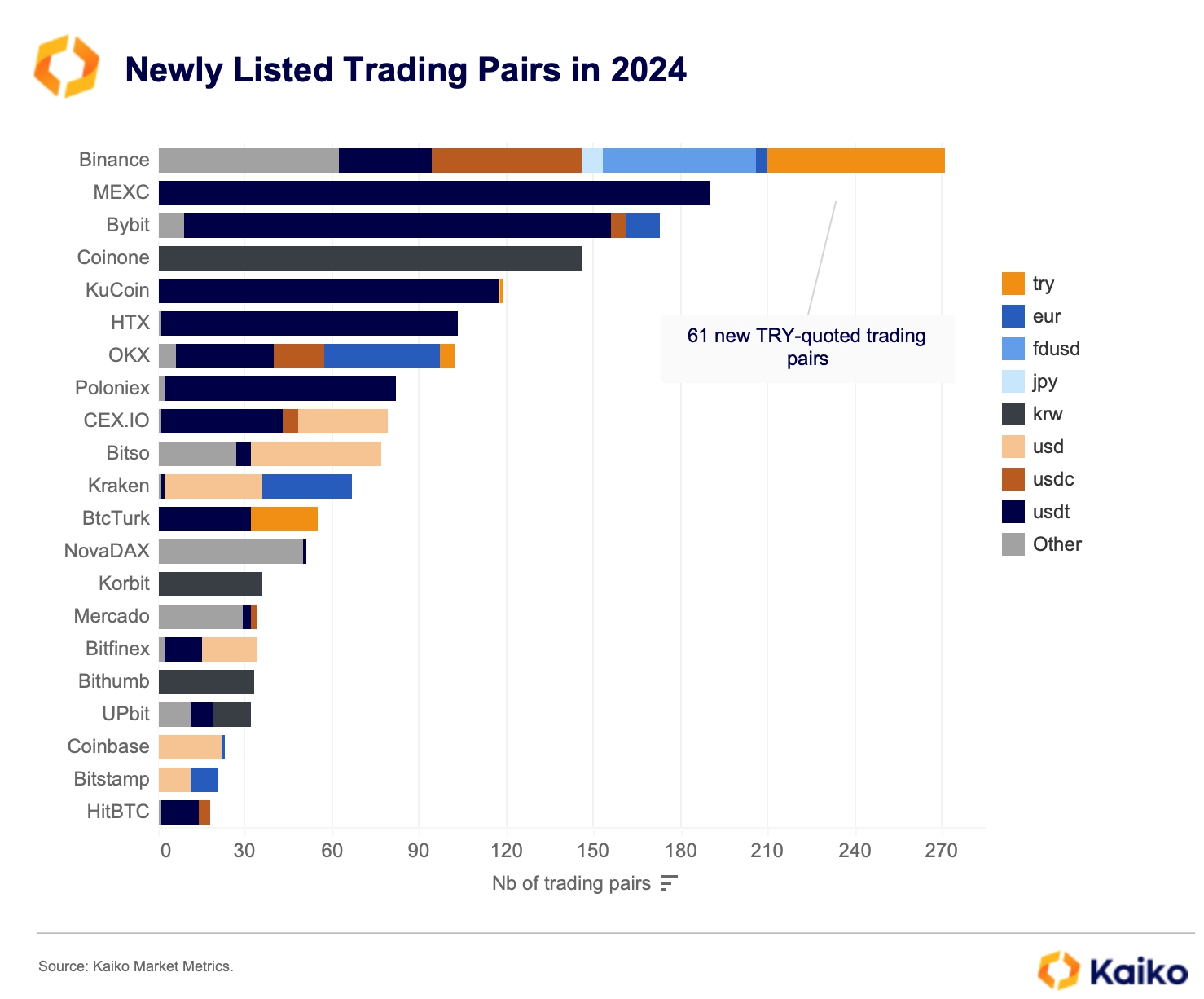

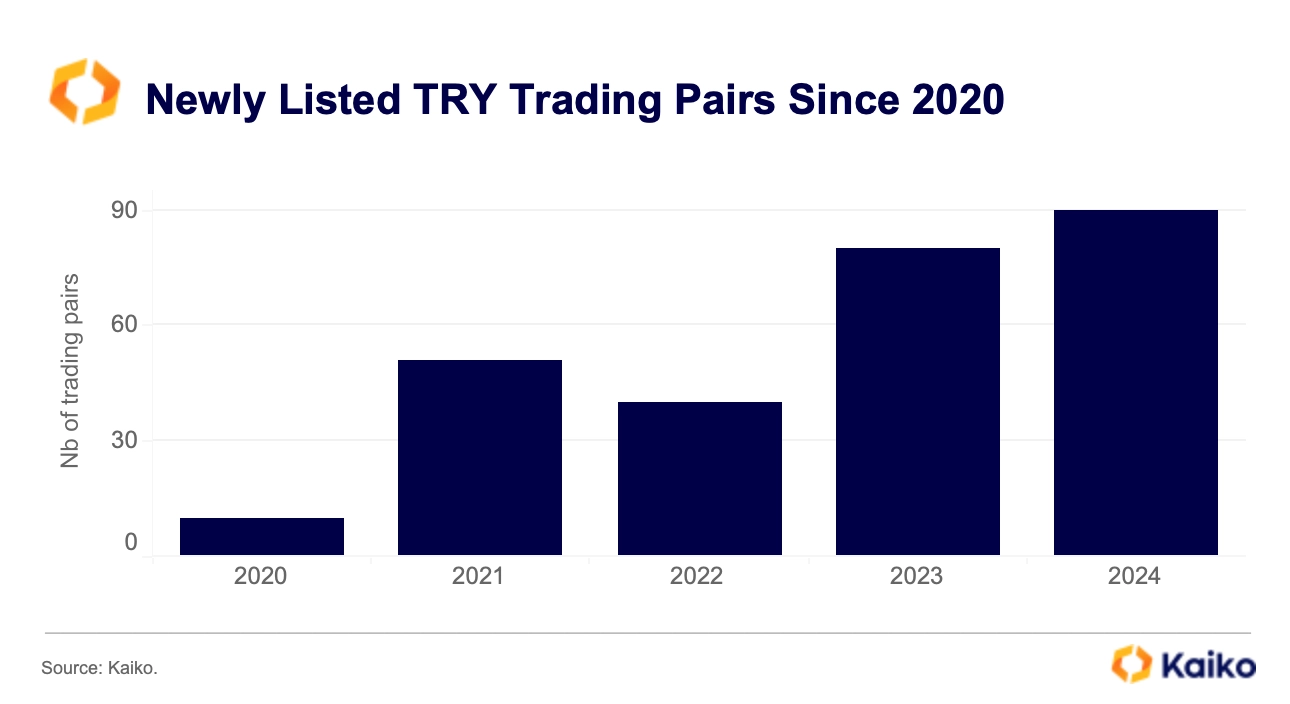

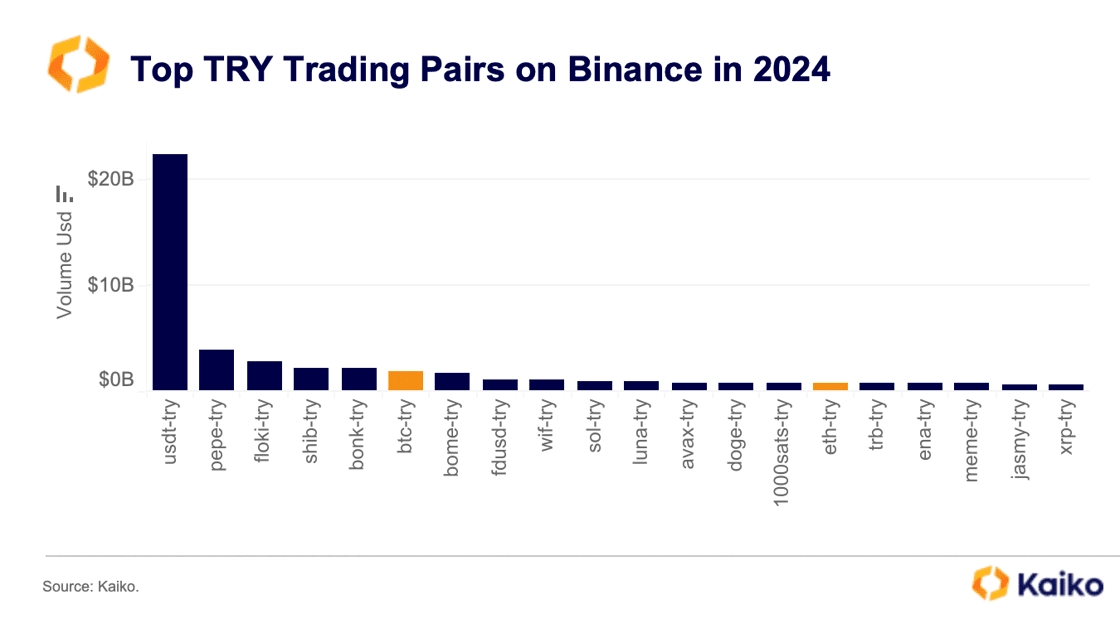

Binance also offers a large diversity of TRY-denominated trading pairs and has aggressively listed new pairs over the past few years despite the 2022 crypto bear market. This year alone, the exchange introduced 61 new TRY trading pairs, bringing the total number to over 200.

As the market recovered, other exchanges have also increased their TRY listings. In just seven months, the number of new TRY-denominated pairs on the exchanges covered by Kaiko hit an all-time high.

This is notable as crypto platforms have been

more cautious about new asset listings compared to the 2021 bull run due to higher regulatory scrutiny. It suggests robust local demand and underscores the Turkish market’s growing significance as a revenue source for exchanges.

Traders invest in both stablecoins and memecoins

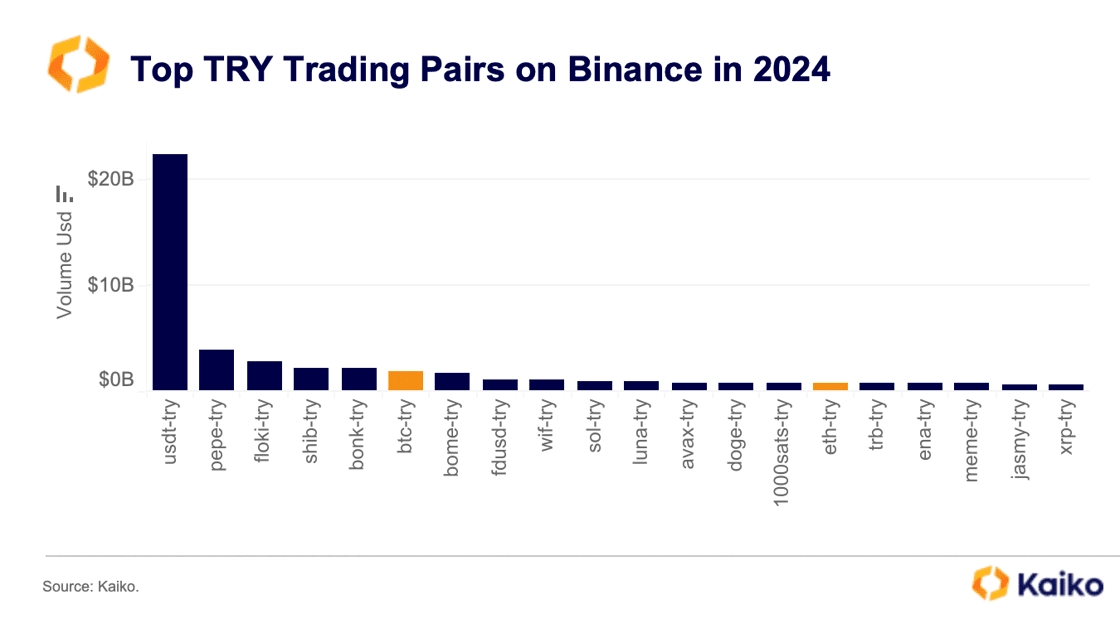

Turkey’s inflationary environment has significantly boosted the use of stablecoins over the past years. In 2024, USDT-TRY is by far the largest trading pair by volume on Binance with more than $22bn. This is more than five times the next in line – pepe- usdt with $4bn.

It is notable that meme tokens all surpass Bitcoin in trade volume this year. This suggests that Turkish traders have also turned to riskier crypto assets to hedge against currency volatility and speculate.

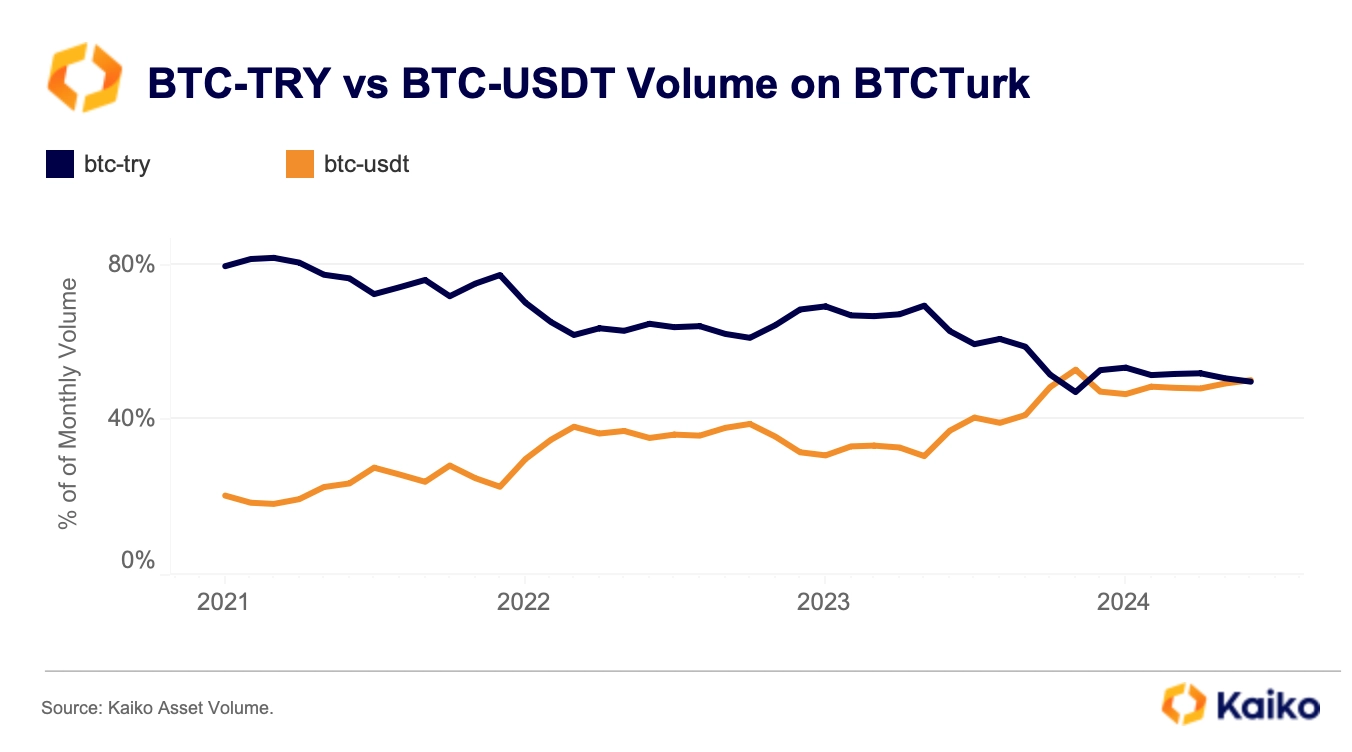

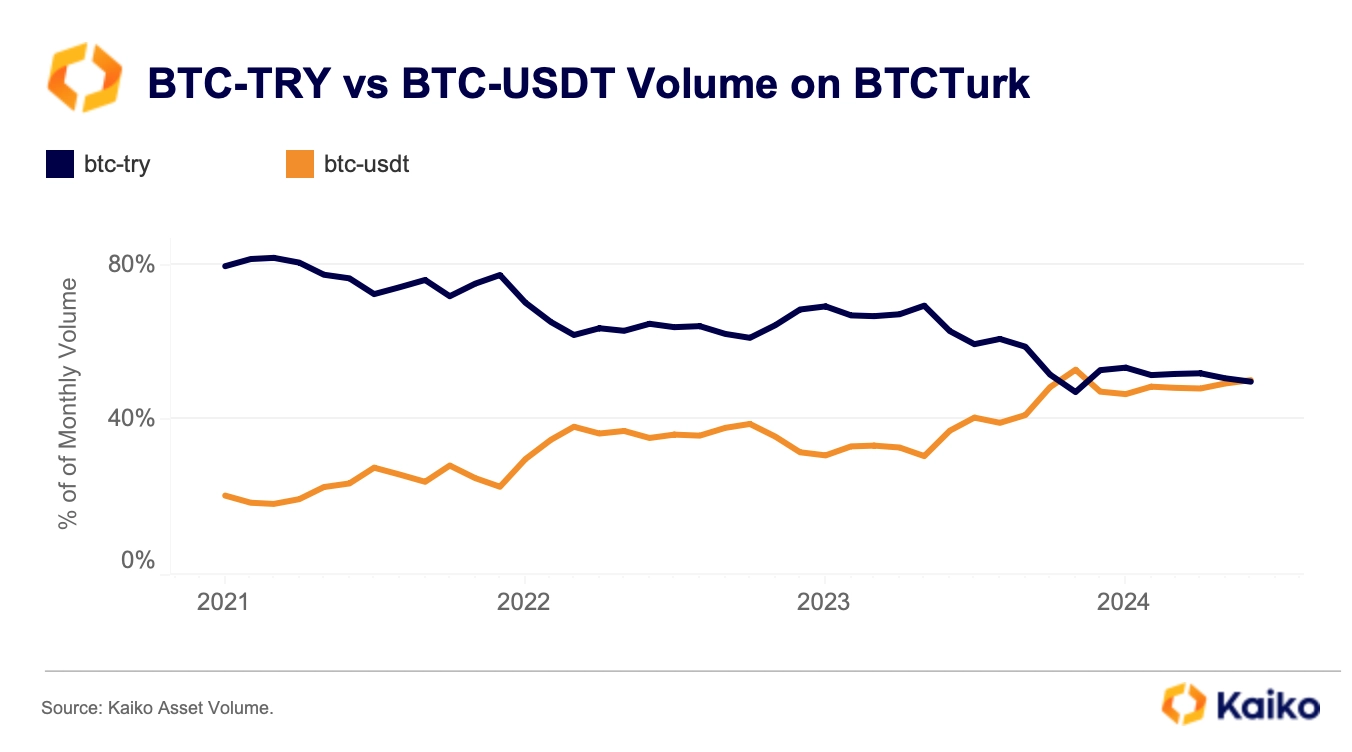

This increased use of stablecoins is also evident when examining the two largest Bitcoin trading pairs on BTCTurk – BTC-USDT and BTC-TRY.

The share of the USDT-quoted trading pair has risen from around 20% in 2021 to more than 50% by the end of June.

Turkey’s new crypto regulation

On July 2, the Turkish parliament approved a new legislation which aims to help Turkey exit the FATF’s “gray list” of countries with insufficient anti-money laundering (AML) measures.

It introduces a licensing regime, compliance, and transaction requirements for crypto-assets service providers – CASP. In addition, platforms and custody services must pay a total annual fee of 2% of their trading income.

The new rules place CASPs under the oversight of the Capital Markets Board of Türkiye (CBM), which can issue additional regulations on various matters such as asset listings and delistings in the coming months. This implies that secondary legislation is yet to come, and more time will be needed to fully grasp the impact of this legislation on both local and foreign market participants.

Overall, exchanges are expected to face increased compliance costs and operational challenges, with varying impacts on local and foreign players. Local exchanges such as BTCTurk must comply with the new rules by August 2nd, a month after the law’s enactment. Global crypto exchanges that lack a separate entity in Turkey but target Turkish customers will also be subject to these regulations. On the day the legislation was passed, Binance announced that it would keep offering TRY trading pairs but would gradually halt all marketing activities targeting Turkish users and remove Turkish language support from its platform.

Conclusion

Despite the ups and downs of the crypto market, crypto adoption in Turkey has continued to grow at a steady pace over the past few years, fuelled by double-digit inflation and currency devaluation. Turkish traders have been investing in both stablecoins and high-beta altcoins suggesting that crypto is both seen as a store of value and speculative instrument.

The strong growth of the Turkish market has led to rising competition among exchanges, seeking new revenue sources. So far, Binance has been the undisputed market leader.

However, the newly adopted Turkish crypto regulation, which aims to bring much-needed clarity, could re-shape the market.

![]()

![]()

![]()

![]()