New Report: LATAM's rise in global crypto markets

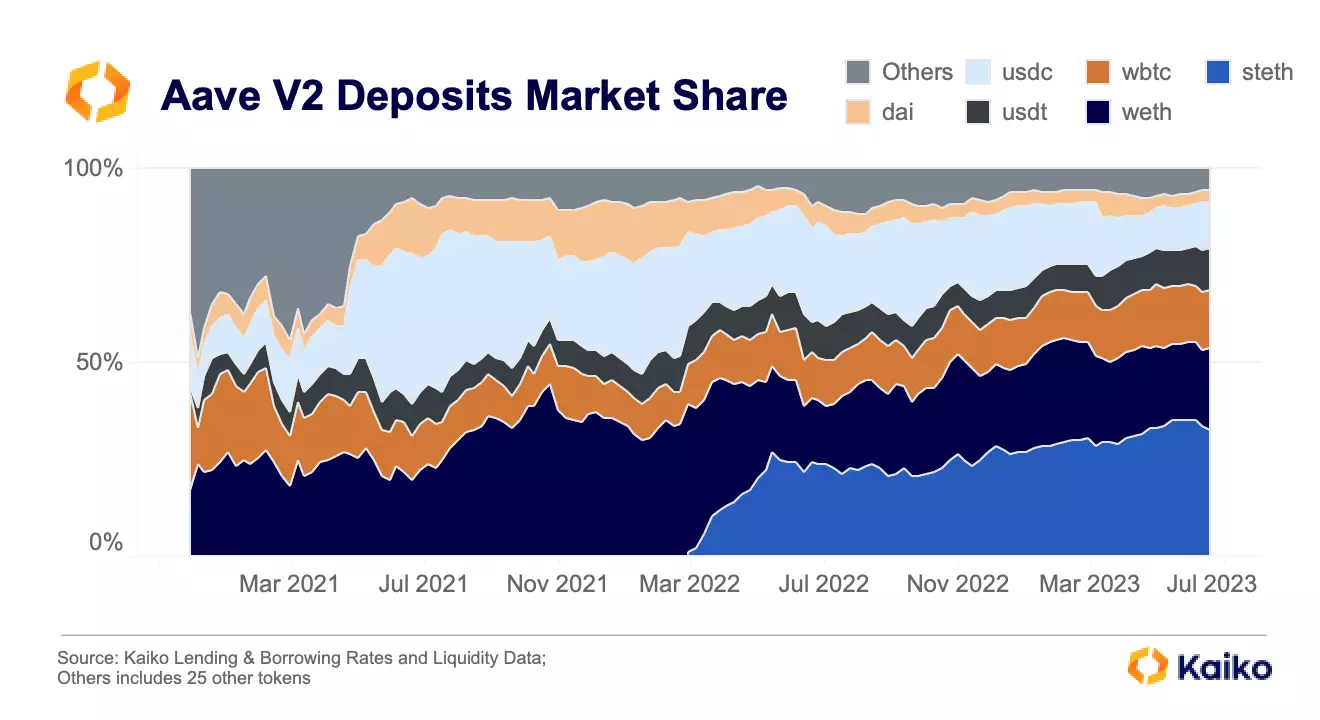

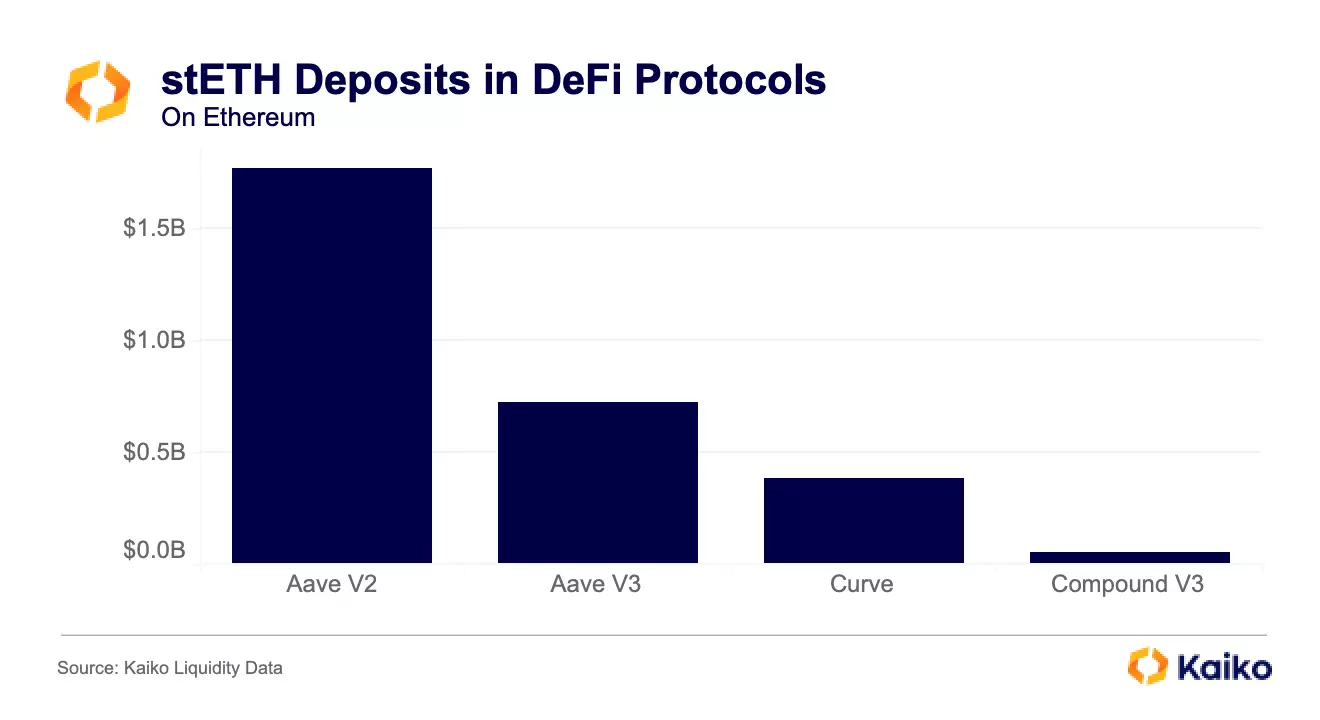

Is stETH Liquid Enough?

06/07/2023

Data Used In This Analysis

More From Kaiko Research

![]()

USDC

16/06/2025 Data Debrief

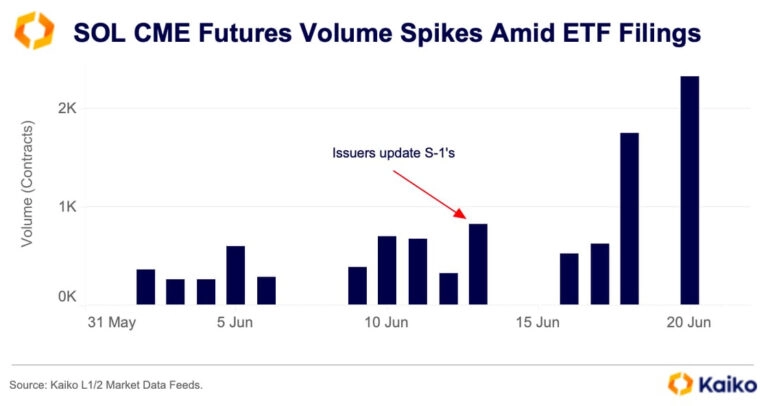

Traders position for potential SOL ETF.This week we’re talking all things Solana. As ETF issuers line up to launch funds tracking SOL the market reaction has been muted in parts. However, looking in the right place shows signs of institutional demand.

Written by The Kaiko Research Team![]()

USDC

16/06/2025 Data Debrief

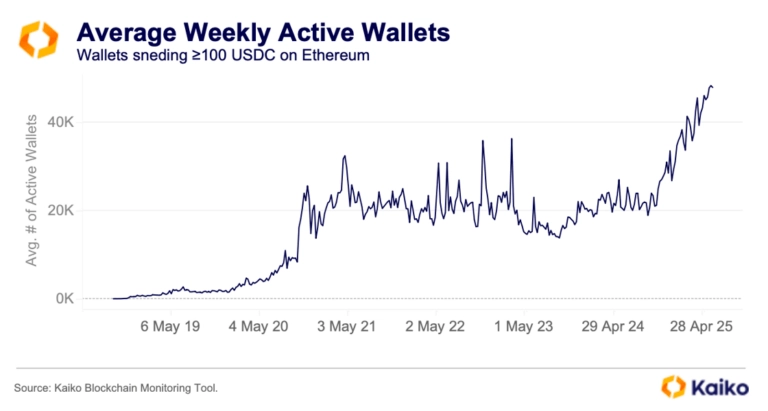

The data behind Circle’s $18B Valuation.Circle’s IPO debut on the New York Stock Exchange on June 5th captured market attention, with shares surging well beyond expectations and outperforming other major crypto listings. This special edition of our Data Debrief examines the on- and off-chain data signals that set the stage for this blockbuster launch and help explain the drivers behind Circle’s remarkable valuation.

Written by The Kaiko Research Team![]()

CEX

09/06/2025 Data Debrief

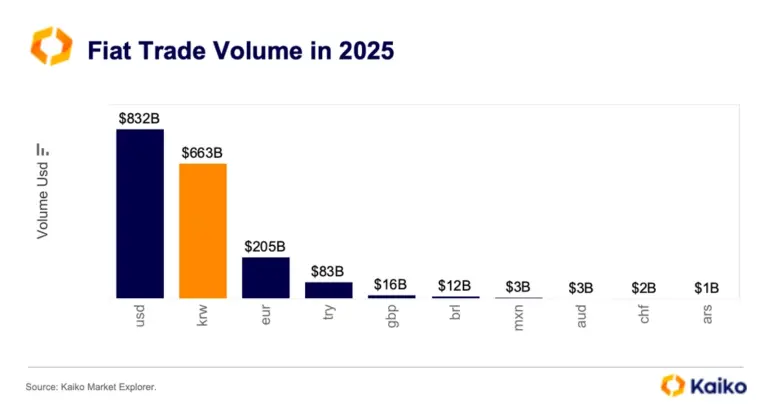

Crypto ETFs enter Korea's political mainstreamSouth Korea has a new president, and it’s got big implications for crypto-related exchange-traded funds. Lee Jae-myung won the June 3 election, succeeding Yoon Suk Yeol, who caused market turmoil last year by briefly imposing martial law.

Written by The Kaiko Research Team![]()

Bitcoin

02/06/2025 Data Debrief

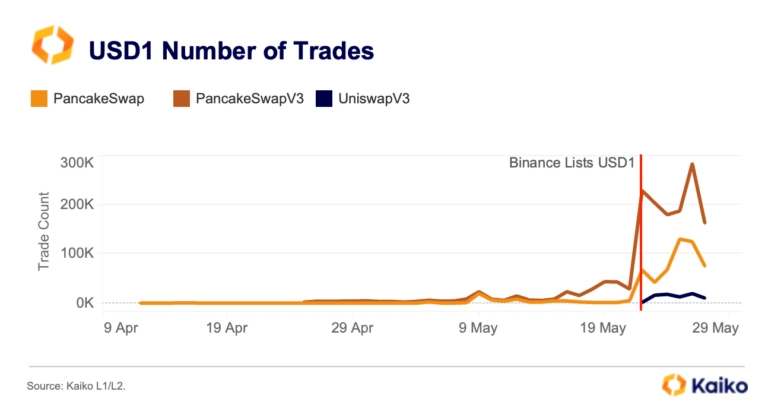

Trump’s stablecoin on-chain activity surges post-Binance listing.This week we explore World Liberty Financial’s stablecoin, USD1. The Trump family’s DeFi project launched the token over a month ago, and its seen significant uptake on-chain, however, off-chain activity has lagged. We also take a look at what crypto ETF applications are leading the approval race, how derivatives markets are maturing, and more.

Written by The Kaiko Research Team