Mapping the AAVE User base.

by Louis Latournerie and Dessislava Aubert

This report examines how Aave’s user base is changing, highlighting shifts in engagement, activity, and risk across different segments. This analysis shows that the Aave protocol on Ethereum, is increasingly driven by a small group of large, active, and risk-tolerant users, while most smaller users remain conservative and favor traditional assets like WETH, WBTC, and stablecoins.

Key Findings

- Users with <$10k deposits make up about ~⅓ of Aave’s base, but their share is declining.

- Largest depositors drive most capital and activity.

- Liquid Staking Tokens (LST) and Liquid Restaking Tokens (LRT) dominate debt, mainly among large users.

- Smaller users favor WETH, WBTC, and stablecoins as collateral.

- Large users borrow riskily, often near liquidation thresholds.

- Small users stay safe, with 70%+ keeping high health factors.

Large users dominate deposits

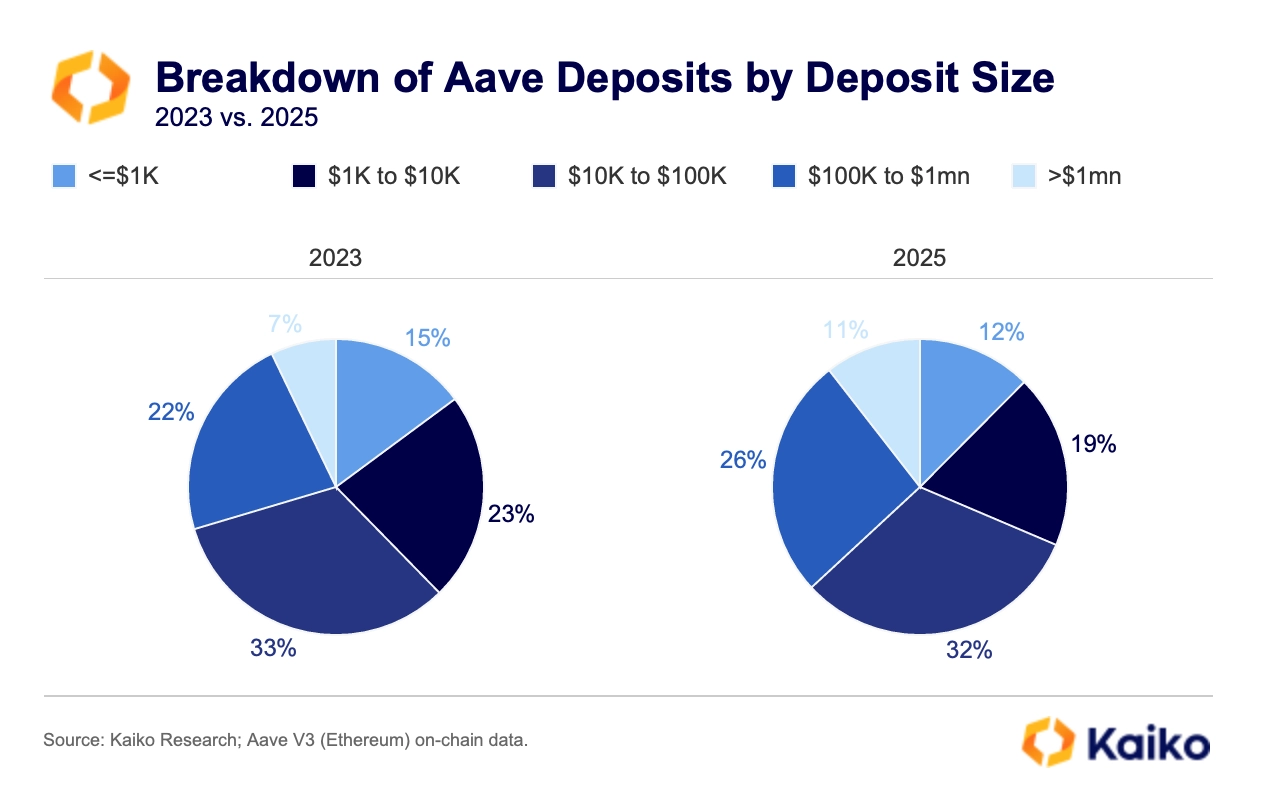

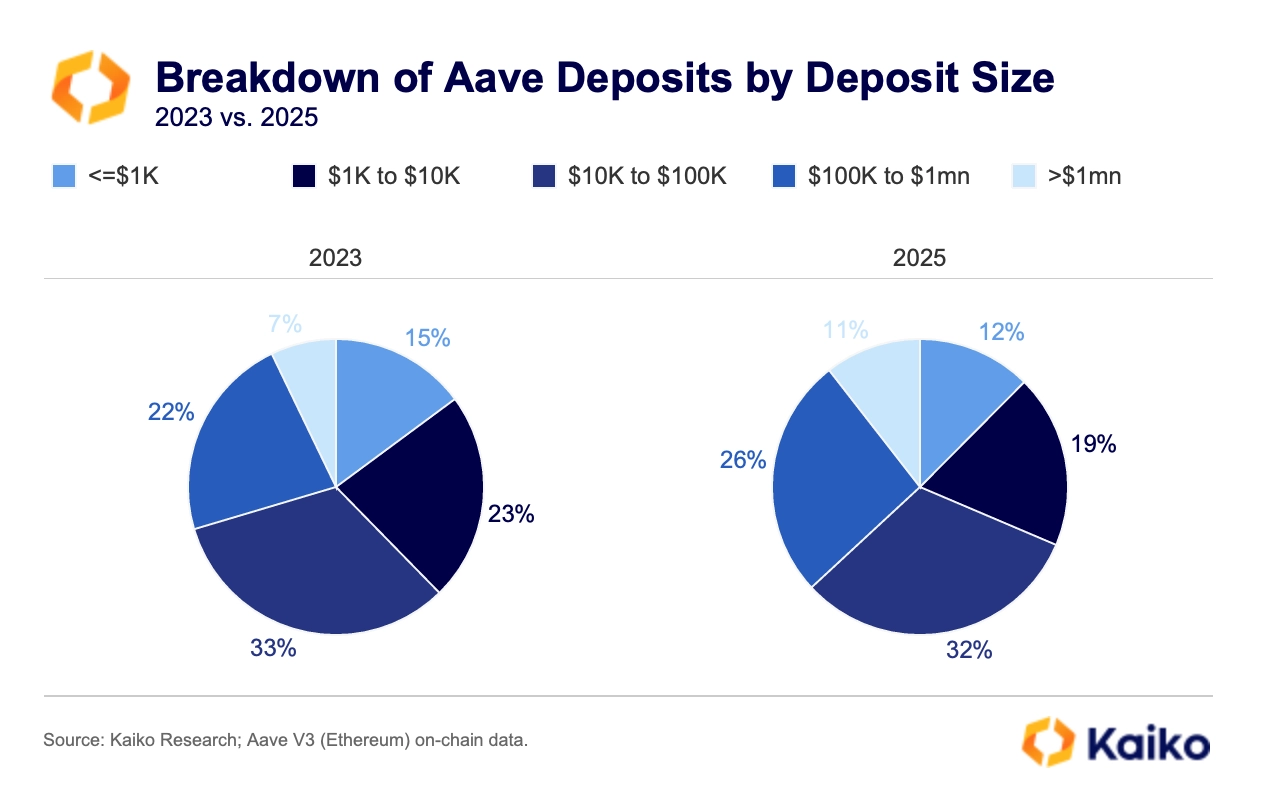

Aave’s deposits are increasingly concentrated in large accounts. Users with over $100k in collateral grew from 29% in 2023 to 37% in early 2025, with the $100k–$1m collateral group rising to 26% and the $1m+ group to 11%, each up about four points.

Over time, growth in large depositors has mostly come at the expense of smaller ones with $1k–$10k deposits. Very small users (<$1k) share for instance, fell from 15% to 12% in the past two years. Meanwhile, mid-size depositors ($10k–$100k) have stayed the backbone of Aave, making up about one-third of deposits still in 2025.

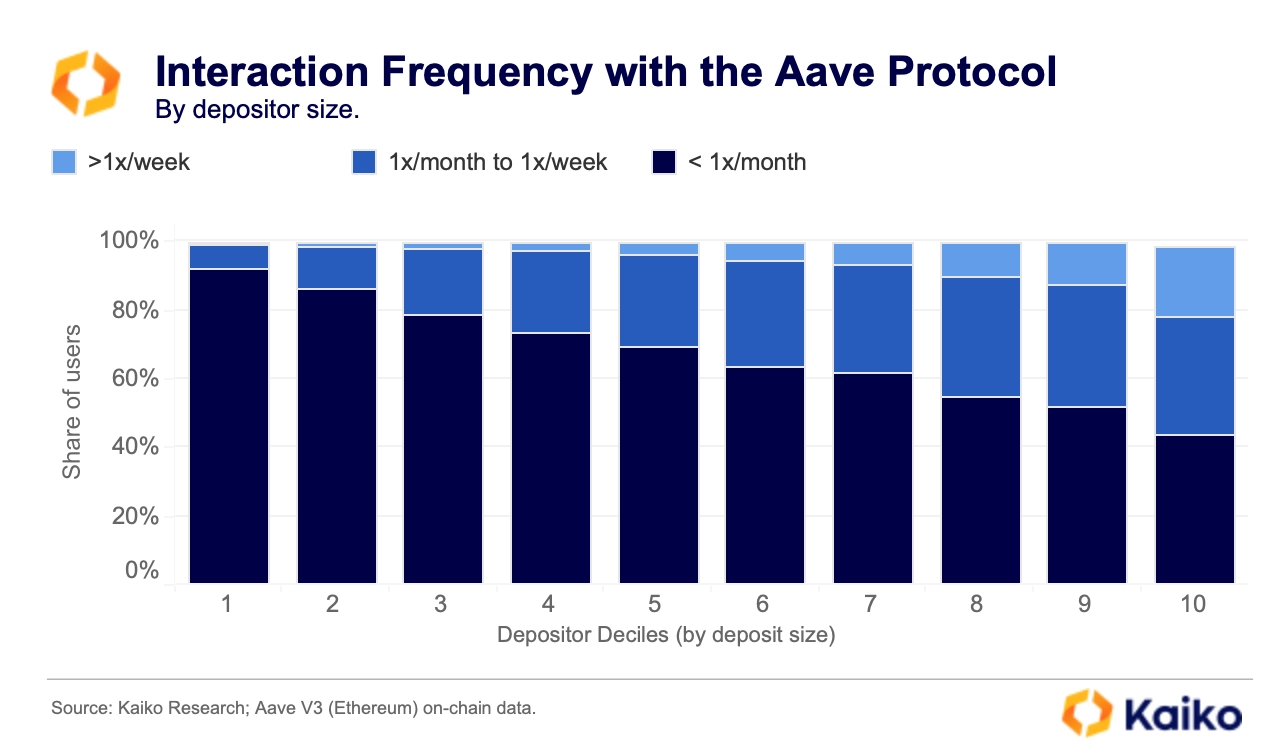

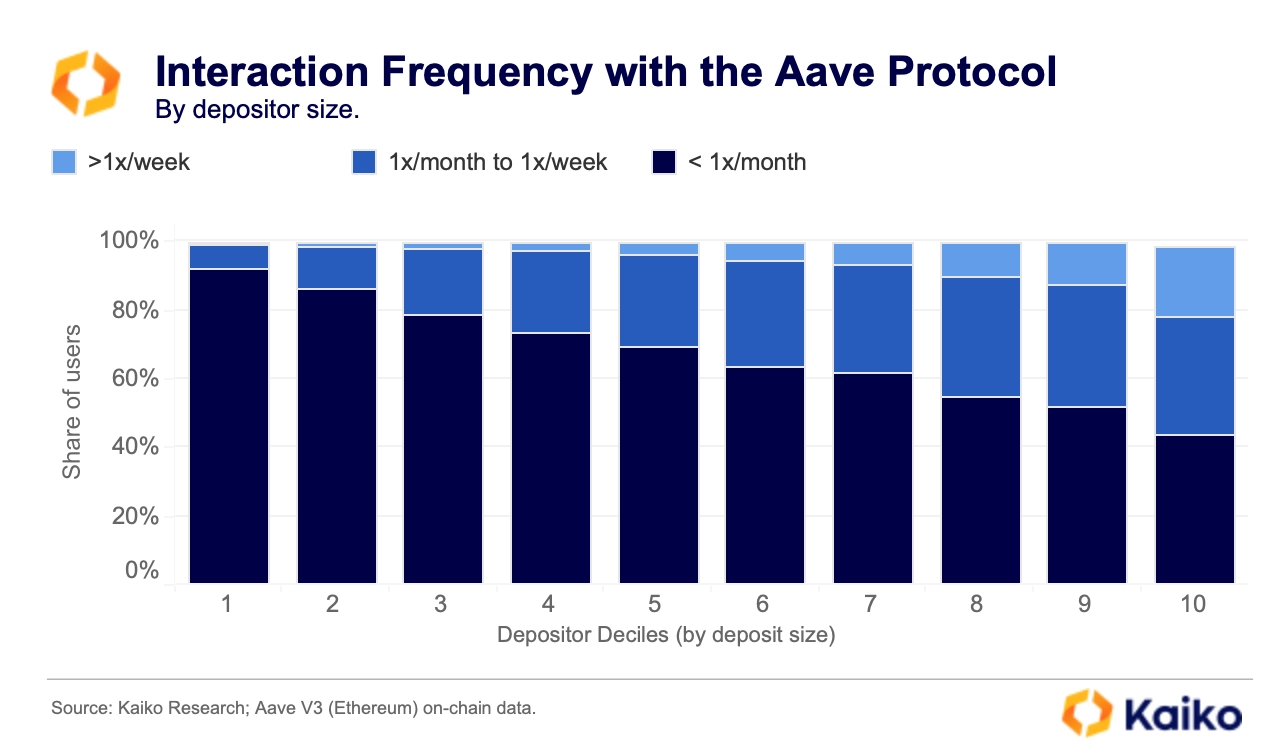

Large depositors are the most active users

Aave user data shows a clear link between deposit size and engagement. Activity increases steadily across deposit-size deciles. Larger depositors engage more frequently (weekly to multiple times per week), while the smallest users mostly interact less than once per month. This suggests both capital and protocol activity are concentrated among a relatively small cohort of highly active users.

When deposits and activity concentrate among a few large users, Aave faces higher systemic risk. A shift in their behavior or exit could threaten the protocol’s stability and liquidity. Low participation from smaller users highlights ongoing barriers to entry. To build a healthier user base, DeFi platforms should prioritize onboarding, retention, user experience, accessibility, and cost efficiency.

LST and LRT reshape Aave’s collateral mix

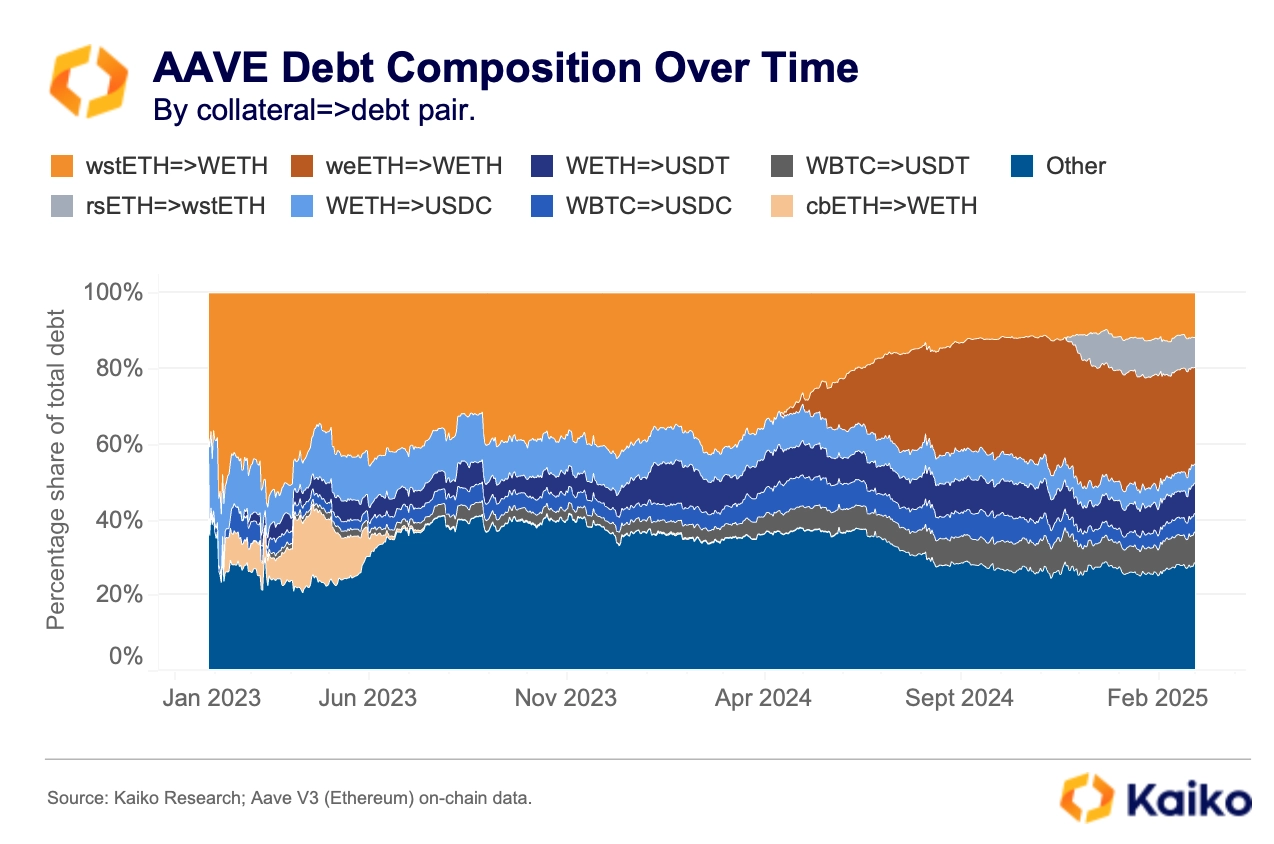

Since the Merge, Aave’s collateral mix has shifted, with liquid staking tokens (LST) and, more recently, liquid restaking tokens (LRT) playing a larger role in funding positions. LST are liquid claims on staked ETH that continue to earn rewards—either through rebasing (e.g., Lido’s stETH) or through an appreciating exchange rate (e.g., wstETH, rETH, cbETH, sfrxETH). LRT are liquid claims on restaked ETH that earn both staking and restaking yields on middleware such as EigenLayer, with examples like Ether.fi’s weETH and KelpDAO’s rsETH.

To capture this shift, we break down Aave’s outstanding debt into collateral→debt pairs. For instance, if WETH→USDC accounts for 10% on a given day, then 10% of all borrowing is USDC backed by WETH. For accounts with multiple collaterals, debt is allocated proportionally to each asset’s share of total collateral value. The chart tracks how these collateral→debt pairings have evolved over time.

weETH (wrapped Ether.fi ETH) adoption on Aave accelerated after its spring 2024 listing, climbing from a marginal share to one of the protocol’s largest LRT-backed markets by year-end before stabilizing. Other LRT also gained traction. For example, use of KelpDAO’s rsETH as collateral to borrow wstETH grew from nearly zero in November 2024 to a 9% share within a month.

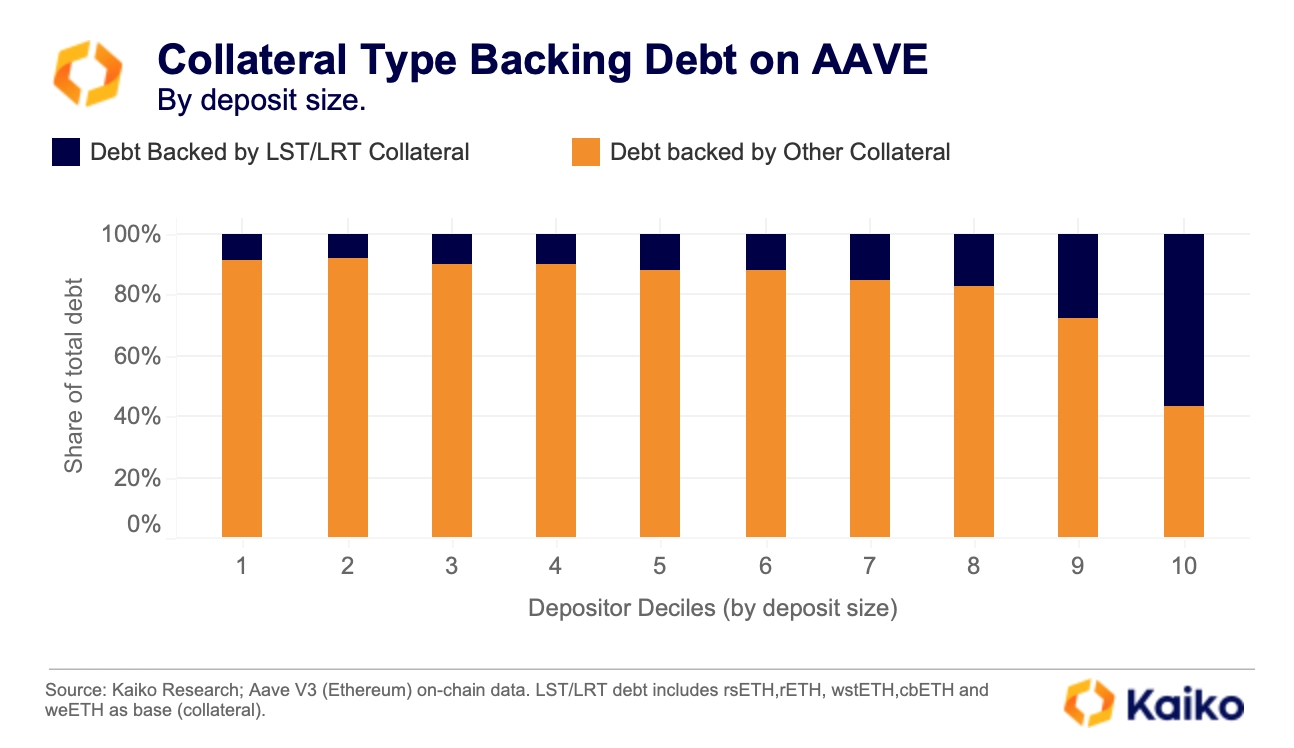

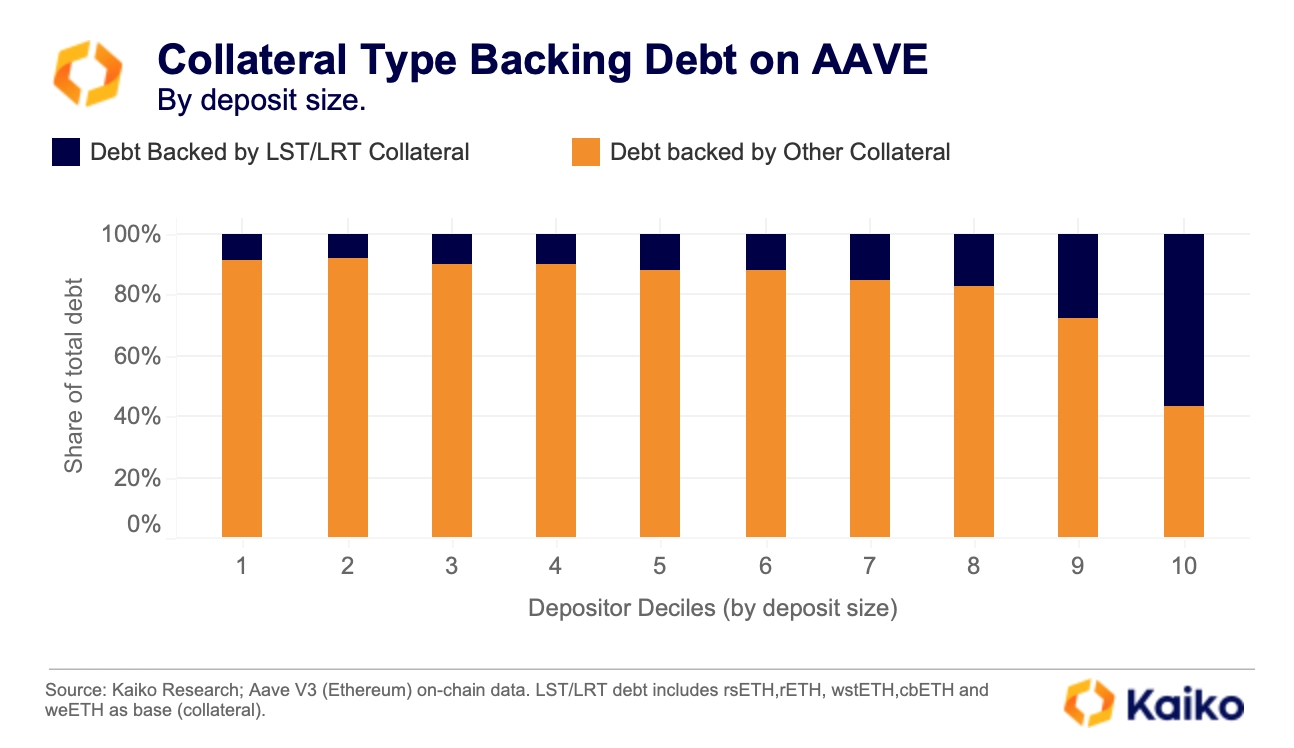

Aave’s largest users power LST and LRT adoption

As of March 1, 2025, adoption of LST and LRT tokens is concentrated among Aave’s largest depositors. These whales drive most borrowing activity with staking assets, while smaller and mid-sized users continue to rely on traditional collateral like WETH, WBTC, USDC, and USDT, as well as established tokens such as DAI, MKR, UNI, and LINK. Overall, LST and LRT growth reflects a niche, sophisticated user base rather than a broad shift across the protocol.

In early 2025, LST and LRT accounted for 57% of collateral backing debt among Aave’s largest depositors, while 91% of borrowing by smaller users was mostly backed by traditional assets like WETH, WBTC and others

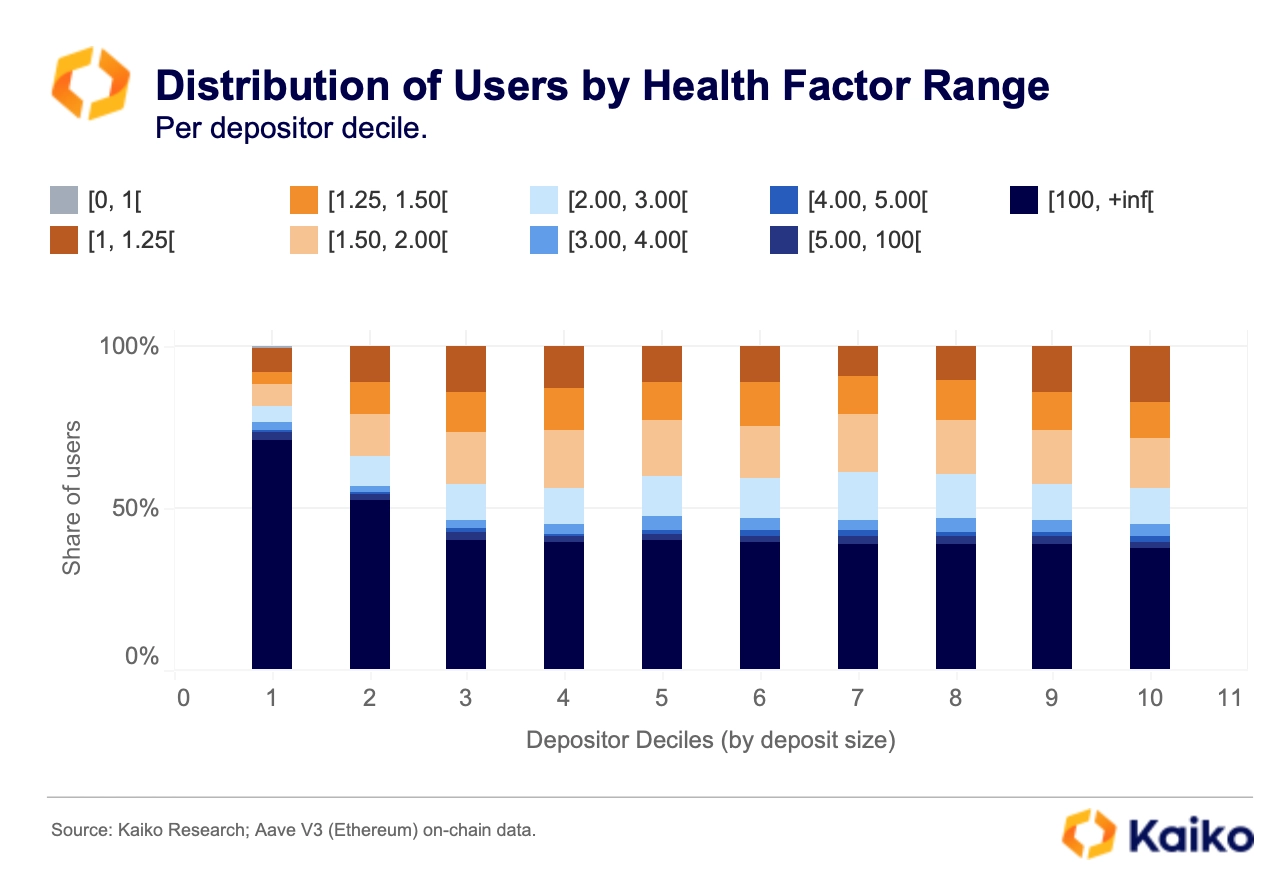

Large depositors show higher risk appetite

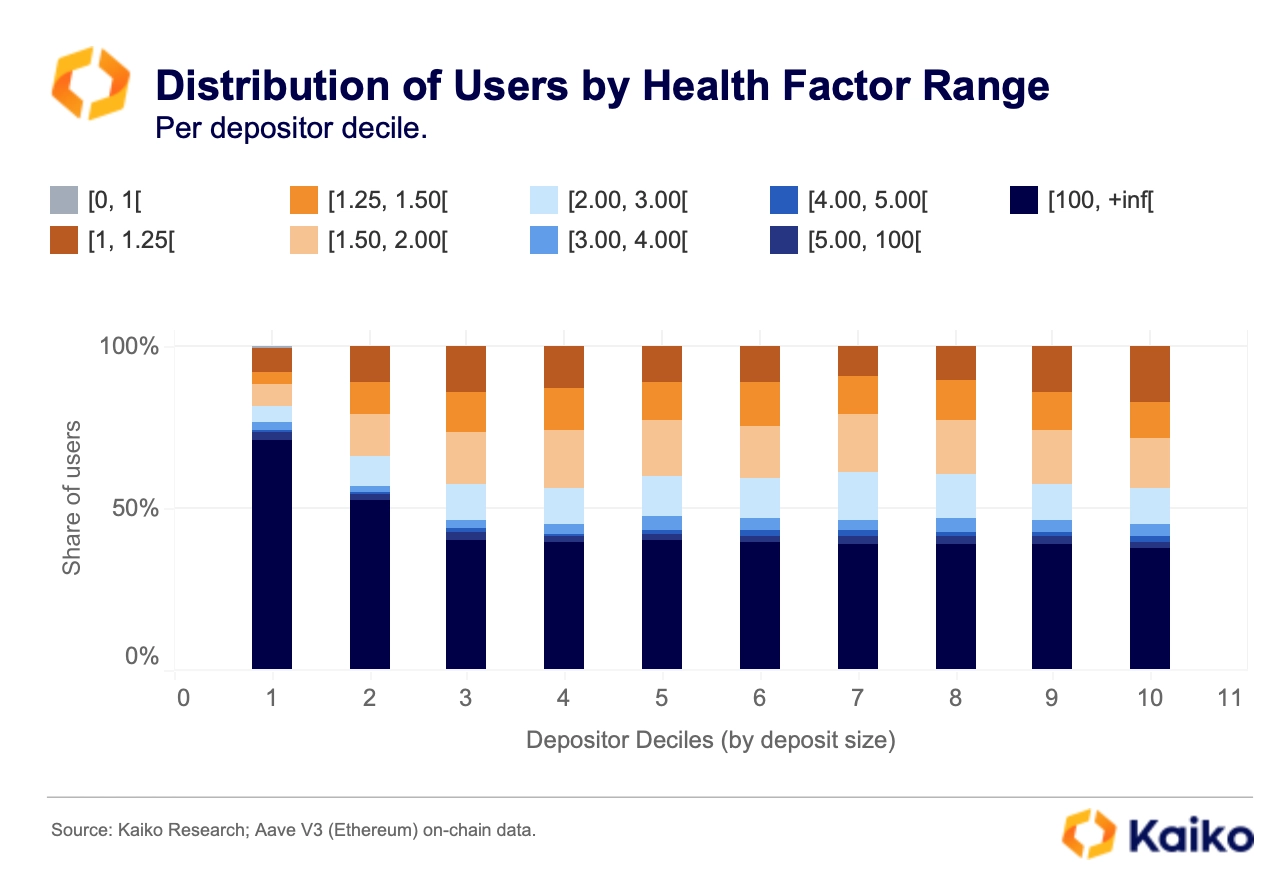

A closer look at Aave’s health factor distribution, a key measure of borrowing safety, reveals wide differences in user risk preferences. The health factor is calculated as the ratio of a user’s weighted collateral to total debt: each collateral asset is multiplied by its liquidation threshold (i.e., only that discounted portion counts), and the sum of these weighted values is divided by total debt. In High Efficiency mode (e-mode) for correlated assets, the liquidation threshold is replaced by a higher, category-specific coefficient. A higher health factor indicates a safer position, while approaching the threshold can trigger liquidation.

Users who supply assets without borrowing have an effectively unlimited health factor and face no liquidation risk. Recent data show that more than 70% of smaller depositors face no debt, and thus exhibit ultra‑high health factors (≥100).

On the other hand, larger depositors show higher risk appetite. As of March 1, 2025, over half of users in the 3rd–10th deposit-size deciles had health factors between 1 and 5. This indicates larger users tend to prioritize capital efficiency, maintaining more leveraged positions with lower health factors and higher sensitivity to liquidation risk.

About The Data

This study analyzes data exclusively from Aave V3 on the Ethereum blockchain. The dataset was extracted directly from Aave’s official smart contracts: the Aave Pool contract (0x87870Bca3F3fD6335C3F4ce8392D69350B4fA4E2) and the UIPoolDataProvider contract (0x3F78BBD206e4D3c504Eb854232EdA7e47E9Fd8FC). To ensure data quality and reduce noise from inactive or negligible accounts, only users with a collateral above $100 are included in the analysis. Although one physical user may control multiple addresses, for the purposes of this study, each address is treated as a distinct entity.

![]()

![]()

![]()

![]()