Data Points

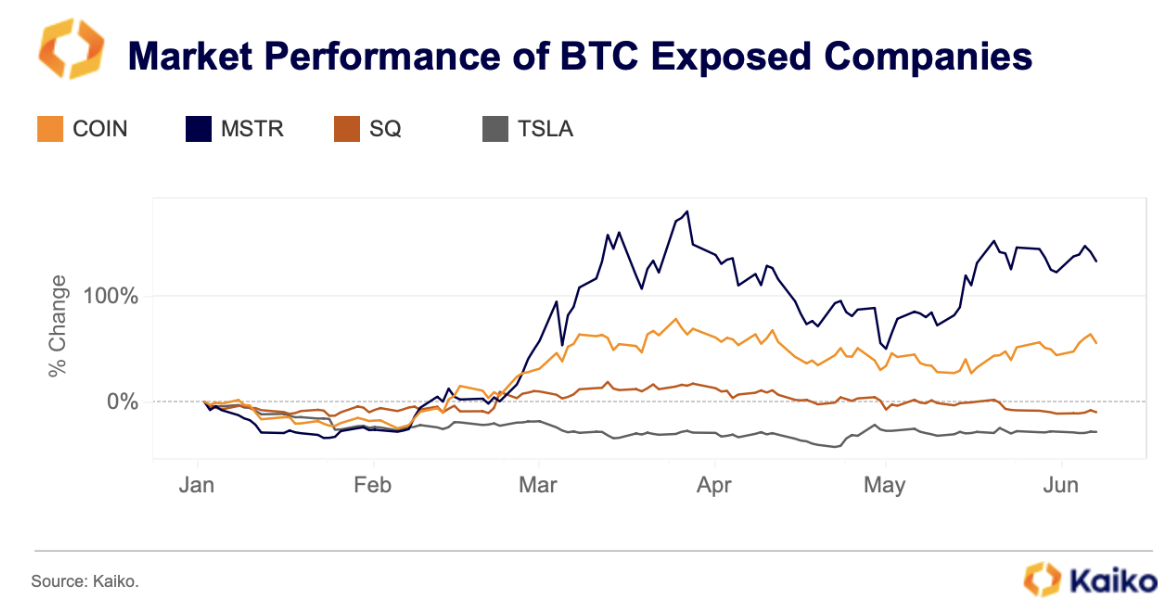

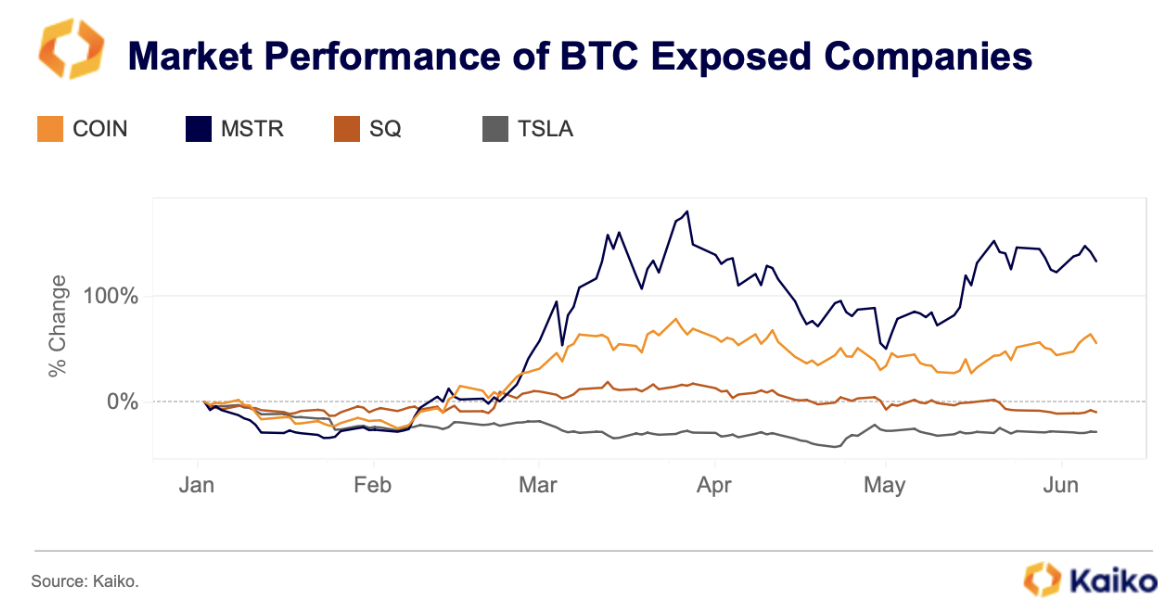

MicroStrategy outperforms despite arrival of BTC ETFs.

MicroStrategy’s shares have surged by an impressive 132% this year, significantly outperforming Bitcoin and other BTC-exposed companies. This outperformance can be partly attributed to a short squeeze, but it is noteworthy given the competition from spot ETFs in the US which offer a convenient alternative to gain exposure to BTC.

Tesla and the Block (SQ), which also hold BTC, have failed to benefit from the recent crypto rally and are down 10% and 29% YTD respectively. They have also exhibited lower correlation with Bitcoin over the past year moving in tandem with tech equities.

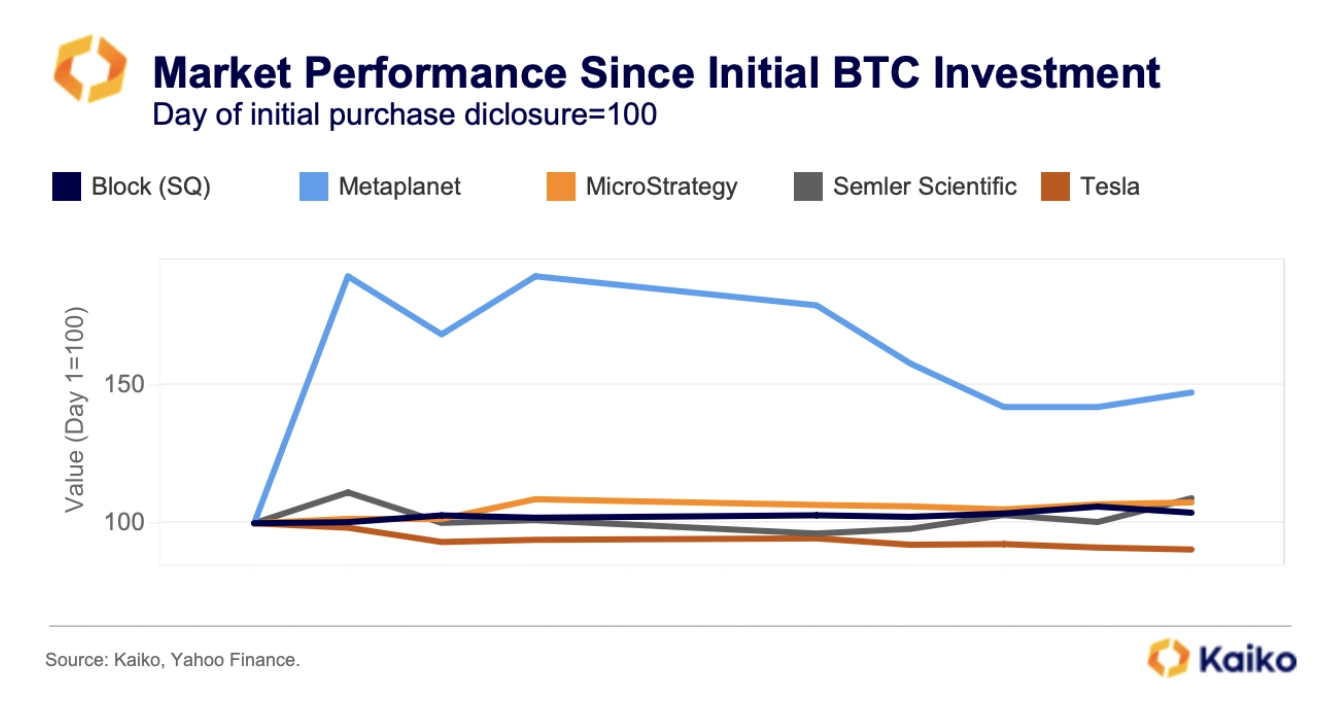

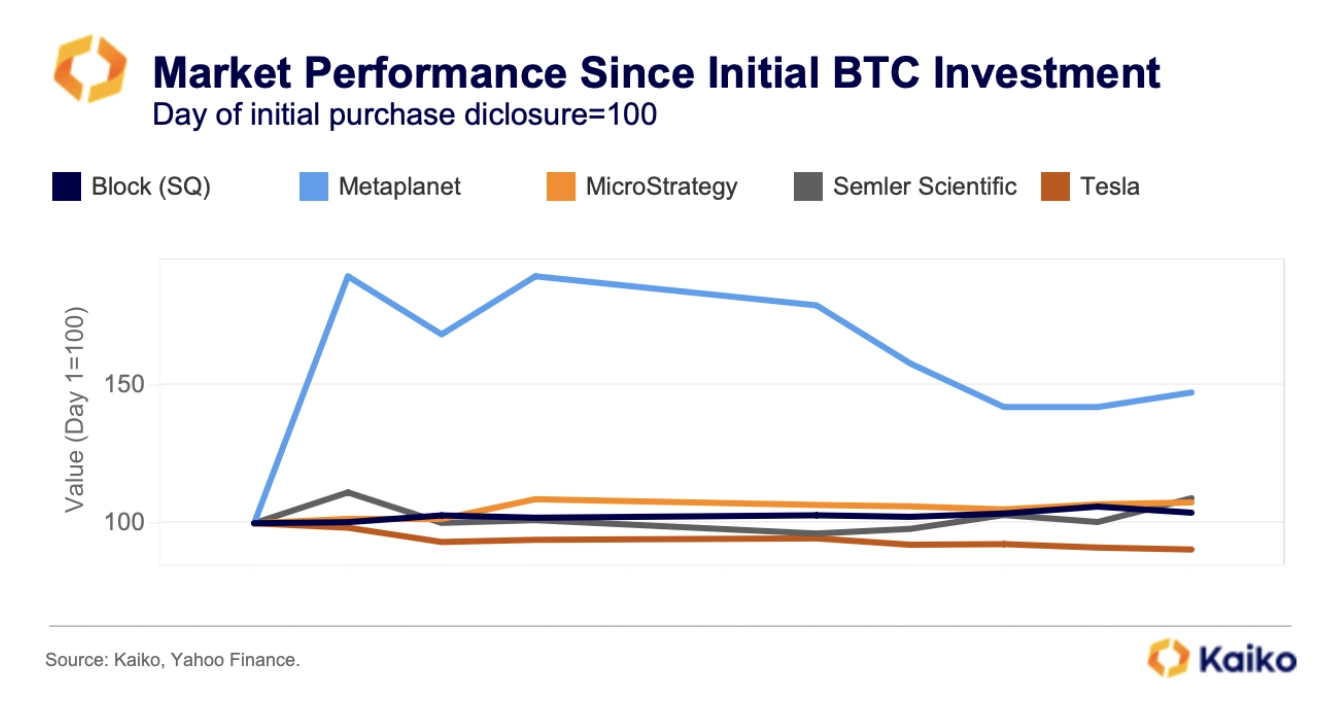

Recently, several companies such as Japan-based investment firm Metaplanet and Nasdaq-listed medical device maker Semler Scientific have followed MicroStrategy, Tesla, and The Block in allocating portions of their balance sheets to Bitcoin.

Interestingly, Metaplanet surged 85% since announcing its BTC investment strategy. SMLR is also up around 10%, both outperforming MSTR, SQ, and TSLA after their initial purchase disclosures.

Bitcoin’s appeal as a treasury asset has increased following the approval of new crypto accounting rules by the US Financial Accounting Standards Board (FASB) in December 2023. Previously, crypto was classified as an indefinite-lived intangible asset under U.S. accounting rules, requiring companies to write the asset down if its value fell below its purchase price, potentially leading to significant impairment losses.

The new rules, which will take effect in December 2024, will allow companies to record Bitcoin and certain other crypto assets at fair market value. In response to these new requirements, Kaiko has introduced several data products in recent months to assist companies with tax reporting, audit, and accounting purposes.

Robinhood looks to crypto for growth.

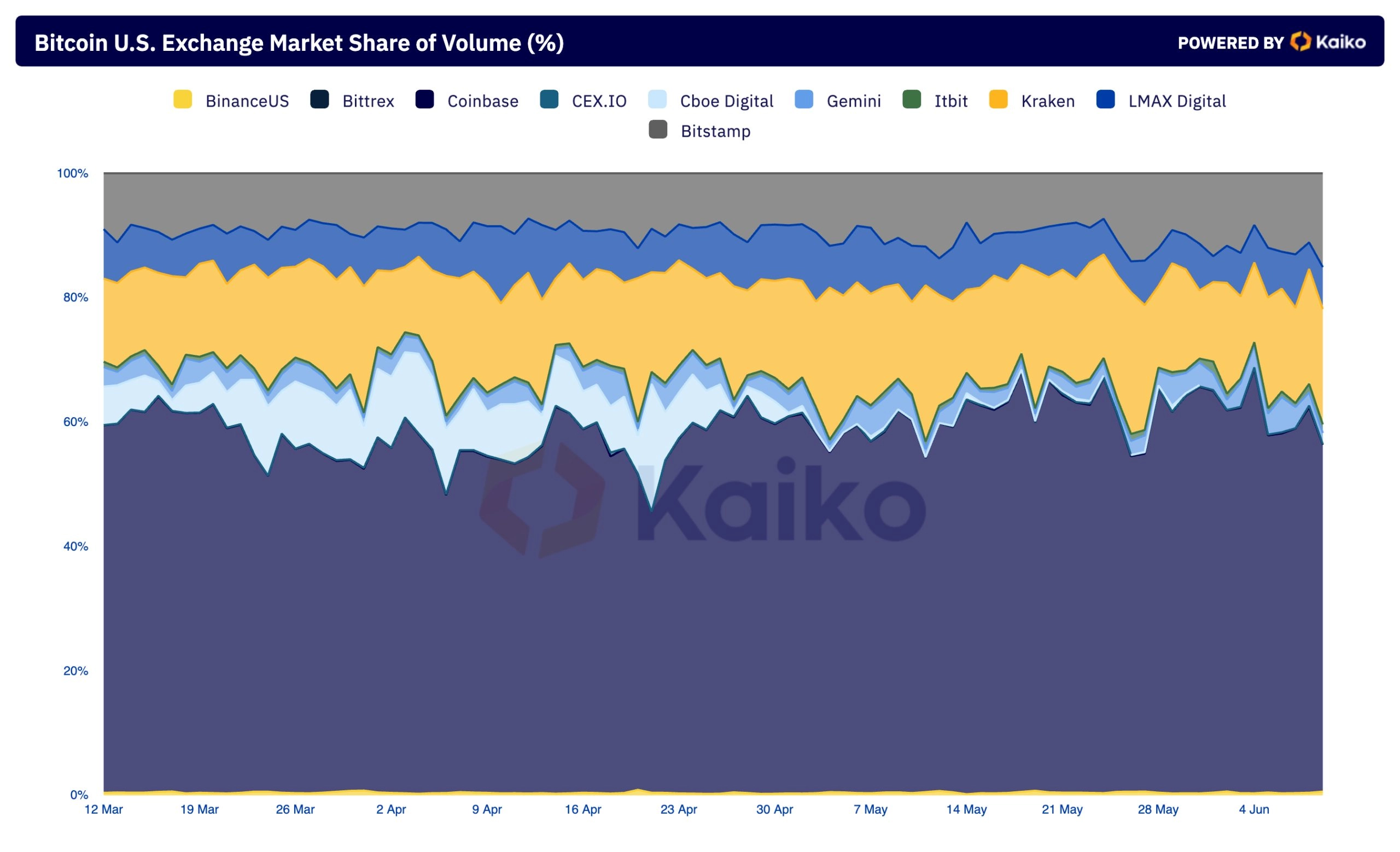

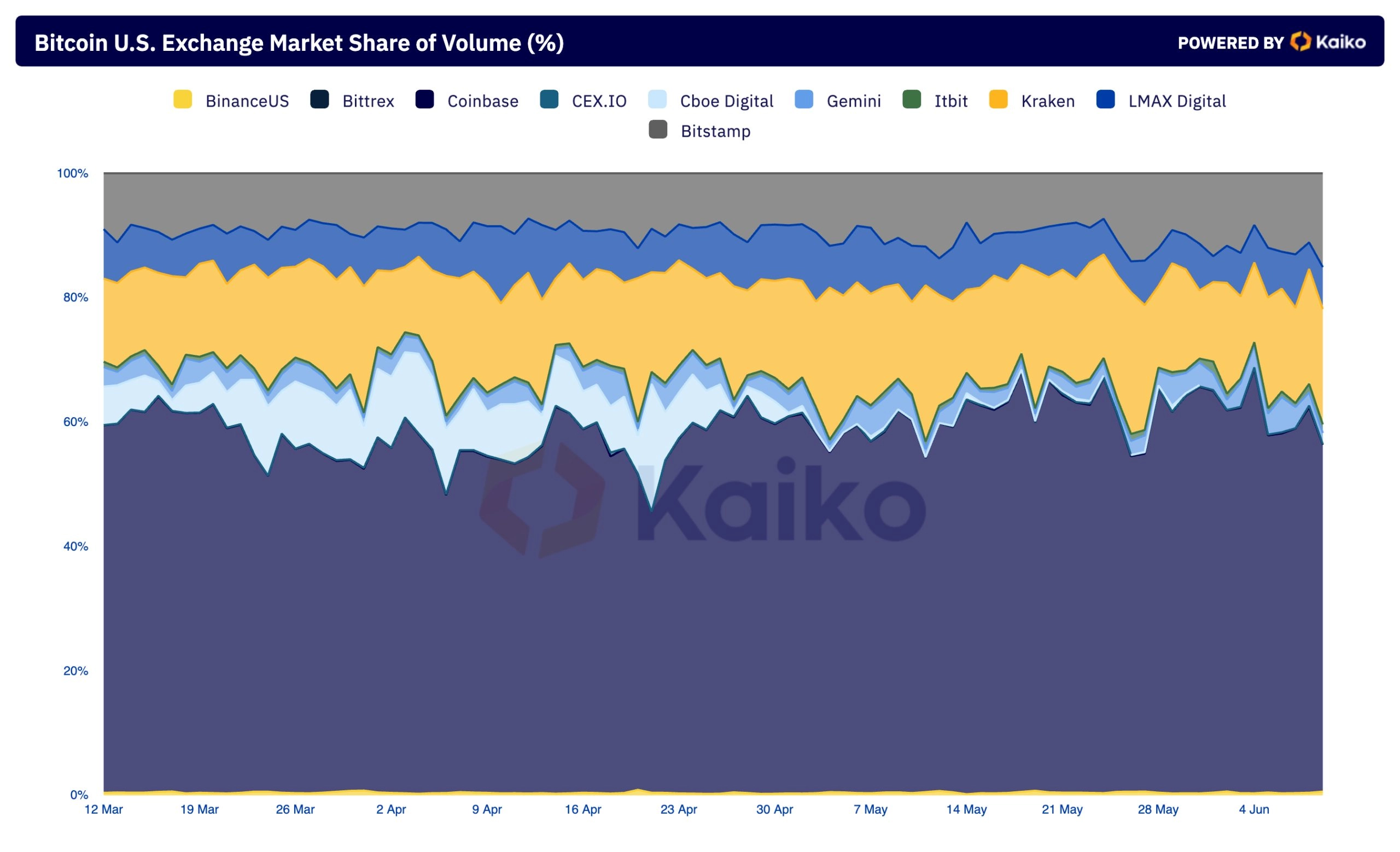

Robinhood announced Thursday that it will acquire Europe-based crypto exchange Bitstamp. The $200 million cash deal will help the US retail trading platform grow its crypto business, the firm said.

Bitstamp accounted for between 10% and 15% of US exchange market share over the past month, with average daily trading volume of around $9.3bn in the second quarter, according to Kaiko’s latest exchange ranking report.

Robinhood offers access to just over 30 cryptocurrencies with trading volumes of $36 billion in the first quarter, according to its latest earnings report. These volumes led to $126 million in transaction based revenue related to crypto trading. The addition of Bitstamp, which offers trading in nearly 80 different cryptoccurencies, could see the firm grow crypto-related revenues further.

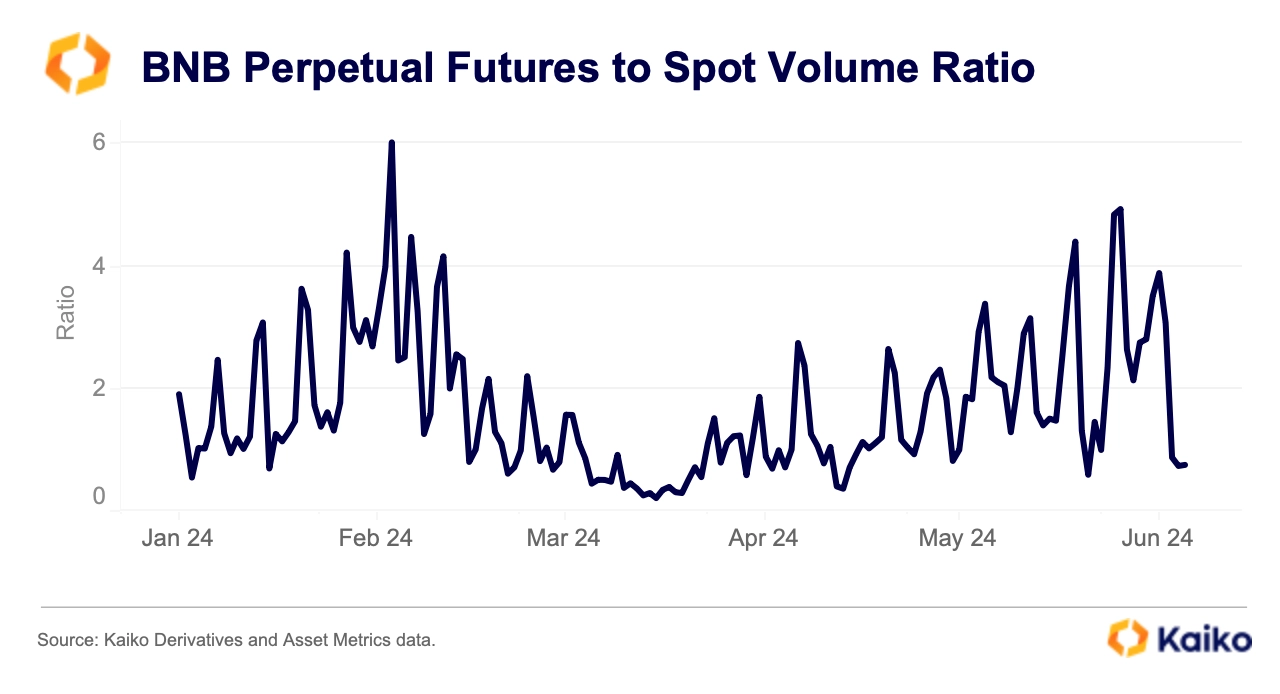

BNB hits record high.

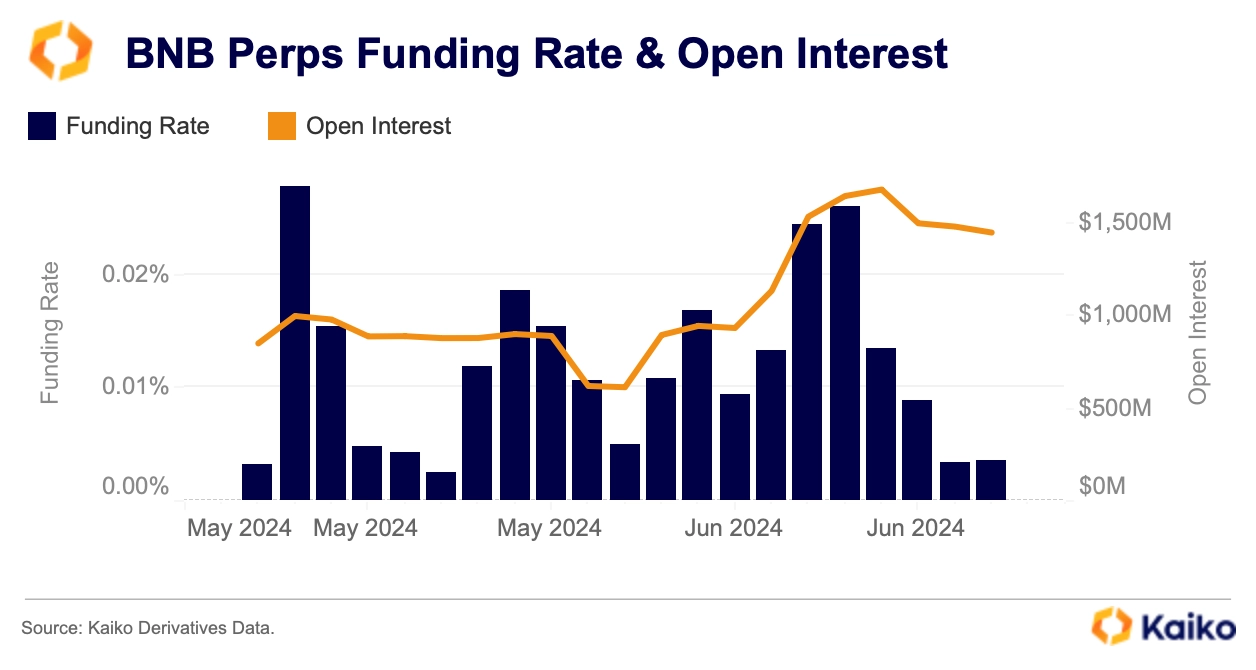

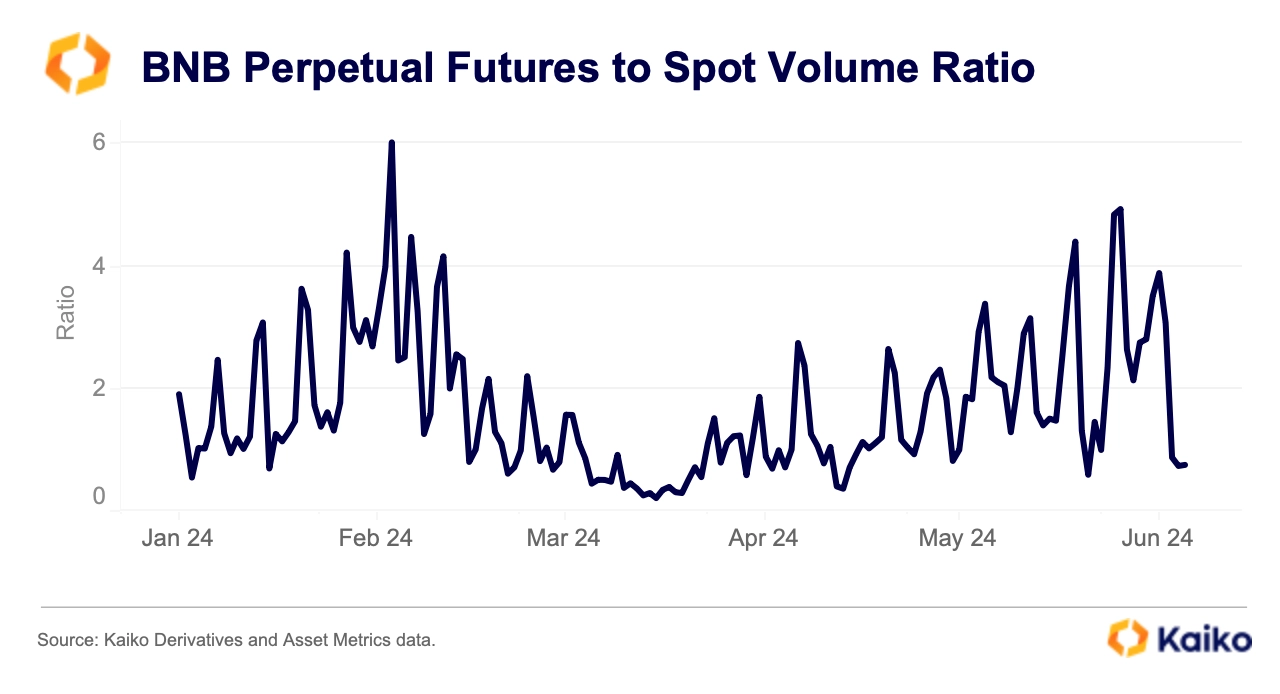

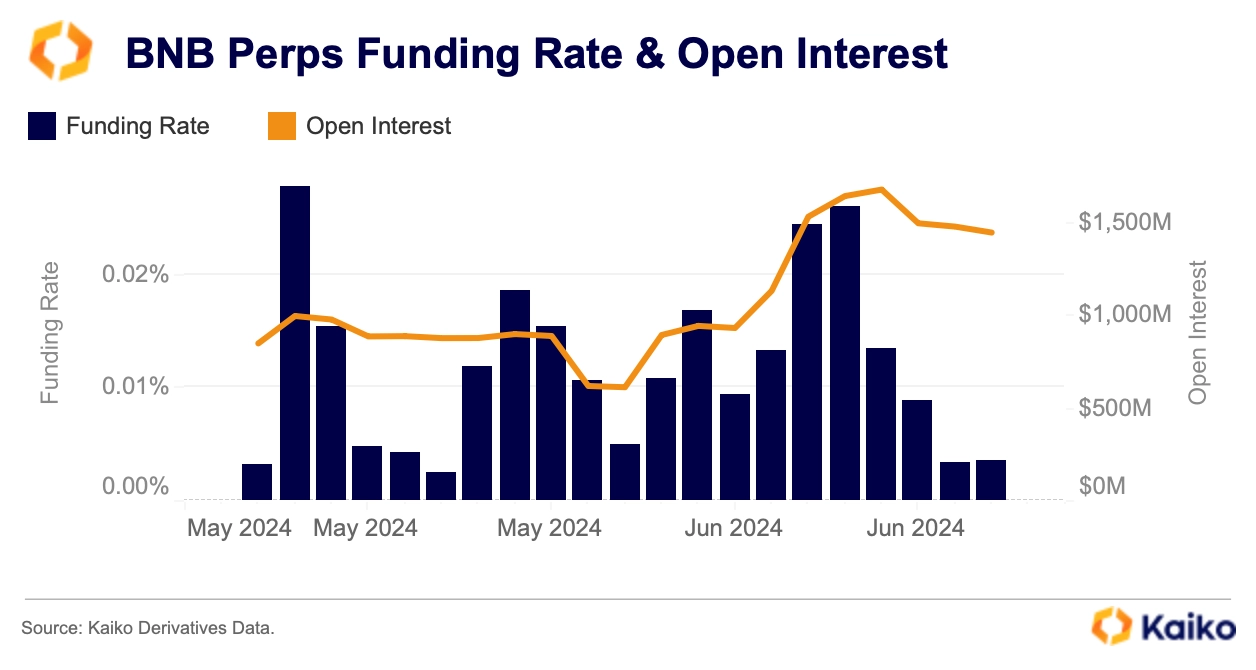

Binance-affiliated BNB hit a record high above $717 last week. Ahead of the move higher most of the token’s trading volume was focused on perpetual futures markets. Price discovery in crypto markets is often linked to volume, and this move higher was a prime example of that.

Kaiko’s data lets us locate price discovery by comparing perpetual futures and spot volume ratios, revealing which market has greater relative volume. BNB perps gained relative to spot in May, with the ratio reaching 5 as open interest soared after funding rates flipped positive. This suggests that price discovery was taking place in perps markets as opposed to spot.

TRY share of fiat volumes hits an all-time high.

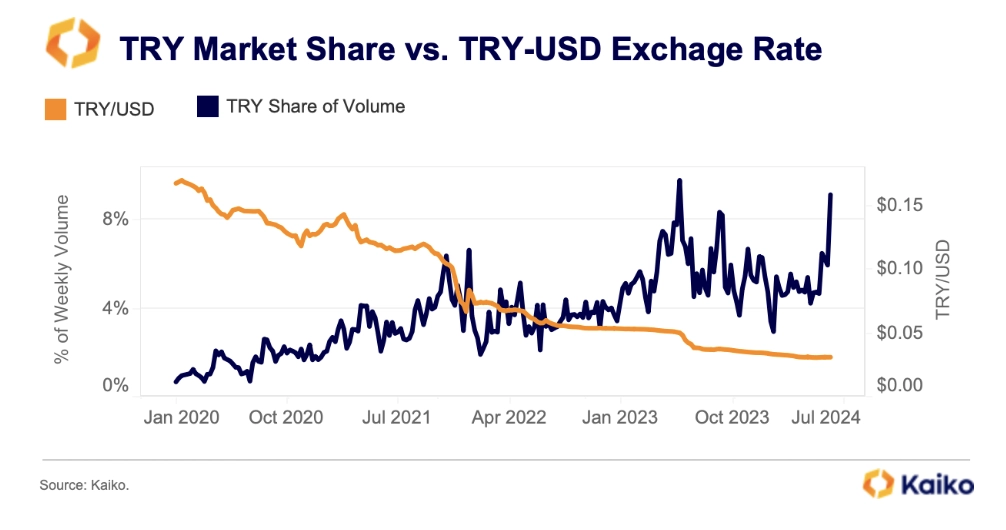

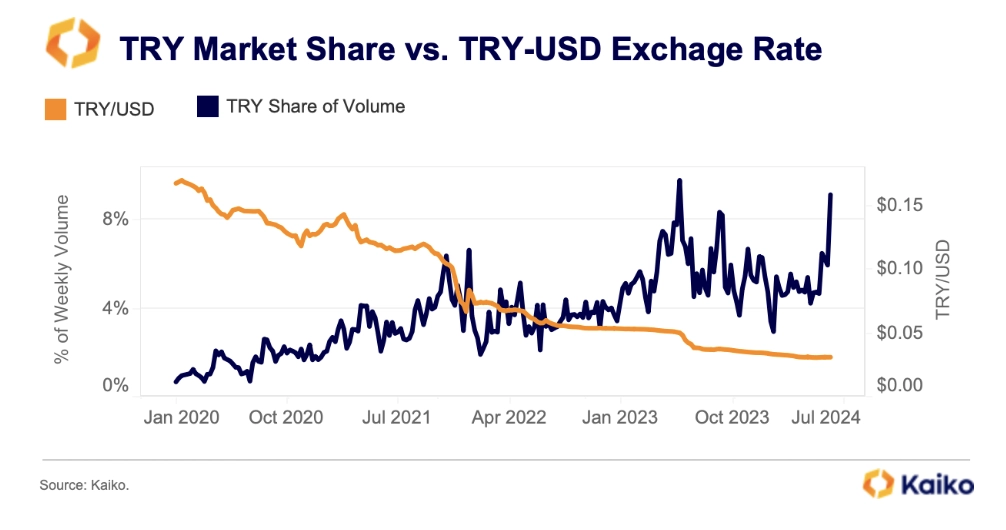

In early June, the Turkish Lira (TRY) market share of crypto volume hit an all-time high of 19%, surpassing the euro as the third largest fiat currency by volume. Historically, currency devaluation and FX volatility have been a significant driver of crypto adoption, particularly in developing markets. Turkey’s inflation surged in 2022 exceeding 70% while the lira has been one of the worst-performing fiat currencies.

The rising share of TRY volume is also related to the increasing regulatory scrutiny and the loss of banking partners that Binance, one of the world’s largest crypto exchanges, has experienced. This led to the delisting of its GBP and AUD trading pairs on the exchange last year and boosted the share of the TRY in overall fiat trade volumes.

FX volatility has increased over the past months due to the growing divergence in monetary policy and the record number of elections in 2024. In the past month and a half, we’ve seen the British pound (GBP) hit its highest level against the euro (EUR) in two years, the Japanese yen (JPY) fall to a 30-year low against the US dollar (USD), and the Mexican peso (MXN) tumble to its weakest level since October 2023.

![]()

![]()

![]()

![]()