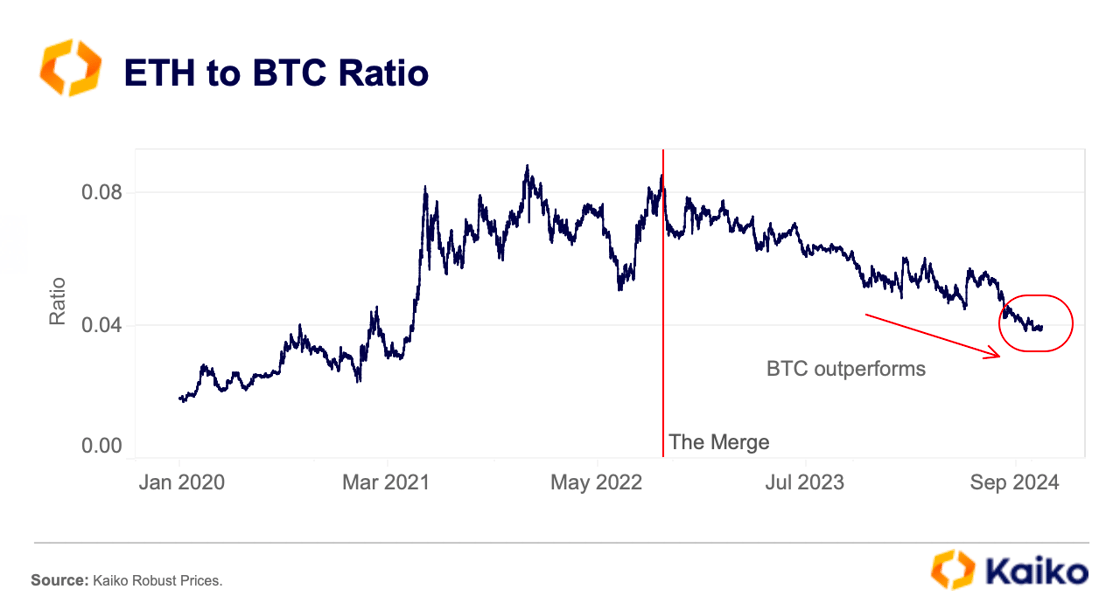

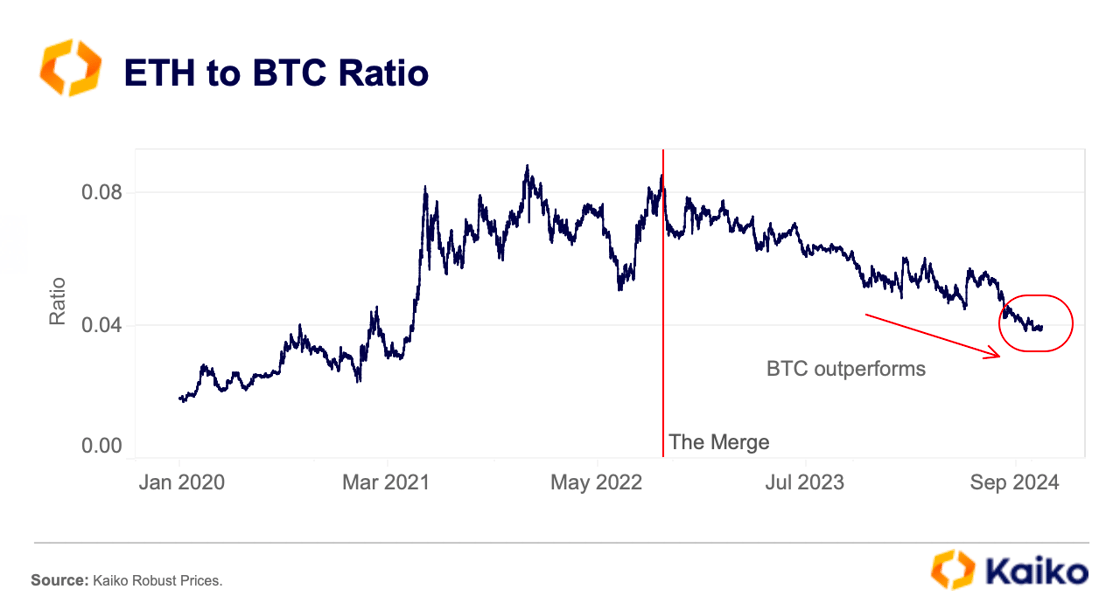

Since the Federal Reserve’s unexpected 50 basis point rate cut last month, Bitcoin has risen by 14%, approaching $70K, with strong inflows into exchange-traded funds (ETFs) driven by improving risk sentiment. While Ethereum has also benefited from positive macroeconomic conditions, the ETH/BTC ratio has persistently declined since the Merge. This ratio compares the performance of the two assets and falls when Ethereum underperforms Bitcoin. In October, it dropped below 0.04, its lowest point since April 2021.

A key reason for this persistent performance gap is the slower growth in institutional demand for Ethereum compared to Bitcoin. The introduction of spot Ethereum ETFs in July 2024 received a mixed reaction and did not significantly reverse this trend over the summer.

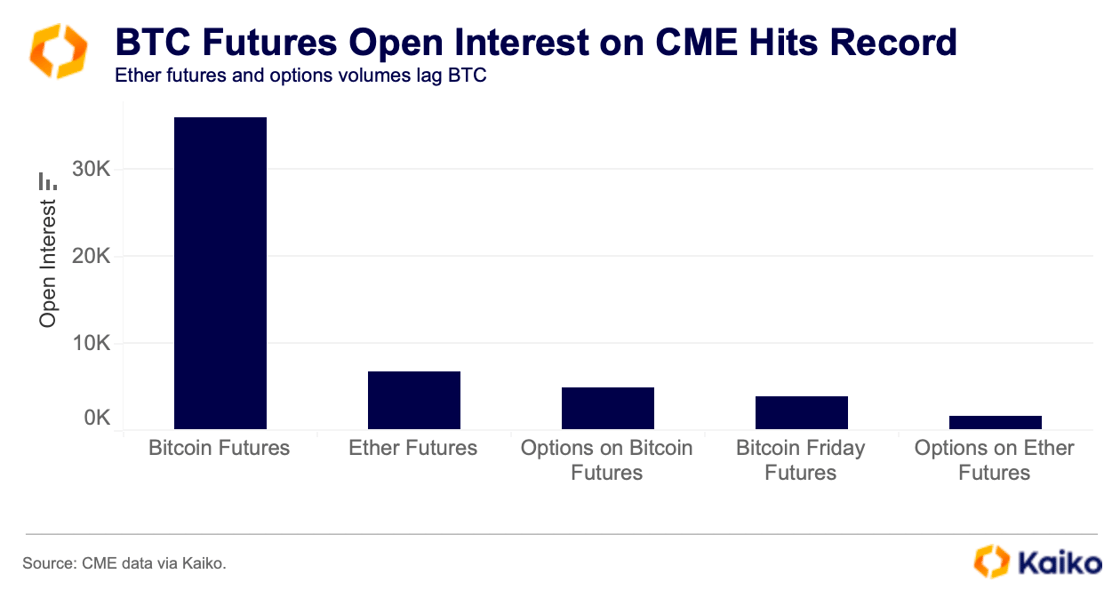

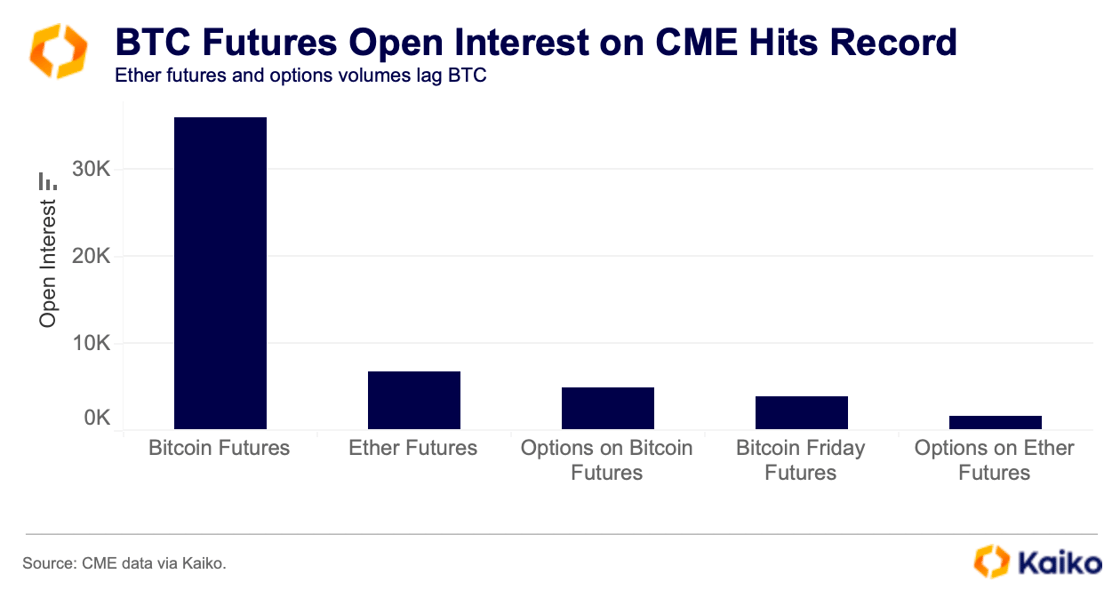

Bitcoin CME futures open interest – a proxy for institutional interest – hit consecutive all-time highs recently, meanwhile, Ether futures open interest on the CME remains relatively low at 7.3K contracts ($970mn). This suggests a less mature market and much lower institutional interest in ETH futures.

Bitcoin’s first-mover advantage within large trading platforms and wealth advisors’ networks has also contributed to its relative outperformance. Many advisors began pitching BTC ETFs to their clients in August 2023, after months of due diligence. Moreover, the lack of ETH staking capabilities in ETFs has made the newly launched ETH ETFs relatively less attractive to both retail and institutional traders.

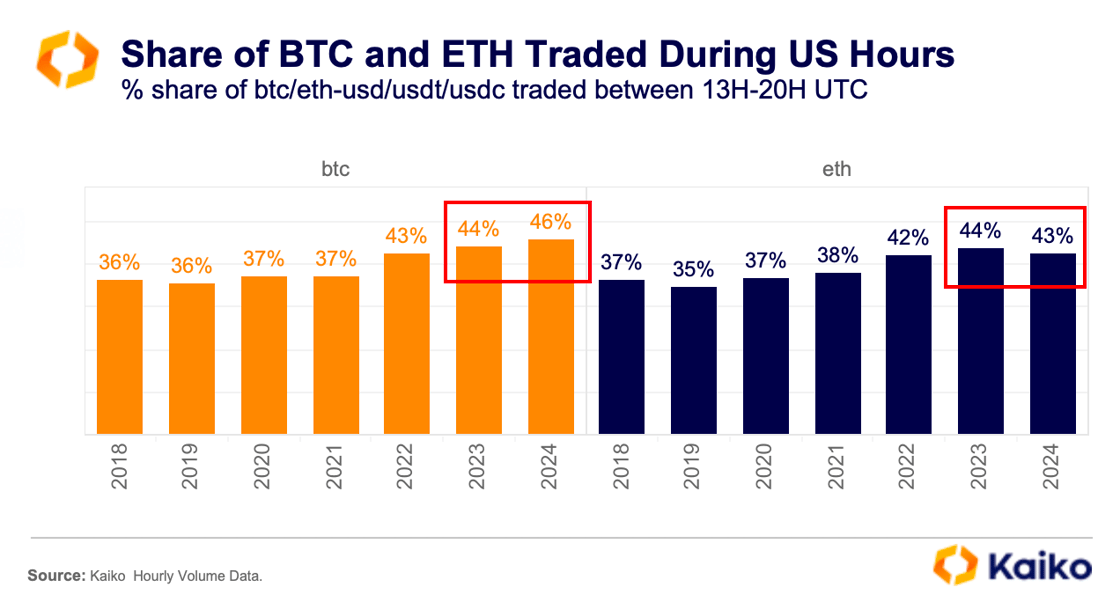

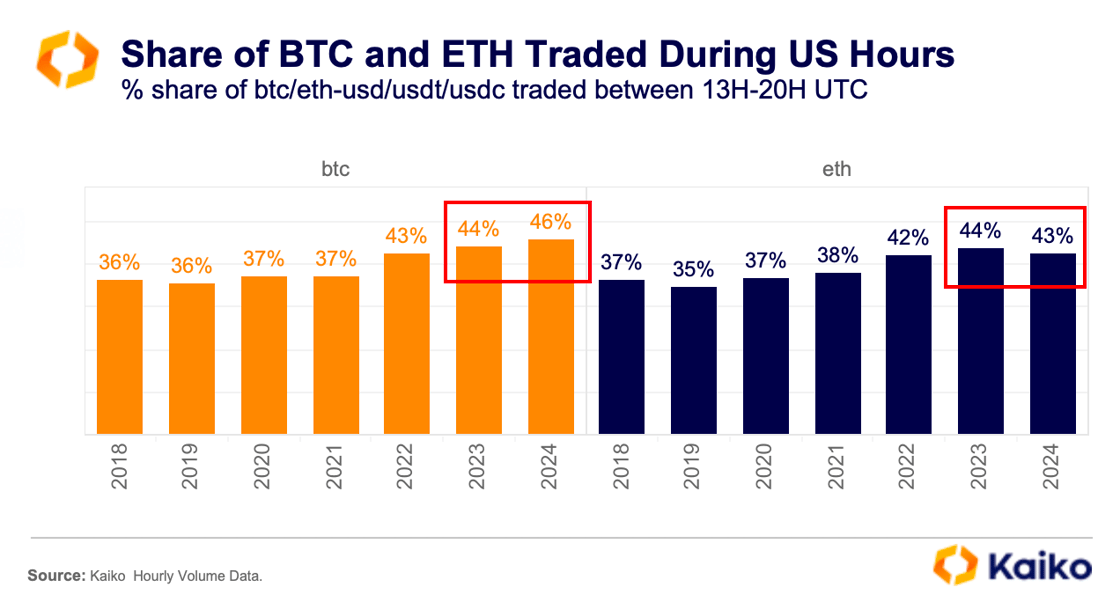

The stronger interest of US investors in Bitcoin is evident when looking at the share of BTC traded during US hours, which hit an all-time high between January and early October 2023. In contrast, this share has declined for ETH.

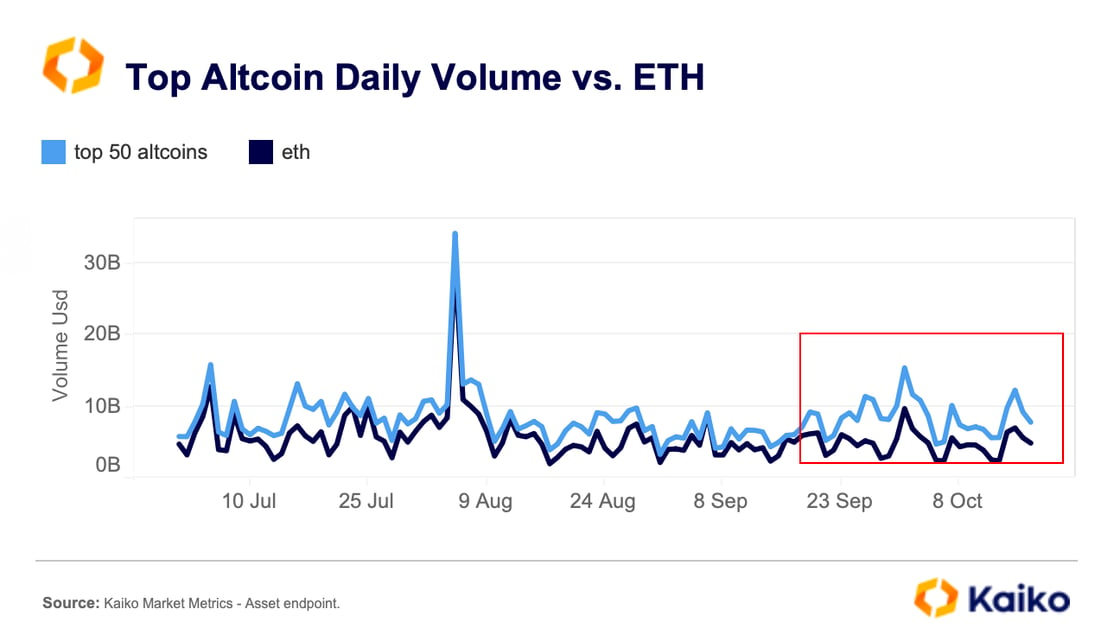

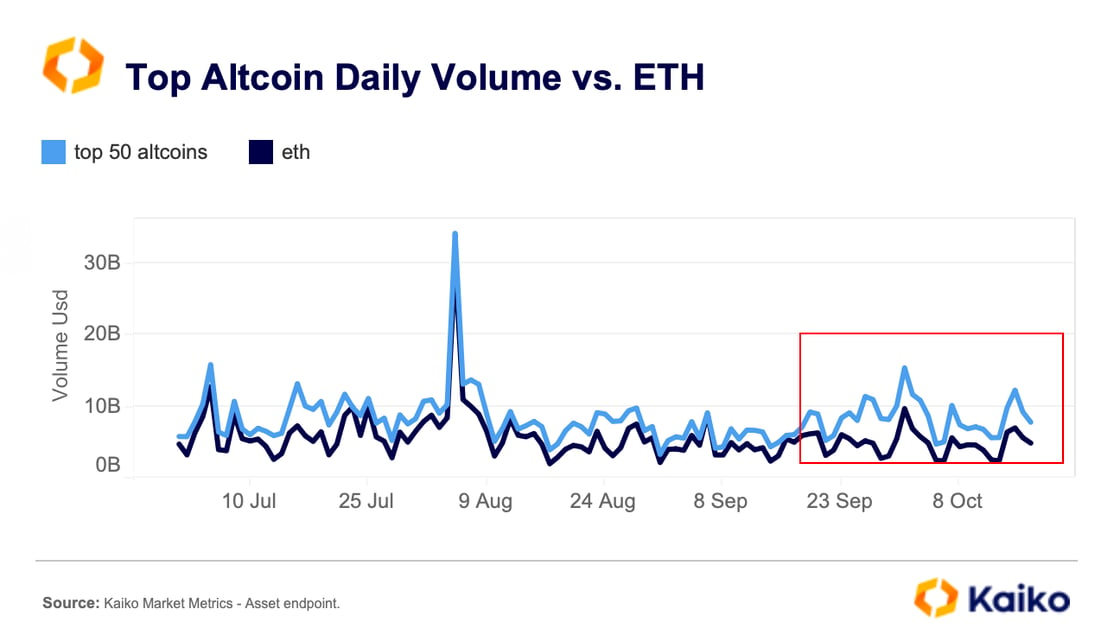

Demand for ETH has also been sluggish on spot markets. In October, Ethereum underperformed most altcoins in volume. The volume gap between ETH and the top 50 altcoins increased to its highest level since March.

Traders have shown a preference for higher beta altcoins, partly due to ETH’s lackluster performance since the Merge and heightened competition from “ETH killers” like Solana. Additionally, investors can gain exposure to Ethereum through various Layer 2 solutions built on its network, which have generally outperformed ETH itself.

It is worth noting that while BTC leads in institutional adoption, the upcoming US elections may benefit ETH, by reducing regulatory risks. The ethereum ecosystem is also constantly evolving which could impact ETH’s adoption and value proposition in the future.

Data Points

What is driving Meme tokens popularity?

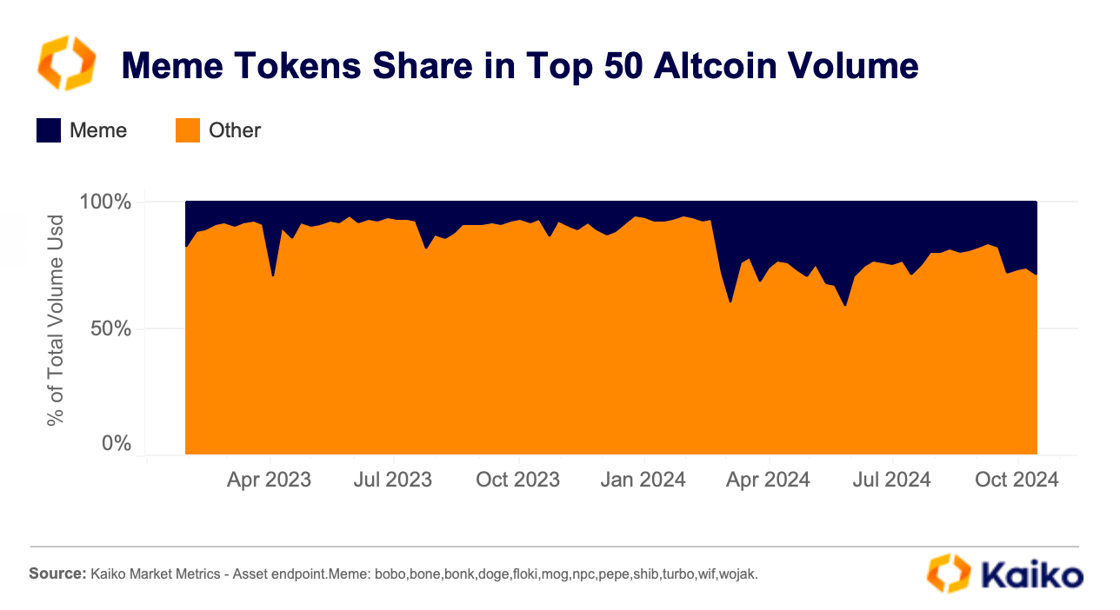

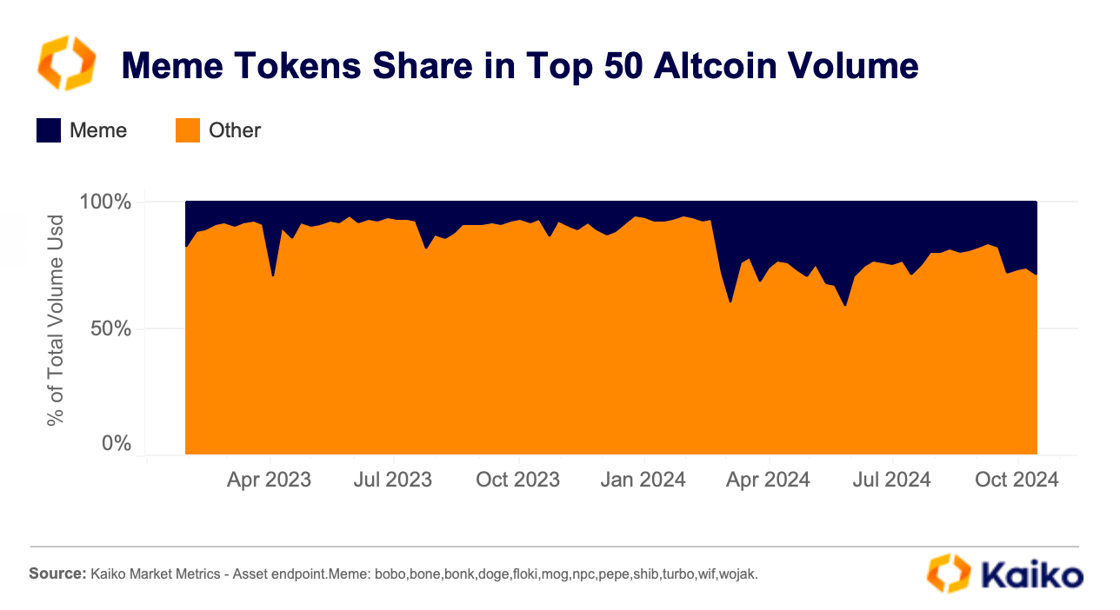

This year, meme tokens have shown resilience to crypto market volatility with trade volumes averaging $16bn up from just $3bn in 2023. Year-to-date meme tokens have outperformed most other altcoins, including Ethereum (ETH). Their share in the top 50 altcoins by market capitalization has also grown, increasing from 7% in early 2023 to between 25%-30% in 2024. This share varies significantly across exchanges, with smaller, retail-driven platforms like BTCTurk seeing meme tokens approach 50% of top altcoin volume.

While many meme tokens are driven by speculative activity and exhibit significantly higher open interest to market cap ratio (an indicator of leverage) than other altcoins, their outperformance shows a strong user base.

What, then, is driving the popularity of meme tokens? They are often perceived as fairer than VC-backed or “tech” tokens, which, in some cases, allocate over half of their supply to teams and investors. Many of these VC-backed tokens launch on centralized exchanges at inflated valuations, leading to sharp price declines as supply increases due to unlock schedules. In contrast, meme tokens usually have fully circulating supplies with no future unlocks, allowing for more organic price discovery. Overall, their potential for growth and the hype surrounding them have attracted retail communities in an increasingly competitive environment.

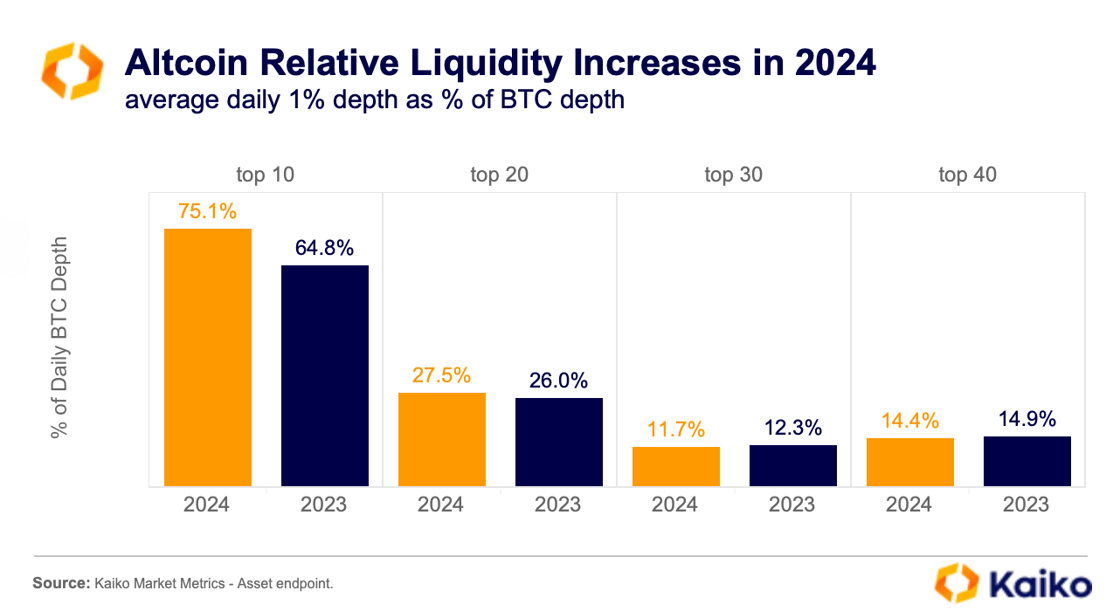

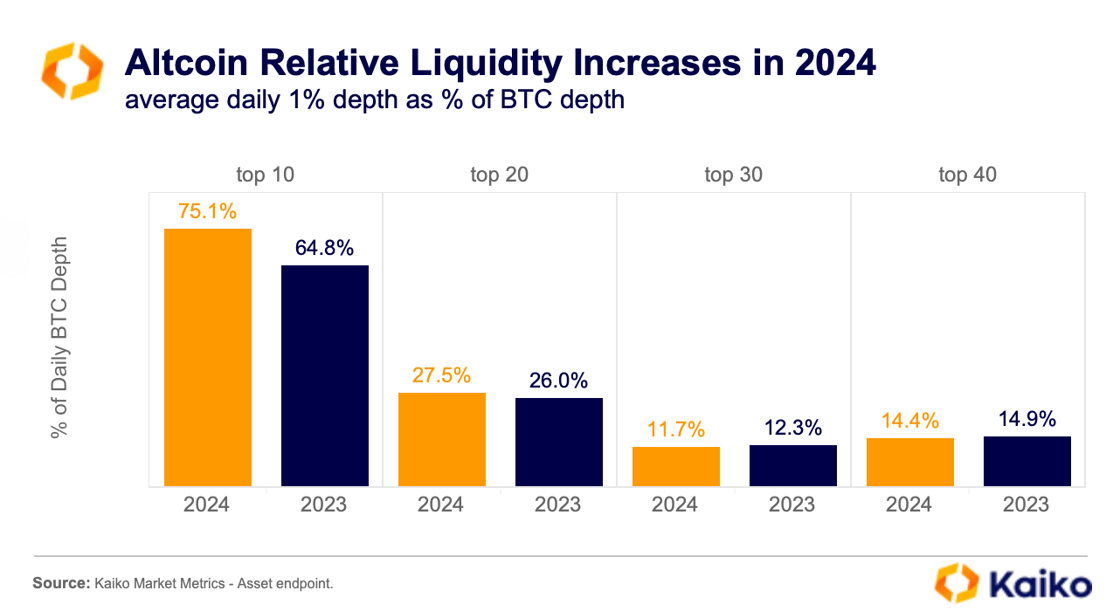

As new token issuance reaches new highs and centralised exchanges listings have slowed compared to the 2021 bull run, competition for altcoin liquidity has intensified.

In 2024, altcoin liquidity has become increasingly concentrated in a smaller number of tokens, leaving many assets to fall into illiquidity, often referred to as “zombie coins.” While overall altcoin market depth has increased as a percentage of Bitcoin’s this year compared to 2023, this growth has primarily been focused on the top ten altcoins by market cap. In contrast, the top 30 to 40 altcoins have seen a decline in relative liquidity. This trend is likely to continue, with over $155 billion in token unlocks expected to flood the market in the next few years.

Diving into FBI’s NexFundAI token case.

On October 9, 2024, three market makers—ZM Quant, CLS Global, and MyTrade—and their employees were charged with wash trading and conspiracy on behalf of NexFundAI, a cryptocurrency company and token. In total, eighteen individuals and entities face charges based on FBI-led evidence.

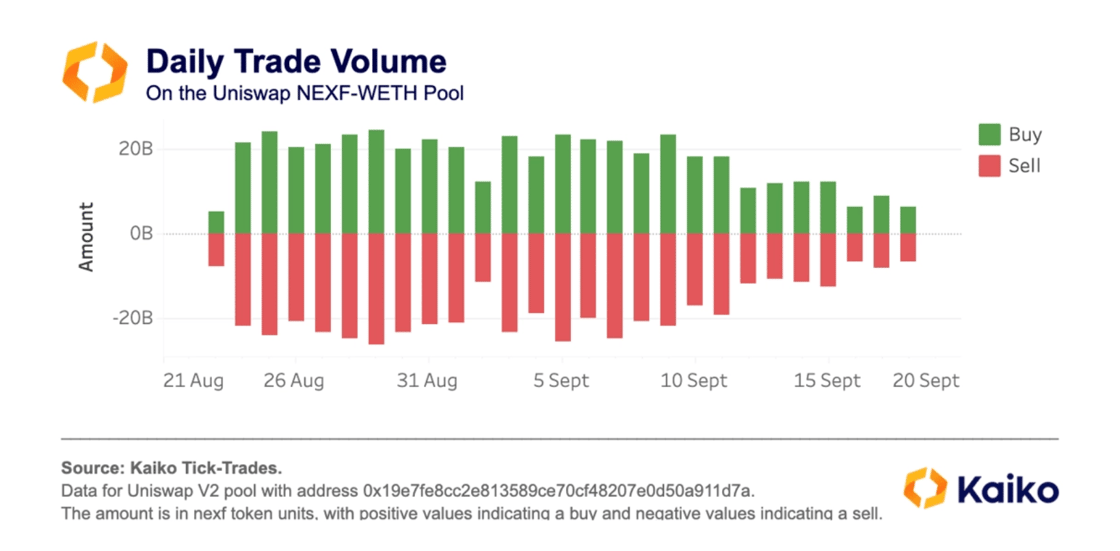

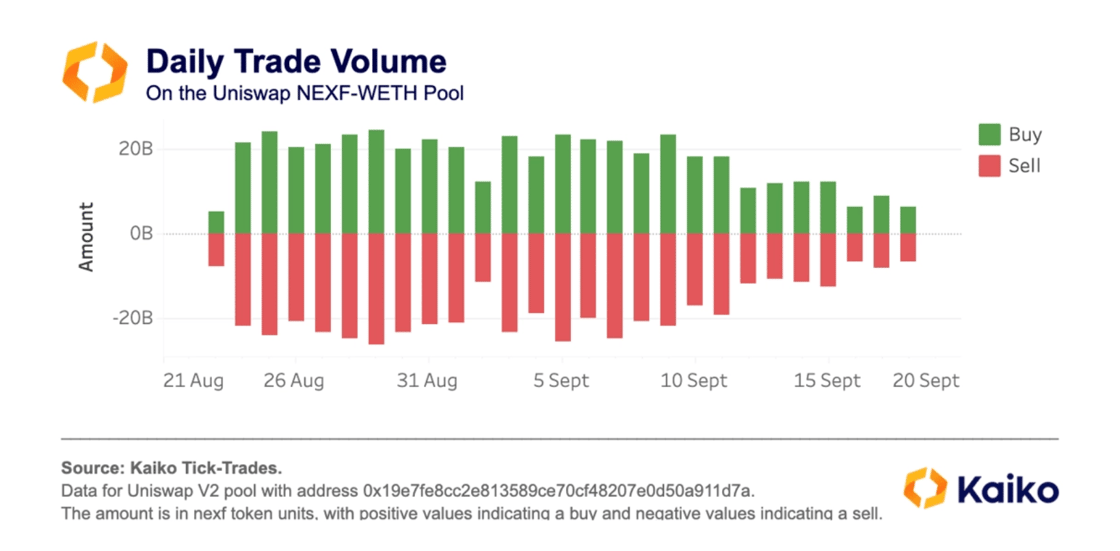

In our deep dive last week, we analyzed Kaiko’s on-chain data for the NexFundAI cryptocurrency (Kaiko ticker NEXF) to identify wash trading patterns. Our findings reinforce information uncovered by the FBI through its undercover ‘sting’ operation. The accused firms used multiple bots and hundreds of wallets to engage in wash trading without alerting unsuspecting investors seeking early opportunities. We also looked at the market data on the only secondary market that existed for NEXF on Uniswap.

By aggregating the daily volume executed on this Uniswap market and comparing the bought and sold volumes, we found a surprising symmetry between the two. This symmetry suggests that market-making companies were offsetting a total amount across all wallets engaged in wash trading on this market each day. For more insights on wash trading tactics in DeFi and how to spot illicit activity on centralized platforms, read our full analysis here.

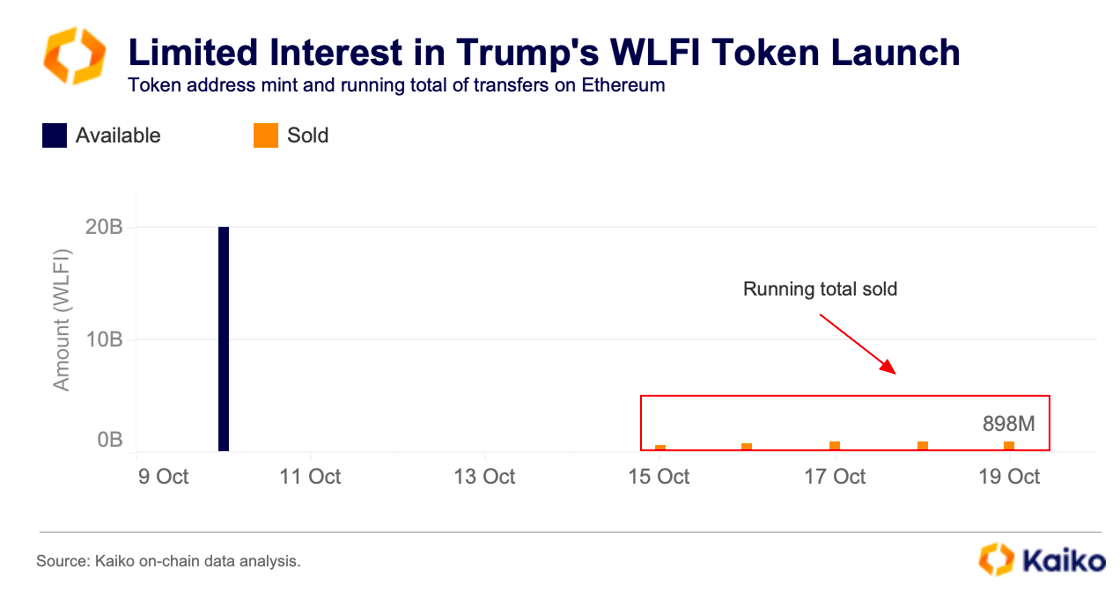

Trump’s WLFI token sale flops.

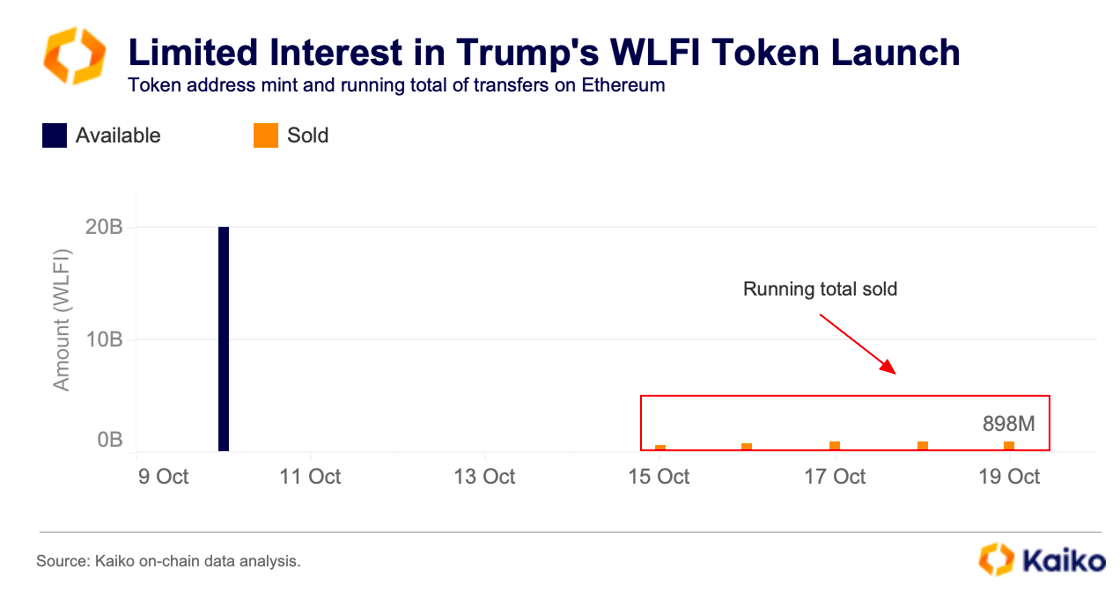

Donald Trump’s latest venture, a crypto project called World Liberty Financial, had a sluggish start last week. Despite launching a range of high-priced watches, the project’s token sale struggled. Out of the 10 billion WLFI tokens created on Ethereum, only 650 million were sold, valued at just over $10 million. This left around $290 million worth of tokens unsold, indicating a lackluster response despite Trump’s recent efforts to engage with the crypto community ahead of his presidential bid.

While Donald Trump may have gained some backing from crypto users for his pledge to support Bitcoin and digital assets, the structure of his token sale likely discouraged many. Chief among these was the fact that WLFI tokens are not transferable and may never be. Developers have stated that WLFI tokens will eventually be used for voting on proposals within a protocol that has not yet been released. Therefore, investors are likely taking a wait-and-see approach with the former president’s latest crypto venture.

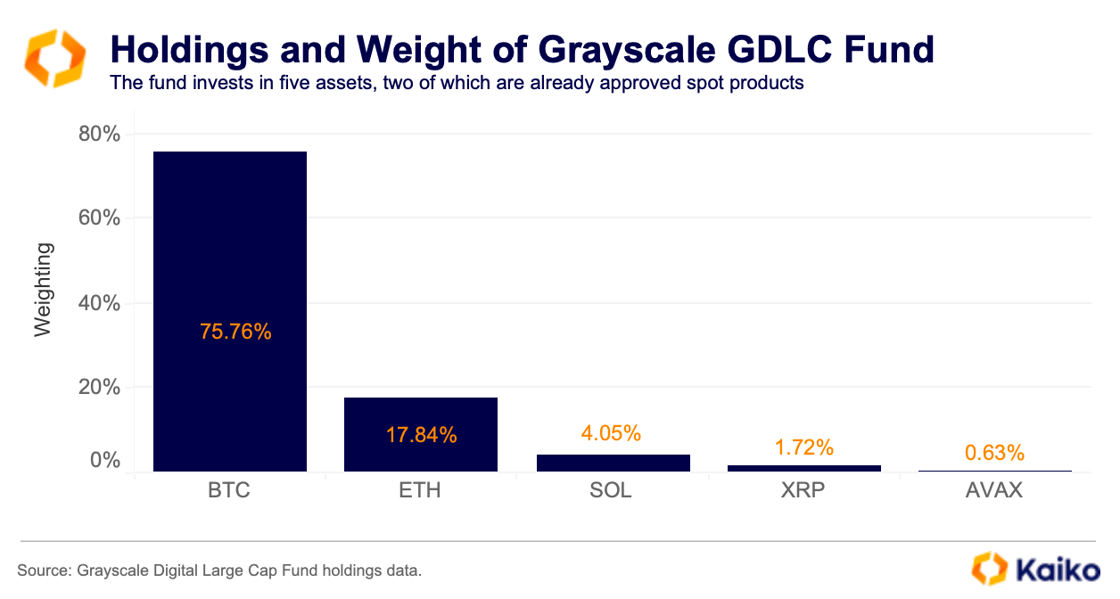

ETF filings rise as Grayscale pushes to convert GDLC.

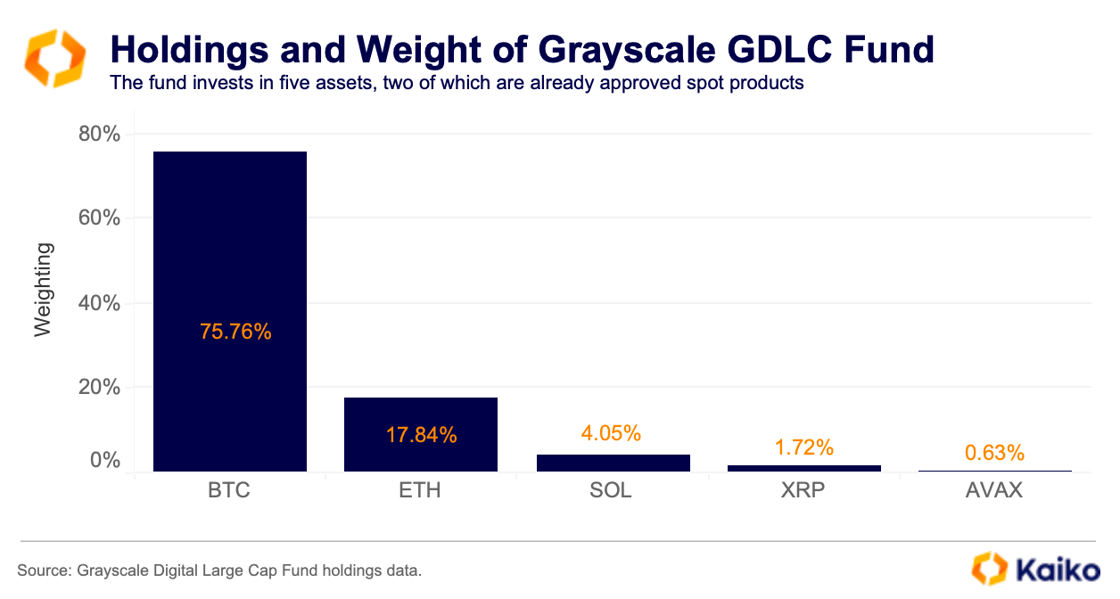

The number of crypto-related exchange-traded fund applications continues to rise as asset managers file for increasingly ambitious products. The latest filing comes from Grayscale, which applied to convert its Digital Large Cap (GDLC) trust into an ETF.

GLDC’s holdings include five assets: BTC, ETH, SOL, XRP, and AVAX. Together, BTC and ETH account for nearly 94% of the total assets under management in the trust.

Grayscale’s filing to convert comes hot on the heels of two others this month. Bitwise filed to launch a spot XRP ETF, shortly afterwards Nashville-based Canary Capital joined them.

The Tennessee firm was launched by Valkyrie co-founder and former chief investment officer, Steven McClurg. Last week, the firm followed up its XRP filing with an application to launch a Litecoin ETF. So far in 2024, US asset managers have filed for SOL, XRP, LTC, and mixed basket ETFs. Most of these applications are seen as a bet on the US presidency, which could likely lead to a change of leadership at the US Securities and Exchange Commission and, therefore, a new regulatory approach to crypto ETFs.

![]()

![]()

![]()

![]()