Trend of The Week

Institutions Ponder SOL After CME Nod.

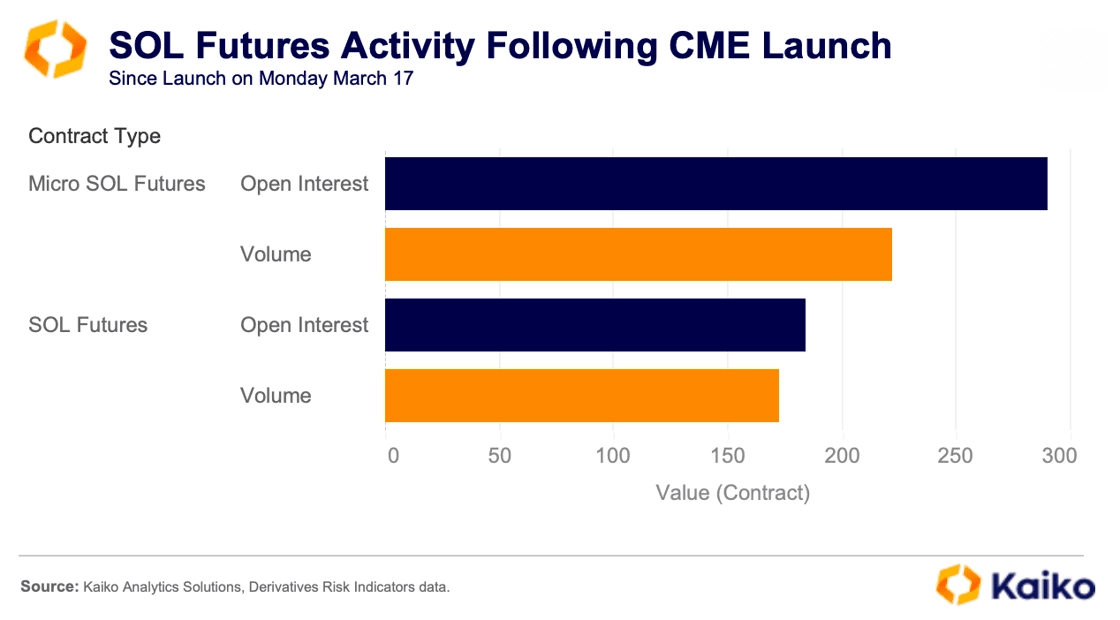

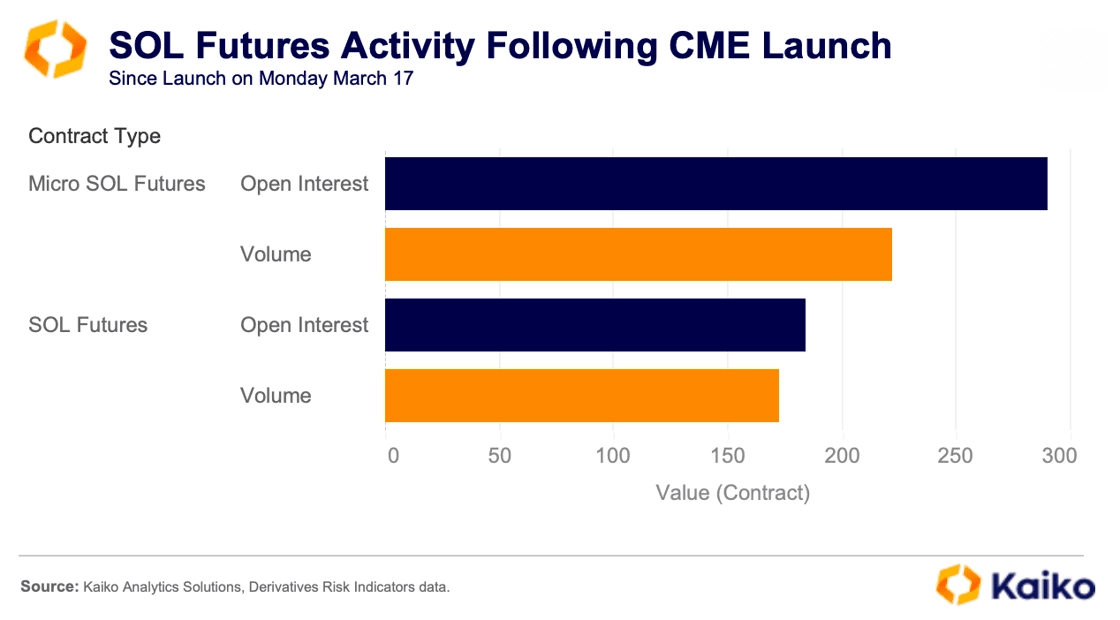

Solana futures had an unremarkable first week of trading on the CME. The lackluster debut was followed on Thursday by the launch of two exchange-traded funds tracking SOL futures. Volatility Shares launched the first SOL ETFs in the U.S., including a futures product and another offering designed to deliver two times (2x) the daily returns of SOL.

On day one, CME’s Solana futures saw about $12 million in trading volume, falling far behind the launches of Bitcoin and Ethereum futures on the same platform. Breaking down the launch, the micro contract (representing 25 SOL) traded more than the larger contract (500 SOL), signaling a lack of substantial interest from institutional investors at this time.

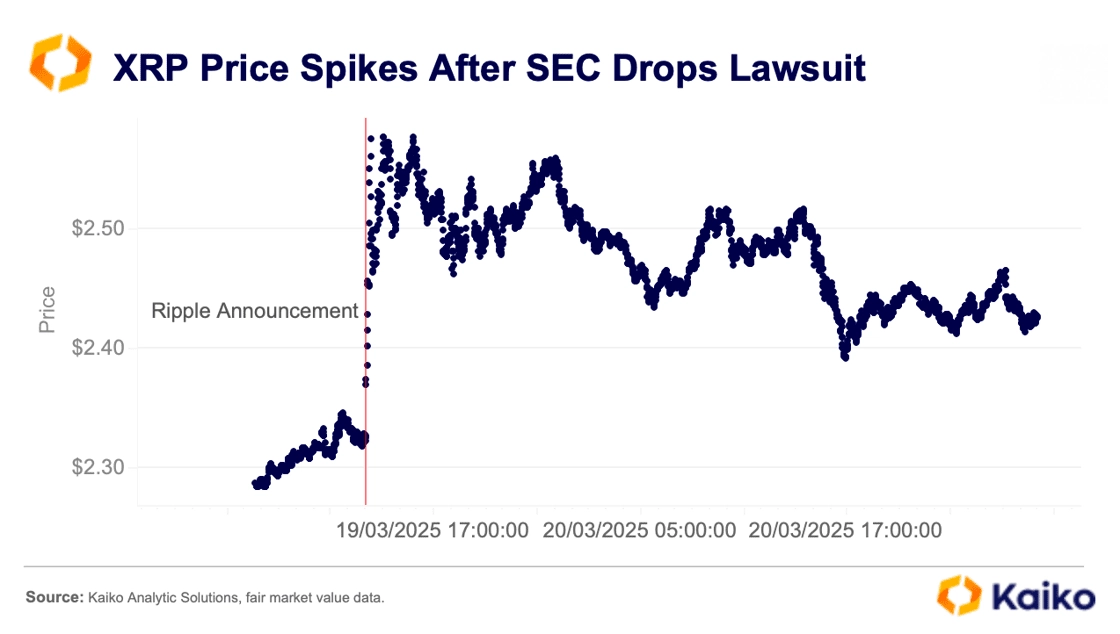

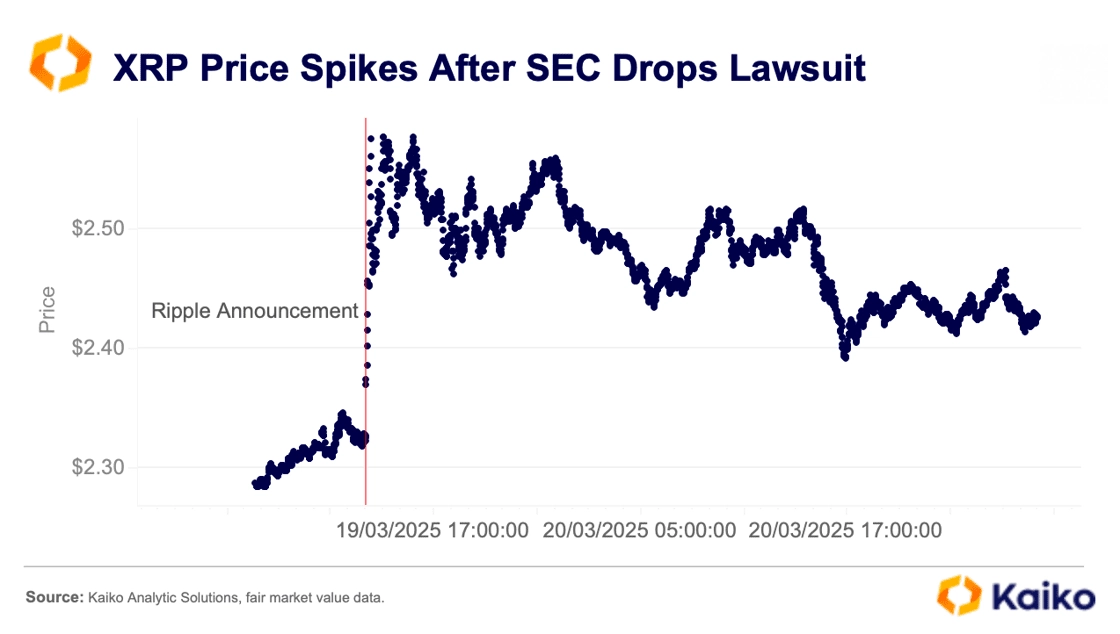

Regardless of the meager futures launch, there was more product-related news for SOL later in the week, which could have a larger impact on the asset going forward. Reportssuggest Fidelity could be set to file for a SOL ETF Trust. SOL isn’t the only token issuers are looking to launch structured products on: Ripple Labs revealed last week that the SEC has dropped its case against the firm, which had previously been a headwind for XRP—the native token of the Ripple Ledger. XRP jumped over 13% after the announcement, while odds of ETF approval rose on prediction markets.

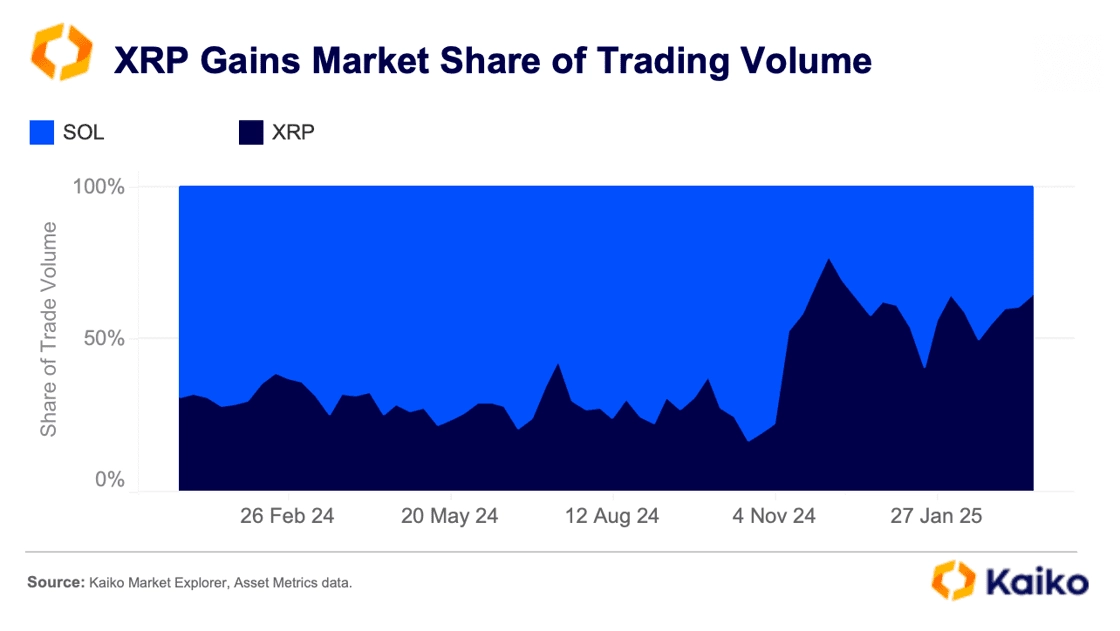

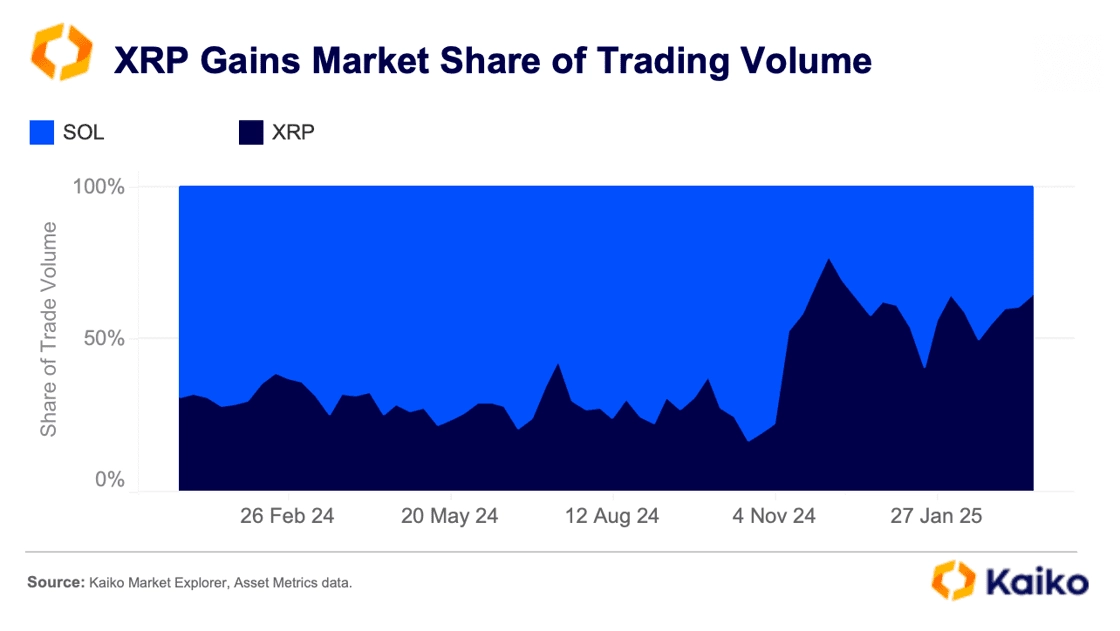

Previously, SOL dominated spot trading with a 70-80% share relative to XRP, but this trend has reversed, with XRP now holding over 50% of the volume on a regular basis. The futures launch this week did nothing to move the dial here as flows were directed towards XRP.

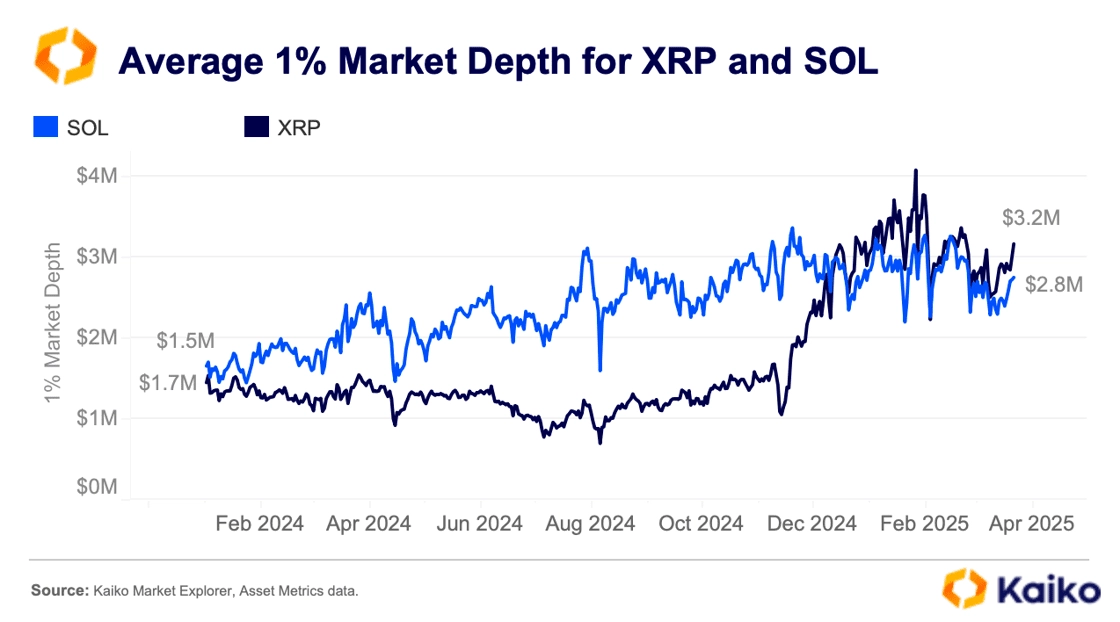

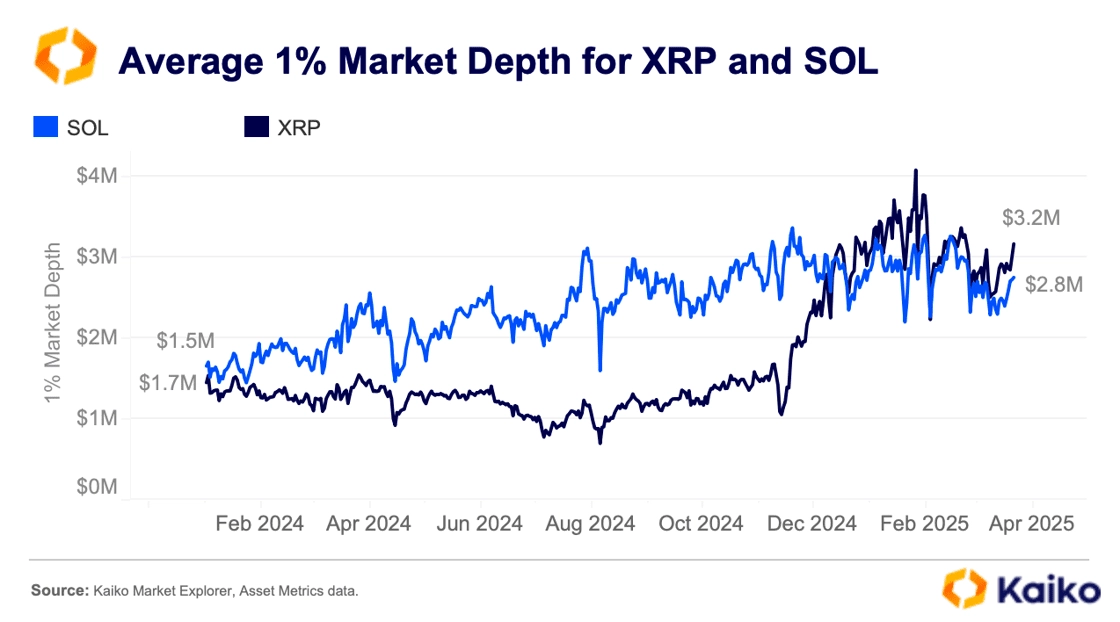

The raft of activity in XRP markets doesn’t appear to be an anomaly either. Higher volumes have been matched by improved liquidity for XRP as the average 1% market depth climbed steadily—now above SOL.

Liquidity begets liquidity and with the regulatory roadblock removed we could see similar product launches for XRP in the coming months. In January the CME released a mock webpage for SOL and XRP futures “in error”. With one of those products now launched and the second released from its regulatory purgatory, we could see more launches for crypto futures products soon. XRP futures on the CME could see more demand if the underlying spot market is anything to go by.

Data Points

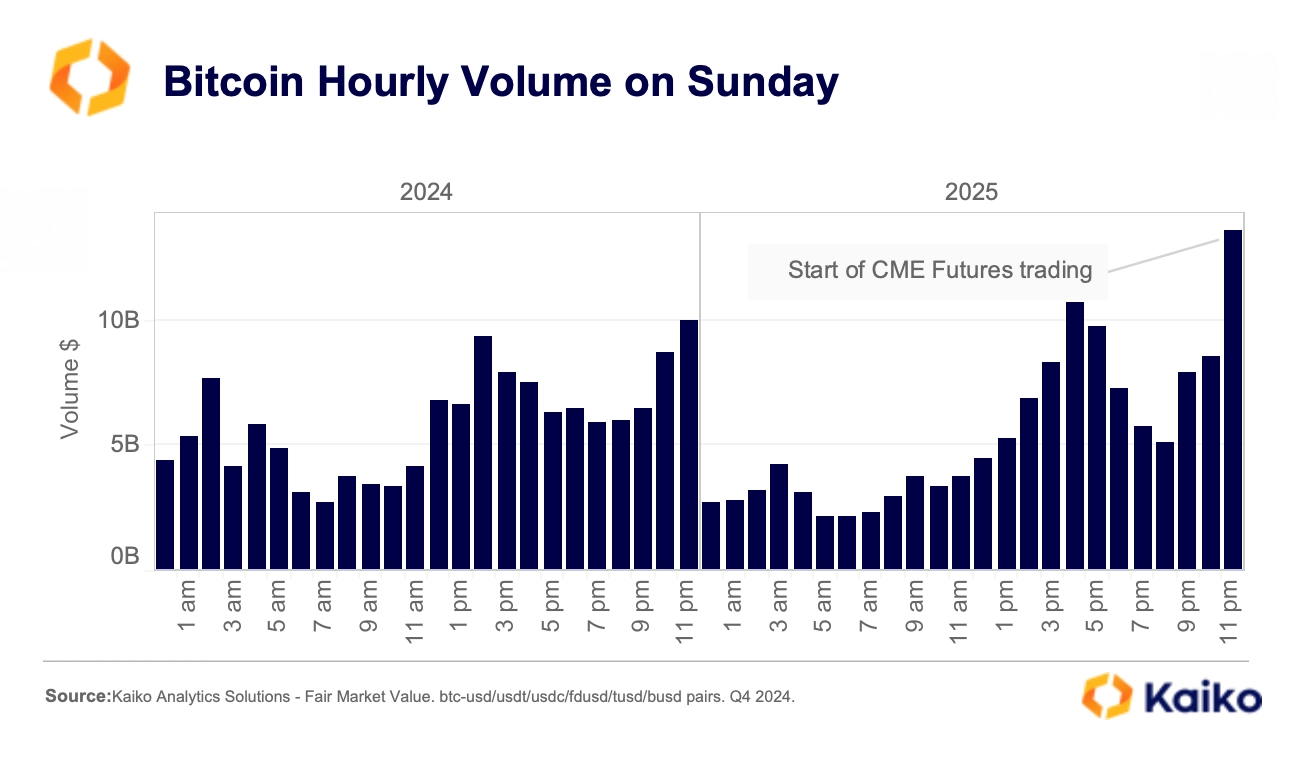

How much BTC trades on the weekend?

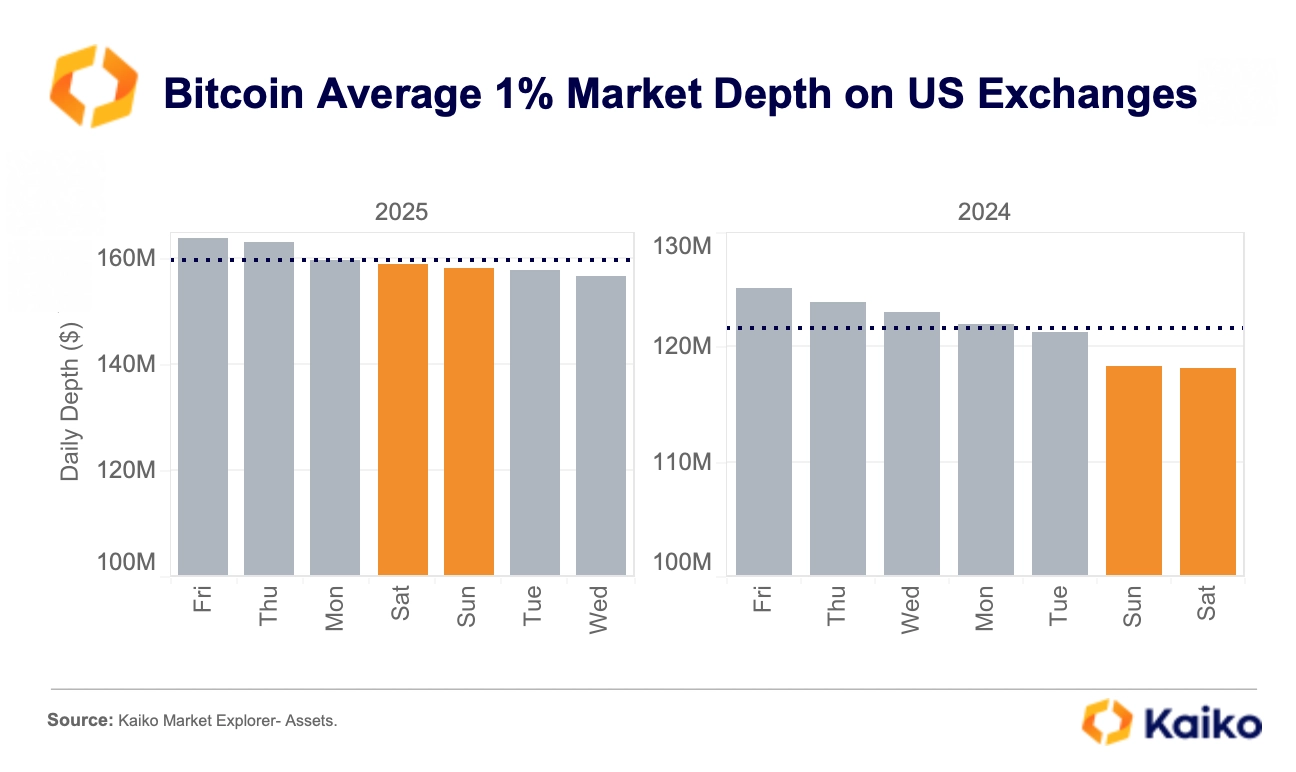

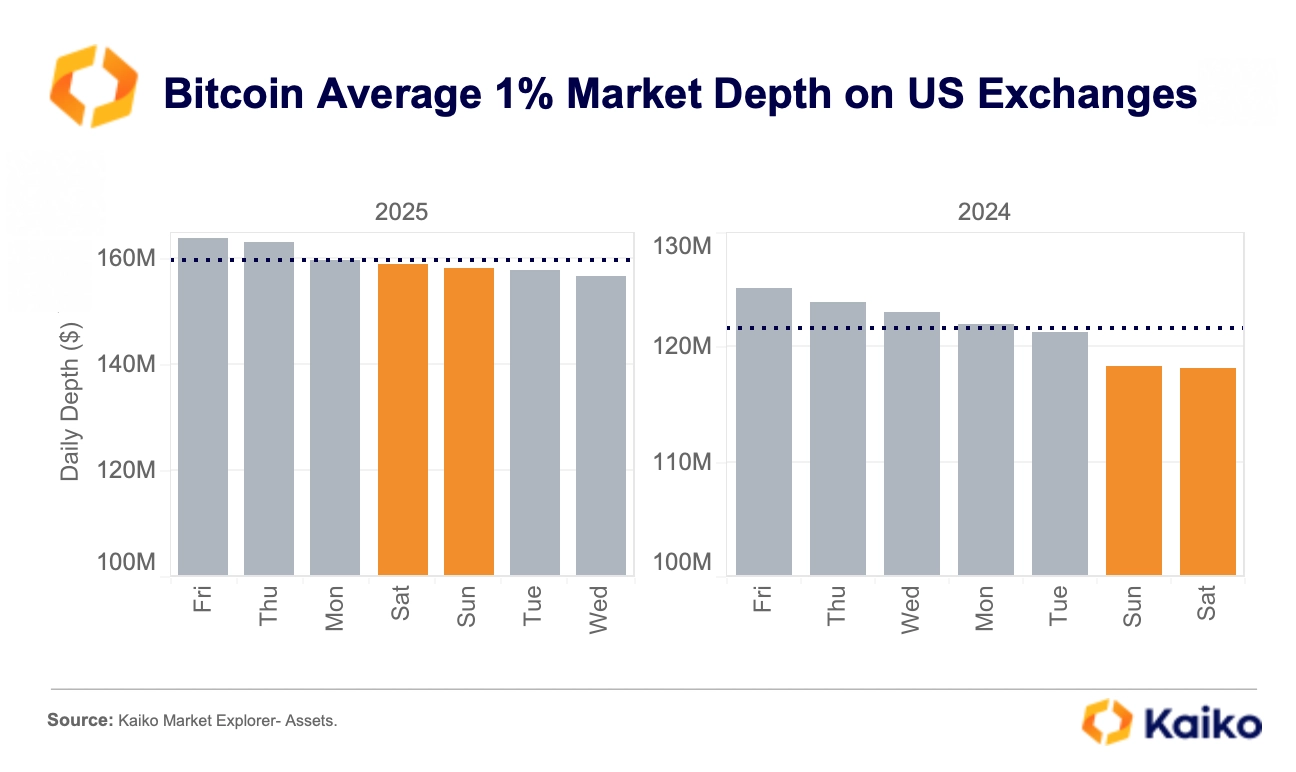

Bitcoin liquidity on weekends is showing signs of a rebound in 2025, hinting at a possible reversal of the years-long decline. So far this year, Bitcoin’s average daily 1% depth has been lowest midweek—particularly on Tuesdays and Wednesdays—while peaking on Fridays.

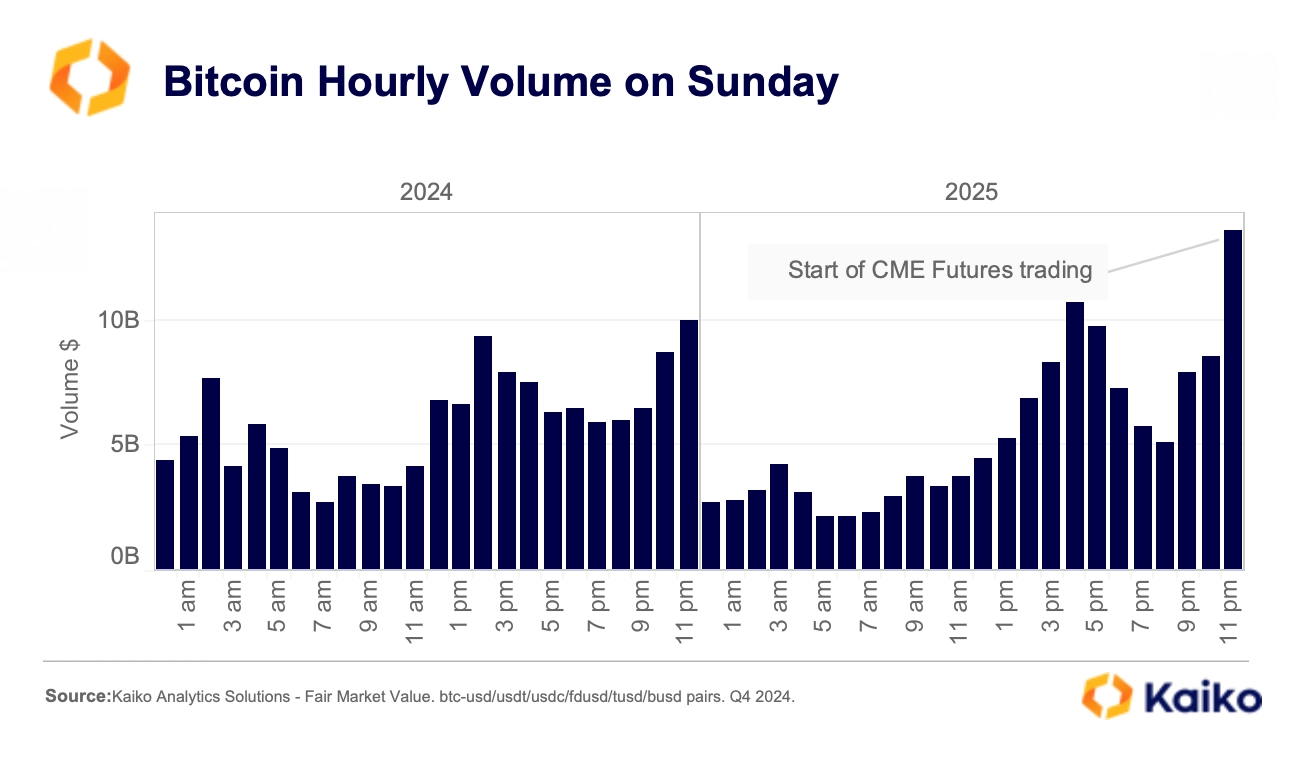

This marks a shift from last year when Saturdays and Sundays experienced the weakest liquidity. Trade volumes on weekends, especially Sundays, have also increased, potentially drawing in more market makers.

What is driving this trend? A closer look at hourly trading volumes reveals that the most significant increase in Sunday volumes occurred around 23:00 UTC, which coincides with the start of CME Futures trading. This suggests the shift is likely fueled by institutional investors.

Demand for continuous trading by traditional investors has been growing, pushing two of the biggest U.S. stock exchanges—Nasdaq and the NYSE—to offer round-the-clock trading.

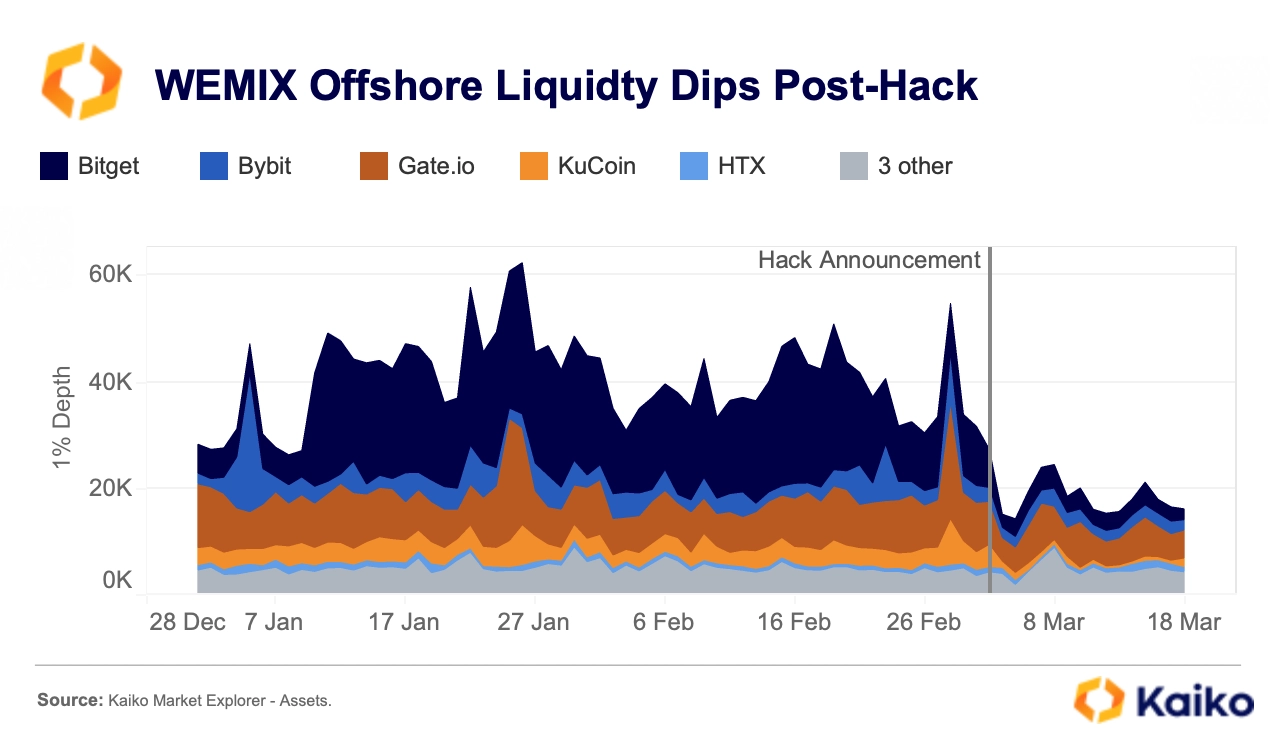

WEMIX hack triggers liquidty crisis and price divergence.

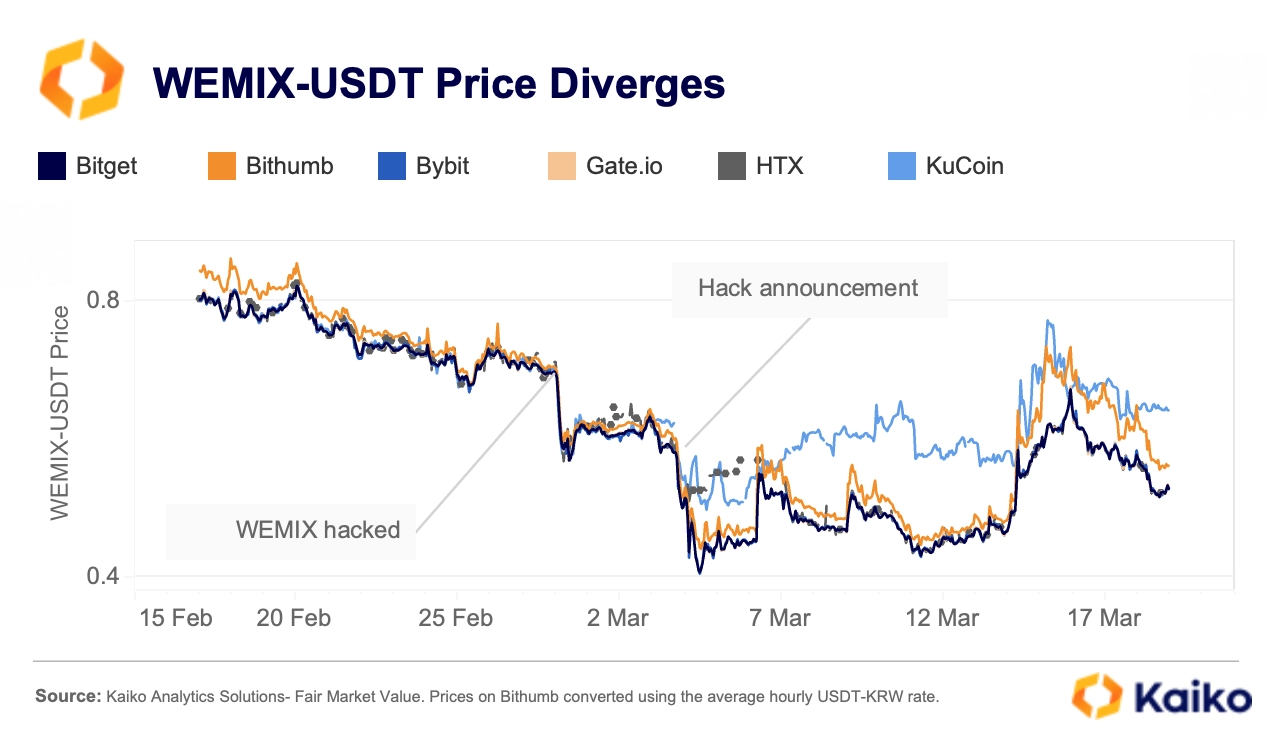

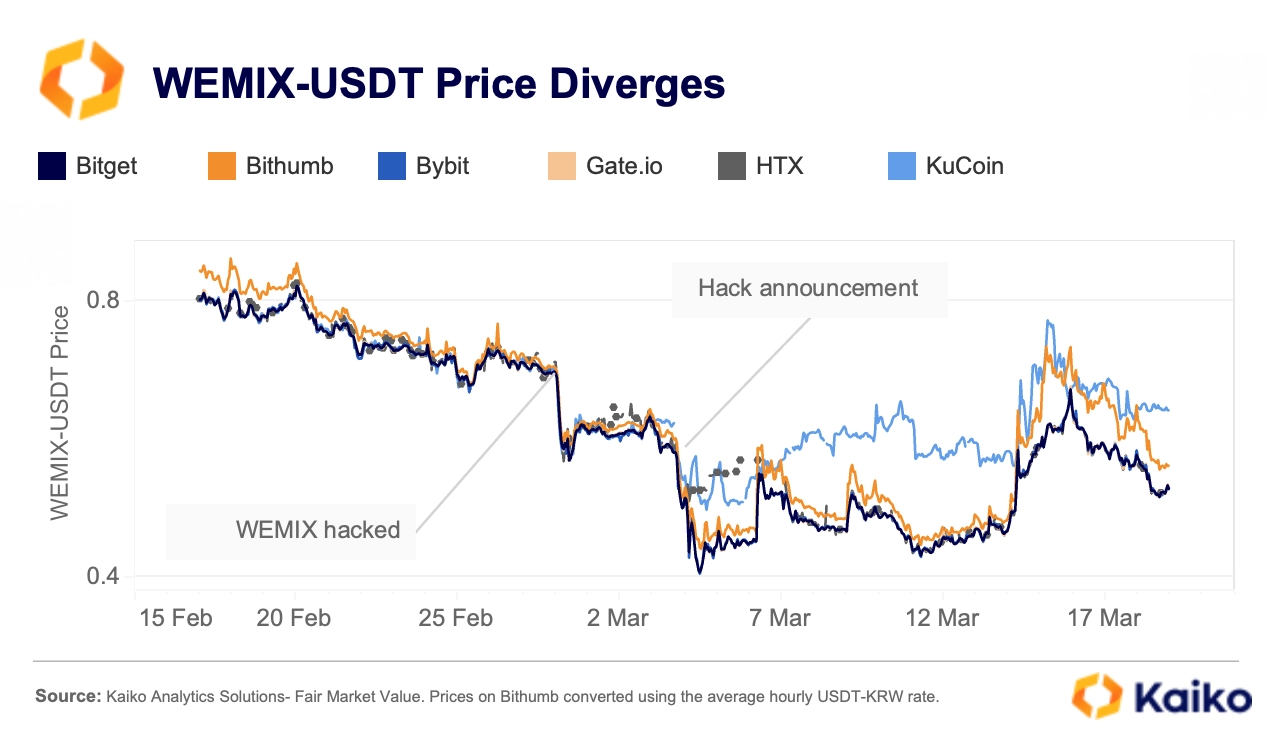

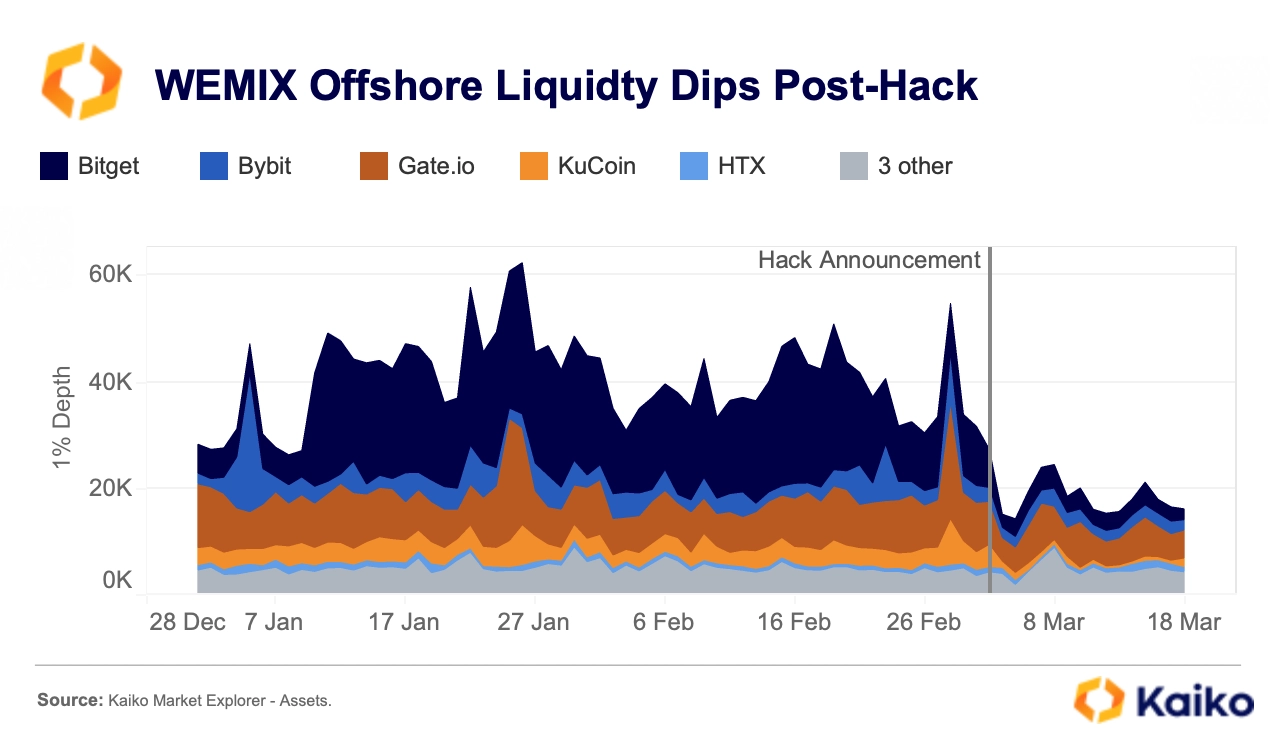

On February 28, Wemade’s WEMIX blockchain platform suffered a $6.1 million exploit, with hackers stealing 8.65 million tokens from the Wemix Foundation’s ‘play bridge vault’ wallet. The breach was only announced on March 3, after most of the stolen funds had already been sold.

The delayed announcement helped avoid immediate panic but allowed hackers to sell tokens under favorable liquidity conditions. WEMIX prices dropped 16% between 1:00 and 6:00 AM UTC right after the exploit on February 28 before stabilizing.

The market impact of the official announcement on March 3 was more severe as market makers, especially on unregulated platforms outside South Korea, pulled out of the market. WEMIX offshore 1% market depth dried up, hitting a record low of just $14K on March 5. As a result, between March 3 and 4, within less than 24 hours, WEMIX prices plunged an additional 27%.

This liquidity squeeze has led to significant price divergences in WEMIX-USDT markets, with KuCoin and HTX showing more than 20% price discrepancies. KuCoin’s price is staying over 10% higher due to ongoing liquidity issues.

Following the hack, the Wemix Foundation announced a buyback plan to minimize the fallout and restore market confidence, which kicked off on March 13. Given the sharp liquidity drop, the buyback could have a significant price impact.

|

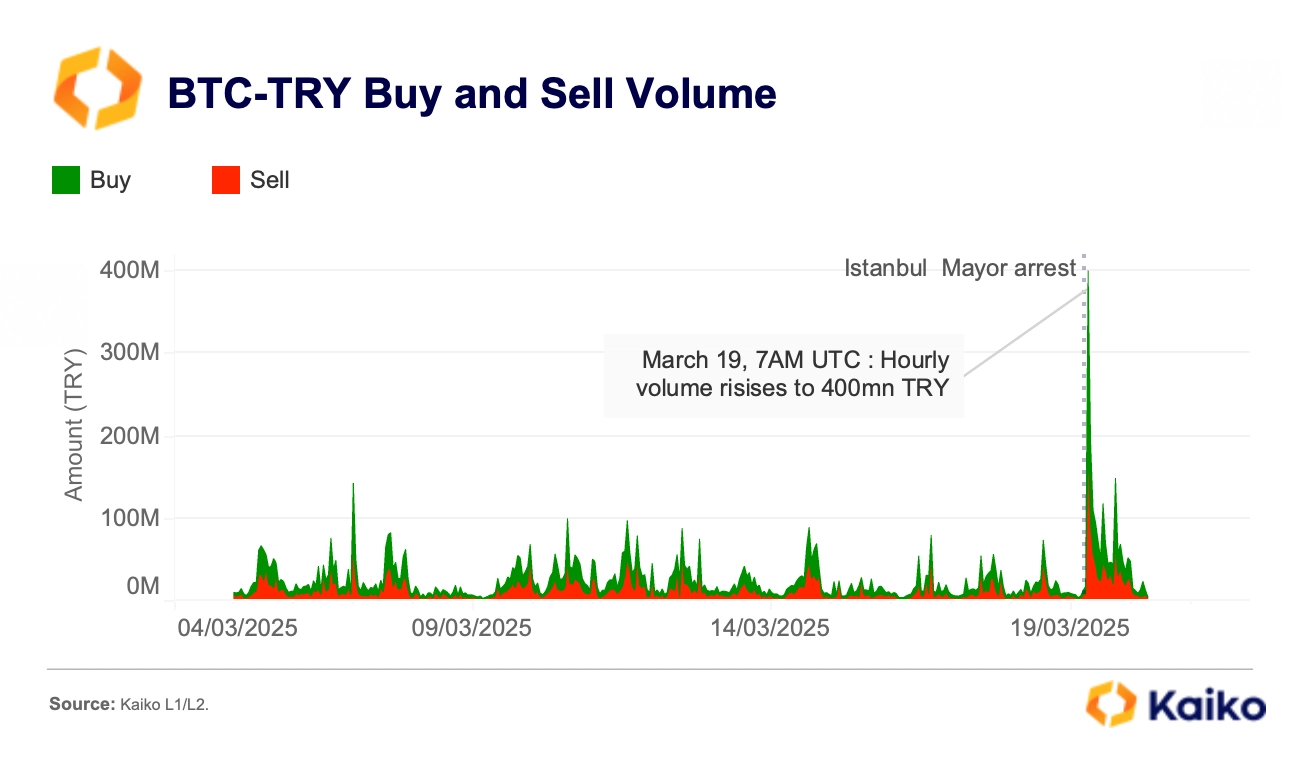

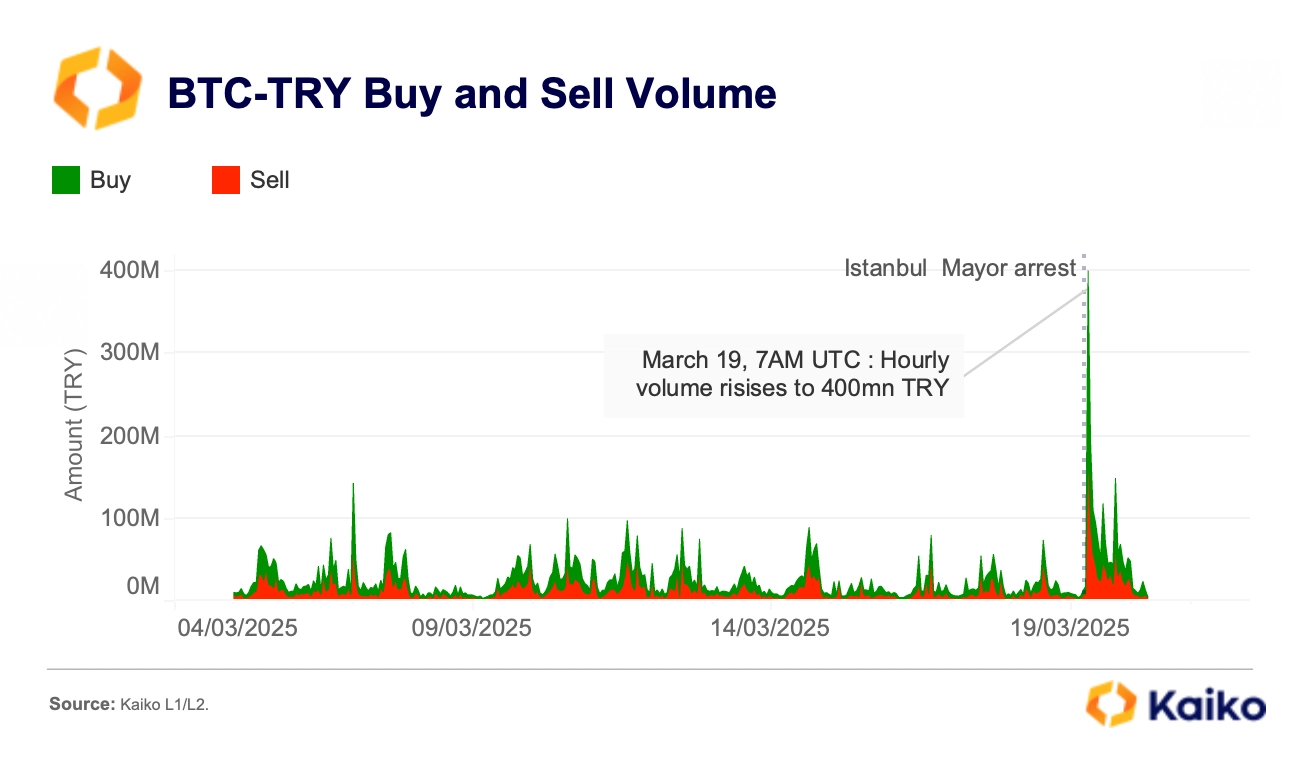

Turkish traders flock into Bitcoin amid political turmoil.

Last week, Bitcoin saw increased demand on Turkish markets following growing political unrest. On March 19, strong buying pressure pushed BTC-TRY volumes higher after the 4:30 AM UTC (7:30 AM local) arrest of Istanbul’s mayor, a key political rival to President Recep Tayyip Erdoğan.

The BTC-TRY cumulative volume delta (CVD), a measure of buying and selling pressure, has been positive over the past month, reflecting growing interest in crypto as traders seek refuge amid rising global uncertainty. This trend has accelerated following last week’s events, highlighting Bitcoin’s ongoing appeal as a safe-haven asset in times of political instability.

The BTC-TRY cumulative volume delta (CVD), a measure of buying and selling pressure, has been positive over the past month, reflecting growing interest in crypto as traders seek refuge amid rising global uncertainty. This trend has accelerated following last week’s events, highlighting Bitcoin’s ongoing appeal as a safe-haven asset in times of political instability.

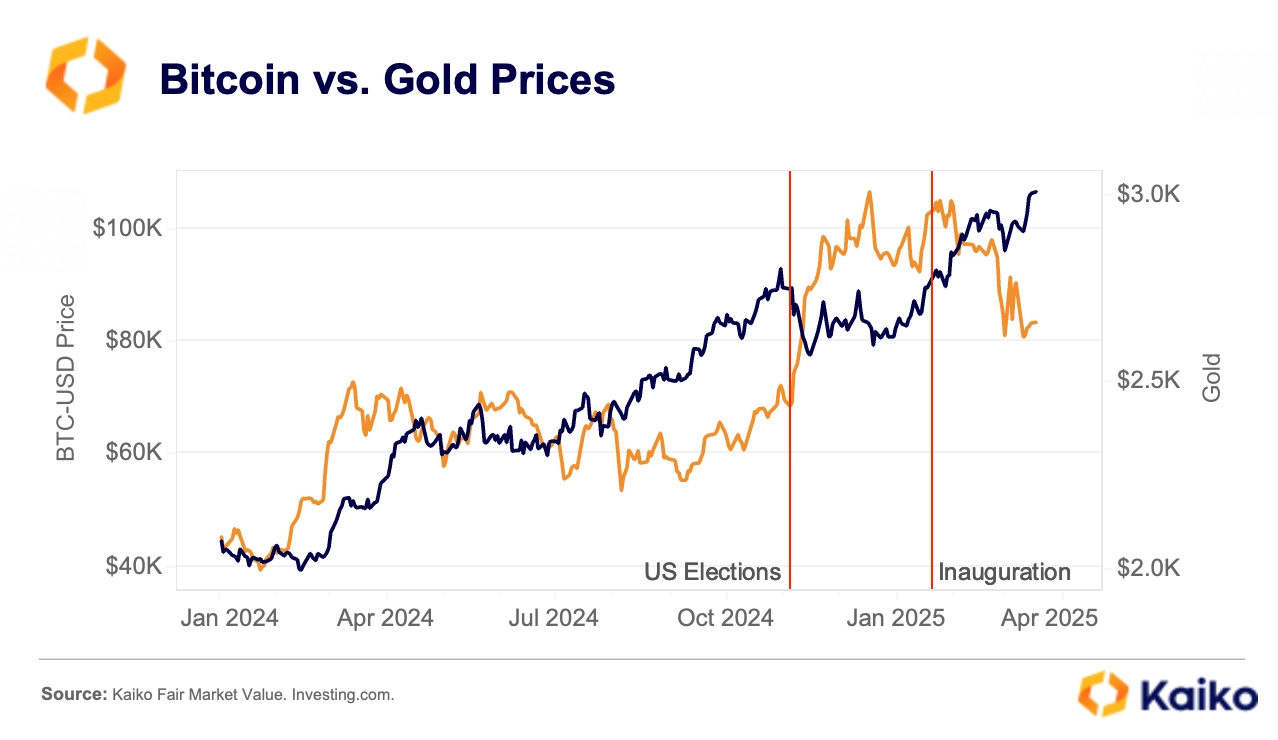

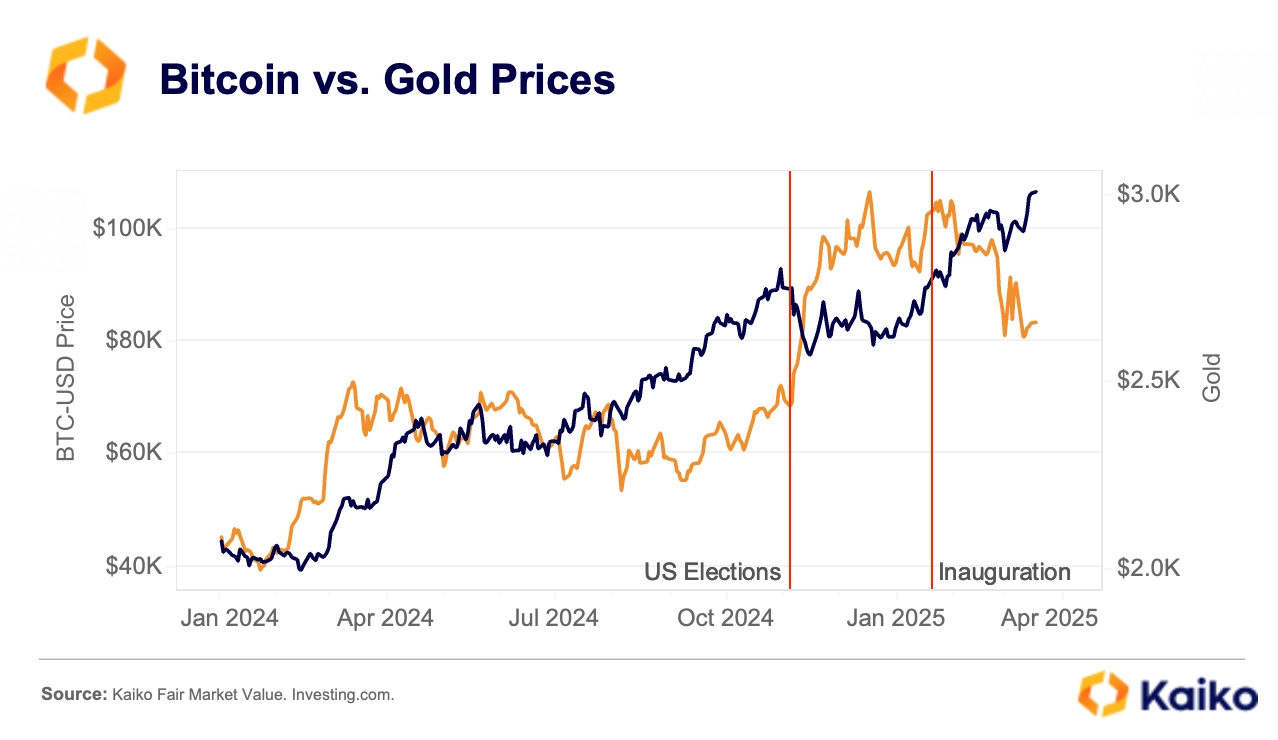

However, despite robust demand in Turkish markets, Bitcoin has underperformed gold, especially since the inauguration of U.S. President Trump, raising doubts about its role as a reliable safe haven. Over the past year, BTC’s 90-day correlation with gold has been strikingly low, averaging just 0.1—indicating that the two assets are influenced by fundamentally different factors.

While gold’s recent gains have been driven by speculation and shifting risk management strategies amid tariff concerns, Bitcoin has largely moved in sync with risk assets, further underscoring its divergence from gold in times of economic turbulence. |

![]()

![]()

![]()

![]()

The BTC-TRY cumulative volume delta (CVD), a measure of buying and selling pressure, has been positive over the past month, reflecting growing interest in crypto as traders seek refuge amid rising global uncertainty. This trend has accelerated following last week’s events, highlighting Bitcoin’s ongoing appeal as a safe-haven asset in times of political instability.

The BTC-TRY cumulative volume delta (CVD), a measure of buying and selling pressure, has been positive over the past month, reflecting growing interest in crypto as traders seek refuge amid rising global uncertainty. This trend has accelerated following last week’s events, highlighting Bitcoin’s ongoing appeal as a safe-haven asset in times of political instability.