Join us for our latest webinar in collaboration with Cboe

![]()

USDC

05/05/2025 Data Debrief

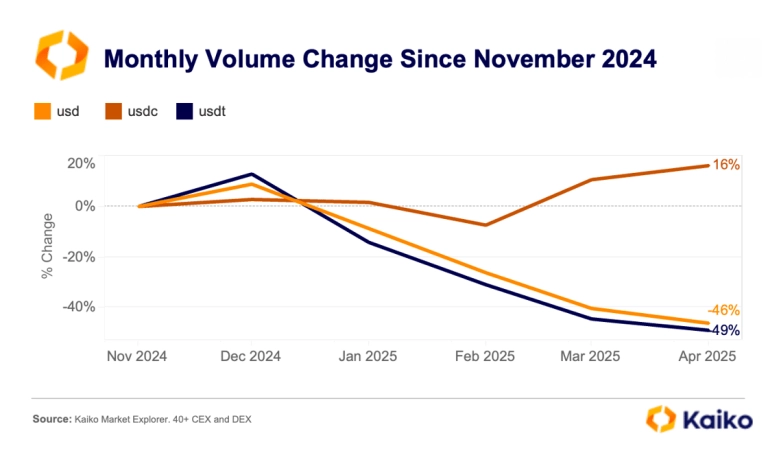

USDC Outpaces Rivals.Bitcoin held near $95K on Monday as markets brace for this week’s Fed meeting. Last week’s U.S. data showed the economy losing steam despite solid job growth—Q1 GDP contracted as importers raced to stockpile goods ahead of tariffs, while consumer sentiment continued to slide. Meanwhile, Tether posted$1B in Q1 profits, and Arizona’s governor vetoed a bill that would have let the state hold Bitcoin.

Written by The Kaiko Research Team![]()

Memecoins

28/04/2025 Data Debrief

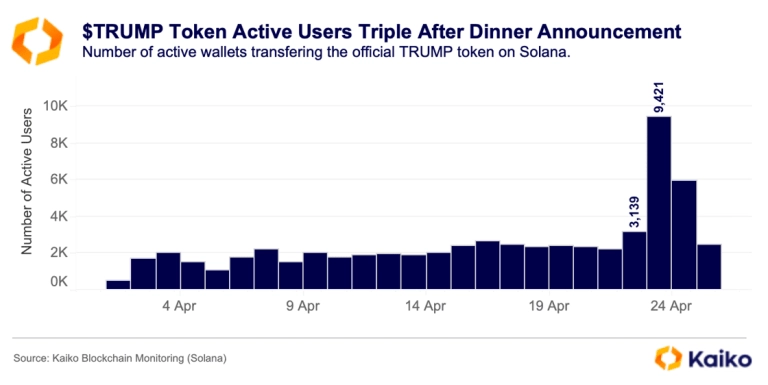

Trump’s Table Turn.The big news last week was Cantor Fitzgerald’s new crypto venture with Softbank, Tether, and Bitfinex. The firm’s $3 billion plans include buying Bitcoin en masse and challenging Michael Saylor’s strategy. Elsewhere, the CME is set to launch XRP futures, and markets continued to move higher.

Written by The Kaiko Research Team![]()

Bitcoin

22/04/2025 Data Debrief

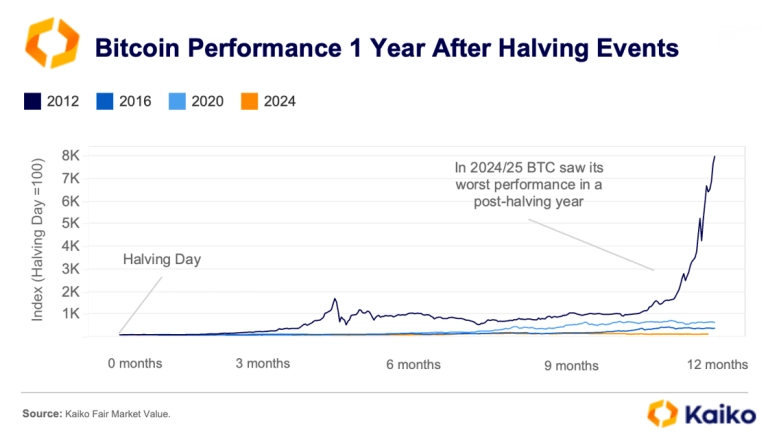

Bitcoin’s Halving Anniversary: This Time Was Different.Bitcoin held its ground last week, rising by 2.4% while equities ended the week lower. Meanwhile, the U.S. SEC postponed its decision on in-kind redemptions and staking ETFs and released new disclosure guidance for crypto issuers.

Written by The Kaiko Research Team![]()

ETF

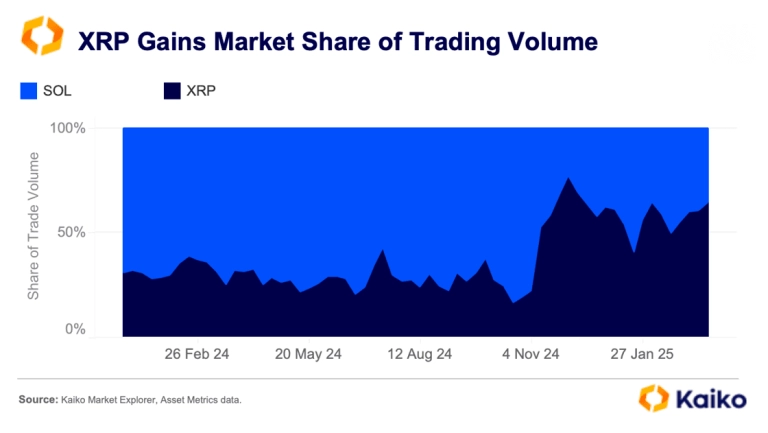

14/04/2025 Data Debrief

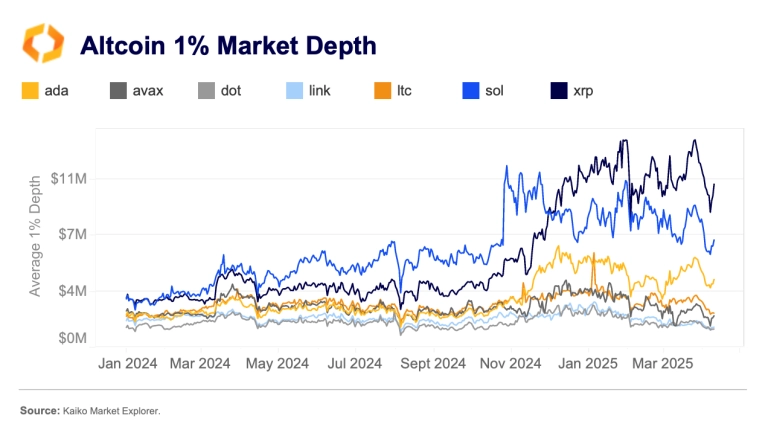

XRP's Liquidity Race As Crypto ETFs Deadlines Loom.Markets declined Friday after China announced 125% tariffs on U.S. goods starting April 12, following the U.S. president’s selective 90-day tariff pause that excluded China. Ripple acquired Hidden Road for $1.25 billion, while Binance continue deal talks with Trump’s crypto company.

Written by The Kaiko Research Team![]()

Macro

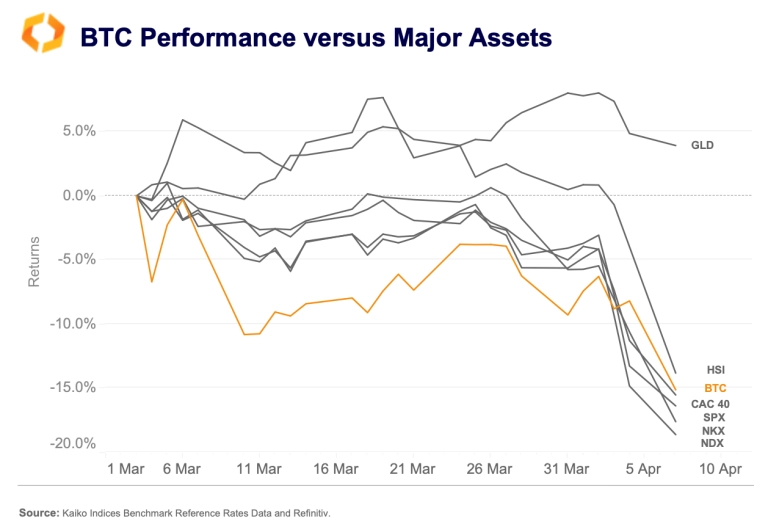

07/04/2025 Data Debrief

Liberation Day Frees Investors From Election Gains.The markets are still digesting last week’s sweeping tariff announcements. Meanwhile, USDC issuer Circle has taken a significant step towards a public listing by filing for an IPO on the NYSE. Additionally, First Digital Trust’s FDUSD briefly lost its peg due to insolvency concerns.

Written by The Kaiko Research Team![]()

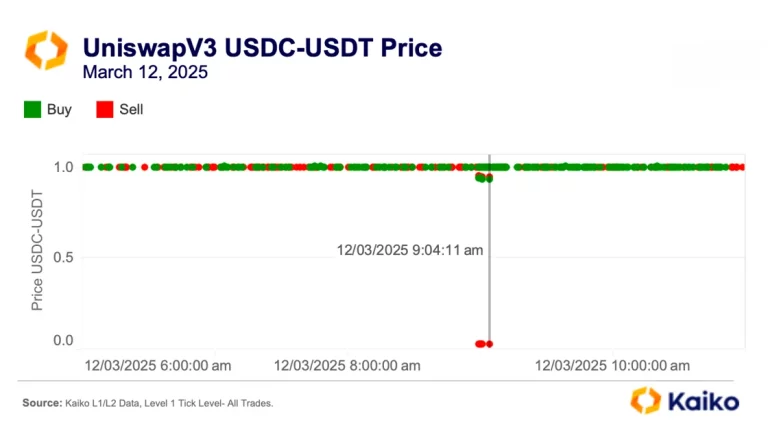

DEX

31/03/2025 Data Debrief

DeFi faces new test as low-liquidity token gets manipulatedBitcoin fell alongside equities as hotter-than-expected U.S. inflation data and weak sentiment indicators fueled stagflation fears on Friday. Meanwhile, Crypto.com announced that it will support Trump Media’s upcoming ETF offerings, and GameStop experienced volatility after doubling down on Bitcoin.

Written by The Kaiko Research Team![]()

CEX

24/03/2025 Data Debrief

SOL Institutional Demand Tested.Risk assets, including crypto, experienced gains in the early hours of Monday as concerns over the upcoming April 2nd tariffs eased. In other news, Kraken acquired a futures exchange for $1.5 billion, the U.S. Treasury lifted economic sanctions on Tornado Cash, and the SEC dropped its appeal against Ripple.

Written by The Kaiko Research Team![]()

DeFi

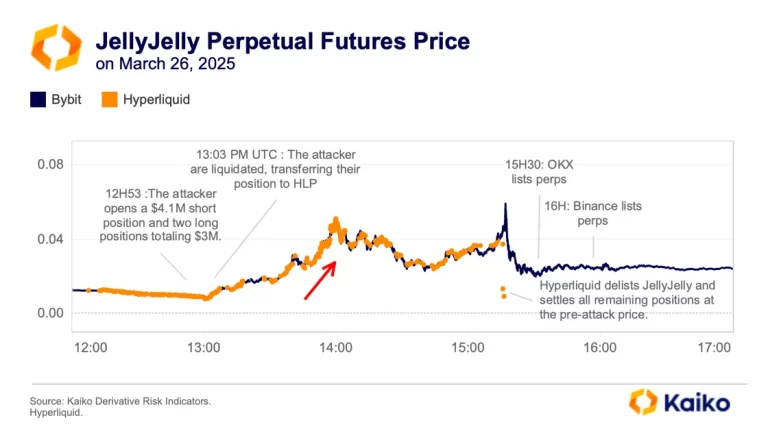

17/03/2025 Data Debrief

Anatomy of market manipulation in DeFiBitcoin bucked its downtrend last week adding 3% while the S&P 500 briefly entered correction. Binance secured its first institutional investment from Abu Dhabi’s MGX group, the largest ever single investment in a crypto firm at over $2bn. Elsewhere, Coinbase prepares for 24/7 BTC and ETH futures trading, as traditional platforms jostle to offer round the clock services.

Written by The Kaiko Research Team