Trend of the Week

Liberation Day frees investors from election gains

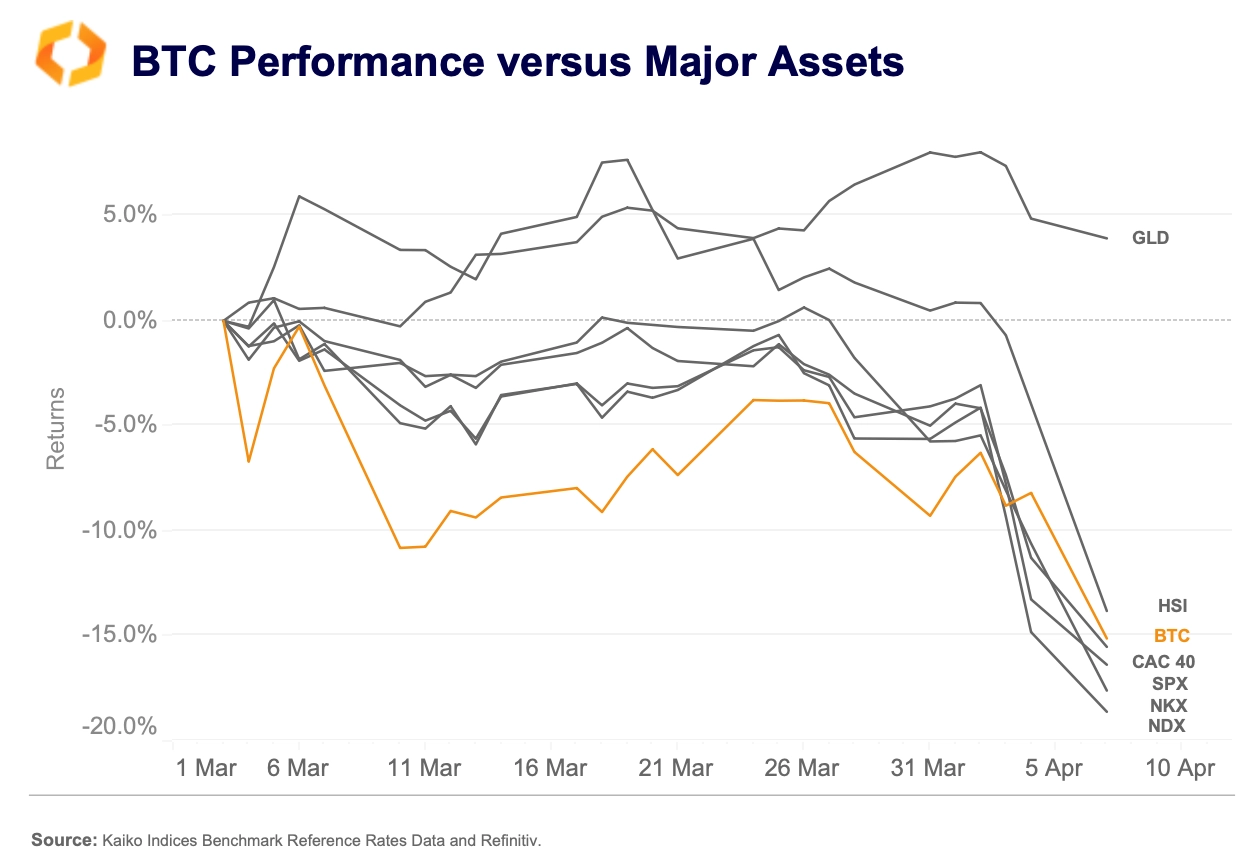

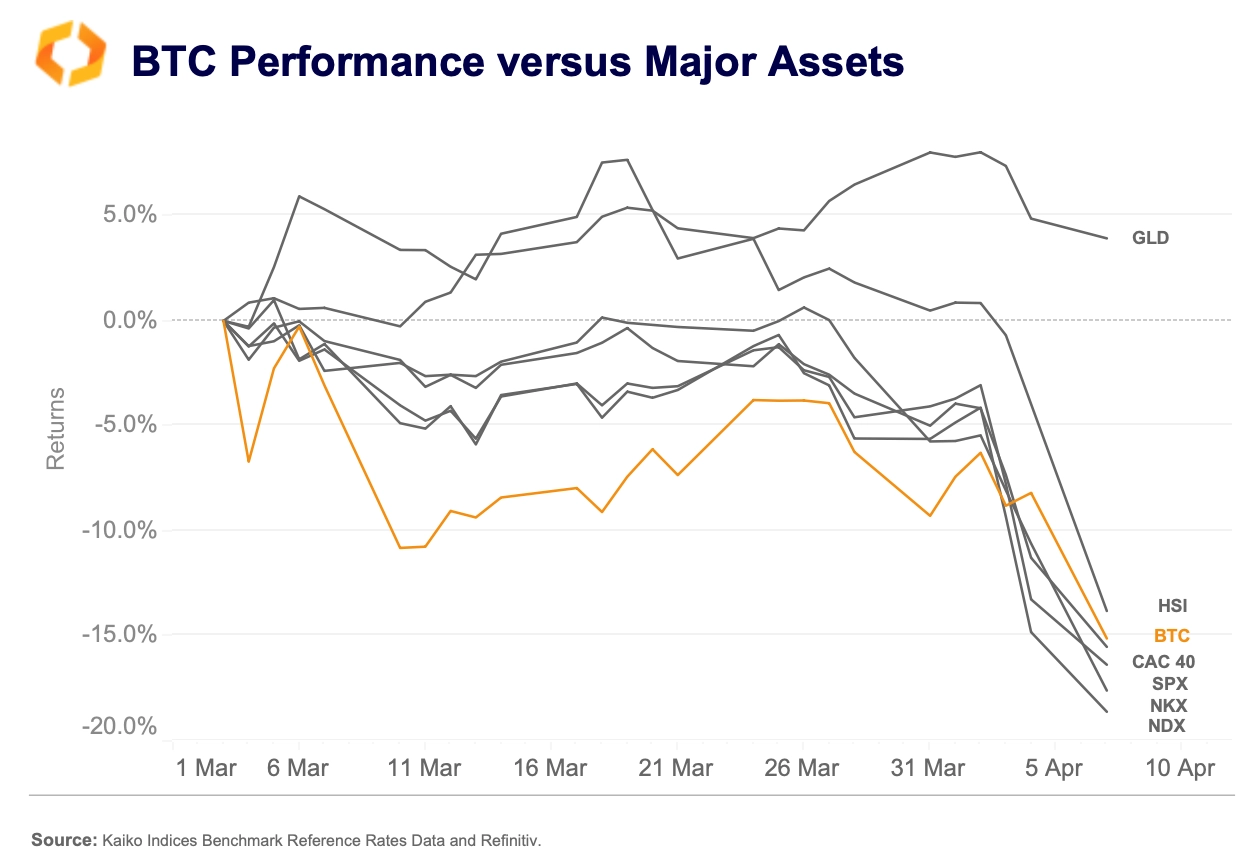

The market experienced significant losses last week across nearly all asset classes due to U.S. President Trump’s implementation of reciprocal and blanket tariffs. Despite this broad market collapse, Bitcoin remained relatively stable, trading around $82k for most of the week. This divergence from equities led some market participants to claim that Bitcoin was proving its value as a hedge against macroeconomic uncertainty. However, this decoupling was short-lived as Bitcoin dropped 10% between Sunday and Monday morning.

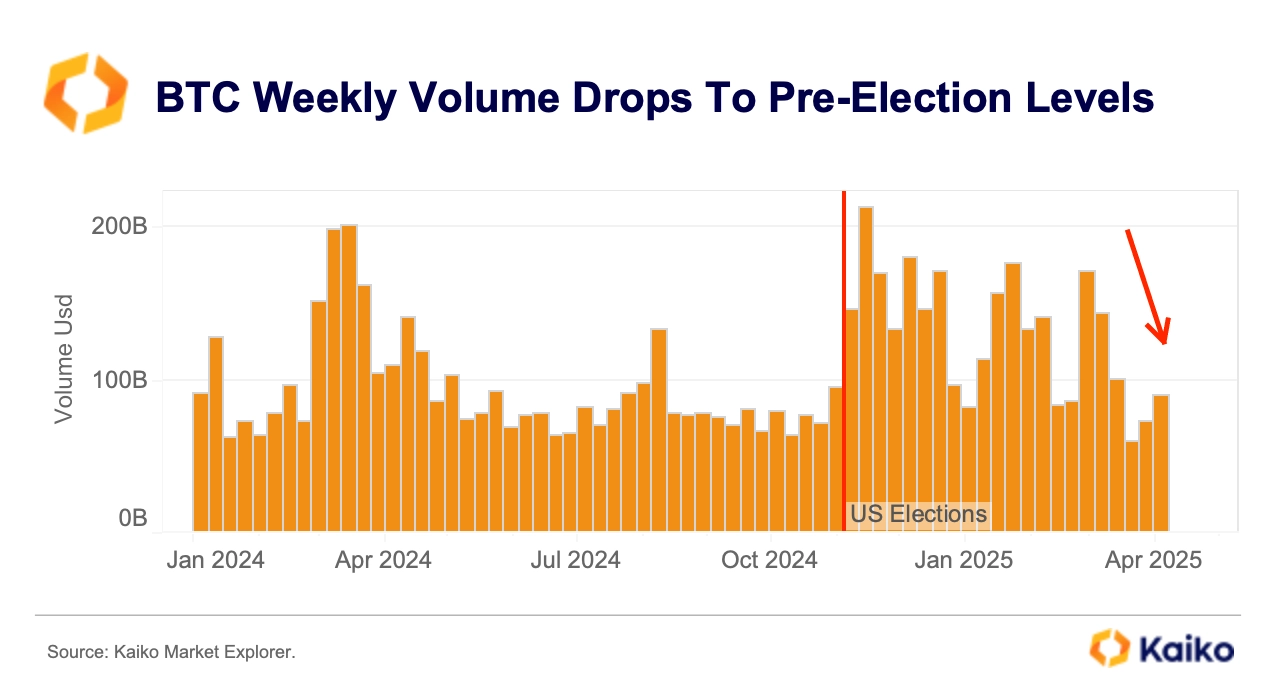

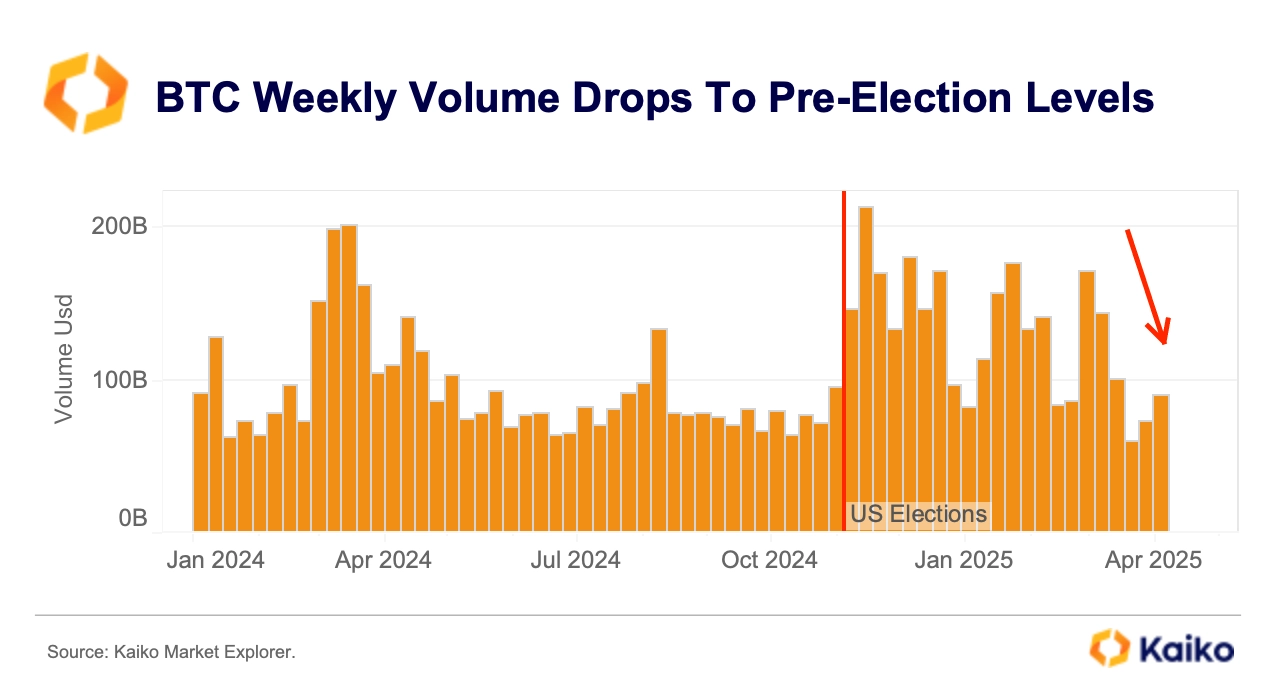

The wave of post-election optimism has waned since mid-February as tariff-related uncertainty took hold. By early April, crypto trading volume had nearly returned to pre-election levels. Last week, Bitcoin’s volume barely exceeded $91 billion, remaining over 45% below the November 2024 average, suggesting that many traders are staying on the sidelines.

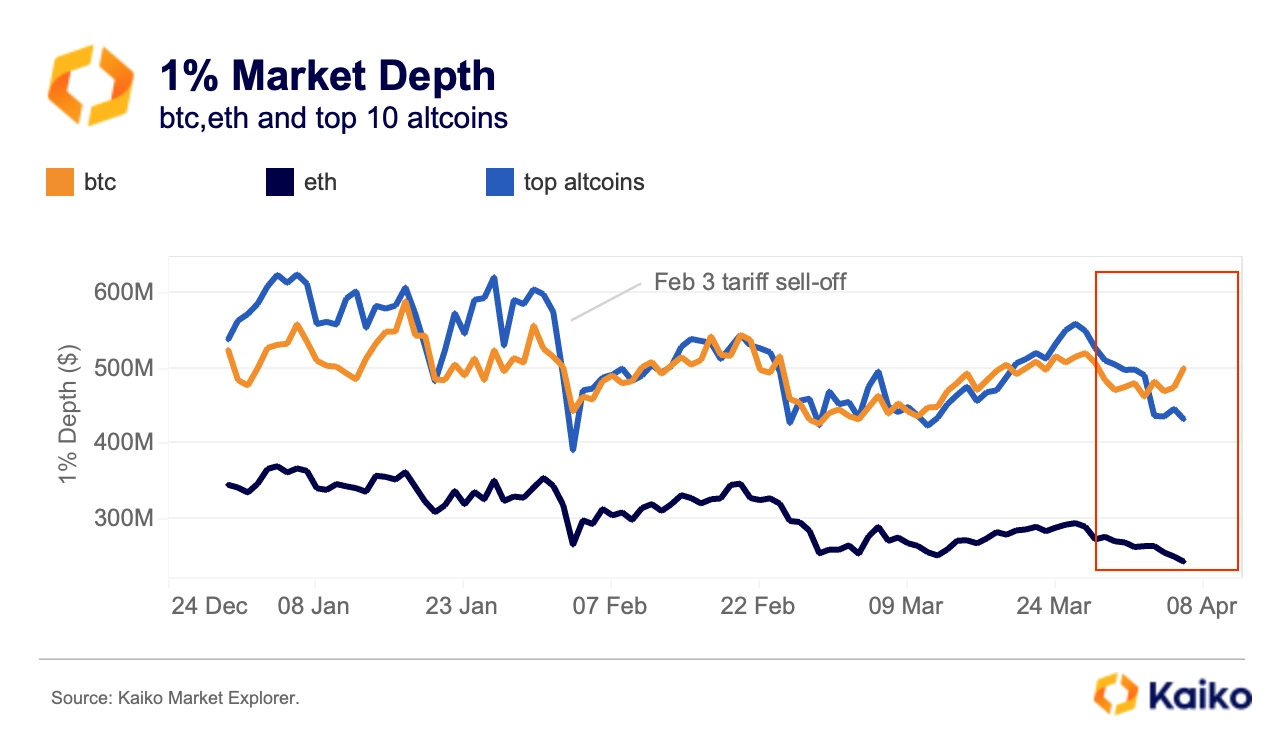

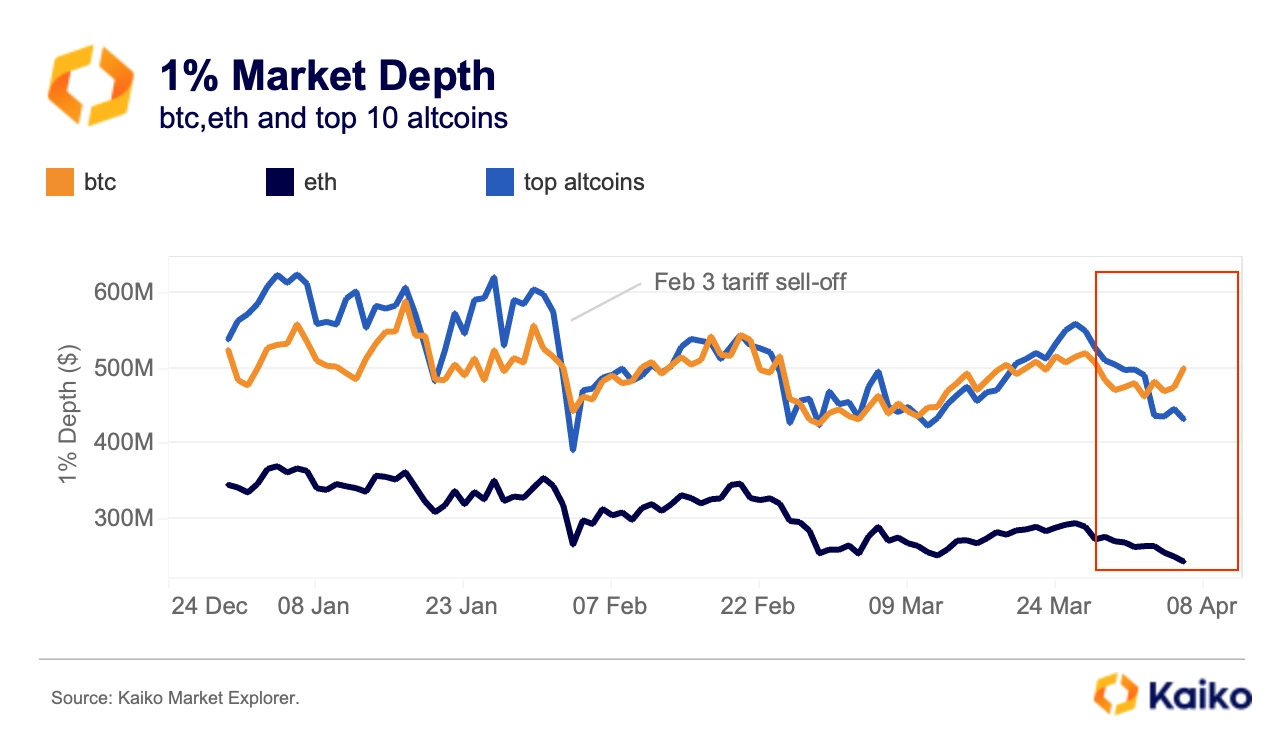

Despite Bitcoin prices faltering over the weekend, market makers maintained their exposure, as BTC’s 1% market depth increased by 8% to $500 million from April 2 to 6. This contrasts with the February 3 tariff sell-off, when BTC liquidity dropped by 14%. Meanwhile, liquidity for the top ten altcoins and ETH decreased by 12% and 8%, respectively, indicating a more cautious stance.

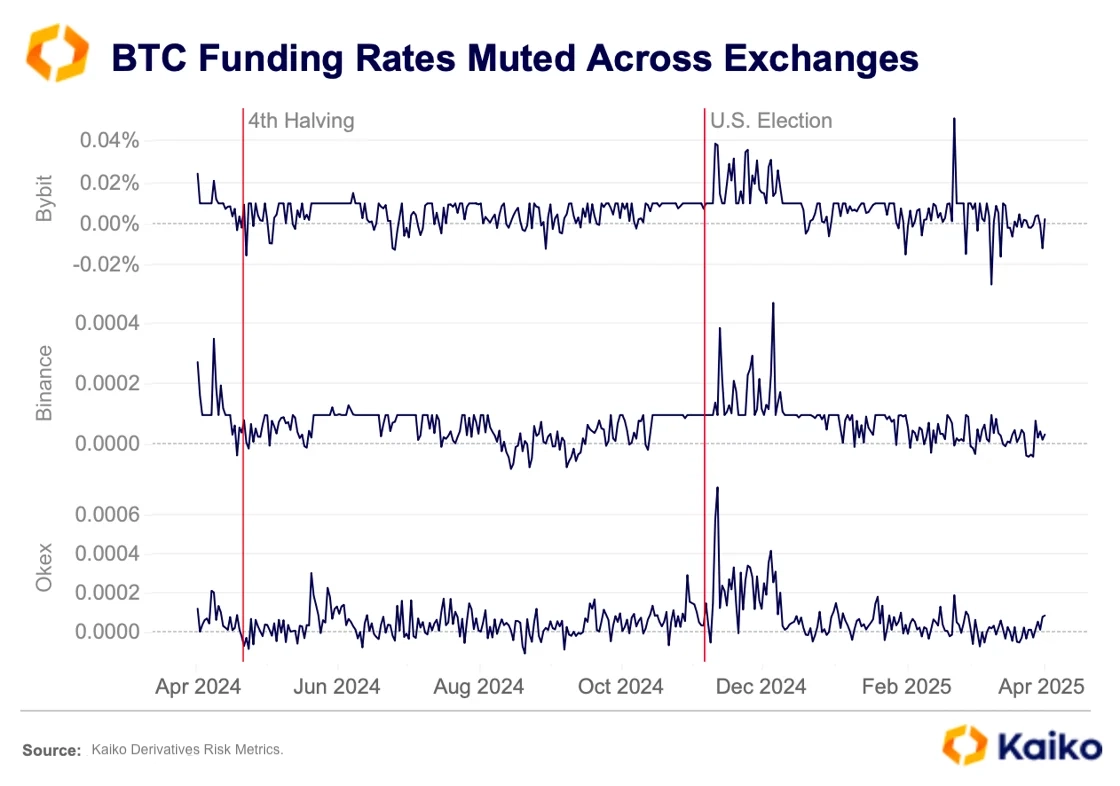

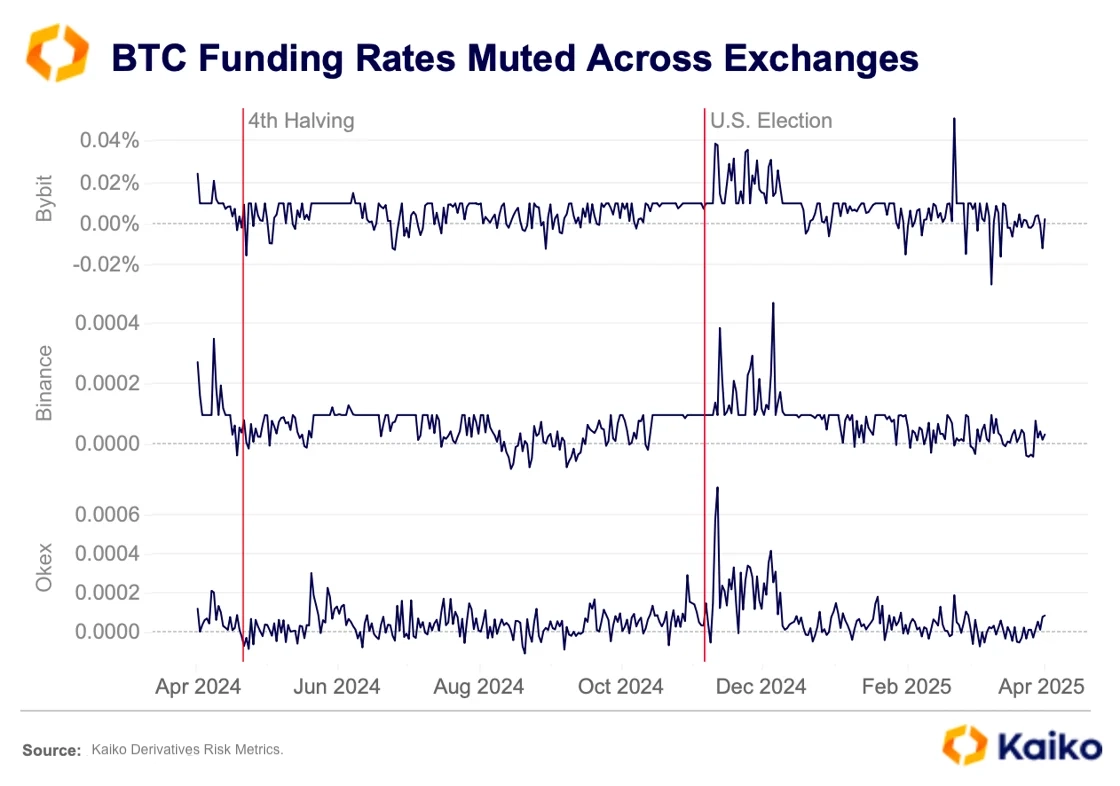

Overall, derivatives markets indicate weak demand for bullish exposure as investors reassess their outlook for 2025. BTC funding rates on perpetual futures contracts have remained muted across most exchanges since the beginning of the year. Rates on Binance and OKX have consistently hovered around zero. Although Bybit rates fluctuated between positive and negative in early March, they have stabilized near zero since then.

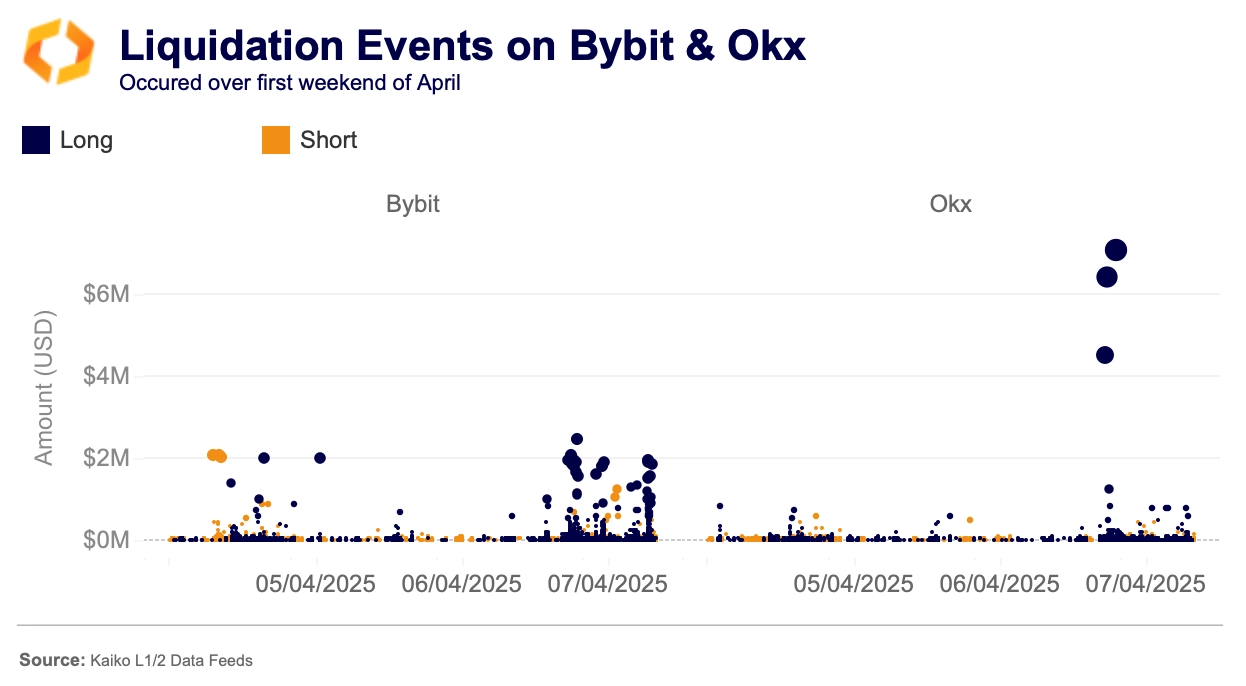

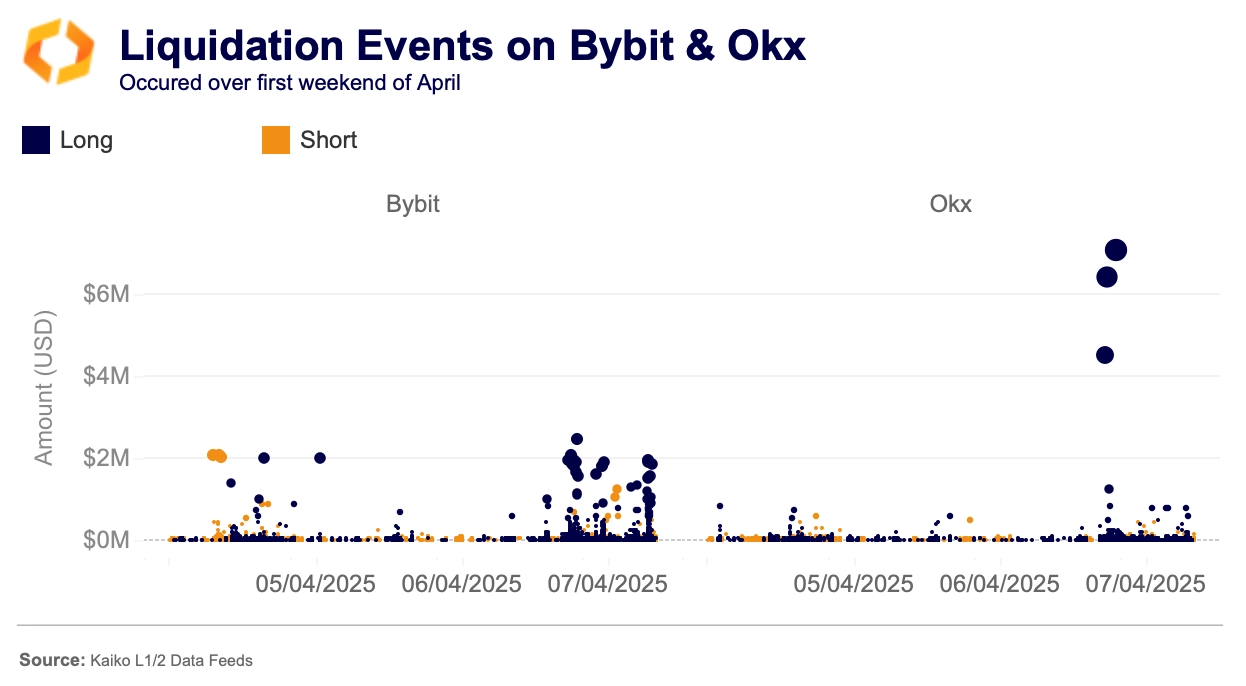

Typically, when the rates spike, it signals an abundance of leverage in the market, which can often precede a rapid decline in prices as traders get washed out, leading to massive liquidations. Recently, there has been a lack of abundant leverage in the market. This was evident over the weekend, as liquidations were relatively small. The largest liquidation in the past 24 hours was a BTC long position on OKX worth over $7 million.

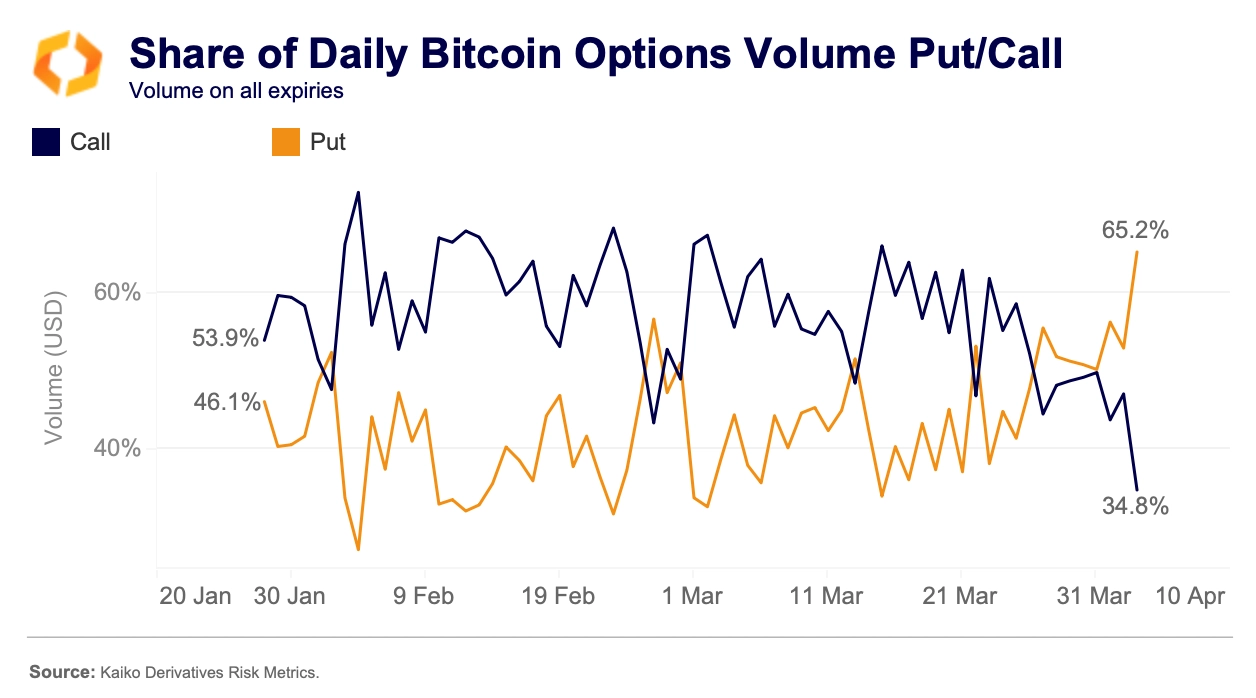

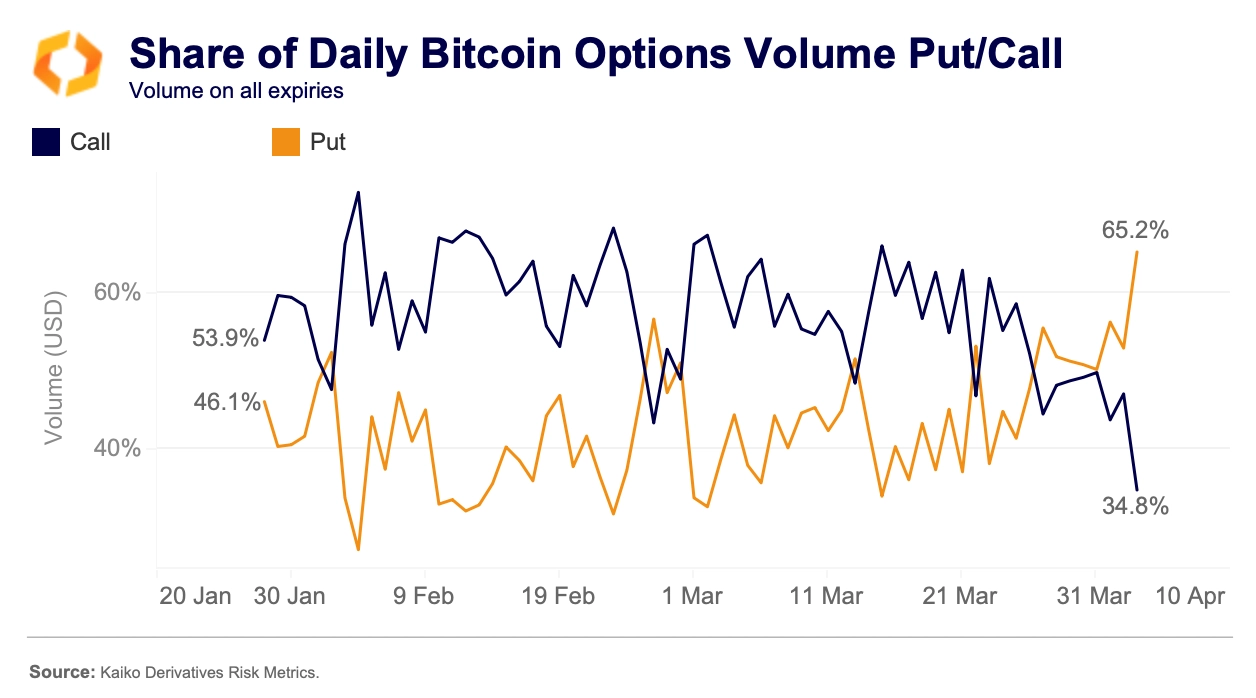

Meanwhile, the outlook in options markets has turned bearish. The volume of puts versus calls on Deribit has significantly deviated over the past week. Puts currently command over 65% of the volume, signaling increased demand for downside protection.

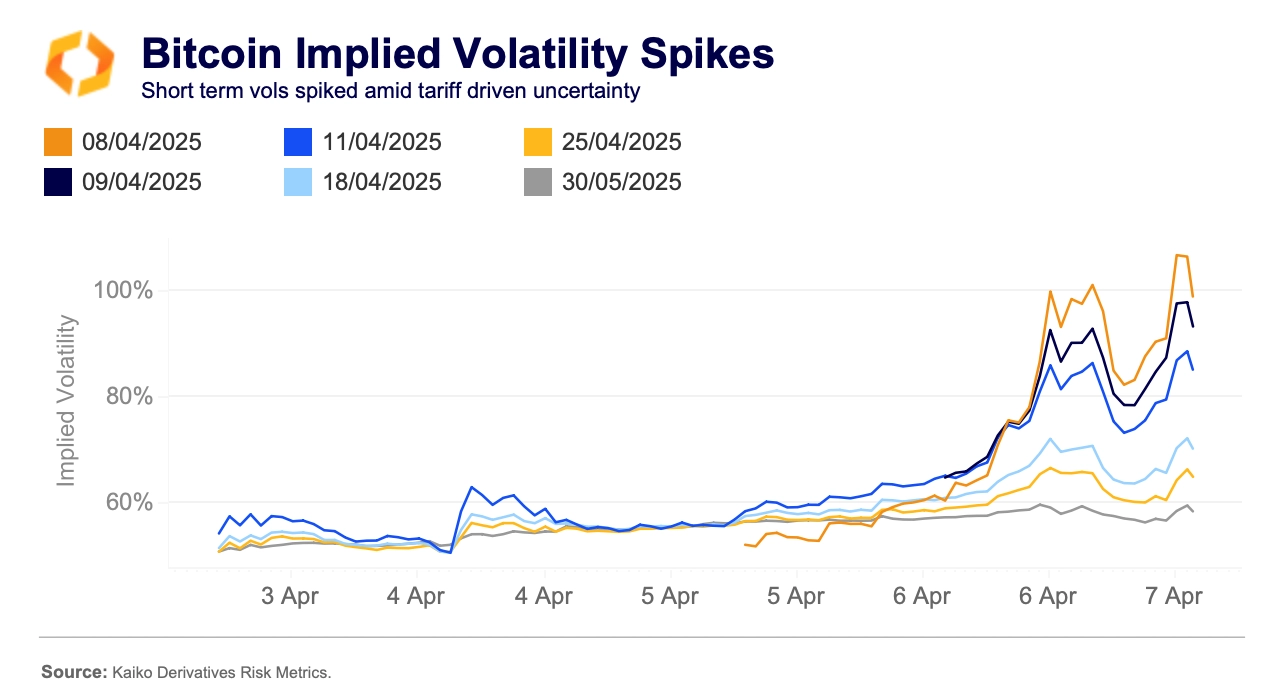

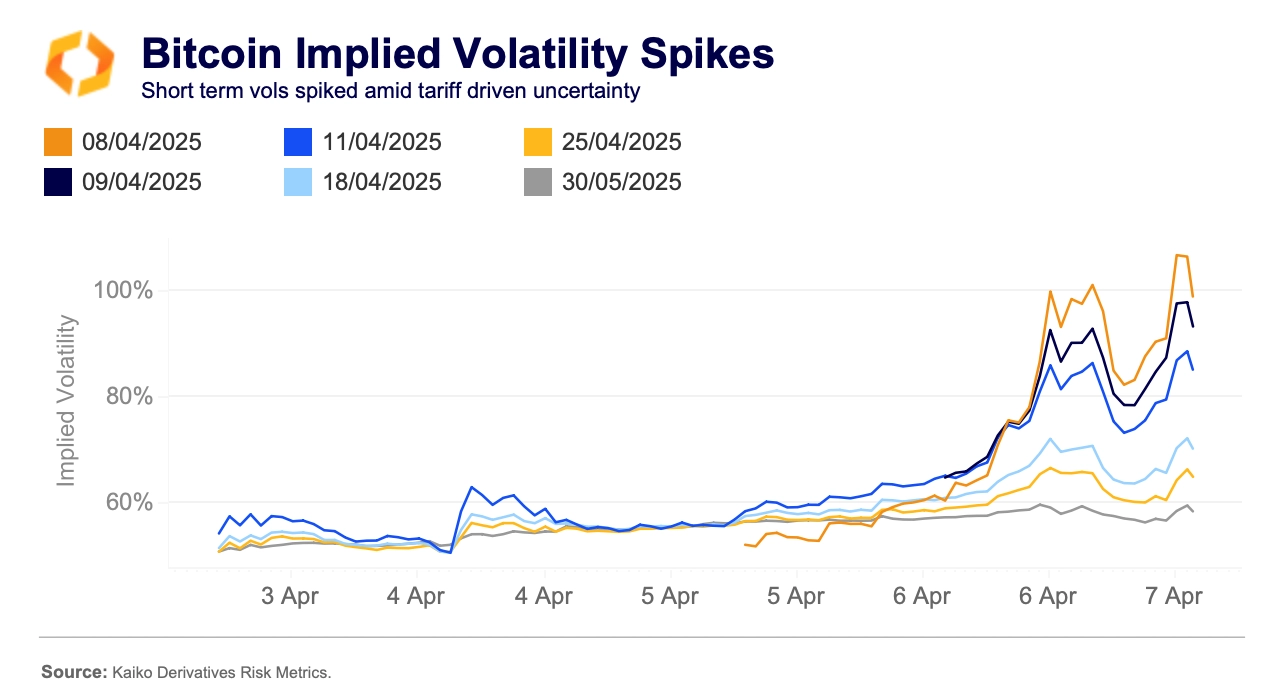

The uncertainty following President Trump’s tariff announcement has led to increased implied volatilities across all near-term expirations. The at-the-money IV on tomorrow’s April 8 expiration is around 100% at present.

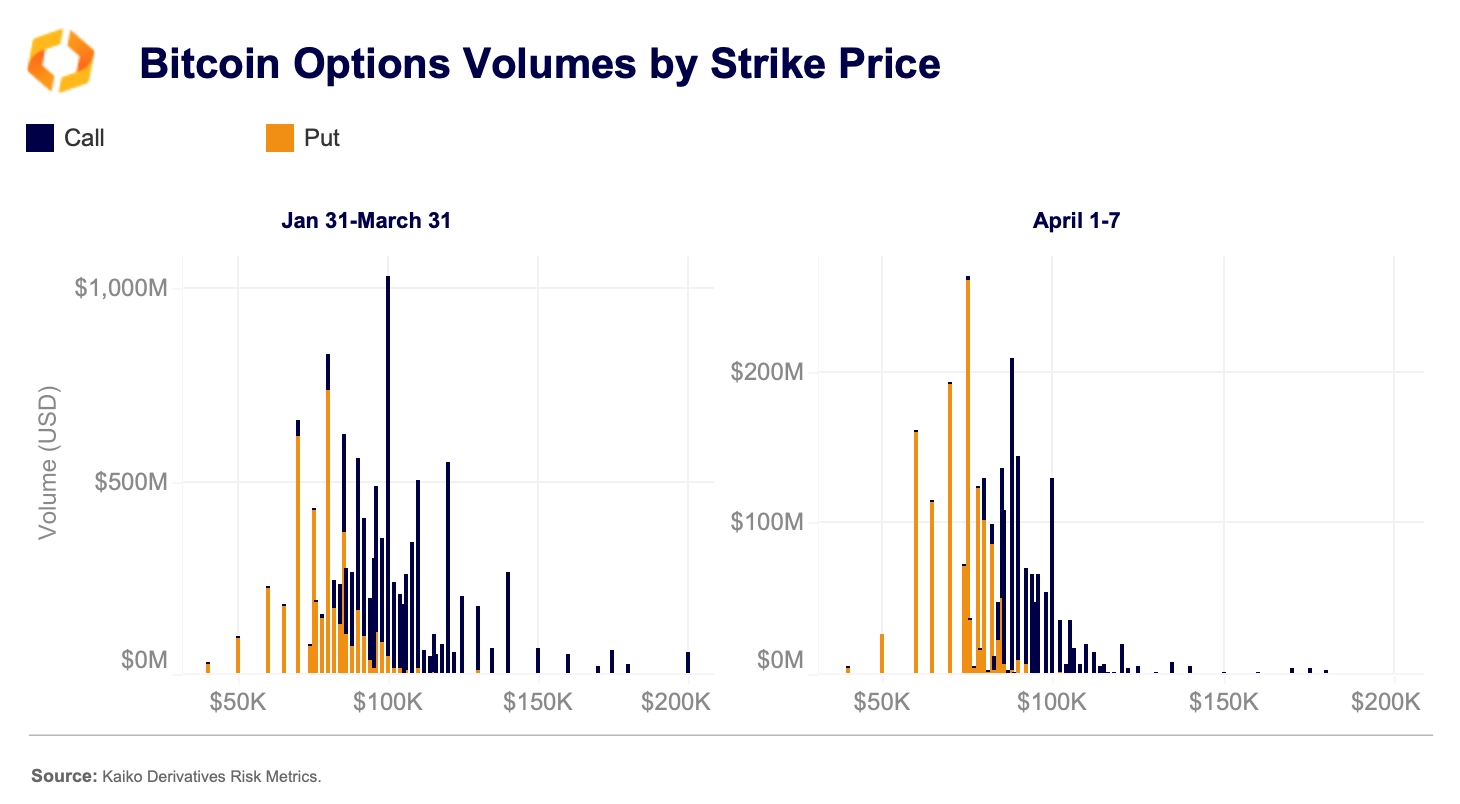

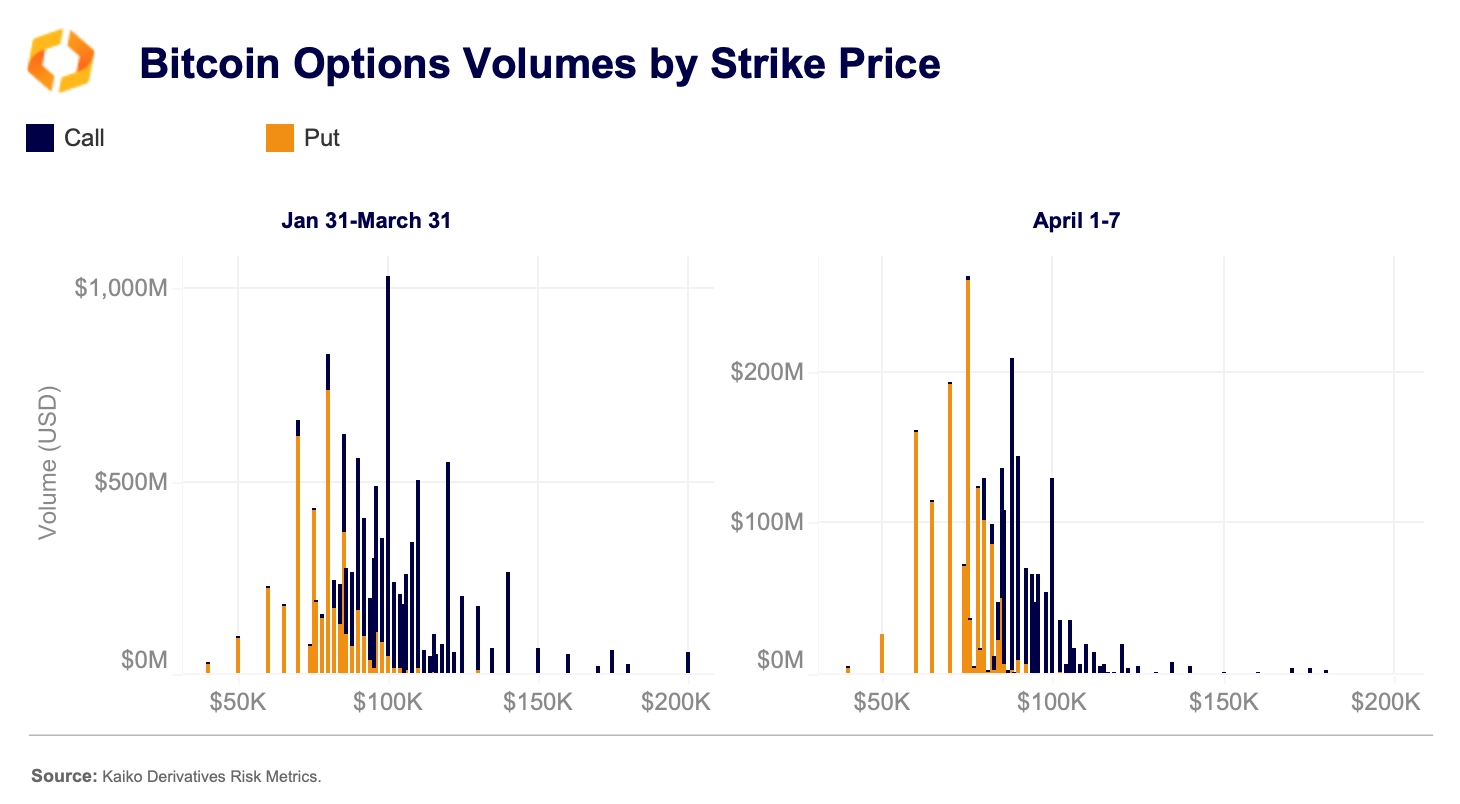

The April 25 expiry currently has an ATM IV of 65%, which is above longer-dated expirations. This has been the most popular expiry recently, with around $10 billion in volume since the beginning of March, the majority of which has been on the $100k strike—seeing over $1 billion in volume.

Since April 1, the $75k strike has been the most popular for this expiry, with $260 million in volume over the past six days. This shift in sentiment among traders further exemplifies how the latest tariff moves by the Trump administration have impacted markets to the downside. It also provides a clearer picture of where demand for protection is and how low (and for how long) prices might go. The $70k and even $60k puts are seeing a lot of volume, and it wouldn’t be surprising if the market gravitates towards these strikes as macro uncertainty persists.

Data points

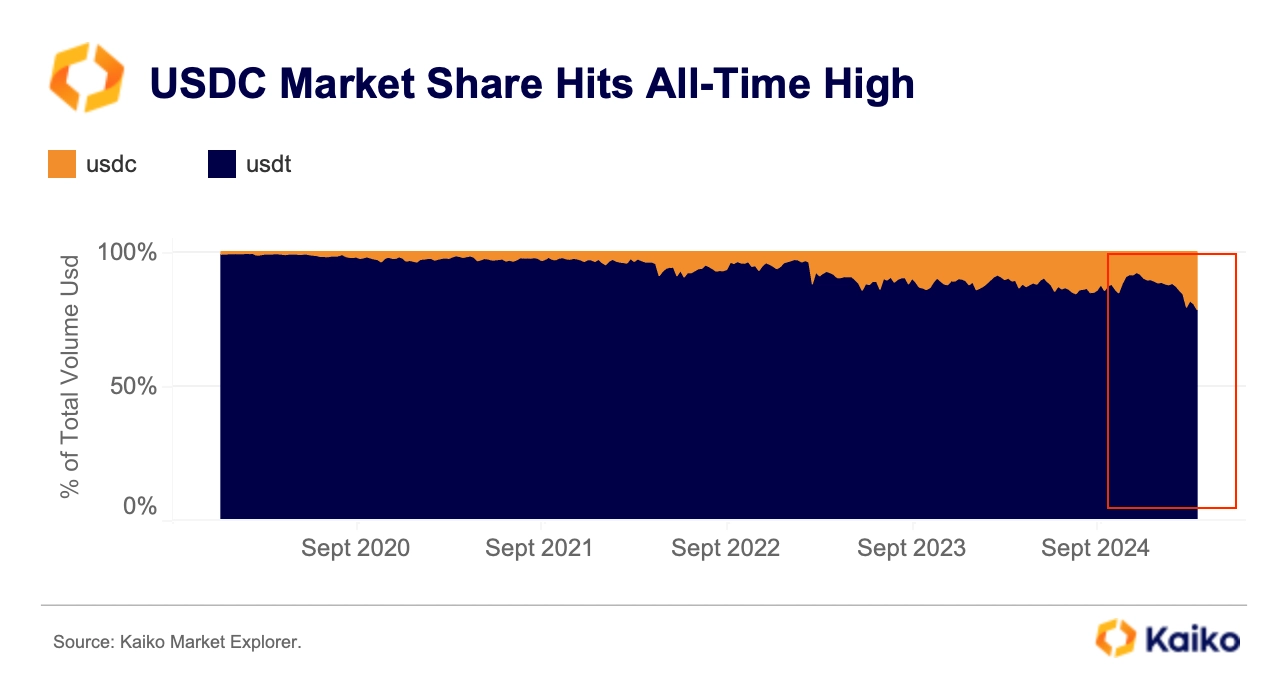

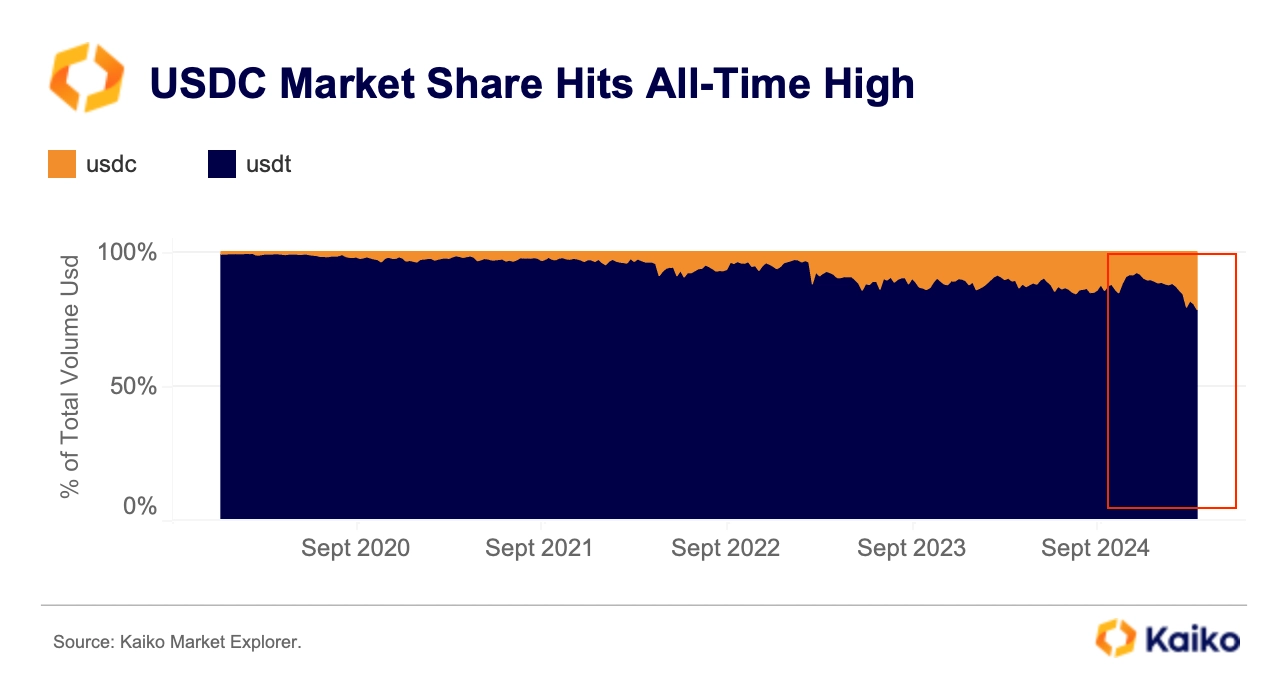

USDC market share hits all-time high.

Circle, the issuer of USDC, announced plans to go public on the New York Stock Exchange (NYSE) in April through an initial public offering (IPO). USDC’s market share has been rising, hitting a record 22% last week against its main rival, Tether’s USDT. This growth was largely driven by Binance, which overtook Bybit as the largest USDC market in December and now accounts for 58% of global USDC volumes.

However, Circle’s IPO filing revealed challenges in its revenue model: while revenue grew 16% year-over-year to $1.7 billion, profitability (EBITDA) fell by 28% to $285 million due to high partner costs.

Coinbase, Circle’s primary distribution partner, received over half of its USDC revenue ($900 million), while expansion efforts—such as a $60.25 million upfront fee to Binance—added further expenses. To sustain long-term growth, USDC must drive broader real-world adoption to offset its thin margins.

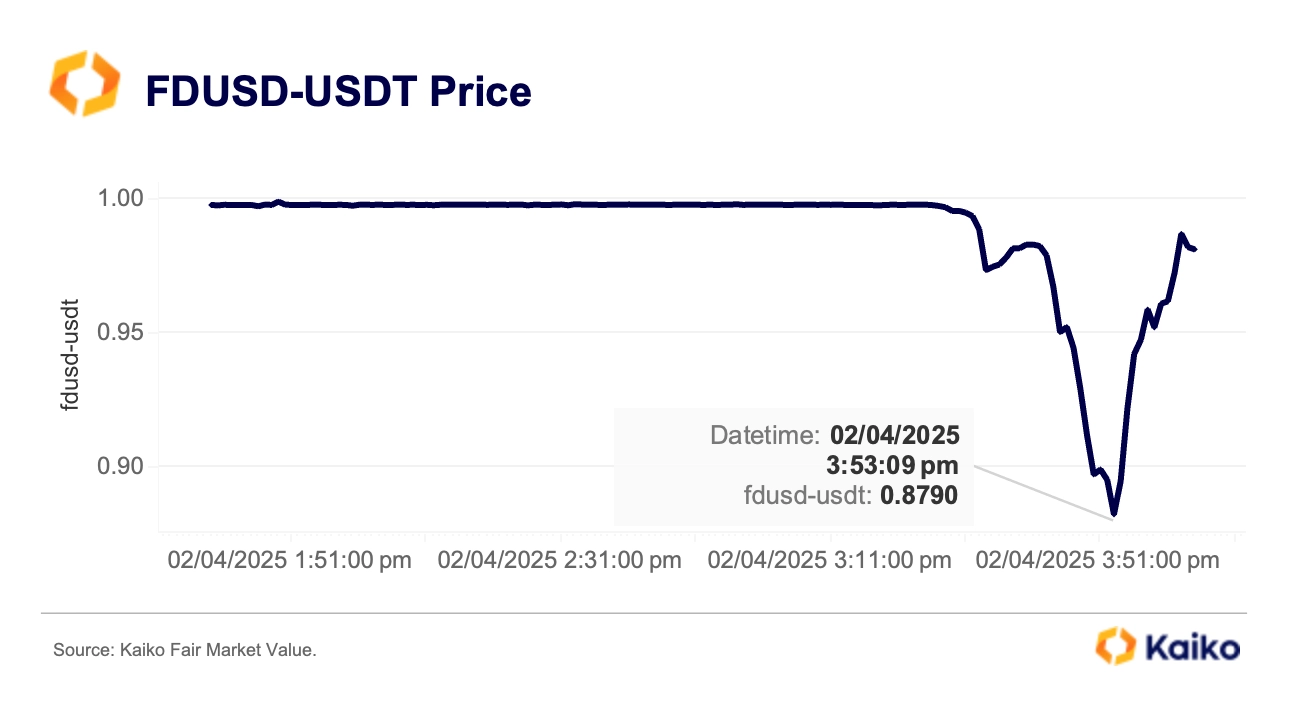

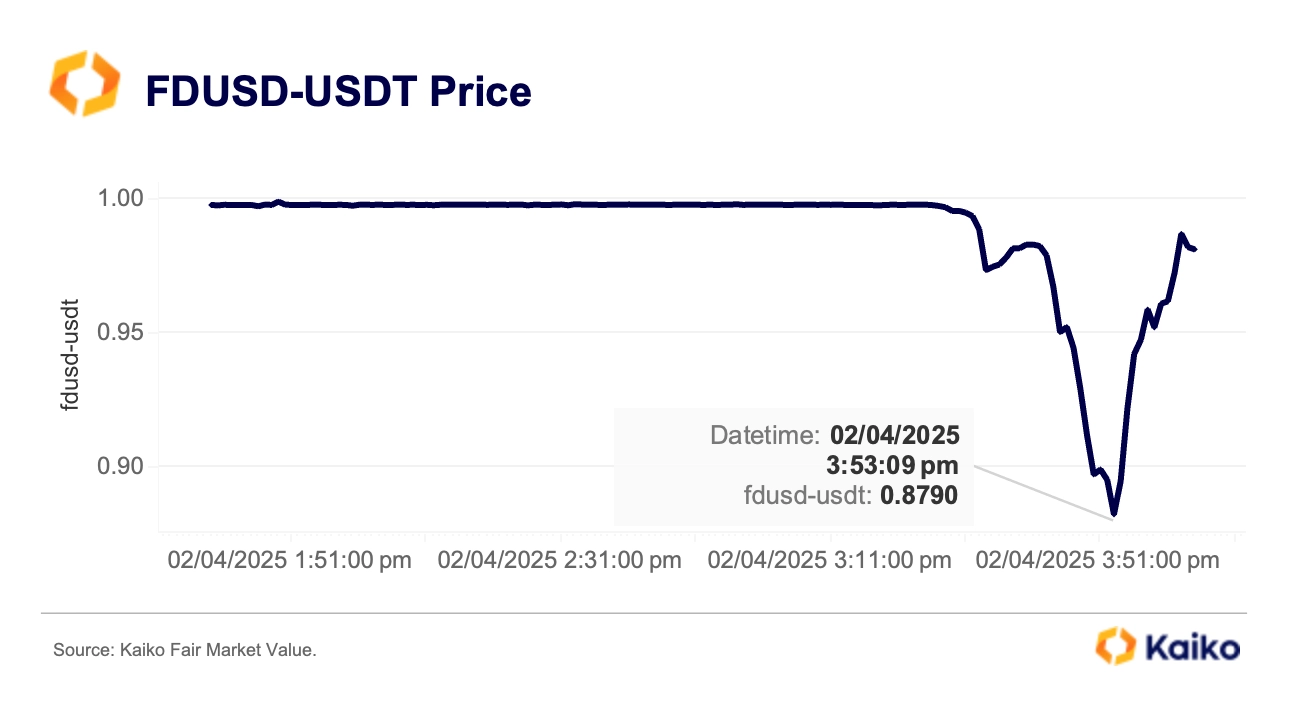

FDUSD depegs amid insolvency fears.

Last week, the stablecoin market experienced turbulence when First Digital USD (FDUSD), issued by the Hong Kong-based First Digital Trust, sharply depegged following comments from TRON founder Justin Sun on X. Sun questioned FDUSD’s redemption capabilities, causing its value to drop to $0.879 against USDT before it partially recovered. First Digital Trust dismissed Sun’s allegations as a smear campaign.

Sun’s comments follow a lawsuit by Techteryx, the issuer of TrueUSD (TUSD), against First Digital’s CEO, Vincent Chok, alleging he redirected $456 million in TUSD reserves into illiquid investments in late 2023. FDUSD, launched in June 2023, quickly gained market share on Binance after the exchange introduced a zero-fee BTC-FDUSD trading pair.

This rise coincided with TUSD’s decline, as it lost traction on Binance when the zero-fee BTC-TUSD pair was removed in September 2023, shifting trading volume from TUSD to FDUSD. The recent depeg of FDUSD could significantly impact Binance since FDUSD pairs account for 30% of the exchange’s stablecoin trading volume.

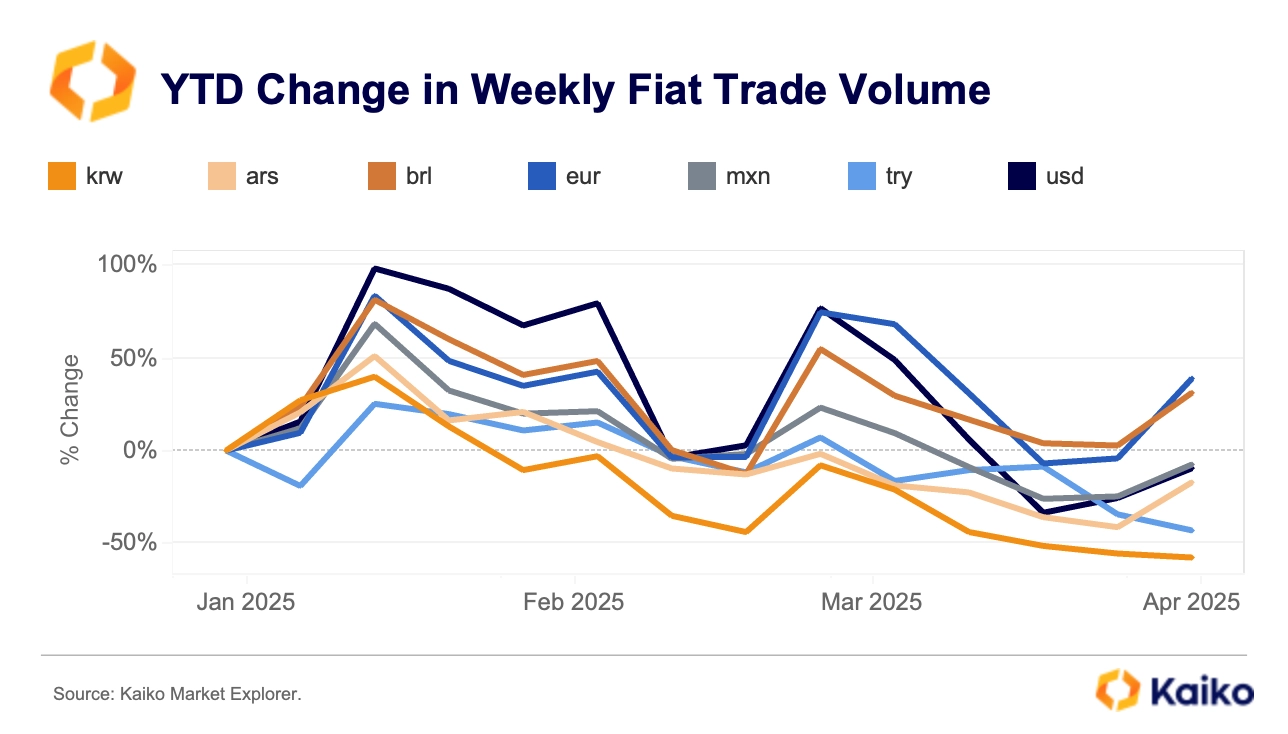

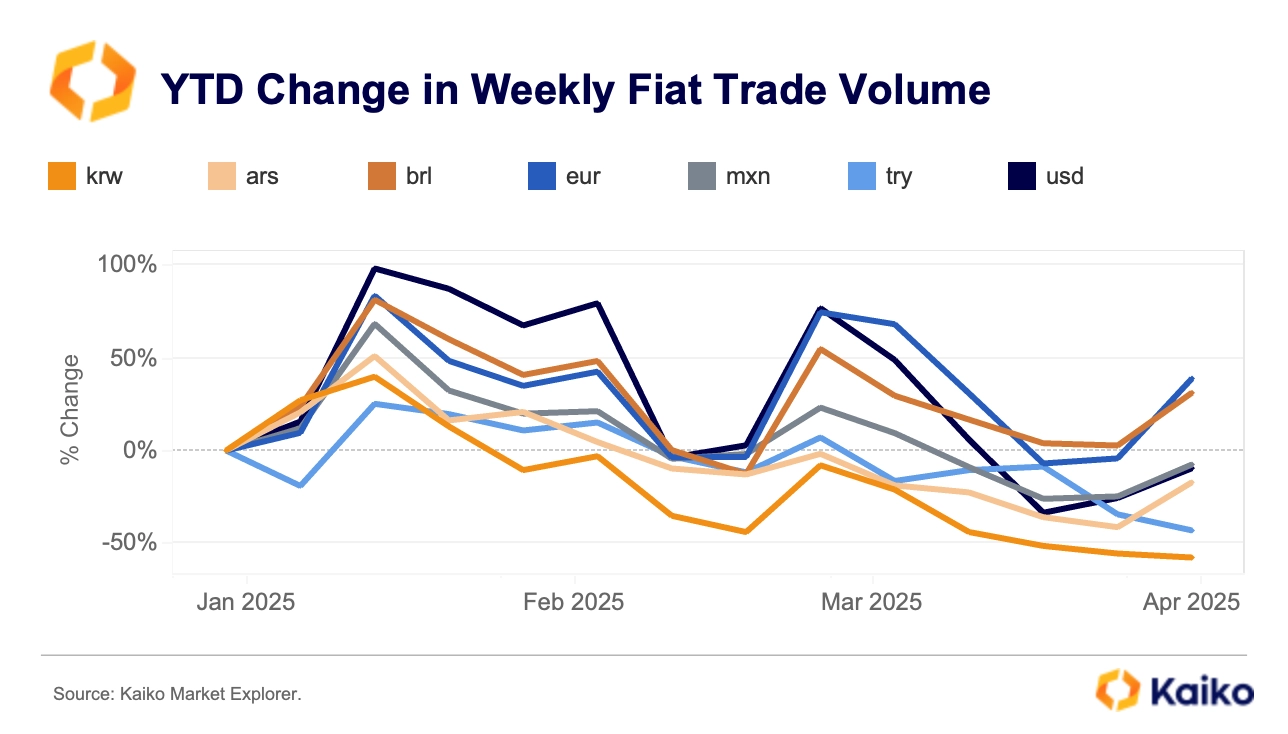

KRW markets collapse amid growing political uncertainty.

Domestic political turmoil and a broader risk-off sentiment have significantly impacted South Korea’s retail-driven cryptocurrency markets. Weekly trading volumes in Korean won (KRW) have dropped by 57% since the beginning of the year, marking the steepest decline among all fiat currencies.

Last week, South Korea’s Constitutional Court confirmed the removal of President Yoon, concluding the longest deliberation on a presidential impeachment in Korean history. Despite this, uncertainty and consumer stress remain high, as the export-oriented South Korean economy is highly vulnerable to U.S. tariffs. Additionally, an unexpected increase in inflation in March, driven by rising import costs, has caused the Bank of Korea to pause its rate-cutting cycle, further dampening risk appetite.

Despite the slowdown, South Korea remains the world’s second-largest crypto market, with the KRW accounting for 35% of global fiat trading volume between 2020 and 2025, trailing only the USD (45%).

![]()

![]()

![]()

![]()