Crypto markets are at their most volatile when liquidity is low. Prices have less support to both the downside and the upside, which could explain BTC’s rapid +17% surge since the start of the month. Liquidity has also become a hot topic in traditional financial markets as the banking sector reels from several high-profile collapses. This has in turn trickled down to crypto, which was already suffering from a dearth of liquidity in the aftermath of FTX.

In this article I’ll examine the state of liquidity in crypto markets by looking at market depth, spreads, slippage and volumes, while outlining the key liquidity hurdles the industry needs to overcome in the near future.

Market Depth

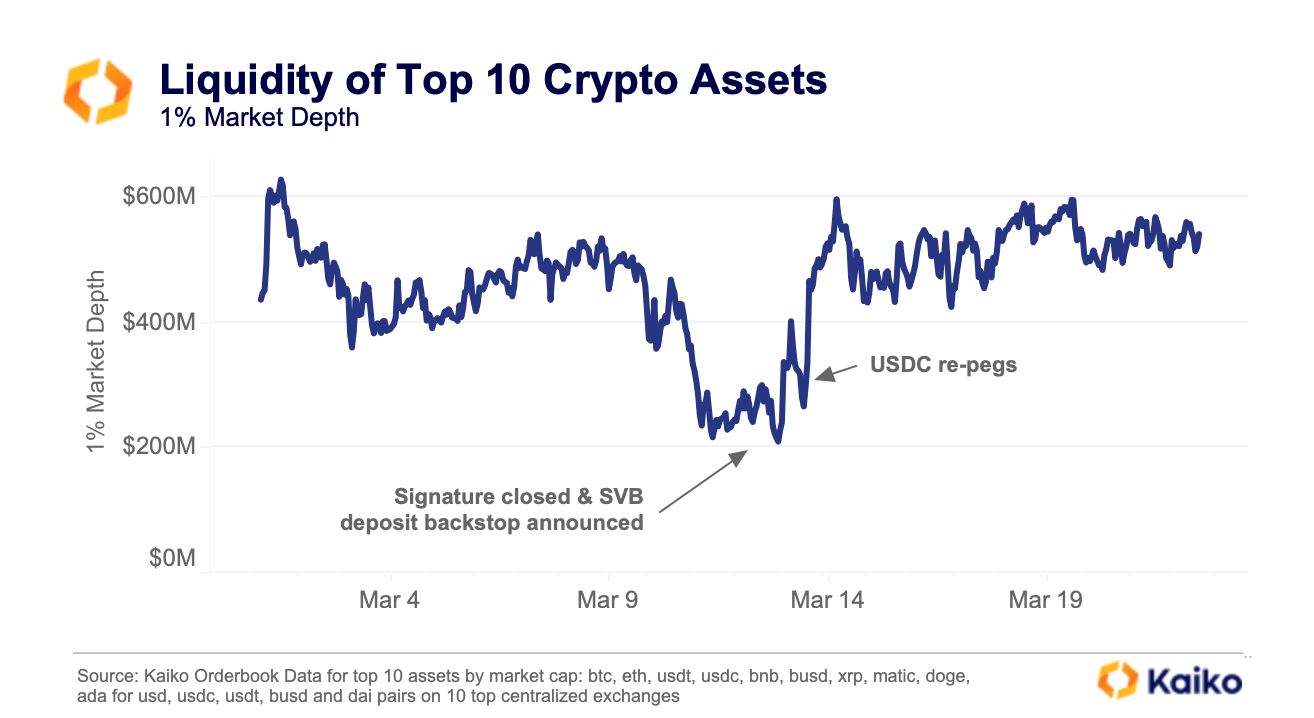

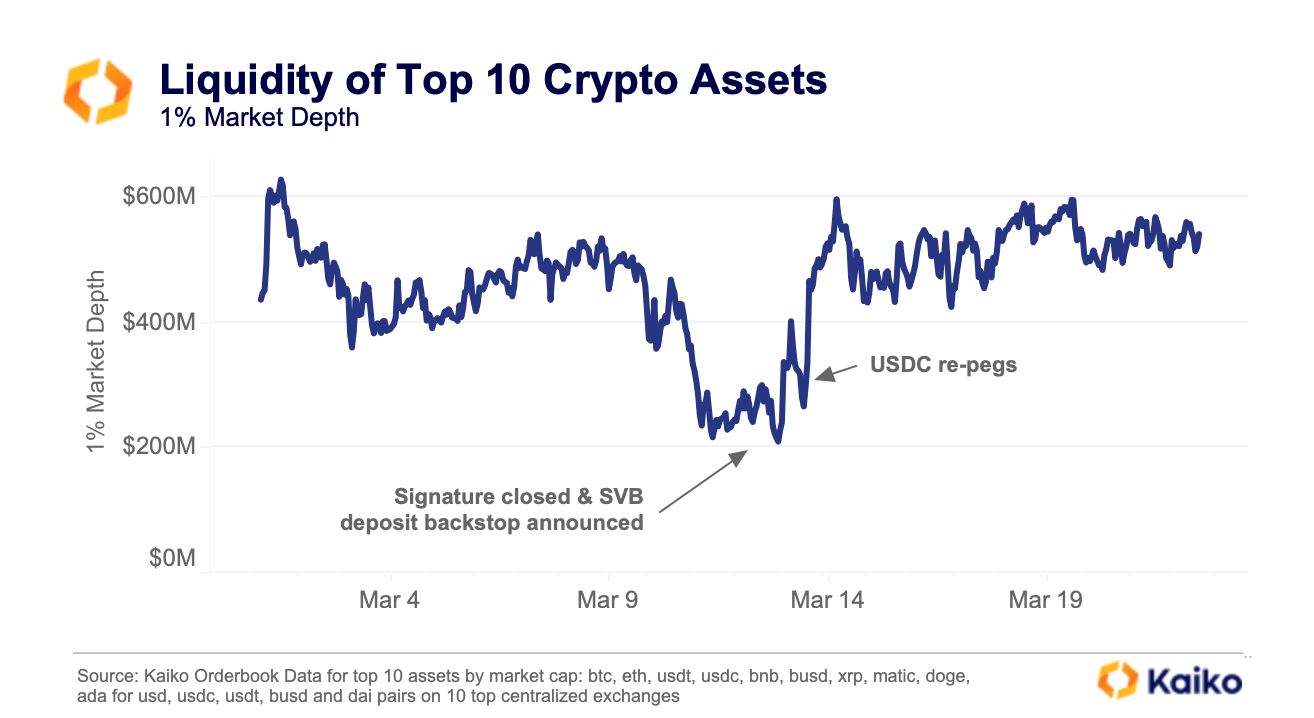

Market depth is arguably the most relevant gauge of liquidity in crypto markets as it represents the amount of orders actually waiting to be filled within a certain price range. By summing both bids and asks within 1% of the mid price for the top 10 assets in crypto, we get a good barometer of liquidity in markets. A quick note on the data: we have started using 1% market depth to avoid potential manipulation of the 2% depth metric we uncovered which is used widely by price display websites.

The above chart serves as a timeline for the liquidity events of the last month, with a $200mn drop around March 4th when Silvergate issues first arose and the SEN network was closed soon after. The next big dip happened when SVB and Signature collapsed, resulting in Circle’s reserves being called into question. Both SEN and Silvergate’s Signet payment network were two critical pieces of infrastructure for market makers in the space, providing 24/7 access to USD settlements with trading firms, OTC desks and other crypto firms. Following the closure of both of these networks, the liquidity situation in crypto hangs in the balance as the industry awaits a viable alternative (I talked about what could happen if no alternative appears in a piece for Coindesk this week).

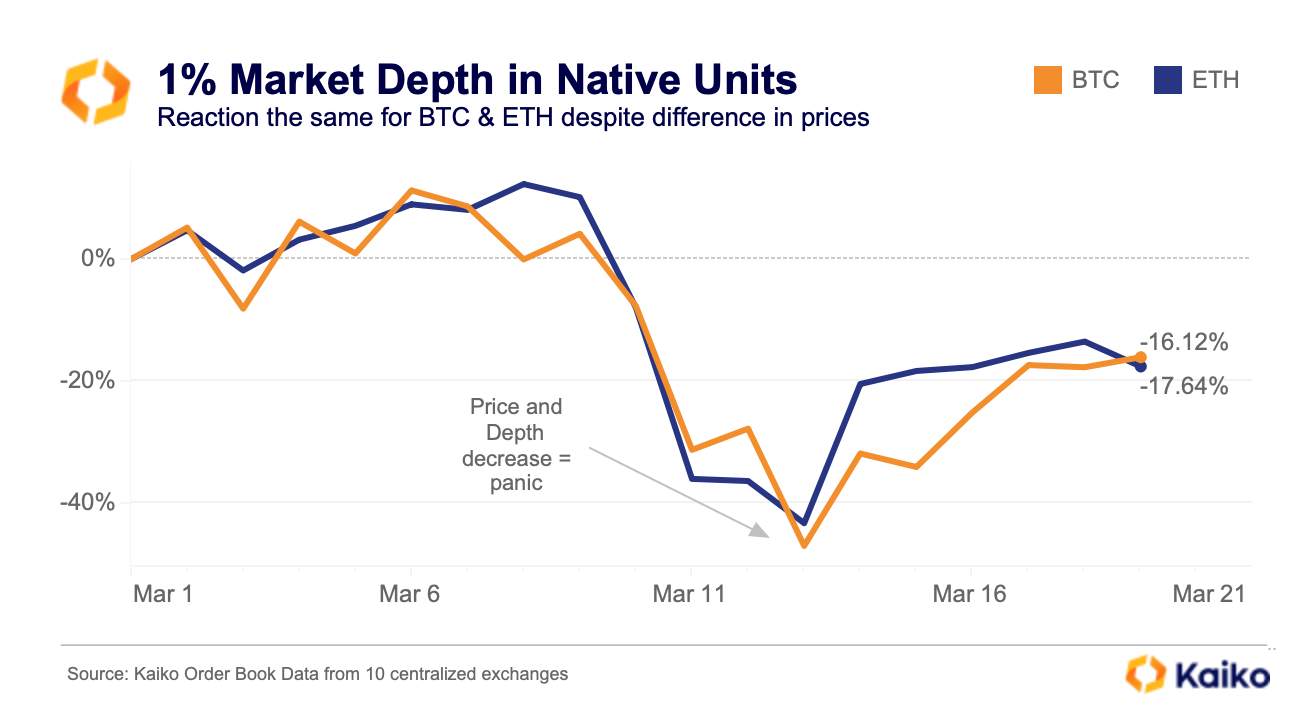

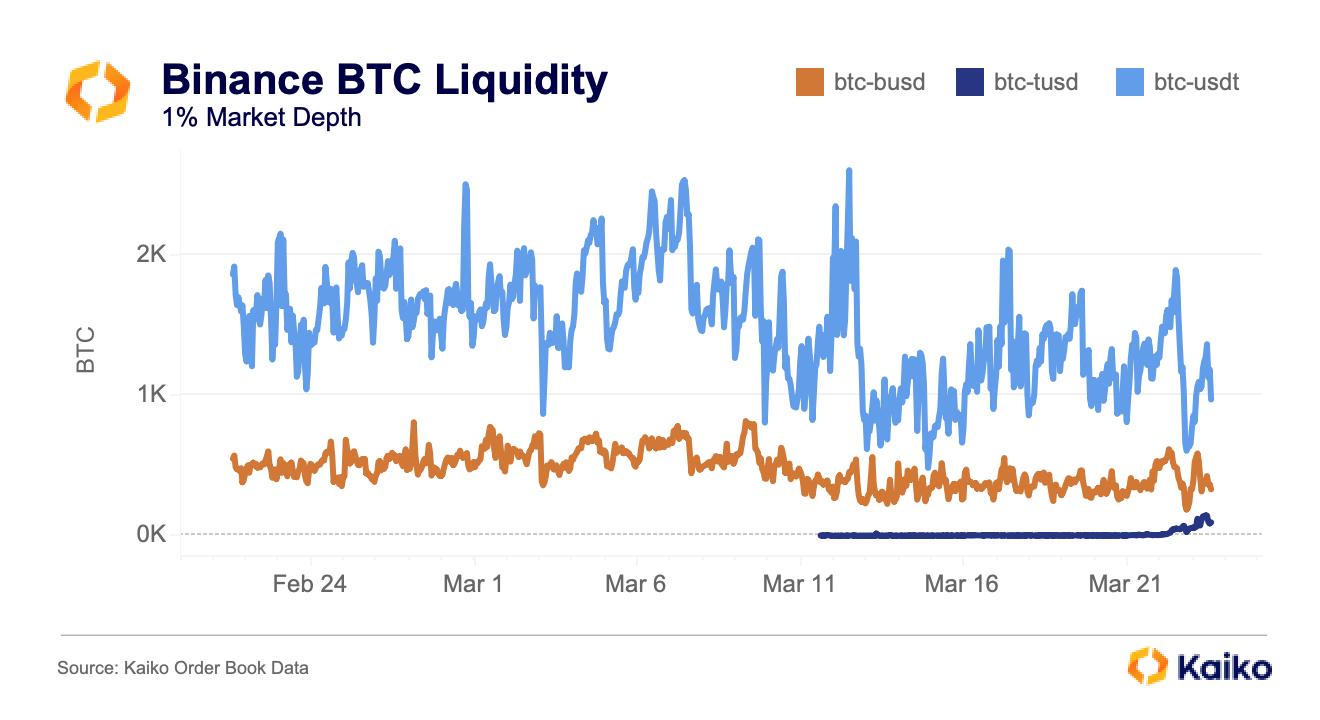

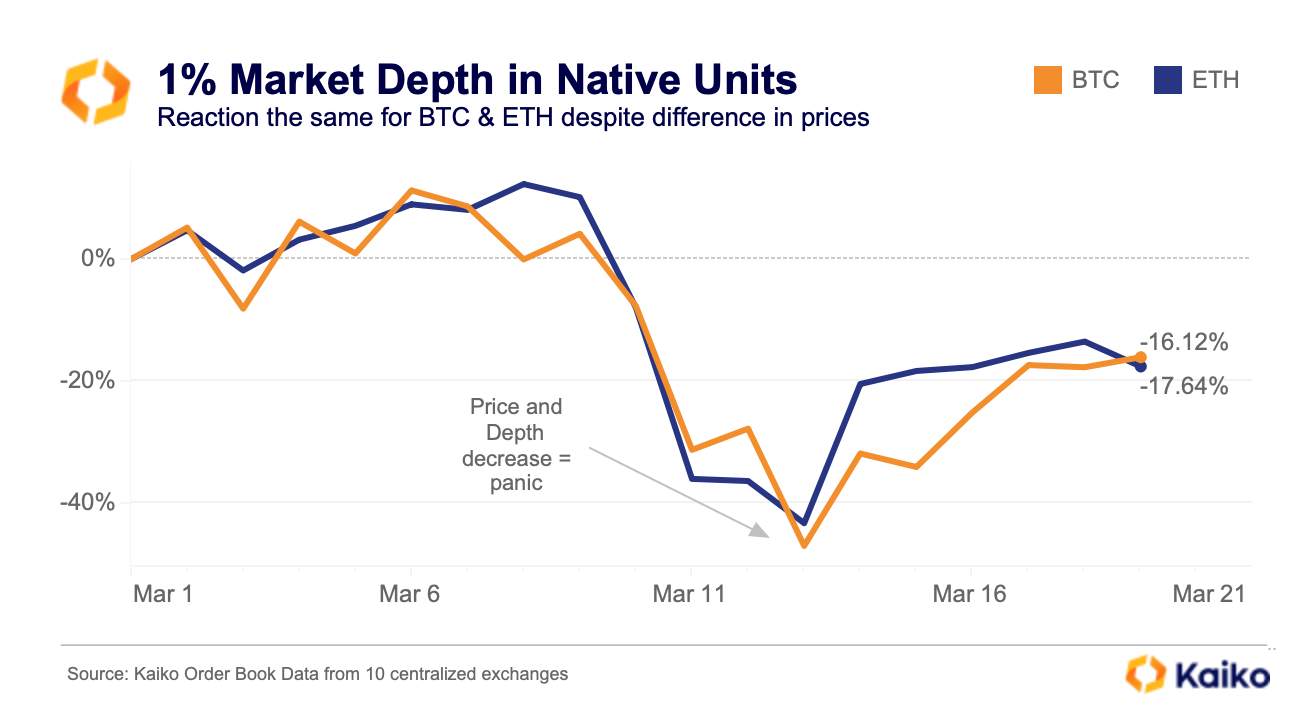

The USD measure of market depth above fails to really capture the hesitance of market makers adding liquidity due to the rally in crypto prices in the last week, restoring USD liquidity metrics to their levels pre banking issues. One way to deal with this is to show market depth in native units to see if there has truly been a fresh injection of liquidity, or if it is just a price increase of the orders already on order books.

We can see that when denominated in native units, neither BTC or ETH have improved in depth, showing that this was purely a price driven increase in liquidity, which is a less sustainable way to increase liquidity in markets. Interestingly, market makers did not treat BTC and ETH any differently, despite the general rotation we’ve seen into BTC in the last week.

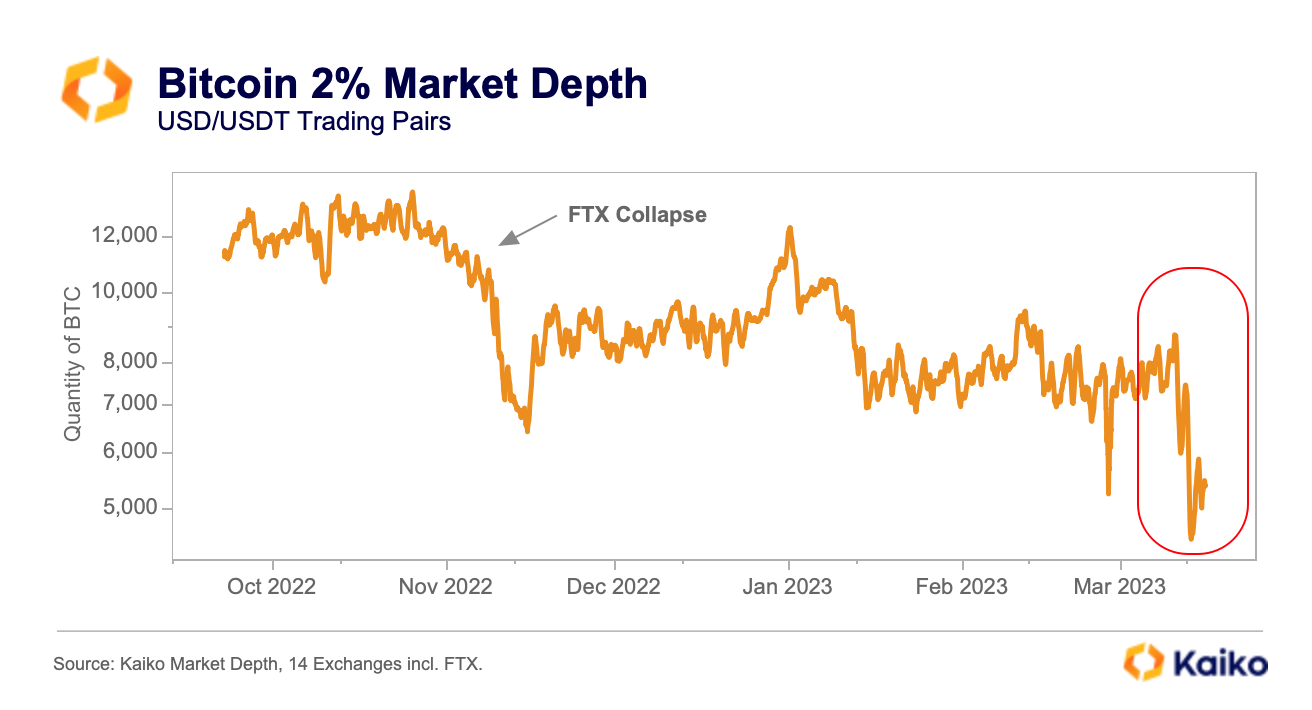

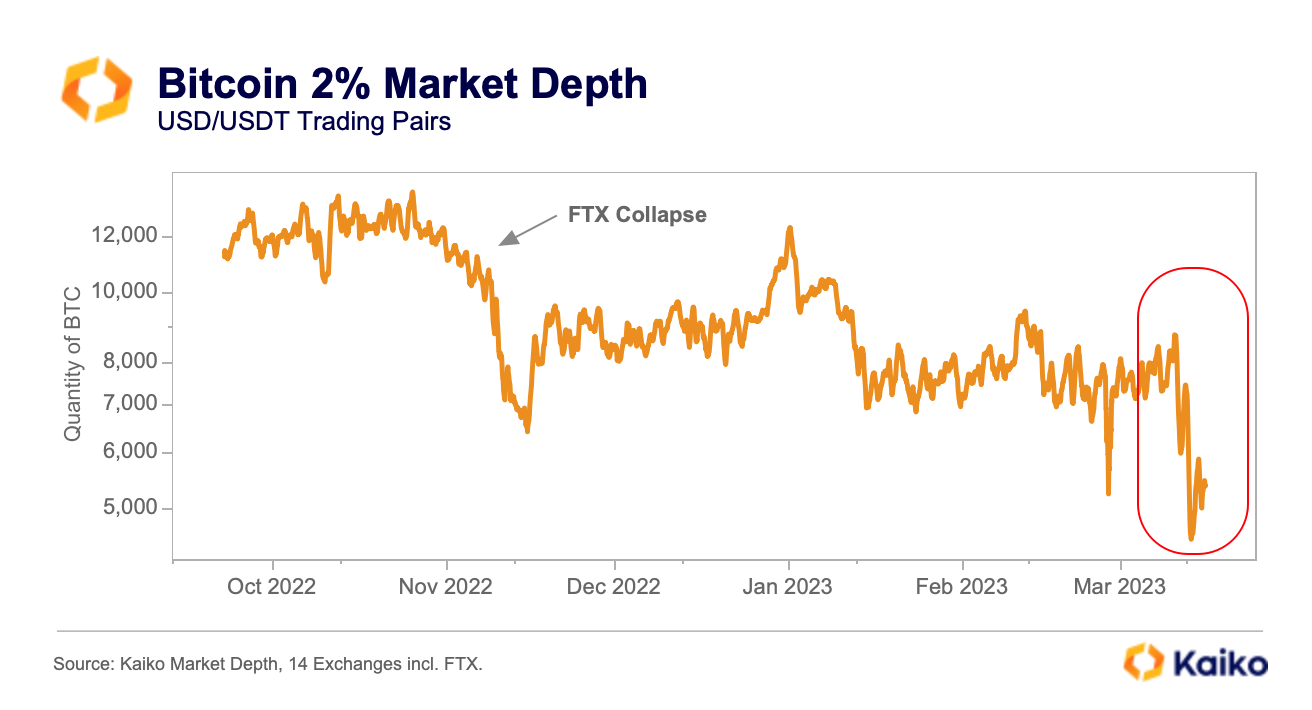

Zooming out over the last few months, market depth in BTC paints a cautionary picture. We are currently at our lowest level of liquidity in BTC markets in 10 months, even lower than the aftermath of FTX. Back when the FTX/Alameda entity collapsed, we first identified the drop in liquidity as “the Alameda Gap”, highlighting the absence of one of the industry’s biggest market makers. That gap has yet to be filled, and with the banking issues of late, liquidity has taken another blow.

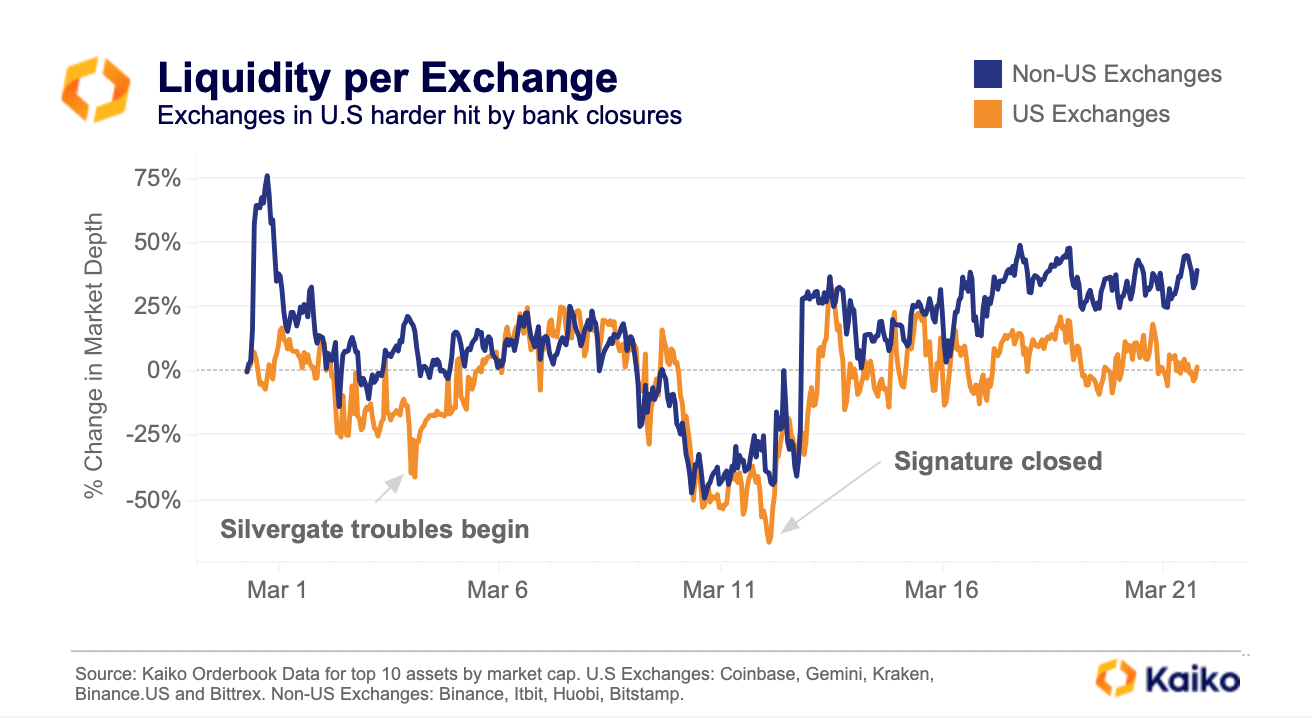

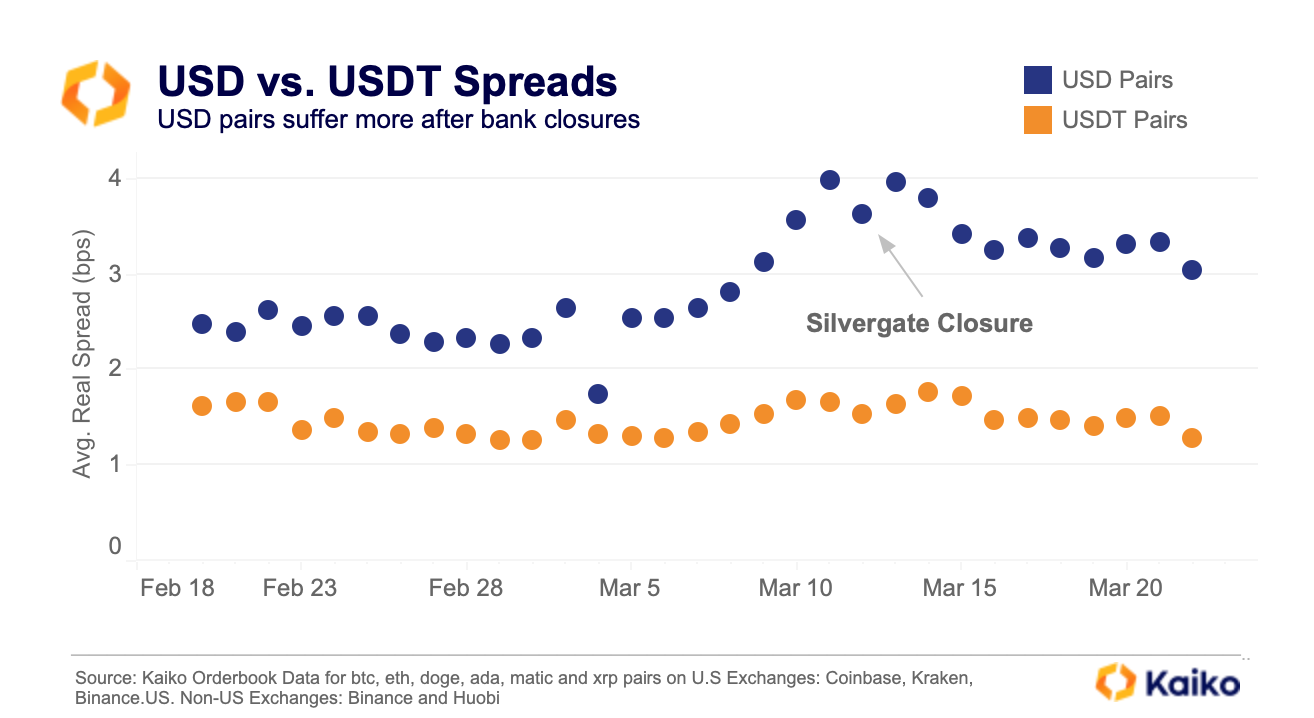

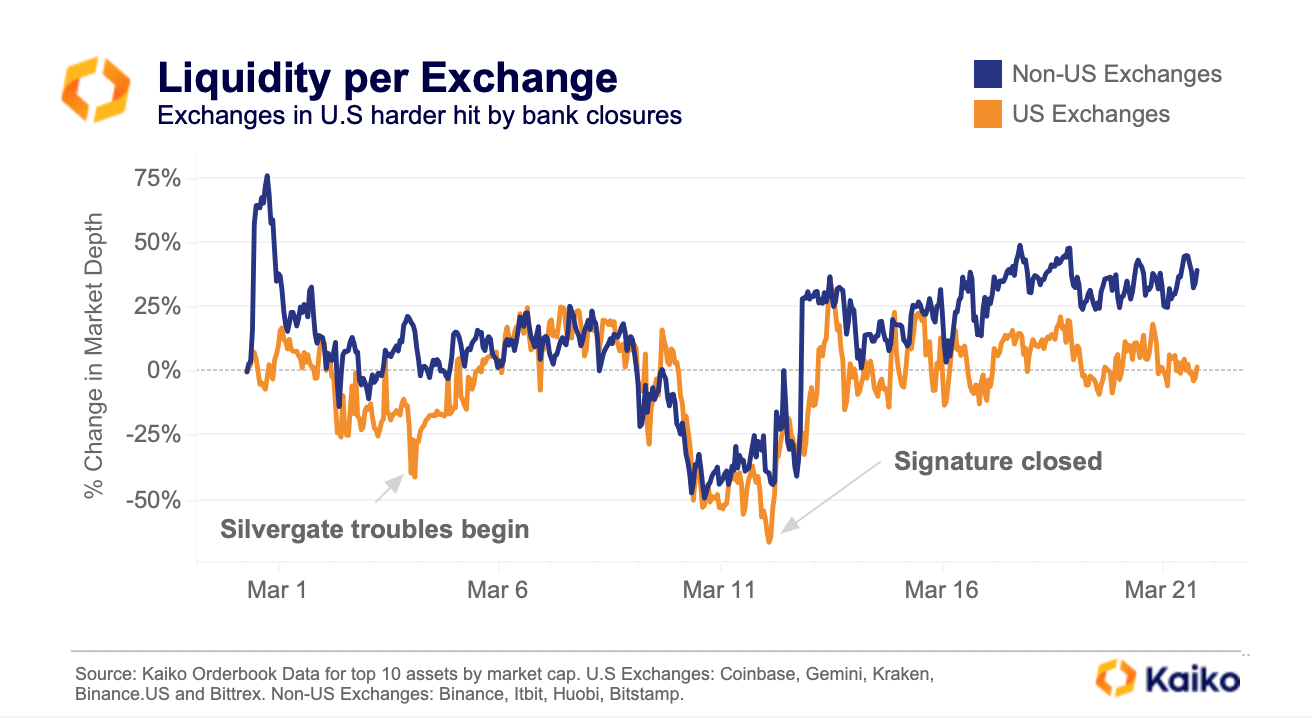

The closure of SEN and wind-down of Signet, some of the only USD payment rails for crypto, resulted in U.S exchanges being harder hit from a liquidity standpoint as market makers in the region face unprecedented challenges to their operations.

We can see the difference in reaction between US and non US exchanges with more severe reactions to some of the liquidity issues of the last month. The good news is that liquidity seems to have recovered to early-March levels, although the loss of easy fiat on-ramps could have a more long term impact.

![]()

![]()

![]()

![]()