Trend of the Week

XRP Races as ETFs deadlines loom.

It’s about to be a new era at the U.S. Securities and Exchange Commission as incoming Chair, Paul Atkins, was confirmed by the Senate last week. The former Commissioner has a lot on his plate once he begins his new role. While crypto is just a tiny fraction of market activity in the U.S., pressing deadlines might push it to the forefront for the new Chair.

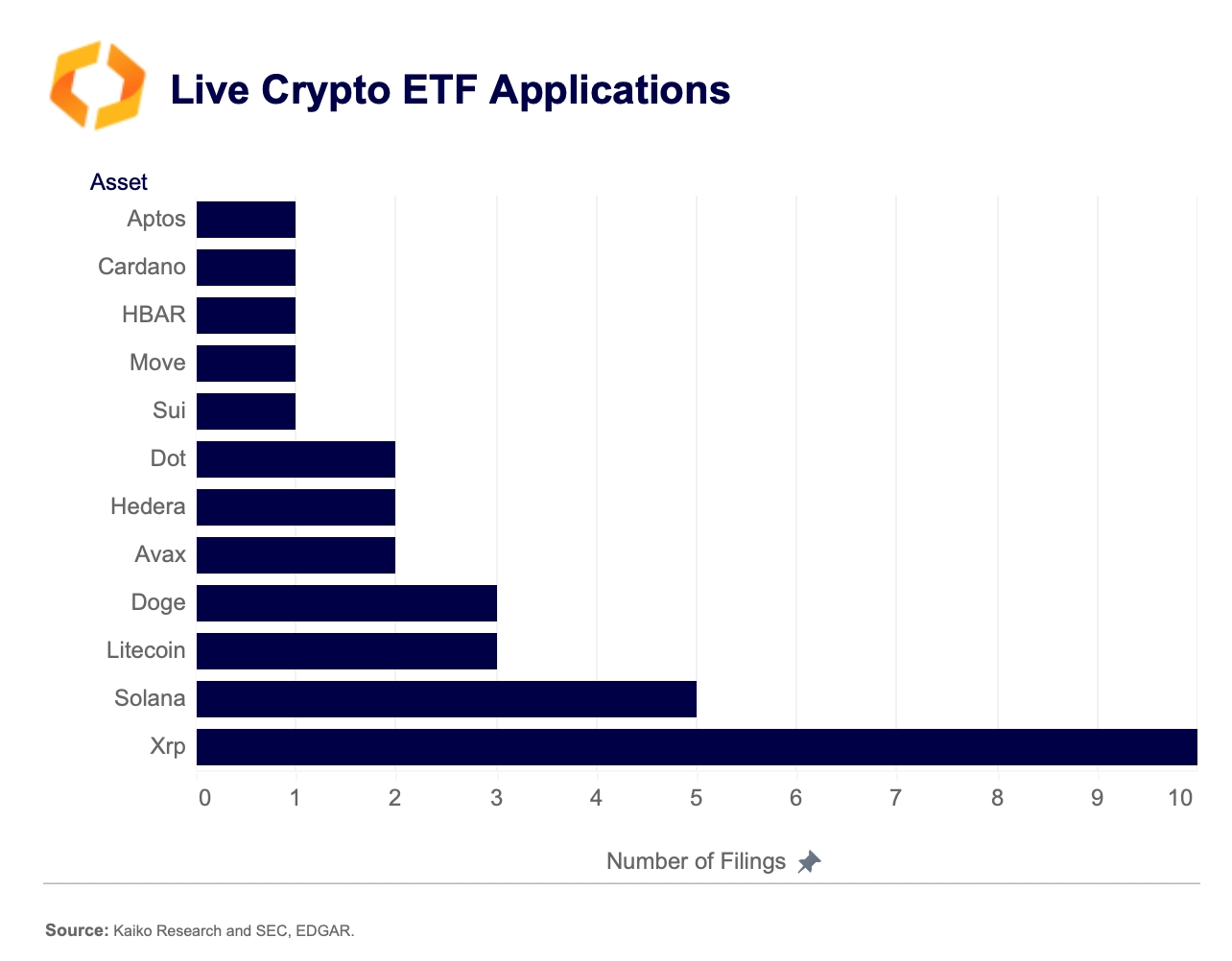

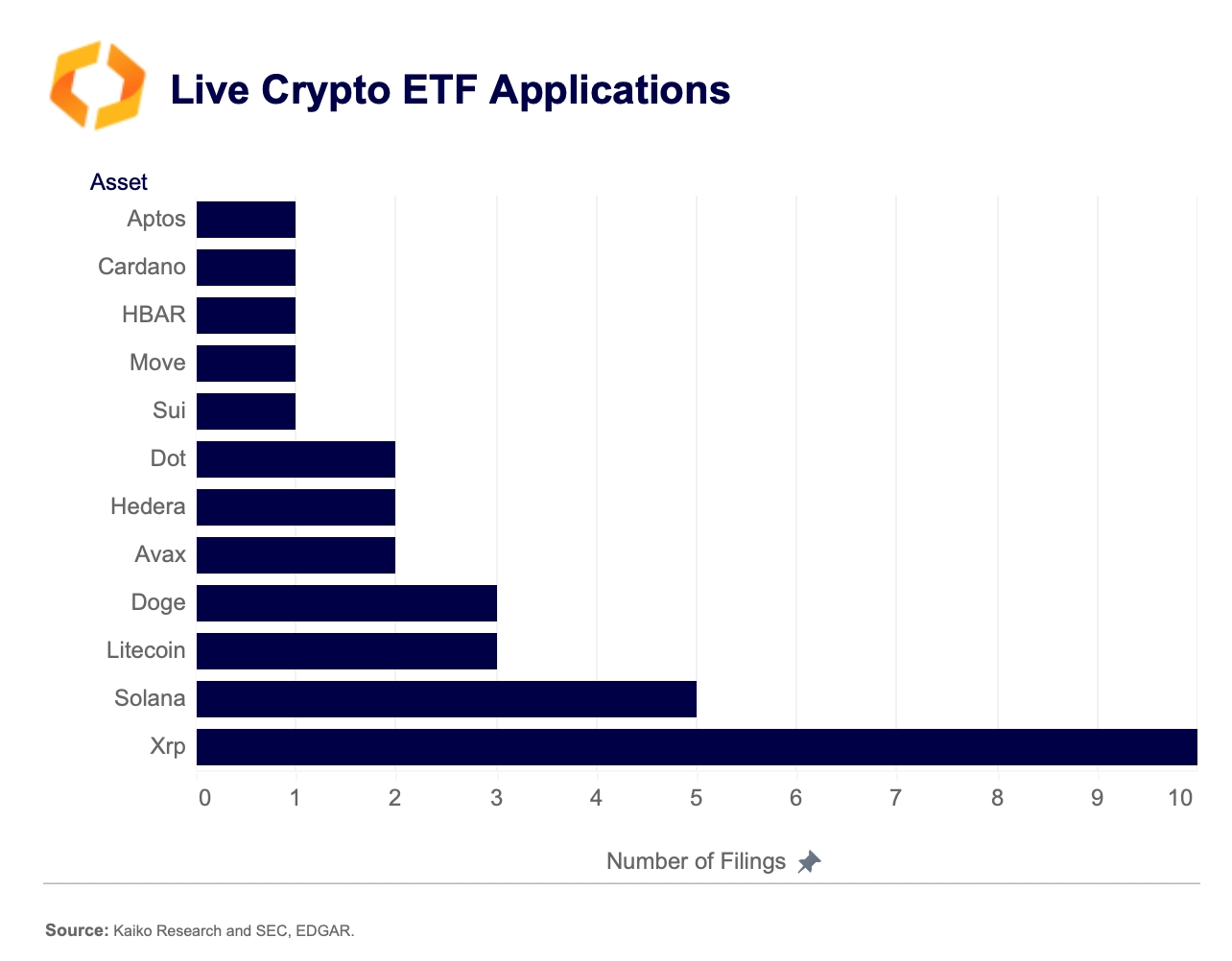

A slew of asset managers have filed for crypto-related ETFs and with deadlines rapidly approaching Atkins could set his stall out early—and change the narrative entirely from the previous regime at the SEC.

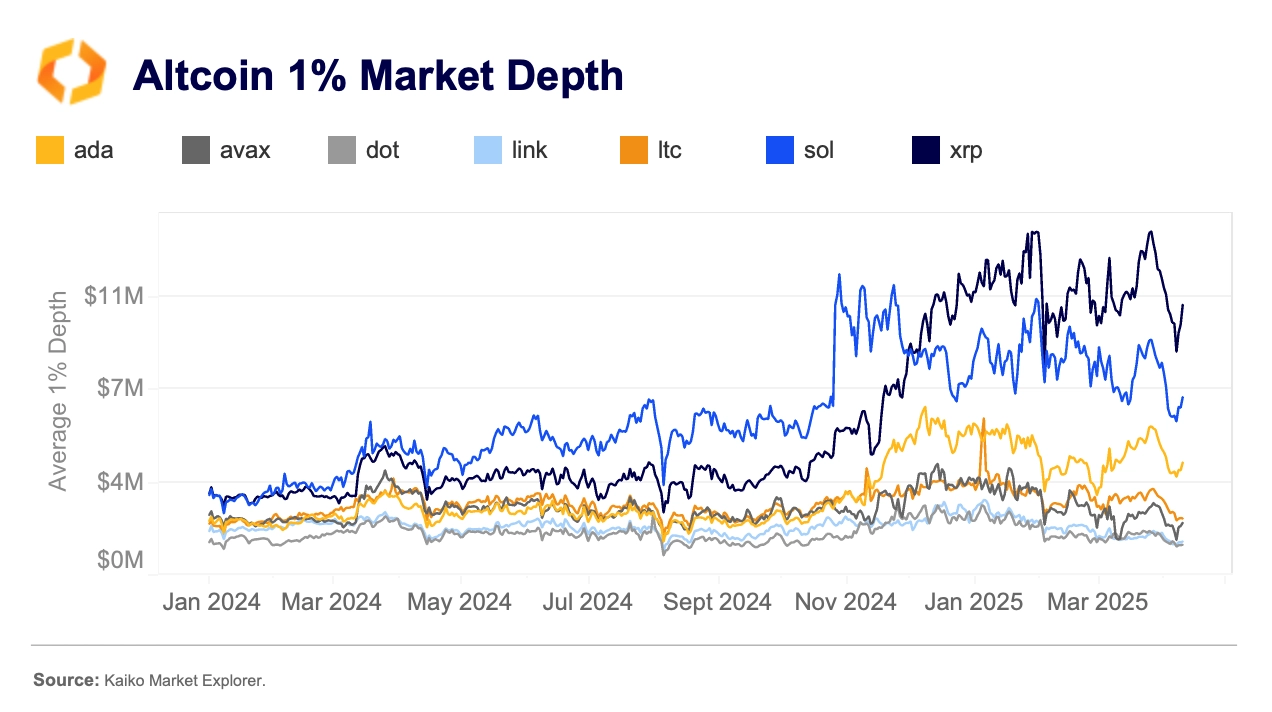

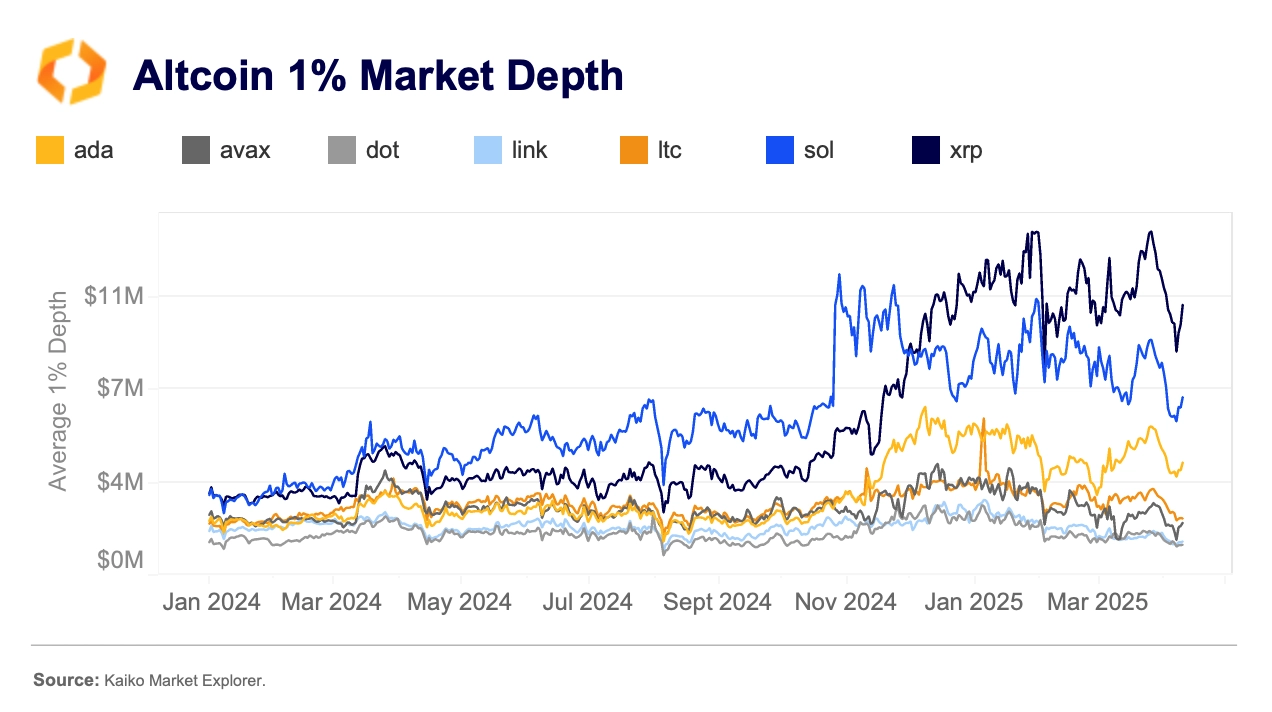

XRP and SOL stand out as two of the most popular assets for ETF applications and are also among the most liquid. A highly liquid spot market is important for creating efficient structured products, and the former SEC leadership was highly sensitive to this.

Both XRP and SOL have the highest average 1% market depth on Kaiko Indices vetted exchanges, while Cardano’s ADA places third. XRP’s market depth soared since the end of 2024, flipping SOL and doubling ADA.

BTC’s ETF approval was driven by Grayscale’s legal case, which pointed out the SEC’s conflicting narratives. The regulator had approved a BTC futures ETF that relied on the CME futures market, and since the futures and spot markets were over 99% correlated, the regulator eventually had to concede and approve the ETF.

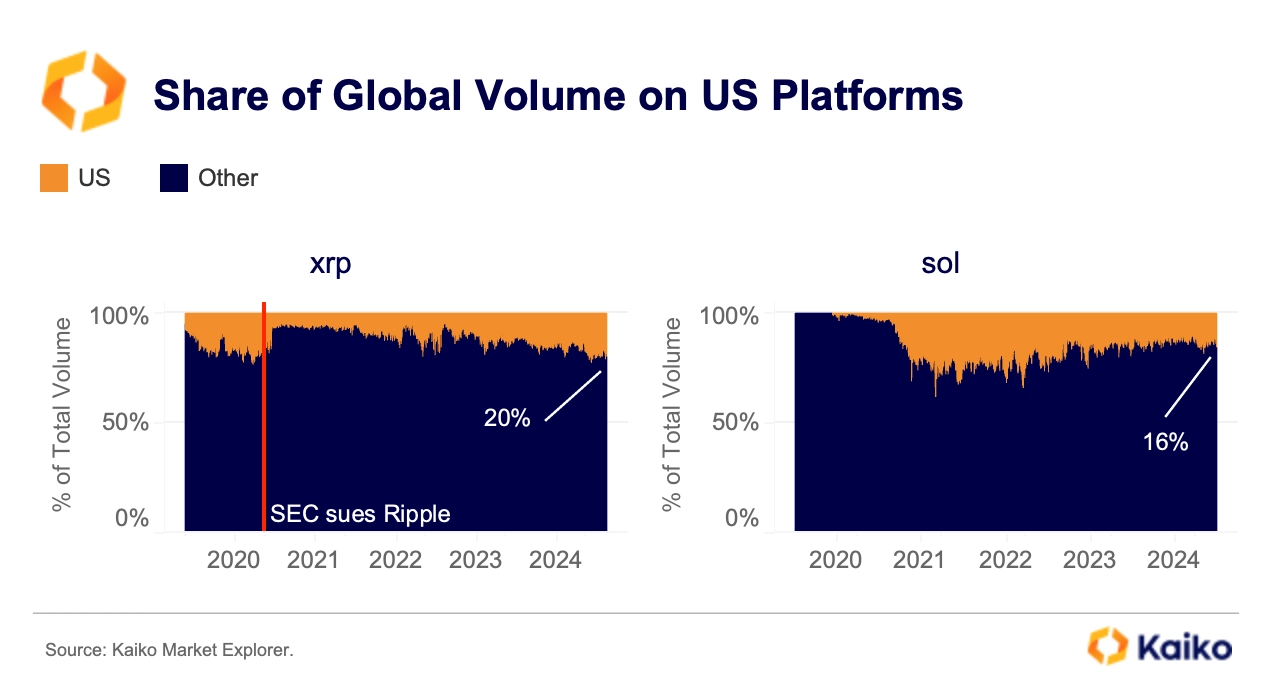

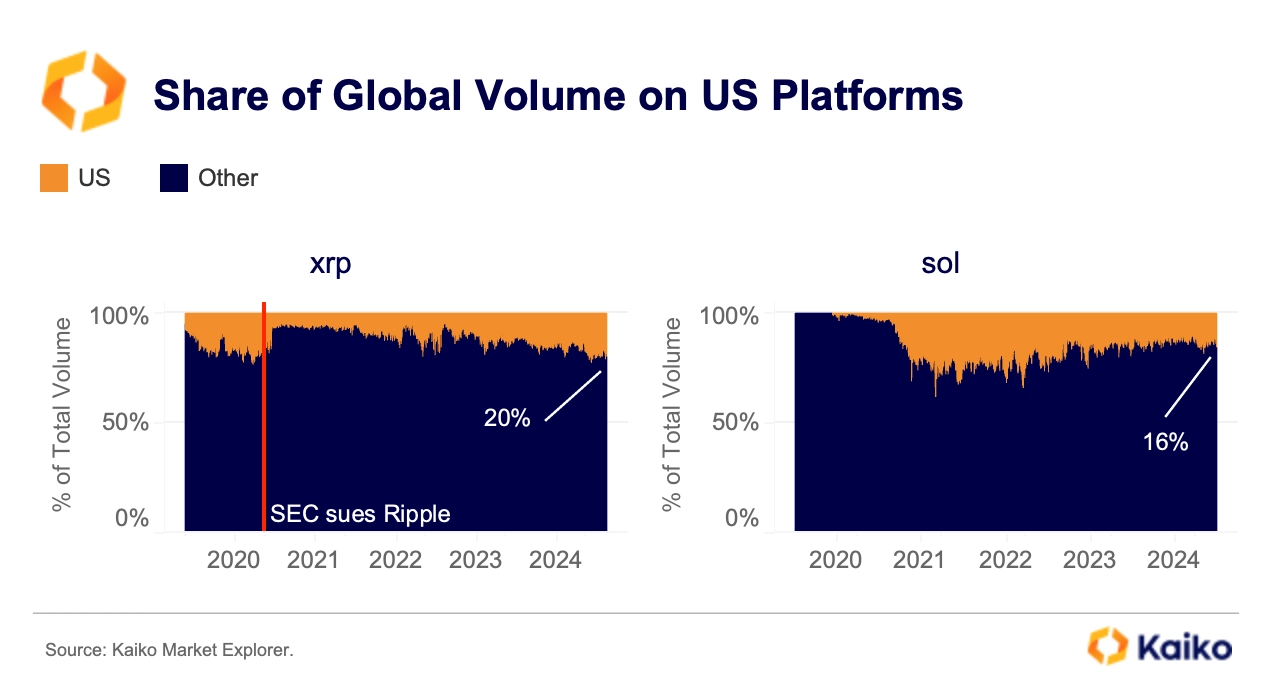

XRP is quite different; it doesn’t have an active futures market—for now—and its volume is heavily concentrated offshore. However, its share of spot volume on U.S. exchanges recently climbed to its highest level since before the SEC’s 2021 lawsuit prompted widespread delistings. In contrast, Solana (SOL) has seen its U.S. market share steadily decline, falling to 16%—down from the 25–30% range it held through much of 2022.

This underlying markets improving dynamics and the launch of a 2x XRP ETF last week position XRP ahead of other assets when it comes to approval. Although some tokens, such as LTC, which have very similar consensus mechanisms to BTC and share similarities to commodities could also have a clear path to approval.

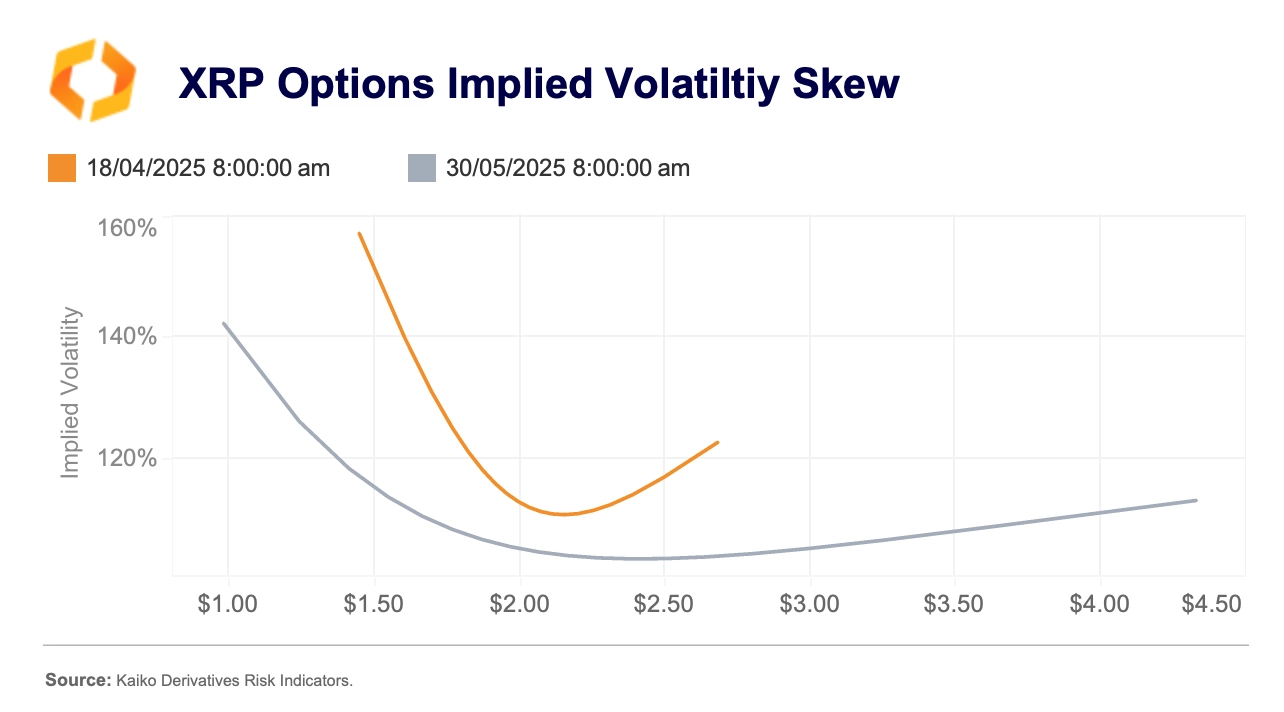

Despite these positive tailwinds for XRP the options market on Deribit is skewed bearish. The IV smile for the upcoming April 18 expiration is skewed heavily to the left, signalling demand for downside protection. This is likely linked to broader market uncertainty at present due to macroeconomic concerns.

The SEC acknowledged XRP applications for spot ETFs towards the end of February, as well as other tokens. May 22 is an important date to watch in light of the recent ETF approval of a 2x XRP ETF from Teucrium, as the SEC must to respond to Grayscale’s XRP spot filing by then. Since this leveraged ETF relies on returns from European ETPs and swap agreements to guarantee twice the daily returns of XRP, its hard to see how a spot product is more risky and therefore diminishes most arguments for denying these applications.

Data points

The liquidity behind Mantra’s OM token collapse.

On Sunday, the OM token from Mantra Chain, a prominent RWA project, plummeted over 90% between 6pm and 8pm UTC. Once a top 20 crypto asset with a market cap of $5.9 billion, its valuation fell to under $1 billion within hours.

The exact cause of the crash is uncertain, but

speculation suggests that the project team or market makers may have sold tokens over-the-counter, leading to panic selling. The project’s official X account

blamed “reckless liquidations” and promised an investigation.

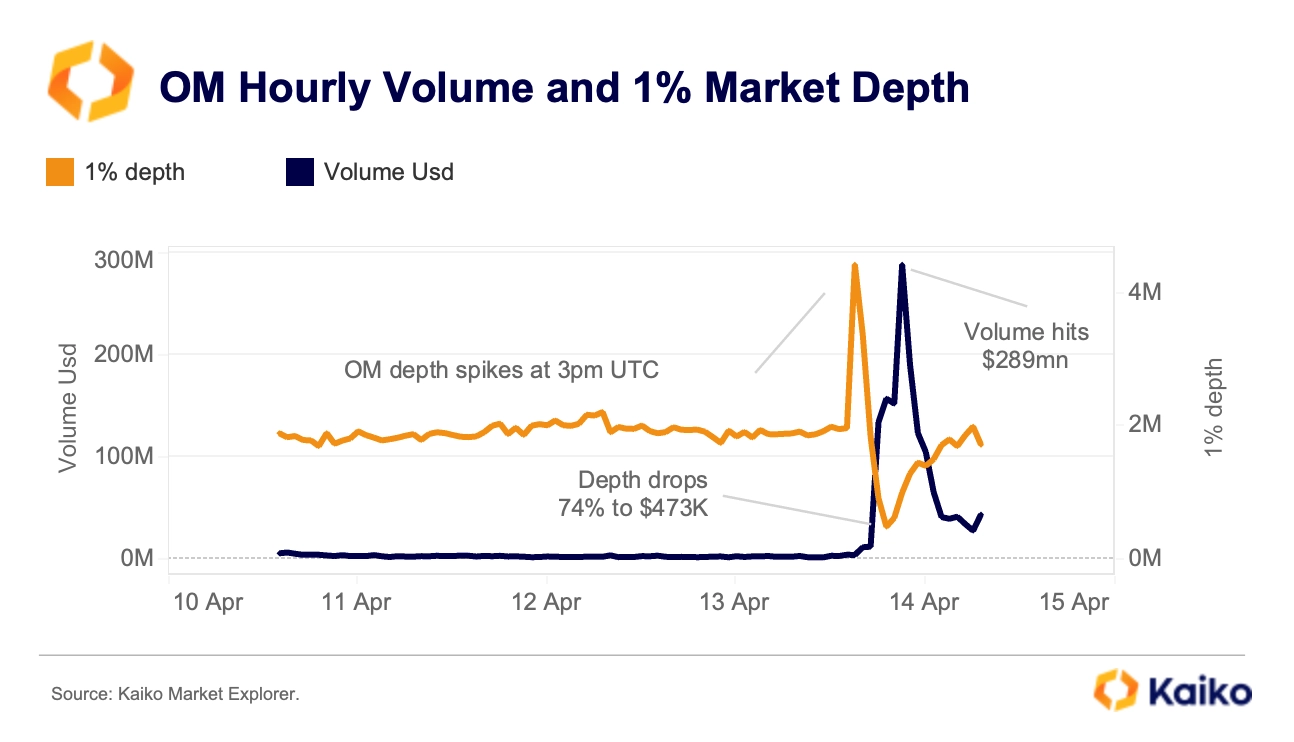

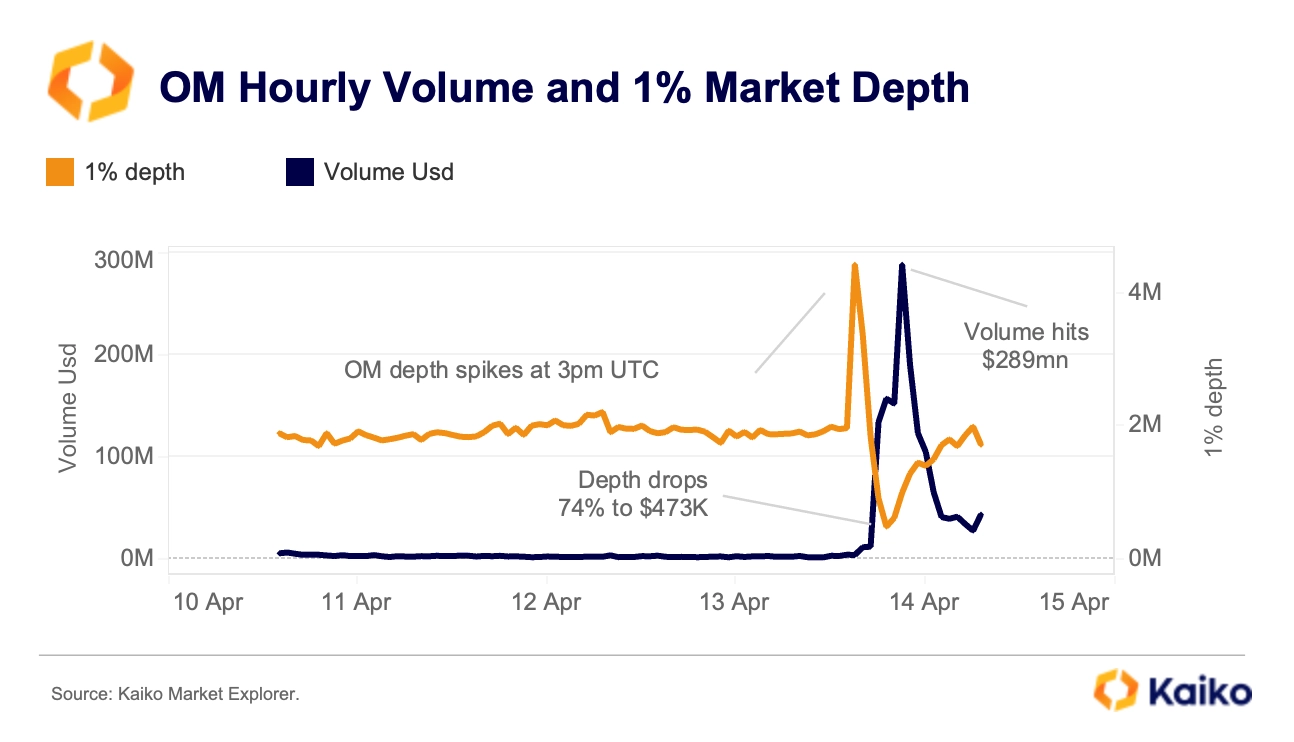

Despite having a strong average hourly market depth of $2.3 million in 2025, the sudden price drop overwhelmed market makers. As they increased their exposure, trade volumes soared, hitting $290 million by 9pm UTC—over 100 times the typical 1% depth.

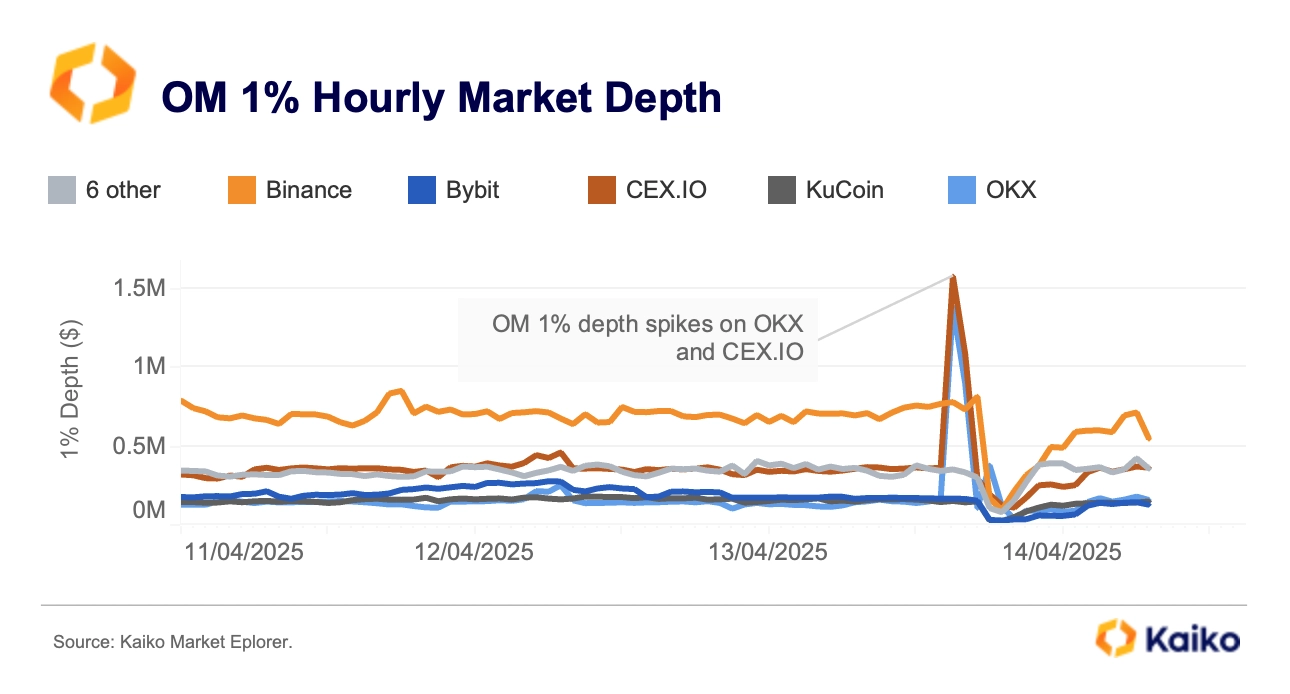

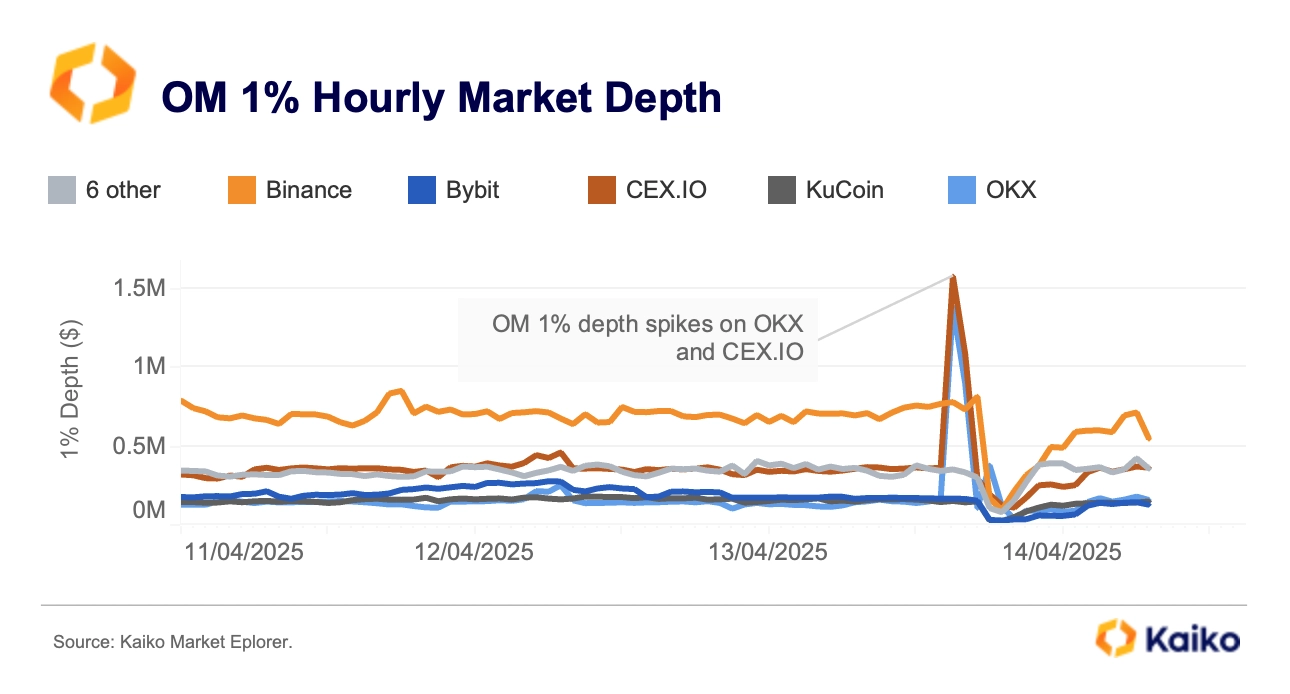

Exchange data showed a temporary liquidity spike before the crash, particularly on OKX. From 5pm to 7pm, aggregate 1% depth across platforms dropped 74% to $473K as liquidity evaporated.

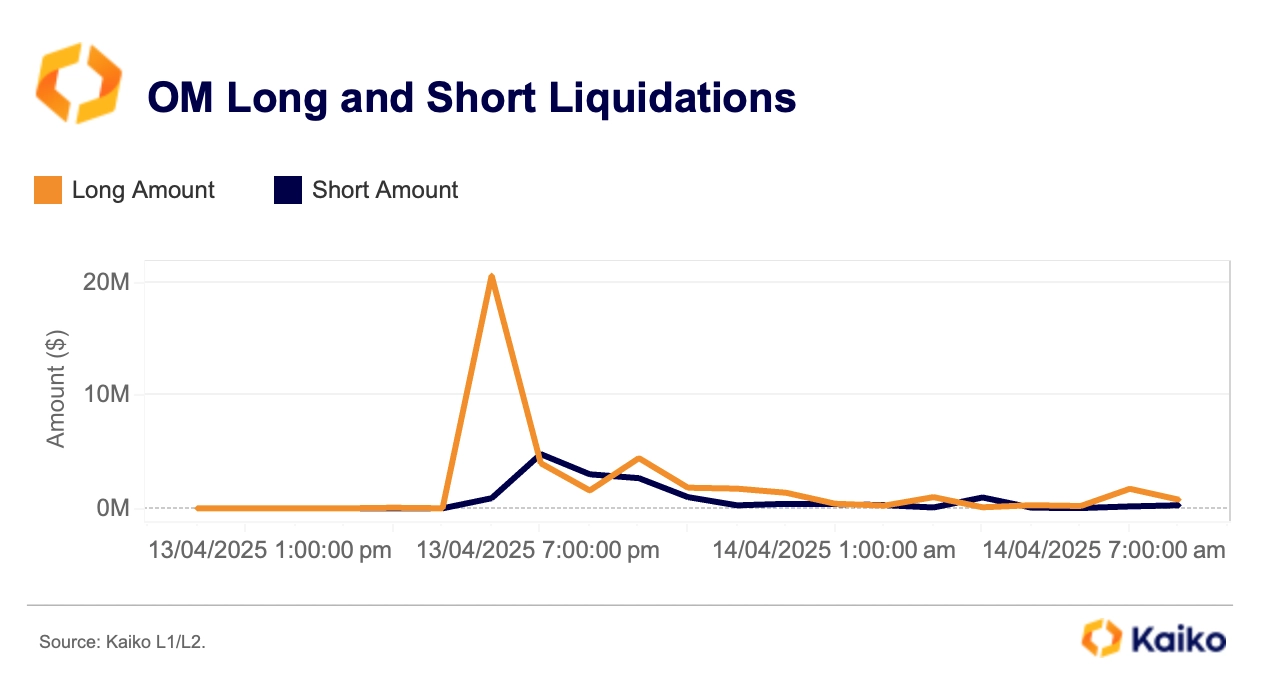

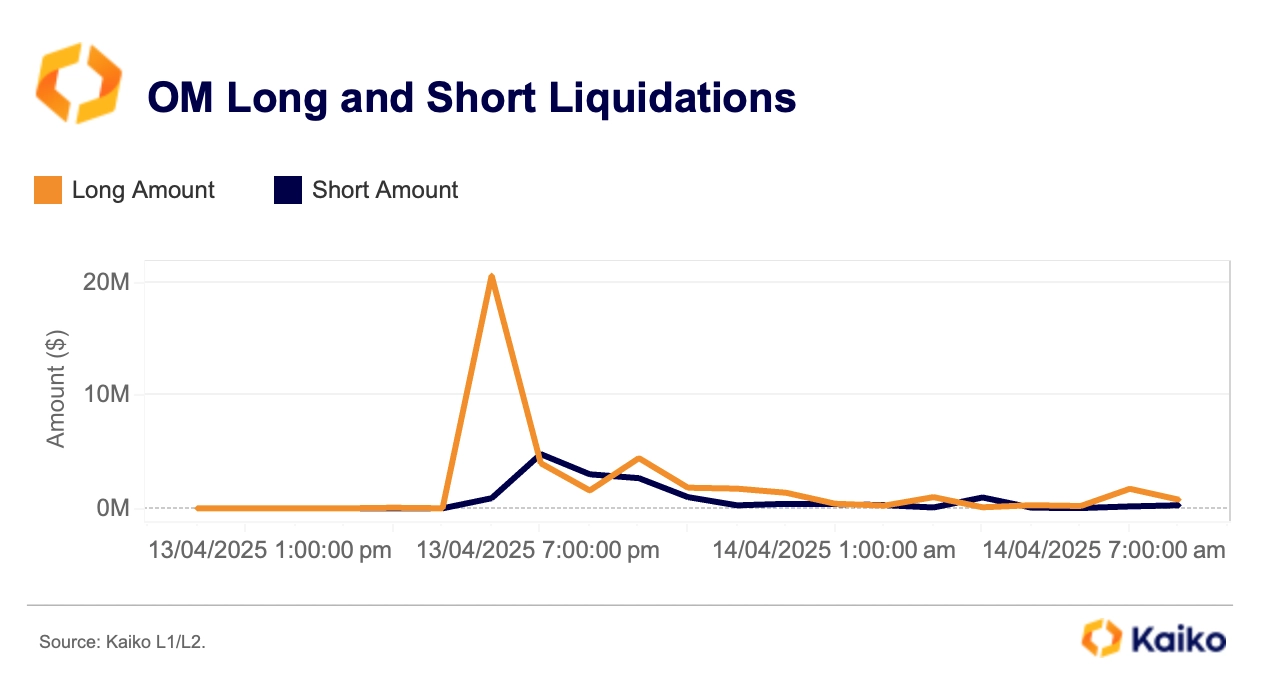

Liquidations on OM perpetuals surged in tandem. Around 6pm, long liquidations peaked at $21 million on OKX alone, likely compounding price pressures in an already fragile market. Funding rates flipped negative during the event and remain below zero—pointing to sustained bearish sentiment.

BTC’s liquidity remains resilient despite rising volatility.

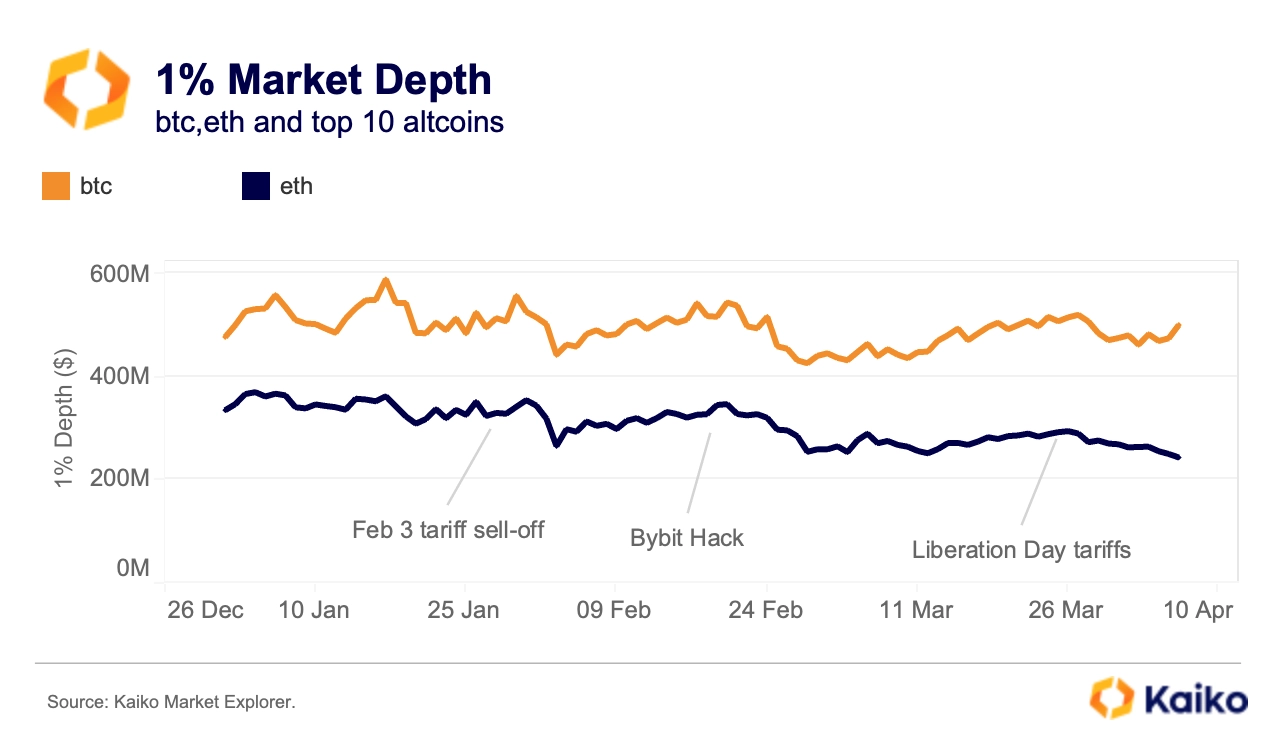

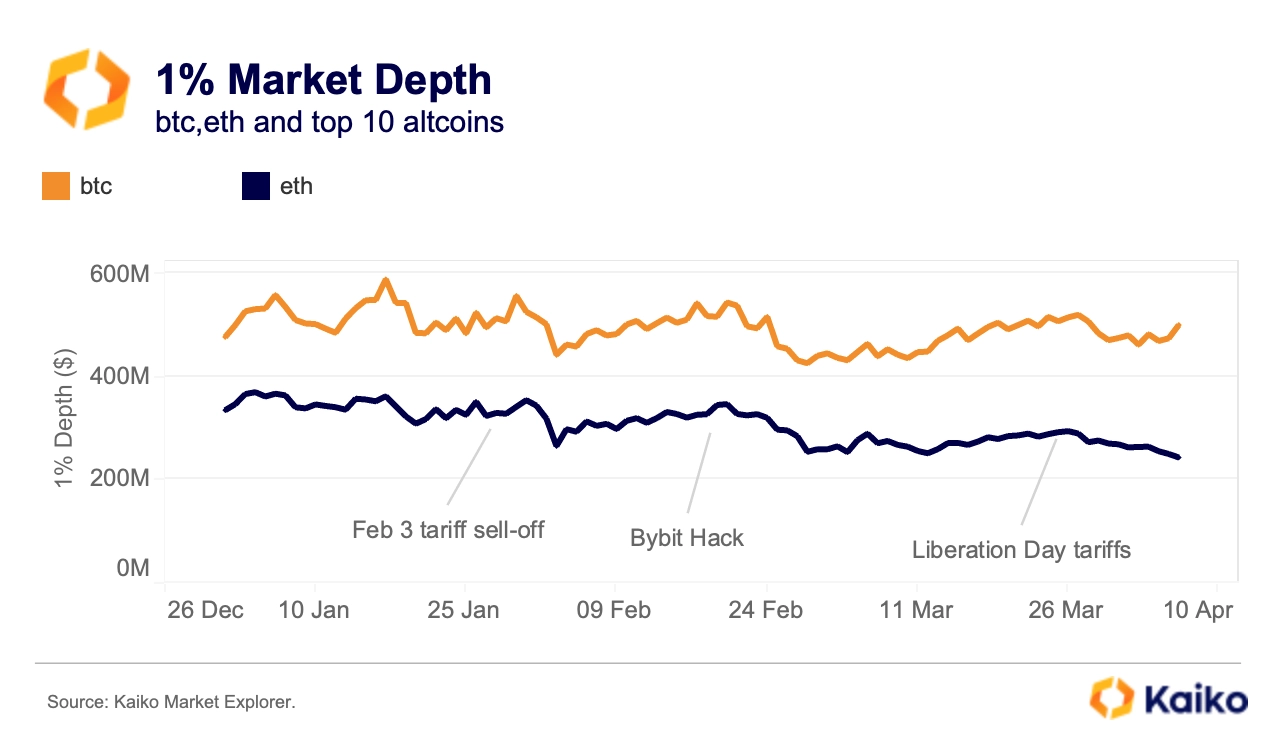

Despite rising volatility, Bitcoin’s 1% market depth rose to $500 million by the quarter’s end. Liquidity declined after the February 3 tariff selloff, but market makers kept stable BTC exposure through March and increased it in early April, despite the Liberation Day global selloff.

U.S. platforms bolstered Bitcoin’s liquidity, with global depth share peaking at 58% before a slight decline in late March. CEX.IO, Kraken, and Coinbase account for over 60% of BTC market depth. Meanwhile, ETH liquidity dropped 27% from January 1 to April 6, to $243 million, as the BTC-to-ETH ratio hit a five-year low. See our quarterly report for detailed Bitcoin liquidity analysis.

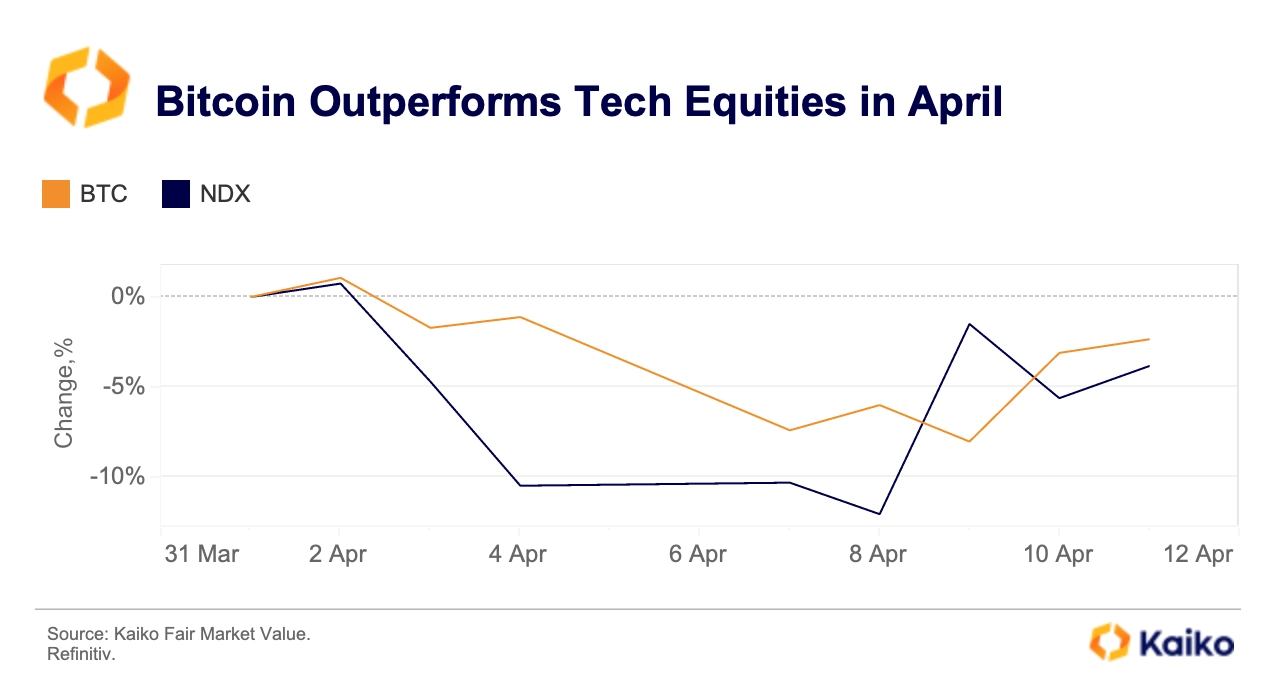

BTC outperforms equities amid ongoing tariff tantrum.

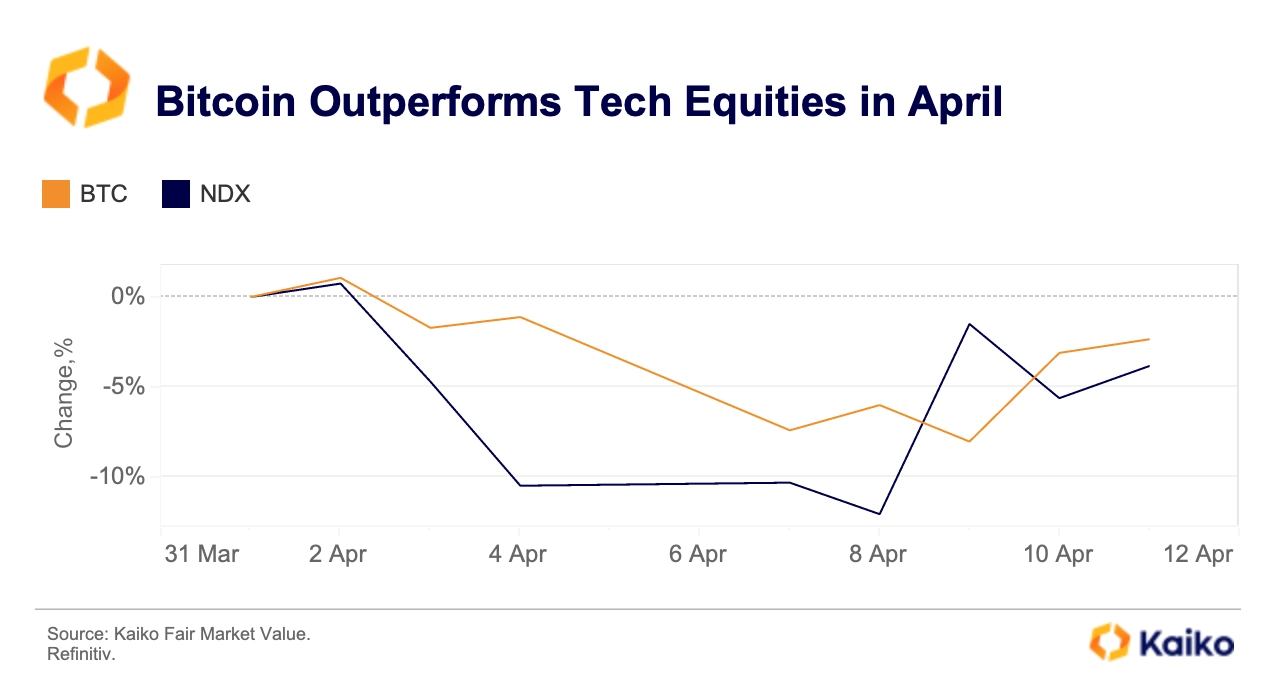

Last week, the U.S. president paused reciprocal tariffs for all countries except China, a move that followed renewed volatility in Treasury markets and revived fears of a COVID-era “dash-for-cash.” The market-wide selloff began on Monday, with both U.S. bonds and equities under pressure. By midweek, the rout intensified, pushing 10-year yields up 16 basis points to 4.425%.

Any hopes for stabilization were short-lived. On Friday, China retaliated with sweeping 125% tariffs on all U.S. goods, triggering another wave of risk-off sentiment. Yet, Bitcoin managed to outperform broader risk assets in April, posting smaller losses than U.S. tech equities.

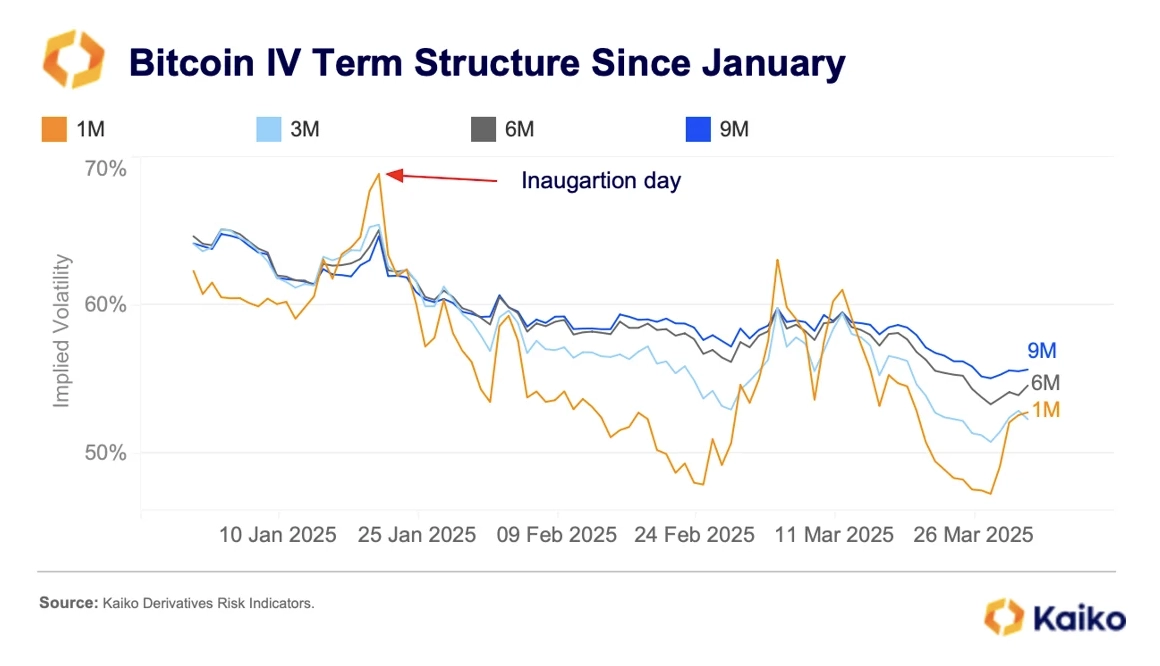

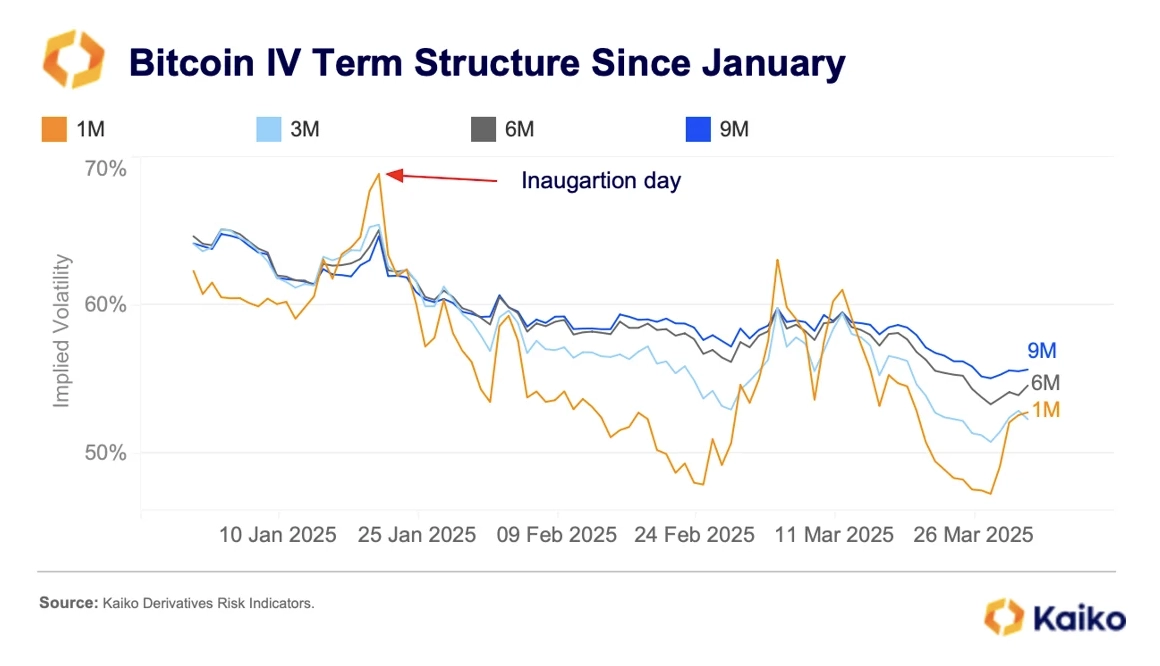

However, crypto option markets signal caution, with traders continuously repricing risk in response to Trump’s unpredictable trade moves. In Q1, the whipsawing price action led to repeated inversions in Bitcoin’s implied volatility (IV) term structure, where short-dated options traded at higher IV than longer-dated ones, highlighting elevated near-term uncertainty.

The April 10 pause on tariffs might only prove to be a brief reprieve, and regular IV term structure inversions shouldn’t surprise anyone as we move forward into the rest of 2025. Expect kinks in the IV term structure around the July 8 tariff deadline.

![]()

![]()

![]()

![]()