The Data

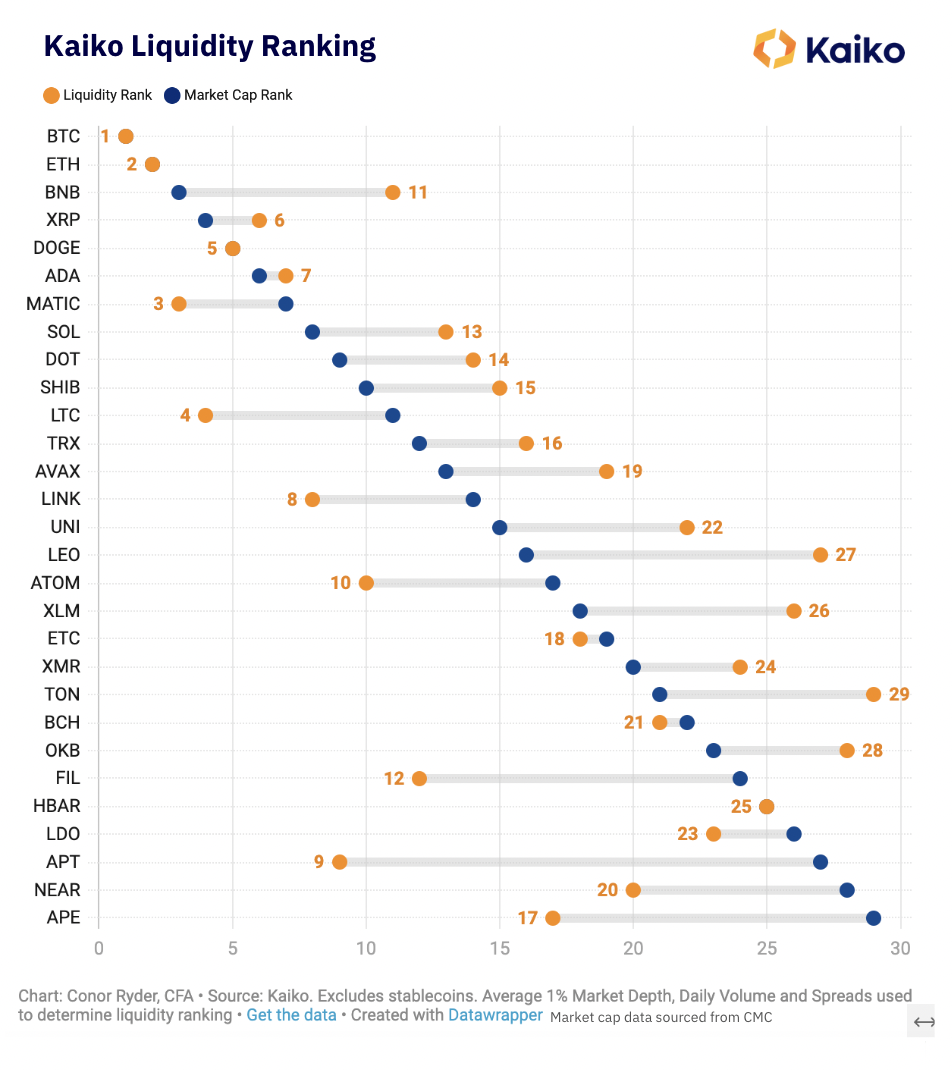

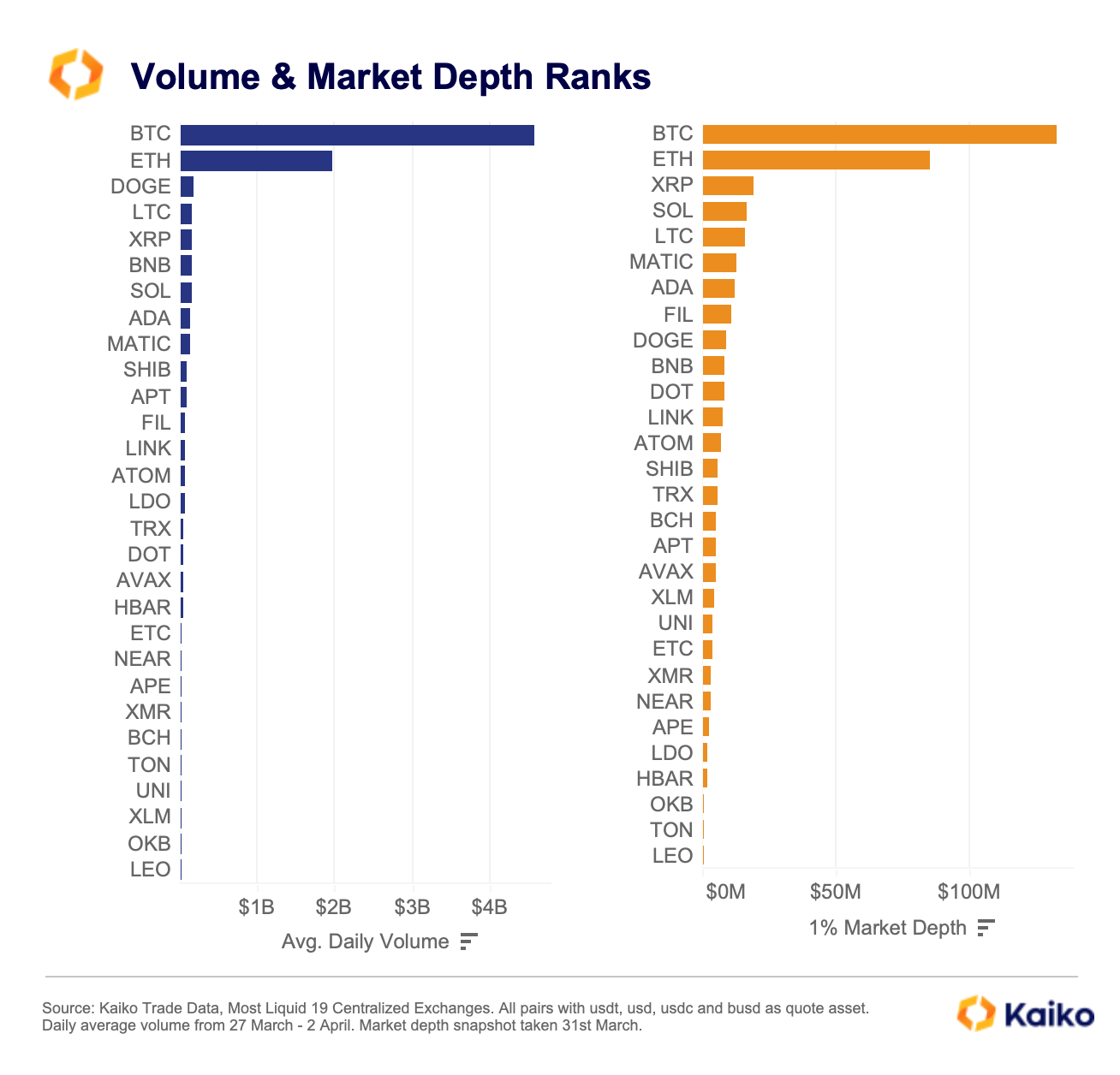

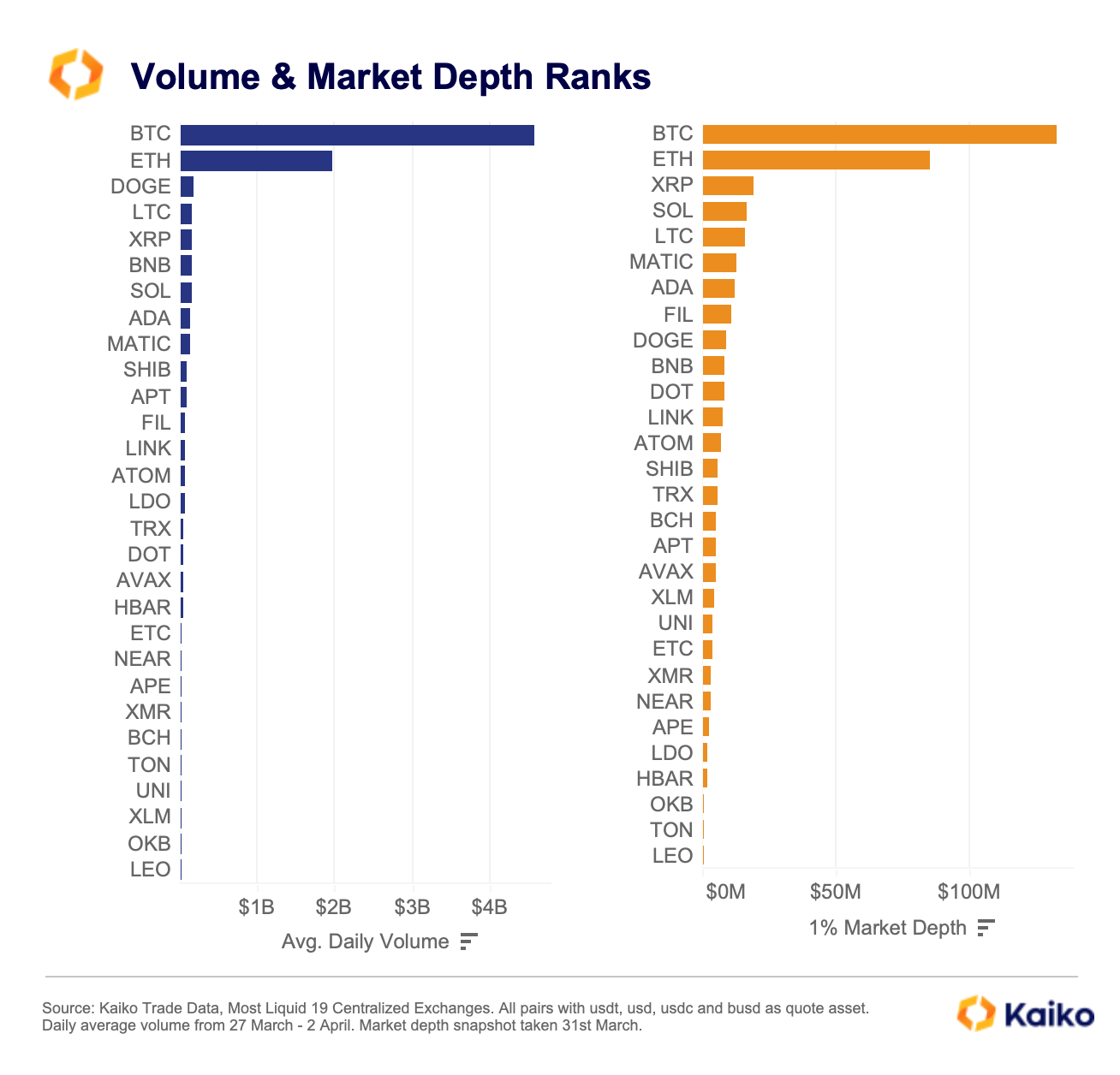

29 tokens were ranked by market capitalization, excluding stablecoins and wrapped tokens. For volume and market depth, data was aggregated across all active USD, BUSD, USDT, and USDC-denominated pairs on 11 of the most liquid centralized exchanges. This encompasses a majority of market activity.

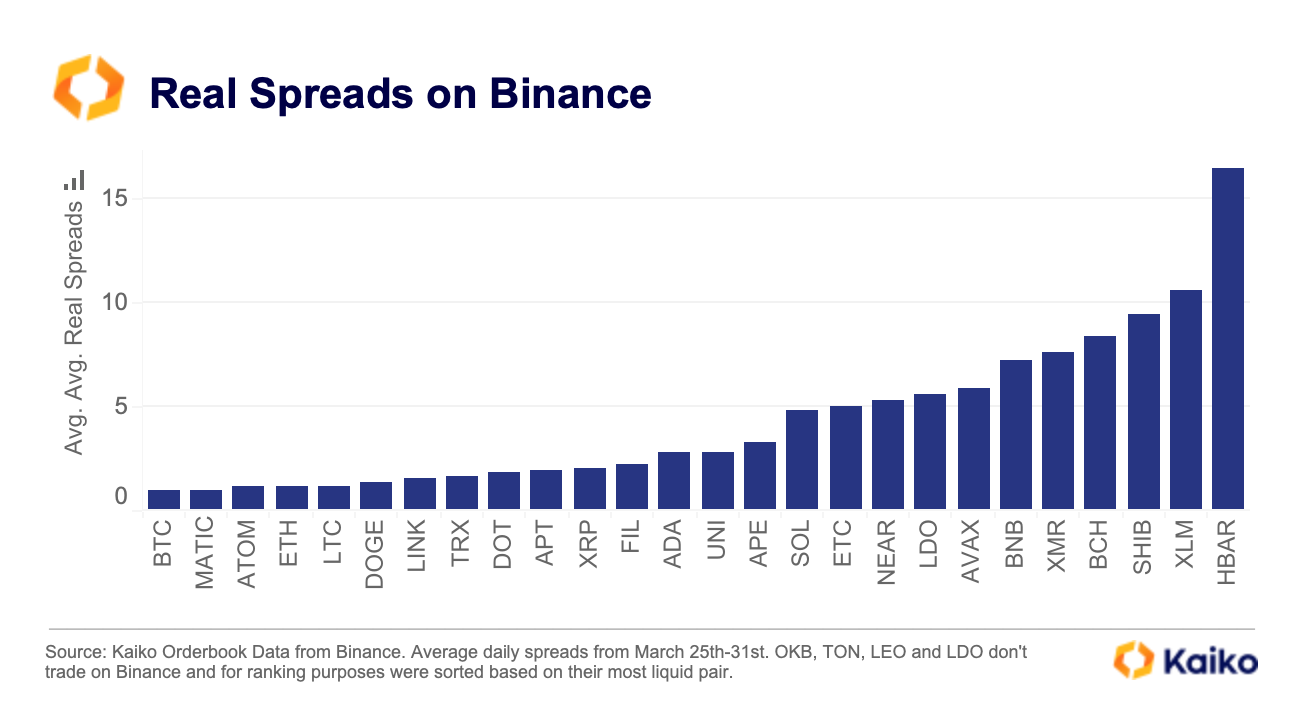

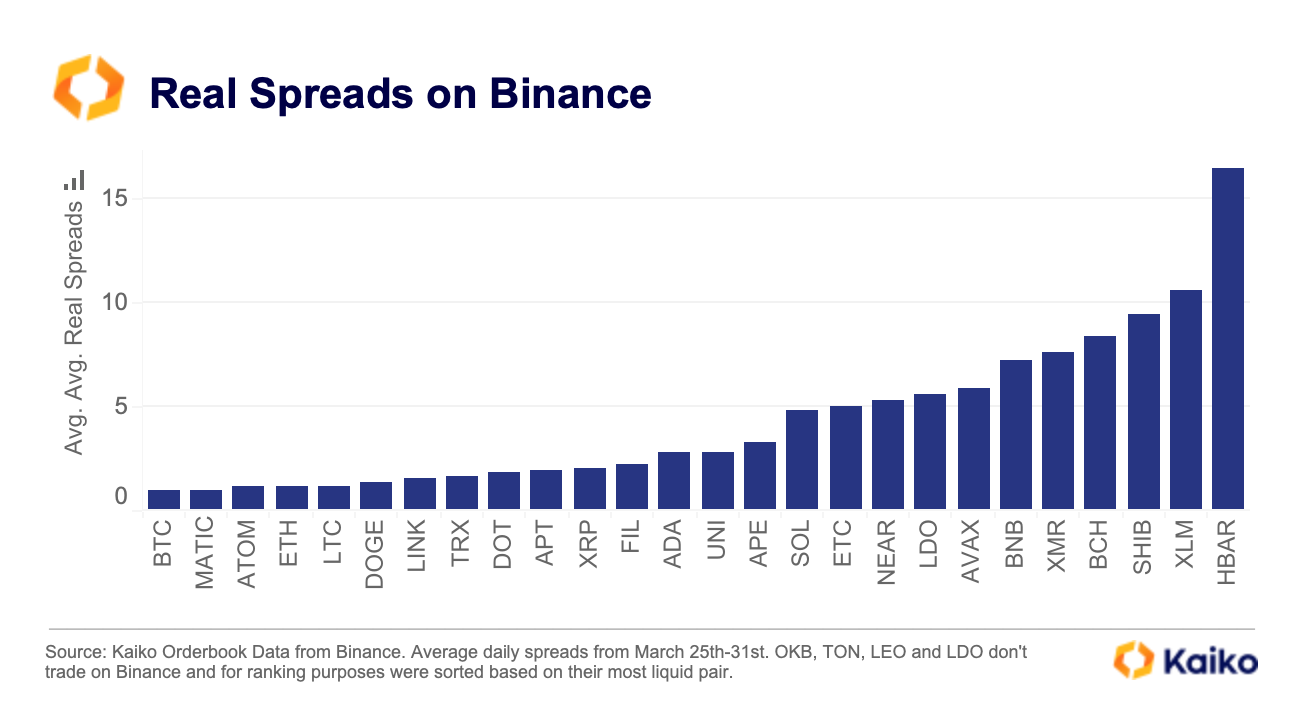

For spreads, only data from Binance is used, which is the most liquid exchange across the widest range of markets. This is due to the problems that outliers can cause when taking an average spread. For example, just one illiquid market would cause the average spread to skyrocket, which wouldn’t reflect the token’s true liquidity.

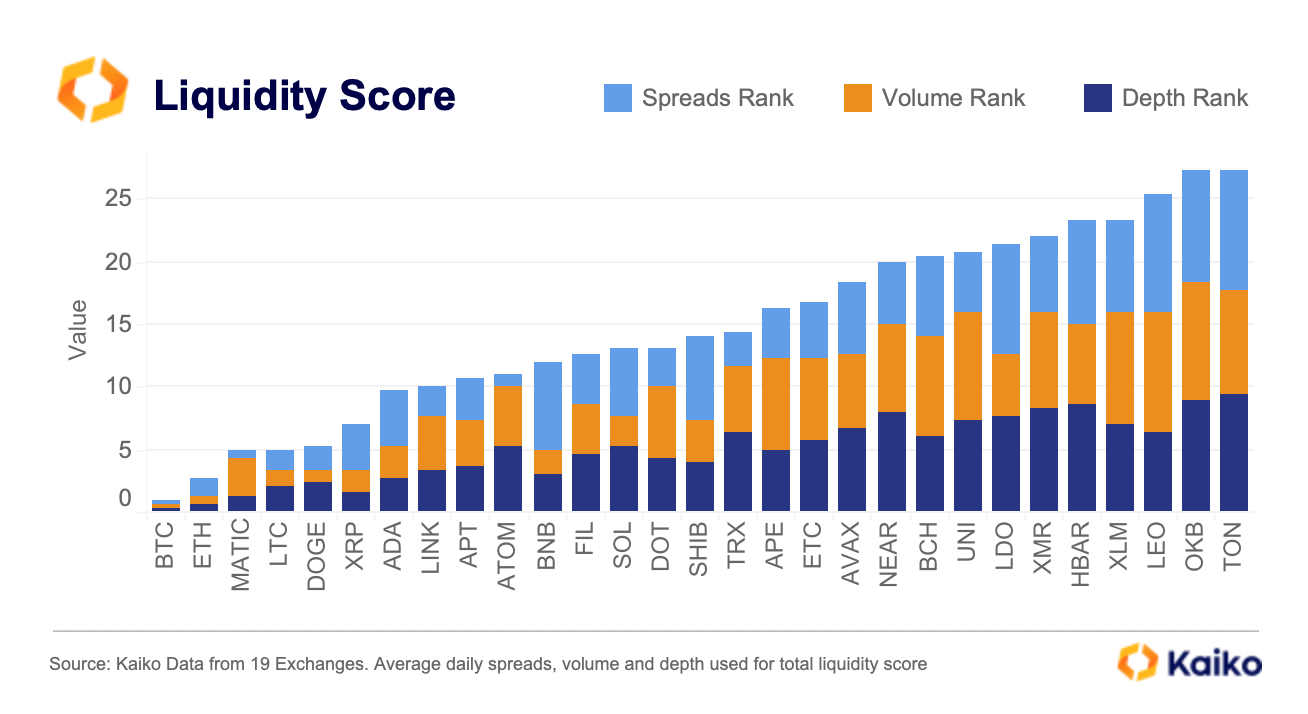

As a final note, this liquidity analysis is still in its early iterations, and we are open for feedback. The following three criteria were used to arrive at a liquidity rank for each token:

1) Volumes

Volumes are strongly correlated to order book liquidity measures such as market depth and spread. Tokens that have higher trade volumes typically have deeper order books, which enables traders to trade an asset with limited impact on price. But, in crypto markets there can be discrepancies in this correlation. For example, wash trading or other types of market manipulation can make a token appear very liquid without having deep order books, which means that trade volume alone is not adequate to fully assess liquidity.

The standout tokens this quarter for volumes were:

- DOGE volumes picked up to start 2023 and rank in an impressive third ahead of several larger cap tokens.

- LTC volumes also impress, ranking fourth despite having a market cap ranking of 11, excluding stablecoins. The cautionary note with LTC volumes is that earlier this year I found some examples of LTC wash trading on Bitforex so the volume figure alone is not enough to conclude that LTC is particularly liquid.

- DOT volumes were remarkably low in the first quarter of 2023 compared to some of its competitors of a similar size market cap. DOT ranked 17th in volumes.

2) Market Depth

Market depth considers the overall level and breadth of open orders and is calculated from the number of buy and sell orders at various price levels on each side of the mid price. In this analysis, 1% market depth is taken.

Last quarter I used 2% depth, however when digging a bit deeper into market depth metrics I found evidence that some exchanges/tokens were purposely gaming the 2% depth figure, inflating the level of orders at that level, likely because big ranking websites started listing a 2% depth column. I found 1% to be a more accurate representation of depth with far less irregularities.

If market depth is “deep” for a given token, this means that there is sufficient volume of open orders on either the bid or ask side, which ultimately makes it easier to exchange the asset at prices reflecting its intrinsic value. The weaker a market’s depth, the easier it is for larger market orders to move the price.

The standout tokens above for market depth are:

- SOL depth improved relative to other tokens since last quarter. In our last ranking, SOL ranked 9th in market depth. This month, SOL comes in at an impressive 4th.

- BNB depth is surprisingly low again, considering it is the native token of the most liquid exchange, remaining in tenth despite being the third largest non-stablecoin token.

3) Spreads

In traditional finance, the bid-ask spread is the most frequently used indicator when assessing a market’s liquidity. The spread is calculated by taking the difference between the best bid and the best ask on an asset’s order book at a moment in time. Spreads in cryptocurrency markets are more fragmented as each exchange offers different incentives to liquidity providers which impact the spreads offered. As a result, I have taken Binance as a barometer for overall market spreads. This month, we had a significant shift in market structure on Binance with the removal of zero fees for all BTC pairs except TUSD, which we wrote about in some detail recently.

Typically, the smaller the spread the more liquid the market. Wide spreads indicate that liquidity is weaker for an asset, and that it will be more difficult to exchange the asset at stable prices, making it an important metric when assessing the overall liquidity of an asset from an investment standpoint.

Despite the removal of fees on Binance and resulting change in spreads, only BTC was impacted, which already ranked first even before the change.

The standout tokens from a spreads point of view are:

- MATIC impresses again from a liquidity standpoint, ranking second in spreads moving up from fourth last quarter.

- BNB disappoints again, ranking a dismal 21st in spreads on its own exchange.

- SOL spreads also underwhelm, ranking 16th despite being the 8th largest non-stable token by market cap.

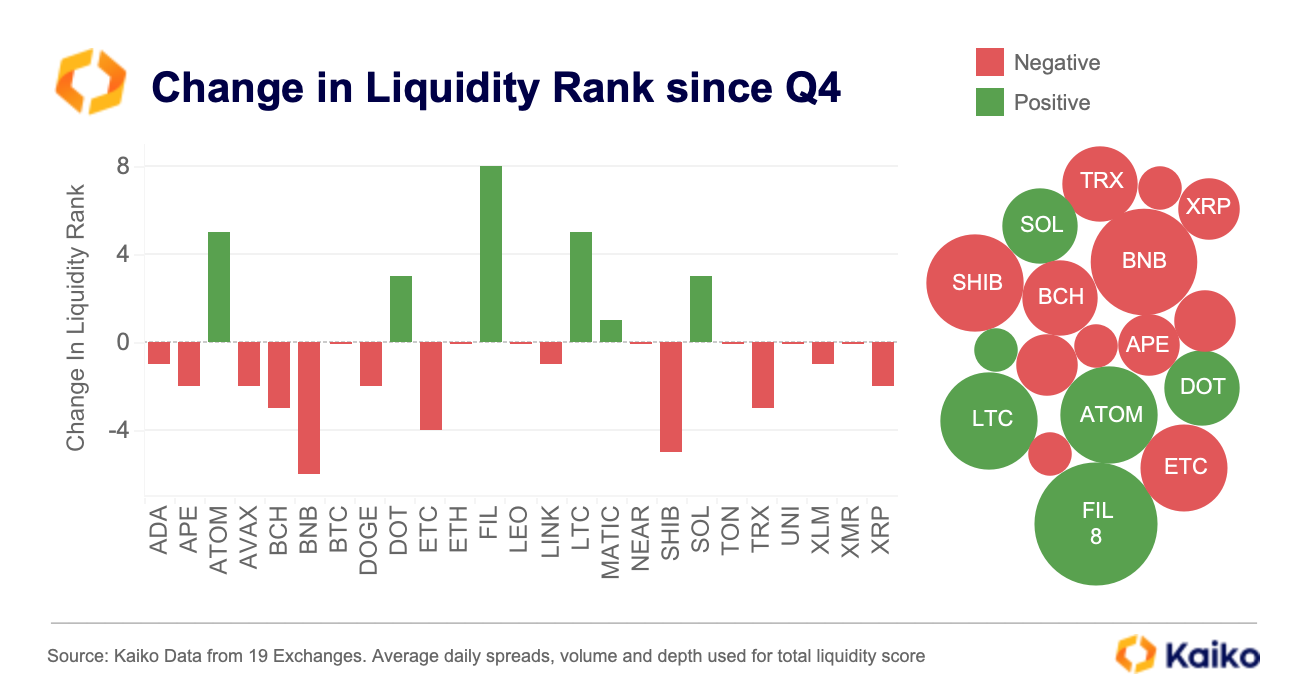

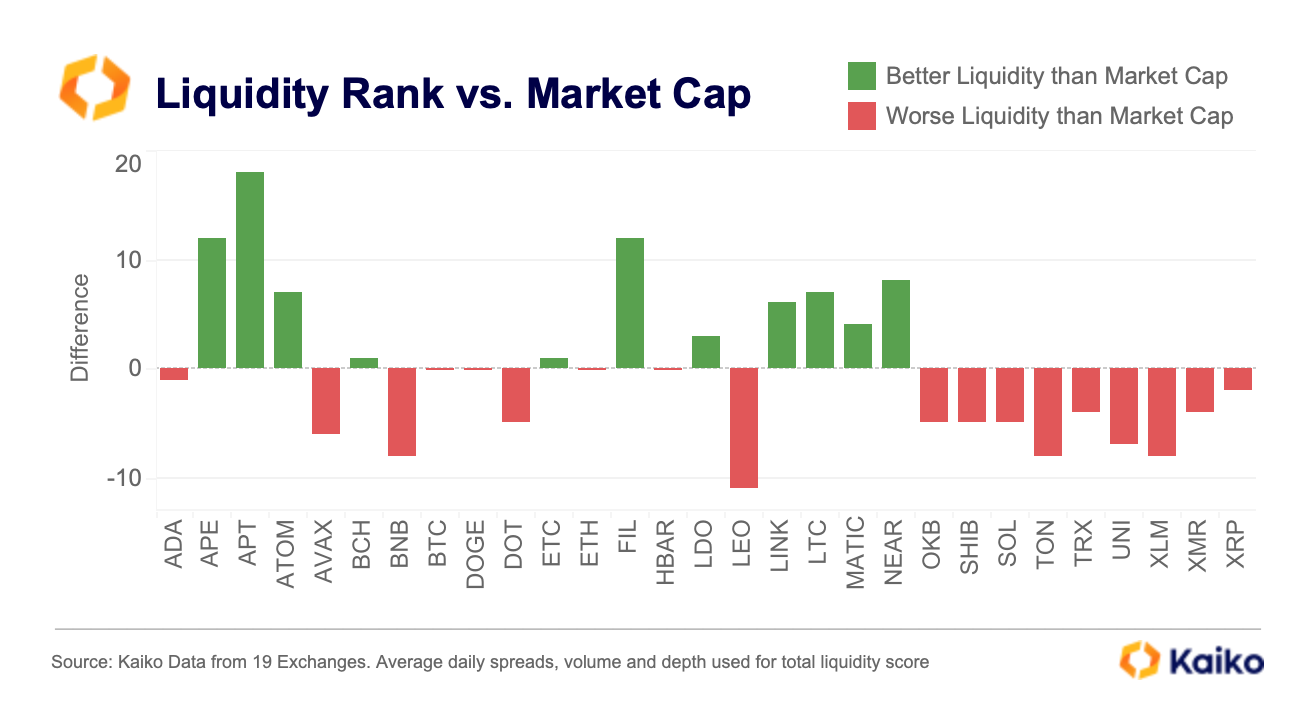

![]()

![]()

![]()

![]()