Join us for our latest webinar in collaboration with Cboe

Is stETH Liquid Enough?

06/07/2023

Data Used In This Analysis

More From Kaiko Research

![]()

Hyperliquid

09/03/2026 Data Debrief

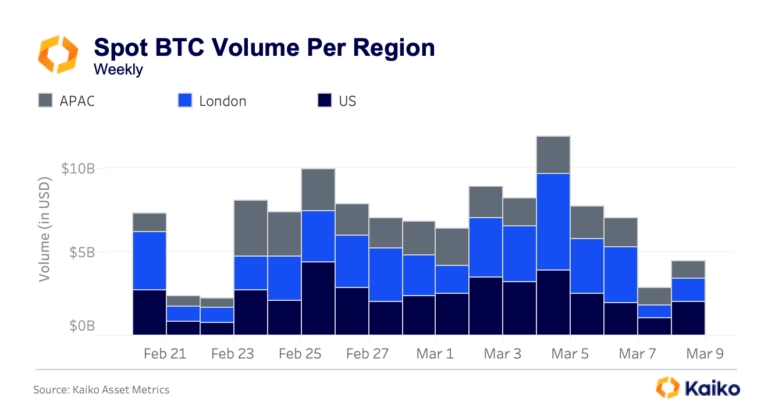

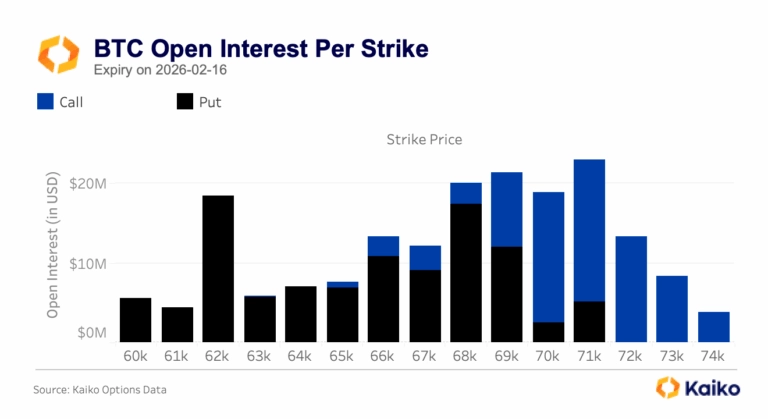

Bitcoin Ranges While Traditional Assets Find New Home on Crypto RailsAs Bitcoin ranges between $60k and $72k following the early February sell-off, the crypto market navigates competing forces, with geopolitical shocks testing 24/7 infrastructure and options markets pricing elevated volatility into the Federal Reserve’s March 18th decision.

Written by Laurens Fraussen![]()

Ethereum

02/03/2026 Data Debrief

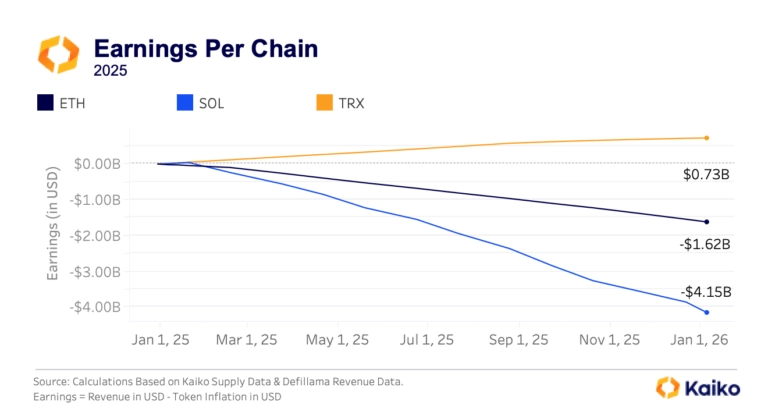

The Pressure of Dilution on Layer 1 ValuationsAs Layer 1 tokens are increasingly traded through ETFs and evaluated like equity investments, the market is discovering an uncomfortable truth, most major blockchains operate as loss-making businesses. With Ethereum posting $1.62B in annual losses and Solana bleeding $4.15B despite generating hundreds of millions in fee revenue, validator dilution costs consistently outpace income by 7-25x.

Written by Laurens Fraussen![]()

Ethereum

23/02/2026 Data Debrief

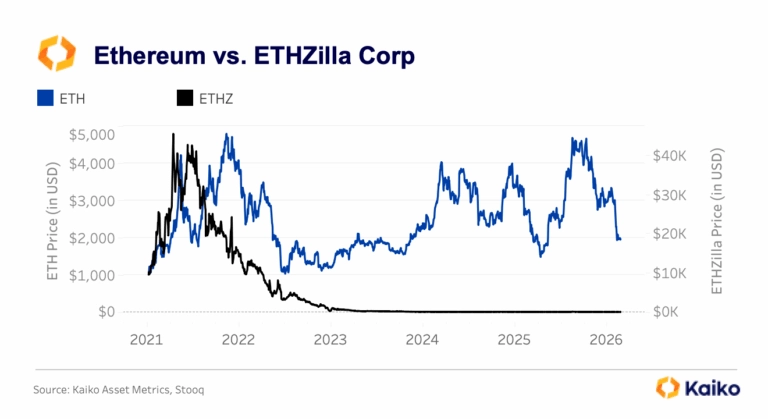

Staking Products Launch Despite Treasury FailuresAs crypto volatility continues, the markets are testing whether institutional ETH adoption follows price or infrastructure development. With ETH plunging 50% from its mid-2025 peaks to $2,000, this triggered a 95%+ collapse in equity treasury vehicles like ETHZilla and $4B in spot ETF outflows.

Written by Laurens Fraussen![]()

Prediction Markets

16/02/2026 Data Debrief

Prediction Markets Liquidity In FocusPrediction markets captured mainstream attention throughout 2025 as Polymarket processed over $2 billion in election-related volume. The post-election collapse from $1 billion to $200 million in open interest exposed fundamental questions about sustainability.

Written by Laurens Fraussen