Introduction

DeFi is still an unregulated frontier where market manipulation can occur, causing many institutional players and market makers to hesitate before entering the space. However, the industry’s ability to detect and address these practices is improving rapidly.

Back in November, we showed how blockchain data can unveil these manipulative tactics, including wash trading on Uniswap pools. While crypto market manipulation detection is still in its early stages, Kaiko’s on-chain data can help regulators, exchanges, and investors tackle the issue over time.

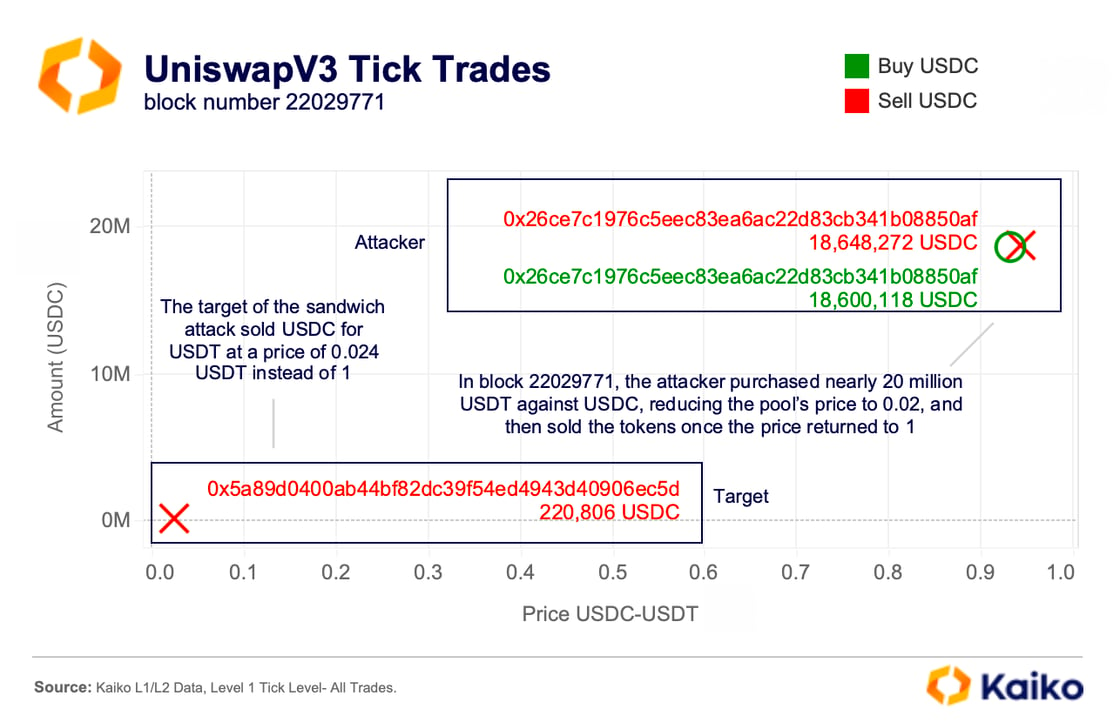

Last week, data revealed that market manipulation still occurs on Uniswap, specifically through so-called sandwich attacks. This tactic, inspired by high-frequency trading in traditional finance, involves an attacker placing a buy order before a trader’s transaction and a sell order immediately after—all within the same block—to manipulate the price for personal gain. The attack was identified almost immediately, and our data helps shed light on the event.

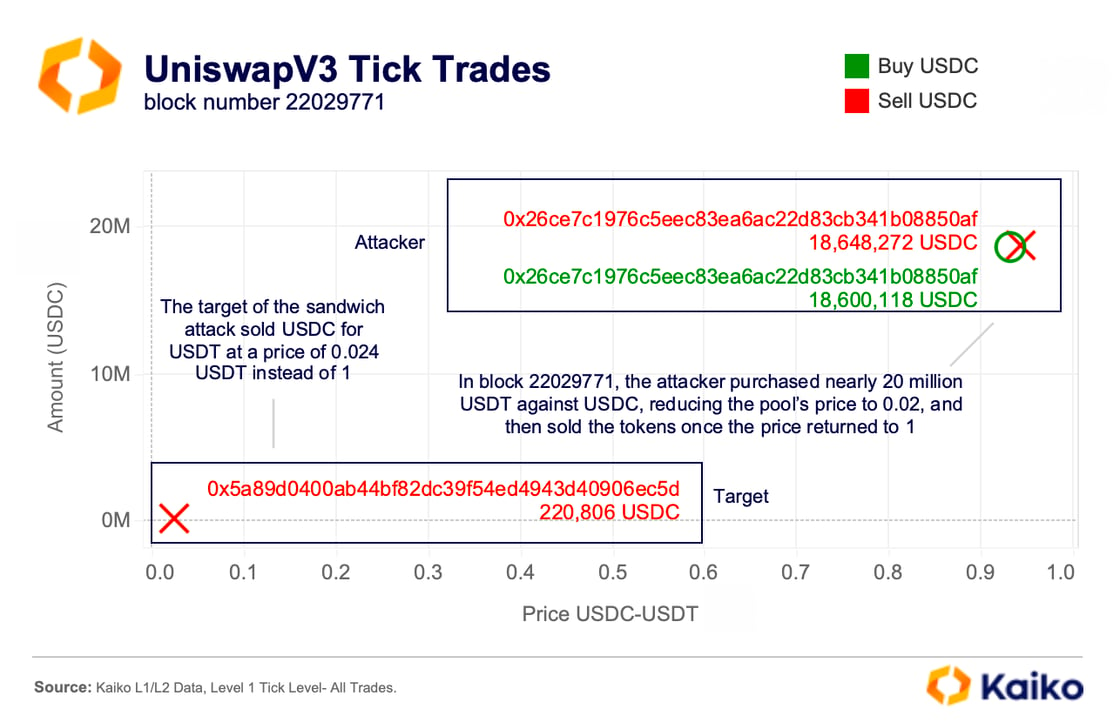

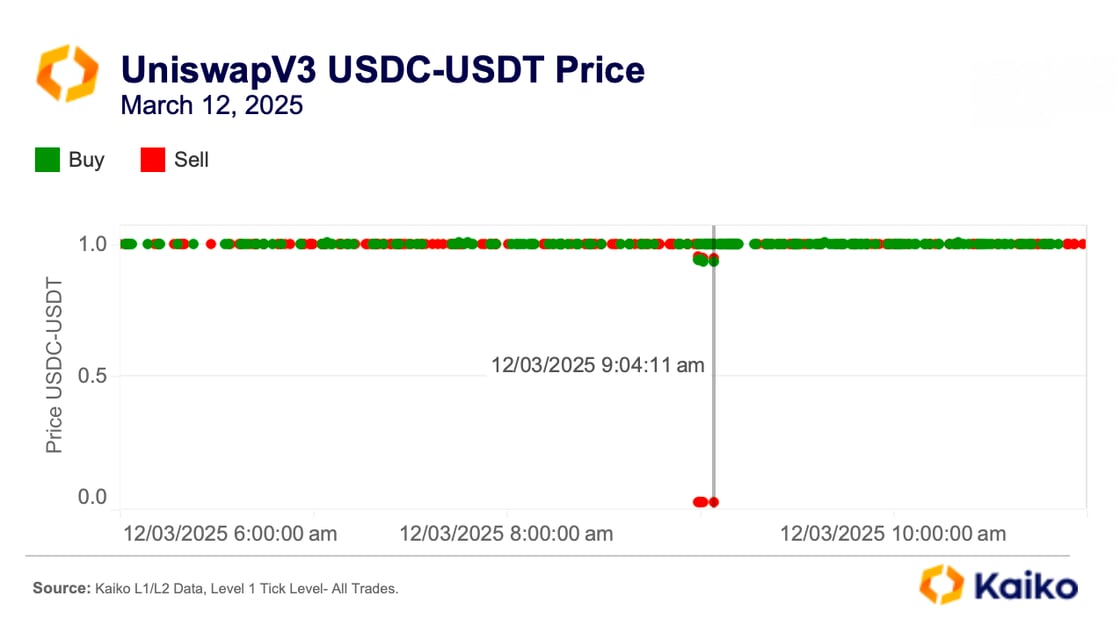

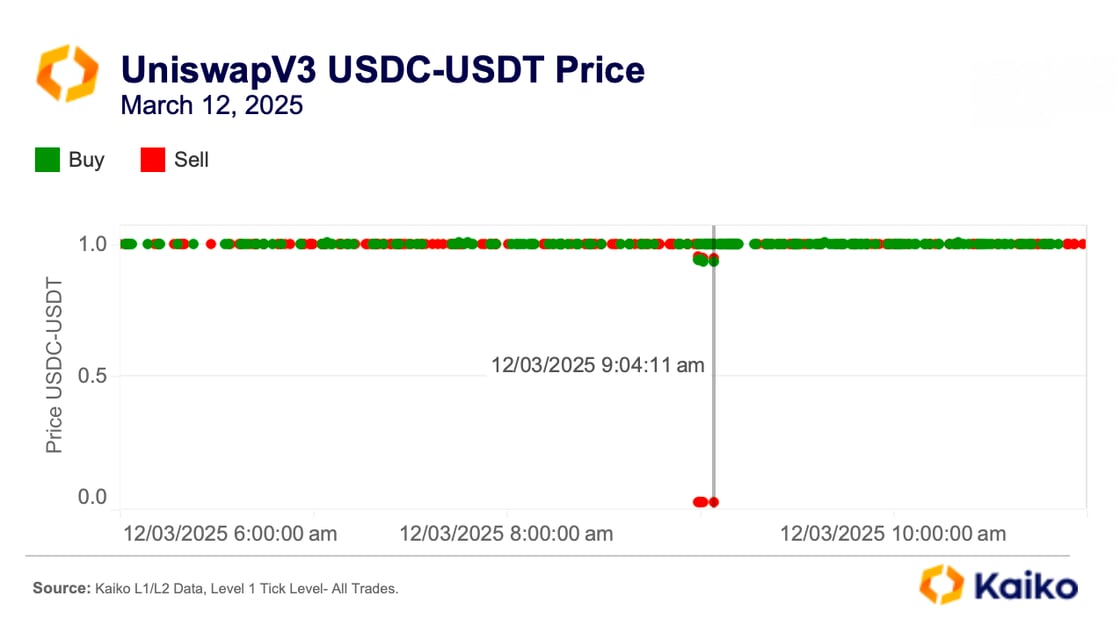

In this case, on a USDC-USDT liquidity pool on Uniswap V3 on Ethereum, a user attempted to swap 220.8k USDC for USDT. Just before the transaction was executed, an attacker sold nearly 20 million USDC for USDT, drastically dropping the USDC’s price to 0.024 USDT for 1 USDC, due to reduced liquidity and increased slippage in the pool.

As a result, the user’s swap was executed at an unfavorable rate, receiving only 5.3k USDT instead of the expected 220.8k USDT, resulting in a loss of 215.5k USDT. The attacker then repurchased the USDC at the lower price, within the same block, securing a profit even after paying a $200k tip to a block builder to prioritize their transaction.

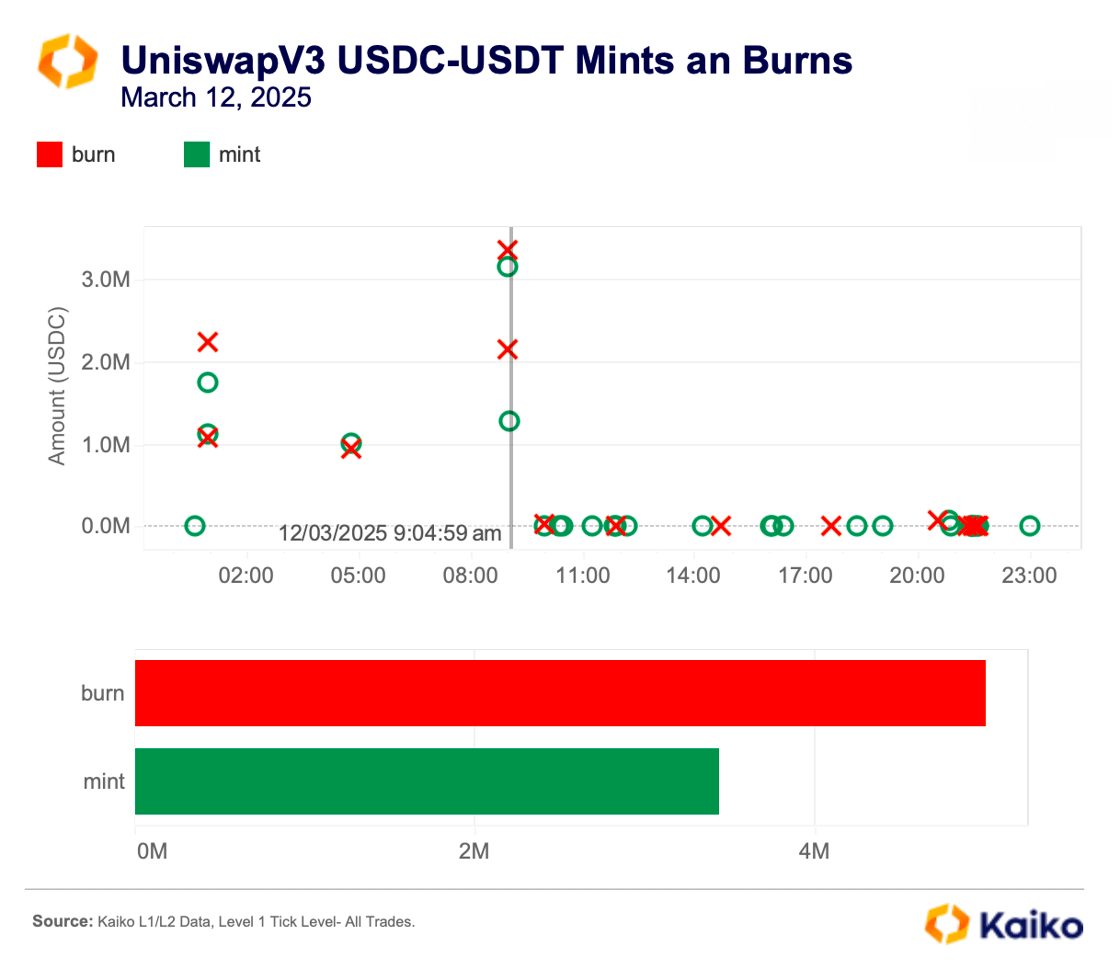

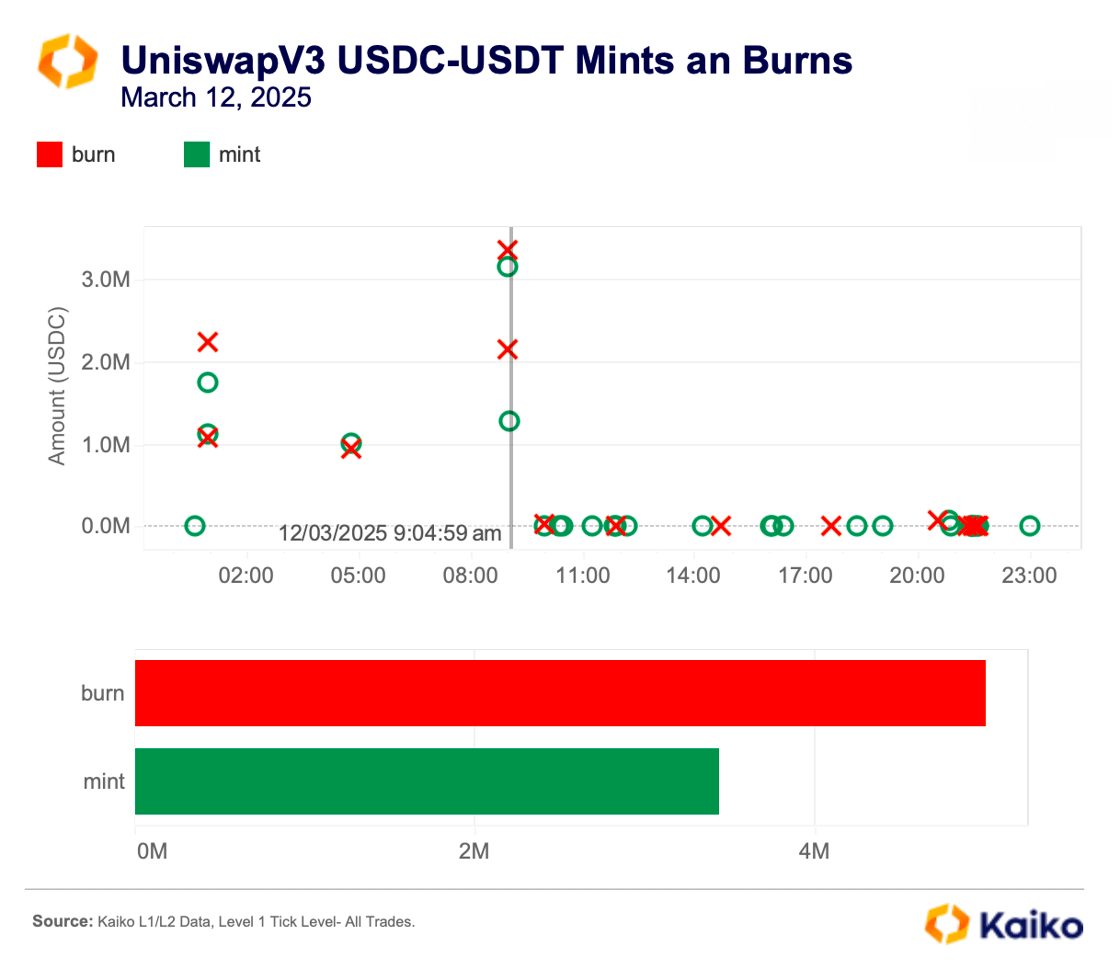

The attack coincided with a decrease in USDC liquidity on Uniswap V3. On the day of the attack, more liquidity was removed than added, making it easier for the attacker’s trades to significantly impact the price.

The result was massive slippage—the gap between the expected price and the actual execution price—creating market risk not only for the victim but also for all traders using this liquidity pool at the time.

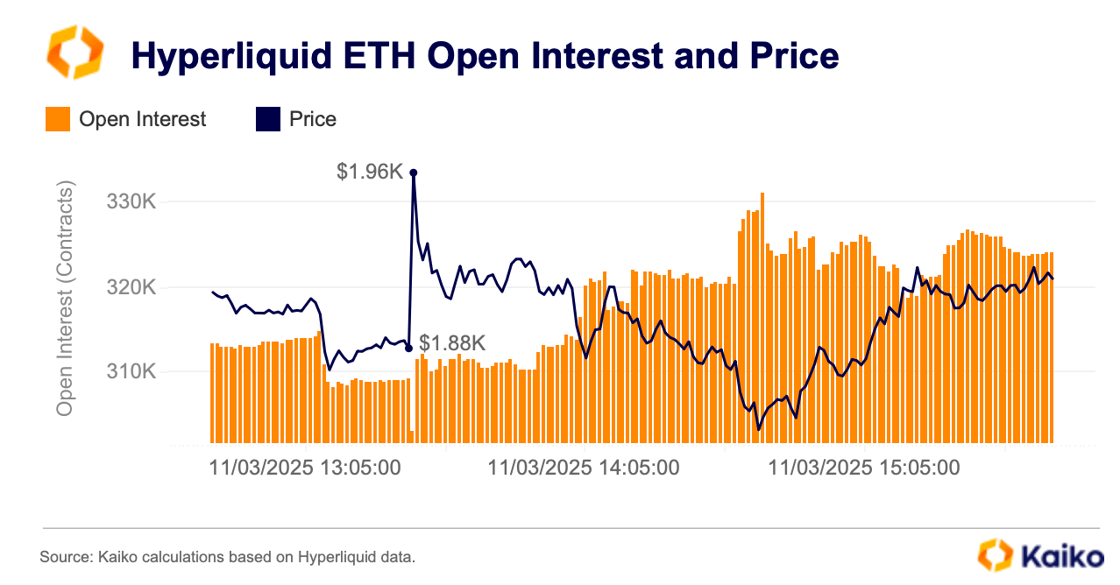

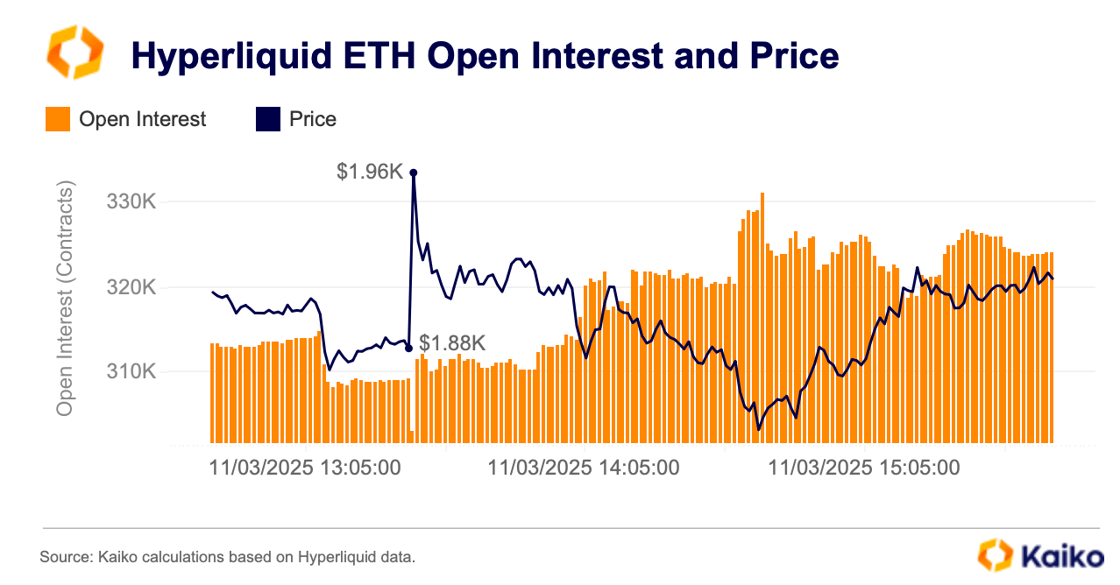

Similar attacks have been observed on other decentralized exchanges like Hyperliquid, proving that these vulnerabilities aren’t limited to a single platform. There are suspicions that one large trader using the on-chain platform may be engaging in market manipulation through spoofing.

Last week, this trader’s large orders significantly moved the market, causing open interest to plunge from 310k to 300k contracts in just one minute. The trader’s specific style has been compared to that of a former European trader who scalped contracts by quickly moving in and out of positions on the German bond markets. Both traders exploited market mechanics to gain an edge and did so on a large scale.

However, the actions of the Hyperliquid whale last week prompted changes on the platform after they intentionally liquidated a $200 million ETH position. This liquidation caused the Hyperliquid vault to lose $4 million. As a result, traders now need to hold more margin for leveraged positions.

As the crypto industry matures, leveraging blockchain data can help detect and prevent such manipulative practices, making DeFi a fairer and more transparent trading environment. However, until stronger protections are established, institutional players will likely remain on the sidelines.

Data Points

Will Pectra be enough to turn the tide for ETH?

Since the start of the year, ETH has dropped nearly 40% to a 15-month low, underperforming most major assets, including BTC (-14%) and SOL (-35%). The ETH/BTC ratio, which has been steadily declining since The Merge, hit a multi-year low of 0.023 last week. This signals Ethereum’s continued underperformance relative to Bitcoin.

What’s behind ETH’s weak demand, and could the upcoming Pectra upgrade—the largest in terms of EIPs—be the catalyst it needs to rebound?

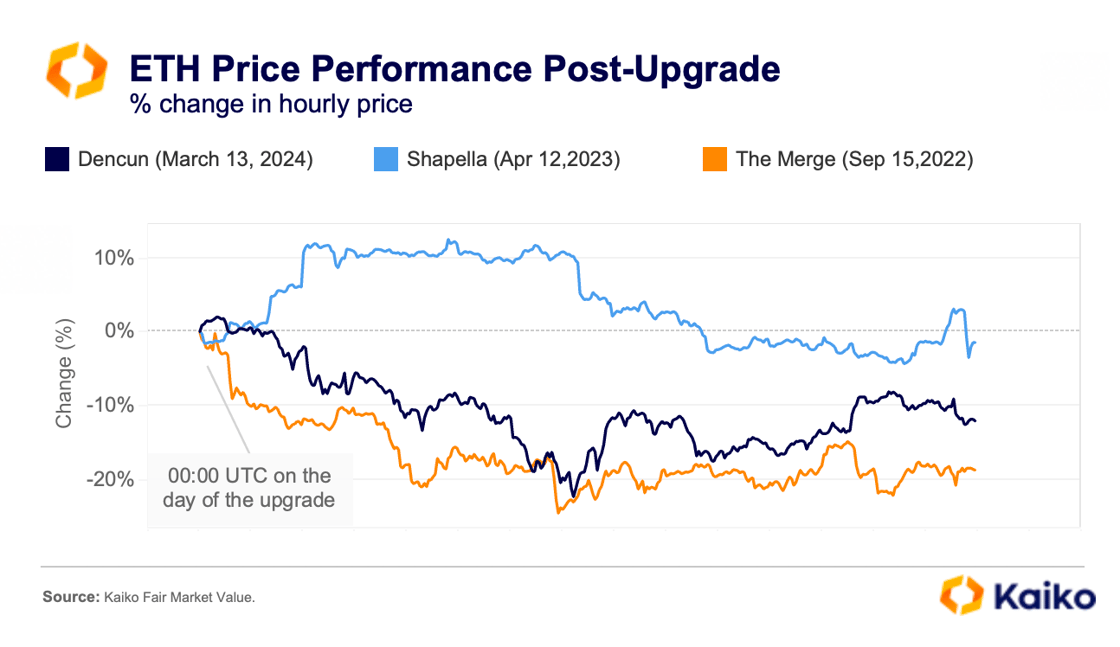

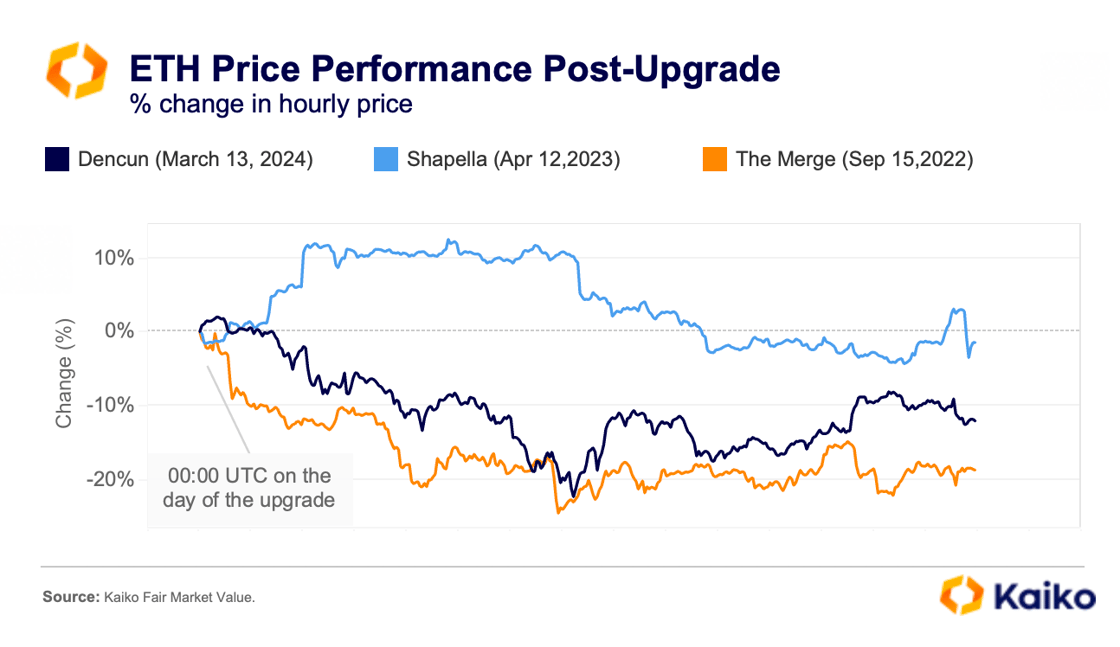

Over the past years, ETH has undergone several major upgrades without a hitch showcasing the network’s ability to evolve despite its growing size and complexity. However, none of them were a major price booster. In fact, most were “sell the news type of events” with prices down by 12% and 18% in the two-week period after Dencun and The Merge.

ETH price has increased temporarily only after Shapella which enabled millions of ETH to be un-staked removing significant risk for ETH’s liquid staked derivatives market.

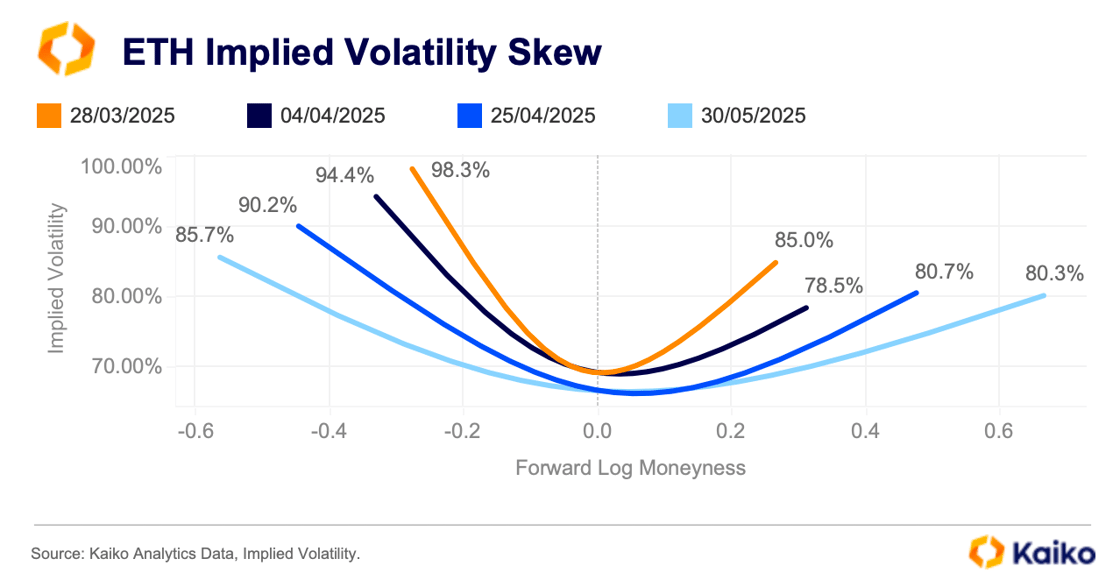

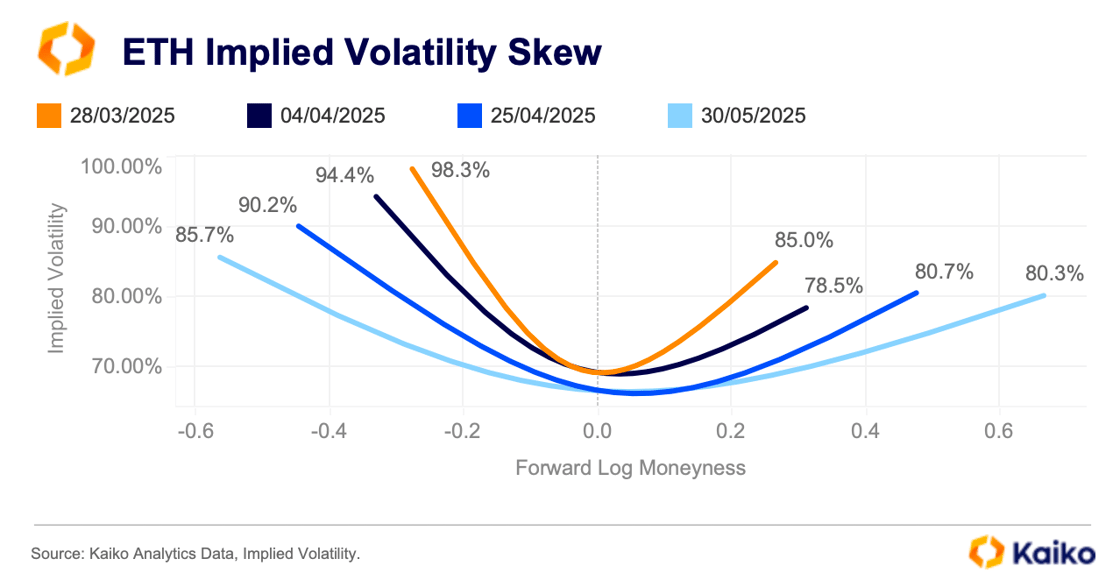

Sophisticated traders are bearish for post upgrade period, with implied volatility skewing to the left. The largest skew is around the April 4 expiration, right around the time Pectra is expected to be on mainnet, and suggests large demand for hedging around this time.

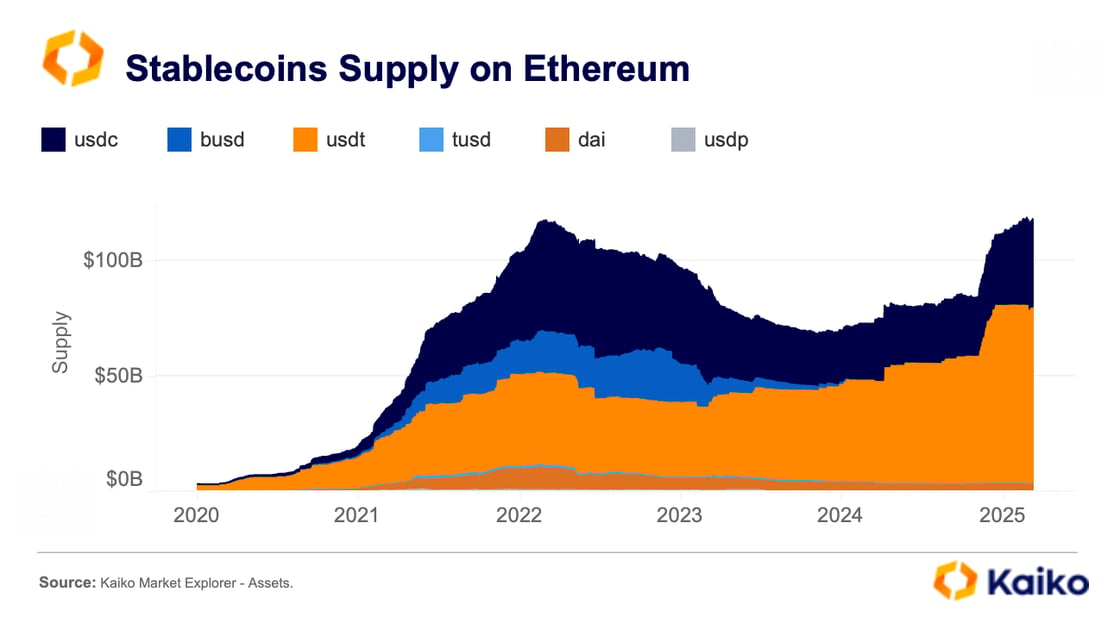

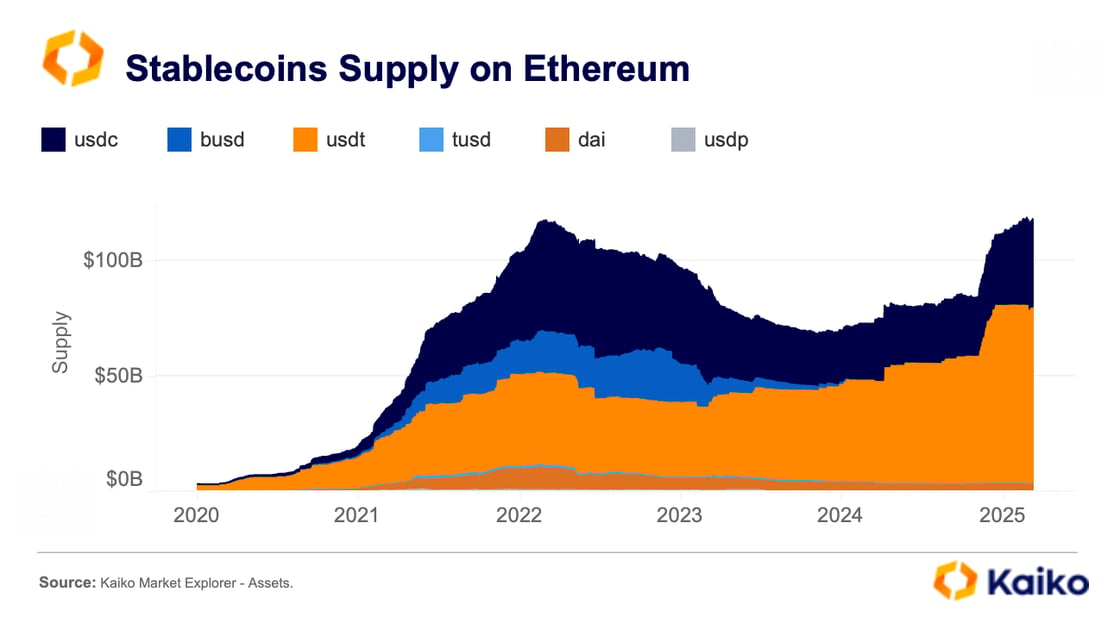

A major long-term catalyst for Ethereum is growing stablecoin adoption and tokenised RWAs. ETH remains the blockchain of choice for the issuance of tokenized assets with a total RWAs of $3.8bn surpassing by far the next most popular blockchain for RWAs – Stellar.

The stablecoin supply on the blockchain has surpassed $110bn nearing its highest level since 2020 and ETH holds a major market share compared to other blockchains. As we wrote last week global regulatory clarity around stablecoins is improving, potentially boosting adoption.

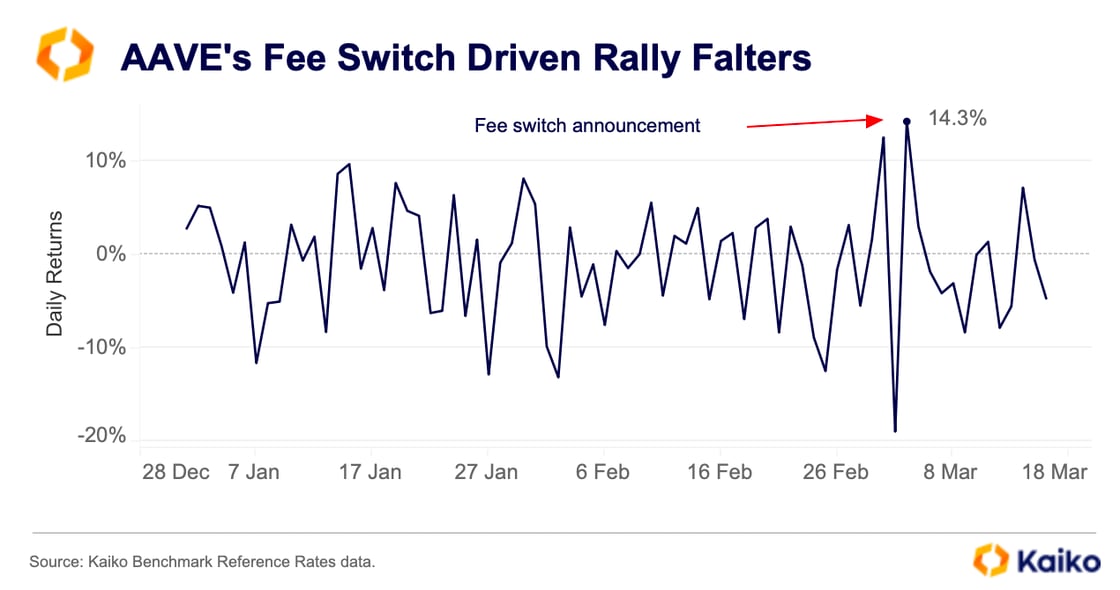

AAVE falters after fee switch inspired rally.

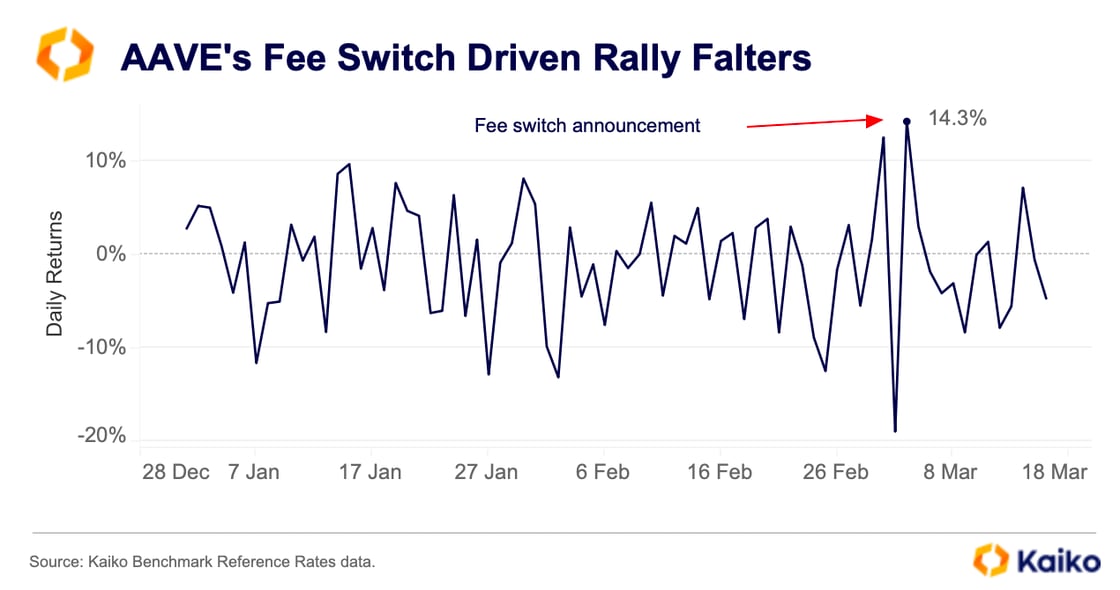

The AAVE token surged in early March after its fee switch proposal advanced, prompting a committee to buy $1 million worth of AAVE weekly for six months. It initially rallied 14% in a day despite broader market concerns but then declined before rebounding 7% last Friday.

Prices were little changed today despite the vote passing early on Monday and Aave-Chan Inititave’s Marc Zeller confirming that buybacks would start as early as this month. However, the increased demand going forward should support stronger price performance.

Last month, we discussed the impact of a potential fee switch on prices in our Index in Focus on the Kaiko DeFi Index. Such proposals add a new dimension to holding a governance token, as the potential to earn income from the asset naturally increases demand. Although the rally may have faltered for now, the value of holding AAVE tokens is set to fundamentally change, which should alter demand dynamics moving forward.

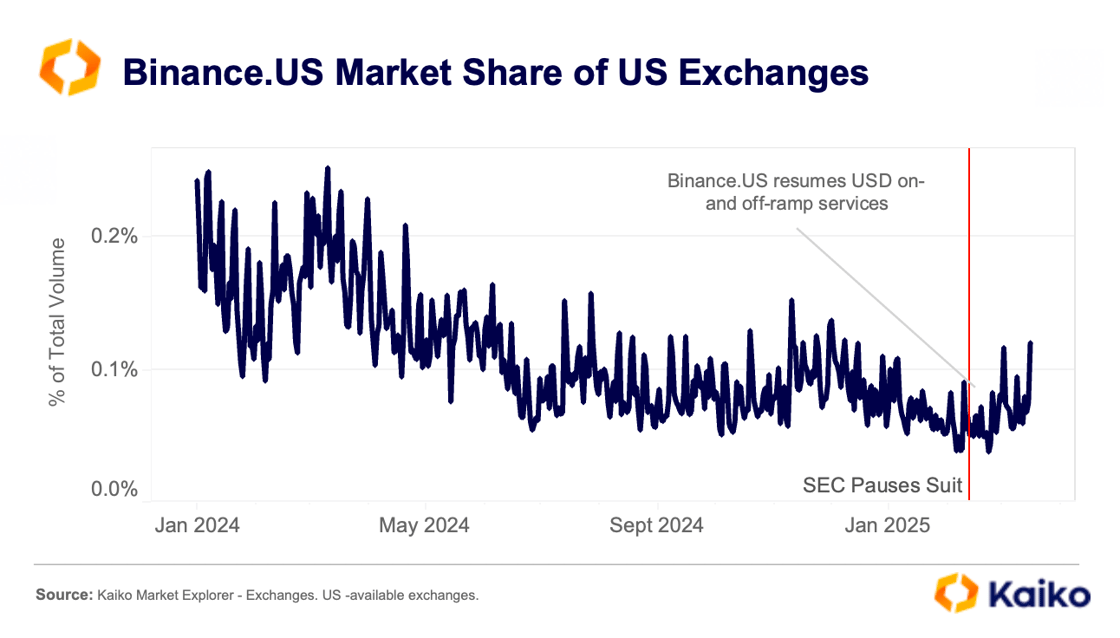

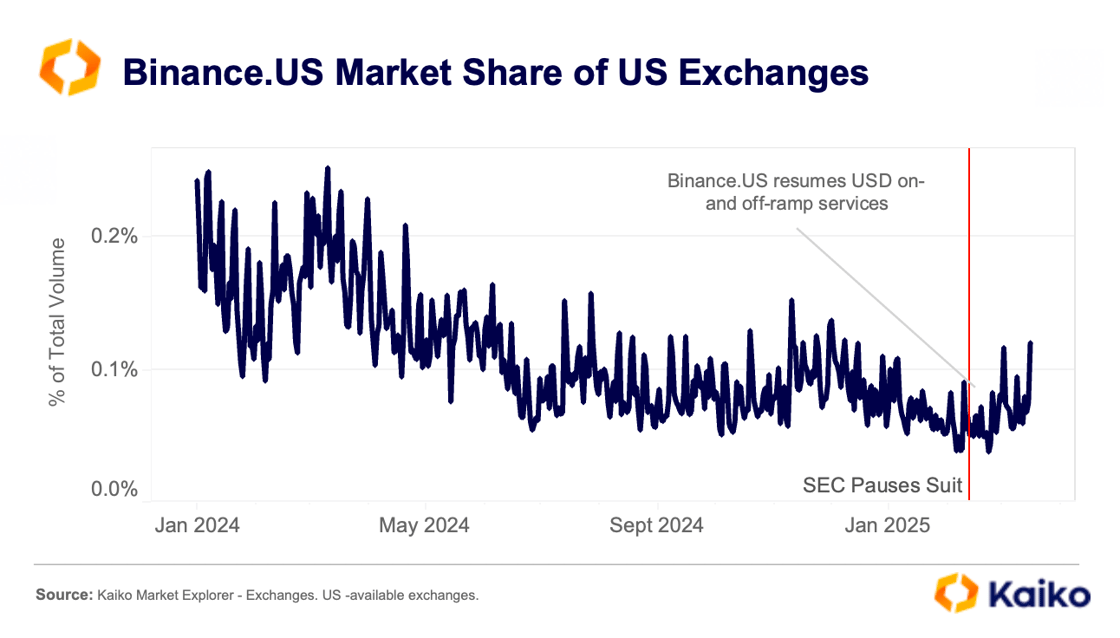

Is Binance.US set for a comeback?

Since early February, Binance.US has seen its market share grow after the SEC paused its lawsuit against the exchange, ending months of decline that continued even during the crypto rally in November. The increase comes amid speculation about potential financial interest from the U.S. President’s family.

While volumes remain low at about $2 billion daily, the exchange is clearly benefiting from the improved regulatory environment. It recently relaunched USD on- and off-ramp services after securing a new banking partner.

Binance.US was once the third-largest crypto platform in the U.S., holding nearly 20% of the market. It took a significant hit following the SEC suit in June 2023.

Trading volumes fell from an average of $144 billion in early 2023 to under $2 billion, and the number of active market makers on the exchange declined fourfold, from twenty to five. The exchange also transitioned to a crypto-only model after losing key banking partners, which impacted liquidity.

![]()

![]()

![]()

![]()